سوق السكر المشتق من النباتات والسكر الصناعي في أمريكا الشمالية، حسب النوع (سكر مشتق من النباتات، سكر صناعي)، الشكل (جاف، سائل)، التطبيق (الأغذية والمشروبات، المكملات الغذائية، الأدوية، التغذية الرياضية، أخرى)، الدولة (الولايات المتحدة وكندا والمكسيك) اتجاهات الصناعة والتوقعات حتى عام 2029.

تحليل ورؤى حول سوق السكر المشتق من النباتات والسكر الصناعي في أمريكا الشمالية

إن سوق السكر المشتق من النباتات والسكر الصناعي في أمريكا الشمالية مدفوع بالعديد من الفوائد التي يقدمونها لكل من الشركات والموظفين. كما أن سوق السكر المشتق من النباتات والسكر الصناعي مدفوع أيضًا بزيادة الطلب على مكونات الأطعمة الصحية في صناعة الأغذية والمشروبات. إن وعي الناس بالمحليات الطبيعية يضع طلب الشركات المصنعة على توريد المحليات الطبيعية. إنه في النهاية يعمل كمحرك لنمو السوق. يبحث المستهلكون بشكل متزايد عن الأطعمة التي تحتوي على الحد الأدنى من السعرات الحرارية والدهون والصوديوم والسكريات المضافة كجزء من الاتجاه المتزايد نحو الأكل الصحي. يمكن لمصنعي السكر الصناعي والسكر المشتق من النباتات الاستفادة من هذه الفرصة لدخول هذه السوق المتوسعة. ومع ذلك، فإن التكلفة العالية للسكر المشتق من النباتات مقارنة بالسكر العادي هي أحد العوامل الرئيسية المقيدة التي تحد من نمو السوق.

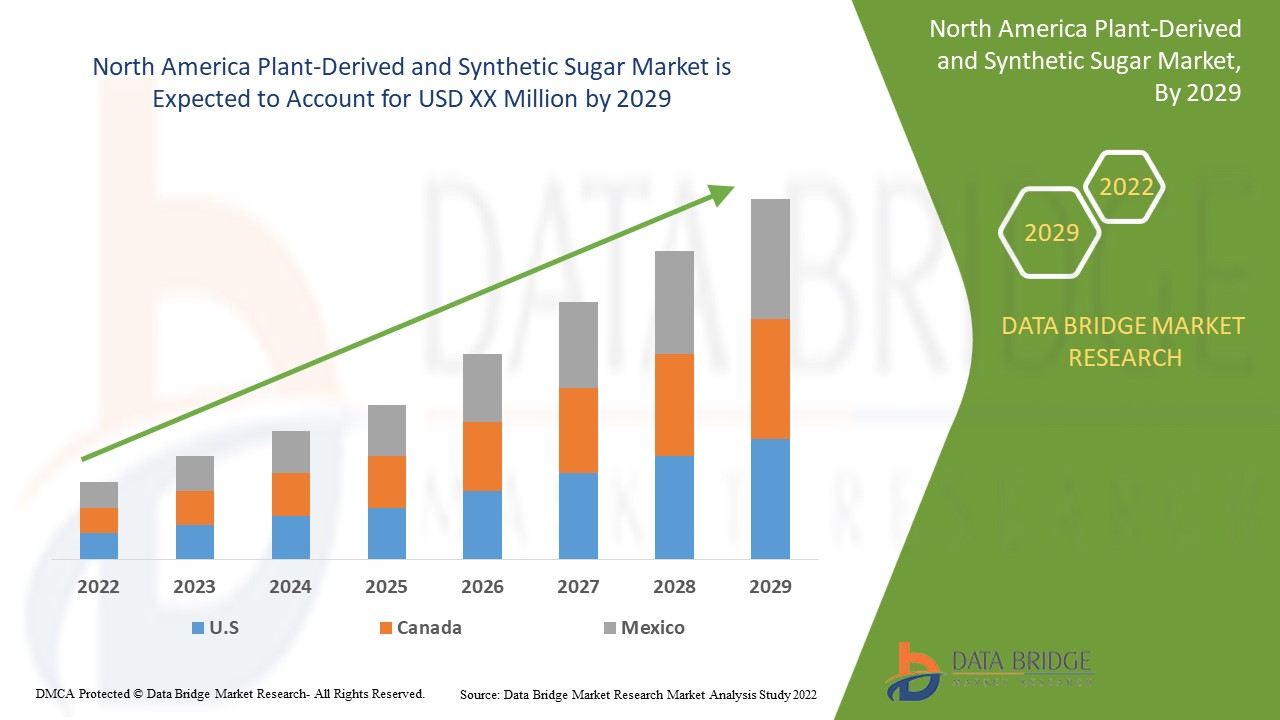

تشير تحليلات Data Bridge Market Research إلى أن سوق السكر المشتق من النباتات والسكر الصناعي في أمريكا الشمالية سينمو بمعدل نمو سنوي مركب قدره 3.2٪ خلال الفترة المتوقعة من 2022 إلى 2029.

|

تقرير القياس |

تفاصيل |

|

فترة التنبؤ |

2022 إلى 2029 |

|

سنة الأساس |

2021 |

|

سنوات تاريخية |

2020 (قابلة للتخصيص حتى 2019 - 2015) |

|

وحدات كمية |

الإيرادات بالملايين من الدولارات الأمريكية، التسعير بالدولار الأمريكي |

|

القطاعات المغطاة |

حسب النوع (سكر مشتق من النباتات، سكر صناعي)، الشكل (جاف، سائل)، الاستخدام (الأغذية والمشروبات، المكملات الغذائية ، الأدوية ، التغذية الرياضية ، أخرى). |

|

المناطق المغطاة |

الولايات المتحدة وكندا والمكسيك |

|

الجهات الفاعلة في السوق المشمولة |

ADM، Cargill، Incorporated، Ingredion، Ajinomoto Co.، Inc.، BENEO، DuPont، Mafco Worldwide LLC، NOW® Foods، Roquette Frères، NutraSweetM™ Co، Tate & Lyle، Pyure، Hermes Sweeteners Ltd.، Südzucker AG، HSWT، Layn Corp.، WILMAR INTERNATIONAL LTD، Celanese Corporation، Grupo PSA، JK Sucralose Inc. |

تعريف السوق

السكر المشتق من النباتات والسكر الصناعي هي منتجات تستخدم للتحلية. يعرف السكر المشتق من النباتات بأنه السكر الذي يتم أخذه مباشرة من مصدر نباتي وبيعه للمستهلكين دون تغيير. من ناحية أخرى، يتم تصنيع السكريات الصناعية بشكل غير مباشر من مصدر منفصل للسكر. بعض أنواع السكر المشتق من النباتات بما في ذلك ستيفيا، وإكسيليتول، وإريثريتول، وشراب الياكون، وغيرها، هي بديل مناسب للسكر لتقليل خطر الإصابة بأمراض مختلفة من السكر. بالإضافة إلى ذلك، يفضل المستهلكون في جميع أنحاء العالم اتباع نظام غذائي صحي وتجنب السلع السكرية الغنية بالسعرات الحرارية والمرتبطة بأمراض القلب. نظرًا للشعبية المتزايدة للمنتجات النباتية، يحظى السكر النباتي باهتمام متزايد. ومع ذلك، فإن ارتفاع أسعار كلا النوعين من السكر مقارنة بالسكر العادي من بين العوامل المقيدة لسوق السكر المشتق من النباتات والسكر الصناعي.

