سوق أسرة الحائط في أمريكا الشمالية، حسب التشغيل (يدوي وأوتوماتيكي)، النوع (سرير فردي وسرير مزدوج)، قناة التوزيع (عبر الإنترنت وخارجها)، الاستخدام النهائي (سكني وغير سكني)، الدولة (الولايات المتحدة وكندا والمكسيك)، اتجاهات الصناعة والتوقعات حتى عام 2029

تحليل السوق والرؤى : سوق الأسرة الجدارية في أمريكا الشمالية

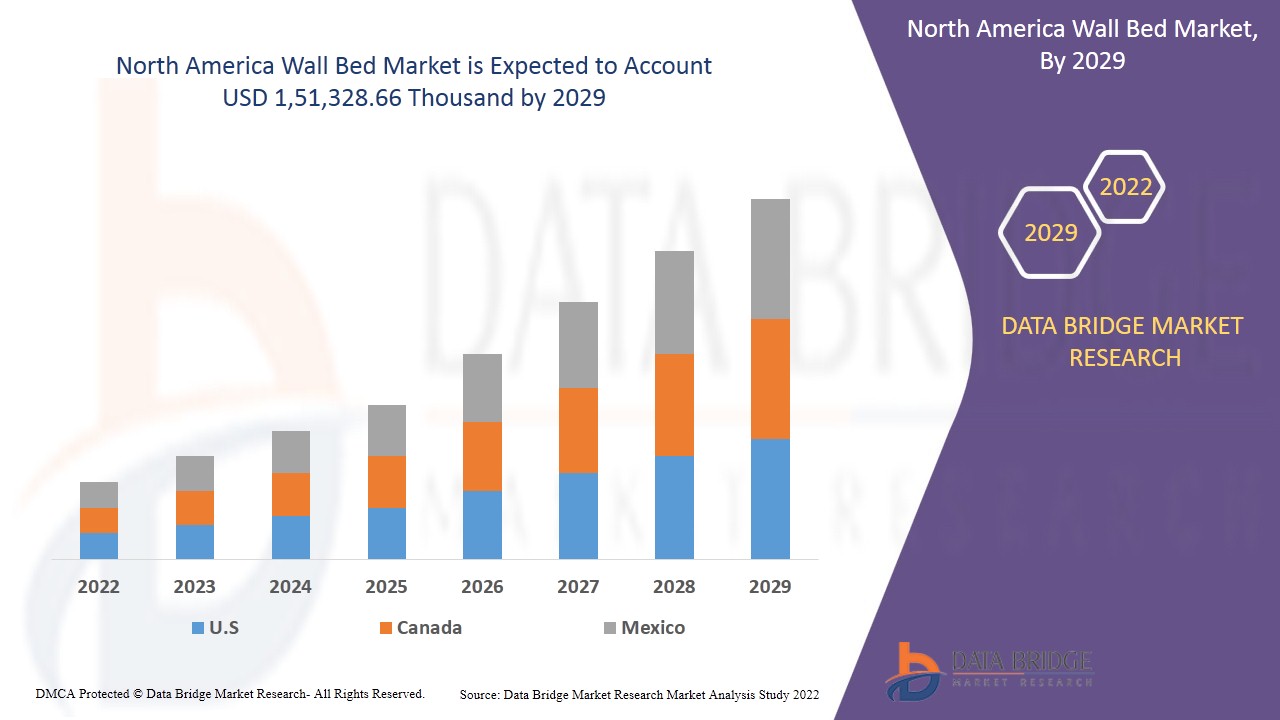

من المتوقع أن يكتسب سوق أسرة الحائط في أمريكا الشمالية نموًا في السوق في الفترة المتوقعة من 2022 إلى 2029. تحلل Data Bridge Market Research أن السوق ينمو بمعدل نمو سنوي مركب بنسبة 3.7٪ في الفترة المتوقعة من 2022 إلى 2029 ومن المتوقع أن يصل إلى 1،51،328.66 ألف دولار أمريكي بحلول عام 2029. من المتوقع أن يؤدي ارتفاع عدد السكان والمفهوم الواسع النطاق للعيش المشترك إلى دفع نمو سوق أسرة الحائط في أمريكا الشمالية.

