Steigende Trauma- und Frakturfälle treiben den Markt für Osteosynthesegeräte in Lateinamerika, Nordamerika, Afrika und Europa maßgeblich voran. Die zunehmende Zahl von Verkehrsunfällen, Sportverletzungen und Stürzen sowie eine alternde, anfälligere Bevölkerung für Osteoporose und Frakturen treiben die Nachfrage nach fortschrittlichen Osteosynthesegeräten an. In diesen Regionen erfordert die zunehmende Anzahl chirurgischer Eingriffe zur Reparatur und Stabilisierung von Knochenbrüchen den Einsatz von Platten, Schrauben und Marknägeln und fördert so das Marktwachstum. Fortschritte in der Medizintechnik und ein zunehmender Fokus auf die Verbesserung der Patientenergebnisse treiben die Verbreitung dieser Geräte weiter voran und machen den Osteosynthesemarkt zu einem wichtigen Bestandteil der Gesundheitssysteme in diesen Regionen. Die Zunahme von Traumafällen hat zu einer höheren Prävalenz von Frakturen geführt, was wiederum den Bedarf an effektiven und zuverlässigen Osteosyntheselösungen erhöht und Innovationen und Investitionen im Markt vorantreibt, um die wachsende Nachfrage nach diesen wichtigen medizinischen Geräten zu decken.

Die zunehmende Prävalenz von Arthrose bei älteren Menschen ist ein wichtiger Treiber für den Markt für Osteosyntheseprodukte in Lateinamerika, Nordamerika, Afrika und Europa. Mit der wachsenden Zahl älterer Menschen steigt auch die Inzidenz von Arthrose – einer degenerativen Gelenkerkrankung, die häufig zu starken Gelenkschmerzen und Mobilitätseinschränkungen führt. Diese Erkrankung erfordert häufig chirurgische Eingriffe wie Gelenkersatz und Knochenumstellung, die wiederum den Einsatz von Osteosyntheseprodukten wie Platten, Schrauben und Stäben zur Stabilisierung und Unterstützung der betroffenen Knochen und Gelenke erfordern. Der Anstieg der Arthrosefälle führt zu einer höheren Nachfrage nach diesen chirurgischen Eingriffen und beflügelt damit den Markt für Osteosyntheseprodukte. Fortschritte in der Medizintechnik, verbesserte Operationstechniken und die zunehmende Betonung der Verbesserung der Lebensqualität älterer Patienten treiben die Akzeptanz dieser Produkte zusätzlich voran. Folglich verzeichnet der Markt für Osteosyntheseprodukte ein starkes Wachstum, da die Gesundheitssysteme in diesen Regionen bestrebt sind, den steigenden Bedürfnissen einer alternden, an Arthrose leidenden Bevölkerung gerecht zu werden.

Darüber hinaus ist der Trend zu minimalinvasiven Osteosynthesetechniken ein wichtiger Treiber für den Markt für Osteosyntheseprodukte in Lateinamerika, Nordamerika, Afrika und Europa. Minimalinvasive Operationstechniken bieten zahlreiche Vorteile, darunter kürzere Genesungszeiten, ein geringeres Komplikationsrisiko und weniger postoperative Schmerzen, was sowohl für Patienten als auch für medizinisches Personal sehr attraktiv ist. Diese Vorliebe für weniger invasive Verfahren hat zu einer zunehmenden Nutzung fortschrittlicher Osteosyntheseprodukte wie Marknägeln, Verriegelungsplatten und bioresorbierbaren Implantaten geführt, die eine schnellere Heilung und bessere Behandlungsergebnisse ermöglichen.

