Regierungen weltweit erkennen die entscheidende Rolle der Lebensmittelindustrie bei der Verbesserung der Ernährungssicherheit, der Abfallreduzierung und der Wertsteigerung landwirtschaftlicher Erzeugnisse an. Daher setzen sie Maßnahmen um und stellen Mittel bereit, um das Wachstum und die Modernisierung dieses Sektors zu fördern.

In Ländern wie Indien hat die Regierung Initiativen wie das Pradhan Mantri Kisan Sampada Yojana (PMKSY) gestartet, um den Aufbau und die Modernisierung von Lebensmittelverarbeitungsanlagen finanziell zu unterstützen. Diese Initiativen zielen darauf ab, die Infrastruktur zu schaffen, die Verarbeitungskapazitäten zu verbessern und die Effizienz der Lebensmittelversorgungskette zu steigern. Solche unterstützenden Maßnahmen stimulieren die Nachfrage nach modernen Lebensmittelverarbeitungsanlagen und fördern so das Marktwachstum.

In den USA gewährt das US-Landwirtschaftsministerium (USDA) Lebensmittelverarbeitern Zuschüsse und Darlehen für die Einführung neuer Technologien und die Erweiterung ihrer Betriebe. Diese finanziellen Anreize ermutigen Unternehmen, in hochmoderne Anlagen zu investieren und fördern so die Nachfrage nach innovativen Lösungen für die Lebensmittelverarbeitung. Die Modernisierung der Lebensmittelverarbeitung steht im Einklang mit den übergeordneten Zielen: Lebensmittelsicherheit gewährleisten, Produktqualität verbessern und Betriebseffizienz steigern.

Vollständigen Bericht abrufen unter https://www.databridgemarketresearch.com/reports/global-food-processing-equipment-market

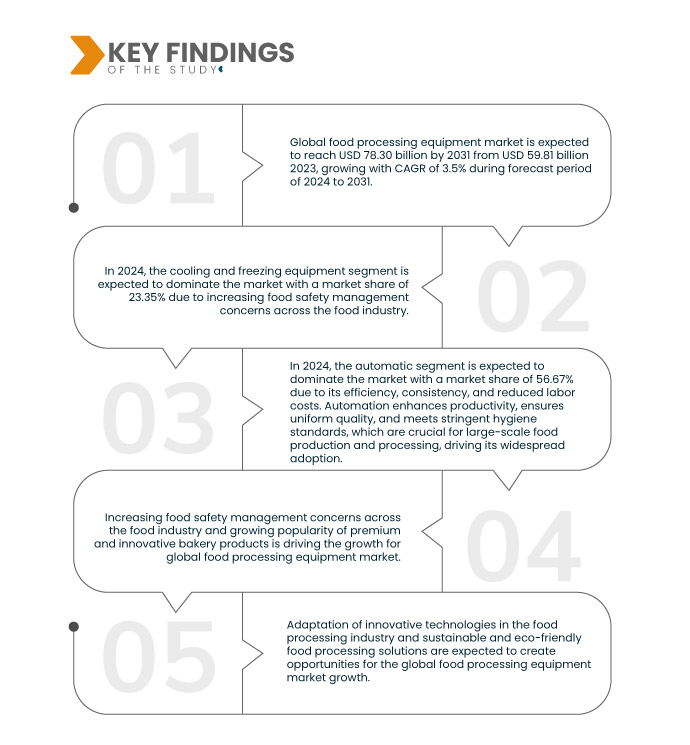

Data Bridge Market Research analysiert, dass der globale Markt für Lebensmittelverarbeitungsgeräte von 59,81 Milliarden US-Dollar im Jahr 2023 auf 78,30 Milliarden US-Dollar im Jahr 2031 anwachsen dürfte, was einem CAGR von 3,5 % im Prognosezeitraum von 2024 bis 2031 entspricht.

Wichtigste Ergebnisse der Studie

Zunehmende Bedenken hinsichtlich des Lebensmittelsicherheitsmanagements in der gesamten Lebensmittelindustrie

Das wachsende Bewusstsein für Lebensmittelsicherheit und -qualität hat zu strengen Vorschriften und Standards geführt und Lebensmittelhersteller dazu gezwungen, moderne Verarbeitungsanlagen einzusetzen. Dieser Trend wird durch die Notwendigkeit vorangetrieben, die Einhaltung von Lebensmittelsicherheitsvorschriften zu gewährleisten, die Produktkonsistenz zu gewährleisten und die Betriebseffizienz zu steigern.

