Lithium-Ionen-Akkus sind wiederaufladbare Energiespeicher, die für ihre hohe Energiedichte und Langlebigkeit bekannt sind. Sie bestehen aus Lithium-Ionen-Zellen und funktionieren nach dem Prinzip, dass sich Lithium-Ionen beim Entladen von der negativen Elektrode (Anode) zur positiven Elektrode (Kathode) bewegen und beim Laden umgekehrt. Dieser Mechanismus ermöglicht eine effiziente Energieübertragung und -speicherung, wodurch Lithium-Ionen-Akkus in verschiedenen Anwendungen unverzichtbar sind, von der Unterhaltungselektronik bis hin zu elektrische Fahrzeugeund Speichersysteme für erneuerbare Energien.

Zugriff auf den vollständigen Bericht @https://www.databridgemarketresearch.com/reports/asia-pacific-europe-south-america-and-middle-east-and-africa-lithium-ion-battery-market

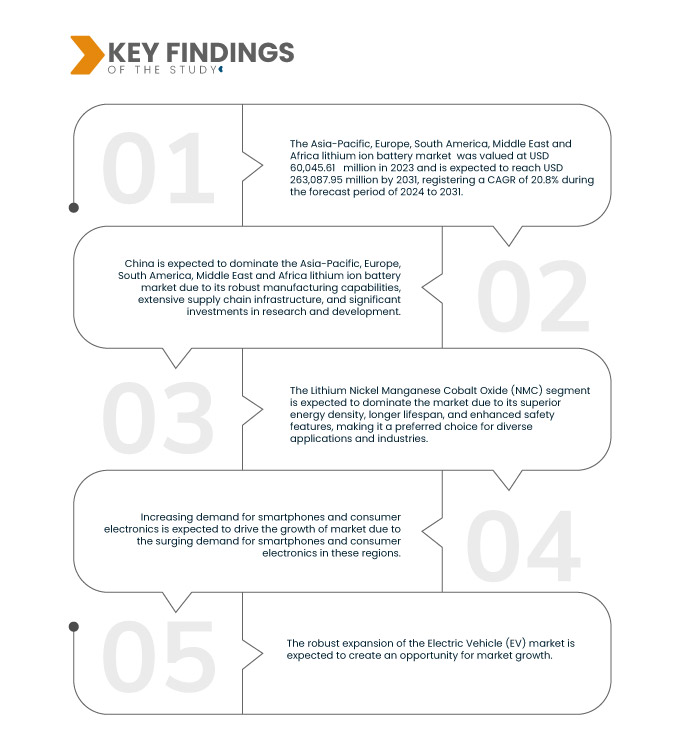

Data Bridge Market Research analysiert, dass die Markt für Lithium-Ionen-Batterien im asiatisch-pazifischen Raum, in Europa, Südamerika, dem Nahen Osten und Afrika wird voraussichtlich bis 2031 263,09 Milliarden USD erreichen, und der Markt wird im Jahr 2023 60,05 Milliarden USD groß sein und im Prognosezeitraum von 2024 bis 2031 mit einer durchschnittlichen jährlichen Wachstumsrate von 20,8 % wachsen.

Wichtigste Ergebnisse der Studie

Zunehmende Nutzung kabelloser Elektrowerkzeuge

Akku-Elektrowerkzeuge werden kabelgebundenen und elektrischen Werkzeugen vorgezogen, da sie kompakt und leicht sind. Sie bieten die Flexibilität, an jedem Standort ohne Stromversorgung eingesetzt werden zu können, und können problemlos überallhin mitgenommen werden. Bei kabelgebundenen Elektrowerkzeugen ist die Reichweite aufgrund der begrenzten Kabellänge begrenzt.

Hersteller von kabellosen Elektrowerkzeugen arbeiten kontinuierlich an Innovationen, um die Leistung und Effizienz ihrer Produkte zu verbessern, was sich direkt auf die Nachfrage nach Lithium-Ionen-Akkus auswirkt. Diese Akkus ermöglichen Elektrowerkzeugen eine konstante Leistungsabgabe, was zu einer verbesserten Produktivität und Benutzerfreundlichkeit führt. Darüber hinaus treiben Fortschritte in der Lithium-Ionen-Akkutechnologie, wie höhere Energiedichten und verbesserte Sicherheitsfunktionen, die Verbreitung von kabellosen Elektrowerkzeugen in allen Branchen weiter voran. Infolgedessen verzeichnet der Markt ein robustes Wachstum, das zum Teil durch den wachsenden Markt für kabellose Elektrowerkzeuge angetrieben wird, der das Marktwachstum vorantreibt.

