Der globale Markt für weiche Innenausstattungsmaterialien für Autos verzeichnet ein starkes Wachstum, das durch den zunehmenden Fokus der Verbraucher auf Komfort und Ästhetik getrieben wird. Da Fahrzeughersteller das Fahrerlebnis verbessern möchten, steigt die Nachfrage nach hochwertigen weichen Innenausstattungsmaterialien und verändert den Fahrzeuginnenraum grundlegend.

Verbraucher legen heute bei der Fahrzeugwahl Wert auf Komfort und Stil. Dieser Trend zeigt sich in der zunehmenden Vorliebe für Soft-Touch-Materialien, die das haptische Erlebnis im Fahrzeuginnenraum verbessern. Materialien wie hochwertige Stoffe, Kunstleder und moderne Polymere tragen nicht nur zu einem optisch ansprechenden Ambiente bei, sondern bieten auch den nötigen Komfort für lange Fahrten. Diese Materialien ermöglichen es Herstellern, luxuriöse und einladende Innenräume zu schaffen, die dem Wunsch der Verbraucher nach personalisierten und hochwertigen Erlebnissen gerecht werden.

Vollständigen Bericht abrufen unter https://www.databridgemarketresearch.com/reports/global-automotive-soft-trim-interior-materials-market

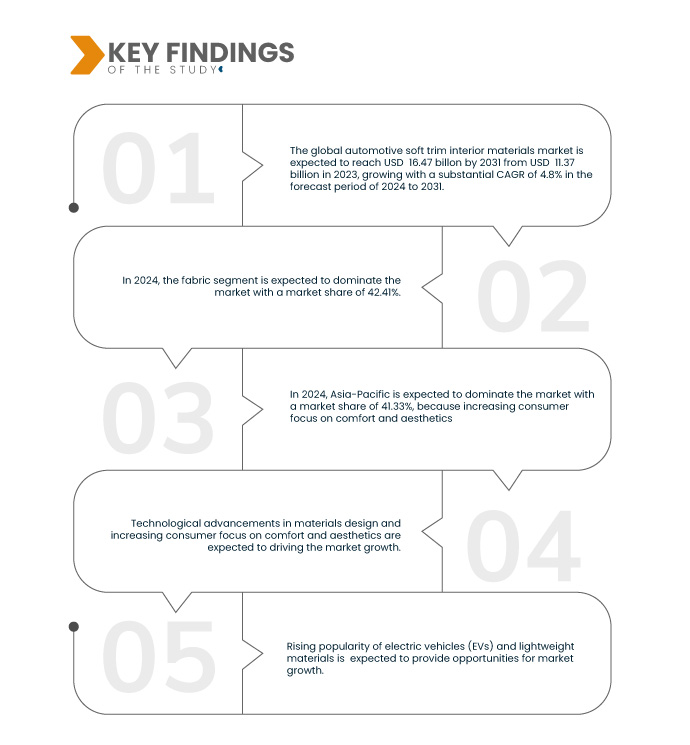

Der globale Markt für weiche Innenausstattungsmaterialien für Autos hatte im Jahr 2023 einen Wert von 11,37 Milliarden US-Dollar und soll bis 2031 16,47 Milliarden US-Dollar erreichen, was einem CAGR von 4,8 % im Prognosezeitraum von 2024 bis 2031 entspricht.

Wichtigste Ergebnisse der Studie

Schnell wachsende Automobilindustrie

Die schnell wachsende Automobilindustrie ist ein wichtiger Treiber des globalen Marktes für weiche Innenausstattungsmaterialien. Angesichts der steigenden Nachfrage nach Fahrzeugen, die durch steigende verfügbare Einkommen und Urbanisierung befeuert wird, konzentrieren sich die Hersteller zunehmend auf die Verbesserung der Qualität und Ästhetik von Fahrzeuginnenräumen. Dieser Fokus auf das Kundenerlebnis hat zu einem starken Anstieg der Verwendung hochwertiger weicher Innenausstattungsmaterialien geführt.

