Middle East And Africa Vegan Protein Market

حجم السوق بالمليار دولار أمريكي

CAGR :

%

USD

441.16 Million

USD

736.17 Million

2024

2032

USD

441.16 Million

USD

736.17 Million

2024

2032

| 2025 –2032 | |

| USD 441.16 Million | |

| USD 736.17 Million | |

|

|

|

|

تجزئة سوق البروتين النباتي في الشرق الأوسط وأفريقيا، حسب المصدر (بروتين الصويا، بروتين البازلاء، بروتين الأرز، بروتين القنب، السبيرولينا، بروتين الكينوا، بروتين بذور الكتان، بروتين الشيا، بروتين الكانولا، بذور اليقطين، وغيرها). نوع البروتين (المعزول، المركز، والمحلل)، مستوى التحلل المائي (سليم، متحلل قليلاً، ومتحلل بقوة)، الشكل (جاف وسائل)، الطبيعة (تقليدي وعضوي)، الوظيفة (الذوبان، الاستحلاب، التجلط، الارتباط بالماء، الرغوة، وغيرها)، الاستخدام (المنتجات الغذائية، المشروبات، المغذيات الدوائية والمكملات الغذائية، مستحضرات التجميل والعناية الشخصية، أعلاف الحيوانات، الأدوية، وغيرها) - اتجاهات الصناعة وتوقعاتها حتى عام 2032

حجم سوق البروتين النباتي في الشرق الأوسط وأفريقيا

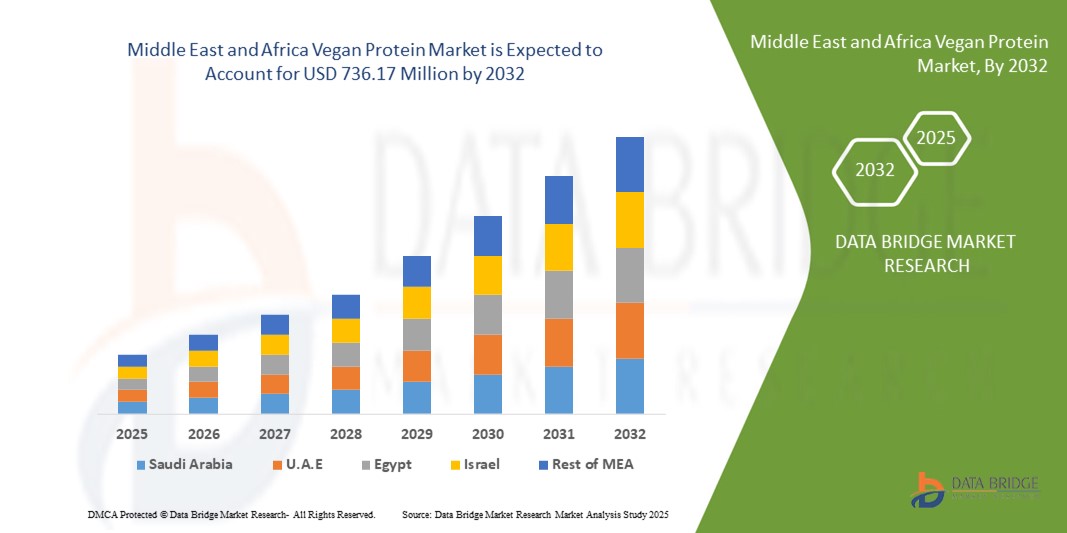

- تم تقييم حجم سوق البروتين النباتي في الشرق الأوسط وأفريقيا بـ 441.16 مليون دولار أمريكي في عام 2024 ومن المتوقع أن يصل إلى 736.17 مليون دولار أمريكي بحلول عام 2032 ، بمعدل نمو سنوي مركب قدره 6.60٪ خلال الفترة المتوقعة.

- ويعود نمو السوق إلى حد كبير إلى التبني المتزايد للأنظمة الغذائية القائمة على النباتات، والتركيز المتزايد من جانب المستهلكين على الصحة والعافية، والوعي البيئي والأخلاقي المتزايد.

