North America Facial Cleanser Market

حجم السوق بالمليار دولار أمريكي

CAGR :

%

USD

4.75 Billion

USD

6.99 Billion

2024

2032

USD

4.75 Billion

USD

6.99 Billion

2024

2032

| 2025 –2032 | |

| USD 4.75 Billion | |

| USD 6.99 Billion | |

|

|

|

|

تجزئة سوق منظفات الوجه في أمريكا الشمالية، حسب نوع المنتج (منظف الوجه الرغوي، منظف الوجه الجل، منظف الوجه الكريمي واللوشن، منظف الوجه الزيتي، منظف الوجه بدون رغوة، ماء ميسيلار، منظف الوجه بالصابون، منظف الوجه المذيب، منظف الكولاجين، وسادات القطن المنظفة، وغيرها)، المصدر (صناعي وطبيعي/عشبي)، نوع التغليف (زجاجات وبرطمانات، أنابيب، موزع، أكياس، عبوات بثور وشرائط، وغيرها)، نوع البشرة (بشرة مختلطة، بشرة دهنية، بشرة محايدة، بشرة جافة، بشرة حساسة، بشرة مختلطة، وغيرها)، الاستخدام (ترطيب، تبييض البشرة، دهنية، مكافحة الشيخوخة، الرؤوس السوداء، البقع الداكنة، إصلاح البشرة، الجفاف، وغيرها)، نطاق السعر (للأفراد العاديين والمميزين)، الفئة العمرية (العشرينيات والثلاثينيات، الأربعينيات، أقل من 20 عامًا، والخمسينيات فأكثر)، التكلفة. (أقل من 25 دولارًا أمريكيًا، من 25 إلى 50 دولارًا أمريكيًا، من 51 إلى 100 دولار أمريكي، من 101 إلى 250 دولارًا أمريكيًا، وأكثر من 250 دولارًا أمريكيًا)، العميل المستهدف (إناث وذكور)، الاستخدام النهائي (المنزل/التجزئة، الصالونات، وكالات عرض الأزياء والموضة، الأفلام والترفيه، دور الإعلام، وغيرها)، قناة التوزيع (غير متصلة بالإنترنت وعبر الإنترنت) - اتجاهات الصناعة والتوقعات حتى عام 2032

حجم سوق منظفات الوجه في أمريكا الشمالية

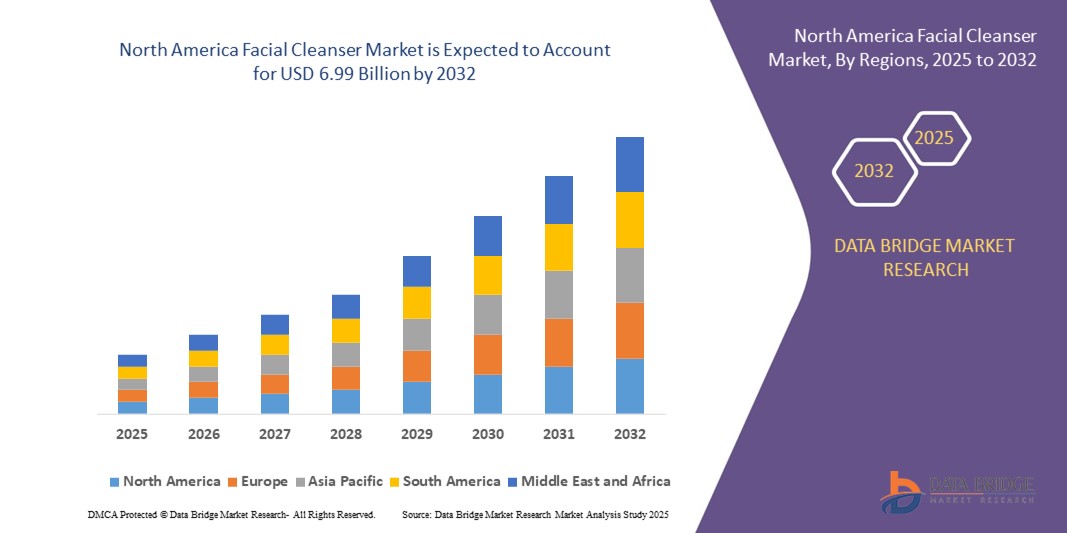

- تم تقييم حجم سوق منظف الوجه في أمريكا الشمالية بـ 4.75 مليار دولار أمريكي في عام 2024 ومن المتوقع أن يصل إلى 6.99 مليار دولار أمريكي بحلول عام 2032 ، بمعدل نمو سنوي مركب قدره 4.95٪ خلال الفترة المتوقعة

- ويعود نمو السوق إلى حد كبير إلى ارتفاع وعي المستهلكين فيما يتعلق بالنظافة الشخصية، والاعتماد المتزايد على روتين العناية بالبشرة، والتفضيل المتزايد للمكونات الطبيعية والعضوية.

