Middle East And Africa Meat Poultry And Seafood Processing Equipment Market

حجم السوق بالمليار دولار أمريكي

CAGR :

%

USD

717.65 Million

USD

982.16 Million

2024

2032

USD

717.65 Million

USD

982.16 Million

2024

2032

| 2025 –2032 | |

| USD 717.65 Million | |

| USD 982.16 Million | |

|

|

|

|

تجزئة سوق معدات تجهيز اللحوم والدواجن والمأكولات البحرية في الشرق الأوسط وأفريقيا، حسب نوع المعدات (معدات التقسيم، معدات القلي، معدات الترشيح، معدات الطلاء، معدات الطهي، معدات التدخين، معدات القتل/الذبح، معدات التبريد، المعالجة بالضغط العالي (معالج الضغط العالي)، معدات التدليك، وغيرها)، العملية (تقليل الحجم، تكبير الحجم، التجانس، الخلط، وغيرها)، طريقة التشغيل (آلي، نصف آلي، ويدوي)، التطبيق (لحوم طازجة معالجة، نيئة مطبوخة، مطبوخة مسبقًا، نيئة مخمرة، مجففة، معالجة، مجمدة، وغيرها)، الوظيفة (التقطيع، المزج، التطرية، الحشو، التتبيل، التقطيع، الطحن، التدخين، القتل وإزالة الريش، إزالة العظام والجلد، نزع الأحشاء، التقطيع إلى شرائح، وغيرها)، نوع المنتجات المصنعة (اللحوم والدواجن والمأكولات البحرية) - اتجاهات الصناعة وتوقعاتها 2032.

ما هو حجم ومعدل نمو سوق معدات تجهيز اللحوم والدواجن والمأكولات البحرية في الشرق الأوسط وأفريقيا؟

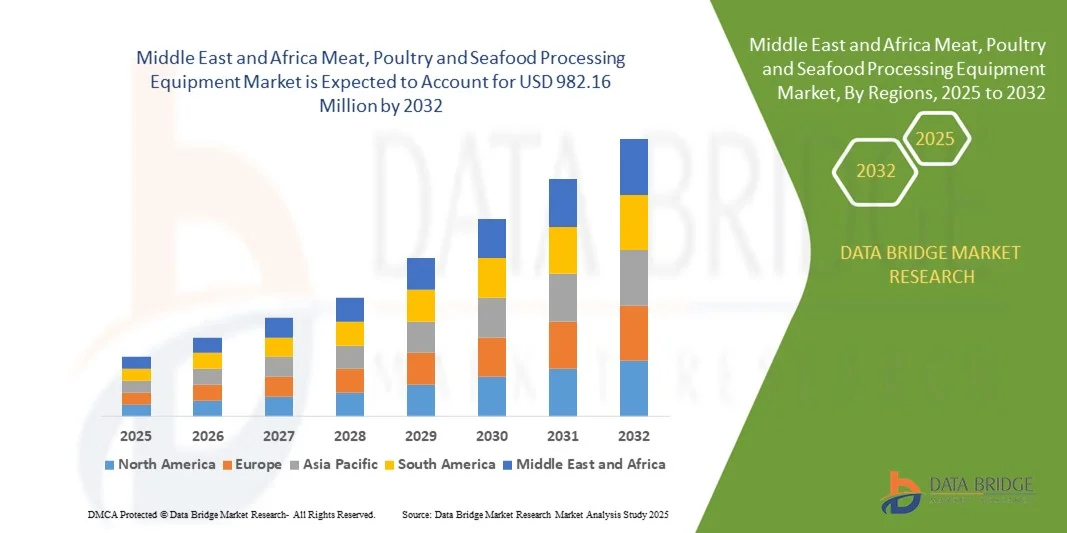

- بلغت قيمة سوق معدات تجهيز اللحوم والدواجن والمأكولات البحرية في الشرق الأوسط وأفريقيا 717.65 مليون دولار أمريكي في عام 2024 ومن المتوقع أن تصل إلى 982.16 مليون دولار أمريكي بحلول عام 2032 ، بمعدل نمو سنوي مركب قدره 4.00٪ خلال الفترة المتوقعة.

