North America Genetic Testing Market

حجم السوق بالمليار دولار أمريكي

CAGR :

%

USD

5,688.94 Billion

USD

17,887.74 Billion

2021

2029

USD

5,688.94 Billion

USD

17,887.74 Billion

2021

2029

| 2022 –2029 | |

| USD 5,688.94 Billion | |

| USD 17,887.74 Billion | |

|

|

|

سوق الاختبارات الجينية في أمريكا الشمالية، حسب النوع (اختبار الناقل، الاختبار التشخيصي، الاختبار قبل الولادة، فحص حديثي الولادة، الاختبار التنبؤي وما قبل الأعراض، أنواع أخرى)، التكنولوجيا (تسلسل الحمض النووي (الاختبار القائم على NGS)، تفاعل البوليميراز المتسلسل، المصفوفات الدقيقة ، تسلسل الجينوم الكامل، التهجين الموضعي الفلوري (FISH)، أخرى)، الأمراض (اضطراب وراثي نادر، السرطانالتليف الكيسي ، فقر الدم المنجلي ، ضمور العضلات دوشين، الثلاسيميا، مرض هنتنغتون، متلازمة X الهش، ضمور العضلات دوشين، أخرى) المستخدم النهائي (المستشفيات والعيادات ومراكز التشخيص والعيادات الخاصة ومقدمي خدمات المختبرات والمختبرات الخاصة) اتجاهات الصناعة والتوقعات حتى عام 2029

تحليل السوق والرؤى

إن سوق الاختبارات الجينية في أمريكا الشمالية مدفوع بعوامل مثل ارتفاع معدل انتشار الاضطرابات الوراثية، والتقدم التكنولوجي المتزايد في سوق الاختبارات الجينية الذي يعزز الطلب عليها، فضلاً عن زيادة الاستثمار في البحث والتطوير، مما يؤدي إلى نمو السوق. في الوقت الحالي، زادت نفقات الرعاية الصحية في جميع أنحاء البلدان المتقدمة والناشئة، ومن المتوقع أن يخلق ذلك ميزة تنافسية للشركات المصنعة لتطوير أسواق اختبارات جينية جديدة ومبتكرة. ومع ذلك، فإن التكلفة العالية المرتبطة بالاختبارات الجينية والأطر التنظيمية الصارمة للاختبارات الجينية.

يقدم تقرير سوق الاختبارات الجينية في أمريكا الشمالية تفاصيل عن حصة السوق والتطورات الجديدة وتحليل خط أنابيب المنتجات وتأثير اللاعبين المحليين والمحليين في السوق وتحليل الفرص من حيث جيوب الإيرادات الناشئة والتغييرات في لوائح السوق وموافقات المنتجات والقرارات الاستراتيجية وإطلاق المنتجات والتوسعات الجغرافية والابتكارات التكنولوجية في السوق. لفهم التحليل وسيناريو السوق، اتصل بنا للحصول على موجز محلل، وسيساعدك فريقنا في إنشاء حل لتأثير الإيرادات لتحقيق هدفك المنشود. إن قابلية التوسع وتوسع أعمال وحدات البيع بالتجزئة في البلدان النامية في مختلف المناطق والشراكة مع الموردين للتوزيع الآمن لمنتجات الآلات والأدوية هي المحركات الرئيسية التي دفعت الطلب على السوق في فترة التنبؤ.

تعريف السوق

الاختبار الجيني هو نوع من الاختبارات الطبية التي تحدد التغيرات في الجينات أو الكروموسومات أو البروتينات. يمكن لنتيجة الاختبار الجيني تأكيد أو استبعاد حالة وراثية مشتبه بها أو المساعدة في تحديد فرصة الشخص في الإصابة باضطراب وراثي أو نقله. هناك أكثر من 77000 اختبار جيني قيد الاستخدام حاليًا، ويتم تطوير اختبارات أخرى.

كما أن الابتكارات والتقنيات المتزايدة والعدد المتزايد من اللاعبين في السوق وإطلاق المنتجات الجديدة تعمل أيضًا على دفع نمو سوق الاختبارات الجينية في أمريكا الشمالية.

