سوق خدمات سلامة العمليات في أمريكا الشمالية، حسب العرض (الحلول والخدمات)، ومستوى سلامة السلامة (المستوى 1، والمستوى 2، والمستوى 3، والمستوى 4)، والمستخدم النهائي (التصنيع العملي، والسيارات والتصنيع المنفصل، والمرافق، والحكومة، والبناء والعقارات، والتجزئة، وغيرها) اتجاهات الصناعة والتوقعات حتى عام 2030.

تحليل حجم سوق خدمات سلامة العمليات في أمريكا الشمالية

شهد سوق خدمات سلامة العمليات نموًا كبيرًا بسبب التبني المتزايد لقواعد ومعايير السلامة في مختلف القطاعات الصناعية مثل النفط والغاز والأدوية والأغذية والمشروبات وغيرها. أصبحت الصناعات أكثر صرامة تجاه معايير السلامة حيث يمكن أن تتسبب الحوادث في خسائر كبيرة للصناعة سواء من حيث الحياة أو الممتلكات. تركز الصناعات على دمج حلول السلامة وإجراء تحليل المخاطر لتحديد عوامل الخطر والعمليات الإضافية للتخفيف من تلك المخاطر. علاوة على ذلك، مع زيادة الرقمنة، يوفر تطوير أنظمة سلامة العمليات الأتمتة في الامتثال والتكامل السهل مع أنظمة التحكم في المنظمات. يتيح هذا التحكم الآمن في العملية بأكملها ويساعد في تحسين الإنتاجية والربح.

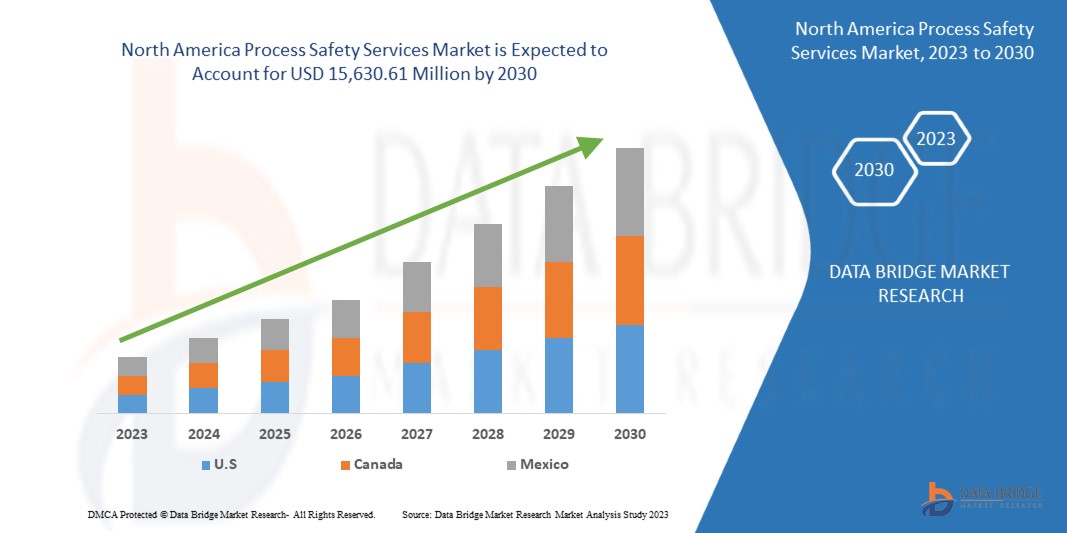

تحلل شركة Data Bridge Market Research أن سوق خدمات سلامة العمليات في أمريكا الشمالية من المتوقع أن تصل قيمته إلى 15,630.61 مليون دولار أمريكي بحلول عام 2030، بمعدل نمو سنوي مركب يبلغ 11.4% خلال الفترة المتوقعة. يغطي تقرير سوق خدمات سلامة العمليات في أمريكا الشمالية أيضًا تحليل الأسعار وتحليل براءات الاختراع والتقدم التكنولوجي بشكل شامل.

|

تقرير القياس |

تفاصيل |

|

فترة التنبؤ |

2023 إلى 2030 |

|

سنة الأساس |

2022 |

|

سنوات تاريخية |

2021 (قابلة للتخصيص حتى 2015-2020) |

|

وحدات كمية |

الإيرادات بالملايين، التسعير بالدولار الأمريكي |

|

القطاعات المغطاة |

من خلال تقديم (الحلول والخدمات)، ومستوى سلامة السلامة (المستوى 2، والمستوى 3، والمستوى 1، والمستوى 4)، والمستخدم النهائي (التصنيع العملي، والتصنيع بالسيارات والتصنيع المنفصل، والمرافق، والحكومة، والبناء والعقارات، والتجزئة، وغيرها) |

|

المناطق المغطاة |

الولايات المتحدة وكندا والمكسيك |

|

الجهات الفاعلة في السوق المشمولة |

سيمنز، جونسون كنترولز، هانيويل إنترناشيونال إنك، إيمرسون إليكتريك كو، شنايدر إليكتريك، بيرو فيريتاس، إس جي إس إس إيه، روكويل أوتوميشن، إيه بي بي، ديكرا، أومرون كوربوريشن، إنترتك جروب بي إل سي، تي يو في سود، سوكوتيك، مجموعة ميستراس، هيما، إنجينيرو، إنك، سميث آند بورجيس بروسيس سيفتي كونسلتينج، بروسيس إنجينيرينغ أسوشيتس، إل إل سي، إي أو كينيتيك، إل إل سي وغيرها |

تعريف السوق

سلامة العمليات هي إطار عمل لإدارة سلامة أنظمة التشغيل والعمليات التي تتعامل مع المواد الخطرة. وهي تعتمد على مبادئ التصميم الجيدة والهندسة وممارسات التشغيل والصيانة. وهي تتعامل مع منع والسيطرة على الأحداث التي يمكن أن تطلق مواد خطرة وطاقة. تشمل خدمات سلامة العمليات وإدارتها تصميم العمليات وإصدار الشهادات لها وتفتيشها واختبارها في الصناعات أو المنظمات المعنية لمنع الحوادث الخطرة وقضايا الجودة وأضرار سلسلة التوريد وأضرار المعدات. تساعد خدمات سلامة العمليات في مساعدة العملاء في تلبية احتياجاتهم المتعلقة بسلامة العمليات وإدارة المخاطر. تساعد خدمات سلامة العمليات العملاء في جميع جوانب سلامة العمليات، من إعداد برامج إدارة سلامة العمليات الكاملة والمساعدة في تنفيذ عناصر مختلفة.

ديناميكيات سوق خدمات سلامة العمليات في أمريكا الشمالية

يتناول هذا القسم فهم محركات السوق والمزايا والفرص والقيود والتحديات. ويتم مناقشة كل هذا بالتفصيل على النحو التالي:

السائقين

- الحاجة المتزايدة إلى التحسين في إدارة التصنيع وكفاءة المنتج

تساعد خدمات سلامة العمليات في إدارة سلامة أنظمة التشغيل والعمليات التي تتعامل مع المواد الخطرة. ويمكن أن تساعد في تحديد وفهم والسيطرة على ومنع الحوادث المتعلقة بالعملية. وفي حالة وقوع أي حادث، يمكن أن يتسبب في تأثير سلبي على عملية التصنيع وكفاءة المنتج في حالة وقوع أي حادث أثناء العملية الجارية. وقد يتسرب المنتج أو يتلف في حالة وقوع حادث. ومع ذلك، مع تنفيذ حلول سلامة العمليات، يمكن تقليل خسارة المنتج، ويمكن تعزيز كفاءة التصنيع، مما يؤدي إلى نمو كبير في سوق خدمات سلامة العمليات.

- ارتفاع كبير في عدد الحوادث الخطرة

يشير مصطلح الحادث الخطير إلى انسكاب أو إطلاق مواد كيميائية أو مواد مشعة أو مواد بيولوجية داخل مبنى أو البيئة، مما يتسبب في خسارة فادحة للأشخاص أو البنية التحتية أو البيئة. يمكن أن تتسبب المواد الخطرة في وقوع حوادث خطيرة، بما في ذلك المتفجرات والمواد القابلة للاشتعال والاحتراق والسموم والمواد المشعة.

