Der Markt für Videomesssysteme der ASEAN-Region bezieht sich auf die gesamte Landschaft innerhalb der Region Association of Southeast Asian Nations (ASEAN), die Nachfrage, Angebot und Handel von Videomesssystemen umfasst. Er umfasst die Bereitstellung, den Verkauf und die Einführung dieser Systeme in verschiedenen Branchen wie Fertigung, Automobilindustrie, Luft- und Raumfahrt, Elektronik, Gesundheitswesen sowie Forschungs- und Entwicklungseinrichtungen in den ASEAN-Mitgliedsländern, darunter Brunei, Kambodscha, Indonesien, Laos, Malaysia, Myanmar, die Philippinen, Singapur, Thailand und Vietnam. Dieser Markt umfasst die Herstellung, den Vertrieb und die Verwendung fortschrittlicher Videomesstechnologien für Präzision, Genauigkeit, Qualitätsprüfung und Inspektionszwecke in verschiedenen Industriezweigen innerhalb der ASEAN-Wirtschaftsregion.

Zugriff auf den vollständigen Bericht @https://www.databridgemarketresearch.com/reports/asean-video-measuring-system-market

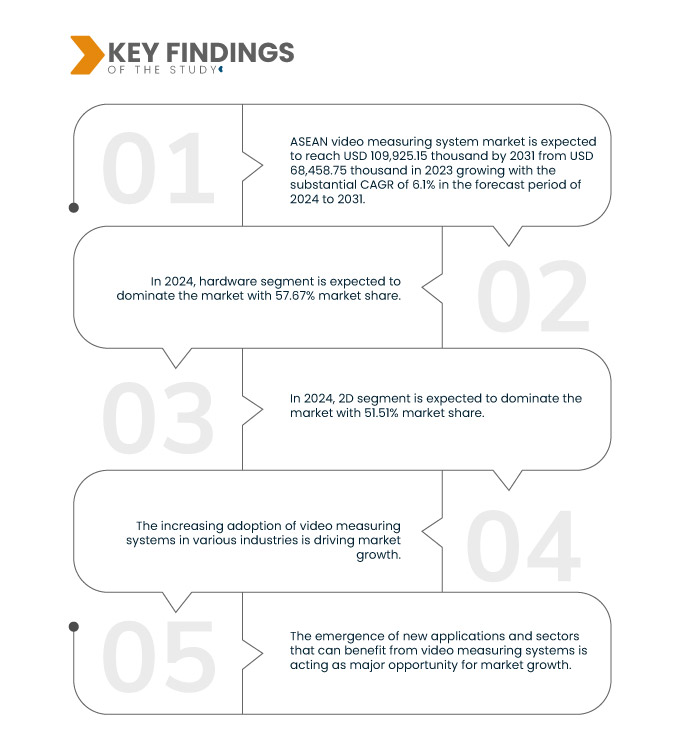

Data Bridge Market Research analysiert, dass die Markt für Videomesssysteme in den ASEAN-Staaten wird voraussichtlich von 68.458,75.000 USD im Jahr 2023 auf 109.925,15.000 USD im Jahr 2031 ansteigen und im Prognosezeitraum von 2024 bis 2031 mit einer beträchtlichen CAGR von 6,1 % wachsen. Der zunehmende Einsatz von Videomesssystemen in verschiedenen Branchen und der steigende Bedarf an genauen und präzisen Messungen komplexer und komplizierter Teile und Komponenten tragen zum Wachstum des Marktes für Videomesssysteme in den ASEAN-Staaten bei.

Wichtigste Ergebnisse der Studie

Zunehmender Einsatz von Videomesssystemen in verschiedenen Branchen

Branchen von der Automobil- und Luftfahrtindustrie bis hin zur Elektronik- und Medizinbranche setzen im ständigen Streben nach Genauigkeit und Spitzenleistung für ihre Qualitätskontroll-, Inspektions- und Testanforderungen zunehmend auf fortschrittliche Technologien. Der transformative Wandel hin zu Videomesssystemen hat sich als unverzichtbares Instrument erwiesen, das beispiellose Genauigkeit, Geschwindigkeit und Vielseitigkeit bietet. Messtechnologien wurden in den letzten Jahren in Betracht gezogen. Im Fertigungssektor werden täglich riesige Mengen an Produkten hergestellt. Jedes Teil des Produkts muss gemäß präziser Spezifikationen hergestellt werden, um die Qualität des fertigen Produkts zu bestätigen.

