سوق أجهزة الاتصال الداخلي في الشرق الأوسط وأفريقيا، حسب نوع الجهاز (أنظمة دخول الأبواب، والأجهزة المحمولة، وأجهزة مراقبة الأطفال بالفيديو)، والتحكم في الوصول (قارئات بصمات الأصابع، والوصول بكلمة مرور، وبطاقات القرب ، والوصول اللاسلكي)، والتكنولوجيا (التناظرية والقائمة على بروتوكول الإنترنت)، والاستخدام النهائي (السيارات، والتجارة، والحكومية، والسكنية، وغيرها)، ونوع الاتصال (الصوت/الفيديو والصوت فقط)، واتجاهات الصناعة والتوقعات حتى عام 2029

تحليل وحجم سوق أجهزة الاتصال الداخلي في الشرق الأوسط وأفريقيا

أجهزة الاتصال الداخلي هي أنظمة اتصالات إلكترونية تتكون من وحدات ميكروفون/مكبر صوت ثابتة متصلة بجهاز تحكم مركزي. هناك نوعان أساسيان من المنتجات: سلكية ولاسلكية. أجهزة الاتصال الداخلي السلكية متصلة بكابلات ويتم تركيبها في المباني والشقق والمكاتب ومرافق التصنيع. تعتمد أجهزة الاتصال الداخلي اللاسلكية على نقل الترددات الراديوية (RF) وتستخدم في محطات التلفزيون ومركبات التحكم في البث ومحطات الطاقة ومرافق الاتصالات.