تُستخدم الأسرة الجدارية لأغراض توفير المساحة وهي شائعة الاستخدام في الأماكن التي تكون فيها مساحة الأرضية محدودة، مثل المنازل الصغيرة والشقق والفنادق والمنازل المتنقلة ومساكن الطلاب. في السنوات الأخيرة، كانت وحدات الأسرة الجدارية مزودة بخيارات مثل الإضاءة وخزائن التخزين ومكونات المكتب. لا تحتوي معظم الأسرة الجدارية على نوابض صندوقية. بدلاً من ذلك، عادةً ما يتم وضع المرتبة على منصة أو شبكة ويتم تثبيتها في مكانها حتى لا تتدلى عند وضعها في وضع مغلق. يتم تثبيت المرتبة بإطار السرير، غالبًا بأشرطة مطاطية لتثبيت المرتبة في مكانها عند طي الوحدة في وضع مستقيم.

منذ النموذج الأول من سرير الحائط، تم إنشاء العديد من الاختلافات والتصميمات الأخرى، والتي تشمل الأسرة المثبتة على الجانب، والأسرة بطابقين، والحلول التي تتضمن وظائف أخرى مثل خزائن المكتب وخيارات الإضاءة. أصبحت الأسرة الحائطية ذات الطاولات أو المكاتب التي تطوى عند طي السرير شائعة، وهناك أيضًا نماذج بها أرائك وحلول رفوف.

من المتوقع أن يؤدي ارتفاع عدد السكان وانتشار مفهوم المعيشة المشتركة إلى دفع نمو سوق الأسرة الجدارية في أمريكا الشمالية. علاوة على ذلك، أدى ارتفاع مستوى المعيشة والوعي بديكور المنزل إلى دفع نمو سوق الأسرة الجدارية. وقد أدى هذا إلى زيادة الطلب على الأسرة الجدارية بسبب المساحات الضيقة والاستخدام المتعدد الأغراض لهذه الأسرة الجدارية. من ناحية أخرى، فإن القيد الرئيسي الذي قد يعيق سوق الأسرة الجدارية في أمريكا الشمالية هو التكلفة العالية للأسرة الجدارية مقارنة بالأسرّة العادية.

من المتوقع أن يؤدي الاستخدام المتزايد في بناء شقق الاستوديو إلى جلب فرص لسوق أسرة الحائط في أمريكا الشمالية. ومع ذلك، فإن أسرة الحائط ليست مناسبة للأشخاص الذين يستأجرون، وهو ما قد يشكل تحديًا لنمو السوق في المستقبل القريب.

يقدم تقرير سوق الأسرة الجدارية في أمريكا الشمالية تفاصيل عن حصة السوق والتطورات الجديدة وتحليل خط أنابيب المنتجات وتأثير اللاعبين المحليين والمحليين في السوق وتحليل الفرص من حيث جيوب الإيرادات الناشئة والتغييرات في لوائح السوق وموافقات المنتجات والقرارات الاستراتيجية وإطلاق المنتجات والتوسعات الجغرافية والابتكارات التكنولوجية في السوق. لفهم التحليل وسيناريو السوق، اتصل بنا للحصول على موجز محلل. سيساعدك فريقنا في إنشاء حل تأثير الإيرادات لتحقيق هدفك المنشود.

نطاق سوق الأسرة الجدارية وحجم السوق في أمريكا الشمالية

يتم تقسيم سوق الأسرة الجدارية في أمريكا الشمالية على أساس التشغيل والنوع وقناة التوزيع والاستخدام النهائي. يساعدك النمو بين القطاعات على تحليل جيوب النمو والاستراتيجيات المتخصصة للتعامل مع السوق وتحديد مجالات التطبيق الأساسية والاختلاف في الأسواق المستهدفة.

