Serbia Romania And Bulgaria Cng Compressed Natural Gas Fuel Market

حجم السوق بالمليار دولار أمريكي

CAGR :

%

USD

563.98 Million

USD

749.83 Million

2023

2035

USD

563.98 Million

USD

749.83 Million

2023

2035

| 2024 –2035 | |

| USD 563.98 Million | |

| USD 749.83 Million | |

|

|

|

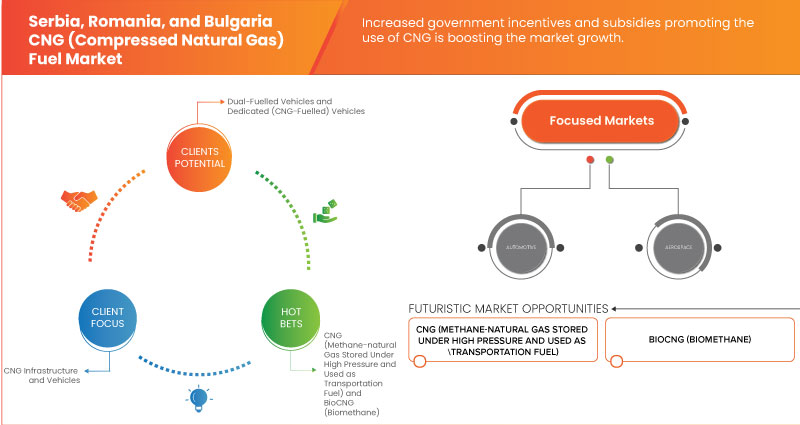

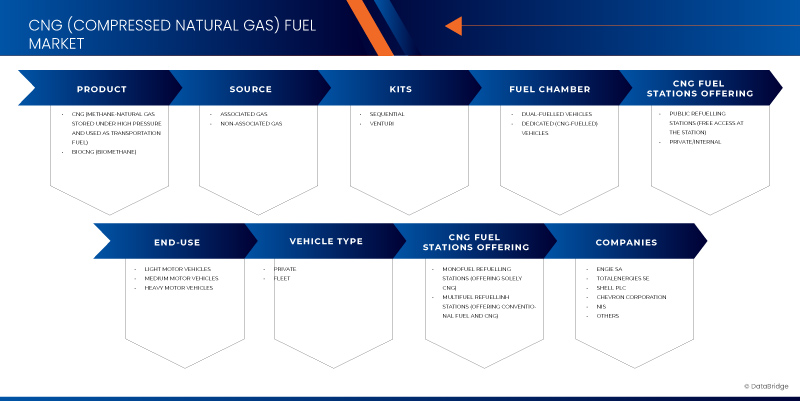

تجزئة سوق وقود الغاز الطبيعي المضغوط ( CNG ) في صربيا ورومانيا وبلغاريا ، حسب المنتجات (CNG (غاز الميثان الطبيعي المخزن تحت ضغط مرتفع والمستخدم كوقود للنقل) وBioCNG (الميثان الحيوي))، المصدر (الغاز المصاحب والغاز غير المصاحب)، مجموعات (متسلسلة وفنتوري)، غرفة الوقود (المركبات ذات الوقود المزدوج والمركبات المخصصة (العاملة بالغاز الطبيعي المضغوط))، نوع المركبة (خاصة وأسطول)، محطات وقود الغاز الطبيعي المضغوط التي تقدم (محطات التزود بالوقود أحادي الوقود (تقدم الغاز الطبيعي المضغوط فقط) ومحطات التزود بالوقود متعدد الوقود (تقدم الوقود التقليدي والغاز الطبيعي المضغوط)، كيان محطات وقود الغاز الطبيعي المضغوط (محطات التزود بالوقود العامة (الوصول المجاني إلى المحطة) والخاصة/الداخلية)، الاستخدام النهائي (المركبات الخفيفة والمركبات المتوسطة والمركبات الثقيلة) - اتجاهات الصناعة وتوقعاتها حتى عام 2035.

تحليل سوق وقود الغاز الطبيعي المضغوط (CNG)

تعمل السياسات والحوافز الحكومية في سوق وقود الغاز الطبيعي المضغوط في صربيا ورومانيا وبلغاريا على تعزيز تبني الغاز الطبيعي المضغوط من خلال دعم حلول الطاقة النظيفة وتشجيع استخدامه كوقود بديل. تعمل التطورات التكنولوجية في سوق وقود الغاز الطبيعي المضغوط في صربيا ورومانيا وبلغاريا على تعزيز الأداء والكفاءة، مما يجعلها أكثر قدرة على المنافسة ويدفع المزيد من التبني في السوق. يدفع الوعي البيئي المتزايد إلى تبني الممارسات المستدامة والمواد الصديقة للبيئة في كلا السوقين. وبالتالي دفع نمو السوق عالميًا.

حجم سوق وقود الغاز الطبيعي المضغوط (CNG)

تم تقييم حجم سوق وقود الغاز الطبيعي المضغوط (CNG) في صربيا ورومانيا وبلغاريا بـ 563.98 مليون دولار أمريكي في عام 2023 ومن المتوقع أن يصل إلى 749.83 مليون دولار أمريكي بحلول عام 2035، مع نمو بمعدل نمو سنوي مركب قدره 2.4٪ خلال الفترة المتوقعة من 2024 إلى 2035. بالإضافة إلى الرؤى حول سيناريوهات السوق مثل القيمة السوقية ومعدل النمو والتجزئة والتغطية الجغرافية واللاعبين الرئيسيين، فإن تقارير السوق التي تم تنظيمها بواسطة Data Bridge Market Research تتضمن أيضًا تحليل الخبراء المتعمق وعلم الأوبئة للمرضى وتحليل خطوط الأنابيب وتحليل الأسعار والإطار التنظيمي.

اتجاهات سوق وقود الغاز الطبيعي المضغوط (CNG)

"إن زيادة السياسات البيئية الصارمة وأهداف خفض الانبعاثات في صربيا ورومانيا وبلغاريا تدعم اعتماد الغاز الطبيعي المضغوط"

وفي صربيا ورومانيا وبلغاريا، تعمل اللوائح البيئية الصارمة وأهداف خفض الانبعاثات على زيادة اعتماد الغاز الطبيعي المضغوط كبديل للوقود النظيف عن الخيارات التقليدية مثل الفحم والنفط والبروبان وما إلى ذلك. وتتوافق صربيا مع معايير الاتحاد الأوروبي من خلال تنفيذ سياسات تهدف إلى الحد من تلوث الهواء وانبعاثات الغازات المسببة للانحباس الحراري العالمي. وتدعم الحكومة هذا التحول من خلال تقديم حوافز لمركبات الغاز الطبيعي المضغوط والاستثمار في توسيع البنية الأساسية للتزود بالوقود.

على سبيل المثال، اتخذت رومانيا نهجًا استباقيًا لدمج الغاز الطبيعي المضغوط في قطاعي الطاقة والنقل. تركز سياسات البلاد على الحد من تلوث الهواء في المناطق الحضرية وتحقيق أهداف الانبعاثات في الاتحاد الأوروبي. تقدم رومانيا إعانات ومنحًا لمركبات الغاز الطبيعي المضغوط، مما يؤدي إلى زيادة الاعتماد عليها، وخاصة في وسائل النقل العام وعمليات الأسطول. إن نمو شبكة التزود بالوقود بالغاز الطبيعي المضغوط، بدعم من المبادرات الحكومية، يعمل على تسريع هذا التحول.

