Der private Krankenversicherungsmarkt in Singapur zeichnet sich durch ein robustes und wettbewerbsintensives Umfeld aus und bietet verschiedene Tarife für unterschiedliche Gesundheitsbedürfnisse. Versicherungsanbieter in Singapur differenzieren ihre Angebote durch innovative Funktionen, kundenorientierte Dienstleistungen und Partnerschaften mit Gesundheitsdienstleistern. Singapurs einzigartiges Gesundheitssystem kombiniert private Versicherungen mit einem öffentlich finanzierten Rahmen und ermutigt Einzelpersonen, Verantwortung für ihre Gesundheit zu übernehmen. Der private Krankenversicherungssektor in Singapur steht für das Engagement, personalisierte, hochwertige Gesundheitslösungen in einem sich schnell entwickelnden und anspruchsvollen Umfeld anzubieten.

Vollständigen Bericht abrufen unter https://www.databridgemarketresearch.com/reports/singapore-private-health-insurance-market

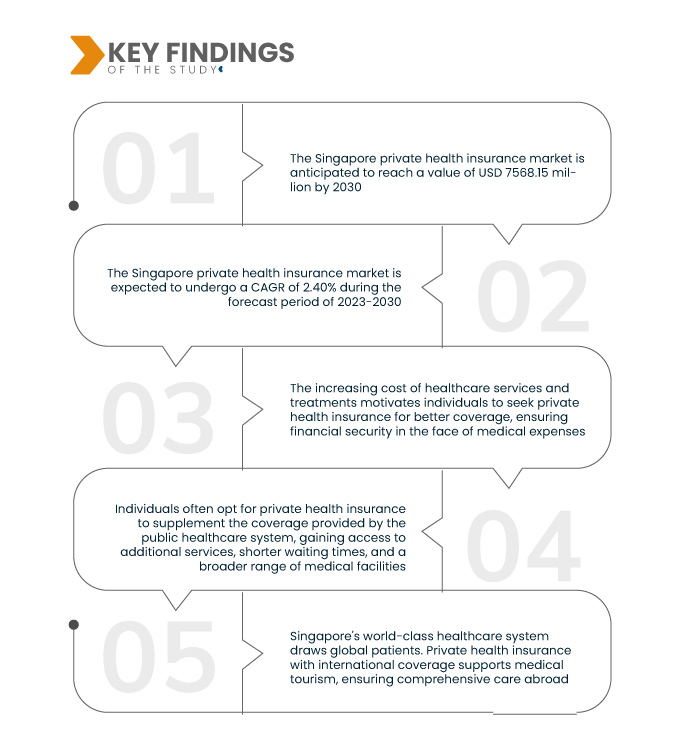

Data Bridge Market Research analysiert, dass der Markt für private Krankenversicherungen in Singapur , der im Jahr 2022 6.231,43 Millionen US-Dollar betrug, bis 2030 voraussichtlich 7.568,15 Millionen US-Dollar erreichen und im Prognosezeitraum 2023 bis 2030 eine durchschnittliche jährliche Wachstumsrate (CAGR) von 2,40 % aufweisen wird. In Singapur bietet MediShield Life Bürgern und Personen mit ständigem Wohnsitz eine obligatorische Krankenversicherung an, deckt jedoch möglicherweise nicht alle medizinischen Kosten ab. Daher entscheiden sich viele Menschen für eine zusätzliche private Krankenversicherung, um umfassenden Schutz und finanzielle Sicherheit gegen Gesundheitskosten zu gewährleisten, die über die Grundversicherung hinausgehen.

Wichtigste Ergebnisse der Studie

Es wird erwartet, dass der technologische Fortschritt die Wachstumsrate des Marktes vorantreibt

Technologische Fortschritte spielen eine entscheidende Rolle bei der Neugestaltung der privaten Krankenversicherung und integrieren Innovationen wie Telemedizin und digitale Gesundheitslösungen. Diese Verbesserungen erhöhen nicht nur den Komfort und die Zugänglichkeit von Gesundheitsdienstleistungen, sondern kommen auch bei technisch versierten Verbrauchern gut an. Die Integration solcher Technologien ermöglicht Fernberatungen, Gesundheitsüberwachung und optimierte Prozesse und trägt so zu einem effizienteren und patientenzentrierteren Ansatz in der privaten Krankenversicherung bei.