- يؤدي تزايد استهلاك اللحوم المصنعة والدواجن والمأكولات البحرية، وتزايد عدد مطاعم الوجبات السريعة وسلاسل المطاعم في السوق، إلى زيادة الطلب على اللحوم المصنعة عالية الجودة وغيرها من المنتجات. كما أن التطورات التكنولوجية في سوق المعدات، وخاصةً في قطاع اللحوم والدواجن والمأكولات البحرية، قد زادت من قيمة السوق حاليًا.

- العوامل التي تعيق نمو السوق هي الاستثمار الرأسمالي المرتفع، والاستبدال البطيء للمعدات بسبب عمرها الافتراضي الأطول

ما هي أهم النقاط المستفادة من سوق معدات تجهيز اللحوم والدواجن والمأكولات البحرية؟

- يمكن أن يكون زيادة الأتمتة في صناعة تجهيز الأغذية أفضل فرصة لسوق معدات تجهيز اللحوم والدواجن والمأكولات البحرية

- إن التكلفة العالية للآلات والبنية التحتية المنخفضة في البلدان النامية والاستخدام المفرط للمياه أثناء المعالجة وتنظيف خطوط الأنابيب يمكن أن تشكل تهديدًا للسوق

- سيطرت المملكة العربية السعودية على سوق معدات تجهيز اللحوم والدواجن والمأكولات البحرية في الشرق الأوسط وأفريقيا في عام 2025، حيث استحوذت على أكبر حصة من الإيرادات بنسبة 28.7٪، مدفوعة بالطلب المتزايد على مرافق تجهيز اللحوم الحديثة والأتمتة والبنية التحتية لسلسلة التبريد.

- من المتوقع أن يشهد سوق معدات تجهيز اللحوم والدواجن والمأكولات البحرية في دولة الإمارات العربية المتحدة أسرع معدل نمو بنسبة 12.1٪، مدفوعًا بالتوسع الحضري السريع، وزيادة الطلب على اللحوم المصنعة والمأكولات البحرية، والمبادرات الحكومية التي تعزز إنتاج الغذاء المحلي.

- هيمن قطاع معدات التقطيع والتوزيع على السوق في عام 2025 بحصة سوقية بلغت 32.8%، مدفوعًا بالطلب المتزايد على التقطيع الدقيق والتحكم في الحصص والتشذيب الآلي في مصانع تجهيز اللحوم والمأكولات البحرية واسعة النطاق.

نطاق التقرير وتجزئة سوق معدات تجهيز اللحوم والدواجن والمأكولات البحرية

|

صفات |

رؤى رئيسية حول سوق معدات تجهيز اللحوم والدواجن والمأكولات البحرية |

|

القطاعات المغطاة |

|

|

الدول المغطاة |

الشرق الأوسط وأفريقيا

|

|

اللاعبون الرئيسيون في السوق |

|

|

فرص السوق |

|

|

مجموعات معلومات البيانات ذات القيمة المضافة |

بالإضافة إلى الرؤى حول سيناريوهات السوق مثل القيمة السوقية ومعدل النمو والتجزئة والتغطية الجغرافية واللاعبين الرئيسيين، فإن تقارير السوق التي تم تنظيمها بواسطة Data Bridge Market Research تشمل أيضًا تحليلًا متعمقًا من الخبراء وتحليل التسعير وتحليل حصة العلامة التجارية واستطلاع رأي المستهلكين وتحليل التركيبة السكانية وتحليل سلسلة التوريد وتحليل سلسلة القيمة ونظرة عامة على المواد الخام / المواد الاستهلاكية ومعايير اختيار البائعين وتحليل PESTLE وتحليل Porter والإطار التنظيمي. |

ما هو الاتجاه الرئيسي في سوق معدات تجهيز اللحوم والدواجن والمأكولات البحرية؟

الأتمتة وتقنيات المعالجة المستدامة

- من أهم الاتجاهات التي تُشكّل سوق معدات تجهيز اللحوم والدواجن والمأكولات البحرية التبني السريع لأنظمة الأتمتة والمعالجة المستدامة المُصممة لتحسين الكفاءة وتقليل الهدر وتعزيز سلامة الغذاء. ويدفع التركيز المتزايد على العمليات الموفرة للطاقة والتصميم الصحي المُصنّعين نحو ابتكارات صديقة للبيئة.

