Orthopädische Implantate, einschließlich Zahnimplantate, sind wichtige medizinische Geräte. Sie stellen die Mobilität und Lebensqualität von Patienten mit Gelenkproblemen, Frakturen oder Zahnverlust wieder her. Diese Implantate bestehen aus biokompatiblen Materialien, die sich in das Körpergewebe integrieren und so Stabilität und Haltbarkeit gewährleisten. Sie werden in orthopädischen Operationen wie Gelenkersatz und Frakturfixierung verwendet. Zahnimplantate bieten eine dauerhafte Lösung für fehlende Zähne und verbessern die Mundfunktion und Ästhetik. Insgesamt verbessern orthopädische Implantate das Wohlbefinden der Patienten erheblich, indem sie die körperliche Mobilität und Zahngesundheit wiederherstellen.

Zugriff auf den vollständigen Bericht @ https://www.databridgemarketresearch.com/reports/mena-and-gcc-orthopedic-implants-including-dental-implants-market

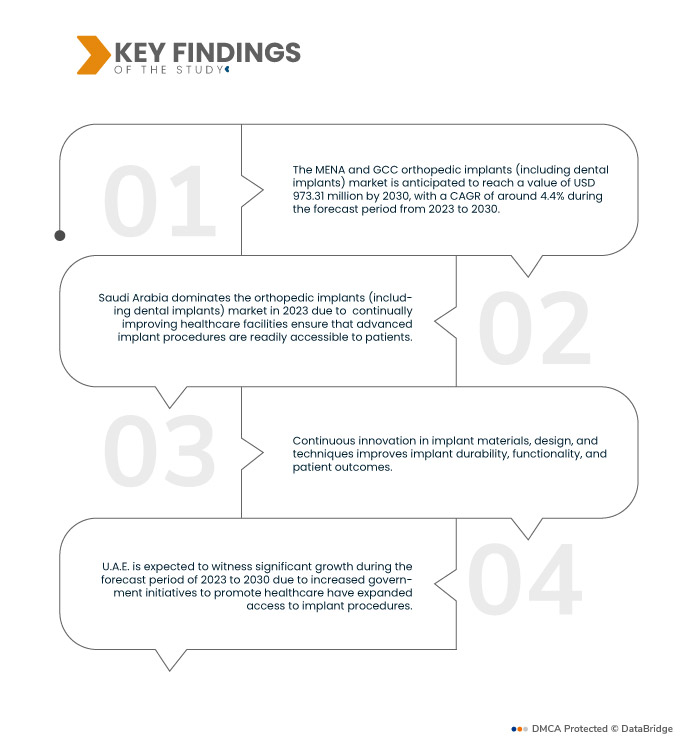

Data Bridge Market Research analysiert, dass die MENA- und GCC-Markt für orthopädische Implantate (einschließlich Zahnimplantate) wird im Jahr 2022 auf 689,67 Millionen USD geschätzt und soll bis 2030 973,31 Millionen USD erreichen, was einer durchschnittlichen jährlichen Wachstumsrate von 4,4 % im Prognosezeitraum von 2023 bis 2030 entspricht. Die alternde Bevölkerung leidet häufiger unter orthopädischen und zahnmedizinischen Problemen wie Gelenkdegeneration und Zahnverlust. Dieser demografische Trend treibt die Nachfrage nach orthopädischen und zahnmedizinischen Implantaten als wirksame Lösungen zur Behandlung dieser altersbedingten Gesundheitsprobleme an und treibt das Wachstum auf dem Implantatmarkt voran.

Wichtigste Ergebnisse der Studie

Das Bewusstsein für Zahngesundheit dürfte die Wachstumsrate des Marktes antreiben

Das zunehmende Bewusstsein für Zahngesundheit und die Vorteile von Zahnimplantaten als dauerhafte Zahnersatzoption ist ein wichtiger Treiber auf dem Markt. Patienten suchen nach langfristigen Lösungen, die natürliche Zähne nachahmen und ihre allgemeine Mundgesundheit verbessern. Dieses Bewusstsein ermutigt mehr Menschen, Zahnimplantate anstelle traditioneller Optionen wie Zahnprothesen oder Brücken in Betracht zu ziehen. Infolgedessen steigt die Nachfrage nach Zahnimplantaten weiter an, da Patienten ihr Zahnwohl und ihre Lebensqualität in den Vordergrund stellen.

