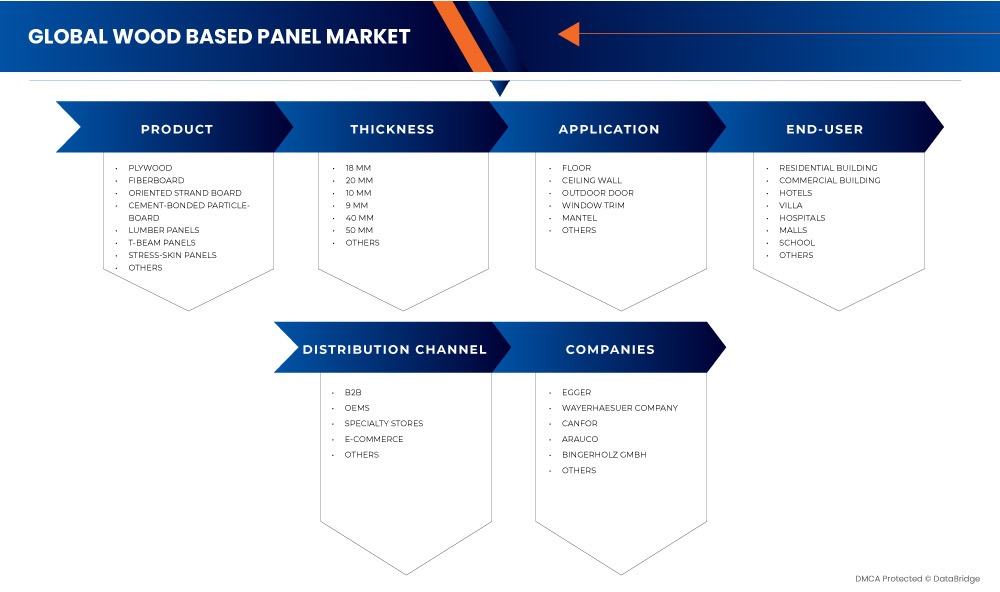

سوق الألواح الخشبية في أمريكا الشمالية حسب المنتج ( الخشب الرقائقي ، والألواح الليفية، والألواح الخشبية الموجهة، والألواح الخشبية المضغوطة، والألواح الخشبية ذات العارضة T، والألواح ذات الجلد المجهد، وغيرها)، والسمك (9 مم، و10 مم، و18 مم، و20 مم، و40 مم، و50 مم، وغيرها)، وقناة التوزيع (B2B، وOEMS، والمتاجر المتخصصة، والتجارة الإلكترونية، وغيرها)، والتطبيق (الباب الخارجي، وزخرفة النوافذ، والجدار السقفي، والرفوف، والأرضيات، وغيرها)، والمستخدم النهائي (المباني السكنية، والمباني التجارية، والفنادق، والفيلات، والمستشفيات، والمدارس، ومراكز التسوق، وغيرها) - اتجاهات الصناعة والتوقعات حتى عام 2029

تحليل وحجم سوق الألواح الخشبية في أمريكا الشمالية

تُستخدم الألواح الخشبية على نطاق واسع في الأسقف والكسوة والأسقف والأرضيات وتطبيقات الأثاث نظرًا لقوتها ومتانتها. إن الطلب المتزايد على المنتجات الخشبية من الصناعات النهائية يعمل على تسريع نمو السوق في جميع أنحاء العالم. وقد تم تحفيز تكييف هذه التقنيات مع صناعة الألواح الخشبية من خلال متطلبات تحسين جودة المنتج وخفض تكاليف التصنيع في وقت واحد، أو بالأحرى، تأمين القدرة التنافسية لمنتجي الألواح الخشبية. وبالتالي، من المرجح أن يؤدي الطلب المتزايد على الألواح الخشبية إلى دفع نمو السوق في الفترة المتوقعة.

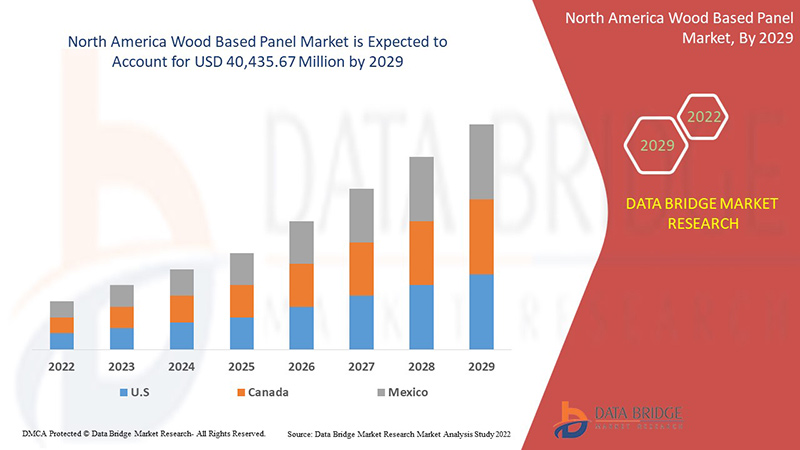

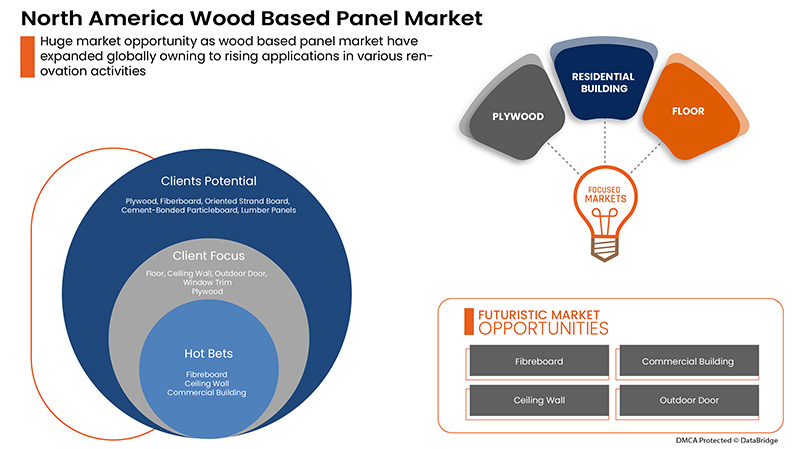

تحلل شركة Data Bridge Market Research أن سوق الألواح الخشبية من المتوقع أن تصل قيمته إلى 40,435.67 مليون دولار أمريكي بحلول عام 2029، بمعدل نمو سنوي مركب يبلغ 3.6% خلال الفترة المتوقعة. تشكل "الأرضيات" قطاع التطبيق الأكثر بروزًا في السوق المعنية بسبب ارتفاع الألواح الخشبية. يتضمن تقرير السوق الذي أعده فريق Data Bridge Market Research تحليلًا متعمقًا من الخبراء، وتحليلًا للاستيراد/التصدير، وتحليلًا للتسعير، وتحليلًا للاستهلاك الإنتاجي، وسيناريو سلسلة المناخ.

|

تقرير القياس |

تفاصيل |

|

فترة التنبؤ |

2022 إلى 2029 |

|

سنة الأساس |

2021 |

|

سنوات تاريخية |

2020 (قابلة للتخصيص حتى 2019 - 2014) |

|

وحدات كمية |

الإيرادات بالملايين من الدولارات الأمريكية |

|

القطاعات المغطاة |

حسب المنتج (الخشب الرقائقي، اللوح الليفي، لوح الخيوط الموجهة، اللوح الخشبي الملتصق بالأسمنت، ألواح الأخشاب، ألواح العارضة T، ألواح الجلد المجهد، وغيرها)، السُمك (9 مم، 10 مم، 18 مم، 20 مم، 40 مم، 50 مم وغيرها)، قناة التوزيع (B2B، OEMS، المتاجر المتخصصة، التجارة الإلكترونية وغيرها)، التطبيق (الباب الخارجي، زخرفة النوافذ، جدار السقف، الرف، الأرضية وغيرها)، المستخدم النهائي (المباني السكنية، المباني التجارية، الفنادق، الفيلات، المستشفيات، المدارس، مراكز التسوق وغيرها). |

|

الدول المغطاة |

الولايات المتحدة وكندا والمكسيك. |

|

الجهات الفاعلة في السوق المشمولة |

Boise Cascade، West Fraser، Dongwha Group، Kronoplus Limited، DARE panel group co.، ltd.، Georgia-Pacific، ARAUCO، Canfor، Sonae Industria، EVERGREEN FIBREBOARD BERHAD، Kastamonu Entegre، Weyerhaeuser Company، و Timber Products Company، وغيرها. |

