Middle East And Africa Renting And Leasing Test And Measurement Equipment Market

حجم السوق بالمليار دولار أمريكي

CAGR :

%

USD

334.44 Million

USD

443.81 Million

2024

2032

USD

334.44 Million

USD

443.81 Million

2024

2032

| 2025 –2032 | |

| USD 334.44 Million | |

| USD 443.81 Million | |

|

|

|

|

تجزئة سوق تأجير واستئجار معدات الاختبار والقياس في الشرق الأوسط وأفريقيا، حسب العرض (الأجهزة والخدمات)، والمكونات (تجميعات الكابلات، والموصلات، والملحقات ذات القيمة المضافة، وغيرها)، ونوع النظام (نظام الاستشعار، ونظام الاتصال، ونظام السلامة والأمان، وواجهة الآلة البشرية (HMI)، ونظام إدارة الطاقة والطاقة، ونظام التحكم في المحركات، ونظام الإضاءة)، والنوع (التأجير)، والميزات (معدات التشخيص، والاستشعار الكهربائي، وأنظمة التحكم الصناعي للقياس، وغيرها)، والمستخدم النهائي (تكنولوجيا المعلومات والاتصالات، والسيارات، والفضاء والدفاع، والصناعة، والإلكترونيات الاستهلاكية، والطاقة والمرافق، والمعدات الطبية، وغيرها) - اتجاهات الصناعة وتوقعاتها حتى عام 2032

حجم سوق تأجير واستئجار معدات الاختبار والقياس في الشرق الأوسط وأفريقيا

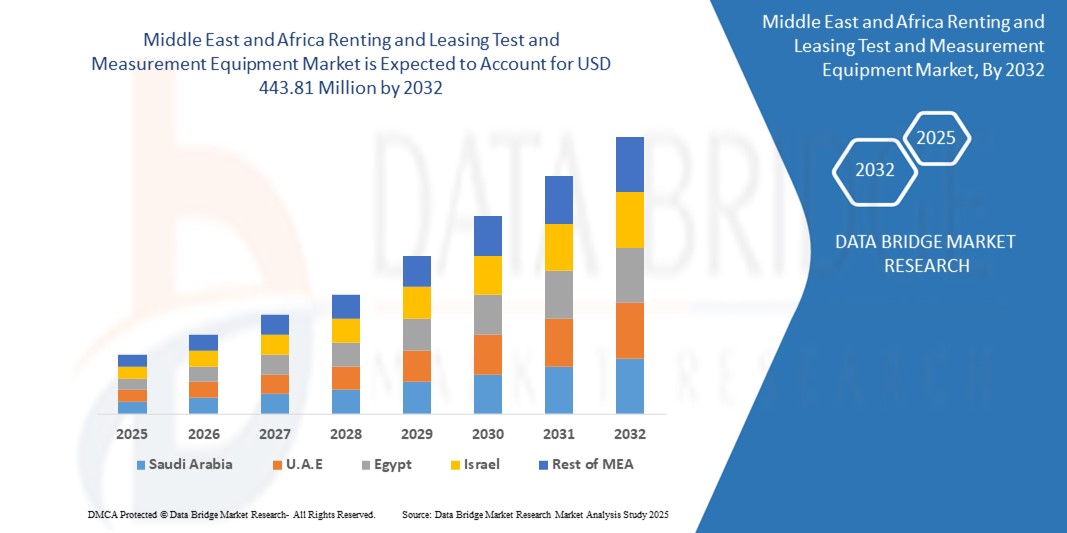

- تم تقييم حجم سوق تأجير واستئجار معدات الاختبار والقياس في الشرق الأوسط وأفريقيا بـ 334.44 مليون دولار أمريكي في عام 2024 ومن المتوقع أن يصل إلى 443.81 مليون دولار أمريكي بحلول عام 2032 ، بمعدل نمو سنوي مركب قدره 3.60٪ خلال الفترة المتوقعة.