نطاق التقرير وتقسيم السوق

|

صفات |

رؤى أساسية حول سوق وقود الغاز الطبيعي المضغوط (CNG) |

|

القطاعات المغطاة |

حسب المنتج : الغاز الطبيعي المضغوط (غاز الميثان المخزن تحت ضغط مرتفع والمستخدم كوقود للنقل) والبيوميثان الحيوي (CNG) حسب المصدر : الغاز المصاحب والغاز غير المصاحب حسب الطقم : متسلسل وفنتورى حسب غرفة الوقود : المركبات التي تعمل بالوقود المزدوج والمركبات المخصصة (التي تعمل بالغاز الطبيعي المضغوط) حسب نوع السيارة : خاصة وأسطول من خلال محطات الوقود التي تعمل بالغاز الطبيعي المضغوط والتي تقدم : محطات التزود بالوقود أحادي الوقود (التي تقدم الغاز الطبيعي المضغوط فقط) ومحطات التزود بالوقود متعدد الوقود (التي تقدم الوقود التقليدي والغاز الطبيعي المضغوط) حسب كيان محطات الوقود CNG : (محطات التزود بالوقود العامة (الوصول مجاني) في المحطة) و (خاصة/داخلية) حسب الاستخدام النهائي: المركبات الخفيفة، والمركبات المتوسطة، والمركبات الثقيلة |

|

الدول المغطاة |

بلغاريا، صربيا، رومانيا |

|

اللاعبون الرئيسيون في السوق |

NIS (ألمانيا)، KryoGas (أوروبا)، Engie SA (فرنسا)، Total Energies SE (فرنسا)، Chevron Corporation (الولايات المتحدة)، وShell PLC (المملكة المتحدة) |

|

فرص السوق |

· إمكانات كبيرة في تحويل أساطيل النقل العام والخاص الحالية إلى الغاز الطبيعي المضغوط · جهود تعاونية بين صربيا ورومانيا وبلغاريا في تطوير البنية التحتية للغاز الطبيعي المضغوط عبر الحدود |

|

مجموعات معلومات البيانات ذات القيمة المضافة |

بالإضافة إلى الرؤى حول سيناريوهات السوق مثل القيمة السوقية ومعدل النمو والتجزئة والتغطية الجغرافية واللاعبين الرئيسيين، فإن تقارير السوق التي تم تنظيمها بواسطة Data Bridge Market Research تتضمن أيضًا تحليلًا متعمقًا من الخبراء، وتحليل التسعير، وتحليل حصة العلامة التجارية، واستطلاع رأي المستهلكين، وتحليل التركيبة السكانية، وتحليل سلسلة التوريد، وتحليل سلسلة القيمة، ونظرة عامة على المواد الخام / المواد الاستهلاكية، ومعايير اختيار البائعين، وتحليل PESTLE، وتحليل بورتر، والإطار التنظيمي. |

تعريف سوق وقود الغاز الطبيعي المضغوط (CNG)

يغطي سوق وقود الغاز الطبيعي المضغوط في صربيا ورومانيا وبلغاريا دورة حياة الغاز الطبيعي المضغوط بالكامل كوقود للنقل، من الإنتاج والتوزيع إلى الاستهلاك. ويشمل ذلك بناء البنية الأساسية مثل محطات التزود بالوقود، وتطوير تكنولوجيا المركبات التي تعمل بالغاز الطبيعي المضغوط، وتنفيذ اللوائح التي تدعم الطاقة النظيفة. والهدف هو خفض الانبعاثات والحد من الاعتماد على الوقود التقليدي، مع استكشاف المزايا الاقتصادية والبيئية الفريدة لكل دولة.

ديناميكيات سوق وقود الغاز الطبيعي المضغوط (CNG)

السائقين

- إن زيادة السياسات البيئية الصارمة وأهداف خفض الانبعاثات في صربيا ورومانيا وبلغاريا تدعم اعتماد الغاز الطبيعي المضغوط

في صربيا ورومانيا وبلغاريا، تعمل اللوائح البيئية الصارمة وأهداف خفض الانبعاثات على زيادة اعتماد الغاز الطبيعي المضغوط كبديل للوقود النظيف للخيارات التقليدية مثل الفحم والنفط والبروبان وما إلى ذلك. تتماشى صربيا مع معايير الاتحاد الأوروبي من خلال تنفيذ سياسات تهدف إلى الحد من تلوث الهواء وانبعاثات الغازات المسببة للانحباس الحراري العالمي. تدعم الحكومة هذا التحول من خلال تقديم حوافز لمركبات الغاز الطبيعي المضغوط والاستثمار في توسيع البنية التحتية للتزود بالوقود. اتخذت رومانيا نهجًا استباقيًا لدمج الغاز الطبيعي المضغوط في قطاعي الطاقة والنقل. تركز سياسات البلاد على الحد من تلوث الهواء في المناطق الحضرية وتحقيق أهداف الانبعاثات في الاتحاد الأوروبي. تقدم رومانيا إعانات ومنحًا لمركبات الغاز الطبيعي المضغوط، مما يؤدي إلى زيادة التبني، وخاصة في وسائل النقل العام وعمليات الأسطول. إن نمو شبكة التزود بالوقود بالغاز الطبيعي المضغوط، بدعم من المبادرات الحكومية، يعمل على تسريع هذا التحول بشكل أكبر.

على سبيل المثال،

- في عام 2021، وفقًا لتقرير مفوضية الأمم المتحدة الاقتصادية لأوروبا، فإن مزيج الطاقة المعتمد على الفحم في بلغاريا يحد من تبني المركبات الكهربائية، لكن البنية التحتية الحالية للمركبات العاملة بالغاز الطبيعي توفر إمكانات. لتعزيز استخدام المركبات العاملة بالغاز الطبيعي، تعمل بلغاريا على توسيع محطات التزود بالوقود بالغاز الطبيعي المضغوط/الغاز الطبيعي المسال والمرافق الداعمة، وتقييم الطلب، وتقييم الاستثمارات والتأثيرات الاجتماعية والاقتصادية والبيئية.

الفوائد الاقتصادية المتزايدة لاستخدام الغاز الطبيعي المضغوط

يتمتع الغاز الطبيعي المضغوط بمزايا اقتصادية كبيرة، مما يجعله بديلاً مقنعًا للوقود التقليدي مثل البنزين والديزل. تتمثل إحدى الفوائد الرئيسية للغاز الطبيعي المضغوط في فعاليته من حيث التكلفة؛ فهو أرخص عمومًا من البنزين والديزل، مما يؤدي إلى انخفاض تكاليف الوقود للمستهلكين والشركات على حد سواء. وهذا مفيد بشكل خاص لأساطيل المركبات التجارية، حيث يمكن أن تترجم نفقات الوقود المنخفضة إلى وفورات مالية كبيرة. غالبًا ما تتكبد مركبات الغاز الطبيعي المضغوط تكاليف صيانة أقل بسبب احتراقها الأنظف، مما يقلل من تآكل المحرك والحاجة إلى الإصلاحات المتكررة وتغيير الزيت. يؤدي هذا إلى إطالة عمر السيارة وتوفير المزيد من المدخرات. تتمثل إحدى الفوائد الاقتصادية الأخرى للغاز الطبيعي المضغوط في استقرار سعره مقارنة بأسعار الوقود الأكثر تقلبًا التي تعتمد على النفط، مما يوفر تكاليف وقود أكثر قابلية للتنبؤ بها وإدارتها.

على سبيل المثال،

- وفقًا لمقال نشرته شركة Pacific Gas and Electric Company، فإن الغاز الطبيعي هو وقود نظيف الاحتراق يتبدد بسرعة إذا تسرب، مما يتجنب تلوث المياه وينتج غازات دفيئة أقل، مما يساعد في تقليل الانحباس الحراري العالمي مقارنة بالوقود الآخر.

فرص

- إمكانات كبيرة في تحويل أساطيل النقل العام والخاص الحالية إلى الغاز الطبيعي المضغوط

إن تحويل أساطيل النقل العام والخاص الحالية إلى الغاز الطبيعي المضغوط (CNG) يوفر فوائد اقتصادية وبيئية وتشغيلية كبيرة. من الناحية الاقتصادية، يعد الغاز الطبيعي المضغوط بديلاً فعالاً من حيث التكلفة للبنزين والديزل، مما يؤدي إلى انخفاض تكاليف الوقود وتوفير كبير لمشغلي الأساطيل. وهذا مفيد بشكل خاص للأساطيل الكبيرة، مثل تلك المستخدمة في النقل العام والخدمات اللوجستية، حيث تشكل نفقات الوقود جزءًا كبيرًا من ميزانيات التشغيل. غالبًا ما تتكبد المركبات التي تعمل بالغاز الطبيعي المضغوط تكاليف صيانة أقل بسبب احتراقها الأنظف، مما يقلل من تآكل المحرك وتكرار الإصلاحات. يؤدي هذا إلى إطالة عمر المركبة وزيادة المدخرات. من الناحية البيئية، يعد الغاز الطبيعي المضغوط وقودًا أنظف يقلل بشكل كبير من انبعاثات أكاسيد النيتروجين (NOx) والجسيمات وثاني أكسيد الكربون (CO2) مقارنة بالوقود التقليدي. يساعد هذا الانخفاض في الملوثات على تحسين جودة الهواء، والامتثال للوائح الانبعاثات الصارمة، والاستفادة من الصحة العامة.

