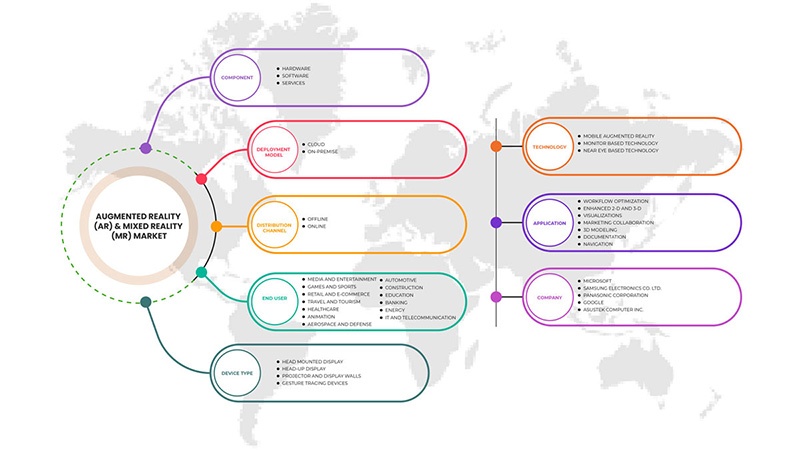

سوق الواقع المعزز (AR) والواقع المختلط (MR) في أمريكا الشمالية، حسب المكون (الأجهزة والبرامج والخدمات)، نموذج النشر (السحابة، في الموقع)، قناة التوزيع (غير متصلة بالإنترنت، عبر الإنترنت)، نوع الجهاز (شاشة عرض أمامية، شاشة مثبتة على الرأس ، جهاز عرض وجدار عرض، أجهزة تتبع الإيماءات)، التكنولوجيا (الواقع المعزز المحمول، التكنولوجيا القائمة على الشاشة، التكنولوجيا القائمة على العين القريبة)، التطبيق (تحسين سير العمل، التعاون التسويقي، تحسين 2-D و 3-D، التصور، النمذجة ثلاثية الأبعاد، التوثيق، الملاحة)، المستخدم النهائي (التجزئة والتجارة الإلكترونية، تكنولوجيا المعلومات والاتصالات، السيارات، الفضاء والدفاع، الرعاية الصحية، الرسوم المتحركة، السفر والسياحة، الطاقة، وسائل الإعلام والترفيه، التعليم، البناء، الألعاب والرياضة، الخدمات المصرفية) - اتجاهات الصناعة والتوقعات حتى عام 2029.

تحليل وحجم سوق الواقع المعزز (AR) والواقع المختلط (MR) في أمريكا الشمالية

لقد جلب الواقع المعزز والواقع المختلط تغييرًا جديدًا إلى الرقمنة. أصبح من الأسهل الآن تجربة العالم الحقيقي من خلال ضبط ظروف بيئية مختلفة. يتمتع الواقع المعزز والواقع المختلط بمجموعة واسعة من التطبيقات، وزاد نمو السوق بشكل كبير حيث أصبح استخدام الواقع المعزز والواقع المختلط شائعًا في أجهزة محاكاة القيادة. يوفر الواقع المعزز والواقع المختلط للسائق إحساسًا حقيقيًا بالطريق وظروف القيادة وأدلة السيارة وحركة المرور على الطرق مما يساعد على تجنب الحوادث في المرحلة الأولية من التعلم ويجهز السائقين لمواقف مختلفة. أدت هذه السمات إلى زيادة استخدام الواقع المعزز والواقع المختلط في الدفاع والفضاء أيضًا. استخدمه أفراد الجيش للتدريب في ظروف مختلفة مثل القفز بالمظلات والغواصات ومواقف القتال والقيادة في ظروف بيئية مختلفة.

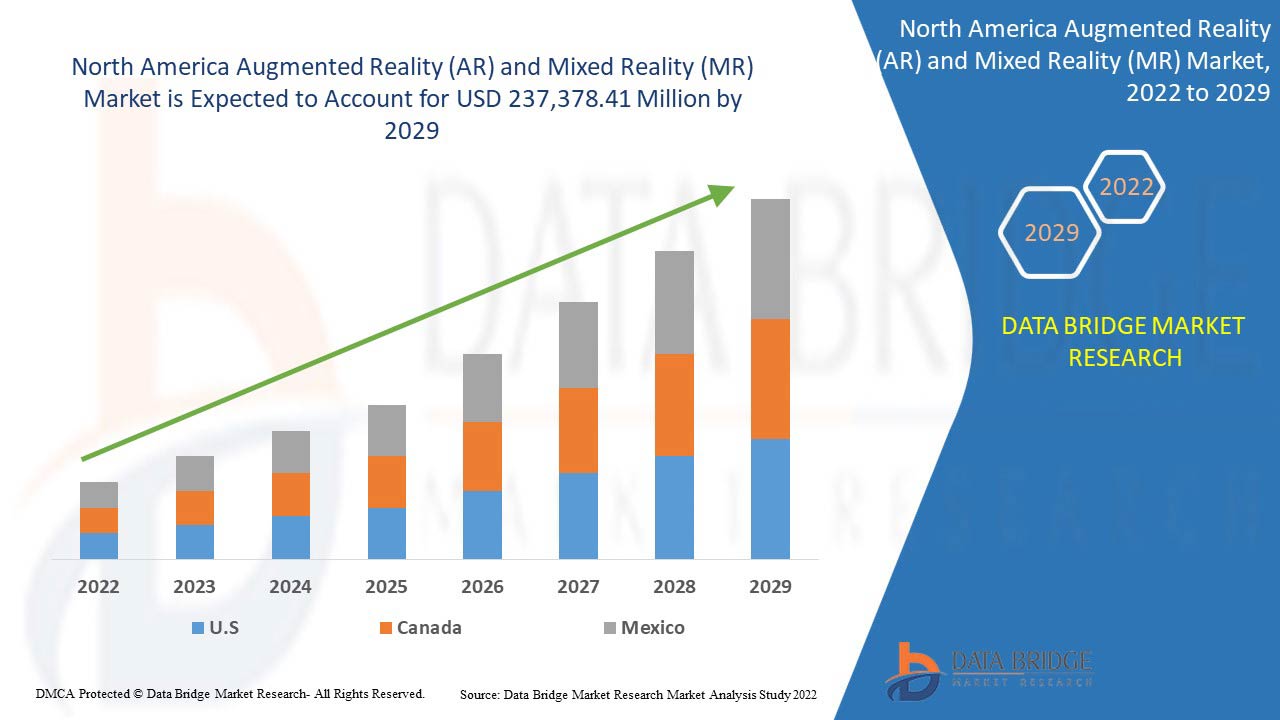

تحلل شركة Data Bridge Market Research أن سوق الواقع المعزز والواقع المختلط في أمريكا الشمالية من المتوقع أن تصل قيمته إلى 237,378.41 مليون دولار أمريكي بحلول عام 2029، بمعدل نمو سنوي مركب قدره 50.8% خلال الفترة المتوقعة. يشكل قطاع الأجهزة أكبر قطاع مكونات في سوق الواقع المعزز والواقع المختلط في أمريكا الشمالية. يغطي تقرير سوق الواقع المعزز والواقع المختلط في أمريكا الشمالية أيضًا تحليل الأسعار وتحليل براءات الاختراع والتقدم التكنولوجي بعمق.