Berichtsumfang und Marktsegmentierung

|

Berichtsmetrik

|

Einzelheiten

|

|

Prognosezeitraum

|

2024 bis 2031

|

|

Basisjahr

|

2023

|

|

Historische Jahre

|

2022 (anpassbar auf 2016–2021)

|

|

Quantitative Einheiten

|

Umsatz in Mrd. USD, Volumen in GWh

|

|

Abgedeckte Segmente

|

Typ (Lithium-Nickel-Mangan-Kobaltoxid (Li-NMC), Lithium-Eisenphosphat (LFP), Lithium-Kobaltoxid, Lithium-Nickel-Kobalt-Aluminiumoxid (NCA) und Lithium-Manganoxid, Lithiumtitanat), Komponente (Kathode, Anode, Elektrolyt, Separator und andere), Produkt (Zellen, Speichersystem (ESS), Modul und Pack), Ladung (wiederaufladbar und nicht wiederaufladbar), Endverbrauch (Automobil, Unterhaltungselektronik, Energie, Industrie, Bauwesen, Telekommunikation, Medizin, Luft- und Raumfahrt & Verteidigung und Marine und andere)

|

|

Abgedeckte Länder

|

China, Japan, Südkorea, Indien, Australien, Singapur, Thailand, Malaysia, Indonesien, Philippinen, Vietnam, Bangladesch, Myanmar und Rest des asiatisch-pazifischen Raums, Deutschland, Großbritannien, Frankreich, Italien, Russland, Spanien, Türkei, Belgien, Ungarn, Serbien, Restliches Europa, Brasilien, Argentinien, Chile, Bolivien, Restliches Südamerika, Saudi-Arabien, Vereinigte Arabische Emirate, Israel, Südafrika, Ägypten, Nigeria, Marokko, Äthiopien, Kenia, Ghana, Namibia und Rest des Nahen Ostens und Afrikas

|

|

Abgedeckte Marktteilnehmer

|

Contemporary Amperex Technology Co., Limited (China), LG Chem. (Südkorea), SAMSUNG SDI CO., LTD. (Südkorea), BYD Motors Inc. (China), Saft (Frankreich), Panasonic Industry Co., Ltd. (Japan), CALB (China), VARTA AG. (Deutschland), CBAK Energy Technology, Inc. (China), TOSHIBA CORPORATION (Japan), GlobTek, Inc. (USA), Wanxiang A123 Systems Corp. (China), XALT Energy (USA), LITHIUMWERKS (Niederlande), Leclanché SA (Schweiz), Amperex Technology Limited (China), Shenzhen A&S Power Technology Co., Ltd. (China), Tianjin Lishen Battery Co., Ltd. (China), Shenzhen BAK Technology Co., Ltd. (China) und Lithium Energy Japan (Japan) unter anderem

|

|

Im Bericht behandelte Datenpunkte

|

Zusätzlich zu den Einblicken in Marktszenarien wie Marktwert, Wachstumsrate, Segmentierung, geografische Abdeckung und wichtige Akteure enthalten die von Data Bridge Market Research zusammengestellten Marktberichte auch ausführliche Expertenanalysen, geografisch dargestellte Produktion und Kapazität nach Unternehmen, Netzwerklayouts von Distributoren und Partnern, detaillierte und aktuelle Preistrendanalysen und Defizitanalysen von Lieferkette und Nachfrage.

|

Segmentanalyse

Der Markt für Lithium-Ionen-Batterien im asiatisch-pazifischen Raum, in Europa, Südamerika, dem Nahen Osten und Afrika ist basierend auf Typ, Komponente, Produkt, Ladung und Endverwendung in fünf wichtige Segmente unterteilt.

- Auf der Grundlage des Typs ist der Markt in Lithium-Nickel-Mangan-Kobaltoxid (Li-NMC), Lithium-Eisenphosphat (LFP), Lithium-Kobaltoxid, Lithium-Nickel-Kobalt-Aluminiumoxid (NCA), Lithium-Manganoxid und Lithiumtitanat segmentiert.

