Die steigende Nachfrage nach Autos in Saudi-Arabien ist ein wichtiger Wachstumstreiber für den Markt für Ersatzteile. Mit der stetig wachsenden Bevölkerung des Landes und der zunehmenden Urbanisierung steigt auch der Bedarf an persönlichen Transportmitteln. Diese erhöhte Nachfrage zeigt sich in steigenden Fahrzeugverkäufen in verschiedenen Segmenten, darunter Personenkraftwagen, Nutzfahrzeuge und Geländefahrzeuge, wodurch die Gesamtgröße der Fahrzeugflotte des Landes wächst. Da in Saudi-Arabien mehr Autos gekauft und genutzt werden, steigt auch der Bedarf an Ersatzteilen und -dienstleistungen. Diese Nachfrage wird durch mehrere Faktoren getrieben, darunter die Alterung der Fahrzeuge, die regelmäßige Wartung und den periodischen Austausch verschlissener Komponenten erfordert, um optimale Leistung und Sicherheit zu gewährleisten. Zudem beschleunigen die vielfältigen klimatischen Bedingungen in Saudi-Arabien, die durch extreme Temperaturen und raues Gelände gekennzeichnet sind, den Fahrzeugverschleiß und treiben die Nachfrage nach Ersatzteilen wie Filtern, Kühlsystemkomponenten und Aufhängungsteilen weiter an.

Zugriff auf den vollständigen Bericht unter https://www.databridgemarketresearch.com/reports/ksa-aftermarket-spare-parts-market

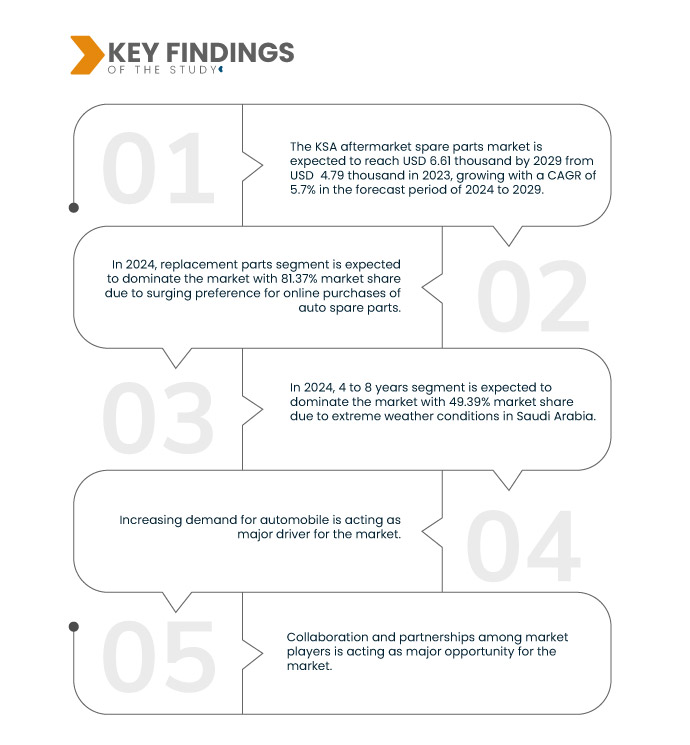

Data Bridge Market Research analysiert, dass der KSA-Ersatzteilmarkt von 4.790.000 USD im Jahr 2023 einen Wert von 6.610.000 USD bis 2029 erreichen dürfte und im Prognosezeitraum von 2024 bis 2029 mit einer durchschnittlichen jährlichen Wachstumsrate (CAGR) von 5,7 % wachsen wird.

Wichtigste Ergebnisse der Studie

Steigende Präferenz für Online-Käufe von Autoersatzteilen

Der zunehmende Trend zum Online-Kauf von Autoersatzteilen ist ein wichtiger Treiber für den saudi-arabischen Ersatzteilmarkt. Mit zunehmender Digitalisierung und E-Commerce schätzen Verbraucher den Komfort, die Zugänglichkeit und die große Produktauswahl von Online-Plattformen. Dank der zunehmenden Verbreitung von E-Commerce-Kanälen und speziellen Websites für Autoteile können Fahrzeugbesitzer bequem von zu Hause oder vom Arbeitsplatz aus stöbern, Preise vergleichen und Ersatzteile kaufen. Diese Verlagerung zum Online-Shopping macht physische Ladenbesuche überflüssig, spart Verbrauchern Zeit und Aufwand und ermöglicht es Aftermarket-Anbietern, eine breitere Kundenbasis in verschiedenen Regionen Saudi-Arabiens zu erreichen.

