Middle East And Africa Phytogenic Feed Additives Market

حجم السوق بالمليار دولار أمريكي

CAGR :

%

USD

54.11 Million

USD

102.30 Million

2022

2030

USD

54.11 Million

USD

102.30 Million

2022

2030

| 2023 –2030 | |

| USD 54.11 Million | |

| USD 102.30 Million | |

|

|

|

|

سوق إضافات الأعلاف النباتية في الشرق الأوسط وأفريقيا، حسب النوع ( الزيوت الأساسية ، الفلافونويدات، الصابونين، الراتنجات الزيتية، العفص، وغيرها)، نوع العلف الحيواني (أعلاف الدواجن، أعلاف المجترات، أعلاف الأسماك، أعلاف الخنازير وغيرها)، المصادر (الأعشاب والتوابل)، الشكل (جاف وسائل)، الوظيفة (معززات الأداء، خصائص مضادة للميكروبات، معززات الطعم، معززات الهضم وغيرها) - اتجاهات الصناعة وتوقعاتها حتى عام 2030.

تحليل وحجم سوق إضافات الأعلاف النباتية في الشرق الأوسط وأفريقيا

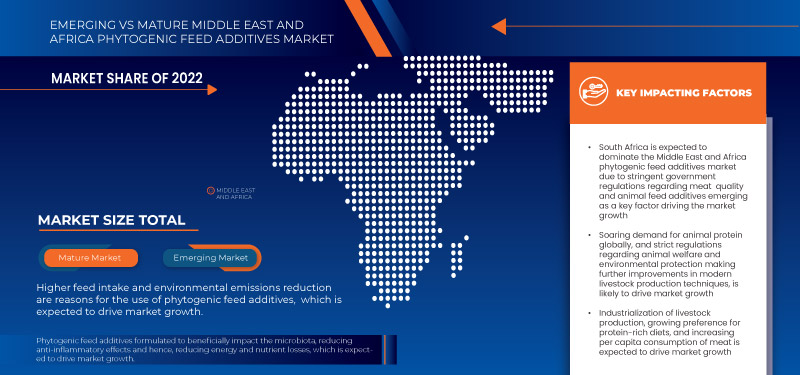

ومن المتوقع أن يؤدي الطلب المتزايد على إضافات الأعلاف الطبيعية، وزيادة استهلاك البروتين الحيواني، واللوائح الصارمة المفروضة على إضافات الأعلاف التي تحتوي على المضادات الحيوية، والقلق المتزايد بشأن رعاية الحيوان، إلى دفع نمو السوق. ومع ذلك، من المتوقع أن يؤدي توافر البدائل الراسخة لإضافات الأعلاف في السوق إلى كبح نمو السوق.

يقدم تقرير سوق إضافات الأعلاف النباتية في الشرق الأوسط وأفريقيا تفاصيل عن حصة السوق والتطورات الجديدة وتأثير اللاعبين المحليين والمحليين في السوق، ويحلل الفرص من حيث جيوب الإيرادات الناشئة والتغييرات في لوائح السوق وموافقات المنتجات والقرارات الاستراتيجية وإطلاق المنتجات والتوسعات الجغرافية والابتكارات التكنولوجية في السوق. لفهم التحليل وسيناريو السوق، اتصل بنا للحصول على موجز محلل. سيساعدك فريقنا في إنشاء حل يؤثر على الإيرادات لتحقيق هدفك المنشود.

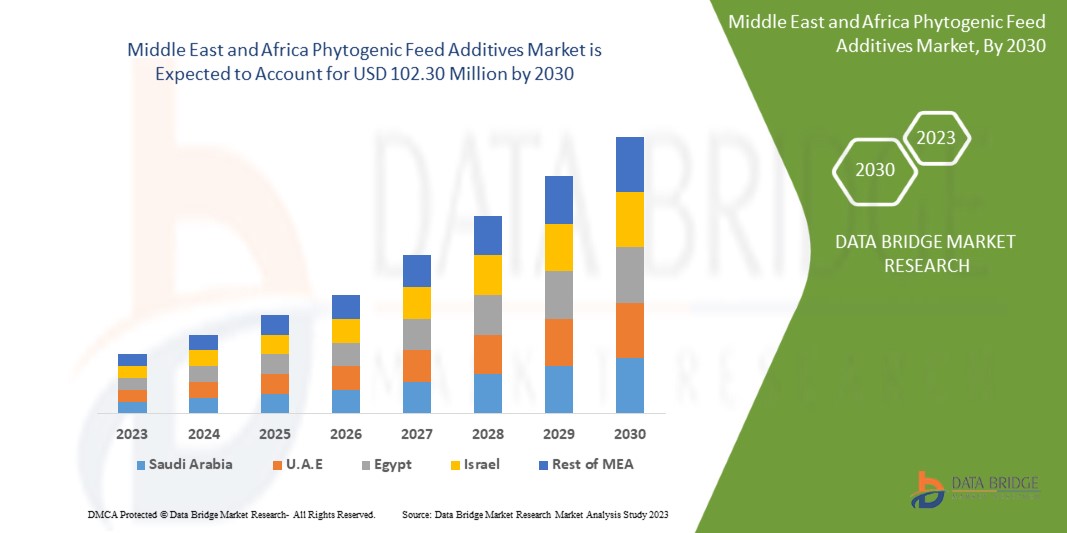

من المتوقع أن ينمو سوق إضافات الأعلاف النباتية في الشرق الأوسط وأفريقيا بشكل كبير في الفترة المتوقعة من 2023 إلى 2030. تحلل شركة Data Bridge Market Research أن السوق ينمو بمعدل نمو سنوي مركب بنسبة 8.4٪ في الفترة المتوقعة من 2023 إلى 2030 ومن المتوقع أن يصل إلى 102.30 مليون دولار أمريكي بحلول عام 2030 من 54.11 مليون دولار أمريكي في عام 2022.

