Asia Pacific Hepatitis B Infection Market

Marktgröße in Milliarden USD

CAGR :

%

USD

4.27 Billion

USD

6.92 Billion

2024

2032

USD

4.27 Billion

USD

6.92 Billion

2024

2032

| 2025 –2032 | |

| USD 4.27 Billion | |

| USD 6.92 Billion | |

|

|

|

|

Marktsegmentierung für Hepatitis-B-Infektionen im asiatisch-pazifischen Raum nach Typ (chronisch und akut), Behandlung (Impfstoff, antivirale Medikamente, Immunmodulatoren und Chirurgie) – Branchentrends und Prognose bis 2032

Marktgröße für Hepatitis-B-Infektionen im asiatisch-pazifischen Raum

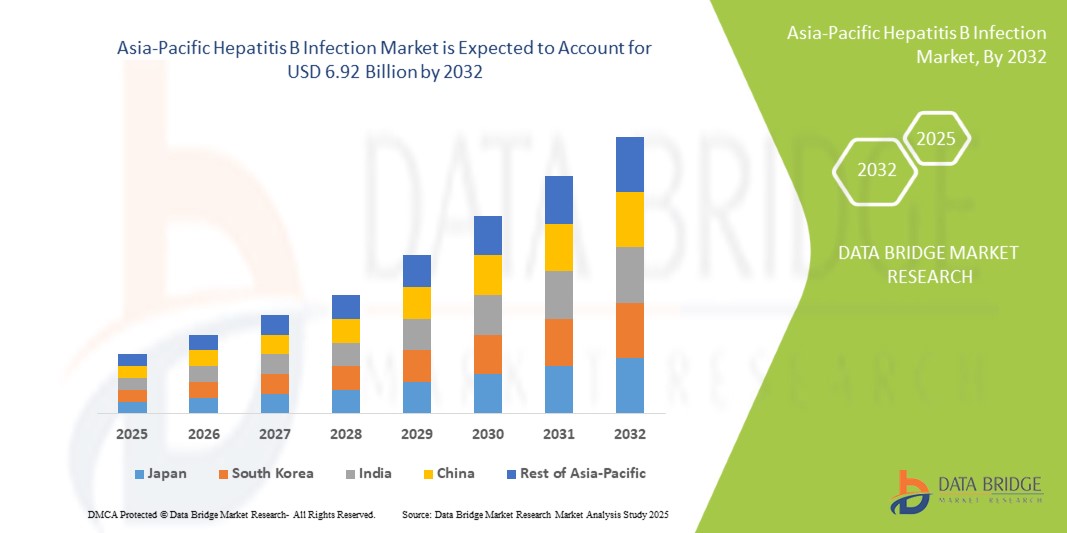

- Der Markt für Hepatitis-B-Infektionen im asiatisch-pazifischen Raum hatte im Jahr 2024 ein Volumen von 4,27 Milliarden US-Dollar und dürfte bis 2032 einen Wert von 6,92 Milliarden US-Dollar erreichen , was einer jährlichen Wachstumsrate von 6,20 % im Prognosezeitraum entspricht.

- Das Marktwachstum wird maßgeblich durch die zunehmende Nutzung fortschrittlicher Diagnosetechnologien und therapeutischer Innovationen für Hepatitis B sowie durch die zunehmende Digitalisierung und Integration elektronischer Gesundheitssysteme in ganz Europa vorangetrieben.

- Darüber hinaus etabliert die steigende Nachfrage von Verbrauchern und der öffentlichen Gesundheitsversorgung nach präzisen, zugänglichen und präventiven Lösungen Hepatitis-B-Managementprotokolle als zentralen Schwerpunkt der Gesundheitspolitik. Diese konvergierenden Faktoren beschleunigen die Einführung von Impfungen, Screenings und antiviralen Therapien und fördern damit das Marktwachstum im Bereich Hepatitis-B-Infektionen in der gesamten Region erheblich.

Marktanalyse für Hepatitis-B-Infektionen im asiatisch-pazifischen Raum

- Die Behandlung und Diagnostik von Hepatitis B ist ein zunehmend wichtiger Bestandteil der öffentlichen Gesundheitsinfrastruktur im asiatisch-pazifischen Raum, insbesondere in städtischen und ländlichen Gebieten. Grund dafür ist das steigende Bewusstsein für die Infektion, die Erweiterung der Diagnosemöglichkeiten und die Fortschritte bei der Verfügbarkeit antiviraler Therapien.

