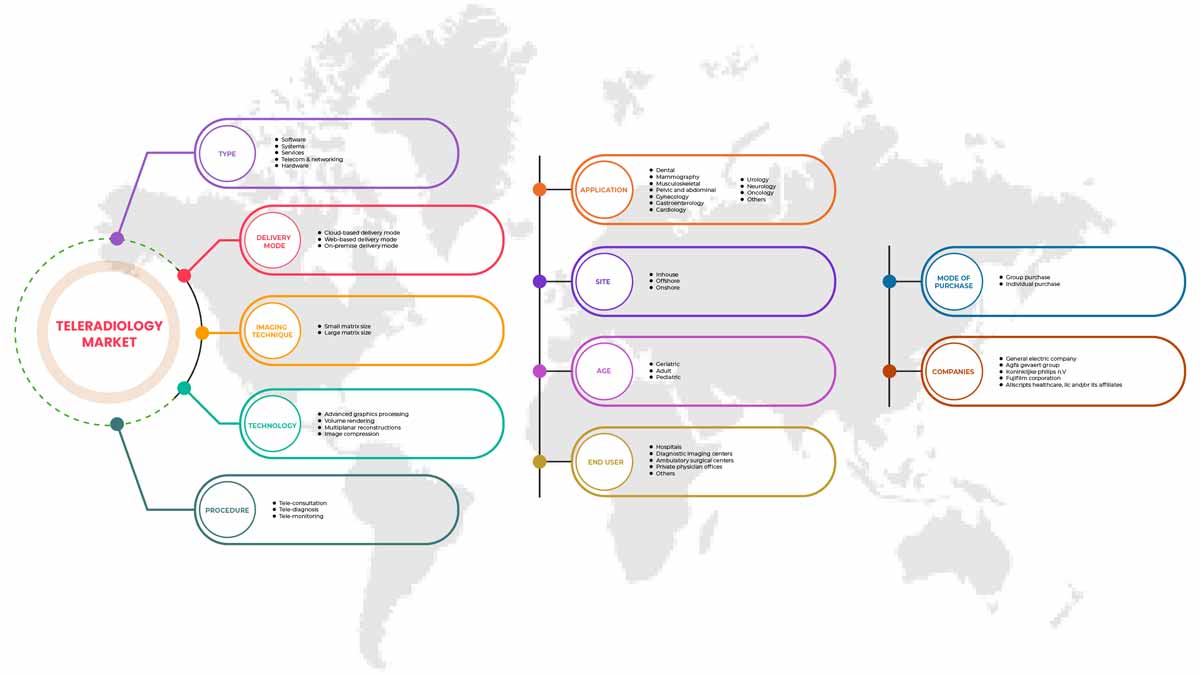

سوق التصوير عن بعد في أمريكا الشمالية، حسب النوع (الأجهزة والأنظمة والبرامج والاتصالات وخدمات الشبكات)، ووضع التسليم (وضع التسليم القائم على الويب ووضع التسليم القائم على السحابة ووضع التسليم في الموقع)، وتقنية التصوير (حجم المصفوفة الصغيرة وحجم المصفوفة الكبيرة)، والتكنولوجيا (معالجة الرسومات المتقدمة، وتقديم الحجم، وإعادة بناء متعدد المستويات، وضغط الصور)، والإجراء (الاستشارة عن بعد والتشخيص عن بعد والمراقبة عن بعد)، والتطبيق (أمراض القلب والأعصاب والأورام والجهاز العضلي الهيكلي وأمراض الجهاز الهضمي والحوض والبطن وأمراض النساء وأمراض المسالك البولية والتصوير الشعاعي للثدي والأسنان وغيرها)، والموقع (داخليًا وخارجيًا وعلى الشاطئ)، والعمر (طب الأطفال وكبار السن والبالغين)، وطريقة الشراء (الشراء الجماعي والشراء الفردي)، والمستخدم النهائي (المستشفيات ومراكز الجراحة الخارجية ومكاتب الأطباء الخاصة)، مراكز التصوير التشخيصي وغيرها، اتجاهات الصناعة وتوقعاتها حتى عام 2029.

تحليل ورؤى حول سوق التطبيب عن بعد في أمريكا الشمالية

يعد التطبيب عن بعد أحد فروع الطب عن بعد حيث تُستخدم أنظمة الاتصالات السلكية واللاسلكية لنقل الصور الإشعاعية من مكان إلى آخر. وقد تطورت تقنيات معالجة الصور الرقمية السريعة لضمان التوزيع الفعال للصور عبر المستويات الإقليمية والمحلية وأمريكا الشمالية. كما أدى ظهور وقبول تكنولوجيا الهاتف المحمول (mHealth) لتصور وتفسير الصور إلى زيادة نمو سوق التطبيب عن بعد في الدول المتقدمة مثل الولايات المتحدة وألمانيا والمملكة المتحدة وأستراليا واليابان. ويؤكد الاستخدام الواسع النطاق للأجهزة الذكية المتصلة والحلول ذات الصلة على التفسير الفعال للصور الطبية، وبالتالي تقليل وقت العلاج. وبالتالي، فإن التطورات في التكنولوجيا الرقمية ستعزز منهجيات مراقبة المرضى عن بعد وإمكانية الوصول إلى تفسيرات واستشارات أخصائيي الأشعة.

بالإضافة إلى ذلك، ووفقًا لبيانات منظمة الصحة العالمية، فإن السرطان مسؤول عن وفاة واحدة من كل ست حالات وفاة في جميع أنحاء العالم. وعلاوة على ذلك، تحدث حوالي 70% من حالات الوفاة بالسرطان في البلدان ذات الدخل المنخفض والمتوسط. كما أن الزيادة في التمويل من قبل الحكومة الفيدرالية لدفع تبني هذه الحلول تؤثر بشكل أكبر على السوق. بالإضافة إلى ذلك، فإن الارتفاع في الإنفاق على الرعاية الصحية، والتقدم في البنية التحتية للرعاية الصحية، والطلب المرتفع على تقديم الرعاية الموسعة يؤثر بشكل إيجابي على سوق الأشعة عن بعد.

ومع ذلك، من المتوقع أن تعمل عمليات السداد والأعباء التنظيمية المتزايدة على تثبيط نمو سوق التطبيب عن بعد. ومن ناحية أخرى، من المتوقع أن تعمل تكاليف التكنولوجيا المتزايدة على كبح نمو السوق.

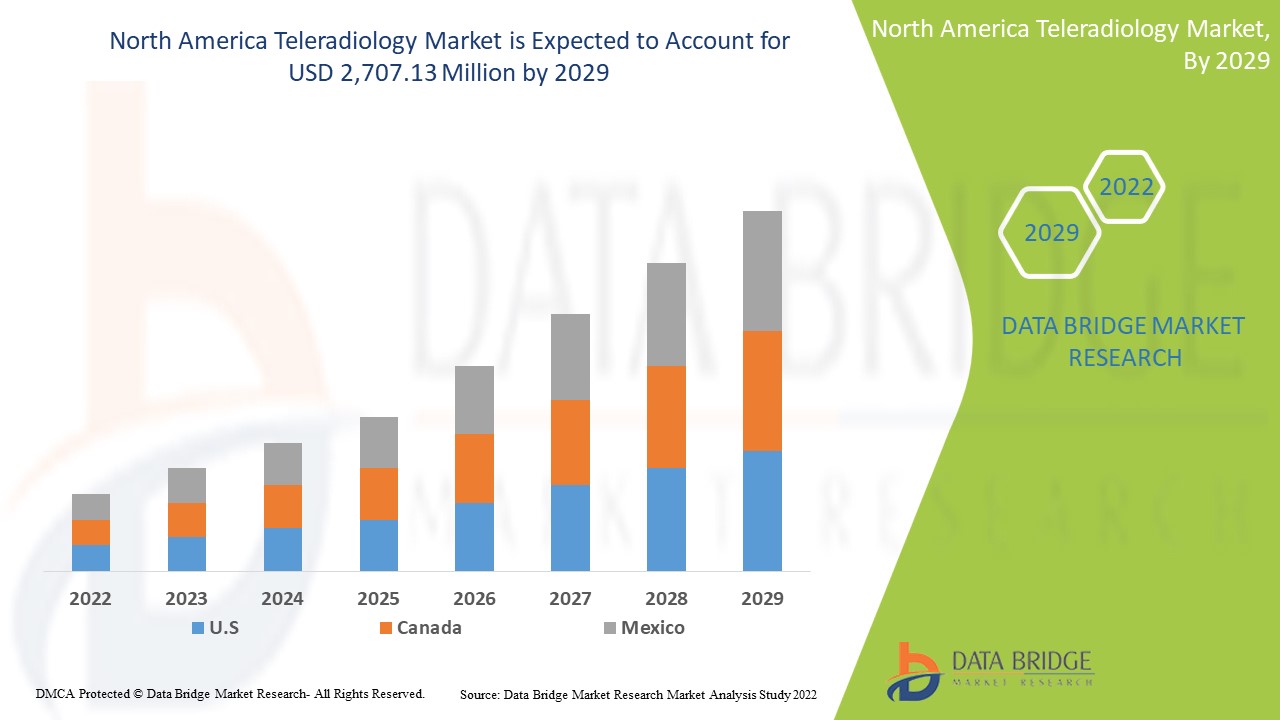

تحلل شركة Data Bridge Market Research أن سوق التطبيب عن بعد في أمريكا الشمالية من المتوقع أن تصل قيمته إلى 2,707.13 مليون دولار أمريكي بحلول عام 2029، بمعدل نمو سنوي مركب يبلغ 18.5% خلال الفترة المتوقعة. تشكل الخدمات أكبر شريحة من النوع في السوق بسبب زيادة خدمات التطبيب عن بعد بين سكان أمريكا الشمالية. يغطي تقرير السوق هذا أيضًا تحليل الأسعار وتحليل براءات الاختراع والتقدم التكنولوجي بعمق.