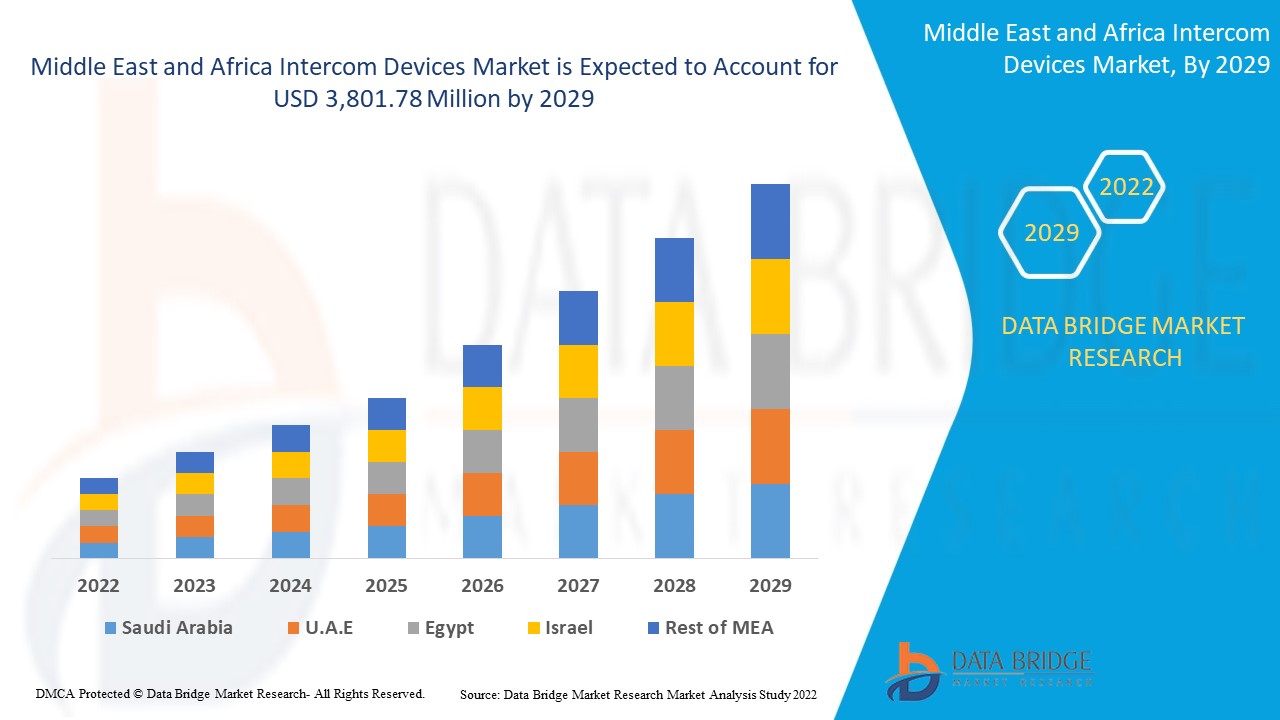

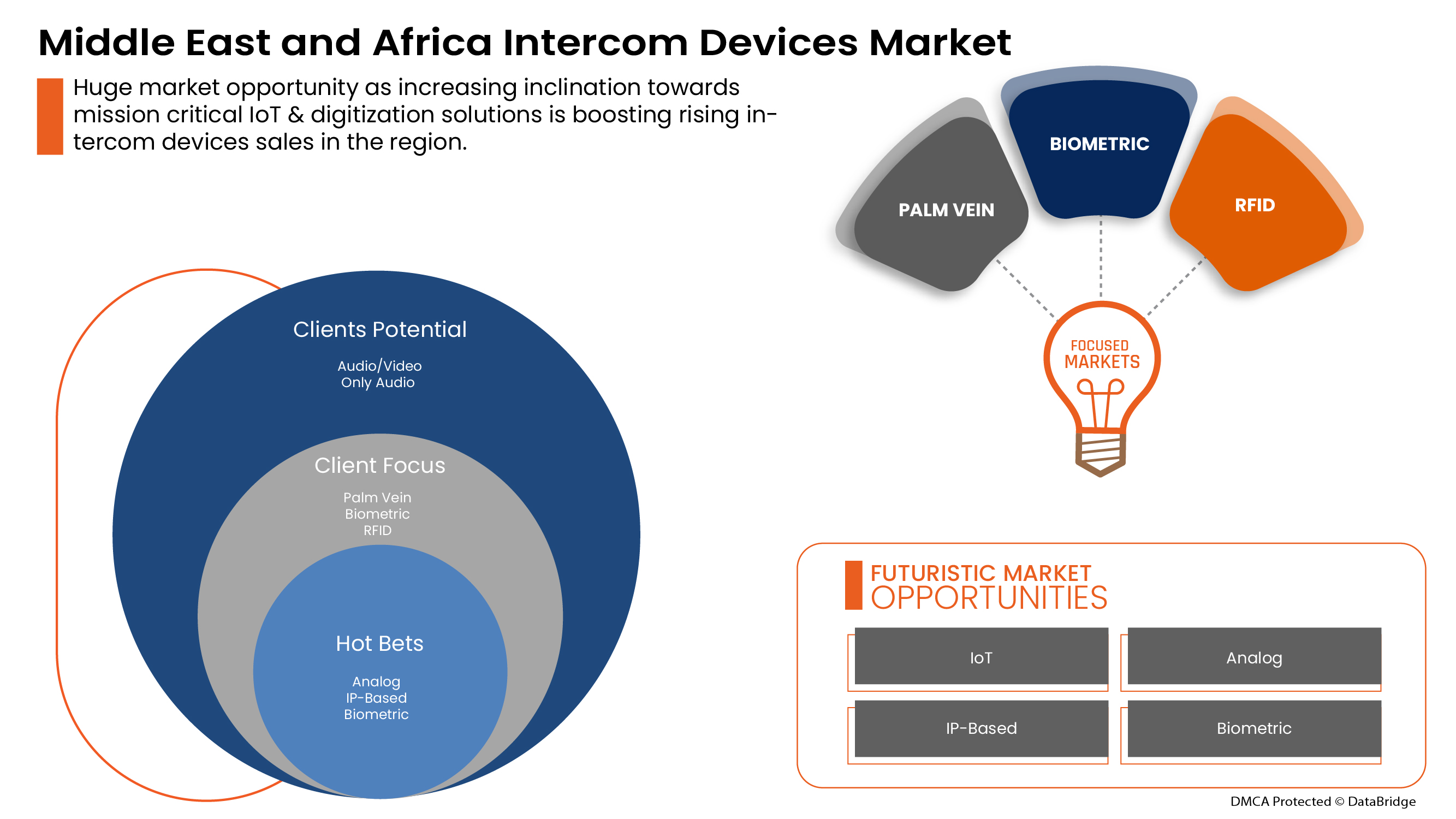

تحلل شركة Data Bridge Market Research أن سوق أجهزة الاتصال الداخلي في الشرق الأوسط وأفريقيا من المتوقع أن تصل قيمته إلى 3,801.78 مليون دولار أمريكي بحلول عام 2029، بمعدل نمو سنوي مركب قدره 11.5% خلال الفترة المتوقعة. "الصوت والفيديو" يشكلان قطاع الاتصالات الأبرز حيث أن هذا النوع من الاتصالات مطلوب وهو الخيار الأفضل لزيادة الأمان. يغطي تقرير سوق أجهزة الاتصال الداخلي في الشرق الأوسط وأفريقيا أيضًا تحليل الأسعار وتحليل براءات الاختراع والتقدم التكنولوجي بعمق.

|

تقرير القياس |

تفاصيل |

|

فترة التنبؤ |

2022 إلى 2029 |

|

سنة الأساس |

2021 |

|

سنوات تاريخية |

2020 (قابلة للتخصيص حتى 2019 - 2015) |

|

وحدات كمية |

الإيرادات بالملايين من الدولارات الأمريكية، التسعير بالدولار الأمريكي |

|

القطاعات المغطاة |

حسب نوع الجهاز (أنظمة دخول الأبواب، والأجهزة المحمولة، وأجهزة مراقبة الأطفال بالفيديو)، والتحكم في الوصول (قارئات بصمات الأصابع، والوصول بكلمة مرور، وبطاقات القرب، والوصول اللاسلكي)، والتكنولوجيا (التناظرية والمبنية على IP)، والاستخدام النهائي (السيارات، والتجارية، والحكومية، والسكنية، وغيرها)، ونوع الاتصال (الصوت/الفيديو والصوت فقط) |

|

الدول المغطاة |

الإمارات العربية المتحدة، المملكة العربية السعودية، جنوب أفريقيا، مصر، إسرائيل، وبقية دول الشرق الأوسط وأفريقيا |

|

الجهات الفاعلة في السوق المشمولة |

Comelit Group SpA، Fujian Aurine Technology Co.,Ltd.، Xiamen Leelen Technology Co., Ltd.، Panasonic Holdings Corporation، Honeywell International Inc.، Commend International GmbH. (علامة تجارية لمجموعة TKH)، Legrand Group، FERMAX INTERNATIONAL، SAU، Zhuhai Taichuan Cloud Technology Co., LTD.، 2N TELEKOMUNIKACE as (علامة تجارية لشركة Axis Communications Inc.)، Competition Electronic(zhuhai) co., ltd.، Hangzhou Hikvision Digital Technology Co., Ltd.، Dahua Technology Co., Ltd، SAMSUNG ELECTRONICS CO., LTD.، TCS TürControlSysteme AG، COMMAX، Siedle، Akuvox (Xiamen) Networks Co., Ltd.، DoorKing، وTOA Corporation، من بين شركات أخرى |

تعريف السوق

نظام الاتصال الداخلي هو نوع متقدم من أنظمة الدخول إلى الباب مزود بكاميرا لإدارة الوصول إلى المبنى. ومثله كمثل أنواع أنظمة الاتصال الداخلي الأخرى، يدعم نظام الاتصال الداخلي عبر الفيديو المزود بكاميرا أيضًا الاتصال بين الزوار والشاغلين. وبدلاً من الاعتماد على الصوت فقط، يمكن للشاغلين مشاهدة صور حية أو مسجلة من قارئ دخول الباب المزود بكاميرا للتحقق من هوية الزائر قبل منحه حق الوصول.

تدعم تقنية الاتصال الداخلي العديد من الميزات المتقدمة الأخرى لتعزيز أمان التحكم في الوصول وتحسين الراحة للسكان والزوار. توفر ميزات مثل الفتح عن بعد والإدارة المستندة إلى السحابة والتكامل مع أنظمة إدارة المباني والذكاء الاصطناعي وتقنيات التعرف على الوجه للشركات ومديري العقارات كفاءة ومرونة أكبر في إدارة الوصول إلى العقارات.

