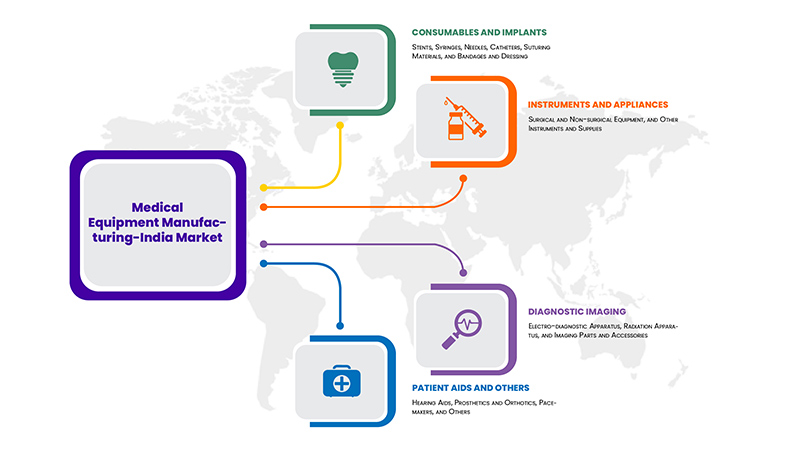

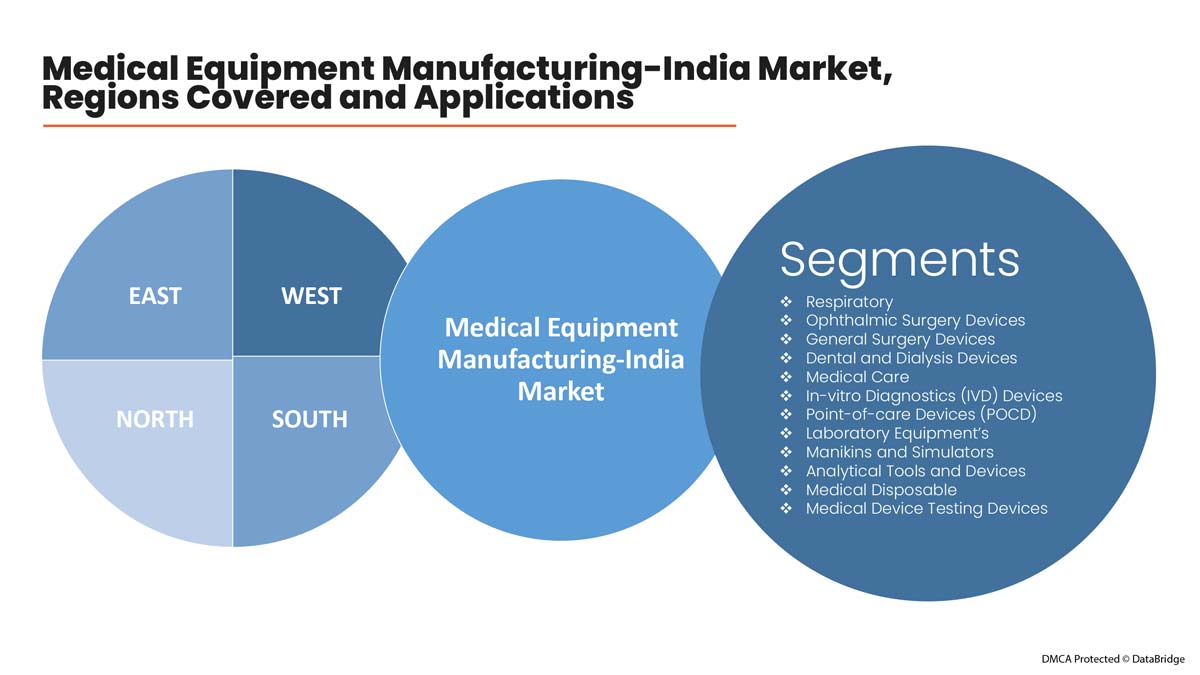

The Indian healthcare market is expected to reach USD 372 billion by 2022 showing exponential growth from past years to the present due to rising income, better health awareness, lifestyle diseases, and increasing access to insurance. The medical devices/equipment mainly focus on the manufacturing, distribution, and supplying of various segments, such as respiratory, ophthalmic surgery devices, general surgery devices, dental and dialysis devices, medical care, in-vitro diagnostics (IVD) devices, point-of-care devices (POCD), laboratory equipment's, manikins and simulators, analytical tools and devices, medical disposables and medical device testing devices.