ديناميكيات سوق السكر المشتق من النباتات والسكر الصناعي

يتناول هذا القسم فهم محركات السوق والمزايا والفرص والقيود والتحديات. ويتم مناقشة كل هذا بالتفصيل على النحو التالي:

السائقين:

- الاستخدام الواسع للسكر المشتق من النباتات والسكر الصناعي في مختلف الصناعات في أمريكا الشمالية

يتمتع السكر المشتق من النباتات والسكر الصناعي بإمكانات هائلة للاستخدام في الأغذية والمشروبات والأدوية والوقود الحيوي ومستحضرات التجميل وغيرها. يتمتع قصب السكر الهجين (Saccharum spp.) بإمكانات هائلة كمواد خام مهمة في أمريكا الشمالية لتوليد الوقود الحيوي. نظرًا لقدرته المتميزة على إنتاج الكتلة الحيوية ومحتوى الكربوهيدرات العالي (السكر + الألياف) ونسبة مدخلات/مخرجات الطاقة المواتية، فإنه يُعتبر أحد أفضل الاحتمالات لإنشاء الوقود الحيوي في الوقت الحاضر. من الضروري تطوير أصناف قصب السكر المحسنة ذات قابلية تحلل الكتلة الحيوية الفائقة من أجل زيادة تحويل الكتلة الحيوية لقصب السكر إلى وقود حيوي . بالإضافة إلى النكهة والملمس في الأغذية والمشروبات، يعد السكر مادة صيدلانية تستخدم في الأقراص والكبسولات لتحسين المظهر والقدرة على الحمل والملمس. كما أصبح السكر شائعًا بشكل متزايد في مستحضرات التجميل الطبيعية.

- نمو الطلب على المُحليات الطبيعية كبديل أكثر أمانًا للمُحليات الصناعية

إن الاستخدام طويل الأمد للمحليات الصناعية قد يؤدي إلى الإصابة بمرض السكري، والذي يتداخل مع قدرة الجسم على التحكم في نسبة السكر في الدم ويجعل توسيع السوق أمرًا صعبًا. إن استهلاك المحليات الصناعية لفترة طويلة من الزمن قد يؤدي إلى مشاكل في الجهاز الهضمي مثل الإسهال والانتفاخ. وجدت دراسة حديثة أن الحلويات عالية الكثافة مثل السكرين والأسبارتام يمكن أن تؤدي إلى حالات مرتبطة بالدم مثل سرطان الدم، والتي يمكن أن تكون قاتلة وتسبب الوفاة. يدرك الناس كل هذه الآثار الضارة للمحليات الصناعية، لذلك يفضلون شراء بدائل أكثر أمانًا للمحليات الصناعية مثل المحليات النباتية مثل ستيفيا وإريثريتول وإكسيليتول وشراب الياكون ومحلي فاكهة الراهب وغيرها. هذه البدائل توفر العديد من الفوائد الصحية أيضًا.

ضبط النفس

- تزايد المشاكل الصحية بسبب تناول كميات كبيرة من السكر

تشمل المحليات الشائعة الأخرى التي تُستخدم كثيرًا بدلاً من السكر الدبس والعسل وشراب القيقب وسكر جوز الهند. يمكن أن يكون استهلاك السكر الطبيعي أو بدائل السكر بكميات كبيرة على المدى الطويل ضارًا بصحة الإنسان. بالإضافة إلى ذلك، حتى في حين أن بدائل السكر الطبيعية هذه قد تكون خيارًا أكثر صحة من السكر العادي إذا تم استخدامها باعتدال، فلا ينبغي النظر إليها كحل مؤقت لمشاكل صحة الإنسان. في الواقع، قد يؤدي الاستخدام الطويل الأمد لكميات كبيرة من السكريات الطبيعية أو بدائل السكر إلى زيادة الرغبة في تناول الحلويات وقد يساعد في التسبب في مشاكل، بما في ذلك زيادة الوزن ومرض السكري من النوع 2. هناك العديد من المحليات الطبيعية المختلفة المتاحة بسبب التنوع المذهل للنباتات، إلا أن لكل منها عيوبًا معينة. علاوة على ذلك، لا يوجد ما يضمن أن المادة الكيميائية المصنعة في المصنع ستكون أكثر أمانًا من تلك المصنعة في المختبر. قبل قبولها على أنها آمنة كمضافات غذائية، لا تزال هذه المحليات النباتية بحاجة إلى الخضوع لاختبارات شاملة.

- توفر بدائل للسكر النباتي والسكريات الصناعية

يستبدل المستهلكون المهتمون بالصحة في كثير من الأحيان العسل وشراب القيقب والدبس وسكر جوز الهند والمحليات السكرية الأخرى الشائعة بالسكر. لا تختلف هذه عن السكر على الإطلاق. لن يتمكن جسم الإنسان من التعرف على الفرق، على الرغم من أنها قد تحتوي على سكر أقل قليلاً وقليل من العناصر الغذائية. بالإضافة إلى ذلك، حتى في حين أن بدائل السكر الطبيعية هذه قد تكون خيارًا أكثر صحة من السكر العادي إذا تم استخدامها باعتدال، فلا ينبغي اعتبارها حلاً مؤقتًا لمشاكلك الصحية. بسبب نقص المعرفة ومخاوف التسعير والعواقب السلبية للسكريات الاصطناعية وعوامل أخرى، فإن الاستهلاك الطويل الأمد للسكر العادي من قبل الناس قد يجعل من الصعب عليهم اختيار السكريات النباتية. بالإضافة إلى ذلك، هناك عدد قليل جدًا من السكريات النباتية والسكريات الاصطناعية المتاحة للعملاء العاديين.

فرصة

- تغييرات في نمط الحياة والتركيبة السكانية لتشجيع عادات الأكل المختلفة

في الاقتصادات النامية، أدى التحديث والتحضر إلى تعزيز قطاع الأغذية. تغيرت عادات المستهلكين الغذائية بشكل كبير؛ وقد تأثرت بتغير أنماط الحياة. أدى ارتفاع الدخول المتاحة وارتفاع مستوى المعيشة نتيجة للتحسن في الظروف الاقتصادية لمختلف الدول إلى زيادة كبيرة في استهلاك كل من السكر المشتق من النباتات والسكر الصناعي. كما زاد هذا الاتجاه لاستهلاك الأطعمة الجاهزة للأكل وتوسع على مدى السنوات القليلة الماضية نتيجة للعدد المتزايد من النساء العاملات وجداول أعمالهن المزدحمة.

التحديات

- القيود واللوائح الصارمة التي فرضتها الحكومة

أدى ميل المستهلكين المتزايد نحو الغذاء الصحي والطبيعة الصحية إلى زيادة كبيرة في استخدام المنتجات التي لا تحتوي على سكر مضاف ومحليات. وضعت الحكومة قواعد وإجراءات معينة للحد من تناول السكر من خلال الضرائب الانتقائية وإعادة الصياغة ووضع ملصقات التعبئة والتغليف. كانت الحكومة تراقب باستمرار الوضع في قطاع السكر، بما في ذلك إنتاج السكر واستهلاكه وتصديره واتجاهات الأسعار في أسواق الجملة والتجزئة في جميع أنحاء البلاد.

على الرغم من أن المنتجات المعتمدة من قبل إدارة الغذاء والدواء تعتبر آمنة، إلا أن هناك جوانب سلبية صحية مشكوك فيها مرتبطة بالمحليات الصناعية وغير المغذية. وفي حالة المحليات الطبيعية، يمكن أن يؤدي الإفراط في تناولها إلى مشاكل صحية مثل تسوس الأسنان وسوء التغذية وما إلى ذلك.

تأثير ما بعد كوفيد-19

انخفض الطلب والعرض على السكر ومنتجات السكر الصناعي في البداية خلال بداية جائحة كوفيد-19 بسبب الإغلاق المؤقت والتباعد الاجتماعي، مما أدى إلى فرض قيود تجارية وقيود على النقل وقيود على الإنتاج. وقد أثر هذا بشكل طفيف على سوق السكر المشتق من النباتات والسكر الصناعي في أمريكا الشمالية.

لقد أثر تفشي فيروس كورونا المستجد (كوفيد-19) على الاقتصادات والصناعات في مختلف البلدان بسبب عمليات الإغلاق وحظر السفر وإغلاق الشركات. بالإضافة إلى ذلك، تواجه صناعة مكونات الأغذية، مثل المُحليات المستخدمة في صناعة الأغذية والمشروبات، العديد من الاضطرابات الخطيرة، مثل انقطاع سلسلة التوريد وإلغاء الأحداث التكنولوجية وإغلاق المكاتب بسبب هذا التفشي. وقد أثر ذلك في النهاية على صناعة السكر ومكونات المُحليات بشكل عام. ومع ذلك، بعد كوفيد، زاد الطلب على السكر النباتي في منتجات الأغذية الصحية والعافية بسرعة بسبب العدد المتزايد من الأشخاص المهتمين بالصحة وزيادة الوعي بالمكونات الغذائية الصحية وفوائدها.

