سوق الملابس النسيجية في الشرق الأوسط وأفريقيا، حسب نوع المادة (القطن، الدنيم، الصوف، الحرير ، وغيرها)، المنتج (النساء، والرجال، والأطفال)، اتجاهات الصناعة والتوقعات حتى عام 2030.

تحليل ورؤى حول سوق الملابس النسيجية في الشرق الأوسط وأفريقيا

تهتم صناعة سوق المنسوجات بتصميم وإنتاج وتوزيع الخيوط والأقمشة والملابس والأزياء. قد تكون المواد الخام طبيعية أو صناعية، والتي قد تستخدم منتجات الصناعة الكيميائية. تساهم صناعة المنسوجات والملابس بشكل كبير في الاقتصاد الوطني للعديد من البلدان. يساعد الوعي المتزايد بأحدث اتجاهات الموضة بين جيل الشباب في دفع سوق الملابس النسيجية. تساعد زيادة الإنفاق على الملابس والإكسسوارات من المنصات عبر الإنترنت والاستعداد المتزايد لدفع علاوة مقابل الملابس عالية الجودة، وزيادة الوعي بالملابس المستدامة والصديقة للبيئة في تعزيز نمو سوق الملابس النسيجية.

يقدم تقرير سوق الملابس النسيجية في الشرق الأوسط وأفريقيا تفاصيل عن حصة السوق والتطورات الجديدة وتأثير اللاعبين المحليين والمحليين في السوق، ويحلل الفرص من حيث جيوب الإيرادات الناشئة والتغييرات في لوائح السوق وموافقات المنتجات والقرارات الاستراتيجية وإطلاق المنتجات والتوسعات الجغرافية والابتكارات التكنولوجية في السوق. لفهم التحليل وسيناريو السوق، اتصل بنا للحصول على موجز محلل. سيساعدك فريقنا في إنشاء حل تأثير الإيرادات لتحقيق هدفك المنشود.

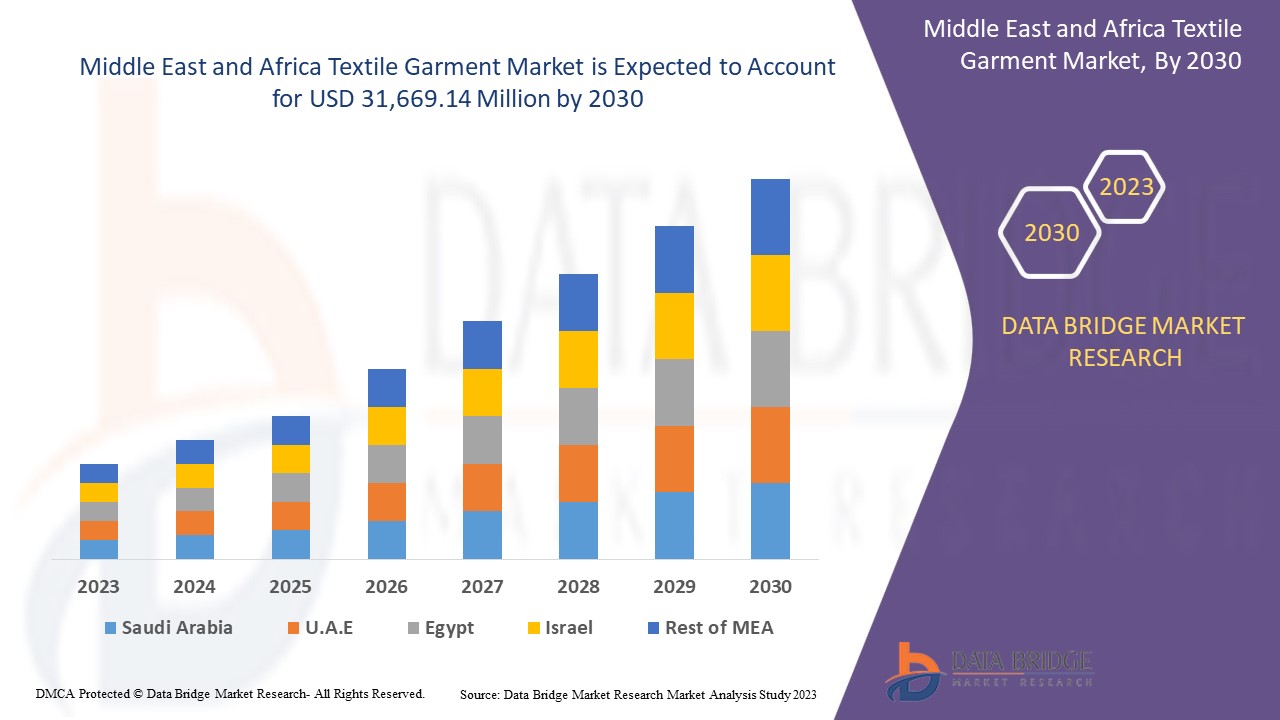

من المتوقع أن ينمو سوق الملابس النسيجية في الشرق الأوسط وأفريقيا بشكل كبير في الفترة المتوقعة من 2023 إلى 2030. تحلل شركة Data Bridge Market Research أن السوق ينمو بمعدل نمو سنوي مركب بنسبة 3.4٪ في الفترة المتوقعة من 2023 إلى 2030 ومن المتوقع أن يصل إلى 31،669.14 مليون دولار أمريكي بحلول عام 2030. العامل الرئيسي الذي يدفع نمو سوق الملابس النسيجية هو الميل نحو أحدث اتجاهات الموضة بين جيل الشباب ومن المتوقع أن يدفع نمو السوق.

