سوق الخدمات اللوجستية العكسية في الشرق الأوسط وأفريقيا، حسب نوع الإرجاع (الإرجاع، وتجنب الإرجاع، وإعادة التصنيع، والتجديد، والتغليف، والسلع غير المباعة، ونهاية العمر، وفشل التسليم، والإيجارات والتأجير، والإصلاحات والصيانة، وغيرها)، والمكونات (سياسة وإجراءات الإرجاع (RPP)، وإعادة التصنيع أو التجديد (ROR)، والتخلص من النفايات (WAD))، ونوع الخدمة (النقل، والتخزين ، وإعادة البيع، وإدارة الاستبدال، وتفويض إدارة استرداد الأموال، وغيرها)، والمستخدم النهائي (المنسوجات والملابس، والسيارات ، والإلكترونيات الاستهلاكية ، والتجارة الإلكترونية، والتجزئة، والسلع الفاخرة، والأدوية، والتغليف القابل لإعادة الاستخدام، وغيرها)، والدولة (جنوب أفريقيا، ومصر، والمملكة العربية السعودية، والإمارات العربية المتحدة، وإسرائيل، وبقية دول الشرق الأوسط وأفريقيا)، واتجاهات الصناعة والتوقعات حتى عام 2029.

تحليل السوق والرؤى : سوق الخدمات اللوجستية العكسية في الشرق الأوسط وأفريقيا

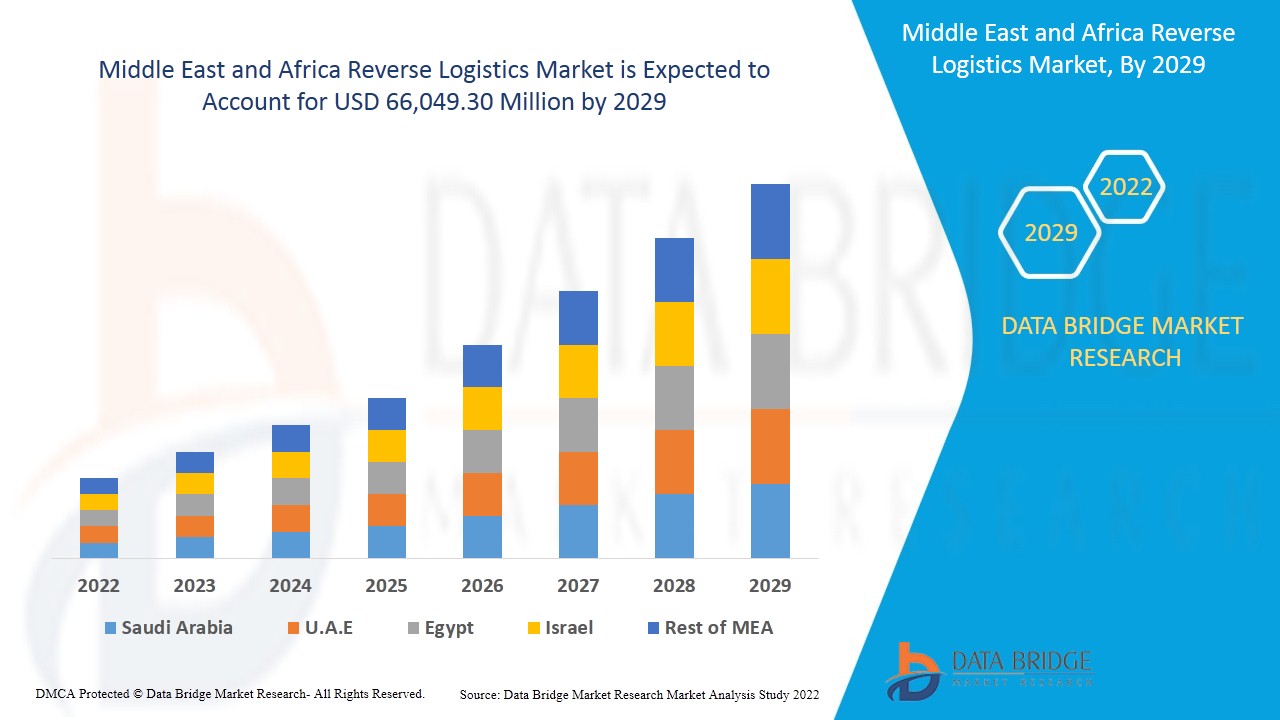

من المتوقع أن يحقق سوق الخدمات اللوجستية العكسية في الشرق الأوسط وأفريقيا نموًا في السوق في الفترة المتوقعة من 2022 إلى 2029. تحلل شركة Data Bridge Market Research أن السوق ينمو بمعدل نمو سنوي مركب قدره 4.2٪ في الفترة المتوقعة من 2022 إلى 2029 ومن المتوقع أن يصل إلى 66،049.30 مليون دولار أمريكي بحلول عام 2029. ومن المتوقع أن يؤدي زيادة اعتماد الهواتف الذكية والتسوق عبر الإنترنت إلى دفع نمو السوق.

اللوجستيات العكسية هي نوع من إدارة سلسلة التوريد التي تتبعها العديد من المنظمات من أجل نقل البضائع/المنتجات من العملاء إلى البائعين/المصنعين بطريقة منظمة وآمنة. بمجرد أن يتلقى العميل منتجًا، فإن العمليات التي يرغب العميل من خلالها في إرجاع المنتج أو إعادة تدويره تندرج تحت اللوجستيات العكسية. تبدأ اللوجستيات العكسية من نهاية المستهلك، وتتحرك للخلف عبر سلسلة التوريد لإدارة التوزيع إلى الموزع ومن الموزع إلى الشركة المصنعة للمنتج. يمكن أن تشمل اللوجستيات العكسية أيضًا العمليات التي تكون فيها مسؤولة عن التخلص النهائي من المنتج، بما في ذلك إعادة تدوير المنتج أو إعادة بيعه. الخطوات الأساسية المشاركة في إدارة اللوجستيات العكسية هي معالجة الإرجاع والتعامل مع المرتجعات والحفاظ على نقل المرتجعات وإصلاحها وإعادة التدوير.

العوامل الرئيسية التي تدفع نمو سوق الخدمات اللوجستية العكسية هي النمو المتزايد في التجارة عبر الحدود والعولمة والنمو السريع في قطاع التجارة الإلكترونية. ومع ذلك، فإن التكلفة المرتفعة المرتبطة بالخدمات اللوجستية العكسية قد تعمل كقيد رئيسي لسوق الخدمات اللوجستية العكسية.

إن الميل المتزايد نحو رقمنة القطاع يخلق فرصًا لنمو السوق. من ناحية أخرى، قد يشكل عدم كفاية موارد العمالة للتعامل مع العائدات تحديًا كبيرًا لنمو السوق.