- جهود تعاونية بين صربيا ورومانيا وبلغاريا في تطوير البنية التحتية للغاز الطبيعي المضغوط عبر الحدود

إن الجهود التعاونية التي تبذلها صربيا ورومانيا وبلغاريا في تطوير البنية الأساسية للغاز الطبيعي المضغوط عبر الحدود تمثل تقدماً حاسماً في تعزيز أمن الطاقة الإقليمي وتعزيز النقل المستدام. وإدراكاً منها للفوائد المتبادلة المترتبة على شبكة الغاز الطبيعي المضغوط المتصلة، تعمل هذه البلدان معاً لإنشاء بنية أساسية شاملة ومتكاملة للتزود بالوقود تمتد عبر حدودها. ويتمثل أحد الجوانب الأساسية لهذا التعاون في تطوير محطات التزود بالوقود عبر الحدود المصممة لتوفير وصول مستمر إلى الغاز الطبيعي المضغوط للمركبات التي تسافر بين هذه الدول. ومن خلال إنشاء شبكة من محطات التزود بالوقود الموضوعة بشكل استراتيجي على طول طرق النقل الرئيسية، تهدف صربيا ورومانيا وبلغاريا إلى تسهيل التبني الواسع النطاق للمركبات التي تعمل بالغاز الطبيعي المضغوط وتبسيط حركة أساطيل النقل التجاري والعام عبر الحدود.

على سبيل المثال،

- وفقًا لمدونة نشرتها Vignette Bulgariia، فإن صربيا وبلغاريا تربطهما علاقة تاريخية تشكلت من خلال فترات من الصراع والتعاون. منذ تفكك يوغوسلافيا في تسعينيات القرن العشرين، أقامت الدولتان حدودهما الدولية الحالية المعترف بها، مع وجود لوائح ثنائية للسلع والأشخاص والأمن المتبادل، بما في ذلك متطلبات وجود حدود بلغارية.

القيود/التحديات

- تزايد المنافسة مع الوقود البديل

إن صعود الوقود البديل مثل المركبات الكهربائية والهيدروجين والوقود الحيوي يشكل منافسة مباشرة للغاز الطبيعي المضغوط. وتكتسب المركبات الكهربائية على وجه الخصوص زخمًا بسبب التقدم في تكنولوجيا البطاريات والاستثمارات المتزايدة في البنية التحتية للشحن. كما يتم استكشاف خلايا وقود الهيدروجين لإمكاناتها في توفير حلول نقل خالية من الانبعاثات. وغالبًا ما تستفيد هذه البدائل من الدعم الحكومي القوي والإعانات التي تهدف إلى الحد من انبعاثات الكربون. قد يطغى تطوير وتوسيع البنية التحتية للتزود بالوقود للبدائل مثل المركبات الكهربائية والهيدروجين على الاستثمارات في محطات الغاز الطبيعي المضغوط. وتركز الحكومات والمستثمرون من القطاع الخاص بشكل متزايد على هذه التقنيات الجديدة، والتي قد تحول الموارد والانتباه بعيدًا عن بناء شبكة قوية للغاز الطبيعي المضغوط.

على سبيل المثال

- في أبريل 2024، وفقًا للأخبار التي نشرها Green Forum، ستواجه رومانيا نقصًا في محطات الشحن، لكن التبني المتزايد للسيارات الكهربائية يؤكد الطلب المتزايد. لتسهيل الانتقال إلى السيارات الكهربائية ودعم النقل المستدام، تحتاج رومانيا إلى تعزيز بنيتها التحتية وتنفيذ اللوائح المواتية. أبرز ميهاي دراجيسي، الشريك في EY Romania، في مقابلة مع Green أن رومانيا تتوقع معدل نمو سنوي يتراوح بين 20 و25٪ لمبيعات السيارات الكهربائية، ومن المتوقع أن تصل حصة السوق إلى ما يقرب من 30٪ بحلول عام 2024 وربما تتجاوز 50٪ بحلول عام 2027

تؤدي معايير السلامة والتنظيم الصارمة إلى زيادة التعقيد والتكاليف

إن معايير السلامة والتنظيم الصارمة تزيد بشكل كبير من التعقيد والتكاليف المرتبطة بمختلف الصناعات، مما يمثل تحديات ملحوظة. هذه المعايير، على الرغم من أهميتها لضمان سلامة وموثوقية واستدامة المنتجات والعمليات بيئيًا، إلا أنها تفرض طبقات من التعقيد في الامتثال والتنفيذ. غالبًا ما يتطلب تلبية متطلبات السلامة والتنظيم الصارمة عمليات توثيق واختبار وإصدار شهادات مكثفة. بالنسبة للمصنعين، يعني هذا الاستثمار في مرافق وإجراءات اختبار شاملة لضمان تلبية منتجاتهم للمعايير المطلوبة. هذا لا يزيد من التكاليف التشغيلية فحسب، بل يطيل أيضًا جداول التطوير، مما قد يؤخر دخول السوق ويؤثر على الموقف التنافسي.

يقدم تقرير السوق هذا تفاصيل عن التطورات الحديثة الجديدة واللوائح التجارية وتحليل الاستيراد والتصدير وتحليل الإنتاج وتحسين سلسلة القيمة وحصة السوق وتأثير اللاعبين المحليين والمحليين في السوق وتحليل الفرص من حيث جيوب الإيرادات الناشئة والتغييرات في لوائح السوق وتحليل نمو السوق الاستراتيجي وحجم السوق ونمو سوق الفئات ومنافذ التطبيق والهيمنة وموافقات المنتجات وإطلاق المنتجات والتوسعات الجغرافية والابتكارات التكنولوجية في السوق. للحصول على مزيد من المعلومات حول السوق، اتصل بـ Data Bridge Market Research للحصول على موجز محلل، وسيساعدك فريقنا في اتخاذ قرار سوقي مستنير لتحقيق نمو السوق.

سيناريو تغير المناخ

غالبًا ما يتم وضع سوق وقود الغاز الطبيعي المضغوط كبديل أنظف للوقود الأحفوري التقليدي مثل البنزين والديزل. ومع ذلك، لا تزال المخاوف البيئية قائمة، وخاصة فيما يتعلق بتسرب الميثان أثناء الاستخراج والنقل والاستخدام، والذي يمكن أن يعوض فوائد الحد من الكربون للغاز الطبيعي المضغوط. الميثان هو غاز دفيئة قوي ذو إمكانات احترار عالمي أعلى بكثير من ثاني أكسيد الكربون، مما يجعل إدارته أمرًا بالغ الأهمية لجدوى الغاز الطبيعي المضغوط البيئية. بالإضافة إلى ذلك، في حين يحترق الغاز الطبيعي المضغوط بشكل أنظف من أنواع الوقود الأحفوري الأخرى، إلا أنه لا يزال موردًا غير متجدد، ودوره الطويل الأجل في الاقتصاد الخالي من الكربون محل نقاش.

محتوى الإطار التنظيمي

تلعب اللوائح دورًا حاسمًا في سوق وقود الغاز الطبيعي المضغوط (CNG) في صربيا ورومانيا وبلغاريا، مما يضمن جودة المنتج والسلامة والامتثال البيئي طوال عملية التصنيع.

- فيما يلي الجدول الذي يوضح القواعد المختلفة التي تحكم السوق:

وزارة التعدين والطاقة في جمهورية صربيا: قدمت وزارة التعدين والطاقة إطارًا تنظيميًا جديدًا لقطاع الغاز. وينص الإطار التنظيمي على أن يصدر الوزير تصاريح لمشاريع البنية التحتية المختلفة للغاز ويؤسس كيانات جديدة للنقل والتوزيع لتعزيز وظائف السوق.

لائحة الأمم المتحدة: تعمل لائحة الأمم المتحدة رقم 110 على توحيد معايير الموافقة على المكونات والمركبات التي تستخدم الغاز الطبيعي المضغوط (CNG) والغاز الطبيعي المسال (LNG) للدفع، مما يضمن معايير موحدة للتركيب والسلامة.

مجلس الوزراء البلغاري: تهدف السياسة الوطنية البلغارية للوقود البديل إلى التوافق مع معايير الاتحاد الأوروبي من خلال تطوير البنية التحتية للغاز الطبيعي المضغوط والغاز الطبيعي المسال. وتشمل هذه السياسة تخفيض الرسوم الجمركية، وتوفير مواقف خاصة للسيارات، ومكافآت المشتريات. وتتضمن الخطة توسيع البنية التحتية على مراحل من ممرات النقل إلى الشبكات الإقليمية بحلول عام 2030.

سيناريو تكلفة الإنتاج

متوسط تكلفة الإنتاج للمصنعين ليست ثابتة، بل تعتمد أو تتغير على عوامل مختلفة. وفقًا لتحليلنا، يبلغ متوسط إنتاج وقود الغاز الطبيعي المضغوط (CNG) 458,708.69 طن في عام 2023، ومن المتوقع أن يصل إلى 460,447.76 طن في عام 2024. يبلغ متوسط الاستهلاك 421,507.42 طن في عام 2023 ومن المتوقع أن يصل إلى 427,111.35 طن في عام 2024.