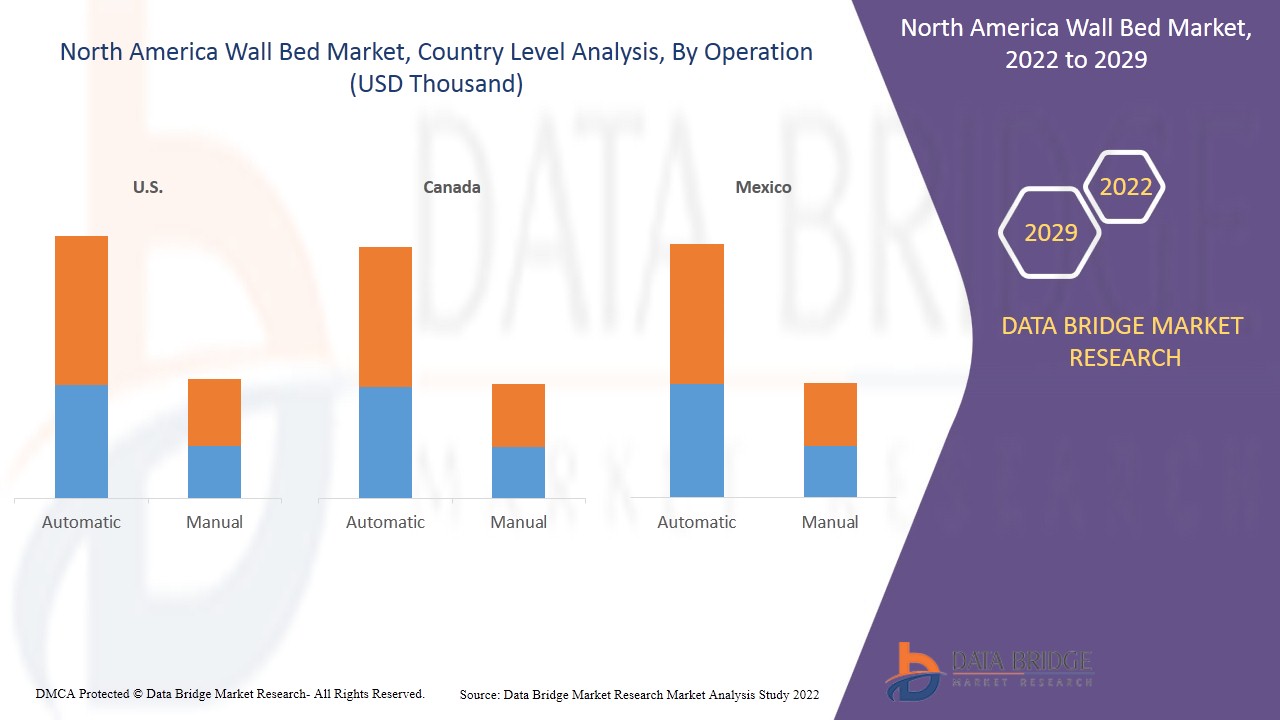

- على أساس التشغيل، يتم تقسيم سوق أسرة الحائط في أمريكا الشمالية إلى أوتوماتيكية ويدوية. في عام 2022، من المتوقع أن تهيمن الشريحة الأوتوماتيكية على سوق أسرة الحائط في أمريكا الشمالية حيث أن أسرة الحائط التي يتم تشغيلها تلقائيًا يسهل طيها ونشرها، مما من المرجح أن يعزز الطلب في عام التنبؤ. حتى الأطفال وكبار السن يجدون أنه من الملائم استخدامها دون مساعدة أحد.

- على أساس النوع، يتم تقسيم سوق الأسرة الجدارية في أمريكا الشمالية إلى سرير فردي وسرير مزدوج. في عام 2022، من المتوقع أن تهيمن شريحة الأسرة الفردية على سوق الأسرة الجدارية في أمريكا الشمالية لأنها توفر راحة النوم على السرير وتعمل كمخزن أو طاولة عند عدم الاستخدام. بالإضافة إلى ذلك، هناك طلب كبير على الأسرة الفردية من الأشخاص الذين يعيشون في شقق الاستوديو التي لديها مساحة أقل للأثاث.

- على أساس قناة التوزيع، يتم تقسيم سوق الأسرة الجدارية في أمريكا الشمالية إلى سوق عبر الإنترنت وسوق غير متصل بالإنترنت. في عام 2022، من المتوقع أن يهيمن قطاع غير متصل بالإنترنت على سوق الأسرة الجدارية في أمريكا الشمالية حيث يفضل الكثير من الناس زيارة المتاجر والتحقق من جودة الأسرة الجدارية، كما يتم الشراء بالجملة دون اتصال بالإنترنت في معظم الحالات. ومن المتوقع أن يساعد هذا في نمو هذا القطاع في فترة التوقعات.

- على أساس الاستخدام النهائي، يتم تقسيم سوق أسرة الحائط في أمريكا الشمالية إلى سكنية وغير سكنية. في عام 2022، من المتوقع أن يهيمن القطاع السكني على سوق أسرة الحائط في أمريكا الشمالية. توفر هذه الأسرة مساحة كبيرة يمكن استخدامها كمناطق معيشة أو مناطق لعب للأطفال، ومن المتوقع أن يعزز الطلب عليها في فترة التوقعات.

