سوق أنظمة الكابلات البحرية في الشرق الأوسط وأفريقيا، حسب المنتج (منتجات المصانع الرطبة ومنتجات المصانع الجافة)، الجهد (الجهد المتوسط والعالي، الجهد العالي جدًا)، العرض (التركيب والتشغيل والإصلاح والصيانة والترقيات)، فئة الألياف (غير المكررة والمكررة)، نوع الكابلات (كابلات الأنابيب الفضفاضة وكابلات الشريط وغيرها)، نوع الدرع (درع خفيف الوزن، درع واحد، درع مزدوج ودرع صخري)، العمق (0 إلى 500 متر، 500 متر إلى 1000 متر، 1000 متر إلى 5000 متر وغيرها)، التطبيق (كابلات الطاقة وكابلات الاتصالات) - اتجاهات الصناعة والتوقعات حتى عام 2029.

تحليل وحجم سوق أنظمة الكابلات البحرية في الشرق الأوسط وأفريقيا

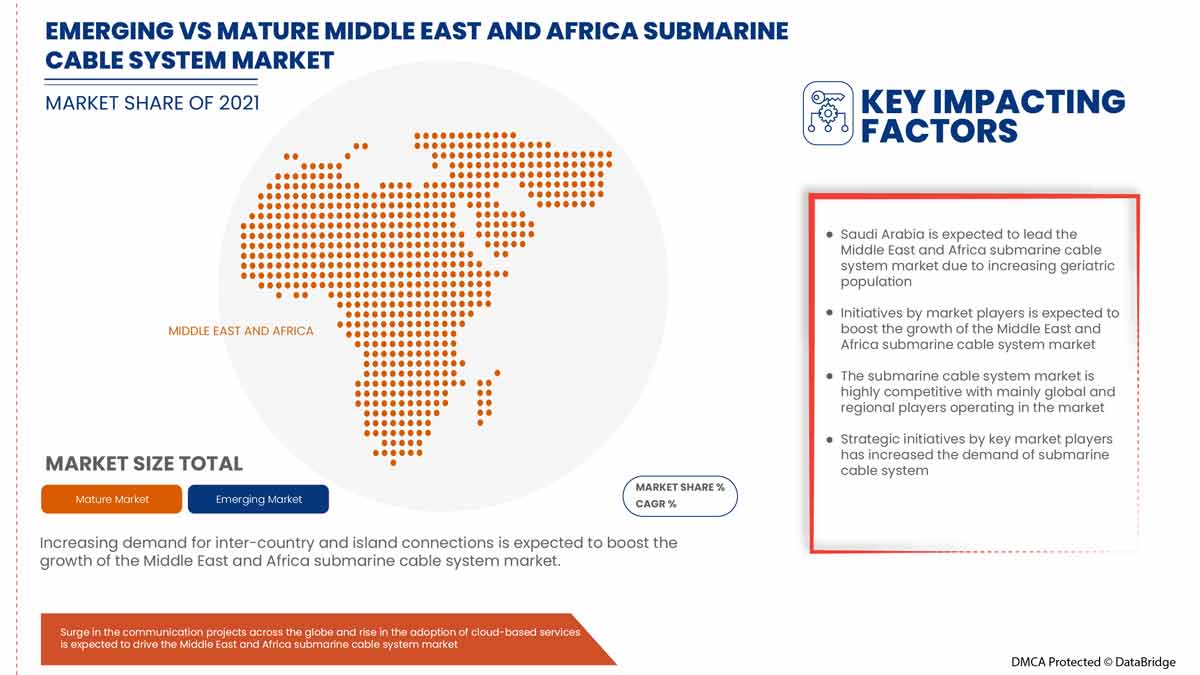

يتم وضع كابل بحري على قاع البحر بين محطات أرضية لنقل إشارات الاتصالات عبر مساحات من البحر والمحيط. أثرت اشتراكات الاتصالات المتزايدة والاستثمارات الكبيرة في مزارع الرياح البحرية بشكل مباشر على نمو سوق الكابلات البحرية. كما أن الاستثمارات المتزايدة لمقدمي خدمات المحتوى والسحابة تزدهر في نمو سوق الكابلات البحرية. كما أن زيادة حركة الإنترنت في المناطق الناشئة تؤثر بشكل إيجابي على نمو السوق. علاوة على ذلك، يعمل الطلب المتزايد على النطاق الترددي أيضًا كمحرك نمو نشط لنمو سوق الكابلات البحرية. علاوة على ذلك، فإن العدد المتزايد من مزارع الرياح البحرية والطلب المتزايد على توصيلات الطاقة بين البلدان والجزر يخلق طلبًا كبيرًا على الكابلات البحرية ويرفع نمو سوق الكابلات البحرية.

ومع ذلك، فإن الإجراءات التنظيمية والبيئية وإجراءات الترخيص المعقدة التي تؤدي إلى التأخير، فضلاً عن إجراءات الإصلاح المعقدة لوصلات كابلات الطاقة في المياه العميقة، تعمل كقيود رئيسية على نمو الكابلات البحرية في الفترة المتوقعة المذكورة أعلاه، في حين أن الضجة المتزايدة حول مجموعات اتصالات الإنترنت الفضائية يمكن أن تشكل تحديًا لنمو سوق الكابلات البحرية.

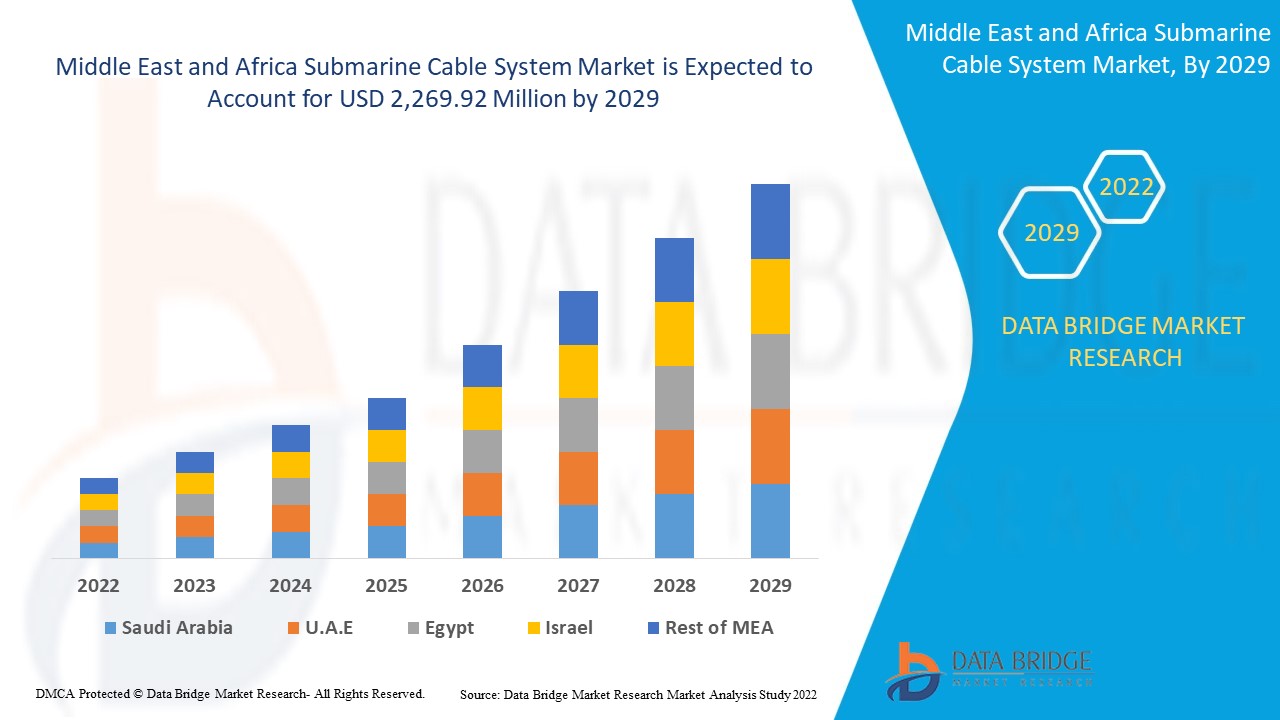

تحلل شركة Data Bridge Market Research أن سوق أنظمة الكابلات البحرية في الشرق الأوسط وأفريقيا من المتوقع أن يصل إلى 2,269.92 مليون دولار أمريكي بحلول عام 2029، بمعدل نمو سنوي مركب قدره 6.1% خلال الفترة المتوقعة. تشكل "منتجات النباتات الجافة" قطاع التكنولوجيا الأكثر بروزًا. هذا النوع من التكنولوجيا مطلوب لأنه يوفر أقصى قدر من كفاءة العمل من خلال تجنب تركيب الكابلات في المناطق الحرجة. يغطي تقرير سوق أنظمة الكابلات البحرية أيضًا بشكل شامل التسعير وبراءات الاختراع والتقدم التكنولوجي.

