Middle East And Africa Point Of Care Poc Drug Abuse Testing Market

حجم السوق بالمليار دولار أمريكي

CAGR :

%

USD

63.21 Million

USD

81.96 Million

2024

2032

USD

63.21 Million

USD

81.96 Million

2024

2032

| 2025 –2032 | |

| USD 63.21 Million | |

| USD 81.96 Million | |

|

|

|

|

تجزئة سوق اختبارات تعاطي المخدرات في نقطة الرعاية (POC) في الشرق الأوسط وأفريقيا، حسب نوع المخدر (الأمفيتامينات، المواد الأفيونية، القنب، الكوكايين، الباربيتورات، البنزوديازيبينات، الميثادون، فينسيكليدين، مضادات الاكتئاب ثلاثية الحلقات، وغيرها)، المنتجات (الأجهزة والمواد الاستهلاكية والملحقات)، الوصفات الطبية (الاختبارات المتاحة دون وصفة طبية والاختبارات المعتمدة على الوصفات الطبية)، نوع العينة (البول، اللعاب، الدم، الشعر، النفس، وغيرها)، نوع الاختبار (الاختبار العشوائي، اختبار ما بعد الحادث، اختبار الامتناع عن التعاطي)، التطبيق (الفحص الطبي، فحص مكان العمل، إنفاذ القانون والعدالة الجنائية، إدارة الألم، علاج وإعادة تأهيل تعاطي المخدرات، اختبار المخدرات للوالدين أو المنزل، اختبار الرياضة وألعاب القوى، فحص المخدرات في المدارس والمؤسسات التعليمية، وغيرها)، المستخدم النهائي (مرافق الرعاية الصحية، أصحاب العمل، المؤسسات الحكومية). وغيرها)، وقنوات التوزيع (العطاء المباشر، ومبيعات التجزئة، وغيرها) - اتجاهات الصناعة وتوقعاتها حتى عام 2032

حجم سوق اختبار تعاطي المخدرات في نقطة الرعاية (POC) في الشرق الأوسط وأفريقيا

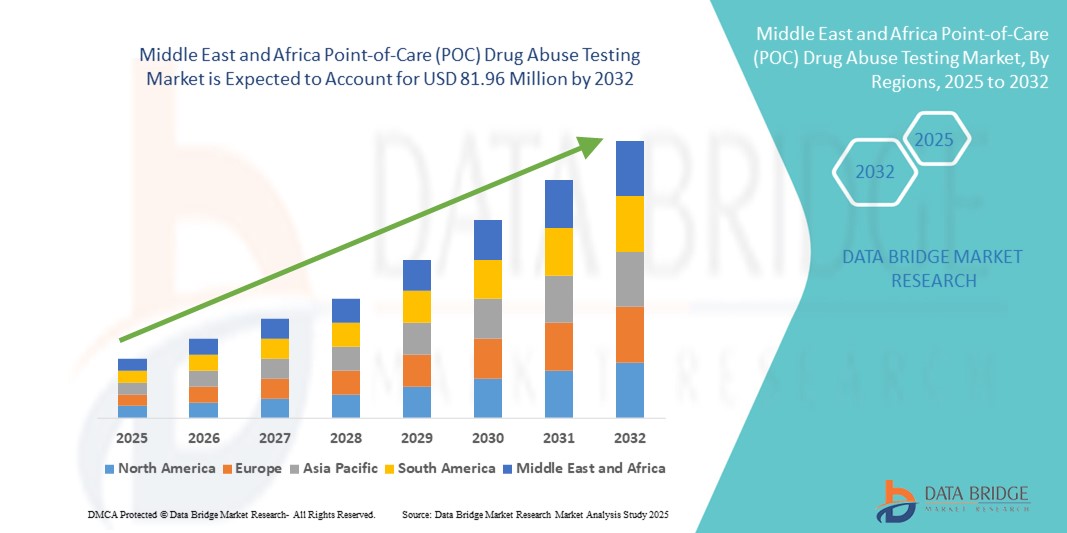

- تم تقييم حجم سوق اختبار تعاطي المخدرات في نقطة الرعاية (POC) في الشرق الأوسط وأفريقيا بـ 63.21 مليون دولار أمريكي في عام 2024 ومن المتوقع أن يصل إلى 81.96 مليون دولار أمريكي بحلول عام 2032 ، بمعدل نمو سنوي مركب قدره 3.30٪ خلال الفترة المتوقعة.

- ينشأ نمو السوق في المقام الأول بسبب الانتشار المتزايد لتعاطي المخدرات والحاجة الملحة إلى حلول تشخيصية سريعة عبر إنفاذ القانون وأماكن العمل ومرافق الرعاية الصحية

- بالإضافة إلى ذلك، تُرسّخ المبادرات الحكومية المتنامية للحد من إساءة استخدام المخدرات، إلى جانب تزايد استخدام أجهزة الفحص المحمولة وسهلة الاستخدام، أهمية فحص المخدرات في نقطة الرعاية كأداة حيوية للكشف المبكر والتدخل. تُسهم هذه العوامل المتقاربة في زيادة الطلب في جميع أنحاء المنطقة، مما يُسرّع بشكل كبير من توسع السوق.