- يتم دعم نمو السوق إلى حد كبير من خلال الطلب المتزايد على الوصول الفعال من حيث التكلفة إلى حلول الاختبار المتقدمة والاعتماد المتزايد على نماذج الأعمال المرنة عبر الصناعات

- إن التركيز المتزايد على تقليل الإنفاق الرأسمالي مع ضمان الوصول إلى أحدث التقنيات يعمل أيضًا على تسريع تبني السوق

تحليل سوق تأجير واستئجار معدات الاختبار والقياس في الشرق الأوسط وأفريقيا

- يشهد السوق نموًا قويًا حيث تختار الشركات في قطاعات الإلكترونيات والاتصالات والسيارات والتصنيع نماذج التأجير والاستئجار لتحسين التكاليف والحفاظ على المرونة التشغيلية

- إن التعقيد التكنولوجي المتزايد، ودورات حياة المنتج الأقصر، والحاجة إلى ترقيات منتظمة تجبر الشركات على تبني الوصول المرن بدلاً من عمليات الشراء المباشرة

- سيطرت المملكة العربية السعودية على سوق تأجير واستئجار معدات الاختبار والقياس في الشرق الأوسط وأفريقيا في عام 2024، مدفوعة بالمشاريع الصناعية واسعة النطاق، والاستثمارات المتزايدة في قطاعي الاتصالات والطاقة، والمبادرات الحكومية الداعمة لتبني التكنولوجيا.

- من المتوقع أن تشهد دولة الإمارات العربية المتحدة أعلى معدل نمو سنوي مركب (CAGR) في سوق تأجير واستئجار معدات الاختبار والقياس في منطقة الشرق الأوسط وأفريقيا بسبب التبني السريع للتكنولوجيا والتركيز المتزايد على مبادرات المدينة الذكية وزيادة الاستثمارات في قطاعات الاتصالات والفضاء والطاقة المتجددة.

- حقق قطاع الخدمات أكبر حصة من إيرادات السوق في عام ٢٠٢٤، بفضل الإقبال المتزايد على حلول التأجير الشاملة، بما في ذلك المعايرة والصيانة والدعم الفني. توفر اتفاقيات الخدمات سهولة تشغيلية وتقلل الحاجة إلى الخبرة الداخلية، مما يجعلها تحظى بشعبية كبيرة بين الشركات.

نطاق التقرير وتجزئة سوق تأجير واستئجار معدات الاختبار والقياس في الشرق الأوسط وأفريقيا

|

صفات |

رؤى رئيسية حول سوق تأجير واستئجار معدات الاختبار والقياس في الشرق الأوسط وأفريقيا |

|

القطاعات المغطاة |

|

|

الدول المغطاة |

الشرق الأوسط وأفريقيا

|

|

اللاعبون الرئيسيون في السوق |

|

|

فرص السوق |

|

|

مجموعات معلومات البيانات ذات القيمة المضافة |

بالإضافة إلى رؤى السوق مثل القيمة السوقية ومعدل النمو وشرائح السوق والتغطية الجغرافية واللاعبين في السوق وسيناريو السوق، فإن تقرير السوق الذي أعده فريق أبحاث السوق في Data Bridge يتضمن تحليلًا متعمقًا من الخبراء وتحليل الاستيراد / التصدير وتحليل التسعير وتحليل استهلاك الإنتاج وتحليل المدقة. |

اتجاهات سوق تأجير واستئجار معدات الاختبار والقياس في الشرق الأوسط وأفريقيا

التحول نحو نماذج الوصول المرنة

- يُعيد التفضيل المتزايد لنماذج التأجير والاستئجار تشكيل صناعة معدات الاختبار والقياس، إذ يُمكّن المؤسسات من الوصول إلى أدوات متطورة دون الحاجة إلى استثمارات أولية كبيرة. يدعم هذا النهج تحسين التكلفة، ويُمكّن الشركات من التكيف مع دورات التكنولوجيا المتغيرة بسرعة.

- إن الحاجة المتزايدة للوصول قصير الأجل إلى أنظمة اختبار عالية الأداء في قطاعات مثل الاتصالات والإلكترونيات والسيارات تُسرّع من اعتماد اتفاقيات الإيجار المرنة. تُتيح هذه النماذج للشركات مرونةً في توسيع نطاق قدرات الاختبار بناءً على متطلبات المشروع.

- إن أسعار عقود التأجير المعقولة وسهولة تشغيلها تجعلها جذابة للشركات الصغيرة والمتوسطة، إذ تتيح الوصول إلى معدات كانت ستكون باهظة التكلفة لولا ذلك. وهذا يضمن تحسين قدرات الاختبار دون التزامات مالية طويلة الأجل.

- على سبيل المثال، في عام 2023، تبنى العديد من مصنعي الإلكترونيات نماذج الإيجار لأجهزة قياس الذبذبات المتقدمة ومحللي الطيف لدعم تطوير المنتجات، وتجنب النفقات الرأسمالية الكبيرة مع الحفاظ على معايير الاختبار عالية الجودة.

