سوق أنظمة الترميز والوسم في أمريكا الشمالية، حسب نوع التكنولوجيا (نفث الحبر المستمر، الترميز بالليزر، نفث الحبر الحراري، بيزو، أخرى)، النوع (طابعات نفث الحبر الصغيرة، طابعات نفث الحبر عالية الدقة، طابعات نفث الحبر الكبيرة، أنظمة الليزر، وأنظمة سوق الرش)، التطبيق (ثانوي، ثالثي، أولي)، المادة (البلاستيك والورق والكرتون والمعادن والخشب والمنسوجات (باستثناء السجاد والصوف)، الرقائق، الأسطح العضوية، المطاط والسجاد والصوف وغيرها)، عدد الفوهات (فوهة واحدة، فوهات متعددة)، الاستخدام النهائي (الأغذية والمشروبات والأدوية والكهرباء والإلكترونيات والسيارات والفضاء والعناية الشخصية والبناء والتصنيع الكيميائي وغيرها) - اتجاهات الصناعة والتوقعات حتى عام 2030.

تحليل وحجم سوق أنظمة الترميز والعلامات في أمريكا الشمالية

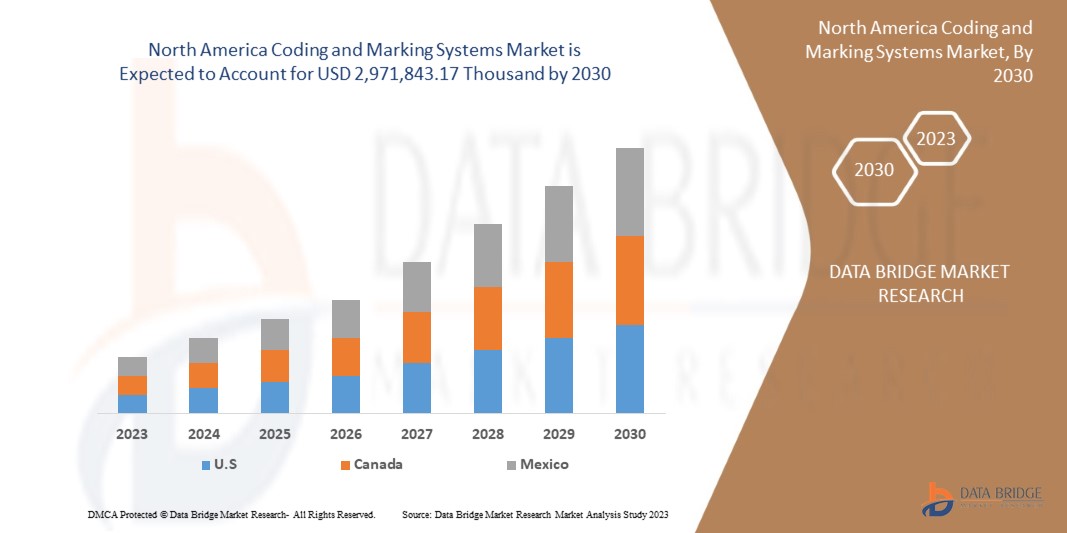

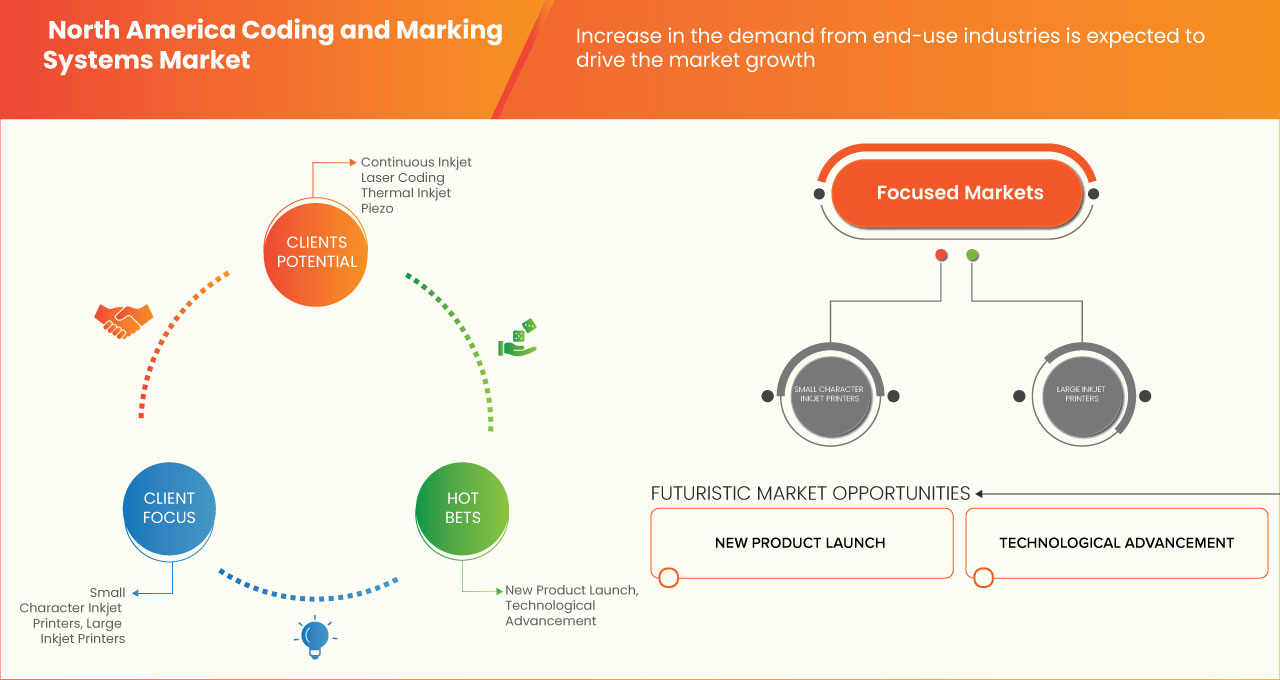

من المتوقع أن ينمو سوق أنظمة الترميز والعلامات في أمريكا الشمالية بشكل كبير في الفترة المتوقعة من 2023 إلى 2030. تحلل Data Bridge Market Research أن السوق ينمو بمعدل نمو سنوي مركب بنسبة 5.7٪ في الفترة المتوقعة من 2023 إلى 2030 ومن المتوقع أن يصل إلى 2،971،843.17 ألف دولار أمريكي بحلول عام 2030. كان الاستخدام المتزايد لأنظمة الترميز والعلامات في مختلف الصناعات هو المحرك الرئيسي لسوق أنظمة الترميز والعلامات في أمريكا الشمالية.

يقدم تقرير سوق أنظمة الترميز والعلامات تفاصيل عن حصة السوق والتطورات الجديدة وتأثير اللاعبين المحليين والمحليين في السوق، ويحلل الفرص من حيث جيوب الإيرادات الناشئة والتغييرات في لوائح السوق وموافقات المنتجات والقرارات الاستراتيجية وإطلاق المنتجات والتوسعات الجغرافية والابتكارات التكنولوجية في السوق. لفهم التحليل وسيناريو السوق، اتصل بنا للحصول على موجز محلل. سيساعدك فريقنا في إنشاء حل تأثير الإيرادات لتحقيق هدفك المنشود.

|

تقرير القياس |

تفاصيل |

|

فترة التنبؤ |

2023 إلى 2030 |

|

سنة الأساس |

2022 |

|

سنوات تاريخية |

2021 (قابلة للتخصيص حتى 2020 - 2015) |

|

وحدات كمية |

الإيرادات بالألف دولار أمريكي |

|

القطاعات المغطاة |

حسب نوع التكنولوجيا (نفث الحبر المستمر، الترميز بالليزر، نفث الحبر الحراري، بيزو، أخرى)، النوع (طابعات نفث الحبر الصغيرة، طابعات نفث الحبر عالية الدقة، طابعات نفث الحبر الكبيرة، أنظمة الليزر، وأنظمة سوق الرش)، التطبيق (ثانوي، ثالثي، أولي)، المادة (البلاستيك، الورق والكرتون، المعادن، الخشب، المنسوجات (باستثناء السجاد والصوف)، الرقائق، الأسطح العضوية، المطاط، السجاد، الصوف، وغيرها)، عدد الفوهات (فوهة واحدة، فوهات متعددة)، الاستخدام النهائي (الأغذية والمشروبات، الأدوية، الكهرباء والإلكترونيات، السيارات والفضاء، العناية الشخصية، البناء، التصنيع الكيميائي، وغيرها) |

|

الدول المغطاة |

الولايات المتحدة وكندا والمكسيك |

|

الجهات الفاعلة في السوق المشمولة |

Danaher، وWeber Marking Systems GmbH، وDover Corporation، وNovanta Inc.، وREA Elektronik GmbH، وProMach Inc.، وLeibinger Group، وPak-Tec، وHitachi, Ltd.، وIllinois Tool Works Inc.، وMatthews International Corporation، وBrother Industries, Ltd.، وHSA Systems A/S وغيرها |

تعريف السوق

تُستخدم أنظمة الترميز والوسم على نطاق واسع في ترميز السيارات. تُستخدم الترميز والوسم لطباعة أرقام الأجزاء أو ملصقات مكافحة التزييف على أجزاء السيارات لمنع بيع الأجزاء المقلدة. تُستخدم أجهزة الترميز والوسم لطباعة تفاصيل المنتج المحددة على غلاف المنتج. تهدف هذه المعلومات إلى تزويد المستخدمين النهائيين والمصنعين بمعلومات موثوقة حول منتجاتهم. يتضمن الترميز، من بين أمور أخرى، طباعة تاريخ التصنيع وتاريخ انتهاء الصلاحية وحجم دفعة التعبئة. من خلال طباعة الرموز أو الملصقات على المنتجات، يمكن للمصنعين تقليل مخاطر التزييف وحماية صورة العلامة التجارية للمستهلك النهائي.

