Markt für anwendungsspezifische integrierte Schaltkreise (ASIC) im asiatisch-pazifischen Raum, nach Designtyp (vollständig benutzerdefiniert, teilweise benutzerdefiniert und programmierbar ), Programmiertechnologie (statischer RAM, Eprom, Eeprom, Antifuse und andere), Anwendung ( UnterhaltungselektronikRechenzentrum und Computer, IT und Telekommunikation, Medizin, Multimedia, Automobil und Industrie), Land (China, Südkorea, Japan, Indien, Australien, Singapur, Malaysia, Indonesien, Thailand, Philippinen und Rest des asiatisch-pazifischen Raums), Branchentrends und Prognose bis 2029.

Marktanalyse und Einblicke : Markt für anwendungsspezifische integrierte Schaltkreise (ASIC) im asiatisch-pazifischen Raum

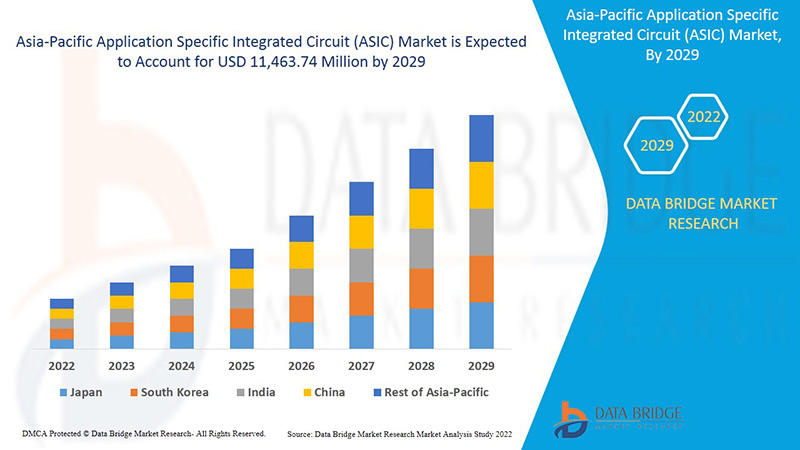

Der Markt für anwendungsspezifische integrierte Schaltkreise (ASIC) im asiatisch-pazifischen Raum wird im Prognosezeitraum von 2022 bis 2029 voraussichtlich an Marktwachstum gewinnen. Data Bridge Market Research analysiert, dass der Markt im Prognosezeitraum von 2022 bis 2029 mit einer CAGR von 8,8 % wächst und bis 2029 voraussichtlich 11.463,74 Millionen USD erreichen wird.

Ein anwendungsspezifischer integrierter Schaltkreis (ASIC) ist ein IC-Chip, der auf eine bestimmte Anwendung zugeschnitten ist und nicht für eine breite Verwendung entwickelt wurde. Ein ASIC ist beispielsweise ein Chip, der in einem digitalen Sprachrekorder oder einem hocheffizienten Video-Encoder (wie AMD VCE) läuft. Anwendungsspezifische Standardprodukt-Chips (ASSP) sind ein Mittelweg zwischen ASICs und Industriestandard-integrierten Schaltkreisen wie der 7400- oder 4000-Serie. Als MOS-integrierte Schaltkreischips werden ASIC-Chips im Allgemeinen in Metalloxid-Halbleiter-Technologie (MOS) hergestellt, zu der auch FPGA gehört . Die größte in einem ASIC verfügbare Komplexität (und damit Nützlichkeit) hat sich von 5.000 Logikgattern auf über 100 Millionen erhöht, da die Strukturgrößen gesunken sind und die Designtools im Laufe der Zeit verbessert wurden. Mikroprozessoren, Speicherblöcke wie ROM, RAM, EEPROM, Flash-Speicher und andere wichtige Bausteine sind häufig in modernen ASICs enthalten. Ein SoC (System-on-Chip) ist eine gängige Bezeichnung für einen solchen ASIC. Eine Hardwarebeschreibungssprache (HDL) wie Verilog oder VHDL wird von Designern digitaler ASICs häufig verwendet, um die Funktionsweise von ASICs zu definieren.

Zu den Faktoren, die den Markt antreiben, gehören die wachsende Nachfrage nach Smartphones und Tablets sowie die steigende Nachfrage nach intelligenten Verbrauchergeräten. Bedrohungen durch Cyberangriffe können jedoch ein hemmender Faktor sein. Darüber hinaus wächst auch der Markt für anwendungsspezifische integrierte Schaltkreise (ASIC) im asiatisch-pazifischen Raum aufgrund der steigenden Nachfrage nach Unterhaltungselektronikprodukten wie intelligenten Wearables, Smart-TVs und anderen, was die Nachfrage steigert.

Dieser Marktbericht für anwendungsspezifische integrierte Schaltkreise (ASIC) enthält Einzelheiten zu Marktanteilen, neuen Entwicklungen und Produktpipeline-Analysen, den Auswirkungen inländischer und lokaler Marktteilnehmer, analysiert Chancen in Bezug auf neu entstehende Umsatzbereiche, Änderungen der Marktvorschriften, Produktzulassungen, strategische Entscheidungen, Produkteinführungen, geografische Expansionen und technologische Innovationen auf dem Markt. Um die Analyse und das Marktszenario zu verstehen, kontaktieren Sie uns für ein Analyst Briefing. Unser Team hilft Ihnen dabei, eine Umsatzauswirkungslösung zu entwickeln, mit der Sie Ihr gewünschtes Ziel erreichen.

Marktumfang und Marktgröße für anwendungsspezifische integrierte Schaltkreise (ASIC) im asiatisch-pazifischen Raum

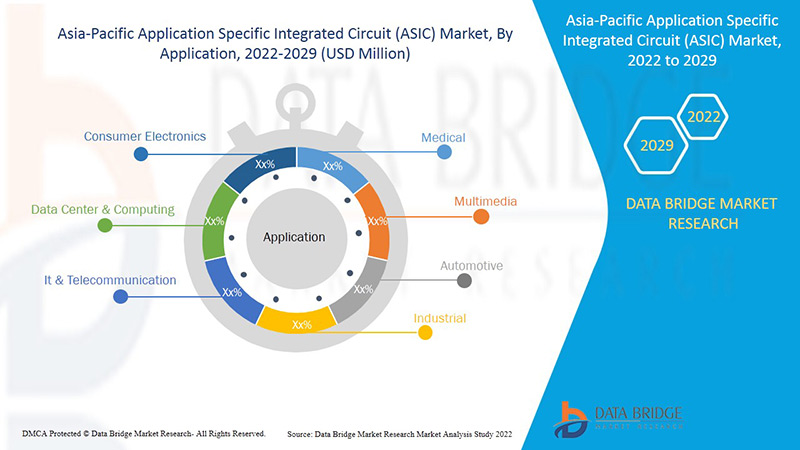

Der Markt für anwendungsspezifische integrierte Schaltkreise (ASIC) im asiatisch-pazifischen Raum ist nach Designtyp, Programmiertechnologie und Anwendung segmentiert. Das Wachstum zwischen den Segmenten hilft Ihnen bei der Analyse von Wachstumsnischen und Strategien zur Marktbearbeitung und bestimmt Ihre wichtigsten Anwendungsbereiche und die Unterschiede in Ihren Zielmärkten.

- Auf der Grundlage des Designtyps wurde der Markt für anwendungsspezifische integrierte Schaltkreise (ASIC) im asiatisch-pazifischen Raum in vollständig kundenspezifische, halbkundenspezifische und programmierbare Produkte segmentiert. Im Jahr 2022 wird das halbkundenspezifische Segment voraussichtlich den Markt für anwendungsspezifische integrierte Schaltkreise (ASIC) im asiatisch-pazifischen Raum dominieren, da die schnelle Einführung und wachsende Nachfrage nach autonomen Fahrzeugen weltweit aufgrund des technologischen Fortschritts wie KI und Computer-Vision-Technologie das Segmentwachstum ankurbelt. Da diese Technologien Gate-Array-basierte ASICs und Standardzellen-basierte ASICs verwenden, die dazu beitragen, die Fähigkeiten der KI- und Computer-Vision-Technologie zu verbessern. Daher kann dies das Segmentwachstum ankurbeln.

- Basierend auf dem Segment der Programmiertechnologie wurde der Markt für anwendungsspezifische integrierte Schaltkreise (ASIC) im asiatisch-pazifischen Raum in statischen RAM, EPROM, EEPROM, Antifuse und andere unterteilt. Im Jahr 2022 wird das Segment des statischen RAM voraussichtlich den Markt für anwendungsspezifische integrierte Schaltkreise (ASIC) im asiatisch-pazifischen Raum dominieren, da kosteneffiziente Systeme leicht verfügbar sind und sich mit zunehmender Komplexität des Chips problemlos implementieren lassen.