تحليل سوق الأسرة الجدارية في أمريكا الشمالية على مستوى الدولة

يتم تحليل سوق أسرة الحائط في أمريكا الشمالية، ويتم توفير معلومات حجم السوق حسب البلد، والتشغيل، والنوع، وقناة التوزيع، والاستخدام النهائي كما هو مذكور أعلاه.

الدول التي يغطيها تقرير سوق أسرة الحائط في أمريكا الشمالية هي الولايات المتحدة وكندا والمكسيك.

من المتوقع أن تهيمن الولايات المتحدة على سوق الأسرة الجدارية في أمريكا الشمالية بسبب الطلب المرتفع من المستخدمين السكنيين. ومن المتوقع أن تهيمن كندا على سوق الأسرة الجدارية في أمريكا الشمالية بسبب ارتفاع مستوى المعيشة والوعي بالديكور المنزلي في هذه المنطقة. ومن المتوقع أن تهيمن المكسيك على سوق الأسرة الجدارية في أمريكا الشمالية بسبب تحسن مستوى المعيشة وزيادة الدخل المتاح والتحضر في المنطقة.

كما يوفر قسم الدولة في التقرير عوامل التأثير الفردية على السوق والتغيرات في تنظيم السوق التي تؤثر على الاتجاهات الحالية والمستقبلية للسوق. تعد نقاط البيانات مثل المبيعات الجديدة ومبيعات الاستبدال والتركيبة السكانية للدولة والقوانين التنظيمية ورسوم الاستيراد والتصدير من بين المؤشرات الرئيسية المستخدمة للتنبؤ بسيناريو السوق للدول الفردية. كما يتم النظر في وجود وتوافر العلامات التجارية العالمية والتحديات التي تواجهها بسبب المنافسة الكبيرة أو النادرة من العلامات التجارية المحلية والمحلية وتأثير قنوات المبيعات أثناء تقديم تحليل تنبؤي لبيانات الدولة.

ارتفاع عدد السكان وانتشار مفهوم العيش المشترك

يوفر لك سوق الأسرة الجدارية في أمريكا الشمالية أيضًا تحليلًا تفصيليًا للسوق لكل دولة من حيث نمو القاعدة المثبتة لأنواع مختلفة من المنتجات لسوق الأسرة الجدارية، وتأثير التكنولوجيا باستخدام منحنيات شريان الحياة والتغييرات في تقنيات الإنتاج، والسيناريوهات التنظيمية، وتأثيرها على سوق الأسرة الجدارية. تتوفر البيانات للفترة التاريخية من 2011 إلى 2020.

تحليل المشهد التنافسي وحصة سوق الأسرة الجدارية في أمريكا الشمالية

يوفر المشهد التنافسي لسوق الأسرة الجدارية في أمريكا الشمالية تفاصيل عن المنافس. تتضمن التفاصيل نظرة عامة على الشركة، والبيانات المالية للشركة، والإيرادات المتولدة، وإمكانات السوق، والاستثمار في البحث والتطوير، ومبادرات السوق الجديدة، والحضور العالمي، ومواقع الإنتاج والمرافق، ونقاط القوة والضعف للشركة، وإطلاق المنتج، وخطوط أنابيب التجارب السريرية، وتحليل العلامة التجارية، وموافقات المنتج، وبراءات الاختراع، وعرض المنتج ونطاقه، وهيمنة التطبيق، ومنحنى شريان الحياة التكنولوجي. ترتبط نقاط البيانات المذكورة أعلاه فقط بتركيز الشركة فيما يتعلق بسوق الأسرة الجدارية في أمريكا الشمالية.

بعض اللاعبين الرئيسيين في السوق المنخرطين في سوق أسرة الحائط في أمريكا الشمالية هم SICO Incorporated و Wilding Wallbeds و Wall Beds Manufacturing, Inc. و Zoom Room Inc و BOFF Wall Beds و Twin Cities Closet Company و Wallbeds “n” more و Wallbeds & Closets North West و Bestar Modern Home and Office furniture و The Bedder Way Co. و Murphy Wall Beds Hardware Inc. و Modern Furniture and Interior Design و Superior Wall Beds، من بين لاعبين آخرين محليين وعالميين. يفهم محللو DBMR نقاط القوة التنافسية ويوفرون تحليلًا تنافسيًا لكل منافس على حدة.