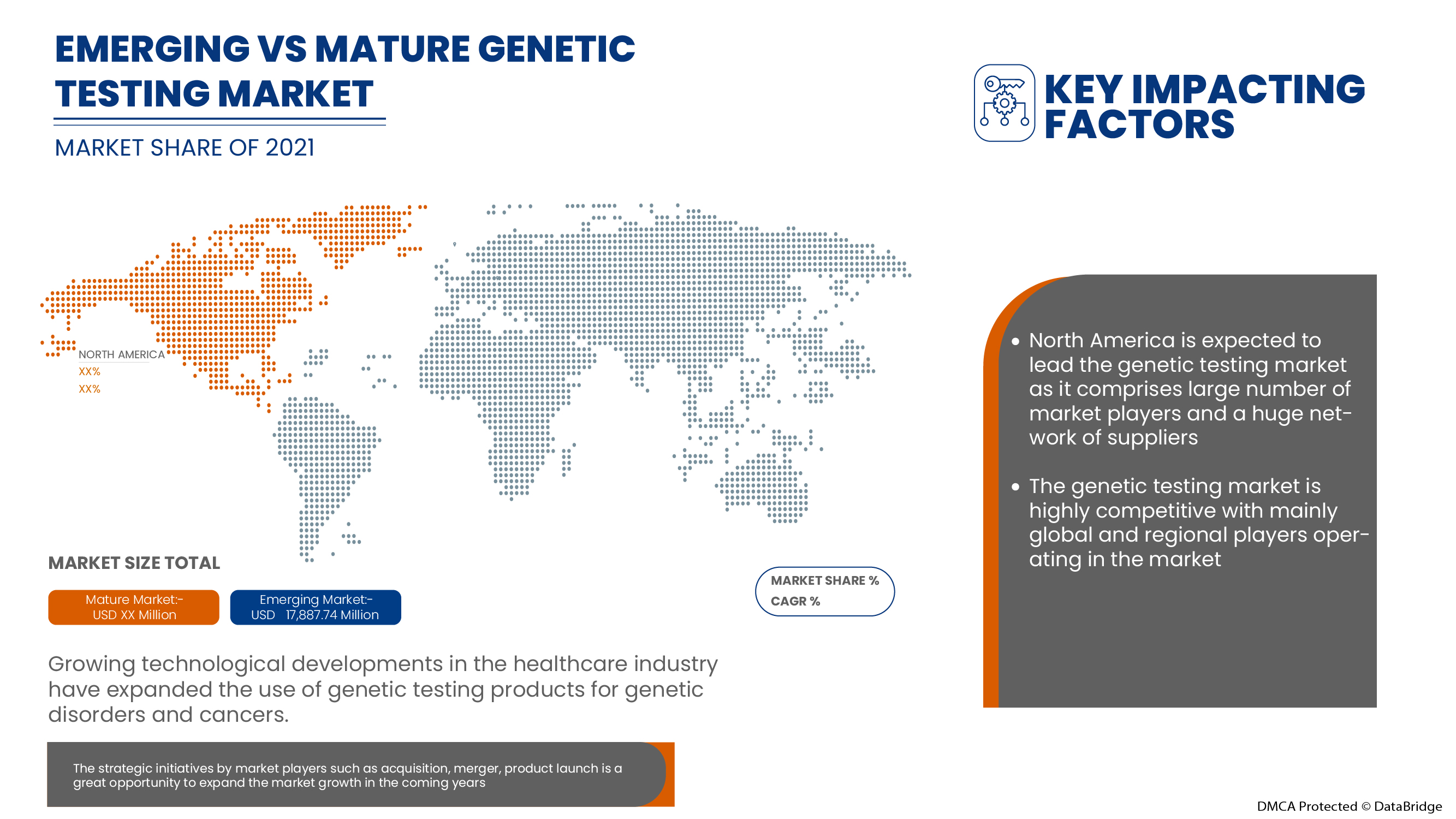

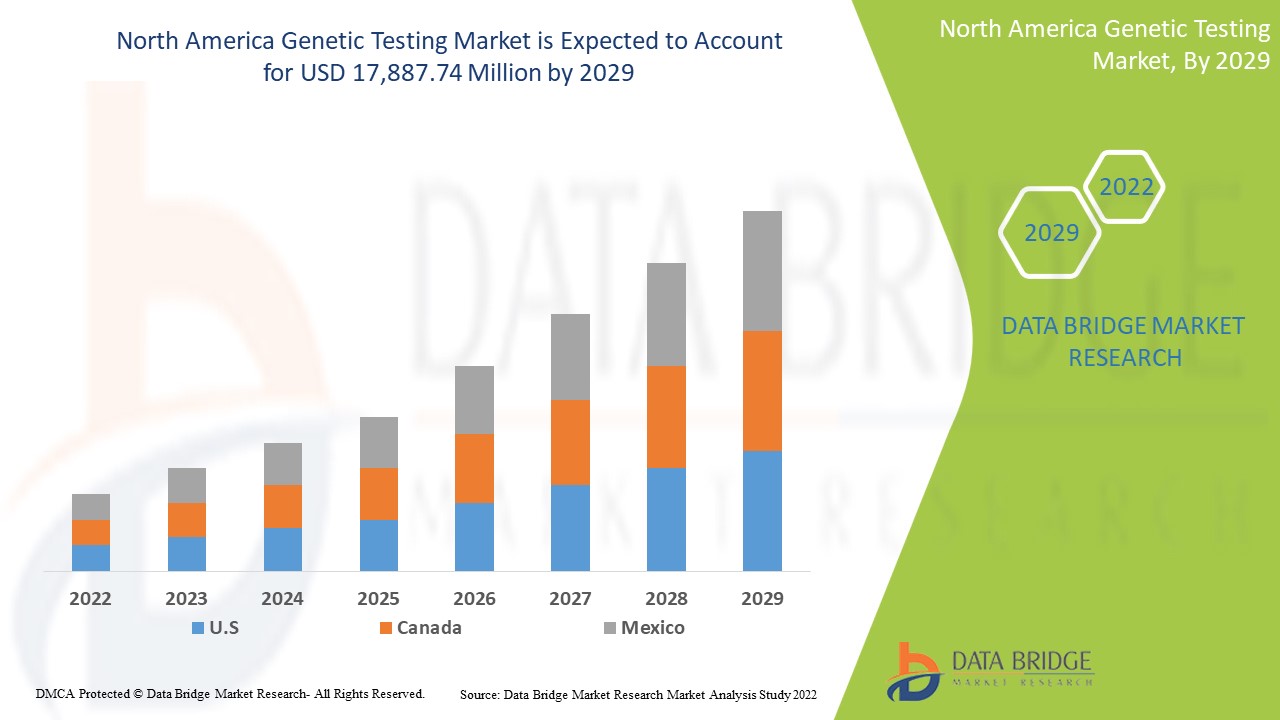

من المتوقع أن يحقق سوق الاختبارات الجينية في أمريكا الشمالية نموًا في السوق في الفترة المتوقعة من 2022 إلى 2029. تحلل شركة Data Bridge Market Research أن السوق ينمو بمعدل نمو سنوي مركب بنسبة 15.6٪ في الفترة المتوقعة من 2022 إلى 2029 ومن المتوقع أن يصل إلى 17،887.74 مليون دولار أمريكي بحلول عام 2029 من 5،688.94 مليون دولار أمريكي في عام 2021.

|

تقرير القياس |

تفاصيل |

|

فترة التنبؤ |

2022 إلى 2029 |

|

سنة الأساس |

2021 |

|

سنوات تاريخية |

2020 |

|

وحدات كمية |

الإيرادات بالملايين من الدولارات الأمريكية |

|

القطاعات المغطاة |

حسب النوع (اختبار الناقل، الاختبار التشخيصي، الاختبار قبل الولادة، فحص حديثي الولادة، الاختبار التنبؤي والاختبار قبل الأعراض، أنواع أخرى)، التكنولوجيا (تسلسل الحمض النووي (الاختبار القائم على NGS)، تفاعل البوليميراز المتسلسل، المصفوفات الدقيقة، تسلسل الجينوم الكامل، التهجين الموضعي الفلوري (FISH)، أخرى)، الأمراض (اضطراب وراثي نادر، السرطان، التليف الكيسي، فقر الدم المنجلي، ضمور العضلات دوشين، الثلاسيميا، مرض هنتنغتون، متلازمة كروموسوم إكس الهش، ضمور العضلات دوشين، أخرى) المستخدم النهائي (المستشفيات والعيادات ومراكز التشخيص والعيادات الخاصة ومقدمي خدمات المختبرات والمختبرات الخاصة) |

|

الدول المغطاة |

الولايات المتحدة وكندا والمكسيك |

|

الجهات الفاعلة في السوق المشمولة |

Thermo Fisher Scientific Inc.، وInvitae Corporation، وBio-Rad Laboratories, Inc.، وPerkinElmer Inc.، وIllumina, Inc.، وQIAGEN، وF. Hoffmann-La Roche Ltd.، وFulgent Genetics، وMyriad Genetics, Inc.، وAbbott، وEurofins Scientific، وSorenson Genomics، وBiocartis، وCepheid (شركة تابعة لشركة Danaher)، وPacBio، وOtogenetics، وBioReference، وSema4 OpCo, Inc.، وNatera, Inc. وغيرها |

ديناميكيات سوق الاختبارات الجينية في أمريكا الشمالية

السائقين

-

تزايد انتشار الأمراض الوراثية

قد تتسبب الاضطرابات الوراثية في حدوث مشكلات صحية خطيرة تجعلها غير متوافقة مع الحياة. وفي الحالات الأكثر شدة، قد تتسبب هذه الحالات في إجهاض الجنين المصاب. ويؤدي الانتشار المتزايد للأمراض الوراثية والعيوب الخلقية إلى زيادة الطلب على الاختبارات الجينية.

وفقًا للمقال، الاضطرابات الوراثية والتشوهات الخلقية: استراتيجيات للحد من العبء في المنطقة، 2022،

-

تحدث الاضطرابات الوراثية والتشوهات الخلقية في حوالي 2% - 5% من جميع المواليد الأحياء، وهو ما يمثل ما يصل إلى 30% من حالات دخول الأطفال إلى المستشفيات ويسبب حوالي 50% من وفيات الأطفال في البلدان الصناعية

ومن ثم، فإن هذا يؤدي إلى زيادة الطلب على سوق الاختبارات الجينية.

-

زيادة في اعتماد تسلسل الجيل التالي

مع استمرار علم الأدوية الذي يركز على الجينوم في لعب دور أكبر في علاج العديد من الأمراض المزمنة، وخاصة السرطان، يتطور التسلسل الجيني للجيل التالي (NGS) كأداة قوية لتوفير نظرة أعمق وأكثر دقة في الأسس الجزيئية للأورام الفردية والمستقبلات المحددة.

تقدم تقنية الجيل التالي من الجينوم مزايا من حيث الدقة والحساسية والسرعة مقارنة بالطرق التقليدية التي لديها القدرة على إحداث تأثير كبير في مجال علم الأورام. ولأن تقنية الجيل التالي من الجينوم قادرة على تقييم جينات متعددة في اختبار واحد، فإن الحاجة إلى طلب اختبارات متعددة لتحديد الطفرة المسببة يتم التخلص منها.

على سبيل المثال،

-

تم استكشاف تقنية NGS أيضًا من أجل وضع ملف تعريف شامل للجينات الدوائية ذات الصلة بحرائك الدواء وديناميكيات الدواء، وتشير التقارير الأولية لعام 2017 إلى أن هذه التقنية قد تمثل أداة موثوقة وفعالة لاكتشاف الاختلافات الجينية الشائعة والنادرة في هذه الجينات.

ومن المتوقع أن يكون هذا بمثابة محرك لنمو سوق الاختبارات الجينية.

فرص

-

ارتفاع الدخل المتاح

إن الإنفاق الذي تنفقه دولة ما على الرعاية الصحية ومعدل نموها بمرور الوقت يتأثر بمجموعة واسعة من العوامل الاقتصادية والاجتماعية بما في ذلك ترتيبات التمويل وهيكل تنظيم النظام الصحي. وعلى وجه الخصوص، هناك ارتباط قوي بين مستوى الدخل الكامل لبلد ما ومقدار ما ينفقه سكان ذلك البلد على الرعاية الصحية.

كما أن المبادرات الاستراتيجية التي اتخذها اللاعبون الرئيسيون في السوق ستوفر السلامة البنيوية والفرص المستقبلية لسوق الاختبارات الجينية في الفترة المتوقعة 2022-2029.

القيود/التحديات

- التكلفة العالية للاختبارات الجينية

قد تكون الاختبارات الجينية مكلفة وقد لا تغطيها بعض خطط التأمين الصحي. وتختلف تكاليف الاختبارات الجينية العديدة وفقًا للمرض المستهدف الذي يتم اختباره من أجله.

وفقًا لموقع Breastcancer.org، يمكن أن تتفاوت تكلفة الاختبار الجيني للسرطان بشكل كبير وقد تتراوح بين 300 و5000 دولار. وقد تعتمد تكلفة الاختبار الجيني على نوع الاختبار وكذلك مدى تعقيده.

قد تتكلف الاختبارات الجينية ما بين 100 دولار إلى أكثر من 2000 دولار، وذلك حسب طبيعة الاختبار وتعقيده. وإذا كان الأمر يتطلب أكثر من اختبار واحد أو كان لابد من اختبار العديد من أفراد الأسرة للحصول على نتيجة مهمة، فإن التكلفة ترتفع. وتختلف تكلفة فحص حديثي الولادة حسب الولاية.

تأثير كوفيد-19 على سوق الاختبارات الجينية في أمريكا الشمالية

لقد أثر فيروس كورونا المستجد (كوفيد-19) بشكل إيجابي على السوق حيث تم إجراء العديد من الاختبارات الجينية والمصليّة لفيروس كورونا المستجد (كوفيد-19) مما يزيد الطلب على الاختبارات الجينية خلال هذه الفترة.

التطورات الأخيرة

- في ديسمبر 2021، أعلنت شركة Thermo Fisher Scientific Inc. أنها أكملت استحواذها على شركة PPD، Inc.، وهي شركة عالمية رائدة في تقديم خدمات البحث السريري لصناعة الأدوية الحيوية والتكنولوجيا الحيوية، مقابل 17.4 مليار دولار. ساعد هذا الاستحواذ في توليد المزيد من الإيرادات وتعزيز نمو السوق.

