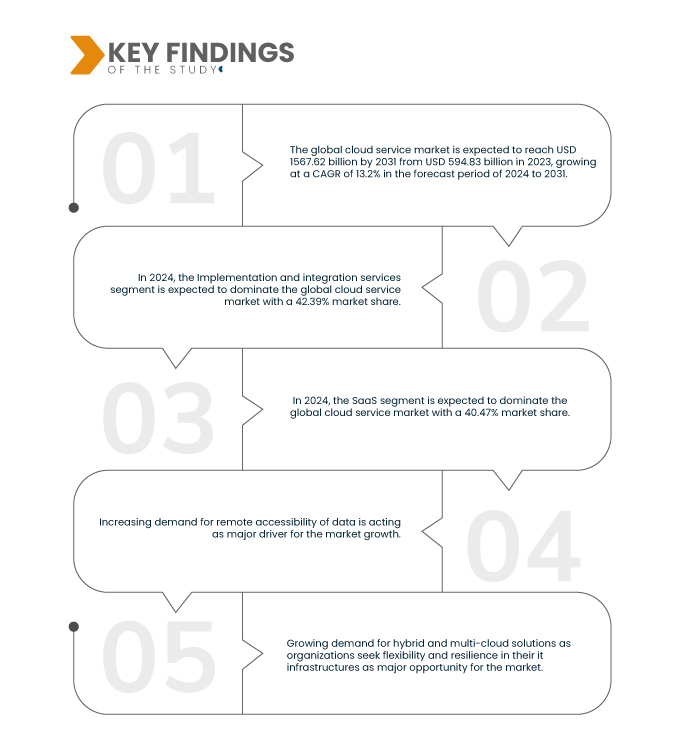

Die steigende Nachfrage nach Fernzugriff auf Daten hat zu einem starken Anstieg der Nutzung von Cloud-Diensten geführt. Diese Dienste ermöglichen Unternehmen und Privatpersonen den Zugriff auf ihre Daten und Anwendungen von überall auf der Welt und mit jedem internetfähigen Gerät. Diese Flexibilität unterstützt die Remote-Arbeit, ermöglicht die Zusammenarbeit in Echtzeit und stellt sicher, dass wichtige Informationen stets verfügbar sind. Dies steigert die Produktivität und Betriebseffizienz und reduziert gleichzeitig den Bedarf an lokaler Infrastruktur.

Die zunehmende Abhängigkeit von Remote-Datenzugriff und verbesserter Verarbeitungseffizienz spiegelt eine branchenübergreifende Digitalisierungsbewegung wider. Unternehmen setzen zunehmend auf Cloud-basierte Lösungen und fortschrittliche Technologien, um die Produktivität zu steigern, die Ressourcenallokation zu optimieren und Entscheidungsprozesse zu beschleunigen. Dieser Wandel unterstreicht die strategische Notwendigkeit, datenbasierte Erkenntnisse zeitnah und sicher von überall aus zu nutzen, um Unternehmen in die Lage zu versetzen, schnell auf Marktdynamiken und Kundenbedürfnisse zu reagieren.

Vollständigen Bericht abrufen unter https://www.databridgemarketresearch.com/reports/global-cloud-service-market

Data Bridge Market Research analysiert, dass der globale Markt für Cloud-Dienste voraussichtlich einen Wert von 1.567,62 Milliarden US-Dollar bis 2031 erreichen wird, von 594,83 Milliarden US-Dollar im Jahr 2023, und im Prognosezeitraum 2024–2031 mit einer durchschnittlichen jährlichen Wachstumsrate (CAGR) von 13,2 % wachsen wird.

Wichtigste Ergebnisse der Studie

Kosteneinsparungen durch flexible Preismodelle

Kosteneinsparungen durch flexible Preismodelle bei Cloud-Diensten werden für Unternehmen, die ihre IT-Ausgaben optimieren möchten, immer wichtiger. Durch die Nutzung von Pay-as-you-go- oder abonnementbasierten Preisstrukturen können Unternehmen ihre Kosten besser an die tatsächliche Nutzung anpassen und so Vorabinvestitionen in die Infrastruktur vermeiden. Darüber hinaus fördern flexible Preismodelle die Effizienz, da sie eine Überbereitstellung vermeiden und so die Ressourcennutzung optimieren und den ROI maximieren. Dieser strategische Ansatz fördert nicht nur die finanzielle Planbarkeit, sondern erhöht auch die operative Flexibilität und ermöglicht Unternehmen eine effizientere Ressourcenverteilung auf verschiedene Projekte und Initiativen.