- إن الطلب المتزايد على منظفات الوجه المتميزة ومتعددة الوظائف التي تعالج مشاكل مثل حب الشباب والشيخوخة والبشرة الحساسة يدعم بشكل أكبر توسع السوق

تحليل سوق منظفات الوجه في أمريكا الشمالية

- يشهد سوق منظفات الوجه في أمريكا الشمالية نموًا ثابتًا بسبب زيادة وعي المستهلكين بالعناية بالبشرة، والتركيز المتزايد على النظافة الشخصية، والطلب المتزايد على المكونات الطبيعية والعضوية

- إن الابتكار في تركيبات المنتجات، بما في ذلك المنظفات متعددة الوظائف التي تستهدف حب الشباب والشيخوخة والبشرة الحساسة، يدفع المستهلكين إلى تبنيها

- استحوذ سوق منظفات الوجه في الولايات المتحدة على أكبر حصة من الإيرادات بنسبة 82% في عام 2024 داخل أمريكا الشمالية، مدعومًا بالاتجاه المتزايد للعناية بالبشرة الشخصية وتبني التركيبات متعددة الفوائد والطبيعية

- من المتوقع أن تشهد كندا أعلى معدل نمو سنوي مركب (CAGR) في سوق منظفات الوجه في أمريكا الشمالية بسبب التبني المتزايد لمنتجات العناية بالبشرة الطبيعية والعضوية، وزيادة انتشار التجارة الإلكترونية، والاهتمام المتزايد بمنظفات الوجه الشخصية والاحترافية.

- حقق قطاع منظفات الوجه الرغوية أكبر حصة من إيرادات السوق في عام ٢٠٢٤، بفضل فعاليته في إزالة الأوساخ والمكياج والزيوت الزائدة، مما يجعله خيارًا مفضلًا للعناية اليومية بالبشرة. كما يوفر المنظفات الرغوية شعورًا بالانتعاش، وتقشيرًا لطيفًا، ومناسبًا للبشرة العادية إلى الدهنية، مما يعزز اعتماده بين المستخدمين المنزليين ومراكز العناية بالبشرة المتخصصة.

نطاق التقرير وتقسيم سوق منظف الوجه في أمريكا الشمالية

|

صفات |

رؤى رئيسية حول سوق منظف الوجه في أمريكا الشمالية |

|

القطاعات المغطاة |

|

|

الدول المغطاة |

أمريكا الشمالية

|

|

اللاعبون الرئيسيون في السوق |

|

|

فرص السوق |

• تزايد الطلب على منظفات الوجه العضوية والطبيعية |

|

مجموعات معلومات البيانات ذات القيمة المضافة |

بالإضافة إلى الرؤى حول سيناريوهات السوق مثل القيمة السوقية ومعدل النمو والتجزئة والتغطية الجغرافية واللاعبين الرئيسيين، فإن تقارير السوق التي تم تنظيمها بواسطة Data Bridge Market Research تشمل أيضًا تحليلًا متعمقًا من الخبراء وتحليل التسعير وتحليل حصة العلامة التجارية واستطلاع رأي المستهلكين وتحليل التركيبة السكانية وتحليل سلسلة التوريد وتحليل سلسلة القيمة ونظرة عامة على المواد الخام / المواد الاستهلاكية ومعايير اختيار البائعين وتحليل PESTLE وتحليل Porter والإطار التنظيمي. |

اتجاهات سوق منظفات الوجه في أمريكا الشمالية

تفضيل متزايد لمنظفات الوجه الطبيعية والعضوية

- يُحدث تحوّل المستهلكين المتزايد نحو منظفات الوجه الطبيعية والعضوية نقلة نوعية في عالم العناية بالبشرة، وذلك بتشجيع استخدام تركيبات نباتية وخالية من المواد الكيميائية. تُوفّر هذه المنتجات حلول تنظيف ألطف، مُناسبة للبشرة الحساسة، تُقلّل من التهيج وتُعزّز صحة البشرة. يُؤدّي هذا التوجّه إلى زيادة اعتماد مُنتجات العناية بالبشرة ذات العلامات التجارية النظيفة بين جيل الألفية وجيل Z.