على سبيل المثال،

- في يناير 2020، أعلنت شركة Bestar Modern Home and Office Furniture عن شراكتها مع MB Capital في مجال الأسهم الخاصة. وقد ساعد هذا التطور الشركة على توسيع أعمالها

- في يناير 2020، استحوذت شركة Bestar Modern Home and Office Furniture على Bush Industries، وهي شركة أمريكية رائدة في تصنيع السلع الجاهزة وأثاث المكاتب والمنزل. وقد ساعد هذا التطور الشركة على جذب المزيد من العملاء

SKU-

احصل على إمكانية الوصول عبر الإنترنت إلى التقرير الخاص بأول سحابة استخبارات سوقية في العالم

- لوحة معلومات تحليل البيانات التفاعلية

- لوحة معلومات تحليل الشركة للفرص ذات إمكانات النمو العالية

- إمكانية وصول محلل الأبحاث للتخصيص والاستعلامات

- تحليل المنافسين باستخدام لوحة معلومات تفاعلية

- آخر الأخبار والتحديثات وتحليل الاتجاهات

- استغل قوة تحليل المعايير لتتبع المنافسين بشكل شامل

Table of Content

1 INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 OVERVIEW OF NORTH AMERICA WALL BED MARKET

1.4 LIMITATION

1.5 MARKETS COVERED

2 MARKET SEGMENTATION

2.1 MARKETS COVERED

2.2 GEOGRAPHICAL SCOPE

2.3 YEARS CONSIDERED FOR THE STUDY

2.4 CURRENCY AND PRICING

2.5 DBMR TRIPOD DATA VALIDATION MODEL

2.6 TYPE LIFE LINE CURVE

2.7 MULTIVARIATE MODELING

2.8 PRIMARY INTERVIEWS WITH KEY OPINION LEADERS

2.9 DBMR MARKET POSITION GRID

2.1 MARKET END USE COVERAGE GRID

2.11 DBMR MARKET CHALLENGE MATRIX

2.12 IMPORT-EXPORT DATA

2.13 SECONDARY SOURCES

2.14 ASSUMPTIONS

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

4.1 DEMOGRAPHIC ANALYSIS

5 MARKET OVERVIEW

5.1 DRIVERS

5.1.1 RISING POPULATION AND WIDESPREAD CONCEPT OF CO-LIVING

5.1.2 GROWING INSTALLATION OF WALL BEDS IN THE HOSPITALITY INDUSTRY

5.1.3 INCREASING AWARENESS REGARDING HOME DÉCOR AND HOME FURNISHING

5.1.4 IMPROVED STANDARD OF LIVING COUPLED WITH RISING DISPOSABLE INCOME AND URBANIZATION

5.2 RESTRAINTS

5.2.1 HIGH COST OF WALL BEDS AS COMPARED TO NORMAL BEDS

5.2.2 AVAILABILITY OF MULTIPURPOSE SUBSTITUTES

5.3 OPPORTUNITIES

5.3.1 GROWING USE IN THE CONSTRUCTION OF STUDIO APARTMENTS

5.4 CHALLENGES

5.4.1 WALL BEDS ARE NOT SUITABLE FOR PEOPLE WHO ARE RENTING

5.4.2 WALL BEDS ARE NOT PORTABLE AND REQUIRE A WALL MOUNTING SYSTEM

6 IMPACT OF COVID 19 IMPACT ON THE NORTH AMERICA WALL BED MARKET

6.1 ANALYSIS ON IMPACT OF COVID-19 ON THE NORTH AMERICA WALL BED MARKET

6.2 AFTERMATH OF COVID-19 AND GOVERNMENT INITIATIVE TO BOOST THE GLOBAL PACKAGING PRINITNG MARKET

6.3 STRATERGIC DECISIONS FOR MANUFACTURERS AFTER COVID-19 TO GAIN COMPETITIVE MARKET SHARE

6.4 PRICE IMPACT

6.5 IMPACT ON DEMAND

6.6 IMPACT ON SUPPLY CHAIN

6.7 CONCLUSION

7 NORTH AMERICA WALL BED MARKET, BY OPERATION

7.1 OVERVIEW

7.2 AUTOMATIC