|

تقرير القياس |

تفاصيل |

|

فترة التنبؤ |

2022 إلى 2029 |

|

سنة الأساس |

2021 |

|

سنوات تاريخية |

2020 (قابلة للتخصيص حتى 2019 - 2014) |

|

وحدات كمية |

الإيرادات بالملايين من الدولارات الأمريكية، الأحجام بالوحدات، التسعير بالدولار الأمريكي |

|

القطاعات المغطاة |

حسب النوع (الأجهزة والأنظمة والبرامج وخدمات الاتصالات والشبكات)، وطريقة التسليم (وضع التسليم المستند إلى الويب ووضع التسليم المستند إلى السحابة ووضع التسليم المحلي)، وتقنية التصوير (حجم المصفوفة الصغيرة وحجم المصفوفة الكبيرة)، والتكنولوجيا (معالجة الرسومات المتقدمة، وتقديم الحجم، وإعادة البناء متعدد المستويات، وضغط الصور)، والإجراء (الاستشارة عن بعد والتشخيص عن بعد والمراقبة عن بعد)، والتطبيق (أمراض القلب والأعصاب والأورام والجهاز العضلي الهيكلي وأمراض الجهاز الهضمي والحوض والبطن وأمراض النساء وأمراض المسالك البولية والتصوير الشعاعي للثدي والأسنان وغيرها)، والموقع (داخليًا وخارجيًا وعلى الشاطئ)، والعمر (طب الأطفال وكبار السن والبالغين)، وطريقة الشراء (الشراء الجماعي والشراء الفردي)، والمستخدم النهائي (المستشفيات ومراكز الجراحة الخارجية ومكاتب الأطباء الخاصة والتصوير التشخيصي) (المراكز وغيرها) |

|

الدول المغطاة |

الولايات المتحدة وكندا والمكسيك |

|

الجهات الفاعلة في السوق المشمولة |

عيادة الطب عن بعد، Virtual Radiologic، RamSoft، Inc.، Koninklijke Philips NV، Everlight Radiology، Teleradiology Solutions، All-American Teleradiology، Medica Group PLC، Vital Radiology Services، PMG Services، Inc.، General Electric، RadNet، Inc.، FUJIFILM Corporation، Agfa-Gevaert Group، USARAD.COM، TeleDiagnosys Services Pvt Ltd.، ONRAD، Inc.، 4ways Healthcare Limited، Allscripts Healthcare، LLC، Redox، Inc.، NightHawk Radiology، NightShift Radiology، وNucleusHealth، وغيرها. |

تعريف سوق التطبيب عن بعد في أمريكا الشمالية

التصوير عن بعد هو طريقة طبية تلتقط صورًا للتشريح الداخلي ووظيفة الجسم مما يساعد في عملية التشخيص الطبي أو العلاج. يمكن إجراء تفسير جميع دراسات التصوير غير الجراحية، مثل الأشعة السينية الرقمية والأشعة المقطعية والتصوير بالرنين المغناطيسي والموجات فوق الصوتية ودراسات الطب النووي، بهذه الطريقة. يمكنها التقاط الصور الطبية في مكان واحد وتسهيلها أو نقلها عبر نطاق حتى يتمكن أخصائي الأشعة من مشاهدتها وتفسيرها لأغراض التشخيص أو الاستشارة. يتم استخدام التصوير عن بعد على نطاق واسع في المراقبة عن بعد والاستشارة عن بعد والتشخيص عن بعد، مما يمكن أخصائي الأشعة من أداء عملهم اليومي بشكل فعال. يتيح التصوير عن بعد حلولًا فعالة في الموقع من خلال التفسير في الوقت الفعلي وشبكات السحابة في أمريكا الشمالية. يساعد التصوير عن بعد في المقام الأول العاملين الطبيين في الوصول إلى معلومات المريض بغض النظر عن الموقع، مما يعزز التغطية التشخيصية. تقدم خدمات التصوير عن بعد تطبيقات واسعة النطاق لأخصائي الأشعة لاستخدام خدمات الويب التي تعمل على تحسين رعاية المرضى والعلاجات دون الحاجة إلى التواجد فعليًا في الموقع.

بالإضافة إلى ذلك، فإن الطلب المتزايد على خدمات الأشعة عن بعد في حالات الاستشارة الطبية الثانية والطوارئ يعد أحد محركات العرض عالية التأثير في السوق. وعلاوة على ذلك، فإن النقص في المتخصصين في الرعاية الصحية، وخاصة في قطاعات فرعية مثل الأشعة للأطفال والأعصاب والجهاز العضلي الهيكلي، يؤدي إلى اعتماد خدمات الأشعة عن بعد.

ديناميكيات سوق التطبيب عن بعد في أمريكا الشمالية

يتناول هذا القسم فهم محركات السوق والفرص والقيود والتحديات. وسيتم مناقشة كل هذا بالتفصيل أدناه:

السائقين

- عدد متزايد من إجراءات التصوير المتقدمة

من المتوقع أن يؤدي ارتفاع إجراءات التصوير إلى زيادة الطلب على حلول التطبيب عن بعد من أجل الموثوقية والكفاءة. وقد اجتذب التصوير التشخيصي المتقدم، بما في ذلك التصوير بالرنين المغناطيسي التشخيصي (MRI) ، والتصوير المقطعي المحوسب (CT)، والتصوير الطبي النووي، مثل التصوير المقطعي بالإصدار البوزيتروني (PET)، العديد من مقدمي الخدمات الجدد. وكان هناك انتشار في حجم خدمات التصوير الطبي التشخيصي التي يصفها الممارسون، بما في ذلك أخصائيو الأشعة.

وتمثل عمليات التصوير المقطعي المحوسب ربع جميع الأميركيين المعرضين للإشعاع. ويتطلب إدارة أنظمة التصوير التشخيصي المتقدمة والمتطورة مستوى عالياً من الهندسة والخبرة، مما يؤدي إلى زيادة تعقيد الحالات في ظل نقص الموارد المناسبة. وقد ساهم اعتماد حلول الاستشعار عن بعد بشكل كبير في تضييق الفجوة بين المناطق الريفية والحضرية في العديد من البلدان الناشئة، بما في ذلك الهند والبرازيل، وكذلك في الاقتصادات المتقدمة مثل الولايات المتحدة والمملكة المتحدة وألمانيا. وهذه الحلول أكثر عملية واقتصادية لأنها تلغي السفر وتسمح لأطباء الأشعة بالعمل من أي مكان. وقد أدى نقص أطباء الأشعة المؤهلين إلى زيادة الطلب على خدمات الأشعة.

ومن المتوقع أن تساعد إجراءات التصوير المتقدمة في مجال الأشعة عن بعد السوق على الحصول على نتائج أكثر دقة بسرعة ودفع نمو سوق الأشعة عن بعد في أمريكا الشمالية في الفترة المتوقعة.

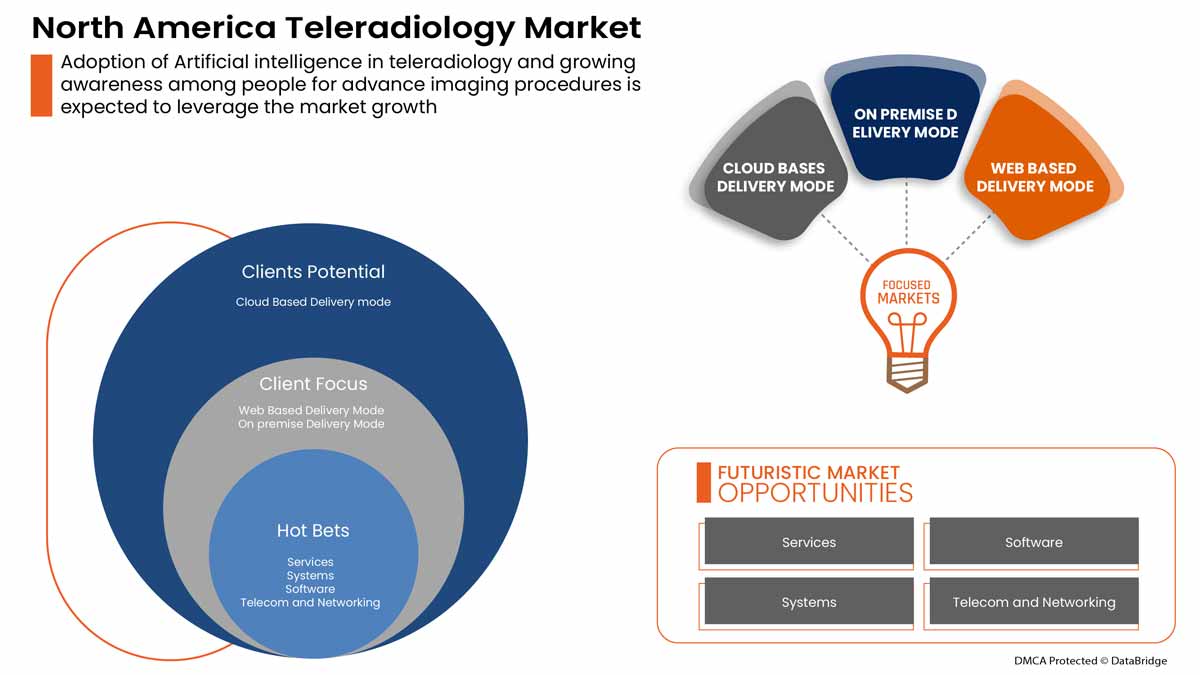

- استخدام الذكاء الاصطناعي في التطبيب عن بعد

الذكاء الاصطناعي هو أحد أكثر الاختراقات الواعدة في مجال الأشعة عن بعد. وتشير التقديرات إلى أن عدد المنشورات حول الذكاء الاصطناعي في الأشعة قد نما من متوسط 100-150 منشورًا بحثيًا سنويًا إلى 700-800 منشور سنويًا على مدى العقد الماضي. ومن بين جميع وسائل التصوير الرئيسية، فإن قبول الذكاء الاصطناعي أعلى في أنظمة التصوير المقطعي المحوسب والتصوير بالرنين المغناطيسي. واعتمادًا على التطبيق، يتم استخدام الذكاء الاصطناعي أيضًا في المقام الأول في الأشعة العصبية. ويقوم العديد من اللاعبين في هذا السوق بتوسيع عروضهم في مجال الذكاء الاصطناعي.