- Die steigende Nachfrage nach einem effektiven Hepatitis-B-Management in der Region wird vor allem durch nationale Immunisierungsprogramme, verstärkte Screening-Bemühungen auf HBV-HDV-Koinfektionen und die wachsende Belastung durch chronische Lebererkrankungen, insbesondere unter der alternden Bevölkerung in Ländern wie China und Japan, vorangetrieben.

- China dominierte den Markt für Hepatitis-B-Infektionen im asiatisch-pazifischen Raum mit dem größten Umsatzanteil von 34,7 % im Jahr 2024. Dies ist geprägt von umfassenden öffentlichen Gesundheitsinitiativen, einer hohen Impfrate und einem breiten Zugang zu diagnostischen Tests. Das Land verzeichnete rasche Verbesserungen bei der Behandlungsverfügbarkeit, insbesondere für ländliche und gefährdete Bevölkerungsgruppen, dank staatlicher Krankenversicherungen und Aufklärungskampagnen zum Thema Lebererkrankungen.

- Indien dürfte die am schnellsten wachsende Region im asiatisch-pazifischen Markt für Hepatitis-B-Infektionen sein. Der Markt profitiert von staatlichen Initiativen wie dem allgemeinen Impfprogramm, einem steigenden öffentlichen Bewusstsein und einem verbesserten Zugang zu erschwinglichen Diagnostika und Generika, insbesondere in unterversorgten Regionen. Diese Faktoren tragen zusammen dazu bei, dass Indien eine immer wichtigere Rolle bei der regionalen Marktexpansion spielt.

- Das Segment der chronischen Hepatitis B dominierte den Markt für Hepatitis-B-Infektionen im asiatisch-pazifischen Raum mit einem Marktanteil von 62,4 % im Jahr 2024, was auf die langfristigen gesundheitlichen Auswirkungen, die steigende Zahl diagnostizierter Fälle und den Bedarf an erweiterten antiviralen Therapie- und Leberüberwachungsprogrammen zurückzuführen ist.

Berichtsumfang und Marktsegmentierung für Hepatitis-B-Infektionen im asiatisch-pazifischen Raum

|

Eigenschaften |

Wichtige Markteinblicke zu Hepatitis-B-Infektionen im asiatisch-pazifischen Raum |

|

Abgedeckte Segmente |

|

|

Abgedeckte Länder |

Asien-Pazifik

|

|

Wichtige Marktteilnehmer |

|

|

Marktchancen |

|

|

Wertschöpfungsdaten-Infosets |

Zusätzlich zu den Einblicken in Marktszenarien wie Marktwert, Wachstumsrate, Segmentierung, geografische Abdeckung und wichtige Akteure enthalten die von Data Bridge Market Research kuratierten Marktberichte auch ausführliche Expertenanalysen, Preisanalysen, Markenanteilsanalysen, Verbraucherumfragen, demografische Analysen, Lieferkettenanalysen, Wertschöpfungskettenanalysen, eine Übersicht über Rohstoffe/Verbrauchsmaterialien, Kriterien für die Lieferantenauswahl, PESTLE-Analysen, Porter-Analysen und regulatorische Rahmenbedingungen. |

Markttrends für Hepatitis-B-Infektionen im asiatisch-pazifischen Raum

„ Mehr Komfort durch integrierte Pflege und erweiterten Behandlungszugang “

- Ein bedeutender und sich beschleunigender Trend im asiatisch-pazifischen Markt für Hepatitis-B-Infektionen ist die zunehmende Integration multidisziplinärer Versorgungsmodelle und der verbesserte Zugang zu Behandlungen durch zentralisierte Gesundheitssysteme. Dieser Trend verbessert die Behandlungsergebnisse und die Therapietreue deutlich, da er eine nahtlose Kommunikation zwischen Allgemeinmedizinern, Hepatologen und öffentlichen Gesundheitseinrichtungen ermöglicht.

- So haben beispielsweise mehrere westeuropäische Länder nationale Hepatitis-Aktionspläne eingeführt, die Patienten eine frühzeitige Diagnose, antivirale Behandlung und regelmäßige Nachsorge in einem koordinierten Rahmen ermöglichen. Das deutsche Modell der integrierten Versorgung ermöglicht beispielsweise eine effiziente Verknüpfung von Diagnose und Behandlung und reduziert so die Krankheitsprogressionsraten.