Berichtsumfang und Marktsegmentierung

|

Berichtsmetrik

|

Einzelheiten

|

|

Prognosezeitraum

|

2024 bis 2031

|

|

Basisjahr

|

2023

|

|

Historische Jahre

|

2022 (anpassbar auf 2016–2021)

|

|

Quantitative Einheiten

|

Umsatz in Tausend USD

|

|

Abgedeckte Segmente

|

Komponente (Hardware und Software), Produkttyp (Manuelles Videomesssystem, Automatisches/CNC-Videomesssystem und Halbautomatisches Videomesssystem), Typ (2D, 3D und 2,5D), Probengewicht (Mehr als 40 kg, 21 kg-40 kg und Bis zu 20 kg), Stromquelle (Mehr als 120 V und Bis zu 120 V), Tragbarkeit (Tischgerät und tragbar), Vergrößerung (Mehr als 20-fach, 10-fach-20-fach, 3-fach-10-fach und Weniger als 3-fach), Mikroskoptechnik (Konfokaloptik und Hellfeldoptik), Anwendung (Produktqualitätskontrolle, Zertifizierung und Inspektion, Dimensionsmessung, Reverse Engineering und Sonstiges), Vertikal (Elektronik, Automobilindustrie, Luft- und Raumfahrt und Verteidigung, Schwermaschinenbau, Medizin, Energie und Strom und Sonstiges)

|

|

Abgedeckte Länder

|

Indien, Singapur, Thailand, Indonesien, Malaysia, Philippinen, Vietnam und Rest des asiatisch-pazifischen Raums

|

|

Abgedeckte Marktteilnehmer

|

Mitutoyo Corporation (Japan), Zeiss Group (Deutschland), QES GROUP BERHAD (Malaysia), Nikon Corporation (Japan), Sipcon (Indien), ACCU-TECH MEASUREMENT SYSTEMS (Indien), Hexagon AB (Schweden), KEYENCE CORPORATION (Japan), AMETEK.Inc (Muttergesellschaft der Zygo Corporation) (USA), Wenzel Group (Deutschland), Dynascan Inspection Systems Company (Indien), Quality Vision International (New York), Radical Scientific Equipments Pvt. Ltd. (Indien), Vision Engineering Ltd (Großbritannien), Sinowon Innovation Metrology Manufacture Limited (China), Rational Precision Instrument (China), Banbros Engineering Pvt. Ltd. (Indien) und unter anderem

|

|

Im Bericht behandelte Datenpunkte

|

Neben Markteinblicken wie Marktwert, Wachstumsrate, Marktsegmente, geografische Abdeckung, Marktteilnehmer und Marktszenario enthält der vom Data Bridge Market Research-Team zusammengestellte Marktbericht eine eingehende Expertenanalyse, Import-/Exportanalyse, Preisanalyse, Produktionsverbrauchsanalyse und PESTLE-Analyse.

|

Segmentanalyse

Der Markt für Videomesssysteme in den ASEAN-Staaten ist in zehn wichtige Segmente unterteilt, die auf Komponente, Produkttyp, Typ, Probengewicht, Stromquelle, Tragbarkeit, Vergrößerung, Mikroskopietechnik, Anwendung und Vertikale basieren.

- Auf der Grundlage der Komponenten ist der Markt in Hardware und Software segmentiert

Im Jahr 2024 wird das Hardwaresegment voraussichtlich den Markt für Videomesssysteme in ASEAN dominieren

Im Jahr 2024 wird das Hardwaresegment voraussichtlich mit einem Anteil von 57,67 % den Markt dominieren, da Videomesssysteme in Branchen wie der Fertigungsindustrie, der Automobilindustrie und der Luft- und Raumfahrt weit verbreitet sind.

- Auf der Grundlage des Produkttyps ist der Markt in manuelle Videomesssysteme, automatisierte/CNC-Videomesssysteme und halbautomatische Videomesssysteme unterteilt.

Im Jahr 2024 wird das Segment der manuellen Videomesssysteme voraussichtlich den Markt für Videomesssysteme in ASEAN dominieren

Im Jahr 2024 wird das Segment der manuellen Videomesssysteme voraussichtlich mit einem Anteil von 56,09 % den Markt dominieren. Manuelle Systeme sind oft günstiger als automatisierte oder CNC-basierte Systeme.

- Auf der Grundlage des Typs ist der Markt in 2D, 3D und 2,5D segmentiert. Im Jahr 2024 wird das 2D-Segment voraussichtlich den Markt mit einem Anteil von 51,51 % dominieren

- Auf der Grundlage des Probengewichts ist der Markt in mehr als 40 kg, 21 kg-40 kg und bis zu 20 kg segmentiert. Im Jahr 2024 wird erwartet, dass das Segment mehr als 40 kg den Markt mit einem Anteil von 44,38 % dominieren wird.