Berichtsumfang und Marktsegmentierung

|

Berichtsmetrik

|

Einzelheiten

|

|

Prognosezeitraum

|

2023 bis 2030

|

|

Basisjahr

|

2022

|

|

Historische Jahre

|

2021 (anpassbar auf 2015–2020)

|

|

Quantitative Einheiten

|

Umsatz in Mio. USD, Mengen in Einheiten, Preise in USD

|

|

Abgedeckte Segmente

|

Produkte (Rekonstruktiver Gelenkersatz, Wirbelsäulenimplantate, Trauma und Kraniomaxillofazialchirurgie, Zahnimplantate, Orthobiologie), Gerätetyp (Geräte zur internen und externen Fixierung), Biomaterial (Metallische Biomaterialien, Polymere Biomaterialien, keramische Biomaterialien, natürliche Biomaterialien und andere), Verfahren (offene Chirurgie und minimalinvasive Chirurgie (MIS)), Endbenutzer (Krankenhäuser, ambulante Versorgungszentren, Fachkliniken, orthopädische Zentren und andere), Eigentum (staatlich und privat)

|

|

Abgedeckte Länder

|

Saudi-Arabien, Kuwait, Vereinigte Arabische Emirate, Katar, Bahrain und Oman

|

|

Abgedeckte Marktteilnehmer

|

3M (USA), B. Braun Melsungen AG (Deutschland), Integra LifeSciences (USA), Depuy Synthes (eine Tochtergesellschaft von JnJ) Inc. (USA), Zimmer Biomet (USA), Smith & Nephew plc (Großbritannien), Medtronic (Irland), Stryker (USA), Changzhou Waston Medical Appliance Co., Ltd. (USA), Narang Medical Limited (Indien), WL Gore & Associates, Inc. (USA), Arthrex, Inc. (USA), GE HEALTHCARE (USA), DJO, LLC (eine Tochtergesellschaft der Colfax Corporation) (China), curex (USA), Samay Surgical (Indien), Dongguan Traumed Technology Co., Ltd. (China), Abou Hamela Group (Ägypten)

|

|

Im Bericht behandelte Datenpunkte

|

Neben den Einblicken in Marktszenarien wie Marktwert, Wachstumsrate, Segmentierung, geografische Abdeckung und wichtige Akteure enthalten die von Data Bridge Market Research kuratierten Marktberichte auch eingehende Expertenanalysen, Patientenepidemiologie, Pipeline-Analysen, Preisanalysen und regulatorische Rahmenbedingungen.

|

Segmentanalyse:

Der Markt für orthopädische Implantate (einschließlich Zahnimplantate) in der MENA- und GCC-Region ist nach Produkten, Gerätetyp, Biomaterial, Verfahren, Endbenutzer und Eigentümer segmentiert.

- Auf der Grundlage der Produkte ist der Markt für orthopädische Implantate (einschließlich Zahnimplantate) in rekonstruktive Gelenkersatzprodukte, Wirbelsäulenimplantate, Trauma- und kraniokzilosziale Implantate, Zahnimplantate und Orthobiologie unterteilt. Im Jahr 2023 dominiert das Segment rekonstruktiver Gelenkersatz den Markt für orthopädische Implantate (einschließlich Zahnimplantate) mit einer CAGR von 5,1 % im Prognosezeitraum 2023 bis 2030, da die alternde Bevölkerung zunimmt und auch die Prävalenz gelenkbezogener Erkrankungen wie Arthrose steigt.