ديناميكيات سوق أجهزة الاتصال الداخلي في الشرق الأوسط وأفريقيا

يتناول هذا القسم فهم محركات السوق والمزايا والفرص والقيود والتحديات. ويتم مناقشة كل هذا بالتفصيل على النحو التالي:

السائقين

- ظهور أنظمة الأمان السمعية والبصرية المتقدمة

لقد حدث تحول تدريجي في مجال إنترنت الأشياء. يتم خدمة هذا المجال من خلال أجزاء إلكترونية قياسية مختلفة مدمجة في الأجهزة مع برامج مختلفة. يعد استخدام خدمات الصوت والصورة المخصصة في عصر إنترنت الأشياء ضروريًا لدفع تكنولوجيا إنترنت الأشياء السمعية والبصرية. نظرًا لأن الأجهزة التي تدعم إنترنت الأشياء يمكنها الاتصال بالشبكة الأوسع المتقدمة، فإنها تحقق وظائف واسعة النطاق. يتم اعتماد أجهزة الاتصال الداخلي بالفيديو التي تدعم إنترنت الأشياء مثل أقفال الأبواب والشاشات التفاعلية مع الإرشادات على نطاق واسع في قطاعات مختلفة مثل السيارات والتجارة والحكومية والسكنية وغيرها.

- ارتفاع حالات السرقة والسطو في جميع أنحاء العالم

السرقة هي فعل السرقة، وخاصة باستخدام القوة الغاشمة أو من خلال التهديد بالعنف. يمكن للصوص سرقة شخص أو مكان، مثل منزل أو شركة. وبسبب زيادة حالات السرقة، يزداد استخدام أجهزة الاتصال الداخلي في العديد من المؤسسات مثل المدارس والمستشفيات وغيرها.

ضبط النفس/التحدي

- ارتفاع في الأمن السيبراني والتهديدات التي تضعف حلول الاتصال الداخلي

زادت الجرائم الإلكترونية/الاختراق وقضايا الأمن الإلكتروني بنسبة 600% خلال الوباء في جميع القطاعات. العيوب في أمان الشبكة أو البرنامج هي نقاط ضعف يستغلها المتسللون للقيام بأعمال غير مصرح بها داخل النظام. وفقًا لشركة Purple Sec LLC، في عام 2018، زادت متغيرات البرامج الضارة للأجهزة المحمولة بنسبة 54%، منها 98% من البرامج الضارة للأجهزة المحمولة تستهدف أجهزة Android. يُقدر أن 25% من الشركات كانت ضحية للقرصنة المشفرة، بما في ذلك صناعة الأمن.

فرص

- مبادرات حكومية متنامية نحو تطوير المدن الذكية

تركز المنصة على تحديد الحلول واحتياجات المطورين المختلفين. وتتمحور منصة أصحاب المصلحة في المدن الذكية بشكل أساسي حول تعزيز الابتكارات. وتهدف إلى تسريع تطوير ونشر تطبيقات كفاءة الطاقة والتكنولوجيا منخفضة الكربون في البيئة الحضرية.

- زيادة الرقابة على منع اللصوص ومراقبة الأطفال وضمان سلامة الممتلكات

تتزايد أنشطة اللصوص يوميًا في بلدان مختلفة مثل جنوب إفريقيا ومصر وغيرهما. يحاول معظم المجرمين تجنب المواقف الخطرة، ويفضل هؤلاء الأشخاص الأهداف السهلة ذات نسبة المخاطرة المنخفضة والمكافأة. تُستخدم أجهزة الاتصال الداخلي لضمان وزيادة أمان الممتلكات في مدن مختلفة. يتم توصيل أجهزة الاتصال الداخلي السلكية بالكابلات وتثبيتها في المباني والشقق ومرافق التصنيع.

تأثير ما بعد كوفيد-19 على سوق أجهزة الاتصال الداخلي في الشرق الأوسط وأفريقيا

أحدثت جائحة كوفيد-19 تأثيرًا كبيرًا على سوق أجهزة الاتصال الداخلي في الشرق الأوسط وأفريقيا، حيث اختارت كل دولة تقريبًا إغلاق جميع مرافق الإنتاج باستثناء تلك التي تتعامل مع إنتاج السلع الأساسية. واتخذت الحكومة بعض الإجراءات الصارمة، مثل إغلاق إنتاج وبيع السلع غير الأساسية، وحظر التجارة الدولية، وغير ذلك الكثير، لمنع انتشار كوفيد-19. وكانت الشركات الوحيدة التي كانت تتعامل في ظل هذا الوضع الوبائي هي الخدمات الأساسية التي سُمح لها بفتح وتشغيل العمليات.

يشهد سوق أجهزة الاتصال الداخلي في الشرق الأوسط وأفريقيا نموًا متزايدًا بسبب أنظمة الصوت والصورة الأمنية المتقدمة بعد كوفيد. كما أن فتح الإغلاق يعزز صناعة الاتصال الداخلي، مما يزيد الطلب على أجهزة الاتصال الداخلي في السوق. ومع ذلك، فإن عوامل مثل ارتفاع الأمن السيبراني والتهديدات التي تضعف حلول الاتصال الداخلي تحد من نمو السوق. كان لإغلاق مرافق الإنتاج أثناء حالة الوباء تأثير كبير على السوق.

يتخذ المصنعون قرارات استراتيجية مختلفة للتعافي بعد جائحة كوفيد-19. ويجري اللاعبون أنشطة بحث وتطوير متعددة لتحسين التكنولوجيا المستخدمة في أجهزة الاتصال الداخلي. وبهذا، ستقدم الشركات حلولاً متقدمة ودقيقة للسوق. بالإضافة إلى ذلك، أدت مبادرات الحكومة لتعزيز التجارة الدولية إلى نمو السوق.

التطورات الأخيرة

- في يوليو 2021، كشفت شركة Hangzhou Hikvision Digital Technology Co., Ltd عن جهازها اللوحي All-in-One Indoor Station، والذي يجمع بين حلول الأمان في المنازل والمكاتب. وبفضل هذا المنتج، تمكنت الشركة من ترك بصمة في تطبيق إدارة الأجهزة المستند إلى السحابة للمستخدمين في جميع أنحاء العالم.

- في مايو 2018، أطلقت شركة باناسونيك القابضة مجموعة حلول أنظمة الاتصال الداخلي عبر الفيديو. وتم استخدام ميزات مثل التقنيات اللاسلكية والتفاعلية المتطورة في سلسلة VL-VM من نظام الاتصال الداخلي عبر الفيديو التناظري. وقد ساعد هذا الشركة على تحسين مجموعة منتجاتها بشكل أكبر وتقديم حلول مبتكرة للمستهلك.

نطاق سوق أجهزة الاتصال الداخلي في الشرق الأوسط وأفريقيا

يتم تقسيم سوق أجهزة الاتصال الداخلي في الشرق الأوسط وأفريقيا على أساس نوع الاتصال ونوع الجهاز والتحكم في الوصول والتكنولوجيا والاستخدام النهائي. سيساعدك النمو بين هذه القطاعات على تحليل قطاعات النمو الضئيلة في الصناعات وتزويد المستخدمين بنظرة عامة قيمة على السوق ورؤى السوق لمساعدتهم على اتخاذ قرارات استراتيجية لتحديد تطبيقات السوق الأساسية.

