سوق بطاقات التحقيق في أمريكا الشمالية، حسب نوع التحقيق (بطاقة التحقيق المتقدمة، وبطاقة التحقيق القياسية)، نوع تكنولوجيا التصنيع ( MEMS ، عمودي، ذراع تعليق، إيبوكسي، شفرة ، أخرى)، حجم الرقاقة (أكثر من 12 بوصة، وأقل من 12 بوصة)، حجم الرأس (أكثر من 40 مم × 40 مم، وأقل من 40 مم × 40 مم)، الاختبار (اختبار التيار المستمر، الاختبار الوظيفي، واختبار التيار المتردد)، المادة (التنغستن، النحاس المغلف (CCL)، الألومنيوم ، أخرى)، التطبيق (WLCSP، SIP، شريحة التقليب ذات الإشارة المختلطة، التناظرية)، حجم الشعاع (أكثر من 1.5 مل، أقل من 1.5 مل)، الاستخدام النهائي (المسبك، البارامتري، جهاز المنطق والذاكرة، DRAM، مستشعر صور CMOS (CIS)، فلاش، أخرى)، الدولة (الولايات المتحدة وكندا والمكسيك) اتجاهات الصناعة والتوقعات حتى عام 2029.

تحليل السوق والرؤى : سوق بطاقات التحقيق في أمريكا الشمالية

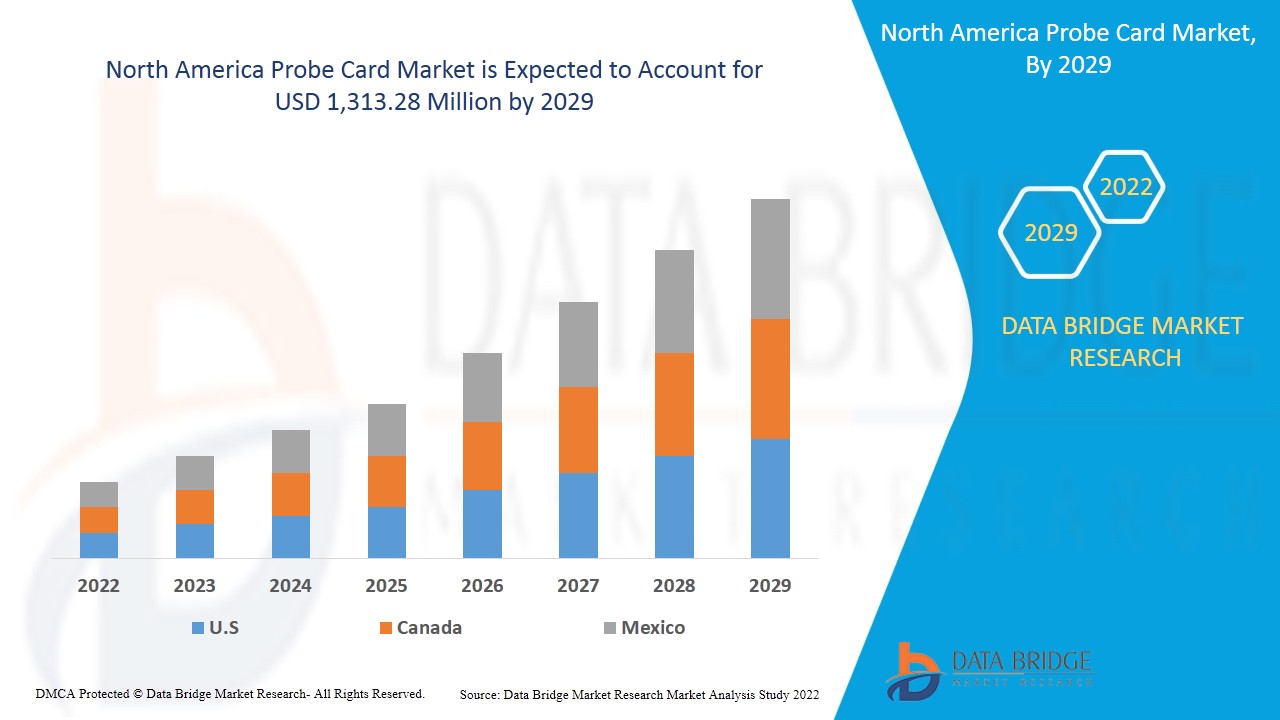

من المتوقع أن يحقق سوق بطاقات التحقيق في أمريكا الشمالية نموًا في السوق في الفترة المتوقعة من 2022 إلى 2029. تحلل Data Bridge Market Research أن السوق ينمو بمعدل نمو سنوي مركب بنسبة 10.7٪ في الفترة المتوقعة من 2022 إلى 2029 ومن المتوقع أن يصل إلى 1،313.28 مليون دولار أمريكي بحلول عام 2029. من المتوقع أن يعزز الاستخدام المتزايد للدوائر المتكاملة في الأجهزة الإلكترونية سوق بطاقات التحقيق في أمريكا الشمالية.

بطاقة المجس هي واجهة تستخدم لإجراء اختبار رقاقة لرقاقة أشباه الموصلات. تُستخدم هذه العملية للتحقق من جودة الدوائر المتكاملة أو الفهرسة الدلالية الكامنة في العملية الأولى لتصنيع أشباه الموصلات. بشكل عام، يتم توصيل بطاقة المجس كهربائيًا بجهاز اختبار وتثبيتها ميكانيكيًا بمجس. تتمثل الوظيفة الرئيسية لبطاقة المجس في توفير مسار كهربائي بين نظام الاختبار والدوائر الموجودة على الرقاقة، حيث يمكن اختبار الدوائر. تسمى الأجزاء الرئيسية المضمنة في بطاقات المجس لوحات الدوائر المطبوعة (PCB) وبعض أشكال عناصر التلامس. يتم أخذ العديد من العناصر في الاعتبار في بطاقة المجس، بعضها شائع الاستخدام للغاية، وبعضها له استخدامات خاصة جدًا.