Im Jahr 2023 dominiert das Segment rekonstruktiver Gelenkersatz den Markt für orthopädische Implantate (einschließlich Zahnimplantate) mit einer CAGR von 5,1 % im Prognosezeitraum 2023 bis 2030

Im Jahr 2023 dominiert das Segment des rekonstruktiven Gelenkersatzes den Markt für orthopädische Implantate (einschließlich Zahnimplantate) mit einer durchschnittlichen jährlichen Wachstumsrate von 5,1 % im Prognosezeitraum 2023 bis 2030, da rekonstruktiver Gelenkersatz, wie Hüft- und Knieersatz, wirksame Lösungen zur Wiederherstellung der Beweglichkeit und Schmerzlinderung bietet. Technologische Fortschritte haben zu langlebigen und innovativen Implantatdesigns geführt, die die Patientenergebnisse verbessern. Darüber hinaus sind diese Verfahren zugänglicher geworden, mit verbesserten Operationstechniken und verkürzten Genesungszeiten.

- Auf der Grundlage des Gerätetyps ist der Markt für orthopädische Implantate (einschließlich Zahnimplantate) in Geräte zur internen Fixierung und Geräte zur externen Fixierung unterteilt. Im Jahr 2023 dominiert das Segment der Geräte zur internen Fixierung den Markt für orthopädische Implantate (einschließlich Zahnimplantate) mit einer CAGR von 4,5 % im Prognosezeitraum 2023 bis 2030, da diese Geräte, darunter Schrauben, Platten und Nägel, für die Stabilisierung von Frakturen und die Erleichterung der Knochenheilung von entscheidender Bedeutung sind.

- Auf der Grundlage von Biomaterialien ist der Markt für orthopädische Implantate (einschließlich Zahnimplantate) in metallische Biomaterialien, polymere Biomaterialien, keramische Biomaterialien unterteilt. natürliche Biomaterialien, und andere. Im Jahr 2023 wird das Segment der metallischen Biomaterialien den Markt für orthopädische Implantate (einschließlich Zahnimplantate) mit einer durchschnittlichen jährlichen Wachstumsrate (CAGR) von 4,7 % im Prognosezeitraum 2023 bis 2030 dominieren, da metallische Biomaterialien wie Titan und Edelstahl für ihre Festigkeit, Haltbarkeit und Biokompatibilität geschätzt werden, was sie ideal für orthopädische Implantate wie Gelenkersatz und Wirbelsäulengeräte macht.

- Auf der Grundlage der Verfahren ist der Markt für orthopädische Implantate (einschließlich Zahnimplantate) in offene Chirurgie und minimal-invasive Chirurgie (MIS). Im Jahr 2023 dominiert das Segment der offenen Chirurgie den Markt für orthopädische Implantate (einschließlich Zahnimplantate) mit einer durchschnittlichen jährlichen Wachstumsrate von 4,5 % im Prognosezeitraum von 2023 bis 2030, da traditionelle offene Chirurgieverfahren orthopädischen Chirurgen direkte Sichtbarkeit und taktiles Feedback bieten und so eine präzise Implantatplatzierung, insbesondere in komplexen Fällen, ermöglichen.

- Auf der Grundlage des Endverbrauchers ist der Markt für orthopädische Implantate (einschließlich Zahnimplantate) in Krankenhäuser, ambulante Pflegezentren, Fachkliniken, orthopädische Zentren und andere unterteilt. Im Jahr 2023 dominiert das Krankenhaussegment den Markt für orthopädische Implantate (einschließlich Zahnimplantate) mit einer CAGR von 4,8 % im Prognosezeitraum 2023 bis 2030, da Krankenhäuser als primäre Zentren für chirurgische Eingriffe, einschließlich orthopädischer Operationen, dienen.