|

تقرير القياس |

تفاصيل |

|

فترة التنبؤ |

2022 إلى 2029 |

|

سنة الأساس |

2021 |

|

سنوات تاريخية |

2020 (قابلة للتخصيص حتى 2019-2014) |

|

وحدات كمية |

الإيرادات بالملايين من الدولارات الأمريكية، التسعير بالدولار الأمريكي |

|

القطاعات المغطاة |

حسب المكون (الأجهزة والبرامج والخدمات)، نموذج النشر (السحابة، في الموقع)، قناة التوزيع (غير متصلة بالإنترنت، عبر الإنترنت)، نوع الجهاز (شاشة عرض أمامية، شاشة مثبتة على الرأس، جهاز عرض وجدار عرض، أجهزة تتبع الإيماءات)، التكنولوجيا (الواقع المعزز المحمول، التكنولوجيا القائمة على الشاشة، التكنولوجيا القائمة على العين القريبة)، التطبيق (تحسين سير العمل، التعاون التسويقي، تحسين 2-D و 3-D، التصور، النمذجة ثلاثية الأبعاد، التوثيق، الملاحة)، المستخدم النهائي (التجزئة والتجارة الإلكترونية، تكنولوجيا المعلومات والاتصالات، السيارات، الفضاء والدفاع، الرعاية الصحية، الرسوم المتحركة، السفر والسياحة، الطاقة، وسائل الإعلام والترفيه، التعليم، البناء، الألعاب والرياضة، الخدمات المصرفية) |

|

الدول المغطاة |

الولايات المتحدة وكندا والمكسيك |

|

الجهات الفاعلة في السوق المشمولة |

شركة HP Development Company، LP، HTC Corporation، Autodesk Inc.، Barco، Intel Corporation، PTC، Seiko Epson Corporation، Ultraleap Limited، ASUSTek Computer Inc.، Dell، Google (شركة تابعة لشركة Alphabet Inc.)، Sony Corporation، Lenovo، Microsoft، SAMSUNG ELECTRONICS CO.، LTD.، Panasonic Corporation، RealWear، Inc.، Magic Leap، Inc.، EON Reality، وTeamViewer وغيرها |

تعريف السوق

الواقع المعزز هو تقنية تستخدم بيئة المستخدم الحالية وتضع فوقها المحتوى أو المعلومات الرقمية أو الافتراضية لتقديم تجربة رقمية غامرة في بيئة الوقت الفعلي. يتم تطوير تطبيقات الواقع المعزز على برامج ثلاثية الأبعاد خاصة، والتي تمكن المطورين من دمج المحتوى السياقي أو الرقمي مع العالم الحقيقي في الوقت الفعلي. يوفر الواقع المعزز تجارب تفاعلية من خلال وسائط حسية متعددة، بما في ذلك اللمسية والسمعية والبصرية والحسية الجسدية والمزيد. تتمتع التكنولوجيا بمجموعة واسعة من التطبيقات في مجالات الترفيه والتدريب والتعليم. تركز الصناعات مثل التصنيع والرعاية الصحية والخدمات اللوجستية، من بين أمور أخرى، بشكل أكبر على تبني هذه التكنولوجيا لتطبيقات التدريب والصيانة والمساعدة والمراقبة.

الواقع المختلط يرمز إلى التصادم المتحكم فيه بين اتجاهات الواقع المعزز والافتراضي وإنترنت الأشياء. الواقع المختلط، والذي يُشار إليه أيضًا باسم الواقع الهجين، هو التكنولوجيا المستخدمة لدمج العوالم الحقيقية والافتراضية وإنتاج بيئات وتصورات جديدة حيث تتعايش الأشياء المادية والرقمية وتتفاعل في الوقت الفعلي. الواقع المختلط هو مجال متعدد التخصصات يشمل رسومات الكمبيوتر ومعالجة الإشارات والظهور الحاسوبي وواجهات المستخدم والحوسبة المتنقلة والحوسبة القابلة للارتداء وتصور المعلومات وتصميم الشاشات وأجهزة الاستشعار. يتم تبني مفاهيم الواقع المختلط بشكل متزايد من قبل العديد من الصناعات، بما في ذلك صناعة السيارات والرعاية الصحية وبيئات المكاتب وغيرها.

ديناميكيات السوق

يتناول هذا القسم فهم محركات السوق والمزايا والفرص والقيود والتحديات. ويتم مناقشة كل هذا بالتفصيل على النحو التالي:

السائقين

- تزايد انتشار الأجهزة الذكية وخدمات الإنترنت

مع ظهور الأجهزة الذكية، وفرت تقنية الواقع المعزز فرصًا قيمة لتجار التجزئة للتفاعل مع المستهلكين وعرض منتجاتهم وخلق ميزة تنافسية، ومن المتوقع أن يؤدي هذا إلى دفع سوق الواقع المعزز (AR) والواقع المختلط (MR) في أمريكا الشمالية بشكل كبير.

- ارتفاع في اعتماد الواقع المعزز من قبل المؤسسات التعليمية

يتيح الواقع المعزز في التعليم للطلاب اكتساب المعرفة من خلال الصور المرئية الغنية والانغماس في الموضوع. علاوة على ذلك، تعمل تقنية الكلام أيضًا على إشراك الطلاب من خلال تقديم تفاصيل شاملة حول الموضوع بتنسيق صوتي. لذلك، أصبح مفهوم التعلم الإلكتروني باستخدام الواقع المعزز استراتيجية أساسية لجمع المعلومات، ومن المتوقع أن يدفع سوق الواقع المعزز والواقع المختلط في أمريكا الشمالية بشكل كبير.

- زيادة التركيز على الأنظمة السيبرانية الفيزيائية

يتيح الواقع المعزز تفاعلات بديهية وفعالة بين البشر وأداة الآلة السيبرانية الفيزيائية. ومع تحول أنظمة الأمن السيبراني الفيزيائي إلى أنظمة قائمة على النماذج والاستفادة من الواقع المعزز أو الافتراضي أو المختلط، تختفي الفجوات بين التدريب والتخطيط/التحليل ومحاكاة الوعي بالموقف. ومن خلال واجهة سياقية تعتمد على النموذج، يمكن للمستخدمين تجربة تمثيل افتراضي لمنشأة في العالم الحقيقي.

- مزيد من التقدم التكنولوجي والرقمنة

لقد أصبح التقارب المستمر للرقمنة في العالمين الحقيقي والافتراضي العامل الرئيسي للابتكار والتغيير في جميع قطاعات اقتصادنا. أصبحت تقنية الواقع المعزز واحدة من تقنيات التحول الرقمي الحاسمة في المجالات الصناعية وغير الصناعية. لقد أدى صعود الواقع المعزز إلى تحويل حياة الناس والعمليات اليومية في التكنولوجيا والضيافة والرعاية الصحية وغيرها من القطاعات. يساعد استخدام الواقع المعزز العملاء على فهم المنتج أو الخدمة بسهولة أكبر ويساعدهم على اتخاذ القرارات بشكل أسهل. بالإضافة إلى ذلك، يمكن للواقع المعزز أيضًا المساعدة في بناء وتحسين صورة العلامة التجارية للمنظمة من خلال منح العملاء تجربة شراء سلسة.

