Telemedizin bietet eine bequeme und leicht zugängliche Plattform für den bequemen Zugang zu psychiatrischen Leistungen von zu Hause aus. Menschen in abgelegenen oder unterversorgten Gebieten können sich ohne weite Anfahrt mit psychiatrischen Fachkräften in Verbindung setzen. Telemedizin trägt dazu bei, das Stigma zu reduzieren, das mit der Inanspruchnahme psychiatrischer Leistungen verbunden ist. Manche Menschen zögern vielleicht, eine psychiatrische Klinik persönlich aufzusuchen, doch Telemedizin ermöglicht privatere und diskretere Konsultationen.

Das wachsende Bewusstsein für psychische Gesundheitsprobleme hat zu einer erhöhten Nachfrage nach entsprechenden Dienstleistungen geführt. Telemedizin ermöglicht es Fachkräften für psychische Gesundheit, ein breiteres Publikum zu erreichen und dem steigenden Bedarf an Unterstützung gerecht zu werden. Telemedizin hilft, traditionelle Hindernisse für die psychische Gesundheitsversorgung zu überwinden, wie z. B. Transportprobleme, Zeitmangel und die Verfügbarkeit von Fachkräften für psychische Gesundheit in bestimmten geografischen Gebieten.

Vollständigen Bericht abrufen unter https://www.databridgemarketresearch.com/reports/germany-sweden-finland-and-great-britain-telemedicine-and-e-health-market

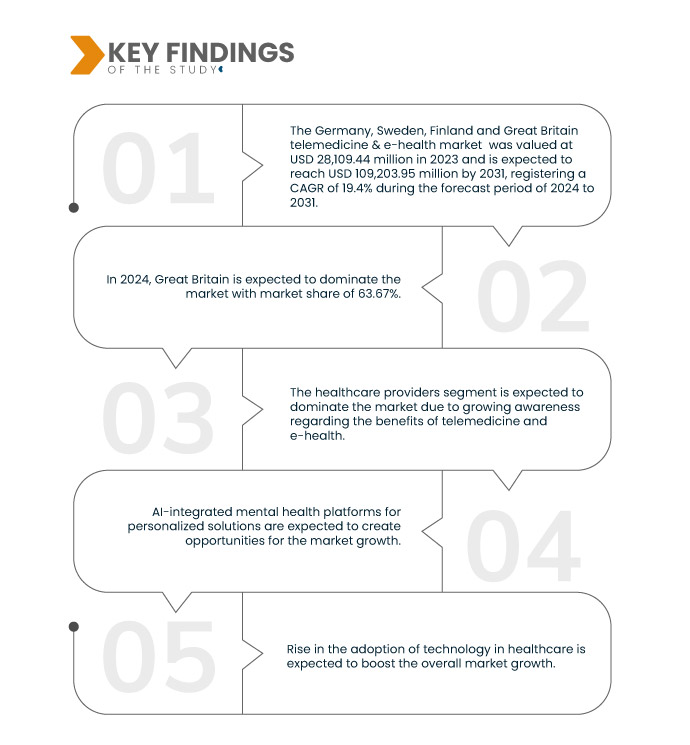

Der Markt für Telemedizin und E-Health in Deutschland, Schweden, Finnland und Großbritannien wird voraussichtlich von 28.109,44 Millionen US-Dollar im Jahr 2023 auf 109.203,95 Millionen US-Dollar im Jahr 2031 anwachsen und im Prognosezeitraum von 2024 bis 2031 eine durchschnittliche jährliche Wachstumsrate (CAGR) von 19,4 % erreichen.

Wichtigste Ergebnisse der Studie

Regierungsinitiativen zur Förderung einer fortschrittlichen Gesundheitsinfrastruktur

Regierungen weltweit erkennen das Potenzial von Telemedizin und E-Health zur Verbesserung der Zugänglichkeit und Bereitstellung von Gesundheitsversorgung. Finanzielle Investitionen und Anreize werden bereitgestellt, um die digitale Gesundheitsinfrastruktur, einschließlich Telekommunikationsnetzen, elektronischen Patientenakten (EHRs) und sicheren Datenübertragungssystemen, aufzubauen und zu verbessern. Regierungen entwickeln und überarbeiten Richtlinien, um ein unterstützendes regulatorisches Umfeld für die Einführung der Telemedizin zu schaffen. Klare Richtlinien zu Lizenzierung, Kostenerstattung und Standards helfen Anbietern und Technologieentwicklern, sich im rechtlichen Umfeld zurechtzufinden. Regulatorische Rahmenbedingungen, die die Privatsphäre der Patienten und die Datensicherheit gewährleisten, sind entscheidend für das Vertrauen in Telemedizinlösungen.