تعريف السوق

تُعَد الألواح الخشبية مصطلحًا شائعًا لمجموعة من منتجات الألواح المختلفة، والتي تتمتع بمجموعة جيدة من الخصائص الهندسية. وفي حين أن بعض أنواع الألواح جديدة نسبيًا في السوق، فقد تم تطوير أنواع أخرى وتقديمها بنجاح منذ أكثر من مائة عام. ومع ذلك، فإن أنواع الألواح ذات التاريخ الطويل من التحسين المستمر لا تزال بعيدة كل البعد عن التطوير الكامل، وقد تكون لديها دائمًا فرصة للتحسين. من ناحية أخرى، تعمل التطورات التكنولوجية، ومتطلبات السوق واللوائح الجديدة، جنبًا إلى جنب مع وضع المواد الخام المتغير باستمرار، على دفع التحسينات المستمرة للألواح الخشبية وعمليات تصنيعها

ديناميكيات السوق لسوق الألواح الخشبية في أمريكا الشمالية

يتناول هذا القسم فهم محركات السوق والفرص والقيود والتحديات. ويتم مناقشة كل هذا بالتفصيل على النحو التالي:

العوامل المحركة/الفرص التي تواجه سوق الألواح الخشبية في أمريكا الشمالية

- ارتفاع إنفاق المستهلكين على الألواح الخشبية في تجديد المنازل والأثاث

تشمل صناعة الألواح الخشبية ألواح الخشب الرقائقي وألواح الخشب الهندسية وألواح الألياف متوسطة الكثافة وألواح الأثاث والألواح الخشبية ومنتجات الأسطح الزخرفية مثل الصفائح. ومن المتوقع أن يؤدي ارتفاع الإنفاق الاستهلاكي على الألواح الخشبية في تجديد المنازل والأثاث إلى تعزيز الطلب على الألواح الخشبية في المباني التجارية والسكنية. ويشكل التحسن والزيادة في أنشطة تجديد المباني مع اعتماد الألواح الخشبية لزيادة الجمالية عاملاً آخر يدفع نمو السوق. وعلاوة على ذلك، أدى زيادة تشييد المباني العامة والفنادق الكبرى والمنتجعات بألواح خشبية مزخرفة إلى نمو السوق.

- إجراءات متوازنة لاستيراد وتصدير الألواح الخشبية بين الدول

تتسم التجارة العالمية في منتجات الأخشاب بطابع إقليمي كبير، حيث تشمل أوروبا وأمريكا الشمالية وآسيا. وفي السنوات الأخيرة، تغيرت التجارة العالمية لمنتجات الأخشاب بشكل كبير مع ارتفاع الطلب على الألواح الخشبية وزيادة الأسواق الناشئة لألواح الأخشاب. وفي السنوات الأخيرة، زاد الإنتاج والتجارة في منتجات الألواح الخشبية مثل الخشب الرقائقي والألواح الخشبية المضغوطة والألواح الليفية والألواح الخشبية الموجهة بسبب ارتفاع الطلب من سوق الإسكان والزيادة العالمية في عدد السكان.

- انخفاض تكلفة المنتج إلى جانب الخصائص المتفوقة لألواح الخشب، بما في ذلك القوة والمتانة

تُعد الألواح الخشبية منتجات متخصصة توفر أداءً متقدمًا وأداءً طويل الأمد ومتانة محسنة، حيث تكون أقل تكلفة في الإنتاج والاستخدام. توفر الألواح الخشبية مجموعة مذهلة من الاحتمالات من حيث التطبيقات الهيكلية والجمالية. نظرًا لأسعارها المعقولة وأدائها المتفوق ومرونتها في التصميم والبناء والتجديد، فإن زيادة استخدام الألواح الخشبية آخذة في الازدياد في الإنشاءات السكنية. لقد تحسن بناء الهياكل الخشبية بشكل كبير مع البناء الأسرع والاستخدام الأفضل للألياف وتقليل النفايات ومراقبة الجودة بشكل أفضل. تعمل التطورات التكنولوجية الجديدة في ألواح العمل الخشبية والوصلات على وضع صناعة المنتجات الخشبية للتنافس بنجاح في بناء هياكل أكبر وأكثر تعقيدًا.

- ارتفاع الاستثمارات والمبادرات نحو أنشطة البناء لكل من المشاريع التجارية والسكنية

لقد أصبحت صناعة البناء قطاع تصنيع قوي وفعال في جميع أنحاء العالم. وفي جميع أنحاء البلدان، فإن النمو في الطلب على مشاريع البناء والعقارات مدفوع بالاتجاهات الاقتصادية الكلية والمتغيرة، مثل زيادة التحضر، وتوسع التجارة، والاتجاهات الديموغرافية مثل ارتفاع مستويات الدخل، والتكنولوجيا والبيئات المستدامة. مع ذلك، تم إطلاق مشاريع مختلفة لإنشاء مجتمعات شاملة اجتماعيًا ومستدامة، حيث يعتمد النمو الاقتصادي لأي بلد في المقام الأول على تطوير بنيته التحتية.

القيود/التحديات التي تواجه سوق الألواح الخشبية في أمريكا الشمالية

- ارتفاع المخاوف من الغبار بسبب استخدام الألواح الخشبية

تغطي الألواح الخشبية إنتاج العديد من المنتجات. وبينما يختلف تدفق الإنتاج من منتج إلى آخر، إلا أن هناك بعض السمات المشتركة فيما يتعلق بالقضايا البيئية الرئيسية. تعد انبعاثات الغبار والمركبات العضوية والفورمالديهايد من أهم المخاوف المتزايدة أثناء تصنيع منتجات الألواح الخشبية. تساهم انبعاثات الجسيمات الدقيقة في انبعاثات الغبار من إنتاج الألواح الخشبية، حيث يمكن أن تشكل الجسيمات التي تقل عن 3 ميكرومتر ما يصل إلى 50٪ من إجمالي الغبار المقاس بسبب انبعاثات الغبار من تصنيع الألواح الخشبية، مما يتسبب في مشاكل صحية وبيئية، وهو أمر على رأس أجندة السياسة البيئية.

- تقلبات في أسعار لب الخشب

إن التقلبات في أسعار المواد الخام سوف تؤثر على تكلفة إنتاج منتجات الألواح الخشبية. وسوف يؤدي التغيير في تكلفة الإنتاج إلى تغيير إيرادات الشركات المصنعة. يتم أخذ لب الخشب من الأشجار، ولكن بسبب الطلب المتزايد في المناطق المختلفة، يتم استيراد وتصدير لب الخشب ضمن الكمية المحددة. تتوفر المواد الخام بجودة مختلفة وبأسعار مختلفة، مما يجعل إنتاج الخشب صعبًا للغاية بالنسبة للشركات المصنعة. إن تكاليف المواد الخام المتقلبة للغاية وإدارة الأسعار غير الفعّالة يمكن أن تعرض الشركة المصنعة للخطر بشكل كبير في السوق. وبسبب تقلب أسعار المواد الخام، يمكن للشركات المصنعة الآن تحديد تكلفة المنتج، مما يؤدي إلى خسارة للشركات المصنعة.