- Auf der Grundlage des Anwendungssegments wurde der Markt für anwendungsspezifische integrierte Schaltkreise (ASIC) im asiatisch-pazifischen Raum in Unterhaltungselektronik, Rechenzentren und Computer, IT und Telekommunikation, Medizin, Multimedia, Automobil und Industrie segmentiert. Im Jahr 2022 wird die Unterhaltungselektronik voraussichtlich den Markt für anwendungsspezifische integrierte Schaltkreise (ASIC) im asiatisch-pazifischen Raum dominieren, da die steigende Nachfrage nach intelligent vernetzten Häusern die Verbreitung intelligenter Haushaltsgeräte im asiatisch-pazifischen Raum unterstützt und die Auswirkungen von COVID die Arbeitnehmer gezwungen haben, von zu Hause aus zu arbeiten. Diese Gründe haben dem Segment Auftrieb gegeben. Darüber hinaus werden ASIC-Technologien in intelligenten Haushaltsgeräten weit verbreitet eingesetzt, was das Segmentwachstum ankurbelt.

Marktanalyse für anwendungsspezifische integrierte Schaltkreise (ASIC) im asiatisch-pazifischen Raum auf Länderebene

Der Markt für anwendungsspezifische integrierte Schaltkreise (ASIC) im asiatisch-pazifischen Raum ist nach Designtyp, Programmiertechnologie und Anwendung segmentiert.

Die im Marktbericht für anwendungsspezifische integrierte Schaltkreise (ASIC) abgedeckten Länder sind China, Japan, Südkorea, Indien, Australien, Malaysia, Singapur, Thailand, Indonesien, die Philippinen und der Rest der asiatisch-pazifischen Region.

China dominiert den Markt für anwendungsspezifische integrierte Schaltkreise (ASIC). Die wachsende Nachfrage nach Smartphones und Tablets sowie die steigende Nachfrage nach intelligenten Verbrauchergeräten können dem Markt für anwendungsspezifische integrierte Schaltkreise (ASIC) Auftrieb geben.

Der Länderabschnitt des Berichts enthält auch Angaben zu einzelnen marktbeeinflussenden Faktoren und Änderungen der Regulierung auf dem Inlandsmarkt, die sich auf die aktuellen und zukünftigen Markttrends auswirken. Datenpunkte wie Neuverkäufe, Ersatzverkäufe, demografische Daten des Landes, Regulierungsgesetze und Import-/Exportzölle sind einige der wichtigsten Anhaltspunkte, die zur Prognose des Marktszenarios für einzelne Länder verwendet werden. Bei der Prognoseanalyse der Länderdaten werden auch die Präsenz und Verfügbarkeit von Marken aus dem asiatisch-pazifischen Raum und ihre Herausforderungen aufgrund großer oder geringer Konkurrenz durch lokale und inländische Marken sowie die Auswirkungen der Vertriebskanäle berücksichtigt.

Steigende Nachfrage nach anwendungsspezifischen integrierten Schaltkreisen (ASIC)

Der Markt für anwendungsspezifische integrierte Schaltkreise (ASIC) bietet Ihnen außerdem eine detaillierte Marktanalyse für jedes Branchenwachstum in jedem Land mit Umsatz, Komponentenverkäufen, Auswirkungen der technologischen Entwicklung bei anwendungsspezifischen integrierten Schaltkreisen (ASIC) und Änderungen der regulatorischen Szenarien mit ihrer Unterstützung für den Markt für anwendungsspezifische integrierte Schaltkreise (ASIC). Die Daten sind für den historischen Zeitraum 2012 bis 2020 verfügbar.

Wettbewerbsumfeld und Analyse der Marktanteile anwendungsspezifischer integrierter Schaltkreise (ASIC)

Die Wettbewerbslandschaft des Marktes für anwendungsspezifische integrierte Schaltkreise (ASIC) liefert Details nach Wettbewerbern. Die enthaltenen Details sind Unternehmensübersicht, Unternehmensfinanzen, erzielter Umsatz, Marktpotenzial, Investitionen in Forschung und Entwicklung, neue Marktinitiativen, Präsenz im asiatisch-pazifischen Raum, Produktionsstandorte und -einrichtungen, Stärken und Schwächen des Unternehmens, Produkteinführung, Produkttestpipelines, Produktzulassungen, Patente, Produktbreite und -umfang, Anwendungsdominanz, Technologie-Lebenslinienkurve. Die oben angegebenen Datenpunkte beziehen sich nur auf den Fokus der Unternehmen in Bezug auf den Markt für anwendungsspezifische integrierte Schaltkreise (ASIC) im asiatisch-pazifischen Raum.

Die wichtigsten im Bericht behandelten Akteure sind unter anderem Intel Corporation, Infineon Technologies AG, NXP Semiconductors, Qualcomm Technologies, Microchip Technology Inc. und Analog Devices. Die Analysten von DBMR verstehen die Stärken der Konkurrenz und erstellen für jeden Wettbewerber eine separate Wettbewerbsanalyse. Viele Produktentwicklungen werden auch von Unternehmen weltweit initiiert, die das Wachstum des Marktes für anwendungsspezifische integrierte Schaltkreise (ASIC) beschleunigen.

Zum Beispiel,

- Im Juni 2021 brachte die Intel Corporation dedizierte FPGA-Infrastrukturprozessoren auf den Markt. Das Hauptmerkmal dieser dedizierten Infrastrukturprozessoren waren Server- und Netzwerkverwaltungsfunktionen, um ein flexibleres Virtualisierungsmodell anzubieten. Diese Produkteinführung wird das Portfolio der Infrastrukturprozessoren stärken.

Partnerschaften, Joint Ventures und andere Strategien steigern den Marktanteil des Unternehmens durch größere Reichweite und Präsenz. Darüber hinaus haben Unternehmen den Vorteil, ihr Angebot für den Markt für anwendungsspezifische integrierte Schaltkreise (ASIC) durch eine erweiterte Produktpalette zu verbessern.

SKU-

Erhalten Sie Online-Zugriff auf den Bericht zur weltweit ersten Market Intelligence Cloud

- Interaktives Datenanalyse-Dashboard

- Unternehmensanalyse-Dashboard für Chancen mit hohem Wachstumspotenzial

- Zugriff für Research-Analysten für Anpassungen und Abfragen

- Konkurrenzanalyse mit interaktivem Dashboard

- Aktuelle Nachrichten, Updates und Trendanalyse

- Nutzen Sie die Leistungsfähigkeit der Benchmark-Analyse für eine umfassende Konkurrenzverfolgung

Inhaltsverzeichnis

1 INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 OVERVIEW OF ASIA PACIFIC APPLICATION SPECIFIC INTEGRATED CIRCUIT (ASIC) MARKET

