Apac Medical Aesthetics Market

Marktgröße in Milliarden USD

CAGR :

%

USD

4.50 Billion

USD

12.64 Billion

2024

2032

USD

4.50 Billion

USD

12.64 Billion

2024

2032

| 2025 –2032 | |

| USD 4.50 Billion | |

| USD 12.64 Billion | |

|

|

|

Marktsegmentierung für medizinische Ästhetik im asiatisch-pazifischen Raum nach Produkttyp (ästhetische Lasergeräte, Energiegeräte, Geräte zur Körperformung, Geräte zur Gesichtsästhetik, ästhetische Implantate und Geräte zur Hautästhetik), Anwendung (Anti-Aging und Falten, Gesichts- und Hautverjüngung, Brustvergrößerung, Körperformung und Cellulite, Tattooentfernung, Gefäßläsionen, Sears, Pigmentläsionen, Rekonstruktiv, Psoriasis und Vitiligo und andere), Endbenutzer (Kosmetikzentren, dermatologische Kliniken, Krankenhäuser und medizinische Spas und Schönheitszentren), Vertriebskanal (Direktausschreibung und Einzelhandel) – Branchentrends und Prognose bis 2032

Analyse des Marktes für medizinische Ästhetik im asiatisch-pazifischen Raum

Die medizinische Ästhetik hat eine reiche Geschichte, die bis in die alten Zivilisationen zurückreicht, in denen Schönheitsbehandlungen mit natürlichen Heilmitteln und frühen Formen kosmetischer Verfahren durchgeführt wurden. Im frühen 20. Jahrhundert begann die medizinische Ästhetik mit Fortschritten in der Medizintechnik zu verschmelzen, mit Innovationen wie dem ersten injizierbaren Kollagen zur Faltenbehandlung in den 1970er Jahren. Die Entwicklung von Botox in den 1980er Jahren war ein wichtiger Meilenstein und führte eine nicht-chirurgische Gesichtsverjüngung ein. Im Laufe der Jahrzehnte wurde das Feld mit dem Aufkommen von Lasertechnologien, Hautfüllern und nicht-invasiven Körperformungsbehandlungen erweitert. Heute verbindet die medizinische Ästhetik fortschrittliche Technologie mit dem wachsenden Wunsch nach nicht-invasiven kosmetischen Verfahren und ist damit eine schnell wachsende Branche im Gesundheitswesen im asiatisch-pazifischen Raum.

Marktgröße für medizinische Ästhetik im asiatisch-pazifischen Raum

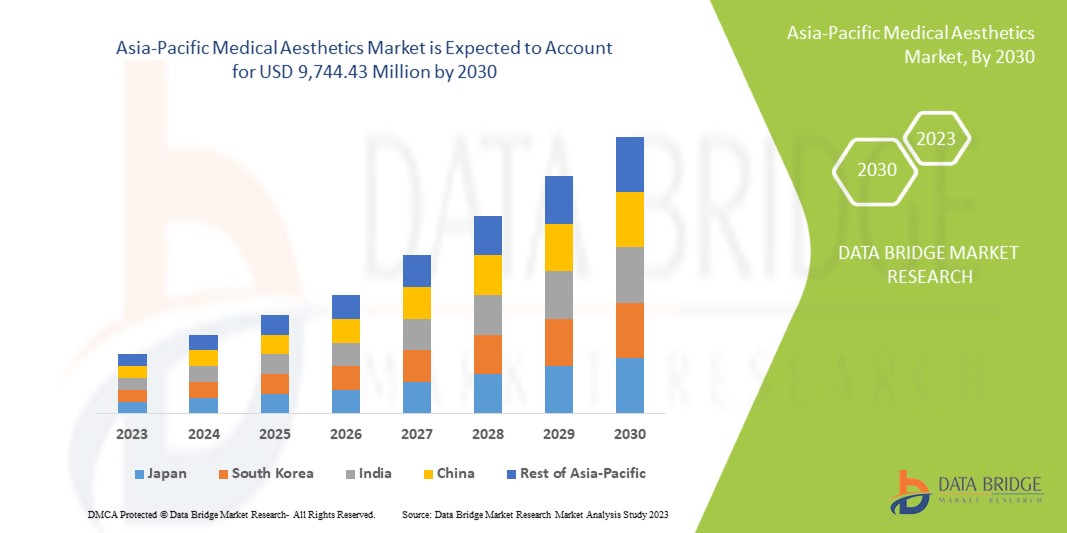

Der Markt für medizinische Ästhetik im asiatisch-pazifischen Raum soll von 4,50 Milliarden US-Dollar im Jahr 2024 auf 12,64 Milliarden US-Dollar im Jahr 2032 anwachsen und im Prognosezeitraum 2024 bis 2032 eine durchschnittliche jährliche Wachstumsrate (CAGR) von 13,8 % aufweisen. Neben Einblicken in Marktszenarien wie Marktwert, Wachstumsrate, Segmentierung, geografische Abdeckung und wichtige Akteure enthalten die von Data Bridge Market Research zusammengestellten Marktberichte auch Import-Export-Analysen, eine Übersicht über die Produktionskapazität, eine Analyse des Produktionsverbrauchs, eine Preistrendanalyse, ein Szenario des Klimawandels, eine Lieferkettenanalyse, eine Wertschöpfungskettenanalyse, eine Übersicht über Rohstoffe/Verbrauchsmaterialien, Kriterien für die Lieferantenauswahl, eine PESTLE-Analyse, eine Porter-Analyse und einen regulatorischen Rahmen.

Markttrends für ästhetische Medizin im Asien-Pazifik-Raum

„Steigende Nachfrage nach nicht-chirurgischen Eingriffen“

Der Markt für medizinische Ästhetik im asiatisch-pazifischen Raum erlebt einen deutlichen Trend hin zu nicht-chirurgischen kosmetischen Eingriffen, der durch technologische Fortschritte, minimale Genesungszeiten und eine zunehmende Vorliebe der Verbraucher für weniger invasive Behandlungen vorangetrieben wird. Verfahren wie Botox-Injektionen, Hautfüller, Laserbehandlungen und nicht-chirurgische Körperkonturierung werden immer beliebter, da Menschen ihr Aussehen verbessern möchten, ohne die mit herkömmlichen Operationen verbundenen Risiken und Ausfallzeiten in Kauf nehmen zu müssen. Das wachsende Bewusstsein für ästhetische Behandlungen sowie der Einfluss der sozialen Medien auf Schönheitsideale haben zu diesem Nachfrageschub beigetragen. Darüber hinaus treiben der Anstieg des verfügbaren Einkommens sowie die alternde Bevölkerung in den entwickelten Märkten die Expansion des Marktes voran. Die zunehmende Verfügbarkeit innovativer, personalisierter Behandlungen und die wachsende Akzeptanz der medizinischen Ästhetik in der Mainstream-Gesellschaft beschleunigen diesen Trend weiter und machen nicht-chirurgische Optionen für viele Verbraucher zur bevorzugten Wahl.

Berichtsumfang und Marktsegmentierung für medizinische Ästhetik im asiatisch-pazifischen Raum

|

Eigenschaften |

Einblicke in den Markt für medizinische Ästhetik im asiatisch-pazifischen Raum |

|

Abgedeckte Segmente |

|

|

Abgedeckte Region |

China, Indien, Japan, Südkorea, Australien, Indonesien, Thailand, Malaysia, Philippinen, Singapur und Rest des asiatisch-pazifischen Raums |

|

Wichtige Marktteilnehmer |

Mentor WorldWide LLC (eine Tochtergesellschaft von Johnsons & Johnsons) (USA), Allergan (eine Tochtergesellschaft von AbbVie Inc.) (Irland), GALDERMA (Schweiz), Cutera, Inc. (USA), Lumenis Be Ltd. (Israel), Densply Sirona (USA), Institut Straumann AG (USA), Candela Corporation (USA), Medytrox (Südkorea), BioHorizons (USA), BTL (Indien), Nobel Biocare Services AG (Schweiz), Merz Pharma (Deutschland), Cynosure, LLC (USA), Sharplight Technologies Inc. (Israel), Alma Lasers (USA), MEGA'GEN IMPLANT CO., LTD. (Indien), 3M (USA), Quanta System (Italien), Sciton (Kalifornien) und andere. |

|

Marktchancen |

|

|

Wertschöpfende Dateninfosets |

Zusätzlich zu den Einblicken in Marktszenarien wie Marktwert, Wachstumsrate, Segmentierung, geografische Abdeckung und wichtige Akteure enthalten die von Data Bridge Market Research zusammengestellten Marktberichte auch Import-Export-Analysen, eine Übersicht über die Produktionskapazität, eine Analyse des Produktionsverbrauchs, eine Preistrendanalyse, ein Szenario des Klimawandels, eine Lieferkettenanalyse, eine Wertschöpfungskettenanalyse, eine Übersicht über Rohstoffe/Verbrauchsmaterialien, Kriterien für die Lieferantenauswahl, eine PESTLE-Analyse, eine Porter-Analyse und einen regulatorischen Rahmen. |

Definition des Marktes für medizinische Ästhetik im asiatisch-pazifischen Raum

Die medizinische Ästhetik umfasst alle medizinischen Behandlungen, die darauf abzielen, das kosmetische Erscheinungsbild der Patienten zu verbessern. Die medizinische Ästhetik ist eine schöne kleine Nische zwischen der Schönheitsindustrie und der plastischen Chirurgie. Qualifizierte Ärzte, Krankenschwestern oder Zahnärzte können eine Vielzahl atemberaubender Behandlungen durchführen, um Ihr Aussehen zu verbessern. Diese Behandlungen erfordern ein hohes Maß an Geschick, Ausbildung und Wissen über Ihre Anatomie und Physiologie. Dies unterscheidet medizinisch-ästhetische Behandlungen von Schönheitsbehandlungen wie Augenbrauen-Threading, Wachsen oder Wimpernverlängerungen. Andererseits sind medizinisch-ästhetische Behandlungen nicht so aggressiv wie chirurgische Eingriffe (ästhetische medizinische Behandlungen werden manchmal als nicht-chirurgische kosmetische Behandlungen bezeichnet), zu denen Verfahren wie Facelifts, Brustvergrößerungen oder Fettabsaugungen gehören.

