Es gibt drei Isomere des aromatischen Isocyanats Methylendiphenyldiisocyanat (MDI). Die Isocyanatgruppe ist an den Ringen 2,2'-MDI, 2,4'-MDI und 4,4'-MDI unterschiedlich angeordnet, wodurch die Isomere entstehen. Das reinste und beliebteste dieser Isomere ist 4,4'-MDI. Es findet breite Anwendung im privaten und großtechnischen Bereich. Anilin wird mit Formaldehyd zu Methylendianilin (MDA) kombiniert, das mit Phosgen zu MDI reagiert. Zur Herstellung von Polyurethan, einem wichtigen Polymer, reagiert MDI mit Polyolen.

Vollständigen Bericht abrufen @ https://www.databridgemarketresearch.com/reports/global-methylene-diphenyl-diisocyanate-mdi-market

Die wichtigsten Anwendungsgebiete von MDI sind Schäume, Beschichtungen, Elastomere, Kleb- und Dichtstoffe sowie weitere Anwendungen. Zu den wichtigsten Endverbrauchern von MDI zählen die Baubranche, die Automobilindustrie, die Schuh- und Möbelindustrie, die Haushaltsgeräteindustrie, die Textilindustrie, das Gesundheitswesen, die Elektro- und Elektronikindustrie, die Verpackungsindustrie, der Industriemaschinenbau und weitere.

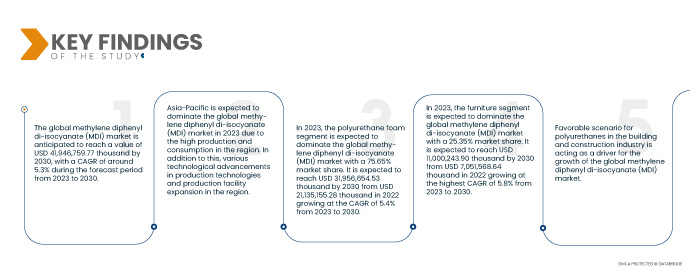

Data Bridge Market Research analysiert, dass der globale Markt für Methylendiphenyldiisocyanat (MDI) von 2023 bis 2030 voraussichtlich mit einer durchschnittlichen jährlichen Wachstumsrate von 5,3 % wachsen und bis 2030 voraussichtlich 41.946.759,77 Tausend USD erreichen wird.

Wichtigste Ergebnisse der Studie

Die zunehmende Verwendung von Polyurethanen in der Möbelindustrie dürfte das Marktwachstum vorantreiben

Polyurethan, typischerweise in Form von Weichschaum, ist eines der am häufigsten verwendeten Materialien für Möbel, Betten und Teppichunterlagen. Weichschaum verleiht Polstermöbeln zusätzliche Polsterung und erhöht so deren Stabilität, Komfort und Halt. Schaumstoff wird unter anderem für Sitzkissen, Armlehnen, Rückenlehnen und Beinstützen verwendet.

Die Hauptvorteile von MDI-basierten Weichschäumen sind ihre inhärente Härte, angenehme Haptik, schnelle Reaktivität und Aushärtung, hervorragende Dichte, schnelle Entformbarkeit, kein Durchhängen und niedriger Dampfdruck. Weichschäume auf MDI-Basis bieten eine hervorragende Blockausbeute, die für äußerst schöne Blockformen und weniger Abfall sorgt. Die verbesserte Haltbarkeit führt zu weniger Abfall, während bessere Konsumgewohnheiten die Umweltbelastung verringern. Die Schäume können wiederverwendet und zur Herstellung neuer, hochwertiger Produkte verwendet werden.

Daher können Produkte wie Matratzen, Topper, Kissen, Polstermöbel, Büromöbel und mehr aus extrem flexiblen Materialien auf Polyurethanbasis hergestellt werden. Daher ist zu erwarten, dass der zunehmende Einsatz von Polyurethan in der Bettwaren- und Möbelindustrie das Wachstum des MDI-Marktes vorantreiben wird.

Berichtsumfang und Marktsegmentierung

Berichtsmetrik

|

Details

|

Prognosezeitraum

|

2023 bis 2030

|

Basisjahr

|

2022

|

Historische Jahre

|

2021 (Anpassbar auf 2015 – 2020)

|

Quantitative Einheiten

|

Umsatz in Tausend USD und Volumen in Tonnen

|

Abgedeckte Segmente

|

Anwendung ( Polyurethanschaum , Polyurethan-Elastomere, Polyurethan-Klebstoffe und -Dichtstoffe, Polyurethan-Beschichtungen und andere), Endverbrauch (Schuhe, Möbel, Automobilindustrie, Bauwesen, Haushaltsgeräte, Textilien, Gesundheitswesen, Elektrik und Elektronik, Verpackung, Industriemaschinen und andere)