1.4 CURRENCY AND PRICING

1.5 LIMITATIONS

1.6 MARKETS COVERED

2 MARKET SEGMENTATION

2.1 MARKETS COVERED

2.2 GEOGRAPHICAL SCOPE

2.3 YEARS CONSIDERED FOR THE STUDY

2.4 DBMR TRIPOD DATA VALIDATION MODEL

2.5 PRIMARY INTERVIEWS WITH KEY OPINION LEADERS

2.6 DBMRMARKET POSITION GRID

2.7 VENDOR SHARE ANALYSIS

2.8 MULTIVARIATE MODELING

2.9 DESIGN TYPE TIMELINE CURVE

2.1 MARKET APPLICATION COVERAGE GRID

2.11 SECONDARY SOURCES

2.12 ASSUMPTIONS

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

5 MARKET OVERVIEW

5.1 DRIVERS

5.1.1 GROWING DEMAND FOR SMARTPHONES AND TABLETS

5.1.2 INCREASE IN DEMAND FROM SMART CONSUMER DEVICES

5.1.3 EMERGENCE OF ASIC DRIVEN IOT DEVICES

5.1.4 RISE IN DEMAND FOR MINIATURIZED ELECTRONICS DEVICE

5.2 RESTRAINTS

5.2.1 HIGH COST ASSOCIATED WITH MANUFACTURING CUSTOMIZED CIRCUITS

5.2.2 ASICS VULNERABILITY TOWARDS SECURITY ATTACKS/CYBER ATTACKS

5.3 OPPORTUNITIES

5.3.1 UTILIZING ASIC TECHNOLOGIES FOR POWERING AI

5.3.2 UPSURGE IN ADOPTION OF MECHATRONICS FOR AUTOMOTIVE APPLICATIONS

5.3.3 RISE IN DEPLOYMENT OF DATA CENTERS AND HIGH-PERFORMANCE COMPUTING

5.3.4 GROW IN PARTNERSHIP, ACQUISITIONS, AND MERGERS FOR ASIC

5.4 CHALLENGES

5.4.1 FUNCTIONAL RELIABILITY ISSUES FACED IN ASIA

5.4.2 COMPLEXITY INVOLVED IN DESIGNING AND FABRICATION OF APPLICATION SPECIFIC CIRCUITS

6 IMPACT OF COVID-19 PANDEMIC ON ASIA PACIFIC APPLICATION SPECIFIC INTEGRATED CIRCUIT (ASIC) MARKET

6.1 AFTERMATH OF COVID-19 AND GOVERNMENT INITIATIVES TO BOOST THE MARKET

6.2 STRATEGIC DECISIONS FOR MANUFACTURERS AFTER COVID-19 TO GAIN COMPETITIVE MARKET SHARE

6.3 IMPACT ON DEMAND

6.4 IMPACT ON PRICE

6.5 IMPACT ON SUPPLY CHAIN

6.6 CONCLUSION

7 ASIA PACIFIC APPLICATION SPECIFIC INTEGRATED CIRCUIT (ASIC) MARKET, BY DESIGN TYPE

7.1 OVERVIEW

7.2 SEMI-CUSTOM

7.2.1 STANDARD –CELL-BASED ASICS

7.2.2 GATE-ARRAY-BASED ASICS

7.2.2.1 CHANNEL LESS GATE ARRAYS

7.2.2.2 STRUCTURED GATE ARRAYS

7.2.2.3 CHANNELLED GATE ARRAYS

7.3 PROGRAMMABLE

7.3.1 FPGAS (FIELD PROGRAMMABLE GATE ARRAY)

7.3.1.1 BY TYPE

7.3.1.1.1 HIGH-END FPGAS

7.3.1.1.2 LOW-END FPGAS

7.3.1.1.3 MID-RANGE FPGAS

7.3.1.2 BY NODE SIZE

7.3.1.2.1 LESS THAN 28 NM

7.3.1.2.2 28-90 NM

7.3.1.2.3 MORE THAN 90 NM

7.3.1.3 BY APPLICATION

7.3.1.3.1 FILTERING AND COMMUNICATION

7.3.1.3.2 MEDICAL IMAGING

7.3.1.3.3 COMPUTER HARDWARE EMULATION

7.3.1.3.4 SOFTWARE-DEFINED RADIO

7.3.1.3.5 BIOINFORMATICS

7.3.1.3.6 DIGITAL SIGNAL PROCESSING

7.3.1.3.7 VOICE RECOGNITION

7.3.1.3.8 CRYPTOGRAPHY

7.3.1.3.9 INTEGRATING MULTIPLE SPLDS

7.3.1.3.10 ASIC PROTOTYPING

7.3.1.3.11 DEVICE CONTROLLERS

7.3.2 PLDS (PROGRAMMABLE LOGIC DEVICES)

7.3.2.1 BY TYPE

7.3.2.1.1 SIMPLE PROGRAMMABLE LOGIC DEVICE (SPLDS)

7.3.2.1.2 HIGH CAPACITY PROGRAMMABLE LOGIC DEVICE (HCPLDS)

7.4 FULL CUSTOM

8 ASIA PACIFIC APPLICATION SPECIFIC INTEGRATED CIRCUIT (ASIC) MARKET, BY PROGRAMMING TECHNOLOGY

8.1 OVERVIEW

8.2 STATIC RAM

8.3 ANTIFUSE

8.4 EEPROM

8.5 EPROM

8.6 OTHERS

9 ASIA PACIFIC APPLICATION SPECIFIC INTEGRATED CIRCUIT (ASIC) MARKET, BY APPLICATION

9.1 OVERVIEW

9.2 CONSUMER ELECTRONICS

9.2.1 SMARTPHONES AND TABLETS

9.2.2 WIRELESS VIRTUAL REALITY DEVICES

9.2.3 OTHERS

9.3 IT & TELECOMMUNICATION

9.3.1 WIRELESS COMMUNICATION

9.3.2 WIRED COMMUNICATION

9.4 DATA CENTER & COMPUTING

9.5 MEDICAL

9.5.1 IMAGING DIAGNOSTICS

9.5.2 WEARABLE DEVICES

9.5.3 OTHERS

9.6 INDUSTRIAL

9.6.1 BY SECTOR

9.6.1.1 MILITARY, AEROSPACE & DEFENSE

9.6.1.2 SATELLITE & SPACE

9.6.1.3 AVIATION

9.6.1.4 POWER GENERATION

9.6.1.5 OIL & GAS

9.6.2 BY APPLICATION

9.6.2.1 MACHINE VISION

9.6.2.2 ROBOTICS

9.6.2.3 INDUSTRIAL SENSOR

9.6.2.4 INDUSTRIAL NETWORKING

9.6.2.5 INDUSTRIAL MOTOR CONTROL

9.6.2.6 VIDEO SURVEILLANCE

9.7 AUTOMOTIVE

9.7.1 ADAS

9.7.2 AUTOMOTIVE INFOTAINMENT & DRIVER INFORMATION SYSTEM

9.8 MULTIMEDIA

9.8.1 COMMUNICATIONS

9.8.2 VIDEO PROCESSING

9.8.3 AUDIO

10 ASIA PACIFIC APPLICATION SPECIFIC INTEGRATED CIRCUIT (ASIC) MARKET, BY REGION

10.1 ASIA-PACIFIC

10.1.1 CHINA

10.1.2 JAPAN

10.1.3 SOUTH KOREA

10.1.4 INDIA

10.1.5 AUSTRALIA

10.1.6 SINGAPORE

10.1.7 THAILAND

10.1.8 INDONESIA

10.1.9 MALAYSIA

10.1.10 PHILIPPINES

10.1.11 REST OF ASIA-PACIFIC

11 ASIA PACIFIC APPLICATION SPECIFIC INTEGRATED CIRCUIT (ASIC) MARKET: COMPANY LANDSCAPE

11.1 COMPANY SHARE ANALYSIS: ASIA PACIFIC

12 SWOT ANALYSIS

13 COMPANY PROFILE

13.1 INTEL CORPORATION

13.1.1 COMPANY SNAPSHOT

13.1.2 REVENUE ANALYSIS

13.1.3 COMPANY SHARE ANALYSIS

13.1.4 PRODUCTS PORTFOLIO

13.1.5 RECENT DEVELOPMENTS

13.2 INFINEON TECHNOLOGIES AG

13.2.1 COMPANY SNAPSHOT

13.2.2 REVENUE ANALYSIS

13.2.3 COMPANY SHARE ANALYSIS

13.2.4 PRODUCTS PORTFOLIO

13.2.5 RECENT DEVELOPMENTS

13.3 ANALOG DEVICES, INC.

13.3.1 COMPANY SNAPHOT

13.3.2 REVENUE ANALYSIS

13.3.3 COMPANY SHARE ANALYSIS

13.3.4 PRODUCT PORTFOLIO

13.3.5 RECENT DEVELOPMENTS

13.4 NXP SEMICONDUCTORS

13.4.1 COMPANY SNAPSHOT

13.4.2 REVENUE ANALYSIS

13.4.3 COMPANY SHARE ANALYSIS

13.4.4 PRODUCTS PORTFOLIO

13.4.5 RECENT DEVELOPMENTS

13.5 MICROCHIP TECHNOLOGY INC.

13.5.1 COMPANY SNAPSHOT

13.5.2 REVENUE ANALYSIS

13.5.3 COMPANY SHARE ANALYSIS

13.5.4 PRODUCT PORTFOLIO

13.5.5 RECENT DEVELOPMENTS

13.6 TEXAS INSTRUMENTS INCORPORATED

13.6.1 COMPANY SNAPSHOT

13.6.2 REVENUE ANALYSIS

13.6.3 PRODUCT PORTFOLIO

13.6.4 RECENT DEVELOPMENTS

13.7 ACHRONIX SEMICONDUCTOR CORPORATION

13.7.1 COMPANY SNAPSHOT

13.7.2 PRODUCTS PORTFOLIO

13.7.3 RECENT DEVELOPMENTS

13.8 AVNET ASIC ISRAEL LTD.

13.8.1 COMPANY SNAPSHOT

13.8.2 PRODUCT PORTFOLIO

13.8.3 RECENT DEVELOPMENTS

13.9 COBHAM LIMITED

13.9.1 COMPANY SNAPSHOT

13.9.2 PRODUCT PORTFOLIO

13.9.3 RECENT DEVELOPMENTS

13.1 ENSILICA

13.10.1 COMPANY SNAPSHOT

13.10.2 PRODUCTS PORTFOLIO

13.10.3 RECENT DEVELOPMENTS

13.11 GOWIN SEMICONDUCTOR

13.11.1 COMPANY SNAPSHOT

13.11.2 PRODUCTS PORTFOLIO

13.11.3 RECENT DEVELOPMENTS

13.12 HONEYWELL INTERNATIONAL INC.

13.12.1 COMPANY SNAPHOT

13.12.2 REVENUE ANALYSIS

13.12.3 PRODUCT PORTFOLIO

13.12.4 RECENT DEVELOPMENTS

13.13 LATTICE SEMICONDUCTOR

13.13.1 COMPANY SNAPSHOT

13.13.2 REVENUE ANALYSIS

13.13.3 PRODUCT PORTFOLIO

13.13.4 RECENT DEVELOPMENTS

13.14 MAXIM INTEGRATED

13.14.1 COMPANY SNAPHOT

13.14.2 REVENUE ANALYSIS

13.14.3 PRODUCT PORTFOLIO

13.14.4 RECENT DEVELOPMENTS

13.15 MEGACHIPS CORPORATION

13.15.1 COMPANY SNAPSHOT

13.15.2 REVENUE ANALYSIS

13.15.3 PRODUCTS PORTFOLIO

13.15.4 RECENT DEVELOPMENTS

13.16 QUALCOMM TECHNOLOGIES, INC.

13.16.1 COMPANY SNAPSHOT

13.16.2 REVENUE ANALYSIS

13.16.3 PRODUCTS PORTFOLIO

13.16.4 RECENT DEVELOPMENTS

13.17 QUICKLOGIC CORPORATION

13.17.1 COMPANY SNAPSHOT

13.17.2 REVENUE ANALYSIS

13.17.3 PRODUCT PORTFOLIO

13.17.4 RECENT DEVELOPMENTS

13.18 RENESAS ELECTRONICS CORPORATION

13.18.1 COMPANY SNAPHOT

13.18.2 REVENUE ANALYSIS

13.18.3 PRODUCT PORTFOLIO

13.18.4 RECENT DEVELOPMENTS