- Maßnahmen wie zentralisierte Patientenregister, digitale Gesundheitsakten und optimierte Überweisungswege optimieren das Hepatitis-B-Infektionsmanagement, indem sie ein rechtzeitiges Eingreifen und Monitoring ermöglichen. Diese Systeme ermöglichen es Gesundheitsdienstleistern, die Leberfunktion, das Ansprechen auf die Behandlung und Koinfektionen wie Hepatitis D in Echtzeit zu verfolgen.

- Die Integration fortschrittlicher Diagnostik in die routinemäßige Primärversorgung erleichtert die Früherkennung sowohl akuter als auch chronischer Fälle. Dieser zentralisierte Ansatz, kombiniert mit dem erschwinglichen Zugang zu neueren antiviralen Therapien, verbessert sowohl die individuelle Patientenversorgung als auch die umfassendere Überwachung der öffentlichen Gesundheit.

- Dieser Trend zu einer rationalisierten, koordinierten und technologiegestützten Hepatitis-B-Behandlung verändert die Erwartungen an die nationalen Gesundheitssysteme grundlegend. Viele europäische Regierungen erweitern daher den Zugang zu Virushepatitis-Screenings, insbesondere für gefährdete und risikoreiche Bevölkerungsgruppen wie Migranten, Drogenkonsumenten und ältere Menschen.

- Die Nachfrage nach zugänglichen, effizienten und integrierten Behandlungsmodellen für Hepatitis B wächst sowohl im öffentlichen als auch im privaten Gesundheitssektor rasant, da die Interessengruppen zunehmend auf die langfristige Bekämpfung der Krankheit und die Ausrichtung auf die Ziele der Weltgesundheitsorganisation zur Eliminierung von Hepatitis B bis 2030 achten.

Marktdynamik für Hepatitis-B-Infektionen im asiatisch-pazifischen Raum

Treiber

„Steigender Bedarf aufgrund steigender Krankheitslast und Einführung präventiver Gesundheitsfürsorge“

- Die zunehmende Verbreitung von Hepatitis-B-Infektionen in ganz Europa sowie das gestiegene Bewusstsein für Lebererkrankungen treiben die Nachfrage nach Lösungen zur Frühdiagnose, Impfung und Behandlung deutlich voran.

- So erweiterte GlaxoSmithKline plc (GSK) im April 2024 seine europäische Hepatitis-B-Impfstoffversorgung durch eine strategische Partnerschaft mit regionalen Gesundheitssystemen, um die Impfraten in Hochrisikogruppen zu verbessern. Solche Initiativen wichtiger Marktteilnehmer dürften das Wachstum des Marktes für Hepatitis-B-Infektionen im asiatisch-pazifischen Raum im Prognosezeitraum ankurbeln.

- Da sich Gesundheitsbehörden und Verbraucher der langfristigen Komplikationen im Zusammenhang mit chronischer Hepatitis B – wie Leberzirrhose und Leberkrebs – immer mehr bewusst werden, steigt die Akzeptanz von Präventionsstrategien wie Impfungen und Früherkennungsuntersuchungen weiter an.

- Darüber hinaus wird durch die Integration von Hepatitis-B-Tests in die routinemäßigen Gesundheitsuntersuchungen und die wachsende Popularität von Point-of-Care-Diagnosetechnologien die Behandlung von Hepatitis B in ganz Europa zugänglicher und effizienter.

- Die Verfügbarkeit wirksamer Impfstoffe, oraler antiviraler Medikamente und die Entwicklung fortschrittlicher Immunmodulatoren ermöglichen eine bessere Krankheitskontrolle. Staatliche Förderung, Erstattungsrichtlinien und die von der WHO verfolgten Ziele zur Eliminierung von Hepatitis begünstigen zudem die Akzeptanz im öffentlichen und privaten Gesundheitswesen.

Einschränkung/Herausforderung

„ Bedenken hinsichtlich der Zugänglichkeit der Behandlung und der hohen Kosten neuartiger Therapien “

- Trotz medizinischer Fortschritte bleibt der eingeschränkte Zugang zu fortschrittlichen antiviralen Therapien und Immunmodulatoren in bestimmten Teilen des asiatisch-pazifischen Raums eine Herausforderung, insbesondere im östlichen und südlichen asiatisch-pazifischen Raum, wo weiterhin Ungleichheiten in der Gesundheitsversorgung bestehen.

