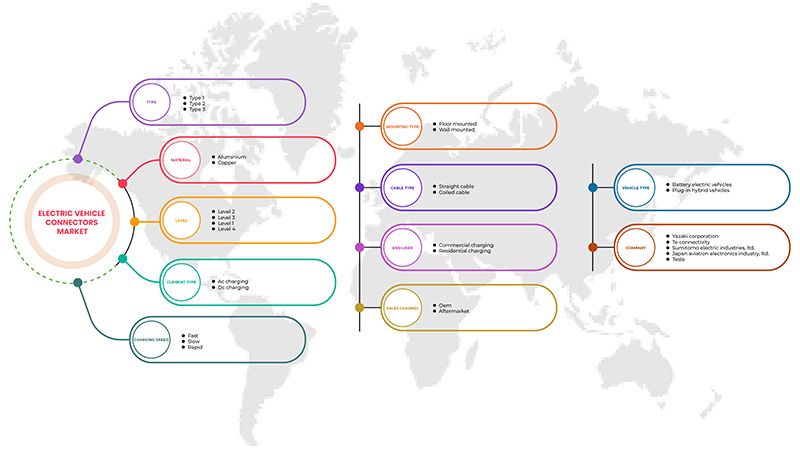

سوق موصلات المركبات الكهربائية في أمريكا الشمالية، حسب النوع (النوع 1 والنوع 2 والنوع 3)، المادة (النحاس والألمنيوم)، نوع التيار (الشحن بالتيار المتردد والشحن بالتيار المستمر)، سرعة الشحن (بطيئة وسريعة وسريعة)، نوع التركيب (مثبت على الحائط ومثبت على الأرض)، نوع الكابل (كابل مستقيم وكابلات ملفوفة)، المستوى (المستوى 1 والمستوى 2 والمستوى 3 والمستوى 4)، المستخدم النهائي (تجاري وسكني)، قناة المبيعات (الشركة المصنعة للمعدات الأصلية وما بعد البيع)، نوع السيارة ( المركبات الكهربائية التي تعمل بالبطارية والمركبات الهجينة القابلة للشحن ) - اتجاهات الصناعة والتوقعات حتى عام 2029.

تحليل وحجم سوق موصلات المركبات الكهربائية في أمريكا الشمالية

تتطلب عملية الكهربة نهجًا جديدًا لتصميم السيارات وتبرز أهمية موصلات السيارات عالية الجودة لإضفاء الحياة على الابتكارات. تضمن الموصلات توزيع الطاقة بشكل موثوق في جميع أنحاء كل نظام كهربائي، من البطارية إلى مجموعة نقل الحركة إلى فيزياء لوحة القيادة والمعدات المتخصصة المختلفة. كما أنها تسهل في حالة حدوث أعطال، مما يسمح للأنظمة التشغيلية بالاستمرار في العمل في حالة فشل نظام واحد. يمكن لمحطة شحن السيارات الكهربائية أن تعمل إما على طاقة التيار المتردد أو المستمر. يتم استخدام مصدر الطاقة لتصنيف أنواع موصلات شحن السيارات الكهربائية.

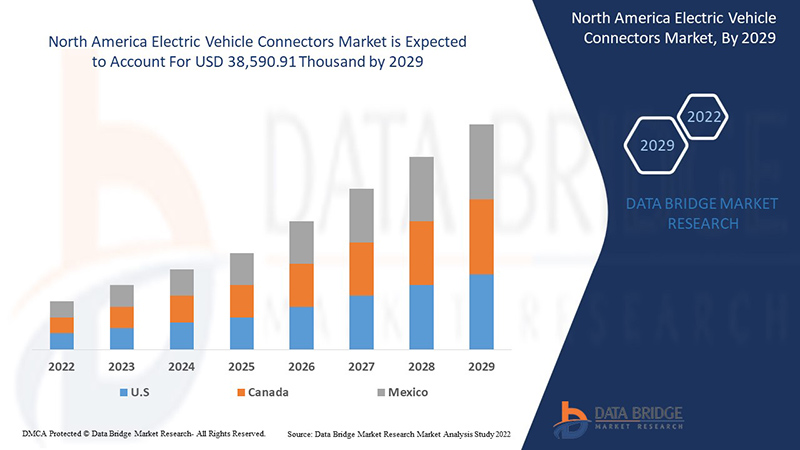

تشير تحاليل Data Bridge Market Research إلى أن سوق موصلات المركبات الكهربائية في أمريكا الشمالية من المتوقع أن تصل قيمته إلى 38,590.91 ألف دولار أمريكي بحلول عام 2029، بمعدل نمو سنوي مركب يبلغ 18.8% خلال الفترة المتوقعة. يغطي تقرير سوق موصلات المركبات الكهربائية في أمريكا الشمالية أيضًا تحليل الأسعار وتحليل براءات الاختراع والتقدم التكنولوجي بعمق.

|

تقرير القياس |

تفاصيل |

|

فترة التنبؤ |

2022 إلى 2029 |

|

سنة الأساس |

2021 |

|

سنوات تاريخية |

2020 (قابلة للتخصيص حتى 2019-2014) |

|

وحدات كمية |

الإيرادات بالألف دولار أمريكي، التسعير بالدولار الأمريكي |

|

القطاعات المغطاة |

حسب النوع (النوع 1 والنوع 2 والنوع 3)، المادة (النحاس والألمنيوم)، نوع التيار (شحن التيار المتردد والشحن المستمر)، سرعة الشحن (بطيئة وسريعة وسريعة)، نوع التركيب (مثبت على الحائط ومثبت على الأرض)، نوع الكابل (كابل مستقيم وكابلات ملفوفة)، المستوى (المستوى 1 والمستوى 2 والمستوى 3 والمستوى 4)، المستخدم النهائي (تجاري وسكني)، قناة المبيعات (الشركة المصنعة الأصلية وما بعد البيع)، نوع السيارة (المركبات الكهربائية التي تعمل بالبطارية والمركبات الهجينة القابلة للشحن) |

|

الدول المغطاة |

الولايات المتحدة وكندا والمكسيك. |

|

الجهات الفاعلة في السوق المشمولة |

شركة YAZAKI Corporation، شركة TE Connectivity، شركة Sumitomo Electric Industries, Ltd.، شركة HUBER+SUHNER، شركة Tesla، شركة REMA Lipprandt GmbH Co. KG، شركة Sumitomo Electric Industries, Ltd.، شركة BESEN INTERNATIONAL GROUP CO., LTD.، مجموعة HARTING Technology Group، شركة Weidmüller، مجموعة BizLink، شركة Japan Aviation Electronics Industry, Ltd.، شركة ITT Inc.، وغيرها. |

تعريف السوق

الموصل هو شيء يستخدم لتوفير الطاقة الكهربائية لحزمة البطارية من محطة الشحن. تتلقى حزمة البطارية الكهرباء من محطة الشحن من خلال موصل شحن. يشبه موصل الشحن كابل الشحن المستخدم لشحن الهاتف المحمول في نواحٍ عديدة. يتميز كابل شحن الهاتف المحمول بموصل حائط وموصل جانبي للهاتف. وبالمثل، يحتوي موصل شحن حزمة بطارية السيارة الكهربائية على موصل جانبي للسيارة وموصل قابس شاحن. الغالبية العظمى من محطات شحن السيارات الكهربائية في جميع أنحاء العالم هي من النوع من الشبكة إلى السيارة (G2V)، مما يسمح بنقل الشحن في اتجاه واحد فقط.