- يُسرّع الطلب على المنظفات متعددة الوظائف، التي تجمع بين فوائد التنظيف والتقشير والترطيب، من إطلاق تركيبات مبتكرة. يبحث المستهلكون عن منتجات تُوفّر الوقت وتُبسّط روتين العناية بالبشرة، لا سيما في البيئات الحضرية سريعة الوتيرة. ويدعم هذا التوجه تنامي الوعي عبر منصات التواصل الاجتماعي وحملات المؤثرين.

- يدفع الاهتمام المتزايد بالمنتجات الصديقة للبيئة والخالية من القسوة الشركات إلى تطوير عبوات وتركيبات مستدامة. وتزداد شعبية العبوات القابلة للتحلل الحيوي، والحاويات القابلة لإعادة التعبئة، والمكونات النباتية، مما يعزز سمعة العلامة التجارية ويشجع على سلوك المستهلك الواعي بيئيًا.

- على سبيل المثال، في عام ٢٠٢٣، أفادت العديد من العلامات التجارية للعناية بالبشرة في أمريكا الشمالية بزيادة مبيعات منظفات الوجه العضوية بعد إطلاق عبوات قابلة للتحلل الحيوي وتركيبات من مكونات نباتية. وقد استجاب المستهلكون بشكل إيجابي، مما أدى إلى زيادة عمليات الشراء المتكررة وزيادة الولاء للعلامة التجارية.

- في حين أن التوجه نحو المنتجات الطبيعية ومتعددة الاستخدامات يعزز نمو السوق، إلا أن الابتكار المستمر وتوعية المستهلك وتوفير المنتجات بأسعار معقولة لا تزال عوامل بالغة الأهمية. يجب على الشركات التركيز على البحث والتطوير لتقديم منظفات وجه آمنة وفعالة وصديقة للبيئة.

ديناميكيات سوق منظفات الوجه في أمريكا الشمالية

سائق

زيادة وعي المستهلك بصحة الجلد والعافية

يدفع الوعي المتزايد بصحة البشرة والعناية الوقائية بها المستهلكين إلى إعطاء الأولوية لمنظفات الوجه عالية الجودة كجزء من روتينهم اليومي للعناية بالبشرة. يبحث المستهلكون عن منتجات تحمي من التلوث، وأضرار الأشعة فوق البنفسجية، وشيخوخة البشرة، مما يزيد الطلب على التركيبات المتطورة التي تحتوي على مضادات الأكسدة، والفيتامينات، والمستخلصات الطبيعية.

• ساهم انتشار وسائل التواصل الاجتماعي، وتأييد المؤثرين، ودروس العناية بالبشرة عبر الإنترنت في تثقيف المستهلكين حول فوائد المنتجات، وتشجيعهم على اتخاذ قرارات شراء مدروسة. وقد عزز هذا من استخدام منظفات الوجه الفاخرة في المناطق الحضرية والضواحي.

يُقدّم تجار التجزئة وعلامات العناية بالبشرة حلولاً وأدوات تشخيصية مُخصّصة للعناية بالبشرة بشكل متزايد، مما يُمكّن المستهلكين من اختيار منتجات مُصمّمة خصيصاً لنوع بشرتهم ومشاكلهم. يُوسّع هذا النهج المُخصّص نطاق انتشاره في السوق ويُعزّز رضا العملاء.

على سبيل المثال، في عام ٢٠٢٢، أفادت العديد من منصات التجارة الإلكترونية في أمريكا الشمالية بزيادة التفاعل مع أدوات تحليل البشرة الافتراضية، مما أدى إلى زيادة مبيعات المنظفات المُخصصة لأنواع البشرة المختلفة. أتاحت هذه الحلول الرقمية للمستهلكين اتخاذ قرارات شراء مدروسة، مما عزز رضاهم وولائهم للعلامة التجارية، مع تعزيز إيرادات السوق الإجمالية.