- So zeigten Anfang 2024 veröffentlichte Studien, dass einige EU-Mitgliedsstaaten aufgrund von Beschaffungs- und Erstattungsproblemen immer noch mit Engpässen bei Hepatitis-B-Impfstoffen und eingeschränktem Zugang zu neuen Behandlungsschemata zu kämpfen haben.

- Um diese Lücke zu schließen, sind politische Anstrengungen erforderlich, um die Standards der Hepatitis-B-Behandlung in allen europäischen Ländern zu harmonisieren, insbesondere durch finanzielle Unterstützung auf EU-Ebene, Preisverhandlungen und vereinfachte behördliche Genehmigungen.

- Während antivirale Medikamente der ersten Wahl immer erschwinglicher werden, sind Therapien der neueren Generation mit verbesserter Wirksamkeit oft teurer, was ihre Akzeptanz bei nicht versicherten oder einkommensschwachen Bevölkerungsgruppen möglicherweise einschränkt.

- Öffentliches Misstrauen oder Impfskepsis, insbesondere im Europa nach der Pandemie, ist ein weiteres Hindernis, das durch Sensibilisierungskampagnen und die Einbindung von Gesundheitsdienstleistern angegangen werden muss.

- Die Bewältigung dieser Herausforderungen durch erweiterten Versicherungsschutz, öffentlich-private Partnerschaften und erhöhte Investitionen in die regionale Gesundheitsinfrastruktur wird entscheidend für die Aufrechterhaltung des langfristigen Wachstums auf dem Markt für Hepatitis-B-Infektionen im asiatisch-pazifischen Raum sein.

Marktumfang für Hepatitis-B-Infektionen im asiatisch-pazifischen Raum

Der Markt ist nach Typ und Behandlung segmentiert.

• Nach Typ

Der Markt für Hepatitis-B-Infektionen im asiatisch-pazifischen Raum wird nach Typ in chronische und akute Fälle unterteilt. Das chronische Segment hatte im Jahr 2024 mit 62,4 % den größten Marktanteil, vor allem aufgrund der hohen Prävalenz chronischer HBV-Fälle und der Notwendigkeit einer lebenslangen Krankheitsbehandlung durch antivirale Therapien und Überwachung.

Das Akutsegment dürfte zwischen 2025 und 2032 mit einer durchschnittlichen jährlichen Wachstumsrate (CAGR) von 6,4 % die höchste Wachstumsrate aufweisen. Grund hierfür sind verstärkte Früherkennungsmaßnahmen, Initiativen im Bereich der öffentlichen Gesundheit und ein wachsendes Bewusstsein, das zu einer rechtzeitigen Diagnose und Behandlung führt.

• Durch Behandlung

Der Markt für Hepatitis-B-Infektionen im asiatisch-pazifischen Raum ist hinsichtlich der Behandlung in Impfstoffe, antivirale Medikamente, Immunmodulatoren und chirurgische Eingriffe unterteilt. Das Impfstoffsegment hielt im Jahr 2024 mit 41,2 % den größten Umsatzanteil, unterstützt durch nationale Impfkampagnen, eine erhöhte Immunisierung ab Geburt und eine starke Akzeptanz bei erwachsenen Hochrisikogruppen.

Für den Bereich der antiviralen Medikamente wird von 2025 bis 2032 mit 7,1 % die höchste durchschnittliche jährliche Wachstumsrate erwartet. Grund hierfür sind die wachsende Zahl chronischer HBV-Patienten, Fortschritte bei oralen Therapien und günstige Erstattungsrichtlinien.

Regionale Analyse des Marktes für Hepatitis-B-Infektionen im asiatisch-pazifischen Raum

- Der asiatisch-pazifische Raum dominierte den Markt für Hepatitis-B-Infektionen mit dem größten Umsatzanteil von 33,27 % im Jahr 2024, was auf eine starke öffentliche Gesundheitsinfrastruktur, eine hohe Impfrate und ein zunehmendes Bewusstsein für die Übertragung und Prävention von Hepatitis B zurückzuführen ist.

- Die Region zeichnet sich durch fortschrittliche Diagnosemöglichkeiten, gut etablierte Immunisierungsprogramme und aktive, von der Regierung geleitete Initiativen zur Hepatitis-Überwachung aus.

