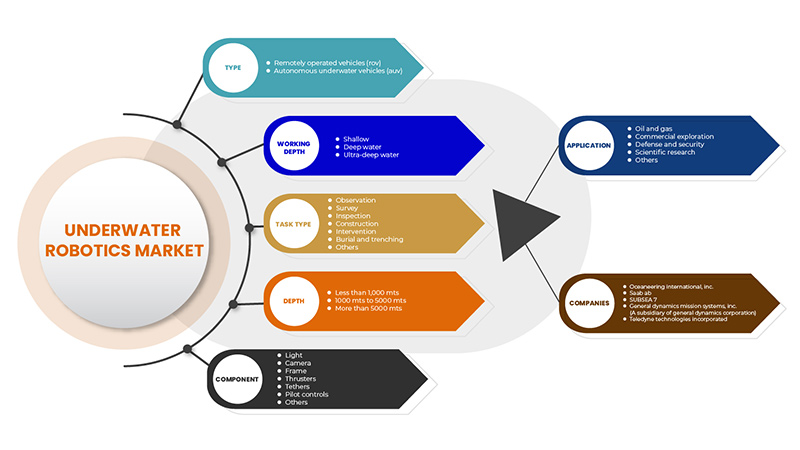

سوق الروبوتات تحت الماء في الشرق الأوسط وأفريقيا، حسب النوع (المركبات التي يتم تشغيلها عن بعد (ROV) والمركبات ذاتية القيادة تحت الماء (AUV))، عمق العمل (المياه الضحلة والعميقة والمياه العميقة للغاية)، نوع المهمة (المراقبة والمسح والتفتيش والبناء والتدخل والدفن والحفر وغيرها)، العمق (أقل من 1000 متر، 1000 متر إلى 5000 متر وأكثر من 5000 متر)، المكون (الضوء، الكاميرا ، الإطار، الدافعات، الحبال، أدوات التحكم في الطيار وغيرها)، التطبيق ( النفط والغاز، الاستكشاف التجاري، الدفاع والأمن ، البحث العلمي وغيرها) - اتجاهات الصناعة والتوقعات حتى عام 2029.

تحليل السوق والحجم

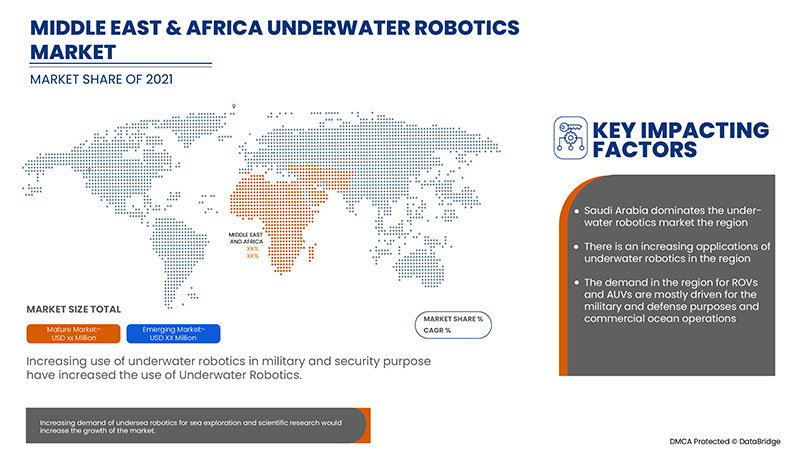

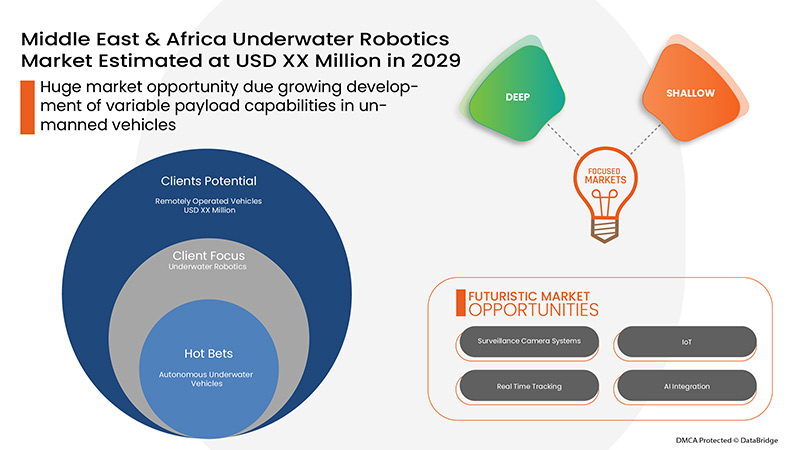

إن سوق الروبوتات تحت الماء في الشرق الأوسط وأفريقيا مدفوع في المقام الأول بالطلب المتزايد على المركبات التي تعمل عن بعد في صناعات النفط والغاز البحرية وحاجتها الأساسية لاستكشاف البحار والبحث العلمي. بالإضافة إلى ذلك، فإن تطبيقات الروبوتات تحت الماء لعمليات الإنقاذ والإنقاذ والإصلاح تعمل على تغذية نمو السوق بمعدل سريع. ومع ذلك، فإن التكلفة العالية للمركبات التي تعمل عن بعد والمركبات التي تعمل تحت الماء بعد الإضافات والتهديدات المتعلقة بالأمن السيبراني قد تحد من نمو سوق الروبوتات تحت الماء في الشرق الأوسط وأفريقيا. علاوة على ذلك، فإن الحاجز الفني للملاحة والاتصال للمركبات التي تعمل تحت الماء والمركبات التي تعمل تحت الماء في التيارات المائية القوية والصفائح الجليدية قد يشكل تحديًا لنمو السوق. بالإضافة إلى ذلك، فإن التقدم البطيء في تكنولوجيا الاستشعار والتعقيد الفني العالي في الروبوتات تحت الماء قد يعيق نمو السوق. ومع ذلك، فإن التطور المتزايد لقدرات الحمولة المتغيرة في المركبات تحت الماء ودمج التقنيات المتقدمة لزيادة كفاءة وعمل الروبوتات تحت الماء توفر فرصًا مربحة لسوق الروبوتات تحت الماء في الشرق الأوسط وأفريقيا.

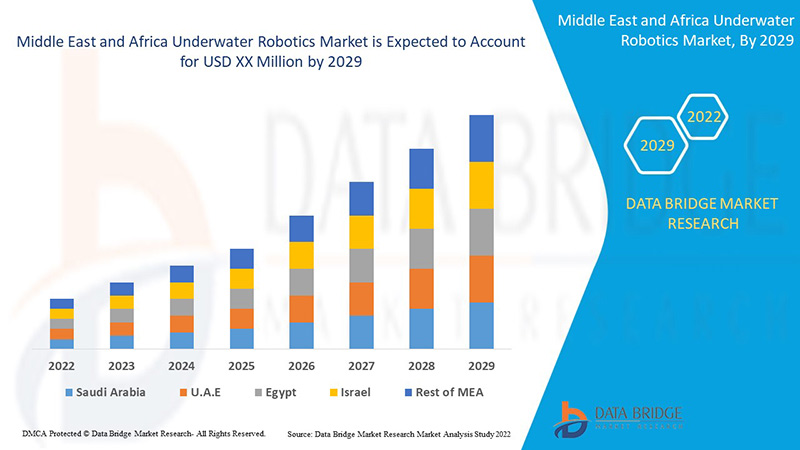

تحلل شركة Data Bridge Market Research أن سوق الروبوتات تحت الماء في الشرق الأوسط وأفريقيا من المتوقع أن يصل إلى XX مليون دولار أمريكي بحلول عام 2029، بمعدل نمو سنوي مركب بنسبة 11.8٪ خلال الفترة المتوقعة. "المركبات التي يتم تشغيلها عن بعد (ROV)" تمثل الشريحة الأكثر بروزًا في السوق المعنية. يتضمن تقرير السوق الذي أعده فريق Data Bridge Market Research تحليلًا متعمقًا من الخبراء، وتحليل الاستيراد / التصدير، وتحليل الأسعار، وتحليل استهلاك الإنتاج، وسيناريو سلسلة المناخ.

