North America Medical Device Regulatory Affairs Outsourcing Market

حجم السوق بالمليار دولار أمريكي

CAGR :

%

USD

2.93 Billion

USD

7.46 Billion

2025

2033

USD

2.93 Billion

USD

7.46 Billion

2025

2033

| 2026 –2033 | |

| USD 2.93 Billion | |

| USD 7.46 Billion | |

|

|

|

|

تقسيم سوق الاستعانة بمصادر خارجية للشؤون التنظيمية للأجهزة الطبية في أمريكا الشمالية، حسب الخدمات (خدمات الشؤون التنظيمية، والاستشارات المتعلقة بالجودة، والكتابة الطبية)، والمنتج (السلع التامة الصنع، والإلكترونيات، والمواد الخام)، ونوع الجهاز (الفئة الأولى، والفئة الثانية، والفئة الثالثة)، والتطبيق (أمراض القلب، والتصوير التشخيصي، وجراحة العظام، والتشخيص المخبري، وطب العيون، والجراحة العامة والتجميلية، وتوصيل الأدوية، وطب الأسنان، والتنظير الداخلي، ورعاية مرضى السكري، وغيرها)، والمستخدم النهائي (شركات الأجهزة الطبية الصغيرة، وشركات الأجهزة الطبية المتوسطة، وشركات الأجهزة الطبية الكبيرة)، - اتجاهات الصناعة وتوقعاتها حتى عام 2033

حجم سوق الاستعانة بمصادر خارجية للشؤون التنظيمية للأجهزة الطبية في أمريكا الشمالية

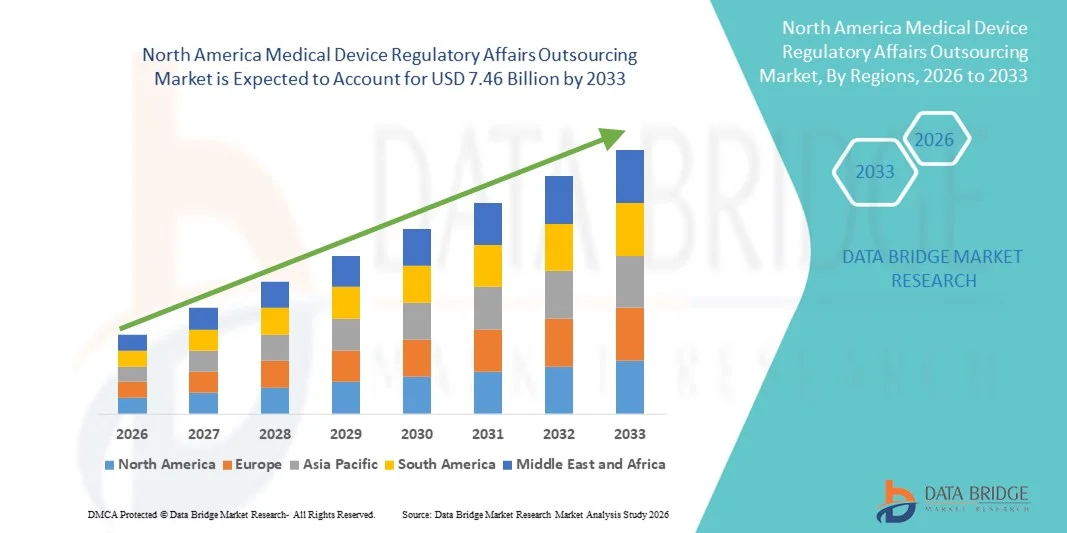

- بلغت قيمة سوق الاستعانة بمصادر خارجية للشؤون التنظيمية للأجهزة الطبية في أمريكا الشمالية 2.93 مليار دولار أمريكي في عام 2025، ومن المتوقع أن تصل إلى 7.46 مليار دولار أمريكي بحلول عام 2033 ، بمعدل نمو سنوي مركب قدره 12.40% خلال فترة التوقعات.

- يعود نمو السوق إلى حد كبير إلى تزايد تعقيد المتطلبات التنظيمية في قطاعات الأدوية والتكنولوجيا الحيوية والأجهزة الطبية، مما يدفع الشركات إلى البحث عن خدمات خارجية متخصصة لإدارة الامتثال.

- علاوة على ذلك، فإن الطلب المتزايد على تقديم الطلبات التنظيمية بكفاءة وفعالية من حيث التكلفة وفي الوقت المناسب يدفع إلى تبني حلول الاستعانة بمصادر خارجية للشؤون التنظيمية. وتساهم هذه العوامل المتضافرة في تسريع تبني خدمات الاستعانة بمصادر خارجية للشؤون التنظيمية، مما يعزز نمو هذا القطاع عالميًا بشكل ملحوظ.

تحليل سوق الاستعانة بمصادر خارجية للشؤون التنظيمية للأجهزة الطبية في أمريكا الشمالية

- يكتسب سوق الاستعانة بمصادر خارجية للشؤون التنظيمية للأجهزة الطبية، والذي يشمل تفويض الاستراتيجية التنظيمية، ووثائق الامتثال، وتسجيل المنتجات، وأنشطة مراقبة ما بعد التسويق إلى مزودي خدمات متخصصين، أهمية متزايدة لشركات الأجهزة الطبية التي تعمل في ظل أطر تنظيمية معقدة ومتطورة في جميع أنحاء الشرق الأوسط.

- تُعدّ زيادة صرامة لوائح الأجهزة الطبية، وتزايد الطلب على تسريع الموافقات، والحاجة إلى خبرات تنظيمية محلية، عوامل رئيسية تدفع إلى تبني خدمات الاستعانة بمصادر خارجية للشؤون التنظيمية للأجهزة الطبية. وتستفيد الشركات من شركاء الاستعانة بمصادر خارجية لتقليل مخاطر الامتثال، وتبسيط جداول الموافقات، والتركيز على أنشطة تطوير المنتجات الأساسية وتسويقها.

