سوق تكنولوجيا المؤتمرات القابلة للارتداء في أمريكا الشمالية، حسب العرض (الأجهزة والبرامج والخدمات)، نوع المؤتمر ( المؤتمرات الصوتية ومؤتمرات الفيديو )، وضع النشر (في الموقع والسحابة ، حجم المنظمة (المنظمة الصغيرة والمتوسطة والمنظمة الكبيرة)، التطبيق (المستهلك والمؤسسة)، الاستخدام النهائي (الشركات والتعليم والرعاية الصحية والحكومة والدفاع والخدمات المصرفية والخدمات المالية والتأمين (BSFI) ووسائل الإعلام والترفيه وغيرها)، الدولة (الولايات المتحدة وكندا والمكسيك) اتجاهات الصناعة والتوقعات حتى عام 2029

تحليل السوق والرؤى : سوق تكنولوجيا المؤتمرات القابلة للارتداء في أمريكا الشمالية

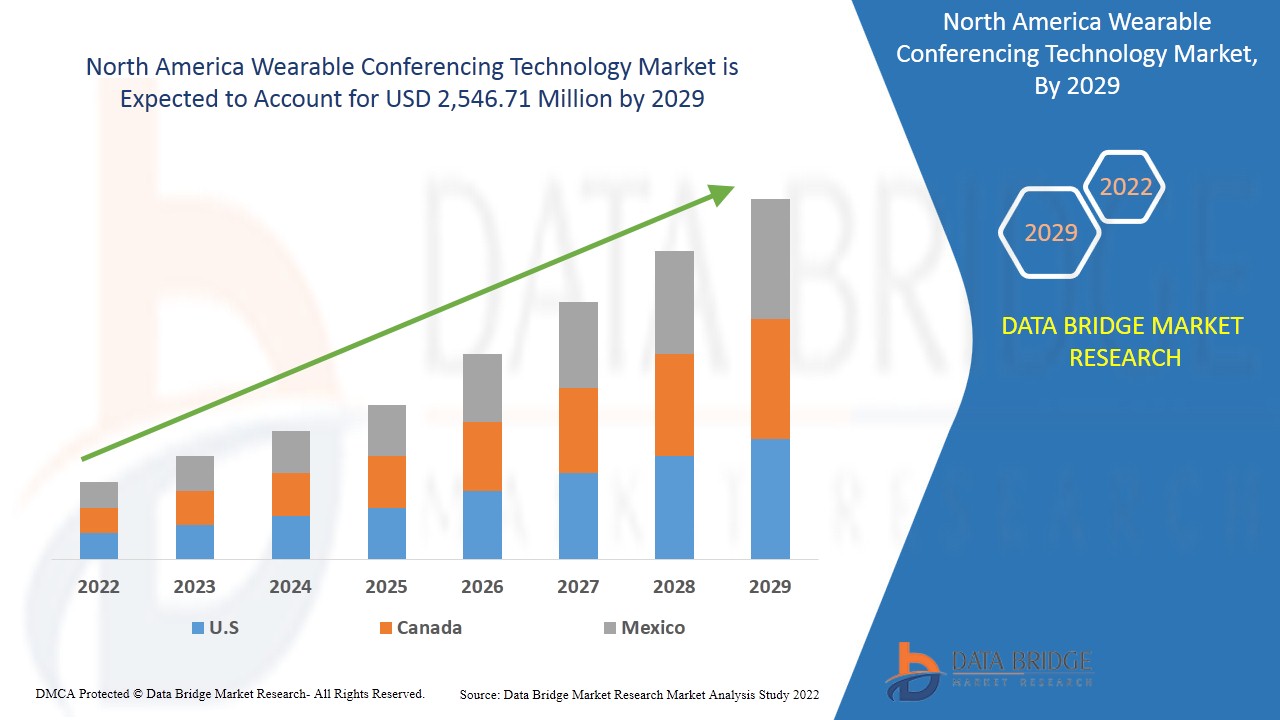

من المتوقع أن يكتسب سوق تكنولوجيا المؤتمرات القابلة للارتداء في أمريكا الشمالية نموًا في السوق في الفترة المتوقعة من 2022 إلى 2029. تحلل Data Bridge Market Research أن السوق ينمو بمعدل نمو سنوي مركب بنسبة 13.6٪ في الفترة المتوقعة من 2022 إلى 2029 ومن المتوقع أن يصل إلى 2،546.71 مليون دولار أمريكي بحلول عام 2029. إن التركيز المتزايد واعتماد ثقافة العمل عن بعد يعزز سوق تكنولوجيا المؤتمرات القابلة للارتداء في أمريكا الشمالية.

تُعرف التكنولوجيا القابلة للارتداء، والتي غالبًا ما تُعرف باسم "الأجهزة القابلة للارتداء"، بأنها فئة من الأجهزة الإلكترونية التي يمكن ارتداؤها على الجسم. هذه الأدوات عبارة عن أجهزة تعمل بدون استخدام اليدين مع تطبيقات عملية تعمل بواسطة المعالجات الدقيقة ولديها القدرة على إرسال واستقبال البيانات عبر الإنترنت. من الممكن التعاون في الوقت الفعلي بين العديد من الأجهزة باستخدام حلول المؤتمرات. يمكن للمشاركين الانضمام إلى مكان رقمي واحد باستخدام أجهزتهم المحمولة أو أجهزة الكمبيوتر المحمولة أو أجهزة الكمبيوتر الشخصية (PC) باستخدام منصة مؤتمرات. يمكن للمستخدمين استخدام اتصال بالإنترنت للوصول إلى تقنيات المؤتمرات التي يتم توفيرها كبرنامج كخدمة (SaaS). يمكن أيضًا توفير منصة مؤتمرات الويب في الموقع، باستخدام قدرات مركز بيانات المؤسسة. وبالتالي، فهي تقنية تُستخدم في أجهزة مثل Google Glasses أو Microsoft HoloLens لتطبيق المؤتمرات والتعاون عبر الوسائط الصوتية أو المرئية. حاليًا، تتمتع هذه السوق بتطبيقات واسعة في عالم الشركات للتعاون المهني وفي القطاعات التعليمية والتدريبية.

إن التركيز المتزايد على ثقافة العمل عن بعد وتبنيها يعمل كمحرك لسوق تكنولوجيا المؤتمرات القابلة للارتداء في أمريكا الشمالية. وتثبت الطبيعة المتقطعة لطاقة الرياح أنها تشكل تحديًا. ومع ذلك، من المتوقع أن توفر الزيادة في القرارات الاستراتيجية المختلفة مثل الشراكات فرصًا لسوق تكنولوجيا المؤتمرات القابلة للارتداء في أمريكا الشمالية. وقد تثبت التكلفة العالية للبنية الأساسية للمؤتمرات أنها تقيد السوق.

يقدم تقرير سوق تكنولوجيا المؤتمرات القابلة للارتداء في أمريكا الشمالية تفاصيل عن حصة السوق والتطورات الجديدة وتحليل خط أنابيب المنتجات وتأثير اللاعبين المحليين والمحليين في السوق وتحليل الفرص من حيث جيوب الإيرادات الناشئة والتغييرات في لوائح السوق وموافقات المنتجات والقرارات الاستراتيجية وإطلاق المنتجات والتوسعات الجغرافية والابتكارات التكنولوجية في السوق. لفهم التحليل وسيناريو سوق تكنولوجيا المؤتمرات القابلة للارتداء في أمريكا الشمالية، اتصل بـ Data Bridge Market Research للحصول على موجز محلل؛ سيساعدك فريقنا في إنشاء حل تأثير الإيرادات لتحقيق هدفك المنشود.

