سوق معدات تربية الأحياء المائية في أمريكا الشمالية، حسب النوع (معدات تنقية المياه، أجهزة التهوية، معدات تدوير المياه والتهوية، وحدة تغذية الأسماك الأوتوماتيكية، معدات الصيد، معدات الاحتواء، بكرات الشباك، معدات الصيانة والإصلاح، جهاز التحكم في درجة حرارة المياه، أداة اختبار جودة المياه، معدات البركة الصافية، وغيرها)، التطبيق (تربية الأحياء المائية في الهواء الطلق، تربية الأحياء المائية في الأماكن المغلقة) الاستخدام النهائي (الحيوانات المائية، النباتات المائية)، قناة التوزيع (المباشرة وغير المباشرة) اتجاهات الصناعة والتوقعات حتى عام 2029.

تحليل ورؤى حول سوق معدات تربية الأحياء المائية في أمريكا الشمالية

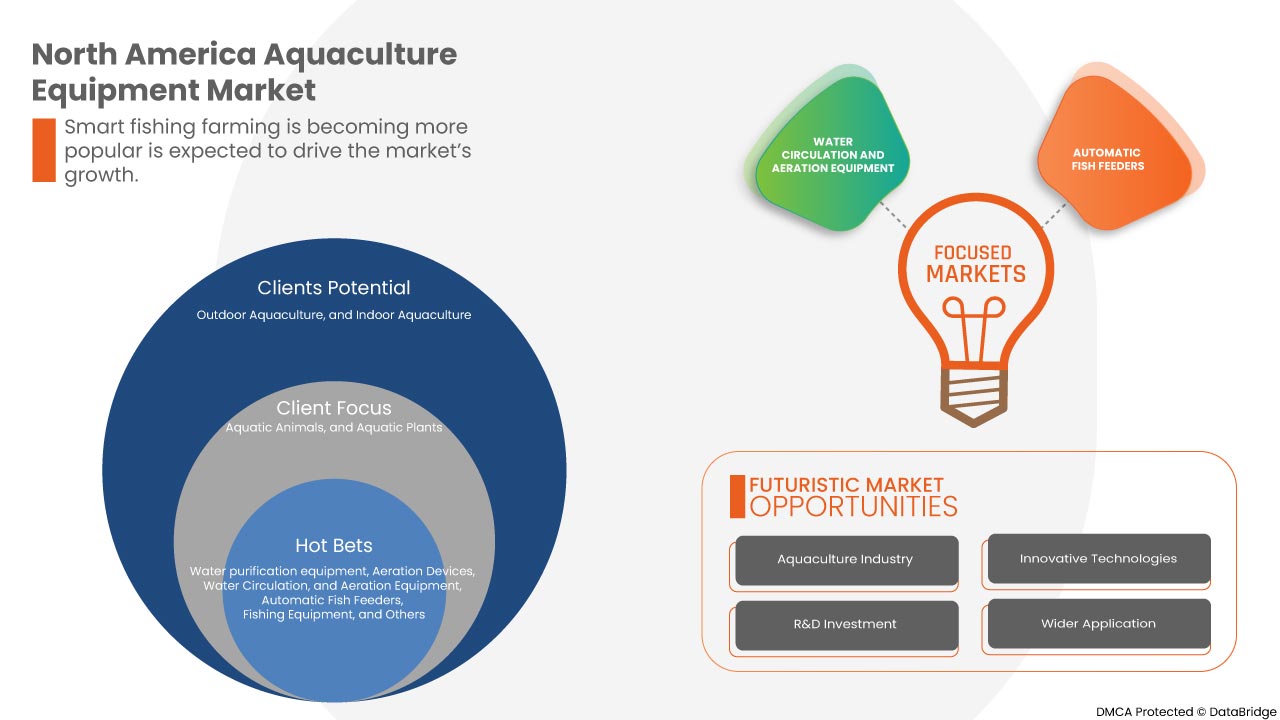

من المتوقع أن يؤدي ارتفاع تجارة المأكولات البحرية والطلب المتزايد على الزراعة المائية إلى زيادة الطلب على سوق معدات تربية الأحياء المائية في أمريكا الشمالية. ومع ذلك، فإن المخاوف بشأن سلامة الغذاء في تربية الأحياء المائية وانتشار الأمراض والطفيليات القاتلة قد تحد من نمو السوق.

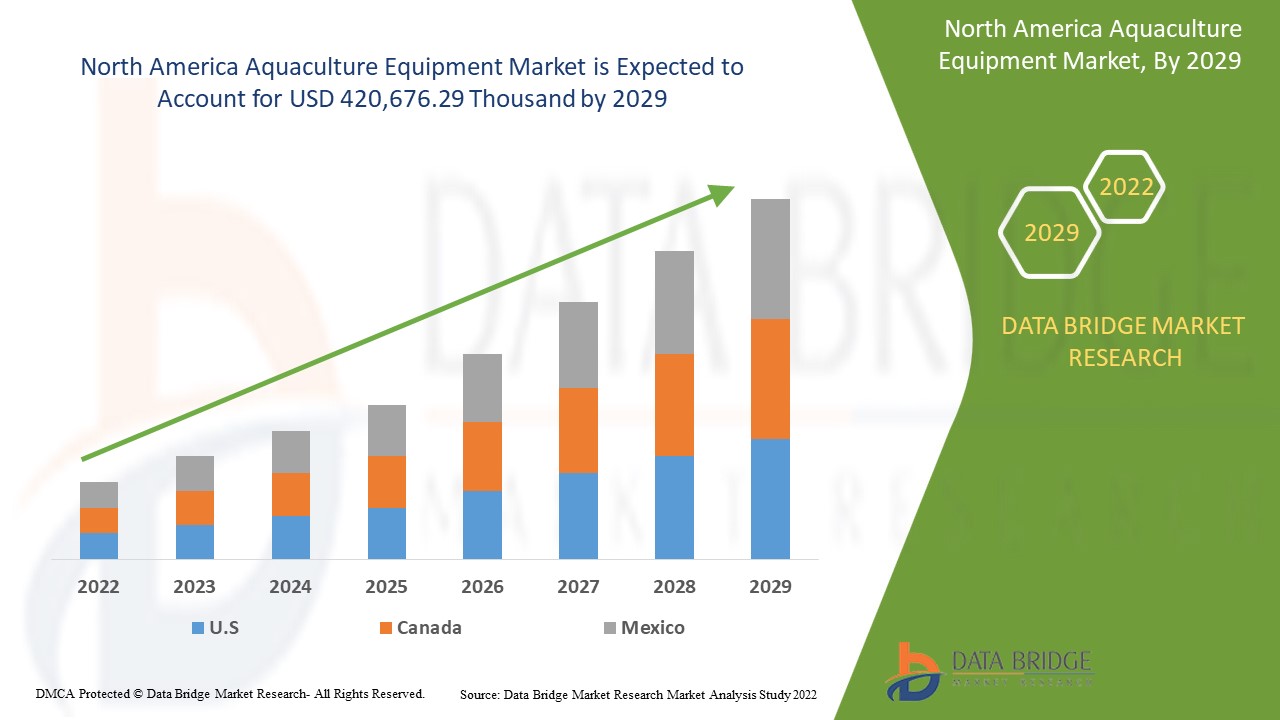

تحلل شركة Data Bridge Market Research أن سوق معدات تربية الأحياء المائية في أمريكا الشمالية من المتوقع أن تصل قيمته إلى 420,676.29 ألف دولار أمريكي بحلول عام 2029، بمعدل نمو سنوي مركب قدره 3.7% خلال الفترة المتوقعة. تشكل معدات تنقية المياه أكبر شريحة من الأنواع في سوق معدات تربية الأحياء المائية في أمريكا الشمالية. يغطي تقرير سوق معدات تربية الأحياء المائية في أمريكا الشمالية أيضًا تحليل الأسعار وتحليل براءات الاختراع والتقدم التكنولوجي بعمق.

