Das National Cancer Institute geht davon aus, dass im Jahr 2019 in den USA etwa 228.150 neue Fälle von Lungenkrebs registriert wurden. Laut der Lung Cancer Alliance ist die 5-Jahres-Überlebensrate bei Lungenkrebs von Stadium 1 (68–92 %) auf Stadium 4 (0–10 %) drastisch gesunken. Weltweit werden zahlreiche klinische Studien, Untersuchungen und Demonstrationsprojekte durchgeführt, um die Wirksamkeit von Screening-Programmen zu bewerten.

Vollständigen Bericht finden Sie unter https://www.databridgemarketresearch.com/reports/global-lung-cancer-screening-software-market

Data Bridge Market Research analysiert, dass der globale Markt für Lungenkrebs-Screening-Software , der im Jahr 2021 einen Wert von 27.846,30 Tausend USD hatte, bis 2029 voraussichtlich einen Wert von 115.027,61 Tausend USD erreichen wird, was einer durchschnittlichen jährlichen Wachstumsrate (CAGR) von 19,4 % im Prognosezeitraum 2022–2029 entspricht. Die zunehmende Prävalenz von Lungenkrebs, das gestiegene öffentliche Bewusstsein für Lungenkrebs, die Ausweitung staatlicher Initiativen und die zunehmende Anzahl von Screening-Programmen sind einige der Hauptgründe für den Bedarf an Lungenkrebs-Screening-Software im Prognosezeitraum. Darüber hinaus eröffnen Verbesserungen bei KI-basierten Lösungen sowie strategische Anstrengungen führender Marktteilnehmer neue Perspektiven im Bereich der Lungenkrebs-Screening-Software.

Steigende Zahl von Patientenscreenings dürfte das Marktwachstum ankurbeln

Es liegen zahlreiche Screening-Empfehlungen vor, die die Programmimplementierung unterstützen. Beispielsweise empfiehlt die US Preventive Services Task Force (USPSTF) eine jährliche LDCT bei Hochrisikopersonen im Alter von 55 bis 80 Jahren, die weniger als 30 Schachteln pro Jahr rauchen, sowie bei aktuellen oder ehemaligen Rauchern, die innerhalb der letzten 15 Jahre mit dem Rauchen aufgehört haben. Dies wird sich positiv auf das Marktwachstum auswirken und den Aufwärtstrend fördern.

Berichtsumfang und Marktsegmentierung

Berichtsmetrik

|

Details

|

Prognosezeitraum

|

2022 bis 2029

|

Basisjahr

|

2021

|

Historische Jahre

|

2020 (Anpassbar auf 2014–2019)

|

Quantitative Einheiten

|

Umsatz in Tausend USD, Mengen in Einheiten, Preise in USD

|

Abgedeckte Segmente

|

Bereitstellungsmodus (Cloud-basierte Lösungen, Vor-Ort-Lösungen und webbasierte Lösungen), Produkt (Radiologie-Lösung für Lungenkrebs-Screening, Patientenverwaltungssoftware für Lungenkrebs-Screening, Software zur Verwaltung von Lungenknoten, Datenerfassung und -berichterstattung, Patientenkoordination und -ablauf, computergestützte Erkennung von Lungenknoten, Pathologie und Krebsstadienbestimmung, statistische Prüfberichte, Screening-PACs, Praxisverwaltung und Prüfprotokollverfolgung), Typ (computergestütztes Screening und traditionelles Screening), Anwendung (nicht-kleinzelliges Lungenkarzinom (NSCLC) und kleinzelliges Lungenkarzinom (SCLC)), Plattform (eigenständig und integriert), Kaufmodus (institutionell und individuell), Endbenutzer (Onkologiezentren, Krankenhäuser, ambulante chirurgische Zentren und andere), Vertriebskanal (Direktausschreibung und Drittanbieter)

|

Abgedeckte Länder

|

USA, Kanada und Mexiko in Nordamerika, Deutschland, Frankreich, Großbritannien, Niederlande, Schweiz, Belgien, Russland, Italien, Spanien, Türkei, Restliches Europa in Europa, China, Japan, Indien, Südkorea, Singapur, Malaysia, Australien, Thailand, Indonesien, Philippinen, Restlicher Asien-Pazifik-Raum (APAC) im Asien-Pazifik-Raum (APAC), Saudi-Arabien, VAE, Südafrika, Ägypten, Israel, Restlicher Naher Osten und Afrika (MEA) als Teil des Nahen Ostens und Afrikas (MEA), Brasilien, Argentinien und Restliches Südamerika als Teil von Südamerika