13.19 SEMICONDUCTOR COMPONENTS INDUSTRIES, LLC

13.19.1 COMPANY SNAPSHOT

13.19.2 REVENUE ANALYSIS

13.19.3 PRODUCTS PORTFOLIO

13.19.4 RECENT DEVELOPMENTS

13.2 SOCIONEXT INC.

13.20.1 COMPANY SNAPSHOT

13.20.2 PRODUCT PORTFOLIO

13.20.3 RECENT DEVELOPMENTS

13.21 XILINX

13.21.1 COMPANY SNAPSHOT

13.21.2 REVENUE ANALYSIS

13.21.3 PRODUCTS PORTFOLIO

13.21.4 RECENT DEVELOPMENTS

14 QUESTIONNAIRE

15 RELATED REPORTS

Tabellenverzeichnis

TABLE 1 ASIA PACIFIC APPLICATION SPECIFIC INTEGRATED CIRCUIT (ASIC) MARKET, BY DESIGN TYPE, 2020-2029 (USD MILLION)

TABLE 2 ASIA PACIFIC SEMI-CUSTOM IN APPLICATION SPECIFIC INTEGRATED CIRCUIT (ASIC) MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 3 ASIA PACIFIC SEMI-CUSTOM IN APPLICATION SPECIFIC INTEGRATED CIRCUIT (ASIC) MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 4 ASIA PACIFIC GATE-ARRAY-BASED ASICS IN APPLICATION SPECIFIC INTEGRATED CIRCUIT (ASIC) MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 5 ASIA PACIFIC PROGRAMMABLE IN APPLICATION SPECIFIC INTEGRATED CIRCUIT (ASIC) MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 6 ASIA PACIFIC PROGRAMMABLE IN APPLICATION SPECIFIC INTEGRATED CIRCUIT (ASIC) MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 7 ASIA PACIFIC FPGAS (FIELD PROGRAMMABLE GATE ARRAY) IN APPLICATION SPECIFIC INTEGRATED CIRCUIT (ASIC) MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 8 ASIA PACIFIC FPGAS (FIELD PROGRAMMABLE GATE ARRAY) IN APPLICATION SPECIFIC INTEGRATED CIRCUIT (ASIC) MARKET, BY NODE SIZE, 2020-2029 (USD MILLION)

TABLE 9 ASIA PACIFIC FPGAS (FIELD PROGRAMMABLE GATE ARRAY) IN APPLICATION SPECIFIC INTEGRATED CIRCUIT (ASIC) MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 10 ASIA PACIFIC PLDS (PROGRAMMABLE LOGIC DEVICES) IN APPLICATION SPECIFIC INTEGRATED CIRCUIT (ASIC) MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 11 ASIA PACIFIC FULL CUSTOM IN APPLICATION SPECIFIC INTEGRATED CIRCUIT (ASIC) MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 12 ASIA PACIFIC APPLICATION SPECIFIC INTEGRATED CIRCUIT (ASIC) MARKET, BY PROGRAMMING TECHNOLOGY, 2020-2029 (USD MILLION)

TABLE 13 ASIA PACIFIC STATIC RAM IN APPLICATION SPECIFIC INTEGRATED CIRCUIT (ASIC) MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 14 ASIA PACIFIC ANTIFUSE IN APPLICATION SPECIFIC INTEGRATED CIRCUIT (ASIC) MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 15 ASIA PACIFIC EEPROM IN APPLICATION SPECIFIC INTEGRATED CIRCUIT (ASIC) MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 16 ASIA PACIFIC EPROM IN APPLICATION SPECIFIC INTEGRATED CIRCUIT (ASIC) MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 17 ASIA PACIFIC OTHERS IN APPLICATION SPECIFIC INTEGRATED CIRCUIT (ASIC) MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 18 ASIA PACIFIC CONSUMER ELECTRONICS SPECIFIC INTEGRATED CIRCUIT (ASIC) MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 19 ASIA PACIFIC CONSUMER ELECTRONICS IN APPLICATION SPECIFIC INTEGRATED CIRCUIT (ASIC) MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 20 ASIA PACIFIC CONSUMER ELECTRONICS IN APPLICATION SPECIFIC INTEGRATED CIRCUIT (ASIC) MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 21 ASIA PACIFIC IT & TELECOMMUNICATION IN APPLICATION SPECIFIC INTEGRATED CIRCUIT (ASIC) MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 22 ASIA PACIFIC IT & TELECOMMUNICATION IN APPLICATION SPECIFIC INTEGRATED CIRCUIT (ASIC) MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 23 ASIA PACIFIC DATA CENTER & COMPUTING IN APPLICATION SPECIFIC INTEGRATED CIRCUIT (ASIC) MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 24 ASIA PACIFIC MEDICAL IN APPLICATION SPECIFIC INTEGRATED CIRCUIT (ASIC) MARKET, BY REGION, 202O-2029 (USD MILLION)

TABLE 25 ASIA PACIFIC MEDICAL IN APPLICATION SPECIFIC INTEGRATED CIRCUIT (ASIC) MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 26 ASIA PACIFIC INDUSTRIAL IN APPLICATION SPECIFIC INTEGRATED CIRCUIT (ASIC) MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 27 ASIA PACIFIC INDUSTRIAL IN APPLICATION SPECIFIC INTEGRATED CIRCUIT (ASIC) MARKET, BY SECTOR, 2020-2029 (USD MILLION)

TABLE 28 ASIA PACIFIC INDUSTRIAL IN APPLICATION SPECIFIC INTEGRATED CIRCUIT (ASIC) MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 29 ASIA PACIFIC AUTOMOTIVE IN APPLICATION SPECIFIC INTEGRATED CIRCUIT (ASIC) MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 30 ASIA PACIFIC AUTOMOTIVE IN APPLICATION SPECIFIC INTEGRATED CIRCUIT (ASIC) MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 31 ASIA PACIFIC MULTIMEDIA IN APPLICATION SPECIFIC INTEGRATED CIRCUIT (ASIC) MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 32 ASIA PACIFIC MULTIMEDIA IN APPLICATION SPECIFIC INTEGRATED CIRCUIT (ASIC) MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 33 ASIA-PACIFIC APPLICATION SPECIFIC INTEGRATED CIRCUIT (ASIC) MARKET, BY COUNTRY, 2020-2029 (USD MILLION)

TABLE 34 ASIA-PACIFIC APPLICATION SPECIFIC INTEGRATED CIRCUIT (ASIC) MARKET, BY DESIGN TYPE, 2020-2029 (USD MILLION)

TABLE 35 ASIA-PACIFIC SEMI-CUSTOM IN APPLICATION SPECIFIC INTEGRATED CIRCUIT (ASIC) MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 36 ASIA-PACIFIC GATE-ARRAY-BASED ASICS IN APPLICATION SPECIFIC INTEGRATED CIRCUIT (ASIC) MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 37 ASIA-PACIFIC PROGRAMMABLE IN APPLICATION SPECIFIC INTEGRATED CIRCUIT (ASIC) MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 38 ASIA-PACIFIC FPGAS (FIELD PROGRAMMABLE GATE ARRAY) IN APPLICATION SPECIFIC INTEGRATED CIRCUIT (ASIC) MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 39 ASIA-PACIFIC FPGAS (FIELD PROGRAMMABLE GATE ARRAY) IN APPLICATION SPECIFIC INTEGRATED CIRCUIT (ASIC) MARKET, BY NODE SIZE, 2020-2029 (USD MILLION)

TABLE 40 ASIA-PACIFIC FPGAS (FIELD PROGRAMMABLE GATE ARRAY) IN APPLICATION SPECIFIC INTEGRATED CIRCUIT (ASIC) MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 41 ASIA-PACIFIC PLDS (PROGRAMMABLE LOGIC DEVICES) IN APPLICATION SPECIFIC INTEGRATED CIRCUIT (ASIC) MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 42 ASIA-PACIFIC APPLICATION SPECIFIC INTEGRATED CIRCUIT (ASIC) MARKET, BY PROGRAMMING TECHNOLOGY, 2020-2029 (USD MILLION)

TABLE 43 ASIA-PACIFIC APPLICATION SPECIFIC INTEGRATED CIRCUIT (ASIC) MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 44 ASIA-PACIFIC CONSUMER ELECTRONICS IN APPLICATION SPECIFIC INTEGRATED CIRCUIT (ASIC) MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 45 ASIA-PACIFIC IT & TELECOMMUNICATION IN APPLICATION SPECIFIC INTEGRATED CIRCUIT (ASIC) MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 46 ASIA-PACIFIC MEDICAL IN APPLICATION SPECIFIC INTEGRATED CIRCUIT (ASIC) MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 47 ASIA-PACIFIC INDUSTRIAL IN APPLICATION SPECIFIC INTEGRATED CIRCUIT (ASIC) MARKET, BY SECTOR, 2020-2029 (USD MILLION)