- تقلب أسعار المواد الخام وعدم اتساق سلسلة التوريد

أصبحت منظومة سلسلة التوريد متقلبة بشكل متزايد بسبب نقص العوامل مثل ارتفاع تكاليف المنتج وتكاليف النقل وما إلى ذلك. يواجه مصنعو المنتجات الخشبية العديد من التحديات بسبب التباين الكبير في المواد الخام. تؤثر كل خطوة معالجة في التصنيع على استخدام المواد وكفاءة التكلفة، وهو سبب ارتفاع تكلفة المواد. التحدي الأكثر شيوعًا لمصنع المنتجات الخشبية هو تحقيق الربح وتنفيذ عملية التصنيع بتكلفة منخفضة ولكن باستخدام مواد خام متغيرة عالية التكلفة.

تأثير ما بعد كوفيد-19 على سوق الألواح الخشبية في أمريكا الشمالية

أثرت جائحة كوفيد-19 على العديد من الصناعات التحويلية في عامي 2020 و2021، حيث أدت إلى إغلاق أماكن العمل، وتعطل سلاسل التوريد، وفرض قيود على النقل. وبسبب الإغلاق، شهد السوق انخفاضًا في المبيعات بسبب إغلاق منافذ البيع بالتجزئة والقيود المفروضة على وصول العملاء على مدى السنوات القليلة الماضية.

ومع ذلك، فإن نمو السوق في فترة ما بعد الوباء يُعزى إلى زيادة عدد الأشخاص الذين يعملون من المنزل وزيادة الدخل المتاح. وقد أدى هذا إلى زيادة الطلب على الأثاث. يتخذ اللاعبون الرئيسيون في السوق قرارات استراتيجية مختلفة للتعافي بعد كوفيد-19. ويقوم اللاعبون بإجراء أنشطة بحث وتطوير متعددة لتحسين عروضهم. إنهم يعززون حصتهم في السوق من خلال استكشاف قنوات البيع بالتجزئة المختلفة والتوسع في مناطق جديدة.

يقدم تقرير سوق الألواح الخشبية في أمريكا الشمالية هذا تفاصيل عن التطورات الحديثة الجديدة، واللوائح التجارية، وتحليل الاستيراد والتصدير، وتحليل الإنتاج، وتحسين سلسلة القيمة، وحصة السوق، وتأثير اللاعبين المحليين والمحليين في السوق، وتحليل الفرص من حيث جيوب الإيرادات الناشئة، والتغيرات في لوائح السوق، وتحليل نمو السوق الاستراتيجي، وحجم السوق، ونمو سوق الفئات، ومنافذ التطبيق والهيمنة، وموافقات المنتجات، وإطلاق المنتجات، والتوسعات الجغرافية، والابتكارات التكنولوجية في السوق. للحصول على مزيد من المعلومات حول سوق الألواح الخشبية، اتصل بـ Data Bridge Market Research للحصول على موجز محلل. سيساعدك فريقنا في اتخاذ قرار سوقي مستنير لتحقيق نمو السوق.

التطورات الأخيرة

- في نوفمبر 2020، استحوذت شركة West Fraser على شركة Norbord، مما أدى إلى إنشاء شركة رائدة في مجال منتجات الأخشاب المتنوعة في أمريكا الشمالية. وقد أدى هذا الاستحواذ إلى زيادة مصداقية الشركة في السوق وبالتالي سيساعد الشركة على تنويع أعمالها.

- في فبراير 2021، أعلنت شركة Weyerhaeuser عن اتفاقية لشراء 69200 فدان من الأراضي الحرجية عالية الجودة في ألاباما من شركة Soterra. اشترت الشركة هذه الأراضي الحرجية مقابل ما يقرب من 149.00 مليون دولار أمريكي. ستعمل الشركة على تعزيز عملياتها في مجال الأراضي الحرجية وتوسيع قاعدة عملائها وفرص التصدير المستقبلية.

نطاق سوق الألواح الخشبية في أمريكا الشمالية

يتم تقسيم سوق الألواح الخشبية في أمريكا الشمالية على أساس المنتج وقناة التوزيع والسمك والتطبيق والمستخدمين النهائيين. سيساعدك النمو بين هذه القطاعات على تحليل قطاعات النمو الضئيلة في الصناعات وتزويد المستخدمين بنظرة عامة قيمة على السوق ورؤى السوق لمساعدتهم على اتخاذ قرارات استراتيجية لتحديد تطبيقات السوق الأساسية.

منتج

- الخشب الرقائقي

- لوح ألياف

- ألواح خشبية مضغوطة بالأسمنت

- لوحة خيوط موجهة

- ألواح الخشب

- ألواح ذات شعاع T

- لوحات الجلد المجهدة

- آحرون

على أساس المنتج، يتم تقسيم سوق الألواح الخشبية في أمريكا الشمالية إلى الخشب الرقائقي، والألواح الليفية، والألواح ذات الخيوط الموجهة، والألواح الخشبية المرتبطة بالأسمنت، وألواح الأخشاب، وألواح العارضة T، وألواح الجلد المجهد، وغيرها.

قناة التوزيع

- التجارة الإلكترونية

- الشركات المصنعة للمعدات الأصلية

- ب2ب

- المتاجر المتخصصة

- آحرون

على أساس قناة التوزيع، يتم تقسيم سوق الألواح الخشبية في أمريكا الشمالية إلى B2B، وOEMS، والمتاجر المتخصصة، والتجارة الإلكترونية، وغيرها.

سماكة

- 9 ملم

- 10 ملم

- 18 ملم

- 20 ملم

- 40 ملم

- 50 ملم

- آحرون

على أساس السُمك، يتم تقسيم سوق الألواح الخشبية في أمريكا الشمالية إلى 9 ملم، و10 ملم، و18 ملم، و20 ملم، و40 ملم، و50 ملم، وغيرها.

طلب

- باب خارجي

- زخرفة النوافذ

- سقف الحائط

- رف الموقد

- أرضية

- آحرون

على أساس التطبيقات، يتم تقسيم سوق الألواح الخشبية في أمريكا الشمالية إلى الباب الخارجي، وتقليم النوافذ، والجدار السقفي، والمدفأة، والأرضية، وغيرها.

المستخدم النهائي

- مبنى سكني

- مبنى تجاري

- الفنادق

- فيلا

- المستشفيات

- مدرسة

- مراكز التسوق

- آحرون

على أساس المستخدمين النهائيين، يتم تقسيم سوق الألواح الخشبية في أمريكا الشمالية إلى المباني السكنية والمباني التجارية والفنادق والفيلات والمستشفيات والمدارس ومراكز التسوق وغيرها.

تحليل/رؤى إقليمية لسوق الألواح الخشبية في أمريكا الشمالية

يتم تحليل سوق الألواح الخشبية في أمريكا الشمالية، ويتم توفير رؤى حجم السوق والاتجاهات حسب المنتج وقناة التوزيع والسمك والتطبيق والمستخدمين النهائيين، كما هو مذكور أعلاه.

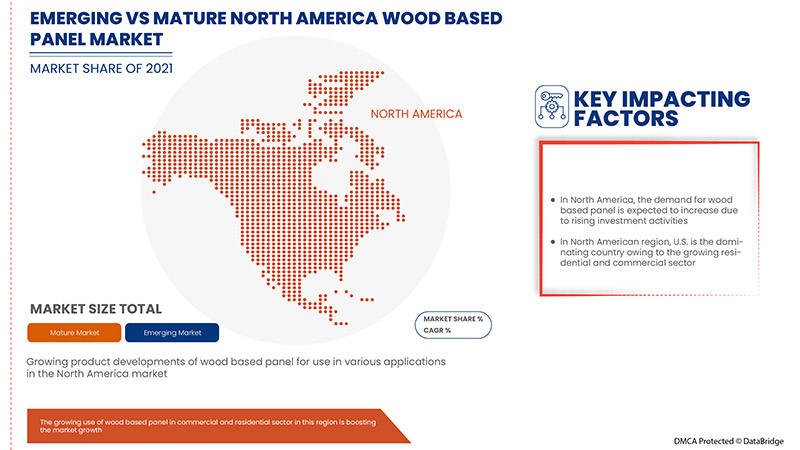

الدول التي يغطيها تقرير سوق الألواح الخشبية في أمريكا الشمالية هي الولايات المتحدة وكندا والمكسيك.

