Eine Hochleistungslegierung entsteht durch die Kombination verschiedener Edelstahlkomponenten. Edelstahl, eine Legierung aus Eisen, Chrom und Nickel, ist unter Umständen korrosionsbeständig. Diese Widerstandsfähigkeit der Legierung ist auf Chrom zurückzuführen . Die Passivschicht ist eine dünne Oxidschicht, die von Chrom abgesondert wird. Neben Chrom enthält diese Legierung auch Stickstoff und Molybdän . Die Legierung ist umweltneutral und inert und daher unbegrenzt recycelbar. Edelstahl ist robust und langlebig und eignet sich daher ideal für den Einsatz in vielen Endverbraucherbranchen.

Den vollständigen Bericht finden Sie unter https://www.databridgemarketresearch.com/reports/mexico-stainless-steel-market

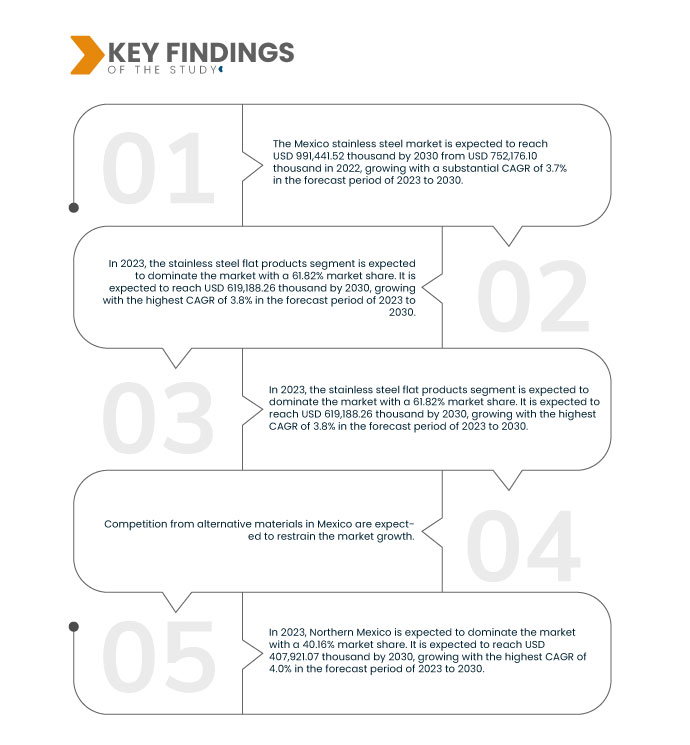

Data Bridge Market Research analysiert, dass der mexikanische Markt für rostfreien Stahl von 752.176.100 USD im Jahr 2022 auf 991.441.520 USD im Jahr 2030 ansteigen dürfte und im Prognosezeitraum von 2023 bis 2030 mit einer beachtlichen jährlichen Wachstumsrate von 3,7 % wachsen wird. Zunehmende industrielle Aktivitäten in Mexiko werden das Marktwachstum vorantreiben.

Wichtigste Ergebnisse der Studie

Zunehmende Industrieaktivitäten in Mexiko

Die zunehmende industrielle Aktivität treibt die Nachfrage nach Edelstahl in Mexiko an. Die Industrialisierung verschiedener Branchen, darunter Automobilindustrie, Bauwesen, Fertigung und Energie, hat deutlich zugenommen. Edelstahl hat sich aufgrund seiner außergewöhnlichen Eigenschaften wie Korrosionsbeständigkeit, Festigkeit und Ästhetik zum bevorzugten Werkstoff für verschiedene industrielle Anwendungen entwickelt. Mit der Ausweitung der industriellen Aktivitäten in Mexiko ist auch der wachsende Bedarf an langlebigen und zuverlässigen Materialien verbunden. Die einzigartigen Eigenschaften von Edelstahl machen ihn zur idealen Wahl für vielfältige Anwendungen in der Industrie. Seine Vielseitigkeit und Widerstandsfähigkeit machen Edelstahl zu einem Schlüsselfaktor für die wirtschaftliche Entwicklung Mexikos, da sich die Industrien kontinuierlich weiterentwickeln und nach Effizienz und Nachhaltigkeit streben.