تم دمج الذكاء الاصطناعي في العديد من المؤسسات الطبية في جميع أنحاء العالم وأثبت أنه شريك قيم في بيئة الأشعة. كانت شركة North America Diagnostics Australia (GDA)، وهي شركة تابعة لمجموعة Integral Diagnostics Group (IDG)، واحدة من أولى شركات التشخيص الأسترالية التي نشرت الذكاء الاصطناعي كجزء من سير عمل الأشعة الخاص بها. قامت الشركة بدمج خوارزميات متطورة في مسار إدارة الرعاية لتسريع رعاية المرضى وعلاج حالات الرأس والرقبة والصدر. تتمثل الفائدة الإضافية للذكاء الاصطناعي في الأشعة عن بعد في أن الذكاء الاصطناعي يساعد أخصائي الأشعة على تحليل سجلات الصور والبيانات بسرعة لفهم حالات المرضى بشكل أفضل وتعزيز دورهم السريري ويصبحوا جزءًا من فريق الإدارة الأساسي. يكتسب الذكاء الاصطناعي وزنًا كافيًا بحيث يمكن لأخصائي الأشعة التركيز على الحالات المعقدة التي تتطلب اهتمامهم المتخصص.

يمكن أن يساعد الذكاء الاصطناعي في إنشاء نظام مدمج يحدد أولويات الحالات بناءً على متطلبات البروتوكول الخاصة بها. على سبيل المثال، يمكن تحديد أولويات حالات الصدمات والسكتات الدماغية وتعيينها في قوائم عمل أخصائي الأشعة، وبالتالي إنقاذ العديد من الأرواح.

يساعد الذكاء الاصطناعي في مجال التطبيب عن بعد في الحصول على نتائج محسنة باستخدام أدوات آلية ويساعد أخصائيي الأشعة على استخدام مهاراتهم بشكل صحيح، ومن المتوقع أن يؤدي ذلك إلى دفع نمو السوق.

ضبط النفس

- عدم القدرة على الوصول إلى الإنترنت عالي السرعة في المناطق الريفية

يتيح التطبيب عن بعد للمرضى والمتخصصين في المناطق الريفية تلقي المشورة التصويرية عالية الجودة دون الحاجة إلى السفر إلى المناطق الحضرية المأهولة بالسكان والتي تتمتع بأنظمة طبية أكثر تقدمًا. بالإضافة إلى ذلك، يحتاج أخصائيو الأشعة الذين يعملون عن بعد إلى اتصال جيد بالإنترنت. ومع ذلك، فقد أثر الافتقار إلى الاتصال بشبكة النطاق العريض عالي السرعة على الوصول المتزايد إلى خدمات التطبيب عن بعد في المناطق الريفية.

يؤثر الوصول المحدود إلى اتصالات الإنترنت عالية السرعة على قدرة أخصائي الأشعة على المشاركة في استشارات الفيديو وتقديم تقارير التصوير الطبي ومراقبة صحة المريض عن بُعد. عندما تتسبب سرعات الاتصال البطيئة في حدوث اختناقات في الدراسات التي تعتمد على الصور بشكل كبير، يمكن أن يصبح سير العمل محبطًا بسرعة ويؤثر على رعاية المرضى. بالإضافة إلى ذلك، يلزم توفير خدمات تكنولوجيا المعلومات لضمان تقديم الصور وفقًا لقانون التأمين الصحي المحمول والمساءلة (HIPAA). وبالتالي، فإن الافتقار إلى اتصال إنترنت موثوق به وضعف اتصال النطاق العريض في المناطق الريفية يشكلان عقبات رئيسية أمام التوسع المطرد في السوق في أمريكا الشمالية.

فرصة

-

زيادة الوعي بين الناس

يقدم التطبيب عن بعد خيارات بديلة لتلقي خدمات الرعاية الصحية في أمريكا الشمالية، مما يحسن الوصول ويقلل التكاليف المرتبطة بالسفر للحصول على الخدمات. ومع ذلك، لم يتم تحقيق الإمكانات الكاملة للتطبيب عن بعد بسبب الاستخدام البطيء والمجزأ.

لقد أدى زيادة برنامج التوعية والتوعية بطب الأشعة عن بعد والدعم من الحكومة إلى زيادة استخدام طب الأشعة عن بعد والرعاية الصحية عن بعد في مختلف المجالات.

تعمل هذه البرامج والأحداث التوعوية بين الناس على زيادة اهتمامهم بصحتهم ومعرفة المزيد عن برامج الرعاية الصحية وما هي الفرص الجديدة المتاحة لصحتهم والتي ستؤدي في نهاية المطاف إلى زيادة نمو سوق التطبيب عن بعد وتوفير فرص للشركات للنمو.

تحدي

- احتمالات عالية للتشخيص الخاطئ

إن الفحص البدني يمكن أن يساعد في فهم الحالة الصحية الفعلية للمريض بشكل أفضل، وهو العنصر الأكثر أهمية في علاج المريض. ويمكن إنشاء جميع برامج العلاج وما ينبغي أن تكون الخطوة التالية للعلاج بمساعدة الفحص البدني السريع. وينبغي تطبيق نفس الإجراء على أخصائيي الأشعة لمعرفة المزيد عن المشاكل والحالات الفعلية، ويتم الحصول على المزيد من النتائج عندما يكون المرضى حاضرين مع أخصائيي الأشعة أثناء الاستشارات. إن عدم وجود التاريخ الطبي للمريض والسجلات الأخرى الضرورية لفحص جسم المريض أثناء التصوير الطبي هو عامل رئيسي في عدم قدرة أخصائي الأشعة على اتخاذ القرار الأمثل في الأشعة عن بعد. على سبيل المثال، ثبت أن التواصل بين الأطباء وأخصائيي الأشعة يؤدي إلى تعديلات التشخيص السريري في 50٪ من الحالات، مما يؤثر على خيارات العلاج. ستتغير دقة التفسير إذا تم الكشف عن التاريخ الطبي للمريض بشكل مناسب

وبالتالي، فإن الاحتمالات العالية للتشخيص الخاطئ والفحص غير السليم للتقرير تدمر استخدام التطبيب عن بعد، والذي من المتوقع أن يشكل تحديًا لنمو سوق التطبيب عن بعد في أمريكا الشمالية.

تأثير ما بعد كوفيد-19 على سوق التطبيب عن بعد في أمريكا الشمالية

لقد أثر تفشي فيروس كورونا المستجد بشكل كبير على الرعاية الصحية في أمريكا الشمالية، وكانت المملكة المتحدة من بين الدول الأكثر تضررًا. انتشر فيروس كورونا في جميع أنحاء العالم، مما أثر على ملايين الأشخاص وأسفر عن آلاف الوفيات. كانت الممارسات الطبية بجميع أحجامها تحت ضغط هائل بسبب تفشي فيروس كورونا المستجد في أمريكا الشمالية. عانى السوق في بداية الوباء لأن أحجام العلاج الطبي انخفضت بشكل كبير بسبب إلغاء أو تأجيل الإجراءات الاختيارية. من ناحية أخرى، طُلب من مقدمي الرعاية الصحية الاعتماد على حلول التطبيب عن بعد لقراءة التقارير التشخيصية وعلاج المرضى، مما عزز صناعة التطبيب عن بعد. عملت حلول التطبيب عن بعد على تحسين كفاءة التصوير التشخيصي من خلال تحسين وتبسيط الأشعة بقراءات دقيقة وأخطاء يدوية أقل. مع استمرار مكافحة فيروس كورونا المستجد، يتم استخدام طرق التطبيب عن بعد على نطاق أوسع.

يتخذ المصنعون قرارات استراتيجية مختلفة للتعافي بعد جائحة كوفيد-19. ويجري اللاعبون أنشطة بحث وتطوير متعددة، وإطلاق منتجات، وشراكات استراتيجية لتحسين التكنولوجيا ونتائج الاختبارات في سوق اختبارات الجينات الدوائية.

التطورات الأخيرة

- في أبريل 2022، أعلنت شركة 4ways أنها كانت ضمن القائمة المختصرة لجوائز مستثمري الصحة لعام 2022. وتتنافس شركة 4ways على جائزة مزود التشخيص لهذا العام. وقد احتفى هذا التكريم بنمو شركة 4ways، مما عزز مكانتها كشريك رئيسي للعملاء. وقد استمرت شركة 4ways في تحسين عروض خدماتها من خلال الابتكارات في سير العمل والاستثمارات في التقنيات الجديدة. وقد مكن هذا شركة 4ways من اكتساب المرونة كمنصة للتطبيب عن بعد ووفر الأمن للعمليات

نطاق سوق التطبيب عن بعد في أمريكا الشمالية

يتم تقسيم سوق التصوير عن بعد في أمريكا الشمالية إلى نوع وطريقة التسليم وتقنية التصوير والتكنولوجيا والإجراء والتطبيق والموقع والعمر وطريقة الشراء والمستخدم النهائي. يساعدك النمو بين القطاعات على تحليل جيوب التطوير والاستراتيجيات المتخصصة للتعامل مع السوق وتحديد مجالات التطبيق الأساسية والاختلاف في الأسواق المستهدفة.

حسب النوع

- الأجهزة

- الأنظمة

- برمجة

- الاتصالات والشبكات

- خدمات

على أساس النوع، يتم تقسيم سوق التطبيب عن بعد في أمريكا الشمالية إلى أجهزة وأنظمة وبرامج وخدمات الاتصالات والشبكات.

حسب طريقة التسليم

- وضع التسليم عبر الويب

- وضع التسليم المستند إلى السحابة

- وضع التسليم في الموقع

على أساس وضع التسليم، يتم تقسيم سوق التطبيب عن بعد في أمريكا الشمالية إلى وضع التسليم المستند إلى الويب، ووضع التسليم المستند إلى السحابة، ووضع التسليم في الموقع.

بواسطة تقنية التصوير

- حجم المصفوفة صغير

- حجم المصفوفة كبير

على أساس تقنيات التصوير، يتم تقسيم سوق التطبيب عن بعد في أمريكا الشمالية إلى حجم مصفوفة صغير وحجم مصفوفة كبير.

حسب التكنولوجيا

- معالجة الرسوميات المتقدمة

- تقديم الحجم

- إعادة بناء متعددة المستويات

- ضغط الصورة

On the basis of technology, the North American teleradiology market is segmented into advanced graphics processing, volume rendering, multiplanar reconstructions, and image compression.

By Procedure

- TELE-CONSULTATION

- TELE-DIAGNOSIS

- TELE-MONITORING

On the basis of procedure, the North American teleradiology market is segmented into teleconsultation, telediagnosis, and telemonitoring.