يقدم تقرير سوق الخدمات اللوجستية العكسية في الشرق الأوسط وأفريقيا تفاصيل عن حصة السوق والتطورات الجديدة وتحليل خط أنابيب المنتجات وتأثير اللاعبين المحليين والمحليين في السوق وتحليل الفرص من حيث جيوب الإيرادات الناشئة والتغييرات في لوائح السوق وموافقات المنتجات والقرارات الاستراتيجية وإطلاق المنتجات والتوسعات الجغرافية والابتكارات التكنولوجية في السوق. لفهم التحليل وسيناريو السوق، اتصل بنا للحصول على موجز محلل. سيساعدك فريقنا في إنشاء حل تأثير الإيرادات لتحقيق هدفك المنشود.

نطاق وحجم سوق الخدمات اللوجستية العكسية في الشرق الأوسط وأفريقيا

يتم تقسيم سوق الخدمات اللوجستية العكسية في الشرق الأوسط وأفريقيا على أساس نوع الإرجاع والمكونات ونوع الخدمة والمستخدم النهائي. يساعدك النمو بين القطاعات على تحليل جيوب النمو والاستراتيجيات المتخصصة للتعامل مع السوق وتحديد مجالات التطبيق الأساسية لديك والاختلاف في أسواقك المستهدفة.

- على أساس نوع الإرجاع، يتم تقسيم سوق الخدمات اللوجستية العكسية في الشرق الأوسط وأفريقيا إلى الإرجاع، وتجنب الإرجاع، وإعادة التصنيع، والتجديد، والتعبئة والتغليف، والسلع غير المباعة، ونهاية العمر، وفشل التسليم، والإيجارات والتأجير، والإصلاحات والصيانة، وغيرها. في عام 2022، من المتوقع أن يهيمن قطاع الإرجاع على السوق، حيث أن الإرجاع هو الخطوة الأولية والحاسمة للخدمات اللوجستية العكسية. علاوة على ذلك، تعمل الإرجاعات في الخدمات اللوجستية العكسية على تحسين خدمة العملاء فضلاً عن المساعدة في تعزيز الأرباح من خلال إعادة استخدام المنتجات التي يتم إرجاعها.

- على أساس المكونات، يتم تقسيم سوق الخدمات اللوجستية العكسية في الشرق الأوسط وأفريقيا إلى سياسة وإجراءات الإرجاع (RPP)، وإعادة التصنيع أو التجديد (ROR)، والتخلص من النفايات (WAD). في عام 2022، من المتوقع أن تهيمن شريحة سياسة وإجراءات الإرجاع (RPP) على السوق، حيث تغطي سياسة وإجراءات الإرجاع جوانب التعامل مع المرتجعات.

- على أساس نوع الخدمة، يتم تقسيم سوق الخدمات اللوجستية العكسية في الشرق الأوسط وأفريقيا إلى النقل والتخزين وإعادة البيع وإدارة الاستبدال وتفويض إدارة استرداد الأموال وغيرها. في عام 2022، من المتوقع أن تهيمن وسائل النقل على السوق، حيث يعد النقل العنصر الأساسي في أي نظام لسلسلة توريد الخدمات اللوجستية. يعد النقل أمرًا بالغ الأهمية ومتكاملًا للخدمات اللوجستية العكسية من الإرجاع إلى إعادة البيع.

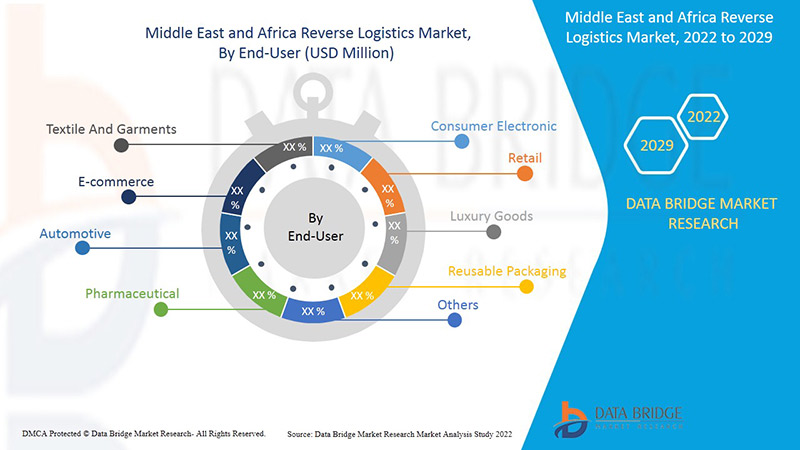

- على أساس المستخدم النهائي، يتم تقسيم سوق الخدمات اللوجستية العكسية في الشرق الأوسط وأفريقيا إلى المنسوجات والملابس، والتجارة الإلكترونية، والسيارات، والأدوية، والإلكترونيات الاستهلاكية، والتجزئة، والسلع الفاخرة، والتغليف القابل لإعادة الاستخدام، وغيرها. في عام 2022، من المتوقع أن يهيمن قطاع التجارة الإلكترونية على السوق حيث شهدت صناعة التجارة الإلكترونية نموًا كبيرًا في السنوات الأخيرة، مما يزيد أيضًا من عدد المرتجعات في جميع أنحاء العالم. علاوة على ذلك، تتمتع صناعة التجارة الإلكترونية بأعلى معدل عائد في جميع أنحاء العالم.

تحليل على مستوى الدولة لسوق الخدمات اللوجستية العكسية في الشرق الأوسط وأفريقيا

يتم تحليل سوق الخدمات اللوجستية العكسية في الشرق الأوسط وأفريقيا، ويتم توفير معلومات حجم السوق حسب نوع الإرجاع والمكونات ونوع الخدمة والمستخدم النهائي.

الدول التي يغطيها تقرير سوق الخدمات اللوجستية العكسية في الشرق الأوسط وأفريقيا هي جنوب أفريقيا ومصر والمملكة العربية السعودية والإمارات العربية المتحدة وإسرائيل وبقية دول الشرق الأوسط وأفريقيا.

ومن المتوقع أن تهيمن دولة الإمارات العربية المتحدة على سوق الخدمات اللوجستية العكسية في منطقة الشرق الأوسط وأفريقيا بسبب عوامل مختلفة مثل الطلب المتزايد على إعادة التدوير والاستدامة التي تدفع الابتكار في سلاسل الخدمات اللوجستية العكسية والنمو المتزايد في التجارة عبر الحدود والعولمة.

كما يوفر قسم الدولة في التقرير عوامل التأثير الفردية على السوق والتغييرات في التنظيم في السوق محليًا والتي تؤثر على الاتجاهات الحالية والمستقبلية للسوق. تعد نقاط البيانات مثل المبيعات الجديدة ومبيعات الاستبدال والتركيبة السكانية للدولة والقوانين التنظيمية ورسوم الاستيراد والتصدير من بين المؤشرات الرئيسية المستخدمة للتنبؤ بسيناريو السوق للدول الفردية. كما يتم النظر في وجود وتوافر العلامات التجارية في الشرق الأوسط وأفريقيا والتحديات التي تواجهها بسبب المنافسة الكبيرة أو النادرة من العلامات التجارية المحلية والمحلية وتأثير قنوات المبيعات أثناء تقديم تحليل تنبؤي لبيانات الدولة.