Definition und Dynamik des Marktes für medizinische Ästhetik im asiatisch-pazifischen Raum

Treiber

- Zunahme der Überalterung der Bevölkerung

Der Anstieg der alternden Bevölkerung treibt den Markt für ästhetische Dienstleistungen erheblich an, da ältere Erwachsene zunehmend den Wunsch haben, ein jugendliches Aussehen zu bewahren und ihre Lebensqualität zu verbessern. Mit zunehmendem Alter erleben Menschen häufig einen Rückgang der Hautelastizität, die Entstehung von Falten und andere Zeichen der Alterung, die das Selbstwertgefühl und das allgemeine Wohlbefinden beeinträchtigen können. Dieser demografische Wandel hat zu einer höheren Nachfrage nach verschiedenen ästhetischen Behandlungen geführt, darunter nicht-invasive Verfahren wie Botox, Hautfüller und Hautverjüngungstherapien. Das zunehmende Bewusstsein für diese ästhetischen Optionen, gepaart mit einer kulturellen Betonung von Schönheit und Aussehen, veranlasst ältere Erwachsene, nach Lösungen zu suchen, die es ihnen ermöglichen, so lebendig auszusehen, wie sie sich fühlen, und treibt so das Marktwachstum an.

Zum Beispiel,

- Laut einem im September 2022 in The Nation veröffentlichten Artikel wurde Thailands Gesundheits- und Schönheitsbranche durch die alternde Bevölkerung des Landes vorangetrieben. Darüber hinaus waren der gleichen Quelle zufolge am 31. Dezember letzten Jahres 12,24 Millionen oder 18,5 % der thailändischen Bevölkerung 60 Jahre oder älter.

- Laut den von PRB veröffentlichten Nachrichten wird im Januar 2024 in den Vereinigten Staaten ein deutlicher Anstieg der alternden Bevölkerung erwartet. Die Zahl der Amerikaner im Alter von 65 Jahren und älter wird bis 2060 voraussichtlich von 17 % auf 23 % steigen. Dieser demografische Wandel treibt den Markt für medizinische Ästhetik im asiatisch-pazifischen Raum an, da ältere Erwachsene nach Behandlungen suchen, um altersbedingte Probleme wie Falten, schlaffe Haut und Volumenverlust zu behandeln. Die wachsende Nachfrage nach Anti-Aging-Verfahren wie Botox, Hautfüllern und Hautverjüngungsbehandlungen treibt das Marktwachstum und die Innovation bei ästhetischen Produkten und Dienstleistungen voran.

- Im Mai 2023 wurde laut einer im US Census Bureau veröffentlichten Meldung ein Anstieg der US-Bevölkerung im Alter von 65 Jahren und älter um 38,6 % von 2010 bis 2020 verzeichnet, was die Nachfrage nach Anti-Aging-Behandlungen wie Botox und Hautfüllern ankurbelt und damit das Wachstum auf dem Markt für medizinische Ästhetik im asiatisch-pazifischen Raum ankurbelt.

Darüber hinaus trägt der Anstieg des verfügbaren Einkommens der alternden Bevölkerung zur Expansion des Marktes für ästhetische Dienstleistungen bei. Da ältere Erwachsene in ihr persönliches Erscheinungsbild und ihr Wohlbefinden investieren möchten, sind sie eher bereit, für Schönheitsbehandlungen Geld auszugeben.

Zusammenfassend lässt sich sagen, dass der technologische Fortschritt ästhetische Eingriffe sicherer, minimalinvasiv und zugänglicher gemacht hat und damit einen größeren Teil älterer Menschen anspricht, die solchen Eingriffen zuvor möglicherweise zögerlich gegenüberstanden. Dieses Zusammentreffen von demografischen Trends, steigenden verfügbaren Einkommen und verbesserten Serviceangeboten bedeutet ein erhebliches Wachstum für den Sektor der ästhetischen Dienstleistungen und fördert Innovation und Wettbewerb unter den Anbietern.

- Veränderte Schönheitsideale und der Einfluss sozialer Medien

Sich entwickelnde Schönheitsideale und der Einfluss von Social-Media-Plattformen treiben die Nachfrage nach medizinisch-ästhetischen Behandlungen erheblich voran. Social-Media-Plattformen wie Instagram und TikTok präsentieren idealisierte Schönheitsideale und ermutigen Menschen, nach ästhetischen Verbesserungen zu suchen, um ein ähnliches Aussehen zu erreichen. Influencer und Prominente werben oft für ästhetische Behandlungen und machen sie dadurch populärer und begehrenswerter. Dieser Trend führt zu einem erhöhten Bewusstsein und einer größeren Akzeptanz der medizinischen Ästhetik und treibt das Marktwachstum voran.

Zum Beispiel,

- Laut einem im Juni 2023 in der National Library of Medicine veröffentlichten Artikel ist die steigende Nachfrage nach medizinischer Ästhetik auf die alternde Bevölkerung und den technologischen Fortschritt zurückzuführen. Mit zunehmendem Alter suchen Menschen nach Behandlungen, um Zeichen der Alterung wie Falten und schlaffe Haut zu bekämpfen. Der technologische Fortschritt hat diese Behandlungen effektiver und zugänglicher gemacht, was das Marktwachstum weiter vorantreibt. Darüber hinaus tragen das wachsende Bewusstsein und die Akzeptanz ästhetischer Verfahren zum wachsenden Markt bei.

- Laut einem im Juli 2024 in ResearchGate veröffentlichten Artikel hatten soziale Medien einen erheblichen Einfluss auf das Körperbild und Überlegungen zu Schönheitsoperationen. Auf Social-Media-Plattformen werden oft idealisierte Schönheitsstandards dargestellt, was dazu führt, dass Menschen nach ästhetischen Verbesserungen suchen, um ein ähnliches Aussehen zu erreichen. Dieser Trend treibt die Nachfrage nach medizinisch-ästhetischen Behandlungen an, da Menschen zunehmend von den Bildern und Lebensstilen beeinflusst werden, die sie online sehen. Die Studie unterstreicht die Rolle der sozialen Medien bei der Gestaltung der Schönheitswahrnehmung und der wachsenden Akzeptanz kosmetischer Eingriffe und fördert so das Marktwachstum.

Der Markt für medizinische Ästhetik im asiatisch-pazifischen Raum wird durch sich ändernde Schönheitsideale und den allgegenwärtigen Einfluss sozialer Medien vorangetrieben. Da die Menschen danach streben, diesen sich entwickelnden Idealen zu entsprechen, steigt die Nachfrage nach ästhetischen Behandlungen weiter an, was Innovation und Expansion innerhalb der Branche fördert.

Gelegenheiten

- Entwicklung neuer innovativer Behandlungen

Die Einführung neuer und innovativer Behandlungen bietet dem Markt für medizinische Ästhetik eine große Chance. Mit den Fortschritten in der Medizintechnik haben sich ästhetische Behandlungen weiterentwickelt und umfassen nun nicht-invasive, hochwirksame Optionen, die der wachsenden Nachfrage nach verbesserten Ergebnissen bei minimalen Ausfallzeiten gerecht werden. Behandlungen wie Stammzellentherapien, fortschrittliche Lasertechniken und nicht-chirurgische Facelifts verändern den Markt, indem sie den Verbrauchern eine größere Auswahl bieten, die ihren unterschiedlichen Bedürfnissen und Vorlieben gerecht wird. Diese Innovationen verbessern nicht nur die Wirksamkeit und Sicherheit der Behandlungen, sondern verringern auch die mit traditionelleren chirurgischen Eingriffen verbundenen Risiken. Da die Verbraucher zunehmend nach hochmodernen Lösungen suchen, um ihre Jugendlichkeit zu bewahren und ihr Aussehen zu verbessern, steigt die Nachfrage nach diesen fortschrittlichen ästhetischen Dienstleistungen weiter an. Dieser Wandel hin zu neueren, wirksameren Behandlungen stellt eine wichtige Chance dar, die das Wachstum des Marktes vorantreibt und ihn für eine langfristige Expansion positioniert, da die Technologie die Branche weiterhin verändert.

Zum Beispiel,

- Laut einem im Februar 2022 von Science Direct veröffentlichten Artikel erweisen sich Stammzellen, die ursprünglich bei chronischen degenerativen Erkrankungen eingesetzt wurden, nun als vielversprechende, minimalinvasive Behandlung in der Ästhetik. Diese Hinwendung zu Stammzellentherapien bietet wirksame Lösungen zur Hautverjüngung und Anti-Aging und stößt bei den Verbrauchern auf wachsendes Interesse. Da diese innovative Behandlung an Bedeutung gewinnt, bietet sie eine bedeutende Chance für den südostasiatischen Markt für ästhetische Dienstleistungen, zu expandieren und sich weiterzuentwickeln.

- Laut einem im August 2021 von NCBI veröffentlichten Artikel erfreuen sich Stammzellen, insbesondere aus Fettgewebe gewonnene, in der kosmetischen Dermatologie zunehmender Beliebtheit, da sie sich selbst erneuern und in verschiedene Zelltypen differenzieren können. Da sie leicht zu sammeln und in großer Menge vorhanden sind, sind sie eine attraktive Option für ästhetische Behandlungen wie die Hautverjüngung. Diese Innovation bietet dem südostasiatischen Markt für ästhetische Dienstleistungen eine wertvolle Gelegenheit, zu wachsen und sein Angebot zu diversifizieren.

- Laut dem im MedEsthetics Magazine veröffentlichten Artikel treiben im Januar 2023 bedeutende technologische Innovationen das Wachstum auf dem Markt für medizinische Ästhetik voran. Zu diesen Fortschritten gehören neuartige schmerzfreie Verfahren, fortschrittliche Geräte, fraktioniertes Resurfacing, ultraschallunterstützte Lipoplastik der dritten Generation und fortschrittliche Hautbildgebung. Die Integration von VR, AR, KI, CAD, Telemedizin und IoT verbessert die Genauigkeit und Effizienz von Verfahren und macht sie präziser und weniger invasiv.

- Im Februar 2024, so der im MDPI veröffentlichte Artikel, konzentrieren sich die Fortschritte in der regenerativen Medizin für die ästhetische Dermatologie auf innovative, minimalinvasive Behandlungen zur Gesichtsverjüngung und -regeneration. Die enge Korrelation zwischen Gewebereparatur, Regeneration und Alterung hat den Weg für die Anwendung von Prinzipien der regenerativen Medizin in der kosmetischen Dermatologie geebnet.