نطاق سوق الاختبارات الجينية في أمريكا الشمالية

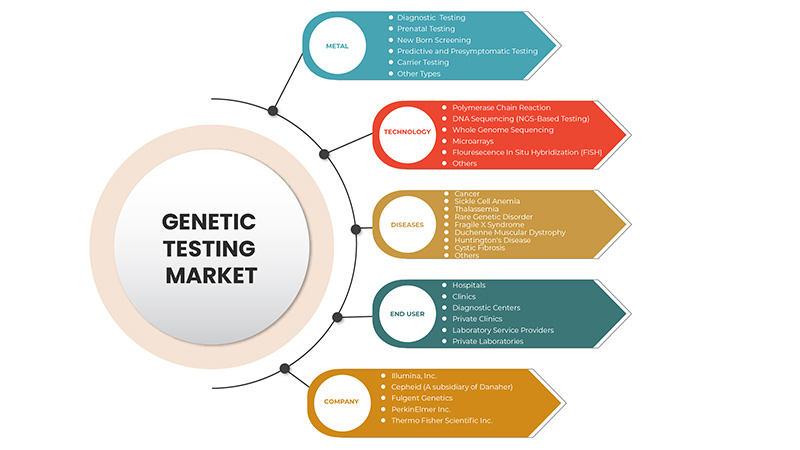

يتم تقسيم سوق الاختبارات الجينية في أمريكا الشمالية إلى النوع والتكنولوجيا والأمراض والمستخدم النهائي. سيساعدك النمو بين هذه القطاعات على تحليل قطاعات النمو الضئيلة في الصناعات وتزويد المستخدمين بنظرة عامة قيمة على السوق ورؤى السوق لاتخاذ قرارات استراتيجية لتحديد تطبيقات السوق الأساسية.

يكتب

- الاختبارات التشخيصية

- اختبارات ما قبل الولادة

- فحص حديثي الولادة

- الاختبارات التنبؤية والاختبارات ما قبل الأعراض

- اختبار الناقل

- أنواع أخرى

على أساس النوع، يتم تقسيم سوق الاختبارات الجينية في أمريكا الشمالية إلى اختبارات تشخيصية، واختبارات ما قبل الولادة، وفحص حديثي الولادة، واختبارات تنبؤية واختبارات ما قبل الأعراض، واختبارات الناقل وأنواع أخرى.

تكنولوجيا

- تفاعل البوليميراز المتسلسل

- تسلسل الحمض النووي (اختبار يعتمد على NGS)

- تسلسل الجينوم الكامل

- المصفوفات الدقيقة

- التهجين الموضعي الفلوري (FISH)

- آحرون

على أساس التكنولوجيا، يتم تقسيم سوق الاختبارات الجينية في أمريكا الشمالية إلى تسلسل الحمض النووي (الاختبار القائم على NGS)، وتفاعل البوليميراز المتسلسل، والمصفوفات الدقيقة، وتسلسل الجينوم الكامل، والتهجين الموضعي الفلوري (FISH)، وغيرها.

الأمراض

- سرطان

- فقر الدم المنجلي

- الثلاسيميا

- اضطراب وراثي نادر

- متلازمة إكس الهش

- ضمور العضلات دوشين

- مرض هنتنغتون

- تليّف كيسي

- آحرون

على أساس الأمراض، يتم تقسيم سوق الاختبارات الجينية في أمريكا الشمالية إلى اضطراب وراثي نادر، والسرطان، والتليف الكيسي، وفقر الدم المنجلي، وخلل العضلات دوشين، والثلاسيميا، ومرض هنتنغتون، ومتلازمة الصبغي X الهش، وغيرها.

المستخدم النهائي

- المستشفيات

- العيادات

- مراكز التشخيص

- العيادات الخاصة

- مقدمي خدمات المختبر

- المختبرات الخاصة

على أساس المستخدمين النهائيين، يتم تقسيم سوق الاختبارات الجينية في أمريكا الشمالية إلى المستشفيات والعيادات ومراكز التشخيص والعيادات الخاصة ومقدمي الخدمات المعملية والمختبرات الخاصة.

تحليل/رؤى إقليمية لسوق الاختبارات الجينية

يتم تحليل سوق الاختبارات الجينية وتوفير رؤى حول حجم السوق والاتجاهات حسب البلد والنوع والتكنولوجيا والأمراض والمستخدم النهائي كما هو مذكور أعلاه.

الولايات المتحدة هي الدولة المهيمنة الرئيسية في السوق بسبب الانتشار المتزايد للاضطرابات الوراثية بين السكان في هذه البلدان. وهي تهيمن على سوق الاختبارات الجينية من حيث حصة السوق وإيرادات السوق وستستمر في ازدهار هيمنتها خلال فترة التوقعات. ويرجع هذا إلى العيوب الوراثية والانحرافات الصبغية لدى السكان في المناطق، كما أن التطوير السريع للأبحاث يعزز السوق.

كما يوفر قسم الدولة في التقرير عوامل التأثير الفردية على السوق والتغييرات في اللوائح في السوق والتي تؤثر على الاتجاهات الحالية والمستقبلية للسوق. تعد نقاط البيانات، مثل المبيعات الجديدة والاستبدالية، والتركيبة السكانية للدولة، وعلم الأوبئة المرضية، ورسوم الاستيراد والتصدير، من بين المؤشرات الرئيسية المستخدمة للتنبؤ بسيناريو السوق للدول الفردية. بالإضافة إلى ذلك، يتم النظر في وجود وتوافر العلامات التجارية العالمية والتحديات التي تواجهها بسبب المنافسة الشديدة من العلامات التجارية المحلية والمحلية، وتأثير قنوات المبيعات أثناء تقديم تحليل توقعات لبيانات الدولة.

تحليل المشهد التنافسي وحصة سوق الاختبارات الجينية

يوفر المشهد التنافسي لسوق الاختبارات الجينية تفاصيل حول المنافسين. وتشمل التفاصيل نظرة عامة على الشركة، والبيانات المالية للشركة، والإيرادات المتولدة، وإمكانات السوق، والاستثمار في البحث والتطوير، ومبادرات السوق الجديدة، والحضور العالمي، ومواقع الإنتاج والمرافق، والقدرات الإنتاجية، ونقاط القوة والضعف في الشركة، وإطلاق المنتج، وعرض المنتج ونطاقه، وهيمنة التطبيق. وتتعلق نقاط البيانات المذكورة أعلاه فقط بتركيز الشركات على سوق الاختبارات الجينية.

بعض اللاعبين الرئيسيين العاملين في سوق الاختبارات الجينية هم Thermo Fisher Scientific Inc. و Invitae Corporation و Bio-Rad Laboratories, Inc. و PerkinElmer Inc. و Illumina, Inc. و QIAGEN و F. Hoffmann-La Roche Ltd. و Fulgent Genetics و Myriad Genetics, Inc. و Abbott و Eurofins Scientific و Sorenson Genomics و Biocartis و Cepheid (شركة تابعة لـ Danaher) و PacBio و Otogenetics و BioReference و Sema4 OpCo, Inc. و Natera, Inc. وغيرها

منهجية البحث

يتم جمع البيانات وتحليل سنة الأساس باستخدام وحدات جمع البيانات ذات أحجام العينات الكبيرة. يتم تحليل بيانات السوق وتقديرها باستخدام إحصاءات السوق والنماذج المتماسكة. بالإضافة إلى ذلك، يعد تحليل حصة السوق وتحليل الاتجاهات الرئيسية من عوامل النجاح الرئيسية في تقرير السوق. منهجية البحث الرئيسية التي يستخدمها فريق بحث DBMR هي التثليث البيانات والتي تنطوي على استخراج البيانات وتحليل تأثير متغيرات البيانات على السوق والتحقق الأساسي (خبير الصناعة). وبصرف النظر عن هذا، تتضمن نماذج البيانات شبكة وضع البائعين وتحليل الخط الزمني للسوق ونظرة عامة على السوق والدليل وشبكة وضع الشركة وتحليل حصة الشركة في السوق ومعايير القياس والتحليل العالمي مقابل الإقليمي وتحليل حصة البائعين. يرجى طلب مكالمة محلل في حالة وجود استفسار آخر.