فرص

-

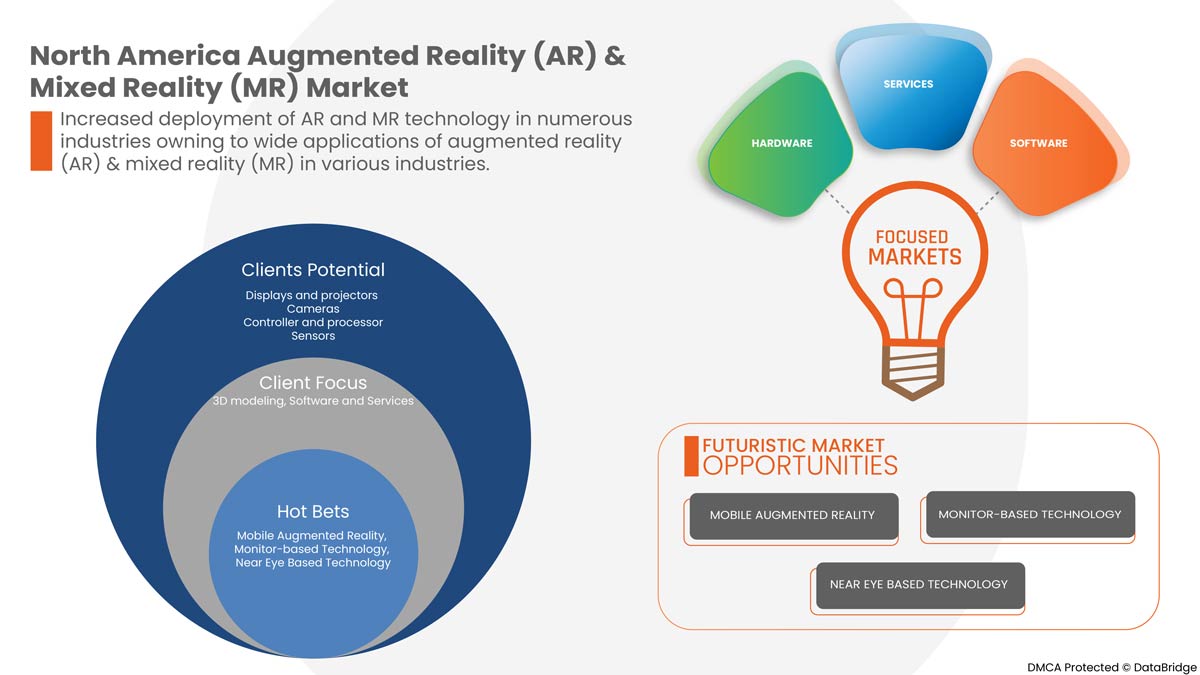

زيادة نشر تقنية الواقع المعزز والواقع المختلط في العديد من الصناعات

تستخدم التطبيقات في مختلف القطاعات الصناعية، وخاصة في صناعة الدفاع، الواقع المعزز والمختلط على نطاق واسع. ومن المتوقع أن يخلق ذلك فرصًا لسوق الواقع المعزز والواقع المختلط في أمريكا الشمالية.

القيود/التحديات

- اللوائح الحكومية الصارمة للمنظمات المختلفة

تخضع أجهزة وتطبيقات الواقع المعزز والواقع المختلط بالفعل لعدة قوانين ولوائح تحكم خصوصية الأفراد وبيانات المستخدمين في مختلف البلدان. ومع ذلك، فإن المشهد التنظيمي الحالي لا يعالج سوى بعض المخاطر المترتبة على استخدام أجهزة الواقع المعزز. وتؤدي المتطلبات المحددة إلى تعقيد عملية جمع البيانات اللازمة لتوفير تجارب غامرة قوية وآمنة عبر القطاعات.

تأثير COVID-19 على سوق الواقع المعزز (AR) والواقع المختلط (MR) في أمريكا الشمالية

أحدثت جائحة كوفيد-19 تأثيرًا كبيرًا على العديد من الصناعات حيث اختارت كل دولة تقريبًا إغلاق جميع المرافق باستثناء تلك التي تتعامل في قطاع السلع الأساسية. اتخذت الحكومة بعض الإجراءات الصارمة مثل إغلاق المرافق وبيع السلع غير الأساسية، وحظر التجارة الدولية، وغير ذلك الكثير لمنع انتشار كوفيد-19. العمل الوحيد الذي يتعامل في هذا الوضع الوبائي هو الخدمات الأساسية المسموح لها بالفتح وإدارة العمليات.

لقد وفر الاستخدام المتزايد للأجهزة القائمة على الواقع المعزز فرصًا كبيرة وسط جائحة كوفيد-19. على الرغم من أن القوة الشرائية للمستهلك قد تقلصت بشكل كبير نتيجة للركود الاقتصادي الناجم عن فيروس كورونا، مما أدى إلى انخفاض هوامش الربح في المنظمات. في حين رأى العديد من المسوقين والقادة الرئيسيين علامات تحسن عن السنوات الماضية، إلا أنه لا يزال من الصعب التأكد من الوضع الفعلي للسوق حيث أن الطلب المكبوت قد يغطي مستوى أدنى من الطلب الجوهري على الأجهزة القائمة على الواقع المعزز. إن الزيادة في تطبيقات الواقع المعزز للهواتف الذكية، وارتفاع الطلب على التعاون عن بعد، والتقدم التكنولوجي في التطبيقات الطبية هي بعض العوامل التي تدفع نمو سوق الواقع المعزز والواقع المختلط.

يتخذ المصنعون قرارات استراتيجية مختلفة لتلبية الطلب المتزايد في فترة COVID-19. شارك اللاعبون في أنشطة استراتيجية مثل الشراكات والتعاون والاستحواذ وغيرها لتحسين التكنولوجيا المشاركة في سوق الواقع المعزز (AR) والواقع المختلط (MR) في أمريكا الشمالية. وبهذا، ستقدم الشركات حلولاً متقدمة ودقيقة للسوق. بالإضافة إلى ذلك، أدت مبادرات الحكومة لتعزيز التحول الرقمي عبر الصناعات إلى نمو السوق.

التطورات الأخيرة

- في أبريل 2021، أعلنت شركة مايكروسوفت عن عقد بين البنتاغون والجيش الأمريكي لتوريد معدات الواقع المعزز للجنود بقيمة 21.88 مليار دولار أمريكي. ستوفر هذه النظارات للجنود رؤية أكثر كفاءة، ورؤية ليلية من الجيل التالي، ووعيًا بالموقف لأي حرب. كما ساعد هذا الشركة على تجاوز الحدود التقليدية للمكان والزمان في مجال الواقع المعزز، وبالتالي توسيع نطاق منتجاتها في السوق.

- في يوليو 2021، وسعت شركة سامسونج للإلكترونيات المحدودة عروضها غير التلامسية للمستهلكين من خلال خدمة جديدة تدعم الواقع المعزز لمنتجاتها الرائدة. وبفضل هذه الخدمة، يمكن للمستهلكين تجربة منتج افتراضيًا في منازلهم، والتحقق من أبعاد المنتج، واتخاذ اختيار مستنير باستخدام خدمة الواقع المعزز. وقد ساعد هذا الشركة أيضًا على توسيع محفظة منتجاتها في سوق الواقع المعزز.