تحليل سوق اختبارات تعاطي المخدرات في نقطة الرعاية (POC) في الشرق الأوسط وأفريقيا

- إن اختبار تعاطي المخدرات في نقطة الرعاية، والذي يوفر الكشف السريع عن المخدرات ومستقلباتها في موقع رعاية المريض أو بالقرب منه، أصبح بشكل متزايد أداة أساسية في إنفاذ القانون، وفحص مكان العمل، والإعدادات الطبية الطارئة في الشرق الأوسط وأفريقيا بسبب قابليته للنقل، وسرعته، وسهولة استخدامه.

- إن الطلب المتزايد على اختبارات تعاطي المخدرات في مراكز الرعاية الأولية مدفوع في المقام الأول بارتفاع حالات تعاطي المخدرات، وتوسيع مبادرات الصحة العامة، والتركيز المتزايد على السلامة في مكان العمل والمرور في البلدان الرئيسية مثل المملكة العربية السعودية وجنوب إفريقيا والإمارات العربية المتحدة.

- سيطرت المملكة العربية السعودية على سوق اختبار تعاطي المخدرات في نقطة الرعاية في الشرق الأوسط وأفريقيا بأكبر حصة إيرادات بلغت 33.1٪ في عام 2024، ويعزى ذلك إلى زيادة الإنفاق الحكومي على برامج مكافحة المخدرات، واختبارات المخدرات المتكررة على جانب الطريق، والفحوصات الإلزامية في مكان العمل في القطاعات الحساسة مثل النفط والغاز والطيران.

- من المتوقع أن تكون جنوب إفريقيا أسرع دولة نموًا في اختبار تعاطي المخدرات في نقطة الرعاية (POC) خلال فترة التنبؤ، وذلك بسبب ارتفاع معدل تعاطي المخدرات، وزيادة توافر مجموعات الاختبار السريع، والتكامل المتزايد لاختبارات نقطة الرعاية في كل من مرافق الرعاية الصحية العامة والخاصة.

- سيطرت شريحة البول على سوق اختبار تعاطي المخدرات في نقطة الرعاية (POC) بحصة بلغت 47.1٪ في عام 2024، وذلك بسبب طبيعتها غير الجراحية وفعاليتها من حيث التكلفة وقبولها الواسع كطريقة موثوقة للكشف عن مجموعة واسعة من المواد

نطاق التقرير وتجزئة سوق اختبار تعاطي المخدرات في نقطة الرعاية (POC) في الشرق الأوسط وأفريقيا

|

صفات |

رؤى رئيسية حول سوق اختبار تعاطي المخدرات في نقطة الرعاية في الشرق الأوسط وأفريقيا |

|

القطاعات المغطاة |

|

|

الدول المغطاة |

الشرق الأوسط وأفريقيا

|

|

اللاعبون الرئيسيون في السوق |

|

|

فرص السوق |

|

|

مجموعات معلومات البيانات ذات القيمة المضافة |

بالإضافة إلى الرؤى حول سيناريوهات السوق مثل القيمة السوقية ومعدل النمو والتجزئة والتغطية الجغرافية واللاعبين الرئيسيين، فإن تقارير السوق التي تم تنظيمها بواسطة Data Bridge Market Research تشمل أيضًا تحليلًا متعمقًا من الخبراء وتحليل التسعير وتحليل حصة العلامة التجارية واستطلاع رأي المستهلكين وتحليل التركيبة السكانية وتحليل سلسلة التوريد وتحليل سلسلة القيمة ونظرة عامة على المواد الخام / المواد الاستهلاكية ومعايير اختيار البائعين وتحليل PESTLE وتحليل Porter والإطار التنظيمي. |

اتجاهات سوق اختبار تعاطي المخدرات في نقطة الرعاية (POC) في الشرق الأوسط وأفريقيا

زيادة استخدام الاختبارات السريعة في أجهزة إنفاذ القانون وأماكن العمل

- من الاتجاهات البارزة والآخذة في التطور بسرعة في سوق اختبارات تعاطي المخدرات في مراكز الرعاية الصحية في الشرق الأوسط وأفريقيا الاستخدام المتزايد لمجموعات التشخيص المحمولة من قِبل جهات إنفاذ القانون، وفرق الاستجابة للطوارئ، وأصحاب الشركات. ويعزى هذا التحول إلى الحاجة إلى الكشف السريع عن تعاطي المخدرات في الموقع لتمكين التدخل في الوقت المناسب وضمان السلامة العامة وسلامة مكان العمل.

- على سبيل المثال، في جنوب أفريقيا، كثّفت قوات الشرطة المحلية ووحدات مراقبة الحدود استخدام اختبارات الكشف عن المخدرات عن طريق اللعاب والبول في نقاط التفتيش على الطرق وموانئ الدخول، مما يُمكّن من التعرّف السريع على الأشخاص الذين يعانون من إدمان المخدرات. وبالمثل، اعتمدت شركات النفط والغاز في المملكة العربية السعودية والإمارات العربية المتحدة الفحص الميداني امتثالاً لسياسات عدم التسامح مطلقاً مع المخدرات.