|

تقرير القياس |

تفاصيل |

|

فترة التنبؤ |

2023 إلى 2030 |

|

سنة الأساس |

2022 |

|

سنوات تاريخية |

2021 (قابلة للتخصيص حتى 2020- 2015) |

|

وحدات كمية |

الإيرادات بالملايين من الدولارات الأمريكية |

|

القطاعات المغطاة |

حسب نوع الخامة (قطن، جينز، صوف، حرير وغيرها)، المنتج (نساء، رجال، وأطفال). |

|

الدول المغطاة |

مصر والمملكة العربية السعودية والإمارات العربية المتحدة وجنوب أفريقيا وإسرائيل وبقية دول الشرق الأوسط وأفريقيا. |

|

الجهات الفاعلة في السوق المشمولة |

TORAY INDUSTRIES, INC.، وArvind Limited، وGrasim Industries Limited، وYONGOR، وPVH Corp، وTabb Textile Company Inc.، وRuby Mills، وAlok Industries Ltd، وDIOR، وKPR MILL LIMITED، وHYOSUNG TNC، وTexhong Textile Group Limited، وApparel Production، وThe TJX Companies, Inc، وVardhman Textiles Limited. |

تعريف السوق

تهتم صناعة سوق المنسوجات بتصميم وإنتاج وتوزيع الخيوط والأقمشة والملابس والأزياء. وقد تكون المواد الخام طبيعية أو صناعية، وقد تستخدم منتجات الصناعة الكيميائية. وتساهم صناعة المنسوجات والأزياء بشكل كبير في الاقتصاد الوطني للعديد من البلدان.

ديناميكيات سوق الملابس النسيجية في الشرق الأوسط وأفريقيا

السائقين

- تزايد الوعي بأحدث اتجاهات الموضة بين جيل الشباب

ينشغل المراهقون بالقبول الاجتماعي والبرودة المرتبطة بالملابس التي يرتدونها. ولهذا السبب، سيُظهر المراهقون قرارًا أكثر توجهًا نحو العلامة التجارية عندما يذهبون للتسوق. يذهب معظم المراهقين للتسوق في المتاجر التي تبيع ملابس مصممة عالية الجودة وعالية الجودة. لذلك، وبسبب الموضة السريعة، أصبحت الضغوط التنافسية أعلى، ويستمر الطلب في الشرق الأوسط وأفريقيا في طلب مجموعات جديدة بسرعة. أدى تغيير المجموعات كل ثلاثة أسابيع تقريبًا إلى حث المستهلكين على التصرف بسلوك جديد. الموضة السريعة هي ظاهرة اقتصادية سمحت للجميع بارتداء الملابس وفقًا لأحدث الاتجاهات. يحب العملاء رؤية منتجات مختلفة كل أسبوع أو شهر في متاجرهم المفضلة، وقد أدى هذا إلى زيادة الطلب على مجموعات الأزياء الجديدة على مدى فترة زمنية أصغر، ومن المتوقع أن يؤدي ذلك إلى دفع الطلب والمبيعات في سوق الملابس النسيجية في الشرق الأوسط وأفريقيا.

- زيادة الإنفاق على الملابس والإكسسوارات من المنصات الإلكترونية

أصبحت صناعة الأزياء مترابطة بشكل متزايد مع العالم الرقمي. أصبحت المنصات الرقمية واستراتيجيات التسويق الرقمي منتشرة في سوق الأزياء، وظهرت العديد من العلامات التجارية الجديدة مع تطور التجارة الإلكترونية ، والتي تسمح للشركات بإشراك المستهلكين من خلال الواقع الافتراضي . تعد صناعة الأزياء والملابس عبر الإنترنت هي التي تشهد أكبر نمو فيما يتعلق بمبيعات التجارة الإلكترونية. لذلك، أدى ظهور المنصات عبر الإنترنت إلى زيادة إنفاق المستهلكين على الملابس من خلال هذه القنوات، مما سيدفع المبيعات والإيرادات في سوق الملابس النسيجية في الشرق الأوسط وأفريقيا.