ديناميكيات سوق موصلات المركبات الكهربائية في أمريكا الشمالية

يتناول هذا القسم فهم محركات السوق والفرص والقيود والتحديات. ويتم مناقشة كل هذا بالتفصيل على النحو التالي:

السائقين

- انتشار سريع للسيارات الكهربائية والهجينة

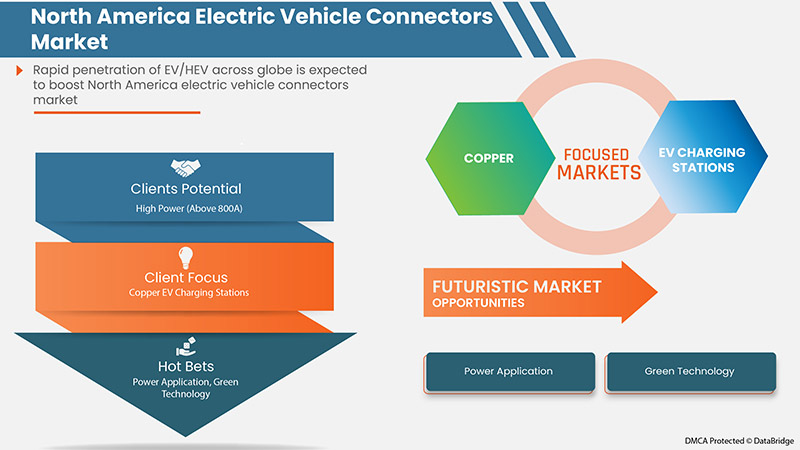

لقد شهدت صناعة المركبات الكهربائية نموًا هائلاً على مر السنين بسبب الطلب المتزايد على المركبات الكهربائية في كل منطقة تقريبًا. علاوة على ذلك، يركز اللاعبون الرئيسيون في سوق المركبات الكهربائية مثل Tesla وBMW Group وNissan Motor Corporation وToyota Motor Corporation وVolkswagen AG وGeneral Motors وDaimler AG وEnergica Motor Company SPA وBYD Company Motors وFord Motors Company على توسيع عملياتهم التجارية في البلدان الناشئة مثل الصين والهند وغيرها. إن الانتشار السريع للمركبات الكهربائية / الهجينة عالميًا يغذي سوق موصلات المركبات الكهربائية في أمريكا الشمالية حيث تعمل موصلات المركبات الكهربائية كمقرن للمركبات الكهربائية مع عمود شحن المحطة المطلوب لنقل الطاقة. تساعد الموصلات في إنشاء اتصال بين بطارية المركبة الكهربائية ونقطة شحن المحطة.

- زيادة الاستثمار في شبكة الشحن من قبل اللاعبين الرئيسيين

إن إنشاء شبكة شحن عامة يسهل الوصول إليها سيكون ضروريًا لتحقيق انتشار واسع النطاق للسيارات الكهربائية. يعد الشحن العام أمرًا حيويًا لمستهلكي السيارات الكهربائية الذين يعيشون في مجمعات متعددة الوحدات أو أولئك الذين ليس لديهم ممر خاص. بالإضافة إلى ذلك، سيحتاج مالكو السيارات الكهربائية إلى شحن سياراتهم على طول الطرق السريعة والممرات لقطع مسافات أطول والشحن على طول الطريق. ومن المتوقع أن تعمل تحسينات البطاريات المستقبلية المتوقعة وزيادة الاستثمار في شبكات الشحن من قبل اللاعبين الرئيسيين كمحركات لسوق موصلات السيارات الكهربائية في أمريكا الشمالية. وبصرف النظر عن المبادرات الحكومية والشركات التابعة لتثبيت محطات شحن السيارات الكهربائية، يستثمر اللاعبون الرئيسيون في سوق السيارات الكهربائية أيضًا بكثافة في بناء شبكة شحن في المناطق التي تكون فيها المبيعات مرتفعة.

- التقدم والتطور في موصلات المركبات الكهربائية

يتزايد تطوير وتقدم موصلات السيارات الكهربائية بمعدل سريع. ويرجع هذا في الأساس إلى تلبية المتطلبات الحالية لشحن السيارات الكهربائية عالي السرعة والقدرة على الشحن من كلا مصدري الكهرباء، التيار المتردد والتيار المستمر، لأصحاب السيارات الكهربائية. ومن المتوقع أن يعزز التقدم والتطور السريع في موصلات السيارات الكهربائية نمو سوق موصلات السيارات الكهربائية.

فرص

-

تزايد الطلب على حلول V2X

مع توسع سوق المركبات الكهربائية، يتزايد الطلب على حلول موصلات الشحن من المركبة إلى كل شيء (V2X). ومع استمرار نمو تبني المركبات الكهربائية، ستلعب الموصلات القوية التي يمكنها دعم شحن المركبات الكهربائية دورًا رئيسيًا في تطوير المشهد المستقبلي للسيارات، فضلاً عن المساهمة في شبكات الطاقة وأنظمة الطاقة السكنية. وبالتالي، من المتوقع أن يؤدي الطلب المتزايد على حلول V2X إلى زيادة تطبيقات موصلات المركبات الكهربائية واستخدامها في المركبات الكهربائية والقطاعات المرتبطة بها، مما يوفر فرصة لسوق موصلات المركبات الكهربائية في أمريكا الشمالية.

القيود/التحديات

- التكلفة العالية المرتبطة بموصلات السيارات الكهربائية

تزداد أهمية الموصلات مع زيادة عدد المركبات الكهربائية/المركبات الهجينة على الطرق في جميع أنحاء العالم. وهي عنصر مهم في شحن المركبات الكهربائية حيث يتم شحن المركبات الكهربائية بالكهرباء. ومع ذلك، فإن التكلفة المرتفعة المرتبطة بموصلات المركبات الكهربائية تشكل عامل تقييد رئيسي لنمو سوق موصلات المركبات الكهربائية في أمريكا الشمالية.

تأثير COVID-19 على سوق موصلات المركبات الكهربائية في أمريكا الشمالية

أحدثت جائحة كوفيد-19 تأثيرًا كبيرًا على مختلف الصناعات حيث اختارت كل دولة تقريبًا إغلاق جميع المرافق باستثناء تلك التي تتعامل مع قطاع السلع الأساسية. اتخذت الحكومة بعض الإجراءات الصارمة، مثل إغلاق المرافق وبيع السلع غير الأساسية، وحظر التجارة الدولية، وغير ذلك الكثير، لمنع انتشار كوفيد-19. العمل الوحيد الذي يتعامل مع هذا الوضع الوبائي هو الخدمات الأساسية المسموح لها بالفتح وتشغيل العمليات.