نطاق وحجم سوق تكنولوجيا المؤتمرات القابلة للارتداء في أمريكا الشمالية

يتم تقسيم سوق تكنولوجيا المؤتمرات القابلة للارتداء في أمريكا الشمالية على أساس العرض ونوع المؤتمرات وطريقة النشر وحجم المنظمة والتطبيق والاستخدام النهائي. يساعدك النمو بين القطاعات على تحليل جيوب النمو والاستراتيجيات المتخصصة للتعامل مع السوق وتحديد مجالات التطبيق الأساسية والاختلاف في الأسواق المستهدفة.

- بناءً على العرض، يتم تقسيم سوق تكنولوجيا المؤتمرات القابلة للارتداء في أمريكا الشمالية إلى أجهزة وبرامج وخدمات. يتم تقسيم الأجهزة بشكل فرعي إلى الكاميرات والميكروفونات وغيرها. بالإضافة إلى ذلك، يتم تقسيم الخدمات بشكل فرعي إلى خدمات مُدارة وخدمات احترافية. في عام 2022، من المتوقع أن تهيمن الأجهزة على سوق تكنولوجيا المؤتمرات القابلة للارتداء في أمريكا الشمالية حيث تولد المزيد من الإيرادات والمزيد من البحث والتطوير في الأجهزة من قبل المؤسسات الكبيرة.

- بناءً على نوع المؤتمرات، يتم تقسيم سوق تكنولوجيا المؤتمرات القابلة للارتداء في أمريكا الشمالية إلى مؤتمرات صوتية ومؤتمرات فيديو . في عام 2022، من المتوقع أن يهيمن قطاع مؤتمرات الفيديو لأنه يسهل الاجتماعات الافتراضية والتعاون على المستندات الرقمية والعروض التقديمية المشتركة من خلال ربط الأفراد في الوقت الفعلي.

- بناءً على وضع النشر، يتم تقسيم سوق تكنولوجيا المؤتمرات القابلة للارتداء في أمريكا الشمالية إلى محلي وسحابي. في عام 2022، من المتوقع أن تهيمن شريحة المحلي على السوق لأنها تساعد في توفير الأمان والخصوصية للبنية الأساسية لأنها تقع محليًا. نشر هذا النوع أرخص مقارنة بالسحابة.

- بناءً على حجم المؤسسة، يتم تقسيم سوق تكنولوجيا المؤتمرات القابلة للارتداء في أمريكا الشمالية إلى مؤسسات صغيرة ومتوسطة الحجم ومؤسسات كبيرة. في عام 2022، من المتوقع أن تهيمن شريحة المؤسسات الكبيرة على السوق حيث يتطلب الحل استثمارًا رأسماليًا أعلى وتبرر التكلفة زيادة إيرادات الشركات من خلال نشر هذه التكنولوجيا.

- بناءً على التطبيق، يتم تقسيم سوق تكنولوجيا المؤتمرات القابلة للارتداء في أمريكا الشمالية إلى المستهلك والمؤسسة. في عام 2022، من المتوقع أن تهيمن شريحة المؤسسات على السوق حيث تساعد الحلول الموظفين على العمل عن بُعد بسهولة وكفاءة.

- بناءً على الاستخدام النهائي، يتم تقسيم سوق تكنولوجيا المؤتمرات القابلة للارتداء في أمريكا الشمالية إلى الشركات والتعليم والرعاية الصحية والحكومة والدفاع والخدمات المصرفية والخدمات المالية والتأمين والإعلام والترفيه وغيرها. في عام 2022، من المتوقع أن تهيمن شريحة الشركات على السوق حيث تساعد حلول المؤتمرات الموظفين على التعاون والعمل على المستندات المشتركة معًا في الوقت الفعلي أو من خلال مشاركة الشاشة.

تحليل على مستوى الدولة لسوق تكنولوجيا المؤتمرات القابلة للارتداء في أمريكا الشمالية

تم تحليل سوق تكنولوجيا المؤتمرات القابلة للارتداء في أمريكا الشمالية، وحجم السوق المعروض، ونوع المؤتمر، وطريقة النشر، وحجم المنظمة، والتطبيق والاستخدام النهائي كما هو مذكور أعلاه.

الدول التي يغطيها تقرير سوق تكنولوجيا المؤتمرات القابلة للارتداء في أمريكا الشمالية هي الولايات المتحدة وكندا والمكسيك. تهيمن الولايات المتحدة على سوق تكنولوجيا المؤتمرات القابلة للارتداء في أمريكا الشمالية بسبب وجود اللاعبين الرئيسيين من الأجهزة القابلة للارتداء بالإضافة إلى موفري برامج المؤتمرات. تحتل كندا المرتبة الثانية حيث تشهد البلاد تطوراً في سوق الواقع المعزز والرنين المغناطيسي مع مرافق البحث للشركات الصغيرة والطلب من صناعة الرعاية الصحية.

كما يوفر قسم الدولة في التقرير عوامل التأثير الفردية على السوق والتغييرات في التنظيم في السوق محليًا والتي تؤثر على الاتجاهات الحالية والمستقبلية للسوق. تعد نقاط البيانات مثل المبيعات الجديدة ومبيعات الاستبدال والتركيبة السكانية للدولة والقوانين التنظيمية ورسوم الاستيراد والتصدير من بين المؤشرات الرئيسية المستخدمة للتنبؤ بسيناريو السوق للدول الفردية. كما يتم النظر في وجود وتوافر العلامات التجارية في أمريكا الشمالية والتحديات التي تواجهها بسبب المنافسة الكبيرة أو النادرة من العلامات التجارية المحلية والمحلية وتأثير قنوات المبيعات أثناء تقديم تحليل تنبؤي لبيانات الدولة.

إن الانتشار المتزايد للأجهزة الذكية وخدمات الإنترنت يعزز نمو سوق تكنولوجيا مؤتمرات الأجهزة القابلة للارتداء في أمريكا الشمالية

كما يوفر لك سوق تكنولوجيا المؤتمرات القابلة للارتداء في أمريكا الشمالية تحليلاً تفصيليًا للسوق لنمو كل دولة في سوق معينة. بالإضافة إلى ذلك، يوفر معلومات تفصيلية حول استراتيجية اللاعبين في السوق وتواجدهم الجغرافي. تتوفر البيانات للفترة التاريخية من 2011 إلى 2020.

تحليل المنافسة وحصة سوق تكنولوجيا المؤتمرات القابلة للارتداء في أمريكا الشمالية

يوفر المشهد التنافسي لسوق تكنولوجيا المؤتمرات القابلة للارتداء في أمريكا الشمالية تفاصيل حسب المنافس. تتضمن التفاصيل نظرة عامة على الشركة، والبيانات المالية للشركة، والإيرادات المتولدة، وإمكانات السوق، والاستثمار في البحث والتطوير، ومبادرات السوق الجديدة، ومواقع الإنتاج والمرافق، ونقاط القوة والضعف في الشركة، وإطلاق المنتج، وخطوط أنابيب تجارب المنتج، وموافقات المنتج، وبراءات الاختراع، وعرض المنتج، ونطاقه، وهيمنة التطبيق، ومنحنى شريان الحياة التكنولوجي. ترتبط نقاط البيانات المذكورة أعلاه فقط بتركيز الشركة فيما يتعلق بسوق تكنولوجيا المؤتمرات القابلة للارتداء في أمريكا الشمالية.