Die Einführung neuer und fortschrittlicher Behandlungen bietet eine wertvolle Chance für den Markt für medizinische Ästhetik. Innovationen wie Stammzellentherapien, verbesserte Laserbehandlungen und nicht-chirurgische Facelifts bieten den Verbrauchern sicherere, effektivere Optionen, die weniger Erholungszeit erfordern. Diese Fortschritte kommen der wachsenden Nachfrage nach nicht-invasiven Verfahren entgegen und sprechen diejenigen an, die bessere, länger anhaltende Ergebnisse suchen. Mit zunehmender Popularität dieser Behandlungen erzeugen sie eine starke Nachfrage, wirken als wichtiger Treiber für das Marktwachstum und positionieren es für eine weitere Expansion.

- Medizinische Partnerschaften und Innovationen

Medizinische Partnerschaften und Innovationen bieten dem Markt für ästhetische Medizin eine große Chance, da sie die Glaubwürdigkeit und Qualität der angebotenen Dienstleistungen verbessern. Kooperationen zwischen Anbietern ästhetischer Dienstleistungen und qualifizierten medizinischen Fachkräften wie Dermatologen und plastischen Chirurgen stellen sicher, dass die Behandlungen nicht nur wirksam, sondern auch sicher für die Verbraucher sind. Diese Partnerschaften ermöglichen auch die Integration fortschrittlicher medizinischer Technologien und Techniken in ästhetische Verfahren, wodurch die Dienstleistungen zuverlässiger und für einen breiteren Kundenstamm attraktiver werden. Durch die Beteiligung vertrauenswürdiger medizinischer Fachkräfte haben die Verbraucher mehr Vertrauen in die Verfahren, was zu einer erhöhten Nachfrage nach ästhetischen Dienstleistungen führt. Darüber hinaus öffnen solche Kooperationen Türen zur Entwicklung neuer, hochmoderner Behandlungen, die auf neue Verbraucherbedürfnisse eingehen. Diese Allianz zwischen Ästhetik und Medizin treibt das Wachstum des Marktes voran, indem sie ihn als vertrauenswürdigen, innovativen und qualitativ hochwertigen Sektor positioniert.

Zum Beispiel,

- Laut dem in The Nation veröffentlichten Artikel positioniert sich MASTER im November 2024 durch seine Partnerschaft mit dem indonesischen „Lumeo Health“ als führender Anbieter kosmetischer Chirurgie in Südostasien. Diese Zusammenarbeit fördert Innovationen und verbessert medizinische Partnerschaften, indem sie einem wachsenden Markt fortschrittliche ästhetische Dienstleistungen anbietet. Durch die Kombination von Fachwissen und Ressourcen eröffnet diese Allianz neue Möglichkeiten für einen erweiterten Zugang, hochmoderne Behandlungen und verbesserte Patientenergebnisse und fördert so das Wachstum im ästhetischen Sektor.

- Laut dem von Health365 veröffentlichten Artikel markiert die im Oktober 2023 geschlossene Partnerschaft mit dem Bangkok Hospital einen bedeutenden Schritt zur Verbesserung der ästhetischen Dienstleistungen in Südostasien. Durch die Kombination der Expertise von Health365 mit der medizinischen Innovation des Bangkok Hospital fördert diese Zusammenarbeit den Zugang zu erstklassigen Behandlungen und fortschrittlichen Technologien. Diese strategische Allianz bietet eine wertvolle Gelegenheit, den Markt für ästhetische Dienstleistungen in der Region zu stärken, das Wachstum voranzutreiben und die Patientenversorgung zu verbessern.

Medizinische Partnerschaften stellen eine wertvolle Chance für den Markt für medizinisch-ästhetische Dienstleistungen dar, da sie die Glaubwürdigkeit und Qualität der Dienstleistungen verbessern. Die Zusammenarbeit zwischen ästhetischen Anbietern und qualifiziertem medizinischem Fachpersonal stellt sicher, dass die Behandlungen sicher und wirksam sind, und stärkt das Vertrauen der Verbraucher. Diese Partnerschaften erleichtern auch die Einführung fortschrittlicher Techniken und Technologien und ziehen so eine breitere Kundenbasis an. Durch die Kombination medizinischer Expertise mit ästhetischer Innovation erlebt der Markt Wachstum und eine erhöhte Nachfrage.

Einschränkungen/Herausforderungen

- Mangel an ausgebildeten Fachkräften

Der Mangel an ausgebildeten Fachkräften im Markt für ästhetische Dienstleistungen behindert das Wachstum und die Verbreitung dieser Dienstleistungen erheblich. Ästhetische Verfahren, die oft spezielle Fähigkeiten und Kenntnisse erfordern, erfordern eine Belegschaft, die mit den neuesten Technologien, Techniken und Sicherheitsprotokollen vertraut ist. Der Mangel an zertifizierten Fachkräften schränkt die Verfügbarkeit von Dienstleistungen ein und birgt Risiken für die Patientensicherheit, was zu potenziellen Komplikationen und Unzufriedenheit mit den Ergebnissen führen kann. Dadurch entsteht ein Kreislauf, in dem Verbraucher zögern, ästhetische Angebote in Anspruch zu nehmen, was das Marktwachstum weiter stagnieren lässt.

Zum Beispiel,

- Laut einem im August 2023 von The Malaysian Reserve veröffentlichten Artikel stellt Unwissenheit oder mangelndes Bewusstsein in Bezug auf riskante ästhetische Verfahren, die von Kosmetikerinnen oder nicht lizenzierten Praktikern in Malaysia durchgeführt werden, eine ernsthafte Bedrohung für die Verbraucher dar. Die Verwendung minderwertiger Produkte oder unhygienischer Praktiken kann zu ernsthaften Gesundheitsproblemen, Infektionen oder irreversiblen Schäden führen. Darüber hinaus macht das Fehlen behördlicher Aufsicht die Verbraucher anfällig für betrügerische Praktiken, was es ihnen erschwert, im Falle von Behandlungsfehlern oder Nebenwirkungen Rechtsmittel einzulegen.

- Im Juli 2019 hieß es in einem Artikel mit dem Titel „Verband fördert qualifizierte Kosmetikerinnen in Malaysia“, dass es lokalen Schätzungen zufolge 20.000 nicht zertifizierte Kosmetikerinnen im Vergleich zu nur 200 zertifizierten Inhabern von Berufsqualifikationen gebe. Dies stellt die Branche vor die Herausforderung, ihre Standards bei der Bereitstellung ästhetischer Dienstleistungen aufrechtzuerhalten.

- Im Oktober 2024, so der in The Evaluation Company veröffentlichte Artikel, besteht in den USA ein erheblicher Mangel an medizinischem Personal, der den Markt für medizinische Ästhetik im asiatisch-pazifischen Raum behindert. Der Mangel betrifft nicht nur Ärzte, sondern auch Krankenschwestern und andere Angehörige der Gesundheitsberufe, was zu längeren Wartezeiten und einer geringeren Verfügbarkeit ästhetischer Behandlungen führt. Dieser Mangel an qualifizierten Fachkräften kann das Wachstum und die Expansion des Marktes für medizinische Ästhetik einschränken, da die Nachfrage nach qualifizierten Fachkräften das Angebot übersteigt

Darüber hinaus kann dieser Mangel an Fachkräften Kliniken und Dienstleister daran hindern, ihre Betriebe zu skalieren oder ihr Angebot zu erweitern. Während die Nachfrage nach ästhetischen Dienstleistungen weiter steigt, insbesondere bei jüngeren Bevölkerungsgruppen, die nicht-invasive Behandlungen suchen, wird die Fähigkeit, diese Nachfrage zu decken, durch einen begrenzten Pool an qualifizierten Fachkräften behindert. Diese Herausforderung wirkt sich auf den Ruf und das Vertrauen der Marke aus, da Kunden eher Einrichtungen wählen, die für ihr qualifiziertes und erfahrenes Personal bekannt sind. Ohne gezielte Schulungsprogramme und unterstützende Initiativen zur Förderung von Gesundheitsfachkräften im Bereich Ästhetik bleibt das Potenzial des Marktes für medizinische Ästhetik im asiatisch-pazifischen Raum daher ungenutzt.

- Risiko von Nebenwirkungen im Zusammenhang mit diesen Verfahren

Das Risiko von Nebenwirkungen im Zusammenhang mit ästhetischen Eingriffen stellt eine erhebliche Einschränkung für den Markt für medizinisch-ästhetische Eingriffe dar, da es bei potenziellen Kunden Befürchtungen hervorruft. Viele kosmetische Eingriffe, ob chirurgisch oder nicht-chirurgisch, bergen das inhärente Risiko von Komplikationen wie Infektionen, Narbenbildung oder unbefriedigenden Ergebnissen. Diese Angst vor Nebenwirkungen kann Menschen davon abhalten, diese Dienste in Anspruch zu nehmen, da Verbraucher über soziale Medien und Online-Plattformen zunehmend über die Erfahrungen anderer, einschließlich negativer Ergebnisse, informiert werden. Folglich kann das Potenzial für Nebenwirkungen den Eindruck erwecken, dass diese Eingriffe das Risiko nicht wert sind, was zu einer geringeren Nachfrage und Beteiligung am Markt führt.

Zum Beispiel,

- Im Oktober 2024 hieß es in einem Artikel mit dem Titel „Gefahren der kosmetischen Chirurgie in Thailand von Dr. Ehsan Jadoon“, dass die mit der kosmetischen Chirurgie verbundenen Gefahren Schwellungen, Blutergüsse, Infektionen, allergische Reaktionen, asymmetrische Ergebnisse, Gefäßverletzungen, Nerventraumata, Sehstörungen, psychische Traumata und schwere Körperschäden umfassen.