نطاق سوق الواقع المعزز (AR) والواقع المختلط (MR) في أمريكا الشمالية

يتم تقسيم سوق الواقع المعزز (AR) والواقع المختلط (MR) في أمريكا الشمالية على أساس المكون ونموذج النشر وقناة التوزيع ونوع الجهاز والتكنولوجيا والتطبيق والمستخدم النهائي. سيساعدك النمو بين هذه القطاعات على تحليل قطاعات النمو الضئيلة في الصناعات وتزويد المستخدمين بنظرة عامة قيمة على السوق ورؤى السوق لمساعدتهم على اتخاذ قرارات استراتيجية لتحديد تطبيقات السوق الأساسية.

حسب المكون

- الأجهزة

- برمجة

- خدمات

على أساس المكون، يتم تقسيم سوق الواقع المعزز (AR) والواقع المختلط (MR) في أمريكا الشمالية إلى أجهزة وبرامج وخدمات.

حسب نموذج النشر

- في الموقع

- سحاب

على أساس نموذج النشر، يتم تقسيم سوق الواقع المعزز (AR) والواقع المختلط (MR) في أمريكا الشمالية إلى محلي وسحابي.

حسب قناة التوزيع

- غير متصل

- متصل

على أساس حجم المنظمة، يتم تقسيم سوق الواقع المعزز (AR) والواقع المختلط (MR) في أمريكا الشمالية إلى سوق غير متصل بالإنترنت وسوق عبر الإنترنت.

حسب نوع الجهاز

- سطح المكتب

- شاشة عرض أمامية

- شاشة عرض مثبتة على الرأس

- جهاز عرض وجدار عرض

- أجهزة تتبع الإيماءات

على أساس نوع الجهاز، تم تقسيم سوق الواقع المعزز (AR) والواقع المختلط (MR) في أمريكا الشمالية إلى شاشة عرض أمامية، وشاشة مثبتة على الرأس، وجهاز عرض وجدار عرض، وأجهزة تتبع الإيماءات.

حسب التكنولوجيا

- الواقع المعزز للجوال

- تقنية تعتمد على الشاشة

- تقنية تعتمد على العين القريبة

على أساس التكنولوجيا، تم تقسيم سوق الواقع المعزز (AR) والواقع المختلط (MR) في أمريكا الشمالية إلى الواقع المعزز المحمول، والتكنولوجيا القائمة على الشاشة، والتكنولوجيا القائمة على العين القريبة.

حسب الطلب

- الخدمات المصرفية والمالية والتأمين

- تحسين سير العمل

- التعاون التسويقي

- تحسين الصور ثنائية الأبعاد وثلاثية الأبعاد

- التصورات

- النمذجة ثلاثية الأبعاد

- التوثيق

- ملاحة

على أساس التطبيق، تم تقسيم سوق الواقع المعزز (AR) والواقع المختلط (MR) في أمريكا الشمالية إلى تحسين سير العمل، والتعاون التسويقي، وتعزيز 2-D و 3-D، والتصورات، والنمذجة ثلاثية الأبعاد، والتوثيق، والملاحة.

حسب المستخدم النهائي

- الخدمات المصرفية والمالية والتأمين

- التجزئة والتجارة الإلكترونية

- تكنولوجيا المعلومات والاتصالات

- السيارات

- الفضاء والدفاع

- الرعاية الصحية

- الرسوم المتحركة

- السفر والسياحة

- طاقة

- الإعلام والترفيه

- تعليم

- بناء

- الألعاب والرياضة

- الخدمات المصرفية

- آحرون

على أساس المستخدم النهائي، يتم تقسيم سوق الواقع المعزز (AR) والواقع المختلط (MR) في أمريكا الشمالية إلى التجزئة والتجارة الإلكترونية، وتكنولوجيا المعلومات والاتصالات، والسيارات، والفضاء والدفاع، والرعاية الصحية، والسفر والسياحة، والطاقة، والإعلام والترفيه، والتعليم، والبناء، والألعاب والرياضة، والخدمات المصرفية وغيرها.

تحليل/رؤى إقليمية لسوق الواقع المعزز (AR) والواقع المختلط (MR) في أمريكا الشمالية

يتم تحليل سوق الواقع المعزز (AR) والواقع المختلط (MR) في أمريكا الشمالية، ويتم توفير رؤى حجم السوق والاتجاهات حسب البلد والمكون ونموذج النشر وقناة التوزيع ونوع الجهاز والتكنولوجيا والتطبيق والمستخدم النهائي كما هو مذكور أعلاه.

الدول التي يغطيها تقرير سوق الواقع المعزز والواقع المختلط في أمريكا الشمالية هي الولايات المتحدة وكندا والمكسيك. ومن المتوقع أن تهيمن الولايات المتحدة على سوق الواقع المعزز والواقع المختلط في أمريكا الشمالية ومن المرجح أن تكون الأسرع نموًا في منطقة أمريكا الشمالية بسبب مكان العمل الرقمي المتزايد باستمرار والقوى العاملة المتنقلة. علاوة على ذلك، كانت الولايات المتحدة متجاوبة للغاية تجاه تبني أحدث التطورات التكنولوجية داخل المؤسسات التي تدفع نمو السوق.

كما يوفر قسم الدولة في التقرير عوامل التأثير الفردية على السوق والتغيرات في تنظيم السوق التي تؤثر على الاتجاهات الحالية والمستقبلية للسوق. نقاط البيانات مثل تحليل سلسلة القيمة المصب والمصب، والاتجاهات الفنية وتحليل قوى بورتر الخمس، ودراسات الحالة هي بعض المؤشرات المستخدمة للتنبؤ بسيناريو السوق للدول الفردية. كما يتم النظر في وجود وتوافر العلامات التجارية في أمريكا الشمالية والتحديات التي تواجهها بسبب المنافسة الكبيرة أو النادرة من العلامات التجارية المحلية والمحلية، وتأثير التعريفات الجمركية المحلية، وطرق التجارة أثناء تقديم تحليل توقعات لبيانات الدولة.

تحليل المشهد التنافسي وحصة سوق الواقع المعزز والواقع المختلط في أمريكا الشمالية

يقدم المشهد التنافسي لسوق الواقع المعزز والواقع المختلط في أمريكا الشمالية تفاصيل عن المنافس. تتضمن التفاصيل نظرة عامة على الشركة، والبيانات المالية للشركة، والإيرادات المولدة، وإمكانات السوق، والاستثمار في البحث والتطوير، ومبادرات السوق الجديدة، والحضور في أمريكا الشمالية، ومواقع الإنتاج والمرافق، والقدرات الإنتاجية، ونقاط القوة والضعف للشركة، وإطلاق المنتج، وعرض المنتج ونطاقه، وهيمنة التطبيق. ترتبط نقاط البيانات المذكورة أعلاه فقط بتركيز الشركات فيما يتعلق بسوق الواقع المعزز والواقع المختلط في أمريكا الشمالية.

بعض اللاعبين الرئيسيين العاملين في سوق الواقع المعزز (AR) والواقع المختلط (MR) في أمريكا الشمالية هم HP Development Company و LP و HTC Corporation و Autodesk Inc. و Barco و Intel Corporation و PTC و Seiko Epson Corporation و Ultraleap Limited و ASUSTek Computer Inc. و Dell و Google (شركة تابعة لشركة Alphabet Inc.) و Sony Corporation و Lenovo و Microsoft و SAMSUNG ELECTRONICS CO.، LTD. و Panasonic Corporation و RealWear، Inc. و Magic Leap، Inc. و EON Reality و TeamViewer وغيرها.