ديناميكيات سوق أنظمة الترميز والعلامات في أمريكا الشمالية

يتناول هذا القسم فهم محركات السوق والفرص والتحديات والقيود. وسيتم مناقشة كل هذا بالتفصيل أدناه:

السائقين

- ارتفاع الطلب في صناعة السيارات

لقد زاد الطلب المتزايد على أنظمة الترميز والوسم في صناعة السيارات بسبب زيادة مبيعات المنتجات المقلدة. لذلك، يستخدم المصنعون أنظمة الترميز والوسم لتقليل استخدام المنتجات المقلدة في السوق ويستخدمون بشكل متكرر أنظمة الترميز والوسم لترميز ملصقات أرقام الأجزاء على آلات المركبات. يجب أن تكون معدات الترميز والوسم قادرة على تلبية المتطلبات المعقدة لمصنعي السيارات بشكل مريح في صناعة تتطلب طباعة المعلومات على المكونات الفردية في مراحل مختلفة من عملية التصنيع. يجب أن توفر أجهزة الترميز القوية تكاملاً خاليًا من المتاعب في العمليات الحالية ثم تعمل باستمرار في بيئات الإنتاج الصعبة. يبحث المصنعون عن حلول تتبع واحتواء في أمريكا الشمالية، بالإضافة إلى القدرة على طباعة شعارهم وتاريخ الإنتاج وتاريخ انتهاء الصلاحية ورقم الدفعة وأرقام الأجزاء والمعلومات الأخرى على منتجاتهم.

- الاستخدام المتزايد لأنظمة الترميز والعلامات في مختلف الصناعات

تستخدم العديد من الصناعات تقنيات الترميز والوسم، مثل صناعة السلع الاستهلاكية سريعة الاستهلاك، والأغذية والمشروبات، والمنتجات الإلكترونية، والمعادن، والمطاط، والمنسوجات، والمواد الكيميائية والزراعية ، والبذور، والبناء، والرعاية الصحية، والمستحضرات الصيدلانية. إن الطلب المتزايد على الأغذية المعبأة، والأغذية المعبأة الصحية، وزيادة التحضر يزيد من استهلاك هذه المنتجات، مما يزيد من الطلب على أنظمة الترميز والوسم. تعد صناعات الأغذية والأدوية من بين أكثر الصناعات تنظيماً من حيث إمكانية تتبع سلسلة التوريد. يساهم ترميز المنتجات ووضع العلامات عليها في إمكانية التتبع الكامل، وحماية كل من المستهلكين والشركات باستخدام أرقام الدفعات والرموز الشريطية وتواريخ انتهاء الصلاحية. مع تطور تقنيات الترميز مع التقارير والتحليلات في الوقت الفعلي، سيتمكن المستهلكون من اكتساب رؤى أكثر شفافية حول أصول المكونات التي يتكون منها المنتج.

فرص

- قواعد حكومية صارمة لأنظمة الترميز والعلامات

لقد قامت الحكومات في جميع أنحاء العالم بتنفيذ لوائح جديدة للتغليف والوسم. وتضطر العديد من شركات التغليف إلى القيام باستثمارات كبيرة في معدات الترميز والوسم من أجل الامتثال للوائح وتجنب العقوبات. وتستخدم العديد من الشركات تقنيات متقدمة مثل مجموعة البيانات لتحديد وتتبع المنتجات في الصناعات مثل الأغذية والمشروبات والرعاية الصحية والأدوية وغيرها. وتفرض العديد من الحكومات في جميع أنحاء العالم لوائح صارمة للتغليف والوسم. وتتطلب هذه اللوائح ترميزًا باللون الأحمر على جوانب ملصقات العبوات الخاصة بمنتجات الأغذية المعبأة ذات المحتوى العالي من الدهون والسكر والملح. ونتيجة لذلك، أصبح الترميز أكثر شيوعًا في جميع أنحاء العالم.

- زيادة استخدام الترميز بالليزر

لقد زاد الطلب على تقنية الترميز بالليزر بشكل كبير، ويرجع ذلك أساسًا إلى خصائصها وقابليتها للتطبيق في التطبيقات الصناعية المختلفة من قبل المستخدمين النهائيين. على سبيل المثال، تكتسب حلول الترميز بالليزر شعبية في السلع الاستهلاكية مثل مستحضرات التجميل والعناية الشخصية وخدمة الأغذية والسيارات. تمثل آلات الترميز بالليزر أحدث التطورات في تكنولوجيا الترميز والوسم وتستخدم لطباعة الرموز على الأجسام المعدنية أو المعدنية وغيرها من العناصر. مع زيادة طلب العملاء على التكنولوجيا المتقدمة، يتجه مصنعو المستخدم النهائي إلى تقنية الليزر. توفر أجهزة الترميز بالليزر علامات مستمرة عالية السرعة والقدرة على تقديم أكواد أو شعارات عالية الدقة لحماية العلامة التجارية. إنها توفر قدرات وسم حادة ومفصلة، وهو أمر مفيد في العديد من الصناعات النهائية. بالإضافة إلى ذلك، يركز مصنعو أنظمة الترميز والوسم على توفير حلول صديقة للبيئة لتلبية الطلب المتزايد من مختلف قطاعات الاستخدام النهائي، مثل الأطعمة ومظاريف التعبئة والتغليف.

ضبط النفس

- ارتفاع تكلفة معدات الترميز والعلامات والرموز المطبوعة بشكل غير صحيح

لقد ظهرت معدات جديدة لتقنيات الطباعة الصناعية، مثل الترميز والعلامات التجارية، والتي تعد بتحسين كفاءة هذه العمليات. ومع ذلك، فقد تطور تطوير وتطبيق معدات الترميز والعلامات التجارية نتيجة لتغير أشكال التعبئة والتغليف وتعقيدات التصميم. إن الرموز الشريطية التي لا تُطبع بشكل صحيح، والعلامات التجارية التالفة، والمعلومات التي يجب استخدامها قبل تاريخ انتهاء الصلاحية والتي تُفقد بسبب بهتان الحبر المطبوع، كلها يمكن أن تؤدي إلى سوء الفهم بين الشركات والعملاء. إن الافتقار إلى الرموز المناسبة يمكن أن يتسبب في فقدان المنتجات لشعبيتها، وقد يعاني المصنعون من عدم القدرة على التتبع بشكل فعال.

تحدي

- تكلفة التركيب العالية والأخطاء التشغيلية

غالبًا ما يؤدي الإهمال والخطأ البشري إلى الإضرار بمصالح صناع السوق والبائعين. وهذا يمثل تحديًا كبيرًا في صناعة الاستخدام النهائي التي يركز عليها المصنعون باستمرار. في شركات التصنيع الكبيرة، يعمل العمال عادةً بنظام المناوبات، مما يزيد من التفاعل بين الإنسان والآلة. يميل هذا إلى زيادة هامش الخطأ حيث تستغرق عملية الطباعة وقتًا أطول للتعلم. علاوة على ذلك، فإنه يستهلك الوقت والموارد من الشركات التي يمكن استخدامها في مكان آخر.

تميل معدات الترميز والوسم إلى أن تكون باهظة الثمن للغاية. لذلك، فإن تركيب أنظمة الترميز والوسم يمثل تحديًا. قد لا يكون لدى جميع المشاركين في سلسلة التوريد، وخاصة الشركات الصغيرة، الموارد المالية لبناء البنية الأساسية اللازمة لتنفيذ أنظمة الترميز والوسم. ستكون تكاليف التشغيل المرتفعة تحديًا كبيرًا للسوق خلال فترة التنبؤ.

التطورات الأخيرة

- في ديسمبر 2021، قدمت شركة Koenig & Bauer عبوات خاصة لأوراق التبغ الفاخرة مع علامات الليزر. سيتم تنفيذ هذه المهمة في الموقع في المستقبل بواسطة نظام الترميز udaFORMAXX Offline شبه التلقائي، والذي تم تجهيزه بليزر تحديد ثاني أكسيد الكربون للعلامات الدائمة دون تلطيخ

- في يونيو 2022، أطلقت شركة CONTROL PRINT LTD. منتجًا جديدًا وهو Pench، وهي طابعة نفث حبر مستمرة. تُستخدم بشكل أساسي في قطاعات مثل الكابلات والأسلاك والصلب وغيرها من التطبيقات فائقة السرعة، حيث يمكنها الطباعة بسرعة تصل إلى 700 متر/دقيقة. سيساعد إطلاق المنتج الشركة على توسيع محفظة منتجاتها وقاعدة عملائها في مختلف الصناعات النهائية

نطاق سوق أنظمة الترميز والعلامات في أمريكا الشمالية

يتم تصنيف سوق أنظمة الترميز والعلامات في أمريكا الشمالية بناءً على نوع التكنولوجيا والنوع والتطبيق وعدد الفوهات والمواد والاستخدام النهائي. سيساعدك النمو بين هذه القطاعات في تحليل قطاعات النمو الرئيسية في الصناعات وتزويد المستخدمين بنظرة عامة قيمة على السوق ورؤى السوق لاتخاذ قرارات استراتيجية لتحديد تطبيقات السوق الأساسية.