- هيمنت الولايات المتحدة على سوق الاستعانة بمصادر خارجية للشؤون التنظيمية للأجهزة الطبية، محققةً أكبر حصة من الإيرادات بلغت حوالي 42.5% في عام 2025، مدفوعةً بنظام بيئي راسخ للرعاية الصحية والأجهزة الطبية، ورقابة تنظيمية قوية من قِبل إدارة الغذاء والدواء الأمريكية، وارتفاع حجم عمليات الأجهزة الطبية، ووجود شركات استشارية تنظيمية رائدة. وقد ساهم تركيز البلاد على الامتثال، والموافقات السريعة، وإجراءات ترخيص السوق الفعّالة في زيادة الطلب بشكل ملحوظ على خدمات الاستعانة بمصادر خارجية متخصصة.

- من المتوقع أن تكون كندا السوق الأسرع نموًا، مسجلةً معدل نمو سنوي مركب يبلغ حوالي 10.1% خلال فترة التوقعات، مدعومةً بالتحديث السريع للرعاية الصحية، والتواجد المتزايد لمصنعي الأجهزة الطبية العالميين، وتطور الأطر التنظيمية في إطار وزارة الصحة الكندية. كما أن تزايد الوعي بحلول التعهيد الفعالة وتبسيط الإجراءات التنظيمية يُسهمان في دفع عجلة توسع السوق في جميع أنحاء البلاد.

- استحوذ قطاع المنتجات النهائية على أكبر حصة من إيرادات السوق بنسبة 52.1% في عام 2025، حيث تخضع الأجهزة الطبية النهائية لموافقات صارمة قبل طرحها في السوق ومتطلبات مراقبة ما بعد طرحها في السوق.

نطاق التقرير وتجزئة سوق الاستعانة بمصادر خارجية للشؤون التنظيمية للأجهزة الطبية

|

صفات |

الاستعانة بمصادر خارجية للشؤون التنظيمية للأجهزة الطبية: رؤى رئيسية حول السوق |

|

القطاعات التي تم تغطيتها |

|

|

الدول المشمولة |

أمريكا الشمالية

|

|

اللاعبون الرئيسيون في السوق |

|

|

فرص السوق |

|

|

مجموعات بيانات القيمة المضافة |

بالإضافة إلى المعلومات المتعلقة بسيناريوهات السوق مثل قيمة السوق ومعدل النمو والتجزئة والتغطية الجغرافية واللاعبين الرئيسيين، تتضمن تقارير السوق التي أعدتها شركة Data Bridge Market Research أيضًا تحليلًا متعمقًا من قبل الخبراء، وعلم الأوبئة الخاص بالمرضى، وتحليل خطوط الإنتاج، وتحليل التسعير، والإطار التنظيمي. |

اتجاهات سوق الاستعانة بمصادر خارجية للشؤون التنظيمية للأجهزة الطبية في أمريكا الشمالية

تزايد تعقيد لوائح الأجهزة الطبية عبر المناطق

- يُعدّ تزايد تعقيد الأطر التنظيمية التي تحكم الأجهزة الطبية وتطورها المستمر اتجاهاً هاماً ومتسارعاً في سوق الاستعانة بمصادر خارجية للشؤون التنظيمية للأجهزة الطبية. وتعمل دول المنطقة على تعزيز إجراءات الموافقة، ومتطلبات مراقبة ما بعد التسويق، ومعايير الامتثال، وذلك لمواءمتها بشكل أوثق مع المعايير الدولية.

- فعلى سبيل المثال، قامت الهيئات التنظيمية في دول مجلس التعاون الخليجي وجنوب إفريقيا بتطبيق أنظمة تسجيل أكثر تنظيماً للأجهزة الطبية، مما دفع الشركات المصنعة إلى الاعتماد على شركاء متخصصين في مجال الاستعانة بمصادر خارجية للشؤون التنظيمية لتسهيل إجراءات التقديم المحلية ومتطلبات التوثيق بكفاءة.

- يؤدي التوسع المتزايد في اعتماد المعايير الدولية، مثل معيار ISO 13485 وأنظمة التصنيف القائمة على المخاطر، إلى زيادة الطلب على الخبرات الخارجية لإدارة الملفات التنظيمية والوثائق الفنية وأنشطة الامتثال للجودة. يوفر شركاء التعهيد الخارجي معرفة خاصة بكل منطقة، مما يساعد على تقليل مدد الموافقة والمخاطر التنظيمية.

- بالإضافة إلى ذلك، يشجع توسع شركات الأجهزة الطبية متعددة الجنسيات في أسواق الشرق الأوسط وأفريقيا على استخدام خدمات تنظيمية خارجية لإدارة عمليات التسجيل في بلدان متعددة من خلال نهج مركزي وفعال من حيث التكلفة.

- يُعيد هذا التوجه نحو خدمات الدعم التنظيمي الاحترافية تشكيل كيفية تعامل المصنّعين مع دخول السوق والامتثال، حيث أصبح الاستعانة بمصادر خارجية ضرورة استراتيجية بدلاً من خدمة اختيارية في جميع أنحاء المنطقة.

- مع ازدياد التدقيق التنظيمي، يستمر الطلب على مزودي خدمات الشؤون التنظيمية المتخصصين ذوي الخبرة الإقليمية في النمو بين مصنعي الأجهزة الطبية العالميين والمحليين على حد سواء.

ديناميكيات سوق الاستعانة بمصادر خارجية للشؤون التنظيمية للأجهزة الطبية في أمريكا الشمالية

السائق

تزايد توسع سوق الأجهزة الطبية وصرامة اللوائح التنظيمية

- يُعد التوسع السريع لقطاع الأجهزة الطبية في جميع أنحاء العالم، مدفوعًا بزيادة الاستثمارات في الرعاية الصحية، والنمو السكاني، وارتفاع معدل انتشار الأمراض المزمنة، محركًا رئيسيًا لخدمات الاستعانة بمصادر خارجية للشؤون التنظيمية.

- فعلى سبيل المثال، أدى التطور المتزايد للبنية التحتية للرعاية الصحية في دول مثل المملكة العربية السعودية والإمارات العربية المتحدة وجنوب إفريقيا إلى زيادة الطلب على الأجهزة الطبية، مما زاد من عبء العمل التنظيمي على الشركات المصنعة التي تسعى للحصول على الموافقات السوقية في الوقت المناسب.