- إن الارتفاع في الطلب على الأطعمة الوظيفية الغنية بالبروتين والمشروبات والمكملات الغذائية يدفع إلى مزيد من التوسع في السوق

تحليل سوق البروتين النباتي في الشرق الأوسط وأفريقيا

- إن تزايد اعتماد الأنظمة الغذائية النباتية وتنامي الوعي الصحي بين المستهلكين يدفعان الطلب على منتجات البروتين النباتي. كما أن تزايد الوعي بالفوائد البيئية والأخلاقية للبروتينات النباتية يعزز نمو السوق.

- إن الارتفاع الكبير في اتجاهات اللياقة البدنية والعافية، إلى جانب الاستخدام المتزايد للبروتين النباتي في الأطعمة الوظيفية والمكملات الغذائية والمكملات الغذائية، يساهم في توسع السوق

- هيمن سوق البروتين النباتي في المملكة العربية السعودية على منطقة الشرق الأوسط وأفريقيا في عام 2024، مدفوعًا بتزايد الوعي الصحي، والتحضر، والاعتماد المتزايد على الأنظمة الغذائية النباتية. يُعطي المستهلكون الأولوية للأطعمة والمشروبات الغنية بالبروتين لتحسين صحتهم، مما يُعزز الطلب عليها باستمرار.

- من المتوقع أن تشهد الإمارات العربية المتحدة أعلى معدل نمو سنوي مركب (CAGR) في سوق البروتين النباتي في الشرق الأوسط وأفريقيا، وذلك بفضل التوسع السريع في قاعدة المستهلكين النباتيين، والاعتماد القوي على العلامات التجارية العالمية القائمة على النباتات، والسياسات الحكومية الداعمة لأنظمة الغذاء المستدامة. كما يعزز قطاع الضيافة وخدمات الطعام المزدهر في الدولة الطلب على منتجات البروتين النباتي.

- حقق قطاع بروتين الصويا أكبر حصة من إيرادات السوق في عام ٢٠٢٤، بفضل استخدامه الواسع في المنتجات الغذائية والمشروبات والمكملات الغذائية. ويُفضل بروتين الصويا لقيمته الغذائية العالية، وتطبيقاته المتعددة، وسلسلة توريده الراسخة عبر البلدان.

نطاق التقرير وتقسيم سوق البروتين النباتي في الشرق الأوسط وأفريقيا

|

صفات |

رؤى رئيسية حول سوق البروتين النباتي في الشرق الأوسط وأفريقيا |

|

القطاعات المغطاة |

|

|

الدول المغطاة |

الشرق الأوسط وأفريقيا

|

|

اللاعبون الرئيسيون في السوق |

|

|

فرص السوق |

|

|

مجموعات معلومات البيانات ذات القيمة المضافة |

بالإضافة إلى الرؤى حول سيناريوهات السوق مثل القيمة السوقية ومعدل النمو والتجزئة والتغطية الجغرافية واللاعبين الرئيسيين، فإن تقارير السوق التي تم تنظيمها بواسطة Data Bridge Market Research تشمل أيضًا تحليلًا متعمقًا من الخبراء وتحليل التسعير وتحليل حصة العلامة التجارية واستطلاع رأي المستهلكين وتحليل التركيبة السكانية وتحليل سلسلة التوريد وتحليل سلسلة القيمة ونظرة عامة على المواد الخام / المواد الاستهلاكية ومعايير اختيار البائعين وتحليل PESTLE وتحليل Porter والإطار التنظيمي. |

اتجاهات سوق البروتين النباتي في الشرق الأوسط وأفريقيا

تزايد اعتماد حلول البروتين النباتي

- يُحدث التحول المتزايد نحو منتجات البروتين النباتي تحولاً في مشهد الأغذية والمستحضرات الغذائية، وذلك بتوفير بدائل بروتينية نباتية ومستدامة. تُمكّن هذه المنتجات المستهلكين من تلبية احتياجاتهم اليومية من البروتين مع تقليل الاعتماد على المصادر الحيوانية، مما يدعم الأهداف الصحية والبيئية. كما أن تزايد اهتمام المستهلكين بالخيارات الغذائية الأخلاقية والصديقة للبيئة يُعزز قبول السوق.