SKU-

احصل على إمكانية الوصول عبر الإنترنت إلى التقرير الخاص بأول سحابة استخبارات سوقية في العالم

- لوحة معلومات تحليل البيانات التفاعلية

- لوحة معلومات تحليل الشركة للفرص ذات إمكانات النمو العالية

- إمكانية وصول محلل الأبحاث للتخصيص والاستعلامات

- تحليل المنافسين باستخدام لوحة معلومات تفاعلية

- آخر الأخبار والتحديثات وتحليل الاتجاهات

- استغل قوة تحليل المعايير لتتبع المنافسين بشكل شامل

Table of Content

1 INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 OVERVIEW OF NORTH AMERICA AUGMENTED REALITY (AR) & MIXED REALITY (MR) MARKET

1.4 CURRENCY AND PRICING

1.5 LIMITATIONS

1.6 MARKETS COVERED

2 MARKET SEGMENTATION

2.1 MARKETS COVERED

2.2 GEOGRAPHICAL SCOPE

2.3 YEARS CONSIDERED FOR THE STUDY

2.4 DBMR TRIPOD DATA VALIDATION MODEL

2.5 PRIMARY INTERVIEWS WITH KEY OPINION LEADERS

2.6 DBMR MARKET POSITION GRID

2.7 VENDOR SHARE ANALYSIS

2.8 MULTIVARIATE MODELING

2.9 COMPONENT TIMELINE CURVE

2.1 MARKET APPLICATION COVERAGE GRID

2.11 SECONDARY SOURCES

2.12 ASSUMPTIONS

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

4.1 REGULATIONS

4.1.1 IEEE STANDARDS

4.2 POST COVID

4.3 MARKETING

4.4 PRICING ANALYSIS/PRICE SENSITIVITY

4.5 KOREAN CONTENT'S POPULARITY

5 MARKET OVERVIEW

5.1 DRIVERS

5.1.1 INCREASING PENETRATION OF SMART DEVICES AND INTERNET SERVICES

5.1.2 RISE IN ADOPTION OF AUGMENTED REALITY BY EDUCATIONAL INSTITUTES

5.1.3 INCREASING FOCUS ON CYBER-PHYSICAL SYSTEMS

5.1.4 MORE OF TECHNOLOGICAL ADVANCEMENT AND DIGITIZATION

5.2 RESTRAINTS

5.2.1 STRINGENT REGULATIONS OF GOVERNMENT FOR VARIED ORGANIZATIONS

5.2.2 LOSS OF DATA AND PRIVACY

5.3 OPPORTUNITIES

5.3.1 INCREASED DEPLOYMENT OF AR AND MR TECHNOLOGY IN NUMEROUS INDUSTRIES

5.3.2 INCREASE IN VARIOUS STRATEGIC DECISIONS SUCH AS PARTNERSHIP AND ACQUISITION

5.3.3 DEVELOPMENT OF HARDWARE WITH FASTER PROCESSING SPEEDS

5.3.4 RISE IN INVESTMENT AND FUNDING BY DEVELOPED COUNTRIES

5.4 CHALLENGES

5.4.1 NORTH AMERICA ECONOMIC SLOWDOWN LIMITS THE MARKET DEVELOPMENT

5.4.2 COMPLICATIONS WHILE OPERATING AUGMENTED REALITY (AR) & MIXED REALITY (MR) BASED PRODUCT

6 NORTH AMERICA AUGMENTED REALITY (AR) & MIXED REALITY (MR) MARKET, BY COMPONENT

6.1 OVERVIEW

6.2 HARDWARE

6.2.1 DISPLAYS AND PROJECTORS

6.2.2 CAMERAS

6.2.3 CONTROLLER AND PROCESSOR

6.2.4 SENSORS

6.2.4.1 ACCELEROMETERS

6.2.4.2 GYROSCOPES

6.2.5 PROXIMITY SENSORS

6.2.6 MAGNETOMETERS

6.2.7 OTHERS

6.2.8 POSITION TRACKERS

6.2.9 OTHERS

6.3 SOFTWARE

6.4 SERVICES

6.4.1 IMPLEMENTATION

6.4.2 SUPPORT AND MAINTENANCE

6.4.3 TRAINING

7 NORTH AMERICA AUGMENTED REALITY (AR) & MIXED REALITY (MR) MARKET, BY DEPLOYMENT MODEL

7.1 OVERVIEW

7.2 CLOUD

7.3 ON-PREMISE

8 NORTH AMERICA AUGMENTED REALITY (AR) & MIXED REALITY (MR) MARKET, BY DEVICE TYPE

8.1 OVERVIEW

8.2 HEAD MOUNTED DISPLAY

8.2.1 SMART GLASSES

8.2.2 SMART HELMET

8.3 HEAD UP DISPLAY

8.4 PROJECTOR & DISPLAY WALLS

8.5 GESTURE-TRACKING DEVICES

9 NORTH AMERICA AUGMENTED REALITY (AR) & MIXED REALITY (MR) MARKET, BY TECHNOLOGY

9.1 OVERVIEW

9.2 MOBILE AUGMENTED REALITY

9.3 MONITOR-BASED TECHNOLOGY

9.4 NEAR EYE BASED TECHNOLOGY

10 NORTH AMERICA AUGMENTED REALITY (AR) & MIXED REALITY (MR) MARKET, BY DISTRIBUTION CHANNEL

10.1 OVERVIEW

10.2 OFFLINE

10.3 ONLINE

11 NORTH AMERICA AUGMENTED REALITY (AR) & MIXED REALITY (MR) MARKET, BY APPLICATION

11.1 OVERVIEW

11.2 WORKFLOW OPTIMIZATION

11.3 ENHANCED 2-D AND 3-D

11.4 VISUALIZATIONS

11.5 MARKETING COLLABORATION

11.6 3D MODELING

11.7 DOCUMENTATION

11.8 NAVIGATION

12 NORTH AMERICA AUGMENTED REALITY (AR) & MIXED REALITY (MR) MARKET, BY END USER

12.1 OVERVIEW

12.2 MEDIA AND ENTERTAINMENT

12.2.1 BROADCAST

12.2.2 MUSIC

12.2.3 ART GALLERIES AND EXHIBITIONS

12.2.4 MUSEUMS

12.2.5 THEME PARKS

12.3 GAMES AND SPORTS

12.4 RETAIL AND E-COMMERCE

12.4.1 JEWELLERY

12.4.2 BEAUTY AND COSMETICS

12.4.3 APPAREL FITTING

12.4.4 GROCERY SHOPPING

12.4.5 FOOTWEAR

12.4.6 FURNITURE AND LIGHTING DESIGN

12.5 TRAVEL AND TOURISM

12.6 HEALTHCARE

12.6.1 SURGERY

12.6.2 FITNESS MANAGEMENT

12.6.3 PATIENT CARE MANAGEMENT

12.6.4 PHARMACY MANAGEMENT

12.6.5 OTHERS

12.7 ANIMATION

12.7.1 CHARACTER

12.7.2 CARTOON

12.8 AEROSPACE AND DEFENSE

12.9 AUTOMOTIVE

12.1 CONSTRUCTION

12.11 EDUCATION

12.12 BANKING

12.13 ENERGY

12.14 IT AND TELECOMMUNICATION

12.15 OTHERS

