اتجاهات الصناعة وتوقعات سوق أجهزة صمامات القلب في أمريكا الشمالية، حسب نوع المنتج (صمامات القلب الميكانيكية وصمامات القلب البيولوجية وصمامات القسطرة)، والعلاج (الجراحة المفتوحة والجراحة الأقل توغلاً (MIS))، والمستخدم النهائي (المستشفيات والعيادات ومراكز الجراحة الخارجية ومراكز القلب ومراكز الأبحاث وغيرها)، وقناة التوزيع (العطاء المباشر والموزعون الخارجيون) حتى عام 2030.

تحليل ورؤى حول سوق أجهزة صمامات القلب في أمريكا الشمالية

تُستخدم أجهزة صمام القلب لعلاج صمامات القلب المسدودة، وزرع هذه الأجهزة هو أحد الإجراءات الأكثر شيوعًا. تشمل أجهزة صمام القلب البنيوية المتاحة في السوق الصمامات الميكانيكية والبيولوجية والقسطرة. من المرجح أن ينمو سوق أجهزة صمام القلب في أمريكا الشمالية بشكل مطرد خلال فترة التنبؤ بسبب العدد المتزايد من جراحات صمام القلب في جميع أنحاء العالم. من المتوقع أن يكون نمو سوق أجهزة صمام القلب في أمريكا الشمالية مدفوعًا بالتطورات في أجهزة القلب البنيوية والإجراءات مثل صمامات الأبهر وأجهزة انسداد الأذين الأيسر وصمامات الأنسجة أو البيولوجية. لقد أحدثت صمامات الأنسجة ثورة في سوق أجهزة صمام القلب. تقدم جراحات صمام القلب من الجيل التالي ملفات تعريف منخفضة للمرضى، وجراحات أكثر تحكمًا، ووظيفة صمام أفضل، وارتجاع صمامي أقل، ومتانة متزايدة، وتكاليف أقل. عززت ابتكارات المنتجات من قبل اللاعبين الرئيسيين في السوق نمو السوق من خلال تمكينهم من معالجة عدد أكبر من المرضى وتحقيق نتائج سريرية أفضل.

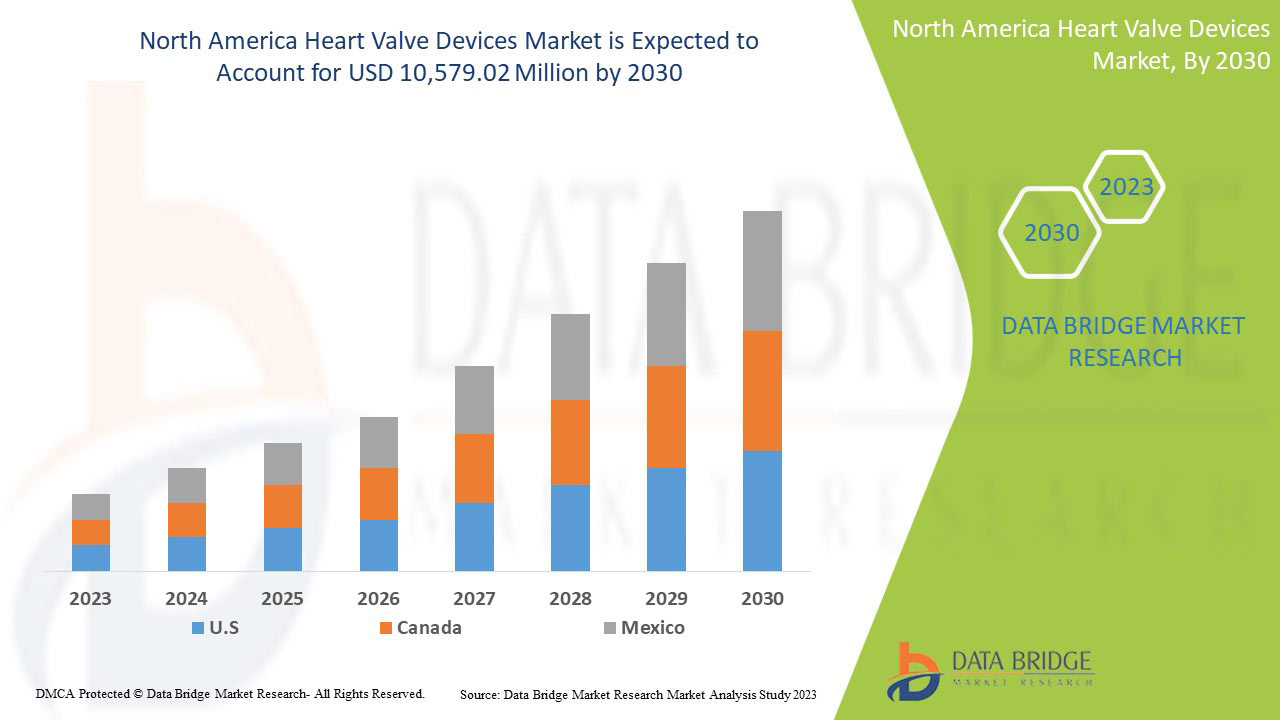

تحلل شركة Data Bridge Market Research أن سوق أجهزة صمامات القلب من المتوقع أن تصل قيمته إلى 10,579.02 مليون دولار أمريكي بحلول عام 2030، بمعدل نمو سنوي مركب قدره 13.6% خلال الفترة المتوقعة. يشكل نوع المنتج أكبر شريحة من الأنواع في السوق بسبب الطلب السريع على أجهزة صمامات القلب على مستوى العالم. يغطي تقرير السوق هذا أيضًا تحليل الأسعار وتحليل براءات الاختراع والتقدم التكنولوجي بعمق.

|

تقرير القياس |

تفاصيل |

|

فترة التنبؤ |

2023 إلى 2030 |

|

سنة الأساس |

2022 |

|

سنوات تاريخية |

2021 (قابلة للتخصيص حتى 2020 - 2015) |

|

وحدات كمية |

الإيرادات بالملايين من الدولارات الأمريكية، الأحجام بالوحدات، التسعير بالدولار الأمريكي |

|

القطاعات المغطاة |

حسب نوع المنتج (صمامات القلب الميكانيكية وصمامات القلب البيولوجية وصمامات القسطرة)، العلاج (الجراحة المفتوحة والجراحة قليلة التوغل (MIS))، المستخدم النهائي (المستشفيات والعيادات ومراكز الجراحة الخارجية ومراكز القلب ومراكز الأبحاث وغيرها)، قناة التوزيع (العطاء المباشر، الموزعون التابعون لجهات خارجية). |

|

الدول المغطاة |

الولايات المتحدة وكندا والمكسيك |

|

الجهات الفاعلة في السوق المشمولة |

Abbott، Boston Scientific Corporation أو الشركات التابعة لها، Artivion, Inc.، Edwards Lifesciences Corporation، Medtronic، NeoVasc، Micro Interventional Devices Incorporated، XELTIS، TTK، Meril Life Sciences Pvt. Ltd، Foldax, Inc.، Venus Medtech (Hangzhou) Inc.، Colibri Heart Valve وغيرها. |