|

تقرير القياس |

تفاصيل |

|

فترة التنبؤ |

2023 إلى 2030 |

|

سنة الأساس |

2022 |

|

سنة تاريخية |

2021 (قابلة للتخصيص حتى 2015 - 2020) |

|

وحدات كمية |

الإيرادات بالملايين من الدولارات الأمريكية |

|

القطاعات المغطاة |

النوع (الزيوت العطرية، الفلافونويدات، الصابونينات، الراتنجات الزيتية، العفص، وغيرها)، نوع العلف الحيواني (أعلاف الدواجن، أعلاف المجترات، أعلاف الأسماك، أعلاف الخنازير، وغيرها)، المصادر (الأعشاب والتوابل)، الشكل (جاف وسائل)، الوظيفة (معززات الأداء، الخواص المضادة للميكروبات، معززات الطعم، معززات الهضم، وغيرها) |

|

الدول المغطاة |

المملكة العربية السعودية، الإمارات العربية المتحدة، الكويت، عمان، قطر، جنوب أفريقيا، وبقية دول الشرق الأوسط وأفريقيا |

|

الجهات الفاعلة في السوق المشمولة |

Cargill, Incorporated.، وDSM، وKemin Industries, Inc.، وADM، وNutreco، وNatural Remedies.، وHimalaya Wellness Company، وVinayak Ingredients. India، وSilvateam Spa، وPhytobiotics Futterzusatzstoffe GmbH، وTegasa، وMIAVIT GMBH، وIndian Herbs، وCustomer DOSTOFARM GmbH، وBritish Horse Feeds، وOrffa، وIgusol، وGlamac International Private Limited.، وNor-Feed وغيرها |

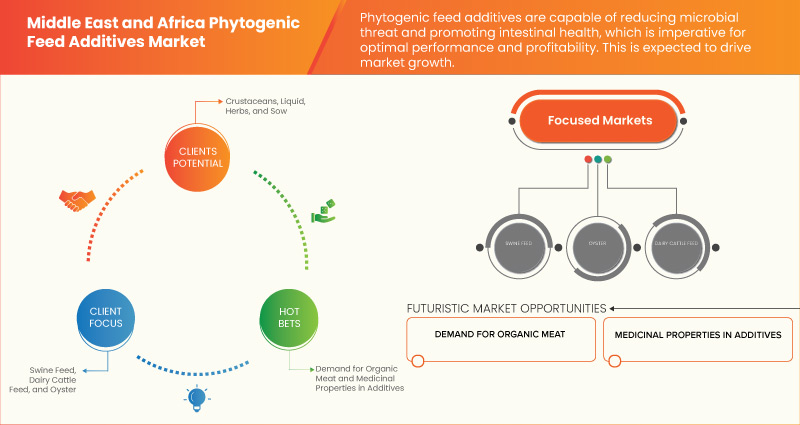

تعريف السوق

إضافات الأعلاف النباتية هي فئة من محفزات النمو العضوية المستخدمة كإضافات للأعلاف والتي يتم استخلاصها من الأعشاب أو التوابل أو غيرها من النباتات. مجموعة إضافات الأعلاف النباتية واسعة وتشمل الزيوت الأساسية وفئات المكونات النشطة مثل الصابونين والفلافونويدات والمخاط والعفص والمواد المرة واللاذعة. إضافات الأعلاف النباتية هي مواد من أصل نباتي تضاف إلى الأنظمة الغذائية للحيوانات بمستويات موصى بها لتعزيز نمو الحيوانات وتغذيتها.

ديناميكيات سوق إضافات الأعلاف النباتية في الشرق الأوسط وأفريقيا

يتناول هذا القسم فهم محركات السوق والمزايا والفرص والقيود والتحديات. وسيتم مناقشة كل هذا بالتفصيل أدناه:

السائقين

- قواعد صارمة بشأن المضادات الحيوية المضافة إلى الأعلاف

المضادات الحيوية هي فئة من المركبات العضوية أو شبه العضوية أو الاصطناعية ذات النشاط المضاد للميكروبات والتي تستخدم على نطاق واسع لعلاج الأمراض المعدية والوقاية منها لدى البشر والحيوانات. كما يمكن إضافتها إلى الأعلاف كمحفزات للنمو للمساعدة في نمو الحيوانات.

إن استخدام المضادات الحيوية في إنتاج الدواجن والماشية يعتبر مفيداً للمزارعين والاقتصاد ككل لأنه أدى بشكل عام إلى تحسين أداء الدواجن اقتصادياً وفعالاً. ومع ذلك، فإن الانتشار المحتمل للسلالات المقاومة للمضادات الحيوية من الكائنات المسببة للأمراض وغير المسببة للأمراض في البيئة وانتقالها اللاحق إلى البشر عبر سلسلة الغذاء قد يؤثر بشكل خطير على الصحة العامة. ويتم وضع التشريعات والقيود الأخرى على استخدام المضادات الحيوية في الحيوانات في المزارع في جميع أنحاء العالم بسبب هذه المخاوف الصحية.

على سبيل المثال،

- في نوفمبر/تشرين الثاني 2017، نشرت منظمة الصحة العالمية مقالاً يحذر من الإفراط في إعطاء المضادات الحيوية لتحفيز النمو ومنع المرض لدى الحيوانات السليمة. ومن خلال الحد من استخدامها بلا داعٍ لدى الحيوانات، تسعى توصيات منظمة الصحة العالمية الجديدة إلى الحفاظ على فعالية المضادات الحيوية التي تشكل أهمية بالغة لصحة الإنسان.

- وفقًا للمفوضية الأوروبية، تم استخدام المضادات الحيوية على نطاق واسع في تربية الماشية في جميع أنحاء العالم لعقود من الزمن. فهي تعزز أداء نمو الحيوانات في المزارع عندما تُضاف بجرعات صغيرة إلى أعلافها. ومع ذلك، قررت المفوضية التخلص التدريجي من تسويق المضادات الحيوية واستخدامها كمحفزات للنمو في الأعلاف وحظرها في نهاية المطاف بدءًا من عام 2006 بسبب ارتفاع مقاومة البكتيريا للمضادات الحيوية المستخدمة لعلاج الأمراض البشرية والحيوانية.

من غير المرجح أن يتم القضاء على المضادات الحيوية من الزراعة الحيوانية على الإطلاق لأن القيام بذلك من شأنه أن يضر بقطاع الثروة الحيوانية. من الأهمية بمكان البحث عن محفزات نمو طبيعية ومتاحة وبأسعار معقولة وفعالة لتحل محل محفزات النمو بالمضادات الحيوية (AGPs) في أنظمة الماشية الغذائية، وخاصة في المناطق التي يُحظر فيها استخدام المضادات الحيوية. ونتيجة لذلك، ومن أجل الاستدامة البيئية، وصحة الإنسان، وسلامة الغذاء، ركز الباحثون مؤخرًا بشكل أكبر على البدائل الطبيعية التي قد تحل محل استخدام المضادات الحيوية في إنتاج الماشية. وهذا يؤدي إلى بدائل فعالة تسمى إضافات الأعلاف الطبيعية، مثل إضافات الأعلاف النباتية. ومن المتوقع أن تدفع هذه العوامل نمو السوق.