- تدمج الشركات بشكل متزايد الروبوتات والتفتيش القائم على الذكاء الاصطناعي وأنظمة المراقبة المدعومة بإنترنت الأشياء لتبسيط عمليات إزالة العظام والقطع والتعبئة والتغليف، مما يضمن الدقة ويقلل من الخطأ البشري

- وعلاوة على ذلك، يكتسب استخدام تكنولوجيات توفير المياه والحد من النفايات زخمًا متزايدًا حيث يهدف المعالجون إلى تلبية لوائح الاستدامة وخفض تكاليف التشغيل.

- ومن الأمثلة البارزة على ذلك شركة GEA Group Aktiengesellschaft (ألمانيا)، التي قدمت خط المعالجة المستدامة الخاص بها والذي يدمج الأتمتة الذكية، والتبريد الفعال، وأنظمة استعادة النفايات لتحسين إنتاج اللحوم والمأكولات البحرية.

- يؤدي هذا التحول نحو الحلول الذكية والصديقة للبيئة والموفرة للطاقة إلى تحويل الصناعة، وتشجيع الاستثمارات في معدات الجيل التالي التي توازن بين الإنتاجية والسلامة والاستدامة

ما هي العوامل الرئيسية المحركة لسوق معدات تجهيز اللحوم والدواجن والمأكولات البحرية؟

- يُعدّ الاستهلاك العالمي المتزايد للأغذية الغنية بالبروتين، بالإضافة إلى الطلب المتزايد على اللحوم المصنعة والمأكولات البحرية، من العوامل الرئيسية التي تُعزز نمو السوق. يبحث المستهلكون عن خيارات غذائية سهلة الاستخدام وآمنة ومُعالجة بطريقة صحية، مما يُسهم في تحديث المعدات.

- على سبيل المثال، في عام 2025، قامت شركة ماريل (أيسلندا) بتوسيع خط إنتاجها باستخدام أنظمة التقطيع والتقطيع الآلية التي تعمل على تعزيز دقة المحصول واتساق المنتج في معالجة الدواجن والمأكولات البحرية.

- وتستفيد الصناعة أيضًا من الاستثمارات الحكومية في لوائح سلامة الأغذية والبنية الأساسية للتصدير، مما يعزز الطلب على آلات المعالجة المتقدمة

- علاوة على ذلك، أدى ارتفاع أسعار المنتجات الجاهزة للأكل والمجمدة إلى تسريع ترقية المعدات لتحسين قدرات التعبئة والتغليف والتبريد والتخزين.

- تعمل الابتكارات مثل أنظمة الفرز التي تعمل بالذكاء الاصطناعي، والناقلات الصحية، وتقنيات الختم الفراغي على تعزيز جودة المنتج بشكل أكبر، وإطالة العمر الافتراضي، ودفع توسع السوق عبر القطاعات الصناعية والتجارية.

ما هو العامل الذي يعيق نمو سوق معدات تجهيز اللحوم والدواجن والمأكولات البحرية؟

- لا تزال تكاليف الاستثمار الرأسمالي والصيانة المرتفعة تُعيق تبني هذه التقنية، لا سيما بين المُصنِّعين الصغار والمتوسطين. تتطلب معدات مثل آلات نزع العظام الآلية وآلات التعبئة الفراغية نفقات أولية كبيرة.

- على سبيل المثال، في عام 2025، ستؤدي أسعار الفولاذ المقاوم للصدأ والمكونات الإلكترونية المرتفعة إلى زيادة تكاليف تصنيع المعدات للاعبين الرئيسيين مثل BAADER (ألمانيا) وشركة JBT Corporation (الولايات المتحدة)، مما يؤثر على هوامش الربح.

- علاوة على ذلك، يمكن لمتطلبات التنظيف والصرف الصحي المعقدة أن تؤدي إلى إطالة وقت التوقف، مما يؤثر على كفاءة الإنتاج

- وتفرض اللوائح البيئية ولوائح الطاقة أيضًا على الشركات تحديث الأنظمة بشكل مستمر لتقليل الانبعاثات وتقليل استخدام المياه.