SKU-

احصل على إمكانية الوصول عبر الإنترنت إلى التقرير الخاص بأول سحابة استخبارات سوقية في العالم

- لوحة معلومات تحليل البيانات التفاعلية

- لوحة معلومات تحليل الشركة للفرص ذات إمكانات النمو العالية

- إمكانية وصول محلل الأبحاث للتخصيص والاستعلامات

- تحليل المنافسين باستخدام لوحة معلومات تفاعلية

- آخر الأخبار والتحديثات وتحليل الاتجاهات

- استغل قوة تحليل المعايير لتتبع المنافسين بشكل شامل

Table of Content

1 INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 OVERVIEW OF THE NORTH AMERICA GENETIC TESTING MARKET

1.4 LIMITATIONS

1.5 MARKETS COVERED

2 MARKET SEGMENTATION

2.1 MARKETS COVERED

2.2 GEOGRAPHICAL SCOPE

2.3 YEARS CONSIDERED FOR THE STUDY

2.4 CURRENCY AND PRICING

2.5 DBMR TRIPOD DATA VALIDATION MODEL

2.6 MULTIVARIATE MODELLING

2.7 TYPE LIFELINE CURVE

2.8 PRIMARY INTERVIEWS WITH KEY OPINION LEADERS

2.9 DBMR MARKET POSITION GRID

2.1 MARKET APPLICATION COVERAGE GRID

2.11 VENDOR SHARE ANALYSIS

2.12 SECONDARY SOURCES

2.13 ASSUMPTIONS

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

4.1 PESTEL ANALYSIS

4.2 PORTER’S FIVE FORCES

4.3 STRATEGIC INITIATIVES:

4.4 CONCLUSION:

4.5 INDUSTRY INSIGHTS

4.5.1 CANCER GENETICS RISK ASSESSMENT AND COUNSELING

4.5.2 GENETIC TESTS PRICING

4.5.3 KEY INSIGHTS

5 EPIDERMIOLOGY

6 NORTH AMERICA GENETIC TESTING MARKET: REGULATIONS

7 MARKET OVERVIEW

7.1 DRIVERS

7.1.1 GROWING PREVALENCE OF GENETIC DISORDERS

7.1.2 INCREASE IN THE ADOPTION OF NEXT GENERATION SEQUENCING

7.1.3 WIDE PRODUCT PORTFOLIO OFFERED BY A MAJOR PLAYER

7.1.4 INCREASE TREND TOWARD PERSONALIZED MEDICATION

7.2 RESTRAINTS

7.2.1 HIGH COST OF GENETIC TESTING

7.2.2 CYBER SECURITY CONCERNS IN GENOMICS

7.3 OPPORTUNITIES

7.3.1 STRATEGIC INITIATIVES BY THE KEY MARKET PLAYER

7.3.2 TECHNOLOGICAL ADVANCEMENT

7.3.3 INCREASING RESEARCH AND DEVELOPMENT

7.3.4 RISING DISPOSABLE INCOME

7.4 CHALLENGES

7.4.1 LACK OF SKILLED PROFESSIONALS TO PERFORM GENETIC TESTING

7.4.2 STRINGENT REGULATION POLICY

8 NORTH AMERICA GENETIC TESTING MARKET, BY TYPE

8.1 OVERVIEW

8.2 DIAGNOSTIC TESTING

8.3 PRENATAL TESTING

8.3.1 NON-INVASIVE SCREENING

8.3.1.1 BY SCREENING METHOD

8.3.1.1.1 WHOLE GENOME SEQUENCING

8.3.1.1.2 COUNTING OF cfDNA FRAGMENTS

8.3.1.1.3 OTHERS

8.3.1.2 BY CONDITION

8.3.1.2.1 TRISOMY 21

8.3.1.2.2 KLINEFELTER SYNDROME

8.3.1.2.3 JACOBS SYNDROME

8.3.1.2.4 CYSTIC FIBROSIS

8.3.1.2.5 TURNER SYNDROME

8.3.1.2.6 TRISOMY 18

8.3.1.2.7 HEMOPHILIA

8.3.1.2.8 TRISOMY 13

8.3.1.2.9 MICRODELETION SYNDROME

8.3.1.2.10 FETAL GENDER

8.3.1.2.11 OTHERS

8.3.1.3 BY SCREENING TYPE

8.3.1.3.1 CARRIER SEQUENCING

8.3.1.3.2 SEQUENTIAL SEQUENCING

8.3.2 MATERNAL SERUM QUAD SCREENING

8.4 NEW BORN SCREENING

8.4.1.1 SICKLE CELL DISEASE

8.4.1.2 CONGENITAL HYPOTHYROIDISM

8.4.1.3 PHENYLKETONURIA (PKU)

8.4.1.4 GALACTOSEMIA

8.4.1.5 MAPLE SYRUP URINE DISEASE

8.4.1.6 OTHERS

8.5 PREDICTIVE AND PRESYMPTOMATIC TESTING

8.6 CARRIER TESTING

8.6.1 BY TEST TYPE

8.6.1.1 MOLECULAR SCREENING TEST

8.6.1.2 BIOCHEMICAL SCREENING TEST

8.6.2 BY TYPE

8.6.2.1 EXPANDED CARRIER SCREENING

8.6.2.1.1 PREDESIGNED PANEL TESTING

8.6.2.1.2 CUSTOM-MADE PANEL TESTING

8.6.2.2 TARGETED DISEASE CARRIER SCREENING

8.6.2.2.1 BY MEDICAL CONDITION

8.6.2.2.2 HEMATOLOGICAL CONDITIONS

8.6.2.2.3 PULMONARY CONDITIONS

8.6.2.2.4 NEUROLOGICAL CONDITIONS

8.6.2.2.5 OTHER CONDITIONS

8.7 OTHER TYPES

9 NORTH AMERICA GENETIC TESTING MARKET, BY TECHNOLOGY

9.1 OVERVIEW

9.2 POLYMERASE CHAIN REACTION

9.2.1 REAL-TIME PCR (QPCR)

9.2.2 DIGITAL PCR (DPCR)

9.2.3 REVERSE TRANSCRIPTION PCR (RT-PCR)

9.2.4 HOT-START PCR

9.2.5 MULTIPLEX PCR

9.2.6 OTHER PCR

9.3 DNA SEQUENCING (NGS-BASED TESTING)

9.3.1 NEXT GENERATION SEQUENCING (NGS)

9.3.2 SANGER SEQUENCING (SINGLE GENE)

9.3.3 OTHER

9.4 WHOLE GENOME SEQUENCING

9.5 MICROARRAYS

9.5.1 DNA MICROARRAYS

9.5.2 PROTEIN MICROARRAYS

9.5.3 OTHER MICROARRAYS

9.6 FLUORESCENCE IN SITU HYBRIDIZATION (FISH)

9.7 OTHERS

10 NORTH AMERICA GENETIC TESTING MARKET, BY DISEASES

10.1 OVERVIEW

10.2 CANCER

10.2.1 BREAST

10.2.2 COLON

10.2.3 LUNG

10.2.4 PROSTATE

10.2.5 OTHERS

10.3 SICKLE CELL ANEMIA

10.4 THALASSEMIA

10.5 RARE GENETIC DISORDER

10.5.1 TRISOMY 21

10.5.2 MONOSOMY X

10.5.3 TRISOMY 13

10.5.4 MICRODELETION SYNDROME

10.5.5 TRISOMY 18

10.5.6 OTHERS

10.6 FRAGILE X SYNDROME

10.7 DUCHENNE MUSCULAR DYSTROPHY

10.8 HUNTINGTON'S DISEASE

10.9 CYSTIC FIBROSIS

10.1 OTHERS

11 NORTH AMERICA GENETIC TESTING MARKET, BY END USER

11.1 OVERVIEW

11.2 HOSPITALS

11.3 CLINICS

11.4 DIAGNOSTIC CENTERS

11.5 PRIVATE CLINICS

11.6 LABORATORY SERVICE PROVIDERS

11.7 PRIVATE LABORATORIES

12 NORTH AMERICA GENETIC TESTING MARKET, BY REGION

12.1 NORTH AMERICA

12.1.1 U.S.

12.1.2 CANADA

12.1.3 MEXICO

13 NORTH AMERICA GENETIC TESTING MARKET, COMPANY LANDSCAPE

13.1 COMPANY SHARE ANALYSIS: NORTH AMERICA

14 SWOT ANALYSIS

15 COMPANY PROFILE

15.1 ILLUMINA, INC.

15.1.1 COMPANY SNAPSHOT

15.1.2 COMPANY SHARE ANALYSIS

15.1.3 PRODUCT PORTFOLIO

15.1.4 RECENT DEVELOPMENT

15.1.4.1 ACQUISITION

15.1.4.2 COLLABORATION

15.2 CEPHEID

15.2.1 COMPANY SNAPSHOT

15.2.2 REVENUE ANALYSIS

15.2.3 COMPANY SHARE ANALYSIS

15.2.4 PRODUCT PORTFOLIO

15.2.5 RECENT DEVELOPMENT

15.2.5.1 BUSINEES EXPANSION

15.3 FULGENT GENETICS

15.3.1 COMPANY SNAPSHOT

15.3.2 REVENUE ANALYSIS

15.3.3 COMPANY SHARE ANALYSIS

15.3.4 PRODUCT PORTFOLIO

15.3.5 RECENT DEVELOPMENT

15.3.5.1 ACQUISITION

15.4 PERKINELMER INC.

15.4.1 COMPANY SNAPSHOT

15.4.2 REVENUE ANALYSIS

15.4.3 COMPANY SHARE ANALYSIS

15.4.4 PRODUCT PORTFOLIO

15.4.5 RECENT DEVELOPMENT

15.4.5.1 PRODUCT LAUNCH

15.5 THERMO FISHER SCIENTIFIC INC.

15.5.1 COMPANY SNAPSHOT

15.5.2 REVENUE ANALYSIS

15.5.3 COMPANY SHARE ANALYSIS

15.5.4 PRODUCT PORTFOLIO

15.5.5 RECENT DEVELOPMENT

15.5.5.1 COLLABORATION

15.6 ABBOTT

15.6.1 COMPANY SNAPSHOT

15.6.2 REVENUE ANALYSIS

15.6.3 PRODUCT PORTFOLIO

15.6.4 RECENT DEVELOPMENT

15.7 BIOCARTIS

15.7.1 COMPANY SNAPSHOT

15.7.2 REVENUE ANALYSIS

15.7.3 PRODUCT PORTFOLIO

15.7.4 RECENT DEVELOPMENT

15.7.4.1 PARTNERSHIP

15.7.4.2 AGREEMENT

15.8 BIO-HELIX