فرص

- الاتجاه المتزايد نحو المنسوجات الذكية

إن الابتكار المستمر في هذا القطاع واتجاهه المتزايد يمكن أن يؤدي إلى مواجهة سوق الملابس النسيجية في الشرق الأوسط وأفريقيا لنمو شديد في المستقبل القريب. تشمل بعض تطبيقات المنسوجات الذكية تغيير لون الملابس في منطقة الإشعاع أو حيث تكون المخاطر البيئية أعلى من حيث الكمية. هناك أيضًا بعض الأمثلة على المراقبة الطبية للمرضى في الصناعات الدوائية أيضًا. تمكن المحركات والمستشعرات المرتبطة بالأقمشة المصنعة بعض الأجهزة القابلة للارتداء من قياس بعض البيانات الدقيقة المتعلقة بالصحة واللياقة البدنية أيضًا.

القيود/التحديات

- هدر مرتفع

وعلى الرغم من التاريخ الطويل للحفاظ على الموارد في قطاع المنسوجات، فإن كمية كبيرة من النفايات غير المرغوب فيها تتولد في تصنيع الملابس. وتعتمد كمية النفايات النسيجية المتولدة على كمية المنتجات النسيجية المنتجة؛ فكلما زاد حجم المنتج، زادت النفايات. وهذا نتيجة للطلب الاستهلاكي، والذي يعتمد بدوره على النمو الاقتصادي للبلد. وقد أدت هيمنة الموضة السريعة والإنتاج في الوقت المناسب في صناعة المنسوجات إلى زيادة تكرار المواسم والمجموعات الصغيرة بين المواسم، مما أدى إلى وصول سلع رخيصة جديدة إلى المتاجر كل أسبوع، بل وفي بعض الحالات، كل يوم. ويؤدي هذا التغير السريع في الموضة إلى تغيير كمية هائلة من النفايات، وهو ما يشكل عقبة أمام نمو سوق الملابس النسيجية في الشرق الأوسط وأفريقيا.

التطورات الأخيرة

في سبتمبر، عرض كريستيان ديور مجموعته الجاهزة للربيع والصيف 2023 من ديور في عرضه، والتي استوحيت من الكهوف الباروكية المظللة والرائعة في نفس الوقت. يستحضر المشهد الحالم الهندسة المعمارية، الطبيعية والخيالية، التي تجسد الغموض والخصوصية. وقد سمح هذا للشركة بعرض مجموعتها الجديدة على قاعدة أكبر من المستهلكين.

نطاق سوق الملابس النسيجية في الشرق الأوسط وأفريقيا

يتم تصنيف سوق الملابس النسيجية في الشرق الأوسط وأفريقيا بناءً على نوع المادة والمنتج. سيساعدك النمو بين هذه القطاعات على تحليل قطاعات النمو الرئيسية في الصناعات وتزويد المستخدمين بنظرة عامة قيمة على السوق ورؤى السوق لاتخاذ قرارات استراتيجية لتحديد تطبيقات السوق الأساسية.

نوع المادة

- القطن

- صوف

- حرير

- الدنيم

- آحرون

وفقًا لنوع المادة، يتم تصنيف سوق الملابس النسيجية في الشرق الأوسط وأفريقيا إلى خمسة قطاعات: القطن والصوف والحرير والدنيم وغيرها.

منتج

- نحيف

- الرجال

- أطفال

وفقًا للمنتج، يتم تصنيف سوق الملابس النسيجية في الشرق الأوسط وأفريقيا إلى ثلاثة قطاعات: النساء والرجال والأطفال.

تحليل/رؤى إقليمية لسوق الملابس النسيجية في الشرق الأوسط وأفريقيا

يتم تقسيم سوق الملابس النسيجية في الشرق الأوسط وأفريقيا على أساس نوع المادة والمنتج.

الدول في سوق الملابس النسيجية في الشرق الأوسط وأفريقيا هي مصر والمملكة العربية السعودية والإمارات العربية المتحدة وجنوب أفريقيا وإسرائيل وبقية دول الشرق الأوسط وأفريقيا. تهيمن الإمارات العربية المتحدة على سوق الملابس النسيجية في الشرق الأوسط وأفريقيا من حيث حصة السوق وإيرادات السوق بسبب الوعي المتزايد تجاه الملابس المستدامة الصديقة للبيئة.

كما يوفر قسم الدولة في التقرير عوامل فردية مؤثرة على السوق والتغيرات في تنظيم السوق التي تؤثر على الاتجاهات الحالية والمستقبلية للسوق. وتشير البيانات إلى تحليل سلسلة القيمة المصب والمصب، والاتجاهات الفنية، وتحليل قوى بورتر الخمس، ودراسات الحالة، وهي بعض المؤشرات المستخدمة للتنبؤ بسيناريو السوق للدول الفردية. كما يتم النظر في وجود وتوافر العلامات التجارية في الشرق الأوسط وأفريقيا والتحديات التي تواجهها بسبب المنافسة الكبيرة أو النادرة من العلامات التجارية المحلية والمحلية، وتأثير التعريفات الجمركية المحلية، وطرق التجارة أثناء تقديم تحليل تنبؤي لبيانات الدولة.