نوع التكنولوجيا

- نفث الحبر المستمر

- الترميز بالليزر

- الترميز الحراري

- بيزو

- آحرون

على أساس نوع التكنولوجيا، يتم تقسيم سوق أنظمة الترميز والعلامات إلى نفث الحبر المستمر، والترميز بالليزر، ونفث الحبر الحراري، والبيزو، وغيرها.

يكتب

- طابعات نفث الحبر ذات الأحرف الصغيرة

- طابعات نفث الحبر عالية الدقة

- الطابعات النافثة للحبر الكبيرة

- أنظمة الليزر وأنظمة الرش

على أساس النوع، يتم تقسيم سوق أنظمة الترميز والعلامات إلى طابعات نفث الحبر ذات الأحرف الصغيرة، وطابعات نفث الحبر عالية الدقة، وطابعات نفث الحبر الكبيرة، وأنظمة الليزر وأنظمة السوق للرش.

طلب

- أساسي

- ثانوي

- ثالثي

على أساس التطبيق، يتم تقسيم سوق أنظمة الترميز والعلامات إلى أولية وثانوية وثالثية.

عدد الفوهات

- فوهة واحدة

- فوهات متعددة

على أساس عدد الفوهات، يتم تقسيم سوق أنظمة الترميز والعلامات إلى فوهة واحدة وفوهات متعددة.

مادة

- البلاستيك

- الورق والكرتون

- معدن

- خشب

- المنسوجات (باستثناء السجاد والصوف)

- رقائق معدنية

- الأسطح العضوية

- ممحاة

- السجادة

- الصوف

- آحرون

على أساس المادة، يتم تقسيم سوق أنظمة الترميز والعلامات إلى البلاستيك والورق والكرتون والمعادن والخشب والمنسوجات (باستثناء السجاد والصوف) والرقائق والأسطح العضوية والمطاط والسجاد والصوف وغيرها.

الاستخدام النهائي

- الأطعمة والمشروبات

- المستحضرات الصيدلانية

- الكهرباء والالكترونيات

- السيارات والفضاء

- العناية الشخصية

- بناء

- التصنيع الكيميائي

- آحرون

على أساس الاستخدام النهائي، يتم تقسيم سوق أنظمة الترميز والعلامات إلى الأغذية والمشروبات، والأدوية، والكهرباء والإلكترونيات، والسيارات والفضاء، والعناية الشخصية، والبناء، والتصنيع الكيميائي، وغيرها.

تحليل/رؤى إقليمية لسوق أنظمة الترميز والعلامات في أمريكا الشمالية

يتم تقسيم سوق أنظمة الترميز والعلامات في أمريكا الشمالية على أساس نوع التكنولوجيا والنوع والتطبيق وعدد الفوهات والمواد والاستخدام النهائي.

الدول الموجودة في سوق أنظمة الترميز والعلامات في أمريكا الشمالية هي الولايات المتحدة وكندا والمكسيك.

من المتوقع أن تهيمن الولايات المتحدة على سوق أنظمة الترميز والعلامات في أمريكا الشمالية بسبب زيادة القيود الحكومية على استخدام أنظمة الترميز والعلامات.

يقدم قسم الدولة في التقرير أيضًا عوامل فردية مؤثرة على السوق والتغيرات في تنظيم السوق التي تؤثر على الاتجاهات الحالية والمستقبلية للسوق. تشير البيانات إلى تحليل سلسلة القيمة المصب والمصب، وتحليل الاتجاهات الفنية لقوى بورتر الخمس، ودراسات الحالة، وهي بعض المؤشرات المستخدمة للتنبؤ بسيناريو السوق للدول الفردية. كما يتم النظر في وجود وتوافر العلامات التجارية في أمريكا الشمالية والتحديات التي تواجهها بسبب المنافسة الكبيرة أو النادرة من العلامات التجارية المحلية والمحلية، وتأثير التعريفات الجمركية المحلية، وطرق التجارة أثناء تقديم تحليل تنبؤي لبيانات الدولة.

تحليل المشهد التنافسي وحصة سوق أنظمة الترميز والعلامات في أمريكا الشمالية

يوفر المشهد التنافسي لسوق أنظمة الترميز والعلامات في أمريكا الشمالية تفاصيل حسب المنافسين. تتضمن التفاصيل نظرة عامة على الشركة، والبيانات المالية للشركة، والإيرادات المتولدة، وإمكانات السوق، والاستثمار في البحث والتطوير، ومبادرات السوق الجديدة، ومواقع الإنتاج والمرافق، ونقاط القوة والضعف في الشركة، وإطلاق المنتج، وخطوط أنابيب تجارب المنتجات، وموافقات المنتج، وبراءات الاختراع، وعرض المنتج ونطاقه، وهيمنة التطبيق، ومنحنى شريان الحياة التكنولوجي. ترتبط نقاط البيانات المذكورة أعلاه فقط بتركيز الشركات فيما يتعلق بسوق أنظمة الترميز والعلامات.

بعض اللاعبين الرئيسيين في السوق الذين يعملون في السوق هم Danaher و Weber Marking Systems GmbH و Dover Corporation و Novanta Inc. و REA Elektronik GmbH و ProMach Inc. و Leibinger Group و Pak-Tec و Hitachi، Ltd. و Illinois Tool Works Inc. و Matthews International Corporation و Brother Industries، Ltd. و HSA Systems A/S وغيرها.

SKU-

احصل على إمكانية الوصول عبر الإنترنت إلى التقرير الخاص بأول سحابة استخبارات سوقية في العالم

- لوحة معلومات تحليل البيانات التفاعلية

- لوحة معلومات تحليل الشركة للفرص ذات إمكانات النمو العالية

- إمكانية وصول محلل الأبحاث للتخصيص والاستعلامات

- تحليل المنافسين باستخدام لوحة معلومات تفاعلية

- آخر الأخبار والتحديثات وتحليل الاتجاهات

- استغل قوة تحليل المعايير لتتبع المنافسين بشكل شامل

Table of Content

1 INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 OVERVIEW OF THE NORTH AMERICA CODING AND MARKING SYSTEMS MARKET