تعريف سوق أجهزة صمام القلب

صمامات القلب ضرورية لتسهيل حركة الدم في الاتجاه الصحيح في الجسم. صمامات القلب مسؤولة عن تدفق الدم المستمر والحفاظ على ضغط الدم. إذا لم تعمل بشكل صحيح فإن قطع القلب يسبب تضيقًا. تشمل أمراض القلب عمومًا العديد من الأمراض التي تؤثر بشكل كبير على القلب. زاد تنظيم صمامات القلب بسرعة في السنوات العشر الماضية مع زيادة عدد المرضى الذين يعانون من أمراض القلب والأوعية الدموية. يتسارع نمو سوق صمامات القلب بسبب عوامل مثل أنماط الحياة غير المستقرة وأمراض نمط الحياة وزيادة عدد المدخنين والشيخوخة السكانية وزيادة جودة الرعاية الصحية والتطور السريع لسداد الرعاية الصحية خلال فترة التنبؤ. بالإضافة إلى ذلك، قد تكون التكلفة العالية لصمامات القلب وخطر إصابة غرسات القلب السبب الذي من المرجح أن يبطئ نمو سوق صمام القلب خلال فترة التنبؤ المذكورة أعلاه. إن النمو في جوانب الأعمال الطبية والعمل الأساسي في الاقتصادات الناشئة يغذي النمو في السياحة الطبية، مما يدفع سوق أجهزة صمام القلب. لقد زادت الحاجة إلى الإجراءات الأقل توغلاً لعلاج التشوهات القلبية بشكل كبير. لقد أفسحت التطبيقات الحالية للأتمتة في جراحة صمامات القلب، مثل استبدال الصمام الأورطي عن طريق القسطرة (TAVR)، المجال لمجموعة متنوعة ومتزايدة من الجراحات المماثلة. وبالنظر إلى النسبة المتزايدة من السكان المسنين، فمن المتوقع أيضًا أن تساهم الزيادة في وثائق التأمين على الحياة في نمو سوق صمامات القلب.

ديناميكيات سوق أجهزة صمام القلب

يتناول هذا القسم فهم محركات السوق والمزايا والفرص والقيود والتحديات. وسيتم مناقشة كل هذا بالتفصيل أدناه:

السائقين

- الابتكارات في أجهزة صمامات القلب تقدم نتائج سريرية أفضل

من المرجح أن يؤدي إطلاق منتجات جديدة للإجراءات الأقل توغلاً إلى دفع سوق أجهزة صمام القلب في أمريكا الشمالية. لقد أحدثت صمامات الأنسجة ثورة في سوق صمام القلب. يوفر الجيل التالي من جراحة صمام القلب منحنيات توصيل أقل، ووضعًا أكثر تحكمًا، ووظيفة صمام محسنة، وتقليل ارتجاع الصمام، وزيادة المتانة، وخفض التكلفة. عزز ابتكار المنتجات آفاق نمو اللاعبين في سوق أجهزة صمام القلب حيث يمكنها علاج عدد أكبر من المرضى بنتائج سريرية متفوقة. على الرغم من التقدم الكبير في السنوات الأخيرة، لا تزال أمراض القلب التداخلية البنيوية سوقًا ناشئة ذات إمكانات كبيرة.

علاوة على ذلك، تواصل التصميمات الذكية والتقنيات الجديدة وتطبيقات المواد الحيوية دفع حدود تطوير المنتجات الجديدة، مما يضمن أن تكون هذه الأجهزة في طليعة ابتكار المنتجات التدخلية لسنوات قادمة. تساعد ابتكارات التصميم اللاعبين في السوق على الاستفادة من فرص النمو المربحة في أجهزة صمام القلب.

ومن ثم، فمن المتوقع أن يتعزز نمو سوق أجهزة صمام القلب في أمريكا الشمالية بسبب الارتفاع في الابتكارات في أجهزة صمام القلب.

- ارتفاع عدد أمراض القلب المختلفة

عادة ما تكون النوبات القلبية والسكتات الدماغية أحداثًا حادة وتحدث في المقام الأول بسبب انسداد يمنع تدفق الدم إلى القلب أو الدماغ. خلال العام الأول من جائحة كوفيد-19، زادت الوفيات الناجمة عن أمراض القلب والسكتات الدماغية بنسبة 5.8% و6.8% على التوالي. ومع ذلك، كانت الزيادات المرتبطة بالعمر 1.6% و1.7% لأمراض القلب والسكتة الدماغية على التوالي. والسبب الأكثر شيوعًا هو تراكم الرواسب الدهنية في بطانة الأوعية الدموية التي تغذي القلب أو الدماغ. يمكن أن تحدث السكتة الدماغية بسبب النزيف أو جلطات الدم في أحد الأوعية الدموية في الدماغ. يشير هذا الاتجاه إلى أن معدل الإصابة بأمراض القلب والأوعية الدموية قد يزيد بشكل كبير بسبب النمو السكاني والشيخوخة.

علاوة على ذلك، فإن ارتفاع نسبة السكر في الدم وارتفاع نسبة الكوليسترول في الدم والتدخين هي عوامل خطر رئيسية لأمراض القلب. يعاني حوالي نصف الأشخاص في الولايات المتحدة (47%) من أحد عوامل الخطر الثلاثة هذه على الأقل. يمكن أن تؤدي الحالات الطبية الأخرى واختيارات نمط الحياة أيضًا إلى زيادة خطر الإصابة بأمراض القلب لدى الأشخاص، بما في ذلك النظام الغذائي غير الصحي، وقلة النشاط البدني، والإفراط في تعاطي الكحول.

علاوة على ذلك، من المتوقع أن يعمل العدد المتزايد من أمراض القلب كمحرك لسوق أجهزة صمام القلب في أمريكا الشمالية.

فرصة

- زيادة الوعي بالأجهزة التعويضية

الصمام الاصطناعي هو جهاز مصمم لاستبدال جزء مفقود من الجسم أو لتحسين وظيفة جزء من الجسم. تُستخدم صمامات القلب الاصطناعية بشكل متزايد في حالات تشوهات الصمامات الطبيعية التي تتطلب التدخل. بشكل عام، يمكن تقسيمها إلى صمامات قلب ميكانيكية وصمامات بيولوجية وطعوم متماثلة. الهدف من الصمامات الاصطناعية هو العمل ديناميكيًا مثل الصمام الطبيعي مع الحد الأدنى من الآثار الجانبية. تم تطوير أجهزة الأطراف الاصطناعية القلبية الوعائية لاستبدال أنسجة القلب التالفة. تم تصميم هذه الأجهزة الطبية لمحاكاة وظيفة الأعضاء القلبية الوعائية الطبيعية. تسمح القلوب الاصطناعية لجراحي القلب بزيادة علاج انسداد القلب.

علاوة على ذلك، يتراوح معدل انتشار الصمامات الاصطناعية من 0.2 لكل 1000 شخص في الأشخاص الذين تبلغ أعمارهم 10 سنوات أو أقل إلى 5.3 شخص في الأشخاص الذين تبلغ أعمارهم 10 سنوات أو أقل.

ومن ثم فإن الوعي المتزايد بشأن الأجهزة الاصطناعية يعد بمثابة فرصة لنمو السوق.

ضبط النفس/التحدي

- تكلفة إنتاج المعدات باهظة الثمن

إن عدد المرضى الذين يتم علاجهم من مرض الصمام الأورطي في الولايات المتحدة ينمو بسرعة. ويحل استبدال الصمام الأورطي عن طريق القسطرة محل استبدال الصمام الأورطي الجراحي والعلاج الطبي. والعواقب الاقتصادية لهذه الاتجاهات غير معروفة. وبالتالي، فإن التكلفة الإجمالية لاستبدال الصمام الأورطي عن طريق القسطرة أعلى من استبدال الصمام الأورطي الجراحي وأكثر تكلفة بكثير من استبدال الصمام الأورطي وحده. وقد انخفضت تكاليف استبدال الصمام الأورطي عن طريق القسطرة بمرور الوقت، بينما ظلت تكاليف استبدال الصمام الأورطي الجراحي والعلاج الطبي كما هي.