في حين أن الوعي والحلول الشخصية تُحرك السوق، إلا أن القدرة على تحمل التكاليف وسهولة الوصول وفعالية المنتج تبقى عوامل أساسية لاستدامة تبنيه من قِبَل المستهلكين. تستثمر العلامات التجارية بشكل متزايد في الاستشارات الإلكترونية والتوصيات المدعومة بالذكاء الاصطناعي والعروض الترويجية الموجهة لضمان حصول المستهلكين على منتجات تُلبي احتياجاتهم الخاصة للعناية بالبشرة، مما يُعزز التفاعل طويل الأمد وتكرار الشراء.

ضبط النفس/التحدي

ارتفاع أسعار المنظفات الفاخرة والمتخصصة يحد من انتشارها

• إن ارتفاع تكلفة منظفات الوجه الفاخرة والعضوية ومتعددة الاستخدامات يحد من إمكانية الحصول عليها بالنسبة للمستهلكين المهتمين بالسعر. ولا يزال العديد من المشترين الصغار يفضلون منظفات السوق الشاملة نظرًا لقيود الميزانية، مما يحد من نمو السوق بشكل عام. وقد دفع هذا العلامات التجارية إلى استكشاف خيارات التعبئة والتغليف القائمة على القيمة وخيارات المنتجات متوسطة الحجم لجذب قاعدة أوسع من المستهلكين مع الحفاظ على جودة منتجاتها المتميزة.

في بعض المناطق، يُقلل توافر المنظفات المتخصصة، وخاصةً تلك التي تحتوي على مكونات عضوية أو نباتية نادرة، من وصول المستهلكين إليها. كما تُفاقم قيود البيع بالتجزئة والتوزيع هذا التحدي. إضافةً إلى ذلك، تُفاقم اضطرابات سلسلة التوريد وصعوبات الحصول على المكونات النادرة الضغط على العلامات التجارية للحفاظ على توافر منتجاتها باستمرار.

تُشكّل المنافسة من العلامات التجارية الخاصة والعامة التي تُقدّم بدائل بأسعار معقولة ضغطًا على العلامات التجارية الفاخرة العريقة لتحقيق التوازن بين التسعير والجودة والابتكار. يُشجّع هذا التوجه على الابتكار في كفاءة التركيبة، والمنتجات متعددة الفوائد، والإنتاج المُحسّن من حيث التكلفة مع الحفاظ على سمعة العلامة التجارية.

على سبيل المثال، في عام ٢٠٢٣، كشفت دراسات السوق أن أكثر من ٦٠٪ من المستهلكين من ذوي الدخل المتوسط فضّلوا منظفات الوجه الشائعة على الخيارات العضوية الفاخرة نظرًا لاعتبارات التكلفة. واستجابت العديد من العلامات التجارية بتقديم عبوات أصغر حجمًا أو مجموعات تجريبية لزيادة إمكانية الحصول عليها وتشجيع تذوق المنتجات الفاخرة.

مع تنامي ابتكار المنتجات والعروض المتميزة، يبقى التصدي لتحديات التسعير والتوزيع أمرًا بالغ الأهمية لتوسيع نطاق انتشار المنتجات وتحقيق نمو طويل الأجل. يجب على الشركات الاستثمار في الإنتاج المحلي، وقنوات التجارة الإلكترونية، واستراتيجيات الترويج، لجعل منظفات الوجه عالية الجودة متاحة بسهولة أكبر لمختلف شرائح المستهلكين.

نطاق سوق منظفات الوجه في أمريكا الشمالية

يتم تقسيم السوق على أساس نوع المنتج، والمصدر، ونوع التعبئة والتغليف، ونوع الجلد، والتطبيق، ونطاق السعر، والفئة العمرية، والتكلفة، والعميل المستهدف، والاستخدام النهائي، وقناة التوزيع.

- حسب نوع المنتج

بناءً على نوع المنتج، يُقسّم سوق منظفات الوجه في أمريكا الشمالية إلى: منظفات الوجه الرغوية، ومنظفات الوجه الهلامية، ومنظفات الوجه الكريمية واللوشن، ومنظفات الوجه الزيتية، ومنظفات الوجه بدون رغوة، وماء ميسيلار، ومنظفات الوجه على شكل صابون، ومنظفات الوجه المذيبة، ومنظفات الكولاجين، ووسادات القطن المنظفة، وغيرها. استحوذت منظفات الوجه الرغوية على أكبر حصة من إيرادات السوق في عام 2024، بفضل فعاليتها في إزالة الأوساخ والمكياج والزيوت الزائدة، مما يجعلها مفضلة للغاية للعناية اليومية بالبشرة. كما توفر المنظفات الرغوية شعورًا بالانتعاش، وتقشيرًا لطيفًا، ومناسبة للبشرة العادية إلى الدهنية، مما يعزز استخدامها بين المستخدمين المنزليين ومراكز العناية بالبشرة الاحترافية.