تحتوي العديد من الصناعات، مثل المصانع الكيميائية والصيدلانية، والتعدين، والسلع الاستهلاكية، واللب والورق ، والسيارات، والنفط والغاز، وعمليات التصنيع، على بيئات خطرة حيث تشكل الحرائق والانفجارات مخاوف أمنية كبيرة. تتسبب شرارة صغيرة في صناعة النفط والغاز أو المصفاة أو المصنع الكيميائي في اندلاع حرائق أو انفجارات، مما قد يؤدي إلى إتلاف الآلات والبيئة، والأسوأ من ذلك، فقدان الأرواح.

ومن ثم، وبسبب العدد المتزايد من الحوادث أو الحوادث الخطرة والانفجارات، بدأ المصنعون في تنفيذ واختيار خدمات مختلفة لسلامة العمليات لضمان سلامة العمال ومصانع التصنيع والبيئة، وهو ما يدفع نمو السوق.

فرص

- ارتفاع الطلب على خدمات سلامة العمليات في الصناعات الدوائية وتجهيز الأغذية

مع تزايد عدد سكان أمريكا الشمالية ومستوى المعيشة والتحضر، يرتفع أيضًا الطلب على الغذاء والأدوية والرعاية الطبية عالية الجودة. وقد نبهت الأوبئة والجوائح غير المتوقعة حكومات العالم إلى نقص البنية الأساسية للرعاية الصحية. وتستثمر الحكومات بشكل كبير في قطاع الرعاية الصحية والبحث والتطوير للأدوية الحديثة. يجب الإشراف على معالجة الأغذية بشكل صحيح، ويجب توفير العديد من عمليات فحص الجودة والتفتيش لخلق فرصة جديدة لنمو سوق خدمات سلامة العمليات في أمريكا الشمالية.

ضبط النفس/التحدي

- التعقيدات المرتبطة بمعايير التنفيذ

تعتمد الصناعات بشكل كبير على مجموعة مفيدة من الأدوات للحد من احتمال وقوع الحوادث والإصابات في مكان العمل. وتشمل هذه القواعد والسياسات والإجراءات والضمانات الميكانيكية المختلفة، مثل معدات الحماية الشخصية وحراس الآلات. وهذه مفيدة للغاية لدمجها ولكنها قد تكون غير كافية أيضًا. وبغض النظر عن مدى جودة تصميمها أو استيعابها، لا يمكن لهذه الأجهزة منع جميع الحوادث في أماكن العمل المعقدة. وعلاوة على ذلك، يمكن أن تنشأ العديد من التعقيدات أثناء تنفيذ معايير السلامة. يجب أن تكون جميع المعدات والأنظمة متوافقة مع أنظمة السلامة.

يمكن لمعايير السلامة الصناعية أن تخفف من المخاطر وتحمي من المخاطر المحتملة. ومع ذلك، فإن تنفيذ هذه المعايير يمكن أن يؤدي إلى العديد من التغييرات في الصناعة ويؤدي إلى تكاليف إضافية يمكن أن تعمل كقيد رئيسي لنمو سوق خدمات سلامة العمليات.

- الافتقار إلى الوعي بين الصناعات فيما يتعلق بسلامة العمليات

تحتاج الصناعات إلى تنفيذ خدمات سلامة العمليات في عملياتها التجارية لأسباب متعددة، مثل الامتثال للوائح، وتأمين سلاسل التوريد، ومنع الحوادث والأحداث الخطرة، والامتثال لمنع التلوث وتوحيد وإصدار الشهادات للتغليف والتوزيع وجودة المنتج، من بين أمور أخرى.

تفتقر العديد من الشركات الصغيرة والمتوسطة الحجم إلى الوعي والموارد اللازمة لاستئجار الخدمات لضمان سلامة العمليات. ونتيجة لهذا، فإن قدرتها على المنافسة في السوق معوقة، حيث يبحث المستهلكون في الغالب عن البائعين المعتمدين فيما يتعلق بالامتثال للأنظمة والجودة. والشركات التي تطور منتجات دون اتباع بروتوكولات السلامة واللوائح التي وضعتها الحكومة تخاطر بإيقاف منتجاتها.

ومن ثم، فإن الافتقار إلى الوعي بين مختلف شركات التصنيع لتنفيذ أنظمة وحلول السلامة الكافية يمكن أن يحد من نمو سوق خدمات سلامة العمليات.

التطورات الأخيرة

- في أكتوبر 2020، قامت شركة ABB برقمنة إدارة دورة حياة سلامة العمليات من خلال إطلاق ABB Ability Safety Insight وهو عبارة عن مجموعة من تطبيقات البرامج الرقمية التي تدعم الشركات في قطاعي الطاقة والعمليات طوال دورة حياة إدارة سلامة العمليات بالكامل. وقد ساعد هذا الشركة على تعزيز عروض إدارة سلامة العمليات في السوق.

- في أغسطس 2018، أبرمت شركة Honeywell International Inc. اتفاقية إعادة بيع مع شركة Applied Engineering Solutions, Inc. وبموجب هذه الاتفاقية، قامت الشركة بدمج برنامج aeSolutions التابع لشركة Applied Engineering Solutions, Inc وبرنامج aeShield في مجموعة سلامة العمليات الجديدة الخاصة بها. وقد أدى هذا التكامل إلى ربط متطلبات التحقق من HAZOP/LOPA وSRS وSIL من aeShield مع Safety Builder وProcess Safety Analyzer وTrace من Honeywell في مجموعة سلامة العمليات. وقد ساعد هذا الشركة على تعزيز مجموعة سلامة العمليات الخاصة بها في السوق.

نطاق سوق خدمات سلامة العمليات في أمريكا الشمالية

يتم تقسيم سوق خدمات سلامة العمليات في أمريكا الشمالية على أساس العرض ومستوى سلامة السلامة والمستخدم النهائي. سيساعدك النمو بين هذه القطاعات على تحليل قطاعات النمو الضئيلة في الصناعات وتزويد المستخدمين بنظرة عامة قيمة على السوق ورؤى السوق لمساعدتهم على اتخاذ قرارات استراتيجية لتحديد تطبيقات السوق الأساسية.

عن طريق العرض

- حل

- خدمات

على أساس العرض، يتم تقسيم سوق خدمات سلامة العمليات إلى الحلول والخدمات.

حسب مستوى سلامة النزاهة

- المستوى 1

- المستوى الثاني

- المستوى 3

- المستوى الرابع

على أساس مستوى سلامة السلامة، يتم تقسيم سوق خدمات سلامة العمليات إلى المستوى 1 والمستوى 2 والمستوى 3 والمستوى 4.

حسب المستخدم النهائي

- تصنيع العملية

- صناعة السيارات والتصنيع المنفصل

- المرافق

- حكومة

- البناء والعقارات

- بيع بالتجزئة

- آحرون

على أساس المستخدم النهائي، يتم تقسيم سوق خدمات سلامة العمليات إلى تصنيع العمليات، والسيارات والتصنيع المنفصل، والمرافق، والحكومة، والبناء والعقارات، وتجارة التجزئة، وغيرها.

تحليل/رؤى إقليمية لسوق خدمات سلامة العمليات في أمريكا الشمالية

يتم تحليل سوق خدمات سلامة العمليات في أمريكا الشمالية، ويتم توفير رؤى حجم السوق والاتجاهات حسب المنطقة والعرض ومستوى سلامة السلامة والمستخدم النهائي كما هو مذكور أعلاه.

الدول التي يغطيها تقرير سوق خدمات سلامة العمليات في أمريكا الشمالية هي الولايات المتحدة وكندا والمكسيك.

ومن المتوقع أن تهيمن الولايات المتحدة في عام 2023 على منطقة أمريكا الشمالية حيث تتمتع البلاد بقاعدة صناعية كبيرة ومتنوعة، تشمل قطاعات مثل النفط والغاز والمواد الكيميائية والتصنيع.

