Alkylierungsmarkt im asiatisch-pazifischen Raum nach Produktionsprozess (Alkylierung mit Schwefelsäure, Alkylierung mit Flusssäure und andere), Anwendung (Motoröl, Flugturbinenkraftstoff, Schmierstoffe (ausgenommen Motoröl für Kraftfahrzeuge), Benzin und andere), Endverbrauch (Automobil, Luftfahrt, Landwirtschaft, Industrie und andere) – Branchentrends und Prognose bis 2040.

Asien-Pazifik-Alkylierung Marktanalyse und Größe

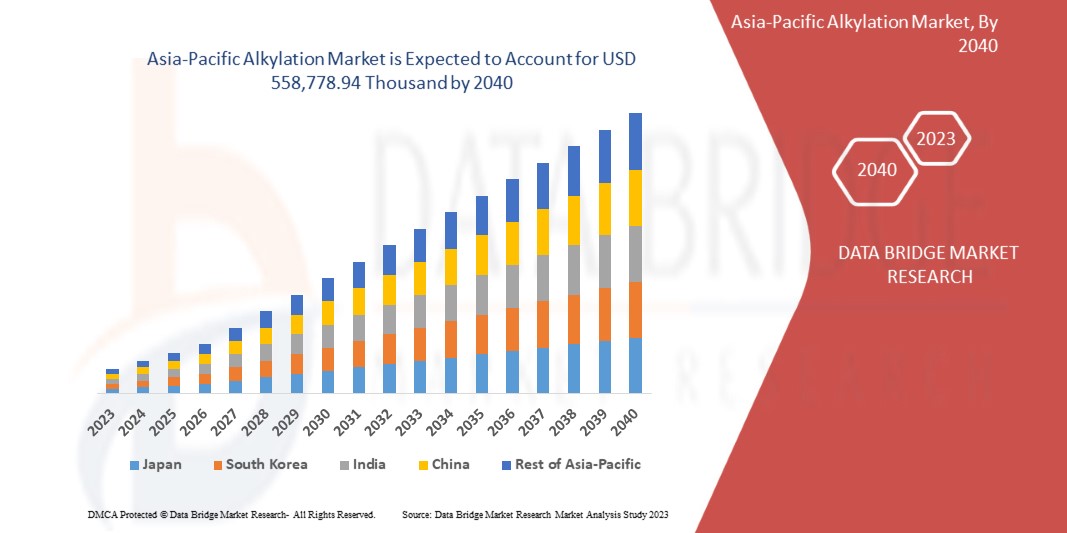

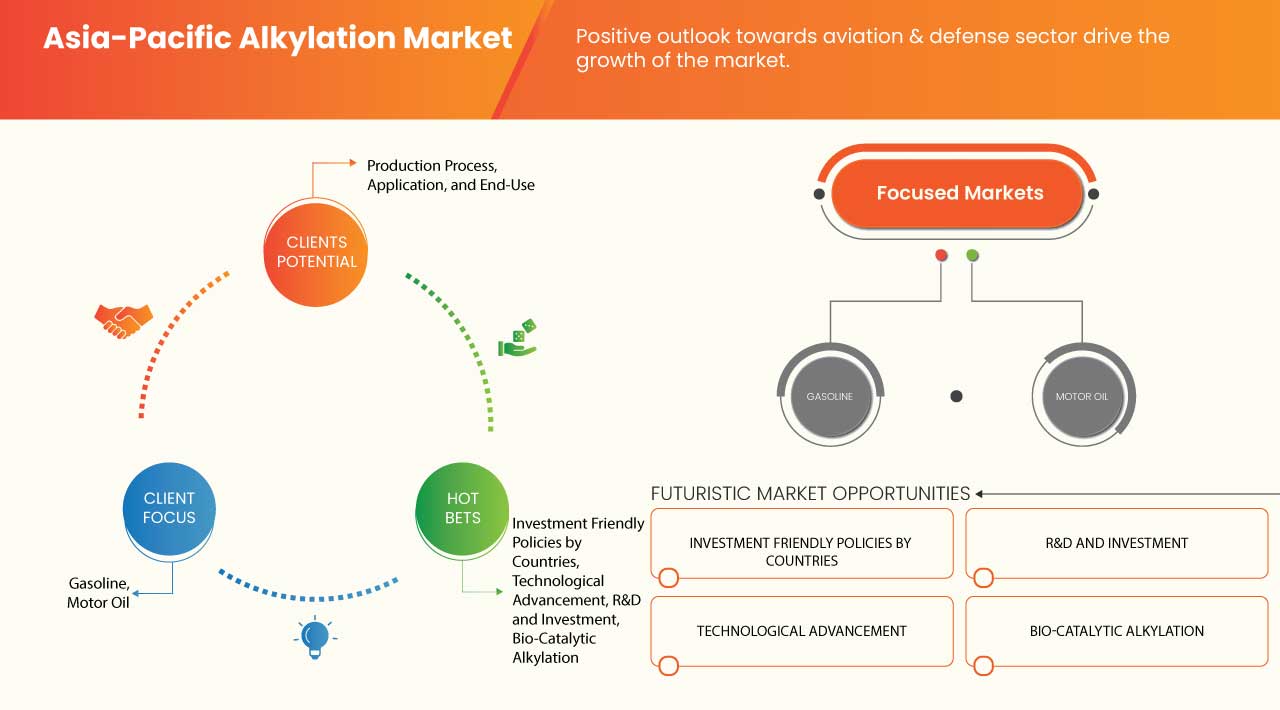

Der Alkylierungsmarkt im asiatisch-pazifischen Raum dürfte im Prognosezeitraum 2023 bis 2040 deutlich wachsen. Data Bridge Market Research analysiert, dass der Markt im Prognosezeitraum 2023 bis 2040 mit einer durchschnittlichen jährlichen Wachstumsrate (CAGR) von 3,8 % wächst und bis 2040 voraussichtlich 558.778,94 Tausend USD erreichen wird. Die Nachfrage nach hocheffizientem Benzin ist der Hauptfaktor für das Wachstum des Alkylierungsmarktes.

