North America Wax Emulsion Market

حجم السوق بالمليار دولار أمريكي

CAGR :

%

USD

714.04 Million

USD

869.99 Million

2024

2032

USD

714.04 Million

USD

869.99 Million

2024

2032

| 2025 –2032 | |

| USD 714.04 Million | |

| USD 869.99 Million | |

|

|

|

|

تجزئة سوق مستحلبات الشمع في أمريكا الشمالية، حسب المادة الأساسية (مستحلب شمعي صناعي ومستحلب شمعي طبيعي)، والمستحلب (مواد خافضة للتوتر السطحي غير أيونية، ومواد خافضة للتوتر السطحي أنيونية، ومواد خافضة للتوتر السطحي كاتيونية)، وقطاعات المستخدمين النهائيين (الدهانات والطلاءات، والمنسوجات، ومستحضرات التجميل، والمواد اللاصقة والمواد المانعة للتسرب، والبناء والنجارة، وصناعة الأغذية، وغيرها) - اتجاهات الصناعة وتوقعاتها حتى عام 2032

حجم سوق مستحلب الشمع في أمريكا الشمالية

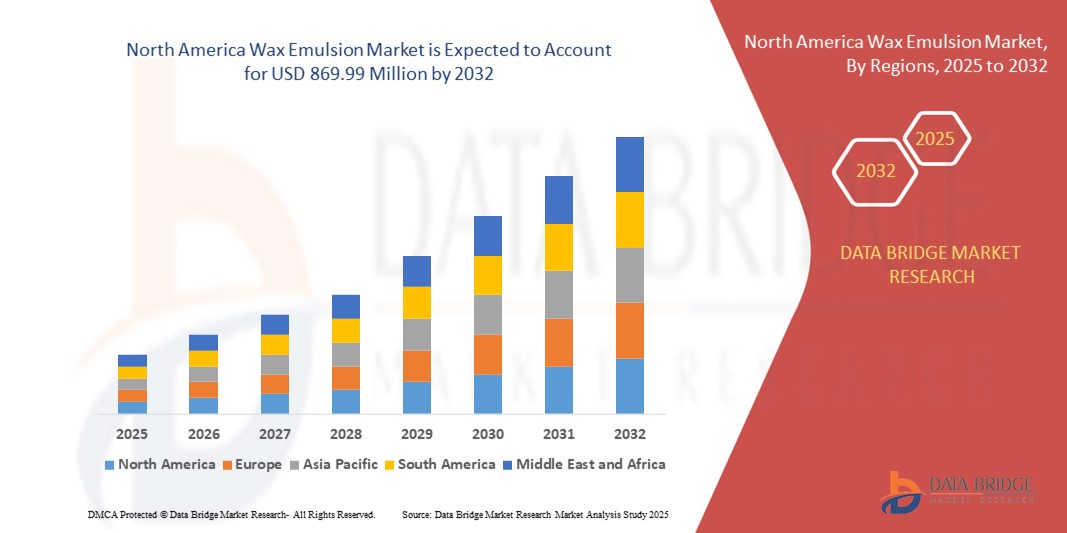

- تم تقييم حجم سوق مستحلب الشمع في أمريكا الشمالية بـ 714.04 مليون دولار أمريكي في عام 2024 ومن المتوقع أن يصل إلى 869.99 مليون دولار أمريكي بحلول عام 2032 ، بمعدل نمو سنوي مركب قدره 2.50٪ خلال الفترة المتوقعة

- يتم تغذية نمو السوق إلى حد كبير بالطلب المتزايد على الطلاءات والتركيبات المستدامة القائمة على الماء عبر الصناعات مثل الدهانات والتعبئة والتغليف والمنسوجات والمواد اللاصقة، حيث يتحول المصنعون نحو البدائل الصديقة للبيئة بدلاً من الأنظمة القائمة على المذيبات

- إن الاستخدام المتزايد لمستحلبات الشمع في المواد الكيميائية المستخدمة في البناء، إلى جانب التقدم في تكنولوجيا المستحلب التي توفر متانة محسنة ولمعانًا ومقاومة للماء، يعزز بشكل أكبر اعتماد المنتج عبر قطاعات الاستخدام النهائي المتعددة