|

Abgedeckte Marktteilnehmer

|

PenRad Technologies Inc. (USA), Volpara Health Limited (Neuseeland), Koninklijke Philips NV (Niederlande), Thynk Health (USA), Nuance Communications, Inc. (USA), Siemens Healthcare GmbH (Deutschland), MyCareWare, Inc. (USA), MagView (USA), MeVis Medical Solutions AG (Deutschland), Canon Medical Informatics, Inc. (USA), General Electric Company (USA), Epic Systems Corporation (USA), Lungview (USA), Medtronic (Irland), Coreline Soft Co., Ltd. (Südkorea), Optellum Ltd (USA), HealthMyne (USA), Oncocyte Corporation (USA), Genesystem (Südkorea), REVEALDX (USA), FUJIFILM Holdings Corporation (Japan), F. Hoffmann-La Roche Ltd (Schweiz), Median Technologies (Frankreich), AstraZeneca (Großbritannien)

|

Im Bericht behandelte Datenpunkte

|

Zusätzlich zu den Markteinblicken wie Marktwert, Wachstumsrate, Marktsegmenten, geografischer Abdeckung, Marktteilnehmern und Marktszenario enthält der vom Data Bridge Market Research-Team kuratierte Marktbericht eine eingehende Expertenanalyse, Patientenepidemiologie, Pipeline-Analyse, Preisanalyse und regulatorische Rahmenbedingungen

|

Segmentanalyse:

Der globale Markt für Lungenkrebs-Screening-Software ist in acht wichtige Segmente unterteilt, die auf Lieferart, Produkt, Typ, Anwendung, Plattform, Kaufart, Endbenutzer und Vertriebskanal basieren.

- Der Markt für Lungenkrebs-Screening-Software ist nach Bereitstellungsart in Cloud-basierte Lösungen, On-Premise-Lösungen und webbasierte Lösungen unterteilt. Im Jahr 2021 dominierte das Segment der Cloud-basierten Lösungen den Markt für Lungenkrebs-Screening-Software mit einem Marktanteil von 49,26 %. Dies ist auf die hohe Verfügbarkeit, die gestiegene Nachfrage nach Cloud-basierten Lösungen für Lungenkrebs-Screening und die Beteiligung der meisten Marktteilnehmer an der Vermarktung dieser Lösungen zurückzuführen.

- Der Markt für Lungenkrebs-Screening-Software ist produktbezogen segmentiert in: Radiologie-Lösung für Lungenkrebs-Screening, Patientenmanagement-Software für Lungenkrebs-Screening, Software für das Knotenmanagement, Datenerfassung und -berichterstattung, Patientenkoordination und -ablauf, computergestützte Lungenknotenerkennung, Pathologie und Krebsstadienbestimmung, statistische Prüfberichte, Screening-PACs, Praxismanagement und Audit-Log-Tracking. Im Jahr 2021 dominierte das Segment der Radiologie-Lösung für Lungenkrebs-Screening-Software mit einem Marktanteil von 30,47 % den Markt für Lungenkrebs-Screening-Software. Die zunehmende Zahl von Lungenkrebsfällen und veränderte Lebensstile dürften die Nachfrage nach Radiologie-Screening-Software für Lungenkrebs erhöhen.

- Der Markt für Lungenkrebs-Screening-Software ist nach Typ in computergestütztes und traditionelles Screening unterteilt. Im Jahr 2021 dominierte das Segment computergestütztes Screening den Markt für Lungenkrebs-Screening-Software mit einem Marktanteil von 70,69 % aufgrund verbesserter Diagnoseergebnisse beim Lungenkrebs-Screening.

- Der Markt für Lungenkrebs-Screening-Software ist je nach Anwendung in nicht-kleinzelligen Lungenkrebs (NSCLC) und kleinzelligen Lungenkrebs (SCLC) unterteilt. Im Jahr 2021 dominierte der nicht-kleinzellige Lungenkrebs (NSCLC) den Markt für Lungenkrebs-Screening-Software mit einem Marktanteil von 69,77 % aufgrund der hohen Prävalenz von nicht-kleinzelligen Lungenkrebsfällen.

- Der Markt für Lungenkrebs-Screening-Software wird plattformbasiert in eigenständige und integrierte Software unterteilt. Im Jahr 2021 dominierte die eigenständige Software den Markt für Lungenkrebs-Screening-Software mit einem Marktanteil von 64,64 %, da sie umfassende Berichtsfunktionen und erweiterte Funktionen mit integrierten Lösungen bietet.