الشركات الكبرى التي تتعامل في تكنولوجيا المؤتمرات القابلة للارتداء في أمريكا الشمالية هي Logitech وVuzix Corporation وVidyo, Inc. وRicoh وZoom Video Communications, Inc. وMicrosoft وLogMeIn, Inc. وRealWear, Inc. وDIALPAD, INC. وGoogle (شركة تابعة لشركة Alphabet Inc.) وChironix وSeiko Epson Corporation وIristick وRobert Bosch GmbH وezTalks وHTC Corporation وSony Corporation وLenovo وEON Reality وTeamViewer وغيرها من الشركات المحلية. يفهم محللو DBMR نقاط القوة التنافسية ويقدمون تحليلاً تنافسيًا لكل منافس على حدة.

كما يتم أيضًا إبرام العديد من العقود والاتفاقيات من قبل الشركات في جميع أنحاء العالم، مما يؤدي إلى تسريع سوق تكنولوجيا مؤتمرات الأجهزة القابلة للارتداء في أمريكا الشمالية.

على سبيل المثال،

- في أكتوبر 2021، أطلقت شركة LogMeIn, Inc. تطبيق GoToConnect Legal، وهو إصدار جديد من منصة الاتصالات الموحدة كخدمة (UCaaS). تم تصميم المنصة لتلبية متطلبات المهنيين القانونيين من خلال تسهيل التعاون مع العملاء والزملاء من أجل تعظيم ساعات العمل القابلة للفوترة. سيسمح الحل بتقليل الوقت غير المدفوع، وتعظيم الإيرادات، وإدارة اللوائح من الهيئات الحاكمة، والحفاظ على مستوى عالٍ من الأمان في ممارساتها. وبالتالي، ستساعد الشركة في تقديم خدمات عالية الجودة وسهلة الفوترة لعملائها.

- في ديسمبر 2021، كشفت شركة Vidyo, Inc. عن واجهات VidyoRoom Solutions الجديدة، بما في ذلك ثلاث تجارب جديدة لمؤتمرات الفيديو في المكتب مصممة خصيصًا لتوفير أفضل بيئة تعاون للفرق الهجينة. ستصبح الواجهات الجديدة لغرف الاجتماعات وغرف الاجتماعات وقاعات الاجتماعات، بما في ذلك أدوات التحكم في المؤتمرات ودعم التجارب الغامرة، ذات أهمية متزايدة مع محاولة الموظفين العودة إلى المكتب بعد الوباء، بينما يواصل آخرون العمل عن بُعد. بفضل هذه الشركة، ستتمكن من توفير تجربة سهلة الاستخدام لعملائها.

SKU-

احصل على إمكانية الوصول عبر الإنترنت إلى التقرير الخاص بأول سحابة استخبارات سوقية في العالم

- لوحة معلومات تحليل البيانات التفاعلية

- لوحة معلومات تحليل الشركة للفرص ذات إمكانات النمو العالية

- إمكانية وصول محلل الأبحاث للتخصيص والاستعلامات

- تحليل المنافسين باستخدام لوحة معلومات تفاعلية

- آخر الأخبار والتحديثات وتحليل الاتجاهات

- استغل قوة تحليل المعايير لتتبع المنافسين بشكل شامل

Table of Content

1 INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 OVERVIEW OF NORTH AMERICA WEARABLE CONFERENCING TECHNOLOGY MARKET