Berichtsumfang und Marktsegmentierung

Berichtsmetrik

|

Details

|

Prognosezeitraum

|

2023 bis 2030

|

Basisjahr

|

2022

|

Historische Jahre

|

2021 (Anpassbar auf 2015 – 2020)

|

Quantitative Einheiten

|

Umsatz in Tausend USD und Volumen in Tonnen

|

Abgedeckte Segmente

|

Produkt (Flachprodukte aus Edelstahl, Langprodukte aus Edelstahl und andere), Umformungsprozess (warmgewalzt und kaltgewalzt), Typ (austenitischer Edelstahl, ferritischer Edelstahl, martensitischer Edelstahl, Duplex-Edelstahl und ausscheidungsgehärteter Edelstahl), Güte (Serie 300, Serie 400, Serie 200, Serie 500 und Serie 600), Anwendung (Automobil- und Transportindustrie, Maschinenbau und Schwerindustrie, Metallprodukte, Konsumgüter, Medizin und Gesundheitswesen, Bauwesen und Konstruktion, Schifffahrt und andere)

|

Abgedeckte Regionen

|

Nordmexiko, Zentralmexiko, Ostmexiko, Westmexiko und Südmexiko

|

Abgedeckte Marktteilnehmer

|

Acerinox (Spanien), Aperam (Luxemburg), NIPPON STEEL CORPORATION (Japan), Alleima (Schweden), MITSUI & CO., LTD. (Japan), Olympic Steel (USA), Outokumpu (Finnland), Ulbrich Stainless Steels and Special Metals Inc. (USA), Swiss Steel Holding AG (Schweiz), Gibbs Wire & Steel Company LLC (USA), TIMEX METALS (Indien), Shrikant Steel Centre (Indien), Nitech Stainless Inc (Indien), Industeel (Frankreich) und RH Alloys (Indien) und andere.

|

Im Bericht behandelte Datenpunkte

|

Zusätzlich zu den Einblicken in Marktszenarien wie Marktwert, Wachstumsrate, Segmentierung, geografische Abdeckung und wichtige Akteure enthalten die von Data Bridge Market Research kuratierten Marktberichte auch ausführliche Expertenanalysen, geografisch dargestellte Produktion und Kapazität nach Unternehmen, Netzwerklayouts von Distributoren und Partnern, detaillierte und aktuelle Preistrendanalysen und Defizitanalysen der Lieferkette und Nachfrage.

|

Segmentanalyse

Der Markt ist auf der Grundlage von Produkt, Umformungsprozess, Typ, Qualität und Anwendung in fünf wichtige Segmente unterteilt.

- Auf der Grundlage des Produkts ist der Markt in Edelstahl-Flachprodukte, Edelstahl-Langprodukte und Sonstiges segmentiert.

Im Jahr 2023 wird dieEdelstahl-FlachprodukteSegment wird voraussichtlich den Markt dominieren

Im Jahr 2023 wird das Segment Edelstahlflachprodukte voraussichtlich mit einem Marktanteil von 61,82 % den Markt dominieren, da es zur Herstellung von Blechen, Platten, Strukturträgern und Bändern verwendet wird. Diese Produkte werden aufgrund ihrer einzigartigen Eigenschaften in der Bau- und Infrastrukturbranche, im Transportwesen und in der Elektrogeräteindustrie eingesetzt.

- Auf der Grundlage des Umformungsprozesses wird der Markt in warmgewalzte und kaltgewalzte Produkte unterteilt.

In2023, diewarmgewalztSegment wird voraussichtlich den Markt dominieren

Im Jahr 2023 wird das Segment Warmwalzen voraussichtlich mit einem Marktanteil von 54,68 % den Markt dominieren, da das Warmwalzen dem Stahl verbesserte Eigenschaften wie Zähigkeit, Flexibilität und Stoßfestigkeit verleiht, was dazu beiträgt, dass der Edelstahl auf lange Sicht haltbar bleibt.