تهيمن الولايات المتحدة على السوق بسبب ارتفاع إنفاق المستهلكين على الألواح الخشبية في تجديد المنازل والأثاث في المنطقة. كما أن ارتفاع الاستثمارات والمبادرات نحو أنشطة البناء التجارية والسكنية على حد سواء يعمل على دفع الطلب في المنطقة على الألواح الخشبية.

كما يوفر قسم الدولة في التقرير عوامل فردية مؤثرة على السوق وتغييرات تنظيم السوق التي تؤثر على اتجاهات السوق الحالية والمستقبلية. تعد نقاط البيانات مثل تحليل سلسلة القيمة النهائية والنهائية، والاتجاهات الفنية، وتحليل قوى بورتر الخمس، ودراسات الحالة بعض المؤشرات المستخدمة للتنبؤ بسيناريو السوق للدول الفردية. كما يتم النظر في وجود وتوافر العلامات التجارية العالمية والتحديات التي تواجهها بسبب المنافسة الكبيرة أو النادرة من العلامات التجارية المحلية والمحلية، وتأثير التعريفات الجمركية المحلية، وطرق التجارة أثناء تقديم تحليل تنبؤي لبيانات الدولة.

تحليل المشهد التنافسي وحصة سوق الألواح الخشبية في أمريكا الشمالية

يوفر المشهد التنافسي لسوق الألواح الخشبية في أمريكا الشمالية تفاصيل حسب المنافس. تتضمن التفاصيل نظرة عامة على الشركة، والبيانات المالية للشركة، والإيرادات المولدة، وإمكانات السوق، والاستثمار في البحث والتطوير، ومبادرات السوق الجديدة، والحضور العالمي، ومواقع الإنتاج والمرافق، والقدرات الإنتاجية، ونقاط القوة والضعف للشركة، وإطلاق المنتج، وعرض المنتج ونطاقه، وهيمنة التطبيق. ترتبط نقاط البيانات المذكورة أعلاه فقط بتركيز الشركات على سوق الألواح الخشبية في أمريكا الشمالية.

بعض اللاعبين الرئيسيين العاملين في سوق الألواح الخشبية هم Boise Cascade و West Fraser و Dongwha Group و Kronoplus Limited و DARE panel group co.، ltd. و Georgia-Pacific و Arauco و Canfor و Sonae Industria و Evergreen Fibreboard Berhad و Kastamonu Entegre و Weyerhaeuser Company و Timber Products Company وغيرها.

SKU-

احصل على إمكانية الوصول عبر الإنترنت إلى التقرير الخاص بأول سحابة استخبارات سوقية في العالم