- في حين أن نماذج التأجير والاستئجار تُوسّع نطاق الوصول وتُقلّل المخاطر المالية، فإن نجاحها يعتمد على الابتكار المستمر في عروض الخدمات، وشفافية التسعير، ودعم العملاء القوي. يجب على مُقدّمي الخدمات التركيز على الاتفاقيات المُخصّصة والخدمات المُجمّعة لتلبية الطلب المتزايد.

ديناميكيات سوق تأجير واستئجار معدات الاختبار والقياس في الشرق الأوسط وأفريقيا

سائق

الطلب المتزايد على تحسين التكلفة والوصول إلى أحدث التقنيات

- تدفع التكلفة المتزايدة لمعدات الاختبار المتقدمة الشركات إلى الاستئجار والاستئجار كبديل اقتصادي. بتجنّب النفقات الأولية الكبيرة، يمكن للمؤسسات إعادة توجيه رأس المال نحو العمليات الأساسية وأنشطة البحث والتطوير. كما يُمكّن هذا النهج الشركات من الاستجابة بسرعة لمتطلبات المشاريع المتقلبة دون الحاجة إلى إهلاك الأصول، مما يضمن مرونة تشغيلية.

- يزداد وعي الشركات بفوائد الحصول على أحدث تقنيات الاختبار دون تحمل عبء الملكية. وقد أدى ذلك إلى زيادة كبيرة في العقود قصيرة ومتوسطة الأجل في مختلف الصناعات ذات دورات المنتجات سريعة التطور. يتيح التأجير للشركات تجربة أدوات جديدة، والتحديث بانتظام، والحفاظ على ميزتها التنافسية دون الحاجة إلى استثمارات طويلة الأجل.

- يُعزز نمو السوق أيضًا مزودو الخدمات الذين يقدمون خدمات المعايرة والصيانة والتحديثات ضمن عقود التأجير، مما يضمن استمرارية العمليات وموثوقية المعدات. كما تستفيد الشركات من الدعم الفني وتحديثات البرامج وضمانات استبدال المعدات، مما يقلل من فترات التوقف عن العمل ومخاطر التشغيل.

- على سبيل المثال، في عام ٢٠٢٢، اعتمدت العديد من شركات الاتصالات اتفاقيات تأجير لأجهزة اختبار الجيل الخامس لتسريع النشر مع تقليل المخاطر المالية، مما عزز الطلب على حلول تأجير مرنة. ساعدتهم هذه الممارسة على توسيع نطاق البنية التحتية للاختبار بسرعة وكفاءة، مما دعم طرح خدمات الشبكة الحيوية بشكل أسرع.

- في حين أن توفير التكاليف والوصول إلى التكنولوجيا يُعدّان من عوامل النمو القوية، إلا أن السوق يتطلب ابتكارًا مستمرًا في تقديم الخدمات، وتحسين التخصيص، والتوافر العالمي لضمان استمرارية تبنيها. ومن المرجح أن يشهد مقدمو الخدمات الذين يستثمرون في المنصات الرقمية لتتبع الأصول، والصيانة التنبؤية، والدعم عن بُعد نموًا متسارعًا.

ضبط النفس/التحدي

الاعتماد الكبير على توافر المعدات وموثوقية الخدمة

- يُسبب قلة توفر معدات الاختبار والقياس المتخصصة في بعض الأسواق اختناقات، إذ لا تستطيع شركات التأجير دائمًا تلبية الطلب على الأجهزة المتخصصة أو عالية الجودة. وهذا يُقيد الوصول في الوقت المناسب ويُؤخر المشاريع الحيوية. وغالبًا ما تواجه الشركات تضاربًا في المواعيد، مما قد يؤثر على الجداول الزمنية لتطوير المنتجات وكفاءة التشغيل بشكل عام.

- في العديد من المناطق النامية، هناك نقص في مقدمي خدمات التأجير الموثوقين القادرين على الحفاظ على جودة المعدات وضمان أداء ثابت. هذا يُسبب مشاكل ثقة ويُحد من اعتماد هذه الخدمات بين الشركات. كما أن فجوات الصيانة، وتأخيرات المعايرة، ونقص الموظفين المدربين تُفاقم التحديات في هذه المناطق.

- كما أن اختراق السوق مقيدٌ بالتحديات اللوجستية، بما في ذلك تأخيرات النقل والتركيب والمعايرة، لا سيما في الأنظمة الكبيرة أو المعقدة. هذه العقبات تزيد من وقت التوقف عن العمل وتقلل من الكفاءة التشغيلية. قد تواجه الشركات تكاليف إضافية للإعداد في الموقع، وإطالة فترات التسليم، ومخاطر النقل، مما قد يُثني عن تبني هذه الحلول في المناطق النائية.