قد يعمل الارتفاع في الطلب على الاختبارات الإلكترونية في صناعة أشباه الموصلات كمحرك لسوق بطاقات الاختبار في أمريكا الشمالية. ومن المتوقع أن يؤدي الافتقار إلى الوعي بين المستهلكين فيما يتعلق بفوائد حل بطاقة الاختبار إلى تحدي نمو السوق. ومع ذلك، من المتوقع أن يوفر ارتفاع الشراكات الاستراتيجية والتعاون بين المنظمات فرصًا لسوق بطاقات الاختبار في أمريكا الشمالية. يمكن أن تؤدي التكلفة العالية المرتبطة بحل بطاقة الاختبار إلى تقييد السوق.

يقدم تقرير سوق بطاقات المسبار في أمريكا الشمالية تفاصيل عن حصة السوق والتطورات الجديدة وتحليل خط أنابيب المنتجات وتأثير اللاعبين المحليين والمحليين في السوق وتحليل الفرص من حيث جيوب الإيرادات الناشئة والتغييرات في لوائح السوق وموافقات المنتجات والقرارات الاستراتيجية وإطلاق المنتجات والتوسعات الجغرافية والابتكارات التكنولوجية في السوق. لفهم التحليل وسيناريو سوق بطاقات المسبار في أمريكا الشمالية، اتصل بـ Data Bridge Market Research للحصول على موجز محلل؛ سيساعدك فريقنا في إنشاء حل تأثير الإيرادات لتحقيق هدفك المنشود.

نطاق سوق بطاقات التحقيق في أمريكا الشمالية وحجم السوق

يتم تقسيم سوق بطاقات المجس في أمريكا الشمالية على أساس نوع المجس ونوع تقنية التصنيع وحجم الرقاقة وحجم الرأس والاختبار والمادة والتطبيق وحجم الشعاع والاستخدام النهائي. يساعدك النمو بين القطاعات على تحليل جيوب النمو والاستراتيجيات المتخصصة للتعامل مع السوق وتحديد مجالات التطبيق الأساسية والاختلاف في الأسواق المستهدفة.

- على أساس نوع المجس، يتم تقسيم سوق بطاقات المجس في أمريكا الشمالية إلى بطاقات مجس متقدمة وبطاقات مجس قياسية. في عام 2022، من المتوقع أن تهيمن شريحة بطاقات المجس المتقدمة على السوق لأنها توفر كفاءة عالية في أشباه الموصلات ذات الحجم الأصغر.

- على أساس نوع تكنولوجيا التصنيع، يتم تقسيم سوق بطاقات المجس في أمريكا الشمالية إلى MEMS، والرأسية، والرافعة، والإيبوكسي، والشفرة، وغيرها. في عام 2022، من المتوقع أن تهيمن شريحة MEMS على السوق لأنها تناسب عمليات التصنيع عالية الكثافة التي تقل عن 14 نانومتر.

- على أساس حجم الرقاقة ، يتم تقسيم سوق بطاقات المجس في أمريكا الشمالية إلى أكثر من 12 بوصة وأقل من 12 بوصة. في عام 2022، من المتوقع أن تهيمن شريحة أكثر من 12 بوصة على السوق لأنها توفر استخدامًا جيدًا لرقاقة أشباه الموصلات وسرعة عالية في الإنتاج.

- على أساس حجم الرأس، يتم تقسيم سوق بطاقات المجس في أمريكا الشمالية إلى أكثر من 40 مم × 40 مم وأقل من 40 مم × 40 مم. في عام 2022، من المتوقع أن تهيمن شريحة أكثر من 40 مم × 40 مم على السوق لأنها تحتوي على أنواع مختلفة من صناعات أشباه الموصلات / شاشات الكريستال السائل.

- على أساس الاختبار، يتم تقسيم سوق بطاقات المجس في أمريكا الشمالية إلى اختبار التيار المستمر، واختبار الوظيفة، واختبار التيار المتردد. في عام 2022، من المتوقع أن تهيمن شريحة اختبار التيار المستمر على السوق لأن اختبار التيار المستمر يساعد في تحديد انقطاع التيار في الدائرة واكتشاف الجودة في المرحلة المبكرة.

- على أساس المواد، يتم تقسيم سوق بطاقات المجس في أمريكا الشمالية إلى التنغستن، والنحاس المغلف (CCL)، والألمنيوم، وغيرها. في عام 2022، من المتوقع أن تهيمن شريحة التنغستن على السوق لأن نقطة انصهارها العالية وثبات شكلها العالي للغاية حتى في بيئة ذات درجة حرارة عالية للغاية تجعلها مناسبة لإبر المجس.

- على أساس التطبيق، يتم تقسيم سوق بطاقات المجس في أمريكا الشمالية إلى WLCSP وSIP وشريحة انعكاس الإشارة المختلطة والتناظرية. في عام 2022، من المتوقع أن تهيمن شريحة WLCSP على السوق لأن هذا التطبيق مفيد في جميع أنواع الدوائر المتكاملة مثل DRAM والمنطق ومستشعر CMOS وغيرها.

- على أساس حجم الشعاع، يتم تقسيم سوق بطاقات المجس في أمريكا الشمالية إلى أكثر من 1.5 مل وأقل من 1.5 مل. في عام 2022، من المتوقع أن تهيمن شريحة أكثر من 1.5 مل على السوق لأنها تحتوي على حجم ميزة أدنى سهل الصيانة.

- على أساس الاستخدام النهائي، يتم تقسيم سوق بطاقات المجس في أمريكا الشمالية إلى أجهزة الصب، والأجهزة البارامترية، والمنطقية وأجهزة الذاكرة، وذاكرة الوصول العشوائي الديناميكية، ومستشعر الصور CMOS (CIS)، والفلاش، وغيرها. في عام 2022، من المتوقع أن تهيمن شريحة الصب على السوق مع ارتفاع الطلب من قطاعي السيارات والإلكترونيات المحمولة.

تحليل على مستوى الدولة لسوق بطاقات التحقيق في أمريكا الشمالية

يتم تقسيم سوق بطاقات التحقيق في أمريكا الشمالية على أساس نوع التحقيق ونوع تكنولوجيا التصنيع وحجم الرقاقة وحجم الرأس والاختبار والمواد والتطبيق وحجم الشعاع والاستخدام النهائي.