|

تقرير القياس |

تفاصيل |

|

فترة التنبؤ |

2022 إلى 2029 |

|

سنة الأساس |

2021 |

|

سنوات تاريخية |

2020 (قابلة للتخصيص حتى 2019-2014) |

|

القطاعات المغطاة |

حسب المنتج (منتجات المصانع الرطبة ومنتجات المصانع الجافة)، الجهد (الجهد المتوسط والجهد العالي، الجهد العالي جدًا)، العرض (التركيب والتشغيل والإصلاح والصيانة والترقيات)، فئة الألياف (غير المكررة والمكررة)، نوع الكابلات (كابلات الأنابيب السائبة، كابلات الشريط وغيرها)، نوع الدرع (درع خفيف الوزن، درع واحد، درع مزدوج ودرع صخري)، العمق (0 إلى 500 متر، 500 متر إلى 1000 متر، 1000 متر إلى 5000 متر وغيرها)، التطبيق (كابلات الطاقة وكابلات الاتصالات) |

|

الدول المغطاة |

المملكة العربية السعودية، الإمارات العربية المتحدة، جنوب أفريقيا، مصر، إسرائيل وبقية دول الشرق الأوسط وأفريقيا |

|

الجهات الفاعلة في السوق المشمولة |

مجموعة HENGTONG المحدودة، TE Connectivity، شركة إريكسون السعودية، APAR، شركة NEC Corporation، NXT A/S، شركة Norddeutsche Seekabelwerke GmbH (شركة تابعة لمجموعة Prysmian)، شركة JDR Cable Systems Ltd، شركة ZTT، مجموعة Hexatronic، شركة Alcatel Submarine Networks، شركة Corning Incorporated، شركة Okonite، شركة AFL (شركة تابعة لشركة Fujikura Ltd.)، شركة LEONI، شركة NEXANS، شركة Ocean Specialists, Inc. (شركة تابعة لشركة Continental Shelf Associates, Inc.)، شركة TFKable، شركة Sumitomo Electric Industries, Ltd.، شركة Tratos، شركة Hellenic Cables SA وشركة HESFIBEL SUBSEA CABLES وغيرها. |

تعريف السوق

يشير نظام الكابلات البحرية إلى أطر الكابلات المتصلة بمحطة أرضية تساعد في نقل الإشارات عبر المحيط والمسطحات المائية البحرية. تجمع مجموعة الاتصال عبر مسافات طويلة بين الاتصالات ونقل الكهرباء من خلال أنظمة الكابلات الموضوعة تحت الماء.

إن الطلب على نظام الكابلات البحرية وانتشاره يعتمدان بشكل كامل على زيادة اشتراكات الاتصالات والإنترنت في الشرق الأوسط وأفريقيا. ومن المتوقع أن يعمل ذلك على توسيع الأنظمة البحرية في مناطق غير مستكشفة. علاوة على ذلك، يلعب الشحن البحري ونظام تحديد المواقع العالمي (GPS) دورًا رئيسيًا في تطوير الكابلات البحرية عبر جميع البلدان والمناطق في العالم الحديث. وهذا يتطلب تطبيق لوائح حكومية مناسبة وفريدة من نوعها لتطوير إجراءات قياسية والاتصال. وبالتالي، فإنه يتضمن مجموعة من القواعد واللوائح التي تساعد في تعزيز السوق.

ديناميكيات سوق أنظمة الكابلات البحرية

يتناول هذا القسم فهم محركات السوق والمزايا والفرص والقيود والتحديات. وسيتم مناقشة كل هذا بالتفصيل أدناه:

السائقون/الفرص

- ارتفاع في اتجاه توليد طاقة الرياح البحرية

كانت الكابلات البحرية موجودة منذ منتصف القرن التاسع عشر. ولكن بالنسبة لجزء كبير من تجاربها، تم استخدام هذه الكابلات بشكل أساسي لنقل الطاقة من مصادر تقليدية، مثل محطات الفحم، إما بين الدول أو إلى الجزر أو منصات النفط. واجهت صناعة الكابلات البحرية انحدارًا خلال القرن التاسع عشر. تغير ذلك خلال العقد الأول من القرن الحادي والعشرين، حيث أدت تكاليف الطاقة المتزايدة والمخاوف بشأن التغير البيئي إلى زيادة الاهتمام بتنمية طاقة الرياح البحرية وشبكات الطاقة العابرة للحدود الوطنية الأكثر فعالية.

إن توليد طاقة الرياح هو مصدر طاقة نظيفة لا يحتاج إلى وقود، كما أن توليد الطاقة في البحر يتميز برياح قوية، مما يجذب مشاريع تطوير توليد طاقة الرياح البحرية في جميع أنحاء العالم.

- ارتفاع في اعتماد الخدمات المستندة إلى السحابة

إن التطور الذي حدث عبر الهواء باستخدام مجموعات الأقمار الصناعية الجديدة المختلفة التي يتم إرسالها والرغبة المتزايدة في الوصول إلى المحتوى من خلال المنظمات المحمولة عبر عمليات الإرسال اللاسلكية عن بعد. يتم توصيل عمليات الإرسال عن بعد هذه من خلال البنية التحتية لمركز البيانات. وهي مترابطة من خلال الكابلات الموضوعة في غواصة لتطوير الاتصالات بين مراكز البيانات المختلفة في بلدان ومناطق مختلفة. وهذا يعني الحاجة إلى كابلات بحرية تساعد في ربط مراكز البيانات وتحسين الاتصال القائم على السحابة بشكل مباشر لجميع أنواع المنظمات. وبالتالي، من المتوقع أن يكون تبني الخدمات والحلول القائمة على السحابة محركًا رئيسيًا لنمو سوق نظام الكابلات البحرية.

- نشر تقنيات مختلفة في أنظمة الكابلات البحرية

إن تغذية أنظمة الكابلات البحرية بالطاقة الكهربائية ممارسة راسخة منذ فترة طويلة، بدءًا من أنظمة الكابلات البحرية المحورية وحتى أنظمة مكبرات الصوت البصرية الحالية. وتتمثل المبادئ الرئيسية لتزويد أنظمة الكابلات البحرية بالطاقة الكهربائية، كما تمت مناقشتها في هذا الفصل، في معدات تغذية الطاقة (PFE) المثبتة في محطات الطرفية، ومسار العودة عبر الأرض والبحر، وتزويد معدات تغذية الطاقة (PFE) بتيار ثابت لتثبيت خصائص المكرر وأداء الإرسال.

ضبط النفس/التحديات

- تشكل الاستثمارات الأولية المرتفعة حاجزًا للدخول للشركات الصغيرة والمتوسطة

إن الاتصال عبر الكابل البحري طويل وبالتالي فإن التكلفة تعتمد بشكل مباشر على طول أنظمة الكابلات المستخدمة والتي يتم توصيلها بشكل مباشر وبالتالي فقد لوحظ أن اللاعبين الرئيسيين في السوق عادة ما يشاركون في أعمال خدمة الكابل البحري لأنها تنطوي على استثمارات ضخمة لا تستطيع الشركات الصغيرة والمتوسطة تقديمها. وهذا من شأنه أن يحد من دخول المزيد من اللاعبين إلى السوق ويعزز الهيمنة، وهو ما من المتوقع أن يحد من نمو السوق.

- إجراءات الإصلاح المعقدة

يتم تحميل سفن الكابلات بكمية كافية من الكابلات للإصلاحات، ربما 5-10 كيلومترات، والتي يمكن تحميلها في غضون ساعات قليلة. يجب إضافة كابل لإجراء الإصلاح، حيث لا يوجد ما يكفي من الركود لرفع الكابل وقطع قطعة منه. بعد استعادة الكابل ووضعه على متن السفينة، في غرفة إصلاح تشبه المختبر، يقوم المهندسون بإصلاح الكابل.