|

تقرير القياس |

تفاصيل |

|

فترة التنبؤ |

2022 إلى 2029 |

|

سنة الأساس |

2021 |

|

سنوات تاريخية |

2020 (قابلة للتخصيص حتى 2019 - 2014) |

|

وحدات كمية |

الإيرادات بالألف دولار أمريكي |

|

القطاعات المغطاة |

حسب النوع (معدات تنقية المياه، أجهزة التهوية، معدات تدوير المياه والتهوية، وحدة تغذية الأسماك الأوتوماتيكية، معدات الصيد، معدات الاحتواء، بكرات الشباك، معدات الصيانة والإصلاح، جهاز التحكم في درجة حرارة المياه، أداة اختبار جودة المياه، معدات البركة الصافية، وغيرها)، التطبيق (تربية الأحياء المائية في الهواء الطلق، تربية الأحياء المائية في الأماكن المغلقة)، الاستخدام النهائي (الحيوانات المائية، النباتات المائية)، قناة التوزيع (مباشرة، غير مباشرة). |

|

الدول المغطاة |

الولايات المتحدة وكندا والمكسيك |

|

الجهات الفاعلة في السوق المشمولة |

شركة AquacuLture Systems Technologies, LLC، وSKAGINN 3X، وNorfab Equipment Ltd.، وSino-Aqua Corporation، وBAADER، وFAIVRE Ets، وCflow، وFREA SOLUTIONS، وAquamof Aquaculture Technologies Ltd. وغيرها. |

تعريف السوق

تربية الأحياء المائية هي تربية النباتات المائية والحيوانات المائية والكائنات المائية الأخرى. إنها تربية وتربية وحصاد الكائنات الحية في البيئات المائية. لذلك، تشير معدات تربية الأحياء المائية إلى المعدات المستخدمة في عملية تربية الأحياء المائية. على مدار العام، اكتسبت صناعة تربية الأحياء المائية زخمًا كبيرًا في معدل نموها وأظهرت إمكانات كبيرة للنمو. ونتيجة لذلك، يدخل المزيد والمزيد من اللاعبين في هذا المجال.

ديناميكيات سوق معدات تربية الأحياء المائية في أمريكا الشمالية

يتناول هذا القسم فهم محركات السوق والمزايا والفرص والقيود والتحديات. وسيتم مناقشة كل هذا بالتفصيل أدناه:

السائقين

-

صعود وتوسع ونمو صناعة تربية الأحياء المائية

إن تربية الأحياء المائية، أو تربية الأسماك والمأكولات البحرية، هي أسرع المجالات نمواً في مجال صناعة الأغذية الحيوانية. وقد غذت التوسعات في تجارة أمريكا الشمالية، وانخفاض توافر الأسماك البرية، وأسعار المنتجات التنافسية، وارتفاع الدخول، والتحضر نمو تربية الأحياء المائية - وكل هذا يساهم في ارتفاع استهلاك الفرد من المأكولات البحرية في جميع أنحاء العالم. وعلاوة على ذلك، فإن إجراء التطورات التقنية الإبداعية، والاستثمار في البحث والتطوير، والتعاون مع كبار اللاعبين في الصناعة من شأنه أن يوسع ويوسع نطاق أعمال تربية الأحياء المائية في جميع أنحاء العالم. وهذا من شأنه أيضاً أن يزيد من نمو معدات تربية الأحياء المائية مثل أجهزة التهوية والمضخات والمغذيات والمرشحات وغيرها التي تعتمد على صناعات تربية الأحياء المائية. وبالتالي، ونتيجة لنمو أعمال تربية الأحياء المائية، سيرتفع الطلب على معدات تربية الأحياء المائية. ومن المتوقع في المستقبل المنظور أن يؤدي هذا إلى دفع سوق معدات تربية الأحياء المائية في أمريكا الشمالية.

-

زيادة في تجارة المأكولات البحرية

بفضل عقود من زيادة إنتاج مصايد الأسماك وتربية الأحياء المائية والطلب المتزايد في أمريكا الشمالية، أصبحت المأكولات البحرية واحدة من أكثر فئات الأغذية تداولاً في العالم اليوم. يكشف أسرع معدل نمو لتجارة المنتجات المائية أن نسبة أعلى من أحجام تجارة المأكولات البحرية تتألف من أنواع مختلفة. تلعب البلدان النامية دورًا رئيسيًا في صادرات المأكولات البحرية حيث تعتمد البلدان المتقدمة بشكل متزايد على البلدان النامية في واردات الأنواع عالية القيمة. وبالتالي، فإن زيادة تجارة المأكولات البحرية تزيد من نمو صناعات تربية الأحياء المائية، وهذا من شأنه أن يؤدي إلى زيادة الطلب على معدات تربية الأحياء المائية. ومن المتوقع أن يؤدي هذا إلى دفع سوق معدات تربية الأحياء المائية في المستقبل القريب.

فرص

-

إجراءات حكومية متزايدة لتعزيز تربية الأحياء المائية

توفر مصايد الأسماك وتربية الأحياء المائية الغذاء لمئات الملايين من الناس في جميع أنحاء العالم كل يوم. كما أنها تساعد في إنتاج الغذاء وتساعد الحيوانات المهددة بالانقراض من خلال خدمة مجموعة متنوعة من الوظائف. إن مبادرات الحكومات، مثل اللوائح والبرامج التي تعزز توسع قطاع تربية الأحياء المائية، لا تخدم سوى تمهيد الطريق للتنمية المستقبلية جنبًا إلى جنب مع الحلول التكنولوجية. سيخلق هذا التوسع فرصًا إضافية للمشاركين المهمين في الصناعة والمزارعين في المستقبل المنظور، مما يجعل تربية الأحياء المائية قطاعًا يجب مراقبته. ونتيجة لهذا، من المتوقع أن توفر التدابير الحكومية المتزايدة لتعزيز تربية الأحياء المائية فرصة نمو السوق لسوق معدات تربية الأحياء المائية

القيود/التحديات

- المخاوف بشأن سلامة الغذاء في تربية الأحياء المائية

تُظهِر البيانات الوبائية عن العدوى المنقولة بالغذاء أن الأسماك التي يتم جمعها من المحيطات المفتوحة تكون عادةً وجبات آمنة وصحية إذا تم تبريدها بسرعة ومعالجتها بشكل مناسب. من ناحية أخرى، ارتبطت منتجات تربية الأحياء المائية ببعض المخاوف المتعلقة بسلامة الأغذية، حيث أن خطر التلوث بالعوامل الكيميائية والبيولوجية أعلى في الموائل ذات المياه العذبة والساحلية مقارنة بالمحيطات المفتوحة. ونتيجة لذلك، فإن الافتقار إلى البنية الأساسية والقيود الحكومية المتسقة قد تحد من توسع السوق. من المؤكد أن إنتاج تربية الأحياء المائية سيصبح وسيلة متزايدة الأهمية لإنتاج المنتجات المائية للاستهلاك البشري، ولكن المخاطر المرتبطة بسلامة الأغذية فيما يتعلق بتربية الأحياء المائية ستتضرر بشدة في الاقتصاد. ستعيق هذه المخاوف المتعلقة بسلامة الأغذية في تربية الأحياء المائية نمو صناعة تربية الأحياء المائية، وبالتالي تحد من نمو سوق معدات تربية الأحياء المائية.