|

Abgedeckte Länder

|

USA, Kanada, Mexiko, Brasilien, Argentinien und übriges Südamerika, Deutschland, Italien, Großbritannien, Frankreich, Spanien, Polen, Türkei, Niederlande, Belgien, Schweden und übriges Europa, Japan, China, Indien, Südkorea, Australien und Neuseeland, Vietnam, Malaysia, Thailand, Indonesien, Taiwan und übriger asiatisch-pazifischer Raum, Saudi-Arabien, Vereinigte Arabische Emirate, Südafrika, Ägypten, Nigeria und übriger Naher Osten und Afrika

|

Abgedeckte Marktteilnehmer

|

BASF SE (Deutschland), SABIC (Saudi-Arabien), Wanhua (China), Covestro AG (Deutschland), DOW (USA), Tosoh Corporation (Japan), LANXESS (Deutschland), Huntsman International LLC (USA), Tokyo Chemical Industry (India) Pvt. Ltd. (Indien), KUMHO MITSUI CHEMICALS (Südkorea), Sadara (Saudi-Arabien), Karun Petrochemical Company (Iran), Henkel Polybit (eine Tochtergesellschaft der Henkel AG & Co. KGaA) (Deutschland), KURMY CORPORATIONS (Indien) und Era Polymers Pty Ltd (Australien)

|

Im Bericht behandelte Datenpunkte

|

Zusätzlich zu den Einblicken in Marktszenarien wie Marktwert, Wachstumsrate, Segmentierung, geografische Abdeckung und wichtige Akteure enthalten die von Data Bridge Market Research kuratierten Marktberichte auch ausführliche Expertenanalysen, Materialhandhabung und -lagerung, Transport sowie Vorsichtsmaßnahmen und Gefahrenidentifizierung.

|

Segmentanalyse

Der globale Markt für Methylendiphenyldiisocyanat (MDI) ist je nach Anwendung und Endverbrauch in zwei wichtige Segmente unterteilt.

- Basierend auf der Endnutzung ist der Markt in die Bereiche Schuhe, Möbel, Automobile, Bauwesen, Haushaltsgeräte, Textilien, Gesundheitswesen, Elektrik und Elektronik, Verpackung, Industriemaschinen und Sonstiges unterteilt.

Im Jahr 2023 wird das Endverbrauchssegment Möbel voraussichtlich den globalen Markt für Methylendiphenyldiisocyanat (MDI) dominieren.

Im Jahr 2023 wird das Möbelsegment voraussichtlich mit einem Marktanteil von 25,35 % den Markt dominieren, und zwar aufgrund seiner Anpassungsfähigkeit, Leichtigkeit, Erschwinglichkeit und Fähigkeit, zusätzliche Haltbarkeit und Stabilität zu bieten.

- Je nach Anwendung ist der Markt in Polyurethanschaum, Polyurethanelastomere, Polyurethanklebstoffe und -dichtstoffe, Polyurethanbeschichtungen und andere unterteilt.

Im Jahr 2023 wird das Anwendungssegment Polyurethanschaum voraussichtlich den globalen Markt für Methylendiphenyldiisocyanat (MDI) dominieren.

Im Jahr 2023 wird das Segment Polyurethanschaum voraussichtlich mit einem Marktanteil von 75,65 % den Markt dominieren, da es eine dauerhafte und schadensresistente Isolierung eines Hauses bietet, den Komfort erhöht und die Heizkosten senkt.

Hauptakteure

Data Bridge Market Research erkennt die folgenden Unternehmen als die Hauptakteure auf dem globalen Markt für Methylendiphenyldiisocyanat (MDI) an, darunter BASF SE (Deutschland), SABIC (Saudi-Arabien), Wanhua (China), Covestro AG (Deutschland), Dow (USA), Tosoh Corporation (Japan), LANXESS (Deutschland), Huntsman International LLC (USA), Tokyo Chemical Industry (India) Pvt. Ltd. (Indien), KUMHO MITSUI CHEMICALS (Südkorea), Sadara (Saudi-Arabien), Karun Petrochemical Company (Iran), Henkel Polybit (eine Tochtergesellschaft der Henkel AG & Co. KGaA) (Deutschland), KURMY CORPORATIONS (Indien) und Era Polymers Pty Ltd (Australien).