- يُسرّع الطلب المتزايد على مساحيق البروتين وألواحه ومكملاته الغذائية من اعتماد حلول البروتين النباتي. تُعد هذه المنتجات فعّالة بشكل خاص في قطاعي اللياقة البدنية والعافية، حيث يبحث المستهلكون عن خيارات سريعة ومغذية. كما أن توافر المنتجات الجاهزة للاستخدام والمنكّهة يُعزز راحة المستهلك ويشجع على الاستخدام المتكرر.

- إن أسعار البروتين النباتي وتنوعه وسهولة دمجه في الأنظمة الغذائية اليومية تجعله جذابًا للمنازل والصالات الرياضية ومطاعم الوجبات السريعة. يُحسّن الاستهلاك المتكرر التنوع الغذائي ويدعم اتجاهات الصحة والعافية العامة. بالإضافة إلى ذلك، يُوسّع التوجه نحو البروتينات النباتية الوظيفية والمُدعّمة نطاق تطبيقاتها في التغذية اليومية.

- على سبيل المثال، في السنوات الأخيرة، أفادت العديد من العلامات التجارية المتخصصة في التغذية بزيادة كبيرة في المبيعات بعد إطلاق مساحيق بروتين البازلاء والأرز والصويا الجديدة، المُخصصة للمستهلكين النباتيين والمرنين. وقد أتاحت هذه الإصدارات انتشارًا أوسع وتفاعلًا أفضل مع المستهلكين. كما ساهمت جهود التسويق التي تُركز على الاستدامة والتغذية والتنوع في توسيع نطاق وصول المنتجات.

- في حين تدعم منتجات البروتين النباتي الاستهلاك الصحي والأنظمة الغذائية المستدامة، فإن نمو سوقها يعتمد على الابتكار المستمر للمنتجات، وتحسين المذاق، والأسعار المعقولة. يجب على المصنّعين التركيز على تركيبات جديدة، ومصادر عالية الجودة، والتسويق الاستراتيجي للاستفادة الكاملة من هذا الطلب المتزايد. كما تساهم التعبئة والتغليف المُحسّن، والأشكال الثابتة على الرفوف، ومزيجات البروتين متعددة الوظائف في زخم السوق.

ديناميكيات سوق البروتين النباتي في الشرق الأوسط وأفريقيا

سائق

زيادة الوعي الصحي والتحول نحو الأنظمة الغذائية النباتية

- يدفع تزايد قاعدة المستهلكين المهتمين بالصحة كلاً من المصنّعين وتجار التجزئة إلى إعطاء الأولوية لمنتجات البروتين النباتي. ويبحث المستهلكون بشكل متزايد عن بدائل للبروتينات الحيوانية التقليدية لتحسين صحة القلب والأوعية الدموية، والتحكم في الوزن، وتحسين صحة الجهاز الهضمي. ويدعم هذا التحول تزايد شعبية المنتجات الغذائية الطبيعية وذات العلامات التجارية النظيفة.

- يدفع الوعي المتزايد بالأثر البيئي لتربية الحيوانات المستهلكين نحو خيارات البروتين النباتي. هذا التوجه يدفع العلامات التجارية إلى تقديم تركيبات نباتية أكثر تنوعًا والاستثمار في ممارسات التوريد المستدامة. كما أن التركيز على تقليل البصمة الكربونية والتغليف الصديق للبيئة يعزز تفضيل المستهلكين للبروتينات النباتية.

- تشجع الحكومات ومنظمات التغذية وبرامج العافية الأنظمة الغذائية النباتية كجزء من حملات الصحة العامة. كما تعزز المبادرات التعليمية وتأييد المؤثرين في مجال اللياقة البدنية والصحة إقبال المستهلكين على هذه الأنظمة. وتساهم المبادرات التي تُسلّط الضوء على التغذية الوقائية وفوائد الأغذية الوظيفية في نمو السوق بشكل مطرد.