- Diese weitverbreitete Einführung präventiver und therapeutischer Maßnahmen wird durch den allgemeinen Zugang zur Gesundheitsversorgung, kontinuierliche Investitionen in Forschung und Entwicklung sowie den zunehmenden Fokus auf Früherkennung und Krankheitskontrolle weiter unterstützt. Dadurch wird der asiatisch-pazifische Raum zu einem wichtigen Akteur auf dem globalen Markt für Hepatitis-B-Infektionen.

Markteinblick in China für Hepatitis-B-Infektionen

Der chinesische Markt für Hepatitis-B-Infektionen dominierte den asiatisch-pazifischen Markt mit dem größten Umsatzanteil von 34,7 % im Jahr 2024. Dies ist auf umfangreiche Impfprogramme, eine starke Regierungspolitik und die weit verbreitete Verfügbarkeit von Diagnosemöglichkeiten zurückzuführen. Die hohe Krankheitslast des Landes hat umfassende nationale Strategien zur HBV-Kontrolle ausgelöst, darunter Früherkennung, erschwingliche antivirale Therapien und öffentliche Gesundheitskampagnen, insbesondere in ländlichen und Hochrisikogruppen.

Markteinblick in Japan für Hepatitis-B-Infektionen

Der japanische Markt für Hepatitis-B-Infektionen machte im Jahr 2024 14,2 % des regionalen Umsatzes aus. Der Markt wird durch ein robustes Gesundheitssystem, regelmäßige Vorsorgeuntersuchungen vor der Geburt und bei Säuglingen sowie staatlich geförderte Impfprogramme unterstützt. Kontinuierliche Forschungs- und Entwicklungsfinanzierung und der Zugang zu fortschrittlichen antiviralen Medikamenten tragen zu nachhaltigem Marktwachstum und verbesserten Patientenergebnissen bei.

Markteinblicke zu Hepatitis-B-Infektionen in Indien und im asiatisch-pazifischen Raum

Der indische Markt für Hepatitis-B-Infektionen hatte im Jahr 2024 einen Umsatzanteil von 13,5 % am asiatisch-pazifischen Markt für Hepatitis-B-Infektionen und wird im Prognosezeitraum voraussichtlich mit einer durchschnittlichen jährlichen Wachstumsrate (CAGR) von 7,1 % wachsen. Der Markt profitiert von staatlichen Initiativen wie dem allgemeinen Impfprogramm, einem steigenden öffentlichen Bewusstsein und einem verbesserten Zugang zu erschwinglicher Diagnostik und Generika, insbesondere in unterversorgten Regionen.

Markteinblick in Südkorea und den asiatisch-pazifischen Raum für Hepatitis-B-Infektionen

Der südkoreanische Markt für Hepatitis-B-Infektionen trug 2024 8,6 % zum regionalen Markt bei. Das Wachstum wird durch hohe öffentliche Gesundheitsausgaben, umfassende HBV-Impfrichtlinien und die Integration von Hepatitis-Diensten in die Primärversorgung unterstützt. Staatlich geförderte Screening- und Frühbehandlungsprogramme verbessern das Krankheitsmanagement zusätzlich.

Marktanteil von Hepatitis-B-Infektionen im asiatisch-pazifischen Raum

Die Hepatitis-B-Infektionsbranche im asiatisch-pazifischen Raum wird hauptsächlich von etablierten Unternehmen geführt, darunter:

- Gilead Sciences, Inc. (USA)

- GSK plc (Großbritannien)

- Dynavax Technologies (USA)

- F. Hoffmann-La Roche Ltd (Schweiz)

- Bristol-Myers Squibb Company (USA)

- Merck & Co., Inc. (USA)

- Novartis AG (Schweiz)

- Arrowhead Pharmaceuticals Inc. (USA)

- Arbutus Biopharma (Kanada)

- Teva Pharmaceuticals, Inc. (Israel)

- Zydus Pharmaceuticals (Indien)

- Aurobindo Pharma (Indien)

- Lupin Pharmaceuticals, Inc. (Indien)

Neueste Entwicklungen auf dem Markt für Hepatitis-B-Infektionen im asiatisch-pazifischen Raum

- Im September 2024 gaben Gilead Sciences und Genesis Therapeutics eine strategische Zusammenarbeit zur Erforschung und Entwicklung neuartiger niedermolekularer Therapien mithilfe der GEMS-KI-Plattform von Genesis bekannt. Gilead erhielt im Rahmen dieser Partnerschaft die exklusiven Rechte zur Entwicklung und Vermarktung von Produkten.

