Die Expansion des Lebensmitteleinzelhandels und der Kühllogistik hat zu einem deutlichen Anstieg der Nachfrage nach Kühlschränken geführt. Die zunehmende Verbreitung von Supermärkten, Convenience Stores und Lebensmittelketten führte zu einem vielfältigen Angebot an verderblichen Lebensmitteln. Um die Qualität dieser Produkte zu erhalten und ihre Haltbarkeit zu verlängern, benötigen Einzelhändler Kühlsysteme für eine fachgerechte Lagerung. Da die Globalisierung den internationalen Handel mit verderblichen Waren weiter erleichtert, spielt die Kühllogistikbranche eine entscheidende Rolle beim Transport temperaturempfindlicher Produkte über weite Strecken. Kühlfahrzeuge, Kühlcontainer und Kühllager sind unerlässlich, um die erforderlichen Temperaturbedingungen entlang der gesamten Lieferkette aufrechtzuerhalten und sicherzustellen, dass die Waren in optimalem Zustand ihr Ziel erreichen.

Vollständigen Bericht abrufen unter https://www.databridgemarketresearch.com/reports/north-america-europe-and-china-commercial-refrigeration-equipment-market

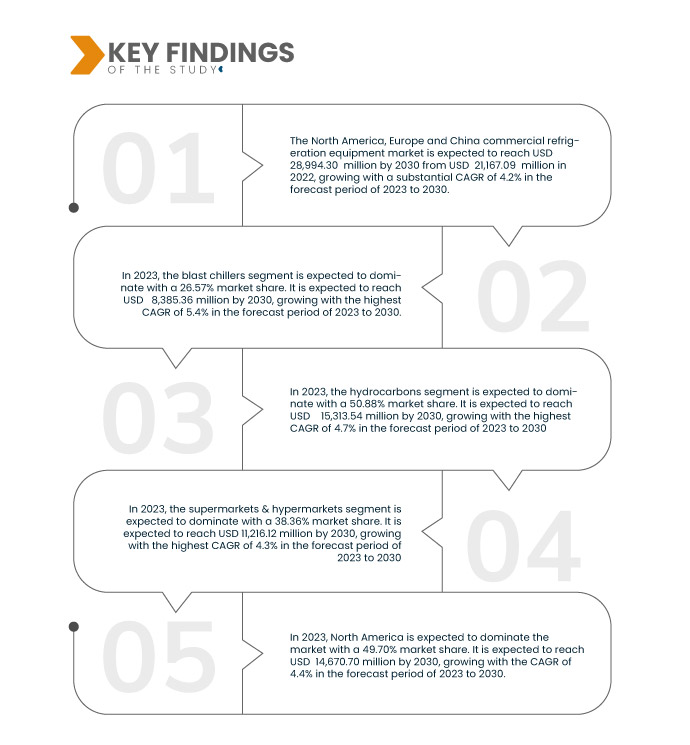

Data Bridge Market Research analysiert den Markt für gewerbliche Kühlgeräte in Nordamerika, Europa und China und geht davon aus, dass dieser von 21.167,09 Millionen US-Dollar im Jahr 2022 auf 28.994,30 Millionen US-Dollar im Jahr 2030 anwachsen wird, was einem beachtlichen CAGR von 4,2 % im Prognosezeitraum von 2023 bis 2030 entspricht. Strenge Vorschriften und die Forderung der Verbraucher nach einem geringeren Energieverbrauch werden das Marktwachstum vorantreiben.