- Der Markt ist nach Typ in austenitischen Edelstahl, ferritischen Edelstahl, martensitischen Edelstahl, Duplex-Edelstahl und ausscheidungsgehärteten Edelstahl unterteilt. Im Jahr 2023 wird das Segment austenitischer Edelstahl voraussichtlich den Markt mit einem wachsenden Marktanteil von 46,59 % dominieren.

. - Der Markt ist nach Qualität in die Serien 300, 400, 200, 500 und 600 unterteilt. Im Jahr 2023 wird das Segment der 300er-Serie voraussichtlich den Markt dominieren und einen Marktanteil von 52,71 % erreichen.

. - Der Markt ist nach Anwendungsbereichen segmentiert in Automobil- und Transportwesen, Maschinenbau und Schwerindustrie, Metallprodukte, Konsumgüter, Medizin und Gesundheitswesen, Bauwesen, Schifffahrt und andere. Im Jahr 2023 wird das Segment Automobil- und Transportwesen voraussichtlich mit einem Marktanteil von 24,87 % den Markt dominieren.

Hauptakteure

Data Bridge Market Research erkennt die folgenden Unternehmen als die Hauptakteure auf dem mexikanischen Edelstahlmarkt an, darunter Acerinox (Spanien), Aperam (Luxemburg), NIPPON STEEL CORPORATION (Japan), Alleima (Schweden), MITSUI & CO., LTD. (Japan), Olympic Steel (USA), Outokumpu (Finnland), Ulbrich Stainless Steels and Special Metals Inc. (USA), Swiss Steel Holding AG (Schweiz), Gibbs Wire & Steel Company LLC (USA), TIMEX METALS (Indien), Shrikant Steel Centre (Indien), Nitech Stainless Inc (Indien), Industeel (Frankreich) und RH Alloys (Indien).

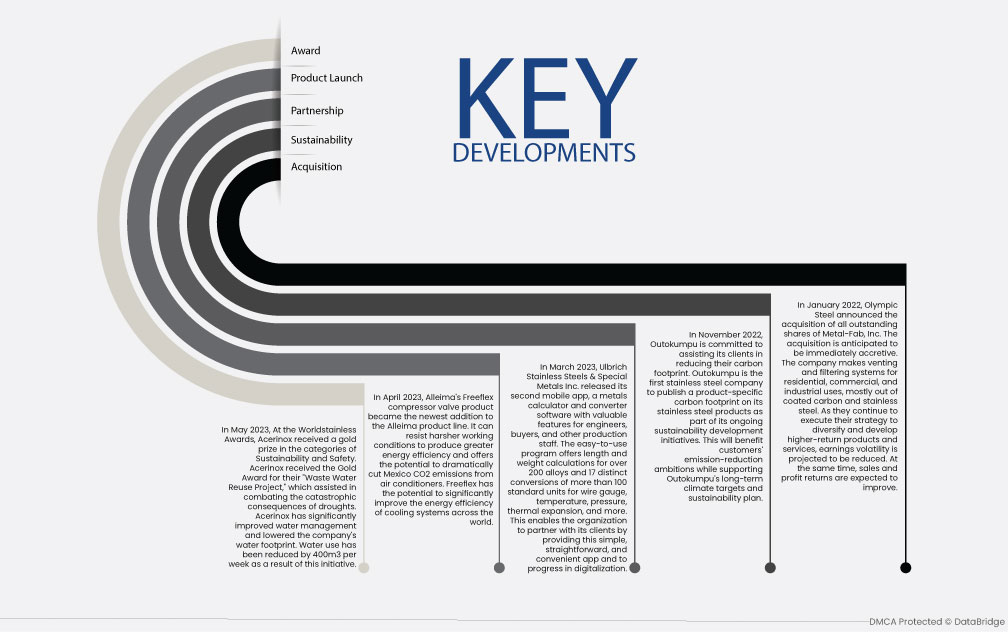

Marktentwicklung

- Im Mai 2023 erhielt Acerinox bei den Worldstainless Awards Gold in den Kategorien Nachhaltigkeit und Sicherheit. Acerinox erhielt den Gold Award für sein „Waste Water Reuse Project“, das dazu beitrug, die katastrophalen Folgen von Dürren zu bekämpfen. Acerinox hat sein Wassermanagement deutlich verbessert und den Wasserverbrauch des Unternehmens gesenkt. Der Wasserverbrauch konnte durch diese Initiative um 400 Kubikmeter pro Woche reduziert werden.