Die Reaktion von Olefinen mit einem Isoparaffin zur Erzeugung von Paraffin mit höherem Molekulargewicht wird als Alkylierung bezeichnet und wird häufig in der Erdölraffination eingesetzt. Insbesondere erzeugt das Verfahren verzweigtkettiges Paraffin im Siedebereich von Benzin durch die Reaktion von Propylen und Butylenen mit Isobutan. Alkylat hat eine hohe Oktanzahl und geringe Empfindlichkeit, was es zu einem erstklassigen Benzinmischmaterial macht.

Der Bericht zum Alkylierungsmarkt im asiatisch-pazifischen Raum enthält Einzelheiten zu Marktanteilen, neuen Entwicklungen und dem Einfluss inländischer und lokaler Marktteilnehmer, analysiert Chancen in Bezug auf neu entstehende Umsatzbereiche, Änderungen der Marktvorschriften, Produktzulassungen, strategische Entscheidungen, Produkteinführungen, geografische Expansionen und technologische Innovationen auf dem Markt. Um die Analyse und das Marktszenario zu verstehen, kontaktieren Sie uns für ein Analystenbriefing. Unser Team hilft Ihnen bei der Entwicklung einer umsatzwirksamen Lösung, um Ihr gewünschtes Ziel zu erreichen.

|

Berichtsmetrik |

Details |

|

Prognosezeitraum |

2023 bis 2040 |

|

Basisjahr |

2022 |

|

Historische Jahre |

2021 (anpassbar auf 2015–2020) |

|

Quantitative Einheiten |

Umsatz in Tausend USD |

|

Abgedeckte Segmente |

Produktionsprozess (Alkylierung mit Schwefelsäure, Alkylierung mit Flusssäure und andere), Anwendung (Motoröl, Flugturbinenkraftstoff, Schmierstoffe (außer Motoröl für Kraftfahrzeuge), Benzin und andere), Endverbrauch (Automobil, Luftfahrt, Landwirtschaft, Industrie und andere) |

|

Abgedeckte Länder |

Japan, China, Südkorea, Indien, Singapur, Thailand, Indonesien, Malaysia, Philippinen, Australien und Neuseeland sowie der Rest des asiatisch-pazifischen Raums |

|

Abgedeckte Marktteilnehmer |

Exxon Mobil Corporation, Honeywell International Inc., Lummus Technology, Elessent Clean Technologies Inc., Sulzer Ltd, KBR Inc. und Well Resources Inc. unter anderem |

Marktdefinition

Durch Alkylierung entstehen aus alkylierenden Olefinen wie Propylen, Butylen und Isobuten länger verzweigte Kohlenwasserstoffe. Die durch Alkylierung entstehenden hochoktanigen Kohlenwasserstoffe werden als Alkylate bezeichnet. Die Mischung dieser Alkylate mit Benzin wurde eingeführt, um die Leistungsfähigkeit der Maschine zu verbessern. Der Hauptfaktor, der die Alkylierung beeinflusst, ist die Verwendung eines geeigneten Katalysators. Schwefelsäure und Flusssäure sind die am häufigsten verwendeten Alkylierungskatalysatoren.

Marktdynamik für Alkylierungen im asiatisch-pazifischen Raum

In diesem Abschnitt geht es um das Verständnis der Markttreiber, Chancen, Beschränkungen und Herausforderungen. All dies wird im Folgenden ausführlich erläutert:

Treiber

- Steigende Nachfrage nach hocheffizienten Benzinern

Der Automobilsektor, ein wichtiger Wirtschaftsindikator, steht an der Schwelle zu neuen Technologien und Entwicklungen. Darüber hinaus treibt der Wunsch der Kunden nach besonderen und teuren Ausstattungsmerkmalen den Automobilsektor derzeit an. Die heutigen Verbraucher nutzen im asiatisch-pazifischen Raum Allzweckfahrzeuge, was die weltweiten Automobilverkäufe ankurbelt. Die meisten Autos basieren auf einem Verbrennungsmotor, der nur mit Diesel oder Benzin betrieben werden kann. Daher steigt die Nachfrage nach Benzin erheblich an, und auf Verbrennungsmotoren basierende Antriebsstränge werden auf absehbare Zeit weiterhin dominieren.

- Anwendungswachstum von Derivaten, nämlich Benzin und Schmierstoffen

Bei der Erdölraffination werden aus Rohöl verschiedene Raffinerieprodukte hergestellt. Die Alkylierung ist ein sekundärer Raffinerieprozess, den zahlreiche Raffinerien weltweit nutzen, um Motor- und Flugbenzin hochoktanige Kohlenwasserstoffe hinzuzufügen. Dabei werden einem Substratmolekül Alkylgruppen hinzugefügt, was bei mehreren Anwendungen hilfreich ist. Bei der Alkylierung entsteht hochoktaniges Benzin, indem Isoparaffine und niedermolekulare Alkene in Alkylate umgewandelt werden. Hochoktanige Kohlenwasserstoffe sind erforderlich, um eine Selbstentzündung (Klopfen) des Benzins in einem Motor zu vermeiden und die Oktanzahlstandards des Motors zu erfüllen.

Gelegenheiten

- Umsetzung investitionsfreundlicher Maßnahmen in Ländern wie China und Indien

Die Alkylierung ist zu einem wesentlichen Raffinerieprozess geworden, da der Bedarf an hochoktanigen und dampfdruckarmen Benzinmischungskomponenten gestiegen ist. Sie wird noch wichtiger, um die strengen Gesetze und Anforderungen der Regierung zu erfüllen. Kommerzieller und behördlicher Druck setzt die Raffinerien unter Druck, sichere und nachhaltige Techniken zu verwenden, um sauber brennende, umweltfreundliche Kraftstoffe bereitzustellen. Etablierte Raffinerienunternehmen im Alkylierungsmarkt können diese Gelegenheit daher nutzen, um mehr in neue Produktionskapazitäten zu investieren. Neue Marktteilnehmer können dagegen mehr in die Integration von Alkylierungseinheiten investieren, um zum Wachstum der Branche beizutragen.

