Middle East And Africa Wheat Gluten Market

حجم السوق بالمليار دولار أمريكي

CAGR :

%

USD

73.71 Million

USD

108.14 Million

2021

2029

USD

73.71 Million

USD

108.14 Million

2021

2029

| 2022 –2029 | |

| USD 73.71 Million | |

| USD 108.14 Million | |

|

|

|

|

سوق الغلوتين من القمح في الشرق الأوسط وأفريقيا، حسب الفئة (العضوي وغير العضوي)، الوظيفة (المستحلب، المتصلب، الموثق وغيرها)، الشكل (السائل والجاف)، التطبيق ( الأغذية والمشروباتأعلاف الحيوانات وغيرها)، التغليف (زجاجة / جرة، كيس وحقائب، صناديق وغيرها)، قناة التوزيع (تجار التجزئة القائمين على المتاجر وتجار التجزئة غير القائمين على المتاجر)، المستخدم النهائي (المنزلي / التجزئة والتجارية) - اتجاهات الصناعة والتوقعات حتى عام 2029.

تحليل ورؤى حول سوق الغلوتين القمحي في الشرق الأوسط وأفريقيا

يشهد سوق جلوتين القمح في الشرق الأوسط وأفريقيا نموًا في عام التوقعات بسبب زيادة عدد اللاعبين في السوق وتوافر بدائل اللحوم النباتية المختلفة في السوق. إلى جانب ذلك، زاد عدد أنشطة البحث والتطوير لاكتشاف بروتينات نباتية جديدة في السوق مما يعزز نمو السوق بشكل أكبر. ومع ذلك، فإن الحالات المتزايدة من الاضطرابات الوراثية والمزمنة بسبب عدم تحمل الغلوتين قد تعيق نمو السوق في فترة التوقعات.

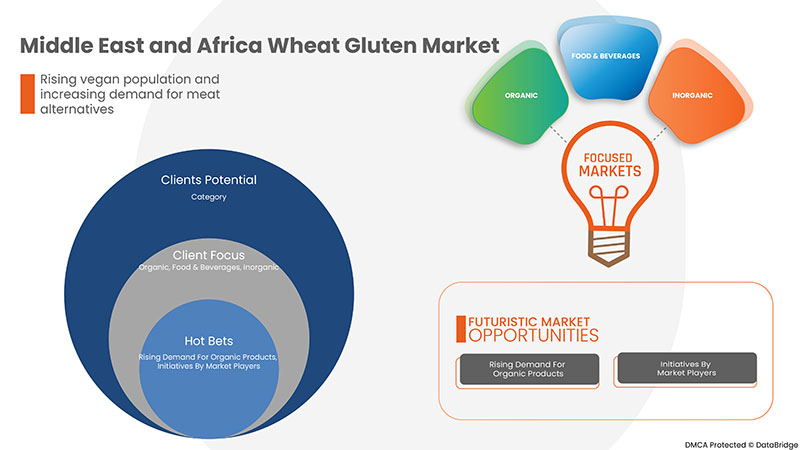

إن الوعي المتزايد بفوائد البروتينات النباتية، والطلب المتزايد على المنتجات العضوية والمبادرات التي يتخذها اللاعبون في السوق، كلها عوامل تمنح السوق فرصًا جديدة. ومع ذلك، فإن ارتفاع تكاليف الإنتاج والتصنيع، وحساسية الجلوتين وردود الفعل المناعية الذاتية لدى البشر هي التحديات الرئيسية التي تعوق نمو السوق.

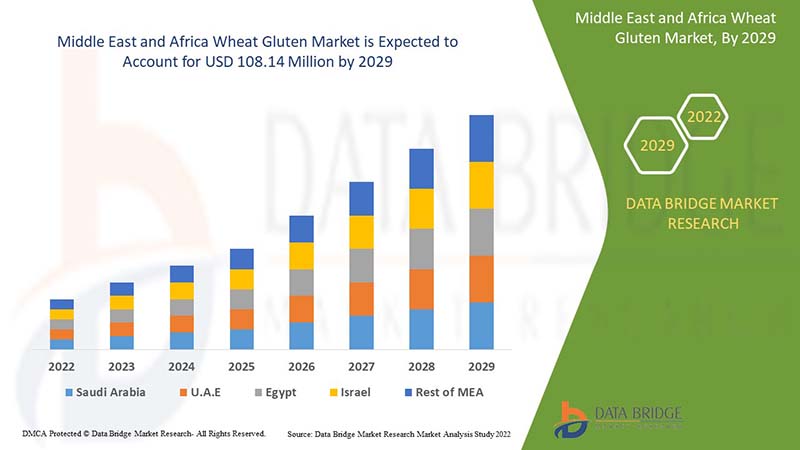

من المتوقع أن يحقق سوق الغلوتين القمح في الشرق الأوسط وأفريقيا نموًا في السوق في الفترة المتوقعة من 2022 إلى 2029. تحلل شركة Data Bridge Market Research أن السوق ينمو بمعدل نمو سنوي مركب قدره 5.1٪ في الفترة المتوقعة من 2022 إلى 2029 ومن المتوقع أن يصل إلى 108.14 مليون دولار أمريكي بحلول عام 2029 من 73.71 مليون دولار أمريكي في عام 2021.

|

تقرير القياس |

تفاصيل |

|

فترة التنبؤ |

2022 إلى 2029 |

|

سنة الأساس |

2021 |

|

سنة تاريخية |

2020 (قابلة للتخصيص حتى 2014-2019) |

|

وحدات كمية |

الإيرادات بالملايين من الدولارات الأمريكية |

|

القطاعات المغطاة |

حسب الفئة (عضوي وغير عضوي)، الوظيفة (مستحلب، مصلّب، رابط وغيرها)، الشكل (سائل وجاف)، التطبيق (الأغذية والمشروبات، أعلاف الحيوانات وغيرها)، التغليف (زجاجة/برطمان، أكياس وحقائب، صناديق وغيرها)، قناة التوزيع (تجار التجزئة المعتمدون على المتاجر وتجار التجزئة غير المعتمدون على المتاجر)، المستخدم النهائي (المنزلي/التجزئة والتجاري) |

|

الدول المغطاة |

جنوب أفريقيا، عُمان، قطر، المملكة العربية السعودية، الإمارات العربية المتحدة، الكويت وبقية دول الشرق الأوسط وأفريقيا |

|

الجهات الفاعلة في السوق المشمولة |

Cargill, Incorporated، ADM، Crespel & Deiters Group، Glico Nutrition Co., Ltd.، Sedamyl، Manildra Group، MGP، Roquette Frères، CropEnergies AG، Anhui Ante Food Co., Ltd.، ARDENT MILLS، Bryan W Nash and Sons، Pioneer Industries Private Limited، Henan Tianguan Group Co. Ltd، Permolex، Meelunie BV، Mühlenchemie GmbH & Co. KG، Royal Ingredients Group، Kröner Stärke وz&f sungold corporation من بين آخرين |

تعريف السوق

يُعرف جلوتين القمح أيضًا باسم السيتان أو لحم القمح أو لحم الجلوتين أو الجلوتين. جلوتين القمح هو بروتين يوجد بشكل طبيعي في القمح أو دقيق القمح. يتم تصنيعه عن طريق غسل عجينة دقيق القمح في الماء حتى تتم إزالة جميع حبيبات النشا. يتم تصنيع مسحوق جلوتين القمح عن طريق ترطيب دقيق القمح الصلب لتنشيط الجلوتين. بعد ذلك، تتم معالجة الكتلة المائية لإزالة النشا مع ترك الجلوتين. أخيرًا، يتم تجفيف الجلوتين وطحنه إلى مسحوق. تتمتع بعض أنواع الجلوتين بملمس خيطي أو مطاطي يشبه اللحم.