Wichtigste Ergebnisse der Studie

Steigender Konsum von Fertiggerichten könnte das Marktwachstum antreiben

Bequemlichkeit hat sich zu einem Schlüsselfaktor entwickelt, der das Verbraucherverhalten in der Lebensmittelindustrie beeinflusst. Mit veränderten Lebensstilen, Urbanisierung und einem volleren Terminkalender greifen die Menschen zunehmend zu verzehrfertigen und einfach zuzubereitenden Convenience- Food- Produkten. Dieser Trend hat in Märkten wie Nordamerika, Europa und China zu einer erheblichen Nachfrage nach gewerblichen Kühlgeräten geführt. Diese gewerblichen Kühlgeräte spielen eine entscheidende Rolle bei der Erhaltung der Frische und Qualität von Convenience-Food und tragen letztendlich zum Wachstum des Marktes für gewerbliche Kühlgeräte in diesen Regionen bei. Moderne Verbraucher, insbesondere in Nordamerika, Europa und China, führen ein hektisches Leben und müssen oft Beruf, Familie und soziale Verpflichtungen unter einen Hut bringen. Infolgedessen steigt die Vorliebe für schnell und einfach verfügbare Lebensmittel. Darüber hinaus hat die Urbanisierung zu kleinerem Wohnraum und einem Anstieg der Einpersonenhaushalte geführt.

Berichtsumfang und Marktsegmentierung

Berichtsmetrik

|

Details

|

Prognosezeitraum

|

2023 bis 2030

|

Basisjahr

|

2022

|

Historische Jahre

|

2021 (Anpassbar auf 2015–2020)

|

Quantitative Einheiten

|

Umsatz in Millionen USD

|

Abgedeckte Segmente

|

Produkttyp ( Schockkühler , Kühl- und Gefrierschrank, Transportkühlung, Kühlvitrine, in sich geschlossen, ferngesteuert, Getränkekühlung, Speiseeis-Verkaufsstand und gekühlter Verkaufsautomat), Kältemitteltyp (Kohlenwasserstoffe, Fluorkohlenwasserstoffe und anorganische Stoffe), Endverbraucher (Supermärkte und Verbrauchermärkte, Convenience Stores, Hotels und Restaurants, Bäckereien und Catering-Dienste)

|

Abgedeckte Länder

|

USA, Kanada und Mexiko, Deutschland, Großbritannien, Italien, Frankreich, Spanien, Schweiz, Russland, Türkei, Belgien, Niederlande und Rest von Europa sowie China

|

Abgedeckte Marktteilnehmer

|

Whirlpool Corporation (USA), DAIKIN INDUSTRIES (Japan), Electrolux Group (Schweden), Carrier (USA), Metalfrio Solutions (Brasilien), True Manufacturing Co., Inc (USA), Hussmann Corporation (eine Tochtergesellschaft der Panasonic Holdings Corporation) (USA), Heatcraft Worldwide Refrigeration (Kanada), Zero Zone, Inc. (USA), Saba Corp (USA), Minus Forty (Kanada), COOLPLUS COMMERCIAL REFRIGERATION & KITCHEN EQUIPMENT COMPANY LIMITED (China), Excellence Industries (USA), VICTORY REFRIGERATION (USA), Dukers Appliance Co., USA Ltd. (USA) und andere

|

Im Bericht behandelte Datenpunkte

|

Zusätzlich zu den Markteinblicken wie Marktwert, Wachstumsrate, Marktsegmenten, geografischer Abdeckung, Marktteilnehmern und Marktszenario enthält der vom Marktforschungsteam von Data Bridge kuratierte Marktbericht eine ausführliche Expertenanalyse, Import-/Exportanalyse, Preisanalyse, Produktionsverbrauchsanalyse und Verbraucherverhalten.

|

Segmentanalyse:

Der Markt für gewerbliche Kühlgeräte in Nordamerika, Europa und China ist in drei wichtige Segmente unterteilt: Produkttyp, Kältemitteltyp und Endverbraucher.

- Auf der Grundlage des Produkttyps ist der Markt in Schockfroster, Kühl- und Gefrierschränke, Transportkühlung, Kühlvitrinen, in sich geschlossene Geräte, ferngesteuerte Geräte, Getränkekühlung, Speiseeisautomaten und gekühlte Verkaufsautomaten segmentiert.

Im Jahr 2023 wird das Segment der Schnellkühler voraussichtlich den Markt für gewerbliche Kühlgeräte in Nordamerika, Europa und China dominieren.

Im Jahr 2023 wird das Segment der Schockfroster voraussichtlich mit einem Marktanteil von 26,57 % den Markt dominieren, da sie die Temperatur von Lebensmitteln schnell und sicher senken und so ihre Qualität und Frische bewahren können.