Vollständigen Bericht abrufen unter https://www.databridgemarketresearch.com/reports/latin-america-north-america-africa-and-the-europe-osteosynthesis-devices-market

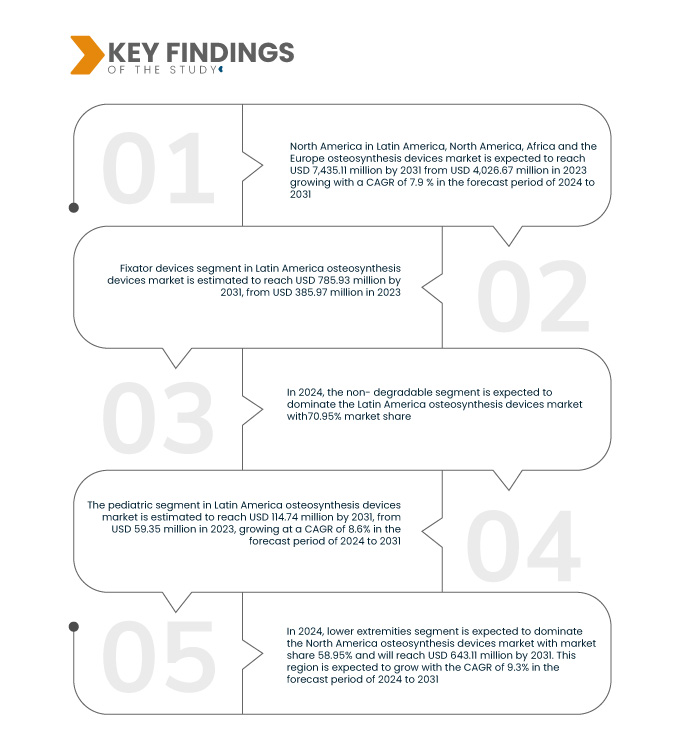

Data Bridge Market Research analysiert, dass der Markt für Osteosynthesegeräte in Lateinamerika, Nordamerika, Afrika und Europa im Prognosezeitraum von 2024 bis 2031 voraussichtlich mit einer durchschnittlichen jährlichen Wachstumsrate (CAGR) von 7,9 % wachsen und von 4.026,67 Millionen USD im Jahr 2023 auf 7.435,12 Millionen USD im Jahr 2031 ansteigen wird. Das Segment der Fixateure wird das Marktwachstum voraussichtlich ankurbeln, da es sich dabei um vielseitige Geräte zur Behandlung komplexer Frakturen, minimale Invasivität und Fortschritte bei Materialien und Designs handelt, die die Behandlungsergebnisse der Patienten verbessern und die Genesungszeiten verkürzen.

Wichtigste Ergebnisse der Studie

Die wachsende Rolle von Osteosynthesegeräten bei der Marktdefinition

Die Rolle von Osteosynthesegeräten auf dem Markt entwickelt sich aufgrund des rasanten technologischen Fortschritts zunehmend dynamischer. Diese Geräte, zu denen Platten, Schrauben, Stäbe und Nägel gehören, sind für die Stabilisierung und Ausrichtung gebrochener Knochen während des Heilungsprozesses unerlässlich. Jüngste Innovationen, wie die Verwendung biokompatibler Materialien wie Titan und bioresorbierbarer Polymere, verbessern die Geräteleistung und die Patientensicherheit. Darüber hinaus ermöglichen Technologien wie 3D-Druck und computergestützte Chirurgie die Entwicklung präziserer und individuellerer Geräte, die auf die Bedürfnisse einzelner Patienten zugeschnitten sind und so die Behandlungsergebnisse verbessern.

Die alternde Weltbevölkerung trägt maßgeblich zur steigenden Nachfrage nach Osteosyntheseprodukten bei. Mit der steigenden Zahl älterer Menschen steigt auch die Anzahl von Frakturen und osteoporosebedingten Erkrankungen, weshalb diese Produkte für eine effektive Knochenreparatur und -behandlung unverzichtbar sind. Darüber hinaus sind Osteosyntheseprodukte nicht mehr nur auf Traumata beschränkt, sondern finden zunehmend Anwendung in einem breiteren Anwendungsspektrum, darunter Wirbelsäulenversteifungen, Korrekturoperationen bei Knochendeformationen und sogar die Behandlung von Knochentumoren. Diese Expansion erweitert den Markt und erhöht die Bedeutung dieser Produkte in der orthopädischen und rekonstruktiven Chirurgie.