- على سبيل المثال، أطلقت العديد من العلامات التجارية مؤخرًا حملات توعية تُركز على الفوائد الغذائية والبيئية للبروتينات النباتية، مما أدى إلى زيادة انتشار المنتج وزيادة اهتمام المستهلكين به. وقد ساعدت حملات الترويج المتبادل مع منصات اللياقة البدنية وأسلوب الحياة والعافية في توسيع نطاق وصولها إلى السوق.

- في حين أن الوعي الصحي والاستدامة يُحفّزان النمو، إلا أن ابتكار المنتجات وتحسين النكهات وتوسيع نطاق التوزيع لا يزالان أساسيين لاستمرار توسع السوق. إضافةً إلى ذلك، يُعزز تطوير البروتينات الهجينة والمزائج المُدعّمة من جاذبية منتجات البروتين النباتي من حيث الأداء الوظيفي.

ضبط النفس/التحدي

التكلفة العالية لتركيبات البروتين المتميزة وتفضيلات التذوق

- غالبًا ما تكون أسعار مساحيق البروتين النباتي الممتاز، والمعزولات، والمخاليط أعلى من أسعار مصادر البروتين التقليدية، مما يحد من اعتمادها بين المستهلكين المهتمين بالأسعار. هذا يحد من انتشار استخدامها في الأسواق الناشئة وبين المستخدمين العاديين. ولا يزال الإنتاج الفعال من حيث التكلفة وتوفير المكونات يشكلان تحديًا رئيسيًا أمام المصنّعين.

- في العديد من المناطق، قد يرى المستهلكون أن البروتينات النباتية أقل مذاقًا أو فعالية من البروتينات المشتقة من مصادر حيوانية. ولا تزال تحديات الطعم والملمس وسهولة الهضم تؤثر على سلوك الشراء المتكرر. وتستثمر العلامات التجارية في إخفاء النكهة وتحسين الملمس وتركيبات البروتين للتغلب على هذه العوائق.

- يمكن أن تؤدي قيود سلسلة التوريد، مثل الحصول على فول الصويا والبازلاء والأرز عالي الجودة، أو غيرها من المكونات الغنية بالبروتين، إلى اختناقات في الإنتاج وارتفاع أسعار التجزئة، مما يؤثر على إمكانية الوصول. كما أن التأخير في توافر المواد الخام وتقلبات العرض العالمي قد تُزعزع استقرار السوق.

- على سبيل المثال، قامت العديد من العلامات التجارية للبروتين النباتي مؤخرًا بمراجعة عبواتها وملصقاتها وادعاءاتها الغذائية لضمان الدقة والشفافية، مما زاد من ثقة المستهلك وشجعه على تكرار الشراء. وشملت هذه المبادرات أيضًا حملات تثقيفية لتوضيح جودة البروتين وفوائده.

- في حين تستمر منتجات البروتين النباتي في التطور من حيث التركيبة والطعم، يبقى من الضروري معالجة التكلفة والتفضيلات الحسية وتحديات سلسلة التوريد. يجب على أصحاب المصلحة التركيز على حلول ميسورة التكلفة وعالية الجودة ولذيذة المذاق للحفاظ على إمكانات النمو على المدى الطويل. الاستثمار في الأبحاث والإنتاج القابل للتوسع ومصادر البروتين البديلة يمكن أن يعزز إمكانية الوصول والربحية.

نطاق سوق البروتين النباتي في الشرق الأوسط وأفريقيا

يتم تقسيم السوق على أساس المصدر ونوع البروتين ومستوى التحلل المائي والشكل والطبيعة والوظيفة والتطبيق.

- حسب المصدر

بناءً على المصدر، يُقسّم سوق البروتين النباتي في الشرق الأوسط وأفريقيا إلى بروتين الصويا، وبروتين البازلاء، وبروتين الأرز، وبروتين القنب، والسبيرولينا، وبروتين الكينوا، وبروتين بذور الكتان، وبروتين الشيا، وبروتين الكانولا، وبذور اليقطين، وغيرها. وقد استحوذ قطاع بروتين الصويا على أكبر حصة من إيرادات السوق في عام 2024، بفضل استخدامه الواسع في المنتجات الغذائية والمشروبات والمكملات الغذائية. ويُفضّل بروتين الصويا لقيمته الغذائية العالية، وتعدد استخداماته، وسلسلة توريده الراسخة عبر الدول.