|

تقرير القياس |

تفاصيل |

|

فترة التنبؤ |

2022 إلى 2029 |

|

سنة الأساس |

2021 |

|

سنوات تاريخية |

2020 (قابلة للتخصيص حتى 2019 - 2014) |

|

وحدات كمية |

الإيرادات بالملايين من الدولارات الأمريكية، التسعير بالدولار الأمريكي |

|

القطاعات المغطاة |

حسب النوع (المركبات التي يتم تشغيلها عن بعد (ROV) والمركبات ذاتية القيادة تحت الماء (AUV))، عمق العمل (المياه الضحلة والعميقة والمياه العميقة للغاية)، نوع المهمة (المراقبة والمسح والتفتيش والبناء والتدخل والدفن والحفر وغيرها)، العمق (أقل من 1000 متر، ومن 1000 متر إلى 5000 متر وأكثر من 5000 متر)، المكون (الضوء والكاميرا والإطار والدوافع والأربطة وأدوات التحكم في الطيار وغيرها)، التطبيق (النفط والغاز والاستكشاف التجاري والدفاع والأمن والبحث العلمي وغيرها) |

|

الدول المغطاة |

المملكة العربية السعودية، الإمارات العربية المتحدة، جنوب أفريقيا، مصر، إسرائيل، بقية دول الشرق الأوسط وأفريقيا |

|

الجهات الفاعلة في السوق المشمولة |

ATLAS ELEKTRONIK GmbH، وGeneral Dynamics Mission Systems, Inc.، وECA GROUP، وEddyfi، وBoeing، وSoil Machine Dynamics Ltd.، وMacArtney A/S، وOceaneering International, Inc.، وSaab AB، وForum Energy Technologies, Inc.، وTechnipFMC plc، وSUBSEA 7، وFugro، وTotal Marine Technology Pty Ltd، وTeledyne Marine، وKONGSBERG، وMitsui E&S Holdings Co., Ltd. |

تعريف السوق

الروبوتات تحت الماء هي فرع من فروع الروبوتات التي تغطي البحث والتطوير والتصميم والتصنيع وتطبيق الروبوتات العاملة في البيئات تحت الماء. يمكن أن يشير المصطلح إلى أي روبوت يعمل عند مستوى الماء أو تحته (أنظمة الروبوتات البحرية). ومع ذلك، فإنه يشير عادةً على وجه التحديد إلى المركبات ذاتية القيادة المصممة للاستخدام تحت الماء. الروبوت تحت الماء يسمى أيضًا مركبة تحت الماء ذاتية القيادة، وهو آلة يمكن تشغيلها عن بُعد. تم تصميمه للعمل تحت الماء للمراقبة المستمرة للمحيطات. تم استخدام الروبوتات في التصنيع في السنوات القليلة الماضية. أدى التوسع الرائع إلى جعلها أكثر ثقافة وموثوقية للتطبيقات العسكرية وتطبيق القانون. تلعب الروبوتات تحت الماء دورًا مهمًا في توسع الصناعة البحرية. بالإضافة إلى ذلك، لديها العديد من التطبيقات في علم الأحياء البحرية وعلم الآثار تحت الماء والأمن البحري.

تتضمن ديناميكيات السوق لسوق الروبوتات تحت الماء في الشرق الأوسط وأفريقيا ما يلي:

- الاستخدام المتزايد للروبوتات تحت الماء للأغراض العسكرية والأمنية

في الشرق الأوسط وأفريقيا، يتزايد استخدام المركبات تحت الماء بسبب تزايد استخدامها في الجيش والبحرية والشرطة والتطبيقات مثل جمع المعلومات الاستخباراتية والمراقبة والاستطلاع ومكافحة الألغام والتفتيش وتحديد الهوية تحت الماء. وهذا يقود سوق الروبوتات تحت الماء في الشرق الأوسط وأفريقيا.

- الاستخدام المتزايد للمركبات التي تعمل عن بعد في صناعات النفط والغاز

إن الوجود الكبير لصناعات النفط والغاز البحرية في الشرق الأوسط وأفريقيا والكفاءة المتزايدة للمركبة تحت الماء للقيام بمهام تحت الماء تعمل على رفع نمو سوق الروبوتات تحت الماء في الشرق الأوسط وأفريقيا.

- تزايد الطلب على المركبات ذاتية القيادة لاستكشاف المياه والبحث العلمي

يرجع الطلب المتزايد على المركبات ذاتية القيادة تحت الماء لأغراض الاستكشاف والبحث العلمي إلى التحسن الكبير الذي شهدته عروض المركبات ذاتية القيادة تحت الماء على مر السنين. وقد أدت القدرة على الغوص عميقًا وإكمال العمليات بسهولة إلى زيادة الطلب على المركبات ذاتية القيادة تحت الماء في الشرق الأوسط وأفريقيا.

- الطلب المتزايد على الروبوتات تحت الماء لعمليات البحث والإنقاذ والإصلاح

إن التطوير المستمر للمركبات تحت الماء وفقًا للمتطلبات اللازمة في العمليات مثل البحث والإنقاذ والإصلاح تحت الماء في المواقع النائية وفي الظروف المعادية يعزز الطلب على المركبات التي تعمل عن بعد، ومن المتوقع أن يكون هذا بمثابة محرك لسوق الروبوتات تحت الماء في الشرق الأوسط وأفريقيا.

القيود والتحديات التي تواجه سوق الروبوتات تحت الماء في الشرق الأوسط وأفريقيا

- التكلفة العالية للروبوتات/المركبات تحت الماء

لقد زاد استخدام المركبات تحت الماء والحاجة إليها بسرعة في العديد من الصناعات. ومع ذلك، لا تستطيع الشركات الصغيرة ومعاهد البحث تحمل تكاليف المركبات تحت الماء بسبب التكلفة العالية. وقد تحد التكلفة العالية للمركبات تحت الماء من سوق الروبوتات تحت الماء في الشرق الأوسط وأفريقيا.

- التهديدات والمخاوف المتعلقة بالأمن السيبراني والأمن التشغيلي

يمكن اختراق نظام الاتصالات المستخدم لتشغيل هذه المركبات ذاتية القيادة وجمع البيانات في مركز التشغيل. ويشكل ذلك خطرًا أمنيًا وقلقًا لمشغلي المركبات ذاتية القيادة ويشمل صناعات مثل القطاع العسكري وعلم الأحياء البحرية والنفط والغاز والطاقة البحرية. وقد تحد هذه التهديدات والمخاوف بشأن الأمن السيبراني والأمن التشغيلي للمركبات تحت الماء من نمو سوق الروبوتات تحت الماء في الشرق الأوسط وأفريقيا.