تأثير وسيناريو السوق الحالي لنقص المواد الخام وتأخيرات الشحن

تقدم Data Bridge Market Research تحليلاً عالي المستوى للسوق وتقدم معلومات من خلال مراعاة تأثير وبيئة السوق الحالية لنقص المواد الخام وتأخيرات الشحن. ويترجم هذا إلى تقييم الاحتمالات الاستراتيجية وإنشاء خطط عمل فعالة ومساعدة الشركات في اتخاذ القرارات المهمة.

Apart from the standard report, we also offer in-depth analysis of the procurement level from forecasted shipping delays, distributor mapping by region, commodity analysis, production analysis, price mapping trends, sourcing, category performance analysis, supply chain risk management solutions, advanced benchmarking, and other services for procurement and strategic support.

Expected Impact of Economic Slowdown on the Pricing and Availability of Products

When economic activity slows, industries begin to suffer. The forecasted effects of the economic downturn on the pricing and accessibility of the products are taken into account in the market insight reports and intelligence services provided by DBMR. With this, our clients can typically keep one step ahead of their competitors, project their sales and revenue, and estimate their profit and loss expenditures.

CNG (Compressed Natural Gas) Fuel Market Scope

The market is segmented on the basis of products, source, kits, fuel chamber, vehicle type, CNG fuel stations offering, CNG fuel stations entity, and end use. The growth amongst these segments will help you analyze meagre growth segments in the industries and provide the users with a valuable market overview and market insights to help them make strategic decisions for identifying core market applications.

Products

- CNG (Methane-Natural Gas Stored Under High Pressure and Used as Transportation Fuel)

- BioCNG (Biomethane)

Source

- Associated Gas

- Non-Associated Gas

Kits

- Sequential

- Venturi

Fuel Chamber

- Dual-Fuelled Vehicles

- Dedicated (CNG-Fuelled) Vehicles

Vehicle Type

- Private

- Fleet

- Taxi/bus

- Police

- Delivery

- Others

CNG Fuel Stations Offering

- Monofuel Refuelling Stations (Offering Solely CNG)

- Multifuel Refuelling Stations (Offering Conventional Fuels and CNG)

CNG Fuel Stations Entity

- Public Refuelling Stations (Free Access at the Station)

- Private/Internal

End Use

- Light Motor Vehicles

- Cars

- SUVs

- MUVs

- Hatchbacks

- Sedans

- Coupes

- Convertibles

- Others

- Jeep

- Minivan

- Others

- Cars

Medium Motor Vehicles

- Bus

- Tempo

- Mini-Truck

Heavy Motor Vehicles

- Truck

- Trailers

- Containers

- Multi-Axle Bus

- Others

CNG (Compressed Natural Gas) Fuel Market Regional Analysis

The market is analyzed and market size insights and trends are provided by country, products, source, kits, fuel chamber, vehicle type, CNG fuel stations offering, CNG fuel stations entity, and end use as referenced above.

The countries covered in the market are Bulgaria, Serbia, and Romania.

Romania is expected to dominate due to its environmental benefits and cost-efficiency, with growing recognition of its lower emissions and expenses.

يقدم قسم الدولة في التقرير أيضًا عوامل التأثير الفردية على السوق والتغييرات في التنظيم في السوق محليًا والتي تؤثر على الاتجاهات الحالية والمستقبلية للسوق. نقاط البيانات مثل تحليل سلسلة القيمة المصب والمصب، والاتجاهات الفنية وتحليل قوى بورتر الخمس، ودراسات الحالة هي بعض المؤشرات المستخدمة للتنبؤ بسيناريو السوق للدول الفردية. أيضًا، يتم النظر في وجود وتوافر العلامات التجارية الإقليمية والتحديات التي تواجهها بسبب المنافسة الكبيرة أو النادرة من العلامات التجارية المحلية والمحلية، وتأثير التعريفات الجمركية المحلية وطرق التجارة أثناء تقديم تحليل تنبؤي لبيانات الدولة.

حصة سوق وقود الغاز الطبيعي المضغوط (CNG)

يوفر المشهد التنافسي للسوق تفاصيل حسب المنافسين. وتشمل التفاصيل نظرة عامة على الشركة، والبيانات المالية للشركة، والإيرادات المولدة، وإمكانات السوق، والاستثمار في البحث والتطوير، ومبادرات السوق الجديدة، والحضور العالمي، ومواقع الإنتاج والمرافق، والقدرات الإنتاجية، ونقاط القوة والضعف في الشركة، وإطلاق المنتج، وعرض المنتج ونطاقه، وهيمنة التطبيق. وتتعلق نقاط البيانات المذكورة أعلاه فقط بتركيز الشركات فيما يتعلق بالسوق.

الشركات الرائدة في سوق وقود الغاز الطبيعي المضغوط (CNG) العاملة في السوق هي:

- NIS (ألمانيا)

- كريوغاز (أوروبا)

- إنجي إس إيه (فرنسا)

- توتال إنيرجييز إس إي (فرنسا)

- شركة شيفرون (الولايات المتحدة)

- شركة شل المحدودة (المملكة المتحدة)

أحدث التطورات في سوق وقود الغاز الطبيعي المضغوط

- وفي نوفمبر/تشرين الثاني 2023، وفقًا لمقال كتبه جورجي جاجكانين، من المقرر أن تستكمل صربيا قسمها من ربط الغاز الطبيعي بين صربيا وبلغاريا بحلول نهاية نوفمبر/تشرين الثاني، وفقًا لوزيرة الطاقة دوبرافكا دجيدوفيتش هاندانوفيتش. ويقترب خط الأنابيب، الذي سينقل 1.8 مليار متر مكعب من الغاز الطبيعي سنويًا، من مرحلة التشغيل. كما وقعت صربيا مؤخرًا اتفاقية مع أذربيجان لاستيراد 400 مليون متر مكعب من الغاز، مما ينوع مصادر الطاقة لديها.

- في فبراير، أكملت شركة شل بي إل سي الاستحواذ على شركة نيتشر إنيرجي، وهي شركة رائدة في إنتاج الغاز الطبيعي المتجدد. تمثل هذه الخطوة الاستراتيجية توسعًا كبيرًا لقدرات شل في قطاع الوقود منخفض الكربون، مما يعزز التزامها بتسريع التحول في مجال الطاقة. تتخصص شركة نيتشر إنيرجي في إنتاج الغاز الحيوي من خلال الهضم اللاهوائي، وتحويل النفايات العضوية إلى غاز طبيعي متجدد. يعزز هذا الاستحواذ من مكانة شل في سوق الغاز الطبيعي المتجدد، مما يوفر بديلاً مستدامًا للوقود الأحفوري الذي يمكن استخدامه في النقل والصناعة والتدفئة.

SKU-

احصل على إمكانية الوصول عبر الإنترنت إلى التقرير الخاص بأول سحابة استخبارات سوقية في العالم