Im Jahr 2023 dominiert das Krankenhaussegment den Markt für orthopädische Implantate (einschließlich Zahnimplantate) mit einer CAGR von 4,8 % im Prognosezeitraum 2023 bis 2030

Im Jahr 2023 dominiert das Krankenhaussegment den Markt für orthopädische Implantate (einschließlich Zahnimplantate) mit einer durchschnittlichen jährlichen Wachstumsrate (CAGR) von 4,8 % im Prognosezeitraum 2023 bis 2030, da sie Zugang zu moderner Ausrüstung, erfahrenen Chirurgen und umfassenden Einrichtungen für die Patientenversorgung haben, was sie zur bevorzugten Wahl für komplexe orthopädische Implantatverfahren macht. Darüber hinaus erhalten Krankenhäuser häufig Überweisungen für spezielle orthopädische Fälle, was ihre Dominanz auf diesem Markt weiter stärkt. Da die Weltbevölkerung altert und orthopädische Probleme immer häufiger auftreten, steigt die Nachfrage nach orthopädischen Implantatverfahren in Krankenhäusern weiter an und festigt die führende Position des Krankenhaussegments beim Marktwachstum.

- Auf der Grundlage der Eigentümerschaft ist der Markt für orthopädische Implantate (einschließlich Zahnimplantate) in staatliche und private Segmente unterteilt. Im Jahr 2023 dominiert das staatliche Segment den Markt für orthopädische Implantate (einschließlich Zahnimplantate) mit einer durchschnittlichen jährlichen Wachstumsrate von 4,7 % im Prognosezeitraum 2023 bis 2030 aufgrund seiner bedeutenden Rolle bei der Regulierung und Finanzierung von Gesundheitssystemen.

Hauptakteure

Data Bridge Market Research erkennt die folgenden Unternehmen als die wichtigsten Marktteilnehmer für orthopädische Implantate (einschließlich Zahnimplantate) in MENA und GCC an: 3M (USA), B. Braun Melsungen AG (Deutschland), Integra LifeSciences (USA), Depuy Synthes (eine Tochtergesellschaft von JnJ) Inc. (USA), Zimmer Biomet (USA), Smith & Nephew plc (Großbritannien), Medtronic (Irland), Stryker (USA), Changzhou Waston Medical Appliance Co., Ltd. (USA)

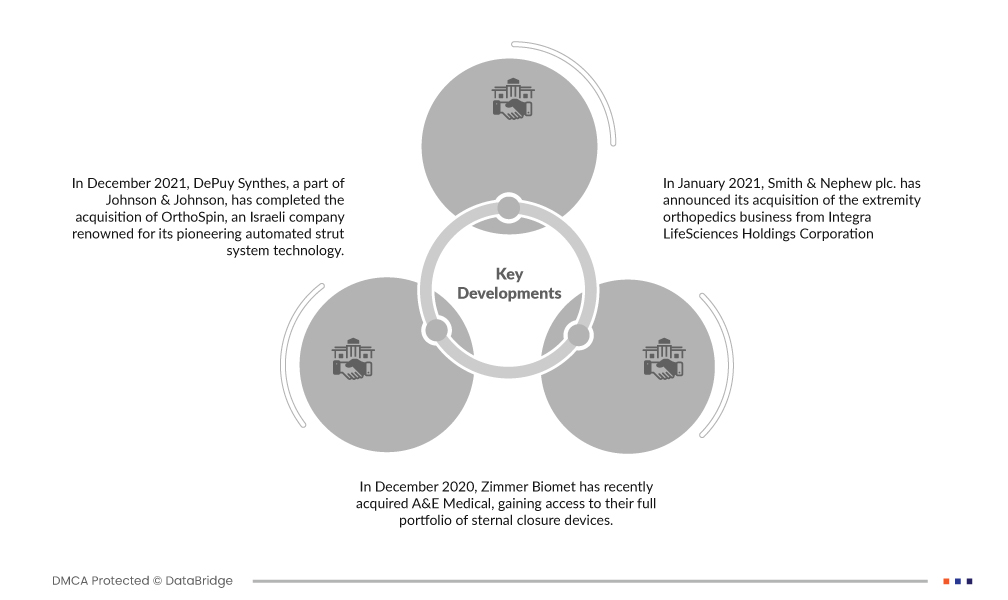

Marktentwicklungen

- Im Dezember 2021 hat DePuy Synthes, ein Teil von Johnson & Johnson, die Übernahme von OrthoSpin abgeschlossen, einem israelischen Unternehmen, das für seine bahnbrechende automatisierte Strebensystemtechnologie bekannt ist. Dieses innovative System ergänzt das MAXFRAME Multi-Axial Correction System von DePuy Synthes, ein externes Ringfixierungssystem, und erweitert die Fähigkeiten des Unternehmens im Bereich der medizinischen Innovation.