Der globale Automobilmarkt verzeichnet ein bemerkenswertes Wachstum, insbesondere in Schwellenländern, in denen die Zahl der Fahrzeugbesitzer steigt. Länder wie Indien, China und Brasilien erleben einen Boom bei den Automobilverkäufen, was zu einer erhöhten Nachfrage nach hochwertigen Innenausstattungen führt. Mit dem Markteintritt steigen auch die Erwartungen an Komfort, Stil und Technologie. Dies veranlasst Hersteller, in innovative Soft-Trim- Lösungen zu investieren .

Berichtsumfang und Marktsegmentierung

Berichtsmetrik

|

Details

|

Prognosezeitraum

|

2024 bis 2031

|

Basisjahr

|

2023

|

Historische Jahre

|

2022 (Anpassbar auf 2016 – 2021)

|

Quantitative Einheiten

|

Umsatz in Milliarden USD

|

Abgedeckte Segmente

|

Material (Stoff, Leder, Thermoplastische Polyurethane (TPU), Thermoplastische Elastomere , Thermoplastische Polymere (einschließlich PVC) und Thermoplastische Olefine (TPO)), Anwendung (Sitze, Cockpit und Armaturenbrett, Türverkleidung, Kofferraum, Dachhimmel, Säulenverkleidung und andere), Vertriebskanal (OEM und Aftermarket), Fahrzeugtyp (Pkw, Nutzfahrzeuge und Elektrofahrzeuge )

|

Abgedeckte Länder

|

China, Japan, Südkorea, Indien, Thailand, Malaysia, Indonesien, Vietnam, Taiwan, Philippinen, Singapur, Neuseeland, Australien, Restlicher Asien-Pazifik-Raum, Deutschland, Frankreich, Großbritannien, Italien, Spanien, Belgien, Niederlande, Russland, Polen, Schweden, Türkei, Schweiz, Dänemark, Norwegen, Finnland, Restliches Europa, USA, Kanada, Mexiko, Brasilien, Argentinien, Restliches Südamerika, Saudi-Arabien, Vereinigte Arabische Emirate, Südafrika, Ägypten, Israel, Kuwait, Katar, Oman, Bahrain, Restlicher Naher Osten und Afrika

|

Abgedeckte Marktteilnehmer

|

Pangea (USA), Recticel Engineered Foams Belgium BV (Belgien), MACAUTO INDUSTRIAL CO., LTD. (Taiwan), Mayur Uniquoters Limited (Indien), The Haartz Corporation (USA), Classic Soft Trim (USA), TS TECH CO.,LTD (Japan), Sage Automotive Interiors (USA), Antolin (Spanien), NHK SPRING Co.,Ltd (Japan), SEIREN CO., LTD. (Japan), Magna International Inc. (Kanada), TOYOTA BOSHOKU CORPORATION (Japan), FORVIA GROUP (Frankreich), Adient plc. (USA) und Lear Corp. (USA)

|

Im Bericht behandelte Datenpunkte

|

Zusätzlich zu den Einblicken in Marktszenarien wie Marktwert, Wachstumsrate, Segmentierung, geografische Abdeckung und wichtige Akteure enthalten die von Data Bridge Market Research kuratierten Marktberichte auch ausführliche Expertenanalysen, geografisch dargestellte Produktion und Kapazität nach Unternehmen, Netzwerklayouts von Distributoren und Partnern, detaillierte und aktuelle Preistrendanalysen und Defizitanalysen der Lieferkette und Nachfrage.

|

Segmentanalyse

- Auf der Grundlage des Materials ist der Markt in Stoff, Leder, thermoplastische Polyurethane (TPU), thermoplastische Elastomere, thermoplastische Polymere (einschließlich PVC) und thermoplastische Olefine (TPO) unterteilt.

Im Jahr 2024 wird das Stoffsegment voraussichtlich den globalen Markt für weiche Innenausstattungsmaterialien für Kraftfahrzeuge dominieren

Im Jahr 2024 wird das Stoffsegment voraussichtlich mit einem Marktanteil von 42,41 % den Markt dominieren, da der Verbraucher zunehmend Wert auf Komfort und Ästhetik legt.