بالإضافة إلى ذلك، فإن التكلفة الجراحية المرتفعة لـ TAVI ترجع بشكل أساسي إلى التكلفة العالية للإنتاج. ومع ذلك، نظرًا لقصر مدة الإقامة في المستشفى، فإن تكلفة TAVI غير الجراحية أقل مقارنة بـ AVR. تبلغ تكلفة مجموعة زرع TAVI وحدها (الصمام، البالون، الغلاف) 32500 دولار، بينما يكلف الصمام الجراحي حوالي 5000 دولار فقط، تمامًا كما هو الحال في سويسرا، حيث تكلف مجموعة زرع TAVI حوالي 32000 فرنك سويسري (حوالي 35000 دولار)، بينما تبلغ تكلفة الطرف الاصطناعي الجراحي حوالي 3000 فرنك سويسري (حوالي 3300 دولار أمريكي). وبحسب الأمراض المصاحبة والمضاعفات، يتراوح التعويض في الولايات المتحدة بين 0000 و5000 دولار، وتبلغ عملية TAVI في سويسرا حوالي 72000 فرنك سويسري (78000 دولار)، وتبلغ عملية AVR حوالي 3000 فرنك سويسري (7000 دولار)، وهو ما يعني خسارة مالية للمستشفى.

ومن ثم، فإن ارتفاع تكاليف إنتاج المعدات قد يعوق نمو السوق.

التطورات الأخيرة

- في سبتمبر 2023، أصدرت شركة أبوت بيانات من خمسة عروض تقديمية في مرحلة متأخرة تُظهر فوائد أجهزتها قليلة التدخل في علاج الأشخاص المصابين بأمراض القلب البنيوية المختلفة. تتضمن البيانات نتائج تدعم قيمة MitraClip™. إنه أول وأهم إصلاح عبر القسطرة من الحافة إلى الحافة (TEER) في العالم لعلاج الصمامات المتسربة لدى الأشخاص المصابين بقصور الصمام التاجي (MR). تم تقديم بيانات جديدة حول علاجات القلب البنيوية لشركة أبوت في الندوة العلمية السنوية الرابعة والثلاثين لعلاج القلب والأوعية الدموية عبر القسطرة (TCT) لمؤسسة أبحاث القلب والأوعية الدموية في بوسطن. وقد ساعد هذا الشركة على زيادة مكانتها التجارية في السوق.

- في سبتمبر 2020، أعلنت شركة Boston Scientific Corporation أنها أطلقت نظام صمام الأبهر ACURATE neo2™ في أوروبا. تعد تقنية زرع صمام الأبهر عبر القسطرة (TAVI) من الجيل التالي منصة جديدة مصممة بميزات متعددة لتحسين الأداء السريري لمنصة ACURATE الجديدة الأصلية. مقارنةً بالجيل السابق، يتمتع نظام صمام ACURATE neo2 بمؤشر موسع للمرضى الذين يعانون من تضيق الأبهر. وقد ساعد هذا الشركة على اكتساب مجموعة منتجاتها.