تحليل سوق مستحلب الشمع في أمريكا الشمالية

- يشهد سوق مستحلب الشمع في أمريكا الشمالية نموًا ثابتًا مدفوعًا بالتطبيقات المتزايدة في الطلاءات الصناعية وتشطيب الأخشاب والتغليف الورقي، حيث تعطي الصناعات الأولوية بشكل متزايد لكفاءة الأداء والاستدامة

- إن الاستثمارات المستمرة في البحث والتطوير والتقدم التكنولوجي في عمليات بلمرة المستحلب تمكن من تطوير منتجات مستحلب الشمع المخصصة والمصممة وفقًا لمتطلبات صناعية محددة، مما يعزز القدرة التنافسية في السوق وأداء المنتج

- استحوذت الولايات المتحدة على أكبر حصة من الإيرادات في عام 2024 داخل أمريكا الشمالية، مدفوعة بالتبني السريع للمواد المستدامة في تطبيقات التعبئة والتغليف والبناء والنجارة

- من المتوقع أن تشهد كندا أعلى معدل نمو سنوي مركب (CAGR) في سوق مستحلب الشمع في أمريكا الشمالية بسبب الطلب المتزايد على حلول التغليف الصديقة للبيئة والصالحة للأكل، والاستثمارات المتزايدة في قطاعي البناء والسيارات، والاعتماد المتزايد على مستحلبات الشمع المستدامة في مستحضرات التجميل والطلاء والتطبيقات الصناعية.

- حقق قطاع مستحلبات الشمع ذات القاعدة الاصطناعية أكبر حصة من إيرادات السوق في عام ٢٠٢٤، بفضل فعاليته من حيث التكلفة، وجودته الثابتة، وتطبيقاته الواسعة في الدهانات والطلاءات ومواد التعبئة والتغليف. كما أن متانته وخصائصه المقاومة للماء تجعله الخيار الأمثل للإنتاج على نطاق صناعي.

نطاق التقرير وتقسيم سوق مستحلب الشمع في أمريكا الشمالية

|

صفات |

رؤى رئيسية حول سوق مستحلب الشمع في أمريكا الشمالية |

|

القطاعات المغطاة |

|

|

الدول المغطاة |

أمريكا الشمالية

|

|

اللاعبون الرئيسيون في السوق |

|

|

فرص السوق |

|

|

مجموعات معلومات البيانات ذات القيمة المضافة |

بالإضافة إلى الرؤى حول سيناريوهات السوق مثل القيمة السوقية ومعدل النمو والتجزئة والتغطية الجغرافية واللاعبين الرئيسيين، فإن تقارير السوق التي تم إعدادها بواسطة Data Bridge Market Research تشمل أيضًا تحليل الاستيراد والتصدير، ونظرة عامة على القدرة الإنتاجية، وتحليل استهلاك الإنتاج، وتحليل اتجاه الأسعار، وسيناريو تغير المناخ، وتحليل سلسلة التوريد، وتحليل سلسلة القيمة، ونظرة عامة على المواد الخام / المواد الاستهلاكية، ومعايير اختيار البائعين، وتحليل PESTLE، وتحليل بورتر، والإطار التنظيمي. |

اتجاهات سوق مستحلب الشمع في أمريكا الشمالية

التحول نحو تركيبات صديقة للبيئة ومستدامة

- يدفع الطلب المتزايد على الطلاءات الصديقة للبيئة والقائمة على الماء إلى اعتماد مستحلبات الشمع القائمة على المواد الحيوية في مختلف الصناعات، وخاصةً في قطاعي التعبئة والتغليف والمنسوجات. ويستبدل المصنعون الأنظمة القائمة على المذيبات ببدائل مستدامة منخفضة المركبات العضوية المتطايرة، وذلك لتلبية اللوائح البيئية الصارمة وتفضيلات المستهلكين المتزايدة للمنتجات الصديقة للبيئة.

- أدى تزايد الوعي بالاستدامة بين المستخدمين النهائيين إلى تسريع استخدام مستحلبات الشمع في الورق والتغليف للتطبيقات الغذائية. تُعزز هذه الطلاءات الصديقة للبيئة خصائص العزل، وتُطيل مدة الصلاحية، وتتماشى مع الجهود العالمية للحد من استخدام البلاستيك، مع دعم مبادرات إعادة التدوير والتحويل إلى سماد عبر سلسلة القيمة.