- Technologischer Fortschritt zur Verbesserung von Alkylierungsprozessen

Die langfristige Nachfrage nach hochwertigem Benzin im asiatisch-pazifischen Raum wird von Makrofaktoren wie einem kontinuierlich wachsenden Kundenstamm und der Einführung von Hochkompressionsmotoren mit niedrigem Dampfdruck angetrieben. Gleichzeitig erhöhen strengere Kraftstoff- und Emissionskriterien, wie z. B. Anforderungen an einen niedrigen oder ultraniedrigen Schwefelgehalt, die Abhängigkeit von Oktanzahl steigernden Mischstoffen wie Alkylat. Raffinerien nutzen verschiedene Technologien zur Herstellung von Alkylat und alle Raffinerien müssen eine innovative, sichere und nachhaltige Alkylierungstechnik verwenden.

Einschränkungen/Herausforderungen

- Sicherheitsbedenken im Zusammenhang mit der Verwendung der Alkylierungstechnologie

Die säurebasierte Alkylierungstechnologie wandelt gemischte Olefinrohstoffe unter Verwendung von Fluorwasserstoff oder Schwefelsäure als Katalysator in hochoktanige Alkylate für die Benzinmischung um. Die stark korrosive Natur der starken Säurekatalysatoren macht jedoch sowohl die Fluorwasserstoff- als auch die Schwefelsäurealkylierungsreaktionen gefährlich. Die Raffinerien, die die säurebasierte Alkylierungstechnologie verwenden, verwenden verschiedene Metalle für die Ausrüstung für die Alkylierungstechnologie und benötigen außerdem teure Sicherheitssysteme zum Schutz der Raffineriemitarbeiter, der Infrastruktur und der äußeren Umwelt. Die Betreiber und Eigentümer sind sehr besorgt um die Sicherheit des Alkylierungsprozesses und überwachen die Sicherheit ihrer Anlagen regelmäßig. Da jedoch jeder industrielle Prozess Risiken birgt, wird es beim Alkylierungsprozess wahrscheinlich potenzielle Sicherheitsbedenken geben.

- Umweltprobleme im Zusammenhang mit der Alkylierungstechnologie

Alkylat wird durch Alkylierungstechnologie aus leichten Olefinen und Isobuten in Gegenwart chemischer Katalysatoren hergestellt. Es ist für die Herstellung von Benzin unverzichtbar, daher sind mit der Alkylierungstechnologie verschiedene Umweltprobleme verbunden. Die Herstellung von Alkylat erfordert die Verwendung von flüssigen, säurekatalysierten Prozessen, beispielsweise chemischen Katalysatoren auf der Basis von Flusssäure oder Schwefelsäure. Die Katalysatoren sind von Natur aus unsicher, ätzend und giftig. Die Temperatur steigt und das Luftdampfvolumen nimmt zu, wenn Flusssäure mit Wasser in Kontakt kommt. Verschüttete Flusssäure verdunstet schnell, ein Teil davon verbleibt jedoch im Boden und kann die Bodenqualität und das Grundwasser stark beeinträchtigen.

Jüngste Entwicklung

- Im Juni 2021 hat Sinopec erfolgreich zwei weitere STRATCO-Alkylierungsspezialeinheiten von Elessent Clean Technologies Inc. in Betrieb genommen. Das Unternehmen erweitert seine Alkylierungskapazität, indem es sein Raffinerienetzwerk um eine fünfte und sechste STRATCO-Alkylierungseinheit erweitert.

- Im März 2023 gab ExxonMobil den erfolgreichen Start seines Beaumont-Raffinerie-Erweiterungsprojekts bekannt, das die Kapazität eines der größten Petrochemie- und Raffineriekomplexe an der amerikanischen Golfküste um 250.000 Barrel pro Tag erhöhen wird. Die größte Raffinerieerweiterung seit mehr als zehn Jahren wird durch die steigende Rohölproduktion des Unternehmens im Permian Basin unterstützt, die dazu beitragen wird, den steigenden Bedarf an erschwinglicher und zuverlässiger Energie zu decken. Die Beaumont-Raffinerie, in der das Unternehmen Fertigprodukte wie Diesel, Benzin und Düsentreibstoff durch das Permian-Rohöl produziert,