حسب نوع الاتصال

- الصوت/الفيديو

- الصوت فقط

على أساس نوع الاتصال، يتم تقسيم سوق أجهزة الاتصال الداخلي في الشرق الأوسط وأفريقيا إلى صوت/فيديو وصوت فقط.

حسب نوع الجهاز

- أنظمة دخول الأبواب

- الأجهزة المحمولة

- أجهزة مراقبة الأطفال بالفيديو

على أساس نوع الجهاز، تم تقسيم سوق أجهزة الاتصال الداخلي في الشرق الأوسط وأفريقيا إلى أنظمة دخول الأبواب، والأجهزة المحمولة، وأجهزة مراقبة الأطفال بالفيديو.

عن طريق التحكم في الوصول

- قارئ بصمات الأصابع

- الوصول بكلمة المرور

- بطاقات القرب

- الوصول اللاسلكي

على أساس التحكم في الوصول، تم تقسيم سوق أجهزة الاتصال الداخلي في الشرق الأوسط وأفريقيا إلى قارئات بصمات الأصابع، ووصول كلمة المرور، وبطاقات القرب، والوصول اللاسلكي.

حسب التكنولوجيا

- التناظرية

- مبني على IP

على أساس التكنولوجيا، تم تقسيم سوق أجهزة الاتصال الداخلي في الشرق الأوسط وأفريقيا إلى أجهزة تناظرية وأجهزة تعتمد على IP.

حسب الاستخدام النهائي

- السيارات

- تجاري

- حكومة

- سكني

- آحرون

على أساس الاستخدام النهائي، تم تقسيم سوق أجهزة الاتصال الداخلي في الشرق الأوسط وأفريقيا إلى أجهزة السيارات، والتجارية، والحكومية، والسكنية، وغيرها.

تحليل/رؤى إقليمية لسوق أجهزة الاتصال الداخلي في الشرق الأوسط وأفريقيا

يتم تحليل سوق أجهزة الاتصال الداخلي في الشرق الأوسط وأفريقيا، ويتم توفير رؤى حجم السوق والاتجاهات حسب البلد ونوع الاتصال ونوع الجهاز والتحكم في الوصول والتكنولوجيا والاستخدام النهائي.

الدول التي يغطيها تقرير سوق أجهزة الاتصال الداخلي في الشرق الأوسط وأفريقيا هي الإمارات العربية المتحدة والمملكة العربية السعودية وجنوب أفريقيا ومصر وإسرائيل وبقية دول الشرق الأوسط وأفريقيا.

من المتوقع أن تهيمن دولة الإمارات العربية المتحدة على سوق أجهزة الاتصال الداخلي في الشرق الأوسط وأفريقيا في عام 2022. ومن المتوقع أن تعمل البنية التحتية المتزايدة والتطورات التجارية والصناعية في البلدان الناشئة مثل دولة الإمارات العربية المتحدة على دفع نمو السوق.

كما يوفر قسم الدولة في التقرير عوامل فردية مؤثرة على السوق والتغيرات في تنظيم السوق التي تؤثر على الاتجاهات الحالية والمستقبلية للسوق. تعد نقاط البيانات مثل تحليل سلسلة القيمة النهائية والعليا، والاتجاهات الفنية، وتحليل قوى بورتر الخمس، ودراسات الحالة بعض المؤشرات المستخدمة للتنبؤ بسيناريو السوق للدول الفردية. كما يتم النظر في وجود وتوافر العلامات التجارية في الشرق الأوسط وأفريقيا والتحديات التي تواجهها بسبب المنافسة الكبيرة أو النادرة من العلامات التجارية المحلية والمحلية، وتأثير التعريفات الجمركية المحلية وطرق التجارة أثناء تقديم تحليل تنبؤي لبيانات الدولة.

تحليل المشهد التنافسي وحصة سوق أجهزة الاتصال الداخلي في الشرق الأوسط وأفريقيا

يقدم المشهد التنافسي لسوق أجهزة الاتصال الداخلي في الشرق الأوسط وأفريقيا تفاصيل عن كل منافس. تتضمن التفاصيل نظرة عامة على الشركة، والبيانات المالية للشركة، والإيرادات المولدة، وإمكانات السوق، والاستثمار في البحث والتطوير، والمبادرات الجديدة في السوق، والحضور في الشرق الأوسط وأفريقيا، ومواقع الإنتاج والمرافق، والقدرات الإنتاجية، ونقاط القوة والضعف للشركة، وإطلاق المنتج، وعرض المنتج ونطاقه، وهيمنة التطبيق. ترتبط نقاط البيانات المذكورة أعلاه فقط بتركيز الشركات فيما يتعلق بسوق أجهزة الاتصال الداخلي في الشرق الأوسط وأفريقيا.

بعض اللاعبين الرئيسيين العاملين في سوق أجهزة الاتصال الداخلي في الشرق الأوسط وأفريقيا هم Comelit Group SpA و Fujian Aurine Technology Co.، Ltd. و Xiamen Leelen Technology Co.، Ltd. و Panasonic Holdings Corporation و Honeywell International Inc. و Commend International GmbH. (علامة تجارية لمجموعة TKH) و Legrand Group و FERMAX INTERNATIONAL و SAU و Zhuhai Taichuan Cloud Technology Co.، LTD. و 2N TELEKOMUNIKACE as (علامة تجارية لشركة Axis Communications Inc.) و Competition Electronic(zhuhai) co.، ltd. و Hangzhou Hikvision Digital Technology Co.، Ltd. و Dahua Technology Co.، Ltd. و SAMSUNG ELECTRONICS CO.، LTD. و TCS TürControlSysteme AG و COMMAX و Siedle و Akuvox (Xiamen) Networks Co.، Ltd. و DoorKing و TOA Corporation وغيرها.