تحليل المشهد التنافسي وحصة سوق الملابس النسيجية في الشرق الأوسط وأفريقيا

يقدم المشهد التنافسي لسوق الملابس النسيجية في الشرق الأوسط وأفريقيا تفاصيل حسب المنافسين. تتضمن التفاصيل نظرة عامة على الشركة، والبيانات المالية للشركة، والإيرادات المتولدة، وإمكانات السوق، والاستثمار في البحث والتطوير، ومبادرات السوق الجديدة، ومواقع الإنتاج والمرافق، ونقاط القوة والضعف في الشركة، وإطلاق المنتج، وخطوط أنابيب تجارب المنتجات، وموافقات المنتج، وبراءات الاختراع، وعرض المنتج واتساعه، وهيمنة التطبيق، ومنحنى شريان الحياة التكنولوجي. ترتبط نقاط البيانات المذكورة أعلاه فقط بتركيز الشركات فيما يتعلق بسوق الملابس النسيجية في الشرق الأوسط وأفريقيا.

بعض المشاركين البارزين الذين يعملون في سوق الملابس النسيجية في الشرق الأوسط وأفريقيا هم TORAY INDUSTRIES، INC.، Arvind Limited، Grasim Industries Limited، YOUNGOR، PVH Corp، Tabb Textile Company Inc.، Ruby Mills، Alok Industries Ltd، DIOR، KPR MILL LIMITED، HYOSUNG TNC، Texhong Textile Group Limited، Apparel Production، The TJX Companies، Inc، و Vardhman Textiles Limited.

منهجية البحث

يتم جمع البيانات وتحليل سنة الأساس باستخدام وحدات جمع البيانات ذات أحجام العينات الكبيرة. يتم تحليل بيانات السوق وتقديرها باستخدام نماذج إحصائية ومتماسكة للسوق. بالإضافة إلى ذلك، يعد تحليل حصة السوق وتحليل الاتجاهات الرئيسية من عوامل النجاح الرئيسية في تقرير السوق. منهجية البحث الرئيسية التي يستخدمها فريق البحث في DBMR هي التثليث البيانات والتي تنطوي على استخراج البيانات وتحليل تأثير متغيرات البيانات على السوق والتحقق الأساسي (خبير الصناعة). وبصرف النظر عن هذا، تتضمن نماذج البيانات شبكات وضع البائعين، وتحليل الخط الزمني للسوق، ونظرة عامة على السوق والدليل، وشبكات وضع الشركة، وتحليل حصة الشركة في السوق، ومعايير القياس، والشرق الأوسط وأفريقيا مقابل المنطقة، وتحليل حصة البائعين. يرجى طلب مكالمة محلل في حالة وجود استفسار إضافي.

التخصيص متاح

تعتبر Data Bridge Market Research رائدة في مجال البحوث التكوينية المتقدمة. نحن نفخر بخدمة عملائنا الحاليين والجدد بالبيانات والتحليلات التي تتطابق مع هدفهم. يمكن تخصيص التقرير ليشمل تحليل اتجاه الأسعار لفهم العلامات التجارية المستهدفة للسوق في بلدان إضافية (اطلب قائمة البلدان)، ونتائج التجارب السريرية في البيانات، ومراجعة الأدبيات، والسوق المجددة، وتحليل قاعدة المنتج. يمكن تحليل تحليل السوق للمنافسين المستهدفين من التحليل القائم على التكنولوجيا إلى استراتيجيات محفظة السوق. يمكننا إضافة عدد كبير من المنافسين حسب الحاجة إلى البيانات بالتنسيق وأسلوب البيانات الذي تبحث عنه. يمكن لفريق المحللين لدينا أيضًا تزويدك بالبيانات في ملفات Excel الخام أو جداول البيانات المحورية (Factbook) أو مساعدتك في إنشاء عروض تقديمية من مجموعات البيانات المتوفرة في التقرير.

SKU-

احصل على إمكانية الوصول عبر الإنترنت إلى التقرير الخاص بأول سحابة استخبارات سوقية في العالم