فرصة

- ارتفاع الطلب على إضافات الأعلاف النباتية في تربية الأحياء المائية وأعلاف الحيوانات الأليفة

يشهد سوق تربية الأحياء المائية العضوية نموًا متصاعدًا نظرًا لأنه يميل إلى حماية صحة المستهلكين من خلال تقليل استخدام أي مواد كيميائية صناعية أو ضارة. يؤدي نمو تربية الأحياء المائية العضوية إلى زيادة مشاركة إضافات الأعلاف العضوية في تصنيع أعلاف تربية الأحياء المائية العضوية مثل إضافات الأعلاف النباتية. لذا، من المتوقع أن يؤدي زيادة تربية الأحياء المائية العضوية إلى خلق فرصة لنمو السوق.

على سبيل المثال،

- في أغسطس 2020، أطلقت شركة Delacon منتجًا باسم Syrena Boost. المنتج عبارة عن مزيج مسبق من الصابونين والتوابل والزيوت الأساسية، مما يوفر حلولاً نباتية كاملة لممارسات تربية الأحياء المائية الحديثة. تم تصميمه بطريقة يمكنها استهداف أداء الأمعاء والإنتاجية. يأتي في تغليف دقيق للحفاظ على استقراره الحراري والإطلاق المعوي التدريجي للمكونات الحساسة المعنية.

- في ديسمبر 2020، وفقًا لمجلة مصايد الأسماك الفلبينية، تم استخدام الأدوية للعلاج الكيميائي لتقليل الأمراض والوقاية منها وعلاجها في تربية الأحياء المائية. وبالتالي، فإن العلاج الكيميائي له بعض التأثيرات السلبية على صحة الأسماك والبشر. وبدلاً من ذلك، أظهرت الأعلاف النباتية نتائج استثنائية، مثل تحفيز الشهية وزيادة الوزن. بالإضافة إلى ذلك، يُقال إنها تعمل كمحفز للمناعة يرث خصائص مضادة للأمراض في الأسماك.

يؤدي استخدام إضافات الأعلاف النباتية في أعلاف الأحياء المائية إلى تحسين شهية الأسماك ويعمل كمحفز للنمو العضوي. بالإضافة إلى ذلك، يُقال إن خصائص المغذيات النباتية المضادة للميكروبات والفطريات تعمل على تحسين صحة الأسماك من خلال منع وعلاج العديد من الأمراض.

في الختام، فإن سوق تربية الأحياء المائية ينمو بسبب استهلاك الأسماك من قبل آكلي اللحوم والمشاركة في المكملات الطبية مثل زيوت الأسماك. نظرًا لأن تربية الأحياء المائية تميل الآن نحو الأساليب العضوية، فإن استهلاك الأعلاف العضوية يتزايد. ونظرًا لجميع الأسباب المذكورة أعلاه، فمن المتوقع أن يوفر استخدام إضافات الأعلاف النباتية في تربية الأحياء المائية فرصة لنمو السوق وجميع مصنعي إضافات الأعلاف النباتية.

ضبط النفس/التحدي

- توافر البدائل المعروفة لإضافات الأعلاف

تُستخدم إضافات الأعلاف النباتية في تربية الحيوانات لتعزيز المناعة والأداء والصحة العامة. ومع التأثيرات المعاكسة للمضادات الحيوية وزيادة الإنتاج، أدخلت إضافات الأعلاف النباتية مكونات مختلفة من الأعلاف والتعديلات المطلوبة في إدارة الحيوانات.

على الرغم من أن إضافات الأعلاف النباتية لها فوائد عديدة وتعزز أداء الحيوانات وصحتها، إلا أن إضافات الأعلاف الطبيعية الأخرى مثل البريبايوتكس والبروبيوتكس والإنزيمات والأحماض العضوية والأملاح والزيوت الأساسية والأعشاب البحرية يتم تسويقها. تصنع هذه الإضافات من مصادر عضوية، بما في ذلك المعادن والنباتات والميكروبات. يتم استخدامها في تغذية الحيوانات لتعزيز أداء الحيوانات وصحتها ورفاهيتها. بالإضافة إلى إضافات الأعلاف النباتية، قدمت العديد من شركات إضافات الأعلاف مؤخرًا منتجات جديدة لبعض إضافات الأعلاف الطبيعية.

على سبيل المثال،

- في نوفمبر 2022، وفقًا للمقال المنشور في Feed-lot Magazine Inc، فإن البريبايوتكس هي مواد موجودة في الطعام تحفز نمو أو نشاط البكتيريا والفطريات الجيدة. في الجهاز الهضمي، يمكن للبريبايوتكس تغيير تكوين البكتيريا في ميكروبيوم الأمعاء. يتم تصنيع البريبايوتكس الدقيق Amaferm من BioZyme, Inc. من منتج تخمير كامل من سلالة معينة من Aspergillus oryzae.

وبالتالي، تكتسب إضافات الأعلاف الطبيعية الأخرى أهمية متزايدة في مختلف أنحاء العالم. وتتمتع هذه الإضافات بفوائد متساوية تقريبًا مقارنة بإضافات الأعلاف النباتية، والتي من المتوقع أن تحد من نمو السوق.

تأثير ما بعد كوفيد-19 على سوق إضافات الأعلاف النباتية في الشرق الأوسط وأفريقيا

لقد أثرت حالة عدم اليقين الناجمة عن تفشي جائحة كوفيد-19 في العالم على الديناميكيات الكاملة لصناعات الشرق الأوسط وأفريقيا وغيّرتها، وكان لها تأثير سلبي على نمو سوق اقتصاد الشرق الأوسط وأفريقيا. ويمكن رؤية التأثيرات على شدة وفعالية جهود الاحتواء، والتغيرات السلوكية (مثل تجنب الشراء والاستثمار)، والتحولات في أنماط الإنفاق، وجهود الاحتواء لإمدادات الاضطرابات، والآثار اللاحقة للتشديد الدراماتيكي في السوق، وتقلب أسعار السلع الأساسية، وزيادة أعباء الديون. وبسبب كوفيد-19، واجهت جميع البلدان أزمة متعددة الطبقات تتألف من اضطرابات اقتصادية محلية، وانخفاض الطلب الخارجي، وانهيار الأسعار، وانهيار العرض والطلب على المنتجات.

التطورات الأخيرة

- في مارس 2023، أعلنت شركة Indian Herbs عن إطلاق منتج جديد باسم HEATBEAT للدواجن. هذا المنتج عبارة عن مزيج من فيتامين سي الطبيعي ومركب الكروم العضوي والنعناع. ساعد هذا الإطلاق الشركة في توسيع محفظة منتجاتها.