- مع فرض السلطات التنظيمية متطلبات امتثال أكثر صرامة، يلجأ المصنعون بشكل متزايد إلى الاستعانة بمصادر خارجية للأنشطة التنظيمية من خلال شركات متخصصة لضمان الدقة والاتساق وتسريع الموافقات على المنتجات

- علاوة على ذلك، غالباً ما تفتقر شركات الأجهزة الطبية الصغيرة والمتوسطة الحجم إلى الخبرة التنظيمية الداخلية اللازمة للتعامل مع اللوائح الإقليمية المتنوعة، مما يجعل الاستعانة بمصادر خارجية حلاً عملياً لإدارة التكاليف وتقليل مخاطر الامتثال.

- إن الحاجة إلى الحفاظ على الامتثال التنظيمي طوال دورة حياة المنتج، بما في ذلك التجديدات والتغييرات والمراقبة ما بعد التسويق، لا تزال تدعم الطلب المستمر على خدمات التعهيد في المنطقة.

ضبط النفس/التحدي

محدودية التنسيق التنظيمي ونقص المهنيين المهرة

- يتمثل أحد التحديات الرئيسية في سوق الاستعانة بمصادر خارجية للشؤون التنظيمية للأجهزة الطبية في عدم وجود أطر تنظيمية متناسقة عبر البلدان، مما يزيد من التعقيد ومتطلبات الموارد لمقدمي الخدمات والمصنعين على حد سواء.

- فعلى سبيل المثال، قد تؤدي اختلافات صيغ التقديم، والجداول الزمنية للموافقة، والتوقعات التنظيمية في أسواق أفريقيا والشرق الأوسط إلى تأخيرات وزيادة في التكاليف التشغيلية، حتى عند الاستعانة بمصادر خارجية للأنشطة التنظيمية.

- ومن المعوقات الهامة الأخرى محدودية توافر المتخصصين ذوي المهارات العالية في مجال التنظيم والذين يتمتعون بمعرفة متعمقة باللوائح المحلية والمعايير الدولية، لا سيما في الأسواق الأفريقية الناشئة.

- بالإضافة إلى ذلك، قد تدفع المخاوف المتعلقة بسرية البيانات، وثغرات التواصل، والاعتماد على مزودي خدمات خارجيين، بعض المصنّعين إلى التردد قبل إسناد الوظائف التنظيمية بالكامل إلى جهات خارجية.

- يُعدّ التغلب على هذه التحديات من خلال بناء القدرات التنظيمية، ومبادرات التنسيق الإقليمي، والاستثمار في تنمية القوى العاملة الماهرة، أمراً بالغ الأهمية للنمو طويل الأجل وفعالية سوق الاستعانة بمصادر خارجية للشؤون التنظيمية للأجهزة الطبية في الشرق الأوسط وأفريقيا.

نطاق سوق الاستعانة بمصادر خارجية للشؤون التنظيمية للأجهزة الطبية في أمريكا الشمالية

يتم تقسيم السوق على أساس الخدمات والمنتج ونوع الجهاز والتطبيق والمستخدم النهائي.

- الخدمات

استنادًا إلى الخدمات، ينقسم سوق الاستعانة بمصادر خارجية للشؤون التنظيمية للأجهزة الطبية إلى خدمات الشؤون التنظيمية، والاستشارات المتعلقة بالجودة، والكتابة الطبية. وقد استحوذ قطاع خدمات الشؤون التنظيمية على الحصة الأكبر من إيرادات السوق بنسبة 46.8% في عام 2025، وذلك نتيجة لتزايد تعقيد لوائح الأجهزة الطبية في مناطق رئيسية مثل أمريكا الشمالية وأوروبا وآسيا والمحيط الهادئ. وتعتمد الشركات على خدمات خارجية للشؤون التنظيمية لتقديم طلبات ما قبل التسويق، وإعداد الوثائق الفنية، وإدارة الامتثال بعد التسويق. وتُحفز المتطلبات التنظيمية المتزايدة للأجهزة من الفئتين الثانية والثالثة الطلب على هذه الخدمات. كما يُسهم عولمة عمليات الأجهزة الطبية وتسجيل المنتجات عبر الحدود في دعم هذا القطاع. وتُقلل الاستعانة بمصادر خارجية للشؤون التنظيمية من التكاليف التشغيلية مع ضمان الامتثال لإرشادات إدارة الغذاء والدواء الأمريكية (FDA) ولوائح الأجهزة الطبية الأوروبية (EU MDR) ولوائح التشخيص المختبري في المختبر (IVDR). ويستفيد هذا القطاع من زيادة عمليات التدقيق التنظيمي والتحديثات المتكررة في معايير التوثيق. وتُعد إدارة دورة حياة الأجهزة، وإعداد تقارير اليقظة، وتخفيف المخاطر من العوامل الرئيسية الدافعة لهذا القطاع. وتُولي الشركات اهتمامًا متزايدًا للاستعانة بمصادر خارجية لتعزيز سرعة طرح المنتجات في السوق مع تقليل العبء على الموارد الداخلية. يُعزز تزايد استخدام الأجهزة الطبية المتطورة والابتكار السريع للمنتجات من هيمنتها. كما يُسهم التوسع في الأسواق الناشئة في خلق طلب مستمر على خدمات الشؤون التنظيمية.