علاوة على ذلك، أصبحت القيود الحكومية والتجارة والاستيراد والتصدير أسهل، وتم إزالة العديد من القيود بعد انتشار فيروس كورونا المستجد (كوفيد-19)، مما جعل من السهل على مصنعي الأغذية الصحية والعافية تلبية متطلبات المستهلكين وأضاف إلى نمو السوق.

التطورات الأخيرة

- في فبراير 2022، استحوذت IFF على منتجات Health Wright. تعد HWP شركة رائدة في أمريكا الشمالية في صناعات الصحة والتغذية للمستهلكين، حيث تقدم المكملات الغذائية عالية الجودة. سيجلب الاستحواذ قدرات الصياغة والصيغة النهائية إلى أعمال البروبيوتيك والمستخلصات الطبيعية والنباتات الصحية والبيولوجية لشركة IFF، مما يسمح بالابتكار في الصياغة المخصصة والمنتجات المركبة من خلال القدرات المشتركة.

- في أغسطس 2021، نشرت شركة Ochsner Health مقالاً بعنوان "المحليات النباتية: دليل كامل". وقد أوضح المقال أن هناك الآن عددًا أكبر من المحليات النباتية الخالية من السعرات الحرارية المتاحة أكثر من أي وقت مضى، مما يجعل تقليل السكر المضاف أسهل من أي وقت مضى.

نطاق سوق السكر المشتق من النباتات والسكر الصناعي في أمريكا الشمالية

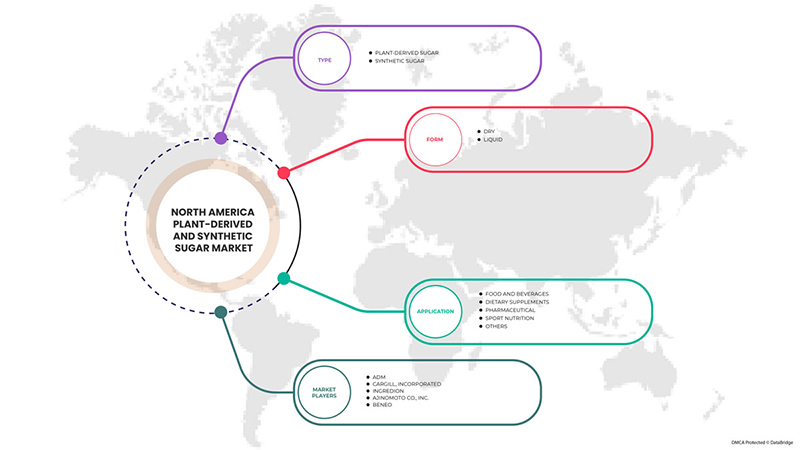

يتم تقسيم سوق السكر المشتق من النباتات والسكر الصناعي في أمريكا الشمالية على أساس النوع والتطبيق والشكل. سيساعدك النمو بين هذه القطاعات في تحليل قطاعات النمو الرئيسية في الصناعات وتزويد المستخدمين بنظرة عامة قيمة على السوق ورؤى السوق لمساعدتهم على اتخاذ قرارات استراتيجية لتحديد تطبيقات السوق الأساسية.

يكتب

- سكر مشتق من النباتات

- سكر صناعي

على أساس النوع، يتم تقسيم سوق السكر المشتق من النباتات والسكر الصناعي في أمريكا الشمالية إلى سكر مشتق من النباتات وسكر صناعي.

طلب

- الأطعمة والمشروبات

- المكملات الغذائية

- الصيدلة

- التغذية الرياضية

- آحرون

على أساس المستخدمين النهائيين، يتم تقسيم سوق السكر المشتق من النباتات والسكر الصناعي في أمريكا الشمالية إلى الأغذية والمشروبات، والمكملات الغذائية، والأدوية، والتغذية الرياضية، وغيرها.

استمارة

- جاف

- سائل

على أساس الشكل، يتم تقسيم سوق السكر المشتق من النباتات والسكر الصناعي في أمريكا الشمالية إلى سكر جاف وسائل.

تحليل/رؤى إقليمية لسوق السكر المشتق من النباتات والسكر الصناعي في أمريكا الشمالية

يتم تحليل سوق السكر المشتق من النباتات والسكر الصناعي في أمريكا الشمالية، ويتم توفير رؤى حول حجم السوق والاتجاهات بناءً على ما هو مذكور أعلاه.

الدول التي يغطيها تقرير سوق السكر المشتق من النباتات والسكر الصناعي في أمريكا الشمالية هي الولايات المتحدة وكندا والمكسيك.

من المتوقع أن تهيمن الولايات المتحدة على سوق السكر النباتي والصناعي في أمريكا الشمالية من حيث حصة السوق والإيرادات. ومن المتوقع أن تحافظ على هيمنتها خلال فترة التوقعات بسبب الطلب المتزايد على هذا السكر وهو السبب الرئيسي لنمو السكر النباتي والصناعي في منطقة أمريكا الشمالية.

كما يوفر قسم المنطقة في التقرير عوامل فردية مؤثرة على السوق والتغييرات في اللوائح في السوق والتي تؤثر على الاتجاهات الحالية والمستقبلية للسوق. تعد نقاط البيانات، مثل المبيعات الجديدة والاستبدالية، والتركيبة السكانية للبلد، وعلم الأوبئة المرضية، ورسوم الاستيراد والتصدير، من بين المؤشرات الرئيسية المستخدمة للتنبؤ بسيناريو السوق للدول الفردية. بالإضافة إلى ذلك، يتم النظر في وجود وتوافر العلامات التجارية في أمريكا الشمالية والتحديات التي تواجهها بسبب المنافسة الشديدة من العلامات التجارية المحلية والمحلية وتأثير الشكل أثناء تقديم تحليل تنبؤي لبيانات الدولة.

تحليل حصة السوق للسكر المشتق من النباتات والسكر الصناعي في أمريكا الشمالية

توفر سوق السكر المشتق من النباتات والسكر الصناعي التنافسي في أمريكا الشمالية تفاصيل عن المنافسين. تتضمن التفاصيل نظرة عامة على الشركة، والبيانات المالية للشركة، والإيرادات المتولدة، وإمكانات السوق، والاستثمار في البحث والتطوير، ومبادرات السوق الجديدة، والحضور في أمريكا الشمالية، ومواقع الإنتاج والمرافق، والقدرات الإنتاجية، ونقاط القوة والضعف للشركة، وإطلاق المنتج، وعرض المنتج ونطاقه، وهيمنة التطبيق. ترتبط نقاط البيانات المذكورة أعلاه فقط بتركيز الشركة على سوق السكر المشتق من النباتات والسكر الصناعي في أمريكا الشمالية.

بعض اللاعبين الرئيسيين العاملين في سوق السكر المشتق من النباتات والسكر الصناعي في أمريكا الشمالية هم ADM وCargill وIncorporated وIngredion وAjinomoto Co.، Inc. وBENEO وDuPont وMafco Worldwide LLC وNOW® Foods وRoquette Frères وNutraSweetM™ Co وTate & Lyle وPyure وHermes Sweeteners Ltd. وSüdzucker AG وHSWT وLayn Corp. وWILMAR INTERNATIONAL LTD وCelanese Corporation وGrupo PSA وJK Sucralose Inc وغيرها.