- Auf der Grundlage der Stromquelle ist der Markt in mehr als 120 V und bis zu 120 V segmentiert. Im Jahr 2024 wird erwartet, dass das Segment mehr als 120 V den Markt mit einem Anteil von 67,94 % dominieren wird.

- Auf der Grundlage der Portabilität wird der Markt in Desktop und Portable unterteilt. Im Jahr 2024 wird das Desktop-Segment voraussichtlich den Markt mit einem Anteil von 54,43 % dominieren

- Auf der Grundlage der Vergrößerung ist der Markt in mehr als 20X, 10X-20X, 3X-10X und weniger als 3X segmentiert. Im Jahr 2024 wird erwartet, dass das Segment mehr als 20X den Markt mit einem Anteil von 44,07 % dominieren wird.

- Auf der Grundlage der Mikroskopietechnik ist der Markt in konfokale Optik und Hellfeldoptik segmentiert. Im Jahr 2024 wird das Segment der konfokalen Optik voraussichtlich mit einem Anteil von 58,53 % den Markt dominieren

- Auf der Grundlage der Anwendung ist der Markt in Produktqualitätskontrolle, Zertifizierung und Inspektion, Maßmessung, Reverse Engineering und andere unterteilt. Im Jahr 2024 wird das Segment Produktqualitätskontrolle voraussichtlich den Markt mit einem Anteil von 42,50 % dominieren.

- Auf vertikaler Basis ist der Markt in die Branchen Elektronik, Automobil, Luft- und Raumfahrt und Verteidigung, Schwermaschinenbau, Medizin, Energie und Strom und andere unterteilt. Im Jahr 2024 wird das Elektroniksegment voraussichtlich den Markt mit einem Anteil von 32,91 % dominieren.

Hauptakteure

Data Bridge Market Research analysiert Mitutoyo Corporation (Japan), Zeiss Group (Deutschland), QES GROUP BERHAD (Malaysia), Nikon Corporation (Japan) und Sipcon (Indien) als die wichtigsten Marktteilnehmer auf diesem Markt.

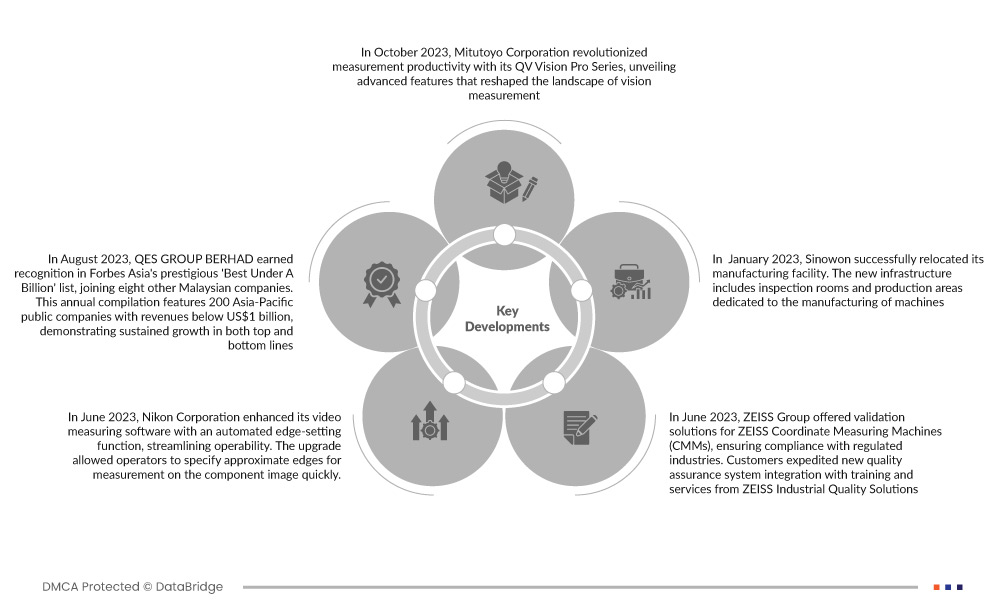

Marktentwicklungen

- Im Oktober 2023 revolutionierte die Mitutoyo Corporation mit ihrer QV Vision Pro-Serie die Messproduktivität und stellte fortschrittliche Funktionen vor, die die Landschaft der Bildmessung neu gestalteten. Die StrobeSnap-Bildmessfunktion beschleunigte die Qualitätslaufzeit um 35 bis 45 Prozent und übertraf damit die Konkurrenz. Der Autofokus der QV Pro-Serie erreichte einen bemerkenswerten Durchsatz und hochpräzise Messungen und arbeitete 39 Prozent schneller als seine Vorgänger, wobei eine beispiellose Genauigkeit erhalten blieb. Die innovativen Verbesserungen stellen einen bedeutenden Sprung nach vorne in der Bildmesstechnologie dar und halfen dem Unternehmen, die Kundenbedürfnisse zu erfüllen, was zu höheren Umsätzen führte