Im Jahr 2024 wird das Segment Lithium-Nickel-Mangan-Kobaltoxid (Li-NMC) voraussichtlich den Markt für Lithium-Ionen-Batterien im asiatisch-pazifischen Raum, in Europa, Südamerika, dem Nahen Osten und Afrika dominieren.

Im Jahr 2024 wird das Segment Lithium-Nickel-Mangan-Kobaltoxid (Li-NMC) voraussichtlich mit einem Marktanteil von 45,63 % den Markt dominieren, da es über eine höhere Energiedichte, längere Lebensdauer und verbesserte Sicherheitsfunktionen verfügt und somit für verschiedene Anwendungen und Branchen die bevorzugte Wahl ist.

- Auf der Grundlage der Komponenten ist der Markt in Kathode, Anode, Elektrolyt, Separator und andere unterteilt

Im Jahr 2024 wird die Kathode Segment wird voraussichtlich den Markt für Lithium-Ionen-Batterien im asiatisch-pazifischen Raum, in Europa, Südamerika, dem Nahen Osten und Afrika dominieren

Im Jahr 2024 wird das Kathodensegment voraussichtlich den Markt mit einem Marktanteil von 47,36 % dominieren, was auf Fortschritte bei Kathodenmaterialien zurückzuführen ist, insbesondere bei solchen mit nickelreichen Formulierungen. Diese Materialien bieten eine höhere Energiedichte, verbesserte Stabilität und Kosteneffizienz, was zu ihrer weit verbreiteten Verwendung in Lithium-Ionen-Batterien für verschiedene Anwendungen, darunter Elektrofahrzeuge und Energiespeichersysteme, führt.

- Auf der Grundlage des Produkts ist der Markt in Zellen, Speichersysteme (ESS), Module und Pakete unterteilt. Im Jahr 2024 wird das Zellensegment voraussichtlich mit einem Marktanteil von 48,89 % den Markt dominieren.

- Auf der Grundlage der Gebühr wird der Markt in wiederaufladbare und nicht wiederaufladbare unterteilt. Im Jahr 2024 wird das wiederaufladbare Segment voraussichtlich den Markt mit einem Marktanteil von 76,97 % dominieren

- Auf der Grundlage der Endnutzung ist der Markt in Automobil, Unterhaltungselektronik, Energie, Industrie, Bauwesen, Telekommunikation, Medizin, Luft- und Raumfahrt und Verteidigung, Marine und andere unterteilt. Im Jahr 2024 wird das Automobilsegment voraussichtlich den Markt mit einem Marktanteil von 45,89 % dominieren.

Hauptakteure

Data Bridge Market Research analysiert Contemporary Amperex Technology Co., Limited (China), LG Chem. (Südkorea), SAMSUNG SDI CO., LTD. (Südkorea), BYD Motors Inc. (China) und Saft (Frankreich) als Marktteilnehmer auf dem Markt für Lithium-Ionen-Batterien im asiatisch-pazifischen Raum, in Europa, Südamerika, dem Nahen Osten und Afrika.

Marktentwicklungen

- Im Januar 2024 festigt LG Chem seine Führungsposition in der Batterietechnologie der nächsten Generation durch eine Investition in Sion Power, ein Startup, das Pionierarbeit in der Lithium-Metall-Batterietechnologie leistet. Dieser Schritt unterstreicht LGs Engagement für offene Innovation und die Zusammenarbeit mit kompetenten Partnern, um technologische Hürden zu überwinden. Die Kapitalbeteiligung stellt einen strategischen Schritt nach vorn dar, um die Effizienz von Lithium-Metall-Batterien zu steigern, Herausforderungen wie die Dendritenbildung anzugehen und eine neue Ära in der Batterietechnologie einzuläuten.

- Im April 2023 haben sich Amperex Technology Limited und AM Batteries zusammengeschlossen, um eine lösungsmittelfreie Elektrodenherstellungstechnologie für Lithium-Ionen-Batterien zu entwickeln, mit dem Ziel, Umweltbedenken und Kostenprobleme anzugehen. Die elektrostatische Sprühtechnik von Amperex Technology Limited, die giftige Lösungsmittel eliminiert, reduziert Betriebskosten und CO2-Emissionen. Diese Partnerschaft verbessert die Nachhaltigkeit in der Batterieproduktion, deckt die steigende Nachfrage nach Lithium-Ionen-Batterien und reduziert gleichzeitig die Umweltbelastung.