- لوحة معلومات تحليل البيانات التفاعلية

- لوحة معلومات تحليل الشركة للفرص ذات إمكانات النمو العالية

- إمكانية وصول محلل الأبحاث للتخصيص والاستعلامات

- تحليل المنافسين باستخدام لوحة معلومات تفاعلية

- آخر الأخبار والتحديثات وتحليل الاتجاهات

- استغل قوة تحليل المعايير لتتبع المنافسين بشكل شامل

Table of Content

1 INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 OVERVIEW OF MIDDLE EAST & AFRICA TEXTILE GARMENT MARKET

1.4 LIMITATIONS

1.5 MARKETS COVERED

2 MARKET SEGMENTATION

2.1 MARKETS COVERED

2.2 GEOGRAPHICAL SCOPE

2.3 YEARS CONSIDERED FOR THE STUDY

2.4 CURRENCY AND PRICING

2.5 DBMR TRIPOD DATA VALIDATION MODEL

2.6 MATERIAL TYPE LIFE LINE CURVE

2.7 MULTIVARIATE MODELING

2.8 PRIMARY INTERVIEWS WITH KEY OPINION LEADERS

2.9 DBMR MARKET POSITION GRID

2.1 DBMR MARKET CHALLENGE MATRIX

2.11 DBMR VENDOR SHARE ANALYSIS

2.12 IMPORT-EXPORT DATA

2.13 SECONDARY SOURCES

2.14 ASSUMPTIONS

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

5 MARKET OVERVIEW

5.1 DRIVERS

5.1.1 GROWING AWARENESS TOWARD LATEST FASHION TRENDS AMONG YOUNG GENERATION

5.1.2 INCREASING SPENDING ON APPAREL AND ACCESSORIES FROM ONLINE PLATFORMS

5.1.3 RISING WILLINGNESS TO PAY PREMIUM FOR HIGH QUALITY APPAREL

5.1.4 SHIFTING INCLINATION TOWARD NATURAL FIBER-BASED TEXTILE GARMENTS

5.2 RESTRAINTS

5.2.1 HIGH WASTAGE OF RESOURCES

5.2.2 USE OF HAZARDOUS CHEMICALS

5.2.3 MIDDLE EAST & AFRICA TRADE LIMITATIONS AS A RESULT OF SUPPLY CHAIN DISRUPTION

5.3 OPPORTUNITIES

5.3.1 INCREASING TREND OF SMART TEXTILES

5.3.2 GROWING INFLUENCE OF SOCIAL MEDIA AND E-COMMERCE PLATFORM

5.3.3 RAISING ADOPTION OF TECHNICAL APPLICATION IN TEXTILE INDUSTRY

5.3.4 RECENT ADVANCEMENTS IN THE TEXTILE INDUSTRY AND RAPID INDUSTRIALIZATION

5.4 CHALLENGES

5.4.1 INCREASING AWARENESS TOWARDS SUSTAINABILITY

5.4.2 SAFETY AND HEALTH ISSUES RELATED TO TEXTILE INDUSTRY

5.4.3 RAPID PRICE FLUCTUATIONS OF RAW MATERIALS

5.4.4 REGULATIONS FROM ENVIRONMENTAL REGULATORY AUTHORITY

6 MIDDLE EAST & AFRICA TEXTILE GARMENT MARKET, BY MATERIAL TYPE

6.1 OVERVIEW

6.2 COTTON

6.3 DENIM

6.4 WOOL

6.5 SILK

6.6 OTHERS

7 MIDDLE EAST & AFRICA TEXTILE GARMENT MARKET, BY PRODUCT

7.1 OVERVIEW

7.2 WOMEN

7.2.1 WOMEN, BY PRODUCT

7.2.1.1 TOPS AND DRESSES

7.2.1.2 BOTTOM WEAR

7.2.1.3 INNERWEAR AND SLEEPWEAR

7.2.1.4 COATS, JACKETS AND SUITS

7.2.1.5 ETHNIC WEARS

7.2.1.6 OTHERS

7.3 MEN

7.3.1 MEN, BY PRODUCT

7.3.1.1 SHIRTS AND T-SHIRTS

7.3.1.2 TROUSERS

7.3.1.3 DENIMS

7.3.1.4 ETHNIC WEARS

7.3.1.5 OTHERS

7.4 KIDS

7.4.1 KIDS, BY PRODUCT

7.4.1.1 SHIRTS OR SHIRTS

7.4.1.2 BOTTOM WEAR

7.4.1.3 DRESSES

7.4.1.4 DENIMS

7.4.1.5 UNIFORM

7.4.1.6 ETHNIC WEAR

7.4.1.7 OTHERS

8 MIDDLE EAST & AFRICA TEXTILE GARMENT MARKET, BY REGION

8.1 MIDDLE EAST & AFRICA

8.1.1 U.A.E.

8.1.2 SAUDI ARABIA

8.1.3 EGYPT

8.1.4 SOUTH AFRICA

8.1.5 ISRAEL

8.1.6 REST OF MIDDLE EAST & AFRICA

9 MIDDLE EAST & AFRICA TEXTILE GARMENT MARKET: COMPANY LANDSCAPE

9.1 COMPANY SHARE ANALYSIS: MIDDLE EAST & AFRICA

9.2 COLLABORATION

9.3 EXPANSIONS

9.4 EVENT

9.5 LAUNCH

10 SWOT ANALYSIS

11 COMPANY PROFILES

11.1 THE TJX COMPANIES, INC.

11.1.1 COMPANY SNAPSHOT

11.1.2 REVENUE ANALYSIS

11.1.3 COMPANY SHARE ANALYSIS

11.1.4 PRODUCT PORTFOLIO

11.1.5 RECENT UPDATES

11.2 PVH CORP

11.2.1 COMPANY SNAPSHOT

11.2.2 REVENUE ANALYSIS

11.2.3 COMPANY SHARE ANALYSIS

11.2.4 PRODUCT PORTFOLIO

11.2.5 RECENT UPDATES

11.3 CHRISTIAN DIOR