- على الرغم من هذه العوائق، تُعالج شركات مثل GEA Group Aktiengesellschaft وKey Technology (الولايات المتحدة) هذه المشكلات من خلال تصميمات معيارية، موفرة للطاقة، وسهلة التنظيف. ويظل تحقيق التوازن بين التكلفة والامتثال والاستدامة أمرًا حيويًا لضمان النمو طويل الأمد والقدرة التنافسية في السوق.

كيف يتم تقسيم سوق معدات تجهيز اللحوم والدواجن والمأكولات البحرية؟

يتم تقسيم سوق معدات معالجة اللحوم والدواجن والمأكولات البحرية على أساس نوع المعدات، والعملية، وطريقة التشغيل، والتطبيق، والوظيفة، ونوع المنتج المعالج.

- حسب نوع المعدات

بناءً على نوع المعدات، يُقسّم السوق إلى معدات التقسيم، ومعدات القلي، ومعدات الترشيح، ومعدات الطلاء، ومعدات الطهي، ومعدات التدخين، ومعدات القتل/الذبح، ومعدات التبريد، ومعدات المعالجة بالضغط العالي (HPP)، ومعدات التدليك، وغيرها. هيمن قطاع معدات التقطيع والتقسيم على السوق في عام 2025 بحصة سوقية بلغت 32.8%، مدفوعًا بالطلب المتزايد على التقطيع الدقيق، والتحكم في الحصص، والتشذيب الآلي في مصانع تجهيز اللحوم والمأكولات البحرية واسعة النطاق. تُحسّن هذه الأنظمة الكفاءة، وتُقلل الهدر، وتُحافظ على جودة المنتج.

من المتوقع أن يسجل قطاع معدات المعالجة بالضغط العالي (HPP) أسرع معدل نمو سنوي مركب في الفترة من 2026 إلى 2033، مدفوعًا بالاعتماد المتزايد على تقنيات الحفظ غير الحرارية لتحسين العمر الافتراضي وضمان منتجات اللحوم والمأكولات البحرية الخالية من مسببات الأمراض دون المساس بالقيمة الغذائية أو الملمس.

- حسب العملية

بناءً على العملية، يُصنف سوق معدات تجهيز اللحوم والدواجن والمأكولات البحرية إلى: تقليل الحجم، وتكبير الحجم، والتجانس، والخلط، وغيرها. وسيُهيمن قطاع تقليل الحجم على السوق بحلول عام 2025 بحصة سوقية تبلغ 39.5%، إذ تُعدّ عمليات الطحن والتقطيع والفرم مراحل أولية بالغة الأهمية في تجهيز اللحوم، مما يُتيح تناسق الملمس وتوحيد المنتج في النقانق والفطائر والمنتجات البحرية. وتُساعد كفاءة أنظمة تقليل الحجم الحديثة على تحسين الإنتاجية والجودة.

من المتوقع أن يشهد قطاع الخلط أسرع معدل نمو سنوي مركب بين عامي 2026 و2033، مدفوعًا بتزايد الطلب على خلطات اللحوم، والتتبيلات، والمأكولات البحرية المصنعة. ويتزايد اعتماد الخلاطات الفراغية والمجدافية المتقدمة لتوزيع المكونات بشكل متساوٍ، وتعزيز اتساق النكهة، وتحسين استقرار المنتج.

- حسب طريقة التشغيل

بناءً على طريقة التشغيل، يُقسّم السوق إلى آلي، وشبه آلي، ويدوي. سيُهيمن القطاع الآلي على السوق بحلول عام 2025 بحصة سوقية تبلغ 46.7%، مدفوعًا بالاعتماد المتزايد على الأتمتة لخفض تكاليف العمالة، وزيادة كفاءة الإنتاج، وضمان الالتزام بمعايير النظافة. تدمج الأنظمة الآلية الروبوتات وأجهزة الاستشعار والبرمجيات لأداء مهام معقدة، مثل إزالة العظام والتغليف، بدقة.