تأثير ما بعد كوفيد-19 على سوق أنظمة الكابلات البحرية

لقد أثرت جائحة كوفيد-19 بشكل كبير على سوق أنظمة الكابلات البحرية حيث اختارت كل دولة تقريبًا إغلاق جميع مرافق الإنتاج باستثناء تلك التي تنتج السلع الأساسية. اتخذت الحكومة إجراءات صارمة، مثل إيقاف إنتاج وبيع السلع غير الأساسية، وحظر التجارة الدولية، وغير ذلك الكثير، لمنع انتشار كوفيد-19. إن العمل الوحيد الذي يتعامل في ظل هذا الوضع الوبائي هو الخدمات الأساسية المسموح لها بالفتح وتشغيل العمليات.

يتخذ المصنعون قرارات استراتيجية مختلفة للتعافي بعد جائحة كوفيد-19. ويجري اللاعبون أنشطة بحث وتطوير متعددة لتحسين التكنولوجيا في سوق أنظمة الكابلات البحرية. وستقدم الشركات حلولاً متقدمة ودقيقة للسوق.

التطورات الأخيرة

- في نوفمبر 2021، أعلنت شركة LEONI عن الشراكة في مشروع ADOPD لتطوير وحدات حسابية فائقة السرعة للألياف الضوئية تعتمد على التشعبات الضوئية التكيفية. سيساعد هذا المشروع الشركة على فهم العمليات والتفاعلات المختلفة ويؤدي إلى تطوير تقنيات منتجات أفضل في قطاعات مختلفة، وخاصة في أنظمة الكابلات

- في يوليو 2022، أعلنت شركة NEXANS عن فوزها بمشروع جديد من شركة EuroAsia Interconnector Limited لتطوير الربط الكهربائي الأوروبي الذي يربط بين الشبكات الوطنية لإسرائيل وقبرص واليونان (كريت). سيساعد هذا المشروع الشركة على توفير التكنولوجيا لكابلات الطاقة تحت سطح البحر باستخدام التطورات طويلة الأجل لشركة NEXANS للمياه العميقة للغاية التي يبلغ عمقها 3000 متر وقدرات التثبيت التي سيتم الاعتراف بها في السوق.

نطاق سوق أنظمة الكابلات البحرية في الشرق الأوسط وأفريقيا

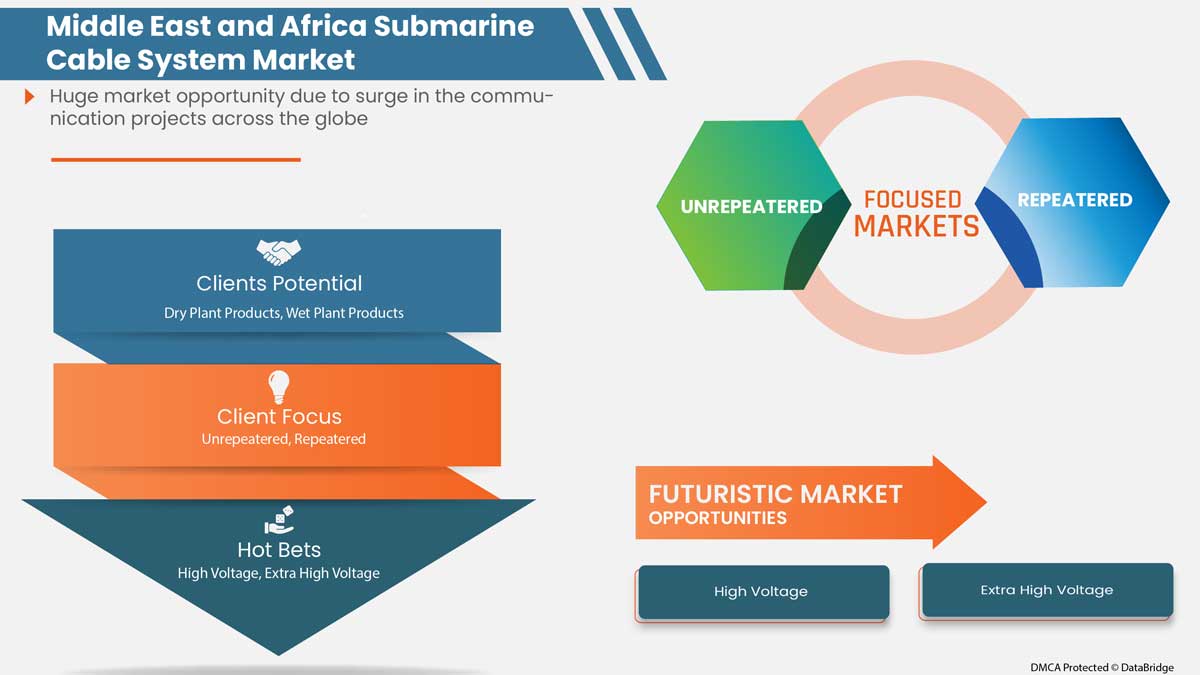

يتم تقسيم سوق أنظمة الكابلات البحرية على أساس المنتج والجهد والعرض والألياف الزجاجية ونوع الكابل ونوع الدرع والعمق والتطبيق. سيساعدك النمو بين هذه القطاعات على تحليل قطاعات النمو الضئيلة في الصناعات وتزويد المستخدمين بنظرة عامة قيمة على السوق ورؤى السوق لمساعدتهم على اتخاذ قرارات استراتيجية لتحديد تطبيقات السوق الأساسية.

حسب المنتج

- منتجات النباتات الرطبة

- منتجات نباتية جافة

على أساس المنتج، يتم تقسيم سوق نظام الكابلات البحرية في الشرق الأوسط وأفريقيا إلى منتجات نباتية رطبة ومنتجات نباتية جافة.

حسب الجهد

- الجهد المتوسط

- الجهد العالي

- جهد عالي جدًا

على أساس الجهد، يتم تقسيم سوق نظام الكابلات البحرية في الشرق الأوسط وأفريقيا إلى جهد متوسط، وجهد عالي، وجهد عالي جدًا.

عن طريق العرض

- صيانة

- الترقيات

- التركيب والتشغيل

على أساس العرض، يتم تقسيم سوق نظام الكابلات البحرية في الشرق الأوسط وأفريقيا إلى الصيانة والترقيات والتركيب والتشغيل .

بواسطة الألياف الزجاجية

- غير مكرر

- مُكرر

على أساس الألياف الزجاجية، يتم تقسيم سوق نظام الكابلات البحرية في الشرق الأوسط وأفريقيا إلى غير مكرر ومكرر.

حسب نوع الكابلات

- كابلات الأنابيب الفضفاضة

- كابلات الشريط

- آحرون

على أساس نوع الكابلات، يتم تقسيم سوق نظام الكابلات البحرية في الشرق الأوسط وأفريقيا إلى كابلات أنبوبية فضفاضة، وكابلات شريطية، وغيرها.

حسب نوع الدرع

- درع خفيف الوزن

- درع واحد

- درع مزدوج

- درع الصخر

على أساس نوع الدروع، يتم تقسيم سوق نظام الكابلات البحرية في الشرق الأوسط وأفريقيا إلى دروع خفيفة الوزن، ودروع مفردة، ودروع مزدوجة، ودروع صخرية.

حسب العمق

- 0 إلى 500 متر

- 500 متر-1000 متر

- 1000 متر-5000 متر

- آحرون

على أساس العمق، يتم تقسيم سوق نظام الكابلات البحرية في الشرق الأوسط وأفريقيا إلى 0 إلى 500 متر، 500 متر إلى 1000 متر، 1000 متر إلى 5000 متر، وغيرها.

حسب الطلب

- كابلات الطاقة

- كابلات الاتصالات

على أساس التطبيق، يتم تقسيم سوق نظام الكابلات البحرية في الشرق الأوسط وأفريقيا إلى كابلات الطاقة وكابلات الاتصالات.

تحليل/رؤى إقليمية لسوق أنظمة الكابلات البحرية

يتم تحليل سوق نظام الكابلات البحرية، ويتم توفير رؤى حجم السوق والاتجاهات حسب المنتج والجهد والعرض والألياف الزجاجية ونوع الكابلات ونوع الدرع والعمق والتطبيق، كما هو مذكور أعلاه.

الدول التي يغطيها تقرير سوق نظام الكابلات البحرية هي المملكة العربية السعودية والإمارات العربية المتحدة وجنوب أفريقيا ومصر وإسرائيل وبقية دول الشرق الأوسط وأفريقيا.