- Laut einem im Oktober 2024 im Journal of Cutaneous and Aesthetic Surgery veröffentlichten Artikel werden viele unerwünschte Ereignisse aufgrund fehlender Regulierung und mangelnder Durchsetzung nicht gemeldet, da Eingriffe häufig in nicht-medizinischen Einrichtungen wie Spas und Schönheitssalons durchgeführt werden. Dieser Mangel an Aufsicht kann zu Komplikationen wie Fettnekrose, Infektionen und anderen Nebenwirkungen führen, insbesondere wenn unerfahrene Ärzte Eingriffe durchführen. Die Angst vor negativer Medienberichterstattung und niedrigen Melderaten verschärfen diese Probleme noch weiter, sodass es für die Branche von entscheidender Bedeutung ist, strenge Risikobewertungs- und Präventionsmaßnahmen umzusetzen, um die Patientensicherheit zu gewährleisten und das Marktwachstum aufrechtzuerhalten

- Im August 2020 hieß es in der im PMFA Journal veröffentlichten Meldung: Komplikationen können durch verschiedene Faktoren entstehen, darunter Patientenauswahl, Injektionstechniken und die inhärenten Risiken der Verfahren selbst. Diese Komplikationen können von kleineren Problemen wie Blutergüssen und Schwellungen bis hin zu schwerwiegenderen Problemen wie Infektionen, Gefäßverschlüssen und allergischen Reaktionen reichen. Die Angst vor diesen potenziellen Komplikationen kann Menschen davon abhalten, ästhetische Behandlungen in Anspruch zu nehmen, und so das Marktwachstum einschränken.

Darüber hinaus verstärkt der Einfluss lokaler Gesundheitssysteme und regulatorischer Rahmenbedingungen die Bedenken hinsichtlich Nebenwirkungen in der Region noch weiter. Wenn Personen den Eindruck haben, dass die Sicherheit in einer Klinik nicht an erster Stelle steht oder sie sich nicht an strenge Gesundheitsvorschriften hält, sind sie möglicherweise weniger geneigt, ästhetische Behandlungen in Anspruch zu nehmen. Diese Skepsis kann durch Medienberichte über verpfuschte Eingriffe und unsichere Praktiken noch verstärkt werden, was potenzielle Kunden vor den damit verbundenen Risiken schreckt. Infolgedessen bremst die Angst vor Nebenwirkungen nicht nur das individuelle Interesse, sondern stellt auch eine Herausforderung für das Marktwachstum dar, da Unternehmen versuchen, das Vertrauen der Verbraucher in ihre Dienstleistungen zu gewinnen.

Marktumfang für medizinische Ästhetik im asiatisch-pazifischen Raum

Der Markt ist nach Produkten, Anwendungen, Endbenutzern und Vertriebskanälen segmentiert. Das Wachstum dieser Segmente hilft Ihnen bei der Analyse schwacher Wachstumssegmente in den Branchen und bietet den Benutzern einen wertvollen Marktüberblick und Markteinblicke, die ihnen bei der strategischen Entscheidungsfindung zur Identifizierung der wichtigsten Marktanwendungen helfen.

Produkt

- Ästhetische Lasergeräte

- Geräte zur ablativen Hauterneuerung

- CO2 Laser

- Erbium-Laser

- Sonstiges

- Nicht-ablative fraktionierte Laser-Oberflächenerneuerungsgeräte

- Radiofrequenz

- Intensives gepulstes Licht

- Fraktionierter Laser

- Der gütegeschaltete ND:YAG-Laser

- Sonstiges

- Energiegeräte

- Geräte für die Laserchirurgie

- Elektrokauterisationsgeräte

- Elektrochirurgiegeräte

- Kryochirurgiegeräte

- Harmonisches Skalpell

- Mikrowellengeräte

- Geräte zur Körperformung

- Fettabsaugung

- Nichtchirurgische Hautstraffung

- Cellulite-Behandlung

- Geräte zur Gesichtsästhetik

- Botox-Injektion

- Hautfüller

- Natürliche Hautfüller

- Synthetische Hautfüller

- Kollagen-Injektionen

- Chemisches Peeling

- Gesichtsstraffung

- Fraxel

- Kosmetische Akupunktur

- Elektrotherapie

- Mikrodermabrasion

- Permanent Make-up

- Ästhetische Implantate

- Brustvergrößerung

- Kochsalzimplantate

- Silikonimplantate

- Gesäßvergrößerung

- Ästhetische Zahnimplantate

- Zahnimplantate aus Titan

- Dentale Zerconium-Implantate

- Gesichtsimplantate

- Weichgewebeimplantate

- Transdermales Implantat

- Sonstiges

- Geräte zur Hautästhetik

- Geräte zur Laser-Hauterneuerung

- Nicht-chirurgische Geräte zur Hautstraffung

- Lichttherapiegeräte

- Geräte zur Tattooentfernung

- Micro-Needling Produkte

- Produkte zum Fadenlifting

- Lasergeräte zur Nagelbehandlung

- Sonstiges

Anwendung

- Anti-Aging und Falten

- Gesichts- und Hautverjüngung

- Brustvergrößerung

- Körperformung und Cellulite

- Tattooentfernung

- Gefäßläsionen

- Sears, Pigmentläsionen, Rekonstruktive

- Psoriasis und Vitiligo

- Sonstiges

Endbenutzer

- Kosmetische Zentren

- Dermatologische Kliniken

- Krankenhäuser

- Medizinische Spas und Schönheitszentren

Vertriebskanal

- Direkte Ausschreibung

- Einzelhandel

Regionale Analyse des Marktes für medizinische Ästhetik im asiatisch-pazifischen Raum

Der Markt wird analysiert und Einblicke in die Marktgröße und Trends werden nach Produkten, Anwendungen, Endbenutzern und Vertriebskanälen bereitgestellt, wie oben angegeben.

Die vom Markt abgedeckten Regionen umfassen China, Indien, Japan, Südkorea, Australien, Indonesien, Thailand, Malaysia, die Philippinen, Singapur und den Rest des asiatisch-pazifischen Raums.

Japan wird den Markt voraussichtlich dominieren, da es über eine fortschrittliche Gesundheitsinfrastruktur, eine hohe Nachfrage der Verbraucher nach nicht-chirurgischen Schönheitsbehandlungen und einen starken Schwerpunkt auf Anti-Aging-Lösungen verfügt. Darüber hinaus sorgen Japans alternde Bevölkerung und der kulturelle Fokus auf Schönheit und Wellness für kontinuierliches Marktwachstum und Innovationen im Bereich ästhetischer Behandlungen.

Indien dürfte aufgrund steigender verfügbarer Einkommen, eines gestiegenen Bewusstseins für Schönheitsbehandlungen und einer großen, jungen Bevölkerung das am schnellsten wachsende Land sein. Darüber hinaus treiben die zunehmende Akzeptanz nicht-chirurgischer Verfahren und technologische Fortschritte die Nachfrage nach ästhetischen Dienstleistungen im ganzen Land in die Höhe.

Der Länderabschnitt des Berichts enthält auch Angaben zu einzelnen marktbeeinflussenden Faktoren und Änderungen der Regulierung auf dem Inlandsmarkt, die sich auf die aktuellen und zukünftigen Trends des Marktes auswirken. Datenpunkte wie Downstream- und Upstream-Wertschöpfungskettenanalysen, technische Trends und Porters Fünf-Kräfte-Analyse sowie Fallstudien sind einige der Hinweise, die zur Prognose des Marktszenarios für einzelne Länder verwendet werden. Bei der Bereitstellung von Prognoseanalysen der Länderdaten werden auch die Präsenz und Verfügbarkeit von Marken aus dem asiatisch-pazifischen Raum und ihre Herausforderungen aufgrund großer oder geringer Konkurrenz durch lokale und inländische Marken sowie die Auswirkungen inländischer Zölle und Handelsrouten berücksichtigt.

Marktanteil im Bereich medizinische Ästhetik im asiatisch-pazifischen Raum

Die Wettbewerbslandschaft des Marktes liefert Einzelheiten zu den einzelnen Wettbewerbern. Die enthaltenen Einzelheiten umfassen Unternehmensübersicht, Unternehmensfinanzen, erzielten Umsatz, Marktpotenzial, Investitionen in Forschung und Entwicklung, neue Marktinitiativen, Präsenz im asiatisch-pazifischen Raum, Produktionsstandorte und -anlagen, Produktionskapazitäten, Stärken und Schwächen des Unternehmens, Produkteinführung, Produktbreite und -umfang, Anwendungsdominanz. Die oben angegebenen Datenpunkte beziehen sich nur auf den Fokus der Unternehmen in Bezug auf den Markt.

Die im asiatisch-pazifischen Raum tätigen Marktführer im Bereich der medizinischen Ästhetik sind:

- Mentor WorldWide LLC (eine Tochtergesellschaft von Johnsons & Johnsons) (USA)

- Allergan (eine Tochtergesellschaft von AbbVie Inc.) (Irland)

- GALDERMA (Schweiz)

- Cutera, Inc. (USA)

- Lumenis Be Ltd. (Israel)

- Densply Sirona (USA)

- Institut Straumann AG (US)

- Candela Corporation (USA)

- Medytrox (Südkorea)

- BioHorizons (USA)

- BTL (Indien)

- Nobel Biocare Services AG (Schweiz)

- Merz Pharma (Deutschland)

- Cynosure, LLC (USA)

- Sharplight Technologies Inc. (Israel)

- Alma Lasers (USA)

- MEGA’GEN IMPLANT CO., LTD. (Indien)

- 3M (USA)

- Quanta System (Italien)

- Sciton (Kalifornien)

Neueste Entwicklungen auf dem Markt für medizinisch-ästhetische Medizin im asiatisch-pazifischen Raum

- Im Januar 2023 kündigte Galderma die Einführung von FACE by Galderma an, einer innovativen Augmented-Reality-Anwendung. Die bahnbrechende Lösung ermöglicht es ästhetischen Praktikern und Patienten, Behandlungsergebnisse bereits in der Planungsphase zu visualisieren. Die Technologie wird der ästhetischen Wissenschaftsgemeinschaft auf dem Weltkongress 2023 des International Master Course on Aging Science (IMCAS) vorgestellt.

- Im Februar 2022 gab Allergan (eine Tochtergesellschaft von AbbVie Inc.) die FDA-Zulassung von JUVÉDERM VOLBELLA XC zur Verbesserung der Infraorbitalhöhlen bei Erwachsenen über 21 Jahren bekannt. Dies half dem Unternehmen, das Produktportfolio der Ästhetik auf dem US-Markt zu erweitern.

- Im Januar 2022 gab Mentor Worldwide LLC (eine Tochtergesellschaft der Johnson & Johnson Medical Devices Companies) bekannt, dass die FDA das Brustimplantat MENTOR MemoryGel BOOST zur Brustvergrößerung und Brustrekonstruktion zugelassen hat. Dieses Produkt hat dem Unternehmen geholfen, das Produktportfolio der Ästhetik auf dem US-Markt zu erweitern

- Im Januar 2021 gab Cutera, Inc. bekannt, dass das Unternehmen truSculpt Flex+ auf den Markt gebracht hat, das für eine gezielte, wiederholbare und gleichmäßige Modellierung von Problemzonen optimiert ist. Dies hilft dem Unternehmen, sein Produktportfolio auf dem Markt zu erweitern.