Einer der Hauptfaktoren für die zunehmenden Bedenken hinsichtlich des Lebensmittelmanagements ist die gestiegene Nachfrage der Verbraucher nach sicheren und hochwertigen Lebensmitteln. Verbraucher sind sich zunehmend der potenziellen Gesundheitsrisiken durch verunreinigte Lebensmittel bewusst, was zu einer stärkeren Betonung der Lebensmittelsicherheit führt. Dies zwingt Lebensmittelverarbeiter dazu, in moderne Geräte zu investieren, die verschiedene Phasen der Lebensmittelproduktion – von der Rohstoffverarbeitung bis zur Verpackung – effektiv überwachen und kontrollieren können. Der Einsatz solcher Geräte trägt dazu bei, Kontaminationsrisiken zu minimieren, die Rückverfolgbarkeit zu gewährleisten und Hygienestandards einzuhalten.

Berichtsumfang und Marktsegmentierung

Berichtsmetrik

|

Details

|

Prognosezeitraum

|

2024 bis 2031

|

Basisjahr

|

2023

|

Historische Jahre

|

2022 (Anpassbar auf 2016–2021)

|

Quantitative Einheiten

|

Umsatz in Milliarden USD

|

Abgedeckte Segmente

|

Gerätetyp (Kühl- und Gefriergeräte, Koch- und Heizgeräte, Füll- und Versiegelungsgeräte, Mischer, Mühlen und Mahlwerke, Schneide- und Schneidemaschinen, Trocknungs- und Dehydrationsgeräte, Schäler, Separatoren und andere), Automatisierungstyp (automatisch, halbautomatisch und manuell), Branche (Fleisch, Geflügel und Meeresfrüchte, Milchprodukte, Backwaren, verarbeitetes Obst und Gemüse, Süßwaren, Getreidemühlenprodukte und andere)

|

Abgedeckte Länder

|

USA, Kanada, Mexiko, Brasilien, Argentinien, übriges Südamerika, China, Indien, Japan, Südkorea, Australien, Indonesien, Thailand, Vietnam, Philippinen, Malaysia, übriger Asien-Pazifik-Raum, Deutschland, Frankreich, Italien, Großbritannien, Niederlande, Spanien, Belgien, Schweiz, Polen, Schweden, Dänemark, übriges Europa, Südafrika, Ägypten, Vereinigte Arabische Emirate, Saudi-Arabien, Israel und übriger Naher Osten und Afrika

|

Abgedeckte Marktteilnehmer

|

JBT (USA), ALFA LAVAL (Schweden), Marel (Island), The Middleby Corporation (USA), Bühler AG (Schweiz), GEA Group Aktiengesellschaft (Deutschland), SPX FLOW (USA), Tetra Pak Group (Schweiz), Bigtem Makine AS (Türkei), TNA Australia Pty Limited (Schweiz), Schaaf Technologie GmbH (Deutschland), ANKO FOOD MACHINE CO., LTD. (Taiwan), Bettcher Industries, Inc. (USA), Baker Perkins (Großbritannien), Heat and Control, Inc. (USA), Key Technology (USA), Provisur Technologies, Inc. (USA), PROXES GMBH (Deutschland), FME Food Machinery Europe Sp. z oo (Polen) und Alto-Shaam, Inc. (USA) unter anderem

|

Im Bericht behandelte Datenpunkte

|

Neben den Einblicken in Marktszenarien wie Marktwert, Wachstumsrate, Segmentierung, geografische Abdeckung und wichtige Akteure enthalten die von Data Bridge Market Research kuratierten Marktberichte auch eingehende Expertenanalysen, geografisch dargestellte Produktion und Kapazität nach Unternehmen, Netzwerklayouts von Distributoren und Partnern, detaillierte und aktualisierte Preistrendanalysen und Defizitanalysen der Lieferkette und der Nachfrage

|

Segmentanalyse

Der globale Markt für Lebensmittelverarbeitungsgeräte ist basierend auf Gerätetyp, Automatisierungstyp und Branche in drei wichtige Segmente unterteilt.

- Auf der Grundlage des Gerätetyps ist der globale Markt für Lebensmittelverarbeitungsgeräte in Kühl- und Gefriergeräte, Koch- und Heizgeräte, Füller, Versiegelungsgeräte, Mischer, Mühlen und Mühlen, Schneide- und Schneidemaschinen, Trocknungs- und Dehydrationsgeräte, Schäler, Separatoren und andere unterteilt.

Im Jahr 2024 wird das Segment der Kühl- und Gefriergeräte voraussichtlich den globalen Markt für Lebensmittelverarbeitungsgeräte dominieren

Im Jahr 2024 wird das Segment der Kühl- und Gefriergeräte voraussichtlich den Markt mit einem Marktanteil von 23,35 % dominieren, da in der gesamten Lebensmittelindustrie zunehmende Bedenken hinsichtlich des Lebensmittelsicherheitsmanagements bestehen.