تهيمن المملكة العربية السعودية على سوق أنظمة الكابلات البحرية في الشرق الأوسط وأفريقيا. وتعمل المملكة العربية السعودية على تطوير حلول وخدمات قائمة على السحابة تهدف إلى تحسين الأمن والمساهمة في مستويات جديدة من الذكاء التشغيلي للحكومات والمؤسسات ووسائل النقل والمجتمعات. ومن شأن هذا أن يعزز الطلب على منتجات أنظمة الكابلات البحرية في الشرق الأوسط وأفريقيا.

كما يوفر قسم الدولة في التقرير عوامل فردية مؤثرة على السوق وتغييرات تنظيم السوق التي تؤثر على اتجاهات السوق الحالية والمستقبلية. تعد نقاط البيانات مثل تحليل سلسلة القيمة النهائية والنهائية، والاتجاهات التكنولوجية، وتحليل قوى بورتر الخمس، ودراسات الحالة بعض المؤشرات المستخدمة للتنبؤ بسيناريو السوق للدول الفردية. كما يتم النظر في وجود وتوافر العلامات التجارية في الشرق الأوسط وأفريقيا والتحديات التي تواجهها بسبب المنافسة الكبيرة أو النادرة من العلامات التجارية المحلية والمحلية، وتأثير التعريفات الجمركية المحلية، وطرق التجارة أثناء تقديم تحليل تنبؤي لبيانات الدولة.

تحليل المشهد التنافسي وحصة سوق أنظمة الكابلات البحرية

يوفر المشهد التنافسي لسوق أنظمة الكابلات البحرية تفاصيل حول المنافس. تتضمن التفاصيل نظرة عامة على الشركة، والبيانات المالية للشركة، والإيرادات المولدة، وإمكانات السوق، والاستثمار في البحث والتطوير، والمبادرات السوقية الجديدة، والتواجد في الشرق الأوسط وأفريقيا، ومواقع الإنتاج والمرافق، والقدرات الإنتاجية، ونقاط القوة والضعف للشركة، وإطلاق المنتج، وعرض المنتج ونطاقه، وهيمنة التطبيق. تتعلق نقاط البيانات المذكورة أعلاه فقط بالشركات التي تركز على سوق أنظمة الكابلات البحرية.

بعض اللاعبين الرئيسيين الذين يعملون في سوق نظام الكابلات البحرية هم HENGTONG GROUP CO.، LTD، TE Connectivity، سعودي إريكسون، APAR، NEC Corporation، NXT A/S، Norddeutsche Seekabelwerke GmbH (شركة تابعة لمجموعة Prysmian)، JDR Cable Systems Ltd، ZTT، Hexatronic Group، Alcatel Submarine Networks، Corning Incorporated، The Okonite Company، AFL (شركة تابعة لشركة Fujikura Ltd.)، LEONI، NEXANS، Ocean Specialists، Inc. (شركة تابعة لشركة Continental Shelf Associates، Inc.)، TFKable، Sumitomo Electric Industries، Ltd.، Tratos، Hellenic Cables SA و HESFIBEL SUBSEA CABLES وغيرها.

SKU-

احصل على إمكانية الوصول عبر الإنترنت إلى التقرير الخاص بأول سحابة استخبارات سوقية في العالم