التطورات الأخيرة

- في أبريل 2022، أعلنت شركة SUBSEA 7 عن فوزها بعقد هندسة وشراء وتركيب وتشغيل خطوط التدفق والأنابيب السرية قبالة سواحل غرب إفريقيا. بدأت الشركة إدارة المشروع، واتصل مهندسوها البحريون بالمشغلين في إفريقيا. ومن المقرر أن تتم العملية في أوائل عام 2024. وقد سمح هذا للشركة بالدخول إلى السوق الأفريقية تحت الماء والترويج لنفسها كمزود خدمة فعال للروبوتات تحت الماء في إفريقيا.

- في مايو 2022، أعلنت شركة Subsea 7 عن فوزها بعقد كبير من شركة BP لمشروع TOPR الواقع قبالة سواحل ترينيداد وتوباغو. يتعين على الشركة العمل في المياه الضحلة بمنتجاتها وتركيب خط أنابيب بطول 96 كيلومترًا وقطر 12 بوصة. بدأ فريق الهندسة والتصميم الأمامي (FEED) في إعداد المشروع. سيسمح هذا العقد للشركة بالتنافس مع شركة تصنيع روبوتات تحت الماء محلية في الولايات المتحدة

نطاق سوق الروبوتات تحت الماء في الشرق الأوسط وأفريقيا

يتم تقسيم سوق الروبوتات تحت الماء في الشرق الأوسط وأفريقيا على أساس النوع وعمق العمل ونوع المهمة والعمق والمكونات والتطبيق. سيساعدك النمو بين هذه القطاعات على تحليل قطاعات النمو الضئيلة في الصناعات وتزويد المستخدمين بنظرة عامة قيمة على السوق ورؤى السوق لمساعدتهم على اتخاذ قرارات استراتيجية لتحديد تطبيقات السوق الأساسية.

يكتب

- المركبات التي يتم تشغيلها عن بعد (ROV)

- مركبة ذاتية القيادة تحت الماء (AUV)

على أساس النوع، يتم تقسيم سوق الروبوتات تحت الماء في الشرق الأوسط وأفريقيا إلى مركبات يتم تشغيلها عن بعد (ROV) ومركبة تحت الماء مستقلة (AUV).

عمق العمل

- أجوف

- مياه عميقة

- مياه عميقة للغاية

على أساس عمق العمل، يتم تقسيم سوق الروبوتات تحت الماء في الشرق الأوسط وأفريقيا إلى مياه ضحلة ومياه عميقة ومياه عميقة للغاية.

نوع المهمة

- ملاحظة

- استطلاع

- تقتيش

- بناء

- تدخل

- الدفن والحفر

- آحرون

على أساس نوع المهمة، يتم تقسيم سوق الروبوتات تحت الماء في الشرق الأوسط وأفريقيا إلى المراقبة والمسح والتفتيش والبناء والتدخل والدفن والحفر وغيرها.

عمق

- أقل من 1000 متر

- 1000 متر إلى 5000 متر

- أكثر من 5000 متر

على أساس العمق، يتم تقسيم سوق الروبوتات تحت الماء في الشرق الأوسط وأفريقيا إلى أقل من 1000 متر، ومن 1000 متر إلى 5000 متر وأكثر من 5000 متر.

عنصر

- ضوء

- آلة تصوير

- إطار

- الدوافع

- الأربطة

- أدوات التحكم في الطيار

- آحرون

على أساس المكون، يتم تقسيم سوق الروبوتات تحت الماء في الشرق الأوسط وأفريقيا إلى الضوء، والكاميرا، والإطار، والدافعات، والحبال، وأدوات التحكم في الطيار، وغيرها.

طلب

- النفط والغاز

- الاستكشاف التجاري

- الدفاع والأمن

- البحث العلمي

- آحرون

على أساس التطبيق، يتم تقسيم سوق الروبوتات تحت الماء في الشرق الأوسط وأفريقيا إلى النفط والغاز، والاستكشاف التجاري، والدفاع والأمن، والبحث العلمي، وغيرها.

تحليل/رؤى إقليمية لسوق الروبوتات تحت الماء في الشرق الأوسط وأفريقيا

يتم تحليل سوق الروبوتات تحت الماء في الشرق الأوسط وأفريقيا، ويتم توفير رؤى حجم السوق والاتجاهات حسب البلد والنوع وعمق العمل ونوع المهمة والعمق والمكونات والتطبيق.

الدول التي يغطيها تقرير سوق الروبوتات تحت الماء في الشرق الأوسط وأفريقيا هي المملكة العربية السعودية والإمارات العربية المتحدة وجنوب أفريقيا ومصر وإسرائيل وبقية دول الشرق الأوسط وأفريقيا (MEA) كجزء من الشرق الأوسط وأفريقيا (MEA).

تهيمن المملكة العربية السعودية على سوق الروبوتات تحت الماء في الشرق الأوسط وأفريقيا حيث شهدت المنطقة حضورًا كبيرًا من قبل الشركات المصنعة الرائدة. علاوة على ذلك، شهدت المنطقة استثمارات كبيرة في معدات البحث والإنقاذ والعسكرية والترفيه والاستكشاف وتربية الأحياء المائية والأحياء البحرية والنفط والغاز والطاقة البحرية والشحن والبنية التحتية المغمورة والمزيد. ومن المتوقع أن تشهد المملكة العربية السعودية نموًا كبيرًا خلال الفترة المتوقعة من 2022 إلى 2029 بسبب الاستثمارات المتزايدة في معدات الروبوتات البحرية.

كما يوفر قسم الدولة في التقرير عوامل التأثير الفردية على السوق والتغيرات في تنظيم السوق التي تؤثر على الاتجاهات الحالية والمستقبلية للسوق. تعد نقاط البيانات مثل تحليل سلسلة القيمة النهائية والنهائية، والاتجاهات الفنية، وتحليل قوى بورتر الخمس، ودراسات الحالة بعض المؤشرات المستخدمة للتنبؤ بسيناريو السوق للدول الفردية. كما يتم النظر في وجود وتوافر العلامات التجارية في الشرق الأوسط وأفريقيا والتحديات التي تواجهها بسبب المنافسة الكبيرة أو النادرة من العلامات التجارية المحلية والمحلية، وتأثير التعريفات الجمركية المحلية وطرق التجارة أثناء تقديم تحليل تنبؤي لبيانات الدولة.

تحليل المشهد التنافسي وحصة سوق الروبوتات تحت الماء في الشرق الأوسط وأفريقيا

يقدم المشهد التنافسي لسوق الروبوتات تحت الماء في الشرق الأوسط وأفريقيا تفاصيل عن المنافس. تتضمن التفاصيل نظرة عامة على الشركة، والبيانات المالية للشركة، والإيرادات المولدة، وإمكانات السوق، والاستثمار في البحث والتطوير، ومبادرات السوق الجديدة، والحضور في الشرق الأوسط وأفريقيا، ومواقع الإنتاج والمرافق، والقدرات الإنتاجية، ونقاط القوة والضعف في الشركة، وإطلاق المنتج، وعرض المنتج ونطاقه، وهيمنة التطبيق. ترتبط نقاط البيانات المذكورة أعلاه فقط بتركيز الشركات على سوق الروبوتات تحت الماء في الشرق الأوسط وأفريقيا.