يقدم قسم المنطقة في التقرير أيضًا عوامل فردية تؤثر على السوق والتغيرات في تنظيم السوق التي تؤثر على الاتجاهات الحالية والمستقبلية للسوق. نقاط البيانات مثل تحليل سلسلة القيمة المصب والمصب، والاتجاهات الفنية، وتحليل قوى بورتر الخمس، ودراسات الحالة هي بعض المؤشرات المستخدمة للتنبؤ بسيناريو السوق للدول الفردية. أيضًا، يتم النظر في وجود وتوافر العلامات التجارية في أمريكا الشمالية والتحديات التي تواجهها بسبب المنافسة الكبيرة أو النادرة من العلامات التجارية المحلية والمحلية، وتأثير التعريفات الجمركية المحلية، وطرق التجارة أثناء تقديم تحليل تنبؤي لبيانات المنطقة.

تحليل المشهد التنافسي وحصة سوق خدمات سلامة العمليات في أمريكا الشمالية

يقدم المشهد التنافسي لسوق خدمات سلامة العمليات في أمريكا الشمالية تفاصيل حسب المنافس. تتضمن التفاصيل نظرة عامة على الشركة، والبيانات المالية للشركة، والإيرادات المتولدة، وإمكانات السوق، والاستثمار في البحث والتطوير، والمبادرات الجديدة في السوق، والحضور في أمريكا الشمالية، ومواقع الإنتاج والمرافق، والقدرات الإنتاجية، ونقاط القوة والضعف للشركة، وإطلاق المنتج، وعرض المنتج ونطاقه، وهيمنة التطبيق. ترتبط نقاط البيانات المذكورة أعلاه فقط بتركيز الشركات فيما يتعلق بسوق خدمات سلامة العمليات في أمريكا الشمالية.

بعض اللاعبين الرئيسيين العاملين في سوق خدمات سلامة العمليات في أمريكا الشمالية هم Siemens و Johnson Controls و Honeywell International Inc. و Emerson Electric Co. و Schneider Electric و Bureau Veritas و SGS SA و Rockwell Automation و ABB و DEKRA و OMRON Corporation و Intertek Group plc و TÜV SÜD و SOCOTEC و MISTRAS Group و HIMA و Ingenero، Inc. و Smith & Burgess Process Safety Consulting و Process Engineering Associates و LLC و ioKinetic، LLC وغيرها.

SKU-

احصل على إمكانية الوصول عبر الإنترنت إلى التقرير الخاص بأول سحابة استخبارات سوقية في العالم