The Indian medical devices market was USD 10.36 billion in 2020 due to increased consumption of home healthcare products and technologies for better health treatment, and due to this, the Indian medical device is contributing 2.5%-3.0% of the global market.

Medical Equipment Manufacturing- India Market Segmentation

Source- Company Websites

Major Impact of COVID-19 on Indian Medical Equipment Manufacturing Market

The COVID-19 pandemic has posed challenges and several opportunities within the Indian market. In 2020, supply chain disruptions of medical devices/equipment and essential medical supplies were prominent due to travel and trade restrictions all over the globe. However, the point-of-care (POC) testing devices segment sees prominent growth due to the virus outbreak, resulting in more infected people. The COVID-19 pandemic has particularly accelerated the POC diagnostics market, with companies focusing on developing POCT devices to provide a rapid and reliable method for virus detection. However, few segments, including IVD, diabetes care, and other medical and hospital supplies, witnessed significant market growth during the same period due to the sudden rise of devices to manage patients suffering from coronavirus.

Indian Medical Equipment Manufacturing Market

Medical equipment is instruments, devices, or software intended by the manufacturer to diagnose, prevent, control, treat administration, mitigate symptoms, or care for an injury. They are generally designed according to strict safety rules. The quality of medical equipment directly affects the quality of healthcare services at different stages, from diagnosis to cure and post-cure. However, medical equipment is an integral part of the healthcare system and is synonymous with the hospital system, where they are placed in patients' rooms to the operating block, home, and ambulatory care.

The Indian medical equipment market was worth USD 4.22 million in 2020, growing with a 7% CAGR from 2016-2020. India is expected to grow in the medical equipment market, with a 60% to 65% market share in the overall medical device market in India.

Source- India Brand Equity Foundation, February 2022

Medical Equipment Manufacturing-India Market Regions Covered and Applications-

Source: DBMR Analysis

Regional Analysis of Medical Equipment Manufacturing- Indian Market

- West Indian region leads the medical equipment market because of the larger number of manufacturers, suppliers, and distributors with operations and a better worldwide supply chain. Gujarat, Maharashtra, Karnataka, Haryana, Andhra Pradesh, Telangana, and Tamil Nadu are the manufacturing hubs for medical devices/equipment in India

- The analytical tools segment is dominating in Indian medical equipment market due to the larger product folio of different advanced devices that are used in every biological diagnosis process and due to their facility for the biological, microbiological, chemical, physical, and radiochemical examination of potable human products, bio-pharmaceutical products, and pharmaceuticals products water, non-potable water, or other environmental matrices. Also, they coordinate production, quality control, analysis, and testing and set the direction for research and development

- In 2022, the analytical tool segment is estimated to reach USD 3908.26 million due to the increase in consumption in key application sectors such as pharmaceutical, biotechnology, testing, inspection & certification industry, and government & academia

- While the growth of the analytical instruments market largely depends on the performance and R&D spending of industries, such as pharmaceutical, biotechnology, chemical, and oil & gas, life sciences, food & beverage are also emerging as prominent sectors which are expected to fuel the market for analytical instruments in the coming years

Manufacturing Landscape in India-

Source: WHO and AMTZ Report' Medical Device - Manufacturing in India - A Sunrise 2017', Government Website

International companies are also entering the Indian MedTech market by either setting up their facilities or acquiring local companies, which increases the product portfolio of medical equipment for better treatment. These leading MedTech players include J&J, Medtronic, and Danaher Corp. Conmed, Becton Dickinson, Thermo Fisher Scientific Inc., Boston Scientific, and GE Healthcare—have set up manufacturing facilities in the country.