By Application

- CARDIOLOGY

- NEUROLOGY

- ONCOLOGY

- MUSCULOSKELETAL

- GASTROENTEROLOGY

- PELVIC AND ABDOMINAL

- GYNECOLOGY

- UROLOGY

- MAMMOGRAPHY

- DENTAL

- OTHERS

On the basis of application, the North American teleradiology market is segmented into cardiology, neurology, oncology, musculoskeletal, gastroenterology, pelvic and abdominal, gynecology, urology, mammography, dental, and others.

By Site

- INHOUSE

- ONSHORE

- OFFSHORE

On the basis of site, the North American teleradiology market is segmented in-house, offshore, and onshore.

By Age

- PEDIATRIC

- ADULT

- GERIATRIC

On the basis of age, the North American teleradiology market is segmented into pediatric, geriatric, and adult.

By Mode Of Purchase

- GROUP PURCHASE

- INDIVIDUAL PURCHASE

On the basis of mode of purchase, the North American teleradiology market is segmented into group purchases and individual purchases.

By End Users

- HOSPITALS

- AMBULATORY SURGICAL CENTERS

- PRIVATE PHYSICIAN OFFICES

- DIAGNOSTIC IMAGING CENTERS

- OTHERS

On the basis of end-user, the North American teleradiology market is segmented into hospitals, ambulatory surgical centers, private physician offices, diagnostics imaging centers, and others.

North America Teleradiology Market Regional Analysis/Insights

The North American teleradiology market is analyzed, and market size information is provided by type, delivery mode, imaging technique, technology, procedure, application, site, age, mode of purchase, and end-user.

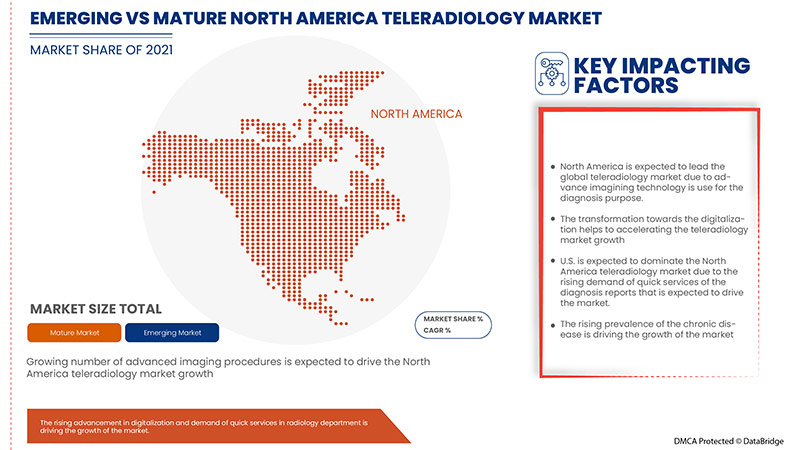

The countries covered in this market report are U.S., Canada, and Mexico.

In 2022, North America will be most dominating due to the presence of key market players in the largest consumer market with high GDP. The U.S is expected to grow due to the rise in technological advancement in teleradiology.

The country section of the report also provides individual market-impacting factors and changes in regulation in the market domestically that impact the current and future trends of the market. Data points such as new sales, replacement sales, country demographics, regulatory acts, and import-export tariffs are some of the major pointers used to forecast the market scenario for individual countries. Also, the presence and availability of North America brands and their challenges faced due to large or scarce competition from local and domestic brands, and the impact of sales channels are considered while providing forecast analysis of the country data.

Competitive Landscape and North America Teleradiology Market Share Analysis

يوفر المشهد التنافسي لسوق التطبيب عن بعد في أمريكا الشمالية تفاصيل حسب المنافس. تتضمن التفاصيل نظرة عامة على الشركة، والبيانات المالية للشركة، والإيرادات المتولدة، وإمكانات السوق، والاستثمار في البحث والتطوير، ومبادرات السوق الجديدة، ومواقع الإنتاج والمرافق، ونقاط القوة والضعف في الشركة، وإطلاق المنتج، وخطوط أنابيب تجارب المنتجات، وموافقات المنتج، وبراءات الاختراع، وعرض المنتج ونفسه، وهيمنة التطبيق، ومنحنى شريان الحياة التكنولوجي. ترتبط نقاط البيانات المذكورة أعلاه فقط بتركيز الشركة على سوق التطبيب عن بعد في أمريكا الشمالية.

منهجية البحث: سوق التطبيب عن بعد في أمريكا الشمالية

يتم جمع البيانات وتحليل سنة الأساس باستخدام وحدات جمع البيانات ذات أحجام العينات الكبيرة. يتم تحليل بيانات السوق وتقديرها باستخدام نماذج إحصائية ومتماسكة للسوق. بالإضافة إلى ذلك، يعد تحليل حصة السوق وتحليل الاتجاهات الرئيسية من عوامل النجاح الرئيسية في تقرير السوق. منهجية البحث الرئيسية التي يستخدمها فريق بحث DBMR هي التثليث البيانات والتي تتضمن استخراج البيانات وتحليل تأثير متغيرات البيانات على السوق والتحقق الأساسي (خبير الصناعة). وبصرف النظر عن هذا، تتضمن نماذج البيانات شبكة وضع البائعين وتحليل الخط الزمني للسوق ونظرة عامة على السوق والدليل وشبكة وضع الشركة وتحليل حصة الشركة في السوق ومعايير القياس وأمريكا الشمالية مقابل المنطقة وتحليل حصة البائعين. يرجى طلب مكالمة محلل في حالة وجود استفسار آخر.

SKU-

احصل على إمكانية الوصول عبر الإنترنت إلى التقرير الخاص بأول سحابة استخبارات سوقية في العالم