7.3 MANUAL

8 NORTH AMERICA WALL BED MARKET, BY TYPE

8.1 OVERVIEW

8.2 SINGLE BED

8.3 DOUBLE BED

9 NORTH AMERICA WALL BED MARKET, BY DISTRIBUTION CHANNEL

9.1 OVERVIEW

9.2 OFFLINE

9.3 ONLINE

10 NORTH AMERICA WALL BED MARKET, BY END USE

10.1 OVERVIEW

10.2 RESIDENTIAL

10.2.1 OFFLINE

10.2.2 ONLINE

10.3 NON-RESIDENTIAL

10.3.1 OFFLINE

10.3.2 ONLINE

11 NORTH AMERICA WALL BED MARKET, BY COUNTRY

11.1 U.S.

11.2 CANADA

11.3 MEXICO

12 NORTH AMERICA WALL BED MARKET, COMPANY LANDSCAPE

12.1 COMPANY SHARE ANALYSIS: NORTH AMERICA

12.2 PARTNERSHIP & ACQUISITION

12.3 PRODUCT DEVELOPMENT

13 SWOT ANALYSIS

14 COMPANY PROFILES

14.1 SICO INCORPORATED

14.1.1 COMPANY SNAPSHOT

14.1.2 PRODUCT PORTFOLIO

14.1.3 RECENT UPDATE

14.2 WILDING WALLBEDS

14.2.1 COMPANY SNAPSHOT

14.2.2 PRODUCT PORTFOLIO

14.2.3 RECENT UPDATE

14.3 WALL BEDS MANUFACTURING, INC.

14.3.1 COMPANY SNAPSHOT

14.3.2 PRODUCT PORTFOLIO

14.3.3 RECENT UPDATES

14.4 ZOOM ROOM INC

14.4.1 COMPANY SNAPSHOT

14.4.2 PRODUCT PORTFOLIO

14.4.3 RECENT UPDATE

14.5 B.O.F.F. WALL BEDS

14.5.1 COMPANY SNAPSHOT

14.5.2 PRODUCT PORTFOLIO

14.5.3 RECENT UPDATE

14.6 BESTAR MODERN HOME AND OFFICE FURNITURE

14.6.1 COMPANY SNAPSHOT

14.6.2 PRODUCT PORTFOLIO

14.6.3 RECENT UPDATES

14.7 MODERN FURNITURE AND INTERIOR DESIGN

14.7.1 COMPANY SNAPSHOT

14.7.2 PRODUCT PORTFOLIO

14.7.3 RECENT UPDATE

14.8 MURPHY WALL BEDS HARDWARE INC

14.8.1 COMPANY SNAPSHOT

14.8.2 PRODUCT PORTFOLIO

14.8.3 RECENT UPDATE

14.9 SUPERIOR WALL BEDS

14.9.1 COMPANY SNAPSHOT

14.9.2 PRODUCT PORTFOLIO

14.9.3 RECENT UPDATE

14.1 THE BEDDER WAY CO

14.10.1 COMPANY SNAPSHOT

14.10.2 PRODUCT PORTFOLIO

14.10.3 RECENT UPDATE

14.11 TWIN CITIES CLOSET COMPANY

14.11.1 COMPANY SNAPSHOT

14.11.2 PRODUCT PORTFOLIO

14.11.3 RECENT UPDATE

14.12 WALLBEDS “N” MORE

14.12.1 COMPANY SNAPSHOT

14.12.2 PRODUCT PORTFOLIO

14.12.3 RECENT UPDATES

14.13 WALLBEDS & CLOSETS NORTH WEST

14.13.1 COMPANY SNAPSHOT

14.13.2 PRODUCT PORTFOLIO

14.13.3 RECENT UPDATES

15 QUESTIONNAIRE

16 RELATED REPORTS

List of Table

TABLE 1 IMPORT DATA OF WOODEN FURNITURE FOR BEDROOMS; HS CODE - 940350 (USD THOUSAND)

TABLE 2 EXPORT DATA OF WOODEN FURNITURE FOR BEDROOMS; HS CODE - 940350 (USD THOUSAND)

TABLE 3 NORTH AMERICA WALL BED MARKET, BY OPERATION, 2020-2029 (UNITS)

TABLE 4 NORTH AMERICA WALL BED MARKET, BY OPERATION, 2020-2029 (USD THOUSAND)

TABLE 5 NORTH AMERICA WALL BED MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 6 NORTH AMERICA WALL BED MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD THOUSAND)

TABLE 7 NORTH AMERICA WALL BED MARKET, BY END USE, 2020-2029 (USD THOUSAND)