ديناميكيات سوق الغلوتين القمح في الشرق الأوسط وأفريقيا

السائقين

- ارتفاع عدد النباتيين وزيادة الطلب على بدائل اللحوم

الجلوتين هو بروتين يوجد بشكل طبيعي في بعض الحبوب مثل القمح والشعير والجاودار. يتكون جلوتين القمح من كسور بروتينية من الجليادين والجلوتينين. يحتوي الجليادين على سلسلة بولي ببتيد واحدة مرتبطة بروابط هيدروجينية وروابط كارهة للماء وتفاعلات ثنائي كبريتيد داخل الجزيئات بينما يحتوي الجلوتينين على تفاعلات ثنائي كبريتيد بين الجزيئات. جلوتين القمح ونشا القمح من المنتجات الثانوية المهمة اقتصاديًا والتي يتم إنتاجها أثناء المعالجة الرطبة لدقيق القمح. جلوتين القمح هو مكون غذائي أساسي وتطبيقاته هي في الغالب في المخبوزات ومنتجات اللحوم المصنعة. له خصائص فريدة مثل أنه عندما يتم ترطيبه وخلطه، فإنه يشكل بنية مرنة قابلة للتمدد للغاية وهي المسؤولة عن قدرة عجينة الخبز على الاحتفاظ بالغاز. يمكن استخدامه مع دقيق القمح والمواد المضافة الأخرى لإنتاج منتج منسوج خالٍ من الصويا.

يتزايد عدد النباتيين في جميع أنحاء العالم ويتزايد أيضًا الطلب على بدائل اللحوم. أصبح الناس أكثر وعيًا بالفوائد الصحية للبروتينات النباتية ويتحولون إلى أنماط الحياة النباتية حيث يمكن أن يعمل جلوتين القمح كبديل للحوم بالنسبة لهم.

- تفضيل متزايد من جانب المستهلكين للأنظمة الغذائية الغنية بالبروتين

يفضل معظم المستهلكين الأنظمة الغذائية الغنية بالبروتينات لأسباب عديدة، منها: البروتين هو اللبنة الأساسية لجسم الإنسان وعضلاته؛ وهو ضروري لأنشطة الجسم والدماغ؛ وهو مهم للحياة الصحية والنشطة. يعد الجلوتين أحد الأنظمة الغذائية الغنية بالبروتين والتي يمكن استخراجها من القمح. يحتوي الجلوتين على نسبة عالية من البروتين إلى جانب الفيتامينات والمعادن مثل مضادات الأكسدة والألياف وفيتامين ب وفيتامين هـ والمغنيسيوم والحديد وحمض الفوليك وغيرها.

علاوة على ذلك، في السنوات الأخيرة، أحدثت الأنظمة الغذائية والمنتجات الغنية بالبروتين تأثيرًا حقيقيًا على التغذية وأعادت تشكيل مواقف المستهلكين تجاه البروتين في تناولهم للطعام حيث تعد التغذية الكافية جانبًا مهمًا من نمط الحياة الصحي لجميع الأفراد. وقد أظهرت دراسات مختلفة الفوائد الصحية للبروتينات النباتية وزاد الوعي العام إلى حد كبير. ونتيجة لذلك، يفضل المستهلكون الأنظمة الغذائية الغنية بالبروتين.

- ارتفاع عدد أنشطة البحث والتطوير لاكتشاف بروتينات نباتية جديدة

يتزايد الطلب على الأنظمة الغذائية الغنية بالبروتين بين الناس، وبالتالي، زاد عدد الأبحاث لاكتشاف البروتينات. نظرًا لأن البروتينات الحيوانية تسبب معظم المخاطر الصحية، فإن الناس يتحولون إلى أنماط حياة نباتية تدريجيًا، في جميع أنحاء العالم. البروتينات النباتية غنية بالفيتامينات والمعادن ولها فوائد صحية كبيرة وفقًا للدراسات الحديثة. يعد الجلوتين القمحي أحد البروتينات النباتية التي يستخدمها معظم الناس في جميع أنحاء العالم كبديل للحوم ونظام غذائي غني بالبروتين.

يفضل معظم البشر اتباع أنظمة غذائية غنية بالبروتين من مصادر نباتية نظرًا للعديد من الفوائد الصحية والتغلب على الأمراض الناجمة عن تناول أنظمة غذائية تعتمد على البروتين الحيواني. لذا، يتزايد عدد الأبحاث والتطوير لاكتشاف بروتينات نباتية جديدة بطرق مختلفة لتلبية الطلب.

فرص

-

تزايد الوعي بشأن فوائد البروتينات النباتية

تتوفر في السوق العديد من منتجات البروتين النباتي بسبب تغير تفضيلات الذوق لدى المستهلكين. ومن بينها الجلوتين القمح ومنتجاته التي تحظى بطلب كبير. ويشهد سوق البروتين النباتي مثل الجلوتين القمحي طلبًا قويًا ونموًا في المخابز والمشروبات الوظيفية وغيرها من الأطعمة. وتتوفر البروتينات النباتية بسهولة بسبب استخدامها على نطاق واسع في مختلف الصناعات. ويُستخدم الجلوتين القمحي في العديد من المنتجات مثل منتجات الأعلاف الحيوانية التي تساعد في تقليل اعتماد المزارعين على المصادر التقليدية للبروتين. وتشمل منتجات الجلوتين القمح والبروتين النباتي العديد من العناصر الغذائية وهي غنية بالبروتين والنكهات. زيادة الوعي بأنماط الحياة الصحية وإدارة فقدان الوزن، جنبًا إلى جنب مع الطلب على ألواح البروتين النباتي بين المستهلكين.

ونتيجة لذلك، فإن الحاجة إلى جلوتين القمح في مختلف المنتجات سوف تعمل كفرصة لنمو السوق. وفي الوقت نفسه، يتم استخدام جلوتين القمح في المنتجات الغازية لتعزيز النكهات المضافة.

-

ارتفاع الطلب على المنتجات العضوية

يتزايد الطلب على المنتجات العضوية بسرعة كبيرة. تعد مكونات الأطعمة العضوية مثل البروتينات النباتية بديلاً بروتينيًا مثاليًا للحوم أو غيرها من المنتجات غير النباتية التي يمكن للمستهلكين تناولها يوميًا. جميع الأحماض الأمينية الأساسية والألياف العالية الموجودة في المنتجات العضوية تجعلها بديلاً مثاليًا للبروتينات الحيوانية.

يعود الطلب على المكونات العضوية في جلوتين القمح ومنتجاته إلى خطط النظام الغذائي التغذوي حيث تتمتع بفوائد صحية مختلفة مثل انخفاض خطر الإصابة بمرض السكري وسهولة الهضم وصحة القلب والأوعية الدموية وغيرها. أدى الوعي المتزايد بين المستهلكين حول الفوائد الصحية التي توفرها المكونات العضوية مثل البروتينات النباتية إلى زيادة الطلب على منتجات الأغذية والمشروبات.

القيود/التحديات

- ارتفاع تكلفة الإنتاج والتصنيع

لقد فتح جلوتين القمح أبوابًا لتحسين ودعم الصحة التي تلعب دورًا رئيسيًا في صناعة الأغذية والمشروبات. ولكن من ناحية أخرى، فقد أدى ذلك إلى تكاليف كبيرة مرتبطة بإنتاجه وتصنيعه

في بعض البلدان حول العالم، يُنظر إلى جلوتين القمح باعتباره حلاً لمشكلة الحفاظ على نمط حياة صحي. ومع ذلك، يواجه تصنيعه وإنتاجه العديد من التحديات مثل العمالة الكثيفة، وكمية المواد الخام المتزايدة والحاجة إلى إنتاج أسرع بسبب الطلب المتزايد. يجب تلبية هذه المطالب بشكل فعال وكفء. يتطلب جلوتين القمح استثمارًا رأسماليًا كبيرًا للحفاظ على البحث والتطوير. تتضمن الآلات والمعدات الجديدة الكثير من التجارب لاختبار الأداء مما يؤدي إلى استثمارات رأسمالية عالية للمؤسسات الصغيرة والمتوسطة.

