North America Corneal Transplant Market

حجم السوق بالمليار دولار أمريكي

CAGR :

%

USD

219.85 Million

USD

355.74 Million

2024

2032

USD

219.85 Million

USD

355.74 Million

2024

2032

| 2025 –2032 | |

| USD 219.85 Million | |

| USD 355.74 Million | |

|

|

|

|

تجزئة سوق زراعة القرنية في أمريكا الشمالية، حسب نوع الإجراء (زراعة القرنية البطانية، زراعة القرنية النافذة، زراعة القرنية الصفيحية الأمامية (ALK)، زراعة الخلايا الجذعية الطرفية القرنية، زراعة القرنية الاصطناعية، وغيرها)، النوع (قرنية بشرية وصناعية)، نوع المتبرع (طُعم ذاتي وزرع خيفي)، نوع الطُعم (طعوم جزئية السُمك (صفيحية) وطعوم كاملة السُمك (نافذة))، نوع الجراحة (الجراحة التقليدية والجراحة بمساعدة الليزر)، دواعي الاستعمال (ضمور بطانة الأوعية الدموية فوكس، التهاب القرنية المعدي، اعتلال القرنية الفقاعي، القرنية المخروطية، عمليات إعادة الزرع، تندب القرنية، قرح القرنية، وغيرها)، الجنس (إناث وذكور)، الفئة العمرية (كبار السن، البالغين، والأطفال)، المستخدم النهائي (المستشفيات، عيادات العيون، العيادات الخارجية). المراكز الجراحية والمعاهد الأكاديمية والبحثية وغيرها - اتجاهات الصناعة وتوقعاتها حتى عام 2032

حجم سوق زراعة القرنية في أمريكا الشمالية

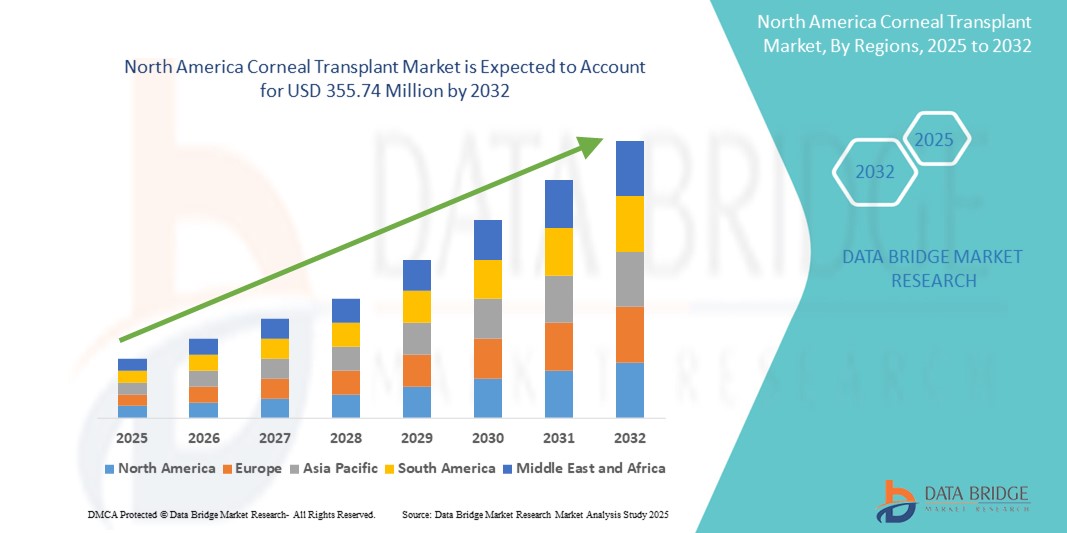

- تم تقييم حجم سوق زراعة القرنية في أمريكا الشمالية بـ 219.85 مليون دولار أمريكي في عام 2024 ومن المتوقع أن يصل إلى 355.74 مليون دولار أمريكي بحلول عام 2032 ، بمعدل نمو سنوي مركب قدره 6.20٪ خلال الفترة المتوقعة

- إن نمو السوق مدفوع إلى حد كبير بالانتشار المتزايد لاضطرابات القرنية والتقدم في تقنيات زرع الأعضاء وتحسين توافر أنسجة المتبرعين في جميع أنحاء المنطقة

- علاوة على ذلك، فإن تزايد الوعي بصحة العين، وأنظمة التعويض الداعمة، والاعتماد المتزايد على الإجراءات الجراحية طفيفة التوغل، كلها عوامل تُرسّخ زراعة القرنية كعلاج مُفضّل لاستعادة البصر. تُسرّع هذه العوامل المُجتمعة من اعتماد إجراءات زراعة القرنية، مما يُعزز نمو سوق المنطقة بشكل كبير.