الدول التي يغطيها تقرير سوق بطاقات المجس في أمريكا الشمالية هي الولايات المتحدة وكندا والمكسيك. ومن المتوقع أن تهيمن الولايات المتحدة على سوق بطاقات المجس في أمريكا الشمالية بسبب استثمار صناعات أشباه الموصلات في هذه الدول بعد جائحة كوفيد-19.

كما يوفر قسم الدولة في التقرير عوامل التأثير الفردية على السوق والتغييرات في التنظيم في السوق محليًا والتي تؤثر على الاتجاهات الحالية والمستقبلية للسوق. تعد نقاط البيانات مثل المبيعات الجديدة ومبيعات الاستبدال والتركيبة السكانية للدولة والقوانين التنظيمية ورسوم الاستيراد والتصدير من بين المؤشرات الرئيسية المستخدمة للتنبؤ بسيناريو السوق للدول الفردية. أيضًا، يتم النظر في وجود وتوافر العلامات التجارية في أمريكا الشمالية والتحديات التي تواجهها بسبب المنافسة الكبيرة أو النادرة من العلامات التجارية المحلية والمحلية، وتأثير قنوات المبيعات أثناء تقديم تحليل تنبؤي لبيانات الدولة.

ارتفاع الطلب على الاختبارات الإلكترونية في صناعة أشباه الموصلات يعزز نمو سوق بطاقات الفحص في أمريكا الشمالية

كما يوفر لك سوق بطاقات التحقيق في أمريكا الشمالية تحليلاً تفصيليًا للسوق فيما يتعلق بنمو كل دولة في سوق معينة. بالإضافة إلى ذلك، يوفر معلومات تفصيلية فيما يتعلق باستراتيجية اللاعبين في السوق وتواجدهم الجغرافي. تتوفر البيانات للفترة التاريخية من 2011 إلى 2020.

تحليل المشهد التنافسي وحصة سوق بطاقات التحري في أمريكا الشمالية

يوفر المشهد التنافسي لسوق بطاقات المسبار في أمريكا الشمالية تفاصيل حسب المنافس. تتضمن التفاصيل نظرة عامة على الشركة، والبيانات المالية للشركة، والإيرادات المتولدة، وإمكانات السوق، والاستثمار في البحث والتطوير، ومبادرات السوق الجديدة، ومواقع الإنتاج والمرافق، ونقاط القوة والضعف في الشركة، وإطلاق المنتج، وخطوط أنابيب تجارب المنتجات، وموافقات المنتج، وبراءات الاختراع، وعرض المنتج، ونطاقه، وهيمنة التطبيق، ومنحنى شريان الحياة التكنولوجي. ترتبط نقاط البيانات المذكورة أعلاه فقط بتركيز الشركة فيما يتعلق بسوق بطاقات المسبار في أمريكا الشمالية.

بعض الشركات الكبرى التي تتعامل في بطاقة اختبار أمريكا الشمالية هي FormFactor وFEINMETALL GmbH وRIKA DENSHI CO., LTD. وTSE co,. Ltd. وdynamic-test وSTAr Technologies Inc. وMICRONICS JAPAN CO., LTD. وTranslarity وSV Probe وMPI Corporation وOnto Innovation وJAPAN ELECTRONIC MATERIALS CORPORATION وWinWay Tech. Co., Ltd. وWentworth Labs وhtt high tech grade GmbH وTechnoprobe SpA وغيرها من الشركات المحلية. يفهم محللو DBMR نقاط القوة التنافسية ويوفرون تحليلًا تنافسيًا لكل منافس على حدة.

كما يتم أيضًا إبرام العديد من العقود والاتفاقيات من قبل الشركات في جميع أنحاء العالم، مما يؤدي إلى تسريع سوق بطاقات التحقيق في أمريكا الشمالية.

على سبيل المثال،

- في ديسمبر 2021، بدأت شركة FormFactor في إنشاء منشأة تصنيع جديدة لبطاقات اختبار رقاقة أشباه الموصلات للإنتاج في كاليفورنيا. تم اتخاذ المبادرة لتوسيع القدرة الإنتاجية لبطاقات الاختبار. ستساعد فائدة منشأة الإنتاج الشركة على تلبية الطلب المتزايد من العملاء. سيكون لدى السوق عدد أكبر من المنتجات ذات الميزات المهمة

SKU-

احصل على إمكانية الوصول عبر الإنترنت إلى التقرير الخاص بأول سحابة استخبارات سوقية في العالم