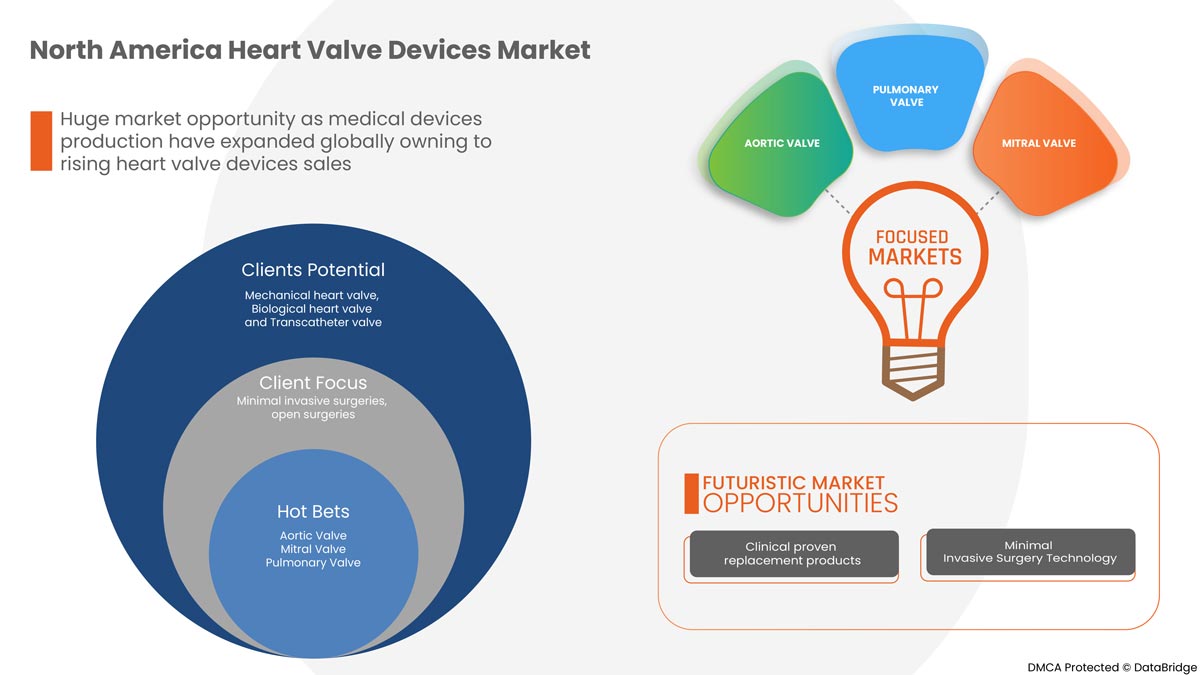

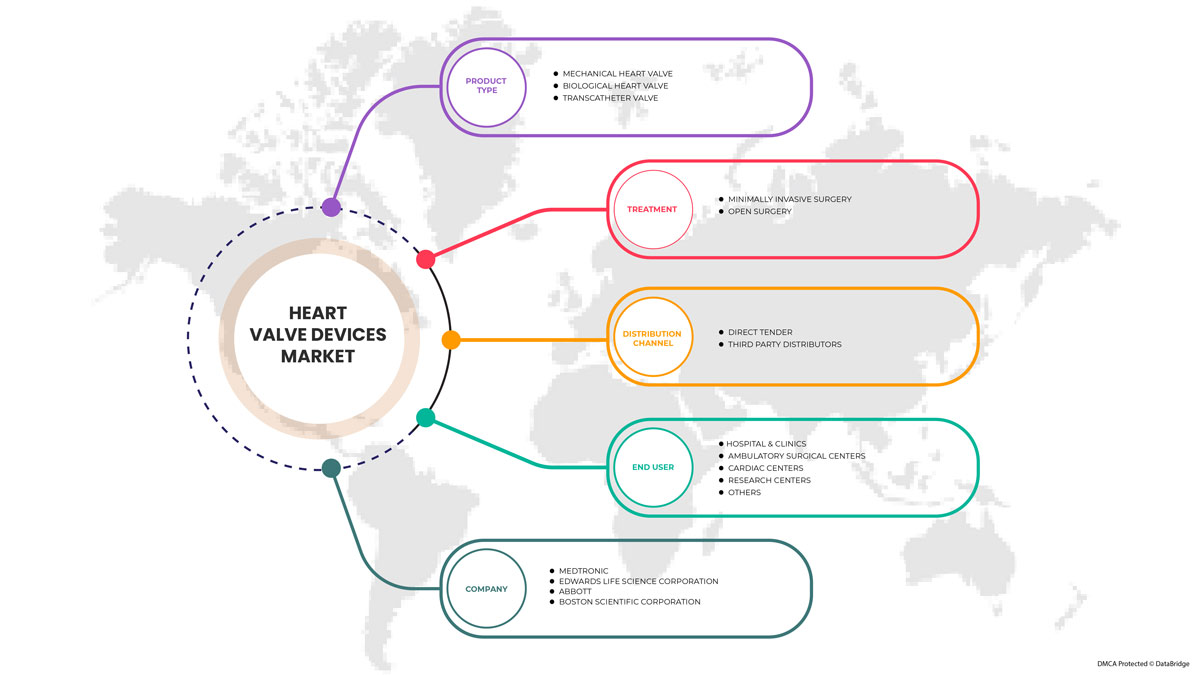

نطاق سوق أجهزة صمام القلب

يتم تقسيم سوق أجهزة صمامات القلب إلى نوع المنتج والعلاج والمستخدم النهائي وقناة التوزيع. يساعدك النمو بين القطاعات على تحليل جيوب النمو والاستراتيجيات المتخصصة للتعامل مع السوق وتحديد مجالات التطبيق الأساسية والاختلاف في الأسواق المستهدفة.

حسب نوع المنتج

- صمامات القلب الميكانيكية

- صمام القلب البيولوجي

- صمامات القسطرة

على أساس نوع المنتج، يتم تقسيم سوق أجهزة صمام القلب إلى صمام قلب ميكانيكي وصمام قلب بيولوجي وصمام عبر القسطرة.

عن طريق العلاج

- الجراحة المفتوحة

- الجراحة الأقل تدخلاً

على أساس العلاج، يتم تقسيم سوق أجهزة صمام القلب إلى جراحة مفتوحة وجراحة طفيفة التوغل.

بواسطة المستخدم النهائي

- المستشفى والعيادات

- مراكز الجراحة الخارجية

- مراكز القلب

- مراكز البحوث

- آحرون

على أساس المستخدم النهائي، يتم تقسيم سوق أجهزة صمام القلب إلى المستشفيات والعيادات ومراكز الجراحة الخارجية ومراكز القلب ومراكز الأبحاث وغيرها.

حسب قناة التوزيع

- العطاء المباشر

- موزعين الطرف الثالث

على أساس قناة التوزيع، يتم تقسيم سوق أجهزة صمام القلب إلى موزعين مباشرين وموزعين تابعين لجهات خارجية.

تحليل/رؤى إقليمية لسوق أجهزة صمام القلب في أمريكا الشمالية

يتم تحليل سوق أجهزة صمام القلب وتوفير معلومات حجم السوق ونوع المنتج والعلاج والمستخدم النهائي وقناة التوزيع.

الدول التي يغطيها تقرير السوق هذا هي الولايات المتحدة وكندا والمكسيك.

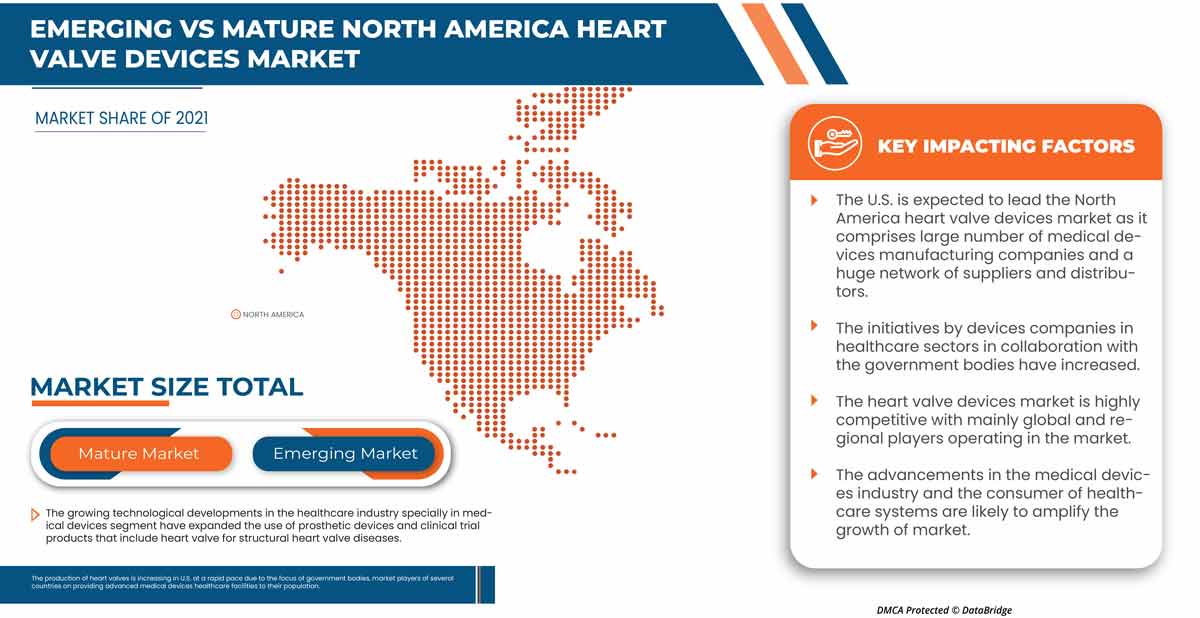

تسيطر أمريكا الشمالية على السوق بسبب الاستثمار المتزايد في البحث والتطوير. وتهيمن الولايات المتحدة على منطقة أمريكا الشمالية بسبب الوجود القوي للاعبين الرئيسيين.

كما يوفر قسم الدولة في التقرير عوامل التأثير الفردية على السوق والتغييرات في التنظيم في السوق محليًا والتي تؤثر على الاتجاهات الحالية والمستقبلية للسوق. تعد نقاط البيانات مثل المبيعات الجديدة ومبيعات الاستبدال والتركيبة السكانية للدولة والقوانين التنظيمية ورسوم الاستيراد والتصدير من بين المؤشرات الرئيسية المستخدمة للتنبؤ بسيناريو السوق للدول الفردية. كما يتم النظر في وجود وتوافر العلامات التجارية في أمريكا الشمالية والتحديات التي تواجهها بسبب المنافسة الكبيرة أو النادرة من العلامات التجارية المحلية والمحلية وتأثير قنوات المبيعات أثناء تقديم تحليل توقعات لبيانات الدولة.

تحليل المنافسة وحصة سوق أجهزة صمام القلب

يوفر المشهد التنافسي لسوق أجهزة صمام القلب تفاصيل حسب المنافس. تتضمن التفاصيل نظرة عامة على الشركة، والبيانات المالية للشركة، والإيرادات المتولدة، وإمكانات السوق، والاستثمار في البحث والتطوير، ومبادرات السوق الجديدة، ومواقع الإنتاج والمرافق، ونقاط القوة والضعف في الشركة، وإطلاق المنتج، وخطوط أنابيب تجارب المنتجات، وموافقات المنتج، وبراءات الاختراع، وعرض المنتج والتنفس، وهيمنة التطبيق، ومنحنى شريان الحياة التكنولوجي. ترتبط نقاط البيانات المذكورة أعلاه فقط بتركيز الشركة على سوق أجهزة صمام القلب.