- Auf der Grundlage des Automatisierungstyps ist der globale Markt für Lebensmittelverarbeitungsgeräte in automatische, halbautomatische und manuelle unterteilt

Im Jahr 2024 wird das automatische Segment voraussichtlich den globalen Markt für Lebensmittelverarbeitungsgeräte dominieren

Im Jahr 2024 wird das Automatisierungssegment voraussichtlich mit einem Marktanteil von 56,67 % den Markt dominieren. Dies ist auf Effizienz, Konsistenz und reduzierte Arbeitskosten zurückzuführen. Automatisierung steigert die Produktivität, gewährleistet eine gleichbleibende Qualität und erfüllt strenge Hygienestandards, die für die großflächige Lebensmittelproduktion und -verarbeitung unerlässlich sind. Dies führt zu einer breiten Akzeptanz.

- Der globale Markt für Lebensmittelverarbeitungsanlagen ist branchenbezogen in Fleisch, Geflügel und Meeresfrüchte, Milchprodukte, Backwaren, verarbeitetes Obst und Gemüse, Süßwaren, Getreidemühlenprodukte und andere unterteilt. Im Jahr 2024 wird erwartet, dass Fleisch, Geflügel und Meeresfrüchte mit einem Marktanteil von 30,04 % dominieren werden.

Hauptakteure

Tetra Pak Group (Schweiz), Bühler AG (Schweiz), Marel (Island), GEA Group Aktiengesellschaft (Deutschland) und SPX FLOW (USA) sind die Hauptakteure auf dem globalen Markt für Lebensmittelverarbeitungsanlagen.

Marktentwicklungen

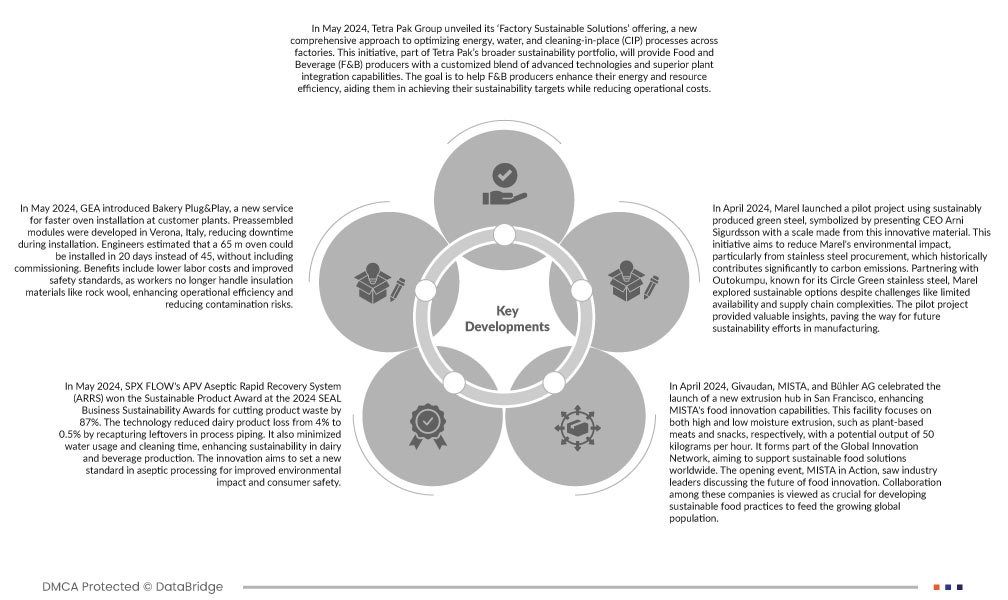

- Im Mai 2024 stellte die Tetra Pak Gruppe ihr Angebot „Factory Sustainable Solutions“ vor, einen neuen, umfassenden Ansatz zur Optimierung von Energie-, Wasser- und CIP-Prozessen in Fabriken. Diese Initiative, Teil des breiteren Nachhaltigkeitsportfolios von Tetra Pak, bietet Lebensmittel- und Getränkeherstellern (F&B) eine maßgeschneiderte Kombination aus fortschrittlichen Technologien und überlegenen Anlagenintegrationsmöglichkeiten. Ziel ist es, Lebensmittel- und Getränkeherstellern zu helfen, ihre Energie- und Ressourceneffizienz zu steigern, ihre Nachhaltigkeitsziele zu erreichen und gleichzeitig die Betriebskosten zu senken.