- في فبراير 2022، أعلنت شركة Orffa عن اتفاقية توزيع جديدة مع شركة Eigenmann & Veronelli، وهي شركة رائدة في توفير الحلول في صناعة المواد الكيميائية المتخصصة ومكونات الأغذية في رو (ميشيغان)، إيطاليا. ستساعد هذه الاتفاقية الشركة على الترويج لمنتجاتها في إيطاليا.

نطاق سوق إضافات الأعلاف النباتية في الشرق الأوسط وأفريقيا

يتم تقسيم سوق إضافات الأعلاف النباتية في الشرق الأوسط وأفريقيا إلى خمسة قطاعات بارزة بناءً على النوع ونوع العلف الحيواني والمصادر والشكل والوظيفة. سيساعدك النمو بين هذه القطاعات على تحليل قطاعات النمو الرئيسية في الصناعات وتزويد المستخدمين بنظرة عامة قيمة على السوق ورؤى السوق لاتخاذ قرارات استراتيجية لتحديد تطبيقات السوق الأساسية.

يكتب

- الزيوت العطرية

- الفلافونويدات

- الصابونين

- الراتنجات الزيتية

- العفص

- آحرون

على أساس النوع، يتم تقسيم السوق إلى الزيوت الأساسية، والفلافونويدات، والسابونين، والراتنجات الزيتية، والعفص، وغيرها.

نوع من الأعلاف الحيوانية

- أعلاف الدواجن

- تغذية المجترات

- تغذية مائية

- علف الخنازير

- آحرون

على أساس نوع العلف الحيواني، يتم تقسيم السوق إلى علف الدواجن، علف المجترات، علف الأسماك، علف الخنازير، وغيرها.

مصادر

- أعشاب

- التوابل

على أساس المصادر، يتم تقسيم السوق إلى الأعشاب والتوابل.

استمارة

- جاف

- سائل

على أساس الشكل، يتم تقسيم السوق إلى جاف وسائل.

وظيفة

- معززات الأداء

- خصائص مضادة للميكروبات

- معززات الطعم

- معززات الهضم

- آحرون

على أساس الوظيفة، يتم تقسيم السوق إلى معززات الأداء، وخصائص مضادة للميكروبات، ومعززات الطعم، ومعززات الهضم، وغيرها.

تحليل/رؤى إقليمية لسوق إضافات الأعلاف النباتية في الشرق الأوسط وأفريقيا

يتم تقسيم سوق إضافات الأعلاف النباتية في الشرق الأوسط وأفريقيا إلى خمسة قطاعات بارزة بناءً على النوع ونوع العلف الحيواني والمصادر والشكل والوظيفة.

الدول التي يغطيها تقرير السوق هذا هي المملكة العربية السعودية والإمارات العربية المتحدة والكويت وعمان وقطر وجنوب أفريقيا وبقية دول الشرق الأوسط وأفريقيا.

من المتوقع أن تهيمن جنوب أفريقيا على سوق إضافات الأعلاف النباتية في الشرق الأوسط وأفريقيا بسبب زيادة الدخل الشخصي المتاح.

كما يوفر قسم الدولة في التقرير عوامل فردية مؤثرة على السوق والتغيرات في تنظيم السوق التي تؤثر على الاتجاهات الحالية والمستقبلية للسوق. وتشير البيانات إلى تحليل سلسلة القيمة المصب والمصب، والاتجاهات الفنية، وتحليل قوى بورتر الخمس، ودراسات الحالة، وهي بعض المؤشرات المستخدمة للتنبؤ بسيناريو السوق للدول الفردية. كما يتم النظر في وجود وتوافر العلامات التجارية الإقليمية والتحديات التي تواجهها بسبب المنافسة الكبيرة أو النادرة من العلامات التجارية المحلية والمحلية، وتأثير التعريفات الجمركية المحلية، وطرق التجارة أثناء تقديم تحليل تنبؤي لبيانات الدولة.

تحليل المشهد التنافسي وحصة سوق إضافات الأعلاف النباتية في الشرق الأوسط وأفريقيا

يقدم المشهد التنافسي لسوق إضافات الأعلاف النباتية في الشرق الأوسط وأفريقيا تفاصيل عن المنافسين. تتضمن التفاصيل نظرة عامة على الشركة، والبيانات المالية للشركة، والإيرادات المتولدة، وإمكانات السوق، والاستثمار في البحث والتطوير، ومبادرات السوق الجديدة، ومواقع الإنتاج والمرافق، ونقاط القوة والضعف في الشركة، وإطلاق المنتج، وخطوط أنابيب تجارب المنتجات، وموافقات المنتجات، وبراءات الاختراع، وعرض المنتج ونطاقه، وهيمنة التطبيق، ومنحنى شريان الحياة التكنولوجي. ترتبط نقاط البيانات المذكورة أعلاه فقط بتركيز الشركات فيما يتعلق بالسوق.

بعض اللاعبين الرئيسيين في السوق الذين يعملون في سوق إضافات الأعلاف النباتية في الشرق الأوسط وأفريقيا هم Cargill, Incorporated.، وDSM، وKemin Industries, Inc.، وADM، وNutreco، وNatural Remedies.، وHimalaya Wellness Company، وVinayak Ingredients. India، وSilvateam Spa، وPhytobiotics Futterzusatzstoffe GmbH، وTegasa، وMIAVIT GMBH، وIndian Herbs، وCustomer DOSTOFARM GmbH، وBritish Horse Feeds، وOrffa، وIgusol، وGlamac International Private Limited.، وNor-Feed وغيرها.

SKU-

احصل على إمكانية الوصول عبر الإنترنت إلى التقرير الخاص بأول سحابة استخبارات سوقية في العالم

- لوحة معلومات تحليل البيانات التفاعلية

- لوحة معلومات تحليل الشركة للفرص ذات إمكانات النمو العالية

- إمكانية وصول محلل الأبحاث للتخصيص والاستعلامات

- تحليل المنافسين باستخدام لوحة معلومات تفاعلية

- آخر الأخبار والتحديثات وتحليل الاتجاهات

- استغل قوة تحليل المعايير لتتبع المنافسين بشكل شامل

Table of Content

1 INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 OVERVIEW OF THE MIDDLE EAST & AFRICA PHYTOGENIC FEED ADDITIVES MARKET