- Der Markt für Lungenkrebs-Screening-Software ist nach Kaufart in individuelle und institutionelle Software segmentiert. Im Jahr 2021 dominierte das institutionelle Segment den Markt für Lungenkrebs-Screening-Software mit einem Marktanteil von 77,44 % aufgrund der hohen Nachfrage nationaler und ausländischer Institutionen nach Krebsforschung und Schulungsmöglichkeiten.

- Der Markt für Lungenkrebs-Screening-Software ist nach Endnutzern in Krankenhäuser, Onkologiezentren, ambulante Operationszentren und weitere Bereiche unterteilt. Im Jahr 2021 werden Onkologiezentren voraussichtlich mit einem Marktanteil von 64,43 % den Markt für Lungenkrebs-Screening-Software dominieren, da die hohe Anzahl an Besuchen in diesen Zentren zu einer hohen Nachfrage nach Lungenkrebs-Screening-Software führt.

Das Segment der Onkologiezentren wird das Endbenutzersegment des Marktes für Lungenkrebs-Screening-Software dominieren

Das Segment der Onkologiezentren wird sich als dominierendes Endverbrauchersegment herauskristallisieren. Dies liegt an der wachsenden Zahl von Krankenhäusern im Markt, insbesondere in Entwicklungsländern. Darüber hinaus werden das Wachstum und die Ausweitung der Forschungs- und Entwicklungsdienstleistungen auf globaler Ebene das Wachstum dieses Segments weiter fördern.

- Der Markt für Lungenkrebs-Screening-Software ist nach Vertriebskanälen in Direktausschreibungen und Drittanbieter segmentiert. Im Jahr 2021 dominierte das Direktausschreibungssegment den Markt für Lungenkrebs-Screening-Software mit einem Marktanteil von 65,24 %, da die meisten Dienstleister die Geräte direkt von den Herstellern beziehen.

Das Segment der Direktausschreibungen wird das Vertriebskanalsegment des Marktes für Lungenkrebs-Screening-Software dominieren

Das Direktausschreibungssegment wird sich mit einem Marktanteil von rund 65,00 % als dominierendes Segment im Vertriebskanal herauskristallisieren. Dies ist auf die zunehmende Zahl von Infrastrukturentwicklungsaktivitäten im Markt, insbesondere in den Entwicklungsländern, zurückzuführen. Darüber hinaus wird das Wachstum und die Expansion der Gesundheitsbranche weltweit das Wachstum dieses Segments weiter fördern.

Hauptakteure

Data Bridge Market Research erkennt die folgenden Unternehmen als die wichtigsten Marktteilnehmer an: PenRad Technologies Inc. (USA), Volpara Health Limited (Neuseeland), Koninklijke Philips NV (Niederlande), Thynk Health (USA), Nuance Communications, Inc. (USA), Siemens Healthcare GmbH (Deutschland), MyCareWare, Inc. (USA), MagView (USA), MeVis Medical Solutions AG (Deutschland), Canon Medical Informatics, Inc. (USA), General Electric Company (USA), Epic Systems Corporation (USA), Lungview (USA), Medtronic (Irland), Coreline Soft Co., Ltd. (Südkorea), Optellum Ltd (USA), HealthMyne (USA), Oncocyte Corporation (USA), Genesystem (Südkorea), REVEALDX (USA), FUJIFILM Holdings Corporation (Japan), F. Hoffmann-La Roche Ltd (Schweiz), Median Technologies (Frankreich), AstraZeneca (Großbritannien).