TABLE 8 NORTH AMERICA RESIDENTIAL IN WALL BED MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD THOUSAND)

TABLE 9 NORTH AMERICA NON-RESIDENTIAL IN WALL BED MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD THOUSAND)

TABLE 10 NORTH AMERICA WALL BED MARKET, BY COUNTRY, 2020-2029 (USD THOUSAND)

TABLE 11 NORTH AMERICA WALL BED MARKET, BY COUNTRY, 2020-2029 (UNITS)

TABLE 12 U.S. WALL BED MARKET, BY OPERATION, 2020-2029 (USD THOUSAND)

TABLE 13 U.S. WALL BED MARKET, BY OPERATION, 2020-2029 (UNITS)

TABLE 14 U.S. WALL BED MARKET, BY TYPE, 2020-2029 (USD THOUSAND )

TABLE 15 U.S. WALL BED MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD THOUSAND )

TABLE 16 U.S. WALL BED MARKET, BY END USE, 2020-2029 (USD THOUSAND )

TABLE 17 U.S. RESIDENTIAL IN WALL BED MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD THOUSAND)

TABLE 18 U.S. NON-RESIDENTIAL IN WALL BED MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD THOUSAND )

TABLE 19 CANADA WALL BED MARKET, BY OPERATION, 2020-2029 (USD THOUSAND)

TABLE 20 CANADA WALL BED MARKET, BY OPERATION, 2020-2029 (UNITS)

TABLE 21 CANADA WALL BED MARKET, BY TYPE, 2020-2029 (USD THOUSAND )

TABLE 22 CANADA WALL BED MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD THOUSAND )

TABLE 23 CANADA WALL BED MARKET, BY END USE, 2020-2029 (USD THOUSAND )

TABLE 24 CANADA RESIDENTIAL IN WALL BED MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD THOUSAND )

TABLE 25 CANADA NON-RESIDENTIAL IN WALL BED MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD THOUSAND )

TABLE 26 MEXICO WALL BED MARKET, BY OPERATION, 2020-2029 (USD THOUSAND)

TABLE 27 MEXICO WALL BED MARKET, BY OPERATION, 2020-2029 (UNITS)

TABLE 28 MEXICO WALL BED MARKET, BY TYPE, 2020-2029 (USD THOUSAND )

TABLE 29 MEXICO WALL BED MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD THOUSAND )

TABLE 30 MEXICO WALL BED MARKET, BY END USE, 2020-2029 (USD THOUSAND )

TABLE 31 MEXICO RESIDENTIAL IN WALL BED MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD THOUSAND )

TABLE 32 MEXICO NON-RESIDENTIAL IN WALL BED MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD THOUSAND )

List of Figure

FIGURE 1 NORTH AMERICA WALL BED MARKET: SEGMENTATION

FIGURE 2 NORTH AMERICA WALL BED MARKET: DATA TRIANGULATION

FIGURE 3 NORTH AMERICA WALL BED MARKET: DROC ANALYSIS

FIGURE 4 NORTH AMERICA WALL BED MARKET: GLOBAL VS REGIONAL MARKET ANALYSIS

FIGURE 5 NORTH AMERICA WALL BED MARKET: COMPANY RESEARCH ANALYSIS

FIGURE 6 NORTH AMERICA WALL BED MARKET: THE TYPE LIFE LINE CURVE

FIGURE 7 NORTH AMERICA WALL BED MARKET: MULTIVARIATE MODELLING

FIGURE 8 NORTH AMERICA WALL BED MARKET: INTERVIEW DEMOGRAPHICS

FIGURE 9 NORTH AMERICA WALL BED MARKET: DBMR MARKET POSITION GRID

FIGURE 10 NORTH AMERICA WALL BED MARKET: END USE COVERAGE GRID

FIGURE 11 NORTH AMERICA WALL BED MARKET: THE MARKET CHALLENGE MATRIX

FIGURE 12 NORTH AMERICA WALL BED MARKET: SEGMENTATION

FIGURE 13 RISING POPULATION AND WIDESPREAD CONCEPT OF CO-LIVING IS DRIVING NORTH AMERICA WALL BED MARKET IN THE FORECAST PERIOD OF 2022 TO 2029

FIGURE 14 AUTOMATIC SEGMENT IS EXPECTED TO ACCOUNT FOR THE LARGEST SHARE OF THE NORTH AMERICA WALL BED MARKET IN 2022 & 2029