Berichtsumfang und Marktsegmentierung

Berichtsmetrik

|

Details

|

Prognosezeitraum

|

2024 bis 2031

|

Basisjahr

|

2023

|

Historische Jahre

|

2022 (Anpassbar auf 2016–2021)

|

Quantitative Einheiten

|

Umsatz in Milliarden USD

|

Abgedeckte Segmente

|

Angebot (Implementierungs- und Integrationsdienste, Migrationsdienste, Verwaltungsdienste, Support- und Wartungsdienste, Schulungs- und Beratungsdienste und andere), Diensttyp (SaaS, PaaS, IaaS und andere), Cloud-Typ (Public Cloud, Hybrid Cloud und Private Cloud), Unternehmensgröße (Großunternehmen, mittlere Unternehmen und kleine Unternehmen), Anwendung (Datenspeicherung und -sicherung, Webhosting und -entwicklung, Big Data Analytics, Content Delivery Networks (CDNs) , Online-Gaming und -Streaming, Videokonferenz- und Kollaborationstools, Internet der Dinge (IoT), künstliche Intelligenz und maschinelles Lernen, Virtual Desktop Infrastructure (VDI) , Notfallwiederherstellung und Geschäftskontinuität, wissenschaftliche Forschung und Simulationen und andere), Endbenutzer (IT und Telekommunikation, Einzelhandel, BFSI, Fertigung, Gesundheitswesen, Automobilindustrie, Medien und Unterhaltung, Transport und Logistik, Regierung und Verteidigung, Bildung, Energie und Versorgung und andere)

|

Abgedeckte Länder

|

Großbritannien, Deutschland, Frankreich, Italien, Spanien, Russland, Niederlande, Schweiz, Schweden, Belgien, Dänemark, Polen, Norwegen, Türkei, Finnland, Restliches Europa, USA, Kanada, Mexiko, China, Japan, Indien, Südkorea, Australien und Neuseeland, Singapur, Malaysia, Thailand, Indonesien, Philippinen, Taiwan, Vietnam, Restlicher Asien-Pazifik-Raum, Saudi-Arabien, Südafrika, Vereinigte Arabische Emirate, Israel, Ägypten, Katar, Oman, Kuwait, Bahrain, Restlicher Naher Osten und Afrika, Brasilien, Argentinien und Restliches Südamerika

|

Abgedeckte Marktteilnehmer

|

IBM Corporation (USA), Microsoft (USA), Amazon Web Services, Inc (USA), Google LLC (USA), HP Development Company, LP (USA), Alibaba Group Holding Limited (China), SAP (Deutschland), Oracle (USA), Dell Inc. (USA), Broadcom (USA), Kyndryl Inc. (USA), Adobe (USA), Cisco Systems, Inc. (USA), Huawei Digital Power Technologies Co., Ltd. (China), Salesforce, Inc. (USA), NetApp (USA), Pure Storage, Inc (USA), Cloud Software Group, Inc (USA), Avaya LLC (USA), BMC Software, Inc. (USA), Cloud4C (Singapur), Commvault (USA), Black Box (Indien), RACKSPACE TECHNOLOGY (USA), Wolfram (USA), Cloudian Inc. (USA), Canadian Cloud Hosting (USA) und IDrive Inc. (USA) unter anderem

|

Im Bericht behandelte Datenpunkte

|

Zusätzlich zu den Markteinblicken wie Marktwert, Wachstumsrate, Marktsegmenten, geografischer Abdeckung, Marktteilnehmern und Marktszenario enthält der vom Data Bridge Market Research-Team kuratierte Marktbericht eine eingehende Expertenanalyse, Import-/Exportanalyse, Preisanalyse, Produktionsverbrauchsanalyse und PESTLE-Analyse.

|

Segmentanalyse

Der globale Markt für Cloud-Dienste ist in sechs wichtige Segmente unterteilt, die auf Angebot, Diensttyp, Cloud-Typ, Unternehmensgröße, Anwendung und Endbenutzern basieren.

- Auf der Grundlage des Angebots ist der Markt in Implementierungs- und Integrationsdienste, Migrationsdienste, Managementdienste, Support- und Wartungsdienste, Schulungs- und Beratungsdienste und andere unterteilt

Im Jahr 2024 wird das Segment Implementierungs- und Integrationsdienste voraussichtlich den globalen Cloud-Service-Markt dominieren

Im Jahr 2024 wird das Segment Implementierungs- und Integrationsdienste voraussichtlich mit einem Marktanteil von 42,39 % den globalen Cloud-Service-Markt dominieren, da es eine entscheidende Rolle dabei spielt, Unternehmen bei der effektiven Bereitstellung und Integration komplexer Technologien wie Cloud Computing, Unternehmenssoftware und Initiativen zur digitalen Transformation zu unterstützen.

- Auf der Grundlage des Servicetyps ist der globale Cloud-Service-Markt in SaaS, PaaS, IaaS und andere segmentiert.