- لوحة معلومات تحليل البيانات التفاعلية

- لوحة معلومات تحليل الشركة للفرص ذات إمكانات النمو العالية

- إمكانية وصول محلل الأبحاث للتخصيص والاستعلامات

- تحليل المنافسين باستخدام لوحة معلومات تفاعلية

- آخر الأخبار والتحديثات وتحليل الاتجاهات

- استغل قوة تحليل المعايير لتتبع المنافسين بشكل شامل

Table of Content

1 INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 OVERVIEW OF MIDDLE EAST & AFRICA SUBMARINE CABLE SYSTEM MARKET

1.4 CURRENCY AND PRICING

1.5 LIMITATIONS

1.6 MARKETS COVERED

2 MARKET SEGMENTATION

2.1 MARKETS COVERED

2.2 YEARS CONSIDERED FOR THE STUDY

2.3 GEOGRAPHIC SCOPE

2.4 DBMR TRIPOD DATA VALIDATION MODEL

2.5 PRIMARY INTERVIEWS WITH KEY OPINION LEADERS

2.6 DBMR MARKET POSITION GRID

2.7 VENDOR SHARE ANALYSIS

2.8 MARKET APPLICATION COVERAGE GRID

2.9 MULTIVARIATE MODELLING

2.1 PRODUCT CURVE

2.11 CHALLENGE MATRIX

2.12 SECONDARY SOURCES

2.13 ASSUMPTIONS

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

5 MARKET OVERVIEW

5.1 DRIVERS

5.1.1 SURGE IN THE COMMUNICATION PROJECTS UNDERSEA PATH ACROSS THE GLOBE

5.1.2 RISE IN THE TREND OF OFFSHORE WIND POWER GENERATION

5.1.3 GROWING DEMAND FOR HIGH BANDWIDTH, LOW-LATENCY, AND HIGH REDUNDANCY OWING TO THE EMERGENCE OF 5G

5.1.4 RISE IN THE ADOPTION OF CLOUD-BASED SERVICES

5.2 RESTRAINTS

5.2.1 HIGH INITIAL INVESTMENTS ACT AS ENTRY BARRIER FOR SMES

5.2.2 HIGH PROBABILITY OF DAMAGE DUE TO VULNERABLE CONDITIONS

5.3 OPPORTUNITIES

5.3.1 PENETRATION OF SUBMARINE CABLE OWING TO THE INCREASING INTERNET TRAFFIC ACROSS THE REGION

5.3.2 INCREASING STRATEGIC PARTNERSHIP AMONG MAJOR MARKET PLAYERS FOR CABLE SYSTEMS

5.3.3 RISING INVESTMENTS BY OTT PROVIDERS TO CREATE ABUNDANT OPPORTUNITIES FOR SALES OF SUBMARINE CABLES

5.3.4 DEPLOYMENT OF VARIED TECHNOLOGIES IN SUBMARINE CABLE SYSTEMS

5.4 CHALLENGES

5.4.1 ALTERNATIVE MODES OF INTERNET SERVICE PROVISIONING

5.4.2 COMPLEX REPAIRING PROCEDURES

6 MIDDLE EAST & AFRICA SUBMARINE CABLE SYSTEM MARKET, BY PRODUCT

6.1 OVERVIEW

6.2 DRY PLANT PRODUCTS

6.2.1 POWER FEEDING EQUIPMENT (PFE)

6.2.2 SUBMARINE LINE TERMINAL EQUIPMENT (SLTE)

6.2.3 SUBMARINE LINE MONITOR (SLM)

6.2.4 OTHERS

6.3 WET PLANT PRODUCTS

6.3.1 CABLES

6.3.2 REPEATER

6.3.3 BRANCHING UNIT (BU)

6.3.4 OTHERS

7 MIDDLE EAST & AFRICA SUBMARINE CABLE SYSTEM MARKET, BY VOLTAGE

7.1 OVERVIEW

7.2 HIGH VOLTAGE

7.3 EXTRA HIGH VOLTAGE

7.4 MEDIUM VOLTAGE

8 MIDDLE EAST & AFRICA SUBMARINE CABLE SYSTEM MARKET, BY OFFERING

8.1 OVERVIEW

8.2 INSTALLATION AND COMMISSIONING

8.3 REPAIR AND MAINTENANCE

8.4 UPGRADES

9 MIDDLE EAST & AFRICA SUBMARINE CABLE SYSTEM MARKET, BY FIBER CLASS

9.1 OVERVIEW

9.2 UNREPEATERED

9.3 REPEATERED

10 MIDDLE EAST & AFRICA SUBMARINE CABLE SYSTEM MARKET, BY CABLES TYPE

10.1 OVERVIEW

10.2 LOOSE TUBE CABLES

10.3 RIBBON CABLES

10.4 OTHERS

11 MIDDLE EAST & AFRICA SUBMARINE CABLE SYSTEM MARKET, BY ARMOR TYPE

11.1 OVERVIEW

11.2 SINGLE ARMOR

11.3 DOUBLE ARMOR

11.4 LIGHT WEIGHT ARMOR

11.5 ROCK ARMOR

12 MIDDLE EAST & AFRICA SUBMARINE CABLE SYSTEM MARKET, BY DEPTH

12.1 OVERVIEW

12.2 1000M-5000M

12.3 5000M-1000M

12.4 0M-500M

12.5 0THERS

13 MIDDLE EAST & AFRICA SUBMARINE CABLE SYSTEM MARKET, BY APPLICATION

13.1 OVERVIEW

13.2 COMMUNICATION CABLES

13.2.1 DRY PLANT PRODUCTS

13.2.1.1 POWER FEEDING EQUIPMENT (PFE)

13.2.1.2 SUBMARINE LINE TERMINAL EQUIPMENT (SLTE)

13.2.1.3 SUBMARINE LINE MONITOR (SLM)

13.2.1.4 OTHERS

13.2.2 WET PLANT PRODUCTS

13.2.2.1 CABLES

13.2.2.2 REPEATER

13.2.2.3 BRANCHING UNIT (BU)

13.2.2.4 OTHERS

13.3 POWER CABLES

13.3.1 DRY PLANT PRODUCTS

13.3.1.1 POWER FEEDING EQUIPMENT (PFE)

13.3.1.2 SUBMARINE LINE TERMINAL EQUIPMENT (SLTE)

13.3.1.3 SUBMARINE LINE MONITOR (SLM)

13.3.1.4 OTHERS

13.3.2 WET PLANT PRODUCTS

13.3.2.1 CABLES

13.3.2.2 REPEATER

13.3.2.3 BRANCHING UNIT (BU)

13.3.2.4 OTHERS

14 MIDDLE EAST & AFRICA SUBMARINE CABLE SYSTEM MARKET, BY REGION

14.1 MIDDLE EAST AND AFRICA

14.1.1 SAUDI ARABIA

14.1.2 U.A.E.

14.1.3 EGYPT

14.1.4 SOUTH AFRICA

14.1.5 ISRAEL

14.1.6 REST OF MIDDLE EAST AND AFRICA

15 MIDDLE EAST & AFRICA SUBMARINE CABLE SYSTEM MARKET: COMPANY LANDSCAPE

15.1 COMPANY SHARE ANALYSIS: MIDDLE EAST & AFRICA

16 SWOT ANALYSIS

17 COMPANY PROFILE

17.1 ZTT

17.1.1 COMPANY SNAPSHOT

17.1.2 COMPANY SHARE ANALYSIS

17.1.3 PRODUCT PORTFOLIO

17.1.4 RECENT DEVELOPMENT

17.2 HENGTONG GROUP CO., LTD

17.2.1 COMPANY SNAPSHOT

17.2.2 COMPANY SHARE ANALYSIS

17.2.3 PRODUCT CATEGORIES

17.2.4 RECENT DEVELOPMENT

17.3 NKT A/S

17.3.1 COMPANY SNAPSHOT

17.3.2 REVENUE ANALYSIS

17.3.3 PRODUCT PORTFOLIO

17.3.4 RECENT DEVELOPMENT

17.4 CORNING INCORPORATED

17.4.1 COMPANY SNAPSHOT

17.4.2 REVENUE ANALYSIS

17.4.3 COMPANY SHARE ANALYSIS

17.4.4 PRODUCT PORTFOLIO

17.4.5 RECENT DEVELOPMENT

17.5 NEXANS

17.5.1 COMPANY SNAPSHOT

17.5.2 REVENUE ANALYSIS

17.5.3 COMPANY SHARE ANALYSIS

17.5.4 PRODUCT PORTFOLIO

17.5.5 RECENT DEVELOPMENTS

17.6 HELLENIC CABLES S.A.

17.6.1 COMPANY SNAPSHOT

17.6.2 REVENUE ANALYSIS

17.6.3 PRODUCT PORTFOLIO

17.6.4 RECENT DEVELOPMENTS

17.7 ALCATEL SUBMARINE NETWORKS

17.7.1 COMPANY SNAPSHOT

17.7.2 PRODUCT PORTFOLIO

17.7.3 RECENT DEVELOPMENTS

17.8 AFL (A SUBSIDIAIRY OF FUJIKURA LTD.)

17.8.1 COMPANY SNAPSHOT

17.8.2 REVENUE ANALYSIS

17.8.3 PRODUCT PORTFOLIO

17.8.4 RECENT DEVELOPMENTS

17.9 APAR

17.9.1 COMPANY SNAPSHOT

17.9.2 REVENUE ANALYSIS

17.9.3 PRODUCT PORTFOLIO

17.9.4 RECENT DEVELOPMENT

17.1 HESFIBEL SUBSEA CABLES

17.10.1 COMPANY SNAPSHOT

17.10.2 PRODUCT PORTFOLIO

17.10.3 RECENT DEVELOPMENT

17.11 HEXATRONIC GROUP

17.11.1 COMPANY SNAPSHOT

17.11.2 REVENUE ANALYSIS

17.11.3 PRODUCT PORTFOLIO

17.11.4 RECENT DEVELOPMENT

17.12 JDR CABLE SYSTEMS LTD.

17.12.1 COMPANY SNAPSHOT

17.12.2 PRODUCT PORTFOLIO

17.12.3 RECENT DEVELOPMENT

17.13 LEONI

17.13.1 COMPANY SNAPSHOT

17.13.2 REVENUE ANALYSIS

17.13.3 PRODUCT PORTFOLIO

17.13.4 RECENT DEVELOPMENT

17.14 NEC CORPORATION

17.14.1 COMPANY SNAPSHOT

17.14.2 REVENUE ANALYSIS

17.14.3 PRODUCT PORTFOLIO

17.14.4 RECENT DEVELOPMENTS

17.15 NORDDEUTSCHE SEEKABELWERKE GMBH

17.15.1 COMPANY SNAPSHOT

17.15.2 PRODUCT PORTFOLIO

17.15.3 RECENT DEVELOPMENT

17.16 OCEAN SPECIALISTS, INC. (A SUBSIDIARY OF CONTINENTAL SHELF ASSOCIATES, INC.)

17.16.1 COMPANY SNAPSHOT

17.16.2 PRODUCT PORTFOLIO

17.16.3 RECENT DEVELOPMENTS

17.17 SAUDI ERICSSON

17.17.1 COMPANY SNAPSHOT

17.17.2 SOLUTION PORTFOLIO

17.17.3 RECENT DEVELOPMENT

17.18 SUMITOMO ELECTRIC INDUSTRIES, LTD.

17.18.1 COMPANY SNAPSHOT

17.18.2 REVENUE ANALYSIS

17.18.3 PRODUCT PORTFOLIO

17.18.4 RECENT DEVELOPMENTS

17.19 TE CONNECTIVITY

17.19.1 COMPANY SNAPSHOT

17.19.2 REVENUE ANALYSIS

17.19.3 SOLUTION PORTFOLIO

17.19.4 RECENT DEVELOPMENT

17.2 TFKABLE

17.20.1 COMPANY SNAPSHOT

17.20.2 PRODUCT PORTFOLIO

17.20.3 RECENT DEVELOPMENT

17.21 THE OKONITE COMPANY

17.21.1 COMPANY SNAPSHOT

17.21.2 PRODUCT PORTFOLIO

17.21.3 RECENT DEVELOPMENTS

17.22 TRATOS

17.22.1 COMPANY SNAPSHOT

17.22.2 PRODUCT PORTFOLIO

17.22.3 RECENT DEVELOPMENTS

18 QUESTIONNAIRE

19 RELATED REPORTS

List of Table

TABLE 1 MIDDLE EAST & AFRICA SUBMARINE CABLE SYSTEM MARKET, BY PRODUCT, 2020-2029 (USD MILLION)

TABLE 2 MIDDLE EAST & AFRICA DRY PLANT PRODUCTS IN SUBMARINE CABLE SYSTEM MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 3 MIDDLE EAST & AFRICA DRY PLANT PRODUCTS IN SUBMARINE CABLE SYSTEM MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 4 MIDDLE EAST & AFRICA WET PLANT PRODUCTS IN SUBMARINE CABLE SYSTEM MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 5 MIDDLE EAST & AFRICA WET PLANT PRODUCTS IN SUBMARINE CABLE SYSTEM MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 6 MIDDLE EAST & AFRICA SUBMARINE CABLE SYSTEM MARKET, BY VOLTAGE, 2020-2029 (USD MILLION)