1.4 LIMITATIONS

1.5 MARKETS COVERED

2 MARKET SEGMENTATION

2.1 MARKETS COVERED

2.2 GEOGRAPHICAL SCOPE

2.3 YEARS CONSIDERED FOR THE STUDY

2.4 CURRENCY AND PRICING

2.5 DBMR TRIPOD DATA VALIDATION MODEL

2.6 MULTIVARIATE MODELLING

2.7 TREATMENT LIFELINE CURVE

2.8 PRIMARY INTERVIEWS WITH KEY OPINION LEADERS

2.9 DBMR MARKET POSITION GRID

2.1 SECONDARY SOURCES

2.11 ASSUMPTIONS

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

4.1 FACTORS INFLUENCING PURCHASE DECISION

4.1.1 PRODUCT PRICING

4.1.2 INGREDIENTS

4.1.3 AUTHENTICITY OF PRODUCT

4.2 GROWTH STRATEGIES ADOPTED BY KEY MARKET PLAYERS

4.3 INDUSTRY TRENDS AND FUTURE PERSPECTIVE

4.3.1 GROWING DEMAND FOR NATURAL ADDITIVES

4.3.2 MANUFACTURERS OFFERING CERTIFIED FEED SUPPLEMENTS

4.3.3 BUSINESS EXPANSIONS THROUGH DIFFERENT STRATEGIC DECISIONS

4.4 FUTURE PERSPECTIVE

4.5 PORTER’S FIVE FORCES ANALYSIS FOR THE MIDDLE EAST & AFRICA PHYTOGENIC FEED ADDITIVES MARKET

4.6 SUPPLY CHAIN ANALYSIS

4.6.1 RAW MATERIAL PROCUREMENT & MANUFACTURING

4.6.2 DISTRIBUTION

4.6.3 END USERS

4.7 TECHNOLOGICAL ADVANCEMENT

4.8 VALUE CHAIN ANALYSIS: MIDDLE EAST & AFRICA PHYTOGENIC FEED ADDITIVES MARKET

5 PRICING INDEX

6 PRODUCTION CAPACITY OF KEY MANUFACTURERS

7 REGULATORY FRAMEWORK AND GUIDELINES

8 IMPACT OF ECONOMIC SLOWDOWN ON THE MARKET

8.1 IMPACT ON PRICE

8.2 IMPACT ON SUPPLY CHAIN

8.3 IMPACT ON SHIPMENT

8.4 IMPACT ON COMPANY'S STRATEGIC DECISIONS

9 BRAND OUTLOOK

10 MARKET OVERVIEW

10.1 DRIVERS

10.1.1 SURGING DEMAND FOR NATURAL FEED ADDITIVES

10.1.2 INCREASE IN THE CONSUMPTION OF ANIMAL PROTEIN

10.1.3 STRINGENT REGULATIONS ON ANTIBIOTIC FEED ADDITIVES

10.1.4 ESCALATING CONCERN REGARDING ANIMAL WEALTH

10.2 RESTRAINTS

10.2.1 AVAILABILITY OF ESTABLISHED ALTERNATIVES FOR FEED ADDITIVES

10.2.2 HIGHER-END PRODUCT PRICES CAUSE LOW-PROFIT MARGIN

10.2.3 LIMITED R&D IN PHYTOGENIC FEED ADDITIVES

10.3 OPPORTUNITIES

10.3.1 RISING DEMAND FOR PHYTOGENIC FEED ADDITIVES IN AQUACULTURE AND PET FEEDS

10.3.2 MEDICINAL PROPERTIES OF HERBS AND SPICES

10.3.3 GROWING DEMAND FOR ORGANIC MEAT

10.4 CHALLENGES

10.4.1 AVAILABILITY AND VOLATILITY OF ORGANIC RAW MATERIALS

10.4.2 THE PREVALENCE OF ADULTERATION AND SIDE EFFECTS OF PHYTOGENIC MATERIALS

11 MIDDLE EAST & AFRICA PHYTOGENIC FEED ADDITIVES MARKET, BY REGION

11.1 MIDDLE EAST AND AFRICA

11.1.1 SOUTH AFRICA

11.1.2 SAUDI ARABIA

11.1.3 U.A.E.

11.1.4 KUWAIT

11.1.5 OMAN

11.1.6 QATAR

11.1.7 REST OF MIDDLE EAST AND AFRICA

12 COMPANY LANDSCAPE

12.1 COMPANY SHARE ANALYSIS: MIDDLE EAST & AFRICA

13 SWOT

14 COMPANY PROFILE

14.1 CARGILL, INCORPORATED

14.1.1 COMPANY SNAPSHOT

14.1.2 REVENUE ANALYSIS

14.1.3 COMPANY SHARE ANALYSIS

14.1.4 PRODUCT PORTFOLIO

14.1.5 RECENT DEVELOPMENT

14.2 DSM

14.2.1 COMPANY SNAPSHOT

14.2.2 REVENUE ANALYSIS

14.2.3 COMPANY SHARE ANALYSIS

14.2.4 PRODUCT PORTFOLIO

14.2.5 RECENT DEVELOPMENTS

14.3 KEMIN INDUSTRIES, INC.

14.3.1 COMPANY SNAPSHOT

14.3.2 COMPANY SHARE ANALYSIS

14.3.3 PRODUCT PORTFOLIO

14.3.4 RECENT DEVELOPMENT

14.4 ADM

14.4.1 COMPANY SNAPSHOT

14.4.2 REVENUE ANALYSIS

14.4.3 COMPANY SHARE ANALYSIS

14.4.4 PRODUCT PORTFOLIO

14.4.5 RECENT DEVELOPMENTS

14.5 NUTRECO

14.5.1 COMPANY SNAPSHOT

14.5.2 COMPANY SHARE ANALYSIS

14.5.3 PRODUCT PORTFOLIO

14.5.4 RECENT DEVELOPMENT

14.6 BRITISH HORSE FEEDS

14.6.1 COMPANY SNAPSHOT

14.6.2 PRODUCT PORTFOLIO

14.6.3 RECENT DEVELOPMENT

14.7 CUSTOMER DOSTOFARM GMBH

14.7.1 COMPANY SNAPSHOT

14.7.2 PRODUCT PORTFOLIO

14.7.3 RECENT DEVELOPMENT

14.8 GLAMAC INTERNATIONAL PRIVATE LIMITED

14.8.1 COMPANY SNAPSHOT

14.8.2 PRODUCT PORTFOLIO

14.8.3 RECENT DEVELOPMENT

14.9 HIMALAYA WELLNESS COMPANY

14.9.1 COMPANY SNAPSHOT

14.9.2 PRODUCT PORTFOLIO

14.9.3 RECENT DEVELOPMENTS

14.1 IGUSOL

14.10.1 COMPANY SNAPSHOT

14.10.2 PRODUCT PORTFOLIO

14.10.3 RECENT DEVELOPMENTS

14.11 INDIAN HERBS

14.11.1 COMPANY SNAPSHOT

14.11.2 PRODUCT PORTFOLIO

14.11.3 RECENT DEVELOPMENT

14.12 MIAVIT GMBH

14.12.1 COMPANY SNAPSHOT

14.12.2 PRODUCT PORTFOLIO

14.12.3 RECENT DEVELOPMENT

14.13 NATURAL REMEDIES

14.13.1 COMPANY SNAPSHOT

14.13.2 PRODUCT PORTFOLIO

14.13.3 RECENT DEVELOPMENT

14.14 NOR-FEED

14.14.1 COMPANY SNAPSHOT

14.14.2 PRODUCT PORTFOLIO

14.14.3 RECENT DEVELOPMENT

14.15 ORFFA

14.15.1 COMPANY SNAPSHOT

14.15.2 PRODUCT PORTFOLIO

14.15.3 RECENT DEVELOPMENTS

14.16 PHYTOBIOTICS FUTTERZUSATZSTOFFE GMBH

14.16.1 COMPANY SNAPSHOT

14.16.2 PRODUCT PORTFOLIO

14.16.3 RECENT DEVELOPMENT

14.17 SILVATEAM S.P.A.

14.17.1 COMPANY SNAPSHOT

14.17.2 PRODUCT PORTFOLIO

14.17.3 RECENT DEVELOPMENT