Ein weiterer wichtiger Trend ist die Hinwendung zu minimalinvasiven Operationstechniken. Dieser Trend treibt die Entwicklung kleinerer, anspruchsvollerer Osteosynthesegeräte voran, die mit weniger chirurgischem Trauma implantiert werden können und so zu schnelleren Genesungszeiten und besseren Patientenergebnissen führen. Da Gesundheitsdienstleister und Patienten nach weniger invasiven Optionen suchen, wird die Nachfrage nach diesen fortschrittlichen Geräten voraussichtlich steigen. Der Fokus auf kürzere Genesungszeiten und ein verbessertes Patientenerlebnis verändert den Markt und prägt zukünftige Innovationen.

Der Markt für Osteosyntheseprodukte wird durch die Notwendigkeit beeinflusst, strenge regulatorische Standards zu erfüllen und langfristige Sicherheit und Wirksamkeit zu gewährleisten. Hersteller stehen unter zunehmendem Innovationsdruck und müssen gleichzeitig komplexe regulatorische Anforderungen erfüllen, was die Markteinführungszeit neuer Produkte beeinträchtigen kann. Trotz dieser Herausforderungen wächst der globale Markt für Osteosyntheseprodukte, angetrieben durch steigende Anforderungen im Gesundheitswesen und zunehmenden Wettbewerb zwischen den Herstellern. Dieses Wettbewerbsumfeld fördert weitere Innovationen und die Entwicklung effektiverer, patientenorientierter Lösungen zur Knochenstabilisierung und -reparatur.

Berichtsumfang und Marktsegmentierung

Berichtsmetrik

|

Details

|

Prognosezeitraum

|

2024–2031

|

Basisjahr

|

2023

|

Historisches Jahr

|

2022 (Anpassbar auf 2016–2021)

|

Quantitative Einheiten

|

Umsatz in Millionen USD

|

Abgedeckte Segmente

|

Produkttyp (Fixateure, Knochenwachstumsstimulatoren und andere), Material (nicht abbaubar und abbaubar), Frakturtyp (Patella, Tibia und Fibula, Wirbelsäule, Hüfte und Becken, Schlüsselbein, Schulterblatt und Oberarmknochen, Femur, Radius oder Ulna und beides, Handgelenk, Brustbein, Rippen, Schädel und Gesichtsknochen), Stelle (untere Extremitäten und obere Extremitäten), Patiententyp (Erwachsene, Geriatrie und Pädiatrie), Endbenutzer (Krankenhäuser, orthopädische Kliniken, ambulante chirurgische Zentren , Traumazentren und andere), Vertriebskanal (Direktvertrieb und Drittanbieter)

|

Abgedeckte Länder

|

USA, Kanada, Mexiko, Deutschland, Frankreich, Großbritannien, Italien, Spanien, Russland, Niederlande, Schweiz, Türkei, Belgien, Dänemark, Norwegen, Schweden, Polen, Restliches Europa, Brasilien, Argentinien, Kolumbien, Peru, Chile, El Salvador, Panama, Honduras, Bolivien, Costa Rica, Ecuador, Guatemala, Paraguay, Jamaika, Trinidad und Tobago, Venezuela, Dominikanische Republik, Südafrika, Ägypten, Algerien, Ghana, Kenia, Nigeria, Sudan, Uganda, Tansania, Äthiopien, Demokratische Republik Kongo, Restliches Afrika

|

Abgedeckte Marktteilnehmer

|

Smith & Nephew (Europa), Zimmer Biomet (USA), Olympus Corporation (Japan), Lepu Medical Technology (Beijing) Co., Ltd. (China), Precision Spine, Inc. (USA), MicroPort Scientific Corporation (China), B. Braun Medical Ltd (Europa), Stryker (USA), Globus Medical (USA), Medtronic (Irland), Arthrex, Inc. (USA), Bioventus Inc. (USA), Exactech. Inc. (USA), Normmed Medical (Türkei), Medartis AG (Europa), Orthofix Medical Inc. (USA) und OssaTechnics (Europa)

|

Im Bericht behandelte Datenpunkte

|

Neben den Einblicken in Marktszenarien wie Marktwert, Wachstumsrate, Segmentierung, geografische Abdeckung und wichtige Akteure enthalten die von Data Bridge Market Research kuratierten Marktberichte auch eingehende Expertenanalysen, geografisch dargestellte Produktion und Kapazität nach Unternehmen, Netzwerklayouts von Distributoren und Partnern, detaillierte und aktualisierte Preistrendanalysen und Defizitanalysen der Lieferkette und der Nachfrage