من المتوقع أن يشهد قطاع الكتابة الطبية أسرع معدل نمو سنوي مركب بنسبة 11.4% خلال الفترة من 2026 إلى 2033، مدفوعًا بالطلب العالمي المتزايد على تقارير التقييم السريري عالية الجودة، والملفات التقنية، والوثائق التنظيمية. وتعتمد شركات الأجهزة الطبية الصغيرة والمتوسطة الحجم بشكل متزايد على كتّاب طبيين خارجيين. وتتطلب الهيئات التنظيمية وثائق دقيقة ومتوافقة مع المعايير للحصول على الموافقات اللازمة للأجهزة، مما يعزز النمو. كما أن اعتماد منصات التقديم الإلكتروني يُسرّع من وتيرة الاستعانة بمصادر خارجية. ويساهم نمو التجارب السريرية، وجمع الأدلة من الواقع، والإبلاغ عن بيانات ما بعد التسويق في زيادة الطلب. وتساهم الرقمنة وأدوات الكتابة الطبية المدعومة بالذكاء الاصطناعي في تسريع إعداد الوثائق. وتسعى الشركات إلى الحصول على عقود مرنة للاستعانة بمصادر خارجية لتخفيف العبء على القوى العاملة الداخلية. كما أن توسع المجالات العلاجية، بما في ذلك أمراض القلب، وجراحة العظام، وأجهزة التشخيص المختبري، يدفع النمو بشكل أكبر. ويدعم التنسيق التنظيمي الدولي المتزايد احتياجات الاستعانة بمصادر خارجية عبر الحدود. وبشكل عام، يستفيد هذا القطاع من تزايد تعقيد الأنظمة التنظيمية وأهمية الوثائق الطبية الدقيقة.

- المنتج الفرعي

استنادًا إلى نوع المنتج، ينقسم سوق الاستعانة بمصادر خارجية للشؤون التنظيمية للأجهزة الطبية إلى ثلاثة قطاعات: المنتجات النهائية، والإلكترونيات، والمواد الخام. وقد استحوذ قطاع المنتجات النهائية على الحصة الأكبر من إيرادات السوق بنسبة 52.1% في عام 2025، نظرًا لخضوع الأجهزة الطبية النهائية لعمليات موافقة صارمة قبل طرحها في السوق، فضلًا عن متطلبات مراقبة ما بعد الطرح. وتلجأ الشركات إلى الاستعانة بمصادر خارجية للعمليات التنظيمية لضمان الامتثال السلس للوائح إدارة الغذاء والدواء الأمريكية (FDA) ولوائح الأجهزة الطبية الأوروبية (EU MDR) وغيرها من اللوائح الإقليمية. وتشمل المنتجات النهائية أجهزة في مجالات أمراض القلب، وجراحة العظام، والتشخيص المختبري، وطب العيون. وتساعد الاستعانة بمصادر خارجية على تقليل عبء العمل الداخلي مع ضمان الالتزام بمعايير الجودة والسلامة. ويسعى المصنّعون إلى الحصول على دعم الخبراء في مجال وضع العلامات، والتوثيق، والتحقق، وإعداد الأدلة السريرية. كما يدعم التدقيق المتزايد على المنتجات المركبة، والأجهزة المتكاملة مع البرمجيات، والأجهزة الطبية المتصلة، هيمنة الشركات على السوق. ويؤدي التوسع العالمي لعمليات الأجهزة الطبية إلى إبرام عقود طويلة الأجل للاستعانة بمصادر خارجية. وتساهم الاستعانة بمصادر خارجية في الحد من المخاطر المرتبطة بعمليات التدقيق وعقوبات عدم الامتثال. تُعطي الشركات الأولوية لسرعة طرح منتجاتها في السوق دون المساس بالامتثال للمعايير. ويُعدّ الرصد بعد التسويق والإبلاغ عن الأحداث الضارة من العوامل الدافعة الإضافية. ويسعى المصنّعون إلى تحسين تخصيص الموارد وخفض التكاليف من خلال الاستعانة بمصادر خارجية.

من المتوقع أن يشهد قطاع الإلكترونيات أسرع معدل نمو سنوي مركب بنسبة 10.7% خلال الفترة من 2026 إلى 2033، وذلك نتيجة لتزايد دمج البرمجيات والمكونات الرقمية في الأجهزة الطبية. يُعدّ الامتثال التنظيمي للبرمجيات والبرامج الثابتة وأمن الأجهزة المتصلة أمرًا معقدًا ومتطورًا باستمرار. ويُفضّل الاستعانة بمصادر خارجية لضمان الجاهزية التنظيمية وتسريع الموافقات. يدعم نمو الأجهزة القابلة للارتداء وأنظمة المراقبة عن بُعد وحلول الصحة الرقمية هذا القطاع. وتعتمد الشركات الناشئة والشركات الصغيرة والمتوسطة بشكل متزايد على شركاء متخصصين في الشؤون التنظيمية للأجهزة التي تعتمد بشكل كبير على الإلكترونيات. ويؤدي تبني الذكاء الاصطناعي والتعلم الآلي في الأجهزة الطبية إلى زيادة متطلبات التوثيق والاختبار. ويحفز التسويق عبر الحدود الطلب على وثائق تنظيمية موحدة. ويُسرّع اتجاه حلول الصحة المتصلة من وتيرة الاستعانة بمصادر خارجية لأنشطة الامتثال. وتسعى الشركات إلى تقليل الأعباء التشغيلية الداخلية مع الالتزام بالمعايير التنظيمية العالمية. كما يدعم توسع أجهزة التطبيب عن بُعد والأجهزة الطبية التي تدعم إنترنت الأشياء هذا النمو بشكل أكبر.