- صعوبات الصيد الجائر

مع اصطياد 90% من "مخزون الأسماك" البري في العالم بالكامل أو استغلاله بشكل مفرط أو استنفاده، فإن تربية الأحياء المائية في ازدياد؛ ومع ذلك، لا يزال من غير الواضح ما إذا كانت تربية الأحياء المائية تشكل حلاً لمشكلة الصيد الجائر. إن الصيد الجائر في ازدياد حيث أصبحت المأكولات البحرية واحدة من أكثر السلع الغذائية تداولاً على هذا الكوكب. عندما يتم صيد الأسماك بشكل مفرط، فإن النظم البيئية البحرية الهشة التي يعتمد عليها كوكبنا تتعرض للاضطراب. تربية الأحياء المائية، التي تغطي كل من الأنواع التي تعيش في المياه المالحة والمياه العذبة، هي تقنية تربية الأسماك في ظل ظروف خاضعة للرقابة. إنها أسرع صناعة إنتاج غذائي نمواً في العالم، حيث تمثل حوالي 44% من إجمالي الأسماك المستهلكة، ولكن من أجل الحفاظ على توسعها، فإنها تعتمد في المقام الأول على صيد الأسماك البرية. وبالتالي، فإن الصعوبات المتعلقة بالصيد الجائر قد تشكل تحديًا لصناعة تربية الأحياء المائية، وقد يشكل هذا تحديًا لنمو سوق معدات تربية الأحياء المائية.

تأثير ما بعد كوفيد-19 على سوق معدات تربية الأحياء المائية في أمريكا الشمالية

أثرت جائحة كوفيد-19 على العديد من الصناعات التحويلية في عامي 2020 و2021، حيث أدت إلى إغلاق أماكن العمل، وتعطل سلاسل التوريد، وفرض قيود على النقل. وبسبب الإغلاق، شهد السوق انخفاضًا في المبيعات بسبب إغلاق منافذ البيع بالتجزئة والقيود المفروضة على وصول العملاء على مدار السنوات القليلة الماضية.

ومع ذلك، فإن نمو السوق في فترة ما بعد الوباء يُعزى إلى زيادة الوعي الصحي بين المستهلكين والطلب المتزايد على المأكولات البحرية الصحية والمغذية. وقد أدى هذا إلى زيادة شعبية تربية الأحياء المائية بين الناس بسبب الفوائد الصحية المختلفة والشعبية المتزايدة للأطعمة الغنية بالبروتين. يتخذ اللاعبون الرئيسيون في السوق قرارات استراتيجية مختلفة للعودة بعد كوفيد-19. يقوم اللاعبون بإجراء أنشطة بحث وتطوير متعددة لتحسين عروضهم. إنهم يعززون حصتهم في السوق من خلال استكشاف قنوات البيع بالتجزئة المختلفة والتوسع في مناطق جديدة.

التطورات الأخيرة

- في أغسطس 2022، وقعت شركة SKAGINN 3X عقدًا مع شركة BlueWild النرويجية لتوريد مصنع كامل لمعالجة الأسماك على متن سفينة الصيد الجديدة المبتكرة للشركة. تم تصميم سفينة الصيد لتوفير الاستدامة والجودة والكفاءة على جميع المستويات. يعد هذا الاتفاق إنجازًا مهمًا للمنظمة.

- في أبريل 2022، شاركت شركة Cflow AS في معرض Nor-Shipping من الرابع إلى السابع من أبريل. يقع معرض Nor-Shipping في قلب المحيطات. هذا هو المكان الذي تلتقي فيه الصناعات البحرية والمحيطية كل عامين - وهو مركز طبيعي لصناع القرار الرئيسيين من جميع أنحاء العالم للتواصل والتعاون وإبرام الصفقات لفتح فرص عمل جديدة.

- في فبراير 2022، وقعت شركة AquaMaof Aquaculture Technologies Ltd.، وهي شركة رائدة في أمريكا الشمالية في مجال تكنولوجيا RAS لتربية الأحياء المائية على اليابسة، أول عقد لها في تشيلي مع شركة Atacama Yellowtail SpA (AYT) لزراعة وإنتاج 900 طن من سمكة Yellowtail Kingfish (Seriola lalandi) في منطقة كوكيمبو. سيساعد هذا الشركة على الحصول على المزيد من الاستثمار وزيادة أنشطتها الاقتصادية في جميع أنحاء العالم.