من المتوقع أن يشهد قطاع منظفات الوجه الهلامية أسرع معدل نمو بين عامي 2025 و2032، بفضل تركيبته الخفيفة وغير الدهنية وخصائصه في التنظيف العميق، مما يجعله مثاليًا للبشرة الحساسة والمعرضة لحب الشباب. وتحظى المنظفات الهلامية بشعبية خاصة لسهولة استخدامها، وسرعة امتصاصها، وتوافقها مع تطبيقات العناية بالبشرة على الهواتف الذكية، بالإضافة إلى روتين العناية الشخصية.

- حسب المصدر

بناءً على المصدر، يُقسّم السوق إلى منتجات صناعية وطبيعية/عشبية. وقد حقق قطاع المنتجات الطبيعية/العشبية أكبر حصة من إيرادات السوق في عام ٢٠٢٤، مدفوعًا بتزايد تفضيل المستهلكين لمنتجات العناية بالبشرة العضوية والخالية من المواد الكيميائية، بالإضافة إلى تزايد شعبية المكونات النباتية مثل الصبار والبابونج ومستخلصات الشاي الأخضر. وتُفضّل المنظفات الطبيعية/العشبية بشكل خاص لتركيباتها الخفيفة وملاءمتها للبشرة الحساسة.

من المتوقع أن يشهد قطاع المنظفات الصناعية أسرع معدل نمو بين عامي 2025 و2032، بفضل فعاليته من حيث التكلفة، وثبات تركيباته، وتوافره الواسع في الأسواق العامة وعبر الإنترنت. وتُحسّن المنظفات الصناعية بشكل متزايد بمكونات وظيفية متطورة، مما يعزز إقبال المستهلكين المهتمين بالسعر والأداء.

- حسب نوع التغليف

يُقسّم السوق إلى زجاجات ومرطبانات، وأنابيب، وموزعات، وأكياس، وعبوات نفطة وشرائط، وغيرها. هيمن قطاع الزجاجات والمرطبانات على السوق في عام ٢٠٢٤، بفضل سهولة التخزين، وسهولة الاستخدام المتكرر، والتوافق مع مختلف درجات لزوجة المنتجات.

من المتوقع أن يشهد قطاع الأنابيب والموزعات أسرع نمو في الفترة من 2025 إلى 2032، مدفوعًا بمزايا النظافة، والقدرة على النقل، والتحكم الدقيق في الجرعات، والتفضيل المتزايد بين مستخدمي المنتجات المتميزة والصديقة للسفر.

- حسب نوع البشرة

يشمل التقسيم حسب نوع البشرة: البشرة المختلطة، والبشرة الدهنية، والبشرة المحايدة، والبشرة الجافة، والبشرة الحساسة، والبشرة المختلطة، وغيرها. وقد حقق قطاع البشرة الحساسة أكبر حصة من إيرادات السوق في عام ٢٠٢٤، بفضل تزايد الوعي بحساسية الجلد وتهيجه، والحاجة إلى تركيبات تنظيف لطيفة.

من المتوقع أن يشهد قطاع البشرة الدهنية أسرع معدل نمو في الفترة من 2025 إلى 2032، مدفوعًا بمخاوف المستهلكين في المناطق الحضرية بشأن حب الشباب، والإفرازات الدهنية الزائدة، والتوافر المتزايد لمنتجات التنظيف العميق والتحكم في الزيوت في قنوات البيع بالتجزئة عبر الإنترنت وخارجها.

- حسب الطلب

يُقسّم السوق إلى منتجات ترطيب، وتبييض البشرة، ومنتجات دهنية، ومضادة للشيخوخة، ورؤوس سوداء، وبقع داكنة، ومستحضرات إصلاح البشرة، ومستحضرات جفاف، وغيرها. وقد هيمن قطاع الترطيب على السوق في عام ٢٠٢٤، بفضل تركيز المستهلكين الكبير على الترطيب، والعناية بالبشرة، والعناية اليومية بها.