- لوحة معلومات تحليل البيانات التفاعلية

- لوحة معلومات تحليل الشركة للفرص ذات إمكانات النمو العالية

- إمكانية وصول محلل الأبحاث للتخصيص والاستعلامات

- تحليل المنافسين باستخدام لوحة معلومات تفاعلية

- آخر الأخبار والتحديثات وتحليل الاتجاهات

- استغل قوة تحليل المعايير لتتبع المنافسين بشكل شامل

Table of Content

1 INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 OVERVIEW OF THE NORTH AMERICA TELERADIOLOGY MARKET

1.4 CURRENCY AND PRICING

1.5 LIMITATIONS

1.6 MARKETS COVERED

2 MARKET SEGMENTATION

2.1 MARKETS COVERED

2.2 GEOGRAPHICAL SCOPE

2.3 YEARS CONSIDERED FOR THE STUDY

2.4 DBMR TRIPOD DATA VALIDATION MODEL

2.5 PRIMARY INTERVIEWS WITH KEY OPINION LEADERS

2.6 MULTIVARIATE MODELLING

2.7 MARKET APPLICATION COVERAGE GRID

2.8 TYPE LIFELINE CURVE

2.9 DBMR MARKET POSITION GRID

2.1 VENDOR SHARE ANALYSIS

2.11 SECONDARY SOURCES

2.12 ASSUMPTIONS

3 EXECUTIVE SUMMARY

3.1 PESTEL_ANALYSIS

3.2 PORTER'S FIVE FORCES

3.3 INDUSTRIAL INSIGHTS:

4 REGULATIONS

5 MARKET OVERVIEW

5.1 DRIVERS

5.1.1 GROWING NUMBER OF ADVANCED IMAGING PROCEDURES

5.1.2 ADOPTION OF ARTIFICIAL INTELLIGENCE IN TELERADIOLOGY

5.1.3 GOVERNMENT INVESTMENTS FOR HEALTHCARE INTEROPERABILITY

5.2 RESTRAINTS

5.2.1 LACK OF ACCESS TO HIGH-SPEED INTERNET IN RURAL AREAS

5.2.2 LACK OF IMAGING DATA SECURITY

5.3 OPPORTUNITIES

5.3.1 TRANSFORMATION TOWARDS DIGITALIZATION

5.3.2 GROWING PREVALENCE OF CHRONIC DISEASES AND CONDITIONS

5.3.3 INCREASING AWARENESS AMONG PEOPLE

5.4 CHALLENGES

5.4.1 HIGH CHANCES OF MISDIAGNOSIS

5.4.2 RISING HEALTHCARE FRAUDS

5.4.3 STRINGENT REGULATORY

6 NORTH AMERICA TELERADIOLOGY MARKET, BY TYPE

6.1 OVERVIEW

6.2 SERVICES

6.2.1 BY TYPE SERVICES

6.2.1.1 NIGHT RADIOLOGY SERVICES

6.2.1.2 DAYTIME RADIOLOGY SERVICES

6.2.2 BY PROCESS SERVICES

6.2.2.1 CERTIFIED REPORTING SERVICES

6.2.2.2 PRELIMINARY REPORTING

6.3 SOFTWARE

6.3.1 BY DEPLOYMENT

6.3.1.1 INTEGRATED SOFTWARE

6.3.1.2 STANDALONE SOFTWARE

6.3.2 BY TYPE SOFTWARE

6.3.2.1 PICTURE ARCHIVING AND COMMUNICATION

6.3.2.2 RADIOLOGY INFORMATION SYSTEM

6.4 SYSTEMS

6.4.1 DIGITAL IMAGING AND COMMUNICATION IN MEDICINE (DICOM)

6.4.2 ELECTRONIC MEDICAL RECORDS (EMR) SYSTEMS

6.4.3 ELECTRONIC HEALTH RECORD (HER) SYSTEM

6.5 TELECOM & NETWORKING

6.5.1 ENTERPRISE-BASED TELERADIOLOGY SOLUTIONS

6.5.2 CLOUD-BASED TELERADIOLOGY SOLUTIONS

6.5.3 WEB-BASED TELERADIOLOGY SOLUTIONS

6.5.4 VIRTUAL PRIVATE NETWORK (VPN)

6.6 HARDWARE

6.6.1 IMAGE PRINTER

6.6.2 RADIOLOGY VIEWSTATION

6.6.3 SCANNERS

6.6.4 FILM DIGITIZER

6.6.5 MONITORS

6.6.6 IMAGE VIEWERS

6.6.7 OTHERS

7 NORTH AMERICA TELERADIOLOGY MARKET, BY DELIVERY MODE

7.1 OVERVIEW

7.2 CLOUD-BASED DELIVERY MODE

7.3 WEB-BASED DELIVERY MODE

7.4 ON-PREMISE DELIVERY MODE

8 NORTH AMERICA TELERADIOLOGY MARKET, BY IMAGING TECHNIQUE

8.1 OVERVIEW

8.1.1 SMALL MATRIX SIZE

8.1.1.1 MAGNETIC RESONANCE IMAGING

8.1.1.2 NUCLEAR IMAGING (SPECT/PET)

8.1.1.3 COMPUTED TOMOGRAPHY (CT) SCAN

8.1.1.4 TELE-ULTRASOUND

8.1.1.5 DIGITAL FLUOROGRAPHY

8.1.1.6 DIGITAL ANGIOGRAPHY

8.1.1.7 ECHOCARDIOGRAM

8.1.1.8 MAMMOGRAPHY

8.1.1.9 DIGITAL X-RAY IMAGING

8.2 LARGE MATRIX SIZE

8.2.1 DIGITIZED RADIOGRAPHIC FILMS

8.2.2 DIGITAL RADIOGRAPHY

9 NORTH AMERICA TELERADIOLOGY MARKET, BY TECHNOLOGY

9.1 OVERVIEW

9.2 ADVANCED GRAPHICS PROCESSING

9.3 VOLUME RENDERING

9.4 MULTIPLANAR RECONSTRUCTIONS

9.5 IMAGE COMPRESSION

10 NORTH AMERICA TELERADIOLOGY MARKET, BY PROCEDURE

10.1 OVERVIEW

10.2 TELE-CONSULTATION

10.3 TELE-DIAGNOSIS

10.4 TELE-MONITORING

11 NORTH AMERICA TELERADIOLOGY MARKET, BY APPLICATION

11.1 OVERVIEW

11.1.1 CARDIOLOGY

11.1.1.1 SERVICES

11.1.1.2 SOFTWARE

11.1.1.3 SYSTEMS

11.1.1.4 TELECOM & NETWORKING

11.1.1.5 HARDWARE

11.1.2 ONCOLOGY

11.1.2.1 SERVICES

11.1.2.2 SOFTWARE

11.1.2.3 SYSTEMS

11.1.2.4 TELECOM & NETWORKING

11.1.2.5 HARDWARE

11.1.3 NEUROLOGY

11.1.3.1 SERVICES

11.1.3.2 SOFTWARE

11.1.3.3 SYSTEMS

11.1.3.4 TELECOM & NETWORKING

11.1.3.5 HARDWARE

11.1.4 MUSCULOSKELETAL

11.1.4.1 SERVICES

11.1.4.2 SOFTWARE

11.1.4.3 SYSTEMS

11.1.4.4 TELECOM & NETWORKING

11.1.4.5 HARDWARE

11.1.5 GASTROENTEROLOGY

11.1.5.1 SERVICES

11.1.5.2 SOFTWARE

11.1.5.3 SYSTEMS

11.1.5.4 TELECOM & NETWORKING

11.1.5.5 HARDWARE

11.1.6 PELVIC AND ABDOMINAL

11.1.6.1 SERVICES

11.1.6.2 SOFTWARE

11.1.6.3 SYSTEMS

11.1.6.4 TELECOM & NETWORKING

11.1.6.5 HARDWARE

11.1.7 GYNECOLOGY

11.1.7.1 SERVICES

11.1.7.2 SOFTWARE

11.1.7.3 SYSTEMS

11.1.7.4 TELECOM & NETWORKING

11.1.7.5 HARDWARE

11.1.8 UROLOGY

11.1.8.1 SERVICES

11.1.8.2 SOFTWARE

11.1.8.3 SYSTEMS

11.1.8.4 TELECOM & NETWORKING

11.1.8.5 HARDWARE

11.1.9 MAMMOGRAPHY

11.1.9.1 SERVICES

11.1.9.2 SOFTWARE

11.1.9.3 SYSTEMS

11.1.9.4 TELECOM & NETWORKING

11.1.9.5 HARDWARE

11.1.10 DENTAL

11.1.10.1 SERVICES

11.1.10.2 SOFTWARE

11.1.10.3 SYSTEMS

11.1.10.4 TELECOM & NETWORKING

11.1.10.5 HARDWARE

11.1.11 OTHERS

12 NORTH AMERICA TELERADIOLOGY MARKET, BY SITE

12.1 OVERVIEW

12.1.1 INHOUSE

12.1.2 OFFSHORE

12.1.3 ONSHORE

13 NORTH AMERICA TELERADIOLOGY MARKET, BY AGE

13.1 OVERVIEW

13.2 PEDIATRIC

13.3 ADULT

13.4 GERIATRIC

14 NORTH AMERICA TELERADIOLOGY MARKET, BY MODE OF PURCHASE

14.1 OVERVIEW

14.2 GROUP PURCHASE

14.3 INDIVIDUAL PURCHASE

15 NORTH AMERICA TELERADIOLOGY MARKET, BY END USER

15.1 OVERVIEW

15.2 HOSPITALS

15.2.1 PRIVATE

15.2.2 PUBLIC

15.3 DIAGNOSTICS IMAGING CENTRES

15.4 AMBULATORY SURGICAL CENTERS

15.5 PRIVATE PHYSICIAN OFFICES

15.6 OTHERS

16 NORTH AMERICA TELERADIOLOGY MARKET, BY GEOGRAPHY

16.1 NORTH AMERICA

16.1.1 U.S.

16.1.2 CANADA

16.1.3 MEXICO

17 NORTH AMERICA TELERADIOLOGY MARKET: COMPANY LANDSCAPE

17.1 COMPANY SHARE ANALYSIS: NORTH AMERICA

18 SWOT ANALYSIS

19 COMPANY PROFILE

19.1 GENERAL ELECTRIC COMPANY (2021)

19.1.1 COMPANY SNAPSHOT

19.1.2 REVENUE ANALYSIS

19.1.3 COMPANY SHARE ANALYSIS

19.1.4 PRODUCT PORTFOLIO

19.1.5 RECENT DEVELOPMENT

19.2 AGFA GEVAERT GROUP

19.2.1 COMPANY SNAPSHOT

19.2.2 REVENUE ANALYSIS

19.2.3 COMPANY SHARE ANALYSIS

19.2.4 PRODUCT PORTFOLIO

19.2.5 RECENT DEVELOPMENTS

19.3 KONINKLIJKE PHILIPS N.V.

19.3.1 COMPANY SNAPSHOT

19.3.2 REVENUE ANALYSIS

19.3.3 COMPANY SHARE ANALYSIS

19.3.4 PRODUCT PORTFOLIO

19.3.5 RECENT DEVELOPMENTS

19.4 FUJIFILM CORPORATION

19.4.1 COMPANY SNAPSHOT

19.4.2 REVENUE ANALYSIS

19.4.3 COMPANY SHARE ANALYSIS

19.4.4 PRODUCT PORTFOLIO

19.4.5 RECENT DEVELOPMENTS

19.5 ALLSCRIPTS HEALTHCARE, LLC AND/OR ITS AFFILIATES.

19.5.1 COMPANY SNAPSHOT

19.5.2 REVENUE ANALYSIS

19.5.3 COMPANY SHARE ANALYSIS

19.5.4 PRODUCT PORTFOLIO

19.5.5 RECENT DEVELOPMENT

19.6 MEDNAX SERVICES, INC

19.6.1 COMPANY SNAPSHOT

19.6.2 REVENUE ANALYSIS

19.6.3 PRODUCT PORTFOLIO

19.6.4 RECENT DEVELOPMENT

19.7 VIRTUAL RADIOLOGIC

19.7.1 COMPANY SNAPSHOT

19.7.2 PRODUCT PORTFOLIO

19.7.3 RECENT DEVELOPMENTS

19.8 NUCLEUSHEALTH

19.8.1 COMPANY SNAPSHOT

19.8.2 PRODUCT PORTFOLIO

19.8.3 RECENT DEVELOPMENTS

19.9 TELERADIOLOGY SOLUTIONS

19.9.1 COMPANY SNAPSHOT

19.9.2 PRODUCT PORTFOLIO

19.9.3 RECENT DEVELOPMENTS

19.1 ALL-AMERICAN TELERADIOLOGY

19.10.1 COMPANY SNAPSHOT

19.10.2 PRODUCT PORTFOLIO

19.10.3 RECENT DEVELOPMENT

19.11 EVERLIGHT RADIOLOGY

19.11.1 COMPANY SNAPSHOT

19.11.2 PRODUCT PORTFOLIO

19.11.3 RECENT DEVELOPMENTS

19.12 MEDICA GROUP PLC.

19.12.1 COMPANY SNAPSHOT

19.12.2 REVENUE ANALYSIS

19.12.3 PRODUCT PORTFOLIO

19.12.4 RECENT DEVELOPMENTS

19.13 NIGHTHAWK RADIOLOGY

19.13.1 COMPANY SNAPSHOT

19.13.2 PRODUCT PORTFOLIO

19.13.3 RECENT DEVELOPMENTS

19.14 NIGHTSHIFT RADIOLOGY

19.14.1 COMPANY SNAPSHOT

19.14.2 PRODUCT PORTFOLIO

19.14.3 RECENT DEVELOPMENTS

19.15 ONRAD, INC.

19.15.1 COMPANY SNAPSHOT

19.15.2 PRODUCT PORTFOLIO

19.15.3 RECENT DEVELOPMENTS

19.16 RADNET, INC.

19.16.1 COMPANY SNAPSHOT

19.16.2 REVENUE ANALYSIS

19.16.3 PRODUCT PORTFOLIO

19.16.4 RECENT DEVELOPMENTS

19.17 RAMSOFT, INC.

19.17.1 COMPANY SNAPSHOT

19.17.2 PRODUCT PORTFOLIO

19.17.3 RECENT DEVELOPMENTS

19.18 REAL RADS

19.18.1 COMPANY SNAPSHOT

19.18.2 PRODUCT PORTFOLIO

19.18.3 RECENT DEVELOPMENT

19.19 REDOX, INC

19.19.1 COMPANY SNAPSHOT

19.19.2 PRODUCT PORTFOLIO

19.19.3 RECENT DEVELOPMENTS

19.2 TELEDIAGNOSYS SERVICES PVT LTD.

19.20.1 COMPANY SNAPSHOT

19.20.2 PRODUCT PORTFOLIO

19.20.3 RECENT DEVELOPMENT

19.21 TELEMEDICINE CLINIC

19.21.1 COMPANY SNAPSHOT

19.21.2 PRODUCT PORTFOLIO

19.21.3 RECENT DEVELOPMENTS

19.22 USARAD.COM.

19.22.1 COMPANY SNAPSHOT

19.22.2 PRODUCT PORTFOLIO

19.22.3 RECENT DEVELOPMENTS

19.23 VITAL RADIOLOGY SERVICES

19.23.1 COMPANY SNAPSHOT

19.23.2 PRODUCT PORTFOLIO

19.23.3 RECENT DEVELOPMENTS

19.24 4 WAYS

19.24.1 COMPANY SNAPSHOT

19.24.2 PRODUCT PORTFOLIO

19.24.3 RECENT DEVELOPMENTS

20 QUESTIONNAIRE

21 RELATED REPORTS

List of Table