بعض اللاعبين الرئيسيين العاملين في سوق الروبوتات تحت الماء في الشرق الأوسط وأفريقيا هم ATLAS ELEKTRONIK GmbH، وGeneral Dynamics Mission Systems، Inc.، وECA GROUP، وEddyfi، وBoeing، وSoil Machine Dynamics Ltd.، وMacArtney A/S، وOceaneering International، Inc.، وSaab AB، وForum Energy Technologies، Inc.، وTechnipFMC plc، وSUBSEA 7، وFugro، وTotal Marine Technology Pty Ltd، وTeledyne Marine، وKONGSBERG، وMitsui E&S Holdings Co.، Ltd. وغيرها.

منهجية البحث: سوق الروبوتات تحت الماء في الشرق الأوسط وأفريقيا

يتم جمع البيانات وتحليل سنة الأساس باستخدام وحدات جمع البيانات ذات أحجام العينات الكبيرة. يتم تحليل بيانات السوق وتقديرها باستخدام نماذج إحصائية ومتماسكة للسوق. كما أن تحليل حصة السوق وتحليل الاتجاهات الرئيسية هما عاملان رئيسيان للنجاح في تقرير السوق. لمعرفة المزيد، يرجى طلب مكالمة محلل أو يمكنك ترك استفسارك.

المنهجية البحثية الرئيسية التي يستخدمها فريق البحث في DBMR هي مثلثات البيانات التي تتضمن استخراج البيانات وتحليل تأثير متغيرات البيانات على السوق والتحقق الأولي (من قبل خبراء الصناعة). وبصرف النظر عن هذا، تتضمن نماذج البيانات شبكة وضع الموردين، وتحليل خط زمني للسوق، ونظرة عامة على السوق ودليل، وتحليل الخبراء، وتحليل الاستيراد/التصدير، وتحليل التسعير، وتحليل استهلاك الإنتاج، وسيناريو سلسلة المناخ، وشبكة وضع الشركة، وتحليل حصة الشركة في السوق، ومعايير القياس، والتحليل العالمي مقابل الإقليمي، وتحليل حصة الموردين. لمعرفة المزيد عن منهجية البحث، أرسل استفسارًا للتحدث إلى خبراء الصناعة لدينا.

SKU-

احصل على إمكانية الوصول عبر الإنترنت إلى التقرير الخاص بأول سحابة استخبارات سوقية في العالم

- لوحة معلومات تحليل البيانات التفاعلية

- لوحة معلومات تحليل الشركة للفرص ذات إمكانات النمو العالية

- إمكانية وصول محلل الأبحاث للتخصيص والاستعلامات

- تحليل المنافسين باستخدام لوحة معلومات تفاعلية

- آخر الأخبار والتحديثات وتحليل الاتجاهات

- استغل قوة تحليل المعايير لتتبع المنافسين بشكل شامل

Table of Content

1 INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 OVERVIEW OF THE MIDDLE EAST & AFRICA UNDERWATER ROBOTICS MARKET

1.4 CURRENCY AND PRICING

1.5 LIMITATIONS

1.6 MARKETS COVERED

2 MARKET SEGMENTATION

2.1 MARKETS COVERED

2.2 YEARS CONSIDERED FOR THE STUDY

2.3 GEOGRAPHIC SCOPE

2.4 DBMR TRIPOD DATA VALIDATION MODEL

2.5 PRIMARY INTERVIEWS WITH KEY OPINION LEADERS

2.6 DBMR MARKET POSITION GRID

2.7 VENDOR SHARE ANALYSIS

2.8 MARKET END-USER COVERAGE GRID

2.9 MULTIVARIATE MODELLING

2.1 TYPE CURVE

2.11 CHALLENGE MATRIX

2.12 SECONDARY SOURCES

2.13 ASSUMPTIONS

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

4.1 PORTER'S FIVE FORCES MODEL

4.2 TECHNOLOGY ANALYSIS

4.3 USE CASES

4.3.1 GENERAL DYNAMICS AND MIT PARTNERED DURING THE U.S. NAVY'S BIENNIAL ICE EXERCISE (ICEX 2020) TO TEST THE BLUEFIN-21 UNMANNED UNDERWATER VEHICLE (UUV) UNDER THE ICE AT THE ARCTIC CIRCLE

4.3.2 OCEANEERING INTERNATIONAL, INC. DEVELOPED ISURUS ROV, WHICH REDUCES COST AND CARBON FOOTPRINT WHILE SHORTENING THE PROJECT SCHEDULE