15.8.1 COMPANY SNAPSHOT

15.8.2 PRODUCT PORTFOLIO

15.8.3 RECENT DEVELOPMENT

15.9 BIO-RAD LABORATORIES, INC.

15.9.1 COMPANY SNAPSHOT

15.9.2 REVENUE ANALYSIS

15.9.3 PRODUCT PORTFOLIO

15.9.4 RECENT DEVELOPMENTS

15.9.4.1 ACQUISITION

15.9.4.2 PARTNERSHIP

15.1 BIOREFERENCE

15.10.1 COMPANY SNAPSHOT

15.10.2 REVENUE ANALYSIS

15.10.3 PRODUCT PORTFOLIO

15.10.4 RECENT DEVELOPMENT

15.10.4.1 ACQUISITION

15.11 ELITECHGROUP

15.11.1 COMPANY SNAPSHOT

15.11.2 PRODUCT PORTFOLIO

15.11.3 RECENT DEVELOPMENTS

15.11.3.1 PRODUCT LAUNCH

15.11.3.2 BUSINESS EXPANSION

15.12 EUROFINS SCIENTIFIC

15.12.1 COMPANY SNAPSHOT

15.12.2 REVENUE ANALYSIS

15.12.3 PRODUCT PORTFOLIO

15.12.4 RECENT DEVELOPMENT

15.12.4.1 PRODUCT LAUNCH

15.13 EUGENE LABS

15.13.1 COMPANY SNAPSHOT

15.13.2 PRODUCT PORTFOLIO

15.13.3 RECENT DEVELOPMENT

15.14 F. HOFFMANN-LA ROCHE LTD)

15.14.1 COMPANY SNAPSHOT

15.14.2 REVENUE ANALYSIS (PARENT COMPANY)

15.14.3 PRODUCT PORTFOLIO

15.14.4 RECENT DEVELOPMENTS

15.14.4.1 PRODUCT LAUNCH

15.15 GENES2ME

15.15.1 COMPANY SNAPSHOT

15.15.2 PRODUCT PORTFOLIO

15.15.3 RECENT DEVELOPMENT

15.16 INVITAE CORPORATION

15.16.1 COMPANY SNAPSHOT

15.16.2 REVENUE ANALYSIS

15.16.3 PRODUCT PORTFOLIO

15.16.4 RECENT DEVELOPMENTS

15.17 MAPMYGENOME

15.17.1 COMPANY SNAPSHOT

15.17.2 PRODUCT PORTFOLIO

15.17.3 RECENT DEVELOPMENT

15.18 MEDGENOME

15.18.1 COMPANY SNAPSHOT

15.18.2 PRODUCT PORTFOLIO

15.18.3 RECENT DEVELOPMENT

15.19 MYRIAD GENETICS

15.19.1 COMPANY SNAPSHOT

15.19.2 REVENUE ANALYSIS

15.19.3 PRODUCT PORTFOLIO

15.19.4 RECENT DEVELOPMENT

15.2 NATERA, INC.

15.20.1 COMPANY SNAPSHOT

15.20.2 PRODUCT PORTFOLIO

15.20.3 RECENT DEVELOPMENT

15.20.3.1 PARTNERSHIP

15.21 OTOGENRTICS

15.21.1 COMPANY SNAPSHOT

15.21.2 PRODUCT PORTFOLIO

15.21.3 RECENT DEVELOPMENT

15.22 PACBIO

15.22.1 COMPANY SNAPSHOT

15.22.2 REVENUE ANALYSIS

15.22.3 PRODUCT PORTFOLIO

15.22.4 RECENT DEVELOPMENT

15.23 QIAGEN

15.23.1 COMPANY SNAPSHOT

15.23.2 PRODUCT PORTFOLIO

15.23.3 RECENT DEVELOPMENTS

15.23.3.1 PARTNERSHIP

15.23.3.2 PRODUCT LAUNCH

15.24 SEMA4 OPCO, INC.

15.24.1 COMPANY SNAPSHOT

15.24.2 REVENUE ANALYSIS

15.24.3 PRODUCT PORTFOLIO

15.24.4 RECENT DEVELOPMENT

15.25 SORENSON GENOMICS

15.25.1 COMPANY SNAPSHOT

15.25.2 PRODUCT PORTFOLIO

15.25.3 RECENT DEVELOPMENT

16 QUESTIONNAIRE

17 RELATED REPORTS

List of Table

TABLE 1 NORTH AMERICA GENETIC TESTING MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 2 NORTH AMERICA GENETIC TESTING MARKET, BY TYPE, 2020-2029 (UNITS)

TABLE 3 NORTH AMERICA GENETIC TESTING MARKET, BY TYPE, 2020-2029 (ASP)

TABLE 4 NORTH AMERICA DIAGNOSTIC TESTING IN GENETIC TESTING MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 5 NORTH AMERICA PRENATAL TESTING IN GENETIC TESTING MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 6 NORTH AMERICA PRENATAL TESTING IN GENETIC TESTING MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 7 NORTH AMERICA PRENATAL TESTING IN GENETIC TESTING MARKET, BY TYPE, 2020-2029 (UNITS)

TABLE 8 NORTH AMERICA PRENATAL TESTING IN GENETIC TESTING MARKET, BY TYPE, 2020-2029 (ASP)

TABLE 9 NORTH AMERICA NON-INVASIVE SCREENING IN GENETIC TESTING MARKET, BY SCREENING METHOD, 2020-2029 (USD MILLION)

TABLE 10 NORTH AMERICA NON-INVASIVE SCREENING IN GENETIC TESTING MARKET, BY SCREENING METHOD, 2020-2029 (UNITS)

TABLE 11 NORTH AMERICA NON-INVASIVE SCREENING IN GENETIC TESTING MARKET, BY SCREENING METHOD, 2020-2029 (ASP)

TABLE 12 NORTH AMERICA NON-INVASIVE SCREENING IN GENETIC TESTING MARKET, BY CONDITION, 2020-2029 (USD MILLION)

TABLE 13 NORTH AMERICA NON-INVASIVE SCREENING IN GENETIC TESTING MARKET, BY SCREENING TYPE, 2020-2029 (USD MILLION)

TABLE 14 NORTH AMERICA NON-INVASIVE SCREENING IN GENETIC TESTING MARKET, BY SCREENING TYPE, 2020-2029 (UNITS)

TABLE 15 NORTH AMERICA NON-INVASIVE SCREENING IN GENETIC TESTING MARKET, BY SCREENING TYPE, 2020-2029 (ASP)

TABLE 16 NORTH AMERICA NEW BORN SCREENING IN GENETIC TESTING MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 17 NORTH AMERICA NEW-BORN SCREENING IN GENETIC TESTING MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 18 NORTH AMERICA PREDICTIVE AND PRESYMPTOMATIC TESTING IN GENETIC TESTING MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 19 NORTH AMERICA CARRIER TESTING IN GENETIC TESTING MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 20 NORTH AMERICA CARRIER TESTING IN GENETIC TESTING MARKET, BY TEST TYPE, 2020-2029 (USD MILLION)

TABLE 21 NORTH AMERICA CARRIER TESTING IN GENETIC TESTING MARKET, BY TEST TYPE, 2020-2029 (UNITS)

TABLE 22 NORTH AMERICA CARRIER TESTING IN GENETIC TESTING MARKET, BY TEST TYPE, 2020-2029 (ASP)

TABLE 23 NORTH AMERICA CARRIER TESTING IN GENETIC TESTING MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 24 NORTH AMERICA CARRIER TESTING IN GENETIC TESTING MARKET, BY TYPE, 2020-2029 (UNITS)

TABLE 25 NORTH AMERICA CARRIER TESTING IN GENETIC TESTING MARKET, BY TYPE, 2020-2029 (ASP)

TABLE 26 NORTH AMERICA EXPANDED CARRIER SCREENING IN GENETIC TESTING MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 27 NORTH AMERICA EXPANDED CARRIER SCREENING IN GENETIC TESTING MARKET, BY TYPE, 2020-2029 (UNITS)

TABLE 28 NORTH AMERICA EXPANDED CARRIER SCREENING IN GENETIC TESTING MARKET, BY TYPE, 2020-2029 (ASP)

TABLE 29 NORTH AMERICA CARRIER TESTING IN GENETIC TESTING MARKET, BY MEDICAL CONDITION, 2020-2029 (USD MILLION)

TABLE 30 NORTH AMERICA OTHER TYPES IN GENETIC TESTING MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 31 NORTH AMERICA GENETIC TESTING MARKET, BY TECHNOLOGY, 2020-2029 (USD MILLION)

TABLE 32 NORTH AMERICA POLYMERASE CHAIN REACTION IN GENETIC TESTING MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 33 NORTH AMERICA POLYMERASE CHAIN REACTION IN GENETIC TESTING MARKET, BY TECHNOLOGY, 2020-2029 (USD MILLION)

TABLE 34 NORTH AMERICA DNA SEQUENCING (NGS-BASED TESTING) IN GENETIC TESTING MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 35 NORTH AMERICA DNA SEQUENCING (NGS-BASED TESTING) IN GENETIC TESTING MARKET, BY TECHNOLOGY, 2020-2029 (USD MILLION)