بعض اللاعبين الرئيسيين العاملين في سوق أجهزة صمام القلب هم Abbott و Boston Scientific Corporation أو الشركات التابعة لها و Artivion، Inc. و Edwards Lifesciences Corporation و Medtronic و NeoVasc و Micro Interventional Devices Incorporated و XELTIS و TTK و Meril Life Sciences Pvt. Ltd و Foldax، Inc. و Venus Medtech (Hangzhou) Inc. و Colibri Heart Valve وغيرها.

SKU-

احصل على إمكانية الوصول عبر الإنترنت إلى التقرير الخاص بأول سحابة استخبارات سوقية في العالم

- لوحة معلومات تحليل البيانات التفاعلية

- لوحة معلومات تحليل الشركة للفرص ذات إمكانات النمو العالية

- إمكانية وصول محلل الأبحاث للتخصيص والاستعلامات

- تحليل المنافسين باستخدام لوحة معلومات تفاعلية

- آخر الأخبار والتحديثات وتحليل الاتجاهات

- استغل قوة تحليل المعايير لتتبع المنافسين بشكل شامل

Table of Content

1 INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 OVERVIEW OF THE NORTH AMERICA HEART VALVE DEVICES MARKET

1.4 CURRENCY AND PRICING

1.5 LIMITATIONS

1.6 MARKETS COVERED

2 MARKET SEGMENTATION

2.1 MARKETS COVERED

2.2 GEOGRAPHICAL SCOPE

2.3 YEARS CONSIDERED FOR THE STUDY

2.4 DBMR TRIPOD DATA VALIDATION MODEL

2.5 PRIMARY INTERVIEWS WITH KEY OPINION LEADERS

2.6 MULTIVARIATE MODELLING

2.7 MARKET APPLICATION COVERAGE GRID

2.8 SOURCE LIFELINE CURVE

2.9 DBMR MARKET POSITION GRID

2.1 VENDOR SHARE ANALYSIS

2.11 SECONDARY SOURCES

2.12 ASSUMPTIONS

3 EXECUTIVE SUMMARY

3.1 EPIDEMIOLOGY

3.2 PESTEL ANALYSIS

3.3 PORTER'S FIVE FORCE

4 MARKET OVERVIEW

4.1 DRIVERS

4.1.1 INNOVATIONS IN HEART VALVE DEVICES OFFER IMPROVED CLINICAL OUTCOME

4.1.2 RISING NUMBER OF VARIOUS HEART DISEASES

4.1.3 ADVANCEMENTS IN TRANSCATHETER VALVE TECHNOLOGY

4.1.4 INCREASING PREFERENCE FOR MINIMALLY INVASIVE SURGERIES

4.2 RESTRAINTS

4.2.1 HIGH COST ASSOCIATED WITH THE SURGERIES

4.2.2 COMPLICATIONS ASSOCIATED WITH HEART VALVE REPLACEMENT

4.3 OPPORTUNITIES

4.3.1 INCREASING AWARENESS OF PROSTHETIC DEVICES

4.3.2 RISING PREVALENCE OF STROKE & CARDIAC ARREST TO REINFORCE DEMAND FOR HEART VALVE DEVICES

4.3.3 INCREASING FDA APPROVALS OF TRANSCATHETER AORTIC VALVES

4.4 CHALLENGES

4.4.1 STRICT GOVERNMENT REGULATIONS

4.4.2 EXPENSIVE PRODUCTION COST OF EQUIPMENT

5 NORTH AMERICA HEART VALVE DEVICES MARKET, BY PRODUCT TYPE

5.1 OVERVIEW

5.2 MECHANICAL HEART VALVES

5.2.1 AORTIC VALVE

5.2.2 MITRAL VALVE

5.3 BIOLOGICAL HEART VALVES

5.3.1 AORTIC VALVE

5.3.2 MITRAL VALVE

5.3.3 PULMONARY VALVE

5.3.4 TRICUSPID VALVE

5.4 TRANSCATHETER VALVE

5.4.1 AORTIC VALVE

5.4.2 MITRAL VALVE

5.4.3 PULMONARY VALVE

6 NORTH AMERICA HEART VALVE DEVICES MARKET, BY TREATMENT

6.1 OVERVIEW

6.2 MINIMALLY INVASIVE SURGERY (MIS)

6.2.1 CARDIAC VALVE REPLACEMENT

6.2.2 CARDIAC VALVE REPAIR

6.3 OPEN SURGERY

6.3.1 CARDIAC VALVE REPLACEMENT

6.3.2 CARDIAC VALVE REPAIR

7 NORTH AMERICA HEART VALVE DEVICES MARKET, BY END USER

7.1 OVERVIEW

7.2 HOSPITAL & CLINICS

7.3 AMBULATORY SURGICAL CENTERS

7.4 CARDIAC CENTERS

7.5 RESEARCH CENTERS

7.6 OTHERS

8 NORTH AMERICA HEART VALVE DEVICES MARKET, BY DISTRIBUTION CHANNEL

8.1 OVERVIEW

8.2 DIRECT TENDER

8.3 THIRD PARTY DISTRIBUTORS

9 NORTH AMERICA HEART VALVE DEVICES MARKET, BY REGION

9.1 NORTH AMERICA

9.1.1 U.S.

9.1.2 CANADA

9.1.3 MEXICO

10 NORTH AMERICA HEART VALVE DEVICES MARKET: COMPANY LANDSCAPE

10.1 COMPANY SHARE ANALYSIS: NORTH AMERICA

11 SWOT ANALYSIS

12 COMPANY PROFILE

12.1 MEDTRONIC

12.1.1 COMPANY SNAPSHOT

12.1.2 REVENUE ANALYSIS

12.1.3 COMPANY SHARE ANALYSIS

12.1.4 PRODUCT PORTFOLIO

12.1.5 RECENT DEVELOPMENTS

12.2 EDWARDS LIFESCIENCES CORPORATION

12.2.1 COMPANY SNAPSHOT

12.2.2 REVENUE ANALYSIS

12.2.3 COMPANY SHARE ANALYSIS

12.2.4 PRODUCT PORTFOLIO

12.2.5 RECENT DEVELOPMENTS

12.3 ABBOTT

12.3.1 COMPANY SNAPSHOT

12.3.2 REVENUE ANALYSIS

12.3.3 COMPANY SHARE ANALYSIS

12.3.4 PRODUCT PORTFOLIO

12.3.5 RECENT DEVELOPMENTS

12.4 BOSTON SCIENTIFIC CORPORATION OR ITS AFFILIATES.

12.4.1 COMPANY SNAPSHOT

12.4.2 REVENUE ANALYSIS

12.4.3 COMPANY SHARE ANALYSIS

12.4.4 PRODUCT PORTFOLIO

12.4.5 RECENT DEVELOPMENT

12.5 ARTIVION, INC.

12.5.1 COMPANY SNAPSHOT

12.5.2 REVENUE ANALYSIS

12.5.3 COMPANY SHARE ANALYSIS

12.5.4 PRODUCT PORTFOLIO

12.5.5 RECENT DEVELOPMENTS

12.6 COLIBRI HEART VALVE

12.6.1 COMPANY SNAPSHOT

12.6.2 PRODUCT PORTFOLIO

12.6.3 RECENT DEVELOPMENTS

12.7 FOLDAX, INC.

12.7.1 COMPANY SNAPSHOT

12.7.2 PRODUCT PORTFOLIO

12.7.3 RECENT DEVELOPMENTS

12.8 MERIL LIFE SCIENCES PVT. LTD.

12.8.1 COMPANY SNAPSHOT

12.8.2 PRODUCT PORTFOLIO

12.8.3 RECENT DEVELOPMENTS

12.9 MICRO INTERVENTIONAL DEVICES, INCORPORATED.

12.9.1 COMPANY SNAPSHOT

12.9.2 PRODUCT PORTFOLIO

12.9.3 RECENT DEVELOPMENTS

12.1 NEOVASC

12.10.1 COMPANY SNAPSHOT