تحليل سوق زراعة القرنية في أمريكا الشمالية

- تعد عمليات زرع القرنية، التي تتضمن استبدال أنسجة القرنية التالفة أو المريضة بأنسجة متبرع سليمة، إجراءات حيوية بشكل متزايد في مجال رعاية العيون في كل من مؤسسات الرعاية الصحية العامة والخاصة نظرًا لفعاليتها في استعادة الرؤية وتحسين نوعية حياة المريض.

- الطلب المتزايد على عمليات زرع القرنية مدفوع في المقام الأول بالانتشار المتزايد لأمراض القرنية مثل القرنية المخروطية واعتلال فوكس، إلى جانب التقدم في التقنيات الجراحية وتوافر أنسجة المتبرعين بشكل أفضل.

- هيمنت الولايات المتحدة على سوق زراعة القرنية في أمريكا الشمالية، محققةً أكبر حصة إيرادات بلغت 42.8% في عام 2024، بفضل بنية تحتية متطورة للرعاية الصحية، وسياسات سداد داعمة، ووجود بنوك عيون ومراكز زراعة رائدة. تشهد البلاد نموًا كبيرًا في حجم الإجراءات، مدفوعةً بمبادرات التوعية والابتكارات في تقنيات زراعة القرنية البطانية.

- من المتوقع أن تكون كندا أسرع دولة نموًا في سوق زراعة القرنية في أمريكا الشمالية خلال الفترة المتوقعة بسبب توسيع نطاق الوصول إلى رعاية العيون المتخصصة وزيادة الاستثمارات في تقنيات الجراحة العينية.

- سيطرت شريحة زراعة القرنية المخترقة على سوق زراعة القرنية في أمريكا الشمالية بحصة سوقية بلغت 47.2% في عام 2024، مدفوعًا باستخدامها على نطاق واسع، والنتائج السريرية الراسخة، والقدرة على علاج تلف القرنية بكامل سمكها.

نطاق التقرير وتقسيم سوق زراعة القرنية في أمريكا الشمالية

|

صفات |

رؤى رئيسية حول سوق زراعة القرنية في أمريكا الشمالية |

|

القطاعات المغطاة |

|

|

الدول المغطاة |

أمريكا الشمالية

|

|

اللاعبون الرئيسيون في السوق |

|

|

فرص السوق |

|

|

مجموعات معلومات البيانات ذات القيمة المضافة |

بالإضافة إلى الرؤى حول سيناريوهات السوق مثل القيمة السوقية ومعدل النمو والتجزئة والتغطية الجغرافية واللاعبين الرئيسيين، فإن تقارير السوق التي تم تنظيمها بواسطة Data Bridge Market Research تشمل أيضًا تحليلًا متعمقًا من الخبراء وتحليل التسعير وتحليل حصة العلامة التجارية واستطلاع رأي المستهلكين وتحليل التركيبة السكانية وتحليل سلسلة التوريد وتحليل سلسلة القيمة ونظرة عامة على المواد الخام / المواد الاستهلاكية ومعايير اختيار البائعين وتحليل PESTLE وتحليل Porter والإطار التنظيمي. |

اتجاهات سوق زراعة القرنية في أمريكا الشمالية

"التطورات التكنولوجية في تقنيات زراعة القرنية"

- من الاتجاهات المهمة والمتسارعة في سوق زراعة القرنية في أمريكا الشمالية التحول نحو تقنيات زراعة القرنية المتقدمة والأقل تدخلاً، مثل زراعة القرنية بغشاء ديسيميه البطاني (DMEK) وزراعة القرنية بغشاء ديسيميه البطاني (DSEK). توفر هذه الإجراءات نتائج بصرية أفضل، وأوقات تعافي أسرع، وتقليل مخاطر المضاعفات مقارنةً بزراعات القرنية التقليدية كاملة السُمك.