TABLE 36 NORTH AMERICA WHOLE GENOME SEQUENCING IN GENETIC TESTING MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 37 NORTH AMERICA MICROARRAYS IN GENETIC TESTING MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 38 NORTH AMERICA MICROARRAYS IN GENETIC TESTING MARKET, BY TECHNOLOGY, 2020-2029 (USD MILLION)

TABLE 39 NORTH AMERICA FLUORESCENCE IN SITU HYBRIDIZATION (FISH) IN GENETIC TESTING MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 40 NORTH AMERICA OTHERS IN GENETIC TESTING MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 41 NORTH AMERICA GENETIC TESTING MARKET, BY DISEASES, 2020-2029 (USD MILLION)

TABLE 42 NORTH AMERICA CANCER IN GENETIC TESTING MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 43 NORTH AMERICA CANCER IN GENETIC TESTING MARKET, BY DISEASES, 2020-2029 (USD MILLION)

TABLE 44 NORTH AMERICA SICKLE CELL ANEMIA IN GENETIC TESTING MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 45 NORTH AMERICA THALASSEMIA IN GENETIC TESTING MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 46 NORTH AMERICA RARE GENETIC DISORDER IN GENETIC TESTING MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 47 NORTH AMERICA RARE GENETIC DISORDER IN GENETIC TESTING MARKET, BY DISEASES, 2020-2029 (USD MILLION)

TABLE 48 NORTH AMERICA FRAGILE X SYNDROME IN GENETIC TESTING MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 49 NORTH AMERICA DUCHENNE MUSCULAR DYSTROPHY IN GENETIC TESTING MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 50 NORTH AMERICA HUNTINGTON'S DISEASE IN GENETIC TESTING MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 51 NORTH AMERICA CYSTIC FIBROSIS IN GENETIC TESTING MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 52 NORTH AMERICA OTHERS IN GENETIC TESTING MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 53 NORTH AMERICA GENETIC TESTING MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 54 NORTH AMERICA HOSPITALS IN GENETIC TESTING MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 55 NORTH AMERICA CLINICS IN GENETIC TESTING MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 56 NORTH AMERICA DIAGNOSTIC CENTERS IN GENETIC TESTING MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 57 NORTH AMERICA PRIVATE CLINICS IN GENETIC TESTING MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 58 NORTH AMERICA LABORATORY SERVICE PROVIDERS IN GENETIC TESTING MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 59 NORTH AMERICA PRIVATE LABORATORIES IN GENETIC TESTING MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 60 NORTH AMERICA GENETIC TESTING MARKET, BY COUNTRY, 2020-2029 (USD MILLION)

TABLE 61 NORTH AMERICA GENETIC TESTING MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 62 NORTH AMERICA GENETIC TESTING MARKET, BY TYPE, 2020-2029 (UNITS)

TABLE 63 NORTH AMERICA GENETIC TESTING MARKET, BY TYPE, 2020-2029 (ASP)

TABLE 64 NORTH AMERICA PRENATAL TESTING IN GENETIC TESTING MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 65 NORTH AMERICA PRENATAL TESTING IN GENETIC TESTING MARKET, BY TYPE, 2020-2029 (UNITS)

TABLE 66 NORTH AMERICA PRENATAL TESTING IN GENETIC TESTING MARKET, BY TYPE, 2020-2029 (ASP)

TABLE 67 NORTH AMERICA NON-INVASIVE SCREENING IN GENETIC TESTING MARKET, BY SCREENING METHOD, 2020-2029 (USD MILLION)

TABLE 68 NORTH AMERICA NON-INVASIVE SCREENING IN GENETIC TESTING MARKET, BY SCREENING METHOD, 2020-2029 (UNITS)

TABLE 69 NORTH AMERICA NON-INVASIVE SCREENING IN GENETIC TESTING MARKET, BY SCREENING METHOD, 2020-2029 (ASP)

TABLE 70 NORTH AMERICA NON-INVASIVE SCREENING IN GENETIC TESTING MARKET, BY CONDITION, 2020-2029 (USD MILLION)

TABLE 71 NORTH AMERICA NON-INVASIVE SCREENING IN GENETIC TESTING MARKET, BY SCREENING TYPE, 2020-2029 (USD MILLION)

TABLE 72 NORTH AMERICA NON-INVASIVE SCREENING IN GENETIC TESTING MARKET, BY SCREENING TYPE, 2020-2029 (UNITS)

TABLE 73 NORTH AMERICA NON-INVASIVE SCREENING IN GENETIC TESTING MARKET, BY SCREENING TYPE, 2020-2029 (ASP)

TABLE 74 NORTH AMERICA NEW-BORN SCREENING IN GENETIC TESTING MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 75 NORTH AMERICA CARRIER TESTING IN GENETIC TESTING MARKET, BY TEST TYPE, 2020-2029 (USD MILLION)

TABLE 76 NORTH AMERICA CARRIER TESTING IN GENETIC TESTING MARKET, BY TEST TYPE, 2020-2029 (UNITS)

TABLE 77 NORTH AMERICA CARRIER TESTING IN GENETIC TESTING MARKET, BY TEST TYPE, 2020-2029 (ASP)

TABLE 78 NORTH AMERICA CARRIER TESTING IN GENETIC TESTING MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 79 NORTH AMERICA CARRIER TESTING IN GENETIC TESTING MARKET, BY TYPE, 2020-2029 (UNITS)

TABLE 80 NORTH AMERICA CARRIER TESTING IN GENETIC TESTING MARKET, BY TYPE, 2020-2029 (ASP)

TABLE 81 NORTH AMERICA EXPANDED CARRIER SCREENING IN GENETIC TESTING MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 82 NORTH AMERICA EXPANDED CARRIER SCREENING IN GENETIC TESTING MARKET, BY TYPE, 2020-2029 (UNITS)

TABLE 83 NORTH AMERICA EXPANDED CARRIER SCREENING IN GENETIC TESTING MARKET, BY TYPE, 2020-2029 (ASP)

TABLE 84 NORTH AMERICA CARRIER TESTING IN GENETIC TESTING MARKET, BY MEDICAL CONDITION, 2020-2029 (USD MILLION)

TABLE 85 NORTH AMERICA GENETIC TESTING MARKET, BY TECHNOLOGY, 2020-2029 (USD MILLION)

TABLE 86 NORTH AMERICA POLYMERASE CHAIN REACTION IN GENETIC TESTING MARKET, BY TECHNOLOGY, 2020-2029 (USD MILLION)

TABLE 87 NORTH AMERICA DNA SEQUENCING IN GENETIC TESTING MARKET, BY TECHNOLOGY, 2020-2029 (USD MILLION)

TABLE 88 NORTH AMERICA MICROARRAYS IN GENETIC TESTING MARKET, BY TECHNOLOGY, 2020-2029 (USD MILLION)

TABLE 89 NORTH AMERICA GENETIC TESTING MARKET, BY DISEASES, 2020-2029 (USD MILLION)

TABLE 90 NORTH AMERICA RARE GENETIC DISORDER IN GENETIC TESTING MARKET, BY DISEASES, 2020-2029 (USD MILLION)

TABLE 91 NORTH AMERICA CANCER IN GENETIC TESTING MARKET, BY DISEASES, 2020-2029 (USD MILLION)

TABLE 92 NORTH AMERICA GENETIC TESTING MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 93 U.S. GENETIC TESTING MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 94 U.S. GENETIC TESTING MARKET, BY TYPE, 2020-2029 (UNITS)

TABLE 95 U.S. GENETIC TESTING MARKET, BY TYPE, 2020-2029 (ASP)

TABLE 96 U.S. PRENATAL TESTING IN GENETIC TESTING MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 97 U.S. PRENATAL TESTING IN GENETIC TESTING MARKET, BY TYPE, 2020-2029 (UNITS)

TABLE 98 U.S. PRENATAL TESTING IN GENETIC TESTING MARKET, BY TYPE, 2020-2029 (ASP)

TABLE 99 U.S. NON-INVASIVE SCREENING IN GENETIC TESTING MARKET, BY SCREENING METHOD, 2020-2029 (USD MILLION)

TABLE 100 U.S. NON-INVASIVE SCREENING IN GENETIC TESTING MARKET, BY SCREENING METHOD, 2020-2029 (UNITS)

TABLE 101 U.S. NON-INVASIVE SCREENING IN GENETIC TESTING MARKET, BY SCREENING METHOD, 2020-2029 (ASP)

TABLE 102 U.S. NON-INVASIVE SCREENING IN GENETIC TESTING MARKET, BY CONDITION, 2020-2029 (USD MILLION)

TABLE 103 U.S. NON-INVASIVE SCREENING IN GENETIC TESTING MARKET, BY SCREENING TYPE, 2020-2029 (USD MILLION)

TABLE 104 U.S. NON-INVASIVE SCREENING IN GENETIC TESTING MARKET, BY SCREENING TYPE, 2020-2029 (UNITS)

TABLE 105 U.S. NON-INVASIVE SCREENING IN GENETIC TESTING MARKET, BY SCREENING TYPE, 2020-2029 (ASP)

TABLE 106 U.S. NEW-BORN SCREENING IN GENETIC TESTING MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 107 U.S. CARRIER TESTING IN GENETIC TESTING MARKET, BY TEST TYPE, 2020-2029 (USD MILLION)