- لوحة معلومات تحليل البيانات التفاعلية

- لوحة معلومات تحليل الشركة للفرص ذات إمكانات النمو العالية

- إمكانية وصول محلل الأبحاث للتخصيص والاستعلامات

- تحليل المنافسين باستخدام لوحة معلومات تفاعلية

- آخر الأخبار والتحديثات وتحليل الاتجاهات

- استغل قوة تحليل المعايير لتتبع المنافسين بشكل شامل

Table of Content

1 INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 OVERVIEW OF NORTH AMERICA WOOD BASED PANELS MARKET

1.4 LIMITATIONS

1.5 MARKETS COVERED

2 MARKET SEGMENTATION

2.1 MARKETS COVERED

2.2 GEOGRAPHICAL SCOPE

2.3 YEARS CONSIDERED FOR THE STUDY

2.4 CURRENCY AND PRICING

2.5 DBMR TRIPOD DATA VALIDATION MODEL

2.6 MULTIVARIATE MODELLING

2.7 DISTRIBUTION CHANNEL LIFELINE CURVE

2.8 PRIMARY INTERVIEWS WITH KEY OPINION LEADERS

2.9 DBMR MARKET POSITION GRID

2.1 MARKET APPLICATION COVERAGE GRID

2.11 DBMR MARKET CHALLENGE MATRIX

2.12 VENDOR SHARE ANALYSIS

2.13 IMPORT-EXPORT DATA

2.14 SECONDARY SOURCES

2.15 ASSUMPTIONS

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

4.1 PESTLE ANALYSIS

4.1.1 POLITICAL FACTORS

4.1.2 ECONOMIC FACTORS

4.1.3 SOCIAL FACTORS

4.1.4 TECHNOLOGICAL FACTORS

4.1.5 LEGAL FACTORS

4.1.6 ENVIRONMENTAL FACTORS

4.2 IMPORT EXPORT SCENARIO

4.3 PORTER’S FIVE FORCES:

4.3.1 THREAT OF NEW ENTRANTS:

4.3.2 THREAT OF SUBSTITUTES:

4.3.3 CUSTOMER BARGAINING POWER:

4.3.4 SUPPLIER BARGAINING POWER:

4.3.5 INTERNAL COMPETITION (RIVALRY):

4.4 PRICING TREND SCENARIO

4.5 PRODUCTION & CONSUMPTION ANALYSIS

4.6 RAW MATERIAL PRODUCTION COVERAGE

4.7 TECHNOLOGICAL ADVANCEMENT BY MANUFACTURERS

4.8 VENDOR SELECTION CRITERIA

4.9 REGULATORY FRAMWORK

5 CLIMATE CHANGE SCENARIO

5.1 ENVIRONMENTAL CONCERNS

5.2 INDUSTRY RESPONSE

5.3 GOVERNMENT’S ROLE

5.4 ANALYST RECOMMENDATION

6 SUPPLY CHAIN ANALYSIS

6.1 OVERVIEW

6.2 LOGISTIC COST SCENARIO

6.3 IMPORTANCE OF LOGISTICS SERVICE PROVIDERS

7 MARKET OVERVIEW

7.1 DRIVERS

7.1.1 RISE IN CONSUMER SPENDING ON WOOD BASED PANELS IN THE RENOVATION OF HOMES AND FURNITURE

7.1.2 BALANCED IMPORT AND EXPORT PROCEDURES OF WOOD PANELS AMONG THE COUNTRIES

7.1.3 LOW PRODUCT COST COUPLED WITH SUPERIOR PROPERTIES OF WOOD PANELS, INCLUDING STRENGTH AND DURABILITY

7.2 RESTRAINTS

7.2.1 STRINGENT RULES AND NORMS BY THE GOVERNMENT REGARDING DEFORESTATION

7.2.2 RISE IN CONCERNS OF DUST BY WOOD PANEL USAGE

7.2.3 FLUCTUATION IN THE PRICES OF WOOD PULP

7.3 OPPORTUNITIES

7.3.1 RISE IN INVESTMENTS AND INITIATIVES TOWARDS CONSTRUCTION ACTIVITIES FOR BOTH COMMERCIAL AND RESIDENTIAL

7.3.2 INCREASE IN PARTNERSHIPS FOR THE GROWTH OF CONSTRUCTION SECTOR IN EMERGING COUNTRIES

7.3.3 INCORPORATION OF APA STANDARDS FOR MANUFACTURERS AIDS THE PRODUCT ENTRY INTO THE MARKET

7.4 CHALLENGES

7.4.1 SHORTAGE OF TIMBER AND CLIMATE CHANGE

7.4.2 FLUCTUATION OF RAW MATERIAL PRICES AND SUPPLY CHAIN INCONSISTENCY

7.4.3 SHORTAGE IN LABOR AND FINANCIAL LOSSES

8 IMPACT OF COVID-19 ON THE NORTH AMERICA WOOD BASED PANEL MARKET

8.1 ANALYSIS ON IMPACT OF COVID-19 ON NORTH AMERICA WOOD BASED PANEL MARKET

8.2 AFTERMATH OF COVID-19 AND GOVERNMENT INITIATIVE TO BOOST THE MARKET

8.3 STRATEGIC DECISION FOR MANUFACTURES AFTER COVID-19 TO GAIN COMPETITIVE MARKET SHARE

8.4 IMPACT ON PRICE

8.5 IMPACT ON DEMAND

8.6 IMPACT ON SUPPLY CHAIN

8.7 CONCLUSION

9 NORTH AMERICA WOOD BASED PANEL MARKET, BY PRODUCT

9.1 OVERVIEW

9.2 PLYWOOD

9.2.1 SOFTWOOD PLYWOOD

9.2.2 HARDWOOD PLYWOOD

9.2.3 OTHERS

9.3 FIBERBOARD

9.3.1 MDF

9.3.2 HDF

9.3.3 PARTICLEBOARD

9.3.4 HARDBOARD

9.3.5 OTHERS

9.4 ORIENTED STRAND BOARD

9.5 CEMENT-BONDED PARTICLEBOARD

9.6 LUMBER PANELS

9.7 T-BEAM PANELS

9.8 STRESS-SKIN PANELS

9.9 OTHERS

10 NORTH AMERICA WOOD BASED PANEL MARKET, BY DISTRIBUTION CHANNEL

10.1 OVERVIEW

10.2 B2B

10.3 OEMS

10.4 SPECIALTY STORES

10.5 E-COMMERCE

10.6 OTHERS

11 NORTH AMERICA WOOD BASED PANEL MARKET, BY THICKNESS

11.1 OVERVIEW

11.2 18 MM

11.3 20 MM

11.4 10 MM

11.5 9 MM

11.6 40 MM

11.7 50 MM

11.8 OTHERS

12 NORTH AMERICA WOOD BASED PANEL MARKET, BY APPLICATION

12.1 OVERVIEW

12.2 FLOOR

12.3 CEILING WALL

12.4 OUTDOOR DOOR

12.5 WINDOW TRIM

12.6 MANTEL

12.7 OTHERS

13 NORTH AMERICA WOOD BASED PANEL MARKET, BY END-USER

13.1 OVERVIEW

13.2 RESIDENTIAL BUILDING

13.2.1 PLYWOOD

13.2.2 FIBERBOARD

13.2.3 ORIENTED STRAND BOARD

13.2.4 CEMENT-BONDED PARTICLEBOARD

13.2.5 LUMBER PANELS

13.2.6 T-BEAM PANELS

13.2.7 STRESS-SKIN PANELS

13.2.8 OTHERS

13.3 COMMERCIAL BUILDING

13.3.1 PLYWOOD

13.3.2 FIBERBOARD

13.3.3 ORIENTED STRAND BOARD

13.3.4 CEMENT-BONDED PARTICLEBOARD

13.3.5 LUMBER PANELS

13.3.6 T-BEAM PANELS

13.3.7 STRESS-SKIN PANELS

13.3.8 OTHERS

13.4 HOTELS

13.4.1 PLYWOOD

13.4.2 FIBERBOARD

13.4.3 ORIENTED STRAND BOARD

13.4.4 CEMENT-BONDED PARTICLEBOARD

13.4.5 LUMBER PANELS

13.4.6 T-BEAM PANELS

13.4.7 STRESS-SKIN PANELS

13.4.8 OTHERS

13.5 VILLA

13.5.1 PLYWOOD

13.5.2 FIBERBOARD

13.5.3 ORIENTED STRAND BOARD

13.5.4 CEMENT-BONDED PARTICLEBOARD

13.5.5 LUMBER PANELS

13.5.6 T-BEAM PANELS

13.5.7 STRESS-SKIN PANELS

13.5.8 OTHERS

13.6 HOSPITALS

13.6.1 PLYWOOD

13.6.2 FIBERBOARD

13.6.3 ORIENTED STRAND BOARD

13.6.4 CEMENT-BONDED PARTICLEBOARD

13.6.5 LUMBER PANELS

13.6.6 T-BEAM PANELS

13.6.7 STRESS-SKIN PANELS

13.6.8 OTHERS

13.7 MALLS

13.7.1 PLYWOOD

13.7.2 FIBERBOARD

13.7.3 ORIENTED STRAND BOARD

13.7.4 CEMENT-BONDED PARTICLEBOARD

13.7.5 LUMBER PANELS

13.7.6 T-BEAM PANELS

13.7.7 STRESS-SKIN PANELS

13.7.8 OTHERS

13.8 SCHOOL

13.8.1 PLYWOOD

13.8.2 FIBERBOARD

13.8.3 ORIENTED STRAND BOARD

13.8.4 CEMENT-BONDED PARTICLEBOARD

13.8.5 LUMBER PANELS

13.8.6 T-BEAM PANELS

13.8.7 STRESS-SKIN PANELS

13.8.8 OTHERS

13.9 OTHERS

13.9.1 PLYWOOD

13.9.2 FIBERBOARD

13.9.3 ORIENTED STRAND BOARD

13.9.4 CEMENT-BONDED PARTICLEBOARD

13.9.5 LUMBER PANELS

13.9.6 T-BEAM PANELS

13.9.7 STRESS-SKIN PANELS

13.9.8 OTHERS

14 NORTH AMERICA WOOD BASED PANEL MARKET, BY REGION

14.1 NORTH AMERICA

14.1.1 U.S.

14.1.2 CANADA

14.1.3 MEXICO

15 NORTH AMERICA WOOD BASED PANEL MARKET, COMPANY LANDSCAPE

15.1 COMPANY SHARE ANALYSIS: NORTH AMERICA

15.2 MERGER & ACQUISITION

15.3 PRODUCT LAUNCH

15.4 PARTNERSHIP

15.5 EXPANSIONS

16 SWOT ANALYSIS

17 COMPANY PROFILE

17.1 WEST FRASER

17.1.1 COMPANY SNAPSHOT

17.1.2 REVENUE ANALYSIS

17.1.3 COMPANY SHARE ANALYSIS

17.1.4 PRODUCT PORTFOLIO

17.1.5 RECENT DEVELOPMENT

17.2 WEYERHAEUSER COMPANY

17.2.1 COMPANY SNAPSHOT

17.2.2 REVENUE ANALYSIS

17.2.3 COMPANY SHARE ANALYSIS

17.2.4 PRODUCT PORTFOLIO

17.2.5 RECENT DEVELOPMENTS

17.3 CANFOR

17.3.1 COMPANY SNAPSHOT

17.3.2 REVENUE ANALYSIS

17.3.3 COMPANY SHARE ANALYSIS

17.3.4 PRODUCT PORTFOLIO

17.3.5 RECENT DEVELOPMENTS

17.4 EGGER GROUP

17.4.1 COMPANY SNAPSHOT

17.4.2 COMPANY SHARE ANALYSIS

17.4.3 PRODUCT PORTFOLIO

17.4.4 RECENT DEVELOPMENT

17.5 ARAUCO

17.5.1 COMPANY SNAPSHOT

17.5.2 REVENUE ANALYSIS

17.5.3 PRODUCT PORTFOLIO

17.5.4 RECENT DEVELOPMENTS

17.6 BINDERHOLZ GMBH

17.6.1 COMPANY SNAPSHOT

17.6.2 PRODUCT PORTFOLIO

17.6.3 RECENT DEVELOPMENTS

17.7 BOISE CASCADE

17.7.1 COMPANY SNAPSHOT

17.7.2 REVENUE ANALYSIS

17.7.3 PRODUCT PORTFOLIO

17.7.4 RECENT DEVELOPMENT