TABLE 7 MIDDLE EAST & AFRICA HIGH VOLTAGE IN SUBMARINE CABLE SYSTEM MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 8 MIDDLE EAST & AFRICA EXTRA HIGH VOLTAGE IN SUBMARINE CABLE SYSTEM MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 9 MIDDLE EAST & AFRICA MEDIUM VOLTAGE IN SUBMARINE CABLE SYSTEM MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 10 MIDDLE EAST & AFRICA SUBMARINE CABLE SYSTEM MARKET, BY OFFERING, 2020-2029 (USD MILLION)

TABLE 11 MIDDLE EAST & AFRICA INSTALLATION AND COMMISSIONING IN SUBMARINE CABLE SYSTEM MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 12 MIDDLE EAST & AFRICA REPAIR AND MAINTENANCE IN SUBMARINE CABLE SYSTEM MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 13 MIDDLE EAST & AFRICA UPGRADES IN SUBMARINE CABLE SYSTEM MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 14 MIDDLE EAST & AFRICA SUBMARINE CABLE SYSTEM MARKET, BY FIBER CLASS, 2020-2029 (USD MILLION)

TABLE 15 MIDDLE EAST & AFRICA UNREPEATERED IN SUBMARINE CABLE SYSTEM MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 16 MIDDLE EAST & AFRICA REPEATERED IN SUBMARINE CABLE SYSTEM MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 17 MIDDLE EAST & AFRICA SUBMARINE CABLE SYSTEM MARKET, BY CABLES TYPE, 2020-2029 (USD MILLION)

TABLE 18 MIDDLE EAST & AFRICA LOOSE TUBE CABLES IN SUBMARINE CABLE SYSTEM MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 19 MIDDLE EAST & AFRICA RIBBON CABLES IN SUBMARINE CABLE SYSTEM MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 20 MIDDLE EAST & AFRICA OTHERS IN SUBMARINE CABLE SYSTEM MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 21 MIDDLE EAST & AFRICA SUBMARINE CABLE SYSTEM MARKET, BY ARMOR TYPE, 2020-2029 (USD MILLION)

TABLE 22 MIDDLE EAST & AFRICA SINGLE ARMOR IN SUBMARINE CABLE SYSTEM MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 23 MIDDLE EAST & AFRICA DOUBLE ARMOR IN SUBMARINE CABLE SYSTEM MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 24 MIDDLE EAST & AFRICA LIGHT WEIGHT ARMOR IN SUBMARINE CABLE SYSTEM MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 25 MIDDLE EAST & AFRICA ROCK ARMOR IN SUBMARINE CABLE SYSTEM MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 26 MIDDLE EAST & AFRICA SUBMARINE CABLE SYSTEM MARKET, BY DEPTH, 2020-2029 (USD MILLION)

TABLE 27 MIDDLE EAST & AFRICA 1000M-5000M IN SUBMARINE CABLE SYSTEM MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 28 MIDDLE EAST & AFRICA 500M-1000M IN SUBMARINE CABLE SYSTEM MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 29 MIDDLE EAST & AFRICA 0M-500M IN SUBMARINE CABLE SYSTEM MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 30 MIDDLE EAST & AFRICA OTHERS IN SUBMARINE CABLE SYSTEM MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 31 MIDDLE EAST & AFRICA SUBMARINE CABLE SYSTEM MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 32 MIDDLE EAST & AFRICA COMMUNICATION CABLES IN SUBMARINE CABLE SYSTEM MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 33 MIDDLE EAST & AFRICA COMMUNICATION CABLE IN SUBMARINE CABLE SYSTEM MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 34 MIDDLE EAST & AFRICA DRY PLANT PRODUCTS IN COMMUNICATION CABLE IN SUBMARINE CABLE SYSTEM MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 35 MIDDLE EAST & AFRICA WET PLANT PRODUCTS IN COMMUNICATION CABLE IN SUBMARINE CABLE SYSTEM MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 36 MIDDLE EAST & AFRICA POWER CABLES IN SUBMARINE CABLE SYSTEM MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 37 MIDDLE EAST & AFRICA POWER CABLE IN SUBMARINE CABLE SYSTEM MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 38 MIDDLE EAST & AFRICA DRY PLANT PRODUCTS IN POWER CABLE IN SUBMARINE CABLE SYSTEM MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 39 MIDDLE EAST & AFRICA WET PLANT PRODUCTS IN POWER CABLE IN SUBMARINE CABLE SYSTEM MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 40 MIDDLE EAST AND AFRICA SUBMARINE CABLE SYSTEM MARKET, BY COUNTRY, 2020-2029 (USD MILLION)

TABLE 41 MIDDLE EAST AND AFRICA SUBMARINE CABLE SYSTEM MARKET, BY PRODUCT, 2020-2029 (USD MILLION)

TABLE 42 MIDDLE EAST AND AFRICA DRY PLANT PRODUCTS IN SUBMARINE CABLE SYSTEM MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 43 MIDDLE EAST AND AFRICA WET PLANT PRODUCTS IN SUBMARINE CABLE SYSTEM MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 44 MIDDLE EAST AND AFRICA SUBMARINE CABLE SYSTEM MARKET, BY VOLTAGE, 2020-2029 (USD MILLION)

TABLE 45 MIDDLE EAST AND AFRICA SUBMARINE CABLE SYSTEM MARKET, BY OFFERING, 2020-2029 (USD MILLION)

TABLE 46 MIDDLE EAST AND AFRICA SUBMARINE CABLE SYSTEM MARKET, BY FIBER CLASS, 2020-2029 (USD MILLION)

TABLE 47 MIDDLE EAST AND AFRICA SUBMARINE CABLE SYSTEM MARKET, BY CABLES TYPE, 2020-2029 (USD MILLION)

TABLE 48 MIDDLE EAST AND AFRICA SUBMARINE CABLE SYSTEM MARKET, BY ARMOR TYPE, 2020-2029 (USD MILLION)

TABLE 49 MIDDLE EAST AND AFRICA SUBMARINE CABLE SYSTEM MARKET, BY DEPTH, 2020-2029 (USD MILLION)

TABLE 50 MIDDLE EAST AND AFRICA SUBMARINE CABLE SYSTEM MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 51 MIDDLE EAST AND AFRICA COMMUNICATION CABLE IN SUBMARINE CABLE SYSTEM MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 52 MIDDLE EAST AND AFRICA DRY PLANT PRODUCTS IN COMMUNICATION CABLE IN SUBMARINE CABLE SYSTEM MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 53 MIDDLE EAST AND AFRICA WET PLANT PRODUCTS IN COMMUNICATION CABLE IN SUBMARINE CABLE SYSTEM MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 54 MIDDLE EAST AND AFRICA POWER CABLE IN SUBMARINE CABLE SYSTEM MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 55 MIDDLE EAST AND AFRICA DRY PLANT PRODUCTS IN POWER CABLE IN SUBMARINE CABLE SYSTEM MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 56 MIDDLE EAST AND AFRICA WET PLANT PRODUCTS IN POWER CABLE IN SUBMARINE CABLE SYSTEM MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 57 SAUDI ARABIA SUBMARINE CABLE SYSTEM MARKET, BY PRODUCT, 2020-2029 (USD MILLION)

TABLE 58 SAUDI ARABIA DRY PLANT PRODUCTS IN SUBMARINE CABLE SYSTEM MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 59 SAUDI ARABIA WET PLANT PRODUCTS IN SUBMARINE CABLE SYSTEM MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 60 SAUDI ARABIA SUBMARINE CABLE SYSTEM MARKET, BY VOLTAGE, 2020-2029 (USD MILLION)

TABLE 61 SAUDI ARABIA SUBMARINE CABLE SYSTEM MARKET, BY OFFERING, 2020-2029 (USD MILLION)

TABLE 62 SAUDI ARABIA SUBMARINE CABLE SYSTEM MARKET, BY FIBER CLASS, 2020-2029 (USD MILLION)

TABLE 63 SAUDI ARABIA SUBMARINE CABLE SYSTEM MARKET, BY CABLES TYPE, 2020-2029 (USD MILLION)

TABLE 64 SAUDI ARABIA SUBMARINE CABLE SYSTEM MARKET, BY ARMOR TYPE, 2020-2029 (USD MILLION)

TABLE 65 SAUDI ARABIA SUBMARINE CABLE SYSTEM MARKET, BY DEPTH, 2020-2029 (USD MILLION)