- على سبيل المثال، تتبنى مراكز زراعة الأعضاء في الولايات المتحدة بشكل متزايد تقنية DMEK لعلاج الخلل الوظيفي في الخلايا البطانية، بدعم من التقدم في الأجهزة الجراحية وإعداد أنسجة المتبرع من قبل بنوك العيون المتخصصة.

- تحافظ هذه التقنيات الحديثة على جزء أكبر من بنية قرنية المريض، مما يُسهم في تحسين بقاء الطعم على المدى الطويل، ويُقلل من احتمالية رفضه من قِبل الجهاز المناعي. علاوة على ذلك، تُعزز التحسينات في التصوير أثناء الجراحة والإجراءات بمساعدة الليزر دقة الجراحة ونسب النجاح.

- يتعزز هذا التوجه أيضًا بتزايد تفضيل الجراحين للتقنيات التي تُسهّل إعادة التأهيل وتُقلّل من مضاعفات ما بعد الجراحة. ونتيجةً لذلك، يتزايد الطلب على الأنسجة المُجرّدة والمُحمّلة مسبقًا من بنوك العيون، مثل معهد ليونز للعيون لزراعة الأعضاء والأبحاث.

- يُحدث هذا التوجه نحو إجراءات زراعة القرنية من الجيل التالي تغييرًا جذريًا في الممارسات السريرية، ويضع معايير جديدة في مجال رعاية طب العيون في جميع أنحاء أمريكا الشمالية. ونتيجةً لذلك، تستثمر شركات الأجهزة الطبية وبنوك الأنسجة المانحة في برامج تدريبية وبنية تحتية متطورة لدعم التبني الواسع النطاق.

- ومن المتوقع أن يؤدي التوافر المتزايد للتدريب الجراحي المتخصص، وتحسين لوجستيات الأنسجة المانحة، واستعداد نظام الرعاية الصحية إلى تعزيز هذا الاتجاه باعتباره حجر الزاوية في مشهد زراعة القرنية المتطور في الولايات المتحدة وكندا.

ديناميكيات سوق زراعة القرنية في أمريكا الشمالية

سائق

"زيادة انتشار أمراض القرنية وتحسين الوصول إلى أنسجة المتبرعين"

- إن الارتفاع المتزايد في حالات أمراض القرنية مثل القرنية المخروطية، وخلل بطانة الأوعية الدموية فوكس، وتندب القرنية هو المحرك الرئيسي لتوسع سوق زراعة القرنية في أمريكا الشمالية

- على سبيل المثال، أفادت جمعية بنوك العيون الأمريكية (EBAA) بإجراء أكثر من 80 ألف عملية زرع قرنية في الولايات المتحدة في عام 2023، مما يسلط الضوء على الطلب القوي على الإجراءات.

- يضمن توفر أنسجة المتبرعين بشكل أفضل، بدعم من شبكة منظمة جيدًا من بنوك العيون وحملات التوعية بالتبرع، الوصول في الوقت المناسب إلى الطعوم عالية الجودة، مما يحسن نتائج عملية الزرع بشكل كبير

- بالإضافة إلى ذلك، فإن أطر السداد القوية والتغطية التأمينية المتزايدة للإجراءات الطبية العينية في الولايات المتحدة وكندا تجعل عمليات زرع القرنية أكثر سهولة في الوصول إليها لقاعدة أوسع من المرضى

- تساهم مبادرات القطاعين العام والخاص لتعزيز التشخيص المبكر والعلاج في الوقت المناسب لأمراض القرنية في زيادة الإقبال على إجراءات زراعة القرنية، وخاصة في المراكز الحضرية ذات مرافق الرعاية الصحية المتقدمة.

ضبط النفس/التحدي

نقص الجراحين المهرة والتفاوت الإقليمي في الوصول

- على الرغم من التقدم التكنولوجي، فإن النقص في جراحي العيون المدربين على تقنيات زراعة القرنية المتقدمة يشكل تحديًا أمام التبني الواسع النطاق لإجراءات زراعة القرنية الحديثة في جميع أنحاء أمريكا الشمالية.

- على سبيل المثال، غالبًا ما تواجه المناطق الريفية في كل من الولايات المتحدة وكندا صعوبة في الوصول إلى الرعاية المتخصصة، مما يؤدي إلى أوقات انتظار أطول وخيارات جراحية أقل للمرضى في المناطق المحرومة.