1.4 CURRENCY AND PRICING

1.5 LIMITATIONS

1.6 MARKETS COVERED

2 MARKET SEGMENTATION

2.1 MARKETS COVERED

2.2 GEOGRAPHICAL SCOPE

2.3 YEARS CONSIDERED FOR THE STUDY

2.4 DBMR TRIPOD DATA VALIDATION MODEL

2.5 PRIMARY INTERVIEWS WITH KEY OPINION LEADERS

2.6 DBMR MARKET POSITION GRID

2.7 VENDOR SHARE ANALYSIS

2.8 MULTIVARIATE MODELING

2.9 TYPE TIMELINE CURVE

2.1 MARKET APPLICATION COVERAGE GRID

2.11 SECONDARY SOURCES

2.12 ASSUMPTIONS

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

5 MARKET OVERVIEW

5.1 DRIVERS

5.1.1 SURGING FOCUS AND ADOPTION OF REMOTE WORKING CULTURE

5.1.2 INCREASING PENETRATION OF SMART DEVICES AND INTERNET SERVICES

5.1.3 RISE IN ADOPTION OF CONFERENCING TECHNOLOGY BY EDUCATIONAL INSTITUTES

5.2 RESTRAINTS

5.2.1 HIGH COST OF CONFERENCING INFRASTRUCTURE

5.2.2 LOSS OF DATA AND PRIVACY

5.3 OPPORTUNITIES

5.3.1 INCREASE IN VARIOUS STRATEGIC DECISIONS SUCH AS PARTNERSHIP AND ACQUISITION

5.3.2 RISE IN INITIATIVES BY GOVERNMENT

5.4 CHALLENGES

5.4.1 NORTH AMERICA ECONOMIC SLOWDOWN LIMITS

5.4.2 ELECTRONIC COMPONENTS ARE PUSHING SMART GLASSES BOUNDARIES

6 IMPACT ANALYSIS OF COVID-19 ON NORTH AMERICA WEARABLE CONFERENCING TECHNOLOGY MARKET

6.1 ANALYSIS ON IMPACT OF COVID-19 ON THE MARKET

6.2 STRATEGIC DECISION BY MANUFACTURERS AND GOVERNMENT INITIATIVES AFTER COVID-19

6.3 IMPACT ON DEMAND

6.4 PRICE IMPACT

6.5 IMPACT ON SUPPLY CHAIN

6.6 CONCLUSION

7 NORTH AMERICA WEARABLE CONFERENCING TECHNOLOGY MARKET, BY OFFERING

7.1 OVERVIEW

7.2 HARDWARE

7.2.1 CAMERA

7.2.2 MICROPHONE

7.2.3 OTHERS

7.3 SOFTWARE

7.4 SERVICES

7.4.1 MANAGED SERVICES

7.4.2 PROFESSIONAL SERVICES

8 NORTH AMERICA WEARABLE CONFERENCING TECHNOLOGY MARKET, BY CONFERENCING TYPE

8.1 OVERVIEW

8.2 VIDEO CONFERENCING

8.3 AUDIO CONFERENCING

9 NORTH AMERICA WEARABLE CONFERENCING TECHNOLOGY MARKET, BY DEPLOYMENT MODE

9.1 OVERVIEW

9.2 ON-PREMISE

9.3 CLOUD

10 NORTH AMERICA WEARABLE CONFERENCING TECHNOLOGY MARKET, BY ORGANIZATION SIZE

10.1 OVERVIEW

10.2 LARGE ORGANIZATION

10.3 SMALL & MEDIUM ORGANIZATION

11 NORTH AMERICA WEARABLE CONFERENCING TECHNOLOGY MARKET, BY APPLICATION

11.1 OVERVIEW

11.2 ENTERPRISE

11.3 CONSUMER

12 NORTH AMERICA WEARABLE CONFERENCING TECHNOLOGY MARKET, BY END USE

12.1 OVERVIEW

12.2 CORPORATE

12.2.1 MARKET BY DEPLOYMENT MODE

12.2.1.1 ON-PREMISE

12.2.1.2 CLOUD

12.2.2 MARKET BY ORGANIZATION SIZE

12.2.2.1 LARGE ORGANIZATION

12.2.2.2 SMALL & MEDIUM ORGANIZATION

12.3 EDUCATION

12.3.1 MARKET BY DEPLOYMENT MODE

12.3.1.1 ON-PREMISE

12.3.1.2 CLOUD

12.3.2 MARKET BY ORGANIZATION SIZE

12.3.2.1 LARGE ORGANIZATION

12.3.2.2 SMALL & MEDIUM ORGANIZATION

12.4 HEALTHCARE

12.4.1 MARKET BY DEPLOYMENT MODE

12.4.1.1 ON-PREMISE

12.4.1.2 CLOUD

12.4.2 MARKET BY ORGANIZATION SIZE

12.4.2.1 LARGE ORGANIZATION

12.4.2.2 SMALL & MEDIUM ORGANIZATION

12.5 GOVERNMENT AND DEFENSE

12.5.1 MARKET BY DEPLOYMENT MODE

12.5.1.1 ON-PREMISE

12.5.1.2 CLOUD

12.5.2 MARKET BY ORGANIZATION SIZE

12.5.2.1 LARGE ORGANIZATION

12.5.2.2 SMALL & MEDIUM ORGANIZATION

12.6 MEDIA AND ENTERTAINMENT

12.6.1 MARKET BY DEPLOYMENT MODE

12.6.1.1 ON-PREMISE

12.6.1.2 CLOUD

12.6.2 MARKET BY ORGANIZATION SIZE

12.6.2.1 LARGE ORGANIZATION

12.6.2.2 SMALL & MEDIUM ORGANIZATION

12.7 BANKING, FINANCIAL SERVICES AND INSURANCE (BFSI)

12.7.1 MARKET BY DEPLOYMENT MODE

12.7.1.1 ON-PREMISE

12.7.1.2 CLOUD

12.7.2 MARKET BY ORGANIZATION SIZE

12.7.2.1 LARGE ORGANIZATION

12.7.2.2 SMALL & MEDIUM ORGANIZATION

12.8 OTHER

12.8.1 MARKET BY DEPLOYMENT MODE

12.8.1.1 ON-PREMISE

12.8.1.2 CLOUD

12.8.2 MARKET BY ORGANIZATION SIZE

12.8.2.1 LARGE ORGANIZATION

12.8.2.2 SMALL & MEDIUM ORGANIZATION

13 NORTH AMERICA WEARABLE CONFERENCING TECHNOLOGY MARKET, BY REGION

13.1 NORTH AMERICA

13.1.1 U.S.

13.1.2 CANADA

13.1.3 MEXICO

14 NORTH AMERICA WEARABLE CONFERENCING TECHNOLOGY MARKET: COMPANY LANDSCAPE

14.1 COMPANY SHARE ANALYSIS: NORTH AMERICA

15 SWOT ANALYSIS

16 COMPANY PROFILE

16.1 GOOGLE (A SUBSIDIARY OF ALPHABET INC.)

16.1.1 COMPANY SNAPSHOT

16.1.2 REVENUE ANALYSIS

16.1.3 COMPANY SHARE ANALYSIS

16.1.4 PRODUCT PORTFOLIO

16.1.5 RECENT DEVELOPMENTS

16.2 MICROSOFT

16.2.1 COMPANY SNAPSHOT

16.2.2 REVENUE ANALYSIS

16.2.3 COMPANY SHARE ANALYSIS

16.2.4 PRODUCT PORTFOLIO

16.2.5 RECENT DEVELOPMENTS

16.3 LENEVO

16.3.1 COMPANY SNAPSHOT

16.3.2 REVENUE ANALYSIS

16.3.3 COMPANY SHARE ANALYSIS

16.3.4 PRODUCT PORTFOLIO

16.3.5 RECENT DEVELOPMENT

16.4 RICOH

16.4.1 COMPANY SNAPSHOT

16.4.2 REVENUE ANALYSIS

16.4.3 COMPANY SHARE ANALYSIS

16.4.4 PRODUCT PORTFOLIO

16.4.5 RECENT DEVELOPMENTS

16.5 SEIKO EPSON CORPORATION

16.5.1 COMPANY SNAPSHOT

16.5.2 REVENUE ANALYSIS

16.5.3 PRODUCT PORTFOLIO

16.5.4 RECENT DEVELOPMENTS

16.6 CHIRONIX

16.6.1 COMPANY SNAPSHOT

16.6.2 PRODUCT PORTFOLIO

16.6.3 RECENT DEVELOPMENT

16.7 DIALPAD, INC.

16.7.1 COMPANY SNAPSHOT

16.7.2 PRODUCT PORTFOLIO

16.7.3 RECENT DEVELOPMENT

16.8 EON REALITY

16.8.1 COMPANY SNAPSHOT

16.8.2 PRODUCT PORTFOLIO

16.8.3 RECENT DEVELOPMENTS

16.9 EZTALKS

16.9.1 COMPANY SNAPSHOT

16.9.2 PRODUCT PORTFOLIO

16.9.3 RECENT DEVELOPMENT

16.1 HTC CORPORATION

16.10.1 COMPANY PROFILE

16.10.2 REVENUE ANALYSIS

16.10.3 PRODUCT PORTFOLIO

16.10.4 RECENT DEVELOPMENTS

16.11 IRISTICK

16.11.1 COMPANY SNAPSHOT

16.11.2 PRODUCT PORTFOLIO

16.11.3 RECENT DEVELOPMENT

16.12 LOGITECH

16.12.1 COMPANY SNAPSHOT

16.12.2 REVENUE ANALYSIS

16.12.3 PRODUCT PORTFOLIO

16.12.4 RECENT DEVELOPMENTS

16.13 LOGMEIN, INC.

16.13.1 COMPANY SNAPSHOT

16.13.2 PRODUCT PORTFOLIO

16.13.3 RECENT DEVELOPMENTS

16.14 REALWEAR, INC.

16.14.1 COMPANY SNAPSHOT

16.14.2 PRODUCT PORTFOLIO

16.14.3 RECENT DEVELOPMENT

16.15 ROBERT BOSCH GMBH

16.15.1 COMPANY SNAPSHOT

16.15.2 REVENUE ANALYSIS

16.15.3 PRODUCT PORTFOLIO

16.15.4 RECENT DEVELOPMENT

16.16 SONY CORPORATION

16.16.1 COMPANY SNAPSHOT

16.16.2 REVENUE ANALYSIS

16.16.3 PRODUCT PORTFOLIO

16.16.4 RECENT DEVELOPMENTS

16.17 TEAMVIEWER

16.17.1 COMPANY SNAPSHOT

16.17.2 REVNUE ANALYSIS

16.17.3 PRODUCT PORTFOLIO

16.17.4 RECENT DEVELOPMENTS

16.18 VIDYO, INC.

16.18.1 COMPANY SNAPSHOT

16.18.2 PRODUCT PORTFOLIO

16.18.3 RECENT DEVELOPMENTS

16.19 VUZIX CORPORATION

16.19.1 COMPANY SNAPSHOT

16.19.2 REVENUE ANALYSIS

16.19.3 PRODUCT PORTFOLIO

16.19.4 RECENT DEVELOPMENT

16.2 ZOOM VIDEO COMMUNICATIONS, INC.

16.20.1 COMPANY SNAPSHOT

16.20.2 REVENUE ANALYSIS

16.20.3 COMPANY SHARE ANALYSIS

16.20.4 PRODUCT PORTFOLIO

16.20.5 RECENT DEVELOPMENTS

17 QUESTIONNAIRE

18 RELATED REPORTS

List of Table

TABLE 1 NORTH AMERICA WEARABLE CONFERENCING TECHNOLOGY MARKET, BY OFFERING, 2020-2029 (USD MILLION)