Im Jahr 2024 wird das SaaS-Segment voraussichtlich den globalen Cloud-Service-Markt dominieren

Im Jahr 2024 wird das SaaS-Segment voraussichtlich den globalen Markt für Cloud-Dienste mit einem Marktanteil von 40,47 % dominieren, da die Nachfrage nach Telemedizin im ländlichen Raum steigt.

- Basierend auf dem Cloud-Typ ist der Markt in Public Cloud, Hybrid Cloud und Private Cloud segmentiert. Im Jahr 2024 wird das Public-Cloud-Segment voraussichtlich mit einem Marktanteil von 49,60 % den globalen Cloud-Service-Markt dominieren.

- Basierend auf der Unternehmensgröße ist der Markt in Großunternehmen, mittlere Unternehmen und kleine Unternehmen segmentiert. Im Jahr 2024 wird das Segment der Großunternehmen voraussichtlich mit einem Marktanteil von 41,54 % den globalen Cloud-Service-Markt dominieren.

- Der Markt ist nach Anwendungsbereichen segmentiert in Datenspeicherung und -sicherung, Webhosting und -entwicklung, Big Data Analytics, Content Delivery Networks (CDNs), Online-Gaming und -Streaming, Videokonferenz- und Kollaborationstools, Internet der Dinge (IoT), künstliche Intelligenz und maschinelles Lernen, Virtual Desktop Infrastructure (VDI), Disaster Recovery und Business Continuity, wissenschaftliche Forschung und Simulationen und weitere. Im Jahr 2024 wird das Segment Datenspeicherung und -sicherung voraussichtlich mit einem Marktanteil von 20,11 % den globalen Cloud-Service-Markt dominieren.

- Der Markt ist nach Endnutzern segmentiert in IT und Telekommunikation, Einzelhandel, Finanz- und Versicherungswesen, Fertigung, Gesundheitswesen, Automobilindustrie, Medien und Unterhaltung, Transport und Logistik, öffentliche Verwaltung und Verteidigung, Bildung, Energie und Versorgung und weitere. Im Jahr 2024 wird erwartet, dass das IT- und Telekommunikationssegment mit einem Marktanteil von 20,22 % den Markt dominieren wird.

Hauptakteure

Data Bridge Market Research analysiert IBM Corporation (USA), Microsoft (USA), Amazon Web Services, Inc (USA), Google LLC (USA) und HP Development Company, LP (USA) als wichtige Marktteilnehmer, die auf diesem Markt tätig sind.

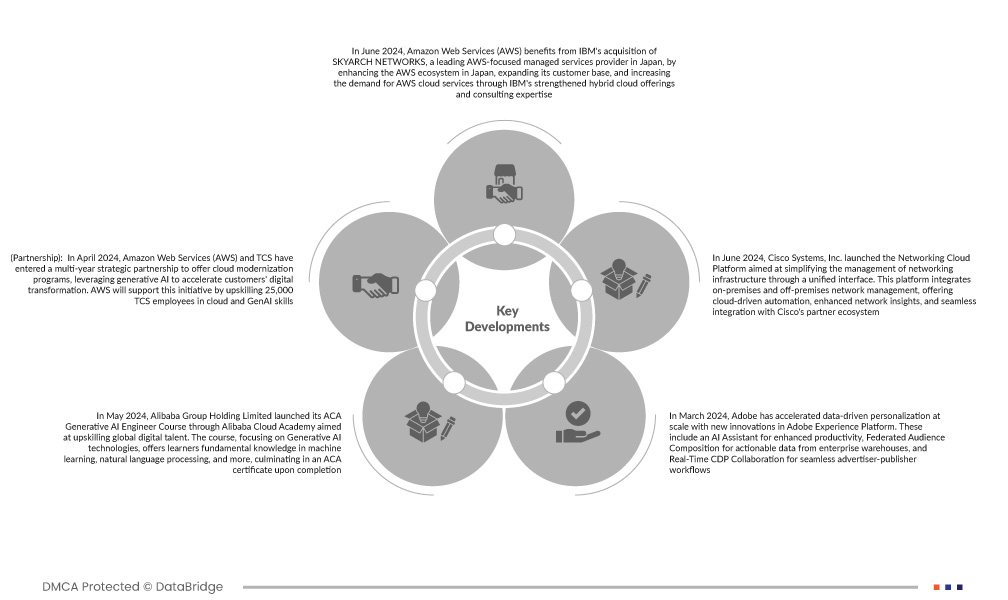

Marktentwicklung

- Im Juni 2024 profitiert Amazon Web Services (AWS) von der Übernahme von SKYARCH NETWORKS durch IBM, einem führenden AWS-fokussierten Managed-Services-Anbieter in Japan. Das Unternehmen stärkt damit das AWS-Ökosystem in Japan, erweitert seinen Kundenstamm und steigert die Nachfrage nach AWS-Cloud-Diensten durch IBMs verstärkte Hybrid-Cloud-Angebote und Beratungskompetenz.