- Im April 2023 wurde das Kompressorventil Freeflex von Alleima als neueste Ergänzung der Alleima-Produktlinie eingeführt. Es hält raueren Betriebsbedingungen stand, sorgt für höhere Energieeffizienz und bietet das Potenzial, die CO2-Emissionen von Klimaanlagen in Mexiko drastisch zu senken. Freeflex hat das Potenzial, die Energieeffizienz von Kühlsystemen weltweit deutlich zu verbessern.

- Im März 2023 veröffentlichte Ulbrich Stainless Steels & Special Metals Inc. seine zweite mobile App, eine Metallrechner- und -konverter-Software mit wertvollen Funktionen für Ingenieure, Einkäufer und andere Produktionsmitarbeiter. Das benutzerfreundliche Programm bietet Längen- und Gewichtsberechnungen für über 200 Legierungen und 17 verschiedene Umrechnungen von mehr als 100 Standardeinheiten für Drahtstärke, Temperatur, Druck, Wärmeausdehnung und mehr. Dies ermöglicht dem Unternehmen, mit dieser einfachen, unkomplizierten und praktischen App eng mit seinen Kunden zusammenzuarbeiten und die Digitalisierung voranzutreiben.

- Im November 2022 unterstützt Outokumpu seine Kunden bei der Reduzierung ihres CO2-Fußabdrucks. Als erstes Edelstahlunternehmen veröffentlicht Outokumpu im Rahmen seiner Nachhaltigkeitsinitiativen einen produktspezifischen CO2-Fußabdruck seiner Edelstahlprodukte. Dies kommt den Kunden bei der Emissionsreduzierung zugute und unterstützt gleichzeitig Outokumpus langfristige Klimaziele und seinen Nachhaltigkeitsplan.

- Im Januar 2022 gab Olympic Steel die Übernahme aller ausstehenden Aktien von Metal-Fab, Inc. bekannt. Die Übernahme dürfte sich unmittelbar positiv auswirken. Das Unternehmen stellt Entlüftungs- und Filtersysteme für den privaten, gewerblichen und industriellen Bereich her, hauptsächlich aus beschichtetem Kohlenstoffstahl und Edelstahl. Im Zuge der weiteren Umsetzung seiner Strategie zur Diversifizierung und Entwicklung ertragreicherer Produkte und Dienstleistungen wird mit einer geringeren Ergebnisvolatilität gerechnet. Gleichzeitig wird mit einer Verbesserung der Umsatz- und Gewinnrenditen gerechnet.

Regionale Analyse

Geografisch gesehen umfasst der mexikanische Edelstahlmarkt die Regionen Nordmexiko, Ostmexiko, Zentralmexiko, Westmexiko und Südmexiko.

Laut Marktforschungsanalyse von Data Bridge:

Nordmexiko Isterwartetinteressiertte und ein am schnellsten wachsendesRegion in derMexiko Edelstahl Marktim Prognosezeitraum 2023-2030

Nordmexiko wird voraussichtlich aufgrund der zunehmenden Urbanisierung und des Infrastrukturausbaus den Markt dominieren. Zudem gilt Nordmexiko als die am schnellsten wachsende Region im mexikanischen Edelstahlmarkt, da dort eine zunehmende industrielle Aktivität herrscht.

Für weitere Informationen über dieMexiko EdelstahlMarktbericht, klicken Sie hier – https://www.databridgemarketresearch.com/reports/mexico-stainless-steel-market