TABLE 48 ASIA-PACIFIC INDUSTRIAL IN APPLICATION SPECIFIC INTEGRATED CIRCUIT (ASIC) MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 49 ASIA-PACIFIC AUTOMOTIVE IN APPLICATION SPECIFIC INTEGRATED CIRCUIT (ASIC) MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 50 ASIA-PACIFIC MULTIMEDIA IN APPLICATION SPECIFIC INTEGRATED CIRCUIT (ASIC) MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 51 CHINA APPLICATION SPECIFIC INTEGRATED CIRCUIT (ASIC) MARKET, BY DESIGN TYPE, 2020-2029 (USD MILLION)

TABLE 52 CHINA SEMI-CUSTOM IN APPLICATION SPECIFIC INTEGRATED CIRCUIT (ASIC) MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 53 CHINA GATE-ARRAY-BASED ASICS IN APPLICATION SPECIFIC INTEGRATED CIRCUIT (ASIC) MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 54 CHINA PROGRAMMABLE IN APPLICATION SPECIFIC INTEGRATED CIRCUIT (ASIC) MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 55 CHINA FPGAS (FIELD PROGRAMMABLE GATE ARRAY) IN APPLICATION SPECIFIC INTEGRATED CIRCUIT (ASIC) MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 56 CHINA FPGAS (FIELD PROGRAMMABLE GATE ARRAY) IN APPLICATION SPECIFIC INTEGRATED CIRCUIT (ASIC) MARKET, BY NODE SIZE, 2020-2029 (USD MILLION)

TABLE 57 CHINA FPGAS (FIELD PROGRAMMABLE GATE ARRAY) IN APPLICATION SPECIFIC INTEGRATED CIRCUIT (ASIC) MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 58 CHINA PLDS (PROGRAMMABLE LOGIC DEVICES) IN APPLICATION SPECIFIC INTEGRATED CIRCUIT (ASIC) MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 59 CHINA APPLICATION SPECIFIC INTEGRATED CIRCUIT (ASIC) MARKET, BY PROGRAMMING TECHNOLOGY, 2020-2029 (USD MILLION)

TABLE 60 CHINA APPLICATION SPECIFIC INTEGRATED CIRCUIT (ASIC) MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 61 CHINA CONSUMER ELECTRONICS IN APPLICATION SPECIFIC INTEGRATED CIRCUIT (ASIC) MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 62 CHINA IT & TELECOMMUNICATION IN APPLICATION SPECIFIC INTEGRATED CIRCUIT (ASIC) MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 63 CHINA MEDICAL IN APPLICATION SPECIFIC INTEGRATED CIRCUIT (ASIC) MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 64 CHINA INDUSTRIAL IN APPLICATION SPECIFIC INTEGRATED CIRCUIT (ASIC) MARKET, BY SECTOR, 2020-2029 (USD MILLION)

TABLE 65 CHINA INDUSTRIAL IN APPLICATION SPECIFIC INTEGRATED CIRCUIT (ASIC) MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 66 CHINA AUTOMOTIVE IN APPLICATION SPECIFIC INTEGRATED CIRCUIT (ASIC) MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 67 CHINA MULTIMEDIA IN APPLICATION SPECIFIC INTEGRATED CIRCUIT (ASIC) MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 68 JAPAN APPLICATION SPECIFIC INTEGRATED CIRCUIT (ASIC) MARKET, BY DESIGN TYPE, 2020-2029 (USD MILLION)

TABLE 69 JAPAN SEMI-CUSTOM IN APPLICATION SPECIFIC INTEGRATED CIRCUIT (ASIC) MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 70 JAPAN GATE-ARRAY-BASED ASICS IN APPLICATION SPECIFIC INTEGRATED CIRCUIT (ASIC) MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 71 JAPAN PROGRAMMABLE IN APPLICATION SPECIFIC INTEGRATED CIRCUIT (ASIC) MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 72 JAPAN FPGAS (FIELD PROGRAMMABLE GATE ARRAY) IN APPLICATION SPECIFIC INTEGRATED CIRCUIT (ASIC) MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 73 JAPAN FPGAS (FIELD PROGRAMMABLE GATE ARRAY) IN APPLICATION SPECIFIC INTEGRATED CIRCUIT (ASIC) MARKET, BY NODE SIZE, 2020-2029 (USD MILLION)

TABLE 74 JAPAN FPGAS (FIELD PROGRAMMABLE GATE ARRAY) IN APPLICATION SPECIFIC INTEGRATED CIRCUIT (ASIC) MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 75 JAPAN PLDS (PROGRAMMABLE LOGIC DEVICES) IN APPLICATION SPECIFIC INTEGRATED CIRCUIT (ASIC) MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 76 JAPAN APPLICATION SPECIFIC INTEGRATED CIRCUIT (ASIC) MARKET, BY PROGRAMMING TECHNOLOGY, 2020-2029 (USD MILLION)

TABLE 77 JAPAN APPLICATION SPECIFIC INTEGRATED CIRCUIT (ASIC) MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 78 JAPAN CONSUMER ELECTRONICS IN APPLICATION SPECIFIC INTEGRATED CIRCUIT (ASIC) MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 79 JAPAN IT & TELECOMMUNICATION IN APPLICATION SPECIFIC INTEGRATED CIRCUIT (ASIC) MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 80 JAPAN MEDICAL IN APPLICATION SPECIFIC INTEGRATED CIRCUIT (ASIC) MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 81 JAPAN INDUSTRIAL IN APPLICATION SPECIFIC INTEGRATED CIRCUIT (ASIC) MARKET, BY SECTOR, 2020-2029 (USD MILLION)

TABLE 82 JAPAN INDUSTRIAL IN APPLICATION SPECIFIC INTEGRATED CIRCUIT (ASIC) MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 83 JAPAN AUTOMOTIVE IN APPLICATION SPECIFIC INTEGRATED CIRCUIT (ASIC) MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 84 JAPAN MULTIMEDIA IN APPLICATION SPECIFIC INTEGRATED CIRCUIT (ASIC) MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 85 SOUTH KOREA APPLICATION SPECIFIC INTEGRATED CIRCUIT (ASIC) MARKET, BY DESIGN TYPE, 2020-2029 (USD MILLION)

TABLE 86 SOUTH KOREA SEMI-CUSTOM IN APPLICATION SPECIFIC INTEGRATED CIRCUIT (ASIC) MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 87 SOUTH KOREA GATE-ARRAY-BASED ASICS IN APPLICATION SPECIFIC INTEGRATED CIRCUIT (ASIC) MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 88 SOUTH KOREA PROGRAMMABLE IN APPLICATION SPECIFIC INTEGRATED CIRCUIT (ASIC) MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 89 SOUTH KOREA FPGAS (FIELD PROGRAMMABLE GATE ARRAY) IN APPLICATION SPECIFIC INTEGRATED CIRCUIT (ASIC) MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 90 SOUTH KOREA FPGAS (FIELD PROGRAMMABLE GATE ARRAY) IN APPLICATION SPECIFIC INTEGRATED CIRCUIT (ASIC) MARKET, BY NODE SIZE, 2020-2029 (USD MILLION)

TABLE 91 SOUTH KOREA FPGAS (FIELD PROGRAMMABLE GATE ARRAY) IN APPLICATION SPECIFIC INTEGRATED CIRCUIT (ASIC) MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 92 SOUTH KOREA PLDS (PROGRAMMABLE LOGIC DEVICES) IN APPLICATION SPECIFIC INTEGRATED CIRCUIT (ASIC) MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 93 SOUTH KOREA APPLICATION SPECIFIC INTEGRATED CIRCUIT (ASIC) MARKET, BY PROGRAMMING TECHNOLOGY, 2020-2029 (USD MILLION)

TABLE 94 SOUTH KOREA APPLICATION SPECIFIC INTEGRATED CIRCUIT (ASIC) MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 95 SOUTH KOREA CONSUMER ELECTRONICS IN APPLICATION SPECIFIC INTEGRATED CIRCUIT (ASIC) MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 96 SOUTH KOREA IT & TELECOMMUNICATION IN APPLICATION SPECIFIC INTEGRATED CIRCUIT (ASIC) MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 97 SOUTH KOREA MEDICAL IN APPLICATION SPECIFIC INTEGRATED CIRCUIT (ASIC) MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 98 SOUTH KOREA INDUSTRIAL IN APPLICATION SPECIFIC INTEGRATED CIRCUIT (ASIC) MARKET, BY SECTOR, 2020-2029 (USD MILLION)

TABLE 99 SOUTH KOREA INDUSTRIAL IN APPLICATION SPECIFIC INTEGRATED CIRCUIT (ASIC) MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 100 SOUTH KOREA AUTOMOTIVE IN APPLICATION SPECIFIC INTEGRATED CIRCUIT (ASIC) MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 101 SOUTH KOREA MULTIMEDIA IN APPLICATION SPECIFIC INTEGRATED CIRCUIT (ASIC) MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 102 INDIA APPLICATION SPECIFIC INTEGRATED CIRCUIT (ASIC) MARKET, BY DESIGN TYPE, 2020-2029 (USD MILLION)