- ارتفاع حالات الاضطرابات الوراثية والمزمنة بسبب عدم تحمل الغلوتين

الجلوتين هو نوع من البروتين المستخرج من القمح والحبوب الأخرى. هناك العديد من الحالات التي تم فيها اكتشاف عدم تحمل الجلوتين. هناك العديد من الأسباب المحتملة لعدم تحمل الجلوتين، بما في ذلك مرض الاضطرابات الهضمية وحساسية الجلوتين غير الاضطرابات الهضمية وحساسية القمح. يمكن أن تسبب الأشكال الثلاثة لعدم تحمل الجلوتين أعراضًا واسعة النطاق. مرض الاضطرابات الهضمية هو الشكل الأكثر شدة لعدم تحمل الجلوتين. إنه مرض مناعي ذاتي يصيب حوالي 1٪ من السكان وقد يؤدي إلى تلف الجهاز الهضمي. يمكن أن يسبب مجموعة واسعة من الأعراض، بما في ذلك مشاكل الجلد ومشاكل الجهاز الهضمي وتغيرات المزاج والمزيد. الأعراض الشائعة المرتبطة بمرض الاضطرابات الهضمية غير الاضطرابات الهضمية هي الانتفاخ والصداع وآلام المعدة والتعب والإسهال والإمساك وغيرها. وبالمثل، فإن الأعراض المرتبطة بحساسية القمح هي الطفح الجلدي ومشاكل الجهاز الهضمي واحتقان الأنف والحساسية المفرطة وغيرها.

بسبب تأثير عدم تحمل الغلوتين، تحدث العديد من الاضطرابات بما في ذلك الحساسية الهضمية وغير الهضمية وحساسية القمح والتي تكون مزمنة ووراثية في بعض الحالات.

تأثير ما بعد كوفيد-19 على سوق الغلوتين القمحي في الشرق الأوسط وأفريقيا

كان لفيروس كورونا تأثير سلبي على سوق جلوتين القمح في الشرق الأوسط وأفريقيا. تسببت عمليات الإغلاق والعزلة أثناء الوباء في إغلاق معظم المتاجر وتأثرت إمدادات النظام الغذائي البروتيني النباتي بدرجة أكبر. زادت عمليات الشراء عبر الإنترنت لبدائل اللحوم النباتية. وبالتالي، أثر فيروس كورونا سلبًا على السوق.

التطورات الأخيرة

- في يناير 2022، أعلنت شركة ADM عن افتتاح أول مركز للعلوم والتكنولوجيا في الصين لترسيخ تطورها عالي الجودة في صناعة التغذية والصحة. وقد ساعد ذلك الشركة على تقديم خدمات أفضل للمستهلكين من خلال مثل هذه الابتكارات في المنظمة.

نطاق سوق الغلوتين القمح في الشرق الأوسط وأفريقيا

يتم تقسيم سوق جلوتين القمح في الشرق الأوسط وأفريقيا إلى سبعة قطاعات بارزة بناءً على الفئة والوظيفة والشكل والتطبيق والتعبئة والتغليف وقناة التوزيع والمستخدم النهائي. سيساعدك النمو بين هذه القطاعات على تحليل قطاعات النمو الضئيلة في الصناعات وتزويد المستخدمين بنظرة عامة قيمة على السوق ورؤى السوق لاتخاذ قرارات استراتيجية لتحديد تطبيقات السوق الأساسية.

حسب الفئة

- عضوي

- غير عضوي

بناءً على الفئة، يتم تقسيم السوق إلى عضوي وغير عضوي.

حسب الوظيفة

- مستحلب

- مُصلِّب

- المجلد

- آحرون

على أساس الوظيفة، يتم تقسيم السوق إلى مستحلب، ومصلب، وموثق وغيرها.

حسب النموذج

- سائل

- جاف

بناءً على الشكل، يتم تقسيم السوق إلى سائل وجاف.

حسب الطلب

- الأطعمة والمشروبات

- أعلاف الحيوانات

- آحرون

بناءً على التطبيق، يتم تقسيم السوق إلى الأغذية والمشروبات والأعلاف الحيوانية وغيرها.

حسب التعبئة والتغليف

- زجاجة/جرة

- الحقائب والأكياس

- الصناديق

- آحرون

بناءً على التعبئة والتغليف، يتم تقسيم السوق إلى زجاجة/جرة، وأكياس وحقائب، وصناديق وغيرها.

حسب قناة التوزيع

- تجار التجزئة القائمين على المتاجر

- تجار التجزئة غير المعتمدين على المتاجر

بناءً على قناة التوزيع، يتم تقسيم السوق إلى تجار التجزئة المعتمدين على المتاجر وتجار التجزئة غير المعتمدين على المتاجر.

حسب المستخدم النهائي

- الأدوات المنزلية/التجزئة

- تجاري

بناءً على المستخدم النهائي، يتم تقسيم السوق إلى منزلي/تجزئة وتجاري.

تحليل/رؤى إقليمية لسوق الغلوتين القمحي في الشرق الأوسط وأفريقيا

يتم تحليل سوق الغلوتين من القمح في الشرق الأوسط وأفريقيا ويتم توفير رؤى حجم السوق والاتجاهات حسب البلد والفئة والوظيفة والشكل والتطبيق والتعبئة والتغليف وقناة التوزيع والمستخدم النهائي.

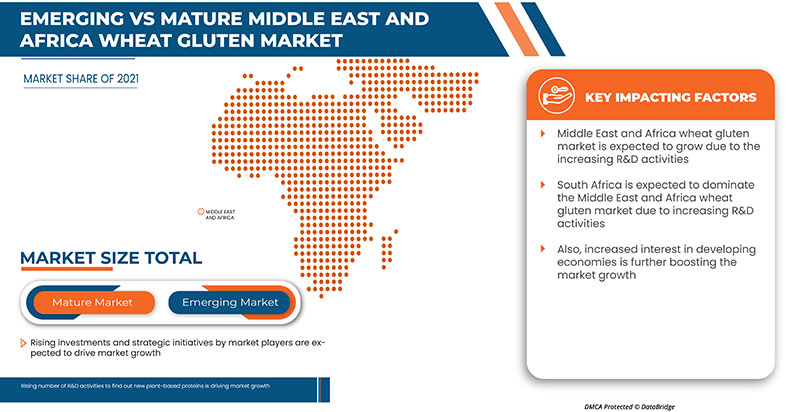

يتألف سوق جلوتين القمح في الشرق الأوسط وأفريقيا من دول جنوب أفريقيا وعمان وقطر والمملكة العربية السعودية والإمارات العربية المتحدة والكويت وبقية دول الشرق الأوسط وأفريقيا. تهيمن جنوب أفريقيا على سوق جلوتين القمح في الشرق الأوسط وأفريقيا من حيث حصة السوق وإيرادات السوق وستواصل هيمنتها خلال فترة التوقعات.

إن الوعي المتزايد بشأن فوائد البروتينات النباتية يعمل على تعزيز نمو السوق. علاوة على ذلك، فإن الطلب المتزايد على المنتجات العضوية والمبادرات التي يقوم بها اللاعبون في السوق تعمل أيضًا على تعزيز نمو السوق.

تحليل المشهد التنافسي وحصة سوق الغلوتين القمحي في الشرق الأوسط وأفريقيا

يقدم المشهد التنافسي لسوق جلوتين القمح في الشرق الأوسط وأفريقيا تفاصيل عن المنافسين. تتضمن التفاصيل نظرة عامة على الشركة، والبيانات المالية للشركة، والإيرادات المولدة، وإمكانات السوق، والاستثمار في البحث والتطوير، ومبادرات السوق الجديدة، والحضور في الشرق الأوسط وأفريقيا، ومواقع الإنتاج والمرافق، والقدرات الإنتاجية، ونقاط القوة والضعف للشركة، وإطلاق المنتج، وعرض المنتج ونطاقه، وهيمنة التطبيق. تتعلق نقاط البيانات المذكورة أعلاه فقط بتركيز الشركات على السوق.