14.18 TEGASA

14.18.1 COMPANY SNAPSHOT

14.18.2 PRODUCT PORTFOLIO

14.18.3 RECENT DEVELOPMENTS

14.19 VINAYAK INGREDIENTS INDIA

14.19.1 COMPANY SNAPSHOT

14.19.2 PRODUCT PORTFOLIO

14.19.3 RECENT DEVELOPMENT

15 QUESTIONNAIRE

16 RELATED REPORTS

List of Table

TABLE 1 REGULATORY FRAMEWORK

TABLE 2 MIDDLE EAST AND AFRICA PHYTOGENIC FEED ADDITIVES MARKET, BY COUNTRY, 2021-2030 (USD MILLION)

TABLE 3 MIDDLE EAST AND AFRICA PHYTOGENIC FEED ADDITIVES MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 4 MIDDLE EAST AND AFRICA PHYTOGENIC FEED ADDITIVES MARKET, BY TYPE OF ANIMAL FEED, 2021-2030 (USD MILLION)

TABLE 5 MIDDLE EAST AND AFRICA POULTRY FEED IN PHYTOGENIC FEED ADDITIVES MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 6 MIDDLE EAST AND AFRICA RUMINANTS FEED IN PHYTOGENIC FEED ADDITIVES MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 7 MIDDLE EAST AND AFRICA SWINE FEED IN PHYTOGENIC FEED ADDITIVES MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 8 MIDDLE EAST AND AFRICA AQUA FEED IN PHYTOGENIC FEED ADDITIVES MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 9 MIDDLE EAST AND AFRICA FISH IN PHYTOGENIC FEED ADDITIVES MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 10 MIDDLE EAST AND AFRICA MOLLUSKS IN PHYTOGENIC FEED ADDITIVES MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 11 MIDDLE EAST AND AFRICA CRUSTACEANS IN PHYTOGENIC FEED ADDITIVES MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 12 MIDDLE EAST AND AFRICA PHYTOGENIC FEED ADDITIVES MARKET, BY SOURCES, 2021-2030 (USD MILLION)

TABLE 13 MIDDLE EAST AND AFRICA HERBS IN PHYTOGENIC FEED ADDITIVES MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 14 MIDDLE EAST AND AFRICA SPICES IN PHYTOGENIC FEED ADDITIVES MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 15 MIDDLE EAST AND AFRICA PHYTOGENIC FEED ADDITIVES MARKET, BY FORM, 2021-2030 (USD MILLION)

TABLE 16 MIDDLE EAST AND AFRICA PHYTOGENIC FEED ADDITIVES MARKET, BY FUNCTION, 2021-2030 (USD MILLION)

TABLE 17 SOUTH AFRICA PHYTOGENIC FEED ADDITIVES MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 18 SOUTH AFRICA PHYTOGENIC FEED ADDITIVES MARKET, BY TYPE OF ANIMAL FEED, 2021-2030 (USD MILLION)

TABLE 19 SOUTH AFRICA POULTRY FEED IN PHYTOGENIC FEED ADDITIVES MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 20 SOUTH AFRICA RUMINANTS FEED IN PHYTOGENIC FEED ADDITIVES MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 21 SOUTH AFRICA SWINE FEED IN PHYTOGENIC FEED ADDITIVES MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 22 SOUTH AFRICA AQUA FEED IN PHYTOGENIC FEED ADDITIVES MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 23 SOUTH AFRICA FISH IN PHYTOGENIC FEED ADDITIVES MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 24 SOUTH AFRICA MOLLUSKS IN PHYTOGENIC FEED ADDITIVES MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 25 SOUTH AFRICA CRUSTACEANS IN PHYTOGENIC FEED ADDITIVES MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 26 SOUTH AFRICA PHYTOGENIC FEED ADDITIVES MARKET, BY SOURCES, 2021-2030 (USD MILLION)

TABLE 27 SOUTH AFRICA HERBS IN PHYTOGENIC FEED ADDITIVES MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 28 SOUTH AFRICA SPICES IN PHYTOGENIC FEED ADDITIVES MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 29 SOUTH AFRICA PHYTOGENIC FEED ADDITIVES MARKET, BY FORM, 2021-2030 (USD MILLION)

TABLE 30 SOUTH AFRICA PHYTOGENIC FEED ADDITIVES MARKET, BY FUNCTION, 2021-2030 (USD MILLION)

TABLE 31 SAUDI ARABIA PHYTOGENIC FEED ADDITIVES MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 32 SAUDI ARABIA PHYTOGENIC FEED ADDITIVES MARKET, BY TYPE OF ANIMAL FEED, 2021-2030 (USD MILLION)

TABLE 33 SAUDI ARABIA POULTRY FEED IN PHYTOGENIC FEED ADDITIVES MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 34 SAUDI ARABIA RUMINANTS FEED IN PHYTOGENIC FEED ADDITIVES MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 35 SAUDI ARABIA SWINE FEED IN PHYTOGENIC FEED ADDITIVES MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 36 SAUDI ARABIA AQUA FEED IN PHYTOGENIC FEED ADDITIVES MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 37 SAUDI ARABIA FISH IN PHYTOGENIC FEED ADDITIVES MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 38 SAUDI ARABIA MOLLUSKS IN PHYTOGENIC FEED ADDITIVES MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 39 SAUDI ARABIA CRUSTACEANS IN PHYTOGENIC FEED ADDITIVES MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 40 SAUDI ARABIA PHYTOGENIC FEED ADDITIVES MARKET, BY SOURCES, 2021-2030 (USD MILLION)