- Im November 2019 gab Lumenis Be Ltd. die Übernahme von Baring Private Equity Asia (BPEA) bekannt, einem führenden Anbieter von speziellen energiebasierten medizinischen Geräten im Bereich der Ästhetik. Dies zeigt, dass das Unternehmen im Ästhetikmarkt starke Unterstützung für das Produktportfolio erhält.

SKU-

Erhalten Sie Online-Zugriff auf den Bericht zur weltweit ersten Market Intelligence Cloud

- Interaktives Datenanalyse-Dashboard

- Unternehmensanalyse-Dashboard für Chancen mit hohem Wachstumspotenzial

- Zugriff für Research-Analysten für Anpassungen und Abfragen

- Konkurrenzanalyse mit interaktivem Dashboard

- Aktuelle Nachrichten, Updates und Trendanalyse

- Nutzen Sie die Leistungsfähigkeit der Benchmark-Analyse für eine umfassende Konkurrenzverfolgung

Inhaltsverzeichnis

1 INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 OVERVIEW OF THE ASIA-PACIFIC MEDICAL AESTHETIC MARKET

1.4 CURRENCY AND PRICING

1.5 LIMITATIONS

1.6 MARKETS COVERED

2 MARKET SEGMENTATION

2.1 MARKETS COVERED

2.2 GEOGRAPHICAL SCOPE

2.3 YEARS CONSIDERED FOR THE STUDY

2.4 DBMR TRIPOD DATA VALIDATION MODEL

2.5 PRIMARY INTERVIEWS WITH KEY OPINION LEADERS

2.6 MULTIVARIATE MODELLING

2.7 DBMR MARKET POSITION GRID

2.8 VENDOR SHARE ANALYSIS

2.9 SECONDARY SOURCES

2.1 ASSUMPTIONS

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

4.1 PORTER’S FIVE FORCES

4.2 PESTEL ANALYSIS

5 MARKET OVERVIEW

5.1 DRIVERS

5.1.1 INCREASE IN THE AGEING POPULATION

5.1.2 CHANGING BEAUTY STANDARDS AND SOCIAL MEDIA INFLUENCE

5.1.3 INCREASE IN POSITIVE ATTITUDE TOWARDS COSMETIC PROCEDURES

5.1.4 INCREASE IN THE NUMBER OF TECHNOLOGICAL ADVANCEMENTS IN DERMATOLOGY

5.2 RESTRAINTS

5.2.1 LACK OF TRAINED PROFESSIONALS

5.2.2 RISK OF SIDE EFFECTS ASSOCIATED WITH THESE PROCEDURES

5.3 OPPORTUNITIES

5.3.1 DEVELOPMENT OF NEW INNOVATIVE TREATMENTS

5.3.2 MEDICAL PARTNERSHIPS AND INNOVATIONS

5.3.3 INCREASING DISPOSABLE INCOME

5.4 CHALLENGES

5.4.1 SAFETY AND LIABILITY RISKS ASSOCIATED WITH AESTHETIC TREATMENTS

5.4.2 LIMITED INSURANCE COVERAGE

6 ASIA-PACIFIC MEDICAL AESTHETIC MARKET, BY PRODUCT TYPE

6.1 OVERVIEW

6.2 AESTHETIC LASER DEVICES

6.2.1 ABLATIVE SKIN RESURFACING DEVICES

6.2.2 NON-ABLATIVE FRACTIONAL LASER RESURFACING DEVICES

6.3 ENERGY DEVICES

6.4 BODY CONTOURING DEVICES

6.5 FACIAL AESTHETIC DEVICES

6.5.1 DERMAL FILLERS

6.6 AESTHETIC IMPLANTS

6.6.1 BREAST AUGMENTATION

6.6.2 AESTHETIC DENTAL IMPLANTS

6.7 SKIN AESTHETIC DEVICES

7 ASIA-PACIFIC MEDICAL AESTHETIC MARKET, BY APPLICATION

7.1 OVERVIEW

7.2 ANTI-AGING AND WRINKLES

7.3 FACIAL AND SKIN REJUVENATION

7.4 BREAST ENHANCEMENT

7.5 BODY SHAPING AND CELLULITE

7.6 TATTOO REMOVAL

7.7 VASCULAR LESIONS

7.8 SEARS, PIGMENT LESIONS, RECONSTRUCTIVE

7.9 PSORIASIS AND VITILIGO

7.1 OTHERS

8 ASIA-PACIFIC MEDICAL AESTHETIC MARKET, BY END USER

8.1 OVERVIEW

8.2 COSMETIC CENTERS

8.3 DERMATOLOGY CLINICS

8.4 HOSPITALS

8.5 MEDICAL SPAS AND BEAUTY CENTERS

9 ASIA-PACIFIC MEDICAL AESTHETIC MARKET, BY DISTRIBUTION CHANNEL

9.1 OVERVIEW

9.2 DIRECT TENDER

9.3 RETAIL

10 ASIA-PACIFIC MEDICAL AESTHETIC MARKET, BY REGION

10.1 ASIA-PACIFIC

10.1.1 JAPAN

10.1.2 INDIA

10.1.3 CHINA

10.1.4 SOUTH KOREA

10.1.5 AUSTRALIA

10.1.6 THAILAND

10.1.7 SINGAPORE

10.1.8 MALAYSIA

10.1.9 INDONESIA

10.1.10 PHILIPPINES

10.1.11 REST OF ASIA-PACIFIC

11 ASIA-PACIFIC MEDICAL AESTHETIC MARKET, COMPANY LANDSCAPE

11.1 COMPANY SHARE ANALYSIS: ASIA-PACIFIC

12 SWOT ANALYSIS

13 COMPANY PROFILE

13.1 ALLERGAN (A SUBSIDIARY OF ABBVIE INC.)

13.1.1 COMPANY SNAPSHOT

13.1.2 REVENUE ANALYSIS

13.1.3 COMPANY SHARE ANALYSIS

13.1.4 PRODUCT PORTFOLIO

13.1.5 RECENT DEVELOPMENT

13.2 CUTERA, INC.

13.2.1 COMPANY SNAPSHOT

13.2.2 REVENUE ANALYSIS

13.2.3 COMPANY SHARE ANALYSIS

13.2.4 PRODUCT PORTFOLIO

13.2.5 RECENT DEVELOPMENTS

13.3 MENTOR WORLDWIDE LLC (A SUBSIDIARY OF JOHNSONS & JOHNSONS)

13.3.1 COMPANY SNAPSHOT

13.3.2 REVENUE ANALYSIS

13.3.3 COMPANY SHARE ANALYSIS

13.3.4 PRODUCT PORTFOLIO

13.3.5 RECENT DEVELOPMENT

13.4 LUMENIS BE LTD.

13.4.1 COMPANY SNAPSHOT

13.4.2 COMPANY SHARE ANALYSIS

13.4.3 PRODUCT PORTFOLIO

13.4.4 RECENT DEVELOPMENT

13.5 GALDERMA

13.5.1 COMPANY SNAPSHOT

13.5.2 COMPANY SHARE ANALYSIS

13.5.3 PRODUCT PORTFOLIO

13.5.4 RECENT DEVELOPMENTS

13.6 ALMA LASERS

13.6.1 COMPANY SNAPSHOT

13.6.2 PRODUCT PORTFOLIO

13.6.3 RECENT DEVELOPMENTS

13.7 BIOHORIZONS

13.7.1 COMPANY SNAPSHOT

13.7.2 PRODUCT PORTFOLIO

13.7.3 RECENT DEVELOPMENTS

13.8 BTL

13.8.1 COMPANY SNAPSHOT

13.8.2 PRODUCT PORTFOLIO

13.8.3 RECENT DEVELOPMENTS

13.9 CANDELA CORPORATION

13.9.1 COMPANY SNAPSHOT

13.9.2 PRODUCT PORTFOLIO

13.9.3 RECENT DEVELOPMENT

13.1 CYNOSURE, LLC

13.10.1 COMPANY SNAPSHOT

13.10.2 PRODUCT PORTFOLIO

13.10.3 RECENT DEVELOPMENTS

13.11 DENTSPLY SIRONA

13.11.1 COMPANY SNAPSHOT

13.11.2 REVENUE ANALYSIS

13.11.3 PRODUCT PORTFOLIO

13.11.4 RECENT DEVELOPMENT

13.12 INSTITUT STRAUMANN AG

13.12.1 COMPANY SNAPSHOT

13.12.2 REVENUE ANALYSIS

13.12.3 PRODUCT PORTFOLIO

13.12.4 RECENT DEVELOPMENT

13.13 MEDYTROX

13.13.1 COMPANY SNAPSHOT

13.13.2 PRODUCT PORTFOLIO

13.13.3 RECENT DEVELOPMENT

13.14 MEGA'GEN IMPLANT CO., LTD.

13.14.1 COMPANY SNAPSHOT

13.14.2 PRODUCT PORTFOLIO

13.14.3 RECENT DEVELOPMENT

13.15 MERZ PHARMA

13.15.1 COMPANY SNAPSHOT

13.15.2 PRODUCT PORTFOLIO

13.15.3 RECENT DEVELOPMENTS

13.16 3M

13.16.1 COMPANY SNAPSHOT

13.16.2 REVENUE ANALYSIS

13.16.3 PRODUCT PORTFOLIO

13.16.4 RECENT DEVELOPMENT

13.17 NOBEL BIOCARE SERVICES AG

13.17.1 COMPANY SNAPSHOT

13.17.2 PRODUCT PORTFOLIO

13.17.3 RECENT DEVELOPMENT

13.18 QUANTA SYSTEM

13.18.1 COMPANY SNAPSHOT

13.18.2 PRODUCT PORTFOLIO

13.18.3 RECENT DEVELOPMENT

13.19 SCITON

13.19.1 COMPANY SNAPSHOT

13.19.2 PRODUCT PORTFOLIO

13.19.3 RECENT DEVELOPMENT

13.2 SHARPLIGHT TECHNOLOGIES INC.

13.20.1 COMPANY SNAPSHOT

13.20.2 PRODUCT PORTFOLIO

13.20.3 RECENT DEVELOPMENT

14 QUESTIONNAIRE

15 RELATED REPORTS

Tabellenverzeichnis

TABLE 1 ASIA-PACIFIC MEDICAL AESTHETIC MARKET, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 2 ASIA-PACIFIC AESTHETIC LASER DEVICES IN MEDICAL AESTHETIC MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 3 ASIA-PACIFIC AESTHETIC LASER DEVICES IN MEDICAL AESTHETIC MARKET, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 4 ASIA-PACIFIC ABLATIVE SKIN RESURFACING DEVICES IN AESTHETIC LASER DEVICES MARKET, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 5 ASIA-PACIFIC NON-ABLATIVE FRACTIONAL LASER RESURFACING DEVICES IN AESTHETIC LASER DEVICES MARKET, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 6 ASIA-PACIFIC ENERGY DEVICES IN MEDICAL AESTHETIC MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 7 ASIA-PACIFIC ENERGY DEVICES IN MEDICAL AESTHETIC MARKET, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 8 ASIA-PACIFIC BODY CONTOURING DEVICES IN MEDICAL AESTHETIC MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 9 ASIA-PACIFIC BODY CONTOURING DEVICES IN MEDICAL AESTHETIC MARKET, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 10 ASIA-PACIFIC FACIAL AESTHETIC DEVICES IN MEDICAL AESTHETIC MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 11 ASIA-PACIFIC FACIAL AESTHETIC DEVICES IN MEDICAL AESTHETIC MARKET, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 12 ASIA-PACIFIC DERMAL FILLERS IN MEDICAL AESTHETIC MARKET, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 13 ASIA-PACIFIC AESTHETIC IMPLANTS IN MEDICAL AESTHETIC MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 14 ASIA-PACIFIC AESTHETIC IMPLANTS