نطاق سوق معدات تربية الأحياء المائية في أمريكا الشمالية

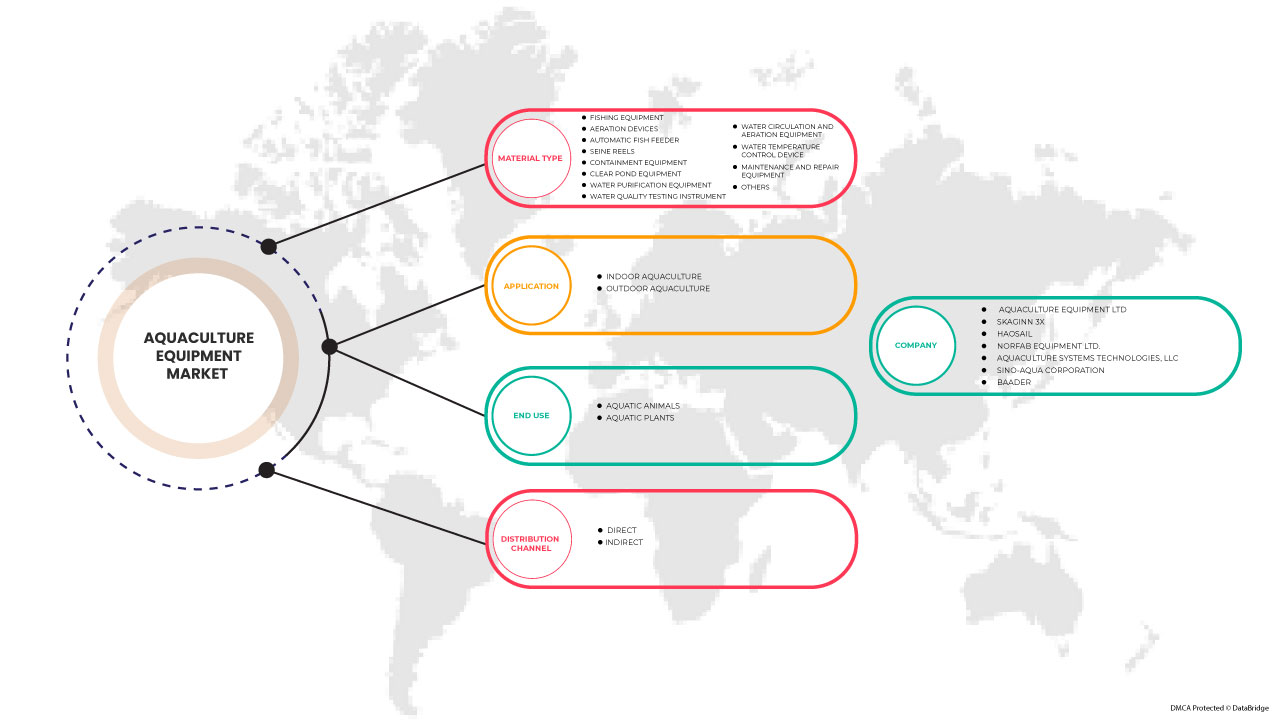

يتم تقسيم سوق معدات تربية الأحياء المائية في أمريكا الشمالية على أساس النوع والتطبيق والاستخدام النهائي وقناة التوزيع. سيساعدك النمو بين هذه القطاعات على تحليل قطاعات النمو الرئيسية في الصناعات وتزويد المستخدمين بنظرة عامة قيمة على السوق ورؤى السوق لمساعدتهم على اتخاذ قرارات استراتيجية لتحديد تطبيقات السوق الأساسية.

يكتب

- معدات تنقية المياه

- أجهزة التهوية

- معدات تدوير المياه والتهوية

- وحدة تغذية الأسماك الأوتوماتيكية

- معدات الصيد

- معدات الاحتواء

- بكرات السين

- معدات الصيانة والإصلاح

- جهاز التحكم في درجة حرارة الماء

- جهاز اختبار جودة المياه

- معدات تنظيف البركة

- آحرون

بناءً على النوع، يتم تقسيم سوق معدات تربية الأحياء المائية في أمريكا الشمالية إلى معدات تنقية المياه، وأجهزة التهوية، ومعدات تدوير المياه والتهوية، ووحدة تغذية الأسماك الأوتوماتيكية، ومعدات الصيد، ومعدات الاحتواء، وبكرات الشباك، ومعدات الصيانة والإصلاح، وجهاز التحكم في درجة حرارة المياه، وأداة اختبار جودة المياه، ومعدات البركة الصافية، وغيرها.

طلب

- تربية الأحياء المائية في الهواء الطلق

- تربية الأحياء المائية في الأماكن المغلقة

على أساس التطبيق، يتم تقسيم سوق معدات تربية الأحياء المائية في أمريكا الشمالية إلى تربية الأحياء المائية في الهواء الطلق وتربية الأحياء المائية في الأماكن المغلقة.

الاستخدام النهائي

- الحيوانات المائية

- النباتات المائية

بناءً على الاستخدام النهائي، يتم تقسيم سوق معدات تربية الأحياء المائية في أمريكا الشمالية إلى الحيوانات المائية والنباتات المائية.

قناة التوزيع

- مباشر

- غير مباشر

بناءً على قناة التوزيع، يتم تقسيم سوق معدات تربية الأحياء المائية في أمريكا الشمالية إلى مباشرة وغير مباشرة.

تحليل/رؤى إقليمية لسوق معدات تربية الأحياء المائية في أمريكا الشمالية

يتم تحليل سوق معدات تربية الأحياء المائية في أمريكا الشمالية، ويتم توفير رؤى حجم السوق واتجاهاتها حسب البلد والنوع والتطبيق والاستخدام النهائي وقناة التوزيع، كما هو مذكور أعلاه.

يغطي سوق معدات تربية الأحياء المائية في أمريكا الشمالية دولًا مثل الولايات المتحدة وكندا والمكسيك.

من المتوقع أن تهيمن الولايات المتحدة على سوق معدات تربية الأحياء المائية في أمريكا الشمالية بسبب زيادة إنتاج تربية الأحياء المائية في البلاد. كانت الولايات المتحدة القوة الدافعة وراء التبني السريع لمعدات تربية الأحياء المائية في منطقة أمريكا الشمالية. كندا والمكسيك دولتان أخريان حيث يتزايد الطلب بسبب الشعبية المتزايدة لتربية الأحياء المائية بين المستهلكين.

يوفر قسم الدولة في تقرير سوق معدات تربية الأحياء المائية في أمريكا الشمالية أيضًا عوامل فردية تؤثر على السوق والتغييرات التنظيمية المحلية التي تؤثر على اتجاهات السوق الحالية والمستقبلية. تعد نقاط البيانات مثل المبيعات الجديدة ومبيعات الاستبدال والتركيبة السكانية للبلد وعلم الأوبئة المرضية وتعريفات الاستيراد والتصدير من بين المؤشرات المهمة المستخدمة للتنبؤ بسيناريو السوق للدول الفردية. كما يتم النظر في وجود وتوافر العلامات التجارية في أمريكا الشمالية والتحديات التي تواجهها بسبب المنافسة الكبيرة أو النادرة من العلامات التجارية المحلية والمحلية وتأثير قنوات المبيعات أثناء تقديم تحليل توقعات لبيانات الدولة.

تحليل المشهد التنافسي وحصة سوق معدات تربية الأحياء المائية في أمريكا الشمالية

يوفر المشهد التنافسي لسوق معدات تربية الأحياء المائية في أمريكا الشمالية تفاصيل عن المنافس. تتضمن التفاصيل نظرة عامة على الشركة، والبيانات المالية للشركة، والإيرادات المتولدة، وإمكانات السوق، والاستثمار في البحث والتطوير، والمبادرات الجديدة في السوق، والحضور في أمريكا الشمالية، ومواقع الإنتاج والمرافق، والقدرات الإنتاجية، ونقاط القوة والضعف للشركة، وإطلاق الحلول، وعرض المنتج ونطاقه، وهيمنة التطبيق. ترتبط نقاط البيانات المذكورة أعلاه فقط بتركيز الشركات على سوق معدات تربية الأحياء المائية في أمريكا الشمالية.

بعض اللاعبين الرئيسيين العاملين في سوق معدات تربية الأحياء المائية في أمريكا الشمالية هم Aquaculture Systems Technologies، LLC، وSKAGINN 3X، وNorfab Equipment Ltd.، وSino-Aqua Corporation، وBAADER، وFAIVRE Ets، وCflow، وFREA SOLUTIONS، وAquamof Aquaculture Technologies Ltd. وغيرها.