- لوحة معلومات تحليل البيانات التفاعلية

- لوحة معلومات تحليل الشركة للفرص ذات إمكانات النمو العالية

- إمكانية وصول محلل الأبحاث للتخصيص والاستعلامات

- تحليل المنافسين باستخدام لوحة معلومات تفاعلية

- آخر الأخبار والتحديثات وتحليل الاتجاهات

- استغل قوة تحليل المعايير لتتبع المنافسين بشكل شامل

Table of Content

1 INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 OVERVIEW OF NORTH AMERICA PROBE CARD MARKET

1.4 CURRENCY AND PRICING

1.5 LIMITATIONS

1.6 MARKETS COVERED

2 MARKET SEGMENTATION

2.1 MARKETS COVERED

2.2 GEOGRAPHICAL SCOPE

2.3 YEARS CONSIDERED FOR THE STUDY

2.4 DBMR TRIPOD DATA VALIDATION MODEL

2.5 PRIMARY INTERVIEWS WITH KEY OPINION LEADERS

2.6 DBMR MARKET POSITION GRID

2.7 VENDOR SHARE ANALYSIS

2.8 MULTIVARIATE MODELING

2.9 PROBE TYPE TIMELINE CURVE

2.1 MARKET APPLICATION COVERAGE GRID

2.11 THE MARKET CHALLENGE MATRIX

2.12 SECONDARY SOURCES

2.13 ASSUMPTIONS

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

4.1 SUPPLY CHAIN

4.1.1 MANUFACTURERS

4.1.2 CONSUMPTION

5 MARKET OVERVIEW

5.1 DRIVERS

5.1.1 INCREASING USE OF INTEGRATED CIRCUITS IN ELECTRONIC DEVICES

5.1.2 SURGE IN DEMAND FOR ELECTRONIC TESTING IN THE SEMICONDUCTOR INDUSTRY

5.1.3 GROWING INVESTMENT IN MINIATURIZATION OF ELECTRONIC COMPONENT

5.1.4 RISING DEMAND FOR SEMICONDUCTORS PROBE CARDS IN AUTOMOBILE INDUSTRY

5.2 RESTRAINTS

5.2.1 HIGH COST ASSOCIATED WITH PROBE CARD SOLUTION

5.2.2 IMPACT OF METAL PRICES ON OVERALL COMPONENT PRODUCTION COST

5.3 OPPORTUNITIES

5.3.1 RISE IN STRATEGIC PARTNERSHIP AND COLLABORATION

5.3.2 RISING ADOPTION OF PROBE CARDS SOLUTION IN AUTOMOTIVE INDUSTRY

5.3.3 INCREASING USE OF SEMICONDUCTORS IN MILITARY AND DEFENSE SECTOR

5.4 CHALLENGES

5.4.1 LACK OF AWARENESS AMONG CONSUMERS REGARDING BENEFITS OF PROBE CARD SOLUTION

5.4.2 DISRUPTION IN SUPPLY OF PROBE CARD

5.4.3 TECHNOLOGICAL ACCELERATION CREATES A CHALLENGING ENVIRONMENT FOR PROBE CARD SOLUTION

6 IMPACT ANALYSIS OF COVID-19 ON NORTH AMERICA PROBE CARD MARKET

6.1 ANALYSIS ON IMPACT OF COVID-19 ON THE MARKET

6.2 STRATEGIC DECISIONS BY MANUFACTURERS AFTER COVID-19

6.3 IMPACT ON PRICE

6.4 IMPACT ON DEMAND AND SUPPLY CHAIN

6.5 CONCLUSION

7 NORTH AMERICA PROBE CARD MARKET, BY PROBE TYPE

7.1 OVERVIEW

7.2 ADVANCED PROBE CARD

7.2.1 MEMS SP

7.2.2 VERTICAL PROBE

7.2.3 U-PROBE

7.2.4 SP-PROBE

7.2.5 OTHERS

7.3 STANDARD PROBE CARD

8 NORTH AMERICA PROBE CARD MARKET, BY MANUFACTURING TECHNOLOGY TYPE

8.1 OVERVIEW

8.2 MEMS

8.3 VERTICAL

8.4 CANTILEVER

8.5 EPOXY

8.6 BLADE

8.7 OTHERS

9 NORTH AMERICA PROBE CARD MARKET, BY WAFER SIZE

9.1 OVERVIEW

9.2 MORE THAN 12 INCHES

9.3 LESS THAN 12 INCHES

10 NORTH AMERICA PROBE CARD MARKET, BY HEAD SIZE

10.1 OVERVIEW

10.2 MORE THAN 40MM X 40MM

10.3 LESS THAN 40MM X 40MM

11 NORTH AMERICA PROBE CARD MARKET, BY TEST

11.1 OVERVIEW

11.2 DC TEST

11.3 FUNCTIONAL TEST

11.4 AC TEST

12 NORTH AMERICA PROBE CARD MARKET, BY MATERIAL

12.1 OVERVIEW

12.2 TUNGSTEN

12.3 COPPER CLAD LAMINATED (CCL)

12.4 ALUMINUM

12.5 OTHERS

13 NORTH AMERICA PROBE CARD MARKET, BY APPLICATION

13.1 OVERVIEW

13.2 WLCSP

13.3 SIP

13.4 MIXED SIGNAL FLIP CHIP

13.5 ANALOG

14 NORTH AMERICA PROBE CARD MARKET, BY BEAM SIZE

14.1 OVERVIEW

14.2 MORE THAN 1.5 MIL

14.3 LESS THAN 1.5 MIL

15 NORTH AMERICA PROBE CARD MARKET, BY END-USE

15.1 OVERVIEW

15.2 FOUNDRY

15.2.1 ADVANCED PROBE CARD

15.2.2 STANDARD PROBE CARD

15.3 PARAMETRIC

15.3.1 ADVANCED PROBE CARD

15.3.2 STANDARD PROBE CARD

15.4 LOGIC AND MEMORY DEVICE

15.4.1 ADVANCED PROBE CARD

15.4.2 STANDARD PROBE CARD

15.5 DRAM

15.5.1 ADVANCED PROBE CARD

15.5.2 STANDARD PROBE CARD

15.6 CMOS IMAGE SENSOR (CIS)

15.6.1 ADVANCED PROBE CARD

15.6.2 STANDARD PROBE CARD

15.7 FLASH

15.7.1 ADVANCED PROBE CARD

15.7.2 STANDARD PROBE CARD

15.8 OTHERS

16 NORTH AMERICA PROBE CARD MARKET, BY REGION

16.1 NORTH AMERICA

16.1.1 U.S.

16.1.2 CANADA

16.1.3 MEXICO

17 NORTH AMERICA PROBE CARD MARKET: COMPANY LANDSCAPE

17.1 COMPANY SHARE ANALYSIS: NORTH AMERICA

18 SWOT ANALYSIS

19 COMPANY PROFILE

19.1 FORMFACTOR

19.1.1 COMPANY SNAPSHOT

19.1.2 REVENUE ANALYSIS

19.1.3 COMPANY SHARE ANALYSIS

19.1.4 PRODUCT PORTFOLIO

19.1.5 RECENT DEVELOPMENTS

19.2 TECHNOPROBE S.P.A.

19.2.1 COMPANY SNAPSHOT

19.2.2 COMPANY SHARE ANALYSIS

19.2.3 PRODUCT PORTFOLIO

19.2.4 RECENT DEVELOPMENT

19.3 MICRONICS JAPAN CO., LTD.

19.3.1 COMPANY SNAPSHOT

19.3.2 REVENUE ANALYSIS