- علاوة على ذلك، في حين أن المستشفيات الحضرية قد تكون مجهزة تجهيزًا جيدًا، فإن التفاوت في التمويل والبنية الأساسية الطبية عبر المقاطعات والولايات يعيق الوصول الموحد إلى الرعاية عالية الجودة.

- إن ضمان تدريب أوسع للجراحين، وزيادة التمويل لخدمات طب العيون في المناطق النائية، وتعزيز شبكات تبادل الأنسجة بين المناطق، سيكون ضروريًا للتغلب على هذه القيود وضمان الوصول العادل إلى رعاية زراعة القرنية.

- في حين أن عمليات زرع القرنية مغطاة بالتأمين في كثير من الحالات، فإن التكلفة الإجمالية - بما في ذلك التقييمات قبل الجراحة، والأدوات الجراحية المتقدمة، ومعالجة أنسجة المتبرع، والرعاية بعد الجراحة - يمكن أن تكون مرتفعة

- يُعد العبء المالي كبيرًا بشكل خاص في الإجراءات التي تتضمن تقنيات متطورة مثل DMEK أو زراعة القرنية بمساعدة ليزر الفيمتو ثانية. بالنسبة للمرضى الذين لا يملكون تأمينًا شاملًا أو المقيمين في مناطق ذات سياسات سداد محدودة، تُصبح التكلفة عائقًا رئيسيًا أمام الحصول على هذه الخدمات.

نطاق سوق زراعة القرنية في أمريكا الشمالية

يتم تقسيم السوق على أساس نوع الإجراء، والنوع، ونوع المتبرع، ونوع الطعم، ونوع الجراحة، والمؤشر، والجنس، والفئة العمرية، والمستخدم النهائي.

- حسب نوع الإجراء

بناءً على نوع الإجراء، يُقسّم سوق زراعة القرنية في أمريكا الشمالية إلى: زراعة القرنية البطانية، وزراعة القرنية النافذة، وزراعة القرنية الصفيحية الأمامية (ALK)، وزراعة الخلايا الجذعية الطرفية القرنية، وزراعة القرنية الاصطناعية، وغيرها. هيمنت زراعة القرنية النافذة على السوق محققةً أكبر حصة من إيرادات السوق بنسبة 47.2% في عام 2024، بفضل فائدتها السريرية الراسخة وفعاليتها في علاج أمراض القرنية كاملة السُمك. ولا تزال تُستخدم على نطاق واسع في حالات ندبات القرنية الشديدة والقرنية المخروطية.

من المتوقع أن يشهد قطاع زراعة القرنية البطانية أسرع معدل نمو بين عامي 2025 و2032، مدفوعًا بالتطورات في التقنيات الجراحية مثل DMEK وDSAEK. توفر هذه الأساليب تعافيًا بصريًا أفضل، ومضاعفات أقل، وتفضيلًا متزايدًا من الجراحين في علاج اضطرابات بطانة الأوعية الدموية مثل ضمور فوكس.

- حسب النوع

يُقسّم سوق زراعة القرنية في أمريكا الشمالية، حسب النوع، إلى قرنية بشرية وقرنية صناعية. وقد استحوذ قطاع القرنية البشرية على أكبر حصة من إيرادات السوق في عام 2024، مدعومًا بالحضور القوي لبنوك العيون والاستخدام الواسع لأنسجة المتبرعين في عمليات الزراعة. ويساهم ارتفاع معدلات بقاء الطعوم وتوافرها عبر أنظمة التبرع الوطنية في هيمنة هذا القطاع.

من المتوقع أن يشهد قطاع المواد التركيبية نموًا مطردًا بين عامي 2025 و2032، مدفوعًا بالابتكار في زراعة القرنية الاصطناعية للمرضى الذين يعانون من رفض متكرر للطعوم أو غير المؤهلين لزراعة القرنية البشرية. كما يدعم هذا النمو تزايد الأبحاث في المواد المتوافقة حيويًا.

- حسب نوع المتبرع

بناءً على نوع المتبرع، يُقسّم سوق زراعة القرنية في أمريكا الشمالية إلى طُعم ذاتي وطُعم متبرع. وقد حصدت زراعة القرنية المتبرع بها أكبر حصة من إيرادات السوق في عام ٢٠٢٤، بفضل انتشار استخدامها باستخدام أنسجة متبرعين من جثث في عمليات زراعة القرنية كاملةً وجزئيةً.