17.8 DARE PANEL GROUP CO., LTD.

17.8.1 COMPANY SNAPSHOT

17.8.2 PRODUCT PORTFOLIO

17.8.3 RECENT DEVELOPMENTS

17.9 DONGWHA GROUP

17.9.1 COMPANY SNAPSHOT

17.9.2 REVENUE ANALYSIS

17.9.3 PRODUCT PORTFOLIO

17.9.4 RECENT DEVELOPMENTS

17.1 EVERGREEN FIBREBOARD BERHAD

17.10.1 COMPANY SNAPSHOT

17.10.2 REVENUE ANALYSIS

17.10.3 PRODUCT PORTFOLIO

17.10.4 RECENT DEVELOPMENTS

17.11 GEORGIA-PACIFIC

17.11.1 COMPANY SNAPSHOT

17.11.2 PRODUCT PORTFOLIO

17.11.3 RECENT DEVELOPMENT

17.12 GREEN RIVER HOLDING CO., LTD.

17.12.1 COMPANY SNAPSHOT

17.12.2 REVENUE ANALYSIS

17.12.3 PRODUCT PORTFOLIO

17.12.4 RECENT DEVELOPMENTS

17.13 KASTAMONU ENTEGRE

17.13.1 COMPANY SNAPSHOT

17.13.2 PRODUCT PORTFOLIO

17.13.3 RECENT DEVELOPMENTS

17.14 KRONOPLUS LIMITED

17.14.1 COMPANY SNAPSHOT

17.14.2 PRODUCT PORTFOLIO

17.14.3 RECENT DEVELOPMENTS

17.15 MIECO CHIPBOARD BERHAD

17.15.1 COMPANY SNAPSHOT

17.15.2 REVENUE ANALYSIS

17.15.3 PRODUCT PORTFOLIO

17.15.4 RECENT DEVELOPMENTS

17.16 PFEIFER GROUP

17.16.1 COMPANY SNAPSHOT

17.16.2 PRODUCT PORTFOLIO

17.16.3 RECENT DEVELOPMENT

17.17 SONAE INDUSTRIA

17.17.1 COMPANY SNAPSHOT

17.17.2 REVENUE ANALYSIS

17.17.3 PRODUCT PORTFOLIO

17.17.4 RECENT DEVELOPMENT

17.18 STARBANK PANEL PRODUCTS LTD

17.18.1 COMPANY SNAPSHOT

17.18.2 PRODUCT PORTFOLIO

17.18.3 RECENT DEVELOPMENT

17.19 TIMBER PRODUCTS COMPANY

17.19.1 COMPANY SNAPSHOT

17.19.2 PRODUCT PORTFOLIO

17.19.3 RECENT DEVELOPMENTS

18 QUESTIONNAIRE

19 RELATED REPORTS

List of Table

TABLE 1 IMPORT DATA OF FLOORING PANELS, ASSEMBLED, OF WOOD (EXCLUDING MULTILAYER PANELS AND FLOORING PANELS FOR MOSAIC FLOORS; HS CODE - 441879 (USD THOUSAND)

TABLE 2 EXPORT DATA OF FLOORING PANELS, ASSEMBLED, OF WOOD (EXCLUDING MULTILAYER PANELS AND FLOORING PANELS FOR MOSAIC FLOORS; HS CODE - 441879 (USD THOUSAND)

TABLE 3 EXPORT OF WOOD BASED PANEL (1,000 M3)

TABLE 4 IMPORT OF WOOD BASED PANEL (1,000 M3)

TABLE 5 NORTH AMERICA WOOD BASED PANEL MARKET, BY PRODUCT, 2020-2029 (USD MILLION)

TABLE 6 NORTH AMERICA WOOD BASED PANEL MARKET, BY PRODUCT, 2020-2029 (MILLION CUBIC METERS)

TABLE 7 NORTH AMERICA PLYWOOD IN WOOD BASED PANEL MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 8 NORTH AMERICA PLYWOOD IN WOOD BASED PANEL MARKET, BY PRODUCT, 2020-2029 (USD MILLION)

TABLE 9 NORTH AMERICA FIBERBOARD IN WOOD BASED PANEL MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 10 NORTH AMERICA FIBERBOARD IN WOOD BASED PANEL MARKET, BY PRODUCT, 2020-2029 (USD MILLION)

TABLE 11 NORTH AMERICA ORIENTED STRAND BOARD IN WOOD BASED PANEL MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 12 NORTH AMERICA CEMENT-BONDED PARTICLEBOARD IN WOOD BASED PANEL MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 13 NORTH AMERICA LUMBER PANELS IN WOOD BASED PANEL MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 14 NORTH AMERICA T-BEAM PANELS IN WOOD BASED PANEL MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 15 NORTH AMERICA STRESS-SKIN PANELS IN WOOD BASED PANEL MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 16 NORTH AMERICA OTHERS IN WOOD BASED PANEL MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 17 NORTH AMERICA WOOD BASED PANEL MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 18 NORTH AMERICA B2B IN WOOD BASED PANEL MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 19 NORTH AMERICA OEMS IN WOOD BASED PANEL MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 20 NORTH AMERICA SPECIALTY STORES IN WOOD BASED PANEL MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 21 NORTH AMERICA E-COMMERCE IN WOOD BASED PANEL MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 22 NORTH AMERICA OTHERS IN WOOD BASED PANEL MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 23 NORTH AMERICA WOOD BASED PANEL MARKET, BY THICKNESS, 2020-2029 (USD MILLION)

TABLE 24 NORTH AMERICA 18 MM IN WOOD BASED PANEL MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 25 NORTH AMERICA 20 MM IN WOOD BASED PANEL MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 26 NORTH AMERICA 10 MM IN WOOD BASED PANEL MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 27 NORTH AMERICA 9 MM IN WOOD BASED PANEL MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 28 NORTH AMERICA 40 MM IN WOOD BASED PANEL MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 29 NORTH AMERICA 50 MM IN WOOD BASED PANEL MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 30 NORTH AMERICA OTHERS IN WOOD BASED PANEL MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 31 NORTH AMERICA WOOD BASED PANEL MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 32 NORTH AMERICA FLOOR IN WOOD BASED PANEL MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 33 NORTH AMERICA CEILING WALL IN WOOD BASED PANEL MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 34 NORTH AMERICA OUTDOOR DOOR IN WOOD BASED PANEL MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 35 NORTH AMERICA WINDOW TRIM IN WOOD BASED PANEL MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 36 NORTH AMERICA MANTEL IN WOOD BASED PANEL MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 37 NORTH AMERICA OTHERS IN WOOD BASED PANEL MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 38 NORTH AMERICA WOOD BASED PANEL MARKET, BY END-USER, 2020-2029 (USD MILLION)

TABLE 39 NORTH AMERICA RESIDENTIAL BUILDING IN WOOD BASED PANEL MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 40 NORTH AMERICA RESIDENTIAL BUILDING IN WOOD BASED PANEL MARKET, BY PRODUCT, 2020-2029 (USD MILLION)

TABLE 41 NORTH AMERICA COMMERCIAL BUILDING IN WOOD BASED PANEL MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 42 NORTH AMERICA COMMERCIAL BUILDING IN WOOD BASED PANEL MARKET, BY PRODUCT, 2020-2029 (USD MILLION)

TABLE 43 NORTH AMERICA HOTELS IN WOOD BASED PANEL MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 44 NORTH AMERICA HOTELS IN WOOD BASED PANEL MARKET, BY PRODUCT, 2020-2029 (USD MILLION)

TABLE 45 NORTH AMERICA VILLA IN WOOD BASED PANEL MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 46 NORTH AMERICA VILLA IN WOOD BASED PANEL MARKET, BY PRODUCT, 2020-2029 (USD MILLION)

TABLE 47 NORTH AMERICA HOSPITALS IN WOOD BASED PANEL MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 48 NORTH AMERICA HOSPITALS IN WOOD BASED PANEL MARKET, BY PRODUCT, 2020-2029 (USD MILLION)

TABLE 49 NORTH AMERICA MALLS IN WOOD BASED PANEL MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 50 NORTH AMERICA MALLS IN WOOD BASED PANEL MARKET, BY PRODUCT, 2020-2029 (USD MILLION)

TABLE 51 NORTH AMERICA SCHOOL IN WOOD BASED PANEL MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 52 NORTH AMERICA SCHOOL IN WOOD BASED PANEL MARKET, BY PRODUCT, 2020-2029 (USD MILLION)

TABLE 53 NORTH AMERICA OTHERS IN WOOD BASED PANEL MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 54 NORTH AMERICA OTHERS IN WOOD BASED PANEL MARKET, BY PRODUCT, 2020-2029 (USD MILLION)

TABLE 55 NORTH AMERICA WOOD BASED PANEL MARKET, BY COUNTRY, 2020-2029 (USD MILLION)

TABLE 56 NORTH AMERICA WOOD BASED PANEL MARKET, BY COUNTRY, 2020-2029 (MILLION CUBIC METERS)