- على سبيل المثال، في عام ٢٠٢٣، أبلغت العديد من الشركات الصغيرة في المنطقة عن تأخيرات في مشاريعها بسبب عدم توفر المعدات المستأجرة وعدم كفاية الدعم الفني، مما سلط الضوء على فجوات في جودة الخدمة وإمكانية الوصول إليها. كما أثرت هذه التأخيرات على الامتثال للمعايير التنظيمية وجداول الاختبار، مما يُظهر الحاجة الماسة إلى شبكات قوية لمقدمي الخدمات.

- في حين أن نماذج التأجير والاستئجار تُخفّض التكاليف الأولية، فإن ضمان انتشارها يعتمد على تقوية سلاسل التوريد، وتحسين خدمات ما بعد البيع، وتوسيع شبكات مقدمي الخدمات لتقديم حلول موثوقة وفي الوقت المناسب. ويمكن لدمج المراقبة الرقمية والصيانة التنبؤية وعقود الخدمة القابلة للتطوير أن يُخفف من المخاطر ويعزز ثقة المستخدمين المحتملين.

نطاق سوق تأجير واستئجار معدات الاختبار والقياس في الشرق الأوسط وأفريقيا

يتم تقسيم السوق على أساس العرض والمكون ونوع النظام والنوع والميزات والمستخدم النهائي.

- عن طريق العرض

بناءً على العرض، يُقسّم السوق إلى قسمي الأجهزة والخدمات. وقد حقق قطاع الخدمات أكبر حصة من إيرادات السوق في عام ٢٠٢٤، مدفوعًا بالإقبال المتزايد على حلول التأجير الشاملة، بما في ذلك المعايرة والصيانة والدعم الفني. تُوفّر اتفاقيات الخدمات سهولة تشغيلية وتُقلّل الحاجة إلى خبرة داخلية، مما يجعلها شائعة جدًا بين الشركات.

من المتوقع أن يشهد قطاع الأجهزة أسرع معدل نمو بين عامي 2025 و2032، مدفوعًا بتزايد توفر أجهزة الاختبار المتقدمة للإيجار أو التأجير. يتيح استئجار الأجهزة للشركات الحصول على أحدث المعدات دون تكاليف رأسمالية باهظة، مما يدعم المشاريع قصيرة الأجل والتحديثات التكنولوجية السريعة.

- حسب المكون

بناءً على المكونات، يُقسّم السوق إلى مجموعات الكابلات، والموصلات، والملحقات ذات القيمة المضافة، وغيرها. وقد حقق قطاع الملحقات ذات القيمة المضافة أكبر حصة من الإيرادات في عام 2024، مدفوعًا بالطلب على باقات الإيجار الشاملة التي تشمل المحولات، والمجسات، ومجموعات المعايرة، مما يضمن التشغيل السلس للمعدات المستأجرة.

ومن المتوقع أن يشهد قطاع الموصلات أسرع معدل نمو في الفترة من 2025 إلى 2032، وذلك بسبب الطلب المتزايد على الموصلات المتوافقة وعالية الأداء التي تعزز قابلية استخدام أجهزة الاختبار المستأجرة أو المستأجرة عبر تطبيقات متعددة.

- حسب نوع النظام

بناءً على نوع النظام، يُقسّم السوق إلى أنظمة الاستشعار، وأنظمة الاتصال، وأنظمة السلامة والأمان، وواجهات الآلة البشرية (HMI)، وأنظمة إدارة الطاقة، وأنظمة التحكم في المحركات، وأنظمة الإضاءة. وقد استحوذ قطاع أنظمة الاتصال على أكبر حصة من إيرادات السوق في عام 2024، مدفوعًا بزيادة الاعتماد عليه في قطاعات تكنولوجيا المعلومات والاتصالات والإلكترونيات التي تتطلب اختبارات موثوقة لشبكات وأجهزة الاتصالات.

ومن المتوقع أن يشهد قطاع أنظمة الاستشعار أسرع معدل نمو في الفترة من 2025 إلى 2032، وذلك بسبب الطلب المتزايد على أدوات القياس الدقيق واكتساب البيانات في الوقت الفعلي المقدمة من خلال نماذج التأجير المرنة.