ومن المتوقع أن يشهد قطاع الطعم الذاتي نموًا معتدلًا خلال الفترة المتوقعة، وخاصة في التطبيقات المتخصصة مثل زراعة الخلايا الجذعية الطرفية وإعادة بناء سطح العين حيث يتم استخدام الأنسجة المشتقة من المريض.

- حسب نوع الطعم

بناءً على نوع الطعوم، يُقسّم سوق زراعة القرنية في أمريكا الشمالية إلى طعوم جزئية السُمك (صفائحية) وطعوم كاملة السُمك (نافذة). هيمنت شريحة الطعوم كاملة السُمك على السوق في عام ٢٠٢٤، ويعود ذلك أساسًا إلى الاعتماد المستمر على رأب القرنية النافذ في حالات التنكس القرني المتقدم والصدمات.

من المتوقع أن ينمو قطاع الطعوم ذات السُمك الجزئي بأسرع معدل من عام 2025 إلى عام 2032، مدفوعًا بالاعتماد المتزايد على تقنيات الخلايا البطانية والصفائحية الأمامية التي توفر نتائج أفضل بعد الجراحة ومعدلات رفض أقل.

- حسب نوع الجراحة

بناءً على نوع الجراحة، يُقسّم سوق زراعة القرنية في أمريكا الشمالية إلى الجراحة التقليدية والجراحة بمساعدة الليزر. وقد استحوذ قطاع الجراحة التقليدية على أكبر حصة من إيرادات السوق في عام 2024 بفضل استخدامه طويل الأمد، وفعاليته من حيث التكلفة، وإمكانية الوصول إليه على نطاق واسع في مراكز جراحة العيون العامة.

من المتوقع أن يشهد قطاع الجراحة بمساعدة الليزر أسرع معدل نمو في الفترة من 2025 إلى 2032، مدفوعًا بالاعتماد المتزايد على تقنية ليزر الفيمتوثانية التي تعمل على تعزيز الدقة وتقليل وقت العملية وتحسين محاذاة واجهة الطعم والمضيف.

- حسب الإشارة

بناءً على دواعي الاستعمال، يُقسّم سوق زراعة القرنية في أمريكا الشمالية إلى ضمور فوكس البطاني، والتهاب القرنية المعدي، واعتلال القرنية الفقاعي، والقرنية المخروطية، وإجراءات إعادة الزرع، وتندب القرنية، وقرح القرنية، وغيرها. هيمنت فئة ضمور فوكس البطاني على السوق في عام 2024، نظرًا لانتشارها الواسع بين كبار السن وزيادة الإقبال على تقنيات رأب القرنية البطاني.

من المتوقع أن ينمو قطاع القرنية المخروطية بأسرع معدل في الفترة من 2025 إلى 2032، بدعم من الكشف المبكر عن المرض، وزيادة الوعي، والعدد المتزايد من إجراءات ترقيع الصفائح الانتقائية في مجموعات المرضى الأصغر سنا.

- حسب الجنس

بناءً على الجنس، يُقسّم سوق زراعة القرنية في أمريكا الشمالية إلى قسمين: قسم للرجال وقسم للنساء. وقد استحوذت شريحة الرجال على أكبر حصة من إيرادات السوق في عام ٢٠٢٤، ويعود ذلك أساسًا إلى ارتفاع معدل إصابات القرنية الناتجة عن الصدمات والتعرض المهني لمخاطر العين.

ومن المتوقع أن يسجل قطاع الإناث نموًا ملحوظًا خلال الفترة المتوقعة، بدعم من التشخيص المتزايد لمرض ضمور فوكس بين النساء الأكبر سناً والوعي المتزايد بصحة العين.

- حسب الفئة العمرية

بناءً على الفئة العمرية، يُقسّم سوق زراعة القرنية في أمريكا الشمالية إلى فئات عمرية تشمل كبار السن، والبالغين، والأطفال. وقد استحوذت فئة البالغين على أكبر حصة من إيرادات السوق في عام 2024، حيث تُجرى معظم عمليات الزراعة في هذه الفئة العمرية، مدفوعةً بحالات القرنية المخروطية والتهاب القرنية المعدي.