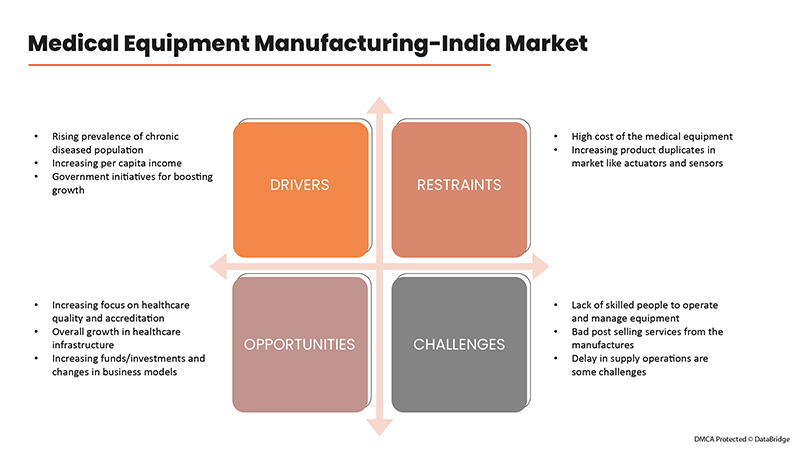

Drivers, Restraints, Opportunities, and Challenges of Medical Equipment Manufacturing-India Market-

Source: DBMR Analysis

Drivers

The rising prevalence of chronic diseases results in demand for healthcare services

India currently has around 60 million diabetics, which is expected to reach 90 million by 2025. It is estimated that every fourth individual in India aged above 18 years has hypertension. Nearly 5.8 million Indians die annually from NCDs (heart and lung diseases, stroke, cancer, and diabetes). The rising NCD burden is estimated to cost India USD 4.58 trillion before 2030.

- Non-communicable diseases are expected to comprise more than 75% of India's disease burden by 2025, compared to 45% in 2010

- India is today referred to as the diabetes capital of the world, with the number of diabetes patients increasing from 38 million in 2010 to 46 million in 2015

- Around 62 million patients suffer from coronary heart disease (the leading cause of death in India), compared to 47 million in 20108

- Similarly, around 23 million patients suffer from Chronic Obstructive Pulmonary Disease (the second leading cause of death in India), compared to 21 million in 2010

Increasing aging population-

- The number of senior citizens (60+ years) is also growing. It is estimated that the share of senior citizens in India's population will double from 8.6% in 2011 to 16% by 2041. By 2050, India is expected to have 300 Million senior citizens

- The share of the aged population (>65 years) is expected to increase to 7% (100 million) of the total population in India by 2020, compared to 5% (60 million) in 2010. This would result in a much higher need for healthcare facilities and thus medical devices, both at health facilities care and homes

Increasing income and affordability, resulting in higher demand and utilization of healthcare services-

- The size of the population earning more than USD 5,000 per annum is estimated to increase to around 450 million (~28% of the total population) in 2025 from the current 145 million (~12% of the total population). This is partly driven by increasing urbanization in India, which is expected to reach 40% by 2030 from the current level of 32%

- In addition, health insurance coverage is also expected to increase from the current 300 million people to 655 million by 202011. As a result, the share of spending on healthcare as a percentage of total household spend is expected to increase from 7% in 2005 to 13% in 2025