من المتوقع أن يُسجل قطاع المنتجات شبه الآلية أسرع معدل نمو سنوي مركب بين عامي 2026 و2033، حيث تسعى شركات التصنيع الصغيرة والمتوسطة إلى تحقيق التوازن بين مزايا الأتمتة وتكاليف التشغيل. وتوفر الأنظمة شبه الآلية مرونةً وتعقيدًا تشغيليًا أقل وقابليةً للتكيف مع مختلف مقاييس الإنتاج.

- حسب الطلب

بناءً على التطبيق، يُقسّم سوق معدات تجهيز اللحوم والدواجن والمأكولات البحرية إلى: طازجة مُعالَجة، نيئة مطبوخة، مطبوخة مسبقًا، نيئة مُخَمَّرة، مجففة، مُعالَجة، مُجمدة، وغيرها. سيستحوذ قطاع اللحوم الطازجة المُعالَجة على أكبر حصة سوقية بنسبة 41.2% بحلول عام 2025، وذلك بفضل الاستهلاك المرتفع لمنتجات اللحوم والمأكولات البحرية قليلة المعالجة، مثل النقانق والناجتس والفطائر، والتي تتطلب آلات تقطيع وخلط وطلاء متطورة. ويدعم الطلب تفضيل المستهلكين للوجبات الطازجة الجاهزة للطهي.

من المتوقع أن ينمو قطاع الأطعمة المجمدة بأسرع معدل نمو سنوي مركب بين عامي 2026 و2033، مدفوعًا بتزايد شعبية المأكولات البحرية المجمدة والوجبات الجاهزة عالميًا. وتُمكّن التحسينات في تقنيات التجميد ولوجستيات سلسلة التبريد من إطالة مدة الصلاحية والحفاظ على الملمس والنكهة.

- حسب الوظيفة

بناءً على الوظيفة، يُصنف السوق إلى: التقطيع، والخلط، والتطرية، والحشو، والتتبيل، والتقطيع، والطحن، والتدخين، والذبح وإزالة الريش، وإزالة العظام والسلخ، ونزع الأحشاء، والتقطيع، والتقطيع إلى شرائح، وغيرها. هيمن قطاع التقطيع والتقطيع على السوق في عام 2025 بحصة سوقية بلغت 36.4%، إذ يُمثل وظيفة أساسية في جميع عمليات تجهيز اللحوم والمأكولات البحرية تقريبًا. ويزداد الطلب على أنظمة التقطيع والتقطيع الدقيقة مدفوعًا بالحاجة إلى تحقيق سُمك موحد، وتقليل الهدر، والحفاظ على سلامة المنتج.

من المتوقع أن يُظهر قطاع إزالة العظام والسلخ أسرع معدل نمو سنوي مركب في الفترة من 2026 إلى 2033، مدفوعًا بالحاجة إلى أنظمة عالية الكفاءة تقلل من العمل اليدوي، وتحسن العائد، وتعزز النظافة، خاصة في خطوط معالجة الدواجن والأسماك.

- حسب نوع المنتجات المعالجة

بناءً على نوع المنتج المُصنّع، يُقسّم السوق إلى لحوم ودواجن ومأكولات بحرية. سيُهيمن قطاع اللحوم على السوق بحلول عام 2025 بحصة سوقية تبلغ 44.9%، ويعزى ذلك إلى تزايد استهلاك منتجات اللحوم المُصنّعة، مثل النقانق ولحم الخنزير المقدد ولحم الخنزير، لا سيما في أمريكا الشمالية والشرق الأوسط وأفريقيا. تتطلب خطوط تجهيز اللحوم أنظمةً متطورةً للطحن والمعالجة والتغليف لضمان السلامة والجودة.

من المتوقع أن ينمو قطاع المأكولات البحرية بأسرع معدل نمو سنوي مركب بين عامي 2026 و2033، مدعومًا بتزايد الطلب العالمي على الأسماك والروبيان والمحاريات المُصنّعة. ويساهم ارتفاع صادرات المأكولات البحرية، إلى جانب التقدم التكنولوجي في التقطيع والتجميد، في تعزيز الأتمتة وتوسيع الطاقة الاستيعابية لمرافق تجهيز المأكولات البحرية حول العالم.