Marktumfang für Alkylierung im asiatisch-pazifischen Raum

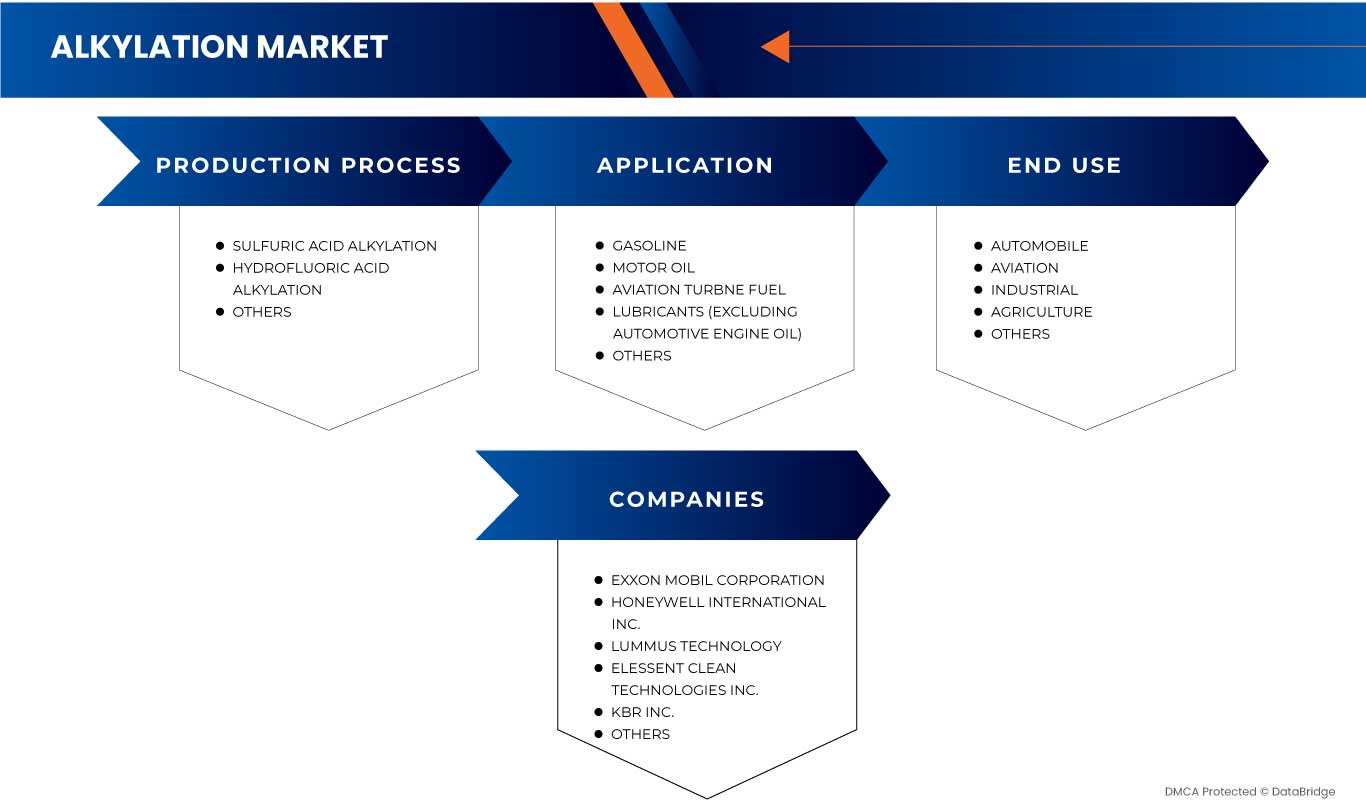

Der Alkylierungsmarkt im asiatisch-pazifischen Raum wird nach Produktionsprozess, Anwendung und Endverbrauch kategorisiert. Das Wachstum dieser Segmente hilft Ihnen bei der Analyse wichtiger Wachstumssegmente in den Branchen und bietet den Benutzern einen wertvollen Marktüberblick und Markteinblicke, um strategische Entscheidungen zur Identifizierung der wichtigsten Marktanwendungen zu treffen.

Produktionsprozess

- Schwefelsäurealkylierung

- Alkylierung mit Flusssäure

- Sonstiges

Auf der Grundlage des Produktionsprozesses wird der Alkylierungsmarkt im asiatisch-pazifischen Raum in Schwefelsäurealkylierung, Flusssäurealkylierung und Sonstiges unterteilt.

Anwendung

- Motoröl

- Flugturbinenkraftstoff

- Schmierstoffe (außer Motorölen für Kraftfahrzeuge)

- Benzin

- Sonstiges

Auf der Grundlage der Anwendung wird der Alkylierungsmarkt im asiatisch-pazifischen Raum in Motoröl, Flugturbinenkraftstoff, Schmierstoffe (ausgenommen Motoröl für Kraftfahrzeuge), Benzin und Sonstiges unterteilt .

Endverwendung

- Automobil

- Luftfahrt

- Landwirtschaft

- Industrie

- Sonstiges

Auf der Grundlage der Endverwendung wird der Alkylierungsmarkt im Asien-Pazifik-Raum in Automobil, Luftfahrt, Landwirtschaft, Industrie und Sonstiges unterteilt.

Regionale Analyse/Einblicke zum Alkylierungsmarkt im asiatisch-pazifischen Raum

Der Alkylierungsmarkt im asiatisch-pazifischen Raum ist nach Produktionsprozess, Anwendung und Endverbrauch segmentiert.

Die Länder im asiatisch-pazifischen Alkylierungsmarkt sind Japan, China, Südkorea, Indien, Singapur, Thailand, Indonesien, Malaysia, die Philippinen, Australien und Neuseeland sowie der Rest des asiatisch-pazifischen Raums. China dominiert den asiatisch-pazifischen Alkylierungsmarkt in Bezug auf Marktanteil und Umsatz aufgrund des wachsenden Bewusstseins für die Eigenschaften der Alkylierungstechnologien in dieser Region.

Der Länderabschnitt des Berichts enthält auch einzelne marktbeeinflussende Faktoren und Änderungen der Marktregulierung, die sich auf die aktuellen und zukünftigen Trends des Marktes auswirken. Datenpunktanalysen der nachgelagerten und vorgelagerten Wertschöpfungsketten, technische Trends, Porters Fünf-Kräfte-Analyse und Fallstudien sind einige der Hinweise, die zur Prognose des Marktszenarios für einzelne Länder verwendet werden. Bei der Bereitstellung von Prognoseanalysen der Länderdaten werden auch die Präsenz und Verfügbarkeit von Marken aus dem asiatisch-pazifischen Raum und ihre Herausforderungen aufgrund großer oder geringer Konkurrenz durch lokale und inländische Marken, die Auswirkungen inländischer Zölle und Handelsrouten berücksichtigt.

Wettbewerbsumfeld und Analyse der Marktanteile von Alkylierungsmitteln im asiatisch-pazifischen Raum

Die Wettbewerbslandschaft des Alkylierungsmarktes im asiatisch-pazifischen Raum liefert Einzelheiten zu den Wettbewerbern. Die enthaltenen Einzelheiten umfassen Unternehmensübersicht, Unternehmensfinanzen, erzielten Umsatz, Marktpotenzial, Investitionen in Forschung und Entwicklung, neue Marktinitiativen, Produktionsstandorte und -anlagen, Stärken und Schwächen des Unternehmens, Produkteinführung, Produkttestpipelines, Produktzulassungen, Patente, Produktbreite und -umfang, Anwendungsdominanz, Technologie-Lebenslinienkurve. Die oben angegebenen Datenpunkte beziehen sich nur auf den Fokus der Unternehmen in Bezug auf den Alkylierungsmarkt im asiatisch-pazifischen Raum.

Zu den bekanntesten Akteuren auf dem Alkylierungsmarkt im asiatisch-pazifischen Raum zählen unter anderem Exxon Mobil Corporation, Honeywell International Inc., Lummus Technology, Elessent Clean Technologies Inc., Sulzer Ltd, KBR Inc. und Well Resources Inc.