- يتضمن تطور أطقم اختبار نقاط الرعاية الآن تنسيقات كشف متعددة الألواح، تتيح إجراء اختبارات متزامنة للعديد من المواد شائعة الاستخدام، مما يزيد من كفاءة التشخيص وفعالية التكلفة. صُممت أجهزة من شركات مثل أبوت وسيكيورتك لتلبية الاحتياجات الإقليمية والمتطلبات التنظيمية، مع توفير تصاميم مدمجة مناسبة للاستخدام في الوحدات المتنقلة والمواقع النائية.

- بالإضافة إلى ذلك، يُسهّل الوعي المتزايد والدعم من سلطات الصحة العامة توافر اختبارات الكشف السريع عن المخدرات وقبولها على نطاق أوسع، حتى في البيئات ذات الموارد المحدودة. تُشجّع الحملات التي تستهدف المدارس والمراكز المجتمعية في دول مثل كينيا ونيجيريا على الفحص المبكر والتوعية.

- إن التحرك نحو النتائج في الوقت الفعلي والاتصال الرقمي في بعض الأجهزة الأحدث يدعم أيضًا الإبلاغ المركزي عن البيانات والتكامل مع السجلات الطبية الإلكترونية، والتي يمكن أن تكون ذات قيمة لمراقبة الصحة العامة وتتبع إعادة التأهيل

- إن هذا التحول المستمر نحو أدوات الاختبار السريعة والدقيقة والقابلة للنشر الميداني يعيد تعريف استراتيجيات مكافحة تعاطي المخدرات في جميع أنحاء المنطقة، مما يدفع الابتكار في تطوير المنتجات ويعزز التبني في كل من القطاعين العام والخاص.

ديناميكيات سوق اختبار تعاطي المخدرات في نقطة الرعاية (POC) في الشرق الأوسط وأفريقيا

سائق

تصاعد تعاطي المخدرات وبرامج الفحص المدعومة من الحكومة

- إن الارتفاع المثير للقلق في تعاطي المخدرات، وخاصة بين الشباب والفئات المهنية عالية الخطورة، هو المحرك الرئيسي الذي يغذي الطلب على اختبارات تعاطي المخدرات في نقطة الرعاية في جميع أنحاء الشرق الأوسط وأفريقيا.

- على سبيل المثال، في أبريل 2024، وسّعت وزارة الداخلية السعودية برنامجها المتنقل لفحص المخدرات بالتعاون مع وزارة الصحة لتكثيف الفحوصات في المدارس ومراكز النقل العام. وبالمثل، تعاونت وزارة الصحة في جنوب أفريقيا مع عيادات لتقديم فحص مجاني للمخدرات في مراكز الرعاية الأولية، كجزء من استراتيجيتها الأوسع للحد من الضرر.

- توفر أجهزة POC نتائج سريعة وهي مناسبة تمامًا لبيئات الاختبار عن بُعد وعالية الحجم، بما يتماشى مع أولويات الحكومة لتقليل معدلات الاعتماد وضمان الإحالات في الوقت المناسب للعلاج

- بفضل الدعم المقدم من منظمات مثل الاتحاد الأفريقي ومكتب الأمم المتحدة المعني بالمخدرات والجريمة، تمكنت العديد من البلدان من تأمين التمويل اللازم لتجهيز العيادات المحلية ووكالات الحدود بمجموعات اختبار حديثة، وخاصة في المناطق المحرومة.

- إن تزايد إمكانية الوصول إلى الأجهزة المدمجة وسهلة الاستخدام، إلى جانب الوعي المتزايد بالأضرار المرتبطة بالمخدرات، يتيح التدخل المبكر والوقاية، وبالتالي تعزيز توسع السوق في كل من المناطق الحضرية والريفية.

ضبط النفس/التحدي

قيود التكلفة والتناقضات التنظيمية

- من التحديات الرئيسية التي تواجه السوق ارتفاع تكلفة أدوات التشخيص المستوردة وتباين اللوائح التنظيمية في مختلف دول المنطقة. تعاني العديد من المناطق ذات الدخل المنخفض من محدودية ميزانيات الرعاية الصحية، مما يعيق اعتماد اختبارات الكشف عن المخدرات التجارية على نطاق واسع.

- على سبيل المثال، لا تزال بعض المرافق العامة في نيجيريا وإثيوبيا تعتمد على طرق الاختبار القديمة أو التي تتطلب جهدًا يدويًا مكثفًا بسبب التكلفة الأعلى لكل وحدة من مجموعات الاختبار السريع ونقص إجراءات الشراء الموحدة.

- وعلاوة على ذلك، فإن الأطر التنظيمية غير المتسقة وغياب سياسات موحدة لاختبار المخدرات عبر الحدود تعيق التنفيذ على نطاق واسع، وخاصة في مناطق النقل عبر الحدود والتجارة الدولية.