IN MEDICAL AESTHETIC MARKET, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 15 ASIA-PACIFIC BREAST AUGMENTATION IN MEDICAL AESTHETIC MARKET, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 16 ASIA-PACIFIC AESTHETIC DENTAL IMPLANTS IN MEDICAL AESTHETIC MARKET, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 17 ASIA-PACIFIC SKIN AESTHETIC DEVICES IN MEDICAL AESTHETIC MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 18 ASIA-PACIFIC SKIN AESTHETIC DEVICES IN MEDICAL AESTHETIC MARKET, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 19 ASIA-PACIFIC MEDICAL AESTHETIC MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 20 ASIA-PACIFIC ANTI-AGING AND WRINKLES IN MEDICAL AESTHETIC MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 21 ASIA-PACIFIC FACIAL AND SKIN REJUVENATION IN MEDICAL AESTHETIC MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 22 ASIA-PACIFIC BREAST ENHANCEMENT IN MEDICAL AESTHETIC MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 23 ASIA-PACIFIC BODY SHAPING AND CELLULITE IN MEDICAL AESTHETIC MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 24 ASIA-PACIFIC VASCULAR LESIONS IN MEDICAL AESTHETIC MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 25 ASIA-PACIFIC SEARS, PIGMENT LESIONS, RECONSTRUCTIVE IN MEDICAL AESTHETIC MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 26 ASIA-PACIFIC PSORIASIS AND VITILIGO IN MEDICAL AESTHETIC MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 27 ASIA-PACIFIC OTHERS IN MEDICAL AESTHETIC MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 28 ASIA-PACIFIC MEDICAL AESTHETIC MARKET, BY END USER, 2018-2032 (USD THOUSAND)

TABLE 29 ASIA-PACIFIC COSMETIC CENTERS IN MEDICAL AESTHETIC MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 30 ASIA-PACIFIC DERMATOLOGY CLINICS IN MEDICAL AESTHETIC MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 31 ASIA-PACIFIC HOSPITALS IN MEDICAL AESTHETIC MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 32 ASIA-PACIFIC MEDICAL SPAS AND BEAUTY CENTERS IN MEDICAL AESTHETIC MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 33 ASIA-PACIFIC MEDICAL AESTHETIC MARKET, BY DISTRIBUTION CHANNEL, 2018-2032 (USD THOUSAND)

TABLE 34 ASIA-PACIFIC DIRECT TENDER IN MEDICAL AESTHETIC MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 35 ASIA-PACIFIC RETAIL IN MEDICAL AESTHETIC MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 36 ASIA-PACIFIC MEDICAL AESTHETIC MARKET, BY COUNTRY, 2018-2032 (USD THOUSAND)

TABLE 37 ASIA-PACIFIC MEDICAL AESTHETIC MARKET, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 38 ASIA-PACIFIC AESTHETIC LASER DEVICES IN MEDICAL AESTHETIC MARKET, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 39 ASIA-PACIFIC ABLATIVE SKIN RESURFACING DEVICES IN AESTHETIC LASER DEVICES MARKET, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 40 ASIA-PACIFIC NON-ABLATIVE FRACTIONAL LASER RESURFACING DEVICES IN AESTHETIC LASER DEVICES MARKET, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 41 ASIA-PACIFIC ENERGY DEVICES IN MEDICAL AESTHETIC MARKET, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 42 ASIA-PACIFIC BODY CONTOURING DEVICES IN MEDICAL AESTHETIC MARKET, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 43 ASIA-PACIFIC FACIAL AESTHETIC DEVICES IN MEDICAL AESTHETIC MARKET, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 44 ASIA-PACIFIC DERMAL FILLERS IN FACIAL AESTHETIC DEVICES MARKET, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 45 ASIA-PACIFIC AESTHETIC IMPLANTS IN MEDICAL AESTHETIC MARKET, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 46 ASIA-PACIFIC BREAST AUGMENTATION IN MEDICAL AESTHETICS MARKET, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 47 ASIA-PACIFIC AESTHETIC DENTAL IMPLANTS IN MEDICAL AESTHETICS MARKET, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 48 ASIA-PACIFIC SKIN AESTHETIC DEVICES IN MEDICAL AESTHETIC MARKET, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 49 ASIA-PACIFIC MEDICAL AESTHETIC MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 50 ASIA-PACIFIC MEDICAL AESTHETIC MARKET, BY END USER, 2018-2032 (USD THOUSAND)

TABLE 51 ASIA-PACIFIC MEDICAL AESTHETIC MARKET, BY DISTRIBUTION CHANNEL, 2018-2032 (USD THOUSAND)

TABLE 52 JAPAN MEDICAL AESTHETIC MARKET, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 53 JAPAN AESTHETIC LASER DEVICES IN MEDICAL AESTHETIC MARKET, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 54 JAPAN ABLATIVE SKIN RESURFACING DEVICES IN AESTHETIC LASER DEVICES MARKET, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 55 JAPAN NON-ABLATIVE FRACTIONAL LASER RESURFACING DEVICES IN AESTHETIC LASER DEVICES MARKET, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 56 JAPAN ENERGY DEVICES IN MEDICAL AESTHETIC MARKET, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 57 JAPAN BODY CONTOURING DEVICES IN MEDICAL AESTHETIC MARKET, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 58 JAPAN FACIAL AESTHETIC DEVICES IN MEDICAL AESTHETIC MARKET, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 59 JAPAN DERMAL FILLERS IN FACIAL AESTHETIC DEVICES MARKET, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 60 JAPAN AESTHETIC IMPLANTS IN MEDICAL AESTHETIC MARKET, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 61 JAPAN BREAST AUGMENTATION IN MEDICAL AESTHETICS MARKET, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 62 JAPAN AESTHETIC DENTAL IMPLANTS IN MEDICAL AESTHETICS MARKET, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 63 JAPAN SKIN AESTHETIC DEVICES IN MEDICAL AESTHETIC MARKET, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 64 JAPAN MEDICAL AESTHETIC MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 65 JAPAN MEDICAL AESTHETIC MARKET, BY END USER, 2018-2032 (USD THOUSAND)

TABLE 66 JAPAN MEDICAL AESTHETIC MARKET, BY DISTRIBUTION CHANNEL, 2018-2032 (USD THOUSAND)

TABLE 67 INDIA MEDICAL AESTHETIC MARKET, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 68 INDIA AESTHETIC LASER DEVICES IN MEDICAL AESTHETIC MARKET, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 69 INDIA ABLATIVE SKIN RESURFACING DEVICES IN AESTHETIC LASER DEVICES MARKET, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 70 INDIA NON-ABLATIVE FRACTIONAL LASER RESURFACING DEVICES IN AESTHETIC LASER DEVICES MARKET, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 71 INDIA ENERGY DEVICES IN MEDICAL AESTHETIC MARKET, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 72 INDIA BODY CONTOURING DEVICES IN MEDICAL AESTHETIC MARKET, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 73 INDIA FACIAL AESTHETIC DEVICES IN MEDICAL AESTHETIC MARKET, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 74 INDIA DERMAL FILLERS IN FACIAL AESTHETIC DEVICES MARKET, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 75 INDIA AESTHETIC IMPLANTS IN MEDICAL AESTHETIC MARKET, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 76 INDIA BREAST AUGMENTATION IN MEDICAL AESTHETICS MARKET, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 77 INDIA AESTHETIC DENTAL IMPLANTS IN MEDICAL AESTHETICS MARKET, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 78 INDIA SKIN AESTHETIC DEVICES IN MEDICAL AESTHETIC MARKET, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 79 INDIA MEDICAL AESTHETIC MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 80 INDIA MEDICAL AESTHETIC MARKET, BY END USER, 2018-2032 (USD THOUSAND)

TABLE 81 INDIA MEDICAL AESTHETIC MARKET, BY DISTRIBUTION CHANNEL, 2018-2032 (USD THOUSAND)