TABLE 108 U.S. CARRIER TESTING IN GENETIC TESTING MARKET, BY TEST TYPE, 2020-2029 (UNITS)

TABLE 109 U.S. CARRIER TESTING IN GENETIC TESTING MARKET, BY TEST TYPE, 2020-2029 (ASP)

TABLE 110 U.S. CARRIER TESTING IN GENETIC TESTING MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 111 U.S. CARRIER TESTING IN GENETIC TESTING MARKET, BY TYPE, 2020-2029 (UNITS)

TABLE 112 U.S. CARRIER TESTING IN GENETIC TESTING MARKET, BY TYPE, 2020-2029 (ASP)

TABLE 113 U.S. EXPANDED CARRIER SCREENING IN GENETIC TESTING MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 114 U.S. EXPANDED CARRIER SCREENING IN GENETIC TESTING MARKET, BY TYPE, 2020-2029 (UNITS)

TABLE 115 U.S. EXPANDED CARRIER SCREENING IN GENETIC TESTING MARKET, BY TYPE, 2020-2029 (ASP)

TABLE 116 U.S. CARRIER TESTING IN GENETIC TESTING MARKET, BY MEDICAL CONDITION, 2020-2029 (USD MILLION)

TABLE 117 U.S. GENETIC TESTING MARKET, BY TECHNOLOGY, 2020-2029 (USD MILLION)

TABLE 118 U.S. POLYMERASE CHAIN REACTION IN GENETIC TESTING MARKET, BY TECHNOLOGY, 2020-2029 (USD MILLION)

TABLE 119 U.S. DNA SEQUENCING IN GENETIC TESTING MARKET, BY TECHNOLOGY, 2020-2029 (USD MILLION)

TABLE 120 U.S. MICROARRAYS IN GENETIC TESTING MARKET, BY TECHNOLOGY, 2020-2029 (USD MILLION)

TABLE 121 U.S. GENETIC TESTING MARKET, BY DISEASES, 2020-2029 (USD MILLION)

TABLE 122 U.S. RARE GENETIC DISORDER IN GENETIC TESTING MARKET, BY DISEASES, 2020-2029 (USD MILLION)

TABLE 123 U.S. CANCER IN GENETIC TESTING MARKET, BY DISEASES, 2020-2029 (USD MILLION)

TABLE 124 U.S. GENETIC TESTING MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 125 CANADA GENETIC TESTING MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 126 CANADA GENETIC TESTING MARKET, BY TYPE, 2020-2029 (UNITS)

TABLE 127 CANADA GENETIC TESTING MARKET, BY TYPE, 2020-2029 (ASP)

TABLE 128 CANADA PRENATAL TESTING IN GENETIC TESTING MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 129 CANADA PRENATAL TESTING IN GENETIC TESTING MARKET, BY TYPE, 2020-2029 (UNITS)

TABLE 130 CANADA PRENATAL TESTING IN GENETIC TESTING MARKET, BY TYPE, 2020-2029 (ASP)

TABLE 131 CANADA NON-INVASIVE SCREENING IN GENETIC TESTING MARKET, BY SCREENING METHOD, 2020-2029 (USD MILLION)

TABLE 132 CANADA NON-INVASIVE SCREENING IN GENETIC TESTING MARKET, BY SCREENING METHOD, 2020-2029 (UNITS)

TABLE 133 CANADA NON-INVASIVE SCREENING IN GENETIC TESTING MARKET, BY SCREENING METHOD, 2020-2029 (ASP)

TABLE 134 CANADA NON-INVASIVE SCREENING IN GENETIC TESTING MARKET, BY CONDITION, 2020-2029 (USD MILLION)

TABLE 135 CANADA NON-INVASIVE SCREENING IN GENETIC TESTING MARKET, BY SCREENING TYPE, 2020-2029 (USD MILLION)

TABLE 136 CANADA NON-INVASIVE SCREENING IN GENETIC TESTING MARKET, BY SCREENING TYPE, 2020-2029 (UNITS)

TABLE 137 CANADA NON-INVASIVE SCREENING IN GENETIC TESTING MARKET, BY SCREENING TYPE, 2020-2029 (ASP)

TABLE 138 CANADA NEW-BORN SCREENING IN GENETIC TESTING MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 139 CANADA CARRIER TESTING IN GENETIC TESTING MARKET, BY TEST TYPE, 2020-2029 (USD MILLION)

TABLE 140 CANADA CARRIER TESTING IN GENETIC TESTING MARKET, BY TEST TYPE, 2020-2029 (UNITS)

TABLE 141 CANADA CARRIER TESTING IN GENETIC TESTING MARKET, BY TEST TYPE, 2020-2029 (ASP)

TABLE 142 CANADA CARRIER TESTING IN GENETIC TESTING MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 143 CANADA CARRIER TESTING IN GENETIC TESTING MARKET, BY TYPE, 2020-2029 (UNITS)

TABLE 144 CANADA CARRIER TESTING IN GENETIC TESTING MARKET, BY TYPE, 2020-2029 (ASP)

TABLE 145 CANADA EXPANDED CARRIER SCREENING IN GENETIC TESTING MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 146 CANADA EXPANDED CARRIER SCREENING IN GENETIC TESTING MARKET, BY TYPE, 2020-2029 (UNITS)

TABLE 147 CANADA EXPANDED CARRIER SCREENING IN GENETIC TESTING MARKET, BY TYPE, 2020-2029 (ASP)

TABLE 148 CANADA CARRIER TESTING IN GENETIC TESTING MARKET, BY MEDICAL CONDITION, 2020-2029 (USD MILLION)

TABLE 149 CANADA GENETIC TESTING MARKET, BY TECHNOLOGY, 2020-2029 (USD MILLION)

TABLE 150 CANADA POLYMERASE CHAIN REACTION IN GENETIC TESTING MARKET, BY TECHNOLOGY, 2020-2029 (USD MILLION)

TABLE 151 CANADA DNA SEQUENCING IN GENETIC TESTING MARKET, BY TECHNOLOGY, 2020-2029 (USD MILLION)

TABLE 152 CANADA MICROARRAYS IN GENETIC TESTING MARKET, BY TECHNOLOGY, 2020-2029 (USD MILLION)

TABLE 153 CANADA GENETIC TESTING MARKET, BY DISEASES, 2020-2029 (USD MILLION)

TABLE 154 CANADA RARE GENETIC DISORDER IN GENETIC TESTING MARKET, BY DISEASES, 2020-2029 (USD MILLION)

TABLE 155 CANADA CANCER IN GENETIC TESTING MARKET, BY DISEASES, 2020-2029 (USD MILLION)

TABLE 156 CANADA GENETIC TESTING MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 157 MEXICO GENETIC TESTING MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 158 MEXICO GENETIC TESTING MARKET, BY TYPE, 2020-2029 (UNITS)

TABLE 159 MEXICO GENETIC TESTING MARKET, BY TYPE, 2020-2029 (ASP)

TABLE 160 MEXICO PRENATAL TESTING IN GENETIC TESTING MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 161 MEXICO PRENATAL TESTING IN GENETIC TESTING MARKET, BY TYPE, 2020-2029 (UNITS)

TABLE 162 MEXICO PRENATAL TESTING IN GENETIC TESTING MARKET, BY TYPE, 2020-2029 (ASP)

TABLE 163 MEXICO NON-INVASIVE SCREENING IN GENETIC TESTING MARKET, BY SCREENING METHOD, 2020-2029 (USD MILLION)

TABLE 164 MEXICO NON-INVASIVE SCREENING IN GENETIC TESTING MARKET, BY SCREENING METHOD, 2020-2029 (UNITS)

TABLE 165 MEXICO NON-INVASIVE SCREENING IN GENETIC TESTING MARKET, BY SCREENING METHOD, 2020-2029 (ASP)

TABLE 166 MEXICO NON-INVASIVE SCREENING IN GENETIC TESTING MARKET, BY CONDITION, 2020-2029 (USD MILLION)

TABLE 167 MEXICO NON-INVASIVE SCREENING IN GENETIC TESTING MARKET, BY SCREENING TYPE, 2020-2029 (USD MILLION)

TABLE 168 MEXICO NON-INVASIVE SCREENING IN GENETIC TESTING MARKET, BY SCREENING TYPE, 2020-2029 (UNITS)

TABLE 169 MEXICO NON-INVASIVE SCREENING IN GENETIC TESTING MARKET, BY SCREENING TYPE, 2020-2029 (ASP)

TABLE 170 MEXICO NEW-BORN SCREENING IN GENETIC TESTING MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 171 MEXICO CARRIER TESTING IN GENETIC TESTING MARKET, BY TEST TYPE, 2020-2029 (USD MILLION)

TABLE 172 MEXICO CARRIER TESTING IN GENETIC TESTING MARKET, BY TEST TYPE, 2020-2029 (UNITS)

TABLE 173 MEXICO CARRIER TESTING IN GENETIC TESTING MARKET, BY TEST TYPE, 2020-2029 (ASP)

TABLE 174 MEXICO CARRIER TESTING IN GENETIC TESTING MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 175 MEXICO CARRIER TESTING IN GENETIC TESTING MARKET, BY TYPE, 2020-2029 (UNITS)

TABLE 176 MEXICO CARRIER TESTING IN GENETIC TESTING MARKET, BY TYPE, 2020-2029 (ASP)