Berichtsumfang und Marktsegmentierung

Berichtsmetrik

|

Details

|

Prognosezeitraum

|

2024 bis 2031

|

Basisjahr

|

2023

|

Historische Jahre

|

2022 (Angepasst an 2016–2021)

|

Quantitative Einheiten

|

Umsatz in Millionen USD

|

Abgedeckte Segmente

|

Typ (E-Health und Telemedizin), Bereitstellungsmodus (Cloud-basiert und vor Ort), Anwendung (Fernkonsultationen, Management chronischer Krankheiten, Telemonitoring, häusliche Krankenpflege, Teletherapie und psychiatrische Dienste, Medikamentenmanagement, Telepharmaziedienste, medizinische Aus- und Weiterbildung und andere), Endbenutzer (Gesundheitsdienstleister, Gesundheitskonsumenten (Patienten), Seniorenpflegeeinrichtungen, ambulante chirurgische Zentren (ASCs), Diagnosezentren und andere)

|

Abgedeckte Länder

|

Deutschland, Schweden, Finnland und Großbritannien

|

Abgedeckte Marktteilnehmer

|

Kry International AB (Schweden), Ada Health GmbH (Deutschland), Telemedicine Clinic (Spanien), TeleClinic GmbH (Deutschland), Avi Medical GmbH (Deutschland), ORTIVUS AB (Schweden), Doktorse Nordic AB (Schweden), everon (Großbritannien), MedKitDoc (Deutschland), Nia Health GmbH (Deutschland), Medloop Ltd. (Großbritannien), Konsilmed (Deutschland), HEARTBEAT LABS GMBH (Deutschland) und arztkonsultation ak GmbH (Deutschland) unter anderem

|

Im Bericht behandelte Datenpunkte

|

Neben den Einblicken in Marktszenarien wie Marktwert, Wachstumsrate, Segmentierung, geografische Abdeckung und wichtige Akteure umfassen die von Data Bridge Market Research kuratierten Marktberichte auch eingehende Expertenanalysen, Patientenepidemiologie, Pipeline-Analysen, Preisanalysen und regulatorische Rahmenbedingungen.

|

Segmentanalyse:

Der Telemedizin- und E-Health-Markt in Deutschland, Schweden, Finnland und Großbritannien ist basierend auf Typ, Bereitstellungsmodus, Anwendung und Endbenutzer in vier wichtige Segmente unterteilt.

- Auf der Grundlage des Typs ist der Markt in E-Health und Telemedizin segmentiert

Im Jahr 2024 wird das E-Health-Segment voraussichtlich den Telemedizin- und E-Health-Markt in Deutschland, Schweden, Finnland und Großbritannien dominieren

Im Jahr 2024 wird das E-Health-Segment aufgrund von regulatorischen Änderungen, technologischen Fortschritten und Verschiebungen bei den Modellen der Gesundheitsversorgung voraussichtlich mit 75,67 % den höchsten Marktanteil haben.

- Auf der Grundlage des Bereitstellungsmodus ist der Markt in Cloud-basierte und On-Premise-Lösungen segmentiert. Im Jahr 2024 wird das Cloud-basierte Segment voraussichtlich den Markt mit einem Marktanteil von 82,59 % dominieren.

- Der Markt ist je nach Anwendung in Fernberatungen, chronisches Krankheitsmanagement, Telemonitoring, häusliche Krankenpflege, Teletherapie und psychiatrische Dienste, Medikamentenmanagement, Telepharmaziedienste, medizinische Aus- und Weiterbildung und weitere Bereiche unterteilt. Im Jahr 2024 wird das Segment der Fernberatung voraussichtlich mit einem Marktanteil von 36,27 % den Markt dominieren.

- Auf der Grundlage des Endverbrauchers ist der Markt in Gesundheitsdienstleister, Gesundheitskonsumenten (Patienten), Seniorenpflegeeinrichtungen, ambulante chirurgische Zentren (ASCs), Diagnosezentren und andere segmentiert

Im Jahr 2024 wird das Segment der Gesundheitsdienstleister voraussichtlich den Telemedizin- und E-Health-Markt in Deutschland, Schweden, Finnland und Großbritannien dominieren.

Im Jahr 2024 wird das Segment der Gesundheitsdienstleister voraussichtlich aufgrund des wachsenden Bewusstseins für die Vorteile von Telemedizin und E-Health mit einem Marktanteil von 32,32 % den Markt dominieren.

Hauptakteure

Data Bridge Market Research analysiert Kry International AB (Schweden), Ada Health GmbH (Deutschland), Telemedicine Clinic (Spanien), TeleClinic GmbH (Deutschland) und Avi Medical GmbH (Deutschland) als die wichtigsten Marktteilnehmer auf diesem Markt.