Berichtsumfang und Marktsegmentierung

Berichtsmetrik

|

Details

|

Prognosezeitraum

|

2023 bis 2030

|

Basisjahr

|

2022

|

Historische Jahre

|

2021 (Anpassbar auf 2015–2020)

|

Quantitative Einheiten

|

Umsatz in Millionen USD, Mengen in Einheiten, Preise in USD

|

Abgedeckte Segmente

|

Typ (Schwere-Krankheiten-Versicherung, individuelle Krankenversicherung, Familienkrankenversicherung, krankheitsspezifische Versicherung und andere), Kategorie/Metallstufen des Krankenversicherungsplans ( Bronze , Silber, Gold, Platin und andere), Anbietertyp (Health Maintenance Organizations (HMOS), Preferred Provider Organizations (PPOS), Exclusive Provider Organizations (EPOS), Point-Of-Service (POS)-Pläne, Krankenversicherungspläne mit hoher Selbstbeteiligung (HDHPS) und andere), Altersgruppe (Junge Erwachsene (19–44 Jahre), Mittlere Erwachsene (45–64 Jahre) und Ältere Erwachsene (65 Jahre und älter)), Vertriebskanal (Direktversicherungsgesellschaften, Versicherungsaggregatoren und andere)

|

Abgedeckte Marktteilnehmer

|

Aetna Inc. (eine Tochtergesellschaft von CVS Health) (USA), Cigna (USA), AIA Group Limited (Hongkong), Allianz (Deutschland), HSBC Group (Hongkong), Tokio Marine (Japan), AXA (Frankreich), Prudential Assurance Malaysia Berhad (Malaysia), Raffles Medical Group (Singapur), Bupa Global (Großbritannien) und AIG Asia Pacific Insurance Pte. Ltd (Singapur)

|

Im Bericht behandelte Datenpunkte

|

Zusätzlich zu den Einblicken in Marktszenarien wie Marktwert, Wachstumsrate, Segmentierung, geografische Abdeckung und wichtige Akteure umfassen die von Data Bridge Market Research kuratierten Marktberichte auch ausführliche Expertenanalysen, Patientenepidemiologie, Pipeline-Analysen, Preisanalysen und regulatorische Rahmenbedingungen.

|

Segmentanalyse:

Der private Krankenversicherungsmarkt in Singapur ist nach Art, Krankenversicherungskategorie/Statusstufe, Anbietertyp, Altersgruppe und Vertriebskanal segmentiert.

- Der private Krankenversicherungsmarkt in Singapur ist nach Art in die Bereiche Schwere-Krankheiten-Versicherung, individuelle Krankenversicherung, Familienkrankenversicherung, krankheitsspezifische Versicherung und andere unterteilt.

- Auf der Grundlage der Krankenversicherungskategorie/Metallstufen ist der private Krankenversicherungsmarkt in Singapur in Bronze, Silber, Gold, Platin und andere unterteilt

- Auf der Grundlage des Anbietertyps ist der private Krankenversicherungsmarkt in Singapur in Health Maintenance Organizations (HMOS), Preferred Provider Organizations (PPOS), Exclusive Provider Organizations (EPOS), Point-of-Service (POS)-Pläne, High-Deductible Health Plans (HDHPS) und andere segmentiert.

- Auf der Grundlage der Altersgruppe ist der private Krankenversicherungsmarkt in Singapur in junge Erwachsene (19–44 Jahre), mittlere Erwachsene (45–64 Jahre) und ältere Erwachsene (65 Jahre und älter) unterteilt.

- Auf der Grundlage des Vertriebskanals ist der private Krankenversicherungsmarkt in Singapur in Direktversicherungsunternehmen, Versicherungsaggregatoren und andere unterteilt

Hauptakteure

Data Bridge Market Research erkennt die folgenden Unternehmen als die wichtigsten Akteure auf dem privaten Krankenversicherungsmarkt in Singapur an: Tokio Marine (Japan), AXA (Frankreich), Prudential Assurance Malaysia Berhad (Malaysia), Raffles Medical Group (Singapur), Bupa Global (Großbritannien) und AIG Asia Pacific Insurance Pte. Ltd (Singapur)