TABLE 57 NORTH AMERICA WOOD BASED PANEL MARKET, BY PRODUCT, 2020-2029 (USD MILLION)

TABLE 58 NORTH AMERICA WOOD BASED PANEL MARKET, BY PRODUCT, 2020-2029 (MILLION CUBIC METERS)

TABLE 59 NORTH AMERICA PLYWOOD IN WOOD BASED PANEL MARKET, BY PRODUCT, 2020-2029 (USD MILLION)

TABLE 60 NORTH AMERICA FIBERBOARD IN WOOD BASED PANEL MARKET, BY PRODUCT, 2020-2029 (USD MILLION)

TABLE 61 NORTH AMERICA WOOD BASED PANEL MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 62 NORTH AMERICA WOOD BASED PANEL MARKET, BY THICKNESS, 2020-2029 (USD MILLION)

TABLE 63 NORTH AMERICA WOOD BASED PANEL MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 64 NORTH AMERICA WOOD BASED PANEL MARKET, BY END-USER, 2020-2029 (USD MILLION)

TABLE 65 NORTH AMERICA RESIDENTIAL BUILDING IN WOOD BASED PANEL MARKET, BY PRODUCT, 2020-2029 (USD MILLION)

TABLE 66 NORTH AMERICA COMMERCIAL BUILDING IN WOOD BASED PANEL MARKET, BY PRODUCT, 2020-2029 (USD MILLION)

TABLE 67 NORTH AMERICA HOTELS IN WOOD BASED PANEL MARKET, BY PRODUCT, 2020-2029 (USD MILLION)

TABLE 68 NORTH AMERICA VILLA IN WOOD BASED PANEL MARKET, BY PRODUCT, 2020-2029 (USD MILLION)

TABLE 69 NORTH AMERICA HOSPITALS IN WOOD BASED PANEL MARKET, BY PRODUCT, 2020-2029 (USD MILLION)

TABLE 70 NORTH AMERICA MALLS IN WOOD BASED PANEL MARKET, BY PRODUCT, 2020-2029 (USD MILLION)

TABLE 71 NORTH AMERICA SCHOOL IN WOOD BASED PANEL MARKET, BY PRODUCT, 2020-2029 (USD MILLION)

TABLE 72 NORTH AMERICA OTHERS IN WOOD BASED PANEL MARKET, BY PRODUCT, 2020-2029 (USD MILLION)

TABLE 73 U.S. WOOD BASED PANEL MARKET, BY PRODUCT, 2020-2029 (USD MILLION)

TABLE 74 U.S. WOOD BASED PANEL MARKET, BY PRODUCT, 2020-2029 (MILLION CUBIC METERS)

TABLE 75 U.S. PLYWOOD IN WOOD BASED PANEL MARKET, BY PRODUCT, 2020-2029 (USD MILLION)

TABLE 76 U.S. FIBERBOARD IN WOOD BASED PANEL MARKET, BY PRODUCT, 2020-2029 (USD MILLION)

TABLE 77 U.S. WOOD BASED PANEL MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 78 U.S. WOOD BASED PANEL MARKET, BY THICKNESS, 2020-2029 (USD MILLION)

TABLE 79 U.S. WOOD BASED PANEL MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 80 U.S. WOOD BASED PANEL MARKET, BY END-USER, 2020-2029 (USD MILLION)

TABLE 81 U.S. RESIDENTIAL BUILDING IN WOOD BASED PANEL MARKET, BY PRODUCT, 2020-2029 (USD MILLION)

TABLE 82 U.S. COMMERCIAL BUILDING IN WOOD BASED PANEL MARKET, BY PRODUCT, 2020-2029 (USD MILLION)

TABLE 83 U.S. HOTELS IN WOOD BASED PANEL MARKET, BY PRODUCT, 2020-2029 (USD MILLION)

TABLE 84 U.S. VILLA IN WOOD BASED PANEL MARKET, BY PRODUCT, 2020-2029 (USD MILLION)

TABLE 85 U.S. HOSPITALS IN WOOD BASED PANEL MARKET, BY PRODUCT, 2020-2029 (USD MILLION)

TABLE 86 U.S. MALLS IN WOOD BASED PANEL MARKET, BY PRODUCT, 2020-2029 (USD MILLION)

TABLE 87 U.S. SCHOOL IN WOOD BASED PANEL MARKET, BY PRODUCT, 2020-2029 (USD MILLION)

TABLE 88 U.S. OTHERS IN WOOD BASED PANEL MARKET, BY PRODUCT, 2020-2029 (USD MILLION)

TABLE 89 CANADA WOOD BASED PANEL MARKET, BY PRODUCT, 2020-2029 (USD MILLION)

TABLE 90 CANADA WOOD BASED PANEL MARKET, BY PRODUCT, 2020-2029 (MILLION CUBIC METERS)

TABLE 91 CANADA PLYWOOD IN WOOD BASED PANEL MARKET, BY PRODUCT, 2020-2029 (USD MILLION)

TABLE 92 CANADA FIBERBOARD IN WOOD BASED PANEL MARKET, BY PRODUCT, 2020-2029 (USD MILLION)

TABLE 93 CANADA WOOD BASED PANEL MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 94 CANADA WOOD BASED PANEL MARKET, BY THICKNESS, 2020-2029 (USD MILLION)

TABLE 95 CANADA WOOD BASED PANEL MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 96 CANADA WOOD BASED PANEL MARKET, BY END-USER, 2020-2029 (USD MILLION)

TABLE 97 CANADA RESIDENTIAL BUILDING IN WOOD BASED PANEL MARKET, BY PRODUCT, 2020-2029 (USD MILLION)

TABLE 98 CANADA COMMERCIAL BUILDING IN WOOD BASED PANEL MARKET, BY PRODUCT, 2020-2029 (USD MILLION)

TABLE 99 CANADA HOTELS IN WOOD BASED PANEL MARKET, BY PRODUCT, 2020-2029 (USD MILLION)

TABLE 100 CANADA VILLA IN WOOD BASED PANEL MARKET, BY PRODUCT, 2020-2029 (USD MILLION)

TABLE 101 CANADA HOSPITALS IN WOOD BASED PANEL MARKET, BY PRODUCT, 2020-2029 (USD MILLION)

TABLE 102 CANADA MALLS IN WOOD BASED PANEL MARKET, BY PRODUCT, 2020-2029 (USD MILLION)

TABLE 103 CANADA SCHOOL IN WOOD BASED PANEL MARKET, BY PRODUCT, 2020-2029 (USD MILLION)

TABLE 104 CANADA OTHERS IN WOOD BASED PANEL MARKET, BY PRODUCT, 2020-2029 (USD MILLION)

TABLE 105 MEXICO WOOD BASED PANEL MARKET, BY PRODUCT, 2020-2029 (USD MILLION)

TABLE 106 MEXICO WOOD BASED PANEL MARKET, BY PRODUCT, 2020-2029 (MILLION CUBIC METERS)

TABLE 107 MEXICO PLYWOOD IN WOOD BASED PANEL MARKET, BY PRODUCT, 2020-2029 (USD MILLION)

TABLE 108 MEXICO FIBERBOARD IN WOOD BASED PANEL MARKET, BY PRODUCT, 2020-2029 (USD MILLION)

TABLE 109 MEXICO WOOD BASED PANEL MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 110 MEXICO WOOD BASED PANEL MARKET, BY THICKNESS, 2020-2029 (USD MILLION)

TABLE 111 MEXICO WOOD BASED PANEL MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 112 MEXICO WOOD BASED PANEL MARKET, BY END-USER, 2020-2029 (USD MILLION)

TABLE 113 MEXICO RESIDENTIAL BUILDING IN WOOD BASED PANEL MARKET, BY PRODUCT, 2020-2029 (USD MILLION)

TABLE 114 MEXICO COMMERCIAL BUILDING IN WOOD BASED PANEL MARKET, BY PRODUCT, 2020-2029 (USD MILLION)

TABLE 115 MEXICO HOTELS IN WOOD BASED PANEL MARKET, BY PRODUCT, 2020-2029 (USD MILLION)