من المتوقع أن يشهد قطاع بروتين البازلاء أسرع معدل نمو بين عامي 2025 و2032، مدفوعًا بتزايد إقبال المستهلكين على مصادر البروتين النباتية الخالية من مسببات الحساسية. ويحظى بروتين البازلاء بشعبية خاصة في مساحيق البروتين والوجبات الخفيفة والأغذية الوظيفية نظرًا لمذاقه المعتدل، وسهولة هضمه، وملاءمته للتركيبات النظيفة.

- حسب نوع البروتين

بناءً على نوع البروتين، يُقسّم سوق البروتين النباتي في الشرق الأوسط وأفريقيا إلى مُعْزَلات، ومُركَّزات، ومُحَلَّلات. وقد حصد قطاع المُعْزَلات أكبر حصة من الإيرادات في عام ٢٠٢٤ بفضل محتواه العالي من البروتين، ونقائه، وخصائصه الوظيفية المناسبة للمشروبات والمكملات الغذائية.

من المتوقع أن يشهد قطاع المُحللات المائية أسرع معدل نمو بين عامي 2025 و2032، مدفوعًا بزيادة قابلية الهضم، وسرعة الامتصاص، وملاءمته للتغذية الرياضية والتطبيقات السريرية. وتحظى المُحللات المائية بشعبية كبيرة بين المستهلكين الذين يسعون إلى الاستفادة السريعة والفعالة من البروتين.

- حسب مستوى التحلل المائي

بناءً على مستوى التحلل المائي، يُقسّم سوق البروتين النباتي في الشرق الأوسط وأفريقيا إلى بروتينات سليمة، وبروتينات مُحلَّلة قليلاً، وبروتينات مُحلَّلة بقوة. وقد هيمنت شريحة البروتين السليم في عام ٢٠٢٤ بفضل خصائصها الغذائية المتوازنة وفعاليتها من حيث التكلفة للاستهلاك الغذائي المنتظم.

ومن المتوقع أن يشهد قطاع التحلل المائي الخفيف أسرع معدل نمو في الفترة من 2025 إلى 2032، مدفوعًا بتحسين القدرة على الذوبان والأداء الوظيفي والقابلية للهضم، مما يجعله مثاليًا للمشروبات المدعمة ومستحضرات البروتين المتخصصة.

- حسب النموذج

بناءً على الشكل، يُقسّم سوق البروتين النباتي في الشرق الأوسط وأفريقيا إلى بروتينات جافة وسائلة. وقد استحوذت البروتينات الجافة على أكبر حصة من إيرادات السوق في عام ٢٠٢٤ بفضل سهولة تخزينها وطول مدة صلاحيتها وإمكانية استخدامها في مساحيق البروتين والألواح ومنتجات المخابز.

ومن المتوقع أن يشهد قطاع السوائل أسرع معدل نمو في الفترة من 2025 إلى 2032، مدفوعًا بالطلب المتزايد على المشروبات الجاهزة للشرب والعصائر والمشروبات الوظيفية الغنية بالبروتين بين المستهلكين المهتمين بالصحة.

- بالطبيعة

بناءً على طبيعة السوق، يُقسّم سوق البروتين النباتي في الشرق الأوسط وأفريقيا إلى بروتينات تقليدية وعضوية. وقد تصدّرت البروتينات التقليدية السوق في عام ٢٠٢٤، مدعومةً ببنية تحتية تصنيعية راسخة وتكلفة معقولة.

ومن المتوقع أن يشهد قطاع الأغذية العضوية أسرع معدل نمو في الفترة من 2025 إلى 2032، مدفوعًا بتفضيل المستهلكين المتزايد للبروتينات النباتية النظيفة وغير المعدلة وراثيًا والمستمدة من مصادر مستدامة في جميع أنحاء الشرق الأوسط وأفريقيا.