لقد أثر فيروس كورونا المستجد بشدة على وسائل نقل الجمهور. فخلال فترة التباعد الاجتماعي، طُلب من المسافرين تجنب السفر ما لم يكن ذلك ضروريًا تمامًا. كما تغير سلوك الأفراد بالتأكيد أثناء الوباء، مما أدى إلى انخفاض مبيعات المركبات الكهربائية. وقد جلب الوباء انخفاضًا كبيرًا في مبيعات المركبات الكهربائية حيث ساد الإغلاق في معظم المناطق، وبالتالي انخفض عدد محطات الشحن وبالتالي انخفضت مبيعات موصلات المركبات الكهربائية. وقد دفع الإغلاق الشركات المصنعة والمستهلكين إلى إيقاف العمليات تمامًا لبضعة أشهر. واجه الطلب على موصلات المركبات الكهربائية انخفاضًا حادًا بسبب إغلاق العديد من صناعات السيارات والنقل والإلكترونيات. ومع ذلك، فإن الأمور تعود إلى طبيعتها يومًا بعد يوم. أصبح نمو موصلات المركبات الكهربائية الآن عتيقًا وينمو بوتيرة سريعة.

يتخذ المصنعون قرارات استراتيجية مختلفة لتلبية الطلب المتزايد في فترة COVID-19. شارك اللاعبون في أنشطة استراتيجية مثل الشراكات والتعاون والاستحواذ وغيرها لتحسين التكنولوجيا المشاركة في سوق موصلات المركبات الكهربائية في أمريكا الشمالية. ستجلب الشركات حلولاً متقدمة ودقيقة للسوق. بالإضافة إلى ذلك، أدت مبادرات الحكومة لتعزيز تبني المركبات الكهربائية وتحسين البنية التحتية للسيارات الكهربائية في جميع البلدان إلى نمو السوق.

التطورات الأخيرة

- في يونيو 2022، أعلنت شركة Robert Bosch GmbH عن الاستحواذ على مجموعة MoTeC. سيسمح هذا الاستحواذ للشركة بتعزيز مجموعة منتجاتها المعروضة في تكنولوجيا السيارات وزيادة إمكانية الوصول إلى السوق

- في أبريل 2021، أعلنت شركة NINGBO DEGSON ELECTRICAL CO., LTD أن الشركة شاركت في معرض ميونيخ للإلكترونيات في مركز شنغهاي الدولي الجديد للمعارض. وقد عرضت الشركة منتجات مختلفة لمختلف القطاعات والتطبيقات في هذا الحدث. ومن خلال هذا، زادت الشركة من إمكانية وصولها إلى السوق من خلال عرض قدرات منتجاتها والتقدم التقني.

نطاق سوق موصلات المركبات الكهربائية في أمريكا الشمالية

يتم تقسيم سوق موصلات المركبات الكهربائية في أمريكا الشمالية على أساس النوع والمادة والنوع الحالي وسرعة الشحن ونوع التركيب ونوع الكابل والمستوى والمستخدم النهائي وقناة المبيعات ونوع المركبة. سيساعدك النمو بين هذه القطاعات على تحليل قطاعات النمو الضئيلة في الصناعات وتزويد المستخدمين بنظرة عامة قيمة على السوق ورؤى السوق لمساعدتهم على اتخاذ قرارات استراتيجية لتحديد تطبيقات السوق الأساسية.

حسب النوع

- النوع الأول

- النوع الثاني

- النوع 3

على أساس النوع، يتم تقسيم سوق موصلات المركبات الكهربائية في أمريكا الشمالية إلى النوع 1 والنوع 2 والنوع 3.

حسب المادة

- الألومنيوم

- نحاس

على أساس المادة، يتم تقسيم سوق موصلات المركبات الكهربائية في أمريكا الشمالية إلى الألومنيوم والنحاس.

حسب المستوى

- المستوى 1

- المستوى الثاني

- المستوى 3

- المستوى الرابع

على أساس المستوى، يتم تقسيم سوق موصلات المركبات الكهربائية في أمريكا الشمالية إلى المستوى 1، والمستوى 2، والمستوى 3، والمستوى 4.

حسب النوع الحالي

- الشحن بالتيار المتردد

- الشحن بالتيار المستمر

على أساس النوع الحالي، يتم تقسيم سوق موصلات المركبات الكهربائية في أمريكا الشمالية إلى شحن التيار المتردد، وشحن التيار المستمر.

حسب سرعة الشحن

- بطيئ

- سريع

- سريع

على أساس سرعة الشحن، يتم تقسيم سوق موصلات المركبات الكهربائية في أمريكا الشمالية إلى بطيء وسريع وسريع.

حسب نوع التركيب

- مثبت على الحائط

- مثبتة على الأرض

على أساس نوع التركيب، يتم تقسيم سوق موصلات المركبات الكهربائية في أمريكا الشمالية إلى موصلات مثبتة على الحائط وموصلات مثبتة على الأرضية.

حسب نوع الكابل

- كابل مستقيم

- كابل ملفوف

على أساس نوع الكابل، يتم تقسيم سوق موصلات المركبات الكهربائية في أمريكا الشمالية إلى كابل مستقيم وكابل ملفوف.

حسب المستخدم النهائي

- الشحن السكني

- الشحن التجاري

على أساس المستخدم النهائي، يتم تقسيم سوق موصلات المركبات الكهربائية في أمريكا الشمالية إلى الشحن السكني والشحن التجاري.

حسب قناة المبيعات

- الشركة المصنعة للمعدات الأصلية

- ما بعد البيع

على أساس قناة المبيعات، يتم تقسيم سوق موصلات المركبات الكهربائية في أمريكا الشمالية إلى OEM وسوق ما بعد البيع.

حسب نوع السيارة

- المركبات الهجينة القابلة للشحن

- المركبات الكهربائية التي تعمل بالبطارية

على أساس نوع السيارة، يتم تقسيم سوق موصلات السيارات الكهربائية في أمريكا الشمالية إلى مركبات هجينة قابلة للشحن ومركبات كهربائية تعمل بالبطارية.

تحليل/رؤى إقليمية لسوق موصلات المركبات الكهربائية في أمريكا الشمالية

يتم تحليل سوق موصلات المركبات الكهربائية في أمريكا الشمالية، ويتم توفير رؤى حجم السوق والاتجاهات حسب البلد والنوع والمادة والنوع الحالي وسرعة الشحن ونوع التركيب ونوع الكابل والمستوى والمستخدم النهائي وقناة المبيعات ونوع السيارة، كما هو مذكور أعلاه.

الدول التي يغطيها تقرير سوق موصلات المركبات الكهربائية هي الولايات المتحدة وكندا والمكسيك.