من المتوقع أن ينمو قطاع طب الشيخوخة بأسرع معدل في الفترة من 2025 إلى 2032، ويعزى ذلك إلى ارتفاع معدل انتشار الخلل الوظيفي في بطانة الأوعية الدموية وأمراض العيون التنكسية في السكان المسنين، وخاصة في جميع أنحاء الولايات المتحدة وكندا.

- حسب المستخدم النهائي

بناءً على المستخدم النهائي، يُقسّم سوق زراعة القرنية في أمريكا الشمالية إلى مستشفيات، وعيادات عيون، ومراكز جراحة خارجية، ومعاهد أكاديمية وبحثية، وغيرها. وقد هيمن قطاع المستشفيات على السوق محققًا أكبر حصة من إيرادات السوق في عام 2024، بفضل توفر أجهزة جراحية عيون متطورة، وتدفق كبير من المرضى للحصول على رعاية متكاملة الخدمات.

من المتوقع أن ينمو قطاع مراكز الجراحة الخارجية بأسرع وتيرة خلال فترة التنبؤ، وذلك بسبب أوقات الإجراءات الأقصر، وكفاءة التكلفة، وزيادة تفضيل المرضى للتدخلات الجراحية للمرضى الخارجيين في طب العيون.

تحليل إقليمي لسوق زراعة القرنية في أمريكا الشمالية

- سيطرت الولايات المتحدة على سوق زراعة القرنية في أمريكا الشمالية بأكبر حصة إيرادات بلغت 42.8% في عام 2024، وتتميز ببنية تحتية متطورة للرعاية الصحية وسياسات سداد داعمة ووجود بنوك عيون ومراكز زراعة رائدة.

- يستفيد المرضى في الولايات المتحدة من سهولة الوصول إلى أنسجة القرنية المتبرع بها، وتوافر جراحي العيون ذوي المهارات العالية، وزيادة الوعي العام بإجراءات استعادة الرؤية مثل DMEK وDSAEK

- ويتم دعم هذا الموقف القيادي من خلال التغطية التأمينية المواتية، والاستثمارات المتزايدة في رعاية طب العيون، والتبني الواسع النطاق لتقنيات زراعة القرنية المبتكرة، مما يضع الولايات المتحدة كمركز مركزي لإجراءات زراعة القرنية في المنطقة.

نظرة عامة على سوق زراعة القرنية في الولايات المتحدة

استحوذ سوق زراعة القرنية في الولايات المتحدة على أكبر حصة من الإيرادات في أمريكا الشمالية عام ٢٠٢٤، مدفوعًا بارتفاع معدل انتشار اضطرابات القرنية والتواجد القوي لبنوك العيون والمراكز الجراحية المتخصصة. وتدعم البنية التحتية المتطورة للرعاية الصحية في البلاد، إلى جانب توافر أنسجة المتبرعين على نطاق واسع وإجراءات زراعة واسعة النطاق، أداءً قويًا للسوق. كما أن تزايد اعتماد تقنيات زراعة القرنية البطانية مثل DMEK وDSAEK، إلى جانب أطر السداد المواتية، يُسرّع نمو السوق. وتُسهم الابتكارات المستمرة في معالجة طعوم القرنية وزيادة وعي المرضى بشكل كبير في تحقيق نمو مستدام.

نظرة عامة على سوق زراعة القرنية في كندا

من المتوقع أن يشهد سوق زراعة القرنية في كندا نموًا ملحوظًا بمعدل نمو سنوي مركب خلال فترة التوقعات، مدعومًا بتحسينات في تقديم الرعاية الصحية، وخدمات طب العيون الممولة حكوميًا، وتوسيع نطاق الوصول إلى رعاية العيون في المناطق الحضرية والنائية. ويساهم التركيز الوطني المتزايد على صحة العين، إلى جانب برامج التدريب الجراحي المتنامية والتعاون مع بنوك العيون الأمريكية، في تعزيز القدرة الإجرائية. ويساهم الطلب المتزايد على خيارات زراعة القرنية الأقل توغلًا، ومبادرات التوعية العامة، والاستثمار المتزايد في أبحاث طب العيون، في تحقيق تقدم مطرد في السوق في جميع أنحاء كندا.