- حسب الوظيفة

بناءً على الوظيفة، يُقسّم سوق البروتين النباتي في الشرق الأوسط وأفريقيا إلى قابلية الذوبان، والاستحلاب، والهلام، والترابط المائي، والرغوة، وغيرها. وقد استحوذ قطاع قابلية الذوبان على أكبر حصة سوقية في عام ٢٠٢٤ نظرًا لأهميته في المشروبات، والمشروبات المخفوقة، والأغذية الوظيفية.

ومن المتوقع أن تشهد قطاعات الاستحلاب والجيلاتين أسرع معدل نمو في الفترة من 2025 إلى 2032، مدفوعًا بالاستخدام المتزايد للبروتينات النباتية في المخابز وبدائل الألبان وتطبيقات الأغذية المصنعة لتحسين الملمس والاستقرار.

- حسب الطلب

بناءً على التطبيق، يُقسّم سوق البروتين النباتي في الشرق الأوسط وأفريقيا إلى منتجات غذائية، ومشروبات، ومكملات غذائية، ومستحضرات تجميل وعناية شخصية، وأعلاف حيوانية، وأدوية، وغيرها. وقد هيمن قطاع المنتجات الغذائية على السوق في عام ٢٠٢٤ بفضل الاستخدام الواسع للبروتينات النباتية في المخبوزات والوجبات الخفيفة والحلويات.

من المتوقع أن يشهد قطاع المكملات الغذائية والمكملات الغذائية أسرع معدل نمو في الفترة من 2025 إلى 2032، مدفوعًا بالاعتماد المتزايد على الأطعمة الوظيفية الغنية بالبروتين، ومكملات العافية، والمشروبات المدعمة.

تحليل إقليمي لسوق البروتين النباتي في الشرق الأوسط وأفريقيا

- هيمن سوق البروتين النباتي في المملكة العربية السعودية على منطقة الشرق الأوسط وأفريقيا في عام 2024، مدفوعًا بتزايد الوعي الصحي، والتحضر، والاعتماد المتزايد على الأنظمة الغذائية النباتية. يُعطي المستهلكون الأولوية للأطعمة والمشروبات الغنية بالبروتين لتحسين صحتهم، مما يُعزز الطلب عليها باستمرار.

- يدعم وجود علامات تجارية عالمية وإقليمية للبروتين النباتي، إلى جانب توسع قنوات البيع بالتجزئة الحديثة، نمو السوق. كما تُعزز حملات التوعية التي تُركز على الاستدامة والتغذية تفضيلات المستهلكين.

- بالإضافة إلى ذلك، تساهم منتجات البروتين الوظيفية والخالية من المواد المسببة للحساسية والنظيفة في توسيع السوق

نظرة عامة على سوق البروتين النباتي في الإمارات العربية المتحدة

من المتوقع أن يشهد سوق البروتين النباتي في الإمارات العربية المتحدة أسرع معدل نمو بين عامي 2025 و2032، مدفوعًا بارتفاع اتجاهات اللياقة البدنية، وأنماط الحياة الصحية، والاهتمام المتزايد بالتغذية النباتية. يبحث المستهلكون عن منتجات بروتين سهلة الاستخدام ومدعمة، بما في ذلك المساحيق والألواح والمشروبات، لتلبية احتياجاتهم الغذائية. ويضمن توسع قطاعي التجزئة والتجارة الإلكترونية سهولة الوصول إلى المنتجات. كما تشجع الحملات التسويقية التي تركز على الاستدامة والتغذية والفوائد الوظيفية على تبني هذه المنتجات. ويدعم إطلاق تركيبات نباتية مبتكرة ومنتجات معززة النمو السريع للسوق.