- للتغلب على هذه العوائق، ثمة حاجة متزايدة إلى التصنيع المحلي، وتوحيد المعايير التنظيمية، وشراكات بين القطاعين العام والخاص لدعم تكاليف الاختبار. وتتعاون شركات التصنيع العالمية، مثل أبوت وروتش، بشكل متزايد مع الموزعين الإقليميين لتحسين القدرة على تحمل التكاليف وموثوقية سلسلة التوريد.

- سيكون بناء البنية التحتية المستدامة والفعالة من حيث التكلفة للاختبار وتدريب العاملين في مجال الرعاية الصحية في المناطق الريفية أمرًا بالغ الأهمية لتوسيع نطاق هذه التشخيصات المنقذة للحياة وضمان الوصول العادل في جميع أنحاء الشرق الأوسط وأفريقيا.

نطاق سوق اختبار تعاطي المخدرات في نقطة الرعاية (POC) في الشرق الأوسط وأفريقيا

يتم تقسيم السوق على أساس نوع الدواء، والمنتجات، ونوع الوصفة الطبية، ونوع العينة، ونوع الاختبار، والتطبيق، والمستخدم النهائي، وقناة التوزيع.

- حسب نوع الدواء

بناءً على نوع المخدر، يُقسّم سوق اختبارات تعاطي المخدرات في نقطة الرعاية (POC) في الشرق الأوسط وأفريقيا إلى الأمفيتامينات، والأفيونيات، والقنّبيات، والكوكايين، والباربيتورات، والبنزوديازيبينات، والميثادون، والفينسيكليدين، ومضادات الاكتئاب ثلاثية الحلقات، وغيرها. هيمن قطاع القنبيات على السوق محققًا أكبر حصة من إيرادات السوق بنسبة 28.3% في عام 2024، مدفوعًا بانتشار تعاطي القنب على نطاق واسع، وخاصة بين الشباب والمناطق الحضرية. ولا يزال اختبار القنبيات هو الأكثر استخدامًا نظرًا لأولويته التنظيمية وسهولة الكشف عنه في مختلف أنواع العينات.

من المتوقع أن يشهد قطاع الأمفيتامينات أسرع معدل نمو بنسبة 9.6% بين عامي 2025 و2032، مدفوعًا بتزايد إساءة استخدام المنشطات وتزايد اعتماد الفحص في المؤسسات التعليمية وأماكن العمل. ويساهم تزايد الوعي بالمخاطر الصحية المرتبطة بالأمفيتامينات في زيادة الطلب على حلول الكشف المبكر والمتكرر والمحمولة.

- حسب المنتجات

بناءً على المنتجات، يُقسّم سوق اختبار تعاطي المخدرات في نقاط الرعاية الصحية (POC) في الشرق الأوسط وأفريقيا إلى أجهزة ومواد استهلاكية وملحقات. وقد هيمن قطاع الأجهزة على السوق محققًا أكبر حصة من إيرادات السوق بنسبة 57.4% في عام 2024، مدفوعًا بالاستخدام المتزايد لأجهزة التحليل المحمولة ومجموعات الاختبار متعددة الألواح في بيئات عالية الإنتاجية مثل المستشفيات ونقاط التفتيش الحدودية والمؤسسات الإصلاحية. وتدعم قدرتها على توفير نتائج فورية في الموقع اتخاذ القرارات في الوقت الفعلي.

من المتوقع أن يشهد قطاع المواد الاستهلاكية والملحقات أسرع معدل نمو بنسبة 10.2% بين عامي 2025 و2032، مدفوعًا بالطلب المتكرر على شرائط الاختبار، وحاويات العينات، ومحاليل العازلة، وأدوات المعايرة. ويواصل تزايد وتيرة إجراء الاختبارات في البرامج الخاصة والحكومية تعزيز الطلب على هذه اللوازم المتكررة.

- حسب الوصفة الطبية

بناءً على الوصفات الطبية، يُقسّم سوق اختبارات تعاطي المخدرات في نقطة الرعاية الصحية (POC) في الشرق الأوسط وأفريقيا إلى اختبارات تُصرف بدون وصفة طبية واختبارات تعتمد على الوصفات الطبية. وقد هيمن قطاع الاختبارات المعتمدة على الوصفات الطبية على السوق محققًا أكبر حصة من إيرادات السوق بنسبة 64.1% في عام 2024، مدعومًا باستخدامه الواسع النطاق في البيئات الطبية الرسمية، والتحقيقات القانونية، وبرامج الامتثال في أماكن العمل، حيث تُعدّ الدقة والتوثيق وسلسلة الحراسة أمرًا بالغ الأهمية.

ومن المتوقع أن يشهد قطاع الاختبارات التي لا تستلزم وصفة طبية أسرع معدل نمو بنسبة 11.3% في الفترة من 2025 إلى 2032، مدفوعًا باتجاهات الاختبار الذاتي المتزايدة بين الآباء والأفراد، وزيادة توافر المنتج في الصيدليات وتجار التجزئة عبر الإنترنت.