- حسب نوع الجهاز

استنادًا إلى نوع الجهاز، يُقسّم سوق الاستعانة بمصادر خارجية للشؤون التنظيمية للأجهزة الطبية إلى ثلاث فئات: الفئة الأولى، والفئة الثانية، والفئة الثالثة. وقد هيمنت أجهزة الفئة الثانية على السوق بحصة إيرادات بلغت 41.6% في عام 2025، وذلك نتيجةً لدخول عدد كبير من الأجهزة ذات التنظيم المتوسط إلى السوق. وتشمل متطلبات تقديم الطلبات التنظيمية لأجهزة الفئة الثانية الوثائق والملفات الفنية والامتثال لإرشادات إدارة الغذاء والدواء الأمريكية (FDA) 510(k) أو علامة CE. وتساعد الاستعانة بمصادر خارجية الشركات المصنعة على تبسيط إجراءات الموافقة وتقليل عبء العمل الداخلي. وتشكل أجهزة تقويم العظام والتشخيص والمراقبة جزءًا كبيرًا من منتجات الفئة الثانية. وتستفيد الشركات من الخبرات الخارجية لإدارة دورة حياة المنتج، ومراقبة ما بعد التسويق، وعمليات التدقيق التنظيمي. كما أن عولمة عمليات الأجهزة وزيادة الابتكار يدفعان الطلب بشكل أكبر. ويُعدّ خفض التكاليف والكفاءة ودخول السوق في الوقت المناسب من المزايا الرئيسية. ويعزز التعقيد التنظيمي في مناطق متعددة الاعتماد على الاستعانة بمصادر خارجية. وتُساهم أنشطة إدارة دورة الحياة، بما في ذلك تعديلات الأجهزة وتحديثاتها وإعداد التقارير، في نمو هذا القطاع. كما يُساهم تزايد استخدام الأجهزة الطبية في الأسواق الناشئة في هيمنته. تمثل الأجهزة من الفئة الثانية توازناً بين الابتكار والتعقيد التنظيمي، مما يجعل الاستعانة بمصادر خارجية أمراً ضرورياً.

من المتوقع أن يشهد قطاع الأجهزة الطبية من الفئة الثالثة أسرع نمو سنوي مركب بنسبة 12.8% خلال الفترة من 2026 إلى 2033، مدفوعًا بالتطور المتزايد للأجهزة القابلة للزرع، والداعمة للحياة، والأجهزة عالية الخطورة. تتطلب هذه الأجهزة أدلة سريرية شاملة، ودراسات تحقق، وموافقات تنظيمية. يساهم الاستعانة بمصادر خارجية للشؤون التنظيمية في تقليل تأخيرات الموافقة وضمان الامتثال للمعايير العالمية. كما أن التدقيق في الأجهزة عالية الخطورة، بما في ذلك غرسات القلب وأجهزة تعديل الأعصاب، يدعم نمو السوق. ويعتمد المصنّعون على شركاء تنظيميين لتوفير الوثائق، وتقارير التقييم السريري، والملفات الفنية. ويؤدي الاتجاه المتزايد نحو المنتجات المركبة إلى زيادة الطلب على الاستعانة بمصادر خارجية. كما تدعم متطلبات المراقبة المستمرة لما بعد التسويق والإبلاغ عن الأحداث الضارة التوسع. وتعزز التحديثات التنظيمية بموجب لوائح الأجهزة الطبية (MDR) ولوائح التشخيص المختبري (IVDR) نمو القطاع. وتلجأ الشركات الصغيرة والمتوسطة بشكل متزايد إلى الاستعانة بمصادر خارجية للامتثال لمتطلبات الأجهزة الطبية من الفئة الثالثة نظرًا لتعقيدها. ويدعم الابتكار في المواد المتوافقة حيويًا والغرسات الذكية تسارع نمو القطاع. وتؤدي المنتجات عالية القيمة في هذا القطاع والمخاطر التنظيمية إلى استمرار الطلب على الاستعانة بمصادر خارجية.

- عن طريق التقديم

استنادًا إلى التطبيقات، يُقسّم سوق الاستعانة بمصادر خارجية للشؤون التنظيمية للأجهزة الطبية إلى قطاعات أمراض القلب، والتصوير التشخيصي، وجراحة العظام، والتشخيص المخبري، وطب العيون، والجراحة العامة والتجميلية، وتوصيل الأدوية، وطب الأسنان، والتنظير الداخلي، ورعاية مرضى السكري، وغيرها. استحوذ قطاع التشخيص المخبري على الحصة الأكبر من إيرادات السوق بنسبة 30.2% في عام 2025، مدفوعًا بالطلب المتزايد على الاختبارات التشخيصية والطب الشخصي. تُعدّ الاستعانة بمصادر خارجية أمرًا بالغ الأهمية نظرًا لمتطلبات الامتثال الصارمة للائحة الاتحاد الأوروبي للأجهزة التشخيصية المخبرية (IVDR) وهيئة الغذاء والدواء الأمريكية (FDA). يعتمد المصنّعون على خبراء الشؤون التنظيمية للحصول على الموافقات على الأجهزة، والتحقق من صحتها، ووضع الملصقات عليها، ومراقبة ما بعد التسويق. يدعم توسع مراكز التشخيص والمختبرات السريرية ومرافق التشخيص الجزيئي هذا النمو. كما يُعزز ازدياد انتشار الأمراض المزمنة الطلب على أجهزة التشخيص الدقيقة. تسعى الشركات إلى خفض التكاليف التشغيلية وتخفيف المخاطر التنظيمية. يُعزز انتشار أجهزة التشخيص المخبري عالميًا متطلبات الاستعانة بمصادر خارجية. يتطلب الابتكار السريع للمنتجات دعمًا تنظيميًا في الوقت المناسب. يُحفز تصنيف أجهزة التشخيص المخبري بناءً على المخاطر الاعتماد على الاستعانة بمصادر خارجية. تساهم عمليات التدقيق التنظيمي، وعلامة المطابقة الأوروبية (CE)، وموافقات إدارة الغذاء والدواء الأمريكية (FDA) في زيادة النشاط السوقي. ويستفيد هذا القطاع من ارتفاع الاستثمارات في الكشف المبكر عن الأمراض والطب الدقيق.