13 NORTH AMERICA AUGMENTED REALITY (AR) & MIXED REALITY (MR) MARKET, BY REGION

13.1 NORTH AMERICA

14 NORTH AMERICA AUGMENTED REALITY (AR) & MIXED REALITY (MR) MARKET, COMPANY LANDSCAPE

14.1 COMPANY SHARE ANALYSIS: NORTH AMERICA

15 SWOT ANALYSIS

16 COMPANY PROFILE

16.1 MICROSOFT

16.1.1 COMPANY SNAPSHOT

16.1.2 REVENUE ANALYSIS

16.1.3 COMPANY SHARE ANALYSIS

16.1.4 PRODUCTS PORTFOLIO

16.1.5 RECENT DEVELOPMENTS

16.2 GOOGLE (A SUBSIDIARY OF ALPHABET INC.)

16.2.1 COMPANY SNAPSHOT

16.2.2 REVENUE ANALYSIS

16.2.3 COMPANY SHARE ANALYSIS

16.2.4 PRODUCTS PORTFOLIO

16.2.5 RECENT DEVELOPMENTS

16.3 SAMSUNG ELECTRONICS CO., LTD.

16.3.1 COMPANY SNAPSHOT

16.3.2 REVENUE ANALYSIS

16.3.3 COMPANY SHARE ANALYSIS

16.3.4 PRODUCT PORTFOLIO

16.3.5 RECENT DEVELOPMENTS

16.4 PANASONIC CORPORATION

16.4.1 COMPANY SNAPSHOT

16.4.2 REVENUE ANALYSIS

16.4.3 COMPANY SHARE ANALYSIS

16.4.4 PRODUCTS PORTFOLIO

16.4.5 RECENT DEVELOPMENTS

16.5 DELL

16.5.1 COMPANY SNAPSHOT

16.5.2 REVENUE ANALYSIS

16.5.3 PRODUCTS PORTFOLIO

16.5.4 RECENT DEVELOPMENTS

16.6 LENOVO

16.6.1 COMPANY SNAPSHOT

16.6.2 REVENUE ANALYSIS

16.6.3 PRODUCTS PORTFOLIO

16.6.4 RECENT DEVELOPMENT

16.7 AUTODESK INC.

16.7.1 COMPANY SNAPSHOT

16.7.2 REVENUE ANALYSIS

16.7.3 PRODUCTS PORTFOLIO

16.7.4 RECENT DEVELOPMENTS

16.8 ASUSTEK COMPUTER INC.

16.8.1 COMPANY SNAPSHOT

16.8.2 REVENUE ANALYSIS

16.8.3 PRODUCT PORTFOLIO

16.8.4 RECENT DEVELOPMENT

16.9 BARCO

16.9.1 COMPANY SNAPSHOT

16.9.2 REVENUE ANALYSIS

16.9.3 PRODUCT PORTFOLIO

16.9.4 RECENT DEVELOPMENTS

16.1 EON REALITY

16.10.1 COMPANY SNAPSHOT

16.10.2 PRODUCT PORTFOLIO

16.10.3 RECENT DEVELOPMENTS

16.11 HP DEVELOPMENT COMPANY, L.P.

16.11.1 COMPANY SNAPSHOT

16.11.2 REVENUE ANALYSIS

16.11.3 PRODUCTS PORTFOLIO

16.11.4 RECENT DEVELOPMENTS

16.12 HTC CORPORATION

16.12.1 COMPANY SNAPSHOT

16.12.2 REVENUE ANALYSIS

16.12.3 PRODUCT PORTFOLIO

16.12.4 RECENT DEVELOPMENTS

16.13 INTEL CORPORATION

16.13.1 COMPANY SNAPSHOT

16.13.2 REVENUE ANALYSIS

16.13.3 PRODUCT PORTFOLIO

16.13.4 RECENT DEVELOPMENTS

16.14 MAGIC LEAP, INC.

16.14.1 COMPANY SNAPSHOT

16.14.2 PRODUCT PORTFOLIO

16.14.3 RECENT DEVELOPMENTS

16.15 PTC

16.15.1 COMPANY SNAPSHOT

16.15.2 REVENUE ANALYSIS

16.15.3 PRODUCTS PORTFOLIO

16.15.4 RECENT DEVELOPMENT

16.16 REALWEAR, INC.

16.16.1 COMPANY SNAPSHOT

16.16.2 PRODUCT PORTFOLIO

16.16.3 RECENT DEVELOPMENTS

16.17 SEIKO EPSON CORPORATION

16.17.1 COMPANY SNAPSHOT

16.17.2 REVENUE ANALYSIS

16.17.3 PRODUCT PORTFOLIO

16.17.4 RECENT DEVELOPMENTS

16.18 SONY CORPORATION

16.18.1 COMPANY SNAPSHOT

16.18.2 REVENUE ANALYSIS

16.18.3 PRODUCTS PORTFOLIO

16.18.4 RECENT DEVELOPMENT

16.19 TEAMVIEWER

16.19.1 COMPANY SNAPSHOT

16.19.2 REVENUE ANALYSIS

16.19.3 PRODUCT PORTFOLIO

16.19.4 RECENT DEVELOPMENTS

16.2 ULTRALEAP LIMITED

16.20.1 COMPANY SNAPSHOT

16.20.2 PRODUCT PORTFOLIO

16.20.3 RECENT DEVELOPMENT

17 QUESTIONNAIRE

18 RELATED REPORTS

List of Table

TABLE 1 AVERAGE DEVELOPMENT TIME AND COST FOR AR:

TABLE 2 NORTH AMERICA AUGMENTED REALITY (AR) & MIXED REALITY (MR) MARKET, BY COMPONENT, 2020-2029 (USD MILLION)

TABLE 3 NORTH AMERICA HARDWARE IN AUGMENTED REALITY (AR) & MIXED REALITY (MR) MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 4 NORTH AMERICA HARDWARE IN AUGMENTED REALITY (AR) & MIXED REALITY (MR) MARKET, BY TYPE 2020-2029 (USD MILLION)

TABLE 5 NORTH AMERICA SENSORS IN AUGMENTED REALITY (AR) & MIXED REALITY (MR) MARKET, BY TYPE 2020-2029 (USD MILLION)

TABLE 6 NORTH AMERICA SOFTWARE IN AUGMENTED REALITY (AR) & MIXED REALITY (MR) MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 7 NORTH AMERICA SERVICES IN AUGMENTED REALITY (AR) & MIXED REALITY (MR) MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 8 NORTH AMERICA SERVICES IN AUGMENTED REALITY (AR) & MIXED REALITY (MR) MARKET, BY TYPE 2020-2029 (USD MILLION)

TABLE 9 NORTH AMERICA AUGMENTED REALITY (AR) & MIXED REALITY (MR) MARKET, BY DEPLOYMENT MODEL, 2020-2029 (USD MILLION)

TABLE 10 NORTH AMERICA CLOUD IN AUGMENTED REALITY (AR) & MIXED REALITY (MR) MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 11 NORTH AMERICA ON-PREMISE IN AUGMENTED REALITY (AR) & MIXED REALITY (MR) MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 12 NORTH AMERICA AUGMENTED REALITY (AR) & MIXED REALITY (MR) MARKET, BY DEVICE TYPE, 2020-2029 (USD MILLION)