TABLE 2 NORTH AMERICA HARDWARE IN WEARABLE CONFERENCING TECHNOLOGY MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 3 NORTH AMERICA HARDWARE IN WEARABLE CONFERENCING TECHNOLOGY MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 4 NORTH AMERICA SOFTWARE IN WEARABLE CONFERENCING TECHNOLOGY MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 5 NORTH AMERICA SERVICES IN WEARABLE CONFERENCING TECHNOLOGY MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 6 NORTH AMERICA SERVICES IN WEARABLE CONFERENCING TECHNOLOGY MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 7 NORTH AMERICA WEARABLE CONFERENCING TECHNOLOGY MARKET, BY CONFERENCING TYPE, 2020-2029 (USD MILLION)

TABLE 8 NORTH AMERICA VIDEO CONFERENCING IN WEARABLE CONFERENCING TECHNOLOGY MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 9 NORTH AMERICA AUDIO CONFERENCING IN WEARABLE CONFERENCING TECHNOLOGY MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 10 NORTH AMERICA WEARABLE CONFERENCING TECHNOLOGY MARKET, BY DEPLOYMENT MODE, 2020-2029 (USD MILLION)

TABLE 11 NORTH AMERICA ON-PREMISE IN WEARABLE CONFERENCING TECHNOLOGY MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 12 NORTH AMERICA CLOUD IN WEARABLE CONFERENCING TECHNOLOGY MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 13 NORTH AMERICA WEARABLE CONFERENCING TECHNOLOGY MARKET, BY ORGANIZATION SIZE, 2020-2029 (USD MILLION)

TABLE 14 NORTH AMERICA LARGE ORGANIZATION IN WEARABLE CONFERENCING TECHNOLOGY MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 15 NORTH AMERICA SMALL & MEDIUM ORGANIZATION IN WEARABLE CONFERENCING TECHNOLOGY MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 16 NORTH AMERICA WEARABLE CONFERENCING TECHNOLOGY MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 17 NORTH AMERICA ENTERPRISE IN WEARABLE CONFERENCING TECHNOLOGY MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 18 NORTH AMERICA CONSUMER IN WEARABLE CONFERENCING TECHNOLOGY MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 19 NORTH AMERICA WEARABLE CONFERENCING TECHNOLOGY MARKET, BY END USE, 2020-2029 (USD MILLION)

TABLE 20 NORTH AMERICA CORPORATE IN WEARABLE CONFERENCING TECHNOLOGY MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 21 NORTH AMERICA CORPORATE IN WEARABLE CONFERENCING TECHNOLOGY MARKET, BY DEPLOYMENT MODE, 2020-2029 (USD MILLION)

TABLE 22 NORTH AMERICA CORPORATE IN WEARABLE CONFERENCING TECHNOLOGY MARKET, BY ORGANIZATION SIZE, 2020-2029 (USD MILLION)

TABLE 23 NORTH AMERICA EDUCATION IN WEARABLE CONFERENCING TECHNOLOGY MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 24 NORTH AMERICA EDUCATION IN WEARABLE CONFERENCING TECHNOLOGY MARKET, BY DEPLOYMENT MODE, 2020-2029 (USD MILLION)

TABLE 25 NORTH AMERICA EDUCATION IN WEARABLE CONFERENCING TECHNOLOGY MARKET, BY ORGANIZATION SIZE, 2020-2029 (USD MILLION)

TABLE 26 NORTH AMERICA HEALTHCARE IN WEARABLE CONFERENCING TECHNOLOGY MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 27 NORTH AMERICA HEALTHCARE IN WEARABLE CONFERENCING TECHNOLOGY MARKET, BY DEPLOYMENT MODE, 2020-2029 (USD MILLION)

TABLE 28 NORTH AMERICA HEALTHCARE IN WEARABLE CONFERENCING TECHNOLOGY MARKET, BY ORGANIZATION SIZE, 2020-2029 (USD MILLION)

TABLE 29 NORTH AMERICA GOVERNMENT AND DEFENSE IN WEARABLE CONFERENCING TECHNOLOGY MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 30 NORTH AMERICA GOVERNMENT AND DEFENSE IN WEARABLE CONFERENCING TECHNOLOGY MARKET, BY DEPLOYMENT MODE, 2020-2029 (USD MILLION)

TABLE 31 NORTH AMERICA GOVERNMENT AND DEFENSE IN WEARABLE CONFERENCING TECHNOLOGY MARKET, BY ORGANIZATION SIZE, 2020-2029 (USD MILLION)

TABLE 32 NORTH AMERICA MEDIA AND ENTERTAINMENT IN WEARABLE CONFERENCING TECHNOLOGY MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 33 NORTH AMERICA MEDIA AND ENTERTAINMENT IN WEARABLE CONFERENCING TECHNOLOGY MARKET, BY DEPLOYMENT MODE, 2020-2029 (USD MILLION)

TABLE 34 NORTH AMERICA MEDIA AND ENTERTAINMENT IN WEARABLE CONFERENCING TECHNOLOGY MARKET, BY ORGANIZATION SIZE, 2020-2029 (USD MILLION)

TABLE 35 NORTH AMERICA BANKING, FINANCIAL SERVICES AND INSURANCE (BFSI) IN WEARABLE CONFERENCING TECHNOLOGY MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 36 NORTH AMERICA BANKING, FINANCIAL SERVICES AND INSURANCE (BFSI) IN WEARABLE CONFERENCING TECHNOLOGY MARKET, BY DEPLOYMENT MODE, 2020-2029 (USD MILLION)

TABLE 37 NORTH AMERICA BANKING, FINANCIAL SERVICES AND INSURANCE (BFSI) IN WEARABLE CONFERENCING TECHNOLOGY MARKET, BY ORGANIZATION SIZE, 2020-2029 (USD MILLION)

TABLE 38 NORTH AMERICA OTHER IN WEARABLE CONFERENCING TECHNOLOGY MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 39 NORTH AMERICA OTHER IN WEARABLE CONFERENCING TECHNOLOGY MARKET, BY DEPLOYMENT MODE, 2020-2029 (USD MILLION)

TABLE 40 NORTH AMERICA OTHER IN WEARABLE CONFERENCING TECHNOLOGY MARKET, BY ORGANIZATION SIZE, 2020-2029 (USD MILLION)

TABLE 41 NORTH AMERICA WEARABLE CONFERENCING TECHNOLOGY MARKET, BY COUNTRY, 2020-2029 (USD MILLION)

TABLE 42 NORTH AMERICA WEARABLE CONFERENCING TECHNOLOGY MARKET, BY OFFERING, 2020-2029 (USD MILLION)

TABLE 43 NORTH AMERICA HARDWARE IN WEARABLE CONFERENCING TECHNOLOGY MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 44 NORTH AMERICA SERVICES IN WEARABLE CONFERENCING TECHNOLOGY MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 45 NORTH AMERICA WEARABLE CONFERENCING TECHNOLOGY MARKET, BY CONFERENCING TYPE, 2020-2029 (USD MILLION)

TABLE 46 NORTH AMERICA WEARABLE CONFERENCING TECHNOLOGY MARKET, BY DEPLOYMENT MODE, 2020-2029 (USD MILLION)