SKU-

احصل على إمكانية الوصول عبر الإنترنت إلى التقرير الخاص بأول سحابة استخبارات سوقية في العالم

- لوحة معلومات تحليل البيانات التفاعلية

- لوحة معلومات تحليل الشركة للفرص ذات إمكانات النمو العالية

- إمكانية وصول محلل الأبحاث للتخصيص والاستعلامات

- تحليل المنافسين باستخدام لوحة معلومات تفاعلية

- آخر الأخبار والتحديثات وتحليل الاتجاهات

- استغل قوة تحليل المعايير لتتبع المنافسين بشكل شامل

Table of Content

1 INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 OVERVIEW OF THE NORTH AMERICA AQUACULTURE EQUIPMENT MARKET

1.4 LIMITATIONS

1.5 MARKETS COVERED

2 MARKET SEGMENTATION

2.1 MARKETS COVERED

2.2 GEOGRAPHICAL SCOPE

2.3 YEARS CONSIDERED FOR THE STUDY

2.4 CURRENCY AND PRICING

2.5 DBMR TRIPOD DATA VALIDATION MODEL

2.6 TYPE LIFELINE CURVE

2.7 MULTIVARIATE MODELING

2.8 PRIMARY INTERVIEWS WITH KEY OPINION LEADERS

2.9 DBMR MARKET POSITION GRID

2.1 MARKET END USE COVERAGE GRID

2.11 DBMR MARKET CHALLENGE MATRIX

2.12 DBMR VENDOR SHARE ANALYSIS

2.13 IMPORT-EXPORT DATA

2.14 SECONDARY SOURCES

2.15 ASSUMPTIONS

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

4.1 BRAND OUTLOOK

4.1.1 COMPARATIVE BRAND ANALYSIS

4.1.2 PRODUCT VS BRAND OVERVIEW

4.2 FACTORS INFLUENCING PURCHASING DECISION OF CUSTOMER

4.2.1 ECONOMIC FACTOR

4.2.2 FUNCTIONAL FACTOR

4.3 GROWTH STRATEGIES ADOPTED BY KEY MARKET PLAYERS

4.4 INDUSTRY TRENDS AND FUTURE PERSPECTIVE

4.4.1 INDUSTRY TRENDS FOR NORTHERN EUROPE

4.5 NEW PRODUCT LAUNCH STRATEGY

4.5.1 OVERVIEW

4.5.2 NUMBER OF NEW PRODUCT LAUNCHES

4.5.3 MEETING CONSUMER REQUIREMENT

4.6 IMPACT OF ECONOMIC SLOWDOWN

4.7 TECHNOLOGICAL ADVANCEMENT BY MANUFACTURERS

4.7.1 TECHNOLOGICAL ADVANCMENTS IN NORTHERN EUROPE

4.8 SUPPLY CHAIN ANALYSIS

4.8.1 RAW MATERIAL PROCUREMENT

4.8.2 MANUFACTURING AND PACKING

4.8.3 MARKETING AND DISTRIBUTION

4.8.4 END USERS

4.9 VALUE CHAIN ANALYSIS

5 REGULATORY FRAMEWORK AND GUIDELINES

6 MARKET OVERVIEW

6.1 DRIVERS

6.1.1 THE RISE, EXPANSION, AND GROWTH OF THE AQUACULTURE INDUSTRY

6.1.2 INCREASE IN SEAFOOD TRADING

6.1.3 DEMAND FOR AQUAPONICS IS INCREASING

6.1.4 SMART FISH FARMING IS BECOMING MORE POPULAR

6.2 RESTRAINTS

6.2.1 CONCERNS ABOUT FOOD SAFETY IN AQUACULTURE

6.2.2 THE SPREAD OF DEADLY DISEASES AND PARASITES

6.3 OPPORTUNITIES

6.3.1 RISING GOVERNMENT MEASURES TO BOOST AQUACULTURE

6.3.2 CONCENTRATING ON THE DEVELOPMENT OF INNOVATIVE TECHNOLOGY SOLUTIONS

6.3.3 ADEQUATE AND AFFORDABLE CREDIT AVAILABILITY AND FINANCING INSTRUMENTS

6.4 CHALLENGES

6.4.1 OVERFISHING DIFFICULTIES

6.4.2 AQUACULTURE'S ENVIRONMENTAL DIFFICULTIES AND CONCERNS

7 NORTH AMERICA AQUACULTURE EQUIPMENT MARKET, BY TYPE

7.1 OVERVIEW

7.2 WATER PURIFICATION EQUIPMENT

7.2.1 WATER PUMPS AND FILTERS

7.2.2 AERATORS

7.2.3 FEEDERS

7.2.4 PROTEIN SKIMMER

7.3 AERATION DEVICES

7.4 WATER CIRCULATION AND AERATION EQUIPMENT

7.5 AUTOMATIC FISH FEEDER

7.6 FISHING EQUIPMENT

7.7 CONTAINMENT EQUIPMENT

7.8 SEINE REELS

7.9 MAINTENANCE AND REPAIR EQUIPMENT

7.9.1 DIGGING TOOLS

7.9.2 LEVELLING TOOLS

7.9.3 DESILTING EQUIPMENT

7.9.4 OTHERS

7.1 WATER TEMPERATURE CONTROL DEVICES

7.11 WATER QUALITY TESTING INSTRUMENT

7.12 CLEAR POND EQUIPMENT

7.13 OTHERS

8 NORTH AMERICA AQUACULTURE EQUIPMENT MARKET, BY APPLICATION

8.1 OVERVIEW

8.2 OUTDOOR AQUACULTURE

8.2.1 BRACKISH WATER

8.2.2 MARINE

8.3 INDOOR AQUACULTURE

9 NORTH AMERICA AQUACULTURE EQUIPMENT MARKET, BY END USE

9.1 OVERVIEW

9.2 AQUATIC ANIMALS

9.2.1 FISH

9.2.2 MOLLUSKS

9.2.3 CRUSTACEAN

9.2.4 OTHERS

9.3 AQUATIC PLANTS

9.3.1 SUBMERGED (SEAWEED)

9.3.2 FLOATING (ALGAE)

9.3.3 EMERGED

10 NORTH AMERICA AQUACULTURE EQUIPMENT MARKET, BY DISTRIBUTION CHANNEL

10.1 OVERVIEW

10.2 DIRECT

10.3 INDIRECT

11 NORTH AMERICA AQUACULTURE EQUIPMENT MARKET, BY GEOGRAPHY

11.1 NORTH AMERICA

11.1.1 U.S.

11.1.2 CANADA

11.1.3 MEXICO

12 NORTH AMERICA AQUACULTURE EQUIPMENT MARKET: COMPANY LANDSCAPE

12.1 COMPANY SHARE ANALYSIS: NORTH AMERICA

12.1.1 NEW PRODUCTION FACILITY

12.1.2 EVENT

12.1.3 NEW PRODUCT LAUNCH

12.1.4 COLLABORATION

13 SWOT ANALYSIS

14 COMPANY PROFILES

14.1 BAADER

14.1.1 COMPANY SNAPSHOT

14.1.2 COMPANY SHARE ANALYSIS

14.1.3 PRODUCT PORTFOLIO

14.1.4 RECENT UPDATES

14.2 SKAGINN 3X

14.2.1 COMPANY SNAPSHOT

14.2.2 COMPANY SHARE ANALYSIS

14.2.3 PORTFOLIO

14.2.4 RECENT UPDATES

14.3 AQUAMAOF AQUACULTURE TECHNOLOGIES LTD.

14.3.1 COMPANY SNAPSHOT