SKU-

Erhalten Sie Online-Zugriff auf den Bericht zur weltweit ersten Market Intelligence Cloud

- Interaktives Datenanalyse-Dashboard

- Unternehmensanalyse-Dashboard für Chancen mit hohem Wachstumspotenzial

- Zugriff für Research-Analysten für Anpassungen und Abfragen

- Konkurrenzanalyse mit interaktivem Dashboard

- Aktuelle Nachrichten, Updates und Trendanalyse

- Nutzen Sie die Leistungsfähigkeit der Benchmark-Analyse für eine umfassende Konkurrenzverfolgung

Inhaltsverzeichnis

1 INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 OVERVIEW

1.4 LIMITATIONS

1.5 MARKETS COVERED

2 MARKET SEGMENTATION

2.1 MARKETS COVERED

2.2 GEOGRAPHICAL SCOPE

2.3 YEARS CONSIDERED FOR THE STUDY

2.4 CURRENCY AND PRICING

2.5 DBMR TRIPOD DATA VALIDATION MODEL

2.6 APPLICATION LIFE LINE CURVE

2.7 MULTIVARIATE MODELING

2.8 PRIMARY INTERVIEWS WITH KEY OPINION LEADERS

2.9 DBMR MARKET POSITION GRID

2.1 MARKET APPLICATION COVERAGE GRID

2.11 DBMR MARKET CHALLENGE MATRIX

2.12 SECONDARY SOURCES

2.13 ASSUMPTIONS

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

4.1 PESTLE ANALYSIS

4.1.1 POLITICAL FACTORS

4.1.2 ECONOMIC FACTORS

4.1.3 SOCIAL FACTORS

4.1.4 TECHNOLOGICAL FACTORS

4.1.5 LEGAL FACTORS

4.1.6 ENVIRONMENTAL FACTORS

4.2 PORTER’S FIVE FORCES:

4.2.1 THREAT OF NEW ENTRANTS:

4.2.2 THE THREAT OF SUBSTITUTES:

4.2.3 CUSTOMER BARGAINING POWER:

4.2.4 SUPPLIER BARGAINING POWER:

4.2.5 INTERNAL COMPETITION (RIVALRY):

4.3 LIST OF FEW ALKYLATION SERVICE PROVIDERS

4.4 CLIMATE CHANGE SCENARIO

4.4.1 ENVIRONMENTAL CONCERNS

4.4.2 INDUSTRY RESPONSE

4.4.3 GOVERNMENT’S ROLE

4.4.4 ANALYST RECOMMENDATION

4.5 SUPPLY CHAIN ANALYSIS

4.5.1 OVERVIEW

4.5.2 LOGISTIC COST SCENARIO

4.5.3 IMPORTANCE OF LOGISTICS SERVICE PROVIDERS

4.6 VENDOR SELECTION CRITERIA

5 REGULATION COVERAGE

6 MARKET OVERVIEW

6.1 DRIVERS

6.1.1 RISE IN DEMAND FOR HIGHLY EFFICIENT GASOLINE

6.1.2 APPLICATION GROWTH OF DERIVATIVES, NAMELY GASOLINE, AND LUBRICANTS

6.1.3 POSITIVE OUTLOOK TOWARDS AVIATION AND DEFENSE SECTOR

6.1.4 GROWING IMPORTANCE OF IMPROVING REFINING MARGINS

6.2 RESTRAINTS

6.2.1 SAFETY CONCERNS RELATED TO THE USE OF ALKYLATION TECHNOLOGY

6.2.2 CREDIBLE THREAT FROM ALTERNATIVE FUEL SOURCES

6.3 OPPORTUNITIES

6.3.1 IMPLEMENTATION OF INVESTMENT-FRIENDLY POLICIES IN COUNTRIES, NAMELY CHINA AND INDIA

6.3.2 TECHNOLOGICAL ADVANCEMENT TO IMPROVISE ALKYLATION PROCESSES

6.4 CHALLENGES

6.4.1 ENVIRONMENTAL ISSUES ASSOCIATED WITH ALKYLATION TECHNOLOGY

6.4.2 STRINGENT RULES AND REGULATIONS

6.4.3 VOLATILITY IN RAW MATERIAL PRICES

7 ASIA PACIFIC ALKYLATION MARKET, BY PRODUCTION PROCESS

7.1 OVERVIEW

7.2 SULFURIC ACID ALKYLATION

7.3 HYDROFLUORIC ACID ALKYLATION

7.4 OTHERS

8 ASIA PACIFIC ALKYLATION MARKET, BY END-USE

8.1 OVERVIEW

8.2 AUTOMOBILE

8.3 AVIATION

8.4 AGRICULTURE

8.5 INDUSTRIAL

8.6 OTHERS

9 ASIA PACIFIC ALKYLATION MARKET BY APPLICATION

9.1 OVERVIEW

9.2 MOTOR OIL

9.3 AVIATION TURBINE FUEL

9.4 GASOLINE

9.5 OTHERS

10 ASIA PACIFIC ALKYLATION MARKET, BY REGION

10.1 ASIA-PACIFIC

10.1.1 CHINA

10.1.2 INDIA

10.1.3 SOUTH KOREA

10.1.4 JAPAN

10.1.5 THAILAND

10.1.6 AUSTRALIA & NEW ZEALAND

10.1.7 INDONESIA

10.1.8 SINGAPORE

10.1.9 PHILIPPINES

10.1.10 MALAYSIA

10.1.11 REST OF ASIA-PACIFIC

11 ASIA PACIFIC ALKYLATION MARKET: COMPANY LANDSCAPE

11.1 COMPANY SHARE ANALYSIS: ASIA PACIFIC

11.2 EXPANSION

11.3 NEW PROJECT

11.4 COLLABORATION

11.5 NEW UNIT

12 COMPANY PROFILES

12.1 EXXON MOBIL CORPORATION

12.1.1 COMPANY SNAPSHOT

