Der europäische Markt für digitale Zahlungen ist ein dynamischer und sich schnell entwickelnder Sektor, der eine breite Palette elektronischer Zahlungsmethoden und -dienste umfasst. Dazu gehören Online-Zahlungsplattformen, mobile Geldbörsen, kontaktlose Zahlungen und traditionelle kartenbasierte Transaktionen. Mit der zunehmenden Verbreitung digitaler Zahlungslösungen in ganz Europa hat dieser Markt in den letzten Jahren ein deutliches Wachstum erlebt. Europäische Verbraucher und Unternehmen nutzen zunehmend digitale Zahlungsoptionen, was diesen Markt äußerst wettbewerbsfähig und innovativ macht. Es wird erwartet, dass sich sein Wachstumstrend fortsetzt, da Digitalisierung und Fintech-Entwicklungen die Zahlungslandschaft neu gestalten.

Vollständigen Bericht abrufen unter https://www.databridgemarketresearch.com/reports/europe-digital-payment-market

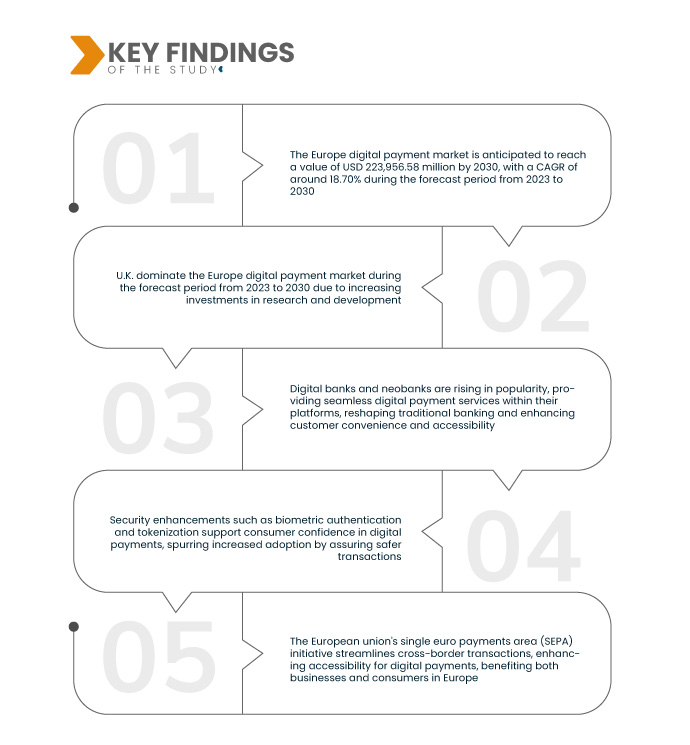

Data Bridge Market Research geht davon aus, dass der europäische Markt für digitale Zahlungen im Prognosezeitraum von 2023 bis 2030 voraussichtlich um durchschnittlich 18,70 % wachsen und von 56.827,44 Millionen US-Dollar im Jahr 2022 bis 2030 ein Volumen von 223.956,58 Millionen US-Dollar erreichen wird. Zahlreiche europäische Länder setzen sich aktiv für bargeldlose Gesellschaften ein und drängen auf die breite Einführung digitaler Zahlungen im Alltag. Diese Initiativen zielen darauf ab, den Komfort zu erhöhen, Kosten zu senken und die finanzielle Inklusion zu fördern sowie gleichzeitig sichere und effiziente elektronische Zahlungsmethoden in der gesamten Region zu fördern.

Wichtigste Ergebnisse der Studie

Es wird erwartet, dass die Expansion des E-Commerce die Wachstumsrate des Marktes vorantreibt

Der wachsende E-Commerce -Sektor ist ein wichtiger Katalysator für den Aufstieg digitaler Zahlungslösungen in Europa. Online-Shopping und die zunehmende Verbreitung von E-Commerce-Plattformen haben die Nachfrage nach digitalen Zahlungsmethoden stark ansteigen lassen. Dieser Trend vereinfacht Online-Einkäufe und bietet Verbrauchern ein bequemes und sicheres Zahlungserlebnis. Digitale Zahlungssysteme spielen daher eine entscheidende Rolle für das Wachstum und die Zugänglichkeit von E-Commerce-Transaktionen auf dem gesamten Kontinent.