- حسب النوع

بناءً على النوع، يُقسّم السوق إلى إيجار وتأجير. وقد استحوذ قطاع الإيجار على أكبر حصة من الإيرادات في عام ٢٠٢٤، حيث تُفضّل الشركات بشكل متزايد الإيجارات قصيرة الأجل لاختبار المشاريع وإعداد النماذج الأولية، مما يُخفّض التكاليف الأولية ويُقلّل من تقادم المعدات.

ومن المتوقع أن يشهد قطاع التأجير أسرع معدل نمو في الفترة من 2025 إلى 2032، مدفوعًا بالعقود طويلة الأجل التي توفر وصولاً مستمراً إلى أجهزة الاختبار والقياس المتطورة إلى جانب الخدمات ذات القيمة المضافة، مما يضمن الكفاءة التشغيلية وتحسين التكلفة.

- حسب الميزات

بناءً على الميزات، يُقسّم السوق إلى معدات التشخيص، والاستشعار الكهربائي، وأنظمة التحكم الصناعي للقياس، وغيرها. وقد حقق قطاع معدات التشخيص أكبر حصة من إيرادات السوق في عام 2024، مدعومًا بالطلب المرتفع في قطاعات الصناعة والسيارات والاتصالات على الاختبارات الدقيقة واستكشاف الأخطاء وإصلاحها.

من المتوقع أن يشهد قطاع الاستشعار الكهربائي أسرع معدل نمو في الفترة من 2025 إلى 2032، وذلك بسبب الاعتماد المتزايد على أدوات الاختبار الكهربائية المستأجرة والمستأجرة لمراقبة الطاقة والامتثال وتطبيقات السلامة.

- حسب المستخدم النهائي

بناءً على المستخدم النهائي، يُقسّم السوق إلى قطاعات تكنولوجيا المعلومات والاتصالات، والسيارات، والفضاء والدفاع، والصناعة، والإلكترونيات الاستهلاكية، والطاقة والمرافق، والمعدات الطبية، وغيرها. وقد استحوذ قطاع تكنولوجيا المعلومات والاتصالات على أكبر حصة من الإيرادات في عام 2024، مدفوعًا بالنشر السريع للبنية التحتية للشبكات وزيادة اعتماد حلول التأجير والاستئجار لاختبار أنظمة الاتصالات عالية السرعة.

من المتوقع أن يشهد قطاع السيارات أسرع معدل نمو في الفترة من 2025 إلى 2032، وذلك بسبب الاعتماد المتزايد على معدات الاختبار والتشخيص المتقدمة في عمليات البحث والتطوير والتصنيع الخاصة بالمركبات والتي يتم تقديمها من خلال نماذج التأجير والاستئجار المرنة.

تحليل إقليمي لسوق تأجير واستئجار معدات الاختبار والقياس في الشرق الأوسط وأفريقيا

- سيطرت المملكة العربية السعودية على سوق تأجير واستئجار معدات الاختبار والقياس في الشرق الأوسط وأفريقيا في عام 2024، مدفوعة بالمشاريع الصناعية واسعة النطاق، والاستثمارات المتزايدة في قطاعي الاتصالات والطاقة، والمبادرات الحكومية الداعمة لتبني التكنولوجيا.

- تستخدم الشركات بشكل متزايد نماذج التأجير والاستئجار للوصول إلى أدوات الاختبار المتطورة للمشاريع الصناعية والطاقة والبنية التحتية دون إنفاق رأسمالي كبير

- ويتم دعم هذا التبني الواسع النطاق من خلال الحاجة إلى الكفاءة التشغيلية ومرونة المشروع وخدمات صيانة المعدات الموثوقة، مما يجعل حلول التأجير والاستئجار الخيار المفضل للمؤسسات

سوق تأجير واستئجار معدات الاختبار والقياس في الإمارات العربية المتحدة

من المتوقع أن يشهد سوق تأجير واستئجار معدات الاختبار والقياس في دولة الإمارات العربية المتحدة أسرع معدل نمو بين عامي 2025 و2032، وذلك بفضل تزايد اعتماد نماذج الوصول المرن للمعدات في قطاعات تكنولوجيا المعلومات والاتصالات والصناعة. وتفضل الشركات حلول التأجير والاستئجار لتقليل التكاليف الأولية، والحفاظ على إمكانية الوصول إلى تقنيات الاختبار المتقدمة، ودعم سرعة تنفيذ المشاريع. ويساهم تزايد الاستثمارات في مبادرات المدن الذكية، والأتمتة الصناعية، ومشاريع البنية التحتية المتقدمة بشكل كبير في تسريع نمو السوق في المنطقة.