19.3.3 COMPANY SHARE ANALYSIS

19.3.4 PRODUCT PORTFOLIO

19.3.5 RECENT DEVELOPMENT

19.4 MPI CORPORATION

19.4.1 COMPANY SNAPSHOT

19.4.2 REVENUE ANALYSIS

19.4.3 COMPANY SHARE ANALYSIUS

19.4.4 PRODUCT PORTFOLIO

19.4.5 RECENT DEVELOPMENTS

19.5 CHUNGHWA PRECISION TEST TECH.CO. LTD

19.5.1 COMPANY SNAPSHOT

19.5.2 REVENUE ANALYSIS

19.5.3 COMPANY SHARE ANALYSIS

19.5.4 PRODUCT PORTFOLIO

19.5.5 RECENT DEVELOPMENT

19.6 FEINMETALL GMBH

19.6.1 COMPANY SNAPSHOT

19.6.2 PRODUCT PORTFOLIO

19.6.3 RECENT DEVELOPMENTS

19.7 HTT HIGH TECH TRADE GMBH

19.7.1 COMPANY SNAPSHOT

19.7.2 PRODUCT PORTFOLIO

19.7.3 RECENT DEVELOPMENTS

19.8 KOREA INSTRUMENT CO., LTD

19.8.1 COMPANY SNAPSHOT

19.8.2 PRODUCT PORTFOLIO

19.8.3 RECENT DEVELOPMENT

19.9 JAPAN ELECTRONIC MATERIALS CORPORATION

19.9.1 COMPANY SNAPSHOT

19.9.2 REVENUE ANALYSIS

19.9.3 PRODUCT PORTFOLIO

19.9.4 RECENT DEVELOPMENT

19.1 MICROFRIEND

19.10.1 COMPANY SNAPSHOT

19.10.2 PRODUCT PORTFOLIO

19.10.3 RECENT DEVELOPMENT

19.11 ONTO INNOVATION

19.11.1 COMPANY SNAPSHOT

19.11.2 REVENUE ANALYSIS

19.11.3 PRODUCT PORTFOLIO

19.11.4 RECENT DEVELOPMENTS

19.12 SV PROBE

19.12.1 COMPANY SNAPSHOT

19.12.2 PRODUCT PORTFOLIO

19.12.3 RECENT DEVELOPMENT

19.13 STAR TECHNOLOGIES INC.

19.13.1 COMPANY SNAPSHOT

19.13.2 PRODUCT PORTFOLIO

19.13.3 RECENT DEVELOPMENTS

19.14 RIKA DENSHI CO., LTD.

19.14.1 COMPANY SNAPSHOT

19.14.2 PRODUCT PORTFOLIO

19.14.3 RECENT DEVELOPMENT

19.15 TSE CO,. LTD.

19.15.1 COMPANY SNAPSHOT

19.15.2 REVENUE ANALYSIS

19.15.3 PRODUCT PORTFOLIO

19.15.4 RECENT DEVELOPMENT

19.16 TRANSLARITY

19.16.1 COMPANY SNAPSHOT

19.16.2 PRODUCT PORTFOLIO

19.16.3 RECENT DEVELOPMENT

19.17 DYNAMIC-TEST

19.17.1 COMPANY SNAPSHOT

19.17.2 PRODUCT PORTFOLIO

19.17.3 RECENT DEVELOPMENTS

19.18 WILL TECHNOLOGY

19.18.1 COMPANY SNAPSHOT

19.18.2 PRODUCT PORTFOLIO

19.18.3 RECENT DEVELOPMENTS

19.19 WENTWORTH LABS

19.19.1 COMPANY SNAPSHOT

19.19.2 PRODUCT PORTFOLIO

19.19.3 RECENT DEVELOPMENTS

19.2 WINWAY TECH. CO., LTD.

19.20.1 COMPANY SNAPSHOT

19.20.2 PRODUCT PORTFOLIO

19.20.3 RECENT DEVELOPMENT

20 QUESTIONNAIRE

21 RELATED REPORTS

List of Table

TABLE 1 NORTH AMERICA PROBE CARD MARKET, BY PROBE TYPE, 2020-2029 (USD MILLION)

TABLE 2 NORTH AMERICA ADVANCED PROBE CARD IN PROBE CARD MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 3 NORTH AMERICA ADVANCED PROBE CARD IN PROBE CARD MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 4 NORTH AMERICA STANDARD PROBE CARD IN PROBE CARD MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 5 NORTH AMERICA PROBE CARD MARKET, BY MANUFACTURING TECHNOLOGY TYPE, 2020-2029 (USD MILLION)

TABLE 6 NORTH AMERICA MEMS IN PROBE CARD MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 7 NORTH AMERICA VERTICAL IN PROBE CARD MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 8 NORTH AMERICA CANTILEVER IN PROBE CARD MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 9 NORTH AMERICA EPOXY IN PROBE CARD MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 10 NORTH AMERICA BLADE IN PROBE CARD MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 11 NORTH AMERICA OTHERS IN PROBE CARD MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 12 NORTH AMERICA PROBE CARD MARKET, BY WAFER SIZE, 2020-2029 (USD MILLION)

TABLE 13 NORTH AMERICA MORE THAN 12 INCHES IN PROBE CARD MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 14 NORTH AMERICA LESS THAN 12 INCHES IN PROBE CARD MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 15 NORTH AMERICA PROBE CARD MARKET, BY HEAD SIZE, 2020-2029 (USD MILLION)

TABLE 16 NORTH AMERICA MORE THAN 40MM X 40MM IN PROBE CARD MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 17 NORTH AMERICA LESS THAN 40MM X 40MM IN PROBE CARD MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 18 NORTH AMERICA PROBE CARD MARKET, BY TEST, 2020-2029 (USD MILLION)

TABLE 19 NORTH AMERICA DC TEST IN PROBE CARD MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 20 NORTH AMERICA FUNCTIONAL TEST IN PROBE CARD MARKET, BY REGION, 2020-2029 (USD MILLION

TABLE 21 NORTH AMERICA AC TEST IN PROBE CARD MARKET, BY REGION, 2020-2029 (USD MILLION

TABLE 22 NORTH AMERICA PROBE CARD MARKET, BY MATERIAL, 2020-2029 (USD MILLION)

TABLE 23 NORTH AMERICA TUNGSTEN IN PROBE CARD MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 24 NORTH AMERICA COPPER CLAD LAMINATED (CCL) IN PROBE CARD MARKET, BY REGION, 2020-2029 (USD MILLION