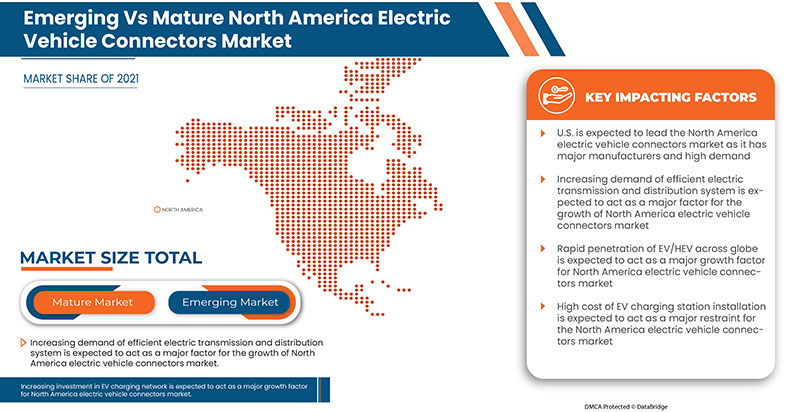

تهيمن الولايات المتحدة على سوق موصلات السيارات الكهربائية في أمريكا الشمالية، ومن المرجح أن تكون الأسرع نموًا في سوق موصلات السيارات الكهربائية في أمريكا الشمالية لأنها تتمتع بحضور ضخم من كبار مزودي موصلات السيارات الكهربائية، مما قد يزيد من نمو السوق في منطقة أمريكا الشمالية.

كما يوفر قسم الدولة في التقرير عوامل فردية مؤثرة على السوق والتغيرات في تنظيم السوق التي تؤثر على الاتجاهات الحالية والمستقبلية للسوق. تعد نقاط البيانات مثل تحليل سلسلة القيمة النهائية والنهائية، والاتجاهات الفنية، وتحليل قوى بورتر الخمس، ودراسات الحالة بعض المؤشرات المستخدمة للتنبؤ بسيناريو السوق للدول الفردية. كما يتم النظر في وجود وتوافر العلامات التجارية في أمريكا الشمالية والتحديات التي تواجهها بسبب المنافسة الكبيرة أو النادرة من العلامات التجارية المحلية والمحلية، وتأثير التعريفات الجمركية المحلية، وطرق التجارة أثناء تقديم تحليل تنبؤي لبيانات الدولة.

تحليل المشهد التنافسي وحصة سوق موصلات المركبات الكهربائية في أمريكا الشمالية

يوفر المشهد التنافسي لسوق موصلات المركبات الكهربائية تفاصيل حسب المنافس. تتضمن التفاصيل نظرة عامة على الشركة، والبيانات المالية للشركة، والإيرادات المتولدة، وإمكانات السوق، والاستثمار في البحث والتطوير، ومبادرات السوق الجديدة، والحضور في أمريكا الشمالية، ومواقع الإنتاج والمرافق، والقدرات الإنتاجية، ونقاط القوة والضعف للشركة، وإطلاق المنتج، وعرض المنتج ونطاقه، وهيمنة التطبيق. ترتبط نقاط البيانات المذكورة أعلاه فقط بتركيز الشركات فيما يتعلق بسوق موصلات المركبات الكهربائية في أمريكا الشمالية.

بعض اللاعبين الرئيسيين العاملين في سوق موصلات المركبات الكهربائية في أمريكا الشمالية هم YAZAKI Corporation و TE Connectivity و Sumitomo Electric Industries، Ltd. و HUBER + SUHNER و Tesla و REMA Lipprandt GmbH Co. KG و Sumitomo Electric Industries، Ltd. و BESEN INTERNATIONAL GROUP CO.، LTD. و HARTING Technology Group و Weidmüller و BizLink Group و Japan Aviation Electronics Industry، Ltd. و ITT Inc. وغيرها.

SKU-

احصل على إمكانية الوصول عبر الإنترنت إلى التقرير الخاص بأول سحابة استخبارات سوقية في العالم

- لوحة معلومات تحليل البيانات التفاعلية

- لوحة معلومات تحليل الشركة للفرص ذات إمكانات النمو العالية

- إمكانية وصول محلل الأبحاث للتخصيص والاستعلامات

- تحليل المنافسين باستخدام لوحة معلومات تفاعلية

- آخر الأخبار والتحديثات وتحليل الاتجاهات

- استغل قوة تحليل المعايير لتتبع المنافسين بشكل شامل

Table of Content

1 INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 OVERVIEW OF THE NORTH AMERICA ELECTRIC VEHICLE CONNECTORS MARKET