- Auf der Grundlage der Anwendung ist der Markt in Sitze, Cockpit und Armaturenbrett , Türverkleidung, Kofferraum, Dachhimmel, Säulenverkleidung und andere segmentiert

Im Jahr 2024 wird das Segment Sitze voraussichtlich den globalen Markt für weiche Innenausstattungsmaterialien für Kraftfahrzeuge dominieren

Im Jahr 2024 wird erwartet, dass das Sitzsegment den Markt mit einem Marktanteil von 32,00 % dominieren wird, da die Automobilindustrie schnell wächst.

- Auf der Grundlage der Vertriebskanäle ist der Markt in OEM und Aftermarket segmentiert. Im Jahr 2024 wird das OEM-Segment voraussichtlich den Markt mit einem Marktanteil von 83,10 % dominieren.

- Der Markt ist nach Fahrzeugtyp in Pkw, Nutzfahrzeuge und Elektrofahrzeuge unterteilt. Im Jahr 2024 wird das Pkw-Segment voraussichtlich mit einem Marktanteil von 40,13 % den Markt dominieren.

Hauptakteure

Data Bridge Market Research analysiert Lear Corp. (USA), Adient plc. (USA), FORVIA Group (USA), TOYOTA BOSHOKU CORPORATION (Japan) und Magna International Inc. (Kanada) als wichtige Marktteilnehmer in diesem Markt.

Marktentwicklungen

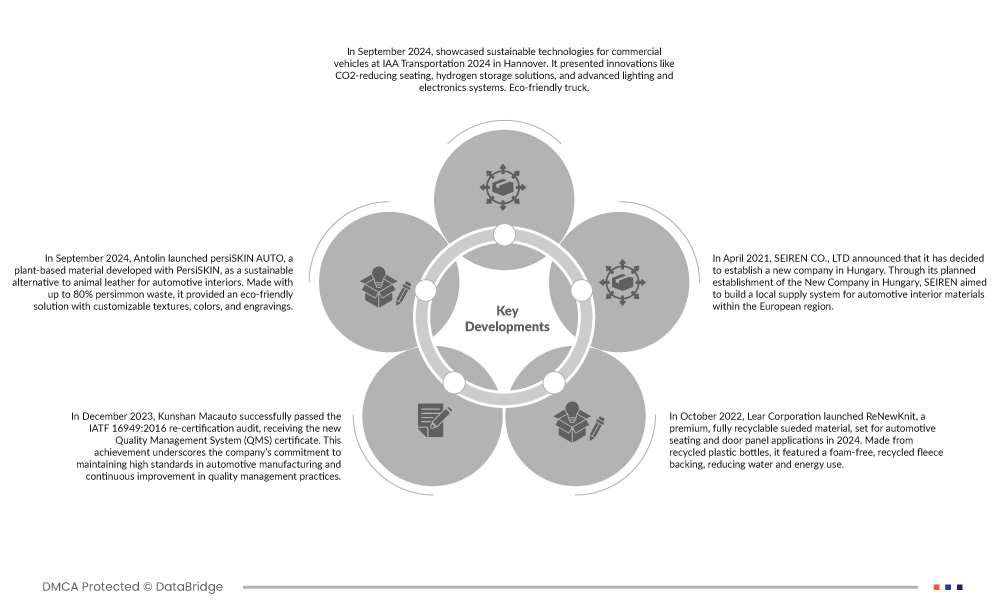

- Im September 2024 präsentierte die IAA Transportation 2024 in Hannover nachhaltige Technologien für Nutzfahrzeuge. Innovationen wie CO2-reduzierende Sitze, Wasserstoffspeicherlösungen sowie fortschrittliche Beleuchtungs- und Elektroniksysteme wurden präsentiert. Umweltfreundliche Lkw-Sitze reduzierten die Emissionen um bis zu 40 %, während neue Wasserstoffspeicher für verschiedene Fahrzeugtypen geeignet waren.