- لوحة معلومات تحليل البيانات التفاعلية

- لوحة معلومات تحليل الشركة للفرص ذات إمكانات النمو العالية

- إمكانية وصول محلل الأبحاث للتخصيص والاستعلامات

- تحليل المنافسين باستخدام لوحة معلومات تفاعلية

- آخر الأخبار والتحديثات وتحليل الاتجاهات

- استغل قوة تحليل المعايير لتتبع المنافسين بشكل شامل

Table of Content

1 INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 OVERVIEW OF NORTH AMERICA PROCESS SAFETY SERVICES MARKET

1.4 CURRENCY AND PRICING

1.5 LIMITATIONS

1.6 MARKETS COVERED

2 MARKET SEGMENTATION

2.1 MARKETS COVERED

2.2 GEOGRAPHICAL SCOPE

2.3 YEARS CONSIDERED FOR THE STUDY

2.4 DBMR TRIPOD DATA VALIDATION MODEL

2.5 PRIMARY INTERVIEWS WITH KEY OPINION LEADERS

2.6 DBMR MARKET POSITION GRID

2.7 VENDOR SHARE ANALYSIS

2.8 MULTIVARIATE MODELING

2.9 OFFERING TIMELINE CURVE

2.1 MARKET END USER COVERAGE GRID

2.11 SECONDARY SOURCES

2.12 ASSUMPTIONS

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

4.1 PORTER’S FIVE FORCE ANALYSIS

4.2 REGULATORY STANDARDS

4.2.1 OVERVIEW

4.2.2 COMAH

4.2.3 CONTROL OF MAJOR ACCIDENT HAZARDS REGULATIONS 1999 (COMAH): EMERGENCY PLANNING FOR MAJOR ACCIDENTS

4.2.4 CONTROL OF MAJOR ACCIDENT HAZARDS REGULATIONS 2015 (COMAH):

4.2.5 HAZOP

4.2.6 SIF-PRO

4.2.7 IEC 61508

4.2.8 IEC 61511

4.2.9 BATTERY TESTING

4.2.9.1 UL-9540

4.2.9.2 UL-9540A

4.2.9.3 IEC 62133

4.2.9.4 IS 1651

4.2.10 NFPA 855

4.2.11 DSEAR

4.3 STANDARDS AND DIRECTIVES ANALYSIS

4.3.1 OVERVIEW

4.3.2 PROCESS SAFETY MANAGEMENT (PSM)

4.3.3 UNITED STATES ENVIRONMENTAL PROTECTION AGENCY (EPA)

5 MARKET OVERVIEW

5.1 DRIVERS

5.1.1 RISING NEED FOR IMPROVEMENT IN MANUFACTURING MANAGEMENT AND PRODUCT EFFICIENCY

5.1.2 STRINGENT GOVERNMENT REGULATIONS FOR HEALTH, SAFETY, AND ENVIRONMENT (HSE)

5.1.3 SURGING GROWTH IN THE NUMBER OF HAZARDOUS INCIDENTS

5.1.4 HIGH BENEFITS OFFERED BY PROCESS SAFETY SOLUTIONS AND SERVICES

5.2 RESTRAINTS

5.2.1 HIGH COST OF EXPENDITURE FOR PROCESS SAFETY SYSTEMS

5.2.2 COMPLEXITIES ASSOCIATED WITH IMPLEMENTATION STANDARDS

5.3 OPPORTUNITIES

5.3.1 RISING DEMAND FOR PROCESS SAFETY SERVICES IN PHARMACEUTICAL AND FOOD PROCESSING INDUSTRIES

5.3.2 INCREASING NEED TO REDUCE HAZARDOUS EVENTS IN OIL AND GAS INDUSTRY

5.3.3 RISING NEED FOR TRAINING FOR THE ENGINEER, OPERATOR, AND MAINTENANCE PROFESSIONALS

5.3.4 INCREASING GROWTH OF INDUSTRY 4.0

5.4 CHALLENGE

5.4.1 LACK OF AWARENESS AMONG INDUSTRIES FOR PROCESS SAFETY

6 NORTH AMERICA PROCESS SAFETY SERVICES MARKET, BY OFFERING

6.1 OVERVIEW

6.2 SOLUTION

6.2.1 PSM PROGRAM MANAGEMENT

6.2.2 MECHANICAL INTEGRITY PROGRAM

6.2.3 EMERGENCY PLANNING AND RESPONSE

6.2.4 PROCESS SAFETY INFORMATION (PSI)

6.2.5 PROCESS HAZARD ANALYSIS (PHA)

6.2.6 CONTRACTOR MANAGEMENT PROGRAM

6.2.7 PRE-STARTUP SAFETY REVIEW (PSSR)

6.2.8 STANDARD OPERATING PROCEDURES (SOP)

6.2.9 DUST HAZARD ANALYSIS (DSA)

6.2.10 MANAGEMENT OF CHANGE (MOC)

6.2.11 COMPLIANCE MANAGEMENT

6.2.12 AUDITS, INCIDENT INVESTIGATION, AND RESPONSE

6.2.13 OTHERS

6.3 SERVICES

6.3.1 TESTING

6.3.2 CERTIFICATION AND INSPECTION

6.3.3 CONSULTING

6.3.4 TRAINING

6.3.5 AUDITING

7 NORTH AMERICA PROCESS SAFETY SERVICES MARKET, BY SAFETY INTEGRITY LEVEL

7.1 OVERVIEW

7.2 LEVEL 2

7.3 LEVEL 3

7.4 LEVEL 1

7.5 LEVEL 4

8 NORTH AMERICA PROCESS SAFETY SERVICES MARKET, BY END USER

8.1 OVERVIEW

8.2 PROCESS MANUFACTURING

8.2.1 PROCESS MANUFACTURING, BY OFFERING

8.2.1.1 SOLUTION

8.2.1.1.1 PSM PROGRAM MANAGEMENT

8.2.1.1.2 MECHANICAL INTEGRITY PROGRAM

8.2.1.1.3 EMERGENCY PLANNING AND RESPONSE

8.2.1.1.4 PROCESS SAFETY INFORMATION (PSI)

8.2.1.1.5 PROCESS HAZARD ANALYSIS (PHA)

8.2.1.1.6 CONTRACTOR MANAGEMENT PROGRAM

8.2.1.1.7 PRE-STARTUP SAFETY REVIEW (PSSR)

8.2.1.1.8 STANDARD OPERATING PROCEDURES (SOP)

8.2.1.1.9 DUST HAZARD ANALYSIS (DSA)

8.2.1.1.10 MANAGEMENT OF CHANGE (MOC)

8.2.1.1.11 COMPLIANCE MANAGEMENT

8.2.1.1.12 AUDITS, INCIDENT INVESTIGATION, AND RESPONSE

8.2.1.1.13 OTHERS

8.2.1.2 SERVICES

8.2.1.2.1 TESTING

8.2.1.2.2 CERTIFICATION AND INSPECTION

8.2.1.2.3 CONSULTING

8.2.1.2.4 TRAINING

8.2.1.2.5 AUDITING

8.2.2 PROCESS MANUFACTURING, BY TYPE

8.2.2.1 CHEMICAL

8.2.2.2 CONSUMER GOODS

8.2.2.2.1 FOOD AND BEVERAGE

8.2.2.2.2 PERSONAL CARE MANUFACTURING

8.2.2.2.3 OTHERS

8.2.2.3 PHARMACEUTICAL

8.2.2.4 METALS AND MINING

8.2.2.5 OIL AND GAS

8.2.2.6 PULP AND PAPER

8.2.2.7 OTHERS

8.3 AUTOMOTIVE AND DISCRETE MANUFACTURING

8.3.1 SOLUTION

8.3.1.1 PSM PROGRAM MANAGEMENT

8.3.1.2 MECHANICAL INTEGRITY PROGRAM

8.3.1.3 EMERGENCY PLANNING AND RESPONSE

8.3.1.4 PROCESS SAFETY INFORMATION (PSI)

8.3.1.5 PROCESS HAZARD ANALYSIS (PHA)

8.3.1.6 CONTRACTOR MANAGEMENT PROGRAM

8.3.1.7 PRE-STARTUP SAFETY REVIEW (PSSR)

8.3.1.8 STANDARD OPERATING PROCEDURES (SOP)

8.3.1.9 DUST HAZARD ANALYSIS (DSA)

8.3.1.10 MANAGEMENT OF CHANGE (MOC)

8.3.1.11 COMPLIANCE MANAGEMENT

8.3.1.12 AUDITS, INCIDENT INVESTIGATION, AND RESPONSE

8.3.1.13 OTHERS

8.3.2 SERVICES

8.3.2.1 TESTING

8.3.2.2 CERTIFICATION AND INSPECTION

8.3.2.3 CONSULTING

8.3.2.4 TRAINING

8.3.2.5 AUDITING

8.4 UTILITIES

8.4.1 UTILITIES, BY OFFERING

8.4.1.1 SOLUTION

8.4.1.1.1 PSM PROGRAM MANAGEMENT

8.4.1.1.2 MECHANICAL INTEGRITY PROGRAM

8.4.1.1.3 EMERGENCY PLANNING AND RESPONSE

8.4.1.1.4 PROCESS SAFETY INFORMATION (PSI)

8.4.1.1.5 PROCESS HAZARD ANALYSIS (PHA)

8.4.1.1.6 CONTRACTOR MANAGEMENT PROGRAM

8.4.1.1.7 PRE-STARTUP SAFETY REVIEW (PSSR)

8.4.1.1.8 STANDARD OPERATING PROCEDURES (SOP)

8.4.1.1.9 DUST HAZARD ANALYSIS (DSA)

8.4.1.1.10 MANAGEMENT OF CHANGE (MOC)

8.4.1.1.11 COMPLIANCE MANAGEMENT

8.4.1.1.12 AUDITS, INCIDENT INVESTIGATION, AND RESPONSE

8.4.1.1.13 OTHERS

8.4.1.2 SERVICES

8.4.1.2.1 TESTING

8.4.1.2.2 CERTIFICATION AND INSPECTION

8.4.1.2.3 CONSULTING

8.4.1.2.4 TRAINING

8.4.1.2.5 AUDITING

8.4.2 UTILITIES, BY TYPE

8.4.2.1 WASTE DISPOSAL

8.4.2.2 ELECTRICITY

8.4.2.3 HEAT

8.4.2.4 WATER

8.5 GOVERNMENT

8.5.1 SOLUTION

8.5.1.1 PSM PROGRAM MANAGEMENT

8.5.1.2 MECHANICAL INTEGRITY PROGRAM

8.5.1.3 EMERGENCY PLANNING AND RESPONSE

8.5.1.4 PROCESS SAFETY INFORMATION (PSI)

8.5.1.5 PROCESS HAZARD ANALYSIS (PHA)

8.5.1.6 CONTRACTOR MANAGEMENT PROGRAM

8.5.1.7 PRE-STARTUP SAFETY REVIEW (PSSR)

8.5.1.8 STANDARD OPERATING PROCEDURES (SOP)

8.5.1.9 DUST HAZARD ANALYSIS (DSA)

8.5.1.10 MANAGEMENT OF CHANGE (MOC)

8.5.1.11 COMPLIANCE MANAGEMENT

8.5.1.12 AUDITS, INCIDENT INVESTIGATION, AND RESPONSE

8.5.1.13 OTHERS

8.5.2 SERVICES

8.5.2.1 TESTING

8.5.2.2 CERTIFICATION AND INSPECTION

8.5.2.3 CONSULTING