11.3.1 COMPANY SNAPSHOT

11.3.2 REVENUE ANALYSIS

11.3.3 COMPANY SHARE ANALYSIS

11.3.4 PRODUCT PORTFOLIO

11.3.5 RECENT UPDATES

11.4 HYOSUNG TNC

11.4.1 COMPANY SNAPSHOT

11.4.2 REVENUE ANALYSIS

11.4.3 COMPANY SHARE ANALYSIS

11.4.4 PRODUCT PORTFOLIO

11.4.5 RECENT UPDATES

11.5 YOUNGOR

11.5.1 COMPANY SNAPSHOT

11.5.2 COMPANY SHARE ANALYSIS

11.5.3 PRODUCT PORTFOLIO

11.5.4 RECENT UPDATES

11.6 APPAREL PRODUCTION

11.6.1 COMPANY SNAPSHOT

11.6.2 PRODUCT PORTFOLIO

11.6.3 RECENT UPDATES

11.7 ALOK INDUSTRIES LIMITED

11.7.1 COMPANY SNAPSHOT

11.7.2 REVENUE ANALYSIS

11.7.3 PRODUCT PORTFOLIO

11.7.4 RECENT UPDATES

11.8 ARVIND LIMITED

11.8.1 COMPANY SNAPSHOT

11.8.2 REVENUE ANALYSIS

11.8.3 PRODUCT PORTFOLIO

11.8.4 RECENT UPDATES

11.9 GRASIM INDUSTRIES LIMITED

11.9.1 COMPANY SNAPSHOT

11.9.2 REVENUE ANALYSIS

11.9.3 PRODUCT PORTFOLIO

11.9.4 RECENT UPDATES

11.1 KPR MILL LIMITED

11.10.1 COMPANY SNAPSHOT

11.10.2 REVENUE ANALYSIS

11.10.3 PRODUCT PORTFOLIO

11.10.4 RECENT UPDATES

11.11 RUBY MILLS

11.11.1 COMPANY SNAPSHOT

11.11.2 REVENUE ANALYSIS

11.11.3 PRODUCT PORTFOLIO

11.11.4 RECENT UPDATE

11.12 TORAY INDUSTRIES, INC.

11.12.1 COMPANY SNAPSHOT

11.12.2 REVENUE ANALYSIS

11.12.3 PRODUCT PORTFOLIO

11.12.4 RECENT UPDATE

11.13 TABB TEXTILE COMPANY

11.13.1 COMPANY SNAPSHOT

11.13.2 PRODUCT PORTFOLIO

11.13.3 RECENT UPDATES

11.14 TEHXONG TEXTILE GROUP LIMITED

11.14.1 COMPANY SNAPSHOT

11.14.2 REVENUE ANALYSIS

11.14.3 PRODUCT PORTFOLIO

11.14.4 RECENT UPDATES

11.15 VARDHMAN TEXTILES LIMITED.

11.15.1 COMPANY SNAPSHOT

11.15.2 REVENUE ANALYSIS

11.15.3 PRODUCT PORTFOLIO

11.15.4 RECENT UPDATE

12 QUESTIONNAIRE

13 RELATED REPORTS

List of Table

TABLE 1 IMPORT DATA OF GARMENTS MADE UP OF FELT OR NONWOVENS, WHETHER OR NOT IMPREGNATED, COATED, COVERED OR LAMINATED; HS CODE – 6210 (USD THOUSAND)

TABLE 2 EXPORT DATA OF GARMENTS MADE UP OF FELT OR NONWOVENS, WHETHER OR NOT IMPREGNATED, COATED, COVERED OR LAMINATED; HS CODE – 6210 (USD THOUSAND)

TABLE 3 MIDDLE EAST & AFRICA TEXTILE GARMENT MARKET, BY MATERIAL TYPE, 2021-2030 (USD MILLION)

TABLE 4 MIDDLE EAST & AFRICA COTTON IN TEXTILE GARMENT MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 5 MIDDLE EAST & AFRICA DENIM IN TEXTILE GARMENT MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 6 MIDDLE EAST & AFRICA WOOL IN TEXTILE GARMENT MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 7 MIDDLE EAST & AFRICA SILK IN TEXTILE GARMENT MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 8 MIDDLE EAST & AFRICA OTHERS IN TEXTILE GARMENT MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 9 MIDDLE EAST & AFRICA TEXTILE GARMENT MARKET, BY PRODUCT , 2021-2030 (USD MILLION)

TABLE 10 MIDDLE EAST & AFRICA WOMEN IN TEXTILE GARMENT MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 11 MIDDLE EAST & AFRICA WOMEN IN TEXTILE GARMENT MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 12 MIDDLE EAST & AFRICA MEN IN TEXTILE GARMENT MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 13 MIDDLE EAST & AFRICA MEN IN TEXTILE GARMENT MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 14 MIDDLE EAST & AFRICA KIDS IN TEXTILE GARMENT MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 15 MIDDLE EAST & AFRICA KIDS IN TEXTILE GARMENT MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 16 MIDDLE EAST & AFRICA TEXTILE GARMENT MARKET, BY COUNTRY, 2021-2030 (USD MILLION)