أية منطقة تمتلك أكبر حصة من سوق معدات تجهيز اللحوم والدواجن والمأكولات البحرية؟

- سيطرت المملكة العربية السعودية على سوق معدات تجهيز اللحوم والدواجن والمأكولات البحرية في الشرق الأوسط وأفريقيا في عام 2025، حيث استحوذت على أكبر حصة من الإيرادات بنسبة 28.7٪، مدفوعة بالطلب المتزايد على مرافق تجهيز اللحوم الحديثة والأتمتة والبنية التحتية لسلسلة التبريد.

- ساهمت استثمارات الدولة في الأمن الغذائي، وإنتاج الدواجن واللحوم على نطاق صناعي، ومبادرات استبدال الواردات، في تسريع اعتماد معدات المعالجة عالية الأداء. ويتزايد دمج تقنيات الذبح وإزالة العظام والتعبئة المتقدمة لضمان الامتثال لمعايير سلامة الأغذية HACCP وISO.

- بشكل عام، أدى تركيز المملكة العربية السعودية على التحديث والتوسع الصناعي والامتثال لسلامة الأغذية إلى وضعها كدولة رائدة في منطقة الشرق الأوسط وأفريقيا في مجال معدات تجهيز اللحوم والدواجن والمأكولات البحرية.

نظرة عامة على سوق معدات تجهيز اللحوم والدواجن والمأكولات البحرية في الإمارات العربية المتحدة

من المتوقع أن يشهد سوق معدات تجهيز اللحوم والدواجن والمأكولات البحرية في دولة الإمارات العربية المتحدة أسرع معدل نمو بنسبة 12.1%، مدفوعًا بالتوسع العمراني السريع، وتزايد الطلب على اللحوم والمأكولات البحرية المصنعة، والمبادرات الحكومية التي تشجع على إنتاج الأغذية محليًا. يستثمر المصنعون ومصنعو الأغذية في الإمارات العربية المتحدة بكثافة في أنظمة التوزيع الآلي والتجميد والتعبئة لتلبية الطلب المتزايد من أسواق الضيافة والتجزئة والتصدير. يُعزز دمج أنظمة التحكم الذكية، والتبريد الموفر للطاقة، وخطوط المعالجة الصحية الإنتاجية ويُقلل من تكاليف التشغيل. إن تركيز دولة الإمارات العربية المتحدة على تقنيات المعالجة المتقدمة والمستدامة وعالية الكفاءة يجعلها مركز نمو رئيسي في سوق الشرق الأوسط وأفريقيا.

نظرة عامة على سوق معدات تجهيز اللحوم والدواجن والمأكولات البحرية في مصر

يشهد سوق معدات تجهيز اللحوم والدواجن والمأكولات البحرية في مصر نموًا مطردًا، مدفوعًا بنمو صناعات تجهيز الدواجن والمأكولات البحرية في البلاد والمبادرات الحكومية الرامية إلى تحسين سلامة الغذاء وتحقيق الاكتفاء الذاتي. ويتزايد اعتماد المصنّعين المصريين على معدات الذبح والتقطيع والتجميد الحديثة لتحسين النظافة والإنتاجية والامتثال لمعايير التصدير الدولية. كما تُعزز الاستثمارات في البنية التحتية للتخزين البارد، وأنظمة التوزيع الآلي، والتغليف، الكفاءة. وبفضل موقعها الاستراتيجي، وسوقها المحلية الكبيرة، وقدراتها الصناعية المتنامية، تلعب مصر دورًا هامًا في تطوير صناعة معدات تجهيز اللحوم والدواجن والمأكولات البحرية في المنطقة.

نظرة عامة على سوق معدات تجهيز اللحوم والدواجن والمأكولات البحرية في جنوب أفريقيا

يشهد سوق معدات تجهيز اللحوم والدواجن والمأكولات البحرية في جنوب أفريقيا نموًا مطردًا، مدعومًا بقطاع تصدير اللحوم القوي في البلاد، وتزايد الطلب على الأغذية المصنعة عالية الجودة. ويتبنى المصنعون في جنوب أفريقيا أنظمة آلية لنزع العظام والتقطيع والتتبيل والتغليف لتحسين الإنتاجية، وخفض تكاليف العمالة، والالتزام بلوائح سلامة الأغذية الدولية. كما تدعم مبادرات الاستدامة، بما في ذلك أنظمة التبريد الموفرة للطاقة وخطوط المعالجة الموفرة للمياه، توسع السوق. وبشكل عام، فإن الطلب المدفوع بالتصدير في جنوب أفريقيا، والقدرات الصناعية المتميزة، والتركيز على الاستدامة، يعزز مكانتها كسوق رائدة في منطقة الشرق الأوسط وأفريقيا.