8.5.2.4 TRAINING

8.5.2.5 AUDITING

8.6 CONSTRUCTION AND REAL ESTATE

8.6.1 SOLUTION

8.6.1.1 PSM PROGRAM MANAGEMENT

8.6.1.2 MECHANICAL INTEGRITY PROGRAM

8.6.1.3 EMERGENCY PLANNING AND RESPONSE

8.6.1.4 PROCESS SAFETY INFORMATION (PSI)

8.6.1.5 PROCESS HAZARD ANALYSIS (PHA)

8.6.1.6 CONTRACTOR MANAGEMENT PROGRAM

8.6.1.7 PRE-STARTUP SAFETY REVIEW (PSSR)

8.6.1.8 STANDARD OPERATING PROCEDURES (SOP)

8.6.1.9 DUST HAZARD ANALYSIS (DSA)

8.6.1.10 MANAGEMENT OF CHANGE (MOC)

8.6.1.11 COMPLIANCE MANAGEMENT

8.6.1.12 AUDITS, INCIDENT INVESTIGATION, AND RESPONSE

8.6.1.13 OTHERS

8.6.2 SERVICES

8.6.2.1 TESTING

8.6.2.2 CERTIFICATION AND INSPECTION

8.6.2.3 CONSULTING

8.6.2.4 TRAINING

8.6.2.5 AUDITING

8.7 RETAIL

8.7.1 SOLUTION

8.7.1.1 PSM PROGRAM MANAGEMENT

8.7.1.2 MECHANICAL INTEGRITY PROGRAM

8.7.1.3 EMERGENCY PLANNING AND RESPONSE

8.7.1.4 PROCESS SAFETY INFORMATION (PSI)

8.7.1.5 PROCESS HAZARD ANALYSIS (PHA)

8.7.1.6 CONTRACTOR MANAGEMENT PROGRAM

8.7.1.7 PRE-STARTUP SAFETY REVIEW (PSSR)

8.7.1.8 STANDARD OPERATING PROCEDURES (SOP)

8.7.1.9 DUST HAZARD ANALYSIS (DSA)

8.7.1.10 MANAGEMENT OF CHANGE (MOC)

8.7.1.11 COMPLIANCE MANAGEMENT

8.7.1.12 AUDITS, INCIDENT INVESTIGATION, AND RESPONSE

8.7.1.13 OTHERS

8.7.2 SERVICES

8.7.2.1 TESTING

8.7.2.2 CERTIFICATION AND INSPECTION

8.7.2.3 CONSULTING

8.7.2.4 TRAINING

8.7.2.5 AUDITING

8.8 OTHERS

9 NORTH AMERICA PROCESS SAFETY SERVICES MARKET, BY REGION

9.1 NORTH AMERICA

9.1.1 U.S.

9.1.2 CANADA

9.1.3 MEXICO

10 NORTH AMERICA PROCESS SAFETY SERVICES MARKET, COMPANY LANDSCAPE

10.1 COMPANY SHARE ANALYSIS: NORTH AMERICA

11 SWOT ANALYSIS

12 COMPANY PROFILE

12.1 SIEMENS

12.1.1 COMPANY SNAPSHOT

12.1.2 REVENUE ANALYSIS

12.1.3 COMPANY SHARE ANALYSIS

12.1.4 PRODUCT PORTFOLIO

12.1.5 RECENT DEVELOPMENTS

12.2 JOHNSON CONTROLS

12.2.1 COMPANY SNAPSHOT

12.2.2 REVENUE ANALYSIS

12.2.3 COMPANY SHARE ANALYSIS

12.2.4 PRODUCT PORTFOLIO

12.2.5 RECENT DEVELOPMENT

12.3 TÜV SÜD

12.3.1 COMPANY SNAPSHOT

12.3.2 COMPANY SHARE ANALYSIS

12.3.3 PRODUCT PORTFOLIO

12.3.4 RECENT DEVELOPMENTS

12.4 EMERSON ELECTRIC CO.

12.4.1 COMPANY SNAPSHOT

12.4.2 REVENUE ANALYSIS

12.4.3 COMPANY SHARE ANALYSIS

12.4.4 PRODUCT PORTFOLIO

12.4.5 RECENT DEVELOPMENTS

12.5 SCHNEIDER ELLECTRIC

12.5.1 COMPANY SNAPSHOT

12.5.2 REVENUE ANALYSIS

12.5.3 COMPANY SHARE ANALYSIS

12.5.4 PRODUCT PORTFOLIO

12.5.5 RECENT DEVELOPMENTS

12.6 ABB

12.6.1 COMPANY SNAPSHOT

12.6.2 REVENUE ANALYSIS

12.6.3 PRODUCT PORTFOLIO

12.6.4 RECENT DEVELOPMENTS

12.7 BUREAU VERITAS

12.7.1 COMPANY SNAPSHOT

12.7.2 REVENUE ANALYSIS

12.7.3 PRODUCT PORTFOLIO

12.7.4 RECENT DEVELOPMENTS

12.8 DEKRA

12.8.1 COMPANY SNAPSHOT

12.8.2 PRODUCT PORTFOLIO

12.8.3 RECENT DEVELOPMENT

12.9 HONEYWELL INTERNATIONAL INC.

12.9.1 COMPANY SNAPSHOT

12.9.2 REVENUE ANALYSIS

12.9.3 SOLUTION PORTFOLIO

12.9.4 RECENT DEVELOPMENTS

12.1 HIMA

12.10.1 COMPANY SNAPSHOT

12.10.2 PRODUCT PORTFOLIO

12.10.3 RECENT DEVELOPMENTS

12.11 INGENERO, INC

12.11.1 COMPANY SNAPSHOT

12.11.2 SERVICE PORTFOLIO

12.11.3 RECENT DEVELOPMENT

12.12 INTERTEK GROUP PLC

12.12.1 COMPANY SNAPSHOT

12.12.2 REVENUE ANALYSIS

12.12.3 PRODUCT PORTFOLIO

12.12.4 RECENT DEVELOPMENTS

12.13 IOKINETIC, LLC

12.13.1 COMPANY SNAPSHOT

12.13.2 PRODUCT PORTFOLIO

12.13.3 RECENT DEVELOPMENTS

12.14 MISTRAS GROUP, INC.

12.14.1 COMPANY SNAPSHOT

12.14.2 REVENUE ANALYSIS

12.14.3 PRODUCT PORTFOLIO

12.14.4 RECENT DEVELOPMENTS

12.15 OMRON CORPORATION

12.15.1 COMPANY SNAPSHOT

12.15.2 REVENUE ANALYSIS

12.15.3 PRODUCT PORTFOLIO

12.15.4 RECENT DEVELOPMENTS

12.16 PROCESS ENGINEERING ASSOCIATES, LLC

12.16.1 COMPANY SNAPSHOT

12.16.2 PRODUCT PORTFOLIO

12.16.3 RECENT DEVELOPMENT

12.17 ROCKWELL AUTOMTAION

12.17.1 COMPANY SNAPSHOT

12.17.2 REVENUE ANALYSIS

12.17.3 PRODUCT PORTFOLIO

12.17.4 RECENT DEVELOPMENTS

12.18 SGS SA

12.18.1 COMPANY SNAPSHOT

12.18.2 REVENUE ANALYSIS

12.18.3 PRODUCT PORTFOLIO

12.18.4 RECENT DEVELOPMENTS

12.19 SMITH & BURGESS PROCESS SAFETY CONSULTING

12.19.1 COMPANY SNAPSHOT

12.19.2 PRODUCT PORTFOLIO

12.19.3 RECENT DEVELOPMENTS

12.2 SOCOTEC

12.20.1 COMPANY SNAPSHOT

12.20.2 PRODUCT PORTFOLIO

12.20.3 RECENT DEVELOPMENTS

13 QUESTIONNAIRE

14 RELATED REPORTS

List of Table

TABLE 1 NORTH AMERICA PROCESS SAFETY SERVICES MARKET, BY OFFERING, 2021-2030 (USD MILLION)

TABLE 2 NORTH AMERICA SOLUTION IN PROCESS SAFETY SERVICES MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 3 NORTH AMERICA SOLUTION IN PROCESS SAFETY SERVICES MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 4 NORTH AMERICA SERVICES IN PROCESS SAFETY SERVICES MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 5 NORTH AMERICA SERVICES IN PROCESS SAFETY SERVICES MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 6 NORTH AMERICA PROCESS SAFETY SERVICES MARKET, BY SAFETY INTEGRITY LEVEL, 2021-2030 (USD MILLION)

TABLE 7 NORTH AMERICA LEVEL 2 IN PROCESS SAFETY SERVICES MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 8 NORTH AMERICA LEVEL 3 IN PROCESS SAFETY SERVICES MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 9 NORTH AMERICA LEVEL 1 IN PROCESS SAFETY SERVICES MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 10 NORTH AMERICA LEVEL 4 IN PROCESS SAFETY SERVICES MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 11 NORTH AMERICA PROCESS SAFETY SERVICES MARKET, BY END USER, 2021-2030 (USD MILLION)

TABLE 12 NORTH AMERICA PROCESS MANUFACTURING IN PROCESS SAFETY SERVICES MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 13 NORTH AMERICA PROCESS MANUFACTURING IN PROCESS SAFETY SERVICES MARKET, BY OFFERING, 2021-2030 (USD MILLION)

TABLE 14 NORTH AMERICA SOLUTION IN PROCESS SAFETY SERVICES MARKET, BY OFFERING, 2021-2030 (USD MILLION)

TABLE 15 NORTH AMERICA SERVICES IN PROCESS SAFETY SERVICES MARKET, BY OFFERING, 2021-2030 (USD MILLION)

TABLE 16 NORTH AMERICA PROCESS MANUFACTURING IN PROCESS SAFETY SERVICES MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 17 NORTH AMERICA CONSUMER GOODS IN PROCESS SAFETY SERVICES MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 18 NORTH AMERICA AUTOMOTIVE AND DISCRETE MANUFACTURING IN PROCESS SAFETY SERVICES MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 19 NORTH AMERICA AUTOMOTIVE AND DISCRETE MANUFACTURING IN PROCESS SAFETY SERVICES MARKET, BY OFFERING, 2021-2030 (USD MILLION)

TABLE 20 NORTH AMERICA SOLUTION IN PROCESS SAFETY SERVICES MARKET, BY OFFERING, 2021-2030 (USD MILLION)