Berichtsumfang und Marktsegmentierung

Berichtsmetrik

|

Details

|

Prognosezeitraum

|

2024 bis 2029

|

Basisjahr

|

2023

|

Historische Jahre

|

2022 (Anpassbar auf 2016–2021)

|

Quantitative Einheiten

|

Umsatz in Tausend USD

|

Abgedeckte Segmente

|

Typ (Ersatzteile und Zubehör), Vertriebskanal (Großhändler, Distributoren und Einzelhändler), Zertifizierungsaussichten (Originalteile, zertifizierte Teile und nicht zertifizierte Teile), Servicekanal (DIFM (Do It for Me), DIY (Do It Yourself) und OE (Delegieren an OEMs)), Fahrzeugalter (4 bis 8 Jahre, 0 bis 4 Jahre und über 8 Jahre), Fahrzeugtyp (Pkw, Nutzfahrzeug, Utility Task Vehicle (UTV), Freizeitfahrzeug), Vertriebskanal (Offline und Online), Antriebsart (Diesel/Benzin, CNG und Elektro)

|

Abgedeckte Länder

|

Saudi-Arabien

|

Abgedeckte Marktteilnehmer

|

Continental AG (Deutschland), The Goodyear Tire & Rubber Company (USA), DENSO CORPORATION (Japan), Tenneco Inc. (USA), Robert Bosch GmbH (Deutschland), Aptiv (Irland), Michelin (Frankreich), ZF Friedrichshafen AG (Deutschland), Yokohama Tire Corporation (Japan) und Knorr-Bremse AG (Deutschland) unter anderem

|

Im Bericht behandelte Datenpunkte

|

Zusätzlich zu den Markteinblicken wie Marktwert, Wachstumsrate, Marktsegmenten, geografischer Abdeckung, Marktteilnehmern und Marktszenario enthält der vom Data Bridge Market Research Team kuratierte Marktbericht eine eingehende Expertenanalyse, Import-/Exportanalyse, Preisanalyse, Produktionsverbrauchsanalyse und PESTLE-Analyse.

|

Segmentanalyse

Der KSA-Ersatzteilmarkt für den Aftermarket ist in acht wichtige Segmente unterteilt, basierend auf Typ, Vertriebskanal, Zertifizierungsaussichten, Antriebsart, Servicekanal, Fahrzeugalter, Fahrzeugtyp und Vertriebskanal.

- Auf der Grundlage des Typs ist der Markt in Ersatzteile und Zubehör unterteilt

Im Jahr 2024 wird das Segment Ersatzteile voraussichtlich den KSA-Ersatzteilmarkt dominieren

Im Jahr 2024 wird das Segment Ersatzteile voraussichtlich mit einem Marktanteil von 81,37 % den Markt dominieren, da mit zunehmendem Alter von Fahrzeugen und Maschinen eine steigende Nachfrage nach Ersatzteilen zur Wartung und Reparatur vorhandener Geräte besteht.

- Auf der Grundlage des Vertriebskanals ist der Markt in Großhändler und Distributoren sowie Einzelhändler unterteilt

Im Jahr 2024 wird das Segment der Großhändler und Distributoren voraussichtlich den KSA-Ersatzteilmarkt dominieren

Im Jahr 2024 wird das Segment der Großhändler und Distributoren voraussichtlich mit einem Marktanteil von 62,32 % den Markt dominieren, da es zunehmend staatliche Initiativen zur lokalen Herstellung von Autoersatzteilen gibt.

- Basierend auf den Zertifizierungsaussichten wird der Markt in Originalteile, zertifizierte Teile und nicht zertifizierte Teile segmentiert. Im Jahr 2024 wird das Segment der Originalteile voraussichtlich mit einem Marktanteil von 52,66 % den Markt dominieren.

- Der Markt ist nach Servicekanälen in DIFM (Do It for Me), DIY (Do It Yourself) und OE (Delegieren an OEMs) segmentiert. Im Jahr 2024 wird das DIFM-Segment (Do It for Me) nach Großhändlern, Distributoren und Einzelhändlern segmentiert. Es wird erwartet, dass das DIFM-Segment (Do It for Me) im Jahr 2024 mit einem Marktanteil von 70,99 % den Markt dominieren wird.

- Basierend auf dem Fahrzeugalter ist der Markt in 4 bis 8 Jahre, 0 bis 4 Jahre und über 8 Jahre segmentiert. Im Jahr 2024 wird das Segment 4 bis 8 Jahre voraussichtlich den Markt mit einem Marktanteil von 49,39 % dominieren.