14.3.2 COMPANY SHARE ANALYSIS

14.3.3 PRODUCT PORTFOLIO

14.3.4 RECENT UPDATES

14.4 NANRONG SHANGHAI CO., LTD.

14.4.1 COMPANY SNAPSHOT

14.4.2 COMPANY SHARE ANALYSIS

14.4.3 PRODUCT PORTFOLIO

14.4.4 RECENT UPDATES

14.5 CFLOW

14.5.1 COMPANY SNAPSHOT

14.5.2 COMPANY SHARE ANALYSIS

14.5.3 PRODUCT PORTFOLIO

14.5.4 RECENT UPDATES

14.6 AQUACULTURE EQUIPMENT LTD

14.6.1 COMPANY SNAPSHOT

14.6.2 PRODUCT PORTFOLIO

14.6.3 RECENT UPDATES

14.7 AQUACULTURE SYSTEMS TECHNOLOGIES, LLC

14.7.1 COMPANY SNAPSHOT

14.7.2 PRODUCT PORTFOLIO

14.7.3 RECENT UPDATES

14.8 AQUANEERING INCORPORATED

14.8.1 COMPANY SNAPSHOT

14.8.2 PRODUCT PORTFOLIO

14.8.3 RECENT UPDATES

14.9 DURA-TECH

14.9.1 COMPANY SNAPSHOT

14.9.2 PRODUCT PORTFOLIO

14.9.3 RECENT UPDATES

14.1 FAIVRE ETS

14.10.1 COMPANY SNAPSHOT

14.10.2 PRODUCT PORTFOLIO

14.10.3 RECENT UPDATES

14.11 FISHFARMFEEDER

14.11.1 COMPANY SNAPSHOT

14.11.2 PRODUCT PORTFOLIO

14.11.3 RECENT UPDATES

14.12 FREA SOLUTIONS

14.12.1 COMPANY SNAPSHOT

14.12.2 PRODUCT PORTFOLIO

14.12.3 RECENT UPDATES

14.13 HAOSAIL

14.13.1 COMPANY SNAPSHOT

14.13.2 PRODUCT PORTFOLIO

14.13.3 RECENT UPDATES

14.14 HUNG STAR ENTERPRISE CORP.

14.14.1 COMPANY SNAPSHOT

14.14.2 PRODUCT PORTFOLIO

14.14.3 RECENT UPDATES

14.15 NORFAB EQUIPMENT LTD.

14.15.1 COMPANY SNAPSHOT

14.15.2 PRODUCT PORTFOLIO

14.15.3 RECENT UPDATES

14.16 PIONEER GROUP

14.16.1 COMPANY SNAPSHOT

14.16.2 PRODUCT PORTFOLIO

14.16.3 RECENT UPDATES

14.17 RASTAQUACULTURE

14.17.1 COMPANY SNAPSHOT

14.17.2 PRODUCT PORTFOLIO

14.17.3 RECENT UPDATES

14.18 SAGAR AQUACULTURE PVT LTD

14.18.1 COMPANY SNAPSHOT

14.18.2 PRODUCT PORTFOLIO

14.18.3 RECENT UPDATES

14.19 SINO-AQUA CORPORATION

14.19.1 COMPANY SNAPSHOT

14.19.2 PRODUCT PORTFOLIO

14.19.3 RECENT UPDATES

14.2 SRR AQUA SUPPLIERS LLP

14.20.1 COMPANY SNAPSHOT

14.20.2 PRODUCT PORTFOLIO

14.20.3 RECENT UPDATES

15 QUESTIONNAIRE

16 RELATED REPORTS

List of Table

TABLE 1 IMPORT DATA OF AIR PUMPS, AIR OR OTHER GAS COMPRESSORS AND VENTILATING OR RECYCLING HOODS, AND OTHER AQUACULTURE EQUIPMENT; HS CODE – 841480 (USD THOUSAND)

TABLE 2 EXPORT DATA OF AIR PUMPS, AIR OR OTHER GAS COMPRESSORS AND VENTILATING OR RECYCLING HOODS AND OTHER AQUACULTURE EQUIPMENT; HS CODE – 841480 (USD THOUSAND)

TABLE 3 REGULATORY FRAMEWORK

TABLE 4 NORTH AMERICA AQUACULTURE EQUIPMENT MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 5 NORTH AMERICA AQUACULTURE EQUIPMENT MARKET, BY TYPE, 2020-2029 (THOUSAND UNITS)

TABLE 6 NORTH AMERICA WATER PURIFICATION EQUIPMENT IN AQUACULTURE EQUIPMENT MARKET, BY REGION, 2020-2029 (USD THOUSAND)

TABLE 7 NORTH AMERICA WATER PURIFICATION EQUIPMENT IN AQUACULTURE EQUIPMENT MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 8 NORTH AMERICA AERATION DEVICES IN AQUACULTURE EQUIPMENT MARKET, BY REGION, 2020-2029 (USD THOUSAND)

TABLE 9 NORTH AMERICA WATER CIRCULATION AND AERATION EQUIPMENT IN AQUACULTURE EQUIPMENT MARKET, BY REGION, 2020-2029 (USD THOUSAND)

TABLE 10 NORTH AMERICA AUTOMATIC FISH FEEDER IN AQUACULTURE EQUIPMENT MARKET, BY REGION, 2020-2029 (USD THOUSAND)

TABLE 11 NORTH AMERICA FISHING EQUIPMENT IN AQUACULTURE EQUIPMENT MARKET, BY REGION, 2020-2029 (USD THOUSAND)

TABLE 12 NORTH AMERICA CONTAINMENT EQUIPMENT IN AQUACULTURE EQUIPMENT MARKET, BY REGION, 2020-2029 (USD THOUSAND)

TABLE 13 NORTH AMERICA SEINE REELS IN AQUACULTURE EQUIPMENT MARKET, BY REGION, 2020-2029 (USD THOUSAND)

TABLE 14 NORTH AMERICA MAINTENANCE AND REPAIR EQUIPMENT IN AQUACULTURE EQUIPMENT MARKET, BY REGION, 2020-2029 (USD THOUSAND)

TABLE 15 NORTH AMERICA MAINTENANCE AND REPAIR EQUIPMENT IN AQUACULTURE EQUIPMENT MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 16 NORTH AMERICA WATER TEMPERATURE CONTROL DEVICES IN AQUACULTURE EQUIPMENT MARKET, BY REGION, 2020-2029 (USD THOUSAND)

TABLE 17 NORTH AMERICA WATER QUALITY TESTING INSTRUMENT IN AQUACULTURE EQUIPMENT MARKET, BY REGION, 2020-2029 (USD THOUSAND)

TABLE 18 NORTH AMERICA CLEAR POND EQUIPMENT IN AQUACULTURE EQUIPMENT MARKET, BY REGION, 2020-2029 (USD THOUSAND)

TABLE 19 NORTH AMERICA OTHERS IN AQUACULTURE EQUIPMENT MARKET, BY REGION, 2020-2029 (USD THOUSAND)

TABLE 20 NORTH AMERICA AQUACULTURE EQUIPMENT MARKET, BY APPLICATION, 2020-2029 (USD THOUSAND)

TABLE 21 NORTH AMERICA OUTDOOR AQUACULTURE IN AQUACULTURE EQUIPMENT MARKET, BY REGION, 2020-2029 (USD THOUSAND)