|

Segmentanalyse

Der Markt für Osteosynthesegeräte in Lateinamerika, Nordamerika, Afrika und Europa ist in sieben wichtige Segmente unterteilt, die auf Produkttyp (Fixateure, Knochenwachstumsstimulatoren und andere), Material (nicht abbaubar und abbaubar), Frakturtyp (Patella, Tibia und Fibula, Wirbelsäule, Hüfte und Becken, Schlüsselbein, Schulterblatt und Oberarmknochen, Femur, Radius oder Ulna und beides, Handgelenk, Brustbein, Rippen, Schädel und Gesichtsknochen), Stelle (untere Extremitäten und obere Extremitäten), Patiententyp (Erwachsene, Geriatrie und Pädiatrie), Endbenutzer (Krankenhäuser, orthopädische Kliniken, ambulante chirurgische Zentren, Traumazentren und andere), Vertriebskanal (Direktvertrieb und Drittanbieter) basieren.

- Basierend auf dem Produkttyp ist der Markt in Fixateure, Knochenwachstumsstimulatoren und andere segmentiert

Im Jahr 2024 wird erwartet, dass das Segment Fixateur-Geräte im Produkt- und Dienstleistungsbereich den Markt dominieren wird

Im Jahr 2024 wird das Segment der Fixateure voraussichtlich mit einem Marktanteil von 73,75 % den Markt dominieren, und zwar aufgrund ihrer Vielseitigkeit bei der Behandlung komplexer Frakturen, ihrer minimalen Invasivität sowie der Fortschritte bei Materialien und Designs, die die Behandlungsergebnisse der Patienten verbessern und die Genesungszeiten verkürzen.

- Basierend auf dem Material ist der Markt in nicht abbaubare und abbaubare unterteilt

Im Jahr 2024 wird das präoperative Segment der Pflegeart voraussichtlich den Markt dominieren

Im Jahr 2024 wird das nicht abbaubare Segment voraussichtlich mit einem Marktanteil von 69,47 % den Markt dominieren. Dies ist auf die Langlebigkeit, Zuverlässigkeit bei der langfristigen Knochenfixierung und den geringeren Bedarf an Entfernungsoperationen zurückzuführen. Diese Produkte bieten eine stabile Fixierung ohne Korrosions- oder Verschleißrisiko und eignen sich daher ideal für ein breites Spektrum orthopädischer Anwendungen, von der Traumachirurgie bis hin zu rekonstruktiven Eingriffen.

- Basierend auf der Frakturart ist der Markt in Patella, Tibia und Fibula, Wirbelsäule, Hüfte und Becken, Schlüsselbein, Schulterblatt, Oberarmknochen, Femur, Radius oder Ulna sowie beides, Handgelenk, Brustbein, Rippen, Schädel und Gesichtsknochen segmentiert. Im Jahr 2024 wird das Patella-Segment voraussichtlich den Markt mit einem Marktanteil von 24,63 % dominieren.

- Der Markt ist je nach Standort in untere und obere Extremitäten segmentiert. Im Jahr 2024 wird das Segment der unteren Extremitäten voraussichtlich mit einem Marktanteil von 58,95 % den Markt dominieren.

- Basierend auf dem Patiententyp ist der Markt in Erwachsene, Geriatrie und Pädiatrie segmentiert. Im Jahr 2024 wird das Segment der unteren Extremitäten voraussichtlich den Markt mit einem Marktanteil von 55,28 % dominieren.

- Basierend auf dem Endverbraucher ist der Markt in Krankenhäuser, orthopädische Kliniken, ambulante chirurgische Zentren, Traumazentren und andere segmentiert. Im Jahr 2024 wird das Krankenhaussegment voraussichtlich den Markt mit einem Marktanteil von 46,35 % dominieren.

- Basierend auf den Vertriebskanälen ist der Markt in Direktvertrieb und Drittanbieter segmentiert. Im Jahr 2024 wird das Direktvertriebssegment voraussichtlich den Markt mit einem Marktanteil von 61,75 % dominieren.