الطلب المتزايد على الخدمات اللوجستية العكسية

كما يوفر لك سوق الخدمات اللوجستية العكسية في الشرق الأوسط وأفريقيا تحليلاً تفصيلياً للسوق لنمو كل دولة في الصناعة من حيث المبيعات ومبيعات المكونات وتأثير التطور التكنولوجي للخدمات اللوجستية العكسية والتغييرات في السيناريوهات التنظيمية مع دعمها لسوق الخدمات اللوجستية العكسية. تتوفر البيانات للفترة التاريخية من 2012 إلى 2020.

تحليل المشهد التنافسي وحصة سوق الخدمات اللوجستية العكسية

يقدم المشهد التنافسي لسوق الخدمات اللوجستية العكسية في الشرق الأوسط وأفريقيا تفاصيل حسب المنافس. تتضمن التفاصيل نظرة عامة على الشركة، والبيانات المالية للشركة، والإيرادات المتولدة، وإمكانات السوق، والاستثمار في البحث والتطوير، ومبادرات السوق الجديدة، والتواجد في الشرق الأوسط وأفريقيا، ومواقع الإنتاج والمرافق، ونقاط القوة والضعف للشركة، وإطلاق المنتج، وخطوط أنابيب تجارب المنتجات، وموافقات المنتج، وبراءات الاختراع، وعرض المنتج ونطاقه، وهيمنة التطبيق، ومنحنى شريان الحياة التكنولوجي. ترتبط نقاط البيانات المذكورة أعلاه فقط بتركيز الشركات فيما يتعلق بسوق الخدمات اللوجستية العكسية في الشرق الأوسط وأفريقيا.

بعض اللاعبين الرئيسيين الذين تم تغطيتهم في التقرير هم FedEx و United Parcel Service of America, Inc. و Deutsche Post DHL Group و CH Robinson Worldwide, Inc. و Kintetsu World Express, Inc. و IBM Corporation و Indev Group of companies و LogiNext Solutions Inc و Schenker AG و YUSEN LOGISTICS CO., LTD. وغيرها. يفهم محللو DBMR نقاط القوة التنافسية ويقدمون تحليلاً تنافسيًا لكل منافس على حدة. كما يتم إطلاق العديد من تطويرات المنتجات من قبل شركات في جميع أنحاء العالم، مما يعمل أيضًا على تسريع نمو سوق الخدمات اللوجستية العكسية في الشرق الأوسط وأفريقيا.

على سبيل المثال،

- في يناير 2022، دخلت شركة FedEx في شراكة مع شركة Microsoft لتطوير حل لوجستي متعدد المنصات للتجارة الإلكترونية. سيضمن إطلاق هذه المنصة تسليم المنتج وإعادته. ستساعد الشراكة كلتا الشركتين على ضمان توسعهما في السوق

- في أكتوبر 2021، دخلت شركة CH Robinson Worldwide, Inc. وشركة SPS Commerce, Inc. في شراكة لحل المشكلات اللوجستية التي تواجهها منطقة أمريكا الشمالية. ساعدت هذه الشراكة صناعة التجزئة على تقليل التكاليف اللوجستية بنسبة 15% وتقليل وقت الحجز. وقد ساعد هذا كلتا الشركتين على توسيع سوقهما الإقليمية

تعمل الشراكات والعقود والمشاريع المشتركة والاستراتيجيات الأخرى على تعزيز حصة الشركة في السوق من خلال زيادة التغطية والحضور. كما توفر أيضًا فائدة للمنظمة لتحسين عروضها لسوق الخدمات اللوجستية العكسية من خلال مجموعة موسعة من الأحجام.

SKU-

احصل على إمكانية الوصول عبر الإنترنت إلى التقرير الخاص بأول سحابة استخبارات سوقية في العالم