TABLE 41 SAUDI ARABIA HERBS IN PHYTOGENIC FEED ADDITIVES MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 42 SAUDI ARABIA SPICES IN PHYTOGENIC FEED ADDITIVES MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 43 SAUDI ARABIA PHYTOGENIC FEED ADDITIVES MARKET, BY FORM, 2021-2030 (USD MILLION)

TABLE 44 SAUDI ARABIA PHYTOGENIC FEED ADDITIVES MARKET, BY FUNCTION, 2021-2030 (USD MILLION)

TABLE 45 U.A.E. PHYTOGENIC FEED ADDITIVES MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 46 U.A.E. PHYTOGENIC FEED ADDITIVES MARKET, BY TYPE OF ANIMAL FEED, 2021-2030 (USD MILLION)

TABLE 47 U.A.E. POULTRY FEED IN PHYTOGENIC FEED ADDITIVES MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 48 U.A.E. RUMINANTS FEED IN PHYTOGENIC FEED ADDITIVES MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 49 U.A.E. SWINE FEED IN PHYTOGENIC FEED ADDITIVES MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 50 U.A.E. AQUA FEED IN PHYTOGENIC FEED ADDITIVES MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 51 U.A.E. FISH IN PHYTOGENIC FEED ADDITIVES MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 52 U.A.E. MOLLUSKS IN PHYTOGENIC FEED ADDITIVES MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 53 U.A.E. CRUSTACEANS IN PHYTOGENIC FEED ADDITIVES MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 54 U.A.E. PHYTOGENIC FEED ADDITIVES MARKET, BY SOURCES, 2021-2030 (USD MILLION)

TABLE 55 U.A.E. HERBS IN PHYTOGENIC FEED ADDITIVES MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 56 U.A.E. SPICES IN PHYTOGENIC FEED ADDITIVES MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 57 U.A.E. PHYTOGENIC FEED ADDITIVES MARKET, BY FORM, 2021-2030 (USD MILLION)

TABLE 58 U.A.E. PHYTOGENIC FEED ADDITIVES MARKET, BY FUNCTION, 2021-2030 (USD MILLION)

TABLE 59 KUWAIT PHYTOGENIC FEED ADDITIVES MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 60 KUWAIT PHYTOGENIC FEED ADDITIVES MARKET, BY TYPE OF ANIMAL FEED, 2021-2030 (USD MILLION)

TABLE 61 KUWAIT POULTRY FEED IN PHYTOGENIC FEED ADDITIVES MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 62 KUWAIT RUMINANTS FEED IN PHYTOGENIC FEED ADDITIVES MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 63 KUWAIT SWINE FEED IN PHYTOGENIC FEED ADDITIVES MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 64 KUWAIT AQUA FEED IN PHYTOGENIC FEED ADDITIVES MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 65 KUWAIT FISH IN PHYTOGENIC FEED ADDITIVES MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 66 KUWAIT MOLLUSKS IN PHYTOGENIC FEED ADDITIVES MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 67 KUWAIT CRUSTACEANS IN PHYTOGENIC FEED ADDITIVES MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 68 KUWAIT PHYTOGENIC FEED ADDITIVES MARKET, BY SOURCES, 2021-2030 (USD MILLION)

TABLE 69 KUWAIT HERBS IN PHYTOGENIC FEED ADDITIVES MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 70 KUWAIT SPICES IN PHYTOGENIC FEED ADDITIVES MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 71 KUWAIT PHYTOGENIC FEED ADDITIVES MARKET, BY FORM, 2021-2030 (USD MILLION)

TABLE 72 KUWAIT PHYTOGENIC FEED ADDITIVES MARKET, BY FUNCTION, 2021-2030 (USD MILLION)

TABLE 73 OMAN PHYTOGENIC FEED ADDITIVES MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 74 OMAN PHYTOGENIC FEED ADDITIVES MARKET, BY TYPE OF ANIMAL FEED, 2021-2030 (USD MILLION)

TABLE 75 OMAN POULTRY FEED IN PHYTOGENIC FEED ADDITIVES MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 76 OMAN RUMINANTS FEED IN PHYTOGENIC FEED ADDITIVES MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 77 OMAN SWINE FEED IN PHYTOGENIC FEED ADDITIVES MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 78 OMAN AQUA FEED IN PHYTOGENIC FEED ADDITIVES MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 79 OMAN FISH IN PHYTOGENIC FEED ADDITIVES MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 80 OMAN MOLLUSKS IN PHYTOGENIC FEED ADDITIVES MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 81 OMAN CRUSTACEANS IN PHYTOGENIC FEED ADDITIVES MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 82 OMAN PHYTOGENIC FEED ADDITIVES MARKET, BY SOURCES, 2021-2030 (USD MILLION)

TABLE 83 OMAN HERBS IN PHYTOGENIC FEED ADDITIVES MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 84 OMAN SPICES IN PHYTOGENIC FEED ADDITIVES MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 85 OMAN PHYTOGENIC FEED ADDITIVES MARKET, BY FORM, 2021-2030 (USD MILLION)

TABLE 86 OMAN PHYTOGENIC FEED ADDITIVES MARKET, BY FUNCTION, 2021-2030 (USD MILLION)

TABLE 87 QATAR PHYTOGENIC FEED ADDITIVES MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 88 QATAR PHYTOGENIC FEED ADDITIVES MARKET, BY TYPE OF ANIMAL FEED, 2021-2030 (USD MILLION)

TABLE 89 QATAR POULTRY FEED IN PHYTOGENIC FEED ADDITIVES MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 90 QATAR RUMINANTS FEED IN PHYTOGENIC FEED ADDITIVES MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 91 QATAR SWINE FEED IN PHYTOGENIC FEED ADDITIVES MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 92 QATAR AQUA FEED IN PHYTOGENIC FEED ADDITIVES MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 93 QATAR FISH IN PHYTOGENIC FEED ADDITIVES MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 94 QATAR MOLLUSKS IN PHYTOGENIC FEED ADDITIVES MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 95 QATAR CRUSTACEANS IN PHYTOGENIC FEED ADDITIVES MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 96 QATAR PHYTOGENIC FEED ADDITIVES MARKET, BY SOURCES, 2021-2030 (USD MILLION)

TABLE 97 QATAR HERBS IN PHYTOGENIC FEED ADDITIVES MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 98 QATAR SPICES IN PHYTOGENIC FEED ADDITIVES MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 99 QATAR PHYTOGENIC FEED ADDITIVES MARKET, BY FORM, 2021-2030 (USD MILLION)