- Im April 2024 haben Amazon Web Services (AWS) und TCS eine mehrjährige strategische Partnerschaft geschlossen, um Cloud-Modernisierungsprogramme anzubieten und generative KI zu nutzen, um die digitale Transformation der Kunden zu beschleunigen. AWS unterstützt diese Initiative durch die Weiterbildung von 25.000 TCS-Mitarbeitern in Cloud- und GenAI-Kompetenzen. Diese Entwicklung kommt AWS zugute, indem sie seine Reichweite in verschiedenen Branchen durch den globalen Kundenstamm von TCS erweitert, die Akzeptanz seiner Cloud-Dienste steigert und die Nachfrage nach seinen generativen KI- und Modernisierungslösungen erhöht.

- Im Mai 2024 startete die Alibaba Group Holding Limited ihren ACA Generative AI Engineer Course über die Alibaba Cloud Academy, um digitale Talente weltweit weiterzubilden. Der Kurs konzentriert sich auf generative KI-Technologien und vermittelt den Lernenden grundlegende Kenntnisse in maschinellem Lernen, natürlicher Sprachverarbeitung und mehr. Nach Abschluss des Kurses erhält man ein ACA-Zertifikat. Diese Initiative unterstreicht das Engagement von Alibaba Cloud für die Demokratisierung der KI-Bildung und befähigt Tausende Menschen weltweit, das transformative Potenzial von KI zu nutzen und zur digitalen Innovation beizutragen.

- Im März 2024 hat Adobe die datengesteuerte Personalisierung mit neuen Innovationen in der Adobe Experience Platform beschleunigt. Dazu gehören ein KI-Assistent für mehr Produktivität, Federated Audience Composition für verwertbare Daten aus Enterprise Warehouses und Real-Time CDP Collaboration für nahtlose Workflows zwischen Werbetreibenden und Publishern. Diese Neuerungen ermöglichen es Marken, Kundendaten zu vereinheitlichen, mithilfe von KI zu analysieren und personalisierte Erlebnisse zu bieten, die Produktivität zu steigern und die Kundenbindung zu verbessern.

- Im Juni 2024 brachte Cisco Systems, Inc. die Networking Cloud Platform auf den Markt, die die Verwaltung der Netzwerkinfrastruktur über eine einheitliche Schnittstelle vereinfachen soll. Diese Plattform integriert lokales und externes Netzwerkmanagement und bietet Cloud-basierte Automatisierung, verbesserte Netzwerkeinblicke und eine nahtlose Integration in das Cisco-Partnernetzwerk. Diese Initiative unterstreicht Ciscos Engagement, die Kundenzufriedenheit, die Mitarbeiterbindung und den Wettbewerbsvorteil durch die Optimierung des IT-Betriebs und die Bereitstellung einheitlicher Netzwerkerlebnisse zu steigern.

Regionale Analyse

Geografisch betrachtet sind dies die folgenden Länder, die im globalen Marktbericht für Cloud-Dienste abgedeckt sind: Großbritannien, Deutschland, Frankreich, Italien, Spanien, Russland, Niederlande, Schweiz, Schweden, Belgien, Dänemark, Polen, Norwegen, Türkei, Finnland, übriges Europa, USA, Kanada, Mexiko, China, Japan, Indien, Südkorea, Australien und Neuseeland, Singapur, Malaysia, Thailand, Indonesien, Philippinen, Taiwan, Vietnam, übriger asiatisch-pazifischer Raum, Saudi-Arabien, Südafrika, Vereinigte Arabische Emirate, Israel, Ägypten, Katar, Oman, Kuwait, Bahrain, übriger Naher Osten und Afrika, Brasilien, Argentinien und übriges Südamerika.

Laut Marktforschungsanalyse von Data Bridge:

Nordamerika wird voraussichtlich die Region im globalen Cloud-Service-Markt dominieren

Nordamerika dominiert den Cloud-Service-Markt aufgrund mehrerer Faktoren. Erstens ist die Region technologisch weit fortgeschritten und präsent, was die Nachfrage nach Cloud-Diensten ankurbelt. Zweitens sind viele große Cloud-Service-Anbieter wie AWS, Microsoft Azure und Google Cloud in Nordamerika ansässig, was zu seiner Dominanz beiträgt.

Der asiatisch-pazifische Raum wird voraussichtlich die am schnellsten wachsende Region im globalen Cloud-Service-Markt sein

Aufgrund der schnellen Einführung von Software-as-a-Service (SaaS) in verschiedenen Branchen dürfte der asiatisch-pazifische Raum die am schnellsten wachsende Region in diesem Markt sein.

Für detailliertere Informationen zum globalen Marktbericht für Cloud-Dienste klicken Sie hier – https://www.databridgemarketresearch.com/reports/global-cloud-service-market