TABLE 1 NORTH AMERICA TELERADIOLOGY MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 2 NORTH AMERICA SERVICES IN TELERADIOLOGY MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 3 NORTH AMERICA SERVICES IN TELERADIOLOGY MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 4 NORTH AMERICA BY TYPE SERVICES IN TELERADIOLOGY MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 5 NORTH AMERICA BY PROCESS SERVICES IN TELERADIOLOGY MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 6 NORTH AMERICA SOFTWARE IN TELERADIOLOGY MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 7 NORTH AMERICA SOFTWARE IN TELERADIOLOGY MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 8 NORTH AMERICA BY DEPLOYMENT SOFTWARE IN TELERADIOLOGY MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 9 NORTH AMERICA BY TYPE SOFTWARE IN TELERADIOLOGY MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 10 NORTH AMERICA SYSTEMS IN TELERADIOLOGY MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 11 NORTH AMERICA SYSTEMS IN TELERADIOLOGY MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 12 NORTH AMERICA TELECOM & NETWORKING IN TELERADIOLOGY MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 13 NORTH AMERICA TELECOM & NETWORKING IN TELERADIOLOGY MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 14 NORTH AMERICA HARDWARE IN TELERADIOLOGY MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 15 NORTH AMERICA HARDWARE IN TELERADIOLOGY MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 16 NORTH AMERICA TELERADIOLOGY MARKET, BY DELIVERY MODE, 2020-2029 (USD MILLION)

TABLE 17 NORTH AMERICA CLOUD-BASED DELIVERY MODE IN TELERADIOLOGY MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 18 NORTH AMERICA WEB-BASED DELIVERY MODE IN TELERADIOLOGY MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 19 NORTH AMERICA ON-PREMISE DELIVERY MODE IN TELERADIOLOGY MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 20 NORTH AMERICA TELERADIOLOGY MARKET, BY IMAGING TECHNIQUE, 2020-2029 (USD MILLION)

TABLE 21 NORTH AMERICA SMALL MATRIX SIZE IN TELERADIOLOGY MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 22 NORTH AMERICA SMALL MATRIX SIZE IN TELERADIOLOGY MARKET, BY IMAGING TECHNIQUE, 2020-2029 (USD MILLION)

TABLE 23 NORTH AMERICA LARGE MATRIX SIZE IN TELERADIOLOGY MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 24 NORTH AMERICA LARGE MATRIX SIZE IN TELERADIOLOGY MARKET, BY IMAGING TECHNIQUE, 2020-2029 (USD MILLION)

TABLE 25 NORTH AMERICA TELERADIOLOGY MARKET, BY TECHNOLOGY, 2020-2029 (USD MILLION)

TABLE 26 NORTH AMERICA ADVANCE GRAPHICS PROCESSING IN TELERADIOLOGY MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 27 NORTH AMERICA VOLUME RENDERING IN TELERADIOLOGY MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 28 NORTH AMERICA MULTIPLANAR RECONSTRUCTIONS IN TELERADIOLOGY MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 29 NORTH AMERICA IMAGE COMPRESSION IN TELERADIOLOGY MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 30 NORTH AMERICA TELERADIOLOGY MARKET, BY PROCEDURE, 2020-2029 (USD MILLION)

TABLE 31 NORTH AMERICA TELE-CONSULTATION IN TELERADIOLOGY MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 32 NORTH AMERICA TELE-DIAGNOSIS IN TELERADIOLOGY MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 33 NORTH AMERICA TELE-MONITORING IN TELERADIOLOGY MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 34 NORTH AMERICA TELERADIOLOGY MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 35 NORTH AMERICA CARDIOLOGY IN TELERADIOLOGY MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 36 NORTH AMERICA CARDIOLOGY IN TELERADIOLOGY MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 37 NORTH AMERICA ONCOLOGY IN TELERADIOLOGY MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 38 NORTH AMERICA ONCOLOGY IN TELERADIOLOGY MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 39 NORTH AMERICA NEUROLOGY IN TELERADIOLOGY MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 40 NORTH AMERICA NEUROLOGY IN TELERADIOLOGY MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 41 NORTH AMERICA MUSCULOSKELETAL IN TELERADIOLOGY MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 42 NORTH AMERICA MUSCULOSKELETAL IN TELERADIOLOGY MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 43 NORTH AMERICA GASTROENTEROLOGY IN TELERADIOLOGY MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 44 NORTH AMERICA GASTROENTEROLOGY IN TELERADIOLOGY MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 45 NORTH AMERICA PELVIC AND ABDOMINAL IN TELERADIOLOGY MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 46 NORTH AMERICA PELVIC AND ABDOMINAL IN TELERADIOLOGY MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 47 NORTH AMERICA GYNECOLOGY IN TELERADIOLOGY MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 48 NORTH AMERICA GYNECOLOGY IN TELERADIOLOGY MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 49 NORTH AMERICA UROLOGY IN TELERADIOLOGY MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 50 NORTH AMERICA UROLOGY IN TELERADIOLOGY MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 51 NORTH AMERICA MAMMOGRAPHY IN TELERADIOLOGY MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 52 NORTH AMERICA MAMMOGRAPHY IN TELERADIOLOGY MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 53 NORTH AMERICA DENTAL IN TELERADIOLOGY MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 54 NORTH AMERICA DENTAL IN TELERADIOLOGY MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 55 NORTH AMERICA OTHERS IN TELERADIOLOGY MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 56 NORTH AMERICA TELERADIOLOGY MARKET, BY SITE, 2020-2029 (USD MILLION)

TABLE 57 NORTH AMERICA INHOUSE IN TELERADIOLOGY MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 58 NORTH AMERICA OFFSHORE IN TELERADIOLOGY MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 59 NORTH AMERICA ONSHORE IN TELERADIOLOGY MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 60 NORTH AMERICA TELERADIOLOGY MARKET, BY AGE, 2020-2029 (USD MILLION)

TABLE 61 NORTH AMERICA PEDIATRIC IN TELERADIOLOGY MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 62 NORTH AMERICA ADULT IN TELERADIOLOGY MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 63 NORTH AMERICA GERIATRIC IN TELERADIOLOGY MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 64 NORTH AMERICA TELERADIOLOGY MARKET, BY MODE OF PURCHASE, 2020-2029 (USD MILLION)

TABLE 65 NORTH AMERICA GROUP PURCHASE IN TELERADIOLOGY MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 66 NORTH AMERICA INDIVIDUAL PURCHASE IN TELERADIOLOGY MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 67 NORTH AMERICA TELERADIOLOGY MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 68 NORTH AMERICA HOSPITALS IN TELERADIOLOGY MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 69 NORTH AMERICA HOSPITALS IN TELERADIOLOGY MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 70 NORTH AMERICA DIAGNOSTICS IMAGINING CENTRES IN TELERADIOLOGY MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 71 NORTH AMERICA AMBULATORY SURGICAL CENTRES IN TELERADIOLOGY MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 72 NORTH AMERICA PRIVATE PHYSICIAN OFFICES IN TELERADIOLOGY MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 73 NORTH AMERICA OTHERS IN TELERADIOLOGY MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 74 NORTH AMERICA TELERADIOLOGY MARKET, BY COUNTRY, 2020-2029 (USD MILLION)

TABLE 75 NORTH AMERICA TELERADIOLOGY MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 76 NORTH AMERICA SERVICES IN TELERADIOLOGY MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 77 NORTH AMERICA BY TYPE SERVICES IN TELERADIOLOGY MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 78 NORTH AMERICA BY PROCESS SERVICES IN TELERADIOLOGY MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 79 NORTH AMERICA SOFTWARE IN TELERADIOLOGY MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 80 NORTH AMERICA BY DEPLOYMENT SOFTWARE IN TELERADIOLOGY MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 81 NORTH AMERICA BY TYPE SOFTWARE IN TELERADIOLOGY MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 82 NORTH AMERICA SYSTEMS IN TELERADIOLOGY MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 83 NORTH AMERICA TELECOM & NETWORKING IN TELERADIOLOGY MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 84 NORTH AMERICA HARDWARE IN TELERADIOLOGY MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 85 NORTH AMERICA TELERADIOLOGY MARKET, BY DELIVERY MODE, 2020-2029 (USD MILLION)

TABLE 86 NORTH AMERICA TELERADIOLOGY MARKET, BY IMAGING TECHNIQUE, 2020-2029 (USD MILLION)

TABLE 87 NORTH AMERICA SMALL MATRIX SIZE IN TELERADIOLOGY MARKET, BY IMAGING TECHNIQUE, 2020-2029 (USD MILLION)

TABLE 88 NORTH AMERICA LARGE MATRIX SIZE IN TELERADIOLOGY MARKET, BY IMAGING TECHNIQUE, 2020-2029 (USD MILLION)

TABLE 89 NORTH AMERICA TELERADIOLOGY MARKET, BY TECHNOLOGY, 2020-2029 (USD MILLION)

TABLE 90 NORTH AMERICA TELERADIOLOGY MARKET, BY PROCEDURE, 2020-2029 (USD MILLION)