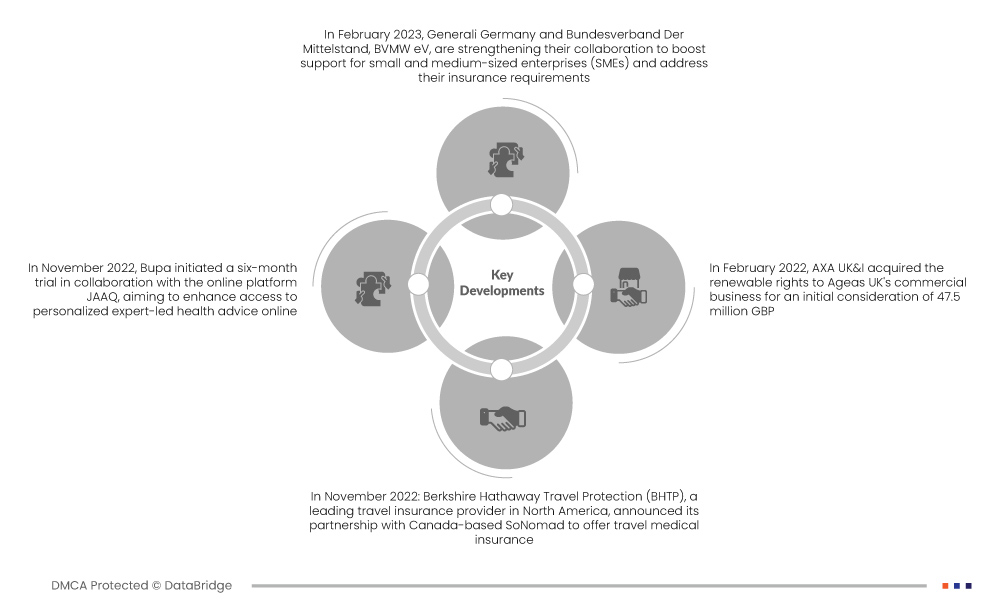

Marktentwicklungen

- Im Februar 2023 verstärken Generali Deutschland und der Bundesverband Mittelstand (BVMW e.V.) ihre Zusammenarbeit, um kleine und mittlere Unternehmen (KMU) stärker zu unterstützen und ihren Versicherungsbedarf zu decken. Ziel dieser intensivierten Zusammenarbeit ist es, Versicherungslösungen zu entwickeln, die auf die besonderen Bedürfnisse von KMU zugeschnitten sind und so das gemeinsame Wachstum und die Widerstandsfähigkeit der deutschen Wirtschaft fördern. Die Zusammenarbeit unterstreicht das Engagement, dem wichtigen Sektor der kleinen und mittleren Unternehmen (KMU) spezialisierte Versicherungsunterstützung zu bieten.

- Im November 2022 startete Bupa in Zusammenarbeit mit der Online-Plattform JAAQ einen sechsmonatigen Testlauf, um den Zugang zu personalisierter, von Experten geleiteter Gesundheitsberatung online zu verbessern. Dies ergänzt Bupas bestehendes Angebot zur psychischen Gesundheitsförderung und bietet kontinuierliche, rund um die Uhr verfügbare Unterstützung bei verschiedenen psychischen Erkrankungen wie Angstzuständen, Depressionen und Sucht. Die Zusammenarbeit unterstreicht Bupas Engagement, digitale Plattformen zu nutzen, um Gesundheitsdienstleistungen zu erweitern und umfassende Unterstützung für das psychische Wohlbefinden zu bieten.

- Im November 2022 gab Berkshire Hathaway Travel Protection (BHTP), ein führender Reiseversicherer in Nordamerika, seine Partnerschaft mit dem kanadischen Unternehmen SoNomad bekannt, um Reisekrankenversicherungen anzubieten. Die Reisekrankenversicherungen von soNomad werden von der kanadischen National Liability and Fire Insurance Company gezeichnet.

- Im Februar 2022 erwarb AXA UK&I die verlängerbaren Rechte am kommerziellen Geschäft von Ageas UK für einen anfänglichen Kaufpreis von 47,5 Millionen GBP. Dieser strategische Schritt unterstützt die Wachstumsstrategie von AXA und das Engagement im kommerziellen Geschäft mit Fokus auf die Marktsegmente KMU und Sozialversicherungen. Rund 100 Mitarbeiter von Ageas UK werden zu AXA Commercial wechseln und so eine nahtlose Unterstützung und Servicebereitstellung für kontinuierliche operative Exzellenz in den übernommenen Geschäftsbereichen gewährleisten.

Für detailliertere Informationen zum Marktbericht für private Krankenversicherungen in Singapur klicken Sie hier – https://www.databridgemarketresearch.com/reports/singapore-private-health-insurance-market