- Im August 2023 wurde QES GROUP BERHAD neben acht anderen malaysischen Unternehmen in die renommierte „Best under a Billion“-Liste von Forbes Asia aufgenommen. Diese jährliche Zusammenstellung umfasst 200 börsennotierte Unternehmen aus dem asiatisch-pazifischen Raum mit einem Umsatz von unter 1 Milliarde US-Dollar, die ein nachhaltiges Wachstum sowohl beim Umsatz als auch beim Gewinn aufweisen. Die Aufnahme in diese angesehene Liste ist ein Beweis für die finanzielle Stabilität und konstante Leistung von QES GROUP BERHAD. Die Anerkennung durch Forbes Asia stärkt nicht nur den Ruf des Unternehmens, sondern unterstreicht auch seine Fähigkeit, sich in einem wettbewerbsintensiven Markt zurechtzufinden und zu gedeihen, was sich positiv auf seine allgemeine Geschäftsstabilität und sein strategisches Management auswirkt.

- Im Juni 2023 erweiterte die Nikon Corporation ihre Videomesssoftware um eine automatische Kanteneinstellungsfunktion, die die Bedienbarkeit optimierte. Das Upgrade ermöglichte es den Bedienern, schnell ungefähre Kanten für die Messung auf dem Komponentenbild festzulegen. Die Software ermittelte dann autonom präzise Merkmalspositionen und ermöglichte so eine effiziente manuelle Auswahl der richtigen Kante aus den vorgeschlagenen Optionen. Dies hat dem Unternehmen geholfen, mit der Konkurrenz zu konkurrieren

- Im Februar 2022 brachte AMETEK Inc. die innovativen digitalen Kraftmessgeräte der DF3-Serie auf den Markt, die sich durch ein benutzerfreundliches Design, ein großes Farbdisplay und eine intuitive Benutzeroberfläche auszeichnen. Es verfügt über zeitsparende Funktionen wie Test-Setup, automatische Speicherung und verlängerte Akkulaufzeit, was die Effizienz bei Krafttests erhöht. Das Messgerät unterstützt verschiedene Funktionen für umfassende Messmöglichkeiten. Dies hat dem Unternehmen geholfen, sein Produktportfolio zu diversifizieren

- Im August 2021 stellte Hexagon AB den HP-L-10.10 vor, einen bahnbrechenden berührungslosen Lasersensor für Koordinatenmessgeräte (KMGs). Das kompromisslose CMM-Laserscanning der Manufacturing Intelligence-Abteilung von Hexagon verspricht Herstellern einen um 70 % schnelleren Inspektionsprozess mit ultrahoher Genauigkeit. Diese Innovation ermöglicht Dimensionsmessungen, die mit taktilen Abtastungen vergleichbar sind, und schnellere Inspektionen nahezu jeder Oberfläche. Dies hat dem Unternehmen geholfen, sein Produktportfolio zu erweitern und die Nachfrage der Kunden zu erfüllen

Regionale Analyse

Geografisch werden im Marktbericht für ASEAN-Videomesssysteme die folgenden Länder abgedeckt: Indien, Singapur, Thailand, Indonesien, Malaysia, die Philippinen, Vietnam und der Rest des asiatisch-pazifischen Raums.

Laut Marktforschungsanalyse von Data Bridge:

Indien ist voraussichtlich dominierendes und am schnellsten wachsendes Land im ASEAN-Videomesssystem Markt während des Prognosezeitraums

Indien dürfte den Markt für Videomesssysteme in der ASEAN-Region dominieren und das am schnellsten wachsende Land sein, da das Land aufgrund seines wachsenden Pools an technischen Talenten, seiner Innovationsorientierung, seines digitalen Marktes, seiner staatlichen Unterstützung, seiner Kosteneffizienz und der Erfüllung lokaler Bedürfnisse für Videomesstechnologien attraktiv ist.

Ausführlichere Informationen zum Markt für Videomesssysteme in den ASEAN-Staaten Bericht, klicken Sie hier –https://www.databridgemarketresearch.com/reports/asean-video-measuring-system-market