TABLE 66 SAUDI ARABIA SUBMARINE CABLE SYSTEM MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 67 SAUDI ARABIA COMMUNICATION CABLE IN SUBMARINE CABLE SYSTEM MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 68 SAUDI ARABIA DRY PLANT PRODUCTS IN COMMUNICATION CABLE IN SUBMARINE CABLE SYSTEM MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 69 SAUDI ARABIA WET PLANT PRODUCTS IN COMMUNICATION CABLE IN SUBMARINE CABLE SYSTEM MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 70 SAUDI ARABIA POWER CABLE IN SUBMARINE CABLE SYSTEM MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 71 SAUDI ARABIA DRY PLANT PRODUCTS IN POWER CABLE IN SUBMARINE CABLE SYSTEM MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 72 SAUDI ARABIA WET PLANT PRODUCTS IN POWER CABLE IN SUBMARINE CABLE SYSTEM MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 73 U.A.E. SUBMARINE CABLE SYSTEM MARKET, BY PRODUCT, 2020-2029 (USD MILLION)

TABLE 74 U.A.E. DRY PLANT PRODUCTS IN SUBMARINE CABLE SYSTEM MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 75 U.A.E. WET PLANT PRODUCTS IN SUBMARINE CABLE SYSTEM MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 76 U.A.E. SUBMARINE CABLE SYSTEM MARKET, BY VOLTAGE, 2020-2029 (USD MILLION)

TABLE 77 U.A.E. SUBMARINE CABLE SYSTEM MARKET, BY OFFERING, 2020-2029 (USD MILLION)

TABLE 78 U.A.E. SUBMARINE CABLE SYSTEM MARKET, BY FIBER CLASS, 2020-2029 (USD MILLION)

TABLE 79 U.A.E. SUBMARINE CABLE SYSTEM MARKET, BY CABLES TYPE, 2020-2029 (USD MILLION)

TABLE 80 U.A.E. SUBMARINE CABLE SYSTEM MARKET, BY ARMOR TYPE, 2020-2029 (USD MILLION)

TABLE 81 U.A.E. SUBMARINE CABLE SYSTEM MARKET, BY DEPTH, 2020-2029 (USD MILLION)

TABLE 82 U.A.E. SUBMARINE CABLE SYSTEM MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 83 U.A.E. COMMUNICATION CABLE IN SUBMARINE CABLE SYSTEM MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 84 U.A.E. DRY PLANT PRODUCTS IN COMMUNICATION CABLE IN SUBMARINE CABLE SYSTEM MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 85 U.A.E. WET PLANT PRODUCTS IN COMMUNICATION CABLE IN SUBMARINE CABLE SYSTEM MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 86 U.A.E. POWER CABLE IN SUBMARINE CABLE SYSTEM MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 87 U.A.E. DRY PLANT PRODUCTS IN POWER CABLE IN SUBMARINE CABLE SYSTEM MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 88 U.A.E. WET PLANT PRODUCTS IN POWER CABLE IN SUBMARINE CABLE SYSTEM MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 89 EGYPT SUBMARINE CABLE SYSTEM MARKET, BY PRODUCT, 2020-2029 (USD MILLION)

TABLE 90 EGYPT DRY PLANT PRODUCTS IN SUBMARINE CABLE SYSTEM MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 91 EGYPT WET PLANT PRODUCTS IN SUBMARINE CABLE SYSTEM MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 92 EGYPT SUBMARINE CABLE SYSTEM MARKET, BY VOLTAGE, 2020-2029 (USD MILLION)

TABLE 93 EGYPT SUBMARINE CABLE SYSTEM MARKET, BY OFFERING, 2020-2029 (USD MILLION)

TABLE 94 EGYPT SUBMARINE CABLE SYSTEM MARKET, BY FIBER CLASS, 2020-2029 (USD MILLION)

TABLE 95 EGYPT SUBMARINE CABLE SYSTEM MARKET, BY CABLES TYPE, 2020-2029 (USD MILLION)

TABLE 96 EGYPT SUBMARINE CABLE SYSTEM MARKET, BY ARMOR TYPE, 2020-2029 (USD MILLION)

TABLE 97 EGYPT SUBMARINE CABLE SYSTEM MARKET, BY DEPTH, 2020-2029 (USD MILLION)

TABLE 98 EGYPT SUBMARINE CABLE SYSTEM MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 99 EGYPT COMMUNICATION CABLE IN SUBMARINE CABLE SYSTEM MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 100 EGYPT DRY PLANT PRODUCTS IN COMMUNICATION CABLE IN SUBMARINE CABLE SYSTEM MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 101 EGYPT WET PLANT PRODUCTS IN COMMUNICATION CABLE IN SUBMARINE CABLE SYSTEM MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 102 EGYPT POWER CABLE IN SUBMARINE CABLE SYSTEM MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 103 EGYPT DRY PLANT PRODUCTS IN POWER CABLE IN SUBMARINE CABLE SYSTEM MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 104 EGYPT WET PLANT PRODUCTS IN POWER CABLE IN SUBMARINE CABLE SYSTEM MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 105 SOUTH AFRICA SUBMARINE CABLE SYSTEM MARKET, BY PRODUCT, 2020-2029 (USD MILLION)

TABLE 106 SOUTH AFRICA DRY PLANT PRODUCTS IN SUBMARINE CABLE SYSTEM MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 107 SOUTH AFRICA WET PLANT PRODUCTS IN SUBMARINE CABLE SYSTEM MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 108 SOUTH AFRICA SUBMARINE CABLE SYSTEM MARKET, BY VOLTAGE, 2020-2029 (USD MILLION)

TABLE 109 SOUTH AFRICA SUBMARINE CABLE SYSTEM MARKET, BY OFFERING, 2020-2029 (USD MILLION)

TABLE 110 SOUTH AFRICA SUBMARINE CABLE SYSTEM MARKET, BY FIBER CLASS, 2020-2029 (USD MILLION)

TABLE 111 SOUTH AFRICA SUBMARINE CABLE SYSTEM MARKET, BY CABLES TYPE, 2020-2029 (USD MILLION)

TABLE 112 SOUTH AFRICA SUBMARINE CABLE SYSTEM MARKET, BY ARMOR TYPE, 2020-2029 (USD MILLION)

TABLE 113 SOUTH AFRICA SUBMARINE CABLE SYSTEM MARKET, BY DEPTH, 2020-2029 (USD MILLION)

TABLE 114 SOUTH AFRICA SUBMARINE CABLE SYSTEM MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 115 SOUTH AFRICA COMMUNICATION CABLE IN SUBMARINE CABLE SYSTEM MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 116 SOUTH AFRICA DRY PLANT PRODUCTS IN COMMUNICATION CABLE IN SUBMARINE CABLE SYSTEM MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 117 SOUTH AFRICA WET PLANT PRODUCTS IN COMMUNICATION CABLE IN SUBMARINE CABLE SYSTEM MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 118 SOUTH AFRICA POWER CABLE IN SUBMARINE CABLE SYSTEM MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 119 SOUTH AFRICA DRY PLANT PRODUCTS IN POWER CABLE IN SUBMARINE CABLE SYSTEM MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 120 SOUTH AFRICA WET PLANT PRODUCTS IN POWER CABLE IN SUBMARINE CABLE SYSTEM MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 121 ISRAEL SUBMARINE CABLE SYSTEM MARKET, BY PRODUCT, 2020-2029 (USD MILLION)

TABLE 122 ISRAEL DRY PLANT PRODUCTS IN SUBMARINE CABLE SYSTEM MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 123 ISRAEL WET PLANT PRODUCTS IN SUBMARINE CABLE SYSTEM MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 124 ISRAEL SUBMARINE CABLE SYSTEM MARKET, BY VOLTAGE, 2020-2029 (USD MILLION)

TABLE 125 ISRAEL SUBMARINE CABLE SYSTEM MARKET, BY OFFERING, 2020-2029 (USD MILLION)

TABLE 126 ISRAEL SUBMARINE CABLE SYSTEM MARKET, BY FIBER CLASS, 2020-2029 (USD MILLION)

TABLE 127 ISRAEL SUBMARINE CABLE SYSTEM MARKET, BY CABLES TYPE, 2020-2029 (USD MILLION)

TABLE 128 ISRAEL SUBMARINE CABLE SYSTEM MARKET, BY ARMOR TYPE, 2020-2029 (USD MILLION)

TABLE 129 ISRAEL SUBMARINE CABLE SYSTEM MARKET, BY DEPTH, 2020-2029 (USD MILLION)