من المتوقع أن يشهد قطاع رعاية مرضى السكري أسرع معدل نمو سنوي مركب بنسبة 13.3% خلال الفترة من 2026 إلى 2033، مدفوعًا بالارتفاع العالمي في معدلات انتشار مرض السكري واعتماد أنظمة مراقبة الجلوكوز المتصلة. تتسم المتطلبات التنظيمية لأجهزة مراقبة الجلوكوز المستمرة وأجهزة توصيل الأنسولين الذكية بالتعقيد، مما يزيد الطلب على الاستعانة بمصادر خارجية. وتعتمد الشركات الناشئة والشركات المصنعة متوسطة الحجم على شركاء خبراء في مجال التوثيق والملفات التقنية والامتثال. وتتطلب أجهزة إدارة مرض السكري المتكاملة مع الذكاء الاصطناعي دعمًا تنظيميًا إضافيًا. ويدعم نمو الأجهزة القابلة للارتداء وحلول الرعاية المنزلية توسع هذا القطاع. ويتطلب دخول الأسواق عبر الحدود تقديم طلبات تنظيمية موحدة. ويدفع التكامل بين العلاجات الرقمية والطب عن بُعد إلى زيادة الاستعانة بمصادر خارجية. وتُعد اليقظة بعد التسويق وإدارة المخاطر من العوامل الحاسمة. ويعزز تركيز الحكومات ومقدمي الرعاية الصحية على إدارة مرض السكري السوق. ويساهم تزايد تمويل المشاريع في حلول مرض السكري الرقمية في تسريع النمو. وتستفيد الشركات المصنعة الصغيرة من انخفاض تكاليف الامتثال الداخلي. وتشجع فجوة المعرفة التنظيمية بين الشركات الجديدة على زيادة اعتماد الاستعانة بمصادر خارجية.

- بواسطة المستخدم النهائي

استنادًا إلى المستخدم النهائي، يُقسّم سوق الاستعانة بمصادر خارجية للشؤون التنظيمية للأجهزة الطبية إلى ثلاث فئات: شركات الأجهزة الطبية الصغيرة، وشركات الأجهزة الطبية المتوسطة، وشركات الأجهزة الطبية الكبيرة. وقد هيمنت فئة شركات الأجهزة الطبية الكبيرة على السوق بحصة إيرادات بلغت 44.9% في عام 2025، وذلك بفضل محافظ منتجاتها الواسعة وعملياتها العالمية. تدعم الاستعانة بمصادر خارجية تقديم الطلبات التنظيمية في مختلف البلدان، وتضمن الامتثال للمعايير المتنوعة. تتطلب عمليات إطلاق المنتجات المتكررة وإدارة دورة حياة المنتج دعمًا من الخبراء. تستفيد الشركات من الاستعانة بمصادر خارجية لتحسين تخصيص الموارد وتقليل أعباء الامتثال الداخلية. تواجه الشركات الكبرى تدقيقًا تنظيميًا مكثفًا للأجهزة من الفئتين الثانية والثالثة، مما يعزز نمو هذا القطاع. يتم الاستعانة بشركات متخصصة في مراقبة ما بعد التسويق، والتقييمات السريرية، والوثائق الفنية. تساهم عمليات التدقيق التنظيمي، وعلامة CE، وموافقات إدارة الغذاء والدواء الأمريكية (FDA 510(k)) في زيادة الإقبال على الاستعانة بمصادر خارجية. يُعزز تخفيف المخاطر، وكفاءة التكلفة، وسرعة دخول السوق من هيمنة هذه الشركات. يتطلب التوسع في الأسواق الناشئة خبرة في مجال الاستعانة بمصادر خارجية. كما يُعزز تكامل البرامج والأجهزة المتصلة الطلب بشكل أكبر. يُمكّن الاستعانة بمصادر خارجية الشركات الكبيرة من التركيز على البحث والتطوير مع ضمان الامتثال للوائح التنظيمية.

من المتوقع أن يشهد قطاع شركات الأجهزة الطبية الصغيرة أسرع نمو سنوي مركب بنسبة 13.1% خلال الفترة من 2026 إلى 2033، مدفوعًا بمحدودية الخبرات التنظيمية الداخلية. وتعتمد الشركات الناشئة والشركات في مراحلها المبكرة بشكل كبير على الخدمات الخارجية لتلبية متطلبات الامتثال العالمية. ويساعد الاستعانة بمصادر خارجية على تقليل مدد الحصول على الموافقات وخفض التكاليف التشغيلية. كما يدعم النموَ الابتكارُ المتزايد في الأجهزة القابلة للارتداء والتشخيصية وأجهزة الرعاية المنزلية. وتجعل متطلبات التوثيق المعقدة والتقييم السريري وما بعد التسويق الاستعانة بمصادر خارجية أمرًا ضروريًا. وتسعى الشركات الممولة من رأس المال المخاطر إلى إيجاد حلول تنظيمية فعالة من حيث التكلفة. ويتطلب التوسع في السوق العالمية خبرة في اللوائح الإقليمية. وتُسرّع متطلبات MDR وIVDR سريعة التطور من اعتماد الاستعانة بمصادر خارجية. وتدعم الأدوات التنظيمية المدعومة بالذكاء الاصطناعي الشركات الصغيرة في توثيق المعلومات بكفاءة. ويُعدّ تخفيف مخاطر الامتثال محركًا رئيسيًا لنمو القطاع. وتستفيد الشركات الناشئة من الاستعانة بمصادر خارجية لتسريع طرح منتجاتها في السوق وتقليل عبء العمل الداخلي. كما تُعزز الشراكات المتزايدة مع منظمات البحث التعاقدية والاستشاريين التنظيميين آفاق النمو.

تحليل إقليمي لسوق الاستعانة بمصادر خارجية للشؤون التنظيمية للأجهزة الطبية في أمريكا الشمالية

- من المتوقع أن يشهد سوق الاستعانة بمصادر خارجية للشؤون التنظيمية للأجهزة الطبية في أمريكا الشمالية نموًا مطردًا خلال الفترة المتوقعة، مدعومًا بتعزيز الأطر التنظيمية، وزيادة الموافقات على الأجهزة الطبية، وتوسيع البنية التحتية للرعاية الصحية في جميع أنحاء المنطقة.

- تُولي الحكومات اهتمامًا متزايدًا بالامتثال التنظيمي، وتسجيل المنتجات، والمراقبة اللاحقة للتسويق لضمان سلامة المرضى ومعايير الجودة. ونتيجةً لذلك، يلجأ مصنّعو الأجهزة الطبية بشكل متزايد إلى الاستعانة بمصادر خارجية متخصصة في الشؤون التنظيمية لتسهيل التعامل مع المتطلبات التنظيمية المعقدة والمتغيرة بكفاءة.