- Der Markt ist nach Fahrzeugtyp in Pkw, Nutzfahrzeuge, Utility Task Vehicles (UTV) und Freizeitfahrzeuge unterteilt. Im Jahr 2024 wird das Pkw-Segment voraussichtlich mit einem Marktanteil von 65,39 % den Markt dominieren.

- Auf der Grundlage der Vertriebskanäle wird der Markt in Offline und Online segmentiert. Im Jahr 2024 wird das Offline-Segment voraussichtlich mit einem Marktanteil von 84,32 % den Markt dominieren.

- Der Markt ist nach Antriebsart in Diesel/Benzin, CNG und Elektro unterteilt. Im Jahr 2024 wird das Diesel-/Benzinsegment voraussichtlich mit einem Marktanteil von 94,83 % den Markt dominieren.

Hauptakteure

Data Bridge Market Research analysiert Michelin (Frankreich), The Goodyear Tire & Rubber Company (USA), Continental AG (Deutschland), Aptiv (Irland) und ZF Friedrichshafen AG (Deutschland) als wichtige Marktteilnehmer in diesem Markt.

Marktentwicklung

- Im April 2024 übernahm die Continental AG den Formenbauspezialisten EMT Púchov sro mit Sitz in der Slowakei. Der Reifenhersteller und die Anteilseigner von EMT, zu denen vor allem Dynamic Design (Rumänien) gehört, haben eine entsprechende Vereinbarung getroffen. Continental hat alle 107 Mitarbeiter übernommen, die alle über spezielle Kenntnisse im Formenbau verfügen. Mit der Übernahme von EMT komplettiert das Unternehmen sein internes Portfolio an Formenbautechnologien. Ab sofort kann der Reifenhersteller bei Bedarf Reifenformen für alle Anwendungen eigenständig herstellen.

- Im März 2024 wurde Aptiv von Ethisphere zum zwölften Mal in Folge als eines der wichtigsten ethischen Unternehmen ausgezeichnet. Das Unternehmen wurde für sein Engagement für geschäftliche Integrität durch solide Ethik-, Compliance- und Governance-Programme ausgezeichnet. Diese Anerkennung bekräftigt das Engagement des Unternehmens, eine Kultur der Ethik, Compliance und Governance-Exzellenz in allen Geschäftsbereichen zu fördern.

- Im März 2024 siegten Reifen der Continental AG in Tests von Automobilclubs und Fachzeitschriften. Die Automobilclubs ADAC und ACE sowie die Fachzeitschriften AutoBild, AutoBild Reisemobil, Autozeitung, auto motor und sport und sportauto waren sich einig: Der PremiumContact 7 von Continental ist klarer Sieger und führt ihre Tests und Bewertungen an. Der Erfolg des PremiumContact 7 trägt dazu bei, die Position von Continental als weltweit führender Hersteller von Premiumreifen zu stärken.

- Im März 2024 führt Goodyear die Reifen RangeMax RSA ULT und RangeMax RTD ULT für regionale Arbeitsfahrzeuge ein. Sie bieten ausgewogene Traktion, Reichweite und Laufleistung. Die Reifen sind für Elektro- und Benzin-/Dieselfahrzeuge geeignet und zeichnen sich durch einen geringen Rollwiderstand und eine nachhaltige Sojaöl-Konstruktion aus. Diese Erweiterung des „Electric Drive Ready“-Reifensortiments hilft Flotten, Betriebskosten und Umweltbelastung zu senken.

- Im Oktober 2023 bringt die Goodyear Tire & Rubber Company neue KMAX S EXTREME GEN2-Reifen für heiße Klimazonen im Nahen Osten und Afrika auf den Markt. Sie bieten bessere Laufleistung und Leistung an Lenkachsen. Die runderneuerbaren und nachschneidbaren Reifen senken Betriebskosten und Umweltbelastung, erweitern das Produktangebot von Goodyear und steigern die Wettbewerbsfähigkeit im Ersatzteilmarkt. Sie fördern zudem die Nachhaltigkeit, indem sie Flotten ermöglichen, ihre Reifenbestände zu optimieren und den ökologischen Fußabdruck zu reduzieren.

Regionale Analyse

Geografisch gesehen sind die im globalen Marktbericht für virtuelle Infrastrukturmanager abgedeckten Länder das Königreich Saudi-Arabien.

Für detailliertere Informationen zum KSA-Ersatzteilmarktbericht klicken Sie hier – https://www.databridgemarketresearch.com/reports/ksa-aftermarket-spare-parts-market