SKU-

احصل على إمكانية الوصول عبر الإنترنت إلى التقرير الخاص بأول سحابة استخبارات سوقية في العالم

- لوحة معلومات تحليل البيانات التفاعلية

- لوحة معلومات تحليل الشركة للفرص ذات إمكانات النمو العالية

- إمكانية وصول محلل الأبحاث للتخصيص والاستعلامات

- تحليل المنافسين باستخدام لوحة معلومات تفاعلية

- آخر الأخبار والتحديثات وتحليل الاتجاهات

- استغل قوة تحليل المعايير لتتبع المنافسين بشكل شامل

Table of Content

1 INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 OVERVIEW OF THE NORTH AMERICA PLANT-DERIVED AND SYNTHETIC SUGAR MARKET

1.4 LIMITATIONS

1.5 MARKETS COVERED

2 MARKET SEGMENTATION

2.1 MARKETS COVERED

2.2 GEOGRAPHICAL SCOPE

2.3 YEARS CONSIDERED FOR THE STUDY

2.4 CURRENCY AND PRICING

2.5 DBMR TRIPOD DATA VALIDATION MODEL

2.6 MULTIVARIATE MODELLING

2.7 TYPE LIFELINE CURVE

2.8 PRIMARY INTERVIEWS WITH KEY OPINION LEADERS

2.9 DBMR MARKET POSITION GRID

2.1 VENDOR SHARE ANALYSIS

2.11 SECONDARY SOURCES

2.12 ASSUMPTIONS

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

4.1 FACTORS INFLUENCING THE PURCHASE DECISION

4.2 GROWTH STRATEGIES ADOPTED BY KEY MARKET PLAYERS

4.3 IMPORT-EXPORT ANALYSIS

4.3.1 IMPORT-EXPORT ANALYSIS- NORTH AMERICA PLANT-DERIVED SYNTHETIC SUGAR MARKET

4.3.2 IMPORT-EXPORT ANALYSIS- NORTH AMERICA SYNTHETIC SUGAR MARKET

4.4 INDUSTRY TRENDS FOR NORTH AMERICA PLANT-DERIVED AND SYNTHETIC SUGAR MARKET

4.4.1 INDUSTRY TRENDS

4.4.1.1 DEMAND FOR SYNTHETIC SUGAR

4.4.1.2 GROWING POPULARITY OF PLANT DERIVED SUGAR

4.4.2 FUTURE PERSPECTIVE

4.5 NEW PRODUCT LAUNCH STRATEGY

4.5.1 PROMOTING BY EMPHASIZING THEIR HEALTH BENEFITS

4.5.2 WEIGHT MANAGEMENT

4.5.3 LAUNCHING ORGANIC PRODUCTS

4.5.4 CONCLUSION

4.6 PRODUCTION AND CONSUMPTION

4.7 TECHNOLOGICAL ADVANCEMENT IN THE PLANT-DERIVED AND SYNTHETIC SUGAR MARKET

5 POST-COVID IMPACT

5.1 AFTERMATH OF COVID-19

5.2 IMPACT ON DEMAND AND SUPPLY CHAIN

5.3 IMPACT ON PRICE

5.4 CONCLUSION

6 VALUE CHAIN ANALYSIS: NORTH AMERICA PLANT DERIVED SUGAR AND SYNTHETIC SUGAR MARKET

7 REGULATORY FRAMEWORK AND GUIDELINES

7.1 NORTH AMERICA

8 SUPPLY CHAIN OF NORTH AMERICA PLANT-DERIVED AND SYNTHETIC SUGAR MARKET

8.1 SUPPLY CHAIN OF PLANT-DERIVED SUGAR

8.1.1 RAW MATERIAL PROCUREMENT

8.1.2 PREPARATION OF SUGAR IN SUGAR MILLS

8.1.3 MARKETING AND DISTRIBUTION

8.1.4 END USERS

8.2 SUPPLY CHAIN OF SYNTHETIC SUGAR

8.2.1 RAW MATERIAL PROCUREMENT

8.2.2 PREPARATION OF SYNTHETIC SUGAR IN THE LAB

8.2.3 MARKETING AND DISTRIBUTION

8.2.4 END USERS

9 MARKET OVERVIEW

9.1 DRIVERS

9.1.1 RISE IN THE DEMAND FOR HEALTHY FOOD INGREDIENTS IN THE FOOD AND BEVERAGE SECTOR

9.1.2 WIDE APPLICATION OF PLANT-DERIVED AND SYNTHETIC SUGAR IN VARIOUS GLOBAL INDUSTRIES

9.1.3 GROWTH IN THE DEMAND FOR NATURAL SWEETENERS AS A SAFER ALTERNATIVE TO ARTIFICIAL SWEETENERS

9.1.4 GROWTH IN THE CONSUMER DEMAND FOR IN CONFECTIONERY PRODUCTS

9.1.5 RISE IN THE HEALTH BENEFITS ASSOCIATED WITH SYNTHETIC SUGAR

9.2 RESTRAINTS

9.2.1 HIGH COSTS OF PLANT-DERIVED AND SYNTHETIC SUGAR

9.2.2 ARTIFICIAL SWEETENERS' ADOPTION IS BEING HAMPERED BY THE GROWING UNCERTAINTY AROUND THEIR SAFETY IN NUMEROUS FOOD PRODUCTS.