- لوحة معلومات تحليل البيانات التفاعلية

- لوحة معلومات تحليل الشركة للفرص ذات إمكانات النمو العالية

- إمكانية وصول محلل الأبحاث للتخصيص والاستعلامات

- تحليل المنافسين باستخدام لوحة معلومات تفاعلية

- آخر الأخبار والتحديثات وتحليل الاتجاهات

- استغل قوة تحليل المعايير لتتبع المنافسين بشكل شامل

Table of Content

1 INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 OVERVIEW OF MIDDLE EAST & AFRICA REVERSE LOGISTICS MARKET

1.4 CURRENCY AND PRICING

1.5 LIMITATIONS

1.6 MARKETS COVERED

2 MARKET SEGMENTATION

2.1 MARKETS COVERED

2.2 GEOGRAPHICAL SCOPE

2.3 YEARS CONSIDERED FOR THE STUDY

2.4 DBMR TRIPOD DATA VALIDATION MODEL

2.5 PRIMARY INTERVIEWS WITH KEY OPINION LEADERS

2.6 DBMR MARKET POSITION GRID

2.7 VENDOR SHARE ANALYSIS

2.8 MULTIVARIATE MODELING

2.9 RETURN TYPE TIMELINE CURVE

2.1 MARKET APPLICATION COVERAGE GRID

2.11 MARKET CHALLENGE MATRIX

2.12 SECONDARY SOURCES

2.13 ASSUMPTIONS

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

5 MARKET OVERVIEW

5.1 DRIVERS

5.1.1 RAPID GROWTH IN THE E-COMMERCE SECTOR

5.1.2 RECYCLING AND SUSTAINABILITY DRIVING INNOVATION IN REVERSE LOGISTICS CHAINS

5.1.3 RISING GROWTH IN CROSS BORDER TRADES AND MIDDLE EAST & AFRICAIZATION

5.1.4 SURGE IN NUMBER OF MANUFACTURING FACILITIES LEADING TO NEED FOR REVERSE LOGISTICS

5.2 RESTRAINTS

5.2.1 HIGH COST ASSOCIATED WITH REVERSE LOGISTICS

5.2.2 CONCERNS RELATED TO INVENTORY MANAGEMENT IN REVERSE LOGISTICS

5.3 OPPORTUNITIES

5.3.1 INCLINATION TOWARDS DIGITIZATION OF THE SECTOR

5.3.2 GROWING DEMAND FOR REVERSE LOGISTICS IN THE AUTOMOTIVE SECTOR

5.3.3 ADOPTION OF CLOUD-BASED REVERSE LOGISTICS SOLUTIONS

5.3.4 STRATEGIC SERVICE LAUNCH, PARTNERSHIP, ACQUISITIONS, AND MERGERS BY REVERSE LOGISTICS COMPANIES

5.4 CHALLENGES

5.4.1 INADEQUATE LABOR RESOURCES TO HANDLE RETURN

5.4.2 FREQUENT DELAYS IN DELIVERY OF RETURN PRODUCTS DUE TO VARIOUS TECHNICAL FACTORS

6 IMPACT OF COVID-19 ON MIDDLE EAST & AFRICA REVERSE LOGISTICS MARKET

6.1 ANALYSIS ON IMPACT OF COVID-19 ON REVERSE LOGISTICS MARKET

6.2 AFTERMATH OF COVID-19 AND GOVERNMENT INITIATIVE TO BOOST THE MARKET

6.3 STRATEGIC DECISIONS FOR MANUFACTURERS AFTER COVID-19 TO GAIN COMPETITIVE MARKET SHARE

6.4 IMPACT ON PRICE

6.5 IMPACT ON DEMAND AND SUPPLY CHAIN

6.6 CONCLUSION

7 MIDDLE EAST & AFRICA REVERSE LOGISTICS MARKET, BY RETURN TYPE

7.1 OVERVIEW

7.2 RETURNS

7.3 END-OF-LIFE

7.4 REMANUFACTURING

7.5 REFURBISHING

7.6 UNSOLD GOODS

7.7 RENTALS & LEASING

7.8 REPAIRS & MAINTENANCE

7.9 DELIVERY FAILURE

7.1 RETURNS AVOIDANCE

7.11 PACKAGING

7.12 OTHERS

8 MIDDLE EAST & AFRICA REVERSE LOGISTICS MARKET, BY COMPONENTS

8.1 OVERVIEW

8.2 RETURN POLICY AND PROCEDURE (RPP)

8.3 REMANUFACTURING OR REFURBISHMENT (ROR)

8.4 WASTE DISPOSAL (WAD)

9 MIDDLE EAST & AFRICA REVERSE LOGISTICS MARKET, BY SERVICE TYPE

9.1 OVERVIEW

9.2 TRANSPORTATION

9.3 WAREHOUSING

9.4 REPLACEMENT MANAGEMENT

9.5 RESELLING

9.6 REFUND MANAGEMENT AUTHORIZATION

9.7 OTHERS

10 MIDDLE EAST & AFRICA REVERSE LOGISTICS MARKET, BY END USER

10.1 OVERVIEW

10.2 E-COMMERCE

10.2.1 RETURN POLICY AND PROCEDURE (RPP)

10.2.2 REMANUFACTURING OR REFURBISHMENT (ROR)

10.2.3 WASTE DISPOSAL (WAD)

10.3 RETAIL

10.3.1 RETURN POLICY AND PROCEDURE (RPP)

10.3.2 REMANUFACTURING OR REFURBISHMENT (ROR)

10.3.3 WASTE DISPOSAL (WAD)

10.4 AUTOMOTIVE

10.4.1 RETURN POLICY AND PROCEDURE (RPP)

10.4.2 REMANUFACTURING OR REFURBISHMENT (ROR)

10.4.3 WASTE DISPOSAL (WAD)

10.5 CONSUMER ELECTRONIC

10.5.1 RETURN POLICY AND PROCEDURE (RPP)

10.5.2 REMANUFACTURING OR REFURBISHMENT (ROR)

10.5.3 WASTE DISPOSAL (WAD)

10.6 PHARMACEUTICAL

10.6.1 RETURN POLICY AND PROCEDURE (RPP)

10.6.2 REMANUFACTURING OR REFURBISHMENT (ROR)

10.6.3 WASTE DISPOSAL (WAD)

10.7 TEXTILE AND GARMENTS

10.7.1 RETURN POLICY AND PROCEDURE (RPP)

10.7.2 REMANUFACTURING OR REFURBISHMENT (ROR)

10.7.3 WASTE DISPOSAL (WAD)

10.8 REUSABLE PACKAGING

10.8.1 RETURN POLICY AND PROCEDURE (RPP)

10.8.2 REMANUFACTURING OR REFURBISHMENT (ROR)

10.8.3 WASTE DISPOSAL (WAD)

10.9 LUXURY GOODS

10.9.1 RETURN POLICY AND PROCEDURE (RPP)

10.9.2 REMANUFACTURING OR REFURBISHMENT (ROR)

10.9.3 WASTE DISPOSAL (WAD)

10.1 OTHERS

11 MIDDLE EAST & AFRICA REVERSE LOGISTICS MARKET, BY REGION

11.1 MIDDLE EAST & AFRICA

11.1.1 U.A.E.

11.1.2 SAUDI ARABIA

11.1.3 ISRAEL

11.1.4 EGYPT

11.1.5 SOUTH AFRICA

11.1.6 REST OF MIDDLE EAST AND AFRICA

12 MIDDLE EAST & AFRICA REVERSE LOGISTICS MARKET: COMPANY LANDSCAPE

12.1 COMPANY SHARE ANALYSIS: MIDDLE EAST & AFRICA

13 SWOT

14 COMPANY PROFILE

14.1 FEDEX

14.1.1 COMPANY SNAPSHOT

14.1.2 REVENUE ANALYSIS

14.1.3 COMPANY SHARE ANALYSIS

14.1.4 SERVICES PORTFOLIO

14.1.5 RECENT DEVELOPMENTS

14.2 UNITED PARCEL SERVICE OF AMERICA, INC.

14.2.1 COMPANY SNAPSHOT

14.2.2 REVENUE ANALYSIS

14.2.3 COMPANY SHARE ANALYSIS

14.2.4 SOLUTION PORTFOLIO

14.2.5 RECENT DEVELOPMENTS

14.3 DEUTSCHE POST DHL GROUP

14.3.1 COMPANY SNAPSHOT

14.3.2 REVENUE ANALYSIS

14.3.3 COMPANY SHARE ANALYSIS

14.3.4 SERVICES PORTFOLIO

14.3.5 RECENT DEVELOPMENTS

14.4 C.H. ROBINSON WORLDWIDE, INC.

14.4.1 COMPANY SNAPSHOT

14.4.2 REVENUE ANALYSIS

14.4.3 COMPANY SHARE ANALYSIS

14.4.4 SERVICES PORTFOLIO

14.4.5 RECENT DEVELOPMENTS

14.5 XPO LOGISTICS, INC

14.5.1 COMPANY SNAPSHOT

14.5.2 REVENUE ANALYSIS

14.5.3 COMPANY SHARE ANALYSIS

14.5.4 SERVICE PORTFOLIO

14.5.5 RECENT DEVELOPMENTS