TABLE 21 NORTH AMERICA SERVICES IN PROCESS SAFETY SERVICES MARKET, BY OFFERING, 2021-2030 (USD MILLION)

TABLE 22 NORTH AMERICA UTILITIES IN PROCESS SAFETY SERVICES MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 23 NORTH AMERICA UTILITIES IN PROCESS SAFETY SERVICES MARKET, BY OFFERING, 2021-2030 (USD MILLION)

TABLE 24 NORTH AMERICA SOLUTION IN PROCESS SAFETY SERVICES MARKET, BY OFFERING, 2021-2030 (USD MILLION)

TABLE 25 NORTH AMERICA SERVICES IN PROCESS SAFETY SERVICES MARKET, BY OFFERING, 2021-2030 (USD MILLION)

TABLE 26 NORTH AMERICA UTILITIES IN PROCESS SAFETY SERVICES MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 27 NORTH AMERICA GOVERNMENT IN PROCESS SAFETY SERVICES MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 28 NORTH AMERICA GOVERNMENT IN PROCESS SAFETY SERVICES MARKET, BY OFFERING, 2021-2030 (USD MILLION)

TABLE 29 NORTH AMERICA SOLUTION IN PROCESS SAFETY SERVICES MARKET, BY OFFERING, 2021-2030 (USD MILLION)

TABLE 30 NORTH AMERICA SERVICES IN PROCESS SAFETY SERVICES MARKET, BY OFFERING, 2021-2030 (USD MILLION)

TABLE 31 NORTH AMERICA CONSTRUCTION AND REAL ESTATE IN PROCESS SAFETY SERVICES MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 32 NORTH AMERICA CONSTRUCTION AND REAL ESTATE IN PROCESS SAFETY SERVICES MARKET, BY OFFERING, 2021-2030 (USD MILLION)

TABLE 33 NORTH AMERICA SOLUTION IN PROCESS SAFETY SERVICES MARKET, BY OFFERING, 2021-2030 (USD MILLION)

TABLE 34 NORTH AMERICA SERVICES IN PROCESS SAFETY SERVICES MARKET, BY OFFERING, 2021-2030 (USD MILLION)

TABLE 35 NORTH AMERICA RETAIL IN PROCESS SAFETY SERVICES MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 36 NORTH AMERICA RETAIL IN PROCESS SAFETY SERVICES MARKET, BY OFFERING, 2021-2030 (USD MILLION)

TABLE 37 NORTH AMERICA SOLUTION IN PROCESS SAFETY SERVICES MARKET, BY OFFERING, 2021-2030 (USD MILLION)

TABLE 38 NORTH AMERICA SERVICES IN PROCESS SAFETY SERVICES MARKET, BY OFFERING, 2021-2030 (USD MILLION)

TABLE 39 NORTH AMERICA OTHERS IN PROCESS SAFETY SERVICES MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 40 NORTH AMERICA PROCESS SAFETY SERVICES MARKET, BY COUNTRY, 2021-2030 (USD MILLION)

TABLE 41 NORTH AMERICA PROCESS SAFETY SERVICES MARKET, BY OFFERING, 2021-2030 (USD MILLION)

TABLE 42 NORTH AMERICA SOLUTION IN PROCESS SAFETY SERVICES MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 43 NORTH AMERICA SERVICES IN PROCESS SAFETY SERVICES MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 44 NORTH AMERICA PROCESS SAFETY SERVICES MARKET, BY SAFETY INTEGRITY LEVEL, 2021-2030 (USD MILLION)

TABLE 45 NORTH AMERICA PROCESS SAFETY SERVICES MARKET, BY END USER, 2021-2030 (USD MILLION)

TABLE 46 NORTH AMERICA PROCESS MANUFACTURING IN PROCESS SAFETY SERVICES MARKET, BY OFFERING, 2021-2030 (USD MILLION)

TABLE 47 NORTH AMERICA SOLUTION IN PROCESS SAFETY SERVICES MARKET, BY OFFERING, 2021-2030 (USD MILLION)

TABLE 48 NORTH AMERICA SERVICES IN PROCESS SAFETY SERVICES MARKET, BY OFFERING, 2021-2030 (USD MILLION)

TABLE 49 NORTH AMERICA PROCESS MANUFACTURING IN PROCESS SAFETY SERVICES MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 50 NORTH AMERICA CONSUMER GOODS IN PROCESS SAFETY SERVICES MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 51 NORTH AMERICA AUTOMOTIVE AND DISCRETE MANUFACTURING IN PROCESS SAFETY SERVICES MARKET, BY OFFERING, 2021-2030 (USD MILLION)

TABLE 52 NORTH AMERICA SOLUTION IN PROCESS SAFETY SERVICES MARKET, BY OFFERING, 2021-2030 (USD MILLION)

TABLE 53 NORTH AMERICA SERVICES IN PROCESS SAFETY SERVICES MARKET, BY OFFERING, 2021-2030 (USD MILLION)

TABLE 54 NORTH AMERICA UTILITIES IN PROCESS SAFETY SERVICES MARKET, BY OFFERING, 2021-2030 (USD MILLION)

TABLE 55 NORTH AMERICA SOLUTION IN PROCESS SAFETY SERVICES MARKET, BY OFFERING, 2021-2030 (USD MILLION)

TABLE 56 NORTH AMERICA SERVICES IN PROCESS SAFETY SERVICES MARKET, BY OFFERING, 2021-2030 (USD MILLION)

TABLE 57 NORTH AMERICA UTILITIES IN PROCESS SAFETY SERVICES MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 58 NORTH AMERICA GOVERNMENT IN PROCESS SAFETY SERVICES MARKET, BY OFFERING, 2021-2030 (USD MILLION)

TABLE 59 NORTH AMERICA SOLUTION IN PROCESS SAFETY SERVICES MARKET, BY OFFERING, 2021-2030 (USD MILLION)

TABLE 60 NORTH AMERICA SERVICES IN PROCESS SAFETY SERVICES MARKET, BY OFFERING, 2021-2030 (USD MILLION)

TABLE 61 NORTH AMERICA CONSTRUCTION AND REAL ESTATE IN PROCESS SAFETY SERVICES MARKET, BY OFFERING, 2021-2030 (USD MILLION)

TABLE 62 NORTH AMERICA SOLUTION IN PROCESS SAFETY SERVICES MARKET, BY OFFERING, 2021-2030 (USD MILLION)

TABLE 63 NORTH AMERICA SERVICES IN PROCESS SAFETY SERVICES MARKET, BY OFFERING, 2021-2030 (USD MILLION)

TABLE 64 NORTH AMERICA RETAIL IN PROCESS SAFETY SERVICES MARKET, BY OFFERING, 2021-2030 (USD MILLION)

TABLE 65 NORTH AMERICA SOLUTION IN PROCESS SAFETY SERVICES MARKET, BY OFFERING, 2021-2030 (USD MILLION)

TABLE 66 NORTH AMERICA SERVICES IN PROCESS SAFETY SERVICES MARKET, BY OFFERING, 2021-2030 (USD MILLION)

TABLE 67 U.S. PROCESS SAFETY SERVICES MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 68 U.S. SOLUTION IN PROCESS SAFETY SERVICES MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 69 U.S. SERVICES IN PROCESS SAFETY SERVICES MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 70 U.S. PROCESS SAFETY SERVICES MARKET, BY SAFETY INTEGRITY LEVEL, 2021-2030 (USD MILLION)

TABLE 71 U.S. PROCESS SAFETY SERVICES MARKET, BY END USER, 2021-2030 (USD MILLION)

TABLE 72 U.S. PROCESS MANUFACTURING IN PROCESS SAFETY SERVICES MARKET, BY OFFERING, 2021-2030 (USD MILLION)

TABLE 73 U.S. PROCESS MANUFACTURING IN PROCESS SAFETY SERVICES MARKET, BY OFFERING, 2021-2030 (USD MILLION)

TABLE 74 U.S. SERVICES IN PROCESS SAFETY SERVICES MARKET, BY OFFERING, 2021-2030 (USD MILLION)