- حسب نوع العينة

بناءً على نوع العينة، يُقسّم سوق اختبارات تعاطي المخدرات في نقطة الرعاية (POC) في الشرق الأوسط وأفريقيا إلى عينات البول، واللعاب، والدم، والشعر، والنَفَس، وغيرها. وقد هيمن قطاع البول على السوق محققًا أكبر حصة من إيرادات السوق بنسبة 47.1% في عام 2024، بفضل فعاليته من حيث التكلفة، وسهولة جمع العينات، وقدرته على الكشف عن مجموعة واسعة من المواد على مدى فترات كشف أطول. وتُستخدم اختبارات البول بشكل شائع في أماكن العمل والعيادات في جميع أنحاء المنطقة.

ومن المتوقع أن يشهد قطاع اللعاب أسرع معدل نمو بنسبة 10.7% في الفترة من 2025 إلى 2032، مدفوعًا بملاءمته للاختبارات السريعة على الطرق والميدانية من قبل جهات إنفاذ القانون وتبنيه المتزايد في برامج الصحة المهنية.

- حسب نوع الاختبار

بناءً على نوع الاختبار، يُقسّم سوق اختبارات تعاطي المخدرات في نقطة الرعاية (POC) في الشرق الأوسط وأفريقيا إلى اختبارات عشوائية، واختبارات ما بعد الحادث، واختبارات الامتناع. وقد هيمن قطاع الاختبارات العشوائية على السوق محققًا أكبر حصة من إيرادات السوق بنسبة 38.5% في عام 2024، بفضل استخدامه في بيئات إنفاذ القانون والشركات وإعادة التأهيل كاستراتيجية ردع وأداة مراقبة.

ومن المتوقع أن يشهد قطاع الاختبارات بعد الحوادث أسرع معدل نمو بنسبة 9.8% من عام 2025 إلى عام 2032، وذلك بسبب المتطلبات التنظيمية المتزايدة للاختبار بعد الحوادث في مكان العمل أو التحقيقات الجنائية لتحديد المسؤولية أو الضرر.

- حسب الطلب

بناءً على التطبيق، يُقسّم سوق فحص تعاطي المخدرات في نقطة الرعاية (POC) في الشرق الأوسط وأفريقيا إلى الفحص الطبي، وفحص أماكن العمل، وإنفاذ القانون والعدالة الجنائية، وإدارة الألم، وعلاج وإعادة تأهيل تعاطي المخدرات، وفحص المخدرات للوالدين أو في المنزل، وفحوصات الرياضة وألعاب القوى، وفحص المخدرات في المدارس والمؤسسات التعليمية، وغيرها. هيمن قطاع إنفاذ القانون والعدالة الجنائية على السوق محققًا أكبر حصة من إيرادات السوق بنسبة 30.2% في عام 2024، مدفوعًا بالتوجيهات الحكومية والجهود المتزايدة للحد من الجرائم المتعلقة بالمخدرات في المملكة العربية السعودية وجنوب أفريقيا والإمارات العربية المتحدة.

من المتوقع أن يشهد قطاع اختبارات المخدرات للوالدين أو في المنزل أسرع معدل نمو بنسبة 11.5٪ من عام 2025 إلى عام 2032، مدفوعًا بزيادة الوعي العام، وسهولة الوصول إلى مجموعات الأدوية التي لا تستلزم وصفة طبية، والمخاوف المتزايدة بشأن تعاطي المخدرات بين المراهقين.

- حسب المستخدم النهائي

بناءً على المستخدم النهائي، يُقسّم سوق اختبارات تعاطي المخدرات في نقاط الرعاية الصحية (POC) في الشرق الأوسط وأفريقيا إلى مرافق الرعاية الصحية، وأصحاب العمل، والمؤسسات الحكومية، وغيرها. وقد هيمن قطاع المؤسسات الحكومية على السوق محققًا أكبر حصة من إيرادات السوق بنسبة 41.6% في عام 2024، مدعومًا بمبادرات واسعة النطاق لمكافحة المخدرات، وجهود مراقبة الحدود، وفحوصات العدالة الجنائية التي تمولها السلطات الوطنية والمحلية.

ومن المتوقع أن يشهد قطاع أصحاب العمل أسرع معدل نمو بنسبة 10.9% في الفترة من 2025 إلى 2032، مدفوعًا بالتطبيق المتزايد لسياسات مكافحة المخدرات في مكان العمل في الصناعات مثل البناء والنقل والتعدين، وخاصة في دول مجلس التعاون الخليجي.

- حسب قناة التوزيع

بناءً على قنوات التوزيع، يُقسّم سوق فحص تعاطي المخدرات في نقطة الرعاية الصحية (POC) في الشرق الأوسط وأفريقيا إلى مناقصة مباشرة، ومبيعات التجزئة، وغيرها. وقد هيمن قطاع المناقصة المباشرة على السوق محققًا أكبر حصة من إيرادات السوق بنسبة 53.9% في عام 2024، مدفوعًا بعمليات شراء ضخمة من وزارات الصحة، والهيئات العسكرية، والمؤسسات الإصلاحية بموجب عقود حكومية.