TABLE 103 INDIA SEMI-CUSTOM IN APPLICATION SPECIFIC INTEGRATED CIRCUIT (ASIC) MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 104 INDIA GATE-ARRAY-BASED ASICS IN APPLICATION SPECIFIC INTEGRATED CIRCUIT (ASIC) MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 105 INDIA PROGRAMMABLE IN APPLICATION SPECIFIC INTEGRATED CIRCUIT (ASIC) MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 106 INDIA FPGAS (FIELD PROGRAMMABLE GATE ARRAY) IN APPLICATION SPECIFIC INTEGRATED CIRCUIT (ASIC) MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 107 INDIA FPGAS (FIELD PROGRAMMABLE GATE ARRAY) IN APPLICATION SPECIFIC INTEGRATED CIRCUIT (ASIC) MARKET, BY NODE SIZE, 2020-2029 (USD MILLION)

TABLE 108 INDIA FPGAS (FIELD PROGRAMMABLE GATE ARRAY) IN APPLICATION SPECIFIC INTEGRATED CIRCUIT (ASIC) MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 109 INDIA PLDS (PROGRAMMABLE LOGIC DEVICES) IN APPLICATION SPECIFIC INTEGRATED CIRCUIT (ASIC) MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 110 INDIA APPLICATION SPECIFIC INTEGRATED CIRCUIT (ASIC) MARKET, BY PROGRAMMING TECHNOLOGY, 2020-2029 (USD MILLION)

TABLE 111 INDIA APPLICATION SPECIFIC INTEGRATED CIRCUIT (ASIC) MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 112 INDIA CONSUMER ELECTRONICS IN APPLICATION SPECIFIC INTEGRATED CIRCUIT (ASIC) MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 113 INDIA IT & TELECOMMUNICATION IN APPLICATION SPECIFIC INTEGRATED CIRCUIT (ASIC) MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 114 INDIA MEDICAL IN APPLICATION SPECIFIC INTEGRATED CIRCUIT (ASIC) MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 115 INDIA INDUSTRIAL IN APPLICATION SPECIFIC INTEGRATED CIRCUIT (ASIC) MARKET, BY SECTOR, 2020-2029 (USD MILLION)

TABLE 116 INDIA INDUSTRIAL IN APPLICATION SPECIFIC INTEGRATED CIRCUIT (ASIC) MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 117 INDIA AUTOMOTIVE IN APPLICATION SPECIFIC INTEGRATED CIRCUIT (ASIC) MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 118 INDIA MULTIMEDIA IN APPLICATION SPECIFIC INTEGRATED CIRCUIT (ASIC) MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 119 AUSTRALIA APPLICATION SPECIFIC INTEGRATED CIRCUIT (ASIC) MARKET, BY DESIGN TYPE, 2020-2029 (USD MILLION)

TABLE 120 AUSTRALIA SEMI-CUSTOM IN APPLICATION SPECIFIC INTEGRATED CIRCUIT (ASIC) MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 121 AUSTRALIA GATE-ARRAY-BASED ASICS IN APPLICATION SPECIFIC INTEGRATED CIRCUIT (ASIC) MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 122 AUSTRALIA PROGRAMMABLE IN APPLICATION SPECIFIC INTEGRATED CIRCUIT (ASIC) MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 123 AUSTRALIA FPGAS (FIELD PROGRAMMABLE GATE ARRAY) IN APPLICATION SPECIFIC INTEGRATED CIRCUIT (ASIC) MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 124 AUSTRALIA FPGAS (FIELD PROGRAMMABLE GATE ARRAY) IN APPLICATION SPECIFIC INTEGRATED CIRCUIT (ASIC) MARKET, BY NODE SIZE, 2020-2029 (USD MILLION)

TABLE 125 AUSTRALIA FPGAS (FIELD PROGRAMMABLE GATE ARRAY) IN APPLICATION SPECIFIC INTEGRATED CIRCUIT (ASIC) MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 126 AUSTRALIA PLDS (PROGRAMMABLE LOGIC DEVICES) IN APPLICATION SPECIFIC INTEGRATED CIRCUIT (ASIC) MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 127 AUSTRALIA APPLICATION SPECIFIC INTEGRATED CIRCUIT (ASIC) MARKET, BY PROGRAMMING TECHNOLOGY, 2020-2029 (USD MILLION)

TABLE 128 AUSTRALIA APPLICATION SPECIFIC INTEGRATED CIRCUIT (ASIC) MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 129 AUSTRALIA CONSUMER ELECTRONICS IN APPLICATION SPECIFIC INTEGRATED CIRCUIT (ASIC) MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 130 AUSTRALIA IT & TELECOMMUNICATION IN APPLICATION SPECIFIC INTEGRATED CIRCUIT (ASIC) MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 131 AUSTRALIA MEDICAL IN APPLICATION SPECIFIC INTEGRATED CIRCUIT (ASIC) MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 132 AUSTRALIA INDUSTRIAL IN APPLICATION SPECIFIC INTEGRATED CIRCUIT (ASIC) MARKET, BY SECTOR, 2020-2029 (USD MILLION)

TABLE 133 AUSTRALIA INDUSTRIAL IN APPLICATION SPECIFIC INTEGRATED CIRCUIT (ASIC) MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 134 AUSTRALIA AUTOMOTIVE IN APPLICATION SPECIFIC INTEGRATED CIRCUIT (ASIC) MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 135 AUSTRALIA MULTIMEDIA IN APPLICATION SPECIFIC INTEGRATED CIRCUIT (ASIC) MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 136 SINGAPORE APPLICATION SPECIFIC INTEGRATED CIRCUIT (ASIC) MARKET, BY DESIGN TYPE, 2020-2029 (USD MILLION)

TABLE 137 SINGAPORE SEMI-CUSTOM IN APPLICATION SPECIFIC INTEGRATED CIRCUIT (ASIC) MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 138 SINGAPORE GATE-ARRAY-BASED ASICS IN APPLICATION SPECIFIC INTEGRATED CIRCUIT (ASIC) MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 139 SINGAPORE PROGRAMMABLE IN APPLICATION SPECIFIC INTEGRATED CIRCUIT (ASIC) MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 140 SINGAPORE FPGAS (FIELD PROGRAMMABLE GATE ARRAY) IN APPLICATION SPECIFIC INTEGRATED CIRCUIT (ASIC) MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 141 SINGAPORE FPGAS (FIELD PROGRAMMABLE GATE ARRAY) IN APPLICATION SPECIFIC INTEGRATED CIRCUIT (ASIC) MARKET, BY NODE SIZE, 2020-2029 (USD MILLION)

TABLE 142 SINGAPORE FPGAS (FIELD PROGRAMMABLE GATE ARRAY) IN APPLICATION SPECIFIC INTEGRATED CIRCUIT (ASIC) MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 143 SINGAPORE PLDS (PROGRAMMABLE LOGIC DEVICES) IN APPLICATION SPECIFIC INTEGRATED CIRCUIT (ASIC) MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 144 SINGAPORE APPLICATION SPECIFIC INTEGRATED CIRCUIT (ASIC) MARKET, BY PROGRAMMING TECHNOLOGY, 2020-2029 (USD MILLION)

TABLE 145 SINGAPORE APPLICATION SPECIFIC INTEGRATED CIRCUIT (ASIC) MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 146 SINGAPORE CONSUMER ELECTRONICS IN APPLICATION SPECIFIC INTEGRATED CIRCUIT (ASIC) MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 147 SINGAPORE IT & TELECOMMUNICATION IN APPLICATION SPECIFIC INTEGRATED CIRCUIT (ASIC) MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 148 SINGAPORE MEDICAL IN APPLICATION SPECIFIC INTEGRATED CIRCUIT (ASIC) MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 149 SINGAPORE INDUSTRIAL IN APPLICATION SPECIFIC INTEGRATED CIRCUIT (ASIC) MARKET, BY SECTOR, 2020-2029 (USD MILLION)

TABLE 150 SINGAPORE INDUSTRIAL IN APPLICATION SPECIFIC INTEGRATED CIRCUIT (ASIC) MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 151 SINGAPORE AUTOMOTIVE IN APPLICATION SPECIFIC INTEGRATED CIRCUIT (ASIC) MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 152 SINGAPORE MULTIMEDIA IN APPLICATION SPECIFIC INTEGRATED CIRCUIT (ASIC) MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 153 THAILAND APPLICATION SPECIFIC INTEGRATED CIRCUIT (ASIC) MARKET, BY DESIGN TYPE, 2020-2029 (USD MILLION)

TABLE 154 THAILAND SEMI-CUSTOM IN APPLICATION SPECIFIC INTEGRATED CIRCUIT (ASIC) MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 155 THAILAND GATE-ARRAY-BASED ASICS IN APPLICATION SPECIFIC INTEGRATED CIRCUIT (ASIC) MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 156 THAILAND PROGRAMMABLE IN APPLICATION SPECIFIC INTEGRATED CIRCUIT (ASIC) MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 157 THAILAND FPGAS (FIELD PROGRAMMABLE GATE ARRAY) IN APPLICATION SPECIFIC INTEGRATED CIRCUIT (ASIC) MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 158 THAILAND FPGAS (FIELD PROGRAMMABLE GATE ARRAY) IN APPLICATION SPECIFIC INTEGRATED CIRCUIT (ASIC) MARKET, BY NODE SIZE, 2020-2029 (USD MILLION)