1.4 LIMITATION

1.5 MARKETS COVERED

2 MARKET SEGMENTATION

2.1 MARKETS COVERED

2.2 GEOGRAPHICAL SCOPE

2.3 YEARS CONSIDERED FOR THE STUDY

2.4 CURRENCY AND PRICING

2.5 DBMR TRIPOD DATA VALIDATION MODEL

2.6 TECHNOLOGY TYPE LIFELINE CURVE

2.7 MULTIVARIATE MODELING

2.8 PRIMARY INTERVIEWS WITH KEY OPINION LEADERS

2.9 DBMR MARKET POSITION GRID

2.1 MARKET APPLICATION COVERAGE GRID

2.11 DBMR MARKET CHALLENGE MATRIX

2.12 DBMR VENDOR SHARE ANALYSIS

2.13 SECONDARY SOURCES

2.14 ASSUMPTIONS

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

4.1 PESTLE ANALYSIS

4.1.1 POLITICAL FACTORS

4.1.2 ECONOMIC FACTORS

4.1.3 SOCIAL FACTORS

4.1.4 TECHNOLOGICAL FACTORS

4.1.5 LEGAL FACTORS

4.1.6 ENVIRONMENTAL FACTORS

4.2 PORTER'S FIVE FORCES:

4.2.1 THREAT OF NEW ENTRANTS:

4.2.2 THREAT OF SUBSTITUTES:

4.2.3 CUSTOMER BARGAINING POWER:

4.2.4 SUPPLIER BARGAINING POWER:

4.2.5 INTERNAL COMPETITION (RIVALRY):

4.3 CLIMATE CHANGE SCENARIO

4.3.1 ENVIRONMENTAL CONCERNS

4.3.2 INDUSTRY RESPONSE

4.3.3 GOVERNMENT’S ROLE

4.3.4 ANALYST RECOMMENDATION

4.4 OVERVIEW ON NEW MACHINES V/S CONSUMBALES SOLD

4.4.1 END USER INDUSTRIES

4.4.2 PRODUCT AND BATCH SIZE

4.4.3 TYPE OF PRINTING

4.4.4 TECHNOLOGICAL ADVANCEMENTS

4.5 LIST OF KEY BUYERS

4.6 PRODUCTION CONSUMPTION ANALYSIS

4.7 SUPPLY CHAIN ANALYSIS

4.7.1 OVERVIEW

4.7.2 LOGISTIC COST SCENARIO

4.7.3 IMPORTANCE OF LOGISTICS SERVICE PROVIDERS

4.8 TECHNOLOGICAL ADVANCEMENTS BY MANUFACTURERS

4.9 VENDOR SELECTION CRITERIA

4.1 RAW MATERIAL PRODUCTION COVERAGE

5 REGULATION COVERAGE

6 MARKET OVERVIEW

6.1 DRIVERS

6.1.1 RISING DEMAND IN THE AUTOMOTIVE INDUSTRY

6.1.2 INCREASING USE OF CODING AND MARKING SYSTEMS IN VARIOUS INDUSTRIES

6.2 RESTRAINT

6.2.1 HIGH COST OF CODING AND MARKING EQUIPMENT AND IMPROPER PRINTED CODES

6.3 OPPORTUNITIES

6.3.1 STRINGENT GOVERNMENT RULES FOR CODING AND MARKING SYSTEMS

6.3.2 INCREASING USE OF LASER CODING

6.4 CHALLENGES

6.4.1 HIGH INSTALLATION COST AND OPERATIONAL ERRORS

7 NORTH AMERICA CODING AND MARKING SYSTEMS MARKET, BY TECHNOLOGY TYPE

7.1 OVERVIEW

7.2 CONTINUOUS INKJET

7.3 LASER CODING

7.4 THERMAL INKJET

7.5 PIEZO

7.6 OTHERS

8 NORTH AMERICA CODING AND MARKING SYSTEMS MARKET, BY TYPE

8.1 OVERVIEW

8.2 SMALL CHARACTER INKJET PRINTERS

8.3 HIGH RESOLUTION INKJET PRINTERS

8.4 LARGE INKJET PRINTERS

8.5 LASER SYSTEMS AND SPRAY MARKET SYSTEMS

9 NORTH AMERICA CODING AND MARKING SYSTEMS MARKET, BY APPLICATION

9.1 OVERVIEW

9.2 SECONDARY

9.3 TERTIARY

9.4 PRIMARY

10 NORTH AMERICA CODING AND MARKING SYSTEMS MARKET, BY MATERIAL

10.1 OVERVIEW

10.2 PLASTICS

10.3 PAPER & CARDBOARD

10.4 METAL

10.5 WOOD

10.6 TEXTILES (EXCLUDING CARPET AND FLEECE)

10.7 FOILS

10.8 ORGANIC SURFACES

10.9 RUBBER

10.1 CARPET

10.11 FLEECE

10.12 OTHERS

11 NORTH AMERICA CODING AND MARKING SYSTEMS MARKET, BY NUMBER OF NOZZLES

11.1 OVERVIEW

11.2 SINGLE NOZZLE

11.3 MULTIPLE NOZZLES

12 NORTH AMERICA CODING AND MARKING SYSTEMS MARKET, BY END USE

12.1 OVERVIEW

12.2 FOOD & BEVERAGE

12.2.1 FOOD & BEVERAGE, BY TYPE

12.2.1.1 PACKAGED FOOD

12.2.1.2 DAIRY PRODUCTS

12.2.1.3 MEAT & POULTRY

12.2.1.4 FRUITS & VEGETABLES

12.2.1.5 PET FOOD & ANIMAL FEED

12.2.1.6 OTHERS

12.2.2 FOOD & BEVERAGE, BY TECHNOLOGY TYPE

12.2.2.1 THERMAL INKJET

12.2.2.2 CONTINUOUS INKJET

12.2.2.3 LASER CODING

12.2.2.4 PIEZO

12.2.2.5 OTHERS

12.2.3 FOOD & BEVERAGE, BY MATERIAL

12.2.3.1 PLASTICS

12.2.3.2 FOILS

12.2.3.3 PAPER & CARDBOARD

12.2.3.4 METAL

12.2.3.5 WOOD

12.2.3.6 RUBBER

12.2.3.7 TEXTILES (EXCLUDING CARPET AND FLEECE)

12.2.3.8 ORGANIC SURFACES

12.2.3.9 CARPET

12.2.3.10 FLEECE

12.2.3.11 OTHERS

12.3 PHARMACEUTICALS

12.3.1 PHARMACEUTICALS, BY TECHNOLOGY TYPE

12.3.1.1 THERMAL INKJET

12.3.1.2 CONTINUOUS INKJET

12.3.1.3 LASER CODING

12.3.1.4 PIEZO

12.3.1.5 OTHERS

12.3.2 PHARMACEUTICALS, BY MATERIAL

12.3.2.1 PAPER & CARDBOARD

12.3.2.2 PLASTICS

12.3.2.3 FOILS

12.3.2.4 METAL

12.3.2.5 TEXTILES (EXCLUDING CARPET AND FLEECE)

12.3.2.6 RUBBER

12.3.2.7 WOOD

12.3.2.8 ORGANIC SURFACES

12.3.2.9 CARPET

12.3.2.10 FLEECE

12.3.2.11 OTHERS

12.4 ELECTRICAL & ELECTRONICS

12.4.1 ELECTRICAL & ELECTRONICS, BY TECHNOLOGY TYPE

12.4.1.1 CONTINUOUS INKJET

12.4.1.2 THERMAL INKJET

12.4.1.3 LASER CODING

12.4.1.4 PIEZO

12.4.1.5 OTHERS

12.4.2 ELECTRICAL & ELECTRONICS, BY MATERIAL

12.4.2.1 PLASTICS

12.4.2.2 METAL

12.4.2.3 RUBBER

12.4.2.4 FOILS

12.4.2.5 WOOD

12.4.2.6 PAPER & CARDBOARD

12.4.2.7 ORGANIC SURFACES

12.4.2.8 TEXTILES (EXCLUDING CARPET AND FLEECE)

12.4.2.9 CARPET

12.4.2.10 FLEECE

12.4.2.11 OTHERS

12.5 AUTOMOTIVE & AEROSPACE

12.5.1 AUTOMOTIVE & AEROSPACE, BY TECHNOLOGY TYPE

12.5.1.1 CONTINUOUS INKJET

12.5.1.2 LASER CODING

12.5.1.3 THERMAL INKJET

12.5.1.4 PIEZO

12.5.1.5 OTHERS

12.5.2 AUTOMOTIVE & AEROSPACE, BY MATERIAL

12.5.2.1 RUBBER

12.5.2.2 METAL

12.5.2.3 PLASTICS

12.5.2.4 TEXTILES (EXCLUDING CARPET AND FLEECE)

12.5.2.5 CARPET

12.5.2.6 FLEECE

12.5.2.7 FOILS

12.5.2.8 PAPER & CARDBOARD

12.5.2.9 WOOD

12.5.2.10 ORGANIC SURFACES

12.5.2.11 OTHERS

12.6 PERSONAL CARE

12.6.1 PERSONAL CARE, BY TECHNOLOGY TYPE

12.6.1.1 CONTINUOUS INKJET

12.6.1.2 THERMAL INKJET

12.6.1.3 LASER CODING

12.6.1.4 PIEZO

12.6.1.5 OTHERS

12.6.2 PERSONAL CARE, BY MATERIAL

12.6.2.1 PLASTICS

12.6.2.2 PAPER & CARDBOARD

12.6.2.3 FOILS

12.6.2.4 METAL

12.6.2.5 RUBBER

12.6.2.6 TEXTILES (EXCLUDING CARPET AND FLEECE)

12.6.2.7 ORGANIC SURFACES

12.6.2.8 WOOD

12.6.2.9 CARPET

12.6.2.10 FLEECE

12.6.2.11 OTHERS

12.7 CONSTRUCTION

12.7.1 CONSTRUCTION, BY TECHNOLOGY TYPE

12.7.1.1 CONTINUOUS INKJET

12.7.1.2 LASER CODING

12.7.1.3 PIEZO

12.7.1.4 THERMAL INKJET

12.7.1.5 OTHERS

12.7.2 CONSTRUCTION, BY MATERIAL

12.7.2.1 METAL

12.7.2.2 WOOD

12.7.2.3 CARPET

12.7.2.4 PLASTICS

12.7.2.5 PAPER & CARDBOARD

12.7.2.6 RUBBER

12.7.2.7 TEXTILES (EXCLUDING CARPET AND FLEECE)

12.7.2.8 FOILS

12.7.2.9 FLEECE

12.7.2.10 ORGANIC SURFACES