12.10.2 REVENUE ANALYSIS

12.10.3 PRODUCT PORTFOLIO

12.10.4 RECENT DEVELOPMENTS

12.11 TTK

12.11.1 COMPANY SNAPSHOT

12.11.2 REVENUE ANALYSIS

12.11.3 PRODUCT PORTFOLIO

12.11.4 RECENT DEVELOPMENTS

12.12 VENUS MEDTECH (HANGZHOU) INC.

12.12.1 COMPANY SNAPSHOT

12.12.2 REVENUE ANALYSIS

12.12.3 PRODUCT PORTFOLIO

12.12.4 RECENT DEVELOPMENTS

12.13 XELTIS

12.13.1 COMPANY SNAPSHOT

12.13.2 PRODUCT PORTFOLIO

12.13.3 RECENT DEVELOPMENTS

13 QUESTIONNAIRE

14 RELATED REPORTS

List of Table

TABLE 1 NORTH AMERICA HEART VALVE DEVICES MARKET, BY PRODUCT TYPE, 2021-2030 (USD MILLION)

TABLE 2 NORTH AMERICA MECHANICAL HEART VALVES IN HEART VALVE DEVICES MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 3 NORTH AMERICA MECHANICAL HEART VALVES IN HEART VALVE DEVICES MARKET, BY PRODUCT TYPE, 2021-2030 (USD MILLION)

TABLE 4 NORTH AMERICA BIOLOGICAL HEART VALVES IN HEART VALVE DEVICES MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 5 NORTH AMERICA BIOLOGICAL HEART VALVES IN HEART VALVE DEVICES MARKET, BY PRODUCT TYPE, 2021-2030 (USD MILLION)

TABLE 6 NORTH AMERICA TRANSCATHETER VALVES IN HEART VALVE DEVICES MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 7 NORTH AMERICA TRANSCATHETER VALVES IN HEART VALVE DEVICES MARKET, BY PRODUCT TYPE, 2021-2030 (USD MILLION)

TABLE 8 NORTH AMERICA HEART VALVE DEVICES MARKET, BY TREATMENT, 2021-2030 (USD MILLION)

TABLE 9 NORTH AMERICA MINIMALLY INVASIVE SURGERY IN HEART VALVE DEVICES MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 10 NORTH AMERICA MINIMALLY INVASIVE SURGERY IN HEART VALVE DEVICES MARKET, BY TREATMENT, 2021-2030 (USD MILLION)

TABLE 11 NORTH AMERICA OPEN SURGERY IN HEART VALVE DEVICES MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 12 NORTH AMERICA OPEN SURGERY IN HEART VALVE DEVICES MARKET, BY TREATMENT, 2021-2030 (USD MILLION)

TABLE 13 NORTH AMERICA HEART VALVE DEVICES MARKET, BY END USER, 2021-2030 (USD MILLION)

TABLE 14 NORTH AMERICA HOSPITALS & CLINICS IN HEART VALVE DEVICES MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 15 NORTH AMERICA AMBULATORY SURGICAL CENTERS IN HEART VALVE DEVICES MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 16 NORTH AMERICA CARDIAC CENTERS IN HEART VALVE DEVICES MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 17 NORTH AMERICA RESEARCH CENTERS IN HEART VALVE DEVICES MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 18 NORTH AMERICA OTHERS IN HEART VALVE DEVICES MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 19 NORTH AMERICA HEART VALVE DEVICES MARKET, BY DISTRIBUTION CHANNEL, 2021-2030 (USD MILLION)

TABLE 20 NORTH AMERICA DIRECT TENDER IN HEART VALVE DEVICES MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 21 NORTH AMERICA THIRD PARTY DISTRIBUTORS IN HEART VALVE DEVICES MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 22 NORTH AMERICA HEART VALVE DEVICES MARKET, BY COUNTRY, 2021-2030 (USD MILLION)

TABLE 23 NORTH AMERICA HEART VALVE DEVICES MARKET, BY PRODUCT TYPE, 2021-2030 (USD MILLION)

TABLE 24 NORTH AMERICA MECHANICAL HEART VALVES IN HEART VALVE DEVICES MARKET, BY PRODUCT TYPE, 2021-2030 (USD MILLION)

TABLE 25 NORTH AMERICA BIOLOGICAL HEART VALVES IN HEART VALVE DEVICES MARKET, BY PRODUCT TYPE, 2021-2030 (USD MILLION)

TABLE 26 NORTH AMERICA TRANSCATHETER VALVES IN HEART VALVE DEVICES MARKET, BY PRODUCT TYPE, 2021-2030 (USD MILLION)

TABLE 27 NORTH AMERICA HEART VALVE DEVICES MARKET, BY TREATMENT, 2021-2030 (USD MILLION)

TABLE 28 NORTH AMERICA MINIMALLY INVASIVE SURGERY IN HEART VALVE DEVICES MARKET, BY TREATMENT, 2021-2030 (USD MILLION)

TABLE 29 NORTH AMERICA OPEN SURGERY IN HEART VALVE DEVICES MARKET, BY TREATMENT, 2021-2030 (USD MILLION)

TABLE 30 NORTH AMERICA HEART VALVE DEVICES MARKET, BY END USER, 2021-2030 (USD MILLION)

TABLE 31 NORTH AMERICA HEART VALVE DEVICES MARKET, BY DISTRIBUTION CHANNEL, 2021-2030 (USD MILLION)

TABLE 32 U.S. HEART VALVE DEVICES MARKET, BY PRODUCT TYPE, 2021-2030 (USD MILLION)

TABLE 33 U.S. MECHANICAL HEART VALVES IN HEART VALVE DEVICES MARKET, BY PRODUCT TYPE, 2021-2030 (USD MILLION)

TABLE 34 U.S. MECHANICAL HEART VALVES IN HEART VALVE DEVICES MARKET, BY PRODUCT TYPE, 2021-2030 UNITS, (VOLUME)

TABLE 35 U.S. MECHANICAL HEART VALVES IN HEART VALVE DEVICES MARKET, BY PRODUCT TYPE, 2021-2030 ASP, (USD)

TABLE 36 U.S. BIOLOGICAL HEART VALVES IN HEART VALVE DEVICES MARKET, BY PRODUCT TYPE, 2021-2030 (USD MILLION)

TABLE 37 U.S. BIOLOGICAL HEART VALVES IN HEART VALVE DEVICES MARKET, BY PRODUCT TYPE, 2021-2030 UNITS, (VOLUME)

TABLE 38 U.S. BIOLOGICAL HEART VALVES IN HEART VALVE DEVICES MARKET, BY PRODUCT TYPE, 2021-2030 ASP, (USD)