- تساهم الاستثمارات المتزايدة في تحديث الرعاية الصحية، إلى جانب التوسع في استخدام التقنيات الطبية المتقدمة، في زيادة الطلب على خدمات الاستعانة بمصادر خارجية للشؤون التنظيمية في جميع أنحاء أمريكا الشمالية.

نظرة عامة على سوق الاستعانة بمصادر خارجية للشؤون التنظيمية للأجهزة الطبية في الولايات المتحدة: هيمنت

الولايات المتحدة على سوق الاستعانة بمصادر خارجية للشؤون التنظيمية للأجهزة الطبية، حيث استحوذت على ما يقارب 42.5% من حصة الإيرادات الإقليمية في عام 2025. ويعود هذا التفوق بشكل أساسي إلى وجود منظومة متكاملة للرعاية الصحية والأجهزة الطبية، ورقابة تنظيمية صارمة من إدارة الغذاء والدواء الأمريكية، وارتفاع حجم عمليات الأجهزة الطبية، ووجود شركات استشارية تنظيمية رائدة. وقد ساهم تركيز الولايات المتحدة على الامتثال، وسرعة الموافقات، وفعالية إجراءات ترخيص السوق، في زيادة الطلب بشكل ملحوظ على خدمات الاستعانة بمصادر خارجية متخصصة.

نظرة عامة على سوق الاستعانة بمصادر خارجية للشؤون التنظيمية للأجهزة الطبية في كندا: من المتوقع أن يسجل سوق الاستعانة بمصادر خارجية للشؤون التنظيمية للأجهزة الطبية

في كندا أسرع نمو في أمريكا الشمالية، بمعدل نمو سنوي مركب متوقع يبلغ حوالي 10.1% خلال فترة التوقعات. ويدعم هذا النمو التحديث السريع للرعاية الصحية، وتزايد حضور مصنعي الأجهزة الطبية العالميين، وتطور الأطر التنظيمية في كندا. كما أن ازدياد الوعي بحلول الاستعانة بمصادر خارجية الفعالة وتبسيط الإجراءات التنظيمية يُسهمان في دفع توسع السوق في جميع أنحاء البلاد.

حصة سوق الاستعانة بمصادر خارجية للشؤون التنظيمية للأجهزة الطبية في أمريكا الشمالية

تتصدر شركات راسخة قطاع الاستعانة بمصادر خارجية للشؤون التنظيمية للأجهزة الطبية، بما في ذلك:

- شركة Accell Clinical Research, LLC (الولايات المتحدة الأمريكية)

- جينباكت (الولايات المتحدة)

- شركة كريتيريوم (الولايات المتحدة الأمريكية)

- بروميديكا الدولية (الولايات المتحدة)

- شركة WuXiAppTec (الصين)

- ميدبيس (الولايات المتحدة)

- شركة PPD (الولايات المتحدة الأمريكية)

- مختبرات تشارلز ريفر (الولايات المتحدة الأمريكية)

- شركة ICON plc (الولايات المتحدة الأمريكية)

- كوفانس (الولايات المتحدة)

- شركة باركسيل الدولية (الولايات المتحدة الأمريكية)

- فريير

- شركة نافيتاس للأبحاث السريرية (الولايات المتحدة الأمريكية)

- شركة ميدليس (الولايات المتحدة الأمريكية)

- سايفورميكس (الولايات المتحدة)

- تيك تامينا (الولايات المتحدة الأمريكية)

- شركة أكورن للاستشارات التنظيمية المحدودة (أيرلندا)

- الخرائط الحيوية (ليتوانيا)

- المهنيون التنظيميون (أستراليا)

- شركة CompareNetworks (الولايات المتحدة الأمريكية)

آخر التطورات في سوق الاستعانة بمصادر خارجية للشؤون التنظيمية للأجهزة الطبية في أمريكا الشمالية

- في يناير 2023، قدمت شركة Medistri SA، وهي شركة سويسرية متخصصة في خدمات التكنولوجيا الطبية، حلاً استشارياً متكاملاً لإدارة الشؤون التنظيمية والجودة، مصمماً خصيصاً لمصنعي الأجهزة الطبية من الشركات الصغيرة والمتوسطة. وقد سهّل هذا الحل إجراءات الامتثال من خلال توفير دعم فعال من حيث التكلفة للحصول على علامة CE، وإعداد الملفات الفنية، ومراقبة ما بعد التسويق، مما يلبي حاجة أساسية للشركات التي تفتقر إلى فرق تنظيمية داخلية متكاملة.

- في مارس 2023، أطلقت شركة ICON plc منصة جديدة للمعلومات التنظيمية مصممة لمساعدة شركات الأجهزة الطبية في تتبع اللوائح العالمية المتغيرة، وإدارة استراتيجيات التقديم، والوصول إلى نماذج الامتثال. تهدف المنصة إلى تحسين الاستراتيجية التنظيمية والكفاءة التشغيلية لعمليات التقديم المعقدة متعددة الاختصاصات القضائية.

- في مارس 2023، افتتحت شركة Freyr Solutions مركزًا عالميًا جديدًا للخدمات التنظيمية في منطقة آسيا والمحيط الهادئ، مما وسّع قدرتها على دعم شركات الأجهزة الطبية في الامتثال الكامل لمتطلبات الموافقات الخاصة بكل دولة. وقد أبرز هذا العرض المُحسّن للخدمات الإقليمية النمو السريع للطلب على الاستعانة بمصادر خارجية في مجال التنظيم في الأسواق الناشئة.

- في أبريل 2023، وسّعت شركة باركسل الدولية نطاق خدماتها الاستشارية التنظيمية العالمية لدعم مطوري الأجهزة الطبية والمنتجات المركبة بشكل أفضل، والذين يواجهون متطلبات متزايدة التعقيد بموجب لائحة الاتحاد الأوروبي للأجهزة الطبية (MDR) ولائحة التشخيص المختبري (IVDR). ويعكس هذا التحسين الاستراتيجي ازدياد طلب الصناعة على الخبرات المتخصصة في مجال MDR/IVDR.