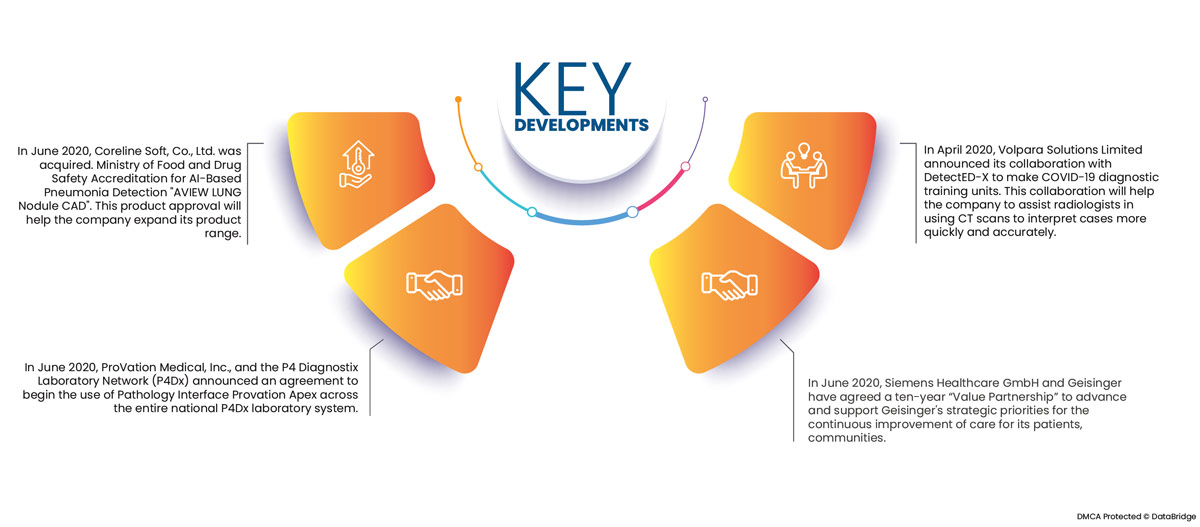

Marktentwicklung

- Im Juni 2020 erhielt Coreline Soft, Co., Ltd. vom Ministerium für Lebensmittel- und Arzneimittelsicherheit die Akkreditierung für die KI-basierte Lungenentzündungserkennung „AVIEW LUNG Nodule CAD“. Diese Produktzulassung wird dem Unternehmen helfen, seine Produktlinie zu erweitern.

- Im Juni 2020 gaben ProVation Medical, Inc. und das P4 Diagnostix Laboratory Network (P4Dx) eine Vereinbarung bekannt, die Pathologieschnittstelle Provation Apex im gesamten nationalen P4Dx-Laborsystem einzusetzen. Dies wird dem Unternehmen helfen, sein Produktangebot auf dem Markt zu erweitern.

- Im Juni 2020 vereinbarten die Siemens Healthcare GmbH und Geisinger eine zehnjährige „Value Partnership“, um die strategischen Prioritäten von Geisinger zur kontinuierlichen Verbesserung der Versorgung seiner Patienten, Gemeinden und Mitarbeiter zu entwickeln und zu unterstützen.

Regionale Analyse

Geografisch betrachtet sind dies die folgenden Länder, die im Marktbericht abgedeckt sind: USA, Kanada und Mexiko in Nordamerika, Deutschland, Frankreich, Großbritannien, Niederlande, Schweiz, Belgien, Russland, Italien, Spanien, Türkei, Restliches Europa in Europa, China, Japan, Indien, Südkorea, Singapur, Malaysia, Australien, Thailand, Indonesien, Philippinen, Restlicher Asien-Pazifik-Raum (APAC) in Asien-Pazifik (APAC), Saudi-Arabien, Vereinigte Arabische Emirate, Südafrika, Ägypten, Israel, Restlicher Naher Osten und Afrika (MEA) als Teil des Nahen Ostens und Afrikas (MEA), Brasilien, Argentinien und Restliches Südamerika als Teil von Südamerika.

Laut Marktforschungsanalyse von Data Bridge:

Nordamerika ist im Prognosezeitraum 2022 bis 2029 die dominierende Region auf dem Markt für Lungenkrebs-Screening-Software

Nordamerika dürfte den Markt dominieren und die am schnellsten wachsende Region sein. Gründe hierfür sind unter anderem die steigende Zahl von Screening-Programmen, die zunehmende Nutzung von Softwarelösungen für das Patientenmanagement, die steigende Nachfrage nach Screenings mit Thorax-Röntgenbildern und die große Zahl von Screening-Zentren.

Der asiatisch-pazifische Raum wird im Prognosezeitraum 2022–2029 voraussichtlich die am schnellsten wachsende Region im Markt für Lungenkrebs-Screening-Software sein.

Angesichts der zunehmenden Häufigkeit von Lungenkrebs und der steigenden Zahl von Studien und Forschungsarbeiten wird für den asiatisch-pazifischen Raum im Prognosezeitraum die höchste durchschnittliche jährliche Wachstumsrate (CAGR) erwartet, insbesondere für Japan, China, Südkorea und Taiwan.

Für detailliertere Informationen zum Marktbericht für Lungenkrebs-Screening-Software klicken Sie hier – https://www.databridgemarketresearch.com/reports/global-lung-cancer-screening-software-market