12.7.2.11 OTHERS

12.8 CHEMICAL MANUFACTURING

12.8.1 CHEMICAL MANUFACTURING, BY TECHNOLOGY TYPE

12.8.1.1 CONTINUOUS INKJET

12.8.1.2 LASER CODING

12.8.1.3 THERMAL INKJET

12.8.1.4 PIEZO

12.8.1.5 OTHERS

12.8.2 CHEMICAL MANUFACTURING, BY MATERIAL

12.8.2.1 PLASTICS

12.8.2.2 RUBBER

12.8.2.3 METAL

12.8.2.4 PAPER & CARDBOARD

12.8.2.5 WOOD

12.8.2.6 FOILS

12.8.2.7 TEXTILES (EXCLUDING CARPET AND FLEECE)

12.8.2.8 ORGANIC SURFACES

12.8.2.9 CARPET

12.8.2.10 FLEECE

12.8.2.11 OTHERS

12.9 OTHERS

13 NORTH AMERICA CODING AND MARKING SYSTEMS MARKET, BY REGION

13.1 NORTH AMERICA

13.1.1 U.S.

13.1.2 CANADA

13.1.3 MEXICO

14 NORTH AMERICA CODING AND MARKING SYSTEMS MARKET: COMPANY LANDSCAPE

14.1 COMPANY SHARE ANALYSIS: NORTH AMERICA

14.2 ACQUISITION

14.3 PRODUCT LAUNCH

14.4 CERTIFICATION

15 COMPANY PROFILES

15.1 ILLINOIS TOOL WORKS INC.

15.1.1 COMPANY SNAPSHOT

15.1.2 REVENUE ANALYSIS

15.1.3 COMPANY SHARE ANALYSIS

15.1.4 SWOT ANALYSIS

15.1.5 PRODUCT PORTFOLIO

15.1.6 RECENT DEVELOPMENTS

15.2 HITACHI, LTD.

15.2.1 COMPANY SNAPSHOT

15.2.2 REVENUE ANALYSIS

15.2.3 COMPANY SHARE ANALYSIS

15.2.4 SWOT ANALYSIS

15.2.5 PRODUCT PORTFOLIO

15.2.6 RECENT DEVELOPMENTS

15.3 DANAHER

15.3.1 COMPANY SNAPSHOT

15.3.2 REVENUE ANALYSIS

15.3.3 COMPANY SHARE ANALYSIS

15.3.4 SWOT ANALYSIS

15.3.5 PRODUCT PORTFOLIO

15.3.6 RECENT DEVELOPMENTS

15.4 BROTHER INDUSTRIES, LTD.

15.4.1 COMPANY SNAPSHOT

15.4.2 REVENUE ANALYSIS

15.4.3 COMPANY SHARE ANALYSIS

15.4.4 SWOT ANALYSIS

15.4.5 PRODUCT PORTFOLIO

15.4.6 RECENT DEVELOPMENTS

15.5 DOVER CORPORATION

15.5.1 COMPANY SNAPSHOT

15.5.2 REVENUE ANALYSIS

15.5.3 COMPANY SHARE ANALYSIS

15.5.4 SWOT ANALYSIS

15.5.5 PRODUCT PORTFOLIO

15.5.6 RECENT DEVELOPMENTS

15.6 ATD UK

15.6.1 COMPANY SNAPSHOT

15.6.2 SWOT ANALYSIS

15.6.3 PRODUCT PORTFOLIO

15.6.4 RECENT DEVELOPMENTS

15.7 CODELINE AUTOMATION

15.7.1 COMPANY SNAPSHOT

15.7.2 SWOT ANALYSIS

15.7.3 PRODUCT PORTFOLIO

15.7.4 RECENT DEVELOPMENTS

15.8 CONTROL PRINT LTD.

15.8.1 COMPANY SNAPSHOT

15.8.2 REVENUE ANALYSIS

15.8.3 SWOT ANALYSIS

15.8.4 PRODUCT PORTFOLIO

15.8.5 RECENT DEVELOPMENTS

15.9 HSA SYSTEMS A/S

15.9.1 COMPANY SNAPSHOT

15.9.2 SWOT ANALYSIS

15.9.3 PRODUCT PORTFOLIO

15.9.4 RECENT DEVELOPMENTS

15.1 LEIBINGER GROUP

15.10.1 COMPANY SNAPSHOT

15.10.2 SWOT ANALYSIS

15.10.3 PRODUCT PORTFOLIO

15.10.4 RECENT DEVELOPMENTS

15.11 MATTHEWS INTERNATIONAL CORPORATION

15.11.1 COMPANY SNAPSHOT

15.11.2 REVENUE ANALYSIS

15.11.3 SWOT ANALYSIS

15.11.4 PRODUCT PORTFOLIO

15.11.5 RECENT DEVELOPMENTS

15.12 NOVANTA INC.

15.12.1 COMPANY SNAPSHOT

15.12.2 REVENUE ANALYSIS

15.12.3 SWOT ANALYSIS

15.12.4 PRODUCT PORTFOLIO

15.12.5 RECENT DEVELOPMENTS

15.13 OVERPRINT LTD.

15.13.1 COMPANY SNAPSHOT

15.13.2 SWOT ANALYSIS

15.13.3 PRODUCT PORTFOLIO

15.13.4 RECENT DEVELOPMENTS

15.14 PAK-TEC

15.14.1 COMPANY SNAPSHOT

15.14.2 SWOT ANALYSIS

15.14.3 PRODUCT PORTFOLIO

15.14.4 RECENT DEVELOPMENTS

15.15 PROMACH INC.

15.15.1 COMPANY SNAPSHOT

15.15.2 SWOT ANALYSIS

15.15.3 PRODUCT PORTFOLIO

15.15.4 RECENT DEVELOPMENTS

15.16 REA ELEKTRONIK GMBH.

15.16.1 COMPANY SNAPSHOT

15.16.2 SWOT ANALYSIS

15.16.3 PRODUCT PORTFOLIO

15.16.4 RECENT DEVELOPMENTS

15.17 WEBER MARKING SYSTEMS GMBH

15.17.1 COMPANY SNAPSHOT

15.17.2 SWOT ANALYSIS

15.17.3 PRODUCT PORTFOLIO

15.17.4 RECENT DEVELOPMENTS

16 QUESTIONNAIRE

17 RELATED REPORTS

List of Table

TABLE 1 REGULATORY COVERAGE

TABLE 2 NORTH AMERICA CODING AND MARKING SYSTEMS MARKET: BY TECHNOLOGY TYPE, 2021-2030 (USD THOUSAND)

TABLE 3 NORTH AMERICA CONTINUOUS INKJET IN CODING AND MARKING SYSTEMS MARKET, BY REGION, 2021-2030 (USD THOUSAND)

TABLE 4 NORTH AMERICA LASER CODING IN CODING AND MARKING SYSTEMS MARKET, BY REGION, 2021-2030 (USD THOUSAND)

TABLE 5 NORTH AMERICA THERMAL INKJET IN CODING AND MARKING SYSTEMS MARKET, BY REGION, 2021-2030 (USD THOUSAND)

TABLE 6 NORTH AMERICA PIEZO IN CODING AND MARKING SYSTEMS MARKET, BY REGION, 2021-2030 (USD THOUSAND)

TABLE 7 NORTH AMERICA OTHERS IN CODING AND MARKING SYSTEMS MARKET, BY REGION, 2021-2030 (USD THOUSAND)

TABLE 8 NORTH AMERICA CODING AND MARKING SYSTEMS MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 9 NORTH AMERICA SMALL CHARACTER INKJET PRINTERS IN CODING AND MARKING SYSTEMS MARKET, BY REGION, 2021-2030 (USD THOUSAND)

TABLE 10 NORTH AMERICA HIGH RESOLUTION INKJET PRINTERS IN CODING AND MARKING SYSTEMS MARKET, BY REGION, 2021-2030 (USD THOUSAND)

TABLE 11 NORTH AMERICA LARGE INKJET PRINTERS IN CODING AND MARKING SYSTEMS MARKET, BY REGION, 2021-2030 (USD THOUSAND)

TABLE 12 NORTH AMERICA LASER SYSTEMS AND SPRAY MARKET SYSTEMS IN CODING AND MARKING SYSTEMS MARKET, BY REGION, 2021-2030 (USD THOUSAND)

TABLE 13 NORTH AMERICA CODING AND MARKING SYSTEMS MARKET, BY APPLICATION, 2021-2030 (USD THOUSAND)

TABLE 14 NORTH AMERICA SECONDARY IN CODING AND MARKING SYSTEMS MARKET, BY REGION, 2021-2030 (USD THOUSAND)

TABLE 15 NORTH AMERICA TERTIARY IN CODING AND MARKING SYSTEMS MARKET, BY REGION, 2021-2030 (USD THOUSAND)

TABLE 16 NORTH AMERICA PRIMARY IN CODING AND MARKING SYSTEMS MARKET, BY REGION, 2021-2030 (USD THOUSAND)

TABLE 17 NORTH AMERICA CODING AND MARKING SYSTEMS MARKET, BY MATERIAL, 2021-2030 (USD THOUSAND)

TABLE 18 NORTH AMERICA PLASTICS IN CODING AND MARKING SYSTEMS MARKET, BY MATERIAL, 2021-2030 (USD THOUSAND)

TABLE 19 NORTH AMERICA PAPER & CARDBOARD IN CODING AND MARKING SYSTEMS MARKET, BY REGION, 2021-2030 (USD THOUSAND)

TABLE 20 NORTH AMERICA METAL IN CODING AND MARKING SYSTEMS MARKET, BY REGION, 2021-2030 (USD THOUSAND)

TABLE 21 NORTH AMERICA WOOD IN CODING AND MARKING SYSTEMS MARKET, BY REGION, 2021-2030 (USD THOUSAND)

TABLE 22 NORTH AMERICA TEXTILES (EXCLUDING CARPET AND FLEECE) CODING AND MARKING SYSTEMS MARKET, BY REGION, 2021-2030 (USD THOUSAND)

TABLE 23 NORTH AMERICA FOILS IN CODING AND MARKING SYSTEMS MARKET, BY REGION, 2021-2030 (USD THOUSAND)