ومن المتوقع أن يشهد قطاع مكافحة الشيخوخة أسرع معدل نمو في الفترة من 2025 إلى 2032، بدعم من الطلب المتزايد من كبار السن، وارتفاع الوعي بالعناية بالبشرة، وإدخال المنظفات متعددة الوظائف التي تجمع بين الترطيب وفوائد مكافحة الشيخوخة.

- حسب نطاق السعر

يشمل التقسيم السعري فئتي المنتجات الشاملة والممتازة. وقد استحوذت فئة المنتجات الشاملة على أكبر حصة سوقية في عام ٢٠٢٤، بفضل أسعارها المعقولة، وتوافرها الواسع، وملاءمتها للاستخدام اليومي في المنازل.

ومن المتوقع أن يشهد قطاع المنتجات الفاخرة أسرع معدل نمو في الفترة من 2025 إلى 2032، وذلك بسبب ارتفاع الدخل المتاح، والشراء المرتبط بأسلوب الحياة، والشعبية المتزايدة لمنظفات الوجه الفاخرة ومتعددة الفوائد.

- حسب الفئة العمرية

يُقسّم السوق إلى فئات عمرية تتراوح بين العشرينات والثلاثينات، والأربعينات، وأقل من عشرين عامًا، والخمسينات فأكثر. هيمنت فئة العشرينات والثلاثينات على السوق في عام ٢٠٢٤، مدفوعةً بارتفاع الوعي بالعناية بالبشرة، وتوافر الدخل المتاح، والعادات الوقائية للعناية بالبشرة.

ومن المتوقع أن تشهد الفئة العمرية الأربعينية أسرع معدل نمو في الفترة من 2025 إلى 2032، وذلك بسبب التركيز المتزايد على مكافحة الشيخوخة والإصلاح والعناية بالبشرة المتخصصة بين المستهلكين في منتصف العمر.

- حسب التكلفة

يشمل التقسيم حسب التكلفة الفئات التالية: أقل من ٢٥ دولارًا أمريكيًا، من ٢٥ إلى ٥٠ دولارًا أمريكيًا، من ٥١ إلى ١٠٠ دولار أمريكي، من ١٠١ إلى ٢٥٠ دولارًا أمريكيًا، وأكثر من ٢٥٠ دولارًا أمريكيًا. استحوذت المنتجات التي تتراوح أسعارها بين ٢٥ و٥٠ دولارًا أمريكيًا على أكبر حصة سوقية في عام ٢٠٢٤، بفضل أسعارها المعقولة وجودتها العالية وتوافر مكونات متعددة الاستخدامات مثل حمض الهيالورونيك وفيتامين سي ومضادات الأكسدة.

من المتوقع أن يشهد قطاع 51 - 100 دولار أمريكي أسرع نمو في الفترة من 2025 إلى 2032، مدفوعًا بالطلب المتزايد على التركيبات المتميزة والمتخصصة التي توفر فوائد متعددة للعناية بالبشرة.

- حسب العميل المستهدف

يُقسّم السوق إلى قسمين: قسم للنساء وقسم للرجال. وسيُهيمن قطاع النساء في عام ٢٠٢٤، بفضل ارتفاع استخدام المنتجات، والوعي بالعلامة التجارية، والتفاعل مع روتين العناية بالبشرة.

من المتوقع أن يشهد قطاع الرجال أسرع معدل نمو في الفترة من 2025 إلى 2032، مدفوعًا بتغييرات نمط الحياة، واتجاهات العناية الشخصية، وحملات التسويق المستهدفة التي تروج لمنظفات الوجه المخصصة للرجال للتحكم في الزيوت، والوقاية من حب الشباب، والراحة.

- حسب الاستخدام النهائي

يشمل التقسيم حسب الاستخدام النهائي قطاعات السلع المنزلية/التجزئة، والصالونات، ووكالات عرض الأزياء، والأفلام والترفيه، ودور الإعلام، وغيرها. هيمن قطاع السلع المنزلية/التجزئة على السوق في عام ٢٠٢٤، بفضل الراحة والتنوع وسهولة الوصول عبر المتاجر الكبرى والصيدليات والمنصات الإلكترونية.

من المتوقع أن يشهد قطاع وكالات الصالونات والعارضات أسرع نمو في الفترة من 2025 إلى 2032، مدفوعًا بالطلب على منظفات الوجه المتخصصة عالية الأداء والاحترافية للبشرة الحساسة أو الجاهزة للتصوير.