نظرة عامة على سوق زراعة القرنية في المكسيك

من المتوقع أن يشهد سوق زراعة القرنية في المكسيك نموًا مطردًا خلال فترة التوقعات، مدفوعًا بزيادة الاستثمارات العامة والخاصة في خدمات رعاية العيون، وارتفاع معدل انتشار عمى القرنية، والتحسن التدريجي في إمكانية الحصول على الرعاية الصحية. تدعم البرامج الحكومية التي تشجع على التبرع بالأعضاء والأنسجة، إلى جانب توسيع قدرات جراحة العيون في المستشفيات الحضرية، تطوير السوق. وبينما لا يزال الحصول على قرنيات المتبرعين يمثل تحديًا في بعض المناطق، فإن التعاون الدولي والمبادرات غير الربحية تساعد في سد الفجوة في توافر الأنسجة والتدريب الجراحي. ومع تحسن الوعي والبنية التحتية للرعاية الصحية، من المتوقع أن تشهد المكسيك نموًا مستدامًا في عمليات زراعة القرنية.

حصة سوق زراعة القرنية في أمريكا الشمالية

إن صناعة زراعة القرنية في أمريكا الشمالية يقودها في المقام الأول شركات راسخة، بما في ذلك:

- شركة كورنياجين (الولايات المتحدة)

- كيرالينك الدولية (الولايات المتحدة)

- سايت لايف (الولايات المتحدة)

- إيفرسايت (الولايات المتحدة)

- معهد ليونز للعيون لزراعة الأعضاء والأبحاث (الولايات المتحدة)

- بوش + لومب (الولايات المتحدة)

- شركة ألكون (سويسرا)

- أورولاب (الهند)

- بنوك الأنسجة الدولية (الولايات المتحدة)

- بنك العيون لاستعادة البصر (الولايات المتحدة)

- بنك العيون في سان دييغو (الولايات المتحدة)

- Lions VisionGift (الولايات المتحدة)

- مستشفى ويلز للعيون (الولايات المتحدة)

- شركة نيو وورلد الطبية (الولايات المتحدة)

- شركة AJL لطب العيون (إسبانيا)

- بنك العيون لاستعادة البصر (الولايات المتحدة)

- شركة ديوبتكس المحدودة (النمسا)

- شبكة مشاركة أعضاء البنكرياس (الولايات المتحدة)

- شركة كيراميد (الولايات المتحدة)

- سترايكر (الولايات المتحدة)

ما هي التطورات الأخيرة في سوق زراعة القرنية في أمريكا الشمالية؟

- في مايو 2024، أطلقت جمعية بنوك العيون الأمريكية (EBAA) حملة توعية وطنية في جميع أنحاء الولايات المتحدة الأمريكية للترويج للتبرع بالقرنية وتثقيف الجمهور حول تأثير عمليات الزراعة على حياة الأفراد. تهدف هذه المبادرة إلى تلبية الطلب المتزايد على أنسجة المتبرعين وتحسين معدلات التبرع. من خلال التعاون مع المستشفيات ومراكز زراعة الأعضاء وجماعات المناصرة، تُعزز الحملة أهمية صحة القرنية وتدعم سلسلة توريد المتبرعين لإجراءات الزراعة.

- في أبريل 2024، أعلنت جامعة كولومبيا البريطانية في كندا عن نجاح تطبيق سريري لغرسة قرنية جديدة مُهندسة بيولوجيًا، طُوّرت بالتعاون مع باحثين دوليين. يُقدّم هذا الابتكار بديلاً واعدًا للمرضى الذين يصعب عليهم الحصول على أنسجة متبرعة، وخاصةً المصابين بالقرنية المخروطية المتقدمة. يُمثّل هذا الإنجاز نقلة نوعية في طب العيون التجديدي، ويُوسّع آفاق زراعة القرنية الاصطناعية في أمريكا الشمالية مستقبلًا.

- في مارس 2024، وسّعت شركة CorneaGen, Inc.، وهي شركة أمريكية متخصصة في توريد وابتكار أنسجة القرنية، شبكة توزيعها في كندا والمكسيك، بهدف تسهيل الوصول إلى الأنسجة المُجرّدة والمُحمّلة مسبقًا لزراعة القرنية البطانية. تُحسّن هذه الخطوة كفاءة الإجراءات وتُمكّن جراحي العيون من الحصول على طعوم جاهزة للاستخدام، مما يُرسّخ معايير رعاية زراعة القرنية عالية الجودة في جميع أنحاء أمريكا الشمالية.