- Im Mai 2024 führte GEA Bakery Plug&Play ein, einen neuen Service für eine schnellere Ofeninstallation in Kundenwerken. Vormontierte Module wurden im italienischen Verona entwickelt, um die Ausfallzeiten während der Installation zu reduzieren. Ingenieure schätzten, dass ein 65 m langer Ofen in 20 statt 45 Tagen installiert werden könnte, ohne Inbetriebnahme. Zu den Vorteilen zählen niedrigere Arbeitskosten und verbesserte Sicherheitsstandards, da die Arbeiter nicht mehr mit Isoliermaterialien wie Steinwolle hantieren müssen. Dies steigert die Betriebseffizienz und reduziert das Kontaminationsrisiko.

- Im Mai 2024 gewann das APV Aseptic Rapid Recovery System (ARRS) von SPX FLOW den Sustainable Product Award bei den SEAL Business Sustainability Awards 2024 für die Reduzierung von Produktabfällen um 87 %. Die Technologie reduzierte den Verlust von Milchprodukten von 4 % auf 0,5 %, indem sie Reste in den Prozessleitungen zurückfing. Sie minimierte außerdem den Wasserverbrauch und den Reinigungsaufwand und steigerte so die Nachhaltigkeit in der Milch- und Getränkeproduktion. Die Innovation setzt einen neuen Standard in der aseptischen Verarbeitung und verbessert so die Umweltverträglichkeit und Verbrauchersicherheit.

- Im April 2024 feierten Givaudan, MISTA und die Bühler AG die Eröffnung eines neuen Extrusionszentrums in San Francisco, das MISTAs Kompetenzen im Bereich Lebensmittelinnovation stärkt. Diese Anlage konzentriert sich auf die Extrusion von Produkten mit hohem und niedrigem Feuchtigkeitsgehalt, beispielsweise für pflanzliches Fleisch und Snacks, mit einer potenziellen Produktionsleistung von 50 Kilogramm pro Stunde. Sie ist Teil des Global Innovation Network, dessen Ziel es ist, weltweit nachhaltige Lebensmittellösungen zu fördern. Bei der Eröffnungsveranstaltung „MISTA in Action“ diskutierten Branchenführer über die Zukunft der Lebensmittelinnovation. Die Zusammenarbeit dieser Unternehmen gilt als entscheidend für die Entwicklung nachhaltiger Lebensmittelpraktiken zur Ernährung der wachsenden Weltbevölkerung.

- Im April 2024 startete Marel ein Pilotprojekt mit nachhaltig produziertem grünem Stahl. Symbolisch dafür überreichte CEO Arni Sigurdsson eine Waage aus diesem innovativen Material. Ziel dieser Initiative ist es, Marels Umweltbelastung zu reduzieren, insbesondere durch die Beschaffung von Edelstahl, der historisch erheblich zu den CO2-Emissionen beiträgt. In Zusammenarbeit mit Outokumpu, bekannt für seinen Circle Green Edelstahl, erkundete Marel trotz Herausforderungen wie begrenzter Verfügbarkeit und komplexen Lieferketten nachhaltige Optionen. Das Pilotprojekt lieferte wertvolle Erkenntnisse und ebnete den Weg für zukünftige Nachhaltigkeitsbemühungen in der Fertigung.

Regionale Analyse

Auf Länderbasis ist der Markt in die USA, Kanada, Mexiko, Brasilien, Argentinien, den Rest von Südamerika, China, Indien, Japan, Südkorea, Australien, Indonesien, Thailand, Vietnam, die Philippinen, Malaysia, den Rest des asiatisch-pazifischen Raums, Deutschland, Frankreich, Italien, Großbritannien, die Niederlande, Spanien, Belgien, die Schweiz, Polen, Schweden, Dänemark, den Rest von Europa, Südafrika, Ägypten, die Vereinigten Arabischen Emirate, Saudi-Arabien, Israel und den Rest des Nahen Ostens und Afrikas unterteilt.

Laut Marktforschungsanalyse von Data Bridge:

Der asiatisch-pazifische Raum ist die am schnellsten wachsende Region und wird voraussichtlich die dominierende Region auf dem globalen Markt für Lebensmittelverarbeitungsgeräte sein.

Der asiatisch-pazifische Raum wird voraussichtlich aufgrund seiner hohen Bevölkerungszahl, der zunehmenden Urbanisierung und des steigenden Einkommensniveaus den Markt dominieren. In der Region steigt die Nachfrage nach verarbeiteten Lebensmitteln, getrieben durch veränderte Lebensstile, Ernährungsgewohnheiten, starkes Wirtschaftswachstum und erhebliche Investitionen in die Lebensmittelindustrie, die den Markt zusätzlich ankurbeln.

Für detailliertere Informationen zum globalen Marktbericht für Lebensmittelverarbeitungsgeräte klicken Sie hier: https://www.databridgemarketresearch.com/reports/global-food-processing-equipment-market