TABLE 13 NORTH AMERICA HEAD MOUNTED DISPLAY IN AUGMENTED REALITY (AR) & MIXED REALITY (MR) MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 14 NORTH AMERICA HEAD MOUNTED DISPLAY IN AUGMENTED REALITY (AR) & MIXED REALITY (MR) MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 15 NORTH AMERICA HEAD UP DISPLAY IN AUGMENTED REALITY (AR) & MIXED REALITY (MR) MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 16 NORTH AMERICA PROJECTORS & DISPLAY WALLS IN AUGMENTED REALITY (AR) & MIXED REALITY (MR) MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 17 NORTH AMERICA GESTURE-TRACKING DEVICES IN AUGMENTED REALITY (AR) & MIXED REALITY (MR) MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 18 NORTH AMERICA AUGMENTED REALITY (AR) & MIXED REALITY (MR) MARKET, BY TECHNOLOGY, 2020-2029 (USD MILLION)

TABLE 19 NORTH AMERICA MOBILE AUGMENTED REALITY IN AUGMENTED REALITY (AR) & MIXED REALITY (MR) MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 20 NORTH AMERICA MONITOR-BASED TECHNOLOGY IN AUGMENTED REALITY (AR) & MIXED REALITY (MR) MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 21 NORTH AMERICA NEAR EYE BASED TECHNOLOGY IN AUGMENTED REALITY (AR) & MIXED REALITY (MR) MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 22 NORTH AMERICA AUGMENTED REALITY (AR) & MIXED REALITY (MR) MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 23 NORTH AMERICA OFFLINE IN AUGMENTED REALITY (AR) & MIXED REALITY (MR) MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 24 NORTH AMERICA ONLINE IN AUGMENTED REALITY (AR) & MIXED REALITY (MR) MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 25 NORTH AMERICA AUGMENTED REALITY (AR) & MIXED REALITY (MR) MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 26 NORTH AMERICA WORKFLOW OPTIMIZATION IN AUGMENTED REALITY (AR) & MIXED REALITY (MR) MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 27 NORTH AMERICA ENHANCED 2-D AND 3-D IN AUGMENTED REALITY (AR) & MIXED REALITY (MR) MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 28 NORTH AMERICA VISUALIZATIONS IN AUGMENTED REALITY (AR) & MIXED REALITY (MR) MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 29 NORTH AMERICA MARKETING COLLABORATION IN AUGMENTED REALITY (AR) & MIXED REALITY (MR) MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 30 NORTH AMERICA 3D MODELING IN AUGMENTED REALITY (AR) & MIXED REALITY (MR) MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 31 NORTH AMERICA DOCUMENTATION IN AUGMENTED REALITY (AR) & MIXED REALITY (MR) MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 32 NORTH AMERICA NAVIGATION IN AUGMENTED REALITY (AR) & MIXED REALITY (MR) MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 33 NORTH AMERICA AUGMENTED REALITY (AR) & MIXED REALITY (MR) MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 34 NORTH AMERICA MEDIA AND ENTERTAINMENT IN AUGMENTED REALITY (AR) & MIXED REALITY (MR) MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 35 NORTH AMERICA MEDIA AND ENTERTAINMENT IN AUGMENTED REALITY (AR) & MIXED REALITY (MR) MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 36 NORTH AMERICA GAMES AND SPORTS IN AUGMENTED REALITY (AR) & MIXED REALITY (MR) MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 37 NORTH AMERICA RETAIL AND E-COMMERCE IN AUGMENTED REALITY (AR) & MIXED REALITY (MR) MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 38 NORTH AMERICA RETAIL AND E-COMMERCE IN AUGMENTED REALITY (AR) & MIXED REALITY (MR) MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 39 NORTH AMERICA TRAVEL AND TOURISM IN AUGMENTED REALITY (AR) & MIXED REALITY (MR) MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 40 NORTH AMERICA HEALTHCARE IN AUGMENTED REALITY (AR) & MIXED REALITY (MR) MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 41 NORTH AMERICA HEALTHCARE IN AUGMENTED REALITY (AR) & MIXED REALITY (MR) MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 42 NORTH AMERICA ANIMATION IN AUGMENTED REALITY (AR) & MIXED REALITY (MR) MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 43 NORTH AMERICA ANIMATION IN AUGMENTED REALITY (AR) & MIXED REALITY (MR) MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 44 NORTH AMERICA AEROSPACE AND DEFENSE IN AUGMENTED REALITY (AR) & MIXED REALITY (MR) MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 45 NORTH AMERICA AUTOMOTIVE IN AUGMENTED REALITY (AR) & MIXED REALITY (MR) MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 46 NORTH AMERICA CONSTRUCTION IN AUGMENTED REALITY (AR) & MIXED REALITY (MR) MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 47 NORTH AMERICA EDUCATION IN AUGMENTED REALITY (AR) & MIXED REALITY (MR) MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 48 NORTH AMERICA BANKING IN AUGMENTED REALITY (AR) & MIXED REALITY (MR) MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 49 NORTH AMERICA ENERGY IN AUGMENTED REALITY (AR) & MIXED REALITY (MR) MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 50 NORTH AMERICA IT AND TELECOMMUNICATION IN AUGMENTED REALITY (AR) & MIXED REALITY (MR) MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 51 NORTH AMERICA OTHERS IN AUGMENTED REALITY (AR) & MIXED REALITY (MR) MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 52 NORTH AMERICA AUGMENTED REALITY (AR) & MIXED REALITY (MR) MARKET, BY COMPONENT, 2020-2029 (USD MILLION)

TABLE 53 NORTH AMERICA HARDWARE IN AUGMENTED REALITY (AR) & MIXED REALITY (MR) MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 54 NORTH AMERICA SENSORS IN AUGMENTED REALITY (AR) & MIXED REALITY (MR) MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 55 NORTH AMERICA SERVICES IN AUGMENTED REALITY (AR) & MIXED REALITY (MR) MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 56 NORTH AMERICA AUGMENTED REALITY (AR) & MIXED REALITY (MR) MARKET, BY DEPLOYMENT MODEL, 2020-2029 (USD MILLION)

TABLE 57 NORTH AMERICA AUGMENTED REALITY (AR) & MIXED REALITY (MR) MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 58 NORTH AMERICA AUGMENTED REALITY (AR) & MIXED REALITY (MR) MARKET, BY DEVICE TYPE, 2020-2029 (USD MILLION)

TABLE 59 NORTH AMERICA HEAD MOUNTED DISPLAY IN AUGMENTED REALITY (AR) & MIXED REALITY (MR) MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 60 NORTH AMERICA AUGMENTED REALITY (AR) & MIXED REALITY (MR) MARKET, BY TECHNOLOGY, 2020-2029 (USD MILLION)

TABLE 61 NORTH AMERICA AUGMENTED REALITY (AR) & MIXED REALITY (MR) MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 62 NORTH AMERICA AUGMENTED REALITY (AR) & MIXED REALITY (MR) MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 63 NORTH AMERICA MEDIA AND ENTERTAINMENT IN AUGMENTED REALITY (AR) & MIXED REALITY (MR) MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 64 NORTH AMERICA RETAIL AND E-COMMERCE IN AUGMENTED REALITY (AR) & MIXED REALITY (MR) MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 65 NORTH AMERICA HEALTHCARE IN AUGMENTED REALITY (AR) & MIXED REALITY (MR) MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 66 NORTH AMERICA ANIMATION IN AUGMENTED REALITY (AR) & MIXED REALITY (MR) MARKET, BY TYPE, 2020-2029 (USD MILLION)