- Im Oktober 2023 stellte CALB auf der RE+ 2023 eine bahnbrechende Weiterentwicklung vor: die weltweit erste 314 Ah starke, hochenergetische und langlebige Batteriezelle mit über 15.000 Zyklen. Diese Innovation mit verbesserter Lithium-Nachfülltechnologie erhöht die Zyklenlebensdauer und nutzbare Kapazität im Vergleich zu Vorgängermodellen um 12 % und erreicht eine beeindruckende Energieumwandlungseffizienz von 96 %. Diese Entwicklung stärkt die Position des Unternehmens als Branchenführer und bietet wirtschaftliche und effiziente Energiespeicherlösungen für verschiedene kommerzielle Anwendungen.

- Im Oktober 2021 gründeten SAMSUNG SDI CO., LTD. und Stellantis ein Joint Venture zur Produktion von Lithium-Ionen-Batterien in Nordamerika und im Nahen Osten. Dieses Unternehmen umfasst verschiedene Produktionsanlagen und Forschungszentren für Lithium-Ionen-Batterien. Diese Entwicklung wirkte sich positiv auf das Unternehmen sowie auf das Wachstum des Marktes für Lithium-Ionen-Batterien aus.

- Im Januar 2023 gab Contemporary Amperex Technology Co., Limited eine strategische Partnerschaft mit NIO bekannt. Diese Partnerschaft der beiden Unternehmen ermöglichte eine fortschrittliche technologische Zusammenarbeit bei neuen Marken, neuen Projekten und neuen Märkten, verbesserte die Koordination von Angebot und Nachfrage, trieb die Expansion ins Ausland voran und entwickelte ein Geschäftsmodell mit Schwerpunkt auf Batterien mit langer Lebensdauer.

Regionale Analyse

Geografisch sind die folgenden Länder im Marktbericht für Lithium-Ionen-Batterien im asiatisch-pazifischen Raum, in Europa, Südamerika, dem Nahen Osten und Afrika abgedeckt: China, Japan, Südkorea, Indien, Australien, Singapur, Thailand, Malaysia, Indonesien, die Philippinen, Vietnam, Bangladesch, Myanmar und der Rest des asiatisch-pazifischen Raums, Deutschland, Großbritannien, Frankreich, Italien, Russland, Spanien, die Türkei, Belgien, Ungarn, Serbien, das restliche Europa, Brasilien, Argentinien, Chile, Bolivien, das restliche Südamerika, Saudi-Arabien, die Vereinigten Arabischen Emirate, Israel, Südafrika, Ägypten, Nigeria, Marokko, Äthiopien, Kenia, Ghana, Namibia sowie der Rest des Nahen Ostens und Afrikas.

Laut Marktforschungsanalyse von Data Bridge:

China gilt als das dominierende und am schnellsten wachsende Land im Markt für Lithium-Ionen-Batterien im asiatisch-pazifischen Raum, in Europa, Südamerika, dem Nahen Osten und Afrika.

Aufgrund seiner robusten Fertigungskapazitäten, seiner umfangreichen Lieferketteninfrastruktur und erheblichen Investitionen in Forschung und Entwicklung wird China voraussichtlich den Markt dominieren. Der strategische Fokus des Landes darauf, führend bei sauberen Energietechnologien zu werden, positioniert es als Schlüsselspieler und verschafft ihm einen Wettbewerbsvorteil in der globalen Lithium-Ionen-Batterieindustrie. China wird voraussichtlich das am schnellsten wachsende Land sein, da sich China zu einem globalen Produktionszentrum für Lithium-Ionen-Batterien entwickelt hat und den asiatisch-pazifischen Markt dominiert. Die umfangreichen Fertigungskapazitäten und die Lieferketteninfrastruktur des Landes tragen erheblich zu seinem Wachstum bei.

Für detailliertere Informationen zum Marktbericht für Lithium-Ionen-Batterien im asiatisch-pazifischen Raum, in Europa, Südamerika, dem Nahen Osten und Afrika klicken Sie hier –https://www.databridgemarketresearch.com/reports/asia-pacific-europe-south-america-and-middle-east-and-africa-lithium-ion-battery-market