TABLE 39 U.S. TRANSCATHETER VALVES IN HEART VALVE DEVICES MARKET, BY PRODUCT TYPE, 2021-2030 (USD MILLION)

TABLE 40 U.S. TRANSCATHETER VALVES IN HEART VALVE DEVICES MARKET, BY PRODUCT TYPE, 2021-2030 UNITS, (VOLUME)

TABLE 41 U.S. TRANSCATHETER VALVES IN HEART VALVE DEVICES MARKET, BY PRODUCT TYPE, 2021-2030 ASP, (USD)

TABLE 42 U.S. HEART VALVE DEVICES MARKET, BY TREATMENT, 2021-2030 (USD MILLION)

TABLE 43 U.S. MINIMALLY INVASIVE SURGERY IN HEART VALVE DEVICES MARKET, BY TREATMENT, 2021-2030 (USD MILLION)

TABLE 44 U.S. OPEN SURGERY IN HEART VALVE DEVICES MARKET, BY TREATMENT, 2021-2030 (USD MILLION)

TABLE 45 U.S. HEART VALVE DEVICES MARKET, BY END USER, 2021-2030 (USD MILLION)

TABLE 46 U.S. HEART VALVE DEVICES MARKET, BY DISTRIBUTION CHANNEL, 2021-2030 (USD MILLION)

TABLE 47 CANADA HEART VALVE DEVICES MARKET, BY PRODUCT TYPE, 2021-2030 (USD MILLION)

TABLE 48 CANADA MECHANICAL HEART VALVES IN HEART VALVE DEVICES MARKET, BY PRODUCT TYPE, 2021-2030 (USD MILLION)

TABLE 49 CANADA MECHANICAL HEART VALVES IN HEART VALVE DEVICES MARKET, BY PRODUCT TYPE, 2021-2030 UNITS, (VOLUME)

TABLE 50 CANADA MECHANICAL HEART VALVES IN HEART VALVE DEVICES MARKET, BY PRODUCT TYPE, 2021-2030 ASP, (USD)

TABLE 51 CANADA BIOLOGICAL HEART VALVES IN HEART VALVE DEVICES MARKET, BY PRODUCT TYPE, 2021-2030 (USD MILLION)

TABLE 52 CANADA BIOLOGICAL HEART VALVES IN HEART VALVE DEVICES MARKET, BY PRODUCT TYPE, 2021-2030 UNITS, (VOLUME)

TABLE 53 CANADA BIOLOGICAL HEART VALVES IN HEART VALVE DEVICES MARKET, BY PRODUCT TYPE, 2021-2030 ASP, (USD)

TABLE 54 CANADA TRANSCATHETER VALVES IN HEART VALVE DEVICES MARKET, BY PRODUCT TYPE, 2021-2030 (USD MILLION)

TABLE 55 CANADA TRANSCATHETER VALVES IN HEART VALVE DEVICES MARKET, BY PRODUCT TYPE, 2021-2030 UNITS, (VOLUME)

TABLE 56 CANADA TRANSCATHETER VALVES IN HEART VALVE DEVICES MARKET, BY PRODUCT TYPE, 2021-2030 ASP, (USD)

TABLE 57 CANADA HEART VALVE DEVICES MARKET, BY TREATMENT, 2021-2030 (USD MILLION)

TABLE 58 CANADA MINIMALLY INVASIVE SURGERY IN HEART VALVE DEVICES MARKET, BY TREATMENT, 2021-2030 (USD MILLION)

TABLE 59 CANADA OPEN SURGERY IN HEART VALVE DEVICES MARKET, BY TREATMENT, 2021-2030 (USD MILLION)

TABLE 60 CANADA HEART VALVE DEVICES MARKET, BY END USER, 2021-2030 (USD MILLION)

TABLE 61 CANADA HEART VALVE DEVICES MARKET, BY DISTRIBUTION CHANNEL, 2021-2030 (USD MILLION)

TABLE 62 MEXICO HEART VALVE DEVICES MARKET, BY PRODUCT TYPE, 2021-2030 (USD MILLION)

TABLE 63 MEXICO MECHANICAL HEART VALVES IN HEART VALVE DEVICES MARKET, BY PRODUCT TYPE, 2021-2030 (USD MILLION)

TABLE 64 MEXICO MECHANICAL HEART VALVES IN HEART VALVE DEVICES MARKET, BY PRODUCT TYPE, 2021-2030 UNITS, (VOLUME)

TABLE 65 MEXICO MECHANICAL HEART VALVES IN HEART VALVE DEVICES MARKET, BY PRODUCT TYPE, 2021-2030 ASP, (USD)

TABLE 66 MEXICO BIOLOGICAL HEART VALVES IN HEART VALVE DEVICES MARKET, BY PRODUCT TYPE, 2021-2030 (USD MILLION)

TABLE 67 MEXICO BIOLOGICAL HEART VALVES IN HEART VALVE DEVICES MARKET, BY PRODUCT TYPE, 2021-2030 UNITS, (VOLUME)

TABLE 68 MEXICO BIOLOGICAL HEART VALVES IN HEART VALVE DEVICES MARKET, BY PRODUCT TYPE, 2021-2030 ASP, (USD)

TABLE 69 MEXICO TRANSCATHETER VALVES IN HEART VALVE DEVICES MARKET, BY PRODUCT TYPE, 2021-2030 (USD MILLION)

TABLE 70 MEXICO TRANSCATHETER VALVES IN HEART VALVE DEVICES MARKET, BY PRODUCT TYPE, 2021-2030 UNITS, (VOLUME)

TABLE 71 MEXICO TRANSCATHETER VALVES IN HEART VALVE DEVICES MARKET, BY PRODUCT TYPE, 2021-2030 ASP, (USD)

TABLE 72 MEXICO HEART VALVE DEVICES MARKET, BY TREATMENT, 2021-2030 (USD MILLION)

TABLE 73 MEXICO MINIMALLY INVASIVE SURGERY IN HEART VALVE DEVICES MARKET, BY TREATMENT, 2021-2030 (USD MILLION)

TABLE 74 MEXICO OPEN SURGERY IN HEART VALVE DEVICES MARKET, BY TREATMENT, 2021-2030 (USD MILLION)

TABLE 75 MEXICO HEART VALVE DEVICES MARKET, BY END USER, 2021-2030 (USD MILLION)

TABLE 76 MEXICO HEART VALVE DEVICES MARKET, BY DISTRIBUTION CHANNEL, 2021-2030 (USD MILLION)

List of Figure

FIGURE 1 NORTH AMERICA HEART VALVE DEVICES MARKET: SEGMENTATION

FIGURE 2 NORTH AMERICA HEART VALVE DEVICES MARKET: DATA TRIANGULATION

FIGURE 3 NORTH AMERICA HEART VALVE DEVICES MARKET: DROC ANALYSIS

FIGURE 4 NORTH AMERICA HEART VALVE DEVICES MARKET: NORTH AMERICA VS REGIONAL MARKET ANALYSIS

FIGURE 5 NORTH AMERICA HEART VALVE DEVICES MARKET: COMPANY RESEARCH ANALYSIS

FIGURE 6 NORTH AMERICA HEART VALVE DEVICES MARKET: INTERVIEW DEMOGRAPHICS

FIGURE 7 NORTH AMERICA HEART VALVE DEVICES MARKET: MARKET APPLICATION COVERAGE GRID

FIGURE 8 NORTH AMERICA HEART VALVE DEVICES MARKET: DBMR MARKET POSITION GRID

FIGURE 9 NORTH AMERICA HEART VALVE DEVICES MARKET: VENDOR SHARE ANALYSIS

FIGURE 10 NORTH AMERICA HEART VALVE DEVICES MARKET: SEGMENTATION

FIGURE 11 GROWING PREVALENCE OF VALVULAR DISEASES, SUCH AS AORTIC STENOSIS & AORTIC REGURGITATION, AND INCREASING PREFERENCE FOR MINIMALLY INVASIVE SURGERIES ARE EXPECTED TO DRIVE THE NORTH AMERICA HEART VALVE DEVICES MARKET IN THE FORECAST PERIOD

