Der Neuseeländischer privater Krankenversicherungsmarkt verzeichnet ein stetiges Wachstum, das durch Faktoren wie steigende Gesundheitskosten, die alternde Bevölkerung und eine begrenzte öffentliche Krankenversicherung angetrieben wird. Krankenversicherungspolicen bieten verschiedene Funktionen und Vorteile, darunter bargeldlose Krankenhausaufenthalte und Erstattungsoptionen. Die Verfügbarkeit mehrerer Versicherungsarten ermöglicht es den Versicherungsnehmern, Pläne auszuwählen, die ihren Bedürfnissen und Vorlieben entsprechen. Angesichts der steigenden Nachfrage nach umfassenden Gesundheitslösungen und finanziellem Schutz gegen medizinische Ausgaben wird erwartet, dass der neuseeländische private Krankenversicherungsmarkt seinen Wachstumskurs fortsetzt.

Zugriff auf den vollständigen Bericht @ https://www.databridgemarketresearch.com/reports/new-zealand-private-health-insurance-market

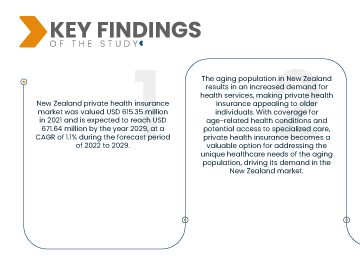

Data Bridge Market Research analysiert, dass der neuseeländische Markt für private Krankenversicherungen im Jahr 2021 einen Wert von 615,35 Millionen USD hatte und bis zum Jahr 2029 voraussichtlich 671,64 Millionen USD erreichen wird, was einer durchschnittlichen jährlichen Wachstumsrate von 1,1 % während des Prognosezeitraums von 2022 bis 2029 entspricht. Die steigenden Kosten für medizinische Behandlungen und Dienstleistungen in Neuseeland veranlassen Einzelpersonen dazu, eine private Krankenversicherung abzuschließen, um sich finanziell gegen unerwartete Gesundheitsausgaben abzusichern, was die Nachfrage nach privaten Krankenversicherungen auf dem Markt antreibt.

Wichtigste Ergebnisse der Studie

Die begrenzte öffentliche Krankenversicherung in Neuseeland dürfte das Marktwachstum ankurbeln

Die begrenzte öffentliche Krankenversicherung in Neuseeland, die zu Wartezeiten und Einschränkungen bei bestimmten medizinischen Behandlungen führen kann, motiviert viele Menschen, eine private Krankenversicherung abzuschließen. Durch die Entscheidung für eine private Versicherung erhalten Menschen schnelleren Zugang zu medizinischen Leistungen und Spezialbehandlungen und können sich so eine zeitnahe und umfassende Gesundheitsversorgung sichern. Der Wunsch nach verbesserten Gesundheitsoptionen und kürzeren Wartezeiten treibt die Nachfrage nach privaten Krankenversicherungen auf dem neuseeländischen Markt an und macht sie zu einem wichtigen Wachstums- und Beliebtheitstreiber für den Markt.

Berichtsumfang und Marktsegmentierung

|

Berichtsmetrik

|

Einzelheiten

|

|

Prognosezeitraum

|

2022 bis 2029

|

|

Basisjahr

|

2021

|

|

Historische Jahre

|

2020 (anpassbar auf 2014–2019)

|

|

Quantitative Einheiten

|

Umsatz in Mio. USD, Mengen in Einheiten, Preise in USD

|

|

Abgedeckte Segmente

|

Typ (Schwere-Krankheiten-Versicherung, individuelle Krankenversicherung, Familienkrankenversicherung, krankheitsspezifische Versicherung und andere), Kategorie/Metallstufen des Krankenversicherungsplans (Bronze, Silber, Gold, Platin und andere), Anbietertyp (Health Maintenance Organizations (HMOS), Preferred Provider Organizations (PPOS), Exclusive Provider Organizations (EPOS), Point-Of-Service-Pläne (POS), Krankenversicherungspläne mit hoher Selbstbeteiligung (HDHPS) und andere), Altersgruppe (Junges Erwachsenenalter (19–44 Jahre), mittleres Erwachsenenalter (45–64 Jahre) und älteres Erwachsenenalter (65 Jahre und älter)), Vertriebskanal (Direktversicherungsgesellschaften, Versicherungsaggregatoren und andere)