12.1.2 REVENUE ANALYSIS

12.1.3 COMPANY SHARE ANALYSIS

12.1.4 SWOT ANALYSIS

12.1.5 PRODUCT PORTFOLIO

12.1.6 RECENT DEVELOPMENT

12.2 HONEYWELL INTERNATIONAL INC.

12.2.1 COMPANY SNAPSHOT

12.2.2 REVENUE ANALYSIS

12.2.3 COMPANY SHARE ANALYSIS

12.2.4 SWOT ANALYSIS

12.2.5 PRODUCT PORTFOLIO

12.2.6 RECENT DEVELOPMENTS

12.3 LUMMUS TECHNOLOGY

12.3.1 COMPANY SNAPSHOT

12.3.2 COMPANY SHARE ANALYSIS

12.3.3 SWOT ANALYSIS

12.3.4 PRODUCT PORTFOLIO

12.3.5 RECENT DEVELOPMENTS

12.4 KBR INC.

12.4.1 COMPANY SNAPSHOT

12.4.2 REVENUE ANALYSIS

12.4.3 COMPANY SHARE ANALYSIS

12.4.4 PRODUCT PORTFOLIO

12.4.5 SWOT ANALYSIS

12.4.6 RECENT DEVELOPMENT

12.5 ELESSENT CLEAN TECHNOLOGIES INC.

12.5.1 COMPANY SNAPSHOT

12.5.2 COMPANY SHARE ANALYSIS

12.5.3 PRODUCT PORTFOLIO

12.5.4 SWOT ANALYSIS

12.5.5 RECENT DEVELOPMENTS

12.6 SULZER LTD

12.6.1 COMPANY SNAPSHOT

12.6.2 REVENUE ANALYSIS

12.6.3 PRODUCT PORTFOLIO

12.6.4 SWOT ANALYSIS

12.6.5 RECENT DEVELOPMENT

12.7 WELL RESOURCES INC.

12.7.1 COMPANY SNAPSHOT

12.7.2 SWOT ANALYSIS

12.7.3 PRODUCT PORTFOLIO

12.7.4 RECENT DEVELOPMENTS

13 QUESTIONNAIRE

14 RELATED REPORTS

Tabellenverzeichnis

TABLE 1 REGULATORY COVERAGE

TABLE 2 ASIA-PACIFIC ALKYLATION MARKET, BY COUNTRY, 2021-2040 (USD THOUSAND)

TABLE 3 ASIA-PACIFIC ALKYLATION MARKET, BY PRODUCTION PROCESS, 2021-2040 (USD THOUSAND)

TABLE 4 ASIA-PACIFIC ALKYLATION MARKET, BY APPLICATION, 2021-2040 (USD THOUSAND)

TABLE 5 ASIA-PACIFIC ALKYLATION MARKET, BY END USE, 2021-2040 (USD THOUSAND)

TABLE 6 ASIA-PACIFIC AUTOMOBILE IN ALKYLATION MARKET, BY TYPE, 2021-2040 (USD THOUSAND)

TABLE 7 ASIA-PACIFIC AVIATION IN ALKYLATION MARKET, BY TYPE, 2021-2040 (USD THOUSAND)

TABLE 8 ASIA-PACIFIC AGRICULTURE IN ALKYLATION MARKET, BY TYPE, 2021-2040 (USD THOUSAND)

TABLE 9 CHINA ALKYLATION MARKET, BY PRODUCTION PROCESS, 2021-2040 (USD THOUSAND)

TABLE 10 CHINA ALKYLATION MARKET, BY APPLICATION, 2021-2040 (USD THOUSAND)

TABLE 11 CHINA ALKYLATION MARKET, BY END USE, 2021-2040 (USD THOUSAND)

TABLE 12 CHINA AUTOMOBILE IN ALKYLATION MARKET, BY TYPE, 2021-2040 (USD THOUSAND)

TABLE 13 CHINA AVIATION IN ALKYLATION MARKET, BY TYPE, 2021-2040 (USD THOUSAND)

TABLE 14 CHINA AGRICULTURE IN ALKYLATION MARKET, BY TYPE, 2021-2040 (USD THOUSAND)

TABLE 15 INDIA ALKYLATION MARKET, BY PRODUCTION PROCESS, 2021-2040 (USD THOUSAND)

TABLE 16 INDIA ALKYLATION MARKET, BY APPLICATION, 2021-2040 (USD THOUSAND)

TABLE 17 INDIA ALKYLATION MARKET, BY END USE, 2021-2040 (USD THOUSAND)

TABLE 18 INDIA AUTOMOBILE IN ALKYLATION MARKET, BY TYPE, 2021-2040 (USD THOUSAND)

TABLE 19 INDIA AVIATION IN ALKYLATION MARKET, BY TYPE, 2021-2040 (USD THOUSAND)

TABLE 20 INDIA AGRICULTURE IN ALKYLATION MARKET, BY TYPE, 2021-2040 (USD THOUSAND)

TABLE 21 SOUTH KOREA ALKYLATION MARKET, BY PRODUCTION PROCESS, 2021-2040 (USD THOUSAND)

TABLE 22 SOUTH KOREA ALKYLATION MARKET, BY APPLICATION, 2021-2040 (USD THOUSAND)

TABLE 23 SOUTH KOREA ALKYLATION MARKET, BY END USE, 2021-2040 (USD THOUSAND)

TABLE 24 SOUTH KOREA AUTOMOBILE IN ALKYLATION MARKET, BY TYPE, 2021-2040 (USD THOUSAND)

TABLE 25 SOUTH KOREA AVIATION IN ALKYLATION MARKET, BY TYPE, 2021-2040 (USD THOUSAND)

TABLE 26 SOUTH KOREA AGRICULTURE IN ALKYLATION MARKET, BY TYPE, 2021-2040 (USD THOUSAND)

TABLE 27 JAPAN ALKYLATION MARKET, BY PRODUCTION PROCESS, 2021-2040 (USD THOUSAND)

TABLE 28 JAPAN ALKYLATION MARKET, BY APPLICATION, 2021-2040 (USD THOUSAND)

TABLE 29 JAPAN ALKYLATION MARKET, BY END USE, 2021-2040 (USD THOUSAND)