بعض اللاعبين الرئيسيين العاملين في سوق الغلوتين القمح في الشرق الأوسط وأفريقيا هم Cargill، Incorporated، ADM، Crespel & Deiters Group، Glico Nutrition Co.، Ltd.، Sedamyl، Manildra Group، MGP، Roquette Frères، CropEnergies AG، Anhui Ante Food Co.، Ltd.، ARDENT MILLS، Bryan W Nash and Sons، Pioneer Industries Private Limited، Henan Tianguan Group Co. Ltd، Permolex، Meelunie BV، Mühlenchemie GmbH & Co. KG، Royal Ingredients Group، Kröner Stärke و z&f sungold corporation وغيرها.

منهجية البحث

يتم جمع البيانات وتحليل سنة الأساس باستخدام وحدات جمع البيانات ذات أحجام العينات الكبيرة. يتم تحليل بيانات السوق وتقديرها باستخدام نماذج إحصائية ومتماسكة للسوق. بالإضافة إلى ذلك، يعد تحليل حصة السوق وتحليل الاتجاهات الرئيسية من عوامل النجاح الرئيسية في تقرير السوق. منهجية البحث الرئيسية التي يستخدمها فريق البحث في DBMR هي التثليث البيانات والتي تنطوي على استخراج البيانات وتحليل تأثير متغيرات البيانات على السوق والتحقق الأساسي (خبير الصناعة). وبصرف النظر عن هذا، تتضمن نماذج البيانات شبكة وضع البائعين، وتحليل الخط الزمني للسوق، ونظرة عامة على السوق والدليل، وشبكة وضع الشركة، وتحليل حصة الشركة في السوق، ومعايير القياس، وتحليل الشرق الأوسط وأفريقيا مقابل التحليل الإقليمي وحصة البائعين. يرجى طلب مكالمة محلل في حالة وجود استفسار آخر.

التخصيص متاح

تعتبر Data Bridge Market Research رائدة في مجال البحوث التكوينية المتقدمة. نحن نفخر بخدمة عملائنا الحاليين والجدد بالبيانات والتحليلات التي تتطابق مع هدفهم. يمكن تخصيص التقرير ليشمل تحليل اتجاه الأسعار للعلامات التجارية المستهدفة وفهم السوق في بلدان إضافية (اطلب قائمة البلدان) وبيانات نتائج التجارب السريرية ومراجعة الأدبيات وتحليل السوق المجدد وقاعدة المنتج. يمكن تحليل تحليل السوق للمنافسين المستهدفين من التحليل القائم على التكنولوجيا إلى استراتيجيات محفظة السوق. يمكننا إضافة عدد كبير من المنافسين حسب الحاجة إلى البيانات بالتنسيق وأسلوب البيانات الذي تبحث عنه. يمكن لفريق المحللين لدينا أيضًا تزويدك بالبيانات في ملفات Excel الخام أو الجداول المحورية (كتاب الحقائق) أو مساعدتك في إنشاء عروض تقديمية من مجموعات البيانات المتوفرة في التقرير.

SKU-

احصل على إمكانية الوصول عبر الإنترنت إلى التقرير الخاص بأول سحابة استخبارات سوقية في العالم