TABLE 75 U.S. PROCESS MANUFACTURING IN PROCESS SAFETY SERVICES MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 76 U.S. CONSUMER GOODS IN PROCESS SAFETY SERVICES MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 77 U.S. AUTOMOTIVE AND DISCRETE MANUFACTURING IN PROCESS SAFETY SERVICES MARKET, BY OFFERING, 2021-2030 (USD MILLION)

TABLE 78 U.S. SOLUTION IN PROCESS SAFETY SERVICES MARKET, BY OFFERING, 2021-2030 (USD MILLION)

TABLE 79 U.S. SERVICES IN PROCESS SAFETY SERVICES MARKET, BY OFFERING, 2021-2030 (USD MILLION)

TABLE 80 U.S. UTILITIES IN PROCESS SAFETY SERVICES MARKET, BY OFFERING, 2021-2030 (USD MILLION)

TABLE 81 U.S. SOLUTION IN PROCESS SAFETY SERVICES MARKET, BY OFFERING, 2021-2030 (USD MILLION)

TABLE 82 U.S. SERVICES IN PROCESS SAFETY SERVICES MARKET, BY OFFERING, 2021-2030 (USD MILLION)

TABLE 83 U.S. UTILITIES IN PROCESS SAFETY SERVICES MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 84 U.S. GOVERNMENT IN PROCESS SAFETY SERVICES MARKET, BY OFFERING, 2021-2030 (USD MILLION)

TABLE 85 U.S. SOLUTION IN PROCESS SAFETY SERVICES MARKET, BY OFFERING, 2021-2030 (USD MILLION)

TABLE 86 U.S. SERVICES IN PROCESS SAFETY SERVICES MARKET, BY OFFERING, 2021-2030 (USD MILLION)

TABLE 87 U.S. CONSTRUCTION AND REAL ESTATE IN PROCESS SAFETY SERVICES MARKET, BY OFFERING, 2021-2030 (USD MILLION)

TABLE 88 U.S. SOLUTION IN PROCESS SAFETY SERVICES MARKET, BY OFFERING, 2021-2030 (USD MILLION)

TABLE 89 U.S. SERVICES IN PROCESS SAFETY SERVICES MARKET, BY OFFERING, 2021-2030 (USD MILLION)

TABLE 90 U.S. RETAIL IN PROCESS SAFETY SERVICES MARKET, BY OFFERING, 2021-2030 (USD MILLION)

TABLE 91 U.S. SOLUTION IN PROCESS SAFETY SERVICES MARKET, BY OFFERING, 2021-2030 (USD MILLION)

TABLE 92 U.S. SERVICES IN PROCESS SAFETY SERVICES MARKET, BY OFFERING, 2021-2030 (USD MILLION)

TABLE 93 CANADA PROCESS SAFETY SERVICES MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 94 CANADA SOLUTION IN PROCESS SAFETY SERVICES MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 95 CANADA SERVICES IN PROCESS SAFETY SERVICES MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 96 CANADA PROCESS SAFETY SERVICES MARKET, BY SAFETY INTEGRITY LEVEL, 2021-2030 (USD MILLION)

TABLE 97 CANADA PROCESS SAFETY SERVICES MARKET, BY END USER, 2021-2030 (USD MILLION)

TABLE 98 CANADA PROCESS MANUFACTURING IN PROCESS SAFETY SERVICES MARKET, BY OFFERING, 2021-2030 (USD MILLION)

TABLE 99 CANADA SOLUTION IN PROCESS SAFETY SERVICES MARKET, BY OFFERING, 2021-2030 (USD MILLION)

TABLE 100 CANADA SERVICES IN PROCESS SAFETY SERVICES MARKET, BY OFFERING, 2021-2030 (USD MILLION)

TABLE 101 CANADA PROCESS MANUFACTURING IN PROCESS SAFETY SERVICES MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 102 CANADA CONSUMER GOODS IN PROCESS SAFETY SERVICES MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 103 CANADA AUTOMOTIVE AND DISCRETE MANUFACTURING IN PROCESS SAFETY SERVICES MARKET, BY OFFERING, 2021-2030 (USD MILLION)

TABLE 104 CANADA SOLUTION IN PROCESS SAFETY SERVICES MARKET, BY OFFERING, 2021-2030 (USD MILLION)

TABLE 105 CANADA SERVICES IN PROCESS SAFETY SERVICES MARKET, BY OFFERING, 2021-2030 (USD MILLION)

TABLE 106 CANADA UTILITIES IN PROCESS SAFETY SERVICES MARKET, BY OFFERING, 2021-2030 (USD MILLION)

TABLE 107 CANADA SOLUTION IN PROCESS SAFETY SERVICES MARKET, BY OFFERING, 2021-2030 (USD MILLION)

TABLE 108 CANADA SERVICES IN PROCESS SAFETY SERVICES MARKET, BY OFFERING, 2021-2030 (USD MILLION)

TABLE 109 CANADA UTILITIES IN PROCESS SAFETY SERVICES MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 110 CANADA GOVERNMENT IN PROCESS SAFETY SERVICES MARKET, BY OFFERING, 2021-2030 (USD MILLION)

TABLE 111 CANADA SOLUTION IN PROCESS SAFETY SERVICES MARKET, BY OFFERING, 2021-2030 (USD MILLION)

TABLE 112 CANADA SERVICES IN PROCESS SAFETY SERVICES MARKET, BY OFFERING, 2021-2030 (USD MILLION)

TABLE 113 CANADA CONSTRUCTION AND REAL ESTATE IN PROCESS SAFETY SERVICES MARKET, BY OFFERING, 2021-2030 (USD MILLION)

TABLE 114 CANADA SOLUTION IN PROCESS SAFETY SERVICES MARKET, BY OFFERING, 2021-2030 (USD MILLION)

TABLE 115 CANADA SERVICES IN PROCESS SAFETY SERVICES MARKET, BY OFFERING, 2021-2030 (USD MILLION)

TABLE 116 CANADA RETAIL IN PROCESS SAFETY SERVICES MARKET, BY OFFERING, 2021-2030 (USD MILLION)

TABLE 117 CANADA SOLUTION IN PROCESS SAFETY SERVICES MARKET, BY OFFERING, 2021-2030 (USD MILLION)

TABLE 118 CANADA SERVICES IN PROCESS SAFETY SERVICES MARKET, BY OFFERING, 2021-2030 (USD MILLION)

TABLE 119 MEXICO PROCESS SAFETY SERVICES MARKET, BY OFFERING, 2021-2030 (USD MILLION)

TABLE 120 MEXICO SOLUTION IN PROCESS SAFETY SERVICES MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 121 MEXICO SERVICES IN PROCESS SAFETY SERVICES MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 122 MEXICO PROCESS SAFETY SERVICES MARKET, BY SAFETY INTEGRITY LEVEL, 2021-2030 (USD MILLION)

TABLE 123 MEXICO PROCESS SAFETY SERVICES MARKET, BY END USER, 2021-2030 (USD MILLION)

TABLE 124 MEXICO PROCESS MANUFACTURING IN PROCESS SAFETY SERVICES MARKET, BY OFFERING, 2021-2030 (USD MILLION)

TABLE 125 MEXICO SOLUTION IN PROCESS SAFETY SERVICES MARKET, BY OFFERING, 2021-2030 (USD MILLION)

TABLE 126 MEXICO SERVICES IN PROCESS SAFETY SERVICES MARKET, BY OFFERING, 2021-2030 (USD MILLION)

TABLE 127 MEXICO PROCESS MANUFACTURING IN PROCESS SAFETY SERVICES MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 128 MEXICO CONSUMER GOODS IN PROCESS SAFETY SERVICES MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 129 MEXICO AUTOMOTIVE AND DISCRETE MANUFACTURING IN PROCESS SAFETY SERVICES MARKET, BY OFFERING, 2021-2030 (USD MILLION)

TABLE 130 MEXICO SOLUTION IN PROCESS SAFETY SERVICES MARKET, BY OFFERING, 2021-2030 (USD MILLION)

TABLE 131 MEXICO SERVICES IN PROCESS SAFETY SERVICES MARKET, BY OFFERING, 2021-2030 (USD MILLION)

TABLE 132 MEXICO UTILITIES IN PROCESS SAFETY SERVICES MARKET, BY OFFERING, 2021-2030 (USD MILLION)