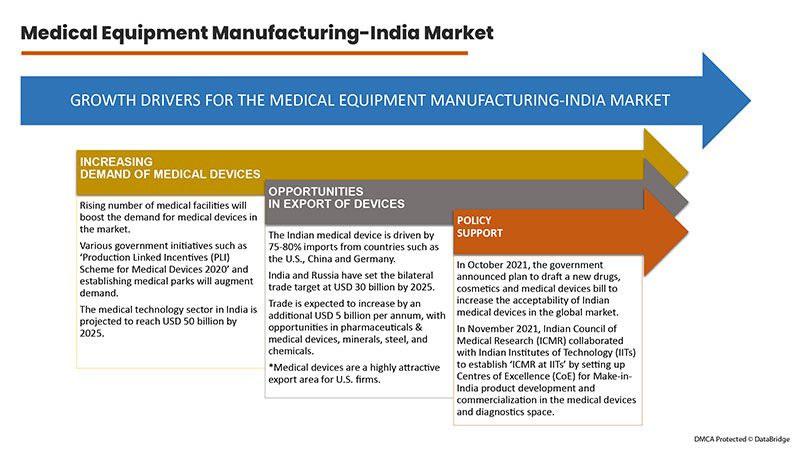

Government initiatives for boosting growth-

In recent years, the Government of India has implemented several policy measures to address the challenges of the medical devices industry. Some of these include:

- Draft Drugs & Cosmetics Amendments Bill (2015) to increase the acceptability of Indian medical devices in the global market.

- 100% FDI in medical devices under automatic route where categories such as equipment and instruments, consumables, and implants attract the most FDI

- 'Make in India' initiative for promoting indigenous manufacturing

- The development of a quality standardization framework in India that is based on international standards and certifies the quality, safety, and performance of medical devices

Opportunities-

Increasing funds/investments and changes in business models-

- FDI inflow in the medical and surgical appliances sector stood at USD 2.19 billion between April 2000 and March 2021

- In FY20, foreign investments in the medical devices sector increased 98% YoY to INR2, 196 crores (USD 301.01 million) as against INR1, 108 crores (USD 151.87 million) in FY19

Several MNCs have been increasing their manufacturing footprint and locating research centers in India to serve the Indian and global markets. Increased funding and investments have also been reflected in other supply-side changes in healthcare delivery in India.

Incentive Schemes-

- To boost domestic manufacturing of medical devices and attract huge investments in India, the department of pharmaceuticals launched a PLI scheme for domestic manufacturing of medical devices, with a total outlay of funds worth INR3, 420 crores (USD 468.78 million) for the period FY21-FY28

- The government also approved applications for nine eligible projects such as Centres of Excellence (CoE) for Make-in-India product development and commercialization, drafting of new drugs, cosmetics and medical devices bill, PLI scheme for medical devices, and among others that are expected to lead to a total committed investment of INR 729.63 crore (USD 100.01 million) by the companies such as Siemens Healthcare Private Limited, Wipro GE Healthcare Private Limited, Nipro India Corporation Private Limited, Sahajanand Medical Technologies Private Limited, Involution Healthcare Private Limited, Integris Health Private Limited. This generated approximately 2,304 jobs

Overall growth in healthcare infrastructure-

- There is a significant increase in the number of hospitals and hospital beds in India. Bed strength increased from 0.8 million in 2002 to 1.6 million in 2012 and is expected to increase to around 2.9 million by 2025. This increase has been driven primarily by the growing presence of corporate hospital chains, international companies, and service providers entering tier 2 and tier 3 cities

- There is an increasing presence of diagnostics laboratory chains focusing on imaging and pathology. It is estimated that there are more than 100,000 diagnostic laboratories across the country, with the number expected to grow at a rate of 15% – 20%

- The healthcare industry is also witnessing the emergence of new formats like chains of multispecialty outpatient clinics, mother-and-child hospitals, short stay surgery centers, and IVF centers, which are driving demand for medical devices

Increasing focus of healthcare providers on quality and accreditation-

- Hospitals and laboratories have strongly focused on upgrading medical technology to comply with accreditation requirements. Around 285 hospitals in India are NABH accredited, with 472 additional proposals submitted for accreditation. Similarly, 347 laboratories in India are NABL accredited, with 150 additional proposals submitted

- In June 2021, the Quality Council of India (QCI) and the Association of Indian Manufacturers of Medical Devices (AiMeD) launched the Indian Certification of Medical Devices (ICMED) 13485 Plus Scheme to undertake verification of the quality, safety, and efficacy of medical devices

Restraints-

The high cost of medical equipment like factory automation, diabetic care, dental chairs, and others can increase the treatment cost for the patients/consumers, and Increasing product duplicates like actuators and sensors in the market are restraining the growth.