TABLE 82 CHINA MEDICAL AESTHETIC MARKET, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 83 CHINA AESTHETIC LASER DEVICES IN MEDICAL AESTHETIC MARKET, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 84 CHINA ABLATIVE SKIN RESURFACING DEVICES IN AESTHETIC LASER DEVICES MARKET, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 85 CHINA NON-ABLATIVE FRACTIONAL LASER RESURFACING DEVICES IN AESTHETIC LASER DEVICES MARKET, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 86 CHINA ENERGY DEVICES IN MEDICAL AESTHETIC MARKET, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 87 CHINA BODY CONTOURING DEVICES IN MEDICAL AESTHETIC MARKET, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 88 CHINA FACIAL AESTHETIC DEVICES IN MEDICAL AESTHETIC MARKET, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 89 CHINA DERMAL FILLERS IN FACIAL AESTHETIC DEVICES MARKET, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 90 CHINA AESTHETIC IMPLANTS IN MEDICAL AESTHETIC MARKET, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 91 CHINA BREAST AUGMENTATION IN MEDICAL AESTHETICS MARKET, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 92 CHINA AESTHETIC DENTAL IMPLANTS IN MEDICAL AESTHETICS MARKET, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 93 CHINA SKIN AESTHETIC DEVICES IN MEDICAL AESTHETIC MARKET, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 94 CHINA MEDICAL AESTHETIC MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 95 CHINA MEDICAL AESTHETIC MARKET, BY END USER, 2018-2032 (USD THOUSAND)

TABLE 96 CHINA MEDICAL AESTHETIC MARKET, BY DISTRIBUTION CHANNEL, 2018-2032 (USD THOUSAND)

TABLE 97 SOUTH KOREA MEDICAL AESTHETIC MARKET, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 98 SOUTH KOREA AESTHETIC LASER DEVICES IN MEDICAL AESTHETIC MARKET, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 99 SOUTH KOREA ABLATIVE SKIN RESURFACING DEVICES IN AESTHETIC LASER DEVICES MARKET, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 100 SOUTH KOREA NON-ABLATIVE FRACTIONAL LASER RESURFACING DEVICES IN AESTHETIC LASER DEVICES MARKET, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 101 SOUTH KOREA ENERGY DEVICES IN MEDICAL AESTHETIC MARKET, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 102 SOUTH KOREA BODY CONTOURING DEVICES IN MEDICAL AESTHETIC MARKET, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 103 SOUTH KOREA FACIAL AESTHETIC DEVICES IN MEDICAL AESTHETIC MARKET, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 104 SOUTH KOREA DERMAL FILLERS IN FACIAL AESTHETIC DEVICES MARKET, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 105 SOUTH KOREA AESTHETIC IMPLANTS IN MEDICAL AESTHETIC MARKET, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 106 SOUTH KOREA BREAST AUGMENTATION IN MEDICAL AESTHETICS MARKET, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 107 SOUTH KOREA AESTHETIC DENTAL IMPLANTS IN MEDICAL AESTHETICS MARKET, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 108 SOUTH KOREA SKIN AESTHETIC DEVICES IN MEDICAL AESTHETIC MARKET, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 109 SOUTH KOREA MEDICAL AESTHETIC MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 110 SOUTH KOREA MEDICAL AESTHETIC MARKET, BY END USER, 2018-2032 (USD THOUSAND)

TABLE 111 SOUTH KOREA MEDICAL AESTHETIC MARKET, BY DISTRIBUTION CHANNEL, 2018-2032 (USD THOUSAND)

TABLE 112 AUSTRALIA MEDICAL AESTHETIC MARKET, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 113 AUSTRALIA AESTHETIC LASER DEVICES IN MEDICAL AESTHETIC MARKET, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 114 AUSTRALIA ABLATIVE SKIN RESURFACING DEVICES IN AESTHETIC LASER DEVICES MARKET, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 115 AUSTRALIA NON-ABLATIVE FRACTIONAL LASER RESURFACING DEVICES IN AESTHETIC LASER DEVICES MARKET, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 116 AUSTRALIA ENERGY DEVICES IN MEDICAL AESTHETIC MARKET, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 117 AUSTRALIA BODY CONTOURING DEVICES IN MEDICAL AESTHETIC MARKET, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 118 AUSTRALIA FACIAL AESTHETIC DEVICES IN MEDICAL AESTHETIC MARKET, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 119 AUSTRALIA DERMAL FILLERS IN FACIAL AESTHETIC DEVICES MARKET, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 120 AUSTRALIA AESTHETIC IMPLANTS IN MEDICAL AESTHETIC MARKET, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 121 AUSTRALIA BREAST AUGMENTATION IN MEDICAL AESTHETICS MARKET, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 122 AUSTRALIA AESTHETIC DENTAL IMPLANTS IN MEDICAL AESTHETICS MARKET, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 123 AUSTRALIA SKIN AESTHETIC DEVICES IN MEDICAL AESTHETIC MARKET, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 124 AUSTRALIA MEDICAL AESTHETIC MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 125 AUSTRALIA MEDICAL AESTHETIC MARKET, BY END USER, 2018-2032 (USD THOUSAND)

TABLE 126 AUSTRALIA MEDICAL AESTHETIC MARKET, BY DISTRIBUTION CHANNEL, 2018-2032 (USD THOUSAND)

TABLE 127 THAILAND MEDICAL AESTHETIC MARKET, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 128 THAILAND AESTHETIC LASER DEVICES IN MEDICAL AESTHETIC MARKET, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 129 THAILAND ABLATIVE SKIN RESURFACING DEVICES IN AESTHETIC LASER DEVICES MARKET, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 130 THAILAND NON-ABLATIVE FRACTIONAL LASER RESURFACING DEVICES IN AESTHETIC LASER DEVICES MARKET, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 131 THAILAND ENERGY DEVICES IN MEDICAL AESTHETIC MARKET, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 132 THAILAND BODY CONTOURING DEVICES IN MEDICAL AESTHETIC MARKET, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 133 THAILAND FACIAL AESTHETIC DEVICES IN MEDICAL AESTHETIC MARKET, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 134 THAILAND DERMAL FILLERS IN FACIAL AESTHETIC DEVICES MARKET, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 135 THAILAND AESTHETIC IMPLANTS IN MEDICAL AESTHETIC MARKET, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 136 THAILAND BREAST AUGMENTATION IN MEDICAL AESTHETICS MARKET, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 137 THAILAND AESTHETIC DENTAL IMPLANTS IN MEDICAL AESTHETICS MARKET, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 138 THAILAND SKIN AESTHETIC DEVICES IN MEDICAL AESTHETIC MARKET, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 139 THAILAND MEDICAL AESTHETIC MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 140 THAILAND MEDICAL AESTHETIC MARKET, BY END USER, 2018-2032 (USD THOUSAND)

TABLE 141 THAILAND MEDICAL AESTHETIC MARKET, BY DISTRIBUTION CHANNEL, 2018-2032 (USD THOUSAND)

TABLE 142 SINGAPORE MEDICAL AESTHETIC MARKET, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 143 SINGAPORE AESTHETIC LASER DEVICES IN MEDICAL AESTHETIC MARKET, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 144 SINGAPORE ABLATIVE SKIN RESURFACING DEVICES IN AESTHETIC LASER DEVICES MARKET, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 145 SINGAPORE NON-ABLATIVE FRACTIONAL LASER RESURFACING DEVICES IN AESTHETIC LASER DEVICES MARKET, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 146 SINGAPORE ENERGY DEVICES IN MEDICAL AESTHETIC MARKET, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 147 SINGAPORE BODY CONTOURING DEVICES IN MEDICAL AESTHETIC MARKET, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 148 SINGAPORE FACIAL AESTHETIC DEVICES IN MEDICAL AESTHETIC MARKET, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 149 SINGAPORE DERMAL FILLERS IN FACIAL AESTHETIC DEVICES MARKET, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 150 SINGAPORE AESTHETIC IMPLANTS IN MEDICAL AESTHETIC MARKET, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 151 SINGAPORE BREAST AUGMENTATION IN MEDICAL AESTHETICS MARKET, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 152 SINGAPORE AESTHETIC DENTAL IMPLANTS IN MEDICAL AESTHETICS MARKET, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 153 SINGAPORE SKIN AESTHETIC DEVICES IN MEDICAL AESTHETIC MARKET, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 154 SINGAPORE MEDICAL AESTHETIC MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 155 SINGAPORE MEDICAL AESTHETIC MARKET, BY END USER, 2018-2032 (USD THOUSAND)

TABLE 156 SINGAPORE MEDICAL AESTHETIC MARKET, BY DISTRIBUTION CHANNEL, 2018-2032 (USD THOUSAND)

TABLE 157 MALAYSIA MEDICAL AESTHETIC MARKET, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 158 MALAYSIA AESTHETIC LASER DEVICES IN MEDICAL AESTHETIC MARKET, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 159 MALAYSIA ABLATIVE SKIN RESURFACING DEVICES IN AESTHETIC LASER DEVICES MARKET, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 160 MALAYSIA NON-ABLATIVE FRACTIONAL LASER RESURFACING DEVICES IN AESTHETIC LASER DEVICES MARKET, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 161 MALAYSIA ENERGY DEVICES IN MEDICAL AESTHETIC MARKET, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 162 MALAYSIA BODY CONTOURING DEVICES IN MEDICAL AESTHETIC MARKET, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 163 MALAYSIA FACIAL AESTHETIC DEVICES IN MEDICAL AESTHETIC MARKET, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 164 MALAYSIA DERMAL FILLERS IN FACIAL AESTHETIC DEVICES MARKET, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 165 MALAYSIA AESTHETIC IMPLANTS IN MEDICAL AESTHETIC MARKET, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 166 MALAYSIA BREAST AUGMENTATION IN MEDICAL AESTHETICS MARKET, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 167 MALAYSIA AESTHETIC DENTAL IMPLANTS IN MEDICAL AESTHETICS MARKET, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 168 MALAYSIA SKIN AESTHETIC DEVICES IN MEDICAL AESTHETIC MARKET, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 169 MALAYSIA MEDICAL AESTHETIC MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 170 MALAYSIA MEDICAL AESTHETIC MARKET, BY END USER, 2018-2032 (USD THOUSAND)

TABLE 171 MALAYSIA MEDICAL AESTHETIC MARKET, BY DISTRIBUTION CHANNEL, 2018-2032 (USD THOUSAND)