14.6 KINTETSU WORLD EXPRESS, INC.

14.6.1 COMPANY SNAPSHOT

14.6.2 REVENUE ANALYSIS

14.6.3 SERVICES PORTFOLIO

14.6.4 RECENT DEVELOPMENTS

14.7 CORE LOGISTIC PRIVATE LIMITED

14.7.1 COMPANY SNAPSHOT

14.7.2 SERVICES PORTFOLIO

14.7.3 RECENT DEVELOPMENTS

14.8 DGS TRANSLOGISTICS INDIA PVT. LTD.

14.8.1 COMPANY SNAPSHOT

14.8.2 SERVICES PORTFOLIO

14.8.3 RECENT DEVELOPMENT

14.9 IBM CORPORATION

14.9.1 COMPANY SNAPSHOT

14.9.2 REVENUE ANALYSIS

14.9.3 SOLUTION PORTFOLIO

14.9.4 RECENT DEVELOPMENTS

14.1 INDEV GROUP OF COMPANIES

14.10.1 COMPANY SNAPSHOT

14.10.2 SERVICES PORTFOLIO

14.10.3 RECENT DEVELOPMENTS

14.11 LOGINEXT SOLUTIONS INC

14.11.1 COMPANY SNAPSHOT

14.11.2 SERVICES PORTFOLIO

14.11.3 RECENT DEVELOPMENTS

14.12 NFI INDUSTRIES

14.12.1 COMPANY SNAPSHOT

14.12.2 SERVICES PORTFOLIO

14.12.3 RECENT DEVELOPMENTS

14.13 OPTORO, INC.

14.13.1 COMPANY SNAPSHOT

14.13.2 SOLUTION PORTFOLIO

14.13.3 RECENT DEVELOPMENTS

14.14 REVERSE LOGISTICS GROUP

14.14.1 COMPANY SNAPSHOT

14.14.2 SOLUTION PORTFOLIO

14.14.3 RECENT DEVELOPMENTS

14.15 REVERSELOGIX

14.15.1 COMPANY SNAPSHOT

14.15.2 SERVICES PORTFOLIO

14.15.3 RECENT DEVELOPMENTS

14.16 SAFEXPRESS PVT. LTD.

14.16.1 COMPANY SNAPSHOT

14.16.2 SERVICES PORTFOLIO

14.16.3 RECENT DEVELOPMENTS

14.17 SCHENKER AG

14.17.1 COMPANY SNAPSHOT

14.17.2 PRODUCTS PORTFOLIO

14.17.3 RECENT DEVELOPMENTS

14.18 SHIPWIZARD

14.18.1 COMPANY SNAPSHOT

14.18.2 SERVICES PORTFOLIO

14.18.3 RECENT DEVELOPMENTS

14.19 WOODFIELD DISTRIBUTION, LLC

14.19.1 COMPANY SNAPSHOT

14.19.2 SERVICES PORTFOLIO

14.19.3 RECENT DEVELOPMENTS

14.2 YUSEN LOGISTICS CO., LTD.

14.20.1 COMPANY SNAPSHOT

14.20.2 SERVICES PORTFOLIO

14.20.3 RECENT DEVELOPMENTS

15 QUESTIONNAIRE

16 RELATED REPORTS

List of Table

TABLE 1 MIDDLE EAST & AFRICA REVERSE LOGISTICS MARKET, BY RETURN TYPE, 2020-2029 (USD MILLION)

TABLE 2 MIDDLE EAST & AFRICA RETURNS IN REVERSE LOGISTICS MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 3 MIDDLE EAST & AFRICA END-OF-LIFE IN REVERSE LOGISTICS MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 4 MIDDLE EAST & AFRICA REMANUFACTURING IN REVERSE LOGISTICS MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 5 MIDDLE EAST & AFRICA REFURBISHING IN REVERSE LOGISTICS MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 6 MIDDLE EAST & AFRICA UNSOLD GOODS IN REVERSE LOGISTICS MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 7 MIDDLE EAST & AFRICA RENTALS & LEASING IN REVERSE LOGISTICS MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 8 MIDDLE EAST & AFRICA REPAIRS & MAINTENANCE IN REVERSE LOGISTICS MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 9 MIDDLE EAST & AFRICA DELIVERY FAILURE IN REVERSE LOGISTICS MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 10 MIDDLE EAST & AFRICA RETURNS AVOIDANCE IN REVERSE LOGISTICS MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 11 MIDDLE EAST & AFRICA PACKAGING IN REVERSE LOGISTICS MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 12 MIDDLE EAST & AFRICA OTHERS IN REVERSE LOGISTICS MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 13 MIDDLE EAST & AFRICA REVERSE LOGISTICS MARKET, BY COMPONENTS, 2020-2029 (USD MILLION)

TABLE 14 MIDDLE EAST & AFRICA RETURN POLICY AND PROCEDURE (RPP) IN REVERSE LOGISTICS MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 15 MIDDLE EAST & AFRICA REMANUFACTURING OR REFURBISHMENT (ROR) IN REVERSE LOGISTICS MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 16 MIDDLE EAST & AFRICA WASTE DISPOSAL (WAD) IN REVERSE LOGISTICS MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 17 MIDDLE EAST & AFRICA REVERSE LOGISTICS MARKET, BY SERVICE TYPE, 2020-2029 (USD MILLION)

TABLE 18 MIDDLE EAST & AFRICA TRANSPORTATION IN REVERSE LOGISTICS MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 19 MIDDLE EAST & AFRICA WAREHOUSING IN REVERSE LOGISTICS MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 20 MIDDLE EAST & AFRICA REPLACEMENT MANAGEMENT IN REVERSE LOGISTICS MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 21 MIDDLE EAST & AFRICA RESELLING IN REVERSE LOGISTICS MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 22 MIDDLE EAST & AFRICA REFUND MANAGEMENT AUTHORIZATION IN REVERSE LOGISTICS MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 23 MIDDLE EAST & AFRICA OTHERS IN REVERSE LOGISTICS MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 24 MIDDLE EAST & AFRICA REVERSE LOGISTICS MARKET, BY END-USER, 2020-2029 (USD MILLION)

TABLE 25 MIDDLE EAST & AFRICA E-COMMERCE IN REVERSE LOGISTICS MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 26 MIDDLE EAST & AFRICA E-COMMERCE IN REVERSE LOGISTICS MARKET, BY COMPONENTS, 2020-2029 (USD MILLION)

TABLE 27 MIDDLE EAST & AFRICA RETAIL IN REVERSE LOGISTICS MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 28 MIDDLE EAST & AFRICA RETAIL IN REVERSE LOGISTICS MARKET, BY COMPONENTS, 2020-2029 (USD MILLION)

TABLE 29 MIDDLE EAST & AFRICA AUTOMOTIVE IN REVERSE LOGISTICS MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 30 MIDDLE EAST & AFRICA AUTOMOTIVE IN REVERSE LOGISTICS MARKET, BY COMPONENTS, 2020-2029 (USD MILLION)

TABLE 31 MIDDLE EAST & AFRICA CONSUMER ELECTRONIC IN REVERSE LOGISTICS MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 32 MIDDLE EAST & AFRICA CONSUMER ELECTRONIC IN REVERSE LOGISTICS MARKET, BY COMPONENTS, 2020-2029 (USD MILLION)