TABLE 133 MEXICO SOLUTION IN PROCESS SAFETY SERVICES MARKET, BY OFFERING, 2021-2030 (USD MILLION)

TABLE 134 MEXICO SERVICES IN PROCESS SAFETY SERVICES MARKET, BY OFFERING, 2021-2030 (USD MILLION)

TABLE 135 MEXICO UTILITIES IN PROCESS SAFETY SERVICES MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 136 MEXICO GOVERNMENT IN PROCESS SAFETY SERVICES MARKET, BY OFFERING, 2021-2030 (USD MILLION)

TABLE 137 MEXICO SOLUTION IN PROCESS SAFETY SERVICES MARKET, BY OFFERING, 2021-2030 (USD MILLION)

TABLE 138 MEXICO SERVICES IN PROCESS SAFETY SERVICES MARKET, BY OFFERING, 2021-2030 (USD MILLION)

TABLE 139 MEXICO CONSTRUCTION AND REAL ESTATE IN PROCESS SAFETY SERVICES MARKET, BY OFFERING, 2021-2030 (USD MILLION)

TABLE 140 MEXICO SOLUTION IN PROCESS SAFETY SERVICES MARKET, BY OFFERING, 2021-2030 (USD MILLION)

TABLE 141 MEXICO SERVICES IN PROCESS SAFETY SERVICES MARKET, BY OFFERING, 2021-2030 (USD MILLION)

TABLE 142 MEXICO RETAIL IN PROCESS SAFETY SERVICES MARKET, BY OFFERING, 2021-2030 (USD MILLION)

TABLE 143 MEXICO SOLUTION IN PROCESS SAFETY SERVICES MARKET, BY OFFERING, 2021-2030 (USD MILLION)

TABLE 144 MEXICO SERVICES IN PROCESS SAFETY SERVICES MARKET, BY OFFERING, 2021-2030 (USD MILLION)

List of Figure

FIGURE 1 NORTH AMERICA PROCESS SAFETY SERVICES MARKET: SEGMENTATION

FIGURE 2 NORTH AMERICA PROCESS SAFETY SERVICES MARKET: DATA TRIANGULATION

FIGURE 3 NORTH AMERICA PROCESS SAFETY SERVICES MARKET: DROC ANALYSIS

FIGURE 4 NORTH AMERICA PROCESS SAFETY SERVICES MARKET: NORTH AMERICA VS REGIONAL MARKET ANALYSIS

FIGURE 5 NORTH AMERICA PROCESS SAFETY SERVICES MARKET: COMPANY RESEARCH ANALYSIS

FIGURE 6 NORTH AMERICA PROCESS SAFETY SERVICES MARKET: INTERVIEW DEMOGRAPHICS

FIGURE 7 NORTH AMERICA PROCESS SAFETY SERVICES MARKET: DBMR MARKET POSITION GRID

FIGURE 8 NORTH AMERICA PROCESS SAFETY SERVICES MARKET: VENDOR SHARE ANALYSIS

FIGURE 9 NORTH AMERICA PROCESS SAFETY SERVICES MARKET: MULTIVARIATE MODELLING

FIGURE 10 NORTH AMERICA PROCESS SAFETY SERVICES MARKET: OFFERING TIMELINE CURVE

FIGURE 11 NORTH AMERICA PROCESS SAFETY SERVICES MARKET: END USER COVERAGE GRID

FIGURE 12 NORTH AMERICA PROCESS SAFETY SERVICES MARKET: SEGMENTATION

FIGURE 13 HIGH BENEFITS OFFERED BY PROCESS SAFETY SOLUTIONS AND SERVICES IS EXPECTED TO DRIVE NORTH AMERICA PROCESS SAFETY SERVICES MARKET IN THE FORECAST PERIOD OF 2023 TO 2030

FIGURE 14 SOLUTION SEGMENT IS EXPECTED TO ACCOUNT FOR THE LARGEST SHARE OF NORTH AMERICA PROCESS SAFETY SERVICES MARKET IN 2023 & 2030

FIGURE 15 DRIVERS, RESTRAINTS, OPPORTUNITIES AND CHALLENGE OF NORTH AMERICA PROCESS SAFETY SERVICES MARKET

FIGURE 16 NORTH AMERICA PROCESS SAFETY SERVICES MARKET: BY OFFERING, 2022

FIGURE 17 NORTH AMERICA PROCESS SAFETY SERVICES MARKET: BY SAFETY INTEGRITY LEVEL, 2022

FIGURE 18 NORTH AMERICA PROCESS SAFETY SERVICES MARKET: BY END USER, 2022

FIGURE 19 NORTH AMERICA PROCESS SAFETY SERVICES MARKET: SNAPSHOT (2022)

FIGURE 20 NORTH AMERICA PROCESS SAFETY SERVICES MARKET: BY COUNTRY (2022)

FIGURE 21 NORTH AMERICA PROCESS SAFETY SERVICES MARKET: BY COUNTRY (2023 & 2030)

FIGURE 22 NORTH AMERICA PROCESS SAFETY SERVICES MARKET: BY COUNTRY (2022 & 2030)

FIGURE 23 NORTH AMERICA PROCESS SAFETY SERVICES MARKET: BY TYPE (2023-2030)

FIGURE 24 NORTH AMERICA PROCESS SAFETY SERVICES MARKET: COMPANY SHARE 2022(%)

منهجية البحث

يتم جمع البيانات وتحليل سنة الأساس باستخدام وحدات جمع البيانات ذات أحجام العينات الكبيرة. تتضمن المرحلة الحصول على معلومات السوق أو البيانات ذات الصلة من خلال مصادر واستراتيجيات مختلفة. تتضمن فحص وتخطيط جميع البيانات المكتسبة من الماضي مسبقًا. كما تتضمن فحص التناقضات في المعلومات التي شوهدت عبر مصادر المعلومات المختلفة. يتم تحليل بيانات السوق وتقديرها باستخدام نماذج إحصائية ومتماسكة للسوق. كما أن تحليل حصة السوق وتحليل الاتجاهات الرئيسية هي عوامل النجاح الرئيسية في تقرير السوق. لمعرفة المزيد، يرجى طلب مكالمة محلل أو إرسال استفسارك.

منهجية البحث الرئيسية التي يستخدمها فريق بحث DBMR هي التثليث البيانات والتي تتضمن استخراج البيانات وتحليل تأثير متغيرات البيانات على السوق والتحقق الأولي (من قبل خبراء الصناعة). تتضمن نماذج البيانات شبكة تحديد موقف البائعين، وتحليل خط زمني للسوق، ونظرة عامة على السوق ودليل، وشبكة تحديد موقف الشركة، وتحليل براءات الاختراع، وتحليل التسعير، وتحليل حصة الشركة في السوق، ومعايير القياس، وتحليل حصة البائعين على المستوى العالمي مقابل الإقليمي. لمعرفة المزيد عن منهجية البحث، أرسل استفسارًا للتحدث إلى خبراء الصناعة لدينا.

التخصيص متاح

تعد Data Bridge Market Research رائدة في مجال البحوث التكوينية المتقدمة. ونحن نفخر بخدمة عملائنا الحاليين والجدد بالبيانات والتحليلات التي تتطابق مع هدفهم. ويمكن تخصيص التقرير ليشمل تحليل اتجاه الأسعار للعلامات التجارية المستهدفة وفهم السوق في بلدان إضافية (اطلب قائمة البلدان)، وبيانات نتائج التجارب السريرية، ومراجعة الأدبيات، وتحليل السوق المجدد وقاعدة المنتج. ويمكن تحليل تحليل السوق للمنافسين المستهدفين من التحليل القائم على التكنولوجيا إلى استراتيجيات محفظة السوق. ويمكننا إضافة عدد كبير من المنافسين الذين تحتاج إلى بيانات عنهم بالتنسيق وأسلوب البيانات الذي تبحث عنه. ويمكن لفريق المحللين لدينا أيضًا تزويدك بالبيانات في ملفات Excel الخام أو جداول البيانات المحورية (كتاب الحقائق) أو مساعدتك في إنشاء عروض تقديمية من مجموعات البيانات المتوفرة في التقرير.