TABLE 17 MIDDLE EAST & AFRICA TEXTILE GARMENT MARKET, BY MATERIAL TYPE, 2021-2030 (USD MILLION)

TABLE 18 MIDDLE EAST & AFRICA TEXTILE GARMENT MARKET, BY PRODUCT, 2021-2030 (USD MILLION)

TABLE 19 MIDDLE EAST & AFRICA WOMEN IN TEXTILE GARMENT MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 20 MIDDLE EAST & AFRICA MEN IN TEXTILE GARMENT MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 21 MIDDLE EAST & AFRICA KIDS IN TEXTILE GARMENT MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 22 U.A.E. TEXTILE GARMENT MARKET, BY MATERIAL TYPE, 2021-2030 (USD MILLION)

TABLE 23 U.A.E. TEXTILE GARMENT MARKET, BY PRODUCT, 2021-2030 (USD MILLION)

TABLE 24 U.A.E. WOMEN IN TEXTILE GARMENT MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 25 U.A.E. MEN IN TEXTILE GARMENT MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 26 U.A.E. KIDS IN TEXTILE GARMENT MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 27 SAUDI ARABIA TEXTILE GARMENT MARKET, BY MATERIAL TYPE, 2021-2030 (USD MILLION)

TABLE 28 SAUDI ARABIA TEXTILE GARMENT MARKET, BY PRODUCT, 2021-2030 (USD MILLION)

TABLE 29 SAUDI ARABIA WOMEN IN TEXTILE GARMENT MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 30 SAUDI ARABIA MEN IN TEXTILE GARMENT MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 31 SAUDI ARABIA KIDS IN TEXTILE GARMENT MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 32 EGYPT TEXTILE GARMENT MARKET, BY MATERIAL TYPE, 2021-2030 (USD MILLION)

TABLE 33 EGYPT TEXTILE GARMENT MARKET, BY PRODUCT, 2021-2030 (USD MILLION)

TABLE 34 EGYPT WOMEN IN TEXTILE GARMENT MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 35 EGYPT MEN IN TEXTILE GARMENT MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 36 EGYPT KIDS IN TEXTILE GARMENT MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 37 SOUTH AFRICA TEXTILE GARMENT MARKET, BY MATERIAL TYPE, 2021-2030 (USD MILLION)

TABLE 38 SOUTH AFRICA TEXTILE GARMENT MARKET, BY PRODUCT, 2021-2030 (USD MILLION)

TABLE 39 SOUTH AFRICA WOMEN IN TEXTILE GARMENT MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 40 SOUTH AFRICA MEN IN TEXTILE GARMENT MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 41 SOUTH AFRICA KIDS IN TEXTILE GARMENT MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 42 ISRAEL TEXTILE GARMENT MARKET, BY MATERIAL TYPE, 2021-2030 (USD MILLION)

TABLE 43 ISRAEL TEXTILE GARMENT MARKET, BY PRODUCT, 2021-2030 (USD MILLION)

TABLE 44 ISRAEL WOMEN IN TEXTILE GARMENT MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 45 ISRAEL MEN IN TEXTILE GARMENT MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 46 ISRAEL KIDS IN TEXTILE GARMENT MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 47 REST OF MIDDLE EAST & AFRICA TEXTILE GARMENT MARKET, BY MATERIAL TYPE, 2021-2030 (USD MILLION)

List of Figure

FIGURE 1 MIDDLE EAST & AFRICA TEXTILE GARMENT MARKET

FIGURE 2 MIDDLE EAST & AFRICA TEXTILE GARMENT MARKET: DATA TRIANGULATION

FIGURE 3 MIDDLE EAST & AFRICA TEXTILE GARMENT MARKET: DROC ANALYSIS

FIGURE 4 MIDDLE EAST & AFRICA TEXTILE GARMENT MARKET: MIDDLE EAST & AFRICA VS REGIONAL MARKET ANALYSIS

FIGURE 5 MIDDLE EAST & AFRICA TEXTILE GARMENT MARKET: COMPANY RESEARCH ANALYSIS

FIGURE 6 MIDDLE EAST & AFRICA TEXTILE GARMENT MARKET: THE MATERIALTYPE LIFE LINE CURVE

FIGURE 7 MIDDLE EAST & AFRICA TEXTILE GARMENT MARKET: MULTIVARIATE MODELLING

FIGURE 8 MIDDLE EAST & AFRICA TEXTILE GARMENT MARKET: INTERVIEW DEMOGRAPHICS

FIGURE 9 MIDDLE EAST & AFRICA TEXTILE GARMENT MARKET: DBMR MARKET POSITION GRID

FIGURE 10 MIDDLE EAST & AFRICA TEXTILE GARMENT MARKET: THE MARKET CHALLENGE MATRIX

FIGURE 11 MIDDLE EAST & AFRICA TEXTILE GARMENT MARKET: VENDOR SHARE ANALYSIS

FIGURE 12 MIDDLE EAST & AFRICA TEXTILE GARMENT MARKET: SEGMENTATION

FIGURE 13 GROWING AWARENESS TOWARD LATEST FASHION TRENDS AMONG YOUNG GENERATION IS EXPECTED TO DRIVE MIDDLE EAST & AFRICA TEXTILE GARMENT MARKET IN THE FORECAST PERIOD