TABLE 159 THAILAND FPGAS (FIELD PROGRAMMABLE GATE ARRAY) IN APPLICATION SPECIFIC INTEGRATED CIRCUIT (ASIC) MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 160 THAILAND PLDS (PROGRAMMABLE LOGIC DEVICES) IN APPLICATION SPECIFIC INTEGRATED CIRCUIT (ASIC) MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 161 THAILAND APPLICATION SPECIFIC INTEGRATED CIRCUIT (ASIC) MARKET, BY PROGRAMMING TECHNOLOGY, 2020-2029 (USD MILLION)

TABLE 162 THAILAND APPLICATION SPECIFIC INTEGRATED CIRCUIT (ASIC) MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 163 THAILAND CONSUMER ELECTRONICS IN APPLICATION SPECIFIC INTEGRATED CIRCUIT (ASIC) MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 164 THAILAND IT & TELECOMMUNICATION IN APPLICATION SPECIFIC INTEGRATED CIRCUIT (ASIC) MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 165 THAILAND MEDICAL IN APPLICATION SPECIFIC INTEGRATED CIRCUIT (ASIC) MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 166 THAILAND INDUSTRIAL IN APPLICATION SPECIFIC INTEGRATED CIRCUIT (ASIC) MARKET, BY SECTOR, 2020-2029 (USD MILLION)

TABLE 167 THAILAND INDUSTRIAL IN APPLICATION SPECIFIC INTEGRATED CIRCUIT (ASIC) MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 168 THAILAND AUTOMOTIVE IN APPLICATION SPECIFIC INTEGRATED CIRCUIT (ASIC) MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 169 THAILAND MULTIMEDIA IN APPLICATION SPECIFIC INTEGRATED CIRCUIT (ASIC) MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 170 INDONESIA APPLICATION SPECIFIC INTEGRATED CIRCUIT (ASIC) MARKET, BY DESIGN TYPE, 2020-2029 (USD MILLION)

TABLE 171 INDONESIA SEMI-CUSTOM IN APPLICATION SPECIFIC INTEGRATED CIRCUIT (ASIC) MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 172 INDONESIA GATE-ARRAY-BASED ASICS IN APPLICATION SPECIFIC INTEGRATED CIRCUIT (ASIC) MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 173 INDONESIA PROGRAMMABLE IN APPLICATION SPECIFIC INTEGRATED CIRCUIT (ASIC) MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 174 INDONESIA FPGAS (FIELD PROGRAMMABLE GATE ARRAY) IN APPLICATION SPECIFIC INTEGRATED CIRCUIT (ASIC) MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 175 INDONESIA FPGAS (FIELD PROGRAMMABLE GATE ARRAY) IN APPLICATION SPECIFIC INTEGRATED CIRCUIT (ASIC) MARKET, BY NODE SIZE, 2020-2029 (USD MILLION)

TABLE 176 INDONESIA FPGAS (FIELD PROGRAMMABLE GATE ARRAY) IN APPLICATION SPECIFIC INTEGRATED CIRCUIT (ASIC) MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 177 INDONESIA PLDS (PROGRAMMABLE LOGIC DEVICES) IN APPLICATION SPECIFIC INTEGRATED CIRCUIT (ASIC) MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 178 INDONESIA APPLICATION SPECIFIC INTEGRATED CIRCUIT (ASIC) MARKET, BY PROGRAMMING TECHNOLOGY, 2020-2029 (USD MILLION)

TABLE 179 INDONESIA APPLICATION SPECIFIC INTEGRATED CIRCUIT (ASIC) MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 180 INDONESIA CONSUMER ELECTRONICS IN APPLICATION SPECIFIC INTEGRATED CIRCUIT (ASIC) MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 181 INDONESIA IT & TELECOMMUNICATION IN APPLICATION SPECIFIC INTEGRATED CIRCUIT (ASIC) MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 182 INDONESIA MEDICAL IN APPLICATION SPECIFIC INTEGRATED CIRCUIT (ASIC) MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 183 INDONESIA INDUSTRIAL IN APPLICATION SPECIFIC INTEGRATED CIRCUIT (ASIC) MARKET, BY SECTOR, 2020-2029 (USD MILLION)

TABLE 184 INDONESIA INDUSTRIAL IN APPLICATION SPECIFIC INTEGRATED CIRCUIT (ASIC) MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 185 INDONESIA AUTOMOTIVE IN APPLICATION SPECIFIC INTEGRATED CIRCUIT (ASIC) MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 186 INDONESIA MULTIMEDIA IN APPLICATION SPECIFIC INTEGRATED CIRCUIT (ASIC) MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 187 MALAYSIA APPLICATION SPECIFIC INTEGRATED CIRCUIT (ASIC) MARKET, BY DESIGN TYPE, 2020-2029 (USD MILLION)

TABLE 188 MALAYSIA SEMI-CUSTOM IN APPLICATION SPECIFIC INTEGRATED CIRCUIT (ASIC) MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 189 MALAYSIA GATE-ARRAY-BASED ASICS IN APPLICATION SPECIFIC INTEGRATED CIRCUIT (ASIC) MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 190 MALAYSIA PROGRAMMABLE IN APPLICATION SPECIFIC INTEGRATED CIRCUIT (ASIC) MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 191 MALAYSIA FPGAS (FIELD PROGRAMMABLE GATE ARRAY) IN APPLICATION SPECIFIC INTEGRATED CIRCUIT (ASIC) MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 192 MALAYSIA FPGAS (FIELD PROGRAMMABLE GATE ARRAY) IN APPLICATION SPECIFIC INTEGRATED CIRCUIT (ASIC) MARKET, BY NODE SIZE, 2020-2029 (USD MILLION)

TABLE 193 MALAYSIA FPGAS (FIELD PROGRAMMABLE GATE ARRAY) IN APPLICATION SPECIFIC INTEGRATED CIRCUIT (ASIC) MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 194 MALAYSIA PLDS (PROGRAMMABLE LOGIC DEVICES) IN APPLICATION SPECIFIC INTEGRATED CIRCUIT (ASIC) MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 195 MALAYSIA APPLICATION SPECIFIC INTEGRATED CIRCUIT (ASIC) MARKET, BY PROGRAMMING TECHNOLOGY, 2020-2029 (USD MILLION)

TABLE 196 MALAYSIA APPLICATION SPECIFIC INTEGRATED CIRCUIT (ASIC) MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 197 MALAYSIA CONSUMER ELECTRONICS IN APPLICATION SPECIFIC INTEGRATED CIRCUIT (ASIC) MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 198 MALAYSIA IT & TELECOMMUNICATION IN APPLICATION SPECIFIC INTEGRATED CIRCUIT (ASIC) MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 199 MALAYSIA MEDICAL IN APPLICATION SPECIFIC INTEGRATED CIRCUIT (ASIC) MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 200 MALAYSIA INDUSTRIAL IN APPLICATION SPECIFIC INTEGRATED CIRCUIT (ASIC) MARKET, BY SECTOR, 2020-2029 (USD MILLION)

TABLE 201 MALAYSIA INDUSTRIAL IN APPLICATION SPECIFIC INTEGRATED CIRCUIT (ASIC) MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 202 MALAYSIA AUTOMOTIVE IN APPLICATION SPECIFIC INTEGRATED CIRCUIT (ASIC) MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 203 MALAYSIA MULTIMEDIA IN APPLICATION SPECIFIC INTEGRATED CIRCUIT (ASIC) MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 204 PHILIPPINES APPLICATION SPECIFIC INTEGRATED CIRCUIT (ASIC) MARKET, BY DESIGN TYPE, 2020-2029 (USD MILLION)

TABLE 205 PHILIPPINES SEMI-CUSTOM IN APPLICATION SPECIFIC INTEGRATED CIRCUIT (ASIC) MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 206 PHILIPPINES GATE-ARRAY-BASED ASICS IN APPLICATION SPECIFIC INTEGRATED CIRCUIT (ASIC) MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 207 PHILIPPINES PROGRAMMABLE IN APPLICATION SPECIFIC INTEGRATED CIRCUIT (ASIC) MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 208 PHILIPPINES FPGAS (FIELD PROGRAMMABLE GATE ARRAY) IN APPLICATION SPECIFIC INTEGRATED CIRCUIT (ASIC) MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 209 PHILIPPINES FPGAS (FIELD PROGRAMMABLE GATE ARRAY) IN APPLICATION SPECIFIC INTEGRATED CIRCUIT (ASIC) MARKET, BY NODE SIZE, 2020-2029 (USD MILLION)