4.3.3 RESULTS:

5 REGIONAL SUMMARY

5.1 NORTH AMERICA

5.2 EUROPE

5.3 ASIA-PACIFIC

5.4 SOUTH AMERICA

5.5 MIDDLE EAST AND AFRICA

6 MARKET OVERVIEW

6.1 DRIVERS

6.1.1 INCREASING USE OF UNDERWATER ROBOTICS FOR MILITARY AND SECURITY PURPOSES

6.1.2 RISING USE OF ROVS IN THE OIL AND GAS INDUSTRY

6.1.3 INCREASING DEMAND FOR AUVS FOR UNDERWATER EXPLORATION AND SCIENTIFIC RESEARCH

6.1.4 GROWING DEMAND FOR UNDERWATER ROBOTICS FOR SEARCH, RESCUE, AND REPAIR OPERATIONS

6.2 RESTRAINTS

6.2.1 HIGH COST OF UNDERWATER ROBOTS/VEHICLES

6.2.2 THREATS AND CONCERNS FOR CYBER SECURITY AND OPERATIONAL SECURITY

6.3 OPPORTUNITIES

6.3.1 GROWING DEVELOPMENT OF VARIABLE PAYLOAD CAPABILITIES IN UNDERWATER VEHICLE

6.3.2 INCREASING DEVELOPMENTS IN UNDERWATER ROBOTICS SYSTEMS

6.3.3 INTEGRATION OF ADVANCED TECHNOLOGIES IN UNDERWATER VEHICLES

6.3.4 INCREASING WORKING DEPTH OF UNDERWATER ROBOTS

6.4 CHALLENGES

6.4.1 THE TECHNICAL BARRIER IN NAVIGATION AND COMMUNICATION OF AUV

6.4.2 SLOW TECHNICAL PROGRESS IN UNDERWATER ROBOT SENSING TECHNOLOGIES

6.4.3 HIGH TECHNICAL COMPLEXITY IN UNDERWATER ROBOTICS

7 MIDDLE EAST & AFRICA UNDERWATER ROBOTICS MARKET, BY TYPE

7.1 OVERVIEW

7.2 REMOTELY OPERATED VEHICLES (ROV)

7.2.1 BY CONFIGURATION

7.2.1.1 OPEN OR BOX FRAME ROVS

7.2.1.2 TORPEDO SHAPED TOVS

7.2.2 BY CLASS TYPE

7.2.2.1 CLASS III (WORK CLASS VEHICLES)

7.2.2.2 CLASS II (OBSERVATION WITH PAYLOAD OPTIONS)

7.2.2.3 CLASS IV (SEABED-WORKING VEHICLES)

7.2.2.4 CLASS I (PURE OBSERVATION)

7.2.2.5 CLASS V (PROTOTYPE OR DEVELOPMENT VEHICLES)

7.3 AUTONOMOUS UNDERWATER VEHICLES

7.3.1 BY SHAPE

7.3.1.1 TORPEDO

7.3.1.2 STREAMLINED RECTANGULAR STYLE

7.3.1.3 LAMINAR FLOW BODY

7.3.1.4 MULTI-HULL VEHICLE

8 MIDDLE EAST & AFRICA UNDERWATER ROBOTICS MARKET, BY WORKING DEPTH

8.1 OVERVIEW

8.2 DEEP WATER

8.3 SHALLOW

8.4 ULTRA-DEEP WATER

9 MIDDLE EAST & AFRICA UNDERWATER ROBOTICS MARKET, BY TASK TYPE

9.1 OVERVIEW

9.2 INSPECTION

9.3 SURVEY

9.4 INTERVENTION

9.5 OBSERVATION

9.6 BURIAL AND TRENCHING

9.7 CONSTRUCTION

9.8 OTHERS

10 MIDDLE EAST & AFRICA UNDERWATER ROBOTICS MARKET, BY DEPTH

10.1 OVERVIEW

10.2 1,000 MTS TO 5,000 MTS

10.3 LESS THAN 1,000 MTS

10.4 MORE THAN 5,000 MTS

11 MIDDLE EAST & AFRICA UNDERWATER ROBOTICS MARKET, BY COMPONENT

11.1 OVERVIEW

11.2 THRUSTERS

11.3 TETHERS

11.4 CAMERA

11.4.1 HIGH-RESOLUTION DIGITAL STILL CAMERA

11.4.2 DUAL-EYE CAMERAS

11.5 LIGHTS

11.6 FRAME

11.7 PILOT CONTROLS

11.8 OTHERS

12 MIDDLE EAST & AFRICA UNDERWATER ROBOTICS MARKET, BY APPLICATION

12.1 OVERVIEW

12.2 OIL & GAS

12.3 DEFENCE & SECURITY

12.4 SCIENTIFIC RESEARCH

12.5 COMMERCIAL EXPLORATION

12.6 OTHERS

13 MIDDLE EAST & AFRICA UNDERWATER ROBOTICS MARKET, BY GEOGRAPHY

13.1 MIDDLE EAST & AFRICA

13.1.1 SAUDI ARABIA

13.1.2 U.A.E.

13.1.3 SOUTH AFRICA

13.1.4 ISRAEL

13.1.5 EGYPT

13.1.6 REST OF MIDDLE EAST AND AFRICA

14 MIDDLE EAST & AFRICA UNDERWATER ROBOTICS MARKET: COMPANY LANDSCAPE

14.1 COMPANY SHARE ANALYSIS: MIDDLE EAST & AFRICA

15 SWOT ANALYSIS

16 COMPANY PROFILE

16.1 OCEANEERING INTERNATIONAL, INC.

16.1.1 COMPANY SNAPSHOT

16.1.2 REVENUE ANALYSIS

16.1.3 COMPANY SHARE ANALYSIS

16.1.4 PRODUCTS PORTFOLIO

16.1.5 RECENT DEVELOPMENTS

16.2 SAAB AB

16.2.1 COMPANY SNAPSHOT

16.2.2 REVENUE ANALYSIS

16.2.3 COMPANY SHARE ANALYSIS

16.2.4 PRODUCTS PORTFOLIO

16.2.5 RECENT DEVELOPMENTS

16.3 GENERAL DYNAMICS MISSION SYSTEMS, INC. (A SUBSIDIARY OF GENERAL DYNAMICS CORPORATION)

16.3.1 COMPANY SNAPSHOT

16.3.2 REVENUE ANALYSIS

16.3.3 COMPANY SHARE ANALYSIS

16.3.4 PRODUCTS PORTFOLIO

16.3.5 RECENT DEVELOPMENTS

16.4 SUBSEA 7

16.4.1 COMPANY SNAPSHOT

16.4.2 REVENUE ANALYSIS

16.4.3 COMPANY SHARE ANALYSIS

16.4.4 PRODUCTS PORTFOLIO

16.4.5 RECENT DEVELOPMENTS

16.5 TELEDYNE TECHNOLOGIES INCORPORATED

16.5.1 COMPANY SNAPSHOT

16.5.2 REVENUE ANALYSIS

16.5.3 COMPANY SHARE ANALYSIS

16.5.4 PRODUCT PORTFOLIO

16.5.5 RECENT DEVELOPMENT

16.6 ATLAS ELEKTRONIK GMBH

16.6.1 COMPANY SNAPSHOT

16.6.2 PRODUCTS PORTFOLIO

16.6.3 RECENT DEVELOPMENTS

16.7 BOEING

16.7.1 COMPANY SNAPSHOT

16.7.2 REVENUE ANALYSIS

16.7.3 PRODUCTS PORTFOLIO

16.7.4 RECENT DEVELOPMENTS

16.8 DEEP TREKKER INC.

16.8.1 COMPANY SNAPSHOT

16.8.2 PRODUCT PORTFOLIO

16.8.3 RECENT DEVELOPMENT

16.9 DEEP OCEAN ENGINEERING, INC.

16.9.1 COMPANY SNAPSHOT

16.9.2 PRODUCTS PORTFOLIO

16.9.3 RECENT DEVELOPMENTS

16.1 ECA GROUP (A SUBSIDIARY OF GROUPE GORGÉ COMPANY)

16.10.1 COMPANY SNAPSHOT

16.10.2 REVENUE ANALYSIS

16.10.3 PRODUCTS PORTFOLIO

16.10.4 RECENT DEVELOPMENTS

16.11 EDDYFI

16.11.1 COMPANY SNAPSHOT

16.11.2 PRODUCTS PORTFOLIO

16.11.3 RECENT DEVELOPMENTS

16.12 FORUM ENERGY TECHNOLOGY, INC.

16.12.1 COMPANY SNAPSHOT

16.12.2 REVENUE ANALYSIS

16.12.3 PRODUCTS PORTFOLIO

16.12.4 RECENT DEVELOPMENT

16.13 FUGRO

16.13.1 COMPANY SNAPSHOT

16.13.2 REVENUE ANALYSIS

16.13.3 SERVICE AND PRODUCT PORTFOLIO

16.13.4 RECENT DEVELOPMENTS

16.14 HUNTINGTON INGALLS INDUSTRIES, INC.

16.14.1 COMPANY SNAPSHOT

16.14.2 REVENUE ANALYSIS

16.14.3 PRODUCT PORTFOLIO

16.14.4 RECENT DEVELOPMENT

16.15 INTERNATIONAL SUBMARINE ENGINEERING LIMITED

16.15.1 COMPANY SNAPSHOT

16.15.2 PRODUCTS PORTFOLIO

16.15.3 RECENT DEVELOPMENTS

16.16 KONGSBERG MARITIME

16.16.1 COMPANY SNAPSHOT

16.16.2 REVENUE ANALYSIS

16.16.3 PRODUCT PORTFOLIO

16.16.4 RECENT DEVELOPMENTS

16.17 MACARTNEY AS

16.17.1 COMPANY SNAPSHOT

16.17.2 PRODUCTS PORTFOLIO

16.17.3 RECENT DEVELOPMENTS

16.18 MITSUI E&S HOLDINGS CO., LTD.

16.18.1 COMPANY SNAPSHOT

16.18.2 REVENUE ANALYSIS

16.18.3 PRODUCT PORTFOLIO

16.18.4 RECENT DEVELOPMENT

16.19 ROVCO LTD

16.19.1 COMPANY SNAPSHOT

16.19.2 SERVICE PORTFOLIO

16.19.3 RECENT DEVELOPMENTS

16.2 SEAROBOTICS CORP.

16.20.1 COMPANY SNAPSHOT

16.20.2 PRODUCT PORTFOLIO

16.20.3 RECENT DEVELOPMENT

16.21 SOIL MACHINE DYNAMICS LTD