TABLE 24 NORTH AMERICA ORGANIC SURFACES IN CODING AND MARKING SYSTEMS MARKET, BY REGION, 2021-2030 (USD THOUSAND)

TABLE 25 NORTH AMERICA RUBBER IN CODING AND MARKING SYSTEMS MARKET, BY REGION, 2021-2030 (USD THOUSAND)

TABLE 26 NORTH AMERICA CARPET IN CODING AND MARKING SYSTEMS MARKET, BY REGION, 2021-2030 (USD THOUSAND)

TABLE 27 NORTH AMERICA FLEECE IN CODING AND MARKING SYSTEMS MARKET, BY REGION, 2021-2030 (USD THOUSAND)

TABLE 28 NORTH AMERICA OTHERS IN CODING AND MARKING SYSTEMS MARKET, BY REGION, 2021-2030 (USD THOUSAND)

TABLE 29 NORTH AMERICA CODING AND MARKING SYSTEMS MARKET, BY NUMBER OF NOZZLES, 2021-2030 (USD THOUSAND)

TABLE 30 NORTH AMERICA SINGLE NOZZLE IN CODING AND MARKING SYSTEMS MARKET, BY NUMBER OF NOZZLES, 2021-2030 (USD THOUSAND)

TABLE 31 NORTH AMERICA MULTIPLE NOZZLES IN CODING AND MARKING SYSTEMS MARKET, BY REGION, 2021-2030 (USD THOUSAND)

TABLE 32 NORTH AMERICA CODING AND MARKING SYSTEMS MARKET, BY END USE, 2021-2030 (USD THOUSAND)

TABLE 33 NORTH AMERICA FOOD & BEVERAGE IN CODING AND MARKING SYSTEMS, BY REGION, 2021-2030 (USD THOUSAND)

TABLE 34 NORTH AMERICA FOOD & BEVERAGE IN CODING AND MARKING SYSTEMS MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 35 NORTH AMERICA FOOD & BEVERAGE IN CODING AND MARKING SYSTEMS MARKET, BY TECHNOLOGY TYPE, 2021-2030 (USD THOUSAND)

TABLE 36 NORTH AMERICA FOOD & BEVERAGE IN CODING AND MARKING SYSTEMS MARKET, BY MATERIAL, 2021-2030 (USD THOUSAND)

TABLE 37 NORTH AMERICA PHARMACEUTICALS IN CODING AND MARKING SYSTEMS, BY REGION, 2021-2030 (USD THOUSAND)

TABLE 38 NORTH AMERICA PHARMACEUTICALS IN CODING AND MARKING SYSTEMS MARKET, BY TECHNOLOGY TYPE, 2021-2030 (USD THOUSAND)

TABLE 39 NORTH AMERICA PHARMACEUTICALS IN CODING AND MARKING SYSTEMS MARKET, BY MATERIAL, 2021-2030 (USD THOUSAND)

TABLE 40 NORTH AMERICA ELECTRICAL & ELECTRONICS IN CODING AND MARKING SYSTEMS, BY REGION, 2021-2030 (USD THOUSAND)

TABLE 41 NORTH AMERICA ELECTRICAL & ELECTRONICS IN CODING AND MARKING SYSTEMS MARKET, BY TECHNOLOGY TYPE, 2021-2030 (USD THOUSAND)

TABLE 42 NORTH AMERICA ELECTRICAL & ELECTRONICS IN CODING AND MARKING SYSTEMS MARKET, BY MATERIAL, 2021-2030 (USD THOUSAND)

TABLE 43 NORTH AMERICA AUTOMOTIVE & AEROSPACE IN CODING AND MARKING SYSTEMS, BY REGION, 2021-2030 (USD THOUSAND)

TABLE 44 NORTH AMERICA AUTOMOTIVE & AEROSPACE IN CODING AND MARKING SYSTEMS MARKET, BY TECHNOLOGY TYPE, 2021-2030 (USD THOUSAND)

TABLE 45 NORTH AMERICA AUTOMOTIVE & AEROSPACE IN CODING AND MARKING SYSTEMS MARKET, BY MATERIAL, 2021-2030 (USD THOUSAND)

TABLE 46 NORTH AMERICA PERSONAL CARE IN CODING AND MARKING SYSTEMS, BY REGION, 2021-2030 (USD THOUSAND)

TABLE 47 NORTH AMERICA PERSONAL CARE IN CODING AND MARKING SYSTEMS MARKET, BY TECHNOLOGY TYPE, 2021-2030 (USD THOUSAND)

TABLE 48 NORTH AMERICA PERSONAL CARE IN CODING AND MARKING SYSTEMS MARKET, BY MATERIAL, 2021-2030 (USD THOUSAND)

TABLE 49 NORTH AMERICA CONSTRUCTION IN CODING AND MARKING SYSTEMS, BY REGION, 2021-2030 (USD THOUSAND)

TABLE 50 NORTH AMERICA CONSTRUCTION IN CODING AND MARKING SYSTEMS MARKET, BY TECHNOLOGY TYPE, 2021-2030 (USD THOUSAND)

TABLE 51 NORTH AMERICA CONSTRUCTION IN CODING AND MARKING SYSTEMS MARKET, BY MATERIAL, 2021-2030 (USD THOUSAND)

TABLE 52 NORTH AMERICA CHEMICAL MANUFACTURING IN CODING AND MARKING SYSTEMS, BY REGION, 2021-2030 (USD THOUSAND)

TABLE 53 NORTH AMERICA CHEMICAL MANUFACTURING IN CODING AND MARKING SYSTEMS MARKET, BY TECHNOLOGY TYPE, 2021-2030 (USD THOUSAND)

TABLE 54 NORTH AMERICA CONSTRUCTION IN CODING AND MARKING SYSTEMS MARKET, BY MATERIAL, 2021-2030 (USD THOUSAND)

TABLE 55 NORTH AMERICA OTHERS IN CODING AND MARKING SYSTEMS, BY REGION, 2021-2030 (USD THOUSAND)

TABLE 56 NORTH AMERICA CODING AND MARKING SYSTEMS MARKET, BY COUNTRY, 2021-2030 (USD THOUSAND)

TABLE 57 NORTH AMERICA CODING AND MARKING SYSTEMS MARKET, BY TECHNOLOGY TYPE, 2021-2030 (USD THOUSAND)

TABLE 58 NORTH AMERICA CODING AND MARKING SYSTEMS MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 59 NORTH AMERICA CODING AND MARKING SYSTEMS MARKET, BY APPLICATION, 2021-2030 (USD THOUSAND)

TABLE 60 NORTH AMERICA CODING AND MARKING SYSTEMS MARKET, BY MATERIAL, 2021-2030 (USD THOUSAND)

TABLE 61 NORTH AMERICA CODING AND MARKING SYSTEMS MARKET, BY NUMBER OF NOZZLES, 2021-2030 (USD THOUSAND)

TABLE 62 NORTH AMERICA CODING AND MARKING SYSTEMS MARKET, BY END USE, 2021-2030 (USD THOUSAND)

TABLE 63 NORTH AMERICA FOOD & BEVERAGE IN CODING AND MARKING SYSTEMS MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 64 NORTH AMERICA FOOD & BEVERAGE IN CODING AND MARKING SYSTEMS MARKET, BY TECHNOLOGY TYPE, 2021-2030 (USD THOUSAND)

TABLE 65 NORTH AMERICA FOOD & BEVERAGE IN CODING AND MARKING SYSTEMS MARKET, BY MATERIAL, 2021-2030 (USD THOUSAND)

TABLE 66 NORTH AMERICA PHARMACEUTICALS IN CODING AND MARKING SYSTEMS MARKET, BY TECHNOLOGY TYPE, 2021-2030 (USD THOUSAND)

TABLE 67 NORTH AMERICA PHARMACEUTICALS IN CODING AND MARKING SYSTEMS MARKET, BY MATERIAL, 2021-2030 (USD THOUSAND)

TABLE 68 NORTH AMERICA ELECTRICAL & ELECTRONICS IN CODING AND MARKING SYSTEMS MARKET, BY TECHNOLOGY TYPE, 2021-2030 (USD THOUSAND)

TABLE 69 NORTH AMERICA ELECTRICAL & ELECTRONICS IN CODING AND MARKING SYSTEMS MARKET, BY MATERIAL, 2021-2030 (USD THOUSAND)

TABLE 70 NORTH AMERICA AUTOMOTIVE & AEROSPACE IN CODING AND MARKING SYSTEMS MARKET, BY TECHNOLOGY TYPE, 2021-2030 (USD THOUSAND)

TABLE 71 NORTH AMERICA AUTOMOTIVE & AEROSPACE IN CODING AND MARKING SYSTEMS MARKET, BY MATERIAL, 2021-2030 (USD THOUSAND)

TABLE 72 NORTH AMERICA PERSONAL CARE IN CODING AND MARKING SYSTEMS MARKET, BY TECHNOLOGY TYPE, 2021-2030 (USD THOUSAND)

TABLE 73 NORTH AMERICA PERSONAL CARE IN CODING AND MARKING SYSTEMS MARKET, BY MATERIAL, 2021-2030 (USD THOUSAND)

TABLE 74 NORTH AMERICA CONSTRUCTION IN CODING AND MARKING SYSTEMS MARKET, BY TECHNOLOGY TYPE, 2021-2030 (USD THOUSAND)