TABLE 22 NORTH AMERICA OUTDOOR AQUACULTURE IN AQUACULTURE EQUIPMENT MARKET, BY APPLICATION, 2020-2029 (USD THOUSAND)

TABLE 23 NORTH AMERICA INDOOR AQUACULTURE IN AQUACULTURE EQUIPMENT MARKET, BY REGION, 2020-2029 (USD THOUSAND)

TABLE 24 NORTH AMERICA AQUACULTURE EQUIPMENT MARKET, BY END-USE, 2020-2029 (USD THOUSAND)

TABLE 25 NORTH AMERICA AQUATIC ANIMALS IN AQUACULTURE EQUIPMENT MARKET, BY REGION, 2020-2029 (USD THOUSAND)

TABLE 26 NORTH AMERICA AQUATIC ANIMALS IN AQUACULTURE EQUIPMENT MARKET, BY END-USE, 2020-2029 (USD THOUSAND)

TABLE 27 NORTH AMERICA AQUATIC PLANTS IN AQUACULTURE EQUIPMENT MARKET, BY REGION, 2020-2029 (USD THOUSAND)

TABLE 28 NORTH AMERICA AQUATIC PLANTS IN AQUACULTURE EQUIPMENT MARKET, BY END-USE, 2020-2029 (USD THOUSAND)

TABLE 29 NORTH AMERICA AQUACULTURE EQUIPMENT MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD THOUSAND)

TABLE 30 NORTH AMERICA DIRECT IN AQUACULTURE EQUIPMENT MARKET, BY REGION, 2020-2029 (USD THOUSAND)

TABLE 31 NORTH AMERICA INDIRECT IN AQUACULTURE EQUIPMENT MARKET, BY REGION, 2020-2029 (USD THOUSAND)

TABLE 32 NORTH AMERICA AQUACULTURE EQUIPMENT MARKET, BY COUNTRY, 2020-2029 (USD THOUSAND)

TABLE 33 NORTH AMERICA AQUACULTURE EQUIPMENT MARKET, BY COUNTRY, 2020-2029 (THOUSAND UNITS)

TABLE 34 NORTH AMERICA AQUACULTURE EQUIPMENT MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 35 NORTH AMERICA AQUACULTURE EQUIPMENT MARKET, BY TYPE, 2020-2029 (THOUSAND UNITS)

TABLE 36 NORTH AMERICA WATER PURIFICATION IN AQUACULTURE EQUIPMENT MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 37 NORTH AMERICA MAINTENANCE & REPAIR EQUIPMENT IN AQUACULTURE EQUIPMENT MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 38 NORTH AMERICA AQUACULTURE EQUIPMENT MARKET, BY APPLICATION, 2020-2029 (USD THOUSAND)

TABLE 39 NORTH AMERICA OUTDOOR AQUACULTURE IN AQUACULTURE EQUIPMENT MARKET, BY APPLICATION, 2020-2029 (USD THOUSAND)

TABLE 40 NORTH AMERICA AQUACULTURE EQUIPMENT MARKET, BY END - USE, 2020-2029 (USD THOUSAND)

TABLE 41 NORTH AMERICA AQUATIC ANIMALS IN AQUACULTURE EQUIPMENT MARKET, BY END- USE, 2020-2029 (USD THOUSAND)

TABLE 42 NORTH AMERICA AQUATIC PLANTS IN AQUACULTURE EQUIPMENT MARKET, BY END- USE, 2020-2029 (USD THOUSAND)

TABLE 43 NORTH AMERICA AQUACULTURE EQUIPMENT MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD THOUSAND)

TABLE 44 U.S. AQUACULTURE EQUIPMENT MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 45 U.S. AQUACULTURE EQUIPMENT MARKET, BY TYPE, 2020-2029 (THOUSAND UNITS)

TABLE 46 U.S. WATER PURIFICATION IN AQUACULTURE EQUIPMENT MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 47 U.S. MAINTENANCE & REPAIR EQUIPMENT IN AQUACULTURE EQUIPMENT MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 48 U.S. AQUACULTURE EQUIPMENT MARKET, BY APPLICATION, 2020-2029 (USD THOUSAND)

TABLE 49 U.S. OUTDOOR AQUACULTURE IN AQUACULTURE EQUIPMENT MARKET, BY APPLICATION, 2020-2029 (USD THOUSAND)

TABLE 50 U.S. AQUACULTURE EQUIPMENT MARKET, BY END - USE, 2020-2029 (USD THOUSAND)

TABLE 51 U.S. AQUATIC ANIMALS IN AQUACULTURE EQUIPMENT MARKET, BY END- USE, 2020-2029 (USD THOUSAND)

TABLE 52 U.S. AQUATIC PLANTS IN AQUACULTURE EQUIPMENT MARKET, BY END- USE, 2020-2029 (USD THOUSAND)

TABLE 53 U.S. AQUACULTURE EQUIPMENT MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD THOUSAND)

TABLE 54 CANADA AQUACULTURE EQUIPMENT MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 55 CANADA AQUACULTURE EQUIPMENT MARKET, BY TYPE, 2020-2029 (THOUSAND UNITS)

TABLE 56 CANADA WATER PURIFICATION IN AQUACULTURE EQUIPMENT MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 57 CANADA MAINTENANCE & REPAIR EQUIPMENT IN AQUACULTURE EQUIPMENT MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 58 CANADA AQUACULTURE EQUIPMENT MARKET, BY APPLICATION, 2020-2029 (USD THOUSAND)

TABLE 59 CANADA OUTDOOR AQUACULTURE IN AQUACULTURE EQUIPMENT MARKET, BY APPLICATION, 2020-2029 (USD THOUSAND)

TABLE 60 CANADA AQUACULTURE EQUIPMENT MARKET, BY END - USE, 2020-2029 (USD THOUSAND)

TABLE 61 CANADA AQUATIC ANIMALS IN AQUACULTURE EQUIPMENT MARKET, BY END- USE, 2020-2029 (USD THOUSAND)

TABLE 62 CANADA AQUATIC PLANTS IN AQUACULTURE EQUIPMENT MARKET, BY END- USE, 2020-2029 (USD THOUSAND)

TABLE 63 CANADA AQUACULTURE EQUIPMENT MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD THOUSAND)

TABLE 64 MEXICO AQUACULTURE EQUIPMENT MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 65 MEXICO AQUACULTURE EQUIPMENT MARKET, BY TYPE, 2020-2029 (THOUSAND UNITS)

TABLE 66 MEXICO WATER PURIFICATION IN AQUACULTURE EQUIPMENT MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 67 MEXICO MAINTENANCE & REPAIR EQUIPMENT IN AQUACULTURE EQUIPMENT MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 68 MEXICO AQUACULTURE EQUIPMENT MARKET, BY APPLICATION, 2020-2029 (USD THOUSAND)

TABLE 69 MEXICO OUTDOOR AQUACULTURE IN AQUACULTURE EQUIPMENT MARKET, BY APPLICATION, 2020-2029 (USD THOUSAND)

TABLE 70 MEXICO AQUACULTURE EQUIPMENT MARKET, BY END - USE, 2020-2029 (USD THOUSAND)