- دفع التحول المتزايد نحو ممارسات الكيمياء الخضراء المصنّعين إلى الاستثمار بكثافة في البحث والتطوير لمستحلبات الشمع النباتية والصناعية القائمة على الإستر. يُمكّن هذا من تحسين أداء الطلاء، وتقليل البصمة الكربونية، والتوافق مع عمليات التصنيع الحالية دون المساس بكفاءة التكلفة أو جودة المنتج.

- على سبيل المثال، في عام ٢٠٢٣، طرحت العديد من شركات التغليف في أمريكا الشمالية أكوابًا ورقية قابلة للتحلل الحيوي ومغطاة بمستحلبات شمعية حيوية. وفّرت هذه الحلول مقاومة للرطوبة، وقابلية تحلل بيولوجية مُحسّنة، ومتوافقة مع معايير سلامة الغذاء، مما منحها ميزة تنافسية في أسواق التغليف المستدام.

- في حين أن الاستدامة محرك رئيسي للنمو، يجب على المصنّعين الموازنة بين فعالية التكلفة وقابلية التوسع وتحسين الأداء لضمان تطبيقها على نطاق واسع. ويستكشف العاملون في الصناعة مصادر المواد الخام الإقليمية وأتمتة العمليات للحفاظ على الربحية في ظلّ مشهد التصنيع الأخضر المتطور.

ديناميكيات سوق مستحلب الشمع في أمريكا الشمالية

سائق

ارتفاع الطلب في صناعات البناء والتعبئة والتغليف

- يُسهم توسع أنشطة البناء في أمريكا الشمالية في زيادة الطلب على مستحلبات الشمع المستخدمة في معالجة الخرسانة، وطلاء الأخشاب، والمواد اللاصقة. تُحسّن هذه المستحلبات حماية الأسطح، ومقاومة الماء، والجاذبية الجمالية لمواد البناء، مما يزيد من المتانة ويُقلل من تكاليف الصيانة للمستخدمين النهائيين.

- يشهد قطاع التغليف نموًا ملحوظًا بفضل توسع التجارة الإلكترونية وتزايد الطلب على حلول تغليف المواد الغذائية. وتُفضّل مستحلبات الشمع بشكل متزايد لتوفير طبقات عازلة ومقاومة للدهون، وتحسين قابلية الطباعة في التغليف الورقي، مما يضمن كفاءة عالية دون المساس بالبيئة.

- شجعت الجهود التنظيمية المبذولة لمواد التغليف المستدامة المصنّعين على تطوير طلاءات مستحلب شمعية آمنة غذائيًا وقابلة للتحلل الحيوي. ويتيح الامتثال لإرشادات إدارة الغذاء والدواء الأمريكية (FDA) ووكالة حماية البيئة (EPA) تطبيقات أوسع في قطاع الأغذية، مع تحقيق أهداف الاستدامة المؤسسية عبر سلسلة التوريد.

- على سبيل المثال، في عام ٢٠٢٣، اعتمد كبار منتجي مواد التغليف في الولايات المتحدة مستحلبات الشمع المعتمدة من إدارة الغذاء والدواء الأمريكية (FDA) لطلاءات الورق الصالحة للأغذية. عزز هذا التطور سلامة المنتجات، وعزز سمعة العلامة التجارية، وعزز القدرة التنافسية في سوق مواد التغليف الصديقة للبيئة.

- بينما يظل قطاعا البناء والتغليف محركين رئيسيين للنمو، فإن تزايد استخدام مستحلبات الشمع في صناعات المنسوجات والسيارات ومستحضرات التجميل يعزز إمكانات السوق. ويستغل المصنعون هذا التوجه بإطلاق مستحلبات شمعية متخصصة مصممة خصيصًا لتطبيقات متخصصة وعالية الأداء.

ضبط النفس/التحدي

تقلب أسعار المواد الخام والوعي المحدود في الشركات الصغيرة والمتوسطة

- تُسبب تقلبات أسعار المواد الخام، مثل البارافين والبولي إيثيلين والشموع الطبيعية، حالة من عدم اليقين بشأن التكاليف بالنسبة للمصنّعين، مما يؤثر على تخطيط الإنتاج ومراقبة المخزون واستراتيجيات التسعير طويلة الأجل. وغالبًا ما تُؤثر هذه التقلبات على هوامش الربح وتُؤخر خطط توسيع الطاقة الإنتاجية في جميع أنحاء الصناعة.