16.21.1 COMPANY SNAPSHOT

16.21.2 PRODUCTS PORTFOLIO

16.21.3 RECENT DEVELOPMENTS

16.22 TECHNIPFMC PLC

16.22.1 COMPANY SNAPSHOT

16.22.2 REVENUE ANALYSIS

16.22.3 PRODUCTS PORTFOLIO

16.22.4 RECENT DEVELOPMENTS

16.23 TOTAL MARINE TECHNOLOGY PTY LTD

16.23.1 COMPANY SNAPSHOT

16.23.2 PRODUCT PORTFOLIO

16.23.3 RECENT DEVELOPMENT

16.24 PHOENIX INTERNATIONAL HOLDINGS, INC.

16.24.1 COMPANY SNAPSHOT

16.24.2 PRODUCTS PORTFOLIO

16.24.3 RECENT DEVELOPMENTS

16.25 VIDEORAY LLC.

16.25.1 COMPANY SNAPSHOT

16.25.2 PRODUCTS PORTFOLIO

16.25.3 RECENT DEVELOPMENTS

17 QUESTIONNAIRE

18 RELATED REPORTS

List of Table

TABLE 1 COMPARATIVE CHARACTERISTICS OF AUV

TABLE 2 MIDDLE EAST & AFRICA UNDERWATER ROBOTICS MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 3 MIDDLE EAST & AFRICA REMOTELY OPERATED VEHICLES (ROV) IN UNDERWATER ROBOTICS MARKET, BY REGION 2020-2029 (USD MILLION)

TABLE 4 MIDDLE EAST & AFRICA REMOTELY OPERATED VEHICLES (ROV) IN UNDERWATER ROBOTICS MARKET, BY CONFIGURATION, 2020-2029 (USD MILLION)

TABLE 5 MIDDLE EAST & AFRICA REMOTELY OPERATED VEHICLES (ROV) IN UNDERWATER ROBOTICS MARKET, BY CLASS TYPE, 2020-2029 (USD MILLION)

TABLE 6 MIDDLE EAST & AFRICA AUTONOMOUS UNDERWATER VEHICLES IN UNDERWATER ROBOTICS MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 7 MIDDLE EAST & AFRICA AUTONOMOUS UNDERWATER VEHICLES IN UNDERWATER ROBOTICS MARKET, BY SHAPE, 2020-2029 (USD MILLION)

TABLE 8 MIDDLE EAST & AFRICA UNDERWATER ROBOTICS MARKET, BY WORKING DEPTH, 2020-2029 (USD MILLION)

TABLE 9 MIDDLE EAST & AFRICA DEEP WATER IN UNDERWATER ROBOTICS MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 10 MIDDLE EAST & AFRICA SHALLOW IN UNDERWATER ROBOTICS MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 11 MIDDLE EAST & AFRICA ULTRA-DEEP WATER IN UNDERWATER ROBOTICS MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 12 MIDDLE EAST & AFRICA UNDERWATER ROBOTICS MARKET, BY TASK TYPE, 2020-2029 (USD MILLION)

TABLE 13 MIDDLE EAST & AFRICA INSPECTION IN UNDERWATER ROBOTICS MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 14 MIDDLE EAST & AFRICA SURVEY IN UNDERWATER ROBOTICS MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 15 MIDDLE EAST & AFRICA INTERVENTION IN UNDERWATER ROBOTICS MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 16 MIDDLE EAST & AFRICA OBSERVATION IN UNDERWATER ROBOTICS MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 17 MIDDLE EAST & AFRICA BURIAL AND TRENCHING IN UNDERWATER ROBOTICS MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 18 MIDDLE EAST & AFRICA CONSTRUCTION IN UNDERWATER ROBOTICS MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 19 MIDDLE EAST & AFRICA OTHERS IN UNDERWATER ROBOTICS MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 20 MIDDLE EAST & AFRICA UNDERWATER ROBOTICS MARKET, BY DEPTH, 2020-2029 (USD MILLION)

TABLE 21 MIDDLE EAST & AFRICA 1,000 MTS TO 5,000 MTS IN UNDERWATER ROBOTICS MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 22 MIDDLE EAST & AFRICA LESS THAN 1,000 MTS IN UNDERWATER ROBOTICS MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 23 MIDDLE EAST & AFRICA MORE THAN 5,000 MTS IN UNDERWATER ROBOTICS MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 24 MIDDLE EAST & AFRICA UNDERWATER ROBOTICS MARKET, BY COMPONENT, 2020-2029 (USD MILLION)

TABLE 25 MIDDLE EAST & AFRICA THRUSTERS IN UNDERWATER ROBOTICS MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 26 MIDDLE EAST & AFRICA TETHERS IN UNDERWATER ROBOTICS MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 27 MIDDLE EAST & AFRICA CAMERA IN UNDERWATER ROBOTICS MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 28 MIDDLE EAST & AFRICA CAMERA IN UNDERWATER ROBOTICS MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 29 MIDDLE EAST & AFRICA LIGHTS IN UNDERWATER ROBOTICS MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 30 MIDDLE EAST & AFRICA FRAME IN UNDERWATER ROBOTICS MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 31 MIDDLE EAST & AFRICA PILOT CONTROLS IN UNDERWATER ROBOTICS MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 32 MIDDLE EAST & AFRICA OTHERS IN UNDERWATER ROBOTICS MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 33 MIDDLE EAST & AFRICA UNDERWATER ROBOTICS MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 34 MIDDLE EAST & AFRICA OIL & GAS IN UNDERWATER ROBOTICS MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 35 MIDDLE EAST & AFRICA DEFENSE & SECURITY IN UNDERWATER ROBOTICS MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 36 MIDDLE EAST & AFRICA SCIENTIFIC RESEARCH IN UNDERWATER ROBOTICS MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 37 MIDDLE EAST & AFRICA COMMERCIAL EXPLORATION IN UNDERWATER ROBOTICS MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 38 MIDDLE EAST & AFRICA OTHERS IN UNDERWATER ROBOTICS MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 39 MIDDLE EAST & AFRICA UNDERWATER ROBOTICS MARKET, BY COUNTRY, 2020-2029 (USD MILLION)

TABLE 40 MIDDLE EAST & AFRICA UNDERWATER ROBOTICS MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 41 MIDDLE EAST & AFRICA REMOTELY OPERATED VEHICLES (ROV) IN UNDERWATER ROBOTICS MARKET, BY CONFIGURATION, 2020-2029 (USD MILLION)

TABLE 42 MIDDLE EAST & AFRICA REMOTELY OPERATED VEHICLES (ROV) IN UNDERWATER ROBOTICS MARKET, BY CLASS TYPE, 2020-2029 (USD MILLION)

TABLE 43 MIDDLE EAST & AFRICA AUTONOMOUS UNDERWATER VEHICLES IN UNDERWATER ROBOTICS MARKET, BY SHAPE, 2020-2029 (USD MILLION)

TABLE 44 MIDDLE EAST & AFRICA UNDERWATER ROBOTICS MARKET, BY WORKING DEPTH, 2020-2029 (USD MILLION)

TABLE 45 MIDDLE EAST & AFRICA UNDERWATER ROBOTICS MARKET, BY TASK TYPE, 2020-2029 (USD MILLION)

TABLE 46 MIDDLE EAST & AFRICA UNDERWATER ROBOTICS MARKET, BY DEPTH, 2020-2029 (USD MILLION)