TABLE 47 NORTH AMERICA WEARABLE CONFERENCING TECHNOLOGY MARKET, BY ORGANIZATION SIZE, 2020-2029 (USD MILLION)

TABLE 48 NORTH AMERICA WEARABLE CONFERENCING TECHNOLOGY MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 49 NORTH AMERICA WEARABLE CONFERENCING TECHNOLOGY MARKET, BY END USE, 2020-2029 (USD MILLION)

TABLE 50 NORTH AMERICA CORPORATE IN WEARABLE CONFERENCING TECHNOLOGY MARKET, BY DEPLOYMENT MODE, 2020-2029 (USD MILLION)

TABLE 51 NORTH AMERICA CORPORATE IN WEARABLE CONFERENCING TECHNOLOGY MARKET, BY ORGANIZATION SIZE, 2020-2029 (USD MILLION)

TABLE 52 NORTH AMERICA EDUCATION IN WEARABLE CONFERENCING TECHNOLOGY MARKET, BY DEPLOYMENT MODE, 2020-2029 (USD MILLION)

TABLE 53 NORTH AMERICA EDUCATION IN WEARABLE CONFERENCING TECHNOLOGY MARKET, BY ORGANIZATION SIZE, 2020-2029 (USD MILLION)

TABLE 54 NORTH AMERICA HEALTHCARE IN WEARABLE CONFERENCING TECHNOLOGY MARKET, BY DEPLOYMENT MODE, 2020-2029 (USD MILLION)

TABLE 55 NORTH AMERICA HEALTHCARE IN WEARABLE CONFERENCING TECHNOLOGY MARKET, BY ORGANIZATION SIZE, 2020-2029 (USD MILLION)

TABLE 56 NORTH AMERICA GOVERNMENT AND DEFENSE IN WEARABLE CONFERENCING TECHNOLOGY MARKET, BY DEPLOYMENT MODE, 2020-2029 (USD MILLION)

TABLE 57 NORTH AMERICA GOVERNMENT AND DEFENSE IN WEARABLE CONFERENCING TECHNOLOGY MARKET, BY ORGANIZATION SIZE, 2020-2029 (USD MILLION)

TABLE 58 NORTH AMERICA MEDIA AND ENTERTAINMENT IN WEARABLE CONFERENCING TECHNOLOGY MARKET, BY DEPLOYMENT MODE, 2020-2029 (USD MILLION)

TABLE 59 NORTH AMERICA MEDIA AND ENTERTAINMENT IN WEARABLE CONFERENCING TECHNOLOGY MARKET, BY ORGANIZATION SIZE, 2020-2029 (USD MILLION)

TABLE 60 NORTH AMERICA BANKING, FINANCIAL SERVICES AND INSURANCE (BFSI) IN WEARABLE CONFERENCING TECHNOLOGY MARKET, BY DEPLOYMENT MODE, 2020-2029 (USD MILLION)

TABLE 61 NORTH AMERICA BANKING, FINANCIAL SERVICES AND INSURANCE (BFSI) IN WEARABLE CONFERENCING TECHNOLOGY MARKET, BY ORGANIZATION SIZE, 2020-2029 (USD MILLION)

TABLE 62 NORTH AMERICA OTHER IN WEARABLE CONFERENCING TECHNOLOGY MARKET, BY DEPLOYMENT MODE, 2020-2029 (USD MILLION)

TABLE 63 NORTH AMERICA OTHER IN WEARABLE CONFERENCING TECHNOLOGY MARKET, BY ORGANIZATION SIZE, 2020-2029 (USD MILLION)

TABLE 64 U.S. WEARABLE CONFERENCING TECHNOLOGY MARKET, BY OFFERING, 2020-2029 (USD MILLION)

TABLE 65 U.S. HARDWARE IN WEARABLE CONFERENCING TECHNOLOGY MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 66 U.S. SERVICES IN WEARABLE CONFERENCING TECHNOLOGY MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 67 U.S. WEARABLE CONFERENCING TECHNOLOGY MARKET, BY CONFERENCING TYPE, 2020-2029 (USD MILLION)

TABLE 68 U.S. WEARABLE CONFERENCING TECHNOLOGY MARKET, BY DEPLOYMENT MODE, 2020-2029 (USD MILLION)

TABLE 69 U.S. WEARABLE CONFERENCING TECHNOLOGY MARKET, BY ORGANIZATION SIZE, 2020-2029 (USD MILLION)

TABLE 70 U.S. WEARABLE CONFERENCING TECHNOLOGY MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 71 U.S. WEARABLE CONFERENCING TECHNOLOGY MARKET, BY END USE, 2020-2029 (USD MILLION)

TABLE 72 U.S. CORPORATE IN WEARABLE CONFERENCING TECHNOLOGY MARKET, BY DEPLOYMENT MODE, 2020-2029 (USD MILLION)

TABLE 73 U.S. CORPORATE IN WEARABLE CONFERENCING TECHNOLOGY MARKET, BY ORGANIZATION SIZE, 2020-2029 (USD MILLION)

TABLE 74 U.S. EDUCATION IN WEARABLE CONFERENCING TECHNOLOGY MARKET, BY DEPLOYMENT MODE, 2020-2029 (USD MILLION)

TABLE 75 U.S. EDUCATION IN WEARABLE CONFERENCING TECHNOLOGY MARKET, BY ORGANIZATION SIZE, 2020-2029 (USD MILLION)

TABLE 76 U.S. HEALTHCARE IN WEARABLE CONFERENCING TECHNOLOGY MARKET, BY DEPLOYMENT MODE, 2020-2029 (USD MILLION)

TABLE 77 U.S. HEALTHCARE IN WEARABLE CONFERENCING TECHNOLOGY MARKET, BY ORGANIZATION SIZE, 2020-2029 (USD MILLION)

TABLE 78 U.S. GOVERNMENT AND DEFENSE IN WEARABLE CONFERENCING TECHNOLOGY MARKET, BY DEPLOYMENT MODE, 2020-2029 (USD MILLION)

TABLE 79 U.S. GOVERNMENT AND DEFENSE IN WEARABLE CONFERENCING TECHNOLOGY MARKET, BY ORGANIZATION SIZE, 2020-2029 (USD MILLION)

TABLE 80 U.S. MEDIA AND ENTERTAINMENT IN WEARABLE CONFERENCING TECHNOLOGY MARKET, BY DEPLOYMENT MODE, 2020-2029 (USD MILLION)

TABLE 81 U.S. MEDIA AND ENTERTAINMENT IN WEARABLE CONFERENCING TECHNOLOGY MARKET, BY ORGANIZATION SIZE, 2020-2029 (USD MILLION)

TABLE 82 U.S. BANKING, FINANCIAL SERVICES AND INSURANCE (BFSI) IN WEARABLE CONFERENCING TECHNOLOGY MARKET, BY DEPLOYMENT MODE, 2020-2029 (USD MILLION)

TABLE 83 U.S. BANKING, FINANCIAL SERVICES AND INSURANCE (BFSI) IN WEARABLE CONFERENCING TECHNOLOGY MARKET, BY ORGANIZATION SIZE, 2020-2029 (USD MILLION)

TABLE 84 U.S. OTHER IN WEARABLE CONFERENCING TECHNOLOGY MARKET, BY DEPLOYMENT MODE, 2020-2029 (USD MILLION)