- حسب قناة التوزيع

يُقسّم السوق إلى تجارة التجزئة التقليدية (غير المتصلة بالإنترنت) وتجار التجزئة عبر الإنترنت. هيمنت تجارة التجزئة التقليدية (غير المتصلة بالإنترنت) على السوق في عام ٢٠٢٤، بفضل عادات المستهلكين الراسخة، وتجارب المنتجات الشخصية، ووجود محلات السوبر ماركت والصيدليات والمتاجر المتخصصة.

ومن المتوقع أن يشهد قطاع التسوق عبر الإنترنت أسرع معدل نمو في الفترة من 2025 إلى 2032، مدفوعًا بانتشار التجارة الإلكترونية، وحملات التسويق الرقمي، ونماذج الاشتراك، والعروض الترويجية التي يقودها المؤثرون والتي تستهدف المستهلكين المهتمين بالتكنولوجيا والراحة.

تحليل إقليمي لسوق منظفات الوجه في أمريكا الشمالية

- استحوذت سوق منظفات الوجه في الولايات المتحدة على أكبر حصة من الإيرادات بنسبة 82% في عام 2024 داخل أمريكا الشمالية، مدفوعة بالاتجاه المتزايد للعناية بالبشرة الشخصية وتبني التركيبات متعددة الفوائد والطبيعية

- أصبح المستهلكون يفضلون بشكل متزايد المنظفات اللطيفة والفعالة المناسبة لأنواع البشرة المختلطة والحساسة والدهنية

- إن صعود منصات التجارة الإلكترونية وصناديق التجميل القائمة على الاشتراك والتسويق الرقمي المستهدف يدفع السوق بشكل أكبر

- علاوة على ذلك، فإن دمج المكونات المتقدمة مثل حمض الهيالورونيك وفيتامين سي والبروبيوتيك في منظفات الوجه يساهم بشكل كبير في توسيع السوق

نظرة عامة على سوق منظفات الوجه في كندا

من المتوقع أن يشهد سوق منظفات الوجه في كندا أسرع معدل نمو بين عامي 2025 و2032، مدفوعًا بتزايد اهتمام المستهلكين بمنتجات العناية بالبشرة الطبيعية والعضوية. ويدعم نمو السوق تزايد الوعي بأهمية ترطيب البشرة، ومكافحة الشيخوخة، والوقاية من حب الشباب، إلى جانب تزايد استخدام منتجات العناية بالبشرة الفاخرة في المدن. كما ينجذب المستهلكون إلى أنواع التغليف المريحة مثل الأنابيب والموزعات، بالإضافة إلى خيارات المنتجات الصديقة للبيئة والمستدامة.

حصة سوق منظفات الوجه في أمريكا الشمالية

إن صناعة منظفات الوجه في أمريكا الشمالية يقودها في المقام الأول شركات راسخة، بما في ذلك:

- بروكتر آند جامبل (الولايات المتحدة)

- جونسون آند جونسون (الولايات المتحدة)

- شركات إستي لودر (الولايات المتحدة)

- شركة كوتي (الولايات المتحدة)

- ريفلون (الولايات المتحدة)

- شركة ماري كاي (الولايات المتحدة)

- كولجيت-بالموليف (الولايات المتحدة)

- منتجات أفون (الولايات المتحدة)

- جمال الجان (الولايات المتحدة)

- د. دينيس جروس للعناية بالبشرة (الولايات المتحدة)

أحدث التطورات في سوق منظفات الوجه في أمريكا الشمالية

- في أغسطس 2023، ووفقًا لمقال نُشر في iCliniq، شهد مجال العناية بالبشرة تقدمًا في أنظمة التوصيل التي تهدف إلى تعزيز تغلغل المكونات وامتصاصها. فبدلاً من استخدام تركيبات تقليدية غير مألوفة، غالبًا ما تبقى على سطح الجلد، مما يحد من فعاليتها، أتاح ظهور التقنيات المتقدمة تغليف المكونات النشطة. يُسهّل هذا الابتكار وصولها إلى طبقات أعمق من الجلد. ومن أمثلة أنظمة التوصيل هذه: الليبوزومات، والجسيمات النانوية، والتغليف الدقيق، مما يُسهم جميعها في زيادة فعالية منتجات العناية بالبشرة.