TABLE 25 NORTH AMERICA ALUMINUM IN PROBE CARD MARKET, BY REGION, 2020-2029 (USD MILLION

TABLE 26 NORTH AMERICA OTHERS IN PROBE CARD MARKET, BY REGION, 2020-2029 (USD MILLION

TABLE 27 NORTH AMERICA PROBE CARD MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 28 NORTH AMERICA WLCSP IN PROBE CARD MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 29 NORTH AMERICA SIP IN PROBE CARD MARKET, BY REGION, 2020-2029 (USD MILLION

TABLE 30 NORTH AMERICA MIXED SIGNAL FLIP CHIP IN PROBE CARD MARKET, BY REGION, 2020-2029 (USD MILLION

TABLE 31 NORTH AMERICA ANALOG IN PROBE CARD MARKET, BY REGION, 2020-2029 (USD MILLION

TABLE 32 NORTH AMERICA PROBE CARD MARKET, BY BEAM SIZE, 2020-2029 (USD MILLION)

TABLE 33 NORTH AMERICA MORE THAN 1.5 MIL IN PROBE CARD MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 34 NORTH AMERICA LESS THAN 1.5 MIL IN PROBE CARD MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 35 NORTH AMERICA PROBE CARD MARKET, BY END-USE, 2020-2029 (USD MILLION)

TABLE 36 NORTH AMERICA FOUNDRY IN PROBE CARD MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 37 NORTH AMERICA FOUNDRY IN PROBE CARD MARKET, BY PROBE TYPE, 2020-2029 (USD MILLION)

TABLE 38 NORTH AMERICA PARAMETRIC IN PROBE CARD MARKET, BY REGION, 2020-2029 (USD MILLION

TABLE 39 NORTH AMERICA PARAMETRIC IN PROBE CARD MARKET, BY PROBE TYPE, 2020-2029 (USD MILLION)

TABLE 40 NORTH AMERICA LOGIC AND MEMORY DEVICE IN PROBE CARD MARKET, BY REGION, 2020-2029 (USD MILLION

TABLE 41 NORTH AMERICA LOGIC AND MEMORY DEVICE IN PROBE CARD MARKET, BY PROBE TYPE, 2020-2029 (USD MILLION)

TABLE 42 NORTH AMERICA DRAM IN PROBE CARD MARKET, BY REGION, 2020-2029 (USD MILLION

TABLE 43 NORTH AMERICA DRAM IN PROBE CARD MARKET, BY PROBE TYPE, 2020-2029 (USD MILLION)

TABLE 44 NORTH AMERICA CMOS IMAGE SENSOR (CIS) IN PROBE CARD MARKET, BY REGION, 2020-2029 (USD MILLION

TABLE 45 NORTH AMERICA CMOS IMAGE SENSOR (CIS) IN PROBE CARD MARKET, BY PROBE TYPE, 2020-2029 (USD MILLION)

TABLE 46 NORTH AMERICA FLASH IN PROBE CARD MARKET, BY REGION, 2020-2029 (USD MILLION

TABLE 47 NORTH AMERICA FLASH IN PROBE CARD MARKET, BY PROBE TYPE, 2020-2029 (USD MILLION)

TABLE 48 NORTH AMERICA OTHERS IN PROBE CARD MARKET, BY REGION, 2020-2029 (USD MILLION

TABLE 49 NORTH AMERICA PROBE CARD MARKET, BY COUNTRY, 2020-2029 (USD MILLION)

TABLE 50 NORTH AMERICA PROBE CARD MARKET, BY PROBE TYPE, 2020-2029 (USD MILLION)

TABLE 51 NORTH AMERICA ADVANCED PROBE CARD IN PROBE CARD MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 52 NORTH AMERICA PROBE CARD MARKET, BY MANUFACTURING TECHNOLOGY TYPE, 2020-2029 (USD MILLION)

TABLE 53 NORTH AMERICA PROBE CARD MARKET, BY WAFER SIZE, 2020-2029 (USD MILLION)

TABLE 54 NORTH AMERICA PROBE CARD MARKET, BY HEAD SIZE, 2020-2029 (USD MILLION)

TABLE 55 NORTH AMERICA PROBE CARD MARKET, BY TEST, 2020-2029 (USD MILLION)

TABLE 56 NORTH AMERICA PROBE CARD MARKET, BY MATERIAL, 2020-2029 (USD MILLION)

TABLE 57 NORTH AMERICA PROBE CARD MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 58 NORTH AMERICA PROBE CARD MARKET, BY BEAM SIZE, 2020-2029 (USD MILLION)

TABLE 59 NORTH AMERICA PROBE CARD MARKET, BY END USE, 2020-2029 (USD MILLION)

TABLE 60 NORTH AMERICA FOUNDRY IN PROBE CARD MARKET, BY PROBE TYPE, 2020-2029 (USD MILLION)

TABLE 61 NORTH AMERICA PARAMETRIC IN PROBE CARD MARKET, BY PROBE TYPE, 2020-2029 (USD MILLION)

TABLE 62 NORTH AMERICA LOGIC AND MEMORY DEVICE IN PROBE CARD MARKET, BY PROBE TYPE, 2020-2029 (USD MILLION)

TABLE 63 NORTH AMERICA DRAM IN PROBE CARD MARKET, BY PROBE TYPE, 2020-2029 (USD MILLION)

TABLE 64 NORTH AMERICA CMOS IMAGE SENSOR (CIS) IN PROBE CARD MARKET, BY PROBE TYPE, 2020-2029 (USD MILLION)

TABLE 65 NORTH AMERICA FLASH IN PROBE CARD MARKET, BY PROBE TYPE, 2020-2029 (USD MILLION)

TABLE 66 U.S. PROBE CARD MARKET, BY PROBE TYPE, 2020-2029 (USD MILLION)

TABLE 67 U.S. ADVANCED PROBE CARD IN PROBE CARD MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 68 U.S. PROBE CARD MARKET, BY MANUFACTURING TECHNOLOGY TYPE, 2020-2029 (USD MILLION)

TABLE 69 U.S. PROBE CARD MARKET, BY WAFER SIZE, 2020-2029 (USD MILLION)