TABLE 33 MIDDLE EAST & AFRICA PHARMACEUTICAL IN REVERSE LOGISTICS MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 34 MIDDLE EAST & AFRICA PHARMACEUTICAL IN REVERSE LOGISTICS MARKET, BY COMPONENTS, 2020-2029 (USD MILLION)

TABLE 35 MIDDLE EAST & AFRICA TEXTILE AND GARMENTS IN REVERSE LOGISTICS MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 36 MIDDLE EAST & AFRICA TEXTILE AND GARMENTS IN REVERSE LOGISTICS MARKET, BY COMPONENTS, 2020-2029 (USD MILLION)

TABLE 37 MIDDLE EAST & AFRICA REUSABLE PACKAGING IN REVERSE LOGISTICS MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 38 MIDDLE EAST & AFRICA REUSABLE PACKAGING IN REVERSE LOGISTICS MARKET, BY COMPONENTS, 2020-2029 (USD MILLION)

TABLE 39 MIDDLE EAST & AFRICA LUXURY GOODS IN REVERSE LOGISTICS MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 40 MIDDLE EAST & AFRICA LUXURY GOODS IN REVERSE LOGISTICS MARKET, BY COMPONENTS, 2020-2029 (USD MILLION)

TABLE 41 MIDDLE EAST & AFRICA OTHERS IN REVERSE LOGISTICS MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 42 MIDDLE EAST & AFRICA REVERSE LOGISTICS MARKET, BY COUNTRY, 2020-2029 (USD MILLION)

TABLE 43 MIDDLE EAST & AFRICA REVERSE LOGISTICS MARKET, BY RETURN TYPE, 2020-2029 (USD MILLION)

TABLE 44 MIDDLE EAST & AFRICA REVERSE LOGISTICS MARKET, BY COMPONENTS, 2020-2029 (USD MILLION)

TABLE 45 MIDDLE EAST & AFRICA REVERSE LOGISTICS MARKET, BY SERVICE TYPE, 2020-2029 (USD MILLION)

TABLE 46 MIDDLE EAST & AFRICA REVERSE LOGISTICS MARKET, BY END-USER, 2020-2029 (USD MILLION)

TABLE 47 MIDDLE EAST & AFRICA E-COMMERCE IN REVERSE LOGISTICS MARKET, BY COMPONENTS, 2020-2029 (USD MILLION)

TABLE 48 MIDDLE EAST & AFRICA RETAIL IN REVERSE LOGISTICS MARKET, BY COMPONENTS, 2020-2029 (USD MILLION)

TABLE 49 MIDDLE EAST & AFRICA AUTOMOTIVE IN REVERSE LOGISTICS MARKET, BY COMPONENTS, 2020-2029 (USD MILLION)

TABLE 50 MIDDLE EAST & AFRICA CONSUMER ELECTRONIC IN REVERSE LOGISTICS MARKET, BY COMPONENTS, 2020-2029 (USD MILLION)

TABLE 51 MIDDLE EAST & AFRICA PHARMACEUTICAL IN REVERSE LOGISTICS MARKET, BY COMPONENTS, 2020-2029 (USD MILLION)

TABLE 52 MIDDLE EAST & AFRICA TEXTILE AND GARMENTS IN REVERSE LOGISTICS MARKET, BY COMPONENTS, 2020-2029 (USD MILLION)

TABLE 53 MIDDLE EAST & AFRICA REUSABLE PACKAGING IN REVERSE LOGISTICS MARKET, BY COMPONENTS, 2020-2029 (USD MILLION)

TABLE 54 MIDDLE EAST & AFRICA LUXURY GOODS IN REVERSE LOGISTICS MARKET, BY COMPONENTS, 2020-2029 (USD MILLION)

TABLE 55 U.A.E. REVERSE LOGISTICS MARKET, BY RETURN TYPE, 2020-2029 (USD MILLION)

TABLE 56 U.A.E. REVERSE LOGISTICS MARKET, BY COMPONENTS, 2020-2029 (USD MILLION)

TABLE 57 U.A.E. REVERSE LOGISTICS MARKET, BY SERVICE TYPE, 2020-2029 (USD MILLION)

TABLE 58 U.A.E. REVERSE LOGISTICS MARKET, BY END-USER, 2020-2029 (USD MILLION)

TABLE 59 U.A.E. E-COMMERCE IN REVERSE LOGISTICS MARKET, BY COMPONENTS, 2020-2029 (USD MILLION)

TABLE 60 U.A.E. RETAIL IN REVERSE LOGISTICS MARKET, BY COMPONENTS, 2020-2029 (USD MILLION)

TABLE 61 U.A.E. AUTOMOTIVE IN REVERSE LOGISTICS MARKET, BY COMPONENTS, 2020-2029 (USD MILLION)

TABLE 62 U.A.E. CONSUMER ELECTRONIC IN REVERSE LOGISTICS MARKET, BY COMPONENTS, 2020-2029 (USD MILLION)

TABLE 63 U.A.E. PHARMACEUTICAL IN REVERSE LOGISTICS MARKET, BY COMPONENTS, 2020-2029 (USD MILLION)

TABLE 64 U.A.E. TEXTILE AND GARMENTS IN REVERSE LOGISTICS MARKET, BY COMPONENTS, 2020-2029 (USD MILLION)

TABLE 65 U.A.E. REUSABLE PACKAGING IN REVERSE LOGISTICS MARKET, BY COMPONENTS, 2020-2029 (USD MILLION)

TABLE 66 U.A.E. LUXURY GOODS IN REVERSE LOGISTICS MARKET, BY COMPONENTS, 2020-2029 (USD MILLION)

TABLE 67 SAUDI ARABIA REVERSE LOGISTICS MARKET, BY RETURN TYPE, 2020-2029 (USD MILLION)

TABLE 68 SAUDI ARABIA REVERSE LOGISTICS MARKET, BY COMPONENTS, 2020-2029 (USD MILLION)

TABLE 69 SAUDI ARABIA REVERSE LOGISTICS MARKET, BY SERVICE TYPE, 2020-2029 (USD MILLION)

TABLE 70 SAUDI ARABIA REVERSE LOGISTICS MARKET, BY END-USER, 2020-2029 (USD MILLION)

TABLE 71 SAUDI ARABIA E-COMMERCE IN REVERSE LOGISTICS MARKET, BY COMPONENTS, 2020-2029 (USD MILLION)

TABLE 72 SAUDI ARABIA RETAIL IN REVERSE LOGISTICS MARKET, BY COMPONENTS, 2020-2029 (USD MILLION)

TABLE 73 SAUDI ARABIA AUTOMOTIVE IN REVERSE LOGISTICS MARKET, BY COMPONENTS, 2020-2029 (USD MILLION)

TABLE 74 SAUDI ARABIA CONSUMER ELECTRONIC IN REVERSE LOGISTICS MARKET, BY COMPONENTS, 2020-2029 (USD MILLION)

TABLE 75 SAUDI ARABIA PHARMACEUTICAL IN REVERSE LOGISTICS MARKET, BY COMPONENTS, 2020-2029 (USD MILLION)