TABLE 130 ISRAEL SUBMARINE CABLE SYSTEM MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 131 ISRAEL COMMUNICATION CABLE IN SUBMARINE CABLE SYSTEM MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 132 ISRAEL DRY PLANT PRODUCTS IN COMMUNICATION CABLE IN SUBMARINE CABLE SYSTEM MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 133 ISRAEL WET PLANT PRODUCTS IN COMMUNICATION CABLE IN SUBMARINE CABLE SYSTEM MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 134 ISRAEL POWER CABLE IN SUBMARINE CABLE SYSTEM MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 135 ISRAEL DRY PLANT PRODUCTS IN POWER CABLE IN SUBMARINE CABLE SYSTEM MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 136 ISRAEL WET PLANT PRODUCTS IN POWER CABLE IN SUBMARINE CABLE SYSTEM MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 137 REST OF SOUTH AMERICA SUBMARINE CABLE SYSTEM MARKET, BY PRODUCT, 2020-2029 (USD MILLION)

List of Figure

FIGURE 1 MIDDLE EAST & AFRICA SUBMARINE CABLE SYSTEM MARKET: SEGMENTATION

FIGURE 2 MIDDLE EAST & AFRICA SUBMARINE CABLE SYSTEM MARKET: DATA TRIANGULATION

FIGURE 3 MIDDLE EAST & AFRICA SUBMARINE CABLE SYSTEM MARKET: DROC ANALYSIS

FIGURE 4 MIDDLE EAST & AFRICA SUBMARINE CABLE SYSTEM MARKET: MIDDLE EAST & AFRICA VS REGIONAL MARKET ANALYSIS

FIGURE 5 MIDDLE EAST & AFRICA SUBMARINE CABLE SYSTEM MARKET: COMPANY RESEARCH ANALYSIS

FIGURE 6 MIDDLE EAST & AFRICA SUBMARINE CABLE SYSTEM MARKET: INTERVIEW DEMOGRAPHICS

FIGURE 7 MIDDLE EAST & AFRICA SUBMARINE CABLE SYSTEM MARKET: DBMR MARKET POSITION GRID

FIGURE 8 MIDDLE EAST & AFRICA SUBMARINE CABLE SYSTEM MARKET: VENDOR SHARE ANALYSIS

FIGURE 9 MIDDLE EAST & AFRICA SUBMARINE CABLE SYSTEM MARKET: MARKET APPLICATION COVERAGE GRID

FIGURE 10 MIDDLE EAST & AFRICA SUBMARINE CABLE SYSTEM MARKET: SEGMENTATION

FIGURE 11 SURGE IN COMMUNICATION PROJECTS UNDERSEA PATH ACROSS THE GLOBE IS EXPECTED TO DRIVE THE MIDDLE EAST & AFRICA SUBMARINE CABLE SYSTEM MARKET IN THE FORECAST PERIOD

FIGURE 12 DRY PLANT PRODUCTS SEGMENT IS EXPECTED TO ACCOUNT FOR THE LARGEST SHARE OF MIDDLE EAST & AFRICA SUBMARINE CABLE SYSTEM MARKET FROM 2022 TO 2029

FIGURE 13 DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES OF THE MIDDLE EAST & AFRICA SUBMARINE CABLE SYSTEM MARKET

FIGURE 14 FDI PROJECTS FOR COMMUNICATIONS AND MEDIA (2019-2020)

FIGURE 15 OFFSHORE WIND ELECTRICITY GENERATION

FIGURE 16 NET ANNUAL WIND CAPACITY EXPANSIONS, 2018-2020

FIGURE 17 MIDDLE EAST & AFRICA SUBMARINE CABLE SYSTEM MARKET, BY PRODUCT, 2021

FIGURE 18 MIDDLE EAST & AFRICA SUBMARINE CABLE SYSTEM MARKET, BY VOLTAGE, 2021

FIGURE 19 MIDDLE EAST & AFRICA SUBMARINE CABLE SYSTEM MARKET, BY OFFERING, 2021

FIGURE 20 MIDDLE EAST & AFRICA SUBMARINE CABLE SYSTEM MARKET, BY FIBER CLASS, 2021

FIGURE 21 MIDDLE EAST & AFRICA SUBMARINE CABLE SYSTEM MARKET, BY CABLES TYPE, 2021

FIGURE 22 MIDDLE EAST & AFRICA SUBMARINE CABLE SYSTEM MARKET, BY ARMOR TYPE, 2021

FIGURE 23 MIDDLE EAST & AFRICA SUBMARINE CABLE SYSTEM MARKET, BY DEPTH, 2021

FIGURE 24 MIDDLE EAST & AFRICA SUBMARINE CABLE SYSTEM MARKET: BY APPLICATION, 2021

FIGURE 25 MIDDLE EAST AND AFRICA SUBMARINE CABLE SYSTEM MARKET: SNAPSHOT (2021)

FIGURE 26 MIDDLE EAST AND AFRICA SUBMARINE CABLE SYSTEM MARKET: BY COUNTRY (2021)

FIGURE 27 MIDDLE EAST AND AFRICA SUBMARINE CABLE SYSTEM MARKET: BY COUNTRY (2022 & 2029)

FIGURE 28 MIDDLE EAST AND AFRICA SUBMARINE CABLE SYSTEM MARKET: BY COUNTRY (2021 & 2029)

FIGURE 29 MIDDLE EAST AND AFRICA SUBMARINE CABLE SYSTEM MARKET: BY PRODUCT (2022-2029)

FIGURE 30 MIDDLE EAST & AFRICA SUBMARINE CABLE SYSTEM MARKET: COMPANY SHARE 2021 (%)

منهجية البحث

يتم جمع البيانات وتحليل سنة الأساس باستخدام وحدات جمع البيانات ذات أحجام العينات الكبيرة. تتضمن المرحلة الحصول على معلومات السوق أو البيانات ذات الصلة من خلال مصادر واستراتيجيات مختلفة. تتضمن فحص وتخطيط جميع البيانات المكتسبة من الماضي مسبقًا. كما تتضمن فحص التناقضات في المعلومات التي شوهدت عبر مصادر المعلومات المختلفة. يتم تحليل بيانات السوق وتقديرها باستخدام نماذج إحصائية ومتماسكة للسوق. كما أن تحليل حصة السوق وتحليل الاتجاهات الرئيسية هي عوامل النجاح الرئيسية في تقرير السوق. لمعرفة المزيد، يرجى طلب مكالمة محلل أو إرسال استفسارك.

منهجية البحث الرئيسية التي يستخدمها فريق بحث DBMR هي التثليث البيانات والتي تتضمن استخراج البيانات وتحليل تأثير متغيرات البيانات على السوق والتحقق الأولي (من قبل خبراء الصناعة). تتضمن نماذج البيانات شبكة تحديد موقف البائعين، وتحليل خط زمني للسوق، ونظرة عامة على السوق ودليل، وشبكة تحديد موقف الشركة، وتحليل براءات الاختراع، وتحليل التسعير، وتحليل حصة الشركة في السوق، ومعايير القياس، وتحليل حصة البائعين على المستوى العالمي مقابل الإقليمي. لمعرفة المزيد عن منهجية البحث، أرسل استفسارًا للتحدث إلى خبراء الصناعة لدينا.

التخصيص متاح

تعد Data Bridge Market Research رائدة في مجال البحوث التكوينية المتقدمة. ونحن نفخر بخدمة عملائنا الحاليين والجدد بالبيانات والتحليلات التي تتطابق مع هدفهم. ويمكن تخصيص التقرير ليشمل تحليل اتجاه الأسعار للعلامات التجارية المستهدفة وفهم السوق في بلدان إضافية (اطلب قائمة البلدان)، وبيانات نتائج التجارب السريرية، ومراجعة الأدبيات، وتحليل السوق المجدد وقاعدة المنتج. ويمكن تحليل تحليل السوق للمنافسين المستهدفين من التحليل القائم على التكنولوجيا إلى استراتيجيات محفظة السوق. ويمكننا إضافة عدد كبير من المنافسين الذين تحتاج إلى بيانات عنهم بالتنسيق وأسلوب البيانات الذي تبحث عنه. ويمكن لفريق المحللين لدينا أيضًا تزويدك بالبيانات في ملفات Excel الخام أو جداول البيانات المحورية (كتاب الحقائق) أو مساعدتك في إنشاء عروض تقديمية من مجموعات البيانات المتوفرة في التقرير.