TABLE 47 MIDDLE EAST & AFRICA UNDERWATER ROBOTICS MARKET, BY COMPONENT, 2020-2029 (USD MILLION)

TABLE 48 MIDDLE EAST & AFRICA CAMERA IN UNDERWATER ROBOTICS MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 49 MIDDLE EAST & AFRICA UNDERWATER ROBOTICS MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 50 SAUDI ARABIA UNDERWATER ROBOTICS MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 51 SAUDI ARABIA REMOTELY OPERATED VEHICLES (ROV) IN UNDERWATER ROBOTICS MARKET, BY CONFIGURATION, 2020-2029 (USD MILLION)

TABLE 52 SAUDI ARABIA REMOTELY OPERATED VEHICLES (ROV) IN UNDERWATER ROBOTICS MARKET, BY CLASS TYPE, 2020-2029 (USD MILLION)

TABLE 53 SAUDI ARABIA AUTONOMOUS UNDERWATER VEHICLES IN UNDERWATER ROBOTICS MARKET, BY SHAPE, 2020-2029 (USD MILLION)

TABLE 54 SAUDI ARABIA UNDERWATER ROBOTICS MARKET, BY WORKING DEPTH, 2020-2029 (USD MILLION)

TABLE 55 SAUDI ARABIA UNDERWATER ROBOTICS MARKET, BY TASK TYPE, 2020-2029 (USD MILLION)

TABLE 56 SAUDI ARABIA UNDERWATER ROBOTICS MARKET, BY DEPTH, 2020-2029 (USD MILLION)

TABLE 57 SAUDI ARABIA UNDERWATER ROBOTICS MARKET, BY COMPONENT, 2020-2029 (USD MILLION)

TABLE 58 SAUDI ARABIA CAMERA IN UNDERWATER ROBOTICS MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 59 SAUDI ARABIA UNDERWATER ROBOTICS MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 60 U.A.E. UNDERWATER ROBOTICS MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 61 U.A.E. REMOTELY OPERATED VEHICLES (ROV) IN UNDERWATER ROBOTICS MARKET, BY CONFIGURATION, 2020-2029 (USD MILLION)

TABLE 62 U.A.E. REMOTELY OPERATED VEHICLES (ROV) IN UNDERWATER ROBOTICS MARKET, BY CLASS TYPE, 2020-2029 (USD MILLION)

TABLE 63 U.A.E. AUTONOMOUS UNDERWATER VEHICLES IN UNDERWATER ROBOTICS MARKET, BY SHAPE, 2020-2029 (USD MILLION)

TABLE 64 U.A.E. UNDERWATER ROBOTICS MARKET, BY WORKING DEPTH, 2020-2029 (USD MILLION)

TABLE 65 U.A.E. UNDERWATER ROBOTICS MARKET, BY TASK TYPE, 2020-2029 (USD MILLION)

TABLE 66 U.A.E. UNDERWATER ROBOTICS MARKET, BY DEPTH, 2020-2029 (USD MILLION)

TABLE 67 U.A.E. UNDERWATER ROBOTICS MARKET, BY COMPONENT, 2020-2029 (USD MILLION)

TABLE 68 U.A.E. CAMERA IN UNDERWATER ROBOTICS MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 69 U.A.E. UNDERWATER ROBOTICS MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 70 SOUTH AFRICA UNDERWATER ROBOTICS MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 71 SOUTH AFRICA REMOTELY OPERATED VEHICLES (ROV) IN UNDERWATER ROBOTICS MARKET, BY CONFIGURATION, 2020-2029 (USD MILLION)

TABLE 72 SOUTH AFRICA REMOTELY OPERATED VEHICLES (ROV) IN UNDERWATER ROBOTICS MARKET, BY CLASS TYPE, 2020-2029 (USD MILLION)

TABLE 73 SOUTH AFRICA AUTONOMOUS UNDERWATER VEHICLES IN UNDERWATER ROBOTICS MARKET, BY SHAPE, 2020-2029 (USD MILLION)

TABLE 74 SOUTH AFRICA UNDERWATER ROBOTICS MARKET, BY WORKING DEPTH, 2020-2029 (USD MILLION)

TABLE 75 SOUTH AFRICA UNDERWATER ROBOTICS MARKET, BY TASK TYPE, 2020-2029 (USD MILLION)

TABLE 76 SOUTH AFRICA UNDERWATER ROBOTICS MARKET, BY DEPTH, 2020-2029 (USD MILLION)

TABLE 77 SOUTH AFRICA UNDERWATER ROBOTICS MARKET, BY COMPONENT, 2020-2029 (USD MILLION)

TABLE 78 SOUTH AFRICA CAMERA IN UNDERWATER ROBOTICS MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 79 SOUTH AFRICA UNDERWATER ROBOTICS MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 80 ISRAEL UNDERWATER ROBOTICS MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 81 ISRAEL REMOTELY OPERATED VEHICLES (ROV) IN UNDERWATER ROBOTICS MARKET, BY CONFIGURATION, 2020-2029 (USD MILLION)

TABLE 82 ISRAEL REMOTELY OPERATED VEHICLES (ROV) IN UNDERWATER ROBOTICS MARKET, BY CLASS TYPE, 2020-2029 (USD MILLION)

TABLE 83 ISRAEL AUTONOMOUS UNDERWATER VEHICLES IN UNDERWATER ROBOTICS MARKET, BY SHAPE, 2020-2029 (USD MILLION)

TABLE 84 ISRAEL UNDERWATER ROBOTICS MARKET, BY WORKING DEPTH, 2020-2029 (USD MILLION)

TABLE 85 ISRAEL UNDERWATER ROBOTICS MARKET, BY TASK TYPE, 2020-2029 (USD MILLION)

TABLE 86 ISRAEL UNDERWATER ROBOTICS MARKET, BY DEPTH, 2020-2029 (USD MILLION)

TABLE 87 ISRAEL UNDERWATER ROBOTICS MARKET, BY COMPONENT, 2020-2029 (USD MILLION)

TABLE 88 ISRAEL CAMERA IN UNDERWATER ROBOTICS MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 89 ISRAEL UNDERWATER ROBOTICS MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 90 EGYPT UNDERWATER ROBOTICS MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 91 EGYPT REMOTELY OPERATED VEHICLES (ROV) IN UNDERWATER ROBOTICS MARKET, BY CONFIGURATION, 2020-2029 (USD MILLION)

TABLE 92 EGYPT REMOTELY OPERATED VEHICLES (ROV) IN UNDERWATER ROBOTICS MARKET, BY CLASS TYPE, 2020-2029 (USD MILLION)

TABLE 93 EGYPT AUTONOMOUS UNDERWATER VEHICLES IN UNDERWATER ROBOTICS MARKET, BY SHAPE, 2020-2029 (USD MILLION)

TABLE 94 EGYPT UNDERWATER ROBOTICS MARKET, BY WORKING DEPTH, 2020-2029 (USD MILLION)

TABLE 95 EGYPT UNDERWATER ROBOTICS MARKET, BY TASK TYPE, 2020-2029 (USD MILLION)

TABLE 96 EGYPT UNDERWATER ROBOTICS MARKET, BY DEPTH, 2020-2029 (USD MILLION)

TABLE 97 EGYPT UNDERWATER ROBOTICS MARKET, BY COMPONENT, 2020-2029 (USD MILLION)