حصة سوق البروتين النباتي في الشرق الأوسط وأفريقيا

وتقود صناعة البروتين النباتي في منطقة الشرق الأوسط وأفريقيا بشكل أساسي شركات راسخة، بما في ذلك:

- ثريف (الإمارات العربية المتحدة)

- هنتر فودز (الإمارات العربية المتحدة)

- يلا نيوترشن (الإمارات العربية المتحدة)

- فود بيبول (الإمارات العربية المتحدة)

- بيور هارفست (الإمارات العربية المتحدة)

- نيوتري برو (جنوب أفريقيا)

- بروتينا فودز (جنوب أفريقيا)

- شركة ديزرت فودز (الإمارات العربية المتحدة)

- مغذيات الصحراء (المغرب)

- بروتين جرين ليف (مصر)

SKU-

احصل على إمكانية الوصول عبر الإنترنت إلى التقرير الخاص بأول سحابة استخبارات سوقية في العالم

- لوحة معلومات تحليل البيانات التفاعلية

- لوحة معلومات تحليل الشركة للفرص ذات إمكانات النمو العالية

- إمكانية وصول محلل الأبحاث للتخصيص والاستعلامات

- تحليل المنافسين باستخدام لوحة معلومات تفاعلية

- آخر الأخبار والتحديثات وتحليل الاتجاهات

- استغل قوة تحليل المعايير لتتبع المنافسين بشكل شامل

منهجية البحث

يتم جمع البيانات وتحليل سنة الأساس باستخدام وحدات جمع البيانات ذات أحجام العينات الكبيرة. تتضمن المرحلة الحصول على معلومات السوق أو البيانات ذات الصلة من خلال مصادر واستراتيجيات مختلفة. تتضمن فحص وتخطيط جميع البيانات المكتسبة من الماضي مسبقًا. كما تتضمن فحص التناقضات في المعلومات التي شوهدت عبر مصادر المعلومات المختلفة. يتم تحليل بيانات السوق وتقديرها باستخدام نماذج إحصائية ومتماسكة للسوق. كما أن تحليل حصة السوق وتحليل الاتجاهات الرئيسية هي عوامل النجاح الرئيسية في تقرير السوق. لمعرفة المزيد، يرجى طلب مكالمة محلل أو إرسال استفسارك.

منهجية البحث الرئيسية التي يستخدمها فريق بحث DBMR هي التثليث البيانات والتي تتضمن استخراج البيانات وتحليل تأثير متغيرات البيانات على السوق والتحقق الأولي (من قبل خبراء الصناعة). تتضمن نماذج البيانات شبكة تحديد موقف البائعين، وتحليل خط زمني للسوق، ونظرة عامة على السوق ودليل، وشبكة تحديد موقف الشركة، وتحليل براءات الاختراع، وتحليل التسعير، وتحليل حصة الشركة في السوق، ومعايير القياس، وتحليل حصة البائعين على المستوى العالمي مقابل الإقليمي. لمعرفة المزيد عن منهجية البحث، أرسل استفسارًا للتحدث إلى خبراء الصناعة لدينا.

التخصيص متاح

تعد Data Bridge Market Research رائدة في مجال البحوث التكوينية المتقدمة. ونحن نفخر بخدمة عملائنا الحاليين والجدد بالبيانات والتحليلات التي تتطابق مع هدفهم. ويمكن تخصيص التقرير ليشمل تحليل اتجاه الأسعار للعلامات التجارية المستهدفة وفهم السوق في بلدان إضافية (اطلب قائمة البلدان)، وبيانات نتائج التجارب السريرية، ومراجعة الأدبيات، وتحليل السوق المجدد وقاعدة المنتج. ويمكن تحليل تحليل السوق للمنافسين المستهدفين من التحليل القائم على التكنولوجيا إلى استراتيجيات محفظة السوق. ويمكننا إضافة عدد كبير من المنافسين الذين تحتاج إلى بيانات عنهم بالتنسيق وأسلوب البيانات الذي تبحث عنه. ويمكن لفريق المحللين لدينا أيضًا تزويدك بالبيانات في ملفات Excel الخام أو جداول البيانات المحورية (كتاب الحقائق) أو مساعدتك في إنشاء عروض تقديمية من مجموعات البيانات المتوفرة في التقرير.