ومن المتوقع أن يشهد قطاع مبيعات التجزئة أسرع معدل نمو بنسبة 12.1% في الفترة من 2025 إلى 2032، مع ارتفاع الطلب على أدوات الاختبار الذاتي من خلال الصيدليات ومنصات التجارة الإلكترونية، مما يتيح إمكانية الوصول على نطاق أوسع للمستخدمين الأفراد والعائلات.

تحليل إقليمي لسوق اختبارات تعاطي المخدرات في نقطة الرعاية (POC) في الشرق الأوسط وأفريقيا

- سيطرت المملكة العربية السعودية على سوق اختبارات تعاطي المخدرات في نقطة الرعاية في الشرق الأوسط وأفريقيا بأكبر حصة إيرادات بلغت 33.1٪ في عام 2024، ويعزى ذلك إلى زيادة الإنفاق الحكومي على برامج مكافحة المخدرات، واختبارات المخدرات المتكررة على جانب الطريق، والفحوصات الإلزامية في مكان العمل في القطاعات الحساسة مثل النفط والغاز والطيران.

- تولي السلطات ومقدمو الرعاية الصحية في البلاد أولوية متزايدة لاختبارات المخدرات السريعة في الموقع كإجراء استباقي لمعالجة تعاطي المخدرات المتزايد وضمان السلامة العامة والامتثال للسياسات الوطنية الخالية من المخدرات.

- ويتم دعم هذا التبني الواسع النطاق من خلال تفويضات تنظيمية قوية، وزيادة الوعي العام، والاستثمارات في تقنيات التشخيص الحديثة، مما يضع المملكة العربية السعودية في مكانة رائدة إقليمية في تنفيذ اختبارات الأدوية في نقطة الرعاية في كل من المناطق الحضرية والنائية.

نظرة عامة على سوق اختبارات تعاطي المخدرات في المملكة العربية السعودية

استحوذ سوق فحص تعاطي المخدرات في نقاط الرعاية الصحية في المملكة العربية السعودية على أكبر حصة من الإيرادات بنسبة 33.1% في منطقة الشرق الأوسط وأفريقيا في عام 2024، مدعومًا بتشريعات صارمة لمكافحة المخدرات وتطبيق واسع النطاق لوحدات الفحص المتنقلة. ويساهم الدور الاستباقي للحكومة في نشر الفحوصات في المدارس، ونقاط التفتيش المرورية، والقطاعات عالية المخاطر مثل الطاقة والطيران في تسريع اعتمادها. بالإضافة إلى ذلك، تُعزز الشراكات مع شركات التشخيص العالمية وهيئات الصحة العامة البنية التحتية للفحص وإمكانية الوصول إليه في جميع أنحاء المملكة، مما يضع المملكة العربية السعودية كنموذج إقليمي رائد في جهود فحص المخدرات.

نظرة عامة على سوق اختبارات تعاطي المخدرات في جنوب أفريقيا

من المتوقع أن يشهد سوق اختبارات تعاطي المخدرات في مراكز الرعاية الصحية (POC) في جنوب أفريقيا نموًا ملحوظًا بمعدل نمو سنوي مركب خلال فترة التوقعات، مدفوعًا بارتفاع معدل انتشار تعاطي المخدرات، وجهود قطاع الرعاية الصحية الحثيثة لتطبيق الكشف المبكر. تدعم برامج الحد من الضرر التي تقودها الحكومة والمنظمات غير الحكومية الاختبارات المجتمعية، بينما تدمج العيادات الخاصة وأصحاب العمل بشكل متزايد تشخيصات مراكز الرعاية الصحية في بروتوكولات الفحص. كما أن ازدياد التصنيع والتوزيع المحلي لمجموعات الاختبار يُحسّن من القدرة على تحمل التكاليف وتوافرها، مما يجعل جنوب أفريقيا واحدة من أسرع الأسواق نموًا في المنطقة.

نظرة عامة على سوق اختبارات تعاطي المخدرات في الإمارات العربية المتحدة

من المتوقع أن يشهد سوق اختبارات تعاطي المخدرات في نقاط الرعاية الصحية (POC) في دولة الإمارات العربية المتحدة نموًا ملحوظًا بمعدل نمو سنوي مركب، مدفوعًا بلوائح صارمة لمكافحة المخدرات، وثقافة امتثال مؤسسية راسخة، واستثمارات متزايدة في الرعاية الصحية. ويعزز التزام الدولة بسلامة أماكن العمل، لا سيما في قطاعات الخدمات اللوجستية والطيران والبناء، انتشار استخدام مجموعات اختبار المخدرات المحمولة على نطاق واسع. كما أن حملات التوعية العامة المتنامية ودمج تشخيصات نقاط الرعاية الصحية في المرافق الطبية الحكومية والخاصة يعززان نمو السوق، لا سيما في دبي وأبوظبي.