1.4 CURRENCY AND PRICING

1.5 LIMITATIONS

1.6 MARKETS COVERED

2 MARKET SEGMENTATION

2.1 MARKETS COVERED

2.2 YEARS CONSIDERED FOR THE STUDY

2.3 GEOGRAPHIC SCOPE

2.4 DBMR TRIPOD DATA VALIDATION MODEL

2.5 NORTH AMERICA ELECTRIC VEHICLE CONNECTORS MARKET: DROC ANALYSIS

2.6 PRIMARY INTERVIEWS WITH KEY OPINION LEADERS

2.7 DBMR MARKET POSITION GRID

2.8 VENDOR SHARE ANALYSIS

2.9 MARKET END-USER COVERAGE GRID

2.1 MULTIVARIATE MODELLING

2.11 TYPE LIFELINE CURVE

2.12 CHALLENGE MATRIX

2.13 SECONDARY SOURCES

2.14 ASSUMPTIONS

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

4.1 CHARGING SOFTWARE

4.2 RENEWABLE CHARGING

4.3 TECHNOLOGY & INNOVATION LANDSCAPE

4.4 ELECTRIC VEHICLE CONNECTORS INDUSTRIAL STANDARDS

5 REGIONAL REASONING

6 MARKET OVERVIEW

6.1 DRIVERS

6.1.1 RAPID PENETRATION OF EV & HEV

6.1.2 INCREASING INVESTMENT IN CHARGING NETWORK BY KEY PLAYERS

6.1.3 ADVANCEMENT AND DEVELOPMENT IN ELECTRIC VEHICLE CONNECTORS

6.1.4 RISING IMPORTANCE OF EV CONNECTORS

6.2 RESTRAINTS

6.2.1 HIGH COST ASSOCIATED WITH EV CONNECTORS

6.2.2 VOLATILITY IN GEOPOLITICAL SCENARIO

6.3 OPPORTUNITIES

6.3.1 INITIATIVES BY GOVERNMENTS FOR CHARGING INFRASTRUCTURE

6.3.2 INCREASING DEMAND FOR V2X SOLUTIONS

6.3.3 INCREASING PARTNERSHIP AND ACQUISITION AMONG MARKET PLAYERS

6.4 CHALLENGES

6.4.1 FLUCTUATIONS IN THE PRICE OF RAW MATERIALS

6.4.2 INDUCTIVE CHARGING FOR EVS

6.4.3 STRINGENT EV CONNECTOR STANDARDS

7 NORTH AMERICA ELECTRIC VEHICLE CONNECTORS MARKET, BY TYPE

7.1 OVERVIEW

7.2 TYPE 2

7.2.1 CCS

7.2.2 CHADEMO

7.2.3 GB/T

7.2.4 TESLA

7.3 TYPE 1

7.4 TYPE 3

8 NORTH AMERICA ELECTRIC VEHICLE CONNECTORS MARKET, BY MATERIAL

8.1 OVERVIEW

8.2 COPPER

8.3 ALUMINIUM

9 NORTH AMERICA ELECTRIC VEHICLE CONNECTORS MARKET, BY LEVEL

9.1 OVERVIEW

9.2 LEVEL 2

9.3 LEVEL 3

9.4 LEVEL 1

9.5 LEVEL 4

10 NORTH AMERICA ELECTRIC VEHICLE CONNECTORS MARKET, BY CURRENT TYPE

10.1 OVERVIEW

10.2 AC CHARGING

10.3 DC CHARGING

11 NORTH AMERICA ELECTRIC VEHICLE CONNECTORS MARKET, BY CHARGING SPEED

11.1 OVERVIEW

11.2 FAST

11.3 SLOW

11.4 RAPID

12 NORTH AMERICA ELECTRIC VEHICLE CONNECTORS MARKET, BY MOUNTING TYPE

12.1 OVERVIEW

12.2 FLOOR MOUNTED

12.3 WALL MOUNTED

13 NORTH AMERICA ELECTRIC VEHICLE CONNECTORS MARKET, BY CABLE TYPE

13.1 OVERVIEW

13.2 STRAIGHT CABLE

13.3 COILED CABLE

14 NORTH AMERICA ELECTRIC VEHICLE CONNECTORS MARKET, BY END USER

14.1 OVERVIEW

14.2 COMMERCIAL CHARGING

14.3 RESIDENTIAL CHARGING

15 NORTH AMERICA ELECTRIC VEHICLE CONNECTORS MARKET, BY SALES CHANNEL

15.1 OVERVIEW

15.2 OEM

15.3 AFTERMARKET

16 NORTH AMERICA ELECTRIC VEHICLE CONNECTORS MARKET, BY VEHICLE TYPE

16.1 OVERVIEW

16.2 BATTERY ELECTRIC VEHICLES

16.3 PLUG-IN HYBRID VEHICLES

17 NORTH AMERICA ELECTRIC VEHICLE CONNECTORS MARKET, BY REGION

17.1 NORTH AMERICA

17.1.1 U.S.

17.1.2 CANADA

17.1.3 MEXICO

18 NORTH AMERICA ELECTRIC VEHICLE CONNECTORS MARKET: COMPANY LANDSCAPE

18.1 COMPANY SHARE ANALYSIS: NORTH AMERICA

19 NORTH AMERICA ELECTRIC VEHICLE CONNECTORS MARKET: SWOT ANALYSIS

20 COMPANY PROFILE

20.1 YAZAKI CORPORATION

20.1.1 COMPANY SNAPSHOT

20.1.2 COMPANY SHARE ANALYSIS

20.1.3 PRODUCT PORTFOLIO

20.1.4 RECENT DEVELOPMENTS

20.2 TE CONNECTIVITY

20.2.1 COMPANY SNAPSHOT

20.2.2 REVENUE ANALYSIS

20.2.3 COMPANY SHARE ANALYSIS

20.2.4 PRODUCT PORTFOLIO

20.2.5 RECENT DEVELOPMENTS

20.3 SUMITOMO ELECTRIC INDUSTRIES, LTD.

20.3.1 COMPANY SNAPSHOT

20.3.2 REVENUE ANALYSIS

20.3.3 COMPANY SHARE ANALYSIS

20.3.4 PRODUCT PORTFOLIO

20.3.5 RECENT DEVELOPMENTS

20.4 JAPAN AVIATION ELECTRONICS INDUSTRY, LTD.

20.4.1 COMPANY SNAPSHOT

20.4.2 REVENUE ANALYSIS

20.4.3 COMPANY SHARE ANALYSIS

20.4.4 PRODUCT PORTFOLIO

20.4.5 RECENT DEVELOPMENTS

20.5 TESLA

20.5.1 COMPANY SNAPSHOT

20.5.2 REVENUE ANALYSIS

20.5.3 COMPANY SHARE ANALYSIS

20.5.4 PRODUCT PORTFOLIO

20.5.5 RECENT DEVELOPMENTS

20.6 APTIV (2021)

20.6.1 COMPANY SNAPSHOT

20.6.2 REVENUE ANALYSIS

20.6.3 COMPANY SHARE ANALYSIS

20.6.4 SOLUTION PORTFOLIO

20.6.5 RECENT DEVELOPMENTS

20.7 BESEN INTERNATIONAL GROUP CO., LTD.

20.7.1 COMPANY SNAPSHOT

20.7.2 PRODUCT PORTFOLIO

20.7.3 RECENT DEVELOPMENTS

20.8 BIZLINK GROUP

20.8.1 COMPANY SNAPSHOT

20.8.2 REVENUE ANALYSIS

20.8.3 PRODUCT PORTFOLIO

20.8.4 RECENT DEVELOPMENTS

20.9 FUJIKURA LTD. (2021)

20.9.1 COMPANY SNAPSHOT

20.9.2 REVENUE ANALYSIS

20.9.3 PRODUCT PORTFOLIO

20.9.4 RECENT DEVELOPMENT

20.1 HARTING TECHNOLOGY GROUP

20.10.1 COMPANY SNAPSHOT

20.10.2 PRODUCT PORTFOLIO

20.10.3 RECENT DEVELOPMENTS

20.11 HUBER+SUHNER

20.11.1 COMPANY SNAPSHOT

20.11.2 REVENUE ANALYSIS

20.11.3 PRODUCT PORTFOLIO

20.11.4 RECENT DEVELOPMENTS

20.12 ITT INC.

20.12.1 COMPANY SNAPSHOT

20.12.2 PRODUCT PORTFOLIO

20.12.3 RECENT DEVELOPMENTS

20.13 JUICEPOINT

20.13.1 COMPANY SNAPSHOT

20.13.2 PRODUCT PORTFOLIO

20.13.3 RECENT DEVELOPMENTS

20.14 LEVITON MANUFACTURING CO., INC.