TABLE 172 INDONESIA MEDICAL AESTHETIC MARKET, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 173 INDONESIA AESTHETIC LASER DEVICES IN MEDICAL AESTHETIC MARKET, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 174 INDONESIA ABLATIVE SKIN RESURFACING DEVICES IN AESTHETIC LASER DEVICES MARKET, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 175 INDONESIA NON-ABLATIVE FRACTIONAL LASER RESURFACING DEVICES IN AESTHETIC LASER DEVICES MARKET, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 176 INDONESIA ENERGY DEVICES IN MEDICAL AESTHETIC MARKET, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 177 INDONESIA BODY CONTOURING DEVICES IN MEDICAL AESTHETIC MARKET, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 178 INDONESIA FACIAL AESTHETIC DEVICES IN MEDICAL AESTHETIC MARKET, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 179 INDONESIA DERMAL FILLERS IN FACIAL AESTHETIC DEVICES MARKET, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 180 INDONESIA AESTHETIC IMPLANTS IN MEDICAL AESTHETIC MARKET, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 181 INDONESIA BREAST AUGMENTATION IN MEDICAL AESTHETICS MARKET, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 182 INDONESIA AESTHETIC DENTAL IMPLANTS IN MEDICAL AESTHETICS MARKET, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 183 INDONESIA SKIN AESTHETIC DEVICES IN MEDICAL AESTHETIC MARKET, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 184 INDONESIA MEDICAL AESTHETIC MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 185 INDONESIA MEDICAL AESTHETIC MARKET, BY END USER, 2018-2032 (USD THOUSAND)

TABLE 186 INDONESIA MEDICAL AESTHETIC MARKET, BY DISTRIBUTION CHANNEL, 2018-2032 (USD THOUSAND)

TABLE 187 PHILIPPINES MEDICAL AESTHETIC MARKET, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 188 PHILIPPINES AESTHETIC LASER DEVICES IN MEDICAL AESTHETIC MARKET, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 189 PHILIPPINES ABLATIVE SKIN RESURFACING DEVICES IN AESTHETIC LASER DEVICES MARKET, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 190 PHILIPPINES NON-ABLATIVE FRACTIONAL LASER RESURFACING DEVICES IN AESTHETIC LASER DEVICES MARKET, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 191 PHILIPPINES ENERGY DEVICES IN MEDICAL AESTHETIC MARKET, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 192 PHILIPPINES BODY CONTOURING DEVICES IN MEDICAL AESTHETIC MARKET, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 193 PHILIPPINES FACIAL AESTHETIC DEVICES IN MEDICAL AESTHETIC MARKET, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 194 PHILIPPINES DERMAL FILLERS IN FACIAL AESTHETIC DEVICES MARKET, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 195 PHILIPPINES AESTHETIC IMPLANTS IN MEDICAL AESTHETIC MARKET, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 196 PHILIPPINES BREAST AUGMENTATION IN MEDICAL AESTHETICS MARKET, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 197 PHILIPPINES AESTHETIC DENTAL IMPLANTS IN MEDICAL AESTHETICS MARKET, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 198 PHILIPPINES SKIN AESTHETIC DEVICES IN MEDICAL AESTHETIC MARKET, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 199 PHILIPPINES MEDICAL AESTHETIC MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 200 PHILIPPINES MEDICAL AESTHETIC MARKET, BY END USER, 2018-2032 (USD THOUSAND)

TABLE 201 PHILIPPINES MEDICAL AESTHETIC MARKET, BY DISTRIBUTION CHANNEL, 2018-2032 (USD THOUSAND)

TABLE 202 REST OF ASIA-PACIFIC MEDICAL AESTHETIC MARKET, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

Abbildungsverzeichnis

FIGURE 1 ASIA-PACIFIC MEDICAL AESTHETIC MARKET: SEGMENTATION

FIGURE 2 ASIA-PACIFIC MEDICAL AESTHETIC MARKET: DATA TRIANGULATION

FIGURE 3 ASIA-PACIFIC MEDICAL AESTHETIC MARKET: DROC ANALYSIS

FIGURE 4 ASIA-PACIFIC MEDICAL AESTHETIC MARKET: REGION VS COUNTRY MARKET ANALYSIS

FIGURE 5 ASIA-PACIFIC MEDICAL AESTHETIC MARKET: COMPANY RESEARCH ANALYSIS

FIGURE 6 ASIA-PACIFIC MEDICAL AESTHETIC MARKET: INTERVIEW DEMOGRAPHICS

FIGURE 7 ASIA-PACIFIC MEDICAL AESTHETIC MARKET: DBMR MARKET POSITION GRID

FIGURE 8 ASIA-PACIFIC MEDICAL AESTHETIC MARKET: VENDOR SHARE ANALYSIS

FIGURE 9 ASIA-PACIFIC MEDICAL AESTHETIC MARKET: SEGMENTATION

FIGURE 10 EXECUTIVE SUMMARY

FIGURE 11 SIX SEGMENTS COMPRISE THE ASIA-PACIFIC MEDICAL AESTHETIC MARKET, BY PRODUCT TYPE

FIGURE 12 STRATEGIC DECISIONS

FIGURE 13 INCREASE IN POSITIVE ATTITUDE TOWARDS COSMETIC PROCEDURES IS DRIVING THE GROWTH OF THE ASIA-PACIFIC MEDICAL AESTHETIC MARKET FROM 2025 TO 2032

FIGURE 14 THE AESTHETIC LASER DEVICES SEGMENT IS EXPECTED TO ACCOUNT FOR THE LARGEST SHARE OF THE ASIA-PACIFIC MEDICAL AESTHETIC MARKET IN 2025 AND 2032

FIGURE 15 ASIA-PACIFIC MEDICAL AESTHETIC MARKET: BY PRODUCT TYPE, 2024

FIGURE 16 ASIA-PACIFIC MEDICAL AESTHETIC MARKET: BY PRODUCT TYPE, 2025-2032 (USD THOUSAND)

FIGURE 17 ASIA-PACIFIC MEDICAL AESTHETIC MARKET: PRODUCT TYPE, CAGR (2025-2032)

FIGURE 18 ASIA-PACIFIC MEDICAL AESTHETIC MARKET: BY PRODUCT TYPE, LIFELINE CURVE

FIGURE 19 ASIA-PACIFIC MEDICAL AESTHETIC MARKET: BY APPLICATION, 2024

FIGURE 20 ASIA-PACIFIC MEDICAL AESTHETIC MARKET: BY APPLICATION, 2025-2032 (USD THOUSAND)

FIGURE 21 ASIA-PACIFIC MEDICAL AESTHETIC MARKET: BY APPLICATION, CAGR (2025-2032)

FIGURE 22 ASIA-PACIFIC MEDICAL AESTHETIC MARKET: BY APPLICATION, LIFELINE CURVE

FIGURE 23 ASIA-PACIFIC MEDICAL AESTHETIC MARKET: BY END USER, 2024

FIGURE 24 ASIA-PACIFIC MEDICAL AESTHETIC MARKET: BY END USER, 2025-2032 (USD THOUSAND)

FIGURE 25 ASIA-PACIFIC MEDICAL AESTHETIC MARKET: BY END USER, CAGR (2025-2032)

FIGURE 26 ASIA-PACIFIC MEDICAL AESTHETIC MARKET: BY END USER, LIFELINE CURVE

FIGURE 27 ASIA-PACIFIC MEDICAL AESTHETIC MARKET: BY DISTRIBUTION CHANNEL, 2024

FIGURE 28 ASIA-PACIFIC MEDICAL AESTHETIC MARKET: BY DISTRIBUTION CHANNEL, 2025-2032 (USD THOUSAND)

FIGURE 29 ASIA-PACIFIC MEDICAL AESTHETIC MARKET: BY DISTRIBUTION CHANNEL, CAGR (2025-2032)

FIGURE 30 ASIA-PACIFIC MEDICAL AESTHETIC MARKET: BY DISTRIBUTION CHANNEL, LIFELINE CURVE

FIGURE 31 ASIA-PACIFIC MEDICAL AESTHETIC MARKET: SNAPSHOT (2024)

FIGURE 32 ASIA-PACIFIC MEDICAL AESTHETIC MARKET: COMPANY SHARE 2024 (%)

Forschungsmethodik

Die Datenerfassung und Basisjahresanalyse werden mithilfe von Datenerfassungsmodulen mit großen Stichprobengrößen durchgeführt. Die Phase umfasst das Erhalten von Marktinformationen oder verwandten Daten aus verschiedenen Quellen und Strategien. Sie umfasst die Prüfung und Planung aller aus der Vergangenheit im Voraus erfassten Daten. Sie umfasst auch die Prüfung von Informationsinkonsistenzen, die in verschiedenen Informationsquellen auftreten. Die Marktdaten werden mithilfe von marktstatistischen und kohärenten Modellen analysiert und geschätzt. Darüber hinaus sind Marktanteilsanalyse und Schlüsseltrendanalyse die wichtigsten Erfolgsfaktoren im Marktbericht. Um mehr zu erfahren, fordern Sie bitte einen Analystenanruf an oder geben Sie Ihre Anfrage ein.

Die wichtigste Forschungsmethodik, die vom DBMR-Forschungsteam verwendet wird, ist die Datentriangulation, die Data Mining, die Analyse der Auswirkungen von Datenvariablen auf den Markt und die primäre (Branchenexperten-)Validierung umfasst. Zu den Datenmodellen gehören ein Lieferantenpositionierungsraster, eine Marktzeitlinienanalyse, ein Marktüberblick und -leitfaden, ein Firmenpositionierungsraster, eine Patentanalyse, eine Preisanalyse, eine Firmenmarktanteilsanalyse, Messstandards, eine globale versus eine regionale und Lieferantenanteilsanalyse. Um mehr über die Forschungsmethodik zu erfahren, senden Sie eine Anfrage an unsere Branchenexperten.

Anpassung möglich

Data Bridge Market Research ist ein führendes Unternehmen in der fortgeschrittenen formativen Forschung. Wir sind stolz darauf, unseren bestehenden und neuen Kunden Daten und Analysen zu bieten, die zu ihren Zielen passen. Der Bericht kann angepasst werden, um Preistrendanalysen von Zielmarken, Marktverständnis für zusätzliche Länder (fordern Sie die Länderliste an), Daten zu klinischen Studienergebnissen, Literaturübersicht, Analysen des Marktes für aufgearbeitete Produkte und Produktbasis einzuschließen. Marktanalysen von Zielkonkurrenten können von technologiebasierten Analysen bis hin zu Marktportfoliostrategien analysiert werden. Wir können so viele Wettbewerber hinzufügen, wie Sie Daten in dem von Ihnen gewünschten Format und Datenstil benötigen. Unser Analystenteam kann Ihnen auch Daten in groben Excel-Rohdateien und Pivot-Tabellen (Fact Book) bereitstellen oder Sie bei der Erstellung von Präsentationen aus den im Bericht verfügbaren Datensätzen unterstützen.