TABLE 75 NORTH AMERICA CONSTRUCTION IN CODING AND MARKING SYSTEMS MARKET, BY MATERIAL, 2021-2030 (USD THOUSAND)

TABLE 76 NORTH AMERICA CHEMICAL MANUFACTURING IN CODING AND MARKING SYSTEMS MARKET, BY TECHNOLOGY TYPE, 2021-2030 (USD THOUSAND)

TABLE 77 NORTH AMERICA CHEMICAL MANUFACTURING IN CODING AND MARKING SYSTEMS MARKET, BY MATERIAL, 2021-2030 (USD THOUSAND)

TABLE 78 U.S. CODING AND MARKING SYSTEMS MARKET, BY TECHNOLOGY TYPE, 2021-2030 (USD THOUSAND)

TABLE 79 U.S. CODING AND MARKING SYSTEMS MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 80 U.S. CODING AND MARKING SYSTEMS MARKET, BY APPLICATION, 2021-2030 (USD THOUSAND)

TABLE 81 U.S. CODING AND MARKING SYSTEMS MARKET, BY MATERIAL, 2021-2030 (USD THOUSAND)

TABLE 82 U.S. CODING AND MARKING SYSTEMS MARKET, BY NUMBER OF NOZZLES, 2021-2030 (USD THOUSAND)

TABLE 83 U.S. CODING AND MARKING SYSTEMS MARKET, BY END USE, 2021-2030 (USD THOUSAND)

TABLE 84 U.S. FOOD & BEVERAGE IN CODING AND MARKING SYSTEMS MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 85 U.S. FOOD & BEVERAGE IN CODING AND MARKING SYSTEMS MARKET, BY TECHNOLOGY TYPE, 2021-2030 (USD THOUSAND)

TABLE 86 U.S. FOOD & BEVERAGE IN CODING AND MARKING SYSTEMS MARKET, BY MATERIAL, 2021-2030 (USD THOUSAND)

TABLE 87 U.S. PHARMACEUTICALS IN CODING AND MARKING SYSTEMS MARKET, BY TECHNOLOGY TYPE, 2021-2030 (USD THOUSAND)

TABLE 88 U.S. PHARMACEUTICALS IN CODING AND MARKING SYSTEMS MARKET, BY MATERIAL, 2021-2030 (USD THOUSAND)

TABLE 89 U.S. ELECTRICAL & ELECTRONICS IN CODING AND MARKING SYSTEMS MARKET, BY TECHNOLOGY TYPE, 2021-2030 (USD THOUSAND)

TABLE 90 U.S. ELECTRICAL & ELECTRONICS IN CODING AND MARKING SYSTEMS MARKET, BY MATERIAL, 2021-2030 (USD THOUSAND)

TABLE 91 U.S. AUTOMOTIVE & AEROSPACE IN CODING AND MARKING SYSTEMS MARKET, BY TECHNOLOGY TYPE, 2021-2030 (USD THOUSAND)

TABLE 92 U.S. AUTOMOTIVE & AEROSPACE IN CODING AND MARKING SYSTEMS MARKET, BY MATERIAL, 2021-2030 (USD THOUSAND)

TABLE 93 U.S. PERSONAL CARE IN CODING AND MARKING SYSTEMS MARKET, BY TECHNOLOGY TYPE, 2021-2030 (USD THOUSAND)

TABLE 94 U.S. PERSONAL CARE IN CODING AND MARKING SYSTEMS MARKET, BY MATERIAL, 2021-2030 (USD THOUSAND)

TABLE 95 U.S. CONSTRUCTION IN CODING AND MARKING SYSTEMS MARKET, BY TECHNOLOGY TYPE, 2021-2030 (USD THOUSAND)

TABLE 96 U.S. CONSTRUCTION IN CODING AND MARKING SYSTEMS MARKET, BY MATERIAL, 2021-2030 (USD THOUSAND)

TABLE 97 U.S. CHEMICAL MANUFACTURING IN CODING AND MARKING SYSTEMS MARKET, BY TECHNOLOGY TYPE, 2021-2030 (USD THOUSAND)

TABLE 98 U.S. CHEMICAL MANUFACTURING IN CODING AND MARKING SYSTEMS MARKET, BY MATERIAL, 2021-2030 (USD THOUSAND)

TABLE 99 CANADA CODING AND MARKING SYSTEMS MARKET, BY TECHNOLOGY TYPE, 2021-2030 (USD THOUSAND)

TABLE 100 CANADA CODING AND MARKING SYSTEMS MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 101 CANADA CODING AND MARKING SYSTEMS MARKET, BY APPLICATION, 2021-2030 (USD THOUSAND)

TABLE 102 CANADA CODING AND MARKING SYSTEMS MARKET, BY MATERIAL, 2021-2030 (USD THOUSAND)

TABLE 103 CANADA CODING AND MARKING SYSTEMS MARKET, BY NUMBER OF NOZZLES, 2021-2030 (USD THOUSAND)

TABLE 104 CANADA CODING AND MARKING SYSTEMS MARKET, BY END USE, 2021-2030 (USD THOUSAND)

TABLE 105 CANADA FOOD & BEVERAGE IN CODING AND MARKING SYSTEMS MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 106 CANADA FOOD & BEVERAGE IN CODING AND MARKING SYSTEMS MARKET, BY TECHNOLOGY TYPE, 2021-2030 (USD THOUSAND)

TABLE 107 CANADA FOOD & BEVERAGE IN CODING AND MARKING SYSTEMS MARKET, BY MATERIAL, 2021-2030 (USD THOUSAND)

TABLE 108 CANADA PHARMACEUTICALS IN CODING AND MARKING SYSTEMS MARKET, BY TECHNOLOGY TYPE, 2021-2030 (USD THOUSAND)

TABLE 109 CANADA PHARMACEUTICALS IN CODING AND MARKING SYSTEMS MARKET, BY MATERIAL, 2021-2030 (USD THOUSAND)

TABLE 110 CANADA ELECTRICAL & ELECTRONICS IN CODING AND MARKING SYSTEMS MARKET, BY TECHNOLOGY TYPE, 2021-2030 (USD THOUSAND)

TABLE 111 CANADA ELECTRICAL & ELECTRONICS IN CODING AND MARKING SYSTEMS MARKET, BY MATERIAL, 2021-2030 (USD THOUSAND)

TABLE 112 CANADA AUTOMOTIVE & AEROSPACE IN CODING AND MARKING SYSTEMS MARKET, BY TECHNOLOGY TYPE, 2021-2030 (USD THOUSAND)

TABLE 113 CANADA AUTOMOTIVE & AEROSPACE IN CODING AND MARKING SYSTEMS MARKET, BY MATERIAL, 2021-2030 (USD THOUSAND)

TABLE 114 CANADA PERSONAL CARE IN CODING AND MARKING SYSTEMS MARKET, BY TECHNOLOGY TYPE, 2021-2030 (USD THOUSAND)

TABLE 115 CANADA PERSONAL CARE IN CODING AND MARKING SYSTEMS MARKET, BY MATERIAL, 2021-2030 (USD THOUSAND)

TABLE 116 CANADA CONSTRUCTION IN CODING AND MARKING SYSTEMS MARKET, BY TECHNOLOGY TYPE, 2021-2030 (USD THOUSAND)

TABLE 117 CANADA CONSTRUCTION IN CODING AND MARKING SYSTEMS MARKET, BY MATERIAL, 2021-2030 (USD THOUSAND)

TABLE 118 CANADA CHEMICAL MANUFACTURING IN CODING AND MARKING SYSTEMS MARKET, BY TECHNOLOGY TYPE, 2021-2030 (USD THOUSAND)

TABLE 119 CANADA CHEMICAL MANUFACTURING IN CODING AND MARKING SYSTEMS MARKET, BY MATERIAL, 2021-2030 (USD THOUSAND)

TABLE 120 MEXICO CODING AND MARKING SYSTEMS MARKET, BY TECHNOLOGY TYPE, 2021-2030 (USD THOUSAND)

TABLE 121 MEXICO CODING AND MARKING SYSTEMS MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 122 MEXICO CODING AND MARKING SYSTEMS MARKET, BY APPLICATION, 2021-2030 (USD THOUSAND)

TABLE 123 MEXICO CODING AND MARKING SYSTEMS MARKET, BY MATERIAL, 2021-2030 (USD THOUSAND)

TABLE 124 MEXICO CODING AND MARKING SYSTEMS MARKET, BY NUMBER OF NOZZLES, 2021-2030 (USD THOUSAND)

TABLE 125 MEXICO CODING AND MARKING SYSTEMS MARKET, BY END USE, 2021-2030 (USD THOUSAND)

TABLE 126 MEXICO FOOD & BEVERAGE IN CODING AND MARKING SYSTEMS MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 127 MEXICO FOOD & BEVERAGE IN CODING AND MARKING SYSTEMS MARKET, BY TECHNOLOGY TYPE, 2021-2030 (USD THOUSAND)

TABLE 128 MEXICO FOOD & BEVERAGE IN CODING AND MARKING SYSTEMS MARKET, BY MATERIAL, 2021-2030 (USD THOUSAND)