- غالبًا ما تفتقر الشركات الصغيرة والمتوسطة إلى الوعي التقني بمستحلبات الشمع المتقدمة، مما يحد من استخدامها في تطبيقات متخصصة مثل الطلاءات المتخصصة ومواد التشحيم الصناعية. وتُقلل هذه الفجوة المعرفية من فرص الشركات الصغيرة والمتوسطة في التحول إلى خطوط إنتاج عالية القيمة وصديقة للبيئة.

- كما أن توافر البدائل الاصطناعية منخفضة التكلفة يعيق نمو مستحلبات الشمع الحيوي عالية الجودة في الأسواق الحساسة للسعر. فالعملاء الذين يواجهون قيودًا في الميزانية غالبًا ما يُفضلون البدائل الأرخص على الرغم من مزايا الأداء والاستدامة التي توفرها التركيبات المتقدمة.

- على سبيل المثال، في عام ٢٠٢٣، أبلغت العديد من الشركات الصغيرة والمتوسطة في المكسيك عن تأخر في التحول إلى مستحلبات الشمع المستدامة بسبب ارتفاع تكاليفها مقارنةً بالطلاءات التقليدية. يُبرز هذا التوجه الحاجة إلى حوافز مالية وبرامج تدريب فني للشركات الصغيرة في هذه الصناعة.

- يجب على الجهات الفاعلة في السوق التركيز على تنويع المواد الخام، وتحسين التكاليف، وبرامج التوعية للتغلب على هذه العوائق وضمان نمو مطرد. وتُعدّ المبادرات التعاونية بين الموردين والمصنعين وصانعي السياسات أساسية لتعزيز تبني التكنولوجيا الخضراء بأسعار معقولة في الأسواق الناشئة.

نطاق سوق مستحلب الشمع في أمريكا الشمالية

يتم تقسيم السوق على أساس قاعدة المواد، والمستحلب، وصناعة المستخدم النهائي.

- حسب قاعدة المواد

بناءً على المادة المستخدمة، يُقسّم سوق مستحلب الشمع في أمريكا الشمالية إلى مستحلب شمعي ذو قاعدة صناعية ومستحلب شمعي ذو قاعدة طبيعية. وقد حصد قطاع مستحلب الشمع ذو القاعدة الصناعية أكبر حصة من إيرادات السوق في عام 2024، بفضل فعاليته من حيث التكلفة، وجودته الثابتة، وتطبيقاته الواسعة في الدهانات والطلاءات ومواد التعبئة والتغليف. كما أن متانته وخصائصه المقاومة للماء تجعله الخيار الأمثل للإنتاج الصناعي.

من المتوقع أن يشهد قطاع مستحلبات الشمع ذات القاعدة الطبيعية أسرع معدل نمو بين عامي 2025 و2032، مدفوعًا بتزايد الطلب على المنتجات العضوية والصديقة للبيئة في مختلف القطاعات. كما أن لوائح الاستدامة المتنامية وتفضيل المستهلكين للمواد الخضراء يعززان اعتماد مستحلبات الشمع الطبيعية في تطبيقات تغليف الأغذية ومستحضرات التجميل.

- بواسطة المستحلب

بناءً على المستحلب، يُقسّم السوق إلى مواد خافضة للتوتر السطحي غير أيونية، ومواد خافضة للتوتر السطحي أنيونية، ومواد خافضة للتوتر السطحي كاتيونية. وقد هيمن قطاع المواد الخافضة للتوتر السطحي غير الأيونية على حصة السوق من الإيرادات في عام 2024، بفضل ثباته الممتاز، وتوافقه مع تركيبات متنوعة، وقدرته على توفير خصائص طلاء موحدة عبر العديد من صناعات المستخدمين النهائيين.

من المتوقع أن يشهد قطاع المواد الخافضة للتوتر السطحي الكاتيونية أسرع معدل نمو بين عامي 2025 و2032، بفضل خصائص التصاقها الفائقة واستخدامها المتزايد في تطبيقات البناء والنجارة. تُعزز هذه المستحلبات مقاومة الماء والمتانة، مما يجعلها مناسبة للطلاءات الصناعية والتخصصية.