TABLE 91 NORTH AMERICA TELERADIOLOGY MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 92 NORTH AMERICA CARDIOLOGY IN TELERADIOLOGY MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 93 NORTH AMERICA ONCOLOGY IN TELERADIOLOGY MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 94 NORTH AMERICA NEUROLOGY IN TELERADIOLOGY MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 95 NORTH AMERICA MUSCULOSKELETAL IN TELERADIOLOGY MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 96 NORTH AMERICA GASTROENTEROLOGY IN TELERADIOLOGY MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 97 NORTH AMERICA PELVIC AND ABDOMINAL IN TELERADIOLOGY MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 98 NORTH AMERICA GYNECOLOGY IN TELERADIOLOGY MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 99 NORTH AMERICA UROLOGY IN TELERADIOLOGY MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 100 NORTH AMERICA MAMMOGRAPHY IN TELERADIOLOGY MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 101 NORTH AMERICA DENTAL IN TELERADIOLOGY MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 102 NORTH AMERICA TELERADIOLOGY MARKET, BY SITE, 2020-2029 (USD MILLION)

TABLE 103 NORTH AMERICA TELERADIOLOGY MARKET, BY AGE, 2020-2029 (USD MILLION)

TABLE 104 NORTH AMERICA TELERADIOLOGY MARKET, BY MODE OF PURCHASE, 2020-2029 (USD MILLION)

TABLE 105 NORTH AMERICA TELERADIOLOGY MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 106 NORTH AMERICA HOSPITALS IN TELERADIOLOGY MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 107 U.S. TELERADIOLOGY MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 108 U.S. SERVICES IN TELERADIOLOGY MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 109 U.S. BY TYPE SERVICES IN TELERADIOLOGY MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 110 U.S. BY PROCESS SERVICES IN TELERADIOLOGY MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 111 U.S. SOFTWARE IN TELERADIOLOGY MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 112 U.S. BY DEPLOYMENT SOFTWARE IN TELERADIOLOGY MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 113 U.S. BY TYPE SOFTWARE IN TELERADIOLOGY MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 114 U.S. SYSTEMS IN TELERADIOLOGY MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 115 U.S. TELECOM & NETWORKING IN TELERADIOLOGY MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 116 U.S. HARDWARE IN TELERADIOLOGY MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 117 U.S. TELERADIOLOGY MARKET, BY DELIVERY MODE, 2020-2029 (USD MILLION)

TABLE 118 U.S. TELERADIOLOGY MARKET, BY IMAGING TECHNIQUE, 2020-2029 (USD MILLION)

TABLE 119 U.S. SMALL MATRIX SIZE IN TELERADIOLOGY MARKET, BY IMAGING TECHNIQUE, 2020-2029 (USD MILLION)

TABLE 120 U.S. LARGE MATRIX SIZE IN TELERADIOLOGY MARKET, BY IMAGING TECHNIQUE, 2020-2029 (USD MILLION)

TABLE 121 U.S. TELERADIOLOGY MARKET, BY TECHNOLOGY, 2020-2029 (USD MILLION)

TABLE 122 U.S. TELERADIOLOGY MARKET, BY PROCEDURE, 2020-2029 (USD MILLION)

TABLE 123 U.S. TELERADIOLOGY MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 124 U.S. CARDIOLOGY IN TELERADIOLOGY MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 125 U.S. ONCOLOGY IN TELERADIOLOGY MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 126 U.S. NEUROLOGY IN TELERADIOLOGY MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 127 U.S. MUSCULOSKELETAL IN TELERADIOLOGY MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 128 U.S. GASTROENTEROLOGY IN TELERADIOLOGY MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 129 U.S. PELVIC AND ABDOMINAL IN TELERADIOLOGY MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 130 U.S. GYNECOLOGY IN TELERADIOLOGY MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 131 U.S. UROLOGY IN TELERADIOLOGY MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 132 U.S. MAMMOGRAPHY IN TELERADIOLOGY MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 133 U.S. DENTAL IN TELERADIOLOGY MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 134 U.S. TELERADIOLOGY MARKET, BY SITE, 2020-2029 (USD MILLION)

TABLE 135 U.S. TELERADIOLOGY MARKET, BY AGE, 2020-2029 (USD MILLION)

TABLE 136 U.S. TELERADIOLOGY MARKET, BY MODE OF PURCHASE, 2020-2029 (USD MILLION)

TABLE 137 U.S. TELERADIOLOGY MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 138 U.S. HOSPITALS IN TELERADIOLOGY MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 139 CANADA TELERADIOLOGY MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 140 CANADA SERVICES IN TELERADIOLOGY MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 141 CANADA BY TYPE SERVICES IN TELERADIOLOGY MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 142 CANADA BY PROCESS SERVICES IN TELERADIOLOGY MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 143 CANADA SOFTWARE IN TELERADIOLOGY MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 144 CANADA BY DEPLOYMENT SOFTWARE IN TELERADIOLOGY MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 145 CANADA BY TYPE SOFTWARE IN TELERADIOLOGY MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 146 CANADA SYSTEMS IN TELERADIOLOGY MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 147 CANADA TELECOM & NETWORKING IN TELERADIOLOGY MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 148 CANADA HARDWARE IN TELERADIOLOGY MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 149 CANADA TELERADIOLOGY MARKET, BY DELIVERY MODE, 2020-2029 (USD MILLION)

TABLE 150 CANADA TELERADIOLOGY MARKET, BY IMAGING TECHNIQUE, 2020-2029 (USD MILLION)

TABLE 151 CANADA SMALL MATRIX SIZE IN TELERADIOLOGY MARKET, BY IMAGING TECHNIQUE, 2020-2029 (USD MILLION)

TABLE 152 CANADA LARGE MATRIX SIZE IN TELERADIOLOGY MARKET, BY IMAGING TECHNIQUE, 2020-2029 (USD MILLION)

TABLE 153 CANADA TELERADIOLOGY MARKET, BY TECHNOLOGY, 2020-2029 (USD MILLION)

TABLE 154 CANADA TELERADIOLOGY MARKET, BY PROCEDURE, 2020-2029 (USD MILLION)

TABLE 155 CANADA TELERADIOLOGY MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 156 CANADA CARDIOLOGY IN TELERADIOLOGY MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 157 CANADA ONCOLOGY IN TELERADIOLOGY MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 158 CANADA NEUROLOGY IN TELERADIOLOGY MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 159 CANADA MUSCULOSKELETAL IN TELERADIOLOGY MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 160 CANADA GASTROENTEROLOGY IN TELERADIOLOGY MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 161 CANADA PELVIC AND ABDOMINAL IN TELERADIOLOGY MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 162 CANADA GYNECOLOGY IN TELERADIOLOGY MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 163 CANADA UROLOGY IN TELERADIOLOGY MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 164 CANADA MAMMOGRAPHY IN TELERADIOLOGY MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 165 CANADA DENTAL IN TELERADIOLOGY MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 166 CANADA TELERADIOLOGY MARKET, BY SITE, 2020-2029 (USD MILLION)

TABLE 167 CANADA TELERADIOLOGY MARKET, BY AGE, 2020-2029 (USD MILLION)

TABLE 168 CANADA TELERADIOLOGY MARKET, BY MODE OF PURCHASE, 2020-2029 (USD MILLION)

TABLE 169 CANADA TELERADIOLOGY MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 170 CANADA HOSPITALS IN TELERADIOLOGY MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 171 MEXICO TELERADIOLOGY MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 172 MEXICO SERVICES IN TELERADIOLOGY MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 173 MEXICO BY TYPE SERVICES IN TELERADIOLOGY MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 174 MEXICO BY PROCESS SERVICES IN TELERADIOLOGY MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 175 MEXICO SOFTWARE IN TELERADIOLOGY MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 176 MEXICO BY DEPLOYMENT SOFTWARE IN TELERADIOLOGY MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 177 MEXICO BY TYPE SOFTWARE IN TELERADIOLOGY MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 178 MEXICO SYSTEMS IN TELERADIOLOGY MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 179 MEXICO TELECOM & NETWORKING IN TELERADIOLOGY MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 180 MEXICO HARDWARE IN TELERADIOLOGY MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 181 MEXICO TELERADIOLOGY MARKET, BY DELIVERY MODE, 2020-2029 (USD MILLION)

TABLE 182 MEXICO TELERADIOLOGY MARKET, BY IMAGING TECHNIQUE, 2020-2029 (USD MILLION)

TABLE 183 MEXICO SMALL MATRIX SIZE IN TELERADIOLOGY MARKET, BY IMAGING TECHNIQUE, 2020-2029 (USD MILLION)

TABLE 184 MEXICO LARGE MATRIX SIZE IN TELERADIOLOGY MARKET, BY IMAGING TECHNIQUE, 2020-2029 (USD MILLION)

TABLE 185 MEXICO TELERADIOLOGY MARKET, BY TECHNOLOGY, 2020-2029 (USD MILLION)

TABLE 186 MEXICO TELERADIOLOGY MARKET, BY PROCEDURE, 2020-2029 (USD MILLION)

TABLE 187 MEXICO TELERADIOLOGY MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 188 MEXICO CARDIOLOGY IN TELERADIOLOGY MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 189 MEXICO ONCOLOGY IN TELERADIOLOGY MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 190 MEXICO NEUROLOGY IN TELERADIOLOGY MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 191 MEXICO MUSCULOSKELETAL IN TELERADIOLOGY MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 192 MEXICO GASTROENTEROLOGY IN TELERADIOLOGY MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 193 MEXICO PELVIC AND ABDOMINAL IN TELERADIOLOGY MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 194 MEXICO GYNECOLOGY IN TELERADIOLOGY MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 195 MEXICO UROLOGY IN TELERADIOLOGY MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 196 MEXICO MAMMOGRAPHY IN TELERADIOLOGY MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 197 MEXICO DENTAL IN TELERADIOLOGY MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 198 MEXICO TELERADIOLOGY MARKET, BY SITE, 2020-2029 (USD MILLION)

TABLE 199 MEXICO TELERADIOLOGY MARKET, BY AGE, 2020-2029 (USD MILLION)

TABLE 200 MEXICO TELERADIOLOGY MARKET, BY MODE OF PURCHASE, 2020-2029 (USD MILLION)

TABLE 201 MEXICO TELERADIOLOGY MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 202 MEXICO HOSPITALS IN TELERADIOLOGY MARKET, BY END USER, 2020-2029 (USD MILLION)