FIGURE 14 COTTON SEGMENT IS EXPECTED TO ACCOUNT FOR THE LARGEST SHARE OF THE MIDDLE EAST & AFRICA TEXTILE GARMENT MARKET IN 2022 & 2029

FIGURE 15 DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES OF MIDDLE EAST & AFRICA TEXTILE GARMENTS MARKET

FIGURE 16 MIDDLE EAST & AFRICA TEXTILE GARMENT MARKET: BY MATERIAL TYPE, 2022

FIGURE 17 MIDDLE EAST & AFRICA TEXTILE GARMENT MARKET: BY PRODUCT, 2022

FIGURE 18 MIDDLE EAST & AFRICA TEXTILE GARMENT MARKET: SNAPSHOT (2022)

FIGURE 19 MIDDLE EAST & AFRICA TEXTILE GARMENT MARKET: BY COUNTRY (2022)

FIGURE 20 MIDDLE EAST & AFRICA TEXTILE GARMENT MARKET: BY COUNTRY (2023 & 2030)

FIGURE 21 MIDDLE EAST & AFRICA TEXTILE GARMENT MARKET: BY COUNTRY (2022 & 2030)

FIGURE 22 MIDDLE EAST & AFRICA TEXTILE GARMENT MARKET: BY MATERIAL TYPE (2023-2030)

FIGURE 23 MIDDLE EAST & AFRICA TEXTILE GARMENT MARKET: COMPANY SHARE 2021 (%)

منهجية البحث

يتم جمع البيانات وتحليل سنة الأساس باستخدام وحدات جمع البيانات ذات أحجام العينات الكبيرة. تتضمن المرحلة الحصول على معلومات السوق أو البيانات ذات الصلة من خلال مصادر واستراتيجيات مختلفة. تتضمن فحص وتخطيط جميع البيانات المكتسبة من الماضي مسبقًا. كما تتضمن فحص التناقضات في المعلومات التي شوهدت عبر مصادر المعلومات المختلفة. يتم تحليل بيانات السوق وتقديرها باستخدام نماذج إحصائية ومتماسكة للسوق. كما أن تحليل حصة السوق وتحليل الاتجاهات الرئيسية هي عوامل النجاح الرئيسية في تقرير السوق. لمعرفة المزيد، يرجى طلب مكالمة محلل أو إرسال استفسارك.

منهجية البحث الرئيسية التي يستخدمها فريق بحث DBMR هي التثليث البيانات والتي تتضمن استخراج البيانات وتحليل تأثير متغيرات البيانات على السوق والتحقق الأولي (من قبل خبراء الصناعة). تتضمن نماذج البيانات شبكة تحديد موقف البائعين، وتحليل خط زمني للسوق، ونظرة عامة على السوق ودليل، وشبكة تحديد موقف الشركة، وتحليل براءات الاختراع، وتحليل التسعير، وتحليل حصة الشركة في السوق، ومعايير القياس، وتحليل حصة البائعين على المستوى العالمي مقابل الإقليمي. لمعرفة المزيد عن منهجية البحث، أرسل استفسارًا للتحدث إلى خبراء الصناعة لدينا.

التخصيص متاح

تعد Data Bridge Market Research رائدة في مجال البحوث التكوينية المتقدمة. ونحن نفخر بخدمة عملائنا الحاليين والجدد بالبيانات والتحليلات التي تتطابق مع هدفهم. ويمكن تخصيص التقرير ليشمل تحليل اتجاه الأسعار للعلامات التجارية المستهدفة وفهم السوق في بلدان إضافية (اطلب قائمة البلدان)، وبيانات نتائج التجارب السريرية، ومراجعة الأدبيات، وتحليل السوق المجدد وقاعدة المنتج. ويمكن تحليل تحليل السوق للمنافسين المستهدفين من التحليل القائم على التكنولوجيا إلى استراتيجيات محفظة السوق. ويمكننا إضافة عدد كبير من المنافسين الذين تحتاج إلى بيانات عنهم بالتنسيق وأسلوب البيانات الذي تبحث عنه. ويمكن لفريق المحللين لدينا أيضًا تزويدك بالبيانات في ملفات Excel الخام أو جداول البيانات المحورية (كتاب الحقائق) أو مساعدتك في إنشاء عروض تقديمية من مجموعات البيانات المتوفرة في التقرير.