SKU-

احصل على إمكانية الوصول عبر الإنترنت إلى التقرير الخاص بأول سحابة استخبارات سوقية في العالم

- لوحة معلومات تحليل البيانات التفاعلية

- لوحة معلومات تحليل الشركة للفرص ذات إمكانات النمو العالية

- إمكانية وصول محلل الأبحاث للتخصيص والاستعلامات

- تحليل المنافسين باستخدام لوحة معلومات تفاعلية

- آخر الأخبار والتحديثات وتحليل الاتجاهات

- استغل قوة تحليل المعايير لتتبع المنافسين بشكل شامل

Table of Content

1 INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 OVERVIEW OF MIDDLE EAST & AFRICA INTERCOM DEVICES MARKET

1.4 CURRENCY AND PRICING

1.5 LIMITATIONS

1.6 MARKETS COVERED

2 MARKET SEGMENTATION

2.1 MARKETS COVERED

2.2 GEOGRAPHICAL SCOPE

2.3 YEARS CONSIDERED FOR THE STUDY

2.4 DBMR TRIPOD DATA VALIDATION MODEL

2.5 PRIMARY INTERVIEWS WITH KEY OPINION LEADERS

2.6 DBMR MARKET POSITION GRID

2.7 VENDOR SHARE ANALYSIS

2.8 MULTIVARIATE MODELING

2.9 COMMUNICATION TYPE TIMELINE CURVE

2.1 MARKET END-USE COVERAGE GRID

2.11 SECONDARY SOURCES

2.12 ASSUMPTIONS

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

4.1 AUDIO AND AUDIO/VIDEO INTERNAL UNIT

4.2 U.S. COMPETITORS

5 MARKET OVERVIEW

5.1 DRIVERS

5.1.1 ADVENT OF ADVANCED SECURITY AUDIOVISUAL SYSTEMS

5.1.2 INCREASE IN ROBBERY, BURGLARY, AND THIEF CASES ACROSS THE GLOBE

5.1.3 INCREASE IN CLOUD BASED-AI AIDED INTERCOM DEVICES

5.1.4 GROWING IMPORTANCE OF SMART HOMES AND SMART BUILDINGS

5.2 RESTRAINT

5.2.1 RISE IN CYBER SECURITY & THREATS WEAKENING INTERCOM SOLUTIONS

5.3 OPPORTUNITIES

5.3.1 GROWING GOVERNMENT INITIATIVES TOWARD THE DEVELOPMENT OF SMART CITIES

5.3.2 INCREASED CHECK ON DETER BURGLARS, BABY MONITORING AND ENSURING SAFETY OF PROPERTY

5.3.3 RISE IN DEMAND FOR WIRELESS AUDIO/VIDEO INTERCOM DEVICES

5.3.4 RISING STRATEGIC PARTNERSHIP AND ACQUISITION AMONG ORGANIZATIONS FOR AUDIO/VIDEO INTERCOM DEVICES

5.4 CHALLENGE

5.4.1 MALFUNCTION ISSUES ASSOCIATED WITH THE AUDIO/VIDEO INTERCOM DEVICES

6 MIDDLE EAST & AFRICA INTERCOM DEVICE MARKET, BY COMMUNICATION TYPE

6.1 OVERVIEW

6.2 AUDIO/VIDEO

6.3 ONLY AUDIO

7 MIDDLE EAST & AFRICA INTERCOM DEVICE MARKET, BY DEVICE TYPE

7.1 OVERVIEW

7.2 DOOR ENTRY SYSTEMS

7.3 HANDHELD DEVICES

7.4 VIDEO BABY MONITORS

8 MIDDLE EAST & AFRICA INTERCOM DEVICE MARKET, BY ACCESS CONTROL

8.1 OVERVIEW

8.2 FINGERPRINT READERS

8.3 PROXIMITY CARDS

8.4 PASSWORD ACCESS

8.5 WIRELESS ACCESS

9 MIDDLE EAST & AFRICA INTERCOM DEVICE MARKET, BY TECHNOLOGY

9.1 OVERVIEW

9.2 ANALOG

9.3 IP-BASED

10 MIDDLE EAST & AFRICA INTERCOM DEVICE MARKET, BY END-USE

10.1 OVERVIEW

10.2 COMMERCIAL

10.3 RESIDENTIAL

10.4 GOVERNMENT

10.5 AUTOMOTIVE

10.6 OTHERS

11 MIDDLE EAST & AFRICA INTERCOM DEVICES MARKET, BY REGION

11.1 MIDDLE EAST AND AFRICA

11.1.1 SOUTH AFRICA

11.1.2 SAUDI ARABIA

11.1.3 U.A.E.

11.1.4 ISRAEL

11.1.5 EGYPT

11.1.6 REST OF MIDDLE EAST AND AFRICA

12 MIDDLE EAST & AFRICA INTERCOM DEVICES MARKET, COMPANY LANDSCAPE

12.1 COMPANY SHARE ANALYSIS: MIDDLE EAST & AFRICA

13 SWOT ANALYSIS

14 COMPANY PROFILE

14.1 HANGZHOU HIKVISION DIGITAL TECHNOLOGY CO., LTD

14.1.1 COMPANY SNAPSHOT

14.1.2 REVENUE ANALYSIS

14.1.3 COMPANY SHARE ANALYSIS

14.1.4 PRODUCT PORTFOLIO

14.1.5 RECENT DEVELOPMENTS

14.2 PANASONIC HOLDINGS CORPORATION

14.2.1 COMPANY SNAPSHOT

14.2.2 REVENUE ANALYSIS

14.2.3 COMPANY SHARE ANALYSIS

14.2.4 PRODUCTS PORTFOLIO

14.2.5 RECENT DEVELOPMENTS

14.3 SAMSUNG ELECTRONICS CO., LTD. ELECTRONICS CO., LTD.

14.3.1 COMPANY PROFILE

14.3.2 REVENUE ANALYSIS

14.3.3 COMPANY SHARE ANALYSIS

14.3.4 PRODUCT PORTFOLIO

14.3.5 RECENT DEVELOPMENTS

14.4 LEGRAND GROUP

14.4.1 COMPANY SNAPSHOT

14.4.2 REVENUE ANALYSIS

14.4.3 COMPANY SHARE ANALYSIS

14.4.4 PRODUCTS PORTFOLIO

14.4.5 RECENT DEVELOPMENT

14.5 HONEYWELL INTERNATIONAL INC.

14.5.1 COMPANY SNAPSHOT

14.5.2 REVENUE ANALYSIS

14.5.3 COMPANY SHARE ANALYSIS

14.5.4 PRODUCTS PORTFOLIO

14.5.5 RECENT DEVELOPMENT