List of Figure

FIGURE 1 NORTH AMERICA TELERADIOLOGY MARKET: SEGMENTATION

FIGURE 2 NORTH AMERICA TELERADIOLOGY MARKET: DATA TRIANGULATION

FIGURE 3 NORTH AMERICA TELERADIOLOGY MARKET: DROC ANALYSIS

FIGURE 4 NORTH AMERICA TELERADIOLOGY MARKET: REGIONAL VS COUNTRY MARKET ANALYSIS

FIGURE 5 NORTH AMERICA TELERADIOLOGY MARKET: COMPANY RESEARCH ANALYSIS

FIGURE 6 NORTH AMERICA TELERADIOLOGY MARKET: INTERVIEW DEMOGRAPHICS

FIGURE 7 NORTH AMERICA TELERADIOLOGY MARKET: MARKET APPLICATION COVERAGE GRID

FIGURE 8 NORTH AMERICA TELERADIOLOGY MARKET: DBMR MARKET POSITION GRID

FIGURE 9 NORTH AMERICA TELERADIOLOGY MARKET: VENDOR SHARE ANALYSIS

FIGURE 10 NORTH AMERICA TELERADIOLOGY MARKET: SEGMENTATION

FIGURE 11 THE RISING GERIATRIC POPULATION AND THE SUBSEQUENT INCREASE IN THE PREVALENCE OF ASSOCIATED DISEASES ARE EXPECTED TO DRIVE THE NORTH AMERICA TELERADIOLOGY MARKET IN THE FORECAST PERIOD

FIGURE 12 SERVICES ARE EXPECTED TO ACCOUNT FOR THE LARGEST SHARE OF THE NORTH AMERICA TELERADIOLOGY MARKET IN 2022 & 2029

FIGURE 13 DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES OF THE NORTH AMERICA TELERADIOLOGY MARKET

FIGURE 14 NORTH AMERICA TELERADIOLOGY MARKET: BY TYPE, 2021

FIGURE 15 NORTH AMERICA TELERADIOLOGY MARKET: BY TYPE, 2020-2029 (USD MILLION)

FIGURE 16 NORTH AMERICA TELERADIOLOGY MARKET: BY TYPE, CAGR (2022-2029)

FIGURE 17 NORTH AMERICA TELERADIOLOGY MARKET: BY TYPE, LIFELINE CURVE

FIGURE 18 NORTH AMERICA TELERADIOLOGY MARKET: BY DELIVERY MODE, 2021

FIGURE 19 NORTH AMERICA TELERADIOLOGY MARKET: BY DELIVERY MODE, 2020-2029 (USD MILLION)

FIGURE 20 NORTH AMERICA TELERADIOLOGY MARKET: BY DELIVERY MODE, CAGR (2022-2029)

FIGURE 21 NORTH AMERICA TELERADIOLOGY MARKET: BY DELIVERY MODE, LIFELINE CURVE

FIGURE 22 NORTH AMERICA TELERADIOLOGY MARKET: BY IMAGING TECHNIQUE, 2021

FIGURE 23 NORTH AMERICA TELERADIOLOGY MARKET: BY IMAGING TECHNIQUE, 2020-2029 (USD MILLION)

FIGURE 24 NORTH AMERICA TELERADIOLOGY MARKET: BY IMAGING TECHNIQUE, CAGR (2022-2029)

FIGURE 25 NORTH AMERICA TELERADIOLOGY MARKET: BY IMAGING TECHNIQUE, LIFELINE CURVE

FIGURE 26 NORTH AMERICA TELERADIOLOGY MARKET : BY TECHNOLOGY, 2021

FIGURE 27 NORTH AMERICA TELERADIOLOGY MARKET : BY TECHNOLOGY, 2020-2029 (USD MILLION)

FIGURE 28 NORTH AMERICA TELERADIOLOGY MARKET : BY TECHNOLOGY, CAGR (2022-2029)

FIGURE 29 NORTH AMERICA TELERADIOLOGY MARKET : BY TECHNOLOGY, LIFELINE CURVE

FIGURE 30 NORTH AMERICA TELERADIOLOGY MARKET : BY PROCEDURE, 2021

FIGURE 31 NORTH AMERICA TELERADIOLOGY MARKET : BY PROCEDURE, 2020-2029 (USD MILLION)

FIGURE 32 NORTH AMERICA TELERADIOLOGY MARKET : BY PROCEDURE, CAGR (2022-2029)

FIGURE 33 NORTH AMERICA TELERADIOLOGY MARKET : BY PROCEDURE, LIFELINE CURVE

FIGURE 34 NORTH AMERICA TELERADIOLOGY MARKET : BY APPLICATION, 2021

FIGURE 35 NORTH AMERICA TELERADIOLOGY MARKET : BY APPLICATION, 2020-2029 (USD MILLION)

FIGURE 36 NORTH AMERICA TELERADIOLOGY MARKET : BY APPLICATION, CAGR (2022-2029)

FIGURE 37 NORTH AMERICA TELERADIOLOGY MARKET : BY APPLICATION, LIFELINE CURVE

FIGURE 38 NORTH AMERICA TELERADIOLOGY MARKET: BY SITE, 2021

FIGURE 39 NORTH AMERICA TELERADIOLOGY MARKET: BY SITE, 2020-2029 (USD MILLION)

FIGURE 40 NORTH AMERICA TELERADIOLOGY MARKET: BY SITE, CAGR (2022-2029)

FIGURE 41 NORTH AMERICA TELERADIOLOGY MARKET: BY SITE, LIFELINE CURVE

FIGURE 42 NORTH AMERICA TELERADIOLOGY MARKET: BY AGE, 2021

FIGURE 43 NORTH AMERICA TELERADIOLOGY MARKET: BY AGE, 2022-2029 (USD MILLION)

FIGURE 44 NORTH AMERICA TELERADIOLOGY MARKET: BY AGE, CAGR (2022-2029)

FIGURE 45 NORTH AMERICA TELERADIOLOGY MARKET: BY AGE, LIFELINE CURVE

FIGURE 46 NORTH AMERICA TELERADIOLOGY MARKET: BY MODE OF PURCHASE, 2021

FIGURE 47 NORTH AMERICA TELERADIOLOGY MARKET: BY MODE OF PURCHASE, 2020-2029 (USD MILLION)

FIGURE 48 NORTH AMERICA TELERADIOLOGY MARKET: BY MODE OF PURCHASE, CAGR (2022-2029)

FIGURE 49 NORTH AMERICA TELERADIOLOGY MARKET: BY MODE OF PURCHASE, LIFELINE CURVE

FIGURE 50 NORTH AMERICA TELERADIOLOGY MARKET: BY END USER, 2021

FIGURE 51 NORTH AMERICA TELERADIOLOGY MARKET: BY END USER, 2022-2029 (USD MILLION)

FIGURE 52 NORTH AMERICA TELERADIOLOGY MARKET: BY END USER, CAGR (2022-2029)

FIGURE 53 NORTH AMERICA TELERADIOLOGY MARKET: BY END USER, LIFELINE CURVE

FIGURE 54 NORTH AMERICA TELERADIOLOGY MARKET: SNAPSHOT (2021)

FIGURE 55 NORTH AMERICA TELERADIOLOGY MARKET: BY COUNTRY (2021)

FIGURE 56 NORTH AMERICA TELERADIOLOGY MARKET: BY COUNTRY (2022 & 2029)

FIGURE 57 NORTH AMERICA TELERADIOLOGY MARKET: BY COUNTRY (2021 & 2029)

FIGURE 58 NORTH AMERICA TELERADIOLOGY MARKET: BY TYPE (2022-2029)

FIGURE 59 NORTH AMERICA TELERADIOLOGY MARKET: COMPANY SHARE 2021 (%)

منهجية البحث

يتم جمع البيانات وتحليل سنة الأساس باستخدام وحدات جمع البيانات ذات أحجام العينات الكبيرة. تتضمن المرحلة الحصول على معلومات السوق أو البيانات ذات الصلة من خلال مصادر واستراتيجيات مختلفة. تتضمن فحص وتخطيط جميع البيانات المكتسبة من الماضي مسبقًا. كما تتضمن فحص التناقضات في المعلومات التي شوهدت عبر مصادر المعلومات المختلفة. يتم تحليل بيانات السوق وتقديرها باستخدام نماذج إحصائية ومتماسكة للسوق. كما أن تحليل حصة السوق وتحليل الاتجاهات الرئيسية هي عوامل النجاح الرئيسية في تقرير السوق. لمعرفة المزيد، يرجى طلب مكالمة محلل أو إرسال استفسارك.

منهجية البحث الرئيسية التي يستخدمها فريق بحث DBMR هي التثليث البيانات والتي تتضمن استخراج البيانات وتحليل تأثير متغيرات البيانات على السوق والتحقق الأولي (من قبل خبراء الصناعة). تتضمن نماذج البيانات شبكة تحديد موقف البائعين، وتحليل خط زمني للسوق، ونظرة عامة على السوق ودليل، وشبكة تحديد موقف الشركة، وتحليل براءات الاختراع، وتحليل التسعير، وتحليل حصة الشركة في السوق، ومعايير القياس، وتحليل حصة البائعين على المستوى العالمي مقابل الإقليمي. لمعرفة المزيد عن منهجية البحث، أرسل استفسارًا للتحدث إلى خبراء الصناعة لدينا.

التخصيص متاح

تعد Data Bridge Market Research رائدة في مجال البحوث التكوينية المتقدمة. ونحن نفخر بخدمة عملائنا الحاليين والجدد بالبيانات والتحليلات التي تتطابق مع هدفهم. ويمكن تخصيص التقرير ليشمل تحليل اتجاه الأسعار للعلامات التجارية المستهدفة وفهم السوق في بلدان إضافية (اطلب قائمة البلدان)، وبيانات نتائج التجارب السريرية، ومراجعة الأدبيات، وتحليل السوق المجدد وقاعدة المنتج. ويمكن تحليل تحليل السوق للمنافسين المستهدفين من التحليل القائم على التكنولوجيا إلى استراتيجيات محفظة السوق. ويمكننا إضافة عدد كبير من المنافسين الذين تحتاج إلى بيانات عنهم بالتنسيق وأسلوب البيانات الذي تبحث عنه. ويمكن لفريق المحللين لدينا أيضًا تزويدك بالبيانات في ملفات Excel الخام أو جداول البيانات المحورية (كتاب الحقائق) أو مساعدتك في إنشاء عروض تقديمية من مجموعات البيانات المتوفرة في التقرير.