Challenges-

Lack of skilled people to operate and manage high-end medical equipment, bad services from the manufacturers, and delays in supply operations are some challenges faced in this market.

Government Initiatives-

'Make in India' for Medical Devices-

The Government of India is the key sponsor in developing a favorable policy and regulatory environment and laying out an implementation framework for the growth of native manufacturing of medical devices. Simultaneously, the industry must work with the government to encourage innovation and indigenization among its members, thereby improving access to affordable and quality healthcare.

- In September 2021, the Department of Pharmaceuticals notified the scheme for 'Promotion of Medical Device Parks' intending to help medical devices & MedTech companies with easy access to standard testing and world-class common infrastructure facilities

- The Indian government has planned more medical technology parks to stimulate domestic medical equipment manufacturing. This initiative will help increase the inflow of foreign direct investments, promote research & development and production advances, boosting the efficiency and effectiveness of electronic medical devices

- To encourage the domestic MedTech sector, the government has offered a 15-year income tax exemption for locally created medical technology products

- To boost the market and increase investment inflow, the government has allowed 100% FDI

Future Opportunities for MedTech Market in India-

The development of the MedTech sector depends on many factors, but the Make in India movement can be the prime point for the market's growth. While the Make in India initiative is directionally right, its impact on improving access to affordable quality healthcare depends on how it is framed, developed, and implemented over the next few months or years. Collaborating with leaders and manufacturers (national/international) to bring innovations, promote local ideas, and make India a global station for the healthcare and medical devices manufacturing market.

Companies should also invest in R&D to bring cost-effective products and services to lower-income rural people. Being a country of billions of people, India is the market with large production and consumption.

List of Medical Equipment Manufacturing-India Market More than 240 companies was screened for this market based on their product types, according to the segments. The top players in the market are Thermo Fisher Scientific Inc, Becton Dickinson and company, and Siemens Healthcare GmbH, among others.

Thermo Fisher Scientific Inc. -

Thermo Fisher Scientific Inc. is an American supplier of scientific instrumentation, reagents and consumables, and software services based in Waltham, Massachusetts. The company clocked total revenue of USD 39,211 million. Thermo Fisher was formed through the merger of Thermo Electron and Fisher Scientific in 2006, leading in production and manufacturing capacity. The company has four segments- life sciences solutions, analytical instruments, specialty diagnostics, laboratory products, and biopharma services.

Headquartered in Mumbai, we have representatives across 42 locations within India, and our large infrastructure in India includes two R&D centers, six manufacturing sites, eleven distribution centers, and sixteen commercial offices.

22% of the revenue comes from the acquisition, which helps the company build new innovative methods for customer benefits, develop high-impact innovative new products, leverage scale in high growth and emerging markets, and develop a unique value proposition to our customers.

The company recently established Global Technology Development Centre in Bengaluru. Thermo Fisher opened a 1,800 sq. ft. large customer experience center in Bengaluru where scientists and customers can experience various new technologies to incorporate them to accelerate their research, which can lead to" born in India" solutions. On the research front, the company is committed to scaling up facilities at the (R&D) center in Bengaluru.

Thermo Fisher Scientific Inc. launched its new research and development and engineering facility in Hyderabad on April 2022. The newly launched facility is 42,000 sqft and includes an engineering lab to support new product development for laboratory and analytical solutions for Thermo Fisher's global sites.

Related Reports-

- Global Disposable Medical Devices Sensors Market - Industry Trends and Forecast to 2028

- North America Disposable Medical Devices Sensors Market - Industry Trends and Forecast to 2028

- Europe Disposable Medical Devices Sensors Market - Industry Trends and Forecast to 2028

- Global Active Implantable Medical Devices Market - Industry Trends and Forecast to 2029