نظرة عامة على سوق اختبارات تعاطي المخدرات في نيجيريا

من المتوقع أن يشهد سوق فحص تعاطي المخدرات في مراكز الرعاية الصحية في نيجيريا نموًا ملحوظًا بمعدل نمو سنوي مركب، مدفوعًا بتزايد القلق بشأن إدمان المخدرات بين الشباب وزيادة الطلب على حلول الفحص المتاحة. ورغم وجود تحديات في البنية التحتية، فإن الدعم المستمر من هيئات دولية، مثل مكتب الأمم المتحدة المعني بالمخدرات والجريمة ومنظمة الصحة العالمية، يُسهّل برامج التوعية ونشر التشخيص. وتعتمد مراكز الصحة المجتمعية ومرافق إعادة التأهيل أجهزة محمولة للكشف المبكر والتدخل، حيث تُسهم مبادرات الرعاية الصحية المتنقلة في توسيع نطاق الخدمات في المناطق الريفية المحرومة.

حصة سوق اختبار تعاطي المخدرات في نقطة الرعاية (POC) في الشرق الأوسط وأفريقيا

إن صناعة اختبار تعاطي المخدرات في نقطة الرعاية (POC) في منطقة الشرق الأوسط وأفريقيا يقودها في المقام الأول شركات راسخة، بما في ذلك:

- أبوت (الولايات المتحدة)

- شركة ثيرمو فيشر العلمية (الولايات المتحدة)

- شركة إف. هوفمان-لا روش المحدودة (سويسرا)

- شركة سيمنز هيلثينيرز إيه جي (ألمانيا)

- مختبرات بيو-راد، المحدودة (الولايات المتحدة)

- Drägerwerk AG & Co. KGaA (ألمانيا)

- شركة ألفا للتصاميم العلمية (الولايات المتحدة)

- شركة أوراشور للتكنولوجيا (الولايات المتحدة)

- Securetec Detektions-Systeme AG (ألمانيا)

- شركة إم بي بيوميديكالز، ذ.م.م (الولايات المتحدة)

- شركة داناهر (الولايات المتحدة)

- مختبرات راندوكس المحدودة (المملكة المتحدة)

- مجموعة أوميجا للتشخيصات PLC (المملكة المتحدة)

- شركة تي آند دي للتشخيصات الكندية (كندا)

- شركة نوفا الطبية الحيوية (الولايات المتحدة)

- شركة لايفلوك تكنولوجيز (الولايات المتحدة)

- شركة بيوشور (المملكة المتحدة) المحدودة (المملكة المتحدة)

- شركة بريميير بيوتيك (الولايات المتحدة)

- شركة ألكولايزر تكنولوجي المحدودة (أستراليا)

- شركة نيوجين (الولايات المتحدة)

ما هي التطورات الأخيرة في سوق اختبار تعاطي المخدرات في نقطة الرعاية (POC) في الشرق الأوسط وأفريقيا؟

- في يونيو 2024، أبرمت وزارة الصحة السعودية شراكة مع مقدمي الرعاية الصحية من القطاع الخاص لتطبيق مجموعات فحص المخدرات السريع في مراكز الطوارئ والإصابات في المدن الرئيسية، بما في ذلك الرياض وجدة. تهدف هذه المبادرة إلى تعزيز الكشف المبكر والاستجابة لحالات تعاطي المخدرات، لا سيما تلك المتعلقة بالأمفيتامينات والأفيونيات، التي تشهد انتشارًا متزايدًا. يعكس هذا النشر استثمار الحكومة المتزايد في التشخيص السريع، ويؤكد التزامها بالحد من إساءة استخدام المخدرات من خلال التقنيات السريرية الحديثة.

- في أبريل 2024، أعلن المجلس الوطني لتعاطي المخدرات في جنوب أفريقيا عن إطلاق تجريبي لوحدات فحص مخدرات متنقلة في نقاط الرعاية، تستهدف المناطق الريفية والمحرومة. هذه العيادات المتنقلة مجهزة باختبارات سريعة قائمة على المقايسة المناعية للكشف عن القنب والميثامفيتامين والأفيونيات. تمثل هذه الخطوة خطوة مهمة نحو زيادة إمكانية الوصول والتواصل المجتمعي في مجال الكشف عن المخدرات والوقاية منها، مما يسلط الضوء على جهود البلاد الرامية إلى لامركزية تشخيص تعاطي المخدرات وتحسين نتائج الصحة العامة.

- في مارس 2024، وسعت مختبرات أبوت نطاق توزيع جهاز تحليل الدم المحمول i-STAT Alinity ليشمل العديد من دول مجلس التعاون الخليجي، بما في ذلك الإمارات العربية المتحدة والكويت. صُمم الجهاز لتقييم سمية الأدوية بسرعة، ويجري دمجه حاليًا في أنظمة الاستجابة للطوارئ وبرامج الفحص في أماكن العمل. ويؤكد هذا التوسع على الطلب المتزايد على تقنيات فحص الأدوية المحمولة والفورية في منطقة الشرق الأوسط.