14.6 DAHUA TECHNOLOGY CO., LTD

14.6.1 COMPANY SNAPSHOT

14.6.2 REVENUE ANALYSIS

14.6.3 PRODUCTS PORTFOLIO

14.6.4 RECENT DEVELOPMENTS

14.7 AIPHONE CORPORATION.

14.7.1 COMPANY SNAPSHOT

14.7.2 REVENUE ANALYSIS

14.7.3 PRODUCTS PORTFOLIO

14.7.4 RECENT DEVELOPMENTS

14.8 SIEDLE

14.8.1 COMPANY SNAPSHOT

14.8.2 PRODUCTS PORTFOLIO

14.8.3 RECENT DEVELOPMENT

14.9 COMMAX.

14.9.1 COMPANY SNAPSHOT

14.9.2 PRODUCTS PORTFOLIO

14.9.3 RECENT DEVELOPMENT

14.1 2N TELEKOMUNIKACE A.S

14.10.1 COMPANY SNAPSHOT

14.10.2 PRODUCTS PORTFOLIO

14.10.3 RECENT DEVELOPMENTS

14.11 AKUVOX (XIAMEN) NETWORKS CO., LTD.

14.11.1 COMPANY SNAPSHOT

14.11.2 PRODUCT PORTFOLIO

14.11.3 RECENT DEVELOPMENT

14.12 ALPHA COMMUNICATIONS

14.12.1 COMPANY SNAPSHOT

14.12.2 PRODUCT PORTFOLIO

14.12.3 RECENT DEVELOPMENT

14.13 BARIX.COM

14.13.1 COMPANY SNAPSHOT

14.13.2 SOLUTION PORTFOLIO

14.13.3 RECENT DEVELOPMENT

14.14 BIRD HOME AUTOMATION GMBH.

14.14.1 COMPANY SNAPSHOT

14.14.2 PRODUCTS PORTFOLIO

14.14.3 RECENT DEVELOPMENTS

14.15 BUTTERFLYMX, INC.

14.15.1 COMPANY SNAPSHOT

14.15.2 PRODUCT & SOLUTION PORTFOLIO

14.15.3 RECENT DEVELOPMENT

14.16 COMELIT GROUP S.P.A.

14.16.1 COMPANY SNAPSHOT

14.16.2 PRODUCTS PORTFOLIO

14.16.3 RECENT DEVELOPMENTS

14.17 COMMEND INTERNATIONAL GMBH.

14.17.1 COMPANY SNAPSHOT

14.17.2 REVENUE ANALYSIS

14.17.3 PRODUCTS PORTFOLIO

14.17.4 RECENT DEVELOPMENTS

14.18 COMPETITION ELECTRONIC (ZHUHAI) CO., LTD.

14.18.1 COMPANY SNAPSHOT

14.18.2 PRODUCTS PORTFOLIO

14.18.3 RECENT DEVELOPMENTS

14.19 DOORKING

14.19.1 COMPANY SNAPSHOT

14.19.2 PRODUCT PORTFOLIO

14.19.3 RECENT DEVELOPMENT

14.2 FERMAX ELECTRÓNICA, S.A.U.

14.20.1 COMPANY SNAPSHOT

14.20.2 PRODUCTS PORTFOLIO

14.20.3 RECENT DEVELOPMENTS

14.21 FUJIAN AURINE TECHNOLOGY CO., LTD.

14.21.1 COMPANY SNAPSHOT

14.21.2 PRODUCTS PORTFOLIO

14.21.3 RECENT DEVELOPMENT

14.22 JIALE GROUP

14.22.1 COMPANY SNAPSHOT

14.22.2 SOLUTION PORTFOLIO

14.22.3 RECENT DEVELOPMENT

14.23 SWIFTLANE.

14.23.1 COMPANY SNAPSHOT

14.23.2 PRODUCTS PORTFOLIO

14.23.3 RECENT DEVELOPMENTS

14.24 TCS TÜRCONTROLSYSTEME AG

14.24.1 COMPANY SNAPSHOT

14.24.2 PRODUCTS PORTFOLIO

14.24.3 RECENT DEVELOPMENTS

14.25 TOA CORPORATION.

14.25.1 COMPANY SNAPSHOT

14.25.2 REVENUE ANALYSIS

14.25.3 PRODUCT PORTFOLIO

14.25.4 RECENT DEVELOPMENT

14.26 URMET S.P.A.

14.26.1 COMPANY SNAPSHOT

14.26.2 PRODUCTS PORTFOLIO

14.26.3 RECENT DEVELOPMENT

14.27 WRT INTELLIGENT TECHNOLOGY COMPANY LIMITED

14.27.1 COMPANY SNAPSHOT

14.27.2 PRODUCT & SOLUTION PORTFOLIO

14.27.3 RECENT DEVELOPMENT

14.28 XIAMEN LEELEN TECHNOLOGY CO., LTD.

14.28.1 COMPANY SNAPSHOT

14.28.2 PRODUCTS PORTFOLIO

14.28.3 RECENT DEVELOPMENTS

14.29 ZHUHAI TAICHUAN CLOUD TECHNOLOGY CO., LTD.

14.29.1 COMPANY SNAPSHOT

14.29.2 PRODUCT & SOLUTION PORTFOLIO

14.29.3 RECENT DEVELOPMENTS

14.3 ZICOM

14.30.1 COMPANY SNAPSHOT

14.30.2 PRODUCT PORTFOLIO

14.30.3 RECENT DEVELOPMENTS

15 QUESTIONNAIRE

16 RELATED REPORTS

List of Table

TABLE 1 LIST OF U.S. COMPETITORS

TABLE 2 MIDDLE EAST & AFRICA INTERCOM DEVICES MARKET, BY COMMUNICATION TYPE, 2020-2029 (USD MILLION)

TABLE 3 MIDDLE EAST & AFRICA AUDIO/VIDEO IN INTERCOM DEVICES MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 4 MIDDLE EAST & AFRICA ONLY AUDIO IN INTERCOM DEVICES MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 5 MIDDLE EAST & AFRICA INTERCOM DEVICES MARKET, BY DEVICE TYPE, 2020-2029 (USD MILLION)

TABLE 6 MIDDLE EAST & AFRICA DOOR ENTRY SYSTEMS IN INTERCOM DEVICES MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 7 MIDDLE EAST & AFRICA HANDHELD DEVICES IN INTERCOM DEVICES MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 8 MIDDLE EAST & AFRICA VIDEO BABY MONITORS IN INTERCOM DEVICES MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 9 MIDDLE EAST & AFRICA INTERCOM DEVICES MARKET, BY ACCESS CONTROL, 2020-2029 (USD MILLION)