20.14.1 COMPANY SNAPSHOT

20.14.2 PRODUCT PORTFOLIO

20.14.3 RECENT DEVELOPMENTS

20.15 MATERION CORPORATION

20.15.1 COMPANY SNAPSHOT

20.15.2 REVENUE ANALYSIS

20.15.3 PRODUCT PORTFOLIO

20.15.4 RECENT DEVELOPMENTS

20.16 NINGBO DEGSON ELECTRICAL CO.,LTD

20.16.1 COMPANY SNAPSHOT

20.16.2 PRODUCT PORTFOLIO

20.16.3 RECENT DEVELOPMENTS

20.17 PHOENIX CONTACT

20.17.1 COMPANY SNAPSHOT

20.17.2 PRODUCT PORTFOLIO

20.17.3 RECENT DEVELOPMENTS

20.18 REMA LIPPRANDT GMBH CO. KG

20.18.1 COMPANY SNAPSHOT

20.18.2 PRODUCT PORTFOLIO

20.18.3 RECENT DEVELOPMENTS

20.19 ROBERT BOSCH GMBH (2021)

20.19.1 COMPANY SNAPSHOT

20.19.2 REVENUE ANALYSIS

20.19.3 PRODUCT PORTFOLIO

20.19.4 RECENT DEVELOPMENTS

20.2 SHANGHAI MIDA EV POWER CO., LTD.

20.20.1 COMPANY SNAPSHOT

20.20.2 PRODUCT PORTFOLIO

20.20.3 RECENT DEVELOPMENTS

20.21 WEIDMULLER

20.21.1 COMPANY SNAPSHOT

20.21.2 PRODUCT PORTFOLIO

20.21.3 RECENT DEVELOPMENTS

20.22 ZHENGZHOU SAICHUAN ELECTRONIC TECHNOLOGY CO., LTD.

20.22.1 COMPANY SNAPSHOT

20.22.2 PRODUCT PORTFOLIO

20.22.3 RECENT DEVELOPMENTS

21 QUESTIONNAIRE

22 RELATED REPORTS

List of Table

TABLE 1 DIFFERENT TYPES OF CONNECTORS USED ACROSS DIFFERENT COUNTRIES/REGIONS.

TABLE 2 NORTH AMERICA ELECTRIC VEHICLE CONNECTORS MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 3 NORTH AMERICA TYPE 2 IN ELECTRIC VEHICLE CONNECTORS MARKET, BY REGION, 2020-2029 (USD THOUSAND)

TABLE 4 NORTH AMERICA TYPE 2 IN ELECTRIC VEHICLE CONNECTORS MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 5 NORTH AMERICA TYPE 1 IN ELECTRIC VEHICLE CONNECTORS MARKET, BY REGION, 2020-2029 (USD THOUSAND)

TABLE 6 NORTH AMERICA TYPE 3 IN ELECTRIC VEHICLE CONNECTORS MARKET, BY REGION, 2020-2029 (USD THOUSAND)

TABLE 7 NORTH AMERICA ELECTRIC VEHICLE CONNECTORS MARKET, BY MATERIAL, 2020-2029 (USD THOUSAND)

TABLE 8 NORTH AMERICA COPPER IN ELECTRIC VEHICLE CONNECTORS MARKET, BY REGION, 2020-2029 (USD THOUSAND)

TABLE 9 NORTH AMERICA ALUMINIUM IN ELECTRIC VEHICLE CONNECTORS MARKET, BY REGION, 2020-2029 (USD THOUSAND)

TABLE 10 NORTH AMERICA ELECTRIC VEHICLE CONNECTORS MARKET, BY LEVEL, 2020-2029 (USD THOUSAND)

TABLE 11 NORTH AMERICA LEVEL 2 IN ELECTRIC VEHICLE CONNECTORS MARKET, BY REGION, 2020-2029 (USD THOUSAND)

TABLE 12 NORTH AMERICA LEVEL 3 IN ELECTRIC VEHICLE CONNECTORS MARKET, BY REGION, 2020-2029 (USD THOUSAND)

TABLE 13 NORTH AMERICA LEVEL 1 IN ELECTRIC VEHICLE CONNECTORS MARKET, BY REGION, 2020-2029 (USD THOUSAND)

TABLE 14 NORTH AMERICA LEVEL 4 IN ELECTRIC VEHICLE CONNECTORS MARKET, BY REGION, 2020-2029 (USD THOUSAND)

TABLE 15 NORTH AMERICA ELECTRIC VEHICLE CONNECTORS MARKET, BY CURRENT TYPE, 2020-2029 (USD THOUSAND)

TABLE 16 NORTH AMERICA AC CHARGING IN ELECTRIC VEHICLE CONNECTORS MARKET, BY REGION, 2020-2029 (USD THOUSAND)

TABLE 17 NORTH AMERICA DC CHARGING IN ELECTRIC VEHICLE CONNECTORS MARKET, BY REGION, 2020-2029 (USD THOUSAND)

TABLE 18 NORTH AMERICA ELECTRIC VEHICLE CONNECTORS MARKET, BY CHARGING SPEED, 2020-2029 (USD THOUSAND)

TABLE 19 NORTH AMERICA FAST IN ELECTRIC VEHICLE CONNECTORS MARKET, BY REGION, 2020-2029 (USD THOUSAND)

TABLE 20 NORTH AMERICA SLOW IN ELECTRIC VEHICLE CONNECTORS MARKET, BY REGION, 2020-2029 (USD THOUSAND)

TABLE 21 NORTH AMERICA RAPID IN ELECTRIC VEHICLE CONNECTORS MARKET, BY REGION, 2020-2029 (USD THOUSAND)

TABLE 22 NORTH AMERICA ELECTRIC VEHICLE CONNECTORS MARKET, BY MOUNTING TYPE, 2020-2029 (USD THOUSAND)

TABLE 23 NORTH AMERICA FLOOR MOUNTED IN ELECTRIC VEHICLE CONNECTORS MARKET, BY REGION, 2020-2029 (USD THOUSAND)

TABLE 24 NORTH AMERICA WALL MOUNTED IN ELECTRIC VEHICLE CONNECTORS MARKET, BY REGION, 2020-2029 (USD THOUSAND)

TABLE 25 NORTH AMERICA ELECTRIC VEHICLE CONNECTORS MARKET, BY CABLE TYPE, 2020-2029 (USD THOUSAND)

TABLE 26 NORTH AMERICA STRAIGHT CABLE IN ELECTRIC VEHICLE CONNECTORS MARKET, BY REGION, 2020-2029 (USD THOUSAND)

TABLE 27 NORTH AMERICA COILED CABLE IN ELECTRIC VEHICLE CONNECTORS MARKET, BY REGION, 2020-2029 (USD THOUSAND)

TABLE 28 NORTH AMERICA ELECTRIC VEHICLE CONNECTORS MARKET, BY END-USER, 2020-2029 (USD THOUSAND)

TABLE 29 NORTH AMERICA COMMERCIAL CHARGING IN ELECTRIC VEHICLE CONNECTORS MARKET, BY REGION, 2020-2029 (USD THOUSAND)

TABLE 30 NORTH AMERICA RESIDENTIAL CHARGING IN ELECTRIC VEHICLE CONNECTORS MARKET, BY REGION, 2020-2029 (USD THOUSAND)

TABLE 31 NORTH AMERICA ELECTRIC VEHICLE CONNECTORS MARKET, BY SALES CHANNEL, 2020-2029 (USD THOUSAND)

TABLE 32 NORTH AMERICA OEM IN ELECTRIC VEHICLE CONNECTORS MARKET, BY REGION, 2020-2029 (USD THOUSAND)

TABLE 33 NORTH AMERICA AFTERMARKET IN ELECTRIC VEHICLE CONNECTORS MARKET, BY REGION, 2020-2029 (USD THOUSAND)

TABLE 34 NORTH AMERICA ELECTRIC VEHICLE CONNECTORS MARKET, BY VEHICLE TYPE, 2020-2029 (USD THOUSAND)

TABLE 35 NORTH AMERICA BATTERY ELECTRIC VEHICLES IN ELECTRIC VEHICLE CONNECTORS MARKET, BY REGION, 2020-2029 (USD THOUSAND)