- لوحة معلومات تحليل البيانات التفاعلية

- لوحة معلومات تحليل الشركة للفرص ذات إمكانات النمو العالية

- إمكانية وصول محلل الأبحاث للتخصيص والاستعلامات

- تحليل المنافسين باستخدام لوحة معلومات تفاعلية

- آخر الأخبار والتحديثات وتحليل الاتجاهات

- استغل قوة تحليل المعايير لتتبع المنافسين بشكل شامل

Table of Content

1 INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 OVERVIEW OF MIDDLE EAST & AFRICA WHEAT GLUTEN MARKET

1.4 LIMITATIONS

1.5 MARKETS COVERED

2 MARKET SEGMENTATION

2.1 MARKETS COVERED

2.2 GEOGRAPHICAL SCOPE

2.3 YEARS CONSIDERED FOR THE STUDY

2.4 CURRENCY AND PRICING

2.5 DBMR TRIPOD DATA VALIDATION MODEL

2.6 MULTIVARIATE MODELLING

2.7 CATEGORY LIFELINE CURVE

2.8 PRIMARY INTERVIEWS WITH KEY OPINION LEADERS

2.9 DBMR MARKET POSITION GRID

2.1 MARKET APPLICATION COVERAGE GRID

2.11 VENDOR SHARE ANALYSIS

2.12 SECONDARY SOURCES

2.13 ASSUMPTIONS

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

4.1 PATENT ANALYSIS OF MIDDLE EAST & AFRICA WHEAT GLUTEN MARKET

4.2 CONSUMER BUYING BEHAVIOR

4.3 BRAND ANALYSIS

4.4 MIDDLE EAST & AFRICA WHEAT GLUTEN MARKET SUPPLY CHAIN ANALYSIS

4.4.1 RAW MATERIAL PROCUREMENT

4.4.2 MANUFACTURING

4.4.3 TRANSPORTATION OR LOGISTICS

4.4.4 MARKETING AND DISTRIBUTION

4.4.5 END-USER

4.5 MIDDLE EAST & AFRICA WHEAT GLUTEN MARKET UPCOMING TECHNOLOGIES AND TRENDS

4.5.1 CRISPR/CAS9 GENE EDITING OF GLUTEN IN WHEAT

4.5.2 RNA INTERFERENCE IN WHEAT GLUTEN

4.5.3 COLD ETHANOL TECHNOLOGY

5 REGULATORY FRAMEWORK

5.1 FDA

5.1.1 REGULATIONS ON ALLERGEN LABELING

5.2 EUROPEAN UNION (EU)

5.3 REGULATIONS IN INDIA

5.3.1 FSSAI PROPOSES STANDARDS RELATING TO GLUTEN AND NON-GLUTEN FOODS

5.4 REGULATIONS IN CHINA

5.5 REGULATIONS IN THE U.S.

5.6 REGULATIONS IN CANADA

5.7 REGULATIONS IN THAILAND

6 MARKET OVERVIEW

6.1 DRIVERS

6.1.1 RISING VEGAN POPULATION AND INCREASING DEMAND FOR MEAT-ALTERNATIVES

6.1.2 RISING PREFERENCE OF CONSUMERS TOWARDS HIGH PROTEIN-RICH DIETS

6.1.3 RISING NUMBER OF RESEARCH AND DEVELOPMENT ACTIVITIES TO FIND OUT NEW PLANT-BASED PROTEINS

6.2 RESTRAINTS

6.2.1 RISING CASES OF HEREDITARY AND CHRONIC DISORDERS DUE TO GLUTEN INTOLERANCE

6.2.2 HIGHER COST OF PLANT-BASED PROTEINS

6.3 OPPORTUNITIES

6.3.1 GROWING AWARENESS REGARDING THE BENEFITS OF PLANT-BASED PROTEINS

6.3.2 RISING DEMAND FOR ORGANIC PRODUCTS

6.3.3 INITIATIVES BY MARKET PLAYERS

6.4 CHALLENGES

6.4.1 INCREASED COST OF PRODUCTION AND MANUFACTURING

6.4.2 RISING PREVALENCE OF DISEASES

6.4.3 GLUTEN SENSITIVITY AND AUTOIMMUNE REACTIONS IN PEOPLE

7 MIDDLE EAST & AFRICA WHEAT GLUTEN MARKET, BY CATEGORY

7.1 OVERVIEW

7.2 ORGANIC

7.3 INORGANIC

8 MIDDLE EAST & AFRICA WHEAT GLUTEN MARKET, BY FUNCTION

8.1 OVERVIEW

8.2 BINDER

8.3 EMULSIFIER

8.4 SOLIDIFIER

8.5 OTHERS

9 MIDDLE EAST & AFRICA WHEAT GLUTEN, BY FORM

9.1 OVERVIEW

9.2 DRY

9.3 LIQUID

10 MIDDLE EAST & AFRICA WHEAT GLUTEN MARKET, BY APPLICATION

10.1 OVERVIEW

10.2 FOOD & BEVERAGES

10.2.1 BAKERY & CONFECTIONARY PRODUCTS

10.2.1.1 CAKES, MUFFINS & DOUGHNUTS

10.2.1.2 BREADS

10.2.1.3 COOKIES, CRACKERS

10.2.1.4 PIE CRUSTS & PIZZA DOUGH

10.2.1.5 BATTER

10.2.1.6 OTHERS

10.2.2 CONVENIENCE FOOD

10.2.2.1 NOODLES AND PASTA

10.2.2.2 SOUPS & SAUCES

10.2.2.3 SEASONING & DRESSING

10.2.2.4 SNACKS & EXTRUDED SNACKS

10.2.2.5 READY TO EAT MEALS

10.2.2.6 OTHERS

10.2.3 MEAT ANALOGUES

10.2.4 SPORTS NUTRITION

10.2.5 BREAKFAST CEREALS

10.2.6 MEAT & POULTRY PRODUCTS

10.2.7 NUTRITIONAL BARS

10.2.8 BEVERAGES

10.2.9 OTHERS

10.3 ANIMAL FEED

10.3.1 PET FOOD

10.3.2 RUMINANT

10.3.3 SWINE

10.3.4 POULTRY

10.3.5 OTHERS

10.4 OTHERS

11 MIDDLE EAST & AFRICA WHEAT GLUTEN MARKET, BY PACKAGING

11.1 OVERVIEW

11.2 POUCH & BAGS

11.3 BOXES

11.4 BOTTLE/JAR

11.4.1 PLASTIC

11.4.2 GLASS

11.4.3 METAL

11.4.4 PAPER

11.5 OTHERS

12 MIDDLE EAST & AFRICA WHEAT GLUTEN MARKET, BY DISTRIBUTION CHANNEL

12.1 OVERVIEW

12.2 STORE BASED RETAILERS

12.2.1 HYPERMARKETS/SUPER MARKETS

12.2.2 CONVENIENCE STORES

12.2.3 GROCERY STORES

12.2.4 SPECIALITY STORES

12.2.5 OTHERS

12.3 NON-STORE BASED RETAILERS

13 MIDDLE EAST & AFRICA WHEAT GLUTEN MARKET, BY END USER

13.1 OVERVIEW

13.2 COMMERCIAL

13.2.1 BAKERY STORES

13.2.2 RESTAURANTS AND CAFES

13.2.3 HOTELS

13.2.4 CLOUD KITCHEN

13.2.5 OTHERS

13.3 HOUSEHOLD/RETAIL

14 MIDDLE EAST & AFRICA WHEAT GLUTEN MARKET, BY REGION

14.1 MIDDLE EAST AND AFRICA

14.1.1 SOUTH AFRICA

14.1.2 U.A.E

14.1.3 SAUDI ARABIA

14.1.4 OMAN

14.1.5 QATAR

14.1.6 KUWAIT

14.1.7 REST OF MIDDLE EAST AND AFRICA

15 MIDDLE EAST & AFRICA WHEAT GLUTEN MARKET: COMPANY LANDSCAPE

15.1 COMPANY SHARE ANALYSIS: MIDDLE EAST & AFRICA

16 SWOT ANALYSIS

17 COMPANY PROFILE

17.1 CARGILL, INCORPORATED

17.1.1 COMPANY SNAPSHOT

17.1.2 COMPANY SHARE ANALYSIS

17.1.3 PRODUCT PORTFOLIO

17.1.4 RECENT DEVELOPMENT

17.2 ADM

17.2.1 COMPANY SNAPSHOT

17.2.2 REVENUE ANALYSIS

17.2.3 COMPANY SHARE ANALYSIS

17.2.4 PRODUCT PORTFOLIO

17.2.5 RECENT DEVELOPMENT

17.3 CRESPEL & DEITERS GROUP

17.3.1 COMPANY SNAPSHOT

17.3.2 COMPANY SHARE ANALYSIS

17.3.3 PRODUCT PORTFOLIO

17.3.4 RECENT DEVELOPMENT

17.4 GLICO NUTRITION CO., LTD.

17.4.1 COMPANY SNAPSHOT

17.4.2 COMPANY SHARE ANALYSIS

17.4.3 PRODUCT PORTFOLIO

17.4.4 RECENT DEVELOPMENT

17.5 SEDAMYL

17.5.1 COMPANY SNAPSHOT

17.5.2 PRODUCT PORTFOLIO

17.5.3 RECENT DEVELOPMENT

17.6 ANHUI ANTE FOOD CO.,LTD.

17.6.1 COMPANY SNAPSHOT

17.6.2 PRODUCT PORTFOLIO

17.6.3 RECENT DEVELOPMENT

17.7 ARDENT MILLS

17.7.1 COMPANY SNAPSHOT

17.7.2 PRODUCT PORTFOLIO

17.7.3 RECENT DEVELOPMENTS

17.8 BRYAN W NASH AND SONS

17.8.1 COMPANY SNAPSHOT

17.8.2 PRODUCT PORTFOLIO

17.8.3 RECENT DEVELOPMENT

17.9 CROPENERGIES AG

17.9.1 COMPANY SNAPSHOT

17.9.2 REVENUE ANALYSIS

17.9.3 PRODUCT PORTFOLIO

17.9.4 RECENT DEVELOPMENT

17.1 HENAN TIANGUAN GROUP CO., LTD.

17.10.1 COMPANY SNAPSHOT

17.10.2 PRODUCT PORTFOLIO

17.10.3 RECENT DEVELOPMENT

17.11 KRÖNER-STÄRKE GMBH

17.11.1 COMPANY SNAPSHOT

17.11.2 PRODUCT PORTFOLIO

17.11.3 RECENT DEVELOPMENT

17.12 MANILDRA GROUP

17.12.1 COMPANY SNAPSHOT

17.12.2 PRODUCT PORTFOLIO

17.12.3 RECENT DEVELOPMENT

17.13 MEELUNIE B.V.

17.13.1 COMPANY SNAPSHOT

17.13.2 PRODUCT PORTFOLIO

17.13.3 RECENT DEVELOPMENT

17.14 MGP

17.14.1 COMPANY SNAPSHOT

17.14.2 REVENUE ANALYSIS

17.14.3 PRODUCT PORTFOLIO

17.14.4 RECENT DEVELOPMENT

17.15 MUHLENCHEMIE GMBH & CO. KG

17.15.1 COMPANY SNAPSHOT

17.15.2 PRODUCT PORTFOLIO

17.15.3 RECENT DEVELOPMENT

17.16 PERMOLEX

17.16.1 COMPANY SNAPSHOT

17.16.2 PRODUCT PORTFOLIO

17.16.3 RECENT DEVELOPMENT

17.17 PIONEER INDUSTRIES PRIVATE LIMITED

17.17.1 COMPANY SNAPSHOT

17.17.2 PRODUCT PORTFOLIO

17.17.3 RECENT DEVELOPMENT

17.18 ROQUETTE FRÈRES

17.18.1 COMPANY SNAPSHOT

17.18.2 PRODUCT PORTFOLIO

17.18.3 RECENT DEVELOPMENT

17.19 ROYAL INGREDIENTS GROUP

17.19.1 COMPANY SNAPSHOT

17.19.2 PRODUCT PORTFOLIO

17.19.3 RECENT DEVELOPMENT

17.2 Z&F SUNGOLD CORPORATION

17.20.1 COMPANY SNAPSHOT

17.20.2 PRODUCT PORTFOLIO

17.20.3 RECENT DEVELOPMENT

18 QUESTIONNAIRE

19 RELATED REPORTS

List of Table

TABLE 1 MIDDLE EAST & AFRICA WHEAT GLUTEN MARKET, BY CATEGORY, 2020-2029 (USD MILLION)