- لوحة معلومات تحليل البيانات التفاعلية

- لوحة معلومات تحليل الشركة للفرص ذات إمكانات النمو العالية

- إمكانية وصول محلل الأبحاث للتخصيص والاستعلامات

- تحليل المنافسين باستخدام لوحة معلومات تفاعلية

- آخر الأخبار والتحديثات وتحليل الاتجاهات

- استغل قوة تحليل المعايير لتتبع المنافسين بشكل شامل

Table of Content

1 INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 OVERVIEW

1.4 LIMITATIONS

1.5 MARKETS COVERED

2 MARKET SEGMENTATION

2.1 MARKETS COVERED

2.2 YEARS CONSIDERED FOR THE STUDY

2.3 CURRENCY AND PRICING

2.4 DBMR TRIPOD DATA VALIDATION MODEL

2.5 MULTIVARIATE MODELING

2.6 PRIMARY INTERVIEWS WITH KEY OPINION LEADERS

2.7 DBMR MARKET POSITION GRID

2.8 MARKET END-USE COVERAGE GRID

2.9 DBMR VENDOR SHARE ANALYSIS

2.1 SECONDARY SOURCES

2.11 ASSUMPTIONS

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

4.1 PESTLE ANALYSIS

4.1.1 POLITICAL FACTORS

4.1.2 ECONOMIC FACTORS

4.1.3 SOCIAL FACTORS

4.1.4 TECHNOLOGICAL FACTORS

4.1.5 LEGAL FACTORS

4.1.6 ENVIRONMENTAL FACTORS

4.2 PORTER’S FIVE FORCES

4.2.1 THREAT OF NEW ENTRANTS

4.2.2 THREAT OF SUBSTITUTES

4.2.3 BARGAINING POWER OF SUPPLIERS

4.2.4 BARGAINING POWER OF BUYERS

4.2.5 COMPETITIVE RIVALRY

4.3 PRODUCTION CONSUMPTION ANALYSIS

4.4 VENDOR SELECTION CRITERIA

4.5 BIO-CNG LEGISLATION

4.6 CNG OPERATING COMPANIES

4.7 ESTIMATION OF RETAIL CNG SALES PER OPERATING COMPANY

4.8 ESTIMATION OF TOTAL MOTOR FUELS RETAIL MARKET AND CNG RETAIL MARKET

4.9 NUMBER OF CNG REFUELING STATIONS

4.1 PRICE ANALYSIS

4.10.1 AVERAGE CNG PRICE PER COUNTRY IN EUR/KG – HISTORY AND FORECAST

4.10.2 PRICE STRUCTURE: INDUSTRIAL CNG PRICE/VAT/EXCISE DUTY PER COUNTRY IN EUR/KG – HISTORY & FORECAST

4.11 ANALYSIS OF TOTAL NUMBER OF REFUELING STATIONS (OFFERING ALL TYPES OF FUEL)

4.11.1 CURRENT DISTRIBUTION AND TRENDS

4.11.2 IMPLICATIONS AND FUTURE OUTLOOK

4.12 CLIMATE CHANGE SCENARIO

4.12.1 ENVIRONMENTAL CONCERNS

4.12.2 INDUSTRY RESPONSE

4.12.3 GOVERNMENT'S ROLE

4.12.4 ANALYST'S RECOMMENDATIONS

4.13 CNG REFUELLING INFRASTRUCTURE ANALYSIS

4.13.1 SERBIA

4.13.1.1 CURRENT STATE OF INFRASTRUCTURE

4.13.1.2 CHALLENGES

4.13.1.3 OPPORTUNITIES:

4.13.2 ROMANIA:

4.13.2.1 CURRENT STATE OF INFRASTRUCTURE:

4.13.2.2 CHALLENGES:

4.13.2.3 OPPORTUNITIES:

4.13.3 BULGARIA:

4.13.3.1 CURRENT STATE OF INFRASTRUCTURE:

4.13.3.2 CHALLENGES:

4.13.3.3 OPPORTUNITIES:

4.13.4 COMPARATIVE SUMMARY:

4.14 ESTIMATION OF TOTAL MOTOR FUELS RETAIL MARKET AND CNG RETAIL MARKET

4.14.1 INFRASTRUCTURE DEVELOPMENT:

4.14.2 GOVERNMENT POLICIES:

4.14.3 ENVIRONMENTAL CONCERNS:

4.14.4 MARKET SHARE DYNAMICS

4.15 GOVERNMENT AND LOCAL PERMITTING PROCESS FOR CNG INFRASTRUCTURE

4.15.1 INSTALLATION OF CNG EQUIPMENT

4.15.1.1 SERBIA:

4.15.1.2 ROMANIA:

4.15.1.3 BULGARIA:

4.15.2 FILLING OF STATIONARY CONTAINERS

4.15.2.1 SERBIA:

4.15.2.2 ROMANIA:

4.15.2.3 BULGARIA:

4.15.3 BUILDING REFUELING FACILITIES

4.15.3.1 SERBIA:

4.15.3.2 ROMANIA:

4.15.3.3 BULGARIA:

4.15.4 ADDITIONAL CONSIDERATIONS

4.15.4.1 SERBIA:

4.15.4.2 ROMANIA:

4.15.4.3 BULGARIA:

4.16 MARKET ANALYSIS ON VEHICLE TYPE: PASSENGER CARS VS. LDV (LIGHT DUTY BUSUES<5T AND LIGHT DUTY TRUCKS <3,5T) VS. HDV (HEAVY DUTY BUSES>5T AND HEAVY-DUTY VEHICLES>3,5T)

4.16.1 PASSENGER CARS

4.16.2 LIGHT DUTY VEHICLES (LDVS)

4.16.3 HEAVY DUTY VEHICLES (HDVS)

4.17 NATIONAL PROGRAM AND STRATEGIES FOR INCREASING CNG CONSUMPTION

4.17.1 SERBIA

4.17.2 ROMANIA

4.17.3 BULGARIA

4.18 NUMBER OF CNG REFUELING STATIONS AND THEIR SHARE

4.19 RAW MATERIAL COVERAGE

4.19.1 NATURAL GAS

4.19.2 SOURCES AND SUPPLY CHAIN

4.19.3 MARKET DYNAMICS

4.19.4 RECENT DEVELOPMENT

4.2 STANDARDS, TECHNICAL, AND SAFETY SPECIFICATIONS FOR CNG INFRASTRUCTURE

4.20.1 CNG CONTAINERS FOR STORAGE

4.20.1.1 MATERIAL STANDARDS

4.20.1.2 CERTIFICATION

4.20.1.3 INSPECTION AND TESTING

4.20.1.4 SAFETY FEATURES

4.20.2 COMPRESSION PLANTS

4.20.2.1 DESIGN STANDARDS

4.20.2.2 SAFETY PROTOCOLS

4.20.2.3 OPERATIONAL SAFETY

4.20.3 COMPRESSORS INSTALLATIONS

4.20.3.1 TECHNICAL SPECIFICATIONS

4.20.3.2 INSTALLATION REQUIREMENTS

4.20.3.3 SAFETY MEASURES

4.20.4 DISPENSING INSTALLATIONS

4.20.4.1 DISPENSER DESIGN

4.20.4.2 METERING ACCURACY

4.20.4.3 USER SAFETY

4.20.5 PIPING AND FITTINGS

4.20.5.1 MATERIAL SPECIFICATIONS

4.20.5.2 INSTALLATION STANDARDS

4.20.5.3 LEAK PREVENTION

4.20.6 SUPPLEMENTARY ELEMENTS

4.20.6.1 VALVES AND REGULATORS

4.20.6.2 CONTROL SYSTEMS

4.20.6.3 EMERGENCY SYSTEMS

4.20.7 COMPLIANCE AND CERTIFICATION

4.20.7.1 NATIONAL AND INTERNATIONAL STANDARDS

4.20.7.2 CERTIFICATION REQUIREMENTS

4.20.7.3 REGULAR AUDITS AND INSPECTIONS

4.21 SUPPLY CHAIN ANALYSIS

4.21.1 OVERVIEW

4.21.2 LOGISTIC COST SCENARIO

4.21.2.1 FUEL TRANSPORTATION COSTS

4.21.2.2 INFRASTRUCTURE-RELATED COSTS

4.21.2.3 ECONOMIES OF SCALE

4.21.3 IMPORTANCE OF LOGISTICS SERVICE PROVIDERS

4.21.3.1 SPECIALIZED KNOWLEDGE AND CAPABILITIES

4.21.3.2 NETWORK AND INFRASTRUCTUR

4.21.3.3 CROSS-BORDER COORDINATION

4.21.3.4 COST OPTIMIZATION

4.21.3.5 RISK MANAGEMENT

4.21.4 CONCLUSION

4.22 TECHNOLOGICAL ADVANCEMENTS BY MANUFACTURERS

4.22.1 ADVANCED COMPRESSION TECHNOLOGY

4.22.2 IMPROVED STORAGE SOLUTIONS

4.22.3 INFRASTRUCTURE EXPANSION TECHNOLOGIES

4.22.4 DIGITAL MONITORING AND CONTROL SYSTEMS

5 REGULATION COVERAGE

6 MARKET OVERVIEW

6.1 DRIVERS

6.1.1 INCREASING STRINGENT ENVIRONMENTAL POLICIES AND EMISSION REDUCTION TARGETS IN SERBIA, ROMANIA, AND BULGARIA SUPPORT THE ADOPTION OF CNG