TABLE 85 U.S. OTHER IN WEARABLE CONFERENCING TECHNOLOGY MARKET, BY ORGANIZATION SIZE, 2020-2029 (USD MILLION)

TABLE 86 CANADA WEARABLE CONFERENCING TECHNOLOGY MARKET, BY OFFERING, 2020-2029 (USD MILLION)

TABLE 87 CANADA HARDWARE IN WEARABLE CONFERENCING TECHNOLOGY MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 88 CANADA SERVICES IN WEARABLE CONFERENCING TECHNOLOGY MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 89 CANADA WEARABLE CONFERENCING TECHNOLOGY MARKET, BY CONFERENCING TYPE, 2020-2029 (USD MILLION)

TABLE 90 CANADA WEARABLE CONFERENCING TECHNOLOGY MARKET, BY DEPLOYMENT MODE, 2020-2029 (USD MILLION)

TABLE 91 CANADA WEARABLE CONFERENCING TECHNOLOGY MARKET, BY ORGANIZATION SIZE, 2020-2029 (USD MILLION)

TABLE 92 CANADA WEARABLE CONFERENCING TECHNOLOGY MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 93 CANADA WEARABLE CONFERENCING TECHNOLOGY MARKET, BY END USE, 2020-2029 (USD MILLION)

TABLE 94 CANADA CORPORATE IN WEARABLE CONFERENCING TECHNOLOGY MARKET, BY DEPLOYMENT MODE, 2020-2029 (USD MILLION)

TABLE 95 CANADA CORPORATE IN WEARABLE CONFERENCING TECHNOLOGY MARKET, BY ORGANIZATION SIZE, 2020-2029 (USD MILLION)

TABLE 96 CANADA EDUCATION IN WEARABLE CONFERENCING TECHNOLOGY MARKET, BY DEPLOYMENT MODE, 2020-2029 (USD MILLION)

TABLE 97 CANADA EDUCATION IN WEARABLE CONFERENCING TECHNOLOGY MARKET, BY ORGANIZATION SIZE, 2020-2029 (USD MILLION)

TABLE 98 CANADA HEALTHCARE IN WEARABLE CONFERENCING TECHNOLOGY MARKET, BY DEPLOYMENT MODE, 2020-2029 (USD MILLION)

TABLE 99 CANADA HEALTHCARE IN WEARABLE CONFERENCING TECHNOLOGY MARKET, BY ORGANIZATION SIZE, 2020-2029 (USD MILLION)

TABLE 100 CANADA GOVERNMENT AND DEFENSE IN WEARABLE CONFERENCING TECHNOLOGY MARKET, BY DEPLOYMENT MODE, 2020-2029 (USD MILLION)

TABLE 101 CANADA GOVERNMENT AND DEFENSE IN WEARABLE CONFERENCING TECHNOLOGY MARKET, BY ORGANIZATION SIZE, 2020-2029 (USD MILLION)

TABLE 102 CANADA MEDIA AND ENTERTAINMENT IN WEARABLE CONFERENCING TECHNOLOGY MARKET, BY DEPLOYMENT MODE, 2020-2029 (USD MILLION)

TABLE 103 CANADA MEDIA AND ENTERTAINMENT IN WEARABLE CONFERENCING TECHNOLOGY MARKET, BY ORGANIZATION SIZE, 2020-2029 (USD MILLION)

TABLE 104 CANADA BANKING, FINANCIAL SERVICES AND INSURANCE (BFSI) IN WEARABLE CONFERENCING TECHNOLOGY MARKET, BY DEPLOYMENT MODE, 2020-2029 (USD MILLION)

TABLE 105 CANADA BANKING, FINANCIAL SERVICES AND INSURANCE (BFSI) IN WEARABLE CONFERENCING TECHNOLOGY MARKET, BY ORGANIZATION SIZE, 2020-2029 (USD MILLION)

TABLE 106 CANADA OTHER IN WEARABLE CONFERENCING TECHNOLOGY MARKET, BY DEPLOYMENT MODE, 2020-2029 (USD MILLION)

TABLE 107 CANADA OTHER IN WEARABLE CONFERENCING TECHNOLOGY MARKET, BY ORGANIZATION SIZE, 2020-2029 (USD MILLION)

TABLE 108 MEXICO WEARABLE CONFERENCING TECHNOLOGY MARKET, BY OFFERING, 2020-2029 (USD MILLION)

TABLE 109 MEXICO HARDWARE IN WEARABLE CONFERENCING TECHNOLOGY MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 110 MEXICO SERVICES IN WEARABLE CONFERENCING TECHNOLOGY MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 111 MEXICO WEARABLE CONFERENCING TECHNOLOGY MARKET, BY CONFERENCING TYPE, 2020-2029 (USD MILLION)

TABLE 112 MEXICO WEARABLE CONFERENCING TECHNOLOGY MARKET, BY DEPLOYMENT MODE, 2020-2029 (USD MILLION)

TABLE 113 MEXICO WEARABLE CONFERENCING TECHNOLOGY MARKET, BY ORGANIZATION SIZE, 2020-2029 (USD MILLION)

TABLE 114 MEXICO WEARABLE CONFERENCING TECHNOLOGY MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 115 MEXICO WEARABLE CONFERENCING TECHNOLOGY MARKET, BY END USE, 2020-2029 (USD MILLION)

TABLE 116 MEXICO CORPORATE IN WEARABLE CONFERENCING TECHNOLOGY MARKET, BY DEPLOYMENT MODE, 2020-2029 (USD MILLION)

TABLE 117 MEXICO CORPORATE IN WEARABLE CONFERENCING TECHNOLOGY MARKET, BY ORGANIZATION SIZE, 2020-2029 (USD MILLION)

TABLE 118 MEXICO EDUCATION IN WEARABLE CONFERENCING TECHNOLOGY MARKET, BY DEPLOYMENT MODE, 2020-2029 (USD MILLION)

TABLE 119 MEXICO EDUCATION IN WEARABLE CONFERENCING TECHNOLOGY MARKET, BY ORGANIZATION SIZE, 2020-2029 (USD MILLION)

TABLE 120 MEXICO HEALTHCARE IN WEARABLE CONFERENCING TECHNOLOGY MARKET, BY DEPLOYMENT MODE, 2020-2029 (USD MILLION)

TABLE 121 MEXICO HEALTHCARE IN WEARABLE CONFERENCING TECHNOLOGY MARKET, BY ORGANIZATION SIZE, 2020-2029 (USD MILLION)

TABLE 122 MEXICO GOVERNMENT AND DEFENSE IN WEARABLE CONFERENCING TECHNOLOGY MARKET, BY DEPLOYMENT MODE, 2020-2029 (USD MILLION)

TABLE 123 MEXICO GOVERNMENT AND DEFENSE IN WEARABLE CONFERENCING TECHNOLOGY MARKET, BY ORGANIZATION SIZE, 2020-2029 (USD MILLION)

TABLE 124 MEXICO MEDIA AND ENTERTAINMENT IN WEARABLE CONFERENCING TECHNOLOGY MARKET, BY DEPLOYMENT MODE, 2020-2029 (USD MILLION)

TABLE 125 MEXICO MEDIA AND ENTERTAINMENT IN WEARABLE CONFERENCING TECHNOLOGY MARKET, BY ORGANIZATION SIZE, 2020-2029 (USD MILLION)

TABLE 126 MEXICO BANKING, FINANCIAL SERVICES AND INSURANCE (BFSI) IN WEARABLE CONFERENCING TECHNOLOGY MARKET, BY DEPLOYMENT MODE, 2020-2029 (USD MILLION)