TABLE 2 MIDDLE EAST & AFRICA ORGANIC IN WHEAT GLUTEN MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 3 MIDDLE EAST & AFRICA INORGANIC IN WHEAT GLUTEN MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 4 MIDDLE EAST & AFRICA WHEAT GLUTEN MARKET, BY FUNCTION, 2020-2029 (USD MILLION)

TABLE 5 MIDDLE EAST & AFRICA BINDER IN WHEAT GLUTEN MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 6 MIDDLE EAST & AFRICA EMULSIFIER IN WHEAT GLUTEN MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 7 MIDDLE EAST & AFRICA SOLIDIFIER IN WHEAT GLUTEN MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 8 MIDDLE EAST & AFRICA OTHERS IN WHEAT GLUTEN MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 9 MIDDLE EAST & AFRICA WHEAT GLUTEN MARKET, BY FORM, 2020-2029 (USD MILLION)

TABLE 10 MIDDLE EAST & AFRICA DRY IN WHEAT GLUTEN MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 11 MIDDLE EAST & AFRICA LIQUID IN WHEAT GLUTEN MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 12 MIDDLE EAST & AFRICA WHEAT GLUTEN MARKET, APPLICATION, 2020-2029 (USD MILLION)

TABLE 13 MIDDLE EAST & AFRICA FOOD & BEVERAGES IN WHEAT GLUTEN MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 14 MIDDLE EAST & AFRICA BAKERY & CONFECTIONERY PRODUCTS IN WHEAT GLUTEN MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 15 MIDDLE EAST & AFRICA CONVENIENCE FOOD IN WHEAT GLUTEN MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 16 MIDDLE EAST & AFRICA ANIMAL FEED IN WHEAT GLUTEN MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 17 MIDDLE EAST & AFRICA ANIMAL FEED IN WHEAT GLUTEN MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 18 MIDDLE EAST & AFRICA OTHERS IN WHEAT GLUTEN MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 19 MIDDLE EAST & AFRICA WHEAT GLUTEN MARKET, BY PACKAGING, 2020-2029 (USD MILLION)

TABLE 20 MIDDLE EAST & AFRICA POUCH & BAGS IN WHEAT GLUTEN MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 21 MIDDLE EAST & AFRICA BOXES IN WHEAT GLUTEN MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 22 MIDDLE EAST & AFRICA BOTTLE/JAR IN WHEAT GLUTEN MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 23 MIDDLE EAST & AFRICA BOTTLE/JAR IN WHEAT GLUTEN MARKET, BY PACKAGING, 2020-2029 (USD MILLION)

TABLE 24 MIDDLE EAST & AFRICA OTHERS IN WHEAT GLUTEN MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 25 MIDDLE EAST & AFRICA WHEAT GLUTEN MARKET, DISTRIBUTION CHANNEL 2020-2029 (USD MILLION)

TABLE 26 MIDDLE EAST & AFRICA STORE-BASED RETAILERS IN WHEAT GLUTEN MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 27 MIDDLE EAST & AFRICA STORE BASED RETAILERS IN WHEAT GLUTEN MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION

TABLE 28 MIDDLE EAST & AFRICA NON-STORE BASED RETAILERS IN WHEAT GLUTEN MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 29 MIDDLE EAST & AFRICA WHEAT GLUTEN MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 30 MIDDLE EAST & AFRICA COMMERCIAL IN WHEAT GLUTEN MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 31 MIDDLE EAST & AFRICA COMMERCIAL IN WHEAT GLUTEN MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 32 MIDDLE EAST & AFRICA HOUSEHOLD/RETAIL IN WHEAT GLUTEN MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 33 MIDDLE EAST AND AFRICA WHEAT GLUTEN MARKET, 2020-2029 (USD MILLION)

TABLE 34 MIDDLE EAST AND AFRICA WHEAT GLUTEN MARKET, BY CATEGORY, 2020-2029 (USD MILLION)

TABLE 35 MIDDLE EAST AND AFRICA WHEAT GLUTEN MARKET, BY FUNCTION, 2020-2029 (USD MILLION)

TABLE 36 MIDDLE EAST AND AFRICA WHEAT GLUTEN MARKET, BY FORM, 2020-2029 (USD MILLION)

TABLE 37 MIDDLE EAST AND AFRICA WHEAT GLUTEN MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 38 MIDDLE EAST AND AFRICA FOOD & BEVERAGES IN WHEAT GLUTEN MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 39 MIDDLE EAST AND AFRICA BAKERY & CONFECTIONERY PRODUCTS IN WHEAT GLUTEN MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 40 MIDDLE EAST AND AFRICA CONVENIENCE FOOD IN WHEAT GLUTEN MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 41 MIDDLE EAST AND AFRICA ANIMAL FEED IN WHEAT GLUTEN MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 42 MIDDLE EAST AND AFRICA WHEAT GLUTEN MARKET, BY PACKAGING, 2020-2029 (USD MILLION)

TABLE 43 MIDDLE EAST AND AFRICA BOTTLE/JAR IN WHEAT GLUTEN MARKET, BY PACKAGING, 2020-2029 (USD MILLION)

TABLE 44 MIDDLE EAST AND AFRICA WHEAT GLUTEN MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 45 MIDDLE EAST AND AFRICA STORE BASED RETAILERS IN WHEAT GLUTEN MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 46 MIDDLE EAST AND AFRICA WHEAT GLUTEN MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 47 MIDDLE EAST AND AFRICA COMMERCIAL IN WHEAT GLUTEN MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 48 SOUTH AFRICA WHEAT GLUTEN MARKET, BY CATEGORY, 2020-2029 (USD MILLION)

TABLE 49 SOUTH AFRICA WHEAT GLUTEN MARKET, BY FUNCTION, 2020-2029 (USD MILLION)

TABLE 50 SOUTH AFRICA WHEAT GLUTEN MARKET, BY FORM, 2020-2029 (USD MILLION)

TABLE 51 SOUTH AFRICA WHEAT GLUTEN MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 52 SOUTH AFRICA FOOD & BEVERAGES IN WHEAT GLUTEN MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 53 SOUTH AFRICA BAKERY & CONFECTIONERY PRODUCTS IN WHEAT GLUTEN MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 54 SOUTH AFRICA CONVENIENCE FOOD IN WHEAT GLUTEN MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 55 SOUTH AFRICA ANIMAL FEED IN WHEAT GLUTEN MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 56 SOUTH AFRICA WHEAT GLUTEN MARKET, BY PACKAGING, 2020-2029 (USD MILLION)

TABLE 57 SOUTH AFRICA BOTTLE/JAR IN WHEAT GLUTEN MARKET, BY PACKAGING, 2020-2029 (USD MILLION)

TABLE 58 SOUTH AFRICA WHEAT GLUTEN MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 59 SOUTH AFRICA STORE BASED RETAILERS IN WHEAT GLUTEN MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 60 SOUTH AFRICA WHEAT GLUTEN MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 61 SOUTH AFRICA COMMERCIAL IN WHEAT GLUTEN MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 62 U.A.E. WHEAT GLUTEN MARKET, BY CATEGORY, 2020-2029 (USD MILLION)

TABLE 63 U.A.E. WHEAT GLUTEN MARKET, BY FUNCTION, 2020-2029 (USD MILLION)

TABLE 64 U.A.E. WHEAT GLUTEN MARKET, BY FORM, 2020-2029 (USD MILLION)

TABLE 65 U.A.E. WHEAT GLUTEN MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 66 U.A.E. FOOD & BEVERAGES IN WHEAT GLUTEN MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 67 U.A.E. BAKERY & CONFECTIONERY PRODUCTS IN WHEAT GLUTEN MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 68 U.A.E. CONVENIENCE FOOD IN WHEAT GLUTEN MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 69 U.A.E. ANIMAL FEED IN WHEAT GLUTEN MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 70 U.A.E. WHEAT GLUTEN MARKET, BY PACKAGING, 2020-2029 (USD MILLION)