- Im Juli 2024 präsentierte Gilead Sciences, Inc. Forschungsdaten, die die langfristige Wirksamkeit und Sicherheit von Biktarvy bei verschiedenen HIV-Populationen, darunter hispanische/lateinamerikanische Personen und ältere Erwachsene mit Komorbiditäten, belegen. Auch experimentelle Dosierungsschemata mit einmal täglicher und wöchentlicher Verabreichung wurden vorgestellt.

- Im Februar 2024 schloss GSK die Übernahme von Aiolos Bio ab, einschließlich des vielversprechenden monoklonalen Antikörpers AIO-001 gegen schweres Asthma. GSK zahlte 1 Milliarde US-Dollar im Voraus und bis zu 400 Millionen US-Dollar an Meilensteinzahlungen und erweiterte damit sein Portfolio an Atemwegsbiologika.

SKU-

Erhalten Sie Online-Zugriff auf den Bericht zur weltweit ersten Market Intelligence Cloud

- Interaktives Datenanalyse-Dashboard

- Unternehmensanalyse-Dashboard für Chancen mit hohem Wachstumspotenzial

- Zugriff für Research-Analysten für Anpassungen und Abfragen

- Konkurrenzanalyse mit interaktivem Dashboard

- Aktuelle Nachrichten, Updates und Trendanalyse

- Nutzen Sie die Leistungsfähigkeit der Benchmark-Analyse für eine umfassende Konkurrenzverfolgung

Forschungsmethodik

Die Datenerfassung und Basisjahresanalyse werden mithilfe von Datenerfassungsmodulen mit großen Stichprobengrößen durchgeführt. Die Phase umfasst das Erhalten von Marktinformationen oder verwandten Daten aus verschiedenen Quellen und Strategien. Sie umfasst die Prüfung und Planung aller aus der Vergangenheit im Voraus erfassten Daten. Sie umfasst auch die Prüfung von Informationsinkonsistenzen, die in verschiedenen Informationsquellen auftreten. Die Marktdaten werden mithilfe von marktstatistischen und kohärenten Modellen analysiert und geschätzt. Darüber hinaus sind Marktanteilsanalyse und Schlüsseltrendanalyse die wichtigsten Erfolgsfaktoren im Marktbericht. Um mehr zu erfahren, fordern Sie bitte einen Analystenanruf an oder geben Sie Ihre Anfrage ein.

Die wichtigste Forschungsmethodik, die vom DBMR-Forschungsteam verwendet wird, ist die Datentriangulation, die Data Mining, die Analyse der Auswirkungen von Datenvariablen auf den Markt und die primäre (Branchenexperten-)Validierung umfasst. Zu den Datenmodellen gehören ein Lieferantenpositionierungsraster, eine Marktzeitlinienanalyse, ein Marktüberblick und -leitfaden, ein Firmenpositionierungsraster, eine Patentanalyse, eine Preisanalyse, eine Firmenmarktanteilsanalyse, Messstandards, eine globale versus eine regionale und Lieferantenanteilsanalyse. Um mehr über die Forschungsmethodik zu erfahren, senden Sie eine Anfrage an unsere Branchenexperten.

Anpassung möglich

Data Bridge Market Research ist ein führendes Unternehmen in der fortgeschrittenen formativen Forschung. Wir sind stolz darauf, unseren bestehenden und neuen Kunden Daten und Analysen zu bieten, die zu ihren Zielen passen. Der Bericht kann angepasst werden, um Preistrendanalysen von Zielmarken, Marktverständnis für zusätzliche Länder (fordern Sie die Länderliste an), Daten zu klinischen Studienergebnissen, Literaturübersicht, Analysen des Marktes für aufgearbeitete Produkte und Produktbasis einzuschließen. Marktanalysen von Zielkonkurrenten können von technologiebasierten Analysen bis hin zu Marktportfoliostrategien analysiert werden. Wir können so viele Wettbewerber hinzufügen, wie Sie Daten in dem von Ihnen gewünschten Format und Datenstil benötigen. Unser Analystenteam kann Ihnen auch Daten in groben Excel-Rohdateien und Pivot-Tabellen (Fact Book) bereitstellen oder Sie bei der Erstellung von Präsentationen aus den im Bericht verfügbaren Datensätzen unterstützen.