FIGURE 15 DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES OF NORTH AMERICA WALL BED MARKET

FIGURE 16 NORTH AMERICA POPULATION GROWTH RATE

FIGURE 17 URBANIZATION IN DIFFERENT REGIONS

FIGURE 18 RENTER OCCUPIED HOUSING UNITS IN U.S. IN QUARTER 4 OF 2015 TO 2021

FIGURE 19 NORTH AMERICA WALL BED MARKET, BY OPERATION, 2021

FIGURE 20 NORTH AMERICA WALL BED MARKET, BY TYPE, 2021

FIGURE 21 NORTH AMERICA WALL BED MARKET, BY DISTRIBUTION CHANNEL, 2021

FIGURE 22 NORTH AMERICA WALL BED MARKET, BY END USE, 2021

FIGURE 23 CONSTRUCTION OF SINGLE UNIT IN NORTH AMERICAN CITIES, 2020

FIGURE 24 NORTH AMERICA WALL BED MARKET: SNAPSHOT (2021)

FIGURE 25 NORTH AMERICA WALL BED MARKET: BY COUNTRY (2021)

FIGURE 26 NORTH AMERICA WALL BED MARKET: BY COUNTRY (2022 & 2029)

FIGURE 27 NORTH AMERICA WALL BED MARKET: BY COUNTRY (2021 & 2029)

FIGURE 28 NORTH AMERICA WALL BED MARKET: BY OPERATION (2022-2029)

FIGURE 29 NORTH AMERICA WALL BED MARKET: COMPANY SHARE 2021 (%)

منهجية البحث

يتم جمع البيانات وتحليل سنة الأساس باستخدام وحدات جمع البيانات ذات أحجام العينات الكبيرة. تتضمن المرحلة الحصول على معلومات السوق أو البيانات ذات الصلة من خلال مصادر واستراتيجيات مختلفة. تتضمن فحص وتخطيط جميع البيانات المكتسبة من الماضي مسبقًا. كما تتضمن فحص التناقضات في المعلومات التي شوهدت عبر مصادر المعلومات المختلفة. يتم تحليل بيانات السوق وتقديرها باستخدام نماذج إحصائية ومتماسكة للسوق. كما أن تحليل حصة السوق وتحليل الاتجاهات الرئيسية هي عوامل النجاح الرئيسية في تقرير السوق. لمعرفة المزيد، يرجى طلب مكالمة محلل أو إرسال استفسارك.

منهجية البحث الرئيسية التي يستخدمها فريق بحث DBMR هي التثليث البيانات والتي تتضمن استخراج البيانات وتحليل تأثير متغيرات البيانات على السوق والتحقق الأولي (من قبل خبراء الصناعة). تتضمن نماذج البيانات شبكة تحديد موقف البائعين، وتحليل خط زمني للسوق، ونظرة عامة على السوق ودليل، وشبكة تحديد موقف الشركة، وتحليل براءات الاختراع، وتحليل التسعير، وتحليل حصة الشركة في السوق، ومعايير القياس، وتحليل حصة البائعين على المستوى العالمي مقابل الإقليمي. لمعرفة المزيد عن منهجية البحث، أرسل استفسارًا للتحدث إلى خبراء الصناعة لدينا.

التخصيص متاح

تعد Data Bridge Market Research رائدة في مجال البحوث التكوينية المتقدمة. ونحن نفخر بخدمة عملائنا الحاليين والجدد بالبيانات والتحليلات التي تتطابق مع هدفهم. ويمكن تخصيص التقرير ليشمل تحليل اتجاه الأسعار للعلامات التجارية المستهدفة وفهم السوق في بلدان إضافية (اطلب قائمة البلدان)، وبيانات نتائج التجارب السريرية، ومراجعة الأدبيات، وتحليل السوق المجدد وقاعدة المنتج. ويمكن تحليل تحليل السوق للمنافسين المستهدفين من التحليل القائم على التكنولوجيا إلى استراتيجيات محفظة السوق. ويمكننا إضافة عدد كبير من المنافسين الذين تحتاج إلى بيانات عنهم بالتنسيق وأسلوب البيانات الذي تبحث عنه. ويمكن لفريق المحللين لدينا أيضًا تزويدك بالبيانات في ملفات Excel الخام أو جداول البيانات المحورية (كتاب الحقائق) أو مساعدتك في إنشاء عروض تقديمية من مجموعات البيانات المتوفرة في التقرير.