- في فبراير 2024، أطلق مستشفى تورنتو الغربي مركزًا متخصصًا لجراحة القرنية المتقدمة، يُركز على تدريب أطباء العيون على أحدث التقنيات مثل DMEK وDALK. تُعالج هذه المبادرة نقص الجراحين المتخصصين في كندا، وتُعزز الجهود الإقليمية لتحسين النتائج من خلال التميز الجراحي والتعليم.

- في يناير 2024، أبرمت سايت لايف، وهي بنك عيون عالمي غير ربحي مقره الولايات المتحدة، شراكة مع وزارة الصحة المكسيكية لتعزيز الإطار الوطني للتبرع بالقرنية. يشمل البرنامج تدريبًا فنيًا، وجهودًا للتوعية العامة، وأنظمة ضمان جودة في التعامل مع الأنسجة، مما يمثل خطوة مهمة نحو تحسين البنية التحتية لزراعة القرنية ونتائجها في المناطق المحرومة من الخدمات في أمريكا الشمالية.

SKU-

احصل على إمكانية الوصول عبر الإنترنت إلى التقرير الخاص بأول سحابة استخبارات سوقية في العالم

- لوحة معلومات تحليل البيانات التفاعلية

- لوحة معلومات تحليل الشركة للفرص ذات إمكانات النمو العالية

- إمكانية وصول محلل الأبحاث للتخصيص والاستعلامات

- تحليل المنافسين باستخدام لوحة معلومات تفاعلية

- آخر الأخبار والتحديثات وتحليل الاتجاهات

- استغل قوة تحليل المعايير لتتبع المنافسين بشكل شامل

منهجية البحث

يتم جمع البيانات وتحليل سنة الأساس باستخدام وحدات جمع البيانات ذات أحجام العينات الكبيرة. تتضمن المرحلة الحصول على معلومات السوق أو البيانات ذات الصلة من خلال مصادر واستراتيجيات مختلفة. تتضمن فحص وتخطيط جميع البيانات المكتسبة من الماضي مسبقًا. كما تتضمن فحص التناقضات في المعلومات التي شوهدت عبر مصادر المعلومات المختلفة. يتم تحليل بيانات السوق وتقديرها باستخدام نماذج إحصائية ومتماسكة للسوق. كما أن تحليل حصة السوق وتحليل الاتجاهات الرئيسية هي عوامل النجاح الرئيسية في تقرير السوق. لمعرفة المزيد، يرجى طلب مكالمة محلل أو إرسال استفسارك.

منهجية البحث الرئيسية التي يستخدمها فريق بحث DBMR هي التثليث البيانات والتي تتضمن استخراج البيانات وتحليل تأثير متغيرات البيانات على السوق والتحقق الأولي (من قبل خبراء الصناعة). تتضمن نماذج البيانات شبكة تحديد موقف البائعين، وتحليل خط زمني للسوق، ونظرة عامة على السوق ودليل، وشبكة تحديد موقف الشركة، وتحليل براءات الاختراع، وتحليل التسعير، وتحليل حصة الشركة في السوق، ومعايير القياس، وتحليل حصة البائعين على المستوى العالمي مقابل الإقليمي. لمعرفة المزيد عن منهجية البحث، أرسل استفسارًا للتحدث إلى خبراء الصناعة لدينا.

التخصيص متاح

تعد Data Bridge Market Research رائدة في مجال البحوث التكوينية المتقدمة. ونحن نفخر بخدمة عملائنا الحاليين والجدد بالبيانات والتحليلات التي تتطابق مع هدفهم. ويمكن تخصيص التقرير ليشمل تحليل اتجاه الأسعار للعلامات التجارية المستهدفة وفهم السوق في بلدان إضافية (اطلب قائمة البلدان)، وبيانات نتائج التجارب السريرية، ومراجعة الأدبيات، وتحليل السوق المجدد وقاعدة المنتج. ويمكن تحليل تحليل السوق للمنافسين المستهدفين من التحليل القائم على التكنولوجيا إلى استراتيجيات محفظة السوق. ويمكننا إضافة عدد كبير من المنافسين الذين تحتاج إلى بيانات عنهم بالتنسيق وأسلوب البيانات الذي تبحث عنه. ويمكن لفريق المحللين لدينا أيضًا تزويدك بالبيانات في ملفات Excel الخام أو جداول البيانات المحورية (كتاب الحقائق) أو مساعدتك في إنشاء عروض تقديمية من مجموعات البيانات المتوفرة في التقرير.