- Im September 2024 brachte Antolin persiSKIN AUTO auf den Markt, ein gemeinsam mit PersiSKIN entwickeltes pflanzliches Material als nachhaltige Alternative zu Tierleder für Fahrzeuginnenräume. Hergestellt aus bis zu 80 % Kaki-Abfällen, bot es eine umweltfreundliche Lösung mit individuell anpassbaren Texturen, Farben und Gravuren. Entwickelt, um den Chemikalien- und Wasserverbrauch zu reduzieren, zielte es darauf ab, die Innenraumverkleidung von Autos zu verändern.

- Im Dezember 2023 bestand Kunshan Macauto erfolgreich das Re-Zertifizierungsaudit nach IATF 16949:2016 und erhielt das neue Qualitätsmanagementsystem (QMS)-Zertifikat. Dieser Erfolg unterstreicht das Engagement des Unternehmens für die Einhaltung hoher Standards im Automobilbau und die kontinuierliche Verbesserung der Qualitätsmanagementpraktiken.

- Im Oktober 2022 brachte die Lear Corp. Corporation ReNewKnit auf den Markt, ein hochwertiges, vollständig recycelbares Wildledermaterial, das ab 2024 für Autositze und Türverkleidungen eingesetzt werden soll. Hergestellt aus recycelten Plastikflaschen, verfügt es über eine schaumfreie, recycelte Vliesrückseite, die den Wasser- und Energieverbrauch reduziert. Die von Guilford Performance Textiles entwickelten Materialien unterstützen die Ziele der Lear Corp. zur CO2-Reduktion und fördern eine globale Kreislaufwirtschaft.

- Im April 2021 gab SEIREN CO., LTD die Gründung eines neuen Unternehmens in Ungarn bekannt. Mit der geplanten Gründung des neuen Unternehmens in Ungarn wollte SEIREN ein lokales Versorgungssystem für Fahrzeuginnenraummaterialien in Europa aufbauen. Darüber hinaus beabsichtigte das Unternehmen, seine Produktionskapazität für Kunstleder-Autositzmaterialien, die weltweit eine steigende Nachfrage verzeichneten, zu erhöhen, um seine Wettbewerbsfähigkeit auf dem Weltmarkt zu stärken.

Regionale Analyse

Geografisch umfasst der Markt China, Japan, Südkorea, Indien, Thailand, Malaysia, Indonesien, Vietnam, Taiwan, die Philippinen, Singapur, Neuseeland, Australien, den Rest des asiatisch-pazifischen Raums, Deutschland, Frankreich, Großbritannien, Italien, Spanien, Belgien, die Niederlande, Russland, Polen, Schweden, die Türkei, die Schweiz, Dänemark, Norwegen, Finnland, den Rest Europas, die USA, Kanada, Mexiko, Brasilien, Argentinien, den Rest Südamerikas, Saudi-Arabien, die Vereinigten Arabischen Emirate, Südafrika, Ägypten, Israel, Kuwait, Katar, Oman, Bahrain sowie den Rest des Nahen Ostens und Afrikas.

Laut Marktforschungsanalyse von Data Bridge:

Der asiatisch-pazifische Raum ist die dominierende Region auf dem globalen Markt für weiche Innenausstattungsmaterialien für Autos

Der asiatisch-pazifische Raum wird voraussichtlich die dominierende und am schnellsten wachsende Region des Marktes sein, da dort vor allem in China, Japan und Indien eine hohe Fahrzeugproduktion und -nachfrage herrscht. Die kostengünstige Produktion lokaler Hersteller, die rasante Urbanisierung und steigende verfügbare Einkommen steigern die Nachfrage nach hochwertigen Innenausstattungen und treiben das Marktwachstum in dieser Region voran.

Für detailliertere Informationen zum globalen Marktbericht für weiche Innenausstattungsmaterialien für Kraftfahrzeuge klicken Sie hier – https://www.databridgemarketresearch.com/reports/global-automotive-soft-trim-interior-materials-market