نظرة عامة على سوق معدات تجهيز اللحوم والدواجن والمأكولات البحرية في المغرب

يشهد سوق معدات تجهيز اللحوم والدواجن والمأكولات البحرية في المغرب نموًا مطردًا، مدفوعًا بارتفاع الاستهلاك المحلي، وتوسع مزارع الدواجن والمأكولات البحرية، وزيادة الاستثمارات في مرافق التجهيز الحديثة. ويتبنى المصنّعون المغاربة معدات تجميد وتعبئة وتجزئة متطورة لتحسين جودة المنتجات وسلامتها وجاهزيتها للتصدير. كما تُعزز الحوافز الحكومية لتحديث صناعة الأغذية والتعاون مع الموردين الدوليين نقل التكنولوجيا والكفاءة التشغيلية. ونتيجةً لذلك، يبرز المغرب كمساهم رئيسي في النمو الشامل والقدرة التنافسية لسوق معدات تجهيز اللحوم والدواجن والمأكولات البحرية في الشرق الأوسط وأفريقيا.

ما هي الشركات الرائدة في سوق معدات تجهيز اللحوم والدواجن والمأكولات البحرية؟

إن صناعة معدات تجهيز اللحوم والدواجن والمأكولات البحرية يقودها في المقام الأول شركات راسخة، بما في ذلك:

- Equipamientos Cárnicos, SL (إسبانيا)

- براهر إنترناسيونال، سا (إسبانيا)

- RZPO (بولندا)

- مجموعة مينيرفا أوميجا المحدودة (إيطاليا)

- GEA Group Aktiengesellschaft (ألمانيا)

- شركة ريسكو (إيطاليا)

- PSS SVIDNÍK, as (Slovakia)

- ميتالباد (بولندا)

- بادر (ألمانيا)

- شركة JBT (الولايات المتحدة)

- ماريل (أيسلندا)

- التكنولوجيا الرئيسية (الولايات المتحدة)

- شركة إلينوي تول ووركس (الولايات المتحدة)

- شركة ميدلبي (الولايات المتحدة)

- شركة بيتشر للصناعات (الولايات المتحدة)

- بِزِربا (ألمانيا)

ما هي التطورات الأخيرة في سوق معدات تجهيز اللحوم والدواجن والمأكولات البحرية في الشرق الأوسط وأفريقيا؟

- في فبراير 2025، دخلت شركة JBT Marel في شراكة استراتيجية مع شركة Ace Aquatec، حيث اختارتها الشركة كمورد مفضل لحلول معالجة الأسماك لآلات تجهيز الأغذية. يُعزز هذا التعاون مكانة JBT Marel في مجال معالجة المأكولات البحرية المستدامة، ويُوسّع محفظة آلاتها المبتكرة.

- في يناير 2025، استحوذت شركة JBT الأمريكية على شركة Marel بالكامل، لتُشكل كيانًا جديدًا باسم JBT Marel Corporation. يُنشئ هذا الاندماج شركة عالمية رائدة في مجال تكنولوجيا معالجة الأغذية، مما يُعزز الكفاءة والابتكار في قطاعات غذائية متعددة.

- في نوفمبر 2024، أعلنت شركة فورتيفي لحلول معالجة الأغذية عن استحواذها على الملكية الفكرية، وعلاقات العملاء، ومخزونات مختارة، وأصول ثابتة لشركة JWE-BANSS GmbH (ألمانيا)، وهي شركة رائدة في تصنيع أنظمة معالجة البروتين. يُعزز هذا الاستحواذ خبرة فورتيفي في مجال معالجة اللحوم، ويعزز حضورها في سوق الشرق الأوسط وأفريقيا.