TABLE 71 MEXICO AQUATIC ANIMALS IN AQUACULTURE EQUIPMENT MARKET, BY END- USE, 2020-2029 (USD THOUSAND)

TABLE 72 MEXICO AQUATIC PLANTS IN AQUACULTURE EQUIPMENT MARKET, BY END- USE, 2020-2029 (USD THOUSAND)

TABLE 73 MEXICO AQUACULTURE EQUIPMENT MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD THOUSAND)

List of Figure

FIGURE 1 NORTH AMERICA AQUACULTURE EQUIPMENT MARKET

FIGURE 2 NORTH AMERICA AQUACULTURE EQUIPMENT MARKET: DATA TRIANGULATION

FIGURE 3 NORTH AMERICA AQUACULTURE EQUIPMENT MARKET: DROC ANALYSIS

FIGURE 4 NORTH AMERICA AQUACULTURE EQUIPMENT MARKET: NORTH AMERICA VS REGIONAL MARKET ANALYSIS

FIGURE 5 NORTH AMERICA AQUACULTURE EQUIPMENT MARKET: COMPANY RESEARCH ANALYSIS

FIGURE 6 NORTH AMERICA AQUACULTURE EQUIPMENT MARKET: THE TYPE LIFE LINE CURVE

FIGURE 7 NORTH AMERICA AQUACULTURE EQUIPMENT MARKET: MULTIVARIATE MODELLING

FIGURE 8 NORTH AMERICA AQUACULTURE EQUIPMENT MARKET: INTERVIEW DEMOGRAPHICS

FIGURE 9 NORTH AMERICA AQUACULTURE EQUIPMENT MARKET: DBMR MARKET POSITION GRID

FIGURE 10 NORTH AMERICA AQUACULTURE EQUIPMENT MARKET: MARKET END USE COVERAGE GRID

FIGURE 11 NORTH AMERICA AQUACULTURE EQUIPMENT MARKET: THE MARKET CHALLENGE MATRIX

FIGURE 12 NORTH AMERICA AQUACULTURE EQUIPMENT MARKET: VENDOR SHARE ANALYSIS

FIGURE 13 NORTH AMERICA AQUACULTURE EQUIPMENT MARKET: SEGMENTATION

FIGURE 14 RISING, EXPANSION, AND GROWTH OF THE AQUACULTURE INDUSTRY IS EXPECTED TO DRIVE THE NORTH AMERICA AQUACULTURE EQUIPMENT MARKET GROWTH IN THE FORECAST PERIOD OF 2022 -2029

FIGURE 15 WATER PURIFICATION EQUIPMENT SEGMENT IS EXPECTED TO ACCOUNT FOR THE LARGEST SHARE OF THE NORTH AMERICA AQUACULTURE EQUIPMENT MARKET IN 2022 & 2029

FIGURE 16 SUPPLY CHAIN ANALYSIS- NORTH AMERICA AQUACULTURE EQUIPMENT MARKET

FIGURE 17 DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES OF THE NORTH AMERICA AQUACULTURE EQUIPMENT MARKET

FIGURE 18 NORTH AMERICA AQUACULTURE EQUIPMENT MARKET: BY TYPE, 2021

FIGURE 19 NORTH AMERICA AQUACULTURE EQUIPMENT MARKET: BY APPLICATION, 2021

FIGURE 20 NORTH AMERICA AQUACULTURE EQUIPMENT MARKET: BY END-USE, 2021

FIGURE 21 NORTH AMERICA AQUACULTURE EQUIPMENT MARKET: BY DISTRIBUTION CHANNEL, 2021

FIGURE 22 NORTH AMERICA AQUACULTURE EQUIPMENT MARKET: SNAPSHOT (2021)

FIGURE 23 NORTH AMERICA AQUACULTURE EQUIPMENT MARKET: BY COUNTRY (2021)

FIGURE 24 NORTH AMERICA AQUACULTURE EQUIPMENT MARKET: BY COUNTRY (2022 & 2029)

FIGURE 25 NORTH AMERICA AQUACULTURE EQUIPMENT MARKET: BY COUNTRY (2021 & 2029)

FIGURE 26 NORTH AMERICA AQUACULTURE EQUIPMENT MARKET: BY TYPE (2022-2029)

FIGURE 27 NORTH AMERICA AQUACULTURE EQUIPMENT MARKET: COMPANY SHARE 2021 (%)

منهجية البحث

يتم جمع البيانات وتحليل سنة الأساس باستخدام وحدات جمع البيانات ذات أحجام العينات الكبيرة. تتضمن المرحلة الحصول على معلومات السوق أو البيانات ذات الصلة من خلال مصادر واستراتيجيات مختلفة. تتضمن فحص وتخطيط جميع البيانات المكتسبة من الماضي مسبقًا. كما تتضمن فحص التناقضات في المعلومات التي شوهدت عبر مصادر المعلومات المختلفة. يتم تحليل بيانات السوق وتقديرها باستخدام نماذج إحصائية ومتماسكة للسوق. كما أن تحليل حصة السوق وتحليل الاتجاهات الرئيسية هي عوامل النجاح الرئيسية في تقرير السوق. لمعرفة المزيد، يرجى طلب مكالمة محلل أو إرسال استفسارك.

منهجية البحث الرئيسية التي يستخدمها فريق بحث DBMR هي التثليث البيانات والتي تتضمن استخراج البيانات وتحليل تأثير متغيرات البيانات على السوق والتحقق الأولي (من قبل خبراء الصناعة). تتضمن نماذج البيانات شبكة تحديد موقف البائعين، وتحليل خط زمني للسوق، ونظرة عامة على السوق ودليل، وشبكة تحديد موقف الشركة، وتحليل براءات الاختراع، وتحليل التسعير، وتحليل حصة الشركة في السوق، ومعايير القياس، وتحليل حصة البائعين على المستوى العالمي مقابل الإقليمي. لمعرفة المزيد عن منهجية البحث، أرسل استفسارًا للتحدث إلى خبراء الصناعة لدينا.

التخصيص متاح

تعد Data Bridge Market Research رائدة في مجال البحوث التكوينية المتقدمة. ونحن نفخر بخدمة عملائنا الحاليين والجدد بالبيانات والتحليلات التي تتطابق مع هدفهم. ويمكن تخصيص التقرير ليشمل تحليل اتجاه الأسعار للعلامات التجارية المستهدفة وفهم السوق في بلدان إضافية (اطلب قائمة البلدان)، وبيانات نتائج التجارب السريرية، ومراجعة الأدبيات، وتحليل السوق المجدد وقاعدة المنتج. ويمكن تحليل تحليل السوق للمنافسين المستهدفين من التحليل القائم على التكنولوجيا إلى استراتيجيات محفظة السوق. ويمكننا إضافة عدد كبير من المنافسين الذين تحتاج إلى بيانات عنهم بالتنسيق وأسلوب البيانات الذي تبحث عنه. ويمكن لفريق المحللين لدينا أيضًا تزويدك بالبيانات في ملفات Excel الخام أو جداول البيانات المحورية (كتاب الحقائق) أو مساعدتك في إنشاء عروض تقديمية من مجموعات البيانات المتوفرة في التقرير.