TABLE 36 NORTH AMERICA PLUG-IN HYBRID ELECTRIC VEHICLE (PHEV) IN ELECTRIC VEHICLE CONNECTORS MARKET, BY REGION, 2020-2029 (USD THOUSAND)

TABLE 37 NORTH AMERICA ELECTRIC VEHICLE CONNECTORS MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 38 NORTH AMERICA TYPE 2 IN ELECTRIC VEHICLE CONNECTORS MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 39 NORTH AMERICA ELECTRIC VEHICLE CONNECTORS MARKET, BY MATERIAL, 2020-2029 (USD THOUSAND)

TABLE 40 NORTH AMERICA ELECTRIC VEHICLE CONNECTORS MARKET, BY LEVEL, 2020-2029 (USD THOUSAND)

TABLE 41 NORTH AMERICA ELECTRIC VEHICLE CONNECTORS MARKET, BY CURRENT TYPE, 2020-2029 (USD THOUSAND)

TABLE 42 NORTH AMERICA ELECTRIC VEHICLE CONNECTORS MARKET, BY CHARGING SPEED, 2020-2029 (USD THOUSAND)

TABLE 43 NORTH AMERICA ELECTRIC VEHICLE CONNECTORS MARKET, BY MOUNTING TYPE, 2020-2029 (USD THOUSAND)

TABLE 44 NORTH AMERICA ELECTRIC VEHICLE CONNECTORS MARKET, BY CABLE TYPE, 2020-2029 (USD THOUSAND)

TABLE 45 NORTH AMERICA ELECTRIC VEHICLE CONNECTORS MARKET, BY END-USER, 2020-2029 (USD THOUSAND)

TABLE 46 NORTH AMERICA ELECTRIC VEHICLE CONNECTORS MARKET, BY SALES CHANNEL, 2020-2029 (USD THOUSAND)

TABLE 47 NORTH AMERICA ELECTRIC VEHICLE CONNECTORS MARKET, BY VEHICLE TYPE, 2020-2029 (USD THOUSAND)

TABLE 48 U.S. ELECTRIC VEHICLE CONNECTORS MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 49 U.S. TYPE 2 IN ELECTRIC VEHICLE CONNECTORS MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 50 U.S. ELECTRIC VEHICLE CONNECTORS MARKET, BY MATERIAL, 2020-2029 (USD THOUSAND)

TABLE 51 U.S. ELECTRIC VEHICLE CONNECTORS MARKET, BY LEVEL, 2020-2029 (USD THOUSAND)

TABLE 52 U.S. ELECTRIC VEHICLE CONNECTORS MARKET, BY CURRENT TYPE, 2020-2029 (USD THOUSAND)

TABLE 53 U.S. ELECTRIC VEHICLE CONNECTORS MARKET, BY CHARGING SPEED, 2020-2029 (USD THOUSAND)

TABLE 54 U.S. ELECTRIC VEHICLE CONNECTORS MARKET, BY MOUNTING TYPE, 2020-2029 (USD THOUSAND)

TABLE 55 U.S. ELECTRIC VEHICLE CONNECTORS MARKET, BY CABLE TYPE, 2020-2029 (USD THOUSAND)

TABLE 56 U.S. ELECTRIC VEHICLE CONNECTORS MARKET, BY END-USER, 2020-2029 (USD THOUSAND)

TABLE 57 U.S. ELECTRIC VEHICLE CONNECTORS MARKET, BY SALES CHANNEL, 2020-2029 (USD THOUSAND)

TABLE 58 U.S. ELECTRIC VEHICLE CONNECTORS MARKET, BY VEHICLE TYPE, 2020-2029 (USD THOUSAND)

TABLE 59 CANADA ELECTRIC VEHICLE CONNECTORS MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 60 CANADA TYPE 2 IN ELECTRIC VEHICLE CONNECTORS MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 61 CANADA ELECTRIC VEHICLE CONNECTORS MARKET, BY MATERIAL, 2020-2029 (USD THOUSAND)

TABLE 62 CANADA ELECTRIC VEHICLE CONNECTORS MARKET, BY LEVEL, 2020-2029 (USD THOUSAND)

TABLE 63 CANADA ELECTRIC VEHICLE CONNECTORS MARKET, BY CURRENT TYPE, 2020-2029 (USD THOUSAND)

TABLE 64 CANADA ELECTRIC VEHICLE CONNECTORS MARKET, BY CHARGING SPEED, 2020-2029 (USD THOUSAND)

TABLE 65 CANADA ELECTRIC VEHICLE CONNECTORS MARKET, BY MOUNTING TYPE, 2020-2029 (USD THOUSAND)

TABLE 66 CANADA ELECTRIC VEHICLE CONNECTORS MARKET, BY CABLE TYPE, 2020-2029 (USD THOUSAND)

TABLE 67 CANADA ELECTRIC VEHICLE CONNECTORS MARKET, BY END-USER, 2020-2029 (USD THOUSAND)

TABLE 68 CANADA ELECTRIC VEHICLE CONNECTORS MARKET, BY SALES CHANNEL, 2020-2029 (USD THOUSAND)

TABLE 69 CANADA ELECTRIC VEHICLE CONNECTORS MARKET, BY VEHICLE TYPE, 2020-2029 (USD THOUSAND)

TABLE 70 MEXICO ELECTRIC VEHICLE CONNECTORS MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 71 MEXICO TYPE 2 IN ELECTRIC VEHICLE CONNECTORS MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 72 MEXICO ELECTRIC VEHICLE CONNECTORS MARKET, BY MATERIAL, 2020-2029 (USD THOUSAND)

TABLE 73 MEXICO ELECTRIC VEHICLE CONNECTORS MARKET, BY LEVEL, 2020-2029 (USD THOUSAND)

TABLE 74 MEXICO ELECTRIC VEHICLE CONNECTORS MARKET, BY CURRENT TYPE, 2020-2029 (USD THOUSAND)

TABLE 75 MEXICO ELECTRIC VEHICLE CONNECTORS MARKET, BY CHARGING SPEED, 2020-2029 (USD THOUSAND)

TABLE 76 MEXICO ELECTRIC VEHICLE CONNECTORS MARKET, BY MOUNTING TYPE, 2020-2029 (USD THOUSAND)

TABLE 77 MEXICO ELECTRIC VEHICLE CONNECTORS MARKET, BY CABLE TYPE, 2020-2029 (USD THOUSAND)

TABLE 78 MEXICO ELECTRIC VEHICLE CONNECTORS MARKET, BY END-USER, 2020-2029 (USD THOUSAND)

TABLE 79 MEXICO ELECTRIC VEHICLE CONNECTORS MARKET, BY SALES CHANNEL, 2020-2029 (USD THOUSAND)

TABLE 80 MEXICO ELECTRIC VEHICLE CONNECTORS MARKET, BY VEHICLE TYPE, 2020-2029 (USD THOUSAND)