|

|

Abgedeckte Länder

|

Neuseeland

|

|

Abgedeckte Marktteilnehmer

|

Cigna (USA), AIA Group Limited (Hongkong), HCF (Australien), Allianz (Deutschland), Suncorp Group (Australien), HSBC Group (Hongkong), Tokio Marine (Japan), UniMed (Neuseeland), Southern Cross, Accuro Health Insurance (Neuseeland), Partners Life (Neuseeland)

|

|

Im Bericht behandelte Datenpunkte

|

Zusätzlich zu den Einblicken in Marktszenarien wie Marktwert, Wachstumsrate, Segmentierung, geografische Abdeckung und wichtige Akteure enthalten die von Data Bridge Market Research zusammengestellten Marktberichte auch eingehende Expertenanalysen, Patientenepidemiologie, Pipeline-Analysen, Preisanalysen und regulatorische Rahmenbedingungen.

|

Segmentanalyse:

Der Markt für private Krankenversicherungen ist nach Art, Krankenversicherungskategorie/Versicherungsstufe, Anbietertyp, Altersgruppe und Vertriebskanal segmentiert.

- Der Markt für private Krankenversicherungen ist nach Art segmentiert in Schwere-Krankheiten-Versicherungen, individuelle Krankenversicherungen, Familienkrankenversicherungen, krankheitsspezifische Versicherungen und Sonstige.

- Auf der Grundlage der Krankenversicherungskategorie/Metallstufe ist der private Krankenversicherungsmarkt in Bronze, Silber, Gold, Platin und Sonstige segmentiert.

- Auf der Grundlage des Anbietertyps ist der private Krankenversicherungsmarkt in Health Maintenance Organizations (HMOS), Preferred Provider Organizations (PPOS), Exclusive Provider Organizations (EPOS), Point-of-Service-Pläne (POS), High-Deductible Health Plans (HDHPS) und andere segmentiert.

- Auf der Grundlage der Altersgruppen ist der private Krankenversicherungsmarkt in junge Erwachsene (19–44 Jahre), mittlere Erwachsene (45–64 Jahre) und ältere Erwachsene (65 Jahre und älter) segmentiert.

- Auf der Grundlage der Vertriebskanäle ist der private Krankenversicherungsmarkt in Direktversicherungsgesellschaften, Versicherungsaggregatoren und andere segmentiert.

Hauptakteure

Data Bridge Market Research erkennt die folgenden Unternehmen als die wichtigsten Akteure auf dem neuseeländischen privaten Krankenversicherungsmarkt an: Cigna (USA), AIA Group Limited (Hongkong), HCF (Australien), Allianz (Deutschland), Suncorp Group (Australien), HSBC Group (Hongkong), Tokio Marine (Japan) und UniMed (Neuseeland).

Marktentwicklungen

- Im März 2022 gab Allianz Ayudhya Capital PCL (AYUD) die Übernahme von Aetna Thailand bekannt, einem wichtigen Akteur auf dem thailändischen Krankenversicherungsmarkt. Dieser Schritt spiegelt das Engagement von AYUD wider, sein Krankenversicherungsgeschäft auszubauen und in den thailändischen Gesundheitssektor zu investieren, wobei der Schwerpunkt darauf liegt, seinen Kunden bessere Leistungen zu bieten.

- Im Juli 2021 startete Accuro Health Insurance in Zusammenarbeit mit Montoux, einer Decision Science-Plattform für Lebens- und Krankenversicherer, ein Pilotprogramm. Ziel der Initiative war es, frühzeitige Interventionen zu identifizieren, die den Mitgliedern helfen könnten, größere invasive Operationen zu vermeiden. Diese strategische Partnerschaft ermöglichte es Accuro, seine Geschäftsabläufe zu verbessern und seinen Versicherten personalisiertere und effektivere Gesundheitslösungen anzubieten..

Ausführlichere Informationen zum neuseeländischen privaten Krankenversicherungsmarkt Bericht, klicken Sie hier – https://www.databridgemarketresearch.com/reports/new-zealand-private-health-insurance-market