Berichtsumfang und Marktsegmentierung

Berichtsmetrik

|

Details

|

Prognosezeitraum

|

2023 bis 2030

|

Basisjahr

|

2022

|

Historische Jahre

|

2021 (Anpassbar auf 2015–2020)

|

Quantitative Einheiten

|

Umsatz in Millionen USD, Mengen in Einheiten, Preise in USD

|

Abgedeckte Segmente

|

Angebot (Lösungen und Services), Bereitstellungsmodell (vor Ort, Cloud), Unternehmensgröße (Großunternehmen, kleine und mittlere Unternehmen (KMU)), Zahlungsart (Zahlungskarten, Point of Sale, Unified Payments Interface (UPI)-Dienst, mobile Zahlung, Online-Zahlung), Nutzungsart (mobile Anwendung, Desktop-/Webbrowser), Technologie (Application Programming Interface (API), Datenanalyse und maschinelles Lernen, Digital Ledger Technology (DLT), künstliche Intelligenz und Internet der Dinge, biometrische Authentifizierung), Anwendungsfall (Person (P/C), Händler/Unternehmen, Regierung), Endbenutzer (gewerblich, Verbraucher)

|

Abgedeckte Länder

|

Deutschland, Frankreich, Großbritannien, Niederlande, Schweiz, Belgien, Russland, Italien, Spanien, Türkei, Restliches Europa.

|

Abgedeckte Marktteilnehmer

|

ACI Worldwide (USA), PayPal, Inc. (USA), Novatti Group Limited (Australien), Global Payments Inc. (USA), Visa (USA), Stripe, Inc. (Irland), Google, LLC (USA), Finastra (Großbritannien), SAMSUNG (Südkorea), Amazon Web Services, Inc. (USA), Financial Software & Systems Pvt. Ltd. (USA), Aurus Inc. (USA), Adyen (Niederlande), Apple Inc. (USA), Fiserv, Inc. (USA), WEX Inc. (USA), Wirecard (USA), Mastercard (USA) und viele andere.

|

Im Bericht behandelte Datenpunkte

|

Zusätzlich zu den Markteinblicken wie Marktwert, Wachstumsrate, Marktsegmenten, geografischer Abdeckung, Marktteilnehmern und Marktszenario enthält der vom Data Bridge Market Research-Team kuratierte Marktbericht eine eingehende Expertenanalyse, Import-/Exportanalyse, Preisanalyse, Produktionsverbrauchsanalyse und PESTLE-Analyse.

|

Segmentanalyse:

Der europäische Markt für digitale Zahlungen ist nach Angebot, Bereitstellungsmodell, Unternehmensgröße, Zahlungsart, Nutzungsart, Technologie, Anwendungsfall und Endbenutzer segmentiert.

- Auf der Grundlage des Angebots ist der europäische Markt für digitale Zahlungen in Lösungen und Dienste segmentiert.

- Auf der Grundlage des Bereitstellungsmodells ist der europäische Markt für digitale Zahlungen in On-Premises und Cloud segmentiert.

- Auf der Grundlage der Unternehmensgröße ist der europäische Markt für digitale Zahlungen in große Unternehmen sowie kleine und mittlere Unternehmen (KMU) unterteilt.

- Auf der Grundlage der Zahlungsart ist der europäische Markt für digitale Zahlungen in Zahlungskarten, Point of Sale, Unified Payments Interface (UPI)-Dienste, mobile Zahlungen und Online-Zahlungen segmentiert.

- Auf der Grundlage der Nutzungsart ist der europäische Markt für digitale Zahlungen in mobile Anwendungen und Desktop-/Webbrowser segmentiert.

- Auf technologischer Grundlage ist der europäische Markt für digitale Zahlungen in Anwendungsprogrammierschnittstellen (API), Datenanalyse und maschinelles Lernen, Digital-Ledger-Technologie (DLT), künstliche Intelligenz und Internet der Dinge sowie biometrische Authentifizierung segmentiert.

- Auf der Grundlage des Anwendungsfalls ist der europäische Markt für digitale Zahlungen in Personen (P/C), Händler/Unternehmen und Regierung segmentiert.

- Auf der Grundlage des Endbenutzers ist der europäische Markt für digitale Zahlungen in gewerbliche und private Zahlungsmittel segmentiert.

Hauptakteure

Data Bridge Market Research erkennt die folgenden Unternehmen als die wichtigsten Akteure auf dem europäischen Markt für digitale Zahlungen an: ACI Worldwide (USA), PayPal, Inc. (USA), Novatti Group Limited (Australien), Global Payments Inc. (USA), Visa (USA), Stripe, Inc. (Irland), Google, LLC (USA), Finastra (Großbritannien) und SAMSUNG (Südkorea).