TABLE 100 QATAR PHYTOGENIC FEED ADDITIVES MARKET, BY FUNCTION, 2021-2030 (USD MILLION)

TABLE 101 REST OF MIDDLE EAST AND AFRICA PHYTOGENIC FEED ADDITIVES MARKET, BY TYPE, 2021-2030 (USD MILLION)

List of Figure

FIGURE 1 MIDDLE EAST & AFRICA PHYTOGENIC FEED ADDITIVES MARKET: SEGMENTATION

FIGURE 2 MIDDLE EAST & AFRICA PHYTOGENIC FEED ADDITIVES MARKET: DATA TRIANGULATION

FIGURE 3 MIDDLE EAST & AFRICA PHYTOGENIC FEED ADDITIVES MARKET: DROC ANALYSIS

FIGURE 4 MIDDLE EAST & AFRICA PHYTOGENIC FEED ADDITIVES MARKET: MIDDLE EAST & AFRICA VS REGIONAL MARKET ANALYSIS

FIGURE 5 MIDDLE EAST & AFRICA PHYTOGENIC FEED ADDITIVES MARKET: COMPANY RESEARCH ANALYSIS

FIGURE 6 MIDDLE EAST & AFRICA PHYTOGENIC FEED ADDITIVES MARKET: INTERVIEW DEMOGRAPHICS

FIGURE 7 MIDDLE EAST & AFRICA PHYTOGENIC FEED ADDITIVES MARKET: DBMR MARKET POSITION GRID

FIGURE 8 MIDDLE EAST & AFRICA PHYTOGENIC FEED ADDITIVES MARKET: SEGMENTATION

FIGURE 9 SURGING DEMAND FOR NATURAL FEED ADDITIVES IS DRIVING THE GROWTH OF THE MIDDLE EAST & AFRICA PHYTOGENIC FEED ADDITIVES MARKET IN THE FORECAST PERIOD

FIGURE 10 THE ESSENTIAL OILS SEGMENT IS EXPECTED TO ACCOUNT FOR THE LARGEST SHARE OF THE MIDDLE EAST & AFRICA PHYTOGENIC FEED ADDITIVES MARKET IN 2023 AND 2030

FIGURE 11 SUPPLY CHAIN OF THE MIDDLE EAST & AFRICA PHYTOGENIC FEED ADDITIVES MARKET

FIGURE 12 VALUE CHAIN ANALYSIS OF THE MIDDLE EAST & AFRICA PHYTOGENIC FEED ADDITIVES MARKET

FIGURE 13 DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES OF THE MIDDLE EAST & AFRICA PHYTOGENIC FEED ADDITIVES MARKET

FIGURE 14 AUSTRALIAN PRODUCTION AND CONSUMPTION OF CHICKEN MEAT (IN KT/KG)

FIGURE 15 MIDDLE EAST AND AFRICA PHYTOGENIC FEED ADDITIVES MARKET: SNAPSHOT (2022)

FIGURE 16 MIDDLE EAST AND AFRICA PHYTOGENIC FEED ADDITIVES MARKET: BY COUNTRY (2022)

FIGURE 17 MIDDLE EAST AND AFRICA PHYTOGENIC FEED ADDITIVES MARKET: BY COUNTRY (2023 & 2030)

FIGURE 18 MIDDLE EAST AND AFRICA PHYTOGENIC FEED ADDITIVES MARKET: BY COUNTRY (2022 & 2030)

FIGURE 19 MIDDLE EAST AND AFRICA PHYTOGENIC FEED ADDITIVES MARKET: BY TYPE (2023-2030)

FIGURE 20 MIDDLE EAST & AFRICA PHYTOGENIC FEED ADDITIVES MARKET: COMPANY SHARE 2022 (%)

منهجية البحث

يتم جمع البيانات وتحليل سنة الأساس باستخدام وحدات جمع البيانات ذات أحجام العينات الكبيرة. تتضمن المرحلة الحصول على معلومات السوق أو البيانات ذات الصلة من خلال مصادر واستراتيجيات مختلفة. تتضمن فحص وتخطيط جميع البيانات المكتسبة من الماضي مسبقًا. كما تتضمن فحص التناقضات في المعلومات التي شوهدت عبر مصادر المعلومات المختلفة. يتم تحليل بيانات السوق وتقديرها باستخدام نماذج إحصائية ومتماسكة للسوق. كما أن تحليل حصة السوق وتحليل الاتجاهات الرئيسية هي عوامل النجاح الرئيسية في تقرير السوق. لمعرفة المزيد، يرجى طلب مكالمة محلل أو إرسال استفسارك.

منهجية البحث الرئيسية التي يستخدمها فريق بحث DBMR هي التثليث البيانات والتي تتضمن استخراج البيانات وتحليل تأثير متغيرات البيانات على السوق والتحقق الأولي (من قبل خبراء الصناعة). تتضمن نماذج البيانات شبكة تحديد موقف البائعين، وتحليل خط زمني للسوق، ونظرة عامة على السوق ودليل، وشبكة تحديد موقف الشركة، وتحليل براءات الاختراع، وتحليل التسعير، وتحليل حصة الشركة في السوق، ومعايير القياس، وتحليل حصة البائعين على المستوى العالمي مقابل الإقليمي. لمعرفة المزيد عن منهجية البحث، أرسل استفسارًا للتحدث إلى خبراء الصناعة لدينا.

التخصيص متاح

تعد Data Bridge Market Research رائدة في مجال البحوث التكوينية المتقدمة. ونحن نفخر بخدمة عملائنا الحاليين والجدد بالبيانات والتحليلات التي تتطابق مع هدفهم. ويمكن تخصيص التقرير ليشمل تحليل اتجاه الأسعار للعلامات التجارية المستهدفة وفهم السوق في بلدان إضافية (اطلب قائمة البلدان)، وبيانات نتائج التجارب السريرية، ومراجعة الأدبيات، وتحليل السوق المجدد وقاعدة المنتج. ويمكن تحليل تحليل السوق للمنافسين المستهدفين من التحليل القائم على التكنولوجيا إلى استراتيجيات محفظة السوق. ويمكننا إضافة عدد كبير من المنافسين الذين تحتاج إلى بيانات عنهم بالتنسيق وأسلوب البيانات الذي تبحث عنه. ويمكن لفريق المحللين لدينا أيضًا تزويدك بالبيانات في ملفات Excel الخام أو جداول البيانات المحورية (كتاب الحقائق) أو مساعدتك في إنشاء عروض تقديمية من مجموعات البيانات المتوفرة في التقرير.