TABLE 30 JAPAN AUTOMOBILE IN ALKYLATION MARKET, BY TYPE, 2021-2040 (USD THOUSAND)

TABLE 31 JAPAN AVIATION IN ALKYLATION MARKET, BY TYPE, 2021-2040 (USD THOUSAND)

TABLE 32 JAPAN AGRICULTURE IN ALKYLATION MARKET, BY TYPE, 2021-2040 (USD THOUSAND)

TABLE 33 THAILAND ALKYLATION MARKET, BY PRODUCTION PROCESS, 2021-2040 (USD THOUSAND)

TABLE 34 THAILAND ALKYLATION MARKET, BY APPLICATION, 2021-2040 (USD THOUSAND)

TABLE 35 THAILAND ALKYLATION MARKET, BY END USE, 2021-2040 (USD THOUSAND)

TABLE 36 THAILAND AUTOMOBILE IN ALKYLATION MARKET, BY TYPE, 2021-2040 (USD THOUSAND)

TABLE 37 THAILAND AVIATION IN ALKYLATION MARKET, BY TYPE, 2021-2040 (USD THOUSAND)

TABLE 38 THAILAND AGRICULTURE IN ALKYLATION MARKET, BY TYPE, 2021-2040 (USD THOUSAND)

TABLE 39 AUSTRALIA AND NEW ZEALAND ALKYLATION MARKET, BY PRODUCTION PROCESS, 2021-2040 (USD THOUSAND)

TABLE 40 AUSTRALIA AND NEW ZEALAND ALKYLATION MARKET, BY APPLICATION, 2021-2040 (USD THOUSAND)

TABLE 41 AUSTRALIA AND NEW ZEALAND ALKYLATION MARKET, BY END USE, 2021-2040 (USD THOUSAND)

TABLE 42 AUSTRALIA AND NEW ZEALAND AUTOMOBILE IN ALKYLATION MARKET, BY TYPE, 2021-2040 (USD THOUSAND)

TABLE 43 AUSTRALIA AND NEW ZEALAND AVIATION IN ALKYLATION MARKET, BY TYPE, 2021-2040 (USD THOUSAND)

TABLE 44 AUSTRALIA AND NEW ZEALAND AGRICULTURE IN ALKYLATION MARKET, BY TYPE, 2021-2040 (USD THOUSAND)

TABLE 45 INDONESIA ALKYLATION MARKET, BY PRODUCTION PROCESS, 2021-2040 (USD THOUSAND)

TABLE 46 INDONESIA ALKYLATION MARKET, BY APPLICATION, 2021-2040 (USD THOUSAND)

TABLE 47 INDONESIA ALKYLATION MARKET, BY END USE, 2021-2040 (USD THOUSAND)

TABLE 48 INDONESIA AUTOMOBILE IN ALKYLATION MARKET, BY TYPE, 2021-2040 (USD THOUSAND)

TABLE 49 INDONESIA AVIATION IN ALKYLATION MARKET, BY TYPE, 2021-2040 (USD THOUSAND)

TABLE 50 INDONESIA AGRICULTURE IN ALKYLATION MARKET, BY TYPE, 2021-2040 (USD THOUSAND)

TABLE 51 SINGAPORE ALKYLATION MARKET, BY PRODUCTION PROCESS, 2021-2040 (USD THOUSAND)

TABLE 52 SINGAPORE ALKYLATION MARKET, BY APPLICATION, 2021-2040 (USD THOUSAND)

TABLE 53 SINGAPORE ALKYLATION MARKET, BY END USE, 2021-2040 (USD THOUSAND)

TABLE 54 SINGAPORE AUTOMOBILE IN ALKYLATION MARKET, BY TYPE, 2021-2040 (USD THOUSAND)

TABLE 55 SINGAPORE AVIATION IN ALKYLATION MARKET, BY TYPE, 2021-2040 (USD THOUSAND)

TABLE 56 SINGAPORE AGRICULTURE IN ALKYLATION MARKET, BY TYPE, 2021-2040 (USD THOUSAND)

TABLE 57 PHILIPPINES ALKYLATION MARKET, BY PRODUCTION PROCESS, 2021-2040 (USD THOUSAND)

TABLE 58 PHILIPPINES ALKYLATION MARKET, BY APPLICATION, 2021-2040 (USD THOUSAND)

TABLE 59 PHILIPPINES ALKYLATION MARKET, BY END USE, 2021-2040 (USD THOUSAND)

TABLE 60 PHILIPPINES AUTOMOBILE IN ALKYLATION MARKET, BY TYPE, 2021-2040 (USD THOUSAND)

TABLE 61 PHILIPPINES AVIATION IN ALKYLATION MARKET, BY TYPE, 2021-2040 (USD THOUSAND)

TABLE 62 PHILIPPINES AGRICULTURE IN ALKYLATION MARKET, BY TYPE, 2021-2040 (USD THOUSAND)

TABLE 63 MALAYSIA ALKYLATION MARKET, BY PRODUCTION PROCESS, 2021-2040 (USD THOUSAND)

TABLE 64 MALAYSIA ALKYLATION MARKET, BY APPLICATION, 2021-2040 (USD THOUSAND)

TABLE 65 MALAYSIA ALKYLATION MARKET, BY END USE, 2021-2040 (USD THOUSAND)

TABLE 66 MALAYSIA AUTOMOBILE IN ALKYLATION MARKET, BY TYPE, 2021-2040 (USD THOUSAND)

TABLE 67 MALAYSIA AVIATION IN ALKYLATION MARKET, BY TYPE, 2021-2040 (USD THOUSAND)

TABLE 68 MALAYSIA AGRICULTURE IN ALKYLATION MARKET, BY TYPE, 2021-2040 (USD THOUSAND)

TABLE 69 REST OF ASIA-PACIFIC ALKYLATION MARKET, BY PRODUCTION PROCESS, 2021-2040 (USD THOUSAND)