- حسب صناعة المستخدم النهائي

بناءً على قطاع المستخدم النهائي، يُقسّم سوق مستحلب الشمع في أمريكا الشمالية إلى الدهانات والطلاءات، والمنسوجات، ومستحضرات التجميل، والمواد اللاصقة ومانعات التسرب، والبناء والنجارة، وصناعة الأغذية، وغيرها. وقد استحوذ قطاع الدهانات والطلاءات على أكبر حصة سوقية في عام 2024، مدفوعًا بتزايد الطلب على الطلاءات الواقية والزخرفية في مشاريع البناء السكنية والتجارية والصناعية.

من المتوقع أن يشهد قطاع صناعة الأغذية أسرع معدل نمو بين عامي 2025 و2032، مدعومًا بالاعتماد المتزايد على مستحلبات الشمع الآمنة غذائيًا والمعتمدة من إدارة الغذاء والدواء الأمريكية (FDA) في تطبيقات التغليف. كما أن الطلب المتزايد على الطلاءات المقاومة للرطوبة والقابلة للتحلل الحيوي في المنتجات الورقية الصالحة للأغذية يعزز نمو السوق.

تحليل إقليمي لسوق مستحلب الشمع في أمريكا الشمالية

- استحوذت سوق مستحلب الشمع في الولايات المتحدة على أكبر حصة من الإيرادات في عام 2024 داخل أمريكا الشمالية، مدفوعة بالتبني السريع للمواد المستدامة في تطبيقات التعبئة والتغليف والبناء والنجارة

- الطلب المتزايد على الطلاءات المعتمدة من إدارة الغذاء والدواء الأمريكية والصالحة للاستخدام الغذائي والتحول نحو المستحلبات القائمة على المواد الحيوية للتغليف الصديق للبيئة يعملان على تغذية توسع السوق

- علاوة على ذلك، يستفيد السوق الأمريكي من الاستثمارات القوية في البحث والتطوير، والأطر التنظيمية القوية، وتفضيل المستهلكين للمواد المستدامة وعالية الأداء.

نظرة عامة على سوق مستحلب الشمع في كندا

من المتوقع أن يشهد سوق مستحلبات الشمع في كندا أسرع معدل نمو بين عامي 2025 و2032، مدفوعًا بتزايد الطلب على الطلاءات المستدامة والصديقة للبيئة في قطاعات التعبئة والتغليف والبناء والنجارة. ويتسارع اعتماد مستحلبات الشمع المعتمدة من إدارة الغذاء والدواء الأمريكية (FDA) والقائمة على المواد البيولوجية، والمخصصة للاستخدام الغذائي، مدفوعًا بالدعم التنظيمي وتزايد وعي المستهلكين بالمواد الصديقة للبيئة. علاوة على ذلك، تُسهم الاستثمارات في البحث والتطوير، إلى جانب تزايد استخدام مستحلبات الشمع في المواد اللاصقة والدهانات والمنسوجات، في نمو السوق المطرد والتقدم التكنولوجي في كندا.

حصة سوق مستحلب الشمع في أمريكا الشمالية

إن صناعة مستحلب الشمع في أمريكا الشمالية يقودها في المقام الأول شركات راسخة، بما في ذلك:

- هيكسيون (الولايات المتحدة)

- شركة ميشلمان (الولايات المتحدة)

- شركة لوبريزول (الولايات المتحدة)

- مجموعة PMC، المحدودة (الولايات المتحدة)

- شركة هنري (الولايات المتحدة)

- شركة ميكرو باودر، المحدودة (الولايات المتحدة)

- شامروك (الولايات المتحدة)

- شركة بارافينواكسكو (الولايات المتحدة)

أحدث التطورات في سوق مستحلب الشمع في أمريكا الشمالية

- في ديسمبر 2023، سلّطت شركة بيترونافْت الضوء على استخدام مستحلبات الشمع في منتجات العناية الشخصية، مُثبتةً قدرتها على تحسين ملمس الكريمات واللوشن وخصائص الترطيب في تركيبات العناية بالشعر. كما تُحسّن هذه المستحلبات نعومة البشرة وطول عمرها في مستحضرات التجميل، مثل أحمر الشفاه وظلال العيون، مما يضمن أداءً وتجربة استخدام أفضل. يُسهم استخدام مستحلبات الشمع في منتجات التجميل في دفع عجلة الابتكار، ودعم تمايز المنتجات الفاخرة، وزيادة الطلب في سوق العناية الشخصية ومستحضرات التجميل في أمريكا الشمالية.