List of Figure

FIGURE 1 NORTH AMERICA AUGMENTED REALITY (AR) & MIXED REALITY (MR) MARKET: SEGMENTATION

FIGURE 2 NORTH AMERICA AUGMENTED REALITY (AR) & MIXED REALITY (MR) MARKET: DATA TRIANGULATION

FIGURE 3 NORTH AMERICA AUGMENTED REALITY (AR) & MIXED REALITY (MR) MARKET: DROC ANALYSIS

FIGURE 4 NORTH AMERICA AUGMENTED REALITY (AR) & MIXED REALITY (MR) MARKET: NORTH AMERICA VS REGIONAL MARKET ANALYSIS

FIGURE 5 NORTH AMERICA AUGMENTED REALITY (AR) & MIXED REALITY (MR) MARKET: COMPANY RESEARCH ANALYSIS

FIGURE 6 NORTH AMERICA AUGMENTED REALITY (AR) & MIXED REALITY (MR) MARKET: INTERVIEW DEMOGRAPHICS

FIGURE 7 NORTH AMERICA AUGMENTED REALITY (AR) & MIXED REALITY (MR) MARKET: DBMR MARKET POSITION GRID

FIGURE 8 NORTH AMERICA AUGMENTED REALITY (AR) & MIXED REALITY (MR) MARKET: VENDOR SHARE ANALYSIS

FIGURE 9 NORTH AMERICA AUGMENTED REALITY (AR) & MIXED REALITY (MR) MARKET: MULTIVARIATE MODELING

FIGURE 10 NORTH AMERICA AUGMENTED REALITY (AR) & MIXED REALITY (MR) MARKET: COMPONENT TIMELINE CURVE

FIGURE 11 NORTH AMERICA AUGMENTED REALITY (AR) & MIXED REALITY (MR) MARKET: MARKET APPLICATION COVERAGE GRID

FIGURE 12 NORTH AMERICA AUGMENTED REALITY (AR) & MIXED REALITY (MR) MARKET: SEGMENTATION

FIGURE 13 INCREASING PENETRATION OF SMART DEVICES AND INTERNET SERVICES IS EXPECTED TO DRIVE NORTH AMERICA AUGMENTED REALITY (AR) & MIXED REALITY (MR) MARKET IN THE FORECAST PERIOD OF 2022 TO 2029

FIGURE 14 THE HARDWARE SEGMENT IS EXPECTED TO ACCOUNT FOR THE LARGEST SHARE OF THE NORTH AMERICA AUGMENTED REALITY (AR) & MIXED REALITY (MR) MARKET FROM 2022 TO 2029

FIGURE 15 NORTH AMERICA IS EXPECTED TO DOMINATE, AND ASIA-PACIFIC IS THE FASTEST-GROWING REGION IN THE NORTH AMERICA AUGMENTED REALITY (AR) & MIXED REALITY (MR) MARKET IN THE FORECAST PERIOD OF 2022 TO 2029

FIGURE 16 DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES OF THE NORTH AMERICA AUGMENTED REALITY (AR) & MIXED REALITY (MR) MARKET

FIGURE 17 NORTH AMERICA AUGMENTED REALITY (AR) & MIXED REALITY (MR) MARKET: BY COMPONENT, 2021

FIGURE 18 NORTH AMERICA AUGMENTED REALITY (AR) & MIXED REALITY (MR) MARKET: BY DEPLOYMENT MODEL, 2021

FIGURE 19 NORTH AMERICA AUGMENTED REALITY (AR) & MIXED REALITY (MR) MARKET: BY DEVICE TYPE, 2021

FIGURE 20 NORTH AMERICA AUGMENTED REALITY (AR) & MIXED REALITY (MR) MARKET: BY TECHNOLOGY, 2021

FIGURE 21 NORTH AMERICA AUGMENTED REALITY (AR) & MIXED REALITY (MR) MARKET: BY DISTRIBUTION CHANNEL, 2021

FIGURE 22 NORTH AMERICA AUGMENTED REALITY (AR) & MIXED REALITY (MR) MARKET: BY APPLICATION, 2021

FIGURE 23 NORTH AMERICA AUGMENTED REALITY (AR) & MIXED REALITY (MR) MARKET: BY END USER, 2021

FIGURE 24 NORTH AMERICA AUGMENTED REALITY (AR) & MIXED REALITY (MR) MARKET: SNAPSHOT (2021)

FIGURE 25 NORTH ANERICA AUGMENTED REALITY (AR) & MIXED REALITY (MR) MARKET: BY COMPONENT (2022 & 2029)

FIGURE 26 NORTH AMERICA AUGMENTED REALITY (AR) & MIXED REALITY (MR) MARKET: COMPANY SHARE 2021(%)

منهجية البحث

يتم جمع البيانات وتحليل سنة الأساس باستخدام وحدات جمع البيانات ذات أحجام العينات الكبيرة. تتضمن المرحلة الحصول على معلومات السوق أو البيانات ذات الصلة من خلال مصادر واستراتيجيات مختلفة. تتضمن فحص وتخطيط جميع البيانات المكتسبة من الماضي مسبقًا. كما تتضمن فحص التناقضات في المعلومات التي شوهدت عبر مصادر المعلومات المختلفة. يتم تحليل بيانات السوق وتقديرها باستخدام نماذج إحصائية ومتماسكة للسوق. كما أن تحليل حصة السوق وتحليل الاتجاهات الرئيسية هي عوامل النجاح الرئيسية في تقرير السوق. لمعرفة المزيد، يرجى طلب مكالمة محلل أو إرسال استفسارك.

منهجية البحث الرئيسية التي يستخدمها فريق بحث DBMR هي التثليث البيانات والتي تتضمن استخراج البيانات وتحليل تأثير متغيرات البيانات على السوق والتحقق الأولي (من قبل خبراء الصناعة). تتضمن نماذج البيانات شبكة تحديد موقف البائعين، وتحليل خط زمني للسوق، ونظرة عامة على السوق ودليل، وشبكة تحديد موقف الشركة، وتحليل براءات الاختراع، وتحليل التسعير، وتحليل حصة الشركة في السوق، ومعايير القياس، وتحليل حصة البائعين على المستوى العالمي مقابل الإقليمي. لمعرفة المزيد عن منهجية البحث، أرسل استفسارًا للتحدث إلى خبراء الصناعة لدينا.

التخصيص متاح

تعد Data Bridge Market Research رائدة في مجال البحوث التكوينية المتقدمة. ونحن نفخر بخدمة عملائنا الحاليين والجدد بالبيانات والتحليلات التي تتطابق مع هدفهم. ويمكن تخصيص التقرير ليشمل تحليل اتجاه الأسعار للعلامات التجارية المستهدفة وفهم السوق في بلدان إضافية (اطلب قائمة البلدان)، وبيانات نتائج التجارب السريرية، ومراجعة الأدبيات، وتحليل السوق المجدد وقاعدة المنتج. ويمكن تحليل تحليل السوق للمنافسين المستهدفين من التحليل القائم على التكنولوجيا إلى استراتيجيات محفظة السوق. ويمكننا إضافة عدد كبير من المنافسين الذين تحتاج إلى بيانات عنهم بالتنسيق وأسلوب البيانات الذي تبحث عنه. ويمكن لفريق المحللين لدينا أيضًا تزويدك بالبيانات في ملفات Excel الخام أو جداول البيانات المحورية (كتاب الحقائق) أو مساعدتك في إنشاء عروض تقديمية من مجموعات البيانات المتوفرة في التقرير.