Hauptakteure

Data Bridge Market Research erkennt die folgenden Unternehmen als die wichtigsten Marktteilnehmer für Osteosynthesegeräte an, darunter Zimmer Biomet (USA), Stryker (USA), Globus Medical (USA), B. Braun Medical Ltd. (Europa) und Smith & Nephew (Europa).

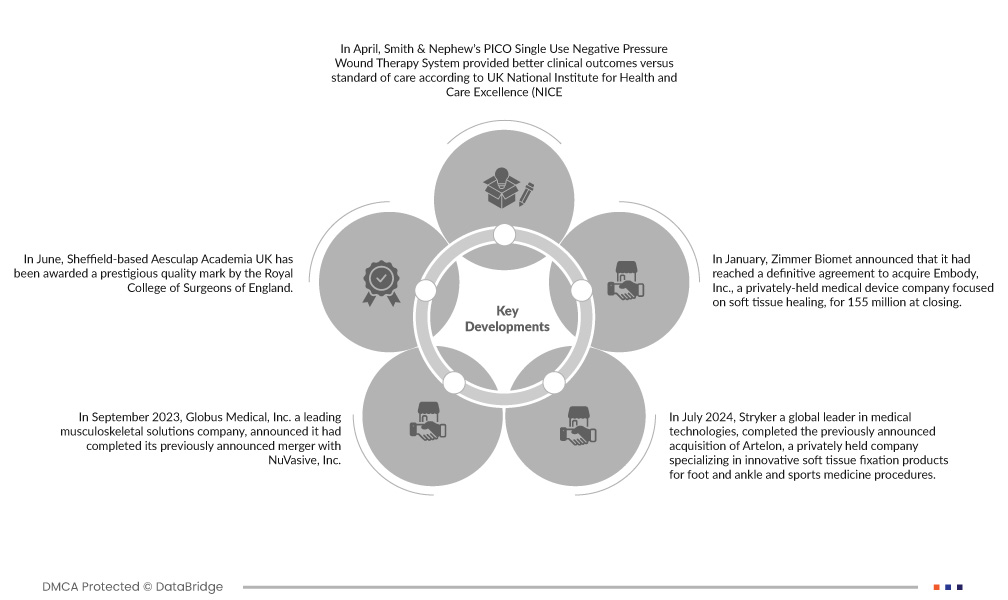

Marktentwicklung

- Im April erzielte das PICO Single Use Negative Pressure Wound Therapy System von Smith & Nephew laut dem britischen National Institute for Health and Care Excellence (NICE) bessere klinische Ergebnisse im Vergleich zur Standardbehandlung. Daraufhin bekräftigte das NICE seine Empfehlung, dass PICOs NPWT als Option für geschlossene chirurgische Inzisionen bei Patienten mit hohem Risiko für Wundinfektionen in Betracht gezogen werden sollte. Zu den wichtigsten Risikofaktoren zählen unter anderem ein hoher Body-Mass-Index (BMI), Diabetes, Niereninsuffizienz und Rauchen.

- Im September 2023 gab Globus Medical, Inc., ein führendes Unternehmen für muskuloskelettale Lösungen, den Abschluss der zuvor angekündigten Fusion mit NuVasive, Inc. bekannt. Das fusionierte Unternehmen wird Chirurgen und Patienten eines der umfassendsten Angebote an muskuloskelettalen Verfahrenslösungen und Schlüsseltechnologien bieten, die das Versorgungskontinuum beeinflussen.

- Im Juli 2023 gab Globus Medical, Inc., ein führendes Unternehmen für muskuloskelettale Lösungen, die Markteinführung des MARVEL Growing Rod Systems bekannt, das für pädiatrische Patienten mit früh einsetzender Skoliose entwickelt wurde, um eine Korrektur zu erreichen und aufrechtzuerhalten und gleichzeitig durch minimalinvasive Distraktion Wachstum zu ermöglichen.

- Im Juni 2024 gab Stryker, ein weltweit führendes Medizintechnikunternehmen, die Unterzeichnung einer endgültigen Vereinbarung zur Übernahme aller ausgegebenen und ausstehenden Aktien von Artelon bekannt. Artelon ist ein privates Unternehmen, das auf innovative Produkte zur Weichteilfixierung für Fuß- und Sprunggelenke sowie sportmedizinische Eingriffe spezialisiert ist. Die Übernahme stärkt Strykers Angebot im Bereich der Weichteilfixierung und unterstreicht Strykers Engagement für differenzierte Lösungen zur Bänder- und Sehnenrekonstruktion.