- في نوفمبر 2022، أفادت شركة Elsevier BV بأن مستحلبات الشمع الدقيقة والمتجانسة ودون الميكرونية اكتسبت أهمية كبيرة في قطاعي مستحضرات التجميل والأدوية. تُمكّن هذه المستحلبات المتطورة من امتصاص أفضل وثبات وقوام أفضل في المراهم والكريمات العلاجية، مما يُعزز فعالية المنتج ورضا المستهلك. يُشجع استخدامها المتزايد استثمارات البحث والتطوير، ويُوسّع فرص السوق لمستحلبات الشمع عالية الأداء في تطبيقات الرعاية الصحية والعناية الشخصية.

SKU-

احصل على إمكانية الوصول عبر الإنترنت إلى التقرير الخاص بأول سحابة استخبارات سوقية في العالم

- لوحة معلومات تحليل البيانات التفاعلية

- لوحة معلومات تحليل الشركة للفرص ذات إمكانات النمو العالية

- إمكانية وصول محلل الأبحاث للتخصيص والاستعلامات

- تحليل المنافسين باستخدام لوحة معلومات تفاعلية

- آخر الأخبار والتحديثات وتحليل الاتجاهات

- استغل قوة تحليل المعايير لتتبع المنافسين بشكل شامل

منهجية البحث

يتم جمع البيانات وتحليل سنة الأساس باستخدام وحدات جمع البيانات ذات أحجام العينات الكبيرة. تتضمن المرحلة الحصول على معلومات السوق أو البيانات ذات الصلة من خلال مصادر واستراتيجيات مختلفة. تتضمن فحص وتخطيط جميع البيانات المكتسبة من الماضي مسبقًا. كما تتضمن فحص التناقضات في المعلومات التي شوهدت عبر مصادر المعلومات المختلفة. يتم تحليل بيانات السوق وتقديرها باستخدام نماذج إحصائية ومتماسكة للسوق. كما أن تحليل حصة السوق وتحليل الاتجاهات الرئيسية هي عوامل النجاح الرئيسية في تقرير السوق. لمعرفة المزيد، يرجى طلب مكالمة محلل أو إرسال استفسارك.

منهجية البحث الرئيسية التي يستخدمها فريق بحث DBMR هي التثليث البيانات والتي تتضمن استخراج البيانات وتحليل تأثير متغيرات البيانات على السوق والتحقق الأولي (من قبل خبراء الصناعة). تتضمن نماذج البيانات شبكة تحديد موقف البائعين، وتحليل خط زمني للسوق، ونظرة عامة على السوق ودليل، وشبكة تحديد موقف الشركة، وتحليل براءات الاختراع، وتحليل التسعير، وتحليل حصة الشركة في السوق، ومعايير القياس، وتحليل حصة البائعين على المستوى العالمي مقابل الإقليمي. لمعرفة المزيد عن منهجية البحث، أرسل استفسارًا للتحدث إلى خبراء الصناعة لدينا.

التخصيص متاح

تعد Data Bridge Market Research رائدة في مجال البحوث التكوينية المتقدمة. ونحن نفخر بخدمة عملائنا الحاليين والجدد بالبيانات والتحليلات التي تتطابق مع هدفهم. ويمكن تخصيص التقرير ليشمل تحليل اتجاه الأسعار للعلامات التجارية المستهدفة وفهم السوق في بلدان إضافية (اطلب قائمة البلدان)، وبيانات نتائج التجارب السريرية، ومراجعة الأدبيات، وتحليل السوق المجدد وقاعدة المنتج. ويمكن تحليل تحليل السوق للمنافسين المستهدفين من التحليل القائم على التكنولوجيا إلى استراتيجيات محفظة السوق. ويمكننا إضافة عدد كبير من المنافسين الذين تحتاج إلى بيانات عنهم بالتنسيق وأسلوب البيانات الذي تبحث عنه. ويمكن لفريق المحللين لدينا أيضًا تزويدك بالبيانات في ملفات Excel الخام أو جداول البيانات المحورية (كتاب الحقائق) أو مساعدتك في إنشاء عروض تقديمية من مجموعات البيانات المتوفرة في التقرير.