Abbildungsverzeichnis

FIGURE 1 ASIA PACIFIC ALKYLATION MARKET

FIGURE 2 ASIA PACIFIC ALKYLATION MARKET: DATA TRIANGULATION

FIGURE 3 ASIA PACIFIC ALKYLATION MARKET: DROC ANALYSIS

FIGURE 4 ASIA PACIFIC ALKYLATION MARKET: ASIA PACIFIC VS REGIONAL MARKET ANALYSIS

FIGURE 5 ASIA PACIFIC ALKYLATION MARKET: COMPANY RESEARCH ANALYSIS

FIGURE 6 ASIA PACIFIC ALKYLATION MARKET: THE APPLICATION LIFE LINE CURVE

FIGURE 7 ASIA PACIFIC ALKYLATION MARKET: MULTIVARIATE MODELLING

FIGURE 8 ASIA PACIFIC ALKYLATION MARKET: INTERVIEW DEMOGRAPHICS

FIGURE 9 ASIA PACIFIC ALKYLATION MARKET: DBMR MARKET POSITION GRID

FIGURE 10 ASIA PACIFIC ALKYLATION MARKET: MARKET APPLICATION COVERAGE GRID

FIGURE 11 ASIA PACIFIC ALKYLATION MARKET: THE MARKET CHALLENGE MATRIX

FIGURE 12 ASIA PACIFIC ALKYLATION MARKET: SEGMENTATION

FIGURE 13 RISE IN DEMAND FOR HIGHLY EFFICIENT GASOLINE IS EXPECTED TO DRIVE THE ASIA PACIFIC ALKYLATION MARKET IN THE FORECAST PERIOD

FIGURE 14 THE SULFURIC ACID ALKYLATION SEGMENT IS EXPECTED TO ACCOUNT FOR THE LARGEST SHARE OF THE ASIA PACIFIC ALKYLATION MARKET IN 2023 AND 2040

FIGURE 15 VENDOR SELECTION CRITERIA

FIGURE 16 DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES OF THE ASIA PACIFIC ALKYLATION MARKET

FIGURE 17 NUMBER OF CAR SALES IN U.S. 2018 TO 2022 (IN MILLION)

FIGURE 18 CONSUMPTION OF REFINERY PRODUCTS FROM 2018 TO 2021 IN INDIA (IN ‘000 METRIC TONS)

FIGURE 19 U.S. JET FUEL CONSUMPTION 2017 TO 2021 (IN THOUSAND BARRELS PER DAY)

FIGURE 20 ASIA PACIFIC ALKYLATION MARKET: BY PRODUCTION PROCESS, 2022

FIGURE 21 ASIA PACIFIC ALKYLATION MARKET: BY END-USE, 2022

FIGURE 22 ASIA PACIFIC ALKYLATION MARKET: BY APPLICATION, 2022

FIGURE 23 ASIA-PACIFIC ALKYLATION MARKET: SNAPSHOT (2022)

FIGURE 24 ASIA-PACIFIC ALKYLATION MARKET: BY COUNTRY (2022)

FIGURE 25 ASIA-PACIFIC ALKYLATION MARKET: BY COUNTRY (2023 & 2040)

FIGURE 26 ASIA-PACIFIC ALKYLATION MARKET: BY COUNTRY (2022 & 2040)

FIGURE 27 ASIA-PACIFIC ALKYLATION MARKET: BY PRODUCTION PROCESS (2023 - 2040)

FIGURE 28 ASIA PACIFIC ALKYLATION MARKET: COMPANY SHARE 2022 (%)

Forschungsmethodik

Die Datenerfassung und Basisjahresanalyse werden mithilfe von Datenerfassungsmodulen mit großen Stichprobengrößen durchgeführt. Die Phase umfasst das Erhalten von Marktinformationen oder verwandten Daten aus verschiedenen Quellen und Strategien. Sie umfasst die Prüfung und Planung aller aus der Vergangenheit im Voraus erfassten Daten. Sie umfasst auch die Prüfung von Informationsinkonsistenzen, die in verschiedenen Informationsquellen auftreten. Die Marktdaten werden mithilfe von marktstatistischen und kohärenten Modellen analysiert und geschätzt. Darüber hinaus sind Marktanteilsanalyse und Schlüsseltrendanalyse die wichtigsten Erfolgsfaktoren im Marktbericht. Um mehr zu erfahren, fordern Sie bitte einen Analystenanruf an oder geben Sie Ihre Anfrage ein.

Die wichtigste Forschungsmethodik, die vom DBMR-Forschungsteam verwendet wird, ist die Datentriangulation, die Data Mining, die Analyse der Auswirkungen von Datenvariablen auf den Markt und die primäre (Branchenexperten-)Validierung umfasst. Zu den Datenmodellen gehören ein Lieferantenpositionierungsraster, eine Marktzeitlinienanalyse, ein Marktüberblick und -leitfaden, ein Firmenpositionierungsraster, eine Patentanalyse, eine Preisanalyse, eine Firmenmarktanteilsanalyse, Messstandards, eine globale versus eine regionale und Lieferantenanteilsanalyse. Um mehr über die Forschungsmethodik zu erfahren, senden Sie eine Anfrage an unsere Branchenexperten.

Anpassung möglich

Data Bridge Market Research ist ein führendes Unternehmen in der fortgeschrittenen formativen Forschung. Wir sind stolz darauf, unseren bestehenden und neuen Kunden Daten und Analysen zu bieten, die zu ihren Zielen passen. Der Bericht kann angepasst werden, um Preistrendanalysen von Zielmarken, Marktverständnis für zusätzliche Länder (fordern Sie die Länderliste an), Daten zu klinischen Studienergebnissen, Literaturübersicht, Analysen des Marktes für aufgearbeitete Produkte und Produktbasis einzuschließen. Marktanalysen von Zielkonkurrenten können von technologiebasierten Analysen bis hin zu Marktportfoliostrategien analysiert werden. Wir können so viele Wettbewerber hinzufügen, wie Sie Daten in dem von Ihnen gewünschten Format und Datenstil benötigen. Unser Analystenteam kann Ihnen auch Daten in groben Excel-Rohdateien und Pivot-Tabellen (Fact Book) bereitstellen oder Sie bei der Erstellung von Präsentationen aus den im Bericht verfügbaren Datensätzen unterstützen.