- في يوليو 2024، أطلقت شركة روس إندستريز جهاز AMS 400 Membrane Skinner، وهو حل مصمم خصيصًا لمصنعي اللحوم الحرفيين ومتوسطي الحجم لتحسين الكفاءة التشغيلية وجودة المنتج النهائي. يعكس هذا الإطلاق تركيز روس إندستريز على تلبية احتياجات الأتمتة المتطورة لمنتجي الأغذية الصغار والمتوسطين.

- في مارس 2024، أُطلقت شركة فورتيفي لحلول معالجة الأغذية رسميًا كمنصة عالمية موحدة لعلامات تجارية متخصصة في معالجة وأتمتة الأغذية، تعمل عبر خمس قارات. ويمثل هذا التأسيس خطوة استراتيجية نحو تقديم حلول متكاملة في قطاعات معالجة البروتين والألبان والفواكه والخضروات.

SKU-

احصل على إمكانية الوصول عبر الإنترنت إلى التقرير الخاص بأول سحابة استخبارات سوقية في العالم

- لوحة معلومات تحليل البيانات التفاعلية

- لوحة معلومات تحليل الشركة للفرص ذات إمكانات النمو العالية

- إمكانية وصول محلل الأبحاث للتخصيص والاستعلامات

- تحليل المنافسين باستخدام لوحة معلومات تفاعلية

- آخر الأخبار والتحديثات وتحليل الاتجاهات

- استغل قوة تحليل المعايير لتتبع المنافسين بشكل شامل

منهجية البحث

يتم جمع البيانات وتحليل سنة الأساس باستخدام وحدات جمع البيانات ذات أحجام العينات الكبيرة. تتضمن المرحلة الحصول على معلومات السوق أو البيانات ذات الصلة من خلال مصادر واستراتيجيات مختلفة. تتضمن فحص وتخطيط جميع البيانات المكتسبة من الماضي مسبقًا. كما تتضمن فحص التناقضات في المعلومات التي شوهدت عبر مصادر المعلومات المختلفة. يتم تحليل بيانات السوق وتقديرها باستخدام نماذج إحصائية ومتماسكة للسوق. كما أن تحليل حصة السوق وتحليل الاتجاهات الرئيسية هي عوامل النجاح الرئيسية في تقرير السوق. لمعرفة المزيد، يرجى طلب مكالمة محلل أو إرسال استفسارك.

منهجية البحث الرئيسية التي يستخدمها فريق بحث DBMR هي التثليث البيانات والتي تتضمن استخراج البيانات وتحليل تأثير متغيرات البيانات على السوق والتحقق الأولي (من قبل خبراء الصناعة). تتضمن نماذج البيانات شبكة تحديد موقف البائعين، وتحليل خط زمني للسوق، ونظرة عامة على السوق ودليل، وشبكة تحديد موقف الشركة، وتحليل براءات الاختراع، وتحليل التسعير، وتحليل حصة الشركة في السوق، ومعايير القياس، وتحليل حصة البائعين على المستوى العالمي مقابل الإقليمي. لمعرفة المزيد عن منهجية البحث، أرسل استفسارًا للتحدث إلى خبراء الصناعة لدينا.

التخصيص متاح

تعد Data Bridge Market Research رائدة في مجال البحوث التكوينية المتقدمة. ونحن نفخر بخدمة عملائنا الحاليين والجدد بالبيانات والتحليلات التي تتطابق مع هدفهم. ويمكن تخصيص التقرير ليشمل تحليل اتجاه الأسعار للعلامات التجارية المستهدفة وفهم السوق في بلدان إضافية (اطلب قائمة البلدان)، وبيانات نتائج التجارب السريرية، ومراجعة الأدبيات، وتحليل السوق المجدد وقاعدة المنتج. ويمكن تحليل تحليل السوق للمنافسين المستهدفين من التحليل القائم على التكنولوجيا إلى استراتيجيات محفظة السوق. ويمكننا إضافة عدد كبير من المنافسين الذين تحتاج إلى بيانات عنهم بالتنسيق وأسلوب البيانات الذي تبحث عنه. ويمكن لفريق المحللين لدينا أيضًا تزويدك بالبيانات في ملفات Excel الخام أو جداول البيانات المحورية (كتاب الحقائق) أو مساعدتك في إنشاء عروض تقديمية من مجموعات البيانات المتوفرة في التقرير.