FIGURE 12 MECHANICAL HEART VALVE SEGMENT IS EXPECTED TO ACCOUNT FOR THE LARGEST SHARE OF THE NORTH AMERICA HEART VALVE DEVICES MARKET IN 2023 & 2030

FIGURE 13 INCIDENDE AND PREVALENCE OF HEART VALVE OF NORTH AMERICA

FIGURE 14 INCIDENDE AND PREVALENCE OF HEART VALVE OF EUROPE

FIGURE 15 INCIDENDE AND PREVALENCE OF HEART VALVE OF ASIA-PACIFIC

FIGURE 16 INCIDENDE AND PREVALENCE OF HEART VALVE OF SOUTH AMERICA & MIDDLE EAST AND AFRICA

FIGURE 17 DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES OF THE NORTH AMERICA HEART VALVE DEVICES MARKET

FIGURE 18 NORTH AMERICA HEART VALVE DEVICES MARKET : BY PRODUCT TYPE, 2022

FIGURE 19 NORTH AMERICA HEART VALVE DEVICES MARKET : BY PRODUCT TYPE, 2023-2030 (USD MILLION)

FIGURE 20 NORTH AMERICA HEART VALVE DEVICES MARKET : BY PRODUCT TYPE, CAGR (2023-2030)

FIGURE 21 NORTH AMERICA HEART VALVE DEVICES MARKET : BY PRODUCT TYPE, LIFELINE CURVE

FIGURE 22 NORTH AMERICA HEART VALVE DEVICES MARKET : BY TREATMENT, 2022

FIGURE 23 NORTH AMERICA HEART VALVE DEVICES MARKET : BY TREATMENT, 2023-2030 (USD MILLION)

FIGURE 24 NORTH AMERICA HEART VALVE DEVICES MARKET : BY TREATMENT, CAGR (2023-2030)

FIGURE 25 NORTH AMERICA HEART VALVE DEVICES MARKET : BY TREATMENT, LIFELINE CURVE

FIGURE 26 NORTH AMERICA HEART VALVE DEVICES MARKET : BY END USER, 2022

FIGURE 27 NORTH AMERICA HEART VALVE DEVICES MARKET : BY END USER, 2023-2030 (USD MILLION)

FIGURE 28 NORTH AMERICA HEART VALVE DEVICES MARKET : BY END USER, CAGR (2023-2030)

FIGURE 29 NORTH AMERICA HEART VALVE DEVICES MARKET : BY END USER, LIFELINE CURVE

FIGURE 30 NORTH AMERICA HEART VALVE DEVICES MARKET : BY DISTRIBUTION CHANNEL, 2022

FIGURE 31 NORTH AMERICA HEART VALVE DEVICES MARKET : BY DISTRIBUTION CHANNEL, 2023-2030 (USD MILLION)

FIGURE 32 NORTH AMERICA HEART VALVE DEVICES MARKET : BY DISTRIBUTION CHANNEL, CAGR (2023-2030)

FIGURE 33 NORTH AMERICA HEART VALVE DEVICES MARKET : BY DISTRIBUTION CHANNEL, LIFELINE CURVE

FIGURE 34 NORTH AMERICA HEART VALVE DEVICES MARKET: SNAPSHOT (2022)

FIGURE 35 NORTH AMERICA HEART VALVE DEVICES MARKET: BY COUNTRY (2022)

FIGURE 36 NORTH AMERICA HEART VALVE DEVICES MARKET: BY COUNTRY (2023 & 2030)

FIGURE 37 NORTH AMERICA HEART VALVE DEVICES MARKET: BY COUNTRY (2022 & 2030)

FIGURE 38 NORTH AMERICA HEART VALVE DEVICES MARKET: BY PRODUCT TYPE (2023-2030)

FIGURE 39 NORTH AMERICA HEART VALVE DEVICES MARKET: COMPANY SHARE 2021 (%)

منهجية البحث

يتم جمع البيانات وتحليل سنة الأساس باستخدام وحدات جمع البيانات ذات أحجام العينات الكبيرة. تتضمن المرحلة الحصول على معلومات السوق أو البيانات ذات الصلة من خلال مصادر واستراتيجيات مختلفة. تتضمن فحص وتخطيط جميع البيانات المكتسبة من الماضي مسبقًا. كما تتضمن فحص التناقضات في المعلومات التي شوهدت عبر مصادر المعلومات المختلفة. يتم تحليل بيانات السوق وتقديرها باستخدام نماذج إحصائية ومتماسكة للسوق. كما أن تحليل حصة السوق وتحليل الاتجاهات الرئيسية هي عوامل النجاح الرئيسية في تقرير السوق. لمعرفة المزيد، يرجى طلب مكالمة محلل أو إرسال استفسارك.

منهجية البحث الرئيسية التي يستخدمها فريق بحث DBMR هي التثليث البيانات والتي تتضمن استخراج البيانات وتحليل تأثير متغيرات البيانات على السوق والتحقق الأولي (من قبل خبراء الصناعة). تتضمن نماذج البيانات شبكة تحديد موقف البائعين، وتحليل خط زمني للسوق، ونظرة عامة على السوق ودليل، وشبكة تحديد موقف الشركة، وتحليل براءات الاختراع، وتحليل التسعير، وتحليل حصة الشركة في السوق، ومعايير القياس، وتحليل حصة البائعين على المستوى العالمي مقابل الإقليمي. لمعرفة المزيد عن منهجية البحث، أرسل استفسارًا للتحدث إلى خبراء الصناعة لدينا.

التخصيص متاح

تعد Data Bridge Market Research رائدة في مجال البحوث التكوينية المتقدمة. ونحن نفخر بخدمة عملائنا الحاليين والجدد بالبيانات والتحليلات التي تتطابق مع هدفهم. ويمكن تخصيص التقرير ليشمل تحليل اتجاه الأسعار للعلامات التجارية المستهدفة وفهم السوق في بلدان إضافية (اطلب قائمة البلدان)، وبيانات نتائج التجارب السريرية، ومراجعة الأدبيات، وتحليل السوق المجدد وقاعدة المنتج. ويمكن تحليل تحليل السوق للمنافسين المستهدفين من التحليل القائم على التكنولوجيا إلى استراتيجيات محفظة السوق. ويمكننا إضافة عدد كبير من المنافسين الذين تحتاج إلى بيانات عنهم بالتنسيق وأسلوب البيانات الذي تبحث عنه. ويمكن لفريق المحللين لدينا أيضًا تزويدك بالبيانات في ملفات Excel الخام أو جداول البيانات المحورية (كتاب الحقائق) أو مساعدتك في إنشاء عروض تقديمية من مجموعات البيانات المتوفرة في التقرير.