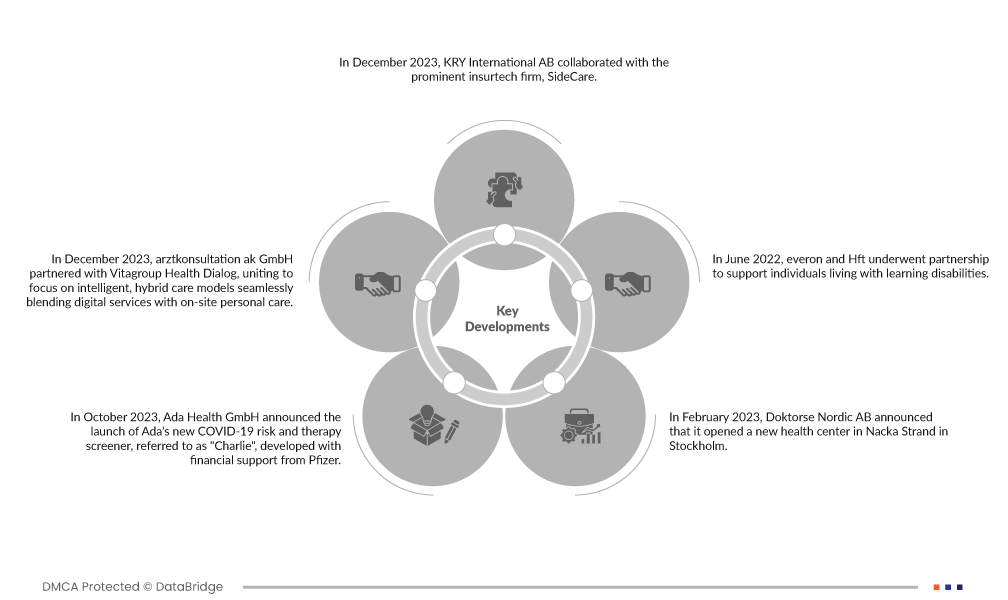

Marktentwicklungen

- Im Dezember 2023 kooperierte KRY International AB mit dem führenden französischen Insurtech-Unternehmen SideCare. Diese neue Partnerschaft beinhaltet die Integration der Telekonsultationsdienste des Unternehmens, um den Zugang zu Primärversorgung, Facharztleistungen und psychologischen Leistungen zu verbessern. Sie stärkte und erweiterte die Marktpräsenz

- Im Dezember 2023 kooperierte die arztkonsultation ak GmbH mit der Vitagroup Health Dialog. Gemeinsam konzentrieren sich die beiden Unternehmen auf intelligente, hybride Versorgungsmodelle, die digitale Services nahtlos mit persönlicher Betreuung vor Ort verbinden. Gemeinsames Ziel ist es, gesetzlichen und privaten Krankenkassen einen komfortablen digitalen Zugang zu optimaler Versorgung zu bieten. Dies stärkt und erweitert ihre Marktpräsenz.

- Im Oktober 2023 gab die Ada Health GmbH die Einführung ihres neuen COVID-19-Risiko- und Therapie-Screeners „Charlie“ bekannt, der mit finanzieller Unterstützung von Pfizer entwickelt wurde. Charlie ist ein Akronym (COVID-19 Hilfe von Ada zu Risiko sowie leitlinienbasierten, individuellen Interventionsmöglichkeiten) und steht für Adas COVID-19-Hilfe zu risiko- und leitlinienbasierten, individuellen Interventionsmöglichkeiten. Das kostenlose Online-Selbstbewertungstool soll Einzelpersonen helfen, anhand offizieller medizinischer Richtlinien festzustellen, ob bei ihnen ein erhöhtes Risiko für einen schweren COVID-19-Verlauf besteht.

- Im Februar 2023 gab Doktorse Nordic AB die Eröffnung eines neuen Gesundheitszentrums in Nacka Strand in Stockholm bekannt. Durch die neue Einrichtung stärkte das Unternehmen sein Angebot für eine besser zugängliche und qualitativ hochwertige Versorgung der Patienten in Stockholm. Im November 2022 schlossen Bio-Rad Laboratories, Inc. und NuProbe eine exklusive Lizenzvereinbarung für digitale PCR-Anwendungen. Dies wird dem Unternehmen helfen, seinen Umsatz zu steigern.

- Im Juni 2022 schlossen everon und Hft eine Partnerschaft zur Unterstützung von Menschen mit Lernbehinderungen. Die flexiblen, digitalen Lösungen von Everon unterstützen Hft, eine nationale Wohltätigkeitsorganisation, die Dienstleistungen für Menschen mit Lernbehinderungen anbietet. Dies half dem Unternehmen, seine Telemedizin-Plattform zu stärken.

Regionale Analyse

Geografisch umfasst der Bericht Deutschland, Schweden, Finnland und Großbritannien.

Für detailliertere Informationen über den Telemedizin- und E-Health-Markt in Deutschland, Schweden, Finnland und Großbritannien klicken Sie hier – https://www.databridgemarketresearch.com/reports/germany-sweden-finland-and-great-britain-telemedicine-and-e-health-market