TABLE 127 MEXICO BANKING, FINANCIAL SERVICES AND INSURANCE (BFSI) IN WEARABLE CONFERENCING TECHNOLOGY MARKET, BY ORGANIZATION SIZE, 2020-2029 (USD MILLION)

TABLE 128 MEXICO OTHER IN WEARABLE CONFERENCING TECHNOLOGY MARKET, BY DEPLOYMENT MODE, 2020-2029 (USD MILLION)

TABLE 129 MEXICO OTHER IN WEARABLE CONFERENCING TECHNOLOGY MARKET, BY ORGANIZATION SIZE, 2020-2029 (USD MILLION)

List of Figure

FIGURE 1 NORTH AMERICA WEARABLE CONFERENCING TECHNOLOGY MARKET: SEGMENTATION

FIGURE 2 NORTH AMERICA WEARABLE CONFERENCING TECHNOLOGY MARKET: DATA TRIANGULATION

FIGURE 3 NORTH AMERICA WEARABLE CONFERENCING TECHNOLOGY MARKET: DROC ANALYSIS

FIGURE 4 NORTH AMERICA WEARABLE CONFERENCING TECHNOLOGY MARKET: NORTH AMERICA VS REGIONAL MARKET ANALYSIS

FIGURE 5 NORTH AMERICA WEARABLE CONFERENCING TECHNOLOGY MARKET: COMPANY RESEARCH ANALYSIS

FIGURE 6 NORTH AMERICA WEARABLE CONFERENCING TECHNOLOGY MARKET: INTERVIEW DEMOGRAPHICS

FIGURE 7 NORTH AMERICA WEARABLE CONFERENCING TECHNOLOGY MARKET: DBMR MARKET POSITION GRID

FIGURE 8 NORTH AMERICA WEARABLE CONFERENCING TECHNOLOGY MARKET: VENDOR SHARE ANALYSIS

FIGURE 9 NORTH AMERICA WEARABLE CONFERENCING TECHNOLOGY MARKET: MARKET APPLICATION COVERAGE GRID

FIGURE 10 NORTH AMERICA WEARABLE CONFERENCING TECHNOLOGY MARKET: SEGMENTATION

FIGURE 11 RISING PREFERENCE FOR REMOTE WORKING IS EXPECTED TO DRIVE NORTH AMERICA WEARABLE CONFERENCING TECHNOLOGY MARKETIN THE FORECAST PERIOD OF 2022 TO 2029

FIGURE 12 TYPE SEGMENT IS EXPECTED TO ACCOUNT FOR THE LARGEST SHARE OF NORTH AMERICA WEARABLE CONFERENCING TECHNOLOGY MARKETIN 2022 & 2029

FIGURE 13 DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES OF NORTH AMERICA WEARABLE CONFERENCING TECHNOLOGY MARKET

FIGURE 14 NORTH AMERICA WEARABLE CONFERENCING TECHNOLOGY MARKET: BY OFFERING, 2021

FIGURE 15 NORTH AMERICA WEARABLE CONFERENCING TECHNOLOGY MARKET: BY CONFERENCING TYPE, 2021

FIGURE 16 NORTH AMERICA WEARABLE CONFERENCING TECHNOLOGY MARKET: BY DEPLOYMENT MODE, 2021

FIGURE 17 NORTH AMERICA WEARABLE CONFERENCING TECHNOLOGY MARKET: BY ORGANIZATION SIZE, 2021

FIGURE 18 NORTH AMERICA WEARABLE CONFERENCING TECHNOLOGY MARKET: BY APPLICATION, 2021

FIGURE 19 NORTH AMERICA WEARABLE CONFERENCING TECHNOLOGY MARKET: BY END USE, 2021

FIGURE 20 NORTH AMERICA WEARABLE CONFERENCING TECHNOLOGY MARKET: SNAPSHOT (2021)

FIGURE 21 NORTH AMERICA WEARABLE CONFERENCING TECHNOLOGY MARKET: BY COUNTRY (2021)

FIGURE 22 NORTH AMERICA WEARABLE CONFERENCING TECHNOLOGY MARKET: BY COUNTRY (2022 & 2029)

FIGURE 23 NORTH AMERICA WEARABLE CONFERENCING TECHNOLOGY MARKET: BY COUNTRY (2021 & 2029)

FIGURE 24 NORTH AMERICA WEARABLE CONFERENCING TECHNOLOGY MARKET: BY OFFERING (2022-2029)

FIGURE 25 NORTH AMERICA WEARABLE CONFERENCING TECHNOLOGY MARKET: COMPANY SHARE 2021 (%)

منهجية البحث

يتم جمع البيانات وتحليل سنة الأساس باستخدام وحدات جمع البيانات ذات أحجام العينات الكبيرة. تتضمن المرحلة الحصول على معلومات السوق أو البيانات ذات الصلة من خلال مصادر واستراتيجيات مختلفة. تتضمن فحص وتخطيط جميع البيانات المكتسبة من الماضي مسبقًا. كما تتضمن فحص التناقضات في المعلومات التي شوهدت عبر مصادر المعلومات المختلفة. يتم تحليل بيانات السوق وتقديرها باستخدام نماذج إحصائية ومتماسكة للسوق. كما أن تحليل حصة السوق وتحليل الاتجاهات الرئيسية هي عوامل النجاح الرئيسية في تقرير السوق. لمعرفة المزيد، يرجى طلب مكالمة محلل أو إرسال استفسارك.

منهجية البحث الرئيسية التي يستخدمها فريق بحث DBMR هي التثليث البيانات والتي تتضمن استخراج البيانات وتحليل تأثير متغيرات البيانات على السوق والتحقق الأولي (من قبل خبراء الصناعة). تتضمن نماذج البيانات شبكة تحديد موقف البائعين، وتحليل خط زمني للسوق، ونظرة عامة على السوق ودليل، وشبكة تحديد موقف الشركة، وتحليل براءات الاختراع، وتحليل التسعير، وتحليل حصة الشركة في السوق، ومعايير القياس، وتحليل حصة البائعين على المستوى العالمي مقابل الإقليمي. لمعرفة المزيد عن منهجية البحث، أرسل استفسارًا للتحدث إلى خبراء الصناعة لدينا.

التخصيص متاح

تعد Data Bridge Market Research رائدة في مجال البحوث التكوينية المتقدمة. ونحن نفخر بخدمة عملائنا الحاليين والجدد بالبيانات والتحليلات التي تتطابق مع هدفهم. ويمكن تخصيص التقرير ليشمل تحليل اتجاه الأسعار للعلامات التجارية المستهدفة وفهم السوق في بلدان إضافية (اطلب قائمة البلدان)، وبيانات نتائج التجارب السريرية، ومراجعة الأدبيات، وتحليل السوق المجدد وقاعدة المنتج. ويمكن تحليل تحليل السوق للمنافسين المستهدفين من التحليل القائم على التكنولوجيا إلى استراتيجيات محفظة السوق. ويمكننا إضافة عدد كبير من المنافسين الذين تحتاج إلى بيانات عنهم بالتنسيق وأسلوب البيانات الذي تبحث عنه. ويمكن لفريق المحللين لدينا أيضًا تزويدك بالبيانات في ملفات Excel الخام أو جداول البيانات المحورية (كتاب الحقائق) أو مساعدتك في إنشاء عروض تقديمية من مجموعات البيانات المتوفرة في التقرير.