- Auf der Grundlage des Kältemitteltyps ist der Markt in Kohlenwasserstoffe , Fluorkohlenwasserstoffe und anorganische Stoffe segmentiert.

Im Jahr 2023 wird das Kohlenwasserstoffsegment voraussichtlich den Markt für gewerbliche Kühlgeräte in Nordamerika, Europa und China dominieren.

Im Jahr 2023 wird das Kohlenwasserstoffsegment voraussichtlich mit einem Marktanteil von 50,88 % den Markt dominieren, da es umweltfreundlich und energieeffizient ist und damit der steigenden Nachfrage nach nachhaltigen und umweltbewussten Lösungen in der Kälteindustrie entspricht.

- Der Markt ist nach Endverbrauchern in Supermärkte und Hypermärkte, Convenience Stores, Hotels und Restaurants, Bäckereien und Catering-Services unterteilt. Im Jahr 2023 wird das Segment Supermärkte und Hypermärkte voraussichtlich mit einem Marktanteil von 38,36 % den Markt dominieren.

Hauptakteure

Data Bridge Market Research erkennt die folgenden Unternehmen als Hauptakteure auf dem Markt für gewerbliche Kühlgeräte in Nordamerika, Europa und China an, darunter Whirlpool, DAIKIN INDUSTRIES, Electrolux Group, Carrier, Metalfrio Solutions, True Manufacturing Co., Inc, Hussmann Corporation (eine Tochtergesellschaft der Panasonic Holdings Corporation), Heatcraft Worldwide Refrigeration, Zero-zone, Saba Corp, Minus Forty, COOLPLUS COMMERCIAL REFRIGERATION & KITCHEN EQUIPMENT COMPANY LIMITED, Excellence Industries, VICTORY REFRIGERATION, DukersUSA und andere.

Marktentwicklungen

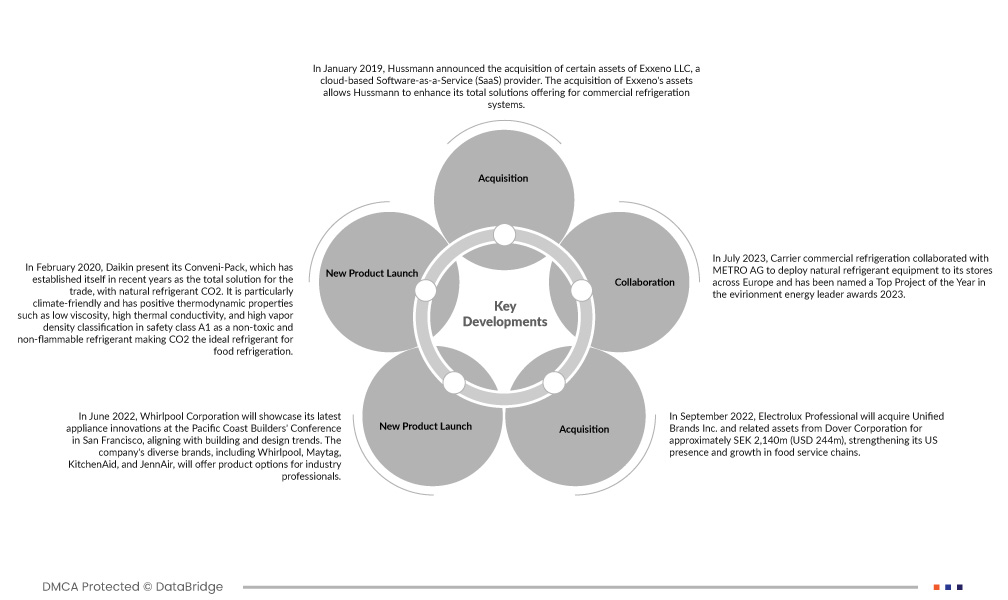

- Im Juni 2022 präsentiert die Whirlpool Corporation auf der Pacific Coast Builders' Conference in San Francisco ihre neuesten Geräteinnovationen, die sich an aktuellen Bau- und Designtrends orientieren. Die verschiedenen Marken des Unternehmens, darunter Whirlpool, Maytag, KitchenAid und JennAir, bieten Produktoptionen für Branchenexperten.