TABLE 70 U.S. PROBE CARD MARKET, BY HEAD SIZE, 2020-2029 (USD MILLION)

TABLE 71 U.S. PROBE CARD MARKET, BY TEST, 2020-2029 (USD MILLION)

TABLE 72 U.S. PROBE CARD MARKET, BY MATERIAL, 2020-2029 (USD MILLION)

TABLE 73 U.S. PROBE CARD MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 74 U.S. PROBE CARD MARKET, BY BEAM SIZE, 2020-2029 (USD MILLION)

TABLE 75 U.S. PROBE CARD MARKET, BY END USE, 2020-2029 (USD MILLION)

TABLE 76 U.S. FOUNDRY IN PROBE CARD MARKET, BY PROBE TYPE, 2020-2029 (USD MILLION)

TABLE 77 U.S. PARAMETRIC IN PROBE CARD MARKET, BY PROBE TYPE, 2020-2029 (USD MILLION)

TABLE 78 U.S. LOGIC AND MEMORY DEVICE IN PROBE CARD MARKET, BY PROBE TYPE, 2020-2029 (USD MILLION)

TABLE 79 U.S. DRAM IN PROBE CARD MARKET, BY PROBE TYPE, 2020-2029 (USD MILLION)

TABLE 80 U.S. CMOS IMAGE SENSOR (CIS) IN PROBE CARD MARKET, BY PROBE TYPE, 2020-2029 (USD MILLION)

TABLE 81 U.S. FLASH IN PROBE CARD MARKET, BY PROBE TYPE, 2020-2029 (USD MILLION)

TABLE 82 TABLE 132 CANADA PROBE CARD MARKET, BY PROBE TYPE, 2020-2029 (USD MILLION)

TABLE 83 CANADA ADVANCED PROBE CARD IN PROBE CARD MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 84 CANADA PROBE CARD MARKET, BY MANUFACTURING TECHNOLOGY TYPE, 2020-2029 (USD MILLION)

TABLE 85 CANADA PROBE CARD MARKET, BY WAFER SIZE, 2020-2029 (USD MILLION)

TABLE 86 CANADA PROBE CARD MARKET, BY HEAD SIZE, 2020-2029 (USD MILLION)

TABLE 87 CANADA PROBE CARD MARKET, BY TEST, 2020-2029 (USD MILLION)

TABLE 88 CANADA PROBE CARD MARKET, BY MATERIAL, 2020-2029 (USD MILLION)

TABLE 89 CANADA PROBE CARD MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 90 CANADA PROBE CARD MARKET, BY BEAM SIZE, 2020-2029 (USD MILLION)

TABLE 91 CANADA PROBE CARD MARKET, BY END USE, 2020-2029 (USD MILLION)

TABLE 92 CANADA FOUNDRY IN PROBE CARD MARKET, BY PROBE TYPE, 2020-2029 (USD MILLION)

TABLE 93 CANADA PARAMETRIC IN PROBE CARD MARKET, BY PROBE TYPE, 2020-2029 (USD MILLION)

TABLE 94 CANADA LOGIC AND MEMORY DEVICE IN PROBE CARD MARKET, BY PROBE TYPE, 2020-2029 (USD MILLION)

TABLE 95 CANADA DRAM IN PROBE CARD MARKET, BY PROBE TYPE, 2020-2029 (USD MILLION)

TABLE 96 CANADA CMOS IMAGE SENSOR (CIS) IN PROBE CARD MARKET, BY PROBE TYPE, 2020-2029 (USD MILLION)

TABLE 97 CANADA FLASH IN PROBE CARD MARKET, BY PROBE TYPE, 2020-2029 (USD MILLION)

TABLE 98 MEXICO PROBE CARD MARKET, BY PROBE TYPE, 2020-2029 (USD MILLION)

TABLE 99 MEXICO ADVANCED PROBE CARD IN PROBE CARD MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 100 MEXICO PROBE CARD MARKET, BY MANUFACTURING TECHNOLOGY TYPE, 2020-2029 (USD MILLION)

TABLE 101 MEXICO PROBE CARD MARKET, BY WAFER SIZE, 2020-2029 (USD MILLION)

TABLE 102 MEXICO PROBE CARD MARKET, BY HEAD SIZE, 2020-2029 (USD MILLION)

TABLE 103 MEXICO PROBE CARD MARKET, BY TEST, 2020-2029 (USD MILLION)

TABLE 104 MEXICO PROBE CARD MARKET, BY MATERIAL, 2020-2029 (USD MILLION)

TABLE 105 MEXICO PROBE CARD MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 106 MEXICO PROBE CARD MARKET, BY BEAM SIZE, 2020-2029 (USD MILLION)

TABLE 107 MEXICO PROBE CARD MARKET, BY END USE, 2020-2029 (USD MILLION)

TABLE 108 MEXICO FOUNDRY IN PROBE CARD MARKET, BY PROBE TYPE, 2020-2029 (USD MILLION)

TABLE 109 MEXICO PARAMETRIC IN PROBE CARD MARKET, BY PROBE TYPE, 2020-2029 (USD MILLION)

TABLE 110 MEXICO LOGIC AND MEMORY DEVICE IN PROBE CARD MARKET, BY PROBE TYPE, 2020-2029 (USD MILLION)

TABLE 111 MEXICO DRAM IN PROBE CARD MARKET, BY PROBE TYPE, 2020-2029 (USD MILLION)

TABLE 112 MEXICO CMOS IMAGE SENSOR (CIS) IN PROBE CARD MARKET, BY PROBE TYPE, 2020-2029 (USD MILLION)

TABLE 113 MEXICO FLASH IN PROBE CARD MARKET, BY PROBE TYPE, 2020-2029 (USD MILLION)