TABLE 116 MEXICO VILLA IN WOOD BASED PANEL MARKET, BY PRODUCT, 2020-2029 (USD MILLION)

TABLE 117 MEXICO HOSPITALS IN WOOD BASED PANEL MARKET, BY PRODUCT, 2020-2029 (USD MILLION)

TABLE 118 MEXICO MALLS IN WOOD BASED PANEL MARKET, BY PRODUCT, 2020-2029 (USD MILLION)

TABLE 119 MEXICO SCHOOL IN WOOD BASED PANEL MARKET, BY PRODUCT, 2020-2029 (USD MILLION)

TABLE 120 MEXICO OTHERS IN WOOD BASED PANEL MARKET, BY PRODUCT, 2020-2029 (USD MILLION)

List of Figure

FIGURE 1 NORTH AMERICA WOOD BASED PANELS MARKET: SEGMENTATION

FIGURE 2 NORTH AMERICA WOOD BASED PANEL MARKET: DATA TRIANGULATION

FIGURE 3 NORTH AMERICA WOOD BASED PANELS MARKET: DROC ANALYSIS

FIGURE 4 NORTH AMERICA WOOD BASED PANELS MARKET: NORTH AMERICA VS REGIONAL MARKET ANALYSIS

FIGURE 5 NORTH AMERICA WOOD BASED PANELS MARKET: COMPANY RESEARCH ANALYSIS

FIGURE 6 NORTH AMERICA WOOD BASED PANELS MARKET: THE DISTRIBUTION CHANNEL LIFE LINE CURVE

FIGURE 7 NORTH AMERICA WOOD BASED PANELS MARKET: INTERVIEW DEMOGRAPHICS

FIGURE 8 NORTH AMERICA WOOD BASED PANELS MARKET: DBMR MARKET POSITION GRID

FIGURE 9 NORTH AMERICA WOOD BASED PANELS MARKET: MARKET APPLICATION COVERAGE GRID

FIGURE 10 NORTH AMERICA WOOD BASED PANELS MARKET: THE MARKET CHALLENGE MATRIX

FIGURE 11 NORTH AMERICA WOOD BASED PANELS MARKET: VENDOR SHARE ANALYSIS

FIGURE 12 NORTH AMERICA WOOD BASED PANELS MARKET: SEGMENTATION

FIGURE 13 RISING CONSUMER SPENDING ON WOOD BASED PANELS IN THE RENOVATION OF HOMES AND FURNITURE EXPECTED TO DRIVE THE NORTH AMERICA WOOD BASED PANELS MARKET IN THE FORECAST PERIOD OF 2022 TO 2029

FIGURE 14 PLYWOOD SEGMENT IS EXPECTED TO ACCOUNT FOR THE LARGEST SHARE OF THE NORTH AMERICA WOOD BASED PANELS MARKET IN 2022 & 2029

FIGURE 15 IMPORT EXPORT SCENARIO (USD THOUSAND)

FIGURE 16 PRICE ANALYSIS FOR NORTH AMERICA WOOD BASED PANEL MARKET, 2018-2022

FIGURE 17 EUROPE, EECCA, NORTH AMERICA WOOD BASED PANELS PRODUCTION, AND NET APPARENT CONSUMPTION, 2018-2020 FROM 2018-2020 (1,000 M3)

FIGURE 18 VENDOR SELECTION CRITERIA

FIGURE 19 SUPPLY CHAIN ANALYSIS- NORTH AMERICA WOOD BASED PANEL MARKET

FIGURE 20 DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES OF NORTH AMERICA WOOD BASED PANEL MARKET

FIGURE 21 EUROPE WOOD BASED PANEL PRODUCTION, IN 2018

FIGURE 22 EXPENDITURE ON FURNISHINGS, EQUIPMENT AND ROUTINE MAINTENANCE

FIGURE 23 WOOD PULP PRICE IN 2020 (USD DOLLAR)

FIGURE 24 NORTH AMERICA WOOD BASED PANEL MARKET, BY PRODUCT, 2021

FIGURE 25 NORTH AMERICA WOOD BASED PANEL MARKET, BY DISTRIBUTION CHANNEL, 2021

FIGURE 26 NORTH AMERICA WOOD BASED PANEL MARKET, BY THICKNESS, 2021

FIGURE 27 NORTH AMERICA WOOD BASED PANEL MARKET, BY APPLICATION, 2021

FIGURE 28 NORTH AMERICA WOOD BASED PANEL MARKET, BY END-USER, 2021

FIGURE 29 NORTH AMERICA WOOD BASED PANEL MARKET: SNAPSHOT (2021)

FIGURE 30 NORTH AMERICA WOOD BASED PANEL MARKET: BY COUNTRY (2021)

FIGURE 31 NORTH AMERICA WOOD BASED PANEL MARKET: BY COUNTRY (2022 & 2029)

FIGURE 32 NORTH AMERICA WOOD BASED PANEL MARKET: BY COUNTRY (2021 & 2029)

FIGURE 33 NORTH AMERICA WOOD BASED PANEL MARKET: BY PRODUCT (2022-2029)

FIGURE 34 NORTH AMERICA WOOD BASED PANEL MARKET: COMPANY SHARE 2021 (%)

منهجية البحث

يتم جمع البيانات وتحليل سنة الأساس باستخدام وحدات جمع البيانات ذات أحجام العينات الكبيرة. تتضمن المرحلة الحصول على معلومات السوق أو البيانات ذات الصلة من خلال مصادر واستراتيجيات مختلفة. تتضمن فحص وتخطيط جميع البيانات المكتسبة من الماضي مسبقًا. كما تتضمن فحص التناقضات في المعلومات التي شوهدت عبر مصادر المعلومات المختلفة. يتم تحليل بيانات السوق وتقديرها باستخدام نماذج إحصائية ومتماسكة للسوق. كما أن تحليل حصة السوق وتحليل الاتجاهات الرئيسية هي عوامل النجاح الرئيسية في تقرير السوق. لمعرفة المزيد، يرجى طلب مكالمة محلل أو إرسال استفسارك.

منهجية البحث الرئيسية التي يستخدمها فريق بحث DBMR هي التثليث البيانات والتي تتضمن استخراج البيانات وتحليل تأثير متغيرات البيانات على السوق والتحقق الأولي (من قبل خبراء الصناعة). تتضمن نماذج البيانات شبكة تحديد موقف البائعين، وتحليل خط زمني للسوق، ونظرة عامة على السوق ودليل، وشبكة تحديد موقف الشركة، وتحليل براءات الاختراع، وتحليل التسعير، وتحليل حصة الشركة في السوق، ومعايير القياس، وتحليل حصة البائعين على المستوى العالمي مقابل الإقليمي. لمعرفة المزيد عن منهجية البحث، أرسل استفسارًا للتحدث إلى خبراء الصناعة لدينا.

التخصيص متاح

تعد Data Bridge Market Research رائدة في مجال البحوث التكوينية المتقدمة. ونحن نفخر بخدمة عملائنا الحاليين والجدد بالبيانات والتحليلات التي تتطابق مع هدفهم. ويمكن تخصيص التقرير ليشمل تحليل اتجاه الأسعار للعلامات التجارية المستهدفة وفهم السوق في بلدان إضافية (اطلب قائمة البلدان)، وبيانات نتائج التجارب السريرية، ومراجعة الأدبيات، وتحليل السوق المجدد وقاعدة المنتج. ويمكن تحليل تحليل السوق للمنافسين المستهدفين من التحليل القائم على التكنولوجيا إلى استراتيجيات محفظة السوق. ويمكننا إضافة عدد كبير من المنافسين الذين تحتاج إلى بيانات عنهم بالتنسيق وأسلوب البيانات الذي تبحث عنه. ويمكن لفريق المحللين لدينا أيضًا تزويدك بالبيانات في ملفات Excel الخام أو جداول البيانات المحورية (كتاب الحقائق) أو مساعدتك في إنشاء عروض تقديمية من مجموعات البيانات المتوفرة في التقرير.