TABLE 210 PHILIPPINES FPGAS (FIELD PROGRAMMABLE GATE ARRAY) IN APPLICATION SPECIFIC INTEGRATED CIRCUIT (ASIC) MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 211 PHILIPPINES PLDS (PROGRAMMABLE LOGIC DEVICES) IN APPLICATION SPECIFIC INTEGRATED CIRCUIT (ASIC) MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 212 PHILIPPINES APPLICATION SPECIFIC INTEGRATED CIRCUIT (ASIC) MARKET, BY PROGRAMMING TECHNOLOGY, 2020-2029 (USD MILLION)

TABLE 213 PHILIPPINES APPLICATION SPECIFIC INTEGRATED CIRCUIT (ASIC) MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 214 PHILIPPINES CONSUMER ELECTRONICS IN APPLICATION SPECIFIC INTEGRATED CIRCUIT (ASIC) MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 215 PHILIPPINES IT & TELECOMMUNICATION IN APPLICATION SPECIFIC INTEGRATED CIRCUIT (ASIC) MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 216 PHILIPPINES MEDICAL IN APPLICATION SPECIFIC INTEGRATED CIRCUIT (ASIC) MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 217 PHILIPPINES INDUSTRIAL IN APPLICATION SPECIFIC INTEGRATED CIRCUIT (ASIC) MARKET, BY SECTOR, 2020-2029 (USD MILLION)

TABLE 218 PHILIPPINES INDUSTRIAL IN APPLICATION SPECIFIC INTEGRATED CIRCUIT (ASIC) MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 219 PHILIPPINES AUTOMOTIVE IN APPLICATION SPECIFIC INTEGRATED CIRCUIT (ASIC) MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 220 PHILIPPINES MULTIMEDIA IN APPLICATION SPECIFIC INTEGRATED CIRCUIT (ASIC) MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 221 REST OF ASIA-PACIFIC APPLICATION SPECIFIC INTEGRATED CIRCUIT (ASIC) MARKET, BY DESIGN TYPE, 2020-2029 (USD MILLION)

Abbildungsverzeichnis

FIGURE 1 ASIA PACIFIC APPLICATION SPECIFIC INTEGRATED CIRCUIT (ASIC) MARKET: SEGMENTATION

FIGURE 2 ASIA PACIFIC APPLICATION SPECIFIC INTEGRATED CIRCUIT (ASIC) MARKET: DATA TRIANGULATION

FIGURE 3 ASIA PACIFIC APPLICATION SPECIFIC INTEGRATED CIRCUIT (ASIC) MARKET: DROC ANALYSIS

FIGURE 4 ASIA PACIFIC APPLICATION SPECIFIC INTEGRATED CIRCUIT (ASIC) MARKET: ASIA PACIFIC VS REGIONAL ANALYSIS

FIGURE 5 ASIA PACIFIC APPLICATION SPECIFIC INTEGRATED CIRCUIT (ASIC) MARKET: COMPANY RESEARCH ANALYSIS

FIGURE 6 ASIA PACIFIC APPLICATION SPECIFIC INTEGRATED CIRCUIT (ASIC) MARKET: INTERVIEW DEMOGRAPHICS

FIGURE 7 ASIA PACIFIC APPLICATION SPECIFIC INTEGRATED CIRCUIT (ASIC) MARKET: DBMRMARKET POSITION GRID

FIGURE 8 ASIA PACIFIC APPLICATION SPECIFIC INTEGRATED CIRCUIT (ASIC) MARKET: VENDOR SHARE ANALYSIS

FIGURE 9 ASIA PACIFIC APPLICATION SPECIFIC INTEGRATED CIRCUIT (ASIC) MARKET:MARKET APPLICATION COVERAGE GRID

FIGURE 10 ASIA PACIFIC APPLICATION SPECIFIC INTEGRATED CIRCUIT (ASIC) MARKET: SEGMENTATION

FIGURE 11 GROWING DEMAND FOR SMARTPHONES AND TABLETS IS EXPECTED TO DRIVE ASIA PACIFIC APPLICATION SPECIFIC INTEGRATED CIRCUIT (ASIC) MARKET IN THE FORECAST PERIOD OF 2022 TO 2029

FIGURE 12 SEMI-CUSTOM SEGMENT IS EXPECTED TO ACCOUNT FOR THE LARGEST SHARE OF ASIA PACIFIC APPLICATION SPECIFIC INTEGRATED CIRCUIT (ASIC) MARKET IN 2022 & 2029

FIGURE 13 ASIA-PACIFIC IS EXPECTED TO DOMINATE AND IS THE FASTEST GROWING REGION IN THE ASIA PACIFIC APPLICATION SPECIFIC INTEGRATED CIRCUIT (ASIC) MARKET IN THE FORECAST PERIOD OF 2022 TO 2029

FIGURE 14 DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES OF ASIA PACIFIC APPLICATION SPECIFIC INTEGRATED CIRCUIT (ASIC) MARKET

FIGURE 15 TOP 10 COUNTRIES WITH SMARTPHONES (IN MILLIONS)

FIGURE 16 ASIA PACIFIC APPLICATION SPECIFIC INTEGRATED CIRCUIT (ASIC) MARKET: BY DESIGN TYPE, 2021

FIGURE 17 ASIA PACIFIC APPLICATION SPECIFIC INTEGRATED CIRCUIT (ASIC) MARKET: BY PROGRAMMING TECHNOLOGY, 2021

FIGURE 18 ASIA PACIFIC CONSUMER ELECTRONICS IN APPLICATION SPECIFIC INTEGRATED CIRCUIT (ASIC) MARKET: BY APPLICATION, 2021

FIGURE 19 ASIA-PACIFIC APPLICATION SPECIFIC INTEGRATED CIRCUIT (ASIC) MARKET: SNAPSHOT (2021)

FIGURE 20 ASIA-PACIFIC APPLICATION SPECIFIC INTEGRATED CIRCUIT (ASIC) MARKET: BY COUNTRY (2021)

FIGURE 21 ASIA-PACIFIC APPLICATION SPECIFIC INTEGRATED CIRCUIT (ASIC) MARKET: BY COUNTRY (2022 & 2029)

FIGURE 22 ASIA-PACIFIC APPLICATION SPECIFIC INTEGRATED CIRCUIT (ASIC) MARKET: BY COUNTRY (2021 & 2029)

FIGURE 23 ASIA-PACIFIC APPLICATION SPECIFIC INTEGRATED CIRCUIT (ASIC) MARKET: BY DESIGN TYPE (2022-2029)

FIGURE 24 ASIA PACIFIC APPLICATION SPECIFIC INTEGRATED CIRCUIT (ASIC) MARKET: COMPANY SHARE 2021 (%)

Forschungsmethodik

Die Datenerfassung und Basisjahresanalyse werden mithilfe von Datenerfassungsmodulen mit großen Stichprobengrößen durchgeführt. Die Phase umfasst das Erhalten von Marktinformationen oder verwandten Daten aus verschiedenen Quellen und Strategien. Sie umfasst die Prüfung und Planung aller aus der Vergangenheit im Voraus erfassten Daten. Sie umfasst auch die Prüfung von Informationsinkonsistenzen, die in verschiedenen Informationsquellen auftreten. Die Marktdaten werden mithilfe von marktstatistischen und kohärenten Modellen analysiert und geschätzt. Darüber hinaus sind Marktanteilsanalyse und Schlüsseltrendanalyse die wichtigsten Erfolgsfaktoren im Marktbericht. Um mehr zu erfahren, fordern Sie bitte einen Analystenanruf an oder geben Sie Ihre Anfrage ein.

Die wichtigste Forschungsmethodik, die vom DBMR-Forschungsteam verwendet wird, ist die Datentriangulation, die Data Mining, die Analyse der Auswirkungen von Datenvariablen auf den Markt und die primäre (Branchenexperten-)Validierung umfasst. Zu den Datenmodellen gehören ein Lieferantenpositionierungsraster, eine Marktzeitlinienanalyse, ein Marktüberblick und -leitfaden, ein Firmenpositionierungsraster, eine Patentanalyse, eine Preisanalyse, eine Firmenmarktanteilsanalyse, Messstandards, eine globale versus eine regionale und Lieferantenanteilsanalyse. Um mehr über die Forschungsmethodik zu erfahren, senden Sie eine Anfrage an unsere Branchenexperten.

Anpassung möglich

Data Bridge Market Research ist ein führendes Unternehmen in der fortgeschrittenen formativen Forschung. Wir sind stolz darauf, unseren bestehenden und neuen Kunden Daten und Analysen zu bieten, die zu ihren Zielen passen. Der Bericht kann angepasst werden, um Preistrendanalysen von Zielmarken, Marktverständnis für zusätzliche Länder (fordern Sie die Länderliste an), Daten zu klinischen Studienergebnissen, Literaturübersicht, Analysen des Marktes für aufgearbeitete Produkte und Produktbasis einzuschließen. Marktanalysen von Zielkonkurrenten können von technologiebasierten Analysen bis hin zu Marktportfoliostrategien analysiert werden. Wir können so viele Wettbewerber hinzufügen, wie Sie Daten in dem von Ihnen gewünschten Format und Datenstil benötigen. Unser Analystenteam kann Ihnen auch Daten in groben Excel-Rohdateien und Pivot-Tabellen (Fact Book) bereitstellen oder Sie bei der Erstellung von Präsentationen aus den im Bericht verfügbaren Datensätzen unterstützen.