- في يوليو 2021، ووفقًا لمقال نشرته شركة Elsevier BV، تشهد وظيفة منتجات التجميل تحولًا سريعًا في مجتمعنا، حيث يُعترف تدريجيًا بأن استخدامها جانب حيوي من جوانب الرفاهية الشخصية. وهذا يُبرز أهمية إجراء دراسة متعمقة لدمج الجسيمات النانوية في مستحضرات التجميل. تهدف هذه الدراسة إلى تقديم مراجعة شاملة ونقدية، تتعمق في آثار استخدام المواد النانوية في تركيبات مستحضرات التجميل المتقدمة. وينصب التركيز على إبراز النتائج الإيجابية الناجمة عن الاستخدام الواسع النطاق لتقنية النانو في منتجات الجيل التالي، على الرغم من التحيزات السائدة ضد تطبيقها في صناعة مستحضرات التجميل.

SKU-

احصل على إمكانية الوصول عبر الإنترنت إلى التقرير الخاص بأول سحابة استخبارات سوقية في العالم

- لوحة معلومات تحليل البيانات التفاعلية

- لوحة معلومات تحليل الشركة للفرص ذات إمكانات النمو العالية

- إمكانية وصول محلل الأبحاث للتخصيص والاستعلامات

- تحليل المنافسين باستخدام لوحة معلومات تفاعلية

- آخر الأخبار والتحديثات وتحليل الاتجاهات

- استغل قوة تحليل المعايير لتتبع المنافسين بشكل شامل

منهجية البحث

يتم جمع البيانات وتحليل سنة الأساس باستخدام وحدات جمع البيانات ذات أحجام العينات الكبيرة. تتضمن المرحلة الحصول على معلومات السوق أو البيانات ذات الصلة من خلال مصادر واستراتيجيات مختلفة. تتضمن فحص وتخطيط جميع البيانات المكتسبة من الماضي مسبقًا. كما تتضمن فحص التناقضات في المعلومات التي شوهدت عبر مصادر المعلومات المختلفة. يتم تحليل بيانات السوق وتقديرها باستخدام نماذج إحصائية ومتماسكة للسوق. كما أن تحليل حصة السوق وتحليل الاتجاهات الرئيسية هي عوامل النجاح الرئيسية في تقرير السوق. لمعرفة المزيد، يرجى طلب مكالمة محلل أو إرسال استفسارك.

منهجية البحث الرئيسية التي يستخدمها فريق بحث DBMR هي التثليث البيانات والتي تتضمن استخراج البيانات وتحليل تأثير متغيرات البيانات على السوق والتحقق الأولي (من قبل خبراء الصناعة). تتضمن نماذج البيانات شبكة تحديد موقف البائعين، وتحليل خط زمني للسوق، ونظرة عامة على السوق ودليل، وشبكة تحديد موقف الشركة، وتحليل براءات الاختراع، وتحليل التسعير، وتحليل حصة الشركة في السوق، ومعايير القياس، وتحليل حصة البائعين على المستوى العالمي مقابل الإقليمي. لمعرفة المزيد عن منهجية البحث، أرسل استفسارًا للتحدث إلى خبراء الصناعة لدينا.

التخصيص متاح

تعد Data Bridge Market Research رائدة في مجال البحوث التكوينية المتقدمة. ونحن نفخر بخدمة عملائنا الحاليين والجدد بالبيانات والتحليلات التي تتطابق مع هدفهم. ويمكن تخصيص التقرير ليشمل تحليل اتجاه الأسعار للعلامات التجارية المستهدفة وفهم السوق في بلدان إضافية (اطلب قائمة البلدان)، وبيانات نتائج التجارب السريرية، ومراجعة الأدبيات، وتحليل السوق المجدد وقاعدة المنتج. ويمكن تحليل تحليل السوق للمنافسين المستهدفين من التحليل القائم على التكنولوجيا إلى استراتيجيات محفظة السوق. ويمكننا إضافة عدد كبير من المنافسين الذين تحتاج إلى بيانات عنهم بالتنسيق وأسلوب البيانات الذي تبحث عنه. ويمكن لفريق المحللين لدينا أيضًا تزويدك بالبيانات في ملفات Excel الخام أو جداول البيانات المحورية (كتاب الحقائق) أو مساعدتك في إنشاء عروض تقديمية من مجموعات البيانات المتوفرة في التقرير.