- في مارس 2024، أنشأت شركة Emergo by UL مركزًا جديدًا للاستشارات التنظيمية في سنغافورة، يركز على خدمة سوق الأجهزة الطبية المتنامي في منطقة آسيا والمحيط الهادئ، ولا سيما دعم مبادرات التنسيق التنظيمي في رابطة دول جنوب شرق آسيا (آسيان) والحصول على الموافقات في عدة دول. وقد أكدت هذه الخطوة التوسع الجغرافي القوي في خدمات التنظيم الخارجية.

- في يوليو 2024، أطلقت شركة باركسل إنترناشونال منصتها التنظيمية الرقمية، التي تدمج الذكاء الاصطناعي والتعلم الآلي لتبسيط عمليات تقديم الطلبات التنظيمية للأجهزة الطبية، وتوفير إدارة المستندات القائمة على السحابة، وتحسين التعاون بين الجهات الراعية والجهات التنظيمية.

- في سبتمبر 2024، وسّعت شركة IQVIA قدراتها في مجال الشؤون التنظيمية من خلال الاستحواذ على قسم الاستشارات التنظيمية التابع لشركة Pharm-Olam، مما عزز خبرتها العالمية في مجال تنظيم الأجهزة الطبية وحسّن خدماتها في جميع أنحاء منطقة آسيا والمحيط الهادئ وأمريكا اللاتينية، لا سيما فيما يتعلق بالاستراتيجيات التنظيمية للأسواق الناشئة.

- في يناير 2025، دخلت مجموعة ProPharma في شراكة مع MedTech Europe لتطوير برامج تدريبية تنظيمية متخصصة للمهنيين في مجال تنظيم الأجهزة الطبية، لمعالجة فجوات المهارات الحرجة التي أعقبت تطبيق أطر تنظيمية أكثر صرامة مثل MDR

- في فبراير 2025، أعلنت شركة IQVIA عن شراكة استراتيجية مع شركة أوروبية لتصنيع الأجهزة الطبية لدعم إعداد الملفات التنظيمية وإعداد تقارير التقييم السريري بموجب لائحة الأجهزة الطبية الأوروبية (EU MDR)، مما يعزز اعتماد الصناعة على الخبرات الخارجية في مجال توثيق الامتثال المعقد.

- في مارس 2025، أشارت رؤى السوق إلى أن شركة ICON plc وسّعت خدماتها في مجال الاستعانة بمصادر خارجية للشؤون التنظيمية في منطقة آسيا والمحيط الهادئ، استجابةً للطلب المحلي المتزايد على الاستشارات التنظيمية ودعم التجارب السريرية في الأسواق ذات النمو المرتفع مثل الصين والهند.

SKU-

احصل على إمكانية الوصول عبر الإنترنت إلى التقرير الخاص بأول سحابة استخبارات سوقية في العالم

- لوحة معلومات تحليل البيانات التفاعلية

- لوحة معلومات تحليل الشركة للفرص ذات إمكانات النمو العالية

- إمكانية وصول محلل الأبحاث للتخصيص والاستعلامات

- تحليل المنافسين باستخدام لوحة معلومات تفاعلية

- آخر الأخبار والتحديثات وتحليل الاتجاهات

- استغل قوة تحليل المعايير لتتبع المنافسين بشكل شامل

منهجية البحث

يتم جمع البيانات وتحليل سنة الأساس باستخدام وحدات جمع البيانات ذات أحجام العينات الكبيرة. تتضمن المرحلة الحصول على معلومات السوق أو البيانات ذات الصلة من خلال مصادر واستراتيجيات مختلفة. تتضمن فحص وتخطيط جميع البيانات المكتسبة من الماضي مسبقًا. كما تتضمن فحص التناقضات في المعلومات التي شوهدت عبر مصادر المعلومات المختلفة. يتم تحليل بيانات السوق وتقديرها باستخدام نماذج إحصائية ومتماسكة للسوق. كما أن تحليل حصة السوق وتحليل الاتجاهات الرئيسية هي عوامل النجاح الرئيسية في تقرير السوق. لمعرفة المزيد، يرجى طلب مكالمة محلل أو إرسال استفسارك.

منهجية البحث الرئيسية التي يستخدمها فريق بحث DBMR هي التثليث البيانات والتي تتضمن استخراج البيانات وتحليل تأثير متغيرات البيانات على السوق والتحقق الأولي (من قبل خبراء الصناعة). تتضمن نماذج البيانات شبكة تحديد موقف البائعين، وتحليل خط زمني للسوق، ونظرة عامة على السوق ودليل، وشبكة تحديد موقف الشركة، وتحليل براءات الاختراع، وتحليل التسعير، وتحليل حصة الشركة في السوق، ومعايير القياس، وتحليل حصة البائعين على المستوى العالمي مقابل الإقليمي. لمعرفة المزيد عن منهجية البحث، أرسل استفسارًا للتحدث إلى خبراء الصناعة لدينا.

التخصيص متاح

تعد Data Bridge Market Research رائدة في مجال البحوث التكوينية المتقدمة. ونحن نفخر بخدمة عملائنا الحاليين والجدد بالبيانات والتحليلات التي تتطابق مع هدفهم. ويمكن تخصيص التقرير ليشمل تحليل اتجاه الأسعار للعلامات التجارية المستهدفة وفهم السوق في بلدان إضافية (اطلب قائمة البلدان)، وبيانات نتائج التجارب السريرية، ومراجعة الأدبيات، وتحليل السوق المجدد وقاعدة المنتج. ويمكن تحليل تحليل السوق للمنافسين المستهدفين من التحليل القائم على التكنولوجيا إلى استراتيجيات محفظة السوق. ويمكننا إضافة عدد كبير من المنافسين الذين تحتاج إلى بيانات عنهم بالتنسيق وأسلوب البيانات الذي تبحث عنه. ويمكن لفريق المحللين لدينا أيضًا تزويدك بالبيانات في ملفات Excel الخام أو جداول البيانات المحورية (كتاب الحقائق) أو مساعدتك في إنشاء عروض تقديمية من مجموعات البيانات المتوفرة في التقرير.