List of Figure

FIGURE 1 NORTH AMERICA PROBE CARD MARKET: SEGMENTATION

FIGURE 2 NORTH AMERICA PROBE CARD MARKET: DATA TRIANGULATION

FIGURE 3 NORTH AMERICA PROBE CARD MARKET: DROC ANALYSIS

FIGURE 4 NORTH AMERICA PROBE CARD MARKET: NORTH AMERICA VS REGIONAL MARKET ANALYSIS

FIGURE 5 NORTH AMERICA PROBE CARD MARKET: COMPANY RESEARCH ANALYSIS

FIGURE 6 NORTH AMERICA PROBE CARD MARKET: INTERVIEW DEMOGRAPHICS

FIGURE 7 NORTH AMERICA PROBE CARD MARKET: DBMR MARKET POSITION GRID

FIGURE 8 NORTH AMERICA PROBE CARD MARKET: VENDOR SHARE ANALYSIS

FIGURE 9 NORTH AMERICA PROBE CARD MARKET: MARKET APPLICATION COVERAGE GRID

FIGURE 10 NORTH AMERICA PROBE CARD MARKET: MARKET CHALLENGE MATRIX

FIGURE 11 NORTH AMERICA PROBE CARD MARKET: SEGMENTATION

FIGURE 12 INCREASING USE OF INTEGRATED CIRCUITS IN ELECTRONIC DEVICES IS EXPECTED TO DRIVE THE NORTH AMERICA PROBE CARD MARKET IN THE FORECAST PERIOD OF 2022 TO 2029

FIGURE 13 THE ADVANCED PROBE TYPE SEGMENT IS EXPECTED TO ACCOUNT FOR THE LARGEST SHARE OF THE NORTH AMERICA PROBE CARD MARKET IN 2022 & 2029

FIGURE 14 ASIA-PACIFIC IS EXPECTED TO DOMINATE AND IS THE FASTEST-GROWING REGION IN THE NORTH AMERICA PROBE CARD MARKET IN THE FORECAST PERIOD

FIGURE 15 DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES FOR NORTH AMERICA PROBE CARD MARKET

FIGURE 16 NORTH AMERICA PROBE CARD MARKET: BY PROBE TYPE, 2021

FIGURE 17 NORTH AMERICA PROBE CARD MARKET: BY MANUFACTURING TECHNOLOGY TYPE, 2021

FIGURE 18 NORTH AMERICA PROBE CARD MARKET: BY WAFER SIZE, 2021

FIGURE 19 NORTH AMERICA PROBE CARD MARKET: BY HEAD SIZE, 2021

FIGURE 20 NORTH AMERICA PROBE CARD MARKET: BY TEST, 2021

FIGURE 21 NORTH AMERICA PROBE CARD MARKET: BY MATERIAL, 2021

FIGURE 22 NORTH AMERICA PROBE CARD MARKET: BY APPLICATION, 2021

FIGURE 23 NORTH AMERICA PROBE CARD MARKET: BY BEAM SIZE, 2021

FIGURE 24 NORTH AMERICA PROBE CARD MARKET: BY END-USE, 2021

FIGURE 25 NORTH AMERICA PROBE CARD MARKET: SNAPSHOT (2021)

FIGURE 26 NORTH AMERICA PROBE CARD MARKET: BY COUNTRY (2021)

FIGURE 27 NORTH AMERICA PROBE CARD MARKET: BY COUNTRY (2022 & 2029)

FIGURE 28 NORTH AMERICA PROBE CARD MARKET: BY COUNTRY (2021 & 2029)

FIGURE 29 NORTH AMERICA PROBE CARD MARKET: BY PROBE TYPE (2022-2029)

FIGURE 30 NORTH AMERICA PROBE CARD MARKET: COMPANY SHARE 2021 (%)

منهجية البحث

يتم جمع البيانات وتحليل سنة الأساس باستخدام وحدات جمع البيانات ذات أحجام العينات الكبيرة. تتضمن المرحلة الحصول على معلومات السوق أو البيانات ذات الصلة من خلال مصادر واستراتيجيات مختلفة. تتضمن فحص وتخطيط جميع البيانات المكتسبة من الماضي مسبقًا. كما تتضمن فحص التناقضات في المعلومات التي شوهدت عبر مصادر المعلومات المختلفة. يتم تحليل بيانات السوق وتقديرها باستخدام نماذج إحصائية ومتماسكة للسوق. كما أن تحليل حصة السوق وتحليل الاتجاهات الرئيسية هي عوامل النجاح الرئيسية في تقرير السوق. لمعرفة المزيد، يرجى طلب مكالمة محلل أو إرسال استفسارك.

منهجية البحث الرئيسية التي يستخدمها فريق بحث DBMR هي التثليث البيانات والتي تتضمن استخراج البيانات وتحليل تأثير متغيرات البيانات على السوق والتحقق الأولي (من قبل خبراء الصناعة). تتضمن نماذج البيانات شبكة تحديد موقف البائعين، وتحليل خط زمني للسوق، ونظرة عامة على السوق ودليل، وشبكة تحديد موقف الشركة، وتحليل براءات الاختراع، وتحليل التسعير، وتحليل حصة الشركة في السوق، ومعايير القياس، وتحليل حصة البائعين على المستوى العالمي مقابل الإقليمي. لمعرفة المزيد عن منهجية البحث، أرسل استفسارًا للتحدث إلى خبراء الصناعة لدينا.

التخصيص متاح

تعد Data Bridge Market Research رائدة في مجال البحوث التكوينية المتقدمة. ونحن نفخر بخدمة عملائنا الحاليين والجدد بالبيانات والتحليلات التي تتطابق مع هدفهم. ويمكن تخصيص التقرير ليشمل تحليل اتجاه الأسعار للعلامات التجارية المستهدفة وفهم السوق في بلدان إضافية (اطلب قائمة البلدان)، وبيانات نتائج التجارب السريرية، ومراجعة الأدبيات، وتحليل السوق المجدد وقاعدة المنتج. ويمكن تحليل تحليل السوق للمنافسين المستهدفين من التحليل القائم على التكنولوجيا إلى استراتيجيات محفظة السوق. ويمكننا إضافة عدد كبير من المنافسين الذين تحتاج إلى بيانات عنهم بالتنسيق وأسلوب البيانات الذي تبحث عنه. ويمكن لفريق المحللين لدينا أيضًا تزويدك بالبيانات في ملفات Excel الخام أو جداول البيانات المحورية (كتاب الحقائق) أو مساعدتك في إنشاء عروض تقديمية من مجموعات البيانات المتوفرة في التقرير.