9.2.3 GROWTH HEALTH PROBLEMS DUE TO HIGH SUGAR INTAKE

9.2.4 AVAILABILITY OF SUBSTITUTE FOR PLANT-DERIVED AND SYNTHETIC SUGARS

9.3 OPPORTUNITIES

9.3.1 EXPANSION AND NEW PRODUCT LAUNCHES IN THIS INDUSTRY

9.3.2 INCREASE IN THE HEALTH-CONSCIOUSNESS AMONG GLOBAL CONSUMERS

9.3.3 CHANGES IN LIFESTYLE AND DEMOGRAPHICS TO ENCOURAGE VARIOUS EATING HABITS

9.3.4 CONSUMERS SHIFTING PREFERENCE TOWARD LOW-SUGAR DRINKS

9.4 CHALLENGES

9.4.1 IMPACT OF COVID-19 ON THE SUPPLY CHAIN OF FINAL PRODUCTS AND RAW MATERIAL

9.4.2 GOVERNMENT- IMPOSED STRICT RESTRICTIONS AND REGULATIONS

9.4.3 PRODUCT LABELING AND TRADE ISSUES

9.4.4 INADEQUATE RAW MATERIAL AVAILABILITY

10 NORTH AMERICA PLANT-DERIVED AND SYNTHETIC SUGAR MARKET, BY TYPE

10.1 OVERVIEW

10.2 PLANT-DERIVED SUGAR

10.2.1 PLANT DERIVED SUGAR, BY TYPE

10.2.1.1 CANE SUGAR

10.2.1.2 SUGAR BEET SUGAR

10.2.1.3 STEVIA

10.2.1.4 MONK FRUIT SWEETENER

10.2.1.5 COCONUT SUGAR

10.2.1.6 MAPLE SUGAR

10.2.1.7 MOLASSES SUGAR

10.2.1.8 BROWN RICE SUGAR

10.2.1.9 MALTITOL

10.2.1.10 ALLULOSE

10.2.1.11 ERYTHRITOL

10.2.1.12 XYLITOL

10.2.1.13 OTHERS

10.2.2 PLANT DERIVED SUGAR, BY CATEGORY

10.2.2.1 CONVENTIONAL SUGAR

10.2.2.2 ORGANIC SUGAR

10.3 SYNTHETIC SUGAR

10.3.1 SYNTHETIC SUGAR, BY TYPE

10.3.1.1 ASPARTAME

10.3.1.2 SACCHARINE

10.3.1.3 ACE-K

10.3.1.4 CYCLAMATE

10.3.1.5 SUCROLOSE

10.3.1.6 GLYCYRRHIZIN

10.3.1.7 ALITAME

10.3.1.8 ADVANTAME

10.3.1.9 NEOTAME

10.3.1.10 OTHERS

11 NORTH AMERICA PLANT-DERIVED AND SYNTHETIC SUGAR MARKET, BY FORM

11.1 OVERVIEW

11.2 DRY

11.2.1 DRY, BY TYPE

11.2.1.1 POWDER

11.2.1.2 CRYSTAL

11.2.1.3 CRYSTALIZED POWDER

11.3 LIQUID

12 NORTH AMERICA PLANT-DERIVED AND SYNTHETIC SUGAR MARKET, BY APPLICATION

12.1 OVERVIEW

12.2 FOOD AND BEVERAGE

12.2.1 FOOD & BEVERAGE, BY TYPE

12.2.1.1 TABLE TOP SUGAR

12.2.1.2 BEVERAGES

12.2.1.2.1 DAIRY BASED DRINKS

12.2.1.2.1.1 REGULAR

12.2.1.2.1.2 PROCESSED MILK

12.2.1.2.1.3 MILK SHAKES

12.2.1.2.1.4 FLAVORED MILK

12.2.1.2.2 JUICES

12.2.1.2.3 SMOOTHIES

12.2.1.2.4 PLANT BASED MILK

12.2.1.2.5 ENERGY DRINKS

12.2.1.2.6 SPORTS DRINKS

12.2.1.2.7 OTHERS

12.2.1.3 FROZEN DESSERTS

12.2.1.3.1 GELATO

12.2.1.3.2 CUSTARD

12.2.1.3.3 OTHERS

12.2.1.4 PROCESSED FOOD

12.2.1.4.1 READY MEALS

12.2.1.4.2 JAMS, PRESERVES & MARMALADES

12.2.1.4.3 SAUCES, DRESSINGS & CONDIMENTS

12.2.1.4.4 SOUPS

12.2.1.4.5 OTHERS

12.2.1.5 CONVENIENCE FOOD

12.2.1.5.1 INSTANT NOODLES

12.2.1.5.2 PIZZA & PASTA

12.2.1.5.3 SNACKS & EXTRUDED SNACKS

12.2.1.5.4 OTHERS

12.2.1.6 CONFECTIONERY

12.2.1.6.1 HARD-BOILED SWEETS

12.2.1.6.2 MINTS

12.2.1.6.3 GUMS & JELLIES

12.2.1.6.4 CHOCOLATE

12.2.1.6.5 CHOCOLATE SYRUPS

12.2.1.6.6 CARAMELS & TOFFEES

12.2.1.6.7 OTHERS

12.2.1.7 BAKERY

12.2.1.7.1 BREAD & ROLLS

12.2.1.7.2 CAKES, PASTRIES & TRUFFLE

12.2.1.7.3 BISCUIT, COOKIES & CRACKERS

12.2.1.7.4 BROWNIES

12.2.1.7.5 TART & PIES

12.2.1.7.6 OTHERS

12.2.1.8 DAIRY PRODUCTS

12.2.1.8.1 YOGURT

12.2.1.8.2 ICE CREAM

12.2.1.8.3 CHEESE

12.2.1.8.4 OTHERS

12.2.1.9 BREAKFAST CEREAL

12.2.1.10 INFANT FORMULA

12.2.1.10.1 FIRST INFANT FORMULA

12.2.1.10.2 ANTI-REFLUX (STAY DOWN) FORMULA

12.2.1.10.3 COMFORT FORMULA

12.2.1.10.4 HYPOALLERGENIC FORMULA

12.2.1.10.5 FOLLOW-ON FORMULA

12.2.1.10.6 OTHERS

12.2.1.11 NUTRITIONAL BARS

12.2.1.12 FUNCTIONAL FOOD

12.2.2 FOOD & BEVERAGE, BY SWEETENER TYPE

12.2.2.1 PLANT-DERIVED SUGAR

12.2.2.2 SYNTHETIC SUGAR

12.3 DIETARY SUPPLEMENTS

12.3.1 DIETARY SUPPLEMENTS, BY TYPE

12.3.1.1 IMMUNITY SUPPLEMENTS

12.3.1.2 OVERALL WELLBEING SUPPLEMENTS

12.3.1.3 SKIN HEALTH SUPPLEMENTS

12.3.1.4 BONE AND JOINT HEALTH SUPPLEMENTS

12.3.1.5 BRAIN HEALTH SUPPLEMENTS

12.3.1.6 OTHERS

12.3.2 DIETARY SUPPLEMENTS, BY SWEETENER TYPE

12.3.2.1 PLANT-DERIVED SUGAR

12.3.2.2 SYNTHETIC SUGAR

12.4 PHARMACEUTICAL

12.4.1 PHARMACEUTICAL, BY TYPE

12.4.1.1 TABLETS

12.4.1.2 CAPSULES

12.4.1.3 OTHERS

12.4.2 PHARMACEUTICAL, BY SWEETENER TYPE

12.4.2.1 PLANT-DERIVED SUGAR

12.4.2.2 SYNTHETIC SUGAR

12.5 SPORTS NUTRITION

12.5.1 SPORTS NUTRITION, BY TYPE

12.5.1.1 PROTEIN POWDERS

12.5.1.2 SPORTS NUTRITION BARS

12.5.1.3 SPORT DRINK MIXES

12.5.1.4 ENERGY GELS

12.5.1.5 OTHERS

12.5.2 SPORTS NUTRITION, BY SWEETENER TYPE

12.5.2.1 PLANT-DERIVED SUGAR

12.5.2.2 SYNTHETIC SUGAR

12.6 OTHERS

12.6.1 OTHERS, BY SWEETENER TYPE

12.6.1.1 PLANT-DERIVED SUGAR

12.6.1.2 SYNTHETIC SUGAR

13 NORTH AMERICA PLANT-DERIVED AND SYNTHETIC SUGAR MARKET, BY COUNTRY

13.1 OVERVIEW

13.2 NORTH AMERICA

13.2.1 U.S.

13.2.2 CANADA

13.2.3 MEXICO

14 COMPANY LANDSCAPE

14.1 COMPANY SHARE ANALYSIS: NORTH AMERICA

15 SWOT ANALYSIS

16 COMPANY PROFILES

16.1 ADM

16.1.1 COMPANY SNAPSHOT

16.1.2 REVENUE ANALYSIS

16.1.3 COMPANY SHARE ANALYSIS

16.1.4 PRODUCT PORTFOLIO

16.1.5 RECENT DEVELOPMENTS

16.2 SUDZUKER AG

16.2.1 COMPANY SNAPSHOT

16.2.2 RECENT FINANCIALS

16.2.3 COMPANY SHARE ANALYSIS

16.2.4 PRODUCT PORTFOLIO

16.2.5 RECENT DEVELOPMENTS

16.3 CARGILL, INCORPORATED

16.3.1 COMPANY SNAPSHOT

16.3.2 COMPANY SHARE ANALYSIS

16.3.3 PRODUCT PORTFOLIO

16.3.4 RECENT DEVELOPMENTS

16.4 INGREDION INCORPORATED

16.4.1 COMPANY SNAPSHOT

16.4.2 REVENUE ANALYSIS

16.4.3 COMPANY SHARE ANALYSIS

16.4.4 PRODUCT PORTFOLIO

16.4.5 RECENT DEVELOPMENTS

16.5 WILMAR INTERNATIONAL LTD

16.5.1 COMPANY SNAPSHOT

16.5.2 REVENUE ANALYSIS

16.5.3 COMPANY SHARE ANALYSIS

16.5.4 PRODUCT PORTFOLIO

16.5.5 RECENT DEVELOPMENTS

16.6 AJINOMOTO CO., INC

16.6.1 COMPANY SNAPSHOT

16.6.2 RECENT FINANCIALS

16.6.3 COMPANY SHARE ANALYSIS

16.6.4 PRODUCT PORTFOLIO

16.6.5 RECENT DEVELOPMENTS