6.1.2 RISING ECONOMIC BENEFITS OF USING CNG

6.1.3 INCREASED GOVERNMENT INCENTIVES AND SUBSIDIES PROMOTING THE USE OF CNG

6.2 RESTRAINTS

6.2.1 HIGH INITIAL COSTS ASSOCIATED WITH DEVELOPING CNG STATIONS AND INFRASTRUCTURE

6.2.2 LACK OF COMPREHENSIVE CNG REFUELLING INFRASTRUCTURE

6.3 OPPORTUNITIES

6.3.1 SUBSTANTIAL POTENTIAL IN CONVERTING EXISTING FLEETS OF PUBLIC AND PRIVATE TRANSPORTATION TO CNG

6.3.2 COLLABORATIVE EFFORTS BETWEEN SERBIA, ROMANIA, AND BULGARIA IN DEVELOPING CROSS-BORDER CNG INFRASTRUCTURE

6.4 CHALLENGES

6.4.1 INCREASING COMPETITION WITH ALTERNATIVE FUELS

6.4.2 STRICT SAFETY AND REGULATORY STANDARDS HEIGHTEN COMPLEXITY AND COSTS

7 SERBIA, ROMANIA, AND BULGARIA CNG (COMPRESSED NATURAL GAS) FUEL MARKET, BY PRODUCTS

7.1 OVERVIEW

7.2 CNG (METHANE-NATURAL GAS STORED UNDER HIGH PRESSURE AND USED AS TRANSPORTATION FUEL)

7.3 BIOCNG (BIOMETHANE)

8 SERBIA, ROMANIA, AND BULGARIA CNG (COMPRESSED NATURAL GAS) FUEL MARKET, BY SOURCE

8.1 OVERVIEW

8.2 ASSOCIATED GAS

8.2.1 NON-ASSOCIATED GAS

9 SERBIA, ROMANIA, AND BULGARIA CNG (COMPRESSED NATURAL GAS) FUEL MARKET, BY KITS

9.1 OVERVIEW

9.2 SEQUENTIAL

9.3 VENTURI

10 SERBIA, ROMANIA, AND BULGARIA CNG (COMPRESSED NATURAL GAS) FUEL MARKET, BY FUEL CHAMBER

10.1 OVERVIEW

10.2 DUAL-FUELLED VEHICLES

10.3 DEDICATED (CNG-FUELLED) VEHICLES

11 SERBIA, ROMANIA, AND BULGARIA CNG (COMPRESSED NATURAL GAS) FUEL MARKET, BY VEHICLE TYPE

11.1 OVERVIEW

11.2 PRIVATE

11.3 FLEET

12 SERBIA, ROMANIA, AND BULGARIA CNG (COMPRESSED NATURAL GAS) FUEL MARKET, BY CNG FUEL STATIONS OFFERING

12.1 OVERVIEW

12.2 MONOFUEL REFUELLING STATIONS (OFFERING SOLELY CNG)

12.3 MULTIFUEL REFUELLING STATIONS (OFFERING CONVENTIONAL FUELS AND CNG)

13 SERBIA, ROMANIA, AND BULGARIA CNG (COMPRESSED NATURAL GAS) FUEL MARKET, BY CNG FUEL STATIONS ENTITY

13.1 OVERVIEW

13.2 PUBLIC REFUELLING STATIONS (FREE ACCESS AT THE STATION)

13.3 PRIVATE/INTERNAL

14 SERBIA, ROMANIA, AND BULGARIA CNG (COMPRESSED NATURAL GAS) FUEL MARKET, BY END USE

14.1 OVERVIEW

14.2 LIGHT MOTOR VEHICLES

14.3 MEDIUM MOTOR VEHICLES

14.4 HEAVY MOTOR VEHICLES

15 SERBIA, ROMANIA, AND BULGARIA CNG (COMPRESSED NATURAL GAS) FUEL MARKET, BY COUNTRY

15.1 ROMANIA

15.2 BULGARIA

15.3 SERBIA

16 SERBIA, ROMANIA, AND BULGARIA CNG (COMPRESSED NATURAL GAS) FUEL MARKET: COMPANY LANDSCAPE

16.1 COMPANY SHARE ANALYSIS: SERBIA

16.2 COMPANY SHARE ANALYSIS: ROMANIA

16.3 COMPANY SHARE ANALYSIS: BULGARIA

17 SWOT ANALYSIS

18 COMPANY PROFILE

18.1 ENGIE SA

18.1.1 COMPANY SNAPSHOT

18.1.2 REVENUE ANALYSIS

18.1.3 PRODUCT PORTFOLIO

18.1.4 RECENT UPDATES

18.2 TOTALENERGIES SE

18.2.1 COMPANY SNAPSHOT

18.2.2 REVENUE ANALYSIS

18.2.3 PRODUCT PORTFOLIO

18.2.4 RECENT UPDATES

18.3 SHELL PLC

18.3.1 COMPANY SNAPSHOT

18.3.2 REVENUE ANALYSIS

18.3.3 PRODUCT PORTFOLIO

18.3.4 RECENT UPDATES

18.4 CHEVRON CORPORATION

18.4.1 COMPANY SNAPSHOT

18.4.2 REVENUE ANALYSIS

18.4.3 PRODUCT PORTFOLIO

18.4.4 RECENT UPDATES

18.5 KRYOGAS

18.5.1 COMPANY SNAPSHOT

18.5.2 PRODUCT PORTFOLIO

18.5.3 RECENT DEVELOPMENTS

18.6 NIS

18.6.1 COMPANY SNAPSHOT

18.6.2 REVENUE ANALYSIS

18.6.3 PRODUCT PORTFOLIO

18.6.4 RECENT DEVELOPMENTS

19 QUESTIONNAIRE

20 RELATED REPORTS

List of Table

TABLE 1 ESTIMATION OF RETAIL CNG SALES PER OPERATING COMPANY, TONS & SHARE

TABLE 2 SERBIA, ROMANIA, AND BULGARIA CNG FUEL RETAIL MARKET (TONS)

TABLE 3 SERBIA, ROMANIA, AND BULGARIA GASOLINE RETAIL MARKET (TONS)

TABLE 4 NUMBER OF CNG STATIONS AND AVERAGE PRICES IN EUROE, BY COUNTRY

TABLE 5 NATURAL GAS VEHICLES

TABLE 6 REGULATION COVERAGE

TABLE 7 SERBIA, ROMANIA, AND BULGARIA CNG (COMPRESSED NATURAL GAS) FUEL MARKET, BY PRODUCTS, 2020-2035 (USD THOUSAND)

TABLE 8 SERBIA, ROMANIA, AND BULGARIA CNG (COMPRESSED NATURAL GAS) FUEL MARKET, BY PRODUCTS, 2020-2035 (TONS)

TABLE 9 SERBIA, ROMANIA, AND BULGARIA CNG (COMPRESSED NATURAL GAS) FUEL MARKET, BY SOURCE, 2020-2035 (USD THOUSAND)

TABLE 10 SERBIA, ROMANIA, AND BULGARIA CNG (COMPRESSED NATURAL GAS) FUEL MARKET, BY SOURCE, 2020-2035 (TONS)

TABLE 11 SERBIA, ROMANIA, AND BULGARIA CNG (COMPRESSED NATURAL GAS) FUEL MARKET, BY KITS, 2020-2035 (USD THOUSAND)

TABLE 12 SERBIA, ROMANIA, AND BULGARIA CNG (COMPRESSED NATURAL GAS) FUEL MARKET, BY FUEL CHAMBER, 2020-2035 (USD THOUSAND)

TABLE 13 SERBIA, ROMANIA, AND BULGARIA CNG (COMPRESSED NATURAL GAS) FUEL MARKET, BY VEHICLE TYPE, 2020-2035 (USD THOUSAND)

TABLE 14 SERBIA, ROMANIA, AND BULGARIA FLEET IN CNG (COMPRESSED NATURAL GAS) FUEL MARKET, BY VEHICLE TYPE, 2020-2035 (USD THOUSAND)

TABLE 15 SERBIA, ROMANIA, AND BULGARIA CNG (COMPRESSED NATURAL GAS) FUEL MARKET, BY CNG FUEL STATIONS OFFERING, 2020-2035 (USD THOUSAND)

TABLE 16 SERBIA, ROMANIA, AND BULGARIA CNG (COMPRESSED NATURAL GAS) FUEL MARKET, BY CNG FUEL STATIONS ENTITY, 2020-2035 (USD THOUSAND)

TABLE 17 SERBIA, ROMANIA, AND BULGARIA CNG (COMPRESSED NATURAL GAS) FUEL MARKET, BY END USE, 2020-2035 (USD THOUSAND)

TABLE 18 SERBIA, ROMANIA, AND BULGARIA LIGHT MOTOR VEHICLES IN CNG (COMPRESSED NATURAL GAS) FUEL MARKET, BY TYPE, 2020-2035 (USD THOUSAND)

TABLE 19 SERBIA, ROMANIA, AND BULGARIA CARS IN CNG (COMPRESSED NATURAL GAS) FUEL MARKET, BY CATEGORY, 2020-2035 (USD THOUSAND)

TABLE 20 SERBIA, ROMANIA, AND BULGARIA MEDIUM MOTOR VEHICLES IN CNG (COMPRESSED NATURAL GAS) FUEL MARKET, BY TYPE, 2020-2035 (USD THOUSAND)