- Im Januar gab Zimmer Biomet den Abschluss einer endgültigen Vereinbarung zur Übernahme von Embody, Inc. bekannt, einem privaten Medizintechnikunternehmen mit Schwerpunkt auf Weichteilheilung. Die Transaktion kostete 155 Millionen Euro. Die Übernahme umfasst Embodys komplettes Portfolio an kollagenbasierten biointegrativen Lösungen zur Unterstützung der Heilung schwierigster orthopädischer Weichteilverletzungen – darunter das biointegrative TAPESTRY-Implantat zur Sehnenheilung und TAPESTRY RC, eines der ersten arthroskopischen Implantatsysteme zur Rotatorenmanschettenrekonstruktion. Die Übernahme unterstützt das Unternehmen bei der Erweiterung seines Produktportfolios und seiner Geschäftsaktivitäten.

- Im Januar startete Arthrex, ein weltweit führendes Unternehmen im Bereich minimalinvasiver chirurgischer Technologie und der Ausbildung chirurgischer Fertigkeiten, eine neue patientenorientierte Ressource, TheNanoExperience.com, die die Wissenschaft und die Vorteile der Nano-Arthroskopie hervorhebt, einem modernen, minimalinvasiven orthopädischen Verfahren, das eine schnelle Rückkehr zur Aktivität und weniger Schmerzen ermöglichen kann.

- Im Januar gab Arthrex, ein weltweit führendes Unternehmen im Bereich minimalinvasiver Chirurgie, bekannt, dass sein ACL TightRope-Implantat von der US-amerikanischen Food and Drug Administration (FDA) für pädiatrische Anwendungen zugelassen wurde. Das TightRope-Implantat wird zur chirurgischen Behandlung orthopädischer Verletzungen eingesetzt und ist das erste und einzige Fixierungsgerät für Verletzungen des vorderen Kreuzbandes (ACL), das für die Anwendung bei Kindern zugelassen ist.

- Im Oktober präsentierte Bioventus, ein weltweit führendes Unternehmen für Innovationen im Bereich aktive Heilung, seine umfassenden Lösungen für Wirbelsäulenbehandlungen auf der Tagung der North American Spine Society (NASS) in Chicago. Diese Veranstaltung markierte die vollständige Markteinführung des BoneScalpel Access

- Im Februar startete Exactech eine bahnbrechende Zusammenarbeit mit Statera Medical zur gemeinsamen Entwicklung des weltweit ersten intelligenten Reverse-Schulterimplantats. Ziel dieser innovativen Partnerschaft war die Integration fortschrittlicher Technologie in orthopädische Lösungen, um die chirurgische Präzision und die Behandlungsergebnisse zu verbessern. Durch die Kombination von Exactechs Expertise im Bereich Gelenkersatz mit Statera Medicals innovativem Ansatz in der Entwicklung medizinischer Geräte versprach die Zusammenarbeit, die Standards in der Schulterchirurgie mit verbesserter Funktionalität und patientenorientiertem Design neu zu definieren.

- Im April gab Medtronic plc, ein weltweit führendes Unternehmen im Bereich der Medizintechnologie, bekannt, dass die US-amerikanische Food and Drug Administration (FDA) den wiederaufladbaren Rückenmarkstimulator (SCS) Inceptiv mit geschlossenem Regelkreis zur Behandlung chronischer Schmerzen zugelassen hat. Inceptiv ist das erste SCS-Gerät von Medtronic mit geschlossenem Regelkreis, das biologische Signale entlang des Rückenmarks erfasst und die Stimulation automatisch in Echtzeit anpasst. So wird die Therapie an die Bewegungen des Alltags angepasst.

Für detailliertere Informationen über den Markt für Osteosynthesegeräte in Lateinamerika, Nordamerika, Afrika und Europa klicken Sie hier – https://www.databridgemarketresearch.com/reports/latin-america-north-america-africa-and-the-europe-osteosynthesis-devices-market