16.7 BENEO

16.7.1 COMPANY SNAPSHOT

16.7.2 PRODUCT PORTFOLIO

16.7.3 RECENT DEVELOPMENTS

16.8 CELANESE CORPORATION

16.8.1 COMPANY SNAPSHOT

16.8.2 REVENUE ANALYSIS

16.8.3 PRODUCT PORTFOLIO

16.8.4 RECENT DEVELOPMENT

16.9 DUPONT

16.9.1 COMPANY SNAPSHOT

16.9.2 RECENT FINANCIALS

16.9.3 PRODUCT PORTFOLIO

16.9.4 RECENT DEVELOPMENTS

16.1 GRUPO PSA

16.10.1 COMPANY SNAPSHOT

16.10.2 PRODUCT PORTFOLIO

16.10.3 RECENT DEVELOPMENT

16.11 HERMES SWEETENERS LTD.

16.11.1 COMPANY SNAPSHOT

16.11.2 PRODUCT PORTFOLIO

16.11.3 RECENT DEVELOPMENT

16.12 JK SUCRALOSE INC.

16.12.1 COMPANY SNAPSHOT

16.12.2 PRODUCT PORTFOLIO

16.12.3 RECENT DEVELOPMENTS

16.13 LAYN CORP

16.13.1 COMPANY SNAPSHOT

16.13.2 PRODUCT PORTFOLIO

16.13.3 RECENT DEVELOPMENT

16.14 MAFCO WORLDWIDE LLC.

16.14.1 COMPANY SNAPSHOT

16.14.2 PRODUCT PORTFOLIO

16.14.3 RECENT DEVELOPMENTS

16.15 NUTRASWEETM CO

16.15.1 COMPANY SNAPSHOT

16.15.2 PRODUCT PORTFOLIO

16.15.3 RECENT DEVELOPMENTS

16.16 PYURE BRANDS LLC.

16.16.1 COMPANY SNAPSHOT

16.16.2 PRODUCT PORTFOLIO

16.16.3 RECENT DEVELOPMENTS

16.17 ROQUETTE FRÈRES.

16.17.1 COMPANY SNAPSHOT

16.17.2 PRODUCT PORTFOLIO

16.17.3 RECENT DEVELOPMENTS

16.18 TATE&LYLE

16.18.1 COMPANY SNAPSHOT

16.18.2 RECENT FINANCIALS

16.18.3 PRODUCT PORTFOLIO

16.18.4 RECENT DEVELOPMENTS

17 QUESTIONNAIRE

18 RELATED REPORTS

List of Table

TABLE 1 TOP IMPORT OF PLANT BASED SUGAR, 2020-2021, IN TONS

TABLE 2 TOP EXPORT OF PLANT BASED SUGAR, 2020-2021, IN TONS

TABLE 3 TOP IMPORT OF SYNTHETIC SUGAR, 2020-2021, IN TONS

TABLE 4 TOP EXPORT OF SYNTHETIC SUGAR, 2020-2021, IN TONS

TABLE 5 PRODUCTION OF SUGAR IN 2021/2022

TABLE 6 CONSUMPTION OF SUGAR IN 2021/2022

TABLE 7 PRICES OF PLANT-DERIVED SUGAR:

TABLE 8 PRICES OF SYNTHETIC SUGAR:

TABLE 9 PRICES OF REGULAR SUGAR:

TABLE 10 NORTH AMERICA PLANT-DERIVED AND SYNTHETIC SUGAR MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 11 NORTH AMERICA PLANT-DERIVED SUGAR IN PLANT-DERIVED AND SYNTHETIC SUGAR MARKET, BY COUNTRY, 2020-2029 (USD MILLION)

TABLE 12 NORTH AMERICA PLANT-DERIVED SUGAR IN PLANT-DERIVED AND SYNTHETIC SUGAR MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 13 NORTH AMERICA PLANT-DERIVED SUGAR IN PLANT-DERIVED AND SYNTHETIC SUGAR MARKET, BY CATEGORY, 2020-2029 (USD MILLION)

TABLE 14 NORTH AMERICA SYNTHETIC SUGAR IN PLANT-DERIVED AND SYNTHETIC SUGAR MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 15 NORTH AMERICA PLANT-DERIVED AND SYNTHETIC SUGAR MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 16 NORTH AMERICA DRY IN PLANT-DERIVED AND SYNTHETIC SUGAR MARKET, BY TYPE , 2020-2029 (USD MILLION)

TABLE 17 NORTH AMERICA PLANT-DERIVED AND SYNTHETIC SUGAR MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 18 NORTH AMERICA FOOD & BEVERAGES IN PLANT-DERIVED AND SYNTHETIC SUGAR MARKET, BY TYPE 2020-2029 (USD MILLION)

TABLE 19 NORTH AMERICA BEVERAGES PLANT-DERIVED AND SYNTHETIC SUGAR MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 20 NORTH AMERICA DAIRY BASED DRINKS IN PLANT-DERIVED AND SYNTHETIC SUGAR MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 21 NORTH AMERICA FROZEN DESSERTS IN PLANT-DERIVED AND SYNTHETIC SUGAR MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 22 NORTH AMERICA PROCESSED FOOD IN PLANT-DERIVED AND SYNTHETIC SUGAR MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 23 NORTH AMERICA CONVENIENCE FOOD IN PLANT-DERIVED AND SYNTHETIC SUGAR MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 24 NORTH AMERICA CONFECTIONERY IN PLANT-DERIVED AND SYNTHETIC SUGAR MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 25 NORTH AMERICA BAKERY IN PLANT-DERIVED AND SYNTHETIC SUGAR MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 26 NORTH AMERICA DAIRY PRODUCTS IN PLANT-DERIVED AND SYNTHETIC SUGAR MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 27 NORTH AMERICA INFANT FORMULA IN PLANT-DERIVED AND SYNTHETIC SUGAR MARKET, BY TYPE 2020-2029 (USD MILLION)

TABLE 28 NORTH AMERICA FOOD & BEVERAGES IN PLANT-DERIVED AND SYNTHETIC SUGAR MARKET, BY SWEETENER TYPE 2020-2029 (USD MILLION)

TABLE 29 NORH AMERICA DIETARY SUPPLEMENTS IN PLANT-DERIVED AND SYNTHETIC SUGAR MARKET, BY TYPE 2020-2029 (USD MILLION)

TABLE 30 NORTH AMERICA DIETARY SUPPLEMENTS IN PLANT-DERIVED AND SYNTHETIC SUGAR MARKET, BY SWEETENER TYPE 2020-2029 (USD MILLION)

TABLE 31 NORTH AMERICA PHARMACEUTICAL IN PLANT-DERIVED AND SYNTHETIC SUGAR MARKET, BY TYPE 2020-2029 (USD MILLION)

TABLE 32 NORTH AMERICA PHARMACEUTICAL IN PLANT-DERIVED AND SYNTHETIC SUGAR MARKET, BY SWEETENER TYPE 2020-2029 (USD MILLION)

TABLE 33 NORTH AMERICA SPORTS NUTRITION IN PLANT-DERIVED AND SYNTHETIC SUGAR MARKET, BY TYPE 2020-2029 (USD MILLION)

TABLE 34 NORTH AMERICA SPORTS NUTRITION IN PLANT-DERIVED AND SYNTHETIC SUGAR MARKET, BY SWEETENER TYPE 2020-2029 (USD MILLION)

TABLE 35 NORTH AMERICA OTHERS IN PLANT-DERIVED AND SYNTHETIC SUGAR MARKET, BY SWEETENER TYPE 2020-2029 (USD MILLION)

TABLE 36 U.S. PLANT-DERIVED AND SYNTHETIC SUGAR MARKET, 2020-2029

TABLE 37 U.S. PLANT-DERIVED AND SYNTHETIC SUGAR MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 38 U.S. PLANT DERIVED SUGAR IN PLANT-DERIVED AND SYNTHETIC SUGAR MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 39 U.S. PLANT DERIVED SUGAR IN PLANT-DERIVED AND SYNTHETIC SUGAR MARKET, BY CATEGORY, 2020-2029 (USD MILLION)

TABLE 40 U.S. SYNTHETIC SUGAR IN PLANT-DERIVED AND SYNTHETIC SUGAR MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 41 U.S. PLANT-DERIVED AND SYNTHETIC SUGAR MARKET, BY FORM, 2020-2029 (USD MILLION)