TABLE 21 SERBIA, ROMANIA, AND BULGARIA HEAVY MOTOR VEHICLES IN CNG (COMPRESSED NATURAL GAS) FUEL MARKET, BY TYPE, 2020-2035 (USD THOUSAND)

TABLE 22 SERBIA, ROMANIA, AND BULGARIA CNG (COMPRESSED NATURAL GAS) FUEL MARKET, BY COUNTRY, 2020-2035 (USD THOUSAND)

TABLE 23 SERBIA, ROMANIA, AND BULGARIA CNG (COMPRESSED NATURAL GAS) FUEL MARKET, BY COUNTRY, 2020-2035 (TONS)

TABLE 24 ROMANIA CNG (COMPRESSED NATURAL GAS) FUEL MARKET, BY PRODUCTS, 2020-2035 (USD THOUSAND)

TABLE 25 ROMANIA CNG (COMPRESSED NATURAL GAS) FUEL MARKET, BY PRODUCTS, 2020-2035 (TONS)

TABLE 26 ROMANIA CNG (COMPRESSED NATURAL GAS) FUEL MARKET, BY SOURCE, 2020-2035 (USD THOUSAND)

TABLE 27 ROMANIA CNG (COMPRESSED NATURAL GAS) FUEL MARKET, BY SOURCE, 2020-2035 (TONS)

TABLE 28 ROMANIA CNG (COMPRESSED NATURAL GAS) FUEL MARKET, BY KITS, 2020-2035 (USD THOUSAND)

TABLE 29 ROMANIA CNG (COMPRESSED NATURAL GAS) FUEL MARKET, BY FUEL CHAMBER, 2020-2035 (USD THOUSAND)

TABLE 30 ROMANIA CNG (COMPRESSED NATURAL GAS) FUEL MARKET, BY VEHICLE TYPE, 2020-2035 (USD THOUSAND)

TABLE 31 ROMANIA FLEET IN CNG (COMPRESSED NATURAL GAS) FUEL MARKET, BY VEHICLE TYPE, 2020-2035 (USD THOUSAND)

TABLE 32 ROMANIA CNG (COMPRESSED NATURAL GAS) FUEL MARKET, BY CNG FUEL STATIONS OFFERING, 2020-2035 (USD THOUSAND)

TABLE 33 ROMANIA CNG (COMPRESSED NATURAL GAS) FUEL MARKET, BY CNG FUEL STATIONS ENTITY, 2020-2035 (USD THOUSAND)

TABLE 34 ROMANIA CNG (COMPRESSED NATURAL GAS) FUEL MARKET, BY END USE, 2020-2035 (USD THOUSAND)

TABLE 35 ROMANIA LIGHT MOTOR VEHICLES IN CNG (COMPRESSED NATURAL GAS) FUEL MARKET, BY TYPE, 2020-2035 (USD THOUSAND)

TABLE 36 ROMANIA CARS IN CNG (COMPRESSED NATURAL GAS) FUEL MARKET, BY CATEGORY, 2020-2035 (USD THOUSAND)

TABLE 37 ROMANIA MEDIUM MOTOR VEHICLES IN CNG (COMPRESSED NATURAL GAS) FUEL MARKET, BY TYPE, 2020-2035 (USD THOUSAND)

TABLE 38 ROMANIA HEAVY MOTOR VEHICLES IN CNG (COMPRESSED NATURAL GAS) FUEL MARKET, BY TYPE, 2020-2035 (USD THOUSAND)

TABLE 39 BULGARIA CNG (COMPRESSED NATURAL GAS) FUEL MARKET, BY PRODUCTS, 2020-2035 (USD THOUSAND)

TABLE 40 BULGARIA CNG (COMPRESSED NATURAL GAS) FUEL MARKET, BY PRODUCTS, 2020-2035 (TONS)

TABLE 41 BULGARIA CNG (COMPRESSED NATURAL GAS) FUEL MARKET, BY SOURCE, 2020-2035 (USD THOUSAND)

TABLE 42 BULGARIA CNG (COMPRESSED NATURAL GAS) FUEL MARKET, BY SOURCE, 2020-2035 (TONS)

TABLE 43 BULGARIA CNG (COMPRESSED NATURAL GAS) FUEL MARKET, BY KITS, 2020-2035 (USD THOUSAND)

TABLE 44 BULGARIA CNG (COMPRESSED NATURAL GAS) FUEL MARKET, BY FUEL CHAMBER, 2020-2035 (USD THOUSAND)

TABLE 45 BULGARIA CNG (COMPRESSED NATURAL GAS) FUEL MARKET, BY VEHICLE TYPE, 2020-2035 (USD THOUSAND)

TABLE 46 BULGARIA FLEET IN CNG (COMPRESSED NATURAL GAS) FUEL MARKET, BY VEHICLE TYPE, 2020-2035 (USD THOUSAND)

TABLE 47 BULGARIA CNG (COMPRESSED NATURAL GAS) FUEL MARKET, BY CNG FUEL STATIONS OFFERING, 2020-2035 (USD THOUSAND)

TABLE 48 BULGARIA CNG (COMPRESSED NATURAL GAS) FUEL MARKET, BY CNG FUEL STATIONS ENTITY, 2020-2035 (USD THOUSAND)

TABLE 49 BULGARIA CNG (COMPRESSED NATURAL GAS) FUEL MARKET, BY END USE, 2020-2035 (USD THOUSAND)

TABLE 50 BULGARIA LIGHT MOTOR VEHICLES IN CNG (COMPRESSED NATURAL GAS) FUEL MARKET, BY TYPE, 2020-2035 (USD THOUSAND)

TABLE 51 BULGARIA CARS IN CNG (COMPRESSED NATURAL GAS) FUEL MARKET, BY CATEGORY, 2020-2035 (USD THOUSAND)

TABLE 52 BULGARIA MEDIUM MOTOR VEHICLES IN CNG (COMPRESSED NATURAL GAS) FUEL MARKET, BY TYPE, 2020-2035 (USD THOUSAND)

TABLE 53 BULGARIA HEAVY MOTOR VEHICLES IN CNG (COMPRESSED NATURAL GAS) FUEL MARKET, BY TYPE, 2020-2035 (USD THOUSAND)

TABLE 54 SERBIA CNG (COMPRESSED NATURAL GAS) FUEL MARKET, BY PRODUCTS, 2020-2035 (USD THOUSAND)

TABLE 55 SERBIA CNG (COMPRESSED NATURAL GAS) FUEL MARKET, BY PRODUCTS, 2020-2035 (TONS)

TABLE 56 SERBIA CNG (COMPRESSED NATURAL GAS) FUEL MARKET, BY SOURCE, 2020-2035 (USD THOUSAND)

TABLE 57 SERBIA CNG (COMPRESSED NATURAL GAS) FUEL MARKET, BY SOURCE, 2020-2035 (TONS)

TABLE 58 SERBIA CNG (COMPRESSED NATURAL GAS) FUEL MARKET, BY KITS, 2020-2035 (USD THOUSAND)

TABLE 59 SERBIA CNG (COMPRESSED NATURAL GAS) FUEL MARKET, BY FUEL CHAMBER, 2020-2035 (USD THOUSAND)

TABLE 60 SERBIA CNG (COMPRESSED NATURAL GAS) FUEL MARKET, BY VEHICLE TYPE, 2020-2035 (USD THOUSAND)

TABLE 61 SERBIA FLEET IN CNG (COMPRESSED NATURAL GAS) FUEL MARKET, BY VEHICLE TYPE, 2020-2035 (USD THOUSAND)

TABLE 62 SERBIA CNG (COMPRESSED NATURAL GAS) FUEL MARKET, BY CNG FUEL STATIONS OFFERING, 2020-2035 (USD THOUSAND)

TABLE 63 SERBIA CNG (COMPRESSED NATURAL GAS) FUEL MARKET, BY CNG FUEL STATIONS ENTITY, 2020-2035 (USD THOUSAND)

TABLE 64 SERBIA CNG (COMPRESSED NATURAL GAS) FUEL MARKET, BY END USE, 2020-2035 (USD THOUSAND)

TABLE 65 SERBIA LIGHT MOTOR VEHICLES IN CNG (COMPRESSED NATURAL GAS) FUEL MARKET, BY TYPE, 2020-2035 (USD THOUSAND)

TABLE 66 SERBIA CARS IN CNG (COMPRESSED NATURAL GAS) FUEL MARKET, BY CATEGORY, 2020-2035 (USD THOUSAND)

TABLE 67 SERBIA MEDIUM MOTOR VEHICLES IN CNG (COMPRESSED NATURAL GAS) FUEL MARKET, BY TYPE, 2020-2035 (USD THOUSAND)