Marktentwicklungen

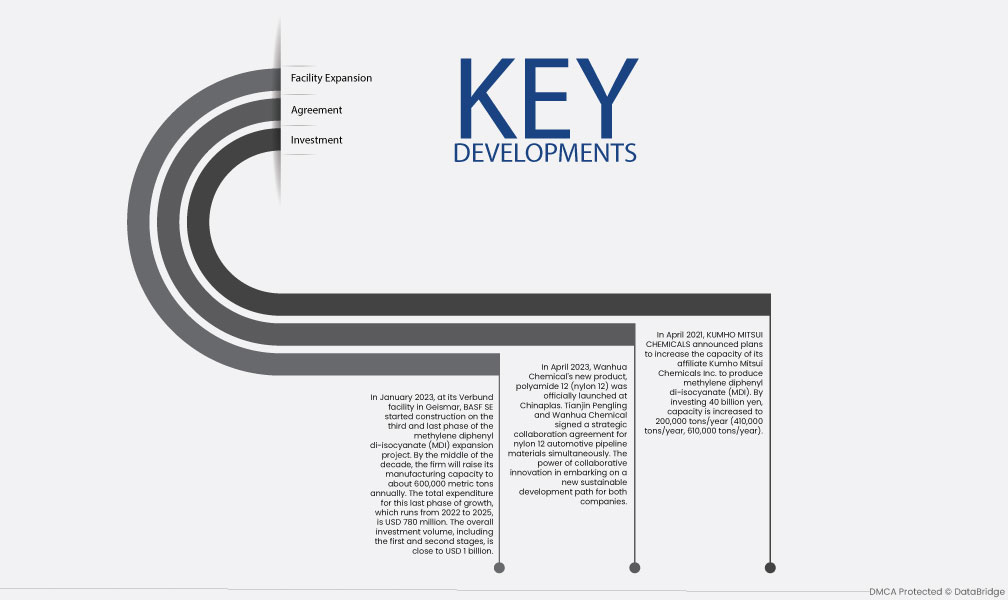

- Im April 2023 wurde das neue Polyamid 12 (Nylon 12) von Wanhua Chemical auf der Chinaplas offiziell vorgestellt. Gleichzeitig unterzeichneten Tianjin Pengling und Wanhua Chemical eine strategische Kooperationsvereinbarung für Nylon 12-Rohrleitungsmaterialien für Automobile. Die Kraft gemeinsamer Innovationen eröffnet beiden Unternehmen einen neuen, nachhaltigen Entwicklungspfad.

- Im Januar 2023 begann die BASF SE in ihrer Verbundanlage in Geismar mit dem Bau der dritten und letzten Ausbaustufe der Methylendiphenyldiisocyanat (MDI)-Produktion. Bis Mitte des Jahrzehnts wird das Unternehmen seine Produktionskapazität auf rund 600.000 Tonnen pro Jahr steigern. Die Gesamtausgaben für diese letzte Ausbaustufe, die von 2022 bis 2025 läuft, belaufen sich auf 780 Millionen US-Dollar. Das Gesamtinvestitionsvolumen, einschließlich der ersten und zweiten Ausbaustufe, liegt bei knapp einer Milliarde US-Dollar.

- Im April 2021 gab Mitsui Chemicals, Inc. heute Pläne zur Kapazitätserweiterung seiner Tochtergesellschaft Kumho Mitsui Chemicals Inc. zur Herstellung von Methylendiphenyldiisocyanat (MDI) bekannt. Durch eine Investition von 40 Milliarden Yen wird die Kapazität auf 200.000 Tonnen/Jahr (410.000 Tonnen/Jahr, 610.000 Tonnen/Jahr) erhöht.

Regionale Analyse

Geografisch betrachtet umfasst der globale Marktbericht für Methylendiphenyldiisocyanat (MDI) die USA, Kanada, Mexiko, Brasilien, Argentinien und den Rest von Südamerika, Deutschland, Italien, Großbritannien, Frankreich, Spanien, Polen, die Türkei, die Niederlande, Belgien, Schweden und den Rest von Europa, Japan, China, Indien, Südkorea, Australien und Neuseeland, Vietnam, Malaysia, Thailand, Indonesien, Taiwan und den Rest des asiatisch-pazifischen Raums, Saudi-Arabien, die Vereinigten Arabischen Emirate, Südafrika, Ägypten, Nigeria und den Rest des Nahen Ostens und Afrikas.

Laut Marktforschungsanalyse von Data Bridge:

Der asiatisch-pazifische Raum ist im Prognosezeitraum 2023–2030 die dominierende Region auf dem globalen Markt für Methylendiphenyldiisocyanat (MDI).

Im Jahr 2023 wird der asiatisch-pazifische Raum voraussichtlich den globalen Markt für Methylendiphenyldiisocyanat (MDI) dominieren, da sich die Entwicklung für Polyurethane in der Bauindustrie günstig entwickelt. Der asiatisch-pazifische Raum wird den globalen Markt für Methylendiphenyldiisocyanat (MDI) in Bezug auf Marktanteil und Umsatz weiterhin dominieren. Seine Dominanz wird im Prognosezeitraum weiter ausgebaut. Die zunehmende Verwendung von Polyurethanen in der Möbel- und Automobilindustrie in der Region steigert die Marktnachfrage zusätzlich.

Der asiatisch-pazifische Raum wird im Prognosezeitraum 2023–2030 voraussichtlich die am schnellsten wachsende Region auf dem globalen Markt für Methylendiphenyldiisocyanat (MDI) sein.

Im asiatisch-pazifischen Raum wird im Prognosezeitraum aufgrund der hohen Produktion und des hohen Verbrauchs in der Region ein Wachstum erwartet. Darüber hinaus werden in der Region verschiedene technologische Fortschritte bei der Produktionstechnologie und der Erweiterung der Produktionsanlagen erzielt.

Für detailliertere Informationen zum globalen Marktbericht für Methylendiphenyldiisocyanat (MDI) klicken Sie hier –