TABLE 76 SAUDI ARABIA TEXTILE AND GARMENTS IN REVERSE LOGISTICS MARKET, BY COMPONENTS, 2020-2029 (USD MILLION)

TABLE 77 SAUDI ARABIA REUSABLE PACKAGING IN REVERSE LOGISTICS MARKET, BY COMPONENTS, 2020-2029 (USD MILLION)

TABLE 78 SAUDI ARABIA LUXURY GOODS IN REVERSE LOGISTICS MARKET, BY COMPONENTS, 2020-2029 (USD MILLION)

TABLE 79 ISRAEL REVERSE LOGISTICS MARKET, BY RETURN TYPE, 2020-2029 (USD MILLION)

TABLE 80 ISRAEL REVERSE LOGISTICS MARKET, BY COMPONENTS, 2020-2029 (USD MILLION)

TABLE 81 ISRAEL REVERSE LOGISTICS MARKET, BY SERVICE TYPE, 2020-2029 (USD MILLION)

TABLE 82 ISRAEL REVERSE LOGISTICS MARKET, BY END-USER, 2020-2029 (USD MILLION)

TABLE 83 ISRAEL E-COMMERCE IN REVERSE LOGISTICS MARKET, BY COMPONENTS, 2020-2029 (USD MILLION)

TABLE 84 ISRAEL RETAIL IN REVERSE LOGISTICS MARKET, BY COMPONENTS, 2020-2029 (USD MILLION)

TABLE 85 ISRAEL AUTOMOTIVE IN REVERSE LOGISTICS MARKET, BY COMPONENTS, 2020-2029 (USD MILLION)

TABLE 86 ISRAEL CONSUMER ELECTRONIC IN REVERSE LOGISTICS MARKET, BY COMPONENTS, 2020-2029 (USD MILLION)

TABLE 87 ISRAEL PHARMACEUTICAL IN REVERSE LOGISTICS MARKET, BY COMPONENTS, 2020-2029 (USD MILLION)

TABLE 88 ISRAEL TEXTILE AND GARMENTS IN REVERSE LOGISTICS MARKET, BY COMPONENTS, 2020-2029 (USD MILLION)

TABLE 89 ISRAEL REUSABLE PACKAGING IN REVERSE LOGISTICS MARKET, BY COMPONENTS, 2020-2029 (USD MILLION)

TABLE 90 ISRAEL LUXURY GOODS IN REVERSE LOGISTICS MARKET, BY COMPONENTS, 2020-2029 (USD MILLION)

TABLE 91 EGYPT REVERSE LOGISTICS MARKET, BY RETURN TYPE, 2020-2029 (USD MILLION)

TABLE 92 EGYPT REVERSE LOGISTICS MARKET, BY COMPONENTS, 2020-2029 (USD MILLION)

TABLE 93 EGYPT REVERSE LOGISTICS MARKET, BY SERVICE TYPE, 2020-2029 (USD MILLION)

TABLE 94 EGYPT REVERSE LOGISTICS MARKET, BY END-USER, 2020-2029 (USD MILLION)

TABLE 95 EGYPT E-COMMERCE IN REVERSE LOGISTICS MARKET, BY COMPONENTS, 2020-2029 (USD MILLION)

TABLE 96 EGYPT RETAIL IN REVERSE LOGISTICS MARKET, BY COMPONENTS, 2020-2029 (USD MILLION)

TABLE 97 EGYPT AUTOMOTIVE IN REVERSE LOGISTICS MARKET, BY COMPONENTS, 2020-2029 (USD MILLION)

TABLE 98 EGYPT CONSUMER ELECTRONIC IN REVERSE LOGISTICS MARKET, BY COMPONENTS, 2020-2029 (USD MILLION)

TABLE 99 EGYPT PHARMACEUTICAL IN REVERSE LOGISTICS MARKET, BY COMPONENTS, 2020-2029 (USD MILLION)

TABLE 100 EGYPT TEXTILE AND GARMENTS IN REVERSE LOGISTICS MARKET, BY COMPONENTS, 2020-2029 (USD MILLION)

TABLE 101 EGYPT REUSABLE PACKAGING IN REVERSE LOGISTICS MARKET, BY COMPONENTS, 2020-2029 (USD MILLION)

TABLE 102 EGYPT LUXURY GOODS IN REVERSE LOGISTICS MARKET, BY COMPONENTS, 2020-2029 (USD MILLION)

TABLE 103 SOUTH AFRICA REVERSE LOGISTICS MARKET, BY RETURN TYPE, 2020-2029 (USD MILLION)

TABLE 104 SOUTH AFRICA REVERSE LOGISTICS MARKET, BY COMPONENTS, 2020-2029 (USD MILLION)

TABLE 105 SOUTH AFRICA REVERSE LOGISTICS MARKET, BY SERVICE TYPE, 2020-2029 (USD MILLION)

TABLE 106 SOUTH AFRICA REVERSE LOGISTICS MARKET, BY END-USER, 2020-2029 (USD MILLION)

TABLE 107 SOUTH AFRICA E-COMMERCE IN REVERSE LOGISTICS MARKET, BY COMPONENTS, 2020-2029 (USD MILLION)

TABLE 108 SOUTH AFRICA RETAIL IN REVERSE LOGISTICS MARKET, BY COMPONENTS, 2020-2029 (USD MILLION)

TABLE 109 SOUTH AFRICA AUTOMOTIVE IN REVERSE LOGISTICS MARKET, BY COMPONENTS, 2020-2029 (USD MILLION)

TABLE 110 SOUTH AFRICA CONSUMER ELECTRONIC IN REVERSE LOGISTICS MARKET, BY COMPONENTS, 2020-2029 (USD MILLION)

TABLE 111 SOUTH AFRICA PHARMACEUTICAL IN REVERSE LOGISTICS MARKET, BY COMPONENTS, 2020-2029 (USD MILLION)

TABLE 112 SOUTH AFRICA TEXTILE AND GARMENTS IN REVERSE LOGISTICS MARKET, BY COMPONENTS, 2020-2029 (USD MILLION)

TABLE 113 SOUTH AFRICA REUSABLE PACKAGING IN REVERSE LOGISTICS MARKET, BY COMPONENTS, 2020-2029 (USD MILLION)

TABLE 114 SOUTH AFRICA LUXURY GOODS IN REVERSE LOGISTICS MARKET, BY COMPONENTS, 2020-2029 (USD MILLION)

TABLE 115 REST OF MIDDLE EAST AND AFRICA REVERSE LOGISTICS MARKET, BY RETURN TYPE, 2020-2029 (USD MILLION)