TABLE 42 U.S. DRY IN PLANT-DERIVED AND SYNTHETIC SUGAR MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 43 U.S. PLANT-DERIVED AND SYNTHETIC SUGAR MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 44 U.S. FOOD & BEVERAGES IN PLANT-DERIVED AND SYNTHETIC SUGAR MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 45 U.S. BAKERY IN PLANT-DERIVED AND SYNTHETIC SUGAR MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 46 U.S. DAIRY PRODUCTS IN PLANT-DERIVED AND SYNTHETIC SUGAR MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 47 U.S. PROCESSED FOOD IN PLANT-DERIVED AND SYNTHETIC SUGAR MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 48 U.S. CONFECTIONERY IN PLANT-DERIVED AND SYNTHETIC SUGAR MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 49 U.S. FROZEN DESSERTS IN PLANT-DERIVED AND SYNTHETIC SUGAR MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 50 U.S. INFANT FORMULA IN PLANT-DERIVED AND SYNTHETIC SUGAR MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 51 U.S. CONVENIENCE FOOD IN PLANT-DERIVED AND SYNTHETIC SUGAR MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 52 U.S. BEVERAGES PLANT-DERIVED AND SYNTHETIC SUGAR MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 53 U.S. DAIRY BASED DRINKS IN PLANT-DERIVED AND SYNTHETIC SUGAR MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 54 U.S. FOOD & BEVERAGES IN PLANT-DERIVED AND SYNTHETIC SUGAR MARKET, BY SWEETENER TYPE, 2020-2029 (USD MILLION)

TABLE 55 U.S. DIETARY SUPPLEMENTS IN PLANT-DERIVED AND SYNTHETIC SUGAR MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 56 U.S. DIETARY SUPPLEMENTS IN PLANT-DERIVED AND SYNTHETIC SUGAR MARKET, BY SWEETENER TYPE, 2020-2029 (USD MILLION)

TABLE 57 U.S. PHARMACEUTICAL IN PLANT-DERIVED AND SYNTHETIC SUGAR MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 58 U.S. PHARMACEUTICAL IN PLANT-DERIVED AND SYNTHETIC SUGAR MARKET, BY SWEETENER TYPE, 2020-2029 (USD MILLION)

TABLE 59 U.S. SPORTS NUTRITION IN PLANT-DERIVED AND SYNTHETIC SUGAR MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 60 U.S. SPORTS NUTRITION IN PLANT-DERIVED AND SYNTHETIC SUGAR MARKET, BY SWEETENER TYPE, 2020-2029 (USD MILLION)

TABLE 61 U.S. OTHERS IN PLANT-DERIVED AND SYNTHETIC SUGAR MARKET, BY SWEETENER TYPE, 2020-2029 (USD MILLION)

TABLE 62 CANADA PLANT-DERIVED AND SYNTHETIC SUGAR MARKET, 2020-2029

TABLE 63 CANADA PLANT-DERIVED AND SYNTHETIC SUGAR MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 64 CANADA PLANT DERIVED SUGAR IN PLANT-DERIVED AND SYNTHETIC SUGAR MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 65 CANADA PLANT DERIVED SUGAR IN PLANT-DERIVED AND SYNTHETIC SUGAR MARKET, BY CATEGORY, 2020-2029 (USD MILLION)

TABLE 66 CANADA SYNTHETIC SUGAR IN PLANT-DERIVED AND SYNTHETIC SUGAR MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 67 CANADA PLANT-DERIVED AND SYNTHETIC SUGAR MARKET, BY FORM, 2020-2029 (USD MILLION)

TABLE 68 CANADA DRY IN PLANT-DERIVED AND SYNTHETIC SUGAR MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 69 CANADA PLANT-DERIVED AND SYNTHETIC SUGAR MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 70 CANADA FOOD & BEVERAGES IN PLANT-DERIVED AND SYNTHETIC SUGAR MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 71 CANADA BAKERY IN PLANT-DERIVED AND SYNTHETIC SUGAR MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 72 CANADA DAIRY PRODUCTS IN PLANT-DERIVED AND SYNTHETIC SUGAR MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 73 CANADA PROCESSED FOOD IN PLANT-DERIVED AND SYNTHETIC SUGAR MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 74 CANADA CONFECTIONERY IN PLANT-DERIVED AND SYNTHETIC SUGAR MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 75 CANADA FROZEN DESSERTS IN PLANT-DERIVED AND SYNTHETIC SUGAR MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 76 CANADA INFANT FORMULA IN PLANT-DERIVED AND SYNTHETIC SUGAR MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 77 CANADA CONVENIENCE FOOD IN PLANT-DERIVED AND SYNTHETIC SUGAR MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 78 CANADA BEVERAGES PLANT-DERIVED AND SYNTHETIC SUGAR MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 79 CANADA DAIRY BASED DRINKS IN PLANT-DERIVED AND SYNTHETIC SUGAR MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 80 CANADA FOOD & BEVERAGES IN PLANT-DERIVED AND SYNTHETIC SUGAR MARKET, BY SWEETENER TYPE, 2020-2029 (USD MILLION)

TABLE 81 CANADA DIETARY SUPPLEMENTS IN PLANT-DERIVED AND SYNTHETIC SUGAR MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 82 CANADA DIETARY SUPPLEMENTS IN PLANT-DERIVED AND SYNTHETIC SUGAR MARKET, BY SWEETENER TYPE, 2020-2029 (USD MILLION)

TABLE 83 CANADA PHARMACEUTICAL IN PLANT-DERIVED AND SYNTHETIC SUGAR MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 84 CANADA PHARMACEUTICAL IN PLANT-DERIVED AND SYNTHETIC SUGAR MARKET, BY SWEETENER TYPE, 2020-2029 (USD MILLION)

TABLE 85 CANADA SPORTS NUTRITION IN PLANT-DERIVED AND SYNTHETIC SUGAR MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 86 CANADA SPORTS NUTRITION IN PLANT-DERIVED AND SYNTHETIC SUGAR MARKET, BY SWEETENER TYPE, 2020-2029 (USD MILLION)

TABLE 87 CANADA OTHERS IN PLANT-DERIVED AND SYNTHETIC SUGAR MARKET, BY SWEETENER TYPE, 2020-2029 (USD MILLION)

TABLE 88 MEXICO PLANT-DERIVED AND SYNTHETIC SUGAR MARKET, 2020-2029

TABLE 89 MEXICO PLANT-DERIVED AND SYNTHETIC SUGAR MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 90 MEXICO PLANT DERIVED SUGAR IN PLANT-DERIVED AND SYNTHETIC SUGAR MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 91 MEXICO PLANT DERIVED SUGAR IN PLANT-DERIVED AND SYNTHETIC SUGAR MARKET, BY CATEGORY, 2020-2029 (USD MILLION)

TABLE 92 MEXICO SYNTHETIC SUGAR IN PLANT-DERIVED AND SYNTHETIC SUGAR MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 93 MEXICO PLANT-DERIVED AND SYNTHETIC SUGAR MARKET, BY FORM, 2020-2029 (USD MILLION)

TABLE 94 MEXICO DRY IN PLANT-DERIVED AND SYNTHETIC SUGAR MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 95 MEXICO PLANT-DERIVED AND SYNTHETIC SUGAR MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 96 MEXICO FOOD & BEVERAGES IN PLANT-DERIVED AND SYNTHETIC SUGAR MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 97 MEXICO BAKERY IN PLANT-DERIVED AND SYNTHETIC SUGAR MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 98 MEXICO DAIRY PRODUCTS IN PLANT-DERIVED AND SYNTHETIC SUGAR MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 99 MEXICO PROCESSED FOOD IN PLANT-DERIVED AND SYNTHETIC SUGAR MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 100 MEXICO CONFECTIONERY IN PLANT-DERIVED AND SYNTHETIC SUGAR MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 101 MEXICO FROZEN DESSERTS IN PLANT-DERIVED AND SYNTHETIC SUGAR MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 102 MEXICO INFANT FORMULA IN PLANT-DERIVED AND SYNTHETIC SUGAR MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 103 MEXICO CONVENIENCE FOOD IN PLANT-DERIVED AND SYNTHETIC SUGAR MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 104 MEXICO BEVERAGES PLANT-DERIVED AND SYNTHETIC SUGAR MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 105 MEXICO DAIRY BASED DRINKS IN PLANT-DERIVED AND SYNTHETIC SUGAR MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 106 MEXICO FOOD & BEVERAGES IN PLANT-DERIVED AND SYNTHETIC SUGAR MARKET, BY SWEETENER TYPE, 2020-2029 (USD MILLION)