TABLE 68 SERBIA HEAVY MOTOR VEHICLES IN CNG (COMPRESSED NATURAL GAS) FUEL MARKET, BY TYPE, 2020-2035 (USD THOUSAND)

List of Figure

FIGURE 1 SERBIA, ROMANIA, AND BULGARIA CNG (COMPRESSED NATURAL GAS) FUEL MARKET

FIGURE 2 SERBIA, ROMANIA, AND BULGARIA CNG (COMPRESSED NATURAL GAS) FUEL MARKET: DATA TRIANGULATION

FIGURE 3 SERBIA, ROMANIA, AND BULGARIA CNG (COMPRESSED NATURAL GAS) FUEL MARKET: DROC ANALYSIS

FIGURE 4 SERBIA, ROMANIA, AND BULGARIA CNG (COMPRESSED NATURAL GAS) FUEL MARKET: REGIONAL MARKET ANALYSIS

FIGURE 5 SERBIA, ROMANIA, AND BULGARIA CNG (COMPRESSED NATURAL GAS) FUEL MARKET: COMPANY RESEARCH ANALYSIS

FIGURE 6 SERBIA, ROMANIA, AND BULGARIA CNG (COMPRESSED NATURAL GAS) FUEL MARKET: MULTIVARIATE MODELLING

FIGURE 7 SERBIA, ROMANIA, AND BULGARIA CNG (COMPRESSED NATURAL GAS) FUEL MARKET: INTERVIEW DEMOGRAPHICS

FIGURE 8 SERBIA, ROMANIA, AND BULGARIA CNG (COMPRESSED NATURAL GAS) FUEL MARKET: DBMR MARKET POSITION GRID

FIGURE 9 SERBIA, ROMANIA, AND BULGARIA CNG (COMPRESSED NATURAL GAS) FUEL MARKET: MARKET END-USE COVERAGE GRID

FIGURE 10 SERBIA, ROMANIA, AND BULGARIA CNG (COMPRESSED NATURAL GAS) FUEL MARKET: VENDOR SHARE ANALYSIS

FIGURE 11 SERBIA, ROMANIA, AND BULGARIA CNG (COMPRESSED NATURAL GAS) FUEL MARKET: SEGMENTATION

FIGURE 12 TWO SEGMENTS COMPRISE THE SERBIA, ROMANIA, AND BULGARIA CNG (COMPRESSED NATURAL GAS) FUEL MARKET, BY PRODUCTS

FIGURE 13 SERBIA, ROMANIA, AND BULGARIA CNG (COMPRESSED NATURAL GAS) FUEL MARKET: OVERVIEW

FIGURE 14 STRATEGIC DECISIONS

FIGURE 15 RISING ECONOMIC BENEFITS OF USING CNG IS EXPECTED TO DRIVE THE SERBIA, ROMANIA, AND BULGARIA CNG (COMPRESSED NATURAL GAS) FUEL MARKET IN THE FORECAST PERIOD

FIGURE 16 THE CNG (METHANE-NATURAL GAS STORED UNDER HIGH PRESSURE AND USED AS TRANSPORTATION FUEL) SEGMENT IS EXPECTED TO ACCOUNT FOR THE LARGEST SHARE OF THE SERBIA, ROMANIA, AND BULGARIA CNG (COMPRESSED NATURAL GAS) FUEL MARKET IN 2024 AND 2031

FIGURE 17 PESTEL ANALYSIS

FIGURE 18 PORTER’S FIVE FORCES

FIGURE 19 PRODUCTION CONSUMPTION ANALYSIS: SERBIA, ROMANIA, AND BULGARIA CNG (COMPRESSED NATURAL GAS) FUEL MARKET

FIGURE 20 VENDOR SELECTION CRITERIA

FIGURE 21 DRIVERS, RESTRAINTS, OPPORTUNITIES AND CHALLENGES OF SERBIA, ROMANIA, AND BULGARIA CNG (COMPRESSED NATURAL GAS) FUEL MARKET

FIGURE 22 SERBIA, ROMANIA, AND BULGARIA CNG (COMPRESSED NATURAL GAS) FUEL MARKET, PRODUCTS, 2023

FIGURE 23 SERBIA, ROMANIA, AND BULGARIA CNG (COMPRESSED NATURAL GAS) FUEL MARKET, SOURCE, 2023

FIGURE 24 SERBIA, ROMANIA, AND BULGARIA CNG (COMPRESSED NATURAL GAS) FUEL MARKET, KITS, 2023

FIGURE 25 SERBIA, ROMANIA, AND BULGARIA CNG (COMPRESSED NATURAL GAS) FUEL MARKET, FUEL CHAMBER, 2023

FIGURE 26 SERBIA, ROMANIA, AND BULGARIA CNG (COMPRESSED NATURAL GAS) FUEL MARKET, VEHICLE TYPE, 2023

FIGURE 27 SERBIA, ROMANIA, AND BULGARIA CNG (COMPRESSED NATURAL GAS) FUEL MARKET, CNG FUEL STATIONS OFFERING, 2023

FIGURE 28 SERBIA, ROMANIA, AND BULGARIA CNG (COMPRESSED NATURAL GAS) FUEL MARKET, CNG FUEL STATIONS ENTITY, 2023

FIGURE 29 SERBIA, ROMANIA, AND BULGARIA CNG (COMPRESSED NATURAL GAS) FUEL MARKET, END USE, 2023

FIGURE 30 SERBIA CNG (COMPRESSED NATURAL GAS) FUEL MARKET: COMPANY SHARE 2023 (%)

FIGURE 31 ROMANIA CNG (COMPRESSED NATURAL GAS) FUEL MARKET: COMPANY SHARE 2023 (%)

FIGURE 32 BULGARIA CNG (COMPRESSED NATURAL GAS) FUEL MARKET: COMPANY SHARE 2023 (%)

منهجية البحث

يتم جمع البيانات وتحليل سنة الأساس باستخدام وحدات جمع البيانات ذات أحجام العينات الكبيرة. تتضمن المرحلة الحصول على معلومات السوق أو البيانات ذات الصلة من خلال مصادر واستراتيجيات مختلفة. تتضمن فحص وتخطيط جميع البيانات المكتسبة من الماضي مسبقًا. كما تتضمن فحص التناقضات في المعلومات التي شوهدت عبر مصادر المعلومات المختلفة. يتم تحليل بيانات السوق وتقديرها باستخدام نماذج إحصائية ومتماسكة للسوق. كما أن تحليل حصة السوق وتحليل الاتجاهات الرئيسية هي عوامل النجاح الرئيسية في تقرير السوق. لمعرفة المزيد، يرجى طلب مكالمة محلل أو إرسال استفسارك.

منهجية البحث الرئيسية التي يستخدمها فريق بحث DBMR هي التثليث البيانات والتي تتضمن استخراج البيانات وتحليل تأثير متغيرات البيانات على السوق والتحقق الأولي (من قبل خبراء الصناعة). تتضمن نماذج البيانات شبكة تحديد موقف البائعين، وتحليل خط زمني للسوق، ونظرة عامة على السوق ودليل، وشبكة تحديد موقف الشركة، وتحليل براءات الاختراع، وتحليل التسعير، وتحليل حصة الشركة في السوق، ومعايير القياس، وتحليل حصة البائعين على المستوى العالمي مقابل الإقليمي. لمعرفة المزيد عن منهجية البحث، أرسل استفسارًا للتحدث إلى خبراء الصناعة لدينا.

التخصيص متاح

تعد Data Bridge Market Research رائدة في مجال البحوث التكوينية المتقدمة. ونحن نفخر بخدمة عملائنا الحاليين والجدد بالبيانات والتحليلات التي تتطابق مع هدفهم. ويمكن تخصيص التقرير ليشمل تحليل اتجاه الأسعار للعلامات التجارية المستهدفة وفهم السوق في بلدان إضافية (اطلب قائمة البلدان)، وبيانات نتائج التجارب السريرية، ومراجعة الأدبيات، وتحليل السوق المجدد وقاعدة المنتج. ويمكن تحليل تحليل السوق للمنافسين المستهدفين من التحليل القائم على التكنولوجيا إلى استراتيجيات محفظة السوق. ويمكننا إضافة عدد كبير من المنافسين الذين تحتاج إلى بيانات عنهم بالتنسيق وأسلوب البيانات الذي تبحث عنه. ويمكن لفريق المحللين لدينا أيضًا تزويدك بالبيانات في ملفات Excel الخام أو جداول البيانات المحورية (كتاب الحقائق) أو مساعدتك في إنشاء عروض تقديمية من مجموعات البيانات المتوفرة في التقرير.