TABLE 177 MEXICO EXPANDED CARRIER SCREENING IN GENETIC TESTING MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 178 MEXICO EXPANDED CARRIER SCREENING IN GENETIC TESTING MARKET, BY TYPE, 2020-2029 (UNITS)

TABLE 179 MEXICO EXPANDED CARRIER SCREENING IN GENETIC TESTING MARKET, BY TYPE, 2020-2029 (ASP)

TABLE 180 MEXICO CARRIER TESTING IN GENETIC TESTING MARKET, BY MEDICAL CONDITION, 2020-2029 (USD MILLION)

TABLE 181 MEXICO GENETIC TESTING MARKET, BY TECHNOLOGY, 2020-2029 (USD MILLION)

TABLE 182 MEXICO POLYMERASE CHAIN REACTION IN GENETIC TESTING MARKET, BY TECHNOLOGY, 2020-2029 (USD MILLION)

TABLE 183 MEXICO DNA SEQUENCING IN GENETIC TESTING MARKET, BY TECHNOLOGY, 2020-2029 (USD MILLION)

TABLE 184 MEXICO MICROARRAYS IN GENETIC TESTING MARKET, BY TECHNOLOGY, 2020-2029 (USD MILLION)

TABLE 185 MEXICO GENETIC TESTING MARKET, BY DISEASES, 2020-2029 (USD MILLION)

TABLE 186 MEXICO RARE GENETIC DISORDER IN GENETIC TESTING MARKET, BY DISEASES, 2020-2029 (USD MILLION)

TABLE 187 MEXICO CANCER IN GENETIC TESTING MARKET, BY DISEASES, 2020-2029 (USD MILLION)

TABLE 188 MEXICO GENETIC TESTING MARKET, BY END USER, 2020-2029 (USD MILLION)

List of Figure

FIGURE 1 NORTH AMERICA GENETIC TESTING MARKET: SEGMENTATION

FIGURE 2 NORTH AMERICA GENETIC TESTING MARKET: DATA TRIANGULATION

FIGURE 3 NORTH AMERICA GENETIC TESTING MARKET: DROC ANALYSIS

FIGURE 4 NORTH AMERICA GENETIC TESTING MARKET: NORTH AMERICA VS REGIONAL MARKET ANALYSIS

FIGURE 5 NORTH AMERICA GENETIC TESTING MARKET: COMPANY RESEARCH ANALYSIS

FIGURE 6 NORTH AMERICA GENETIC TESTING MARKET: INTERVIEW DEMOGRAPHICS

FIGURE 7 NORTH AMERICA GENETIC TESTING MARKET: DBMR MARKET POSITION GRID

FIGURE 8 NORTH AMERICA GENETIC TESTING MARKET: APPLICATION COVERAGE GRID

FIGURE 9 NORTH AMERICA GENETIC TESTING MARKET: VENDOR SHARE ANALYSIS

FIGURE 10 NORTH AMERICA GENETIC TESTING MARKET: SEGMENTATION

FIGURE 11 INCREASING PREVALENCE OF LYMPHEDEMA AND RISING HEALTHCARE EXPENDITURE ARE EXPECTED TO DRIVE THE NORTH AMERICA GENETIC TESTING MARKET IN THE FORECAST PERIOD OF 2022 TO 2029

FIGURE 12 DIAGNOSTIC TESTING SEGMENT IS EXPECTED TO ACCOUNT FOR THE LARGEST SHARE OF THE NORTH AMERICA GENETIC TESTING MARKET IN 2022 & 2029

FIGURE 13 NORTH AMERICA IS EXPECTED TO DOMINATE THE NORTH AMERICA GENETIC TESTING MARKET AND ASIA-PACIFIC EXPECTED TO GROW WITH THE HIGHEST CAGR IN THE FORECAST PERIOD OF 2022 TO 2029

FIGURE 14 DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES OF NORTH AMERICA GENETIC TESTING MARKET

FIGURE 15 NORTH AMERICA GENETIC TESTING MARKET: BY TYPE, 2021

FIGURE 16 NORTH AMERICA GENETIC TESTING MARKET: BY TYPE, 2022-2029 (USD MILLION)

FIGURE 17 NORTH AMERICA GENETIC TESTING MARKET: BY TYPE, CAGR (2022-2029)

FIGURE 18 NORTH AMERICA GENETIC TESTING MARKET: BY TYPE, LIFELINE CURVE

FIGURE 19 NORTH AMERICA GENETIC TESTING MARKET: BY TECHNOLOGY, 2021

FIGURE 20 NORTH AMERICA GENETIC TESTING MARKET: BY TECHNOLOGY, 2022-2029 (USD MILLION)

FIGURE 21 NORTH AMERICA GENETIC TESTING MARKET: BY TECHNOLOGY, CAGR (2022-2029)

FIGURE 22 NORTH AMERICA GENETIC TESTING MARKET: BY TECHNOLOGY, LIFELINE CURVE

FIGURE 23 NORTH AMERICA GENETIC TESTING MARKET: BY DISEASES, 2021

FIGURE 24 NORTH AMERICA GENETIC TESTING MARKET: BY DISEASES, 2022-2029 (USD MILLION)

FIGURE 25 NORTH AMERICA GENETIC TESTING MARKET: BY DISEASES, CAGR (2022-2029)

FIGURE 26 NORTH AMERICA GENETIC TESTING MARKET: BY DISEASES, LIFELINE CURVE

FIGURE 27 NORTH AMERICA GENETIC TESTING MARKET: BY END USER, 2021

FIGURE 28 NORTH AMERICA GENETIC TESTING MARKET: BY END USER, 2022-2029 (USD MILLION)

FIGURE 29 NORTH AMERICA GENETIC TESTING MARKET: BY END USER, CAGR (2022-2029)

FIGURE 30 NORTH AMERICA GENETIC TESTING MARKET: BY END USER, LIFELINE CURVE

FIGURE 31 NORTH AMERICA GENETIC TESTING MARKET: SNAPSHOT (2021)

FIGURE 32 NORTH AMERICA GENETIC TESTING MARKET: BY COUNTRY (2021)

FIGURE 33 NORTH AMERICA GENETIC TESTING MARKET: BY COUNTRY (2022 & 2029)

FIGURE 34 NORTH AMERICA GENETIC TESTING MARKET: BY COUNTRY (2021 & 2029)

FIGURE 35 NORTH AMERICA GENETIC TESTING MARKET: BY TYPE (2022-2029)

FIGURE 36 NORTH AMERICA GENETIC TESTING MARKET: COMPANY SHARE 2021 (%)

منهجية البحث

يتم جمع البيانات وتحليل سنة الأساس باستخدام وحدات جمع البيانات ذات أحجام العينات الكبيرة. تتضمن المرحلة الحصول على معلومات السوق أو البيانات ذات الصلة من خلال مصادر واستراتيجيات مختلفة. تتضمن فحص وتخطيط جميع البيانات المكتسبة من الماضي مسبقًا. كما تتضمن فحص التناقضات في المعلومات التي شوهدت عبر مصادر المعلومات المختلفة. يتم تحليل بيانات السوق وتقديرها باستخدام نماذج إحصائية ومتماسكة للسوق. كما أن تحليل حصة السوق وتحليل الاتجاهات الرئيسية هي عوامل النجاح الرئيسية في تقرير السوق. لمعرفة المزيد، يرجى طلب مكالمة محلل أو إرسال استفسارك.

منهجية البحث الرئيسية التي يستخدمها فريق بحث DBMR هي التثليث البيانات والتي تتضمن استخراج البيانات وتحليل تأثير متغيرات البيانات على السوق والتحقق الأولي (من قبل خبراء الصناعة). تتضمن نماذج البيانات شبكة تحديد موقف البائعين، وتحليل خط زمني للسوق، ونظرة عامة على السوق ودليل، وشبكة تحديد موقف الشركة، وتحليل براءات الاختراع، وتحليل التسعير، وتحليل حصة الشركة في السوق، ومعايير القياس، وتحليل حصة البائعين على المستوى العالمي مقابل الإقليمي. لمعرفة المزيد عن منهجية البحث، أرسل استفسارًا للتحدث إلى خبراء الصناعة لدينا.

التخصيص متاح

تعد Data Bridge Market Research رائدة في مجال البحوث التكوينية المتقدمة. ونحن نفخر بخدمة عملائنا الحاليين والجدد بالبيانات والتحليلات التي تتطابق مع هدفهم. ويمكن تخصيص التقرير ليشمل تحليل اتجاه الأسعار للعلامات التجارية المستهدفة وفهم السوق في بلدان إضافية (اطلب قائمة البلدان)، وبيانات نتائج التجارب السريرية، ومراجعة الأدبيات، وتحليل السوق المجدد وقاعدة المنتج. ويمكن تحليل تحليل السوق للمنافسين المستهدفين من التحليل القائم على التكنولوجيا إلى استراتيجيات محفظة السوق. ويمكننا إضافة عدد كبير من المنافسين الذين تحتاج إلى بيانات عنهم بالتنسيق وأسلوب البيانات الذي تبحث عنه. ويمكن لفريق المحللين لدينا أيضًا تزويدك بالبيانات في ملفات Excel الخام أو جداول البيانات المحورية (كتاب الحقائق) أو مساعدتك في إنشاء عروض تقديمية من مجموعات البيانات المتوفرة في التقرير.