TABLE 107 MEXICO DIETARY SUPPLEMENTS IN PLANT-DERIVED AND SYNTHETIC SUGAR MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 108 MEXICO DIETARY SUPPLEMENTS IN PLANT-DERIVED AND SYNTHETIC SUGAR MARKET, BY SWEETENER TYPE, 2020-2029 (USD MILLION)

TABLE 109 MEXICO PHARMACEUTICAL IN PLANT-DERIVED AND SYNTHETIC SUGAR MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 110 MEXICO PHARMACEUTICAL IN PLANT-DERIVED AND SYNTHETIC SUGAR MARKET, BY SWEETENER TYPE, 2020-2029 (USD MILLION)

TABLE 111 MEXICO SPORTS NUTRITION IN PLANT-DERIVED AND SYNTHETIC SUGAR MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 112 MEXICO SPORTS NUTRITION IN PLANT-DERIVED AND SYNTHETIC SUGAR MARKET, BY SWEETENER TYPE, 2020-2029 (USD MILLION)

TABLE 113 MEXICO OTHERS IN PLANT-DERIVED AND SYNTHETIC SUGAR MARKET, BY SWEETENER TYPE, 2020-2029 (USD MILLION)

List of Figure

FIGURE 1 NORTH AMERICA PLANT-DERIVED AND SYNTHETIC SUGAR MARKET: SEGMENTATION

FIGURE 2 NORTH AMERICA PLANT-DERIVED AND SYNTHETIC SUGAR MARKET: DATA TRIANGULATION

FIGURE 3 NORTH AMERICA PLANT-DERIVED AND SYNTHETIC SUGAR MARKET: DROC ANALYSIS

FIGURE 4 NORTH AMERICA PLANT-DERIVED AND SYNTHETIC SUGAR MARKET: GLOBAL VS REGIONAL ANALYSIS

FIGURE 5 NORTH AMERICA PLANT-DERIVED AND SYNTHETIC SUGAR MARKET: COMPANY RESEARCH ANALYSIS

FIGURE 6 NORTH AMERICA PLANT-DERIVED AND SYNTHETIC SUGAR MARKET: INTERVIEW DEMOGRAPHICS

FIGURE 7 NORTH AMERICA PLANT-DERIVED AND SYNTHETIC SUGAR MARKET: DBMR POSITION GRID

FIGURE 8 NORTH AMERICA PLANT-DERIVED AND SYNTHETIC SUGAR MARKET: VENDOR SHARE ANALYSIS

FIGURE 9 NORTH AMERICA PLANT-DERIVED AND SYNTHETIC SUGAR MARKET: SEGMENTATION

FIGURE 10 THE HIGH DEMAND FOR HEALTHY FOOD INGREDIENTS IN FOOD AND BEVERAGE SECTOR IS EXPECTED TO DRIVE THE NORTH AMERICA PLANT-DERIVED AND SYNTHETIC SUGAR MARKET IN THE FORECAST PERIOD OF 2022 TO 2029

FIGURE 11 THE PLANT DERIVED SUGAR SEGMENT IS EXPECTED TO ACCOUNT FOR THE LARGEST SHARE OF THE NORTH AMERICA PLANT-DERIVED AND SYNTHETIC SUGAR MARKET IN THE FORECAST PERIOD OF 2022 TO 2029

FIGURE 12 VALUE CHAIN OF PLANT DERIVED SUGAR AND SYNTHETIC SUGAR

FIGURE 13 SUPPLY CHAIN OF PLANT-DERIVED SUGAR

FIGURE 14 SUPPLY CHAIN OF SYNTHETIC SUGAR

FIGURE 15 DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES OF THE NORTH AMERICA PLANT-DERIVED AND SYNTHETIC SUGAR MARKET

FIGURE 16 NORTH AMERICA PLANT-DERIVED AND SYNTHETIC SUGAR MARKET, BY TYPE, 2021

FIGURE 17 NORTH AMERICA PLANT-DERIVED AND SYNTHETIC SUGAR MARKET, BY FORM, 2021

FIGURE 18 NORTH AMERICA PLANT-DERIVED AND SYNTHETIC SUGAR MARKET : BY APPLICATION, 2021

FIGURE 19 NORTH AMERICA PLANT-DERIVED AND SYNTHETIC SUGAR MARKET: SNAPSHOT (2021)

FIGURE 20 NORTH AMERICA PLANT-DERIVED AND SYNTHETIC SUGAR MARKET: BY COUNTRY (2021)

FIGURE 21 NORTH AMERICA PLANT-DERIVED AND SYNTHETIC SUGAR MARKET: BY COUNTRY (2022 & 2029)

FIGURE 22 NORTH AMERICA PLANT-DERIVED AND SYNTHETIC SUGAR MARKET: BY COUNTRY (2021 & 2029)

FIGURE 23 NORTH AMERICA PLANT-DERIVED AND SYNTHETIC SUGAR MARKET: BY TYPE (2022 - 2029)

FIGURE 24 NORTH AMERICA: COMPANY SHARE 2021 (%)

منهجية البحث

يتم جمع البيانات وتحليل سنة الأساس باستخدام وحدات جمع البيانات ذات أحجام العينات الكبيرة. تتضمن المرحلة الحصول على معلومات السوق أو البيانات ذات الصلة من خلال مصادر واستراتيجيات مختلفة. تتضمن فحص وتخطيط جميع البيانات المكتسبة من الماضي مسبقًا. كما تتضمن فحص التناقضات في المعلومات التي شوهدت عبر مصادر المعلومات المختلفة. يتم تحليل بيانات السوق وتقديرها باستخدام نماذج إحصائية ومتماسكة للسوق. كما أن تحليل حصة السوق وتحليل الاتجاهات الرئيسية هي عوامل النجاح الرئيسية في تقرير السوق. لمعرفة المزيد، يرجى طلب مكالمة محلل أو إرسال استفسارك.

منهجية البحث الرئيسية التي يستخدمها فريق بحث DBMR هي التثليث البيانات والتي تتضمن استخراج البيانات وتحليل تأثير متغيرات البيانات على السوق والتحقق الأولي (من قبل خبراء الصناعة). تتضمن نماذج البيانات شبكة تحديد موقف البائعين، وتحليل خط زمني للسوق، ونظرة عامة على السوق ودليل، وشبكة تحديد موقف الشركة، وتحليل براءات الاختراع، وتحليل التسعير، وتحليل حصة الشركة في السوق، ومعايير القياس، وتحليل حصة البائعين على المستوى العالمي مقابل الإقليمي. لمعرفة المزيد عن منهجية البحث، أرسل استفسارًا للتحدث إلى خبراء الصناعة لدينا.

التخصيص متاح

تعد Data Bridge Market Research رائدة في مجال البحوث التكوينية المتقدمة. ونحن نفخر بخدمة عملائنا الحاليين والجدد بالبيانات والتحليلات التي تتطابق مع هدفهم. ويمكن تخصيص التقرير ليشمل تحليل اتجاه الأسعار للعلامات التجارية المستهدفة وفهم السوق في بلدان إضافية (اطلب قائمة البلدان)، وبيانات نتائج التجارب السريرية، ومراجعة الأدبيات، وتحليل السوق المجدد وقاعدة المنتج. ويمكن تحليل تحليل السوق للمنافسين المستهدفين من التحليل القائم على التكنولوجيا إلى استراتيجيات محفظة السوق. ويمكننا إضافة عدد كبير من المنافسين الذين تحتاج إلى بيانات عنهم بالتنسيق وأسلوب البيانات الذي تبحث عنه. ويمكن لفريق المحللين لدينا أيضًا تزويدك بالبيانات في ملفات Excel الخام أو جداول البيانات المحورية (كتاب الحقائق) أو مساعدتك في إنشاء عروض تقديمية من مجموعات البيانات المتوفرة في التقرير.