TABLE 71 U.A.E. BOTTLE/JAR IN WHEAT GLUTEN MARKET, BY PACKAGING, 2020-2029 (USD MILLION)

TABLE 72 U.A.E. WHEAT GLUTEN MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 73 U.A.E. STORE BASED RETAILERS IN WHEAT GLUTEN MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 74 U.A.E. WHEAT GLUTEN MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 75 U.A.E. COMMERCIAL IN WHEAT GLUTEN MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 76 SAUDI ARABIA WHEAT GLUTEN MARKET, BY CATEGORY, 2020-2029 (USD MILLION)

TABLE 77 SAUDI ARABIA WHEAT GLUTEN MARKET, BY FUNCTION, 2020-2029 (USD MILLION)

TABLE 78 SAUDI ARABIA WHEAT GLUTEN MARKET, BY FORM, 2020-2029 (USD MILLION)

TABLE 79 SAUDI ARABIA WHEAT GLUTEN MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 80 SAUDI ARABIA FOOD & BEVERAGES IN WHEAT GLUTEN MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 81 SAUDI ARABIA BAKERY & CONFECTIONERY PRODUCTS IN WHEAT GLUTEN MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 82 SAUDI ARABIA CONVENIENCE FOOD IN WHEAT GLUTEN MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 83 SAUDI ARABIA ANIMAL FEED IN WHEAT GLUTEN MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 84 SAUDI ARABIA WHEAT GLUTEN MARKET, BY PACKAGING, 2020-2029 (USD MILLION)

TABLE 85 SAUDI ARABIA BOTTLE/JAR IN WHEAT GLUTEN MARKET, BY PACKAGING, 2020-2029 (USD MILLION)

TABLE 86 SAUDI ARABIA WHEAT GLUTEN MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 87 SAUDI ARABIA STORE BASED RETAILERS IN WHEAT GLUTEN MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 88 SAUDI ARABIA WHEAT GLUTEN MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 89 SAUDI ARABIA COMMERCIAL IN WHEAT GLUTEN MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 90 OMAN WHEAT GLUTEN MARKET, BY CATEGORY, 2020-2029 (USD MILLION)

TABLE 91 OMAN WHEAT GLUTEN MARKET, BY FUNCTION, 2020-2029 (USD MILLION)

TABLE 92 OMAN WHEAT GLUTEN MARKET, BY FORM, 2020-2029 (USD MILLION)

TABLE 93 OMAN WHEAT GLUTEN MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 94 OMAN FOOD & BEVERAGES IN WHEAT GLUTEN MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 95 OMAN BAKERY & CONFECTIONERY PRODUCTS IN WHEAT GLUTEN MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 96 OMAN CONVENIENCE FOOD IN WHEAT GLUTEN MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 97 OMAN ANIMAL FEED IN WHEAT GLUTEN MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 98 OMAN WHEAT GLUTEN MARKET, BY PACKAGING, 2020-2029 (USD MILLION)

TABLE 99 OMAN BOTTLE/JAR IN WHEAT GLUTEN MARKET, BY PACKAGING, 2020-2029 (USD MILLION)

TABLE 100 OMAN WHEAT GLUTEN MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 101 OMAN STORE BASED RETAILERS IN WHEAT GLUTEN MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 102 OMAN WHEAT GLUTEN MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 103 OMAN COMMERCIAL IN WHEAT GLUTEN MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 104 QATAR WHEAT GLUTEN MARKET, BY CATEGORY, 2020-2029 (USD MILLION)

TABLE 105 QATAR WHEAT GLUTEN MARKET, BY FUNCTION, 2020-2029 (USD MILLION)

TABLE 106 QATAR WHEAT GLUTEN MARKET, BY FORM, 2020-2029 (USD MILLION)

TABLE 107 QATAR WHEAT GLUTEN MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 108 QATAR FOOD & BEVERAGES IN WHEAT GLUTEN MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 109 QATAR BAKERY & CONFECTIONERY PRODUCTS IN WHEAT GLUTEN MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 110 QATAR CONVENIENCE FOOD IN WHEAT GLUTEN MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 111 QATAR ANIMAL FEED IN WHEAT GLUTEN MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 112 QATAR WHEAT GLUTEN MARKET, BY PACKAGING, 2020-2029 (USD MILLION)

TABLE 113 QATAR BOTTLE/JAR IN WHEAT GLUTEN MARKET, BY PACKAGING, 2020-2029 (USD MILLION)

TABLE 114 QATAR WHEAT GLUTEN MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 115 QATAR STORE BASED RETAILERS IN WHEAT GLUTEN MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 116 QATAR WHEAT GLUTEN MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 117 QATAR COMMERCIAL IN WHEAT GLUTEN MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 118 KUWAIT WHEAT GLUTEN MARKET, BY CATEGORY, 2020-2029 (USD MILLION)

TABLE 119 KUWAIT WHEAT GLUTEN MARKET, BY FUNCTION, 2020-2029 (USD MILLION)

TABLE 120 KUWAIT WHEAT GLUTEN MARKET, BY FORM, 2020-2029 (USD MILLION)

TABLE 121 KUWAIT WHEAT GLUTEN MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 122 KUWAIT FOOD & BEVERAGES IN WHEAT GLUTEN MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 123 KUWAIT BAKERY & CONFECTIONERY PRODUCTS IN WHEAT GLUTEN MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 124 KUWAIT CONVENIENCE FOOD IN WHEAT GLUTEN MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 125 KUWAIT ANIMAL FEED IN WHEAT GLUTEN MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 126 KUWAIT WHEAT GLUTEN MARKET, BY PACKAGING, 2020-2029 (USD MILLION)

TABLE 127 KUWAIT BOTTLE/JAR IN WHEAT GLUTEN MARKET, BY PACKAGING, 2020-2029 (USD MILLION)

TABLE 128 KUWAIT WHEAT GLUTEN MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 129 KUWAIT STORE BASED RETAILERS IN WHEAT GLUTEN MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 130 KUWAIT WHEAT GLUTEN MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 131 KUWAIT COMMERCIAL IN WHEAT GLUTEN MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 132 REST OF MIDDLE EAST AND AFRICA WHEAT GLUTEN MARKET, BY CATEGORY, 2020-2029 (USD MILLION)

List of Figure

FIGURE 1 MIDDLE EAST & AFRICA WHEAT GLUTEN MARKET: SEGMENTATION

FIGURE 2 MIDDLE EAST & AFRICA WHEAT GLUTEN MARKET: DATA TRIANGULATION

FIGURE 3 MIDDLE EAST & AFRICA WHEAT GLUTEN MARKET: DROC ANALYSIS

FIGURE 4 MIDDLE EAST & AFRICA WHEAT GLUTEN MARKET: MIDDLE EAST & AFRICA VS REGIONAL MARKET ANALYSIS

FIGURE 5 MIDDLE EAST & AFRICA WHEAT GLUTEN MARKET: COMPANY RESEARCH ANALYSIS

FIGURE 6 MIDDLE EAST & AFRICA WHEAT GLUTEN MARKET: INTERVIEW DEMOGRAPHICS

FIGURE 7 MIDDLE EAST & AFRICA WHEAT GLUTEN MARKET: DBMR MARKET POSITION GRID

FIGURE 8 MIDDLE EAST & AFRICA WHEAT GLUTEN MARKET: MARKET APPLICATION COVERAGE GRID

FIGURE 9 MIDDLE EAST & AFRICA WHEAT GLUTEN MARKET: VENDOR SHARE ANALYSIS

FIGURE 10 MIDDLE EAST & AFRICA WHEAT GLUTEN MARKET: SEGMENTATION

FIGURE 11 THE GROWING EXPENDITURE ON WHEAT GLUTEN TECHNOLOGY IS EXPECTED TO DRIVE THE MIDDLE EAST & AFRICA WHEAT GLUTEN MARKET IN THE FORECAST PERIOD OF 2022 TO 2029

FIGURE 12 ORGANIC SEGMENT IS EXPECTED TO ACCOUNT FOR THE LARGEST SHARE OF THE MIDDLE EAST & AFRICA WHEAT GLUTEN MARKET IN 2022 & 2029