- في فبراير 2024، أعلنت مختبرات راندوكس عن تعاونها مع مؤسسات الطب الشرعي الإقليمية في مصر لتوفير منصات متعددة لاختبار المخدرات في نقاط الرعاية. توفر هذه المنصات كشفًا متزامنًا لفئات متعددة من المخدرات، وهي مصممة للاستخدام القضائي وإنفاذ القانون. تؤكد هذه الشراكة على الاعتماد المتزايد على أدوات التشخيص المتقدمة في البيئات القانونية والإصلاحية، مما يعزز مكانة راندوكس في مجال اختبار المخدرات في منطقة الشرق الأوسط وأفريقيا.

- في يناير 2024، أطلقت مجموعة أوميغا للتشخيصات نسخةً محليةً من لوحات الاختبار السريع للكشف عن تعاطي المخدرات (DOA) للسوق الأفريقية، بدعمٍ من المغرب. صُممت مجموعات الاختبار هذه، الحاصلة على علامة CE، بأسعارٍ معقولة وسهولةٍ في الاستخدام، وتستهدف الاستخدام المكثف في مراكز الصحة العامة وعيادات علاج الإدمان. تتماشى هذه المبادرة مع الجهود الإقليمية المتنامية لتوسيع نطاق حلول التشخيص الفعالة من حيث التكلفة في ظل تزايد الأعباء الصحية المرتبطة بالمخدرات.

SKU-

احصل على إمكانية الوصول عبر الإنترنت إلى التقرير الخاص بأول سحابة استخبارات سوقية في العالم

- لوحة معلومات تحليل البيانات التفاعلية

- لوحة معلومات تحليل الشركة للفرص ذات إمكانات النمو العالية

- إمكانية وصول محلل الأبحاث للتخصيص والاستعلامات

- تحليل المنافسين باستخدام لوحة معلومات تفاعلية

- آخر الأخبار والتحديثات وتحليل الاتجاهات

- استغل قوة تحليل المعايير لتتبع المنافسين بشكل شامل

منهجية البحث

يتم جمع البيانات وتحليل سنة الأساس باستخدام وحدات جمع البيانات ذات أحجام العينات الكبيرة. تتضمن المرحلة الحصول على معلومات السوق أو البيانات ذات الصلة من خلال مصادر واستراتيجيات مختلفة. تتضمن فحص وتخطيط جميع البيانات المكتسبة من الماضي مسبقًا. كما تتضمن فحص التناقضات في المعلومات التي شوهدت عبر مصادر المعلومات المختلفة. يتم تحليل بيانات السوق وتقديرها باستخدام نماذج إحصائية ومتماسكة للسوق. كما أن تحليل حصة السوق وتحليل الاتجاهات الرئيسية هي عوامل النجاح الرئيسية في تقرير السوق. لمعرفة المزيد، يرجى طلب مكالمة محلل أو إرسال استفسارك.

منهجية البحث الرئيسية التي يستخدمها فريق بحث DBMR هي التثليث البيانات والتي تتضمن استخراج البيانات وتحليل تأثير متغيرات البيانات على السوق والتحقق الأولي (من قبل خبراء الصناعة). تتضمن نماذج البيانات شبكة تحديد موقف البائعين، وتحليل خط زمني للسوق، ونظرة عامة على السوق ودليل، وشبكة تحديد موقف الشركة، وتحليل براءات الاختراع، وتحليل التسعير، وتحليل حصة الشركة في السوق، ومعايير القياس، وتحليل حصة البائعين على المستوى العالمي مقابل الإقليمي. لمعرفة المزيد عن منهجية البحث، أرسل استفسارًا للتحدث إلى خبراء الصناعة لدينا.

التخصيص متاح

تعد Data Bridge Market Research رائدة في مجال البحوث التكوينية المتقدمة. ونحن نفخر بخدمة عملائنا الحاليين والجدد بالبيانات والتحليلات التي تتطابق مع هدفهم. ويمكن تخصيص التقرير ليشمل تحليل اتجاه الأسعار للعلامات التجارية المستهدفة وفهم السوق في بلدان إضافية (اطلب قائمة البلدان)، وبيانات نتائج التجارب السريرية، ومراجعة الأدبيات، وتحليل السوق المجدد وقاعدة المنتج. ويمكن تحليل تحليل السوق للمنافسين المستهدفين من التحليل القائم على التكنولوجيا إلى استراتيجيات محفظة السوق. ويمكننا إضافة عدد كبير من المنافسين الذين تحتاج إلى بيانات عنهم بالتنسيق وأسلوب البيانات الذي تبحث عنه. ويمكن لفريق المحللين لدينا أيضًا تزويدك بالبيانات في ملفات Excel الخام أو جداول البيانات المحورية (كتاب الحقائق) أو مساعدتك في إنشاء عروض تقديمية من مجموعات البيانات المتوفرة في التقرير.