TABLE 10 MIDDLE EAST & AFRICA FINGERPRINT READERS IN INTERCOM DEVICES MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 11 MIDDLE EAST & AFRICA PROXIMITY CARDS IN INTERCOM DEVICES MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 12 MIDDLE EAST & AFRICA PASSWORD ACCESS IN INTERCOM DEVICES MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 13 MIDDLE EAST & AFRICA WIRELESS ACCESS IN INTERCOM DEVICES MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 14 MIDDLE EAST & AFRICA INTERCOM DEVICES MARKET, BY TECHNOLOGY, 2020-2029 (USD MILLION)

TABLE 15 MIDDLE EAST & AFRICA ANALOG IN INTERCOM DEVICES MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 16 MIDDLE EAST & AFRICA IP-BASED IN INTERCOM DEVICES MARKET, BY DEVICE TYPE, 2020-2029 (USD MILLION)

TABLE 17 MIDDLE EAST & AFRICA INTERCOM DEVICES MARKET, BY END-USE, 2020-2029 (USD MILLION)

TABLE 18 MIDDLE EAST & AFRICA COMMERCIAL IN INTERCOM DEVICES MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 19 MIDDLE EAST & AFRICA RESIDENTIAL IN INTERCOM DEVICES MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 20 MIDDLE EAST & AFRICA GOVERNMENT IN INTERCOM DEVICES MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 21 MIDDLE EAST & AFRICA AUTOMOTIVE IN INTERCOM DEVICES MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 22 MIDDLE EAST & AFRICA OTHERS IN INTERCOM DEVICES MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 23 MIDDLE EAST AND AFRICA INTERCOM DEVICES MARKET, BY COUNTRY, 2020-2029 (USD MILLION)

TABLE 24 MIDDLE EAST AND AFRICA INTERCOM DEVICES MARKET, BY COMMUNICATION TYPE, 2020-2029 (USD MILLION)

TABLE 25 MIDDLE EAST AND AFRICA INTERCOM DEVICES MARKET, BY DEVICE TYPE, 2020-2029 (USD MILLION)

TABLE 26 MIDDLE EAST AND AFRICA INTERCOM DEVICES MARKET, BY ACCESS CONTROL, 2020-2029 (USD MILLION)

TABLE 27 MIDDLE EAST AND AFRICA INTERCOM DEVICES MARKET, BY TECHNOLOGY, 2020-2029 (USD MILLION)

TABLE 28 MIDDLE EAST AND AFRICA INTERCOM DEVICES MARKET, BY END-USE, 2020-2029 (USD MILLION)

TABLE 29 SOUTH AFRICA INTERCOM DEVICES MARKET, BY COMMUNICATION TYPE, 2020-2029 (USD MILLION)

TABLE 30 SOUTH AFRICA INTERCOM DEVICES MARKET, BY DEVICE TYPE, 2020-2029 (USD MILLION)

TABLE 31 SOUTH AFRICA INTERCOM DEVICES MARKET, BY ACCESS CONTROL, 2020-2029 (USD MILLION)

TABLE 32 SOUTH AFRICA INTERCOM DEVICES MARKET, BY TECHNOLOGY, 2020-2029 (USD MILLION)

TABLE 33 SOUTH AFRICA INTERCOM DEVICES MARKET, BY END-USE, 2020-2029 (USD MILLION)

TABLE 34 SAUDI ARABIA INTERCOM DEVICES MARKET, BY COMMUNICATION TYPE, 2020-2029 (USD MILLION)

TABLE 35 SAUDI ARABIA INTERCOM DEVICES MARKET, BY DEVICE TYPE, 2020-2029 (USD MILLION)

TABLE 36 SAUDI ARABIA INTERCOM DEVICES MARKET, BY ACCESS CONTROL, 2020-2029 (USD MILLION)

TABLE 37 SAUDI ARABIA INTERCOM DEVICES MARKET, BY TECHNOLOGY, 2020-2029 (USD MILLION)

TABLE 38 SAUDI ARABIA INTERCOM DEVICES MARKET, BY END-USE, 2020-2029 (USD MILLION)

TABLE 39 U.A.E. INTERCOM DEVICES MARKET, BY COMMUNICATION TYPE, 2020-2029 (USD MILLION)

TABLE 40 U.A.E. INTERCOM DEVICES MARKET, BY DEVICE TYPE, 2020-2029 (USD MILLION)

TABLE 41 U.A.E. INTERCOM DEVICES MARKET, BY ACCESS CONTROL, 2020-2029 (USD MILLION)

TABLE 42 U.A.E. INTERCOM DEVICES MARKET, BY TECHNOLOGY, 2020-2029 (USD MILLION)

TABLE 43 U.A.E. INTERCOM DEVICES MARKET, BY END-USE, 2020-2029 (USD MILLION)

TABLE 44 ISRAEL INTERCOM DEVICES MARKET, BY COMMUNICATION TYPE, 2020-2029 (USD MILLION)

TABLE 45 ISRAEL INTERCOM DEVICES MARKET, BY DEVICE TYPE, 2020-2029 (USD MILLION)

TABLE 46 ISRAEL INTERCOM DEVICES MARKET, BY ACCESS CONTROL, 2020-2029 (USD MILLION)

TABLE 47 ISRAEL INTERCOM DEVICES MARKET, BY TECHNOLOGY, 2020-2029 (USD MILLION)

TABLE 48 ISRAEL INTERCOM DEVICES MARKET, BY END-USE, 2020-2029 (USD MILLION)

TABLE 49 EGYPT INTERCOM DEVICES MARKET, BY COMMUNICATION TYPE, 2020-2029 (USD MILLION)

TABLE 50 EGYPT INTERCOM DEVICES MARKET, BY DEVICE TYPE, 2020-2029 (USD MILLION)

TABLE 51 EGYPT INTERCOM DEVICES MARKET, BY ACCESS CONTROL, 2020-2029 (USD MILLION)

TABLE 52 EGYPT INTERCOM DEVICES MARKET, BY TECHNOLOGY, 2020-2029 (USD MILLION)

TABLE 53 EGYPT INTERCOM DEVICES MARKET, BY END-USE, 2020-2029 (USD MILLION)

TABLE 54 REST OF MIDDLE EAST AND AFRICA INTERCOM DEVICES MARKET, BY COMMUNICATION TYPE, 2020-2029 (USD MILLION)