TABLE 129 MEXICO PHARMACEUTICALS IN CODING AND MARKING SYSTEMS MARKET, BY TECHNOLOGY TYPE, 2021-2030 (USD THOUSAND)

TABLE 130 MEXICO PHARMACEUTICALS IN CODING AND MARKING SYSTEMS MARKET, BY MATERIAL, 2021-2030 (USD THOUSAND)

TABLE 131 MEXICO ELECTRICAL & ELECTRONICS IN CODING AND MARKING SYSTEMS MARKET, BY TECHNOLOGY TYPE, 2021-2030 (USD THOUSAND)

TABLE 132 MEXICO ELECTRICAL & ELECTRONICS IN CODING AND MARKING SYSTEMS MARKET, BY MATERIAL, 2021-2030 (USD THOUSAND)

TABLE 133 MEXICO AUTOMOTIVE & AEROSPACE IN CODING AND MARKING SYSTEMS MARKET, BY TECHNOLOGY TYPE, 2021-2030 (USD THOUSAND)

TABLE 134 MEXICO AUTOMOTIVE & AEROSPACE IN CODING AND MARKING SYSTEMS MARKET, BY MATERIAL, 2021-2030 (USD THOUSAND)

TABLE 135 MEXICO PERSONAL CARE IN CODING AND MARKING SYSTEMS MARKET, BY TECHNOLOGY TYPE, 2021-2030 (USD THOUSAND)

TABLE 136 MEXICO PERSONAL CARE IN CODING AND MARKING SYSTEMS MARKET, BY MATERIAL, 2021-2030 (USD THOUSAND)

TABLE 137 MEXICO CONSTRUCTION IN CODING AND MARKING SYSTEMS MARKET, BY TECHNOLOGY TYPE, 2021-2030 (USD THOUSAND)

TABLE 138 MEXICO CONSTRUCTION IN CODING AND MARKING SYSTEMS MARKET, BY MATERIAL, 2021-2030 (USD THOUSAND)

TABLE 139 MEXICO CHEMICAL MANUFACTURING IN CODING AND MARKING SYSTEMS MARKET, BY TECHNOLOGY TYPE, 2021-2030 (USD THOUSAND)

TABLE 140 MEXICO CHEMICAL MANUFACTURING IN CODING AND MARKING SYSTEMS MARKET, BY MATERIAL, 2021-2030 (USD THOUSAND)

List of Figure

FIGURE 1 NORTH AMERICA CODING AND MARKING SYSTEMS MARKET

FIGURE 2 NORTH AMERICA CODING AND MARKING SYSTEMS MARKET: DATA TRIANGULATION

FIGURE 3 NORTH AMERICA CODING AND MARKING SYSTEMS MARKET: DROC ANALYSIS

FIGURE 4 NORTH AMERICA CODING AND MARKING SYSTEMS MARKET: NORTH AMERICA VS REGIONAL MARKET ANALYSIS

FIGURE 5 NORTH AMERICA CODING AND MARKING SYSTEMS MARKET: COMPANY RESEARCH ANALYSIS

FIGURE 6 NORTH AMERICA CODING AND MARKING SYSTEMS MARKET: THE TECHNOLOGY TYPE LIFE LINE CURVE

FIGURE 7 NORTH AMERICA CODING AND MARKING SYSTEMS MARKET: MULTIVARIATE MODELLING

FIGURE 8 NORTH AMERICA CODING AND MARKING SYSTEMS MARKET: INTERVIEW DEMOGRAPHICS

FIGURE 9 NORTH AMERICA CODING AND MARKING SYSTEMS MARKET: DBMR MARKET POSITION GRID

FIGURE 10 NORTH AMERICA CODING AND MARKING SYSTEMS MARKET: MARKET END – USE COVERAGE GRID

FIGURE 11 NORTH AMERICA CODING AND MARKING SYSTEMS MARKET: THE MARKET CHALLENGE MATRIX

FIGURE 12 NORTH AMERICA CODING AND MARKING SYSTEMS MARKET: VENDOR SHARE ANALYSIS

FIGURE 13 NORTH AMERICA CODING AND MARKING SYSTEMS MARKET: SEGMENTATION

FIGURE 14 THE GROWING USE OF CODING AND MARKING SYSTEMS IN VARIOUS INDUSTRIES IS ONE OF THE DRIVING FACTORS FOR THR MARKET GROWTH

FIGURE 15 CONTINUOUS INKJET IS EXPECTED TO ACCOUNT FOR THE LARGEST SHARE OF THE NORTH AMERICA CODING AND MARKING SYSTEMS MARKET IN 2023 & 2030

FIGURE 16 VENDOR SELECTION CRITERIA

FIGURE 17 DRIVERS, RESTRAINTS, OPPORTUNITIES AND CHALLENGES OF THE NORTH AMERICA CODING AND MARKING SYSTEMS MARKET

FIGURE 18 NORTH AMERICA CODING AND MARKING SYSTEMS MARKET: BY TECHNOLOGY TYPE, 2022

FIGURE 19 NORTH AMERICA CODING AND MARKING SYSTEMS MARKET, BY TYPE, 2022

FIGURE 20 NORTH AMERICA CODING AND MARKING SYSTEMS MARKET: BY APPLICATION, 2022

FIGURE 21 NORTH AMERICA CODING AND MARKING SYSTEMS MARKET: BY MATERIAL, 2022

FIGURE 22 NORTH AMERICA CODING AND MARKING SYSTEMS MARKET: BY NUMBER OF NOZZLES, 2022

FIGURE 23 NORTH AMERICA CODING AND MARKING SYSTEMS MARKET: BY END USE, 2022

FIGURE 24 NORTH AMERICA CODING AND MARKING SYSTEMS MARKET: SNAPSHOT (2022)

FIGURE 25 NORTH AMERICA CODING AND MARKING SYSTEMS MARKET: BY COUNTRY (2022)

FIGURE 26 NORTH AMERICA CODING AND MARKING SYSTEMS MARKET: BY COUNTRY (2023 & 2030)

FIGURE 27 NORTH AMERICA CODING AND MARKING SYSTEMS MARKET: BY COUNTRY (2022 & 2030)

FIGURE 28 NORTH AMERICA CODING AND MARKING SYSTEMS MARKET: BY TECHNOLOGY TYPE (2023-2030)

FIGURE 29 NORTH AMERICA CODING AND MARKING SYSTEMS MARKET: COMPANY SHARE 2022 (%)

منهجية البحث

يتم جمع البيانات وتحليل سنة الأساس باستخدام وحدات جمع البيانات ذات أحجام العينات الكبيرة. تتضمن المرحلة الحصول على معلومات السوق أو البيانات ذات الصلة من خلال مصادر واستراتيجيات مختلفة. تتضمن فحص وتخطيط جميع البيانات المكتسبة من الماضي مسبقًا. كما تتضمن فحص التناقضات في المعلومات التي شوهدت عبر مصادر المعلومات المختلفة. يتم تحليل بيانات السوق وتقديرها باستخدام نماذج إحصائية ومتماسكة للسوق. كما أن تحليل حصة السوق وتحليل الاتجاهات الرئيسية هي عوامل النجاح الرئيسية في تقرير السوق. لمعرفة المزيد، يرجى طلب مكالمة محلل أو إرسال استفسارك.

منهجية البحث الرئيسية التي يستخدمها فريق بحث DBMR هي التثليث البيانات والتي تتضمن استخراج البيانات وتحليل تأثير متغيرات البيانات على السوق والتحقق الأولي (من قبل خبراء الصناعة). تتضمن نماذج البيانات شبكة تحديد موقف البائعين، وتحليل خط زمني للسوق، ونظرة عامة على السوق ودليل، وشبكة تحديد موقف الشركة، وتحليل براءات الاختراع، وتحليل التسعير، وتحليل حصة الشركة في السوق، ومعايير القياس، وتحليل حصة البائعين على المستوى العالمي مقابل الإقليمي. لمعرفة المزيد عن منهجية البحث، أرسل استفسارًا للتحدث إلى خبراء الصناعة لدينا.

التخصيص متاح

تعد Data Bridge Market Research رائدة في مجال البحوث التكوينية المتقدمة. ونحن نفخر بخدمة عملائنا الحاليين والجدد بالبيانات والتحليلات التي تتطابق مع هدفهم. ويمكن تخصيص التقرير ليشمل تحليل اتجاه الأسعار للعلامات التجارية المستهدفة وفهم السوق في بلدان إضافية (اطلب قائمة البلدان)، وبيانات نتائج التجارب السريرية، ومراجعة الأدبيات، وتحليل السوق المجدد وقاعدة المنتج. ويمكن تحليل تحليل السوق للمنافسين المستهدفين من التحليل القائم على التكنولوجيا إلى استراتيجيات محفظة السوق. ويمكننا إضافة عدد كبير من المنافسين الذين تحتاج إلى بيانات عنهم بالتنسيق وأسلوب البيانات الذي تبحث عنه. ويمكن لفريق المحللين لدينا أيضًا تزويدك بالبيانات في ملفات Excel الخام أو جداول البيانات المحورية (كتاب الحقائق) أو مساعدتك في إنشاء عروض تقديمية من مجموعات البيانات المتوفرة في التقرير.