List of Figure

FIGURE 1 MIDDLE EAST & AFRICA REVERSE LOGISTICS MARKET: SEGMENTATION

FIGURE 2 MIDDLE EAST & AFRICA REVERSE LOGISTICS MARKET: DATA TRIANGULATION

FIGURE 3 MIDDLE EAST & AFRICA REVERSE LOGISTICS MARKET: DROC ANALYSIS

FIGURE 4 MIDDLE EAST & AFRICA REVERSE LOGISTICS MARKET: MIDDLE EAST & AFRICA VS REGIONAL MARKET ANALYSIS

FIGURE 5 MIDDLE EAST & AFRICA REVERSE LOGISTICS MARKET: COMPANY RESEARCH ANALYSIS

FIGURE 6 MIDDLE EAST & AFRICA REVERSE LOGISTICS MARKET: INTERVIEW DEMOGRAPHICS

FIGURE 7 MIDDLE EAST & AFRICA REVERSE LOGISTICS MARKET: DBMR MARKET POSITION GRID

FIGURE 8 MIDDLE EAST & AFRICA REVERSE LOGISTICS MARKET: VENDOR SHARE ANALYSIS

FIGURE 9 MIDDLE EAST & AFRICA REVERSE LOGISTICS MARKET: MARKET END-USER COVERAGE GRID

FIGURE 10 MIDDLE EAST & AFRICA REVERSE LOGISTICS MARKET: MARKET CHALLENGE MATRIX

FIGURE 11 MIDDLE EAST & AFRICA REVERSE LOGISTICS MARKET: SEGMENTATION

FIGURE 12 RAPID GROWTH IN E-COMMERCE SECTOR IS EXPECTED TO DRIVE THE MIDDLE EAST & AFRICA REVERSE LOGISTICS MARKET IN THE FORECAST PERIOD OF 2022 TO 2029

FIGURE 13 RETURNS SEGMENT IS EXPECTED TO ACCOUNT FOR THE LARGEST SHARE OF THE MIDDLE EAST & AFRICA REVERSE LOGISTICS MARKET IN 2022 & 2029

FIGURE 14 ASIA-PACIFIC IS EXPECTED TO DOMINATE AND IT IS THE FASTEST-GROWING REGION IN THE MIDDLE EAST & AFRICA REVERSE LOGISTICS MARKET IN THE FORECAST PERIOD OF 2022 TO 2029

FIGURE 15 ASIA-PACIFIC IS THE FASTEST-GROWING MARKET FOR REVERSE LOGISTICS MANUFACTURERS IN THE FORECAST PERIOD OF 2022 TO 2029

FIGURE 16 DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES OF MIDDLE EAST & AFRICA REVERSE LOGISTICS MARKET

FIGURE 17 TOP CATEGORIES OF MERCHANDISE RETURNED

FIGURE 18 REVERSE LOGISTICS SUPPLY CHAIN

FIGURE 19 ECONOMIES BY SIZE OF MERCHANDISE TRADE, 2018

FIGURE 20 MIDDLE EAST & AFRICA REVERSE LOGISTICS MARKET: BY RETURN TYPE, 2021

FIGURE 21 MIDDLE EAST & AFRICA REVERSE LOGISTICS MARKET: BY COMPONENTS, 2021

FIGURE 22 MIDDLE EAST & AFRICA REVERSE LOGISTICS MARKET: BY SERVICE TYPE, 2021

FIGURE 23 MIDDLE EAST & AFRICA REVERSE LOGISTICS MARKET: BY END-USER, 2021

FIGURE 24 MIDDLE EAST & AFRICA REVERSE LOGISTICS MARKET: SNAPSHOT (2021)

FIGURE 25 MIDDLE EAST & AFRICA REVERSE LOGISTICS MARKET: BY COUNTRY (2021)

FIGURE 26 MIDDLE EAST & AFRICA REVERSE LOGISTICS MARKET: BY COUNTRY (2022 & 2029)

FIGURE 27 MIDDLE EAST & AFRICA REVERSE LOGISTICS MARKET: BY COUNTRY (2021 & 2029)

FIGURE 28 MIDDLE EAST & AFRICA REVERSE LOGISTICS MARKET: BY RETURN TYPE (2022-2029)

FIGURE 29 MIDDLE EAST & AFRICA REVERSE LOGISTICS MARKET: COMPANY SHARE 2021 (%)

منهجية البحث

يتم جمع البيانات وتحليل سنة الأساس باستخدام وحدات جمع البيانات ذات أحجام العينات الكبيرة. تتضمن المرحلة الحصول على معلومات السوق أو البيانات ذات الصلة من خلال مصادر واستراتيجيات مختلفة. تتضمن فحص وتخطيط جميع البيانات المكتسبة من الماضي مسبقًا. كما تتضمن فحص التناقضات في المعلومات التي شوهدت عبر مصادر المعلومات المختلفة. يتم تحليل بيانات السوق وتقديرها باستخدام نماذج إحصائية ومتماسكة للسوق. كما أن تحليل حصة السوق وتحليل الاتجاهات الرئيسية هي عوامل النجاح الرئيسية في تقرير السوق. لمعرفة المزيد، يرجى طلب مكالمة محلل أو إرسال استفسارك.

منهجية البحث الرئيسية التي يستخدمها فريق بحث DBMR هي التثليث البيانات والتي تتضمن استخراج البيانات وتحليل تأثير متغيرات البيانات على السوق والتحقق الأولي (من قبل خبراء الصناعة). تتضمن نماذج البيانات شبكة تحديد موقف البائعين، وتحليل خط زمني للسوق، ونظرة عامة على السوق ودليل، وشبكة تحديد موقف الشركة، وتحليل براءات الاختراع، وتحليل التسعير، وتحليل حصة الشركة في السوق، ومعايير القياس، وتحليل حصة البائعين على المستوى العالمي مقابل الإقليمي. لمعرفة المزيد عن منهجية البحث، أرسل استفسارًا للتحدث إلى خبراء الصناعة لدينا.

التخصيص متاح

تعد Data Bridge Market Research رائدة في مجال البحوث التكوينية المتقدمة. ونحن نفخر بخدمة عملائنا الحاليين والجدد بالبيانات والتحليلات التي تتطابق مع هدفهم. ويمكن تخصيص التقرير ليشمل تحليل اتجاه الأسعار للعلامات التجارية المستهدفة وفهم السوق في بلدان إضافية (اطلب قائمة البلدان)، وبيانات نتائج التجارب السريرية، ومراجعة الأدبيات، وتحليل السوق المجدد وقاعدة المنتج. ويمكن تحليل تحليل السوق للمنافسين المستهدفين من التحليل القائم على التكنولوجيا إلى استراتيجيات محفظة السوق. ويمكننا إضافة عدد كبير من المنافسين الذين تحتاج إلى بيانات عنهم بالتنسيق وأسلوب البيانات الذي تبحث عنه. ويمكن لفريق المحللين لدينا أيضًا تزويدك بالبيانات في ملفات Excel الخام أو جداول البيانات المحورية (كتاب الحقائق) أو مساعدتك في إنشاء عروض تقديمية من مجموعات البيانات المتوفرة في التقرير.