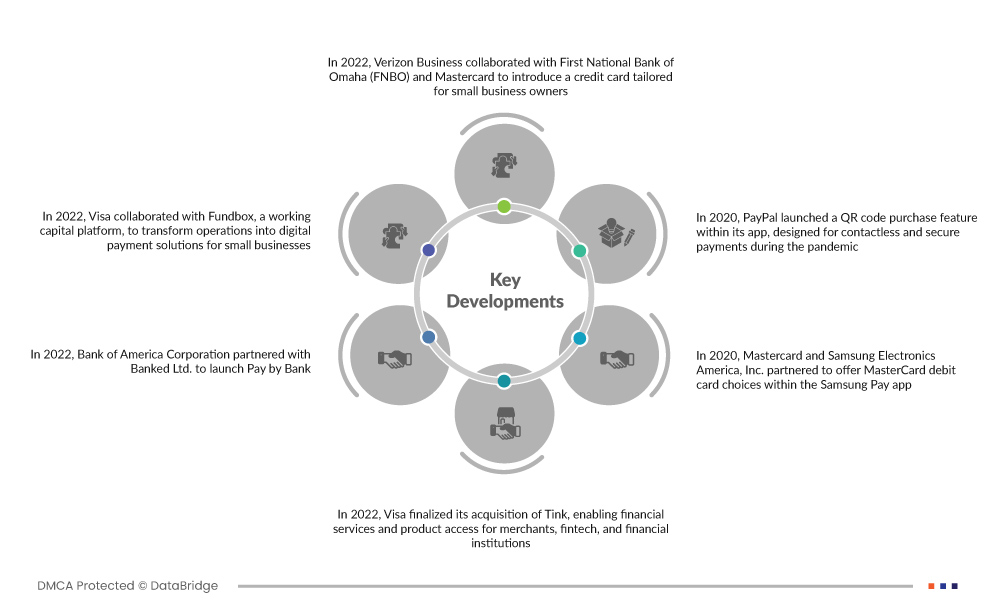

Marktentwicklungen

- Im Jahr 2022 arbeitete Verizon Business mit der First National Bank of Omaha (FNBO) und Mastercard zusammen, um eine Kreditkarte speziell für Kleinunternehmer einzuführen. Die Verizon Business Mastercard, die für Online-Kontoinhaber zugänglich ist, bietet Prämien für jeden Einkauf.

- Im Jahr 2022 arbeitete Visa mit Fundbox, einer Working-Capital-Plattform, zusammen, um Geschäftsprozesse auf digitale Zahlungslösungen für kleine Unternehmen umzustellen. Der erste Schritt war die Einführung der Fundbox Flex Visa Debit Card, herausgegeben von Pathward NA.

- Im Jahr 2022 schloss sich die Bank of America Corporation mit Banked Ltd. zusammen, um Pay by Bank einzuführen, eine Online-Zahlungslösung, die es E-Commerce-Kunden ermöglicht, direkte Zahlungen von ihren Bankkonten zu tätigen. Dieser Schritt ist Teil der laufenden Technologieinvestitionsinitiativen des Unternehmens.

- Im Jahr 2022 schloss Visa die Übernahme von Tink ab und ermöglichte damit Händlern, Fintech-Unternehmen und Finanzinstituten den Zugang zu Finanzdienstleistungen und Produkten. Tink kooperierte mit über 3.400 Banken und Millionen europäischer Bankkunden.

- Im Jahr 2020 führte PayPal eine QR-Code-Kauffunktion in seiner App ein, die kontaktloses und sicheres Bezahlen während der Pandemie ermöglichte. Diese Innovation soll die Sichtbarkeit und Marktpräsenz des Unternehmens erhöhen.

- Im Jahr 2020 haben sich Mastercard und Samsung Electronics America, Inc. zusammengeschlossen, um MasterCard-Debitkartenoptionen innerhalb der Samsung Pay-App anzubieten, wodurch ihre Kundenreichweite erweitert und bequeme Debitkartenzahlungen über die App ermöglicht wurden.

Regionale Analyse

Geografisch betrachtet sind die im europäischen Marktbericht zum digitalen Zahlungsverkehr abgedeckten Länder Deutschland, Frankreich, Großbritannien, Niederlande, Schweiz, Belgien, Russland, Italien, Spanien, Türkei und das übrige Europa.

Laut Marktforschungsanalyse von Data Bridge:

Großbritannien ist im Prognosezeitraum 2023–2030 die dominierende Region auf dem europäischen Markt für digitale Zahlungen

Großbritannien dominiert den Markt für digitale Zahlungen dank hoher Investitionen in Forschung und Entwicklung und fördert fortschrittliche Technologien. Die wachsende digitale Infrastruktur, Online-Plattformen und der Internetzugang der Region fördern die Marktexpansion. Diese Faktoren fördern synergetisch Innovation und Komfort und machen Großbritannien zu einem wichtigen Akteur im digitalen Zahlungswesen.

Für detailliertere Informationen zum europäischen Marktbericht für digitale Zahlungen klicken Sie hier – https://www.databridgemarketresearch.com/reports/europe-digital-payment-market