حصة سوق تأجير واستئجار معدات الاختبار والقياس في الشرق الأوسط وأفريقيا

إن صناعة تأجير واستئجار معدات الاختبار والقياس في منطقة الشرق الأوسط وأفريقيا يقودها في المقام الأول شركات راسخة، بما في ذلك:

- مكيفات الزامل (المملكة العربية السعودية)

- شركة إس كي إم لتكييف الهواء ذ.م.م (الإمارات العربية المتحدة)

- كول تيك (المملكة العربية السعودية)

- شركة آل سالم جونسون كنترولز (المملكة العربية السعودية)

- قطر كول (قطر)

- الإمارات المتقدمة للتبريد (الإمارات العربية المتحدة)

- مجموعة البحري والمزروعي (الإمارات العربية المتحدة)

- الشركة الوطنية للتكييف (المملكة العربية السعودية)

- شركة فريجوجلاس للصناعات (جنوب أفريقيا)

- حلول التبريد لكأس الأمم الأفريقية (مصر)

SKU-

احصل على إمكانية الوصول عبر الإنترنت إلى التقرير الخاص بأول سحابة استخبارات سوقية في العالم

- لوحة معلومات تحليل البيانات التفاعلية

- لوحة معلومات تحليل الشركة للفرص ذات إمكانات النمو العالية

- إمكانية وصول محلل الأبحاث للتخصيص والاستعلامات

- تحليل المنافسين باستخدام لوحة معلومات تفاعلية

- آخر الأخبار والتحديثات وتحليل الاتجاهات

- استغل قوة تحليل المعايير لتتبع المنافسين بشكل شامل

منهجية البحث

يتم جمع البيانات وتحليل سنة الأساس باستخدام وحدات جمع البيانات ذات أحجام العينات الكبيرة. تتضمن المرحلة الحصول على معلومات السوق أو البيانات ذات الصلة من خلال مصادر واستراتيجيات مختلفة. تتضمن فحص وتخطيط جميع البيانات المكتسبة من الماضي مسبقًا. كما تتضمن فحص التناقضات في المعلومات التي شوهدت عبر مصادر المعلومات المختلفة. يتم تحليل بيانات السوق وتقديرها باستخدام نماذج إحصائية ومتماسكة للسوق. كما أن تحليل حصة السوق وتحليل الاتجاهات الرئيسية هي عوامل النجاح الرئيسية في تقرير السوق. لمعرفة المزيد، يرجى طلب مكالمة محلل أو إرسال استفسارك.

منهجية البحث الرئيسية التي يستخدمها فريق بحث DBMR هي التثليث البيانات والتي تتضمن استخراج البيانات وتحليل تأثير متغيرات البيانات على السوق والتحقق الأولي (من قبل خبراء الصناعة). تتضمن نماذج البيانات شبكة تحديد موقف البائعين، وتحليل خط زمني للسوق، ونظرة عامة على السوق ودليل، وشبكة تحديد موقف الشركة، وتحليل براءات الاختراع، وتحليل التسعير، وتحليل حصة الشركة في السوق، ومعايير القياس، وتحليل حصة البائعين على المستوى العالمي مقابل الإقليمي. لمعرفة المزيد عن منهجية البحث، أرسل استفسارًا للتحدث إلى خبراء الصناعة لدينا.

التخصيص متاح

تعد Data Bridge Market Research رائدة في مجال البحوث التكوينية المتقدمة. ونحن نفخر بخدمة عملائنا الحاليين والجدد بالبيانات والتحليلات التي تتطابق مع هدفهم. ويمكن تخصيص التقرير ليشمل تحليل اتجاه الأسعار للعلامات التجارية المستهدفة وفهم السوق في بلدان إضافية (اطلب قائمة البلدان)، وبيانات نتائج التجارب السريرية، ومراجعة الأدبيات، وتحليل السوق المجدد وقاعدة المنتج. ويمكن تحليل تحليل السوق للمنافسين المستهدفين من التحليل القائم على التكنولوجيا إلى استراتيجيات محفظة السوق. ويمكننا إضافة عدد كبير من المنافسين الذين تحتاج إلى بيانات عنهم بالتنسيق وأسلوب البيانات الذي تبحث عنه. ويمكن لفريق المحللين لدينا أيضًا تزويدك بالبيانات في ملفات Excel الخام أو جداول البيانات المحورية (كتاب الحقائق) أو مساعدتك في إنشاء عروض تقديمية من مجموعات البيانات المتوفرة في التقرير.