TABLE 98 EGYPT CAMERA IN UNDERWATER ROBOTICS MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 99 EGYPT UNDERWATER ROBOTICS MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 100 REST OF MIDDLE EAST AND AFRICA UNDERWATER ROBOTICS MARKET, BY TYPE, 2020-2029 (USD MILLION)

List of Figure

FIGURE 1 MIDDLE EAST & AFRICA UNDERWATER ROBOTICS MARKET: SEGMENTATION

FIGURE 2 MIDDLE EAST & AFRICA UNDERWATER ROBOTICS MARKET: DATA TRIANGULATION

FIGURE 3 MIDDLE EAST & AFRICA UNDERWATER ROBOTICS MARKET: DROC ANALYSIS

FIGURE 4 MIDDLE EAST & AFRICA UNDERWATER ROBOTICS MARKET: REGIONAL VS COUNTRY MARKET ANALYSIS

FIGURE 5 MIDDLE EAST & AFRICA UNDERWATER ROBOTICS MARKET: COMPANY RESEARCH ANALYSIS

FIGURE 6 MIDDLE EAST & AFRICA UNDERWATER ROBOTICS MARKET: INTERVIEW DEMOGRAPHICS

FIGURE 7 MIDDLE EAST & AFRICA UNDERWATER ROBOTICS MARKET: DBMR MARKET POSITION GRID

FIGURE 8 MIDDLE EAST & AFRICA UNDERWATER ROBOTICS MARKET: VENDOR SHARE ANALYSIS

FIGURE 9 MIDDLE EAST & AFRICA UNDERWATER ROBOTICS MARKET: END-USER COVERAGE GRID

FIGURE 10 MIDDLE EAST & AFRICA UNDERWATER ROBOTICS MARKET: CHALLENGE MATRIX

FIGURE 11 MIDDLE EAST & AFRICA UNDERWATER ROBOTICS MARKET: SEGMENTATION

FIGURE 12 THE INCREASING USE OF UNDERWATER ROBOTICS FOR MILITARY AND SECURITY PURPOSES IS EXPECTED TO BE A KEY DRIVER FOR THE MIDDLE EAST & AFRICA UNDERWATER ROBOTICS MARKET IN THE FORECAST PERIOD OF 2022 TO 2029

FIGURE 13 REMOTELY OPERATED VEHICLES (ROVS) SEGMENT IS EXPECTED TO ACCOUNT FOR THE LARGEST SHARE OF THE MIDDLE EAST & AFRICA UNDERWATER ROBOTICS MARKET IN THE FORECAST PERIOD 2022 & 2029

FIGURE 14 NORTH AMERICA IS EXPECTED TO DOMINATE AND IS THE FASTEST-GROWING REGION IN THE MIDDLE EAST & AFRICA UNDERWATER ROBOTICS MARKET IN THE FORECAST PERIOD

FIGURE 15 DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES OF THE MIDDLE EAST & AFRICA UNDERWATER ROBOTICS MARKET

FIGURE 16 MIDDLE EAST & AFRICA UNDERWATER ROBOTICS MARKET: BY TYPE, 2021

FIGURE 17 MIDDLE EAST & AFRICA UNDERWATER ROBOTICS MARKET: BY WORKING DEPTH, 2021

FIGURE 18 MIDDLE EAST & AFRICA UNDERWATER ROBOTICS MARKET: BY TASK TYPE, 2021

FIGURE 19 MIDDLE EAST & AFRICA UNDERWATER ROBOTICS MARKET: BY DEPTH, 2021

FIGURE 20 MIDDLE EAST & AFRICA UNDERWATER ROBOTICS MARKET: BY COMPONENT, 2021

FIGURE 21 MIDDLE EAST & AFRICA UNDERWATER ROBOTICS MARKET: BY APPLICATION, 2021

FIGURE 22 MIDDLE EAST & AFRICA UNDERWATER ROBOTICS MARKET: SNAPSHOT (2021)

FIGURE 23 MIDDLE EAST & AFRICA UNDERWATER ROBOTICS MARKET: BY COUNTRY (2021)

FIGURE 24 MIDDLE EAST & AFRICA UNDERWATER ROBOTICS MARKET: BY COUNTRY (2022 & 2029)

FIGURE 25 MIDDLE EAST & AFRICA UNDERWATER ROBOTICS MARKET: BY COUNTRY (2021 & 2029)

FIGURE 26 MIDDLE EAST & AFRICA UNDERWATER ROBOTICS MARKET: BY TYPE (2022 & 2029)

FIGURE 27 MIDDLE EAST & AFRICA UNDERWATER ROBOTICS MARKET: COMPANY SHARE 2021 (%)

منهجية البحث

يتم جمع البيانات وتحليل سنة الأساس باستخدام وحدات جمع البيانات ذات أحجام العينات الكبيرة. تتضمن المرحلة الحصول على معلومات السوق أو البيانات ذات الصلة من خلال مصادر واستراتيجيات مختلفة. تتضمن فحص وتخطيط جميع البيانات المكتسبة من الماضي مسبقًا. كما تتضمن فحص التناقضات في المعلومات التي شوهدت عبر مصادر المعلومات المختلفة. يتم تحليل بيانات السوق وتقديرها باستخدام نماذج إحصائية ومتماسكة للسوق. كما أن تحليل حصة السوق وتحليل الاتجاهات الرئيسية هي عوامل النجاح الرئيسية في تقرير السوق. لمعرفة المزيد، يرجى طلب مكالمة محلل أو إرسال استفسارك.

منهجية البحث الرئيسية التي يستخدمها فريق بحث DBMR هي التثليث البيانات والتي تتضمن استخراج البيانات وتحليل تأثير متغيرات البيانات على السوق والتحقق الأولي (من قبل خبراء الصناعة). تتضمن نماذج البيانات شبكة تحديد موقف البائعين، وتحليل خط زمني للسوق، ونظرة عامة على السوق ودليل، وشبكة تحديد موقف الشركة، وتحليل براءات الاختراع، وتحليل التسعير، وتحليل حصة الشركة في السوق، ومعايير القياس، وتحليل حصة البائعين على المستوى العالمي مقابل الإقليمي. لمعرفة المزيد عن منهجية البحث، أرسل استفسارًا للتحدث إلى خبراء الصناعة لدينا.

التخصيص متاح

تعد Data Bridge Market Research رائدة في مجال البحوث التكوينية المتقدمة. ونحن نفخر بخدمة عملائنا الحاليين والجدد بالبيانات والتحليلات التي تتطابق مع هدفهم. ويمكن تخصيص التقرير ليشمل تحليل اتجاه الأسعار للعلامات التجارية المستهدفة وفهم السوق في بلدان إضافية (اطلب قائمة البلدان)، وبيانات نتائج التجارب السريرية، ومراجعة الأدبيات، وتحليل السوق المجدد وقاعدة المنتج. ويمكن تحليل تحليل السوق للمنافسين المستهدفين من التحليل القائم على التكنولوجيا إلى استراتيجيات محفظة السوق. ويمكننا إضافة عدد كبير من المنافسين الذين تحتاج إلى بيانات عنهم بالتنسيق وأسلوب البيانات الذي تبحث عنه. ويمكن لفريق المحللين لدينا أيضًا تزويدك بالبيانات في ملفات Excel الخام أو جداول البيانات المحورية (كتاب الحقائق) أو مساعدتك في إنشاء عروض تقديمية من مجموعات البيانات المتوفرة في التقرير.