FIGURE 13 DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES OF THE MIDDLE EAST & AFRICA WHEAT GLUTEN MARKET

FIGURE 14 MIDDLE EAST & AFRICA WHEAT GLUTEN MARKET: BY CATEGORY, 2021

FIGURE 15 MIDDLE EAST & AFRICA WHEAT GLUTEN MARKET: BY CATEGORY, 2022-2029 (USD MILLION)

FIGURE 16 MIDDLE EAST & AFRICA WHEAT GLUTEN MARKET: BY CATEGORY, CAGR (2022-2029)

FIGURE 17 MIDDLE EAST & AFRICA WHEAT GLUTEN MARKET: BY CATEGORY, LIFELINE CURVE

FIGURE 18 MIDDLE EAST & AFRICA WHEAT GLUTEN MARKET: BY FUNCTION, 2021

FIGURE 19 MIDDLE EAST & AFRICA WHEAT GLUTEN MARKET: BY FUNCTION, 2022-2029 (USD MILLION)

FIGURE 20 MIDDLE EAST & AFRICA WHEAT GLUTEN MARKET: BY FUNCTION, CAGR (2022-2029)

FIGURE 21 MIDDLE EAST & AFRICA WHEAT GLUTEN MARKET: BY FUNCTION, LIFELINE CURVE

FIGURE 22 MIDDLE EAST & AFRICA WHEAT GLUTEN MARKET: BY FORM, 2021

FIGURE 23 MIDDLE EAST & AFRICA WHEAT GLUTEN MARKET: BY FORM, 2022-2029 (USD MILLION)

FIGURE 24 MIDDLE EAST & AFRICA WHEAT GLUTEN MARKET: BY FORM, CAGR (2022-2029)

FIGURE 25 MIDDLE EAST & AFRICA WHEAT GLUTEN MARKET: BY FORM, LIFELINE CURVE

FIGURE 26 MIDDLE EAST & AFRICA WHEAT GLUTEN MARKET: APPLICATION, 2021

FIGURE 27 MIDDLE EAST & AFRICA WHEAT GLUTEN MARKET: APPLICATION, 2022-2029 (USD MILLION)

FIGURE 28 MIDDLE EAST & AFRICA WHEAT GLUTEN MARKET: APPLICATION, CAGR (2022-2029)

FIGURE 29 MIDDLE EAST & AFRICA WHEAT GLUTEN MARKET: BY FORM, LIFELINE CURVE

FIGURE 30 MIDDLE EAST & AFRICA WHEAT GLUTEN MARKET: BY PACKAGING, 2021

FIGURE 31 MIDDLE EAST & AFRICA WHEAT GLUTEN MARKET: BY PACKAGING, 2022-2029 (USD MILLION)

FIGURE 32 MIDDLE EAST & AFRICA WHEAT GLUTEN MARKET: BY PACKAGING, CAGR (2022-2029)

FIGURE 33 MIDDLE EAST & AFRICA WHEAT GLUTEN MARKET: BY PACKAGING, LIFELINE CURVE

FIGURE 34 MIDDLE EAST & AFRICA WHEAT GLUTEN MARKET: DISTRIBUTION CHANNEL, 2021

FIGURE 35 MIDDLE EAST & AFRICA WHEAT GLUTEN MARKET: DISTRIBUTION CHANNEL, 2022-2029 (USD MILLION)

FIGURE 36 MIDDLE EAST & AFRICA WHEAT GLUTEN MARKET: DISTRIBUTION CHANNEL, CAGR (2022-2029)

FIGURE 37 MIDDLE EAST & AFRICA WHEAT GLUTEN MARKET: DISTRIBUTION CHANNEL, LIFELINE CURVE

FIGURE 38 MIDDLE EAST & AFRICA WHEAT GLUTEN MARKET: BY END USER, 2021

FIGURE 39 MIDDLE EAST & AFRICA WHEAT GLUTEN MARKET: BY END USER, 2022-2029 (USD MILLION)

FIGURE 40 MIDDLE EAST & AFRICA WHEAT GLUTEN MARKET: BY END USER, CAGR (2022-2029)

FIGURE 41 MIDDLE EAST & AFRICA WHEAT GLUTEN MARKET: BY END USER, LIFELINE CURVE

FIGURE 42 MIDDLE EAST AND AFRICA WHEAT GLUTEN MARKET: SNAPSHOT (2021)

FIGURE 43 MIDDLE EAST AND AFRICA WHEAT GLUTEN MARKET: BY COUNTRY (2021)

FIGURE 44 MIDDLE EAST AND AFRICA WHEAT GLUTEN MARKET: BY COUNTRY (2022 & 2029)

FIGURE 45 MIDDLE EAST AND AFRICA WHEAT GLUTEN MARKET: BY COUNTRY (2021 & 2029)

FIGURE 46 MIDDLE EAST AND AFRICA WHEAT GLUTEN MARKET: CATEGORY (2022-2029)

FIGURE 47 MIDDLE EAST & AFRICA WHEAT GLUTEN MARKET: COMPANY SHARE 2021 (%)

منهجية البحث

يتم جمع البيانات وتحليل سنة الأساس باستخدام وحدات جمع البيانات ذات أحجام العينات الكبيرة. تتضمن المرحلة الحصول على معلومات السوق أو البيانات ذات الصلة من خلال مصادر واستراتيجيات مختلفة. تتضمن فحص وتخطيط جميع البيانات المكتسبة من الماضي مسبقًا. كما تتضمن فحص التناقضات في المعلومات التي شوهدت عبر مصادر المعلومات المختلفة. يتم تحليل بيانات السوق وتقديرها باستخدام نماذج إحصائية ومتماسكة للسوق. كما أن تحليل حصة السوق وتحليل الاتجاهات الرئيسية هي عوامل النجاح الرئيسية في تقرير السوق. لمعرفة المزيد، يرجى طلب مكالمة محلل أو إرسال استفسارك.

منهجية البحث الرئيسية التي يستخدمها فريق بحث DBMR هي التثليث البيانات والتي تتضمن استخراج البيانات وتحليل تأثير متغيرات البيانات على السوق والتحقق الأولي (من قبل خبراء الصناعة). تتضمن نماذج البيانات شبكة تحديد موقف البائعين، وتحليل خط زمني للسوق، ونظرة عامة على السوق ودليل، وشبكة تحديد موقف الشركة، وتحليل براءات الاختراع، وتحليل التسعير، وتحليل حصة الشركة في السوق، ومعايير القياس، وتحليل حصة البائعين على المستوى العالمي مقابل الإقليمي. لمعرفة المزيد عن منهجية البحث، أرسل استفسارًا للتحدث إلى خبراء الصناعة لدينا.

التخصيص متاح

تعد Data Bridge Market Research رائدة في مجال البحوث التكوينية المتقدمة. ونحن نفخر بخدمة عملائنا الحاليين والجدد بالبيانات والتحليلات التي تتطابق مع هدفهم. ويمكن تخصيص التقرير ليشمل تحليل اتجاه الأسعار للعلامات التجارية المستهدفة وفهم السوق في بلدان إضافية (اطلب قائمة البلدان)، وبيانات نتائج التجارب السريرية، ومراجعة الأدبيات، وتحليل السوق المجدد وقاعدة المنتج. ويمكن تحليل تحليل السوق للمنافسين المستهدفين من التحليل القائم على التكنولوجيا إلى استراتيجيات محفظة السوق. ويمكننا إضافة عدد كبير من المنافسين الذين تحتاج إلى بيانات عنهم بالتنسيق وأسلوب البيانات الذي تبحث عنه. ويمكن لفريق المحللين لدينا أيضًا تزويدك بالبيانات في ملفات Excel الخام أو جداول البيانات المحورية (كتاب الحقائق) أو مساعدتك في إنشاء عروض تقديمية من مجموعات البيانات المتوفرة في التقرير.