- Im Dezember 2020 hat Zimmer Biomet kürzlich A&E Medical übernommen und erhält damit Zugriff auf deren gesamtes Portfolio an Sternumverschlussgeräten. Diese strategische Übernahme erweitert das Portfolio an orthopädischen Implantaten von Zimmer Biomet erheblich und positioniert das Unternehmen für höhere Umsätze und eine erhöhte Nachfrage auf dem Markt. Dieser Schritt dürfte das zukünftige Umsatzwachstum von Zimmer Biomet vorantreiben.

- Im Januar 2021 gab Smith & Nephew plc. die Übernahme des Extremitätenorthopädie-Geschäfts von Integra LifeSciences Holdings Corporation bekannt. Mit diesem strategischen Schritt hat das Unternehmen sein Produktportfolio effektiv erweitert.

Regionale Analyse

Geografisch sind die im Marktbericht für orthopädische Implantate (einschließlich Zahnimplantate) für die MENA- und GCC-Region abgedeckten Länder Saudi-Arabien, Kuwait, Vereinigte Arabische Emirate, Katar, Bahrain und Oman.

Laut Marktforschungsanalyse von Data Bridge:

Saudi-Arabien dominiert die MENA- und GCC-Region in Markt für orthopädische Implantate (einschließlich Zahnimplantate) im Prognosezeitraum 2023 - 2030

Im Jahr 2023 Saudi-Arabien dominiert den Markt für orthopädische Implantate (einschließlich Zahnimplantate) in MENA und GCC aufgrund der starken Präsenz wichtiger Branchenakteure, die Innovation und Wettbewerb vorantreiben und die Qualität und Vielfalt der verfügbaren Implantate verbessern. Darüber hinaus unterstützt eine außergewöhnliche Gesundheitsinfrastruktur in entwickelten Regionen die nahtlose Integration dieser Implantate. Schließlich trägt eine beträchtliche Zahl von Menschen, die mit Verletzungen und Operationen zu kämpfen haben, insbesondere in einer alternden Bevölkerungsgruppe, zu einem nachhaltigen Marktwachstum bei, da Implantate zu wichtigen Lösungen für die Wiederherstellung von Mobilität und Lebensqualität werden.

In den Vereinigten Arabischen Emiraten wird im Prognosezeitraum von 2023 bis 2030 ein deutliches Wachstum erwartet

Im Jahr 2023 werden die Vereinigten Arabischen Emirate wird voraussichtlich ein deutliches Wachstum verzeichnen, da das Bewusstsein der Öffentlichkeit für die Vorteile von Implantaten steigt und moderne chirurgische Optionen die Nachfrage der Patienten ankurbeln. Drittens hat eine große und wachsende Bevölkerung in Verbindung mit einem steigenden Bedarf an qualitativ hochwertiger Gesundheitsversorgung einen beträchtlichen Markt für diese fortschrittlichen medizinischen Technologien geschaffen. Zusammengefasst treiben diese Faktoren die Expansion des Marktes für orthopädische Implantate als Reaktion auf das gestiegene Bewusstsein und die gestiegene Nachfrage im Gesundheitswesen voran.

Für detailliertere Informationen über den Markt für orthopädische Implantate (einschließlich Zahnimplantate) Bericht, klicken Sie hier – https://www.databridgemarketresearch.com/reports/mena-and-gcc-orthopedic-implants-including-dental-implants-market