List of Figure

FIGURE 1 MIDDLE EAST & AFRICA INTERCOM DEVICES MARKET: SEGMENTATION

FIGURE 2 MIDDLE EAST & AFRICA INTERCOM DEVICES MARKET: DATA TRIANGULATION

FIGURE 3 MIDDLE EAST & AFRICA INTERCOM DEVICES MARKET: DROC ANALYSIS

FIGURE 4 MIDDLE EAST & AFRICA INTERCOM DEVICES MARKET: MIDDLE EAST & AFRICA VS REGIONAL MARKET ANALYSIS

FIGURE 5 MIDDLE EAST & AFRICA INTERCOM DEVICES MARKET: COMPANY RESEARCH ANALYSIS

FIGURE 6 MIDDLE EAST & AFRICA INTERCOM DEVICES MARKET: INTERVIEW DEMOGRAPHICS

FIGURE 7 MIDDLE EAST & AFRICA INTERCOM DEVICES MARKET: DBMR MARKET POSITION GRID

FIGURE 8 MIDDLE EAST & AFRICA INTERCOM DEVICES MARKET: VENDOR SHARE ANALYSIS

FIGURE 9 MIDDLE EAST & AFRICA INTERCOM DEVICES MARKET: MARKET VERTICAL COVERAGE GRID

FIGURE 10 MIDDLE EAST & AFRICA INTERCOM DEVICES MARKET: SEGMENTATION

FIGURE 11 INCREASE IN CLOUD BASED-AI AIDED INTERCOM DEVICES IS EXPECTED TO DRIVE THE MIDDLE EAST & AFRICA INTERCOM DEVICES MARKET IN THE FORECAST PERIOD OF 2022 TO 2029

FIGURE 12 AUDIO/VIDEO SEGMENT IS EXPECTED TO ACCOUNT FOR THE LARGEST SHARE OF THE MIDDLE EAST & AFRICA INTERCOM DEVICES MARKET IN 2022 & 2029

FIGURE 13 ADVANTAGES OFFERED BY VIDEO SYSTEM OVER AUDIO ONLY SYSTEMS

FIGURE 14 DRIVERS, RESTRAINTS, OPPORTUNITIES AND CHALLENGES OF MIDDLE EAST & AFRICA INTERCOM DEVICES MARKET

FIGURE 15 VIDEO SYSTEMS

FIGURE 16 STATS RELATED TO ROBBERY AND BURGLARY

FIGURE 17 TECHNOLOGY AMALGAMATION IN SMART HOME/ BUILDINGS

FIGURE 18 IMPACT OF CYBER SECURITY THREAT

FIGURE 19 MIDDLE EAST & AFRICA INTERCOM DEVICE MARKET: BY COMMUNICATION TYPE, 2021

FIGURE 20 MIDDLE EAST & AFRICA INTERCOM DEVICE MARKET: BY DEVICE TYPE, 2021

FIGURE 21 MIDDLE EAST & AFRICA INTERCOM DEVICE MARKET: BY ACCESS CONTROL, 2021

FIGURE 22 MIDDLE EAST & AFRICA INTERCOM DEVICE MARKET: BY TECHNOLOGY, 2021

FIGURE 23 MIDDLE EAST & AFRICA INTERCOM DEVICE MARKET: BY END-USE, 2021

FIGURE 24 MIDDLE EAST AND AFRICA INTERCOM DEVICES MARKET: SNAPSHOT (2021)

FIGURE 25 MIDDLE EAST AND AFRICA INTERCOM DEVICES MARKET: BY COUNTRY (2021)

FIGURE 26 MIDDLE EAST AND AFRICA INTERCOM DEVICES MARKET: BY COUNTRY (2022 & 2029)

FIGURE 27 MIDDLE EAST AND AFRICA INTERCOM DEVICES MARKET: BY COUNTRY (2021 & 2029)

FIGURE 28 MIDDLE EAST AND AFRICA INTERCOM DEVICES MARKET: BY COMMUNICATION TYPE (2022-2029)

FIGURE 29 MIDDLE EAST & AFRICA INTERCOM DEVICES MARKET: COMPANY SHARE 2021 (%)

منهجية البحث

يتم جمع البيانات وتحليل سنة الأساس باستخدام وحدات جمع البيانات ذات أحجام العينات الكبيرة. تتضمن المرحلة الحصول على معلومات السوق أو البيانات ذات الصلة من خلال مصادر واستراتيجيات مختلفة. تتضمن فحص وتخطيط جميع البيانات المكتسبة من الماضي مسبقًا. كما تتضمن فحص التناقضات في المعلومات التي شوهدت عبر مصادر المعلومات المختلفة. يتم تحليل بيانات السوق وتقديرها باستخدام نماذج إحصائية ومتماسكة للسوق. كما أن تحليل حصة السوق وتحليل الاتجاهات الرئيسية هي عوامل النجاح الرئيسية في تقرير السوق. لمعرفة المزيد، يرجى طلب مكالمة محلل أو إرسال استفسارك.

منهجية البحث الرئيسية التي يستخدمها فريق بحث DBMR هي التثليث البيانات والتي تتضمن استخراج البيانات وتحليل تأثير متغيرات البيانات على السوق والتحقق الأولي (من قبل خبراء الصناعة). تتضمن نماذج البيانات شبكة تحديد موقف البائعين، وتحليل خط زمني للسوق، ونظرة عامة على السوق ودليل، وشبكة تحديد موقف الشركة، وتحليل براءات الاختراع، وتحليل التسعير، وتحليل حصة الشركة في السوق، ومعايير القياس، وتحليل حصة البائعين على المستوى العالمي مقابل الإقليمي. لمعرفة المزيد عن منهجية البحث، أرسل استفسارًا للتحدث إلى خبراء الصناعة لدينا.

التخصيص متاح

تعد Data Bridge Market Research رائدة في مجال البحوث التكوينية المتقدمة. ونحن نفخر بخدمة عملائنا الحاليين والجدد بالبيانات والتحليلات التي تتطابق مع هدفهم. ويمكن تخصيص التقرير ليشمل تحليل اتجاه الأسعار للعلامات التجارية المستهدفة وفهم السوق في بلدان إضافية (اطلب قائمة البلدان)، وبيانات نتائج التجارب السريرية، ومراجعة الأدبيات، وتحليل السوق المجدد وقاعدة المنتج. ويمكن تحليل تحليل السوق للمنافسين المستهدفين من التحليل القائم على التكنولوجيا إلى استراتيجيات محفظة السوق. ويمكننا إضافة عدد كبير من المنافسين الذين تحتاج إلى بيانات عنهم بالتنسيق وأسلوب البيانات الذي تبحث عنه. ويمكن لفريق المحللين لدينا أيضًا تزويدك بالبيانات في ملفات Excel الخام أو جداول البيانات المحورية (كتاب الحقائق) أو مساعدتك في إنشاء عروض تقديمية من مجموعات البيانات المتوفرة في التقرير.