- Im Februar 2020 präsentierte Daikin sein Conveni-Pack, das sich in den letzten Jahren als Komplettlösung für den Handel etabliert hat, mit dem natürlichen Kältemittel CO2. Es ist besonders klimafreundlich und verfügt über positive thermodynamische Eigenschaften wie niedrige Viskosität, hohe Wärmeleitfähigkeit und hohe Dampfdichte. Die Einstufung in die Sicherheitsklasse A1 als ungiftiges und nicht brennbares Kältemittel macht CO2 zum idealen Kältemittel für die Lebensmittelkühlung.

- Im September 2022 wird Electrolux Professional Unified Brands Inc. und zugehörige Vermögenswerte von der Dover Corporation für rund 2.140 Mio. SEK (244 Mio. USD) erwerben und damit seine Präsenz in den USA und sein Wachstum in Gastronomieketten stärken.

- Im Juli 2023 arbeitete Carrier Commercial Refrigeration mit der METRO AG zusammen, um in deren Filialen in ganz Europa Anlagen mit natürlichen Kältemitteln einzuführen, und wurde bei den Environment Energy Leader Awards 2023 zum Top-Projekt des Jahres gekürt.

- Im Juli 2023 setzte Carrier Commercial Refrigeration sein Engagement für die Dekarbonisierung mit der Einführung der innovativen Wärmepumpenreihe HeatCO2OL fort. Dank ihres kompakten, effizienten Designs und der Nutzung erneuerbarer Energiequellen trägt das HeatCO2OL-Produktportfolio von Carrier dazu bei, den CO2-Ausstoß zu reduzieren und Kunden dabei zu unterstützen, ihre Nachhaltigkeitsbemühungen zu beschleunigen.

- Im Januar 2019 gab Hussmann die Übernahme bestimmter Vermögenswerte von Exxeno LLC bekannt, einem Cloud-basierten Software-as-a-Service (SaaS)-Anbieter. Durch die Übernahme der Exxeno-Vermögenswerte kann Hussmann sein Gesamtlösungsangebot für gewerbliche Kühlsysteme erweitern. Durch die Integration cloudbasierter SaaS-Lösungen möchte Hussmann Lebensmittelhändlern datenbasierte Erkenntnisse, vorausschauende Wartungsmöglichkeiten und Energieeinsparungen bieten und so deren Gesamtbetrieb und Kundenzufriedenheit verbessern.

- Im September 2021 übernahm Ronin Equity Partners zwei führende nordamerikanische Hersteller gewerblicher Kühlgeräte, QBD und Minus Forty. Die Marken werden weiterhin unter ihren Namen vertrieben. Diese Übernahme erweitert die Reichweite des Unternehmens in neue Branchen und erweitert den Einsatz umweltfreundlicher Kühldecks. Die IoT-Technologie von Minus Forty wird genutzt, um die Position des Unternehmens im Getränkesektor zu stärken.

Regionale Analyse

Geografisch ist der Markt in Nordamerika, Europa und China unterteilt. Nordamerika ist weiter in die USA, Kanada und Mexiko unterteilt. Europa ist weiter in Deutschland, Großbritannien, Italien, Frankreich, Spanien, die Schweiz, Russland, die Türkei, Belgien, die Niederlande und das übrige Europa unterteilt.

Laut Marktforschungsanalyse von Data Bridge :

Nordamerika ist die am schnellsten wachsende Region und wird voraussichtlich die dominierende Region auf dem Markt sein.

Aufgrund von Faktoren wie robustem Wirtschaftswachstum, einer gut ausgebauten Kühlketteninfrastruktur und einer hohen Nachfrage seitens der Lebensmittel- und Getränkeindustrie in der Region wird Nordamerika voraussichtlich dominieren und eine der am stärksten wachsenden Regionen sein.

Für detailliertere Informationen zum Marktbericht für gewerbliche Kühlgeräte in Nordamerika, Europa und China klicken Sie hier – https://www.databridgemarketresearch.com/reports/north-america-europe-and-china-commercial-refrigeration-equipment-market