List of Figure

FIGURE 1 NORTH AMERICA ELECTRIC VEHICLE CONNECTORS MARKET: SEGMENTATION

FIGURE 2 NORTH AMERICA ELECTRIC VEHICLE CONNECTORS MARKET: DATA TRIANGULATION

FIGURE 3 NORTH AMERICA ELECTRIC VEHICLE CONNECTORS MARKET: NORTH AMERICA VS REGIONAL MARKET ANALYSIS

FIGURE 4 NORTH AMERICA ELECTRIC VEHICLE CONNECTORS MARKET: COMPANY RESEARCH ANALYSIS

FIGURE 5 NORTH AMERICA ELECTRIC VEHICLE CONNECTORS MARKET: INTERVIEW DEMOGRAPHICS

FIGURE 6 NORTH AMERICA ELECTRIC VEHICLE CONNECTORS MARKET: DBMR MARKET POSITION GRID

FIGURE 7 NORTH AMERICA ELECTRIC VEHICLE CONNECTORS MARKET: VENDOR SHARE ANALYSIS

FIGURE 8 NORTH AMERICA ELECTRIC VEHICLE CONNECTORS MARKET: MARKET END-USER COVERAGE GRID

FIGURE 9 NORTH AMERICA ELECTRIC VEHICLE CONNECTORS MARKET: SEGMENTATION

FIGURE 10 INCREASING INVESTMENT IN CHARGING NETWORKS BY KEY PLAYERS IS EXPECTED TO BE A KEY DRIVER FOR THE NORTH AMERICA ELECTRIC VEHICLE CONNECTORS MARKET GROWTH IN THE FORECAST PERIOD OF 2021 TO 2029

FIGURE 11 TYPE 2 IS EXPECTED TO ACCOUNT FOR THE LARGEST SHARE OF THE NORTH AMERICA ELECTRIC VEHICLE CONNECTORS MARKET IN 2022 & 2029

FIGURE 12 DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES OF THE NORTH AMERICA ELECTRIC VEHICLE CONNECTORS MARKET

FIGURE 13 NORTH AMERICA ELECTRIC VEHICLE CONNECTORS MARKET: BY TYPE,2021

FIGURE 14 NORTH AMERICA ELECTRIC VEHICLE CONNECTORS MARKET: BY MATERIAL, 2021

FIGURE 15 NORTH AMERICA ELECTRIC VEHICLE CONNECTORS MARKET: BY LEVEL, 2021

FIGURE 16 NORTH AMERICA ELECTRIC VEHICLE CONNECTORS MARKET: BY CURRENT TYPE, 2021

FIGURE 17 NORTH AMERICA ELECTRIC VEHICLE CONNECTORS MARKET: BY CHARGING SPEED, 2021

FIGURE 18 NORTH AMERICA ELECTRIC VEHICLE CONNECTORS MARKET: BY MOUNTING TYPE, 2021

FIGURE 19 NORTH AMERICA ELECTRIC VEHICLE CONNECTORS MARKET: BY CABLE TYPE, 2021

FIGURE 20 NORTH AMERICA ELECTRIC VEHICLE CONNECTORS MARKET: BY END USER, 2021

FIGURE 21 NORTH AMERICA ELECTRIC VEHICLE CONNECTORS MARKET: BY SALES CHANNEL, 2021

FIGURE 22 NORTH AMERICA ELECTRIC VEHICLE CONNECTORS MARKET: BY VEHICLE TYPE, 2021

FIGURE 23 NORTH AMERICA ELECTRIC VEHICLE CONNECTORS MARKET: SNAPSHOT (2021)

FIGURE 24 NORTH AMERICA ELECTRIC VEHICLE CONNECTORS MARKET: BY COUNTRY (2021)

FIGURE 25 NORTH AMERICA ELECTRIC VEHICLE CONNECTORS MARKET: BY COUNTRY (2022 & 2029)

FIGURE 26 NORTH AMERICA ELECTRIC VEHICLE CONNECTORS MARKET: BY COUNTRY (2021 & 2029)

FIGURE 27 NORTH AMERICA ELECTRIC VEHICLE CONNECTORS MARKET: BY TYPE (2022-2029)

FIGURE 28 NORTH AMERICA ELECTRIC VEHICLE CONNECTORS MARKET: COMPANY SHARE 2021 (%)

منهجية البحث

يتم جمع البيانات وتحليل سنة الأساس باستخدام وحدات جمع البيانات ذات أحجام العينات الكبيرة. تتضمن المرحلة الحصول على معلومات السوق أو البيانات ذات الصلة من خلال مصادر واستراتيجيات مختلفة. تتضمن فحص وتخطيط جميع البيانات المكتسبة من الماضي مسبقًا. كما تتضمن فحص التناقضات في المعلومات التي شوهدت عبر مصادر المعلومات المختلفة. يتم تحليل بيانات السوق وتقديرها باستخدام نماذج إحصائية ومتماسكة للسوق. كما أن تحليل حصة السوق وتحليل الاتجاهات الرئيسية هي عوامل النجاح الرئيسية في تقرير السوق. لمعرفة المزيد، يرجى طلب مكالمة محلل أو إرسال استفسارك.

منهجية البحث الرئيسية التي يستخدمها فريق بحث DBMR هي التثليث البيانات والتي تتضمن استخراج البيانات وتحليل تأثير متغيرات البيانات على السوق والتحقق الأولي (من قبل خبراء الصناعة). تتضمن نماذج البيانات شبكة تحديد موقف البائعين، وتحليل خط زمني للسوق، ونظرة عامة على السوق ودليل، وشبكة تحديد موقف الشركة، وتحليل براءات الاختراع، وتحليل التسعير، وتحليل حصة الشركة في السوق، ومعايير القياس، وتحليل حصة البائعين على المستوى العالمي مقابل الإقليمي. لمعرفة المزيد عن منهجية البحث، أرسل استفسارًا للتحدث إلى خبراء الصناعة لدينا.

التخصيص متاح

تعد Data Bridge Market Research رائدة في مجال البحوث التكوينية المتقدمة. ونحن نفخر بخدمة عملائنا الحاليين والجدد بالبيانات والتحليلات التي تتطابق مع هدفهم. ويمكن تخصيص التقرير ليشمل تحليل اتجاه الأسعار للعلامات التجارية المستهدفة وفهم السوق في بلدان إضافية (اطلب قائمة البلدان)، وبيانات نتائج التجارب السريرية، ومراجعة الأدبيات، وتحليل السوق المجدد وقاعدة المنتج. ويمكن تحليل تحليل السوق للمنافسين المستهدفين من التحليل القائم على التكنولوجيا إلى استراتيجيات محفظة السوق. ويمكننا إضافة عدد كبير من المنافسين الذين تحتاج إلى بيانات عنهم بالتنسيق وأسلوب البيانات الذي تبحث عنه. ويمكن لفريق المحللين لدينا أيضًا تزويدك بالبيانات في ملفات Excel الخام أو جداول البيانات المحورية (كتاب